Exhibit 99.1

CenterState Banks of Florida, Inc.

NASDAQ: CSFL

February 2008

Forward Looking Statement

This presentation contains forward-looking statements, as defined by Federal Securities Laws, relating to present or future trends or factors affecting the operations, markets and products of CenterState Banks of Florida, Inc. (CSFL). These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to CSFL’s most recent Form 10-Q filed with the Securities Exchange Commission.

CSFL undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

Franchise Overview

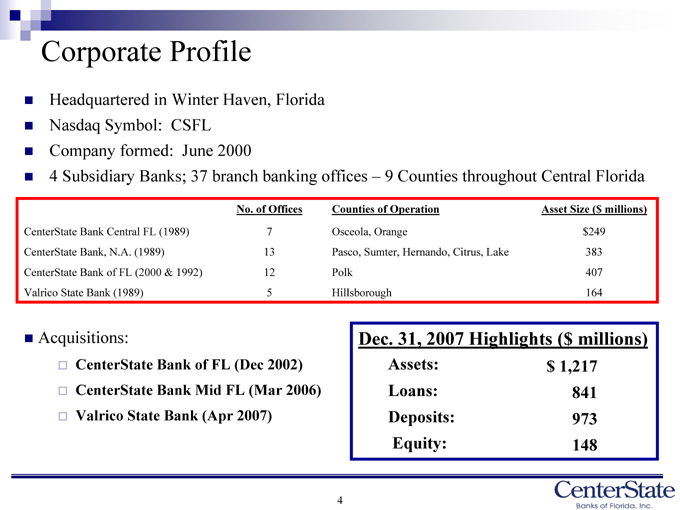

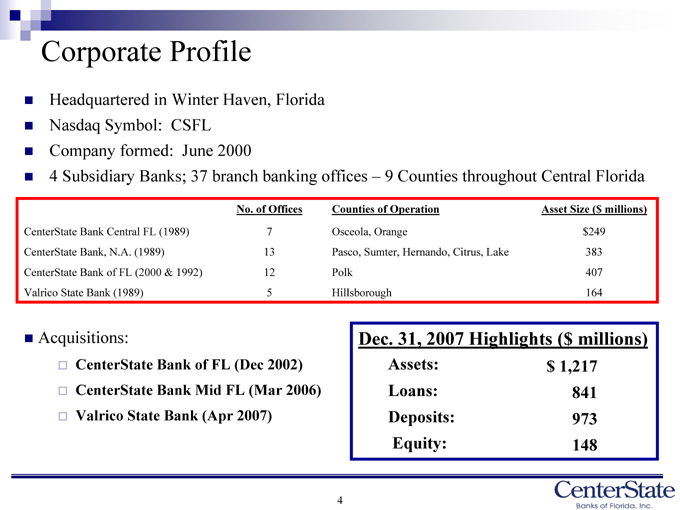

Corporate Profile

Headquartered in Winter Haven, Florida

Nasdaq Symbol: CSFL

Company formed: June 2000

4 | | Subsidiary Banks; 37 branch banking offices – 9 Counties throughout Central Florida |

No. of Offices

Counties of Operation

Asset Size ($ millions)

CenterState Bank Central FL (1989)

Osceola, Orange $249

CenterState Bank, N.A. (1989)

13

Pasco, Sumter, Hernando, Citrus, Lake

383

CenterState Bank of FL (2000 & 1992)

12

Polk

407

Valrico State Bank (1989)

Hillsborough

164

Acquisitions:

CenterState Bank of FL (Dec 2002)

CenterState Bank Mid FL (Mar 2006)

Valrico State Bank (Apr 2007)

Dec. 31, 2007 Highlights ($ millions)

Assets: $ 1,217

Loans:

841

Deposits:

973

Equity:

148

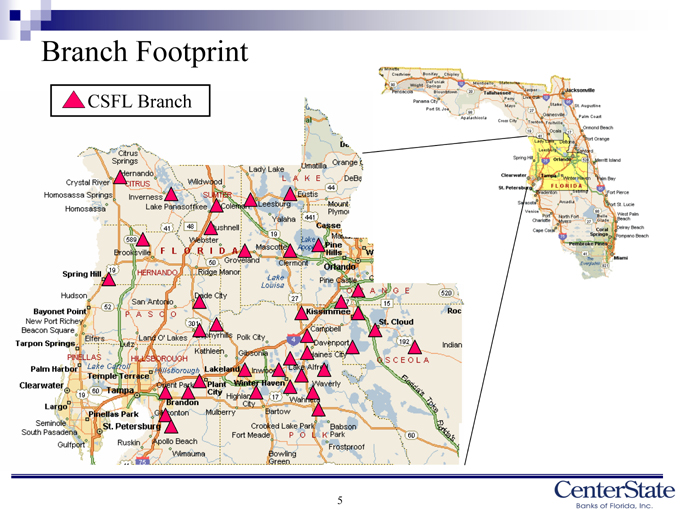

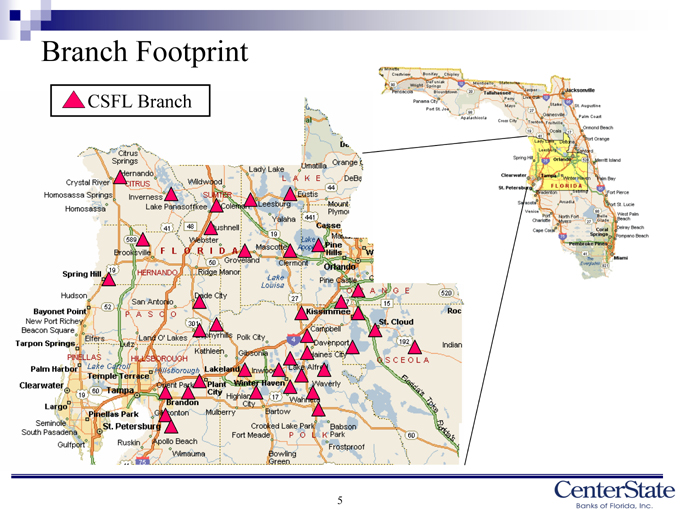

Branch Footprint

CSFL Branch

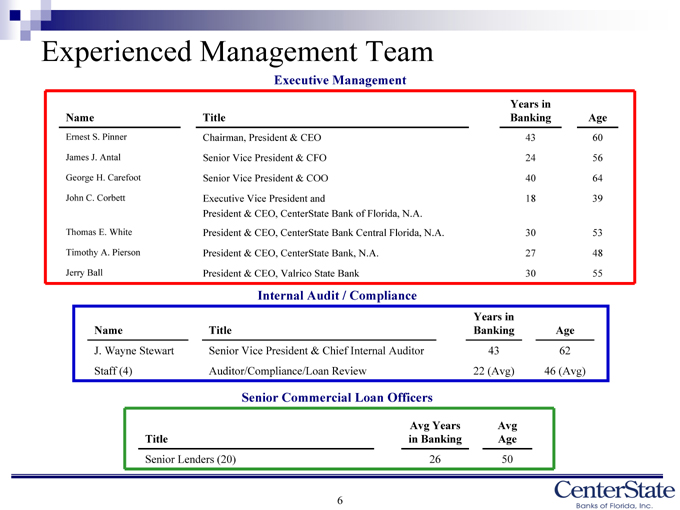

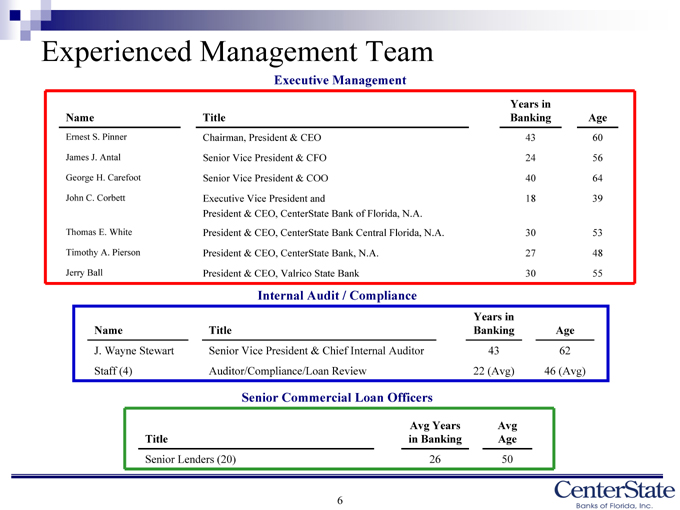

Experienced Management Team

Executive Management

Name Title Years in Banking Age

Ernest S. Pinner Chairman, President & CEO 43 60

James J. Antal Senior Vice President & CFO 24 56

George H. Carefoot Senior Vice President & COO 40 64

John C. Corbett Executive Vice President and 18 39

President & CEO, CenterState Bank of Florida, N.A.

Thomas E. White President & CEO, CenterState Bank Central Florida, N.A. 30 53

Timothy A. Pierson President & CEO, CenterState Bank, N.A. 27 48

Jerry Ball President & CEO, Valrico State Bank 30 55

Internal Audit / Compliance

Years in

Name Title Banking Age

J. Wayne Stewart Senior Vice President & Chief Internal Auditor 43 62

Staff (4) Auditor/Compliance/Loan Review 22 (Avg) 46 (Avg)

Senior Commercial Loan Officers

Title Avg Years in Banking Avg Age

Senior Lenders (20) 26 50

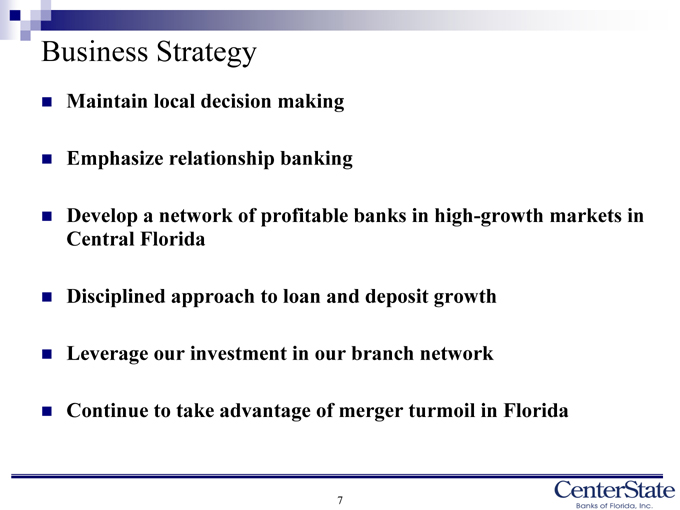

Business Strategy

Maintain local decision making

Emphasize relationship banking

Develop a network of profitable banks in high-growth markets in Central Florida

Disciplined approach to loan and deposit growth

Leverage our investment in our branch network

Continue to take advantage of merger turmoil in Florida

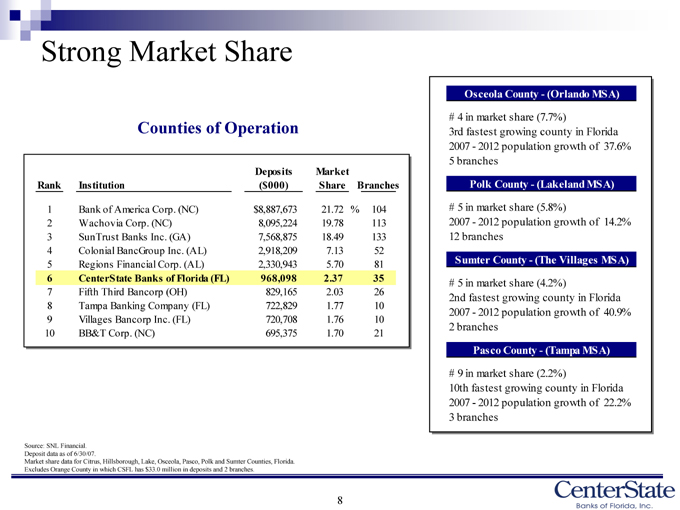

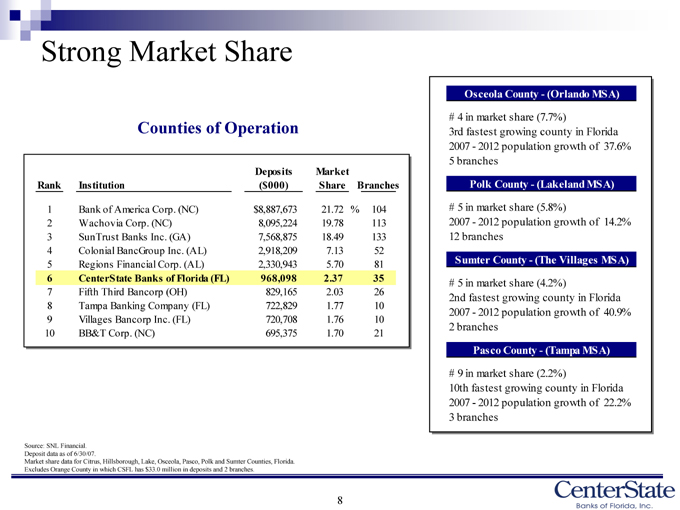

Strong Market Share

Counties of Operation

Deposits

Market

Rank

Institution

($

000)

ShareBranches

1

Bank of America Corp. (NC)

$8,887,673

21.72%

104

2

Wachovia Corp. (NC)

8,095,224

19.78

113

3

SunTrust Banks Inc. (GA)

7,568,875

18.49

133

4

Colonial BancGroup Inc. (AL)

2,918,209

7.13

52

5

Regions Financial Corp. (AL)

2,330,943

5.70

81

6

CenterState Banks of Florida (FL)

968,098

2.37

35

7

Fifth Third Bancorp (OH)

829,165

2.03

26

8

Tampa Banking Company (FL)

722,829

1.77

10

9

Villages Bancorp Inc. (FL)

720,708

1.76

10

10

BB&T Corp. (NC)

695,375

1.70

21

Source: SNL Financial. Deposit data as of 6/30/07.

Market share data for Citrus, Hillsborough, Lake, Osceola, Pasco, Polk and Sumter Counties, Florida. Excludes Orange County in which CSFL has $33.0 million in deposits and 2 branches.

Osceola County—(Orlando MSA)

# 4 in market share (7.7%)

3rd fastest growing county in Florida 2007—2012 population growth of 37.6% 5 branches

Polk County—(Lakeland MSA)

# 5 in market share (5.8%)

2007—2012 population growth of 14.2% 12 branches

Sumter County—(The Villages MSA)

# 5 in market share (4.2%)

2nd fastest growing county in Florida 2007—2012 population growth of 40.9% 2 branches

Pasco County—(Tampa MSA)

# 9 in market share (2.2%)

10th fastest growing county in Florida 2007—2012 population growth of 22.2% 3 branches

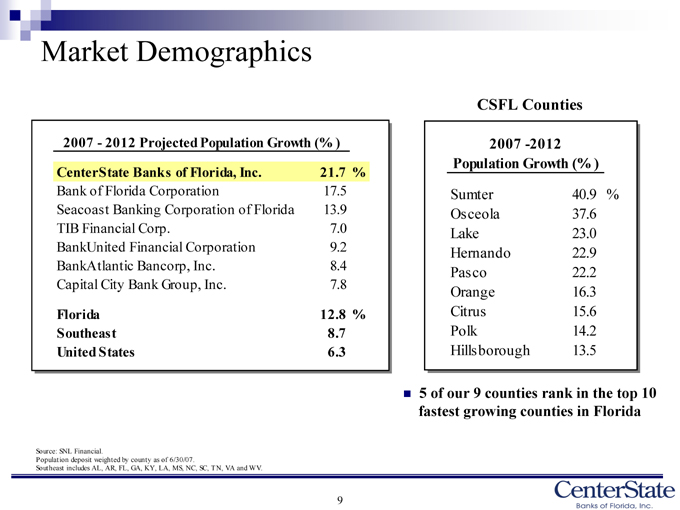

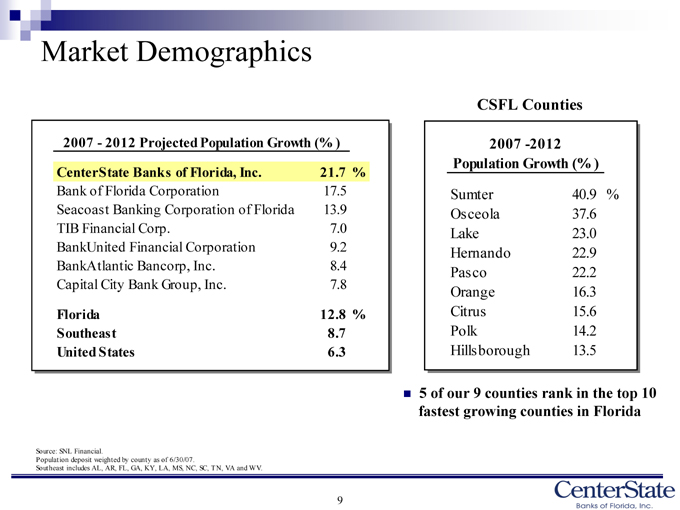

Market Demographics

2007—2012 Projected Population Growth (% )

CenterState Banks of Florida, Inc. 21.7 %

Bank of Florida Corporation 17.5

Seacoast Banking Corporation of Florida 13.9

TIB Financial Corp. 7.0

BankUnited Financial Corporation 9.2

BankAtlantic Bancorp, Inc. 8.4

Capital City Bank Group, Inc. 7.8

Florida 12.8 %

Southeast 8.7

United States 6.3

CSFL Counties

2007 -2012

Population Growth (% )

Sumter 40.9 %

Osceola 37.6

Lake 23.0

Hernando 22.9

Pasco 22.2

Orange 16.3

Citrus 15.6

Polk 14.2

Hillsborough 13.5

5 | | of our 9 counties rank in the top 10 fastest growing counties in Florida |

Source: SNL Financial.

Population deposit weighted by county as of 6/30/07.

Southeast includes AL, AR, FL, GA, KY, LA, MS, NC, SC, TN, VA and WV.

9

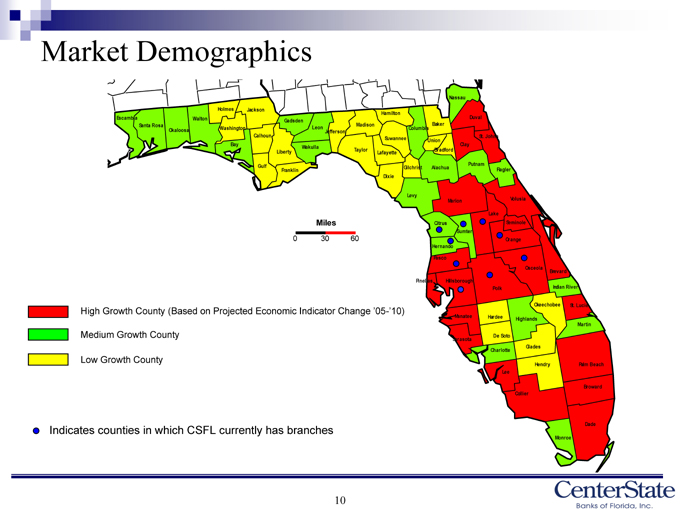

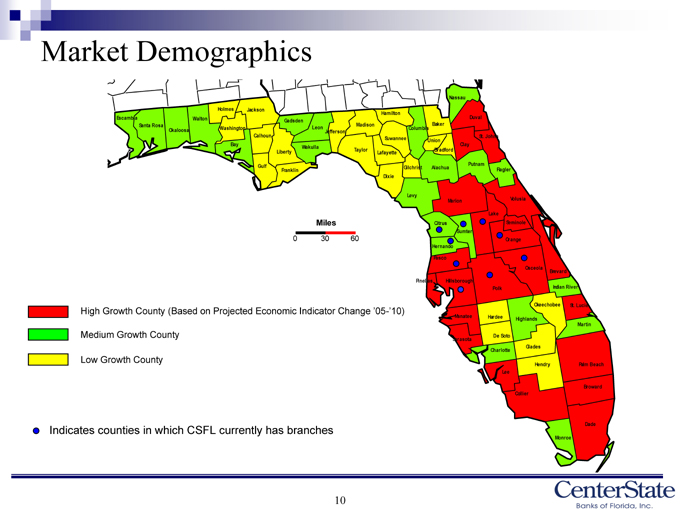

Market Demographics

High Growth County (Based on Projected Economic Indicator Change ‘05-’10)

Medium Growth County

Low Growth County

Indicates counties in which CSFL currently has branches

10

Operating Results

11

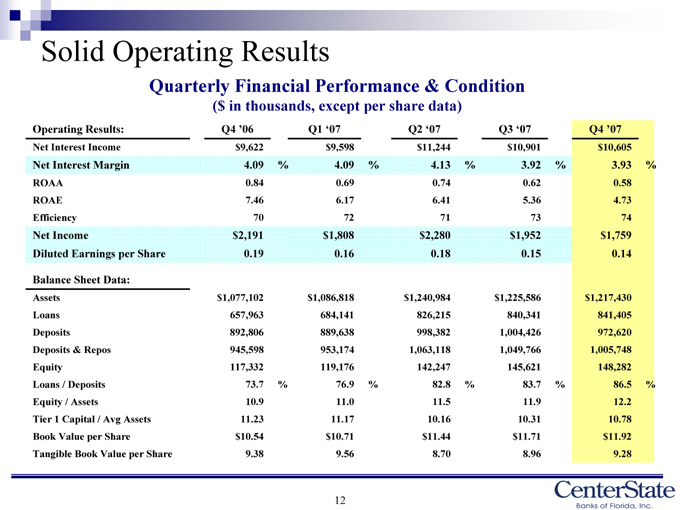

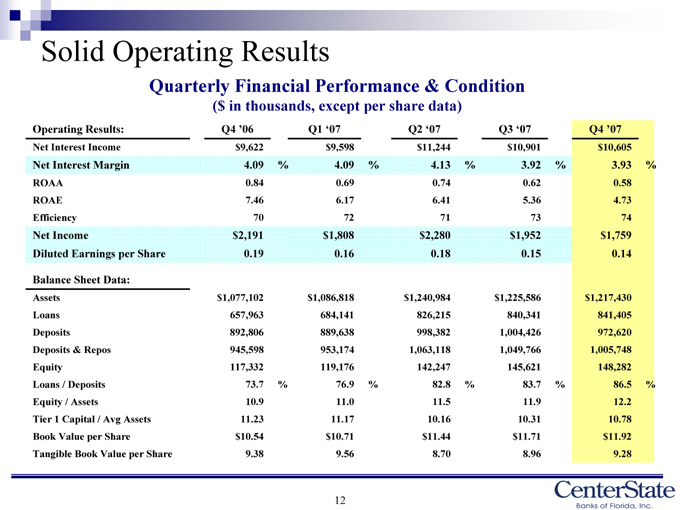

Solid Operating Results

Quarterly Financial Performance & Condition

($ in thousands, except per share data)

Operating Results: Q4 ‘06 Q1 ‘07 Q2 ‘07 Q3 ‘07 Q4 ‘07

Net Interest Income $ 9,622 $ 9,598 $ 11,244 $ 10,901 $ 10,605

Net Interest Margin 4.09 % 4.09 % 4.13 % 3.92 % 3.93 %

ROAA 0.84 0.69 0.74 0.62 0.58

ROAE 7.46 6.17 6.41 5.36 4.73

Efficiency 70 72 71 73 74

Net Income $1,808 $2,191 $ 2,280 $ 1,952 $ 1,759

Diluted Earnings per Share 0.19 0.16 0.18 0.15 0.14

Balance Sheet Data:

Assets $ 1,077,102 $ 1,086,818 $ 1,240,984 $ 1,225,586 $ 1,217,430

Loans 657,963 684,141 826,215 840,341 841,405

Deposits 892,806 889,638 998,382 1,004,426 972,620

Deposits & Repos 945,598 953,174 1,063,118 1,049,766 1,005,748

Equity 117,332 119,176 142,247 145,621 148,282

Loans / Deposits 73.7 % 76.9 % 82.8 % 83.7 % 86.5 %

Equity / Assets 10.9 11.0 11.5 11.9 12.2

Tier 1 Capital / Avg Assets 11.23 11.17 10.16 10.31 10.78

Book Value per Share $ 10.54 $ 10.71 $ 11.44 $ 11.71 $ 11.92

Tangible Book Value per Share 9.38 9.56 8.70 8.96 9.28

12

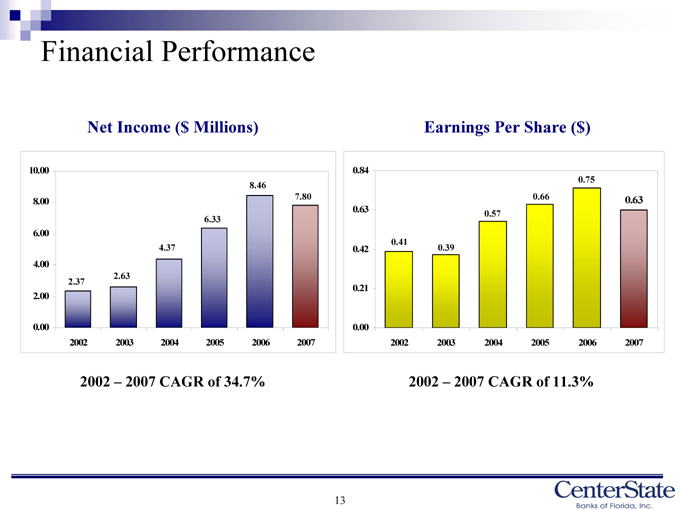

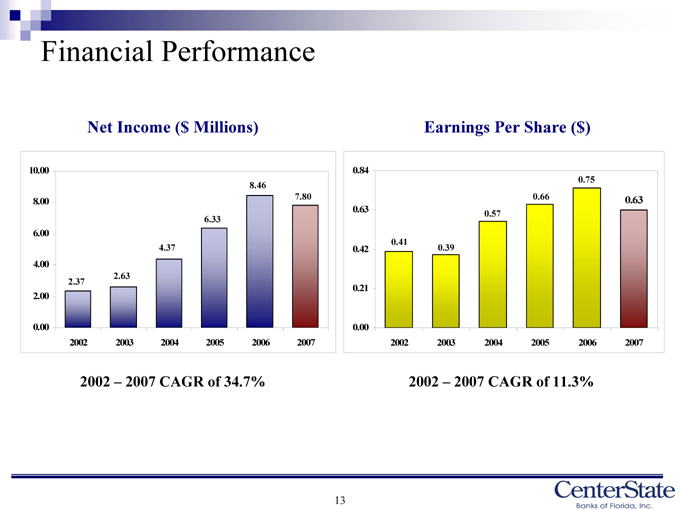

Financial Performance

Net Income ($ Millions)

10.00 8.00 6.00 4.00 2.00 0.00

2.37

2002

2.63

2003

4.37

2004

6.33

2005

8.46

2006

7.80

2007

Earnings Per Share ($)

0.84

0.63

0.42 0.21 0.00

0.41

2002

0.39

2003

0.57

2004

0.66

2005

0.75

2006

0.63

2007

2002 – 2007 CAGR of 34.7%

2002 – 2007 CAGR of 11.3%

13

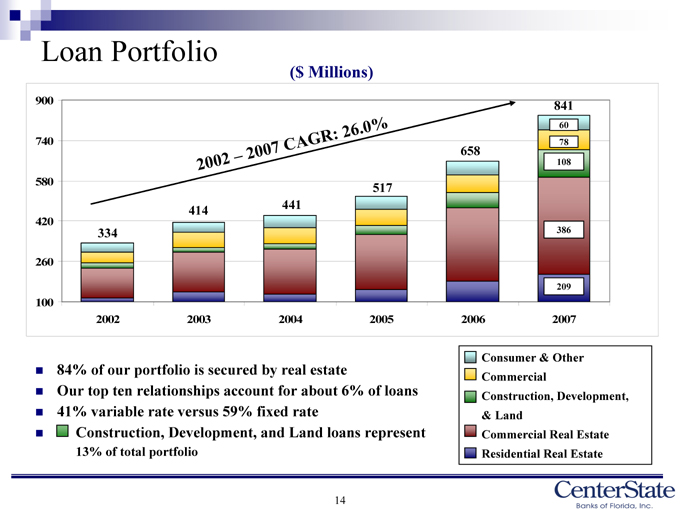

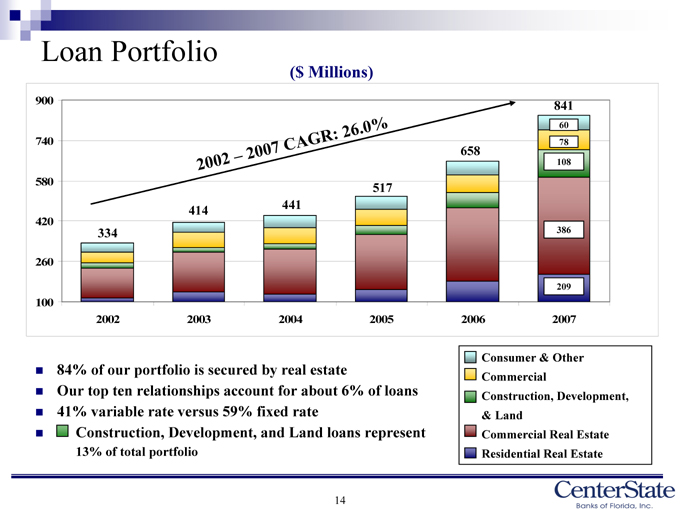

Loan Portfolio

($ Millions)

900 740 580 420 260 100

C A

G

R

:

.

0 %

334

2002

414

2003

441

2004

517

2005

658

2006

841

60 78

108 386 209

2007

84% of our portfolio is secured by real estate

Our top ten relationships account for about 6% of loans

41% variable rate versus 59% fixed rate

Construction, Development, and Land loans represent

13% of total portfolio

Consumer & Other

Commercial

Construction, Development, & Land

Commercial Real Estate

Residential Real Estate

14

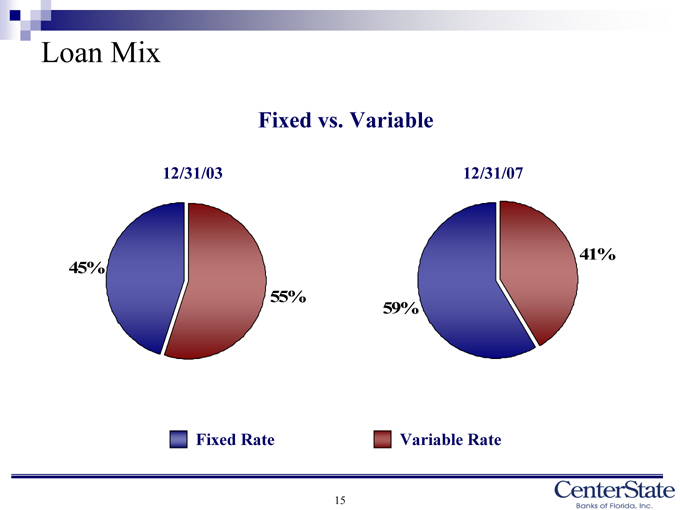

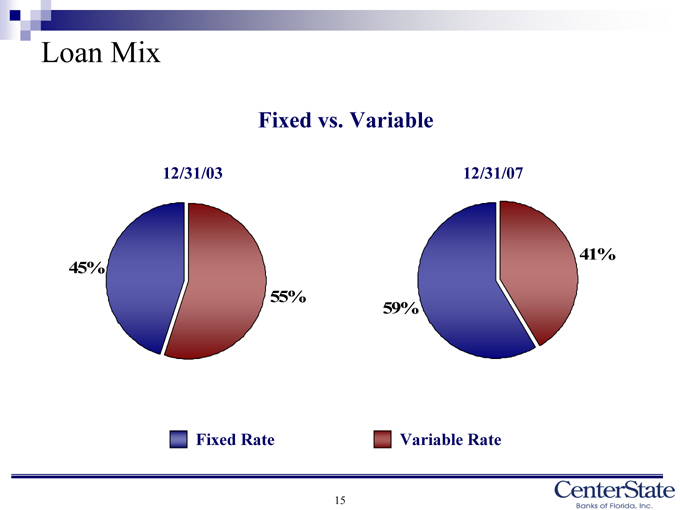

Loan Mix

Fixed vs. Variable

12/31/03

45%

55%

12/31/07

59%

41%

Fixed Rate

Variable Rate

15

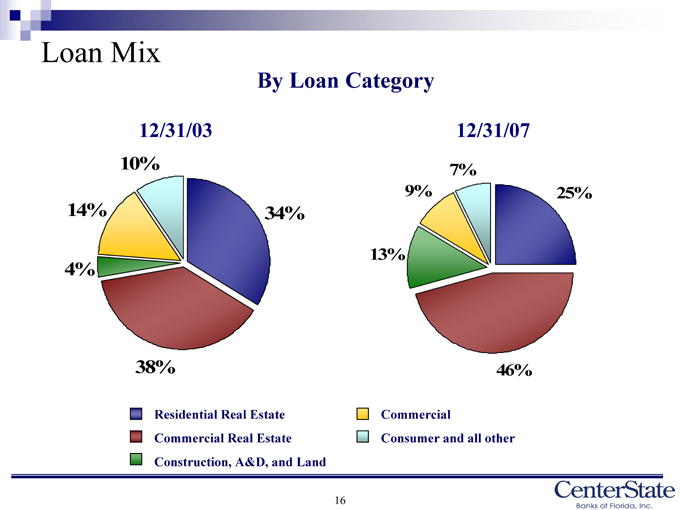

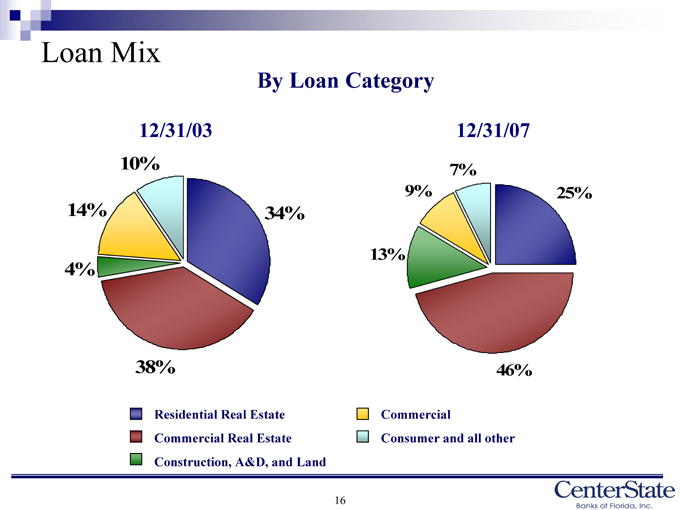

Loan Mix

By Loan Category

12/31/03

10%

14%

4%

34%

38%

12/31/07

7%

9%

13%

25%

46%

Residential Real Estate

Commercial Real Estate

Construction, A&D, and Land

Commercial

Consumer and all other

16

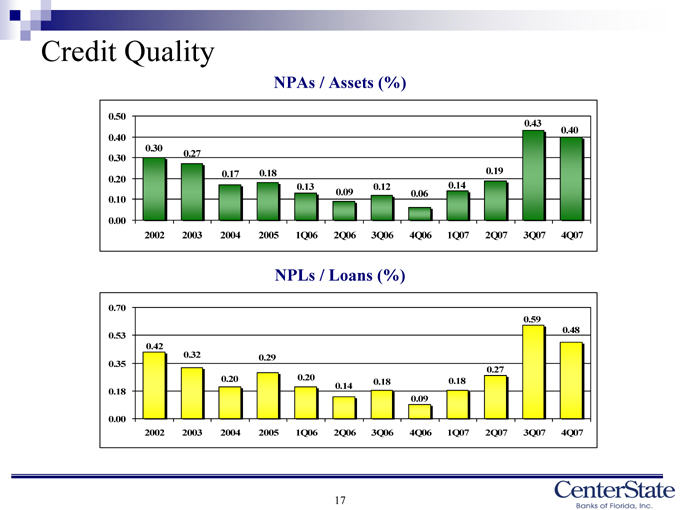

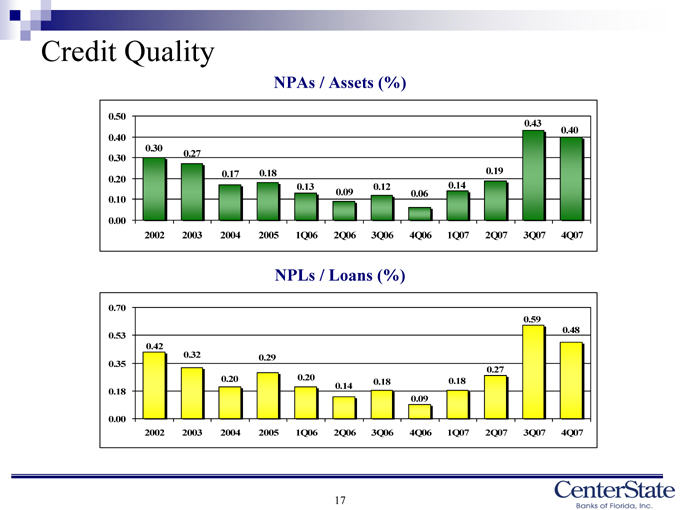

Credit Quality

NPAs / Assets (%)

0.50 0.40 0.30 0.20 0.10 0.00

0.30 0.27

0.17 0.18

0.13 0.09

0.12 0.06

0.19 0.14

0.43 0.40

2002 2003 2004 2005 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07

NPLs / Loans (%)

0.70 0.53 0.35 0.18 0.00

0.59 0.48 0.42 0.32 0.29 0.27 0.20 0.20 0.18 0.18 0.09

2002 2003 2004 2005 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07

17

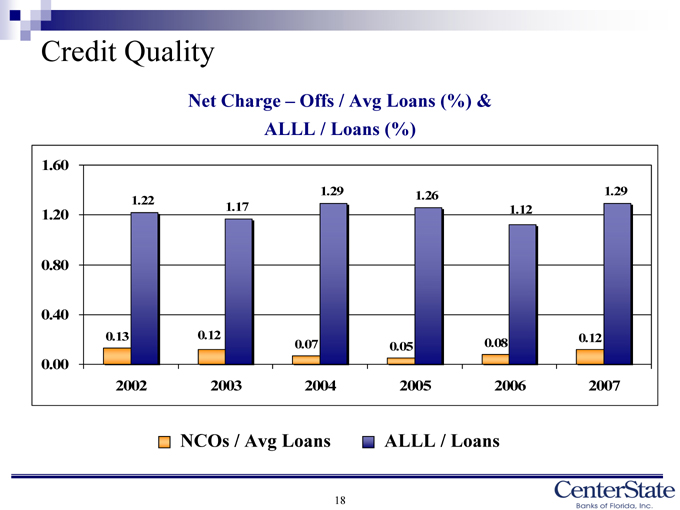

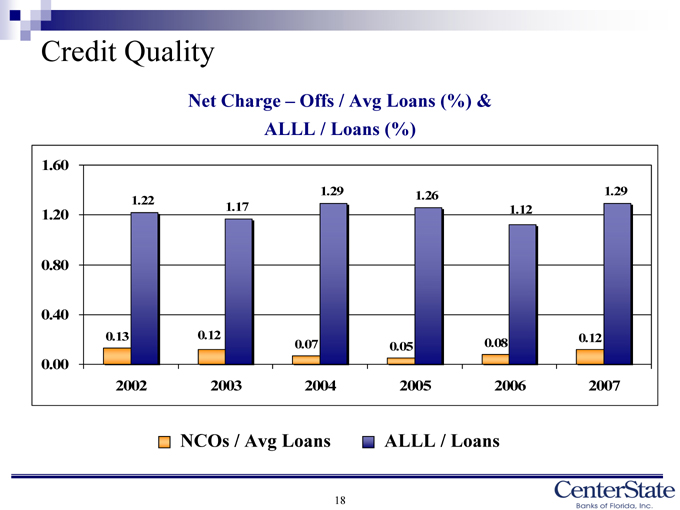

Credit Quality

Net Charge – Offs / Avg Loans (%) & ALLL / Loans (%)

1.60 1.20 0.80 0.40 0.00

0.13

1.22

0.12

1.17

0.07

1.29

0.05

1.26

0.08

1.12

0.12

1.29

2002 2003 2004 2005 2006 2007

NCOs / Avg Loans

ALLL / Loans

18

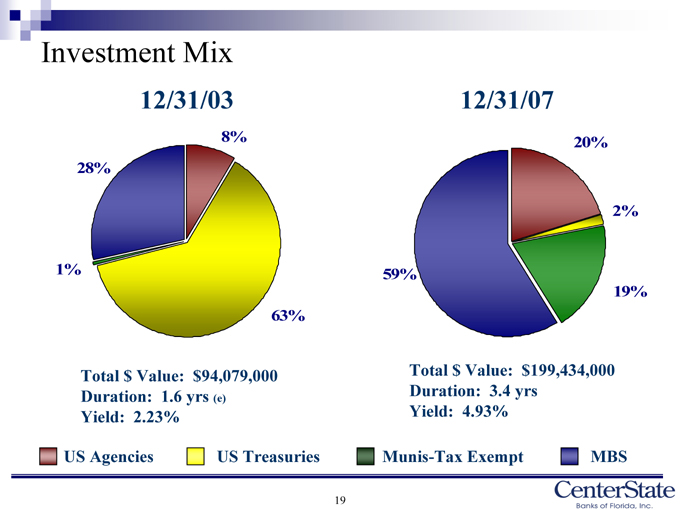

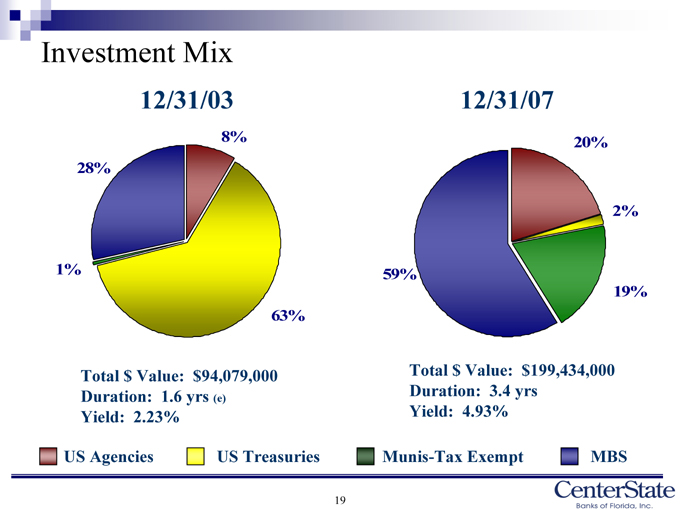

Investment Mix

12/31/03

8%

28%

1%

63%

Total $ Value: $94,079,000 Duration: 1.6 yrs (e) Yield: 2.23%

US Agencies

US Treasuries

12/31/07

20%

2%

19%

59%

Total $ Value: $199,434,000 Duration: 3.4 yrs Yield: 4.93%

Munis-Tax Exempt

MBS

19

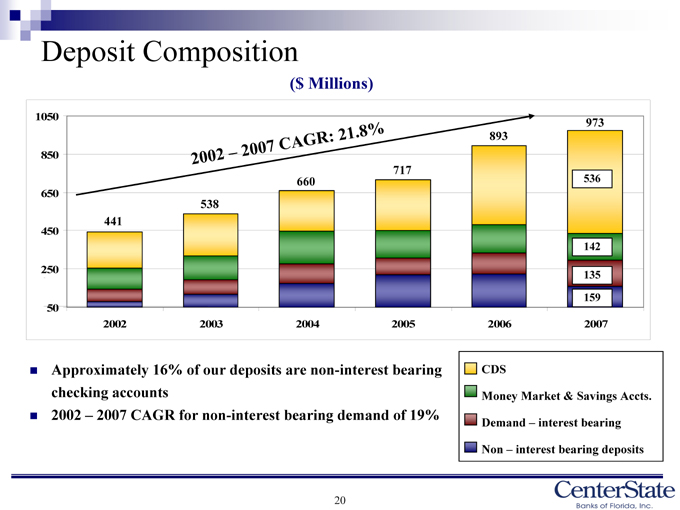

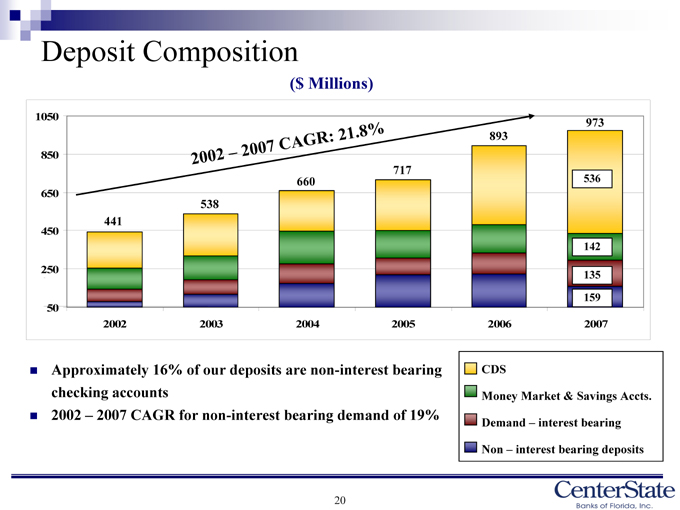

Deposit Composition

($ Millions)

1050 850 650 450 250 50

C A

G

R

:

.

441

2002

538

2003

660

2004

717

2005

893

2006

973

536

142

135 159

2007

Approximately 16% of our deposits are non-interest bearing checking accounts

2002 – 2007 CAGR for non-interest bearing demand of 19%

CDS

Money Market & Savings Accts.

Demand – interest bearing

Non – interest bearing deposits

20

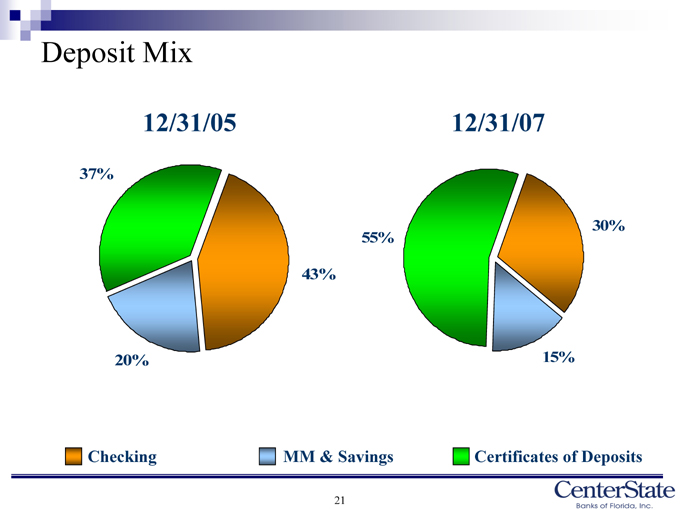

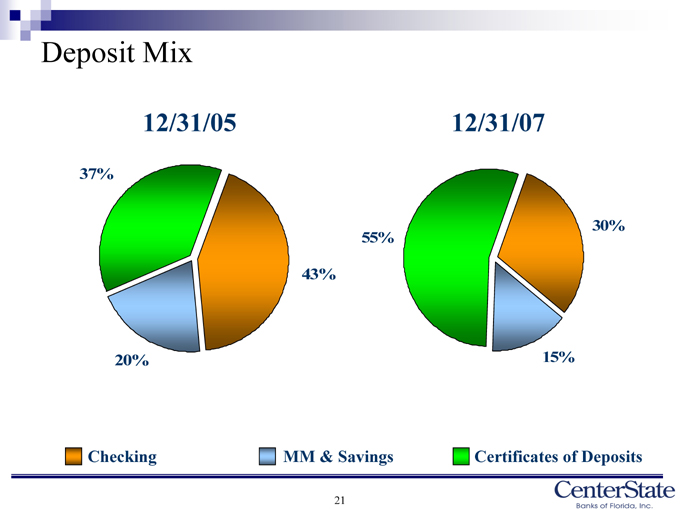

Deposit Mix

12/31/05

37%

20%

43%

12/31/07

55%

30%

15%

Checking

MM & Savings

Certificates of Deposits

21

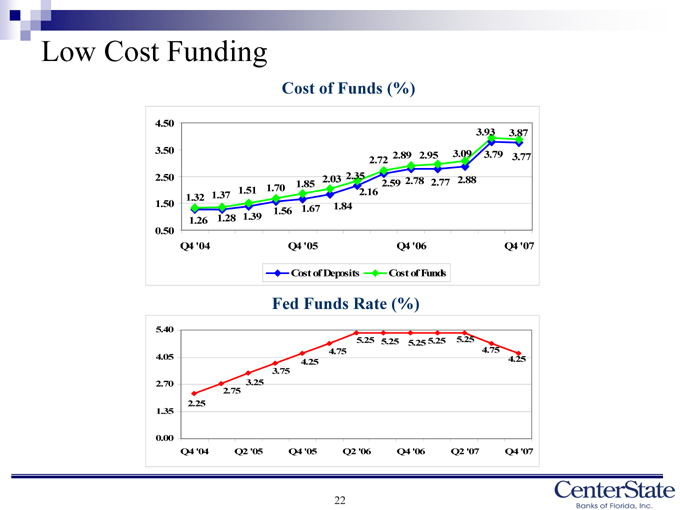

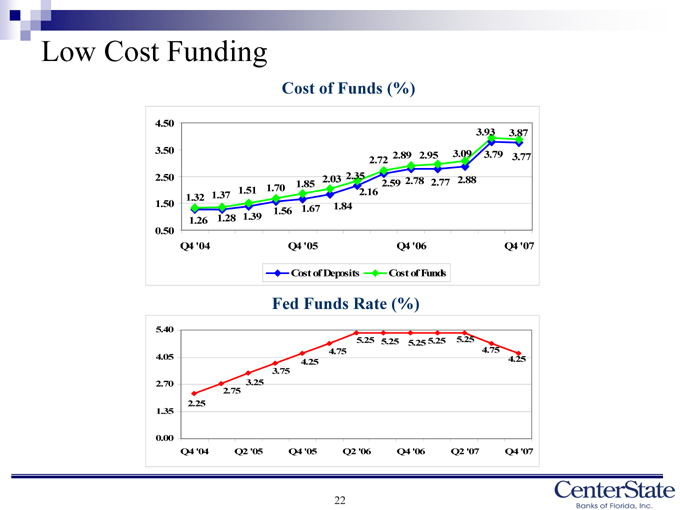

Low Cost Funding

Cost of Funds (%)

4.50 3.50 2.50 1.50 0.50

1.32

1.37

1.51

1.70

1.85

2.03

2.35

2.72

2.89

2.95

3.09

3.93

3.87

1.26

1.28

1.39

1.56

1.67

1.84

2.16

2.59

2.78

2.77

2.88

3.79

3.77

Q4 ‘04

Q4 ‘05

Q4 ‘06

Q4 ‘07

Cost of Deposits

Cost of Funds

Fed Funds Rate (%)

5.40 4.05 2.70 1.35 0.00

2.25

2.75

3.25

3.75

4.25

4.75

5.25

5.25

5.25

5.25

5.25

4.75

4.25

Q4 ‘04

Q2 ‘05

Q4 ‘05

Q2 ‘06

Q4 ‘06

Q2 ‘07

Q4 ‘07

22

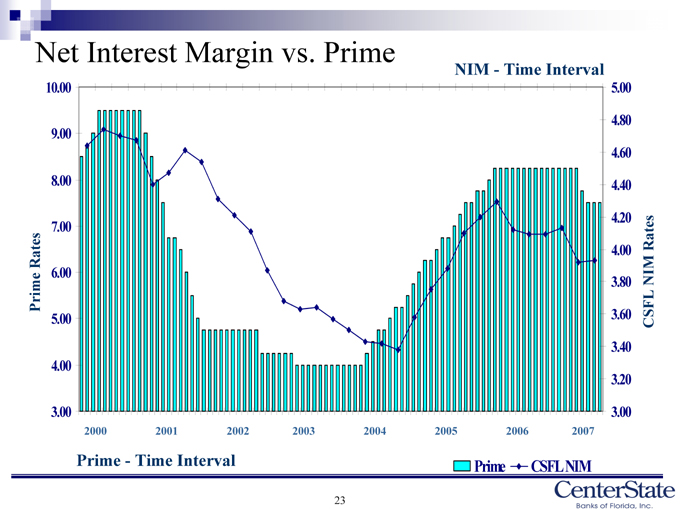

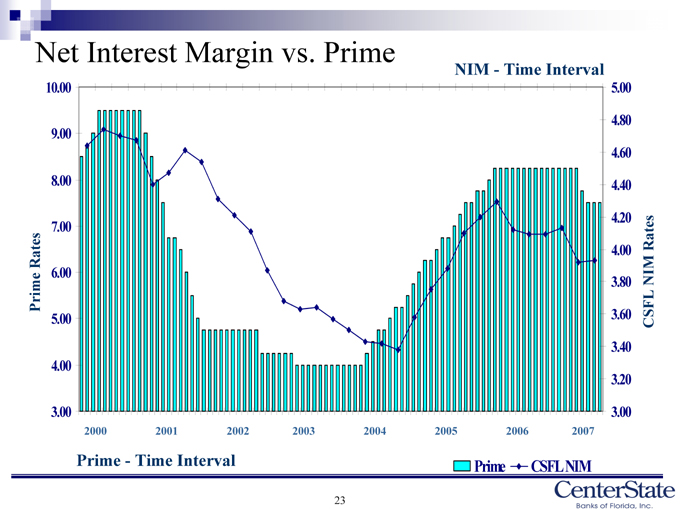

Net Interest Margin vs. Prime

NIM—Time Interval

10.00 9.00 8.00 7.00 6.00 5.00 4.00 3.00

2000 2001 2002 2003 2004 2005 2006 2007

5.00 4.80 4.60 4.40 4.20 4.00 3.80 3.60 3.40 3.20 3.00

CSFL NIM Rates

Prime—Time Interval

Prime CSFL NIM

23

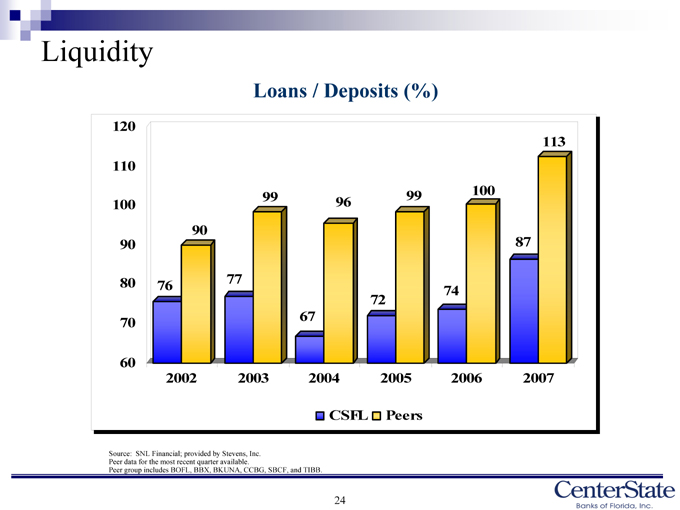

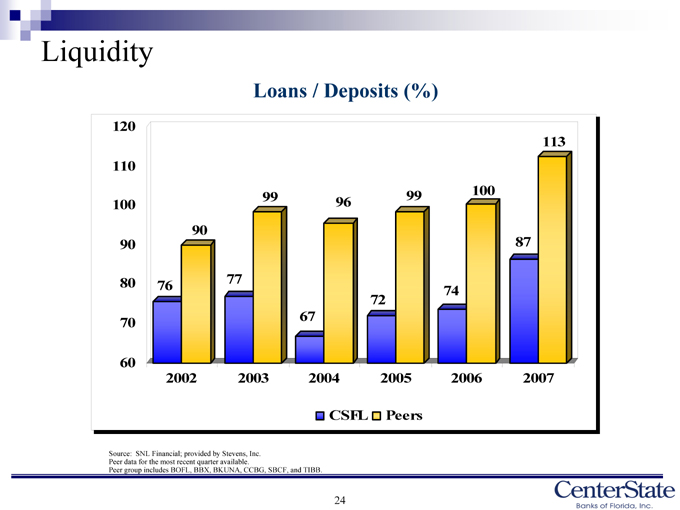

Liquidity

Loans / Deposits (%)

120 110 100 90 80 70 60

76

90

77

99

67

96

72

99

74

100

87

113

2002 2003 2004 2005 2006 2007

CSFL

Peers

Source: SNL Financial; provided by Stevens, Inc. Peer data for the most recent quarter available.

Peer group includes BOFL, BBX, BKUNA, CCBG, SBCF, and TIBB.

24

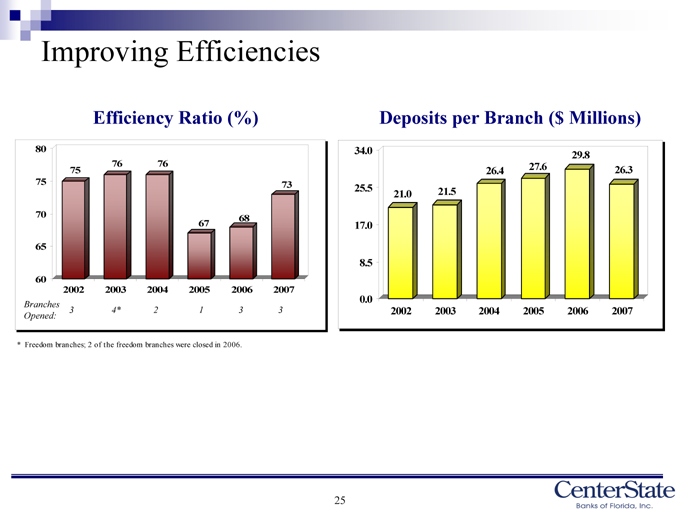

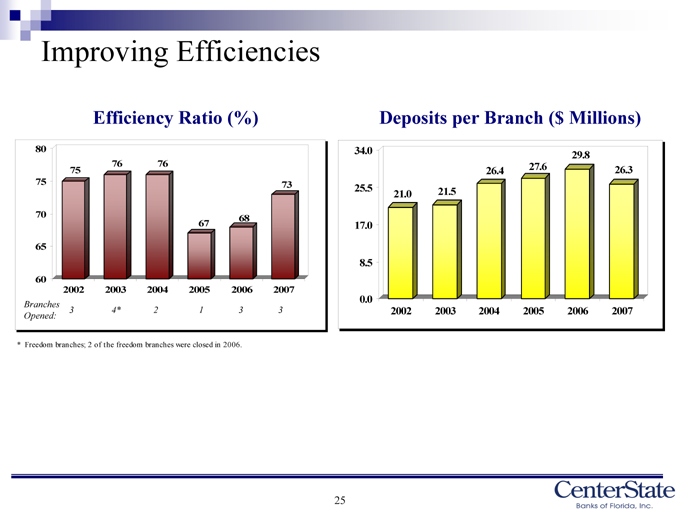

Improving Efficiencies

Efficiency Ratio (%)

80 75 70 65 60

75

2002

76

2003

76

2004

67

2005

68

2006

73

2007

Branches

Deposits per Branch ($ Millions)

34.0 25.5 17.0 8.5 0.0

21.0

2002

21.5

2003

26.4

2004

27.6

2005

29.8

2006

26.3

2007

* | | Freedom branches; 2 of the freedom branches were closed in 2006. |

25

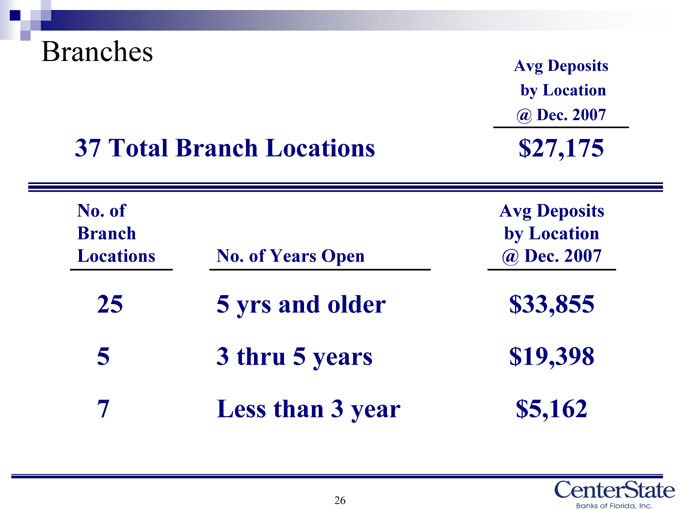

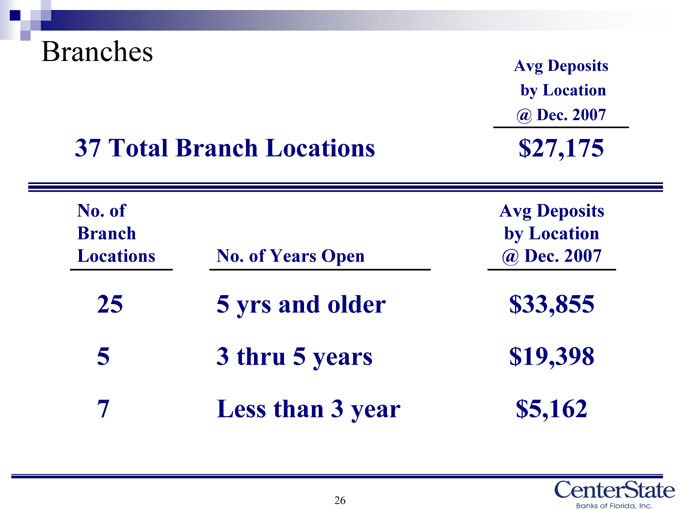

Branches

Avg Deposits by Location @ Dec. 2007

37 Total Branch Locations $27,175

No. of Avg Deposits

Branch by Location

Locations No. of Years Open @ Dec. 2007

25 5 yrs and older $ 33,855

5 | | 3 thru 5 years $ 19,398 |

7 | | Less than 3 year $ 5,162 |

26

Investment Highlights

27

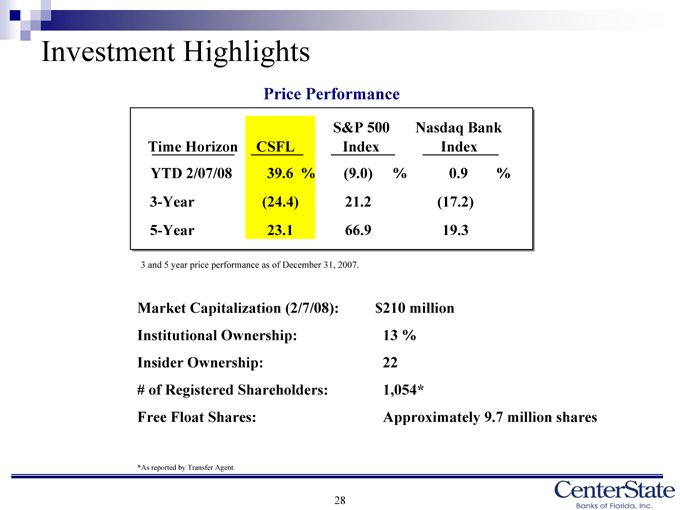

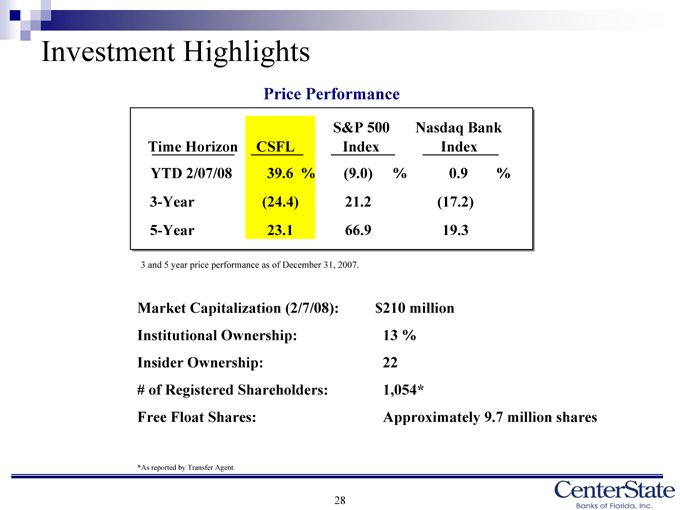

Investment Highlights

Price Performance

S&P 500 Nasdaq Bank

Time Horizon CSFL Index Index

YTD 2/07/08 39.6 % (9.0) % 0.9 %

3-Year (24.4) 21.2 (17.2)

5-Year 23.1 66.9 19.3

3 | | and 5 year price performance as of December 31, 2007. |

Market Capitalization (2/7/08): $210 million

Institutional Ownership: 13 %

Insider Ownership: 22

# of Registered Shareholders: 1,054*

Free Float Shares: Approximately 9.7 million shares

*As reported by Transfer Agent.

28

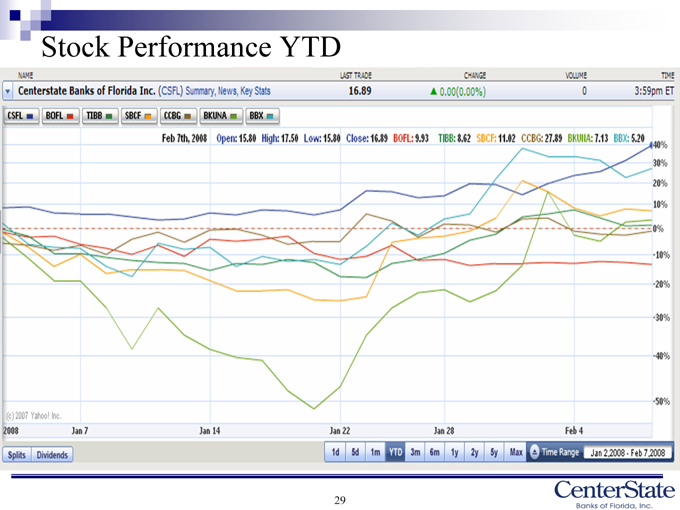

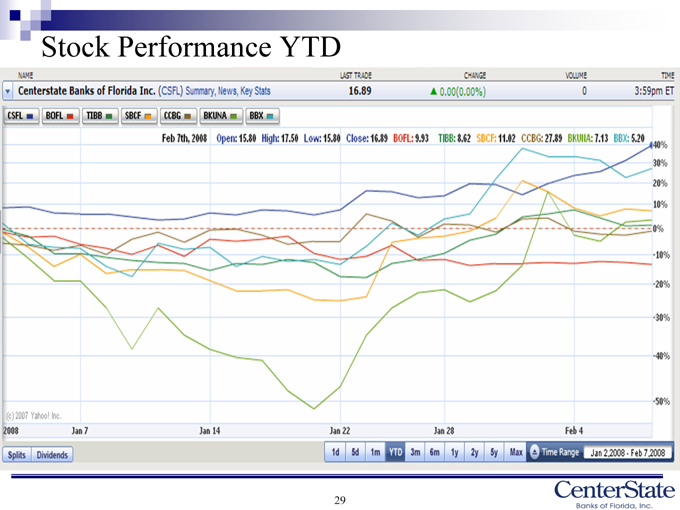

Stock Performance YTD

29

Building Shareholder Value

Dedicated Employees

Sustainable Earnings Growth

Credit Quality

Growth Markets

Vision

Focus

Nothing special – just a candid straight-forward culture, realistic about our business

30

CenterState Banks of Florida, Inc.

NASDAQ: CSFL

February 2007