|

Exhibit 99.1

|

Exhibit 99.1

Investor Presentation

March 7, 2012

Forward Looking Statement

This presentation contains forward-looking statements, as defined by Federal

Securities Laws, relating to present or future trends or factors affecting the operations, markets and products of CenterState Banks, Inc. (CSFL). These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to CSFL’s most recent Form 10-Q and Form 10-K filed with the Securities Exchange Commission.

CSFL undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

Table of Contents

Corporate Overview 4—5

Opportunistic Through the Crisis 6—11

Credit Quality & the Florida Economy 12—16

Profitability Metrics 17

Summary 18

Appendix 19—25

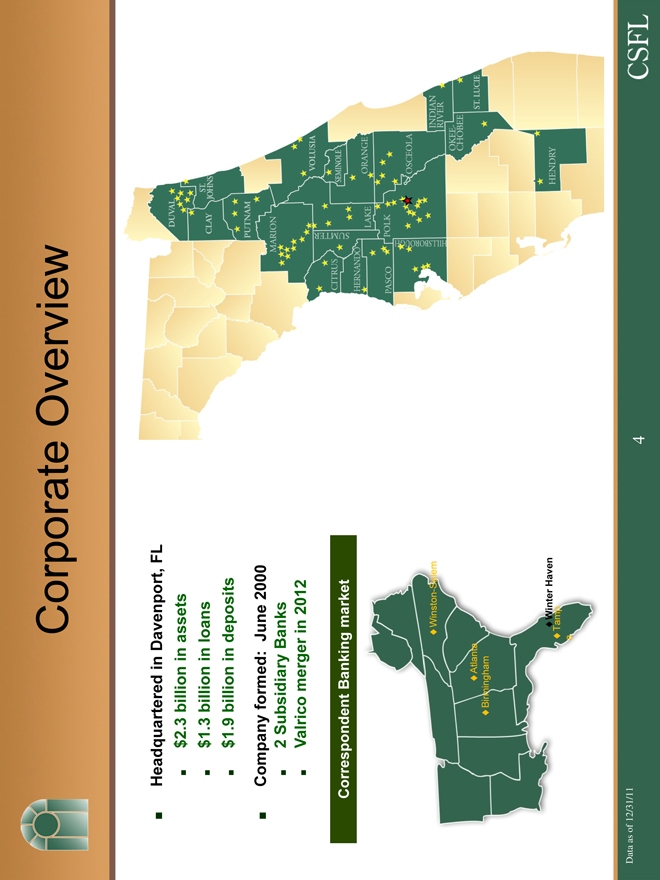

Corporate Overview

Headquartered in Davenport, FL

$2.3 billion in assets

$1.3 billion in loans

$1.9 billion in deposits

Company formed: June 2000

Valrico merger in 2012

Correspondent Banking market

Winston-Salem

Atlanta

Birmingham

Winter Haven

Tampa

Data as of 12/31/11

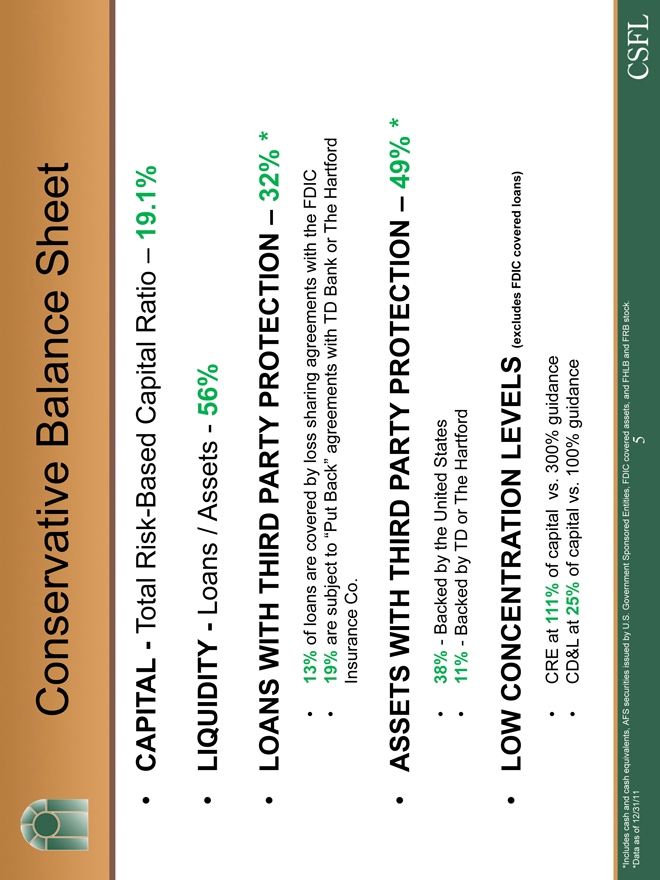

Conservative Balance Sheet

CAPITAL—Total Risk-Based Capital Ratio – 19.1%

LIQUIDITY—Loans / Assets—56%

LOANS WITH THIRD PARTY PROTECTION – 32% *

13% of loans are covered by loss sharing agreements with the FDIC

19% are subject to “Put Back” agreements with TD Bank or The Hartford

Insurance Co.

ASSETS WITH THIRD PARTY PROTECTION – 49% *

38%—Backed by the United States

11%—Backed by TD or The Hartford

LOW CONCENTRATION LEVELS (excludes FDIC covered loans)

CRE at 111% of capital vs. 300% guidance

CD&L at 25% of capital vs. 100% guidance

*Includes cash and cash equivalents, AFS securities issued by U.S. Government Sponsored Entities, FDIC covered assets, and FHLB and FRB stock.

*Data as of 12/31/11

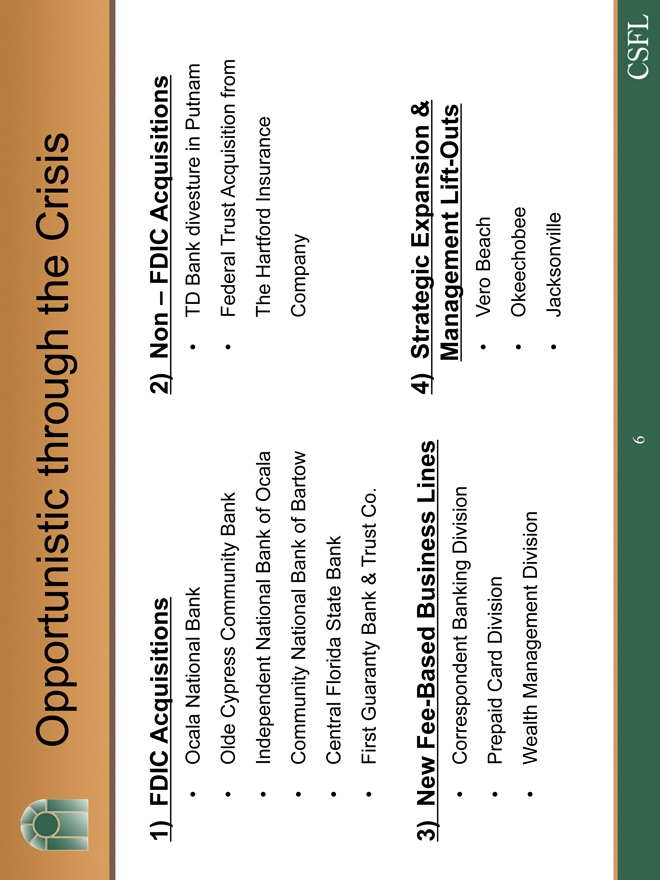

Opportunistic through the Crisis

1) FDIC Acquisitions

Ocala National Bank

Olde Cypress Community Bank

Independent National Bank of Ocala

Community National Bank of Bartow

Central Florida State Bank

First Guaranty Bank & Trust Co.

2) New Fee-Based Business Lines

Correspondent Banking Division

Prepaid Card Division

Wealth Management Division

3) Non – FDIC Acquisitions

TD Bank divesture in Putnam

Federal Trust Acquisition from The Hartford Insurance

Company

47) Strategic Expansion & Management Lift-Outs

Vero Beach

Okeechobee

Jacksonville

Proven History of Acquisitions

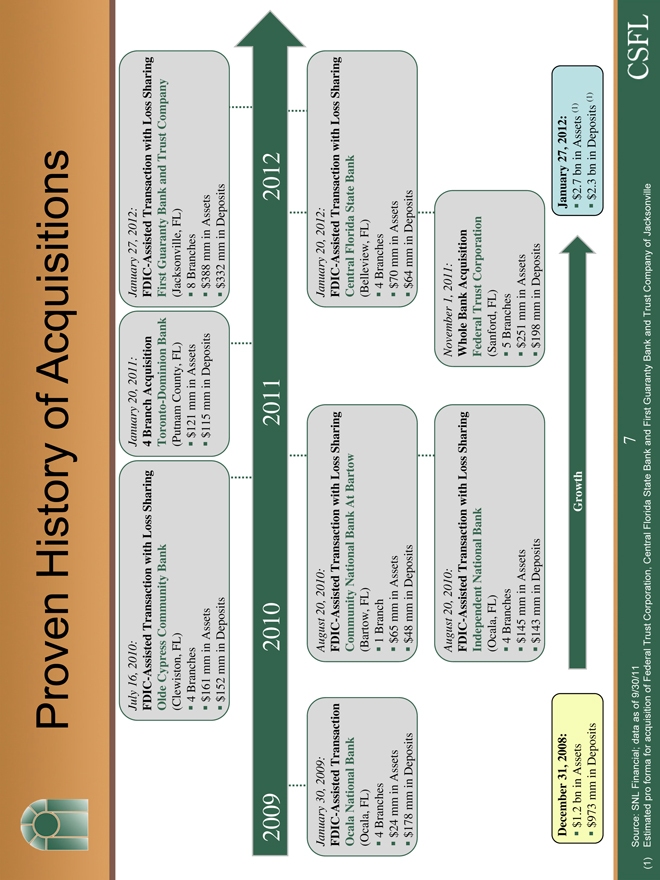

July 16, 2010:

FDIC-Assisted Transaction with Loss Sharing Olde Cypress Community Bank

(Clewiston, FL) 4 Branches $161 mm in Assets $152 mm in Deposits

January 20, 2011:

4 | | Branch Acquisition Toronto-Dominion Bank |

(Putnam County, FL) $121 mm in Assets $115 mm in Deposits

January 27, 2012:

FDIC-Assisted Transaction with Loss Sharing First Guaranty Bank and Trust Company

(Jacksonville, FL) 8 Branches $388 mm in Assets $332 mm in Deposits

2009 2010 2011 2012

January 30, 2009:

FDIC-Assisted Transaction Ocala National Bank

(Ocala, FL) 4 Branches $24 mm in Assets $178 mm in Deposits

August 20, 2010:

FDIC-Assisted Transaction with Loss Sharing Community National Bank At Bartow

(Bartow, FL) 1 Branch $65 mm in Assets $48 mm in Deposits

January 20, 2012:

FDIC-Assisted Transaction with Loss Sharing Central Florida State Bank

(Belleview, FL) 4 Branches $70 mm in Assets $64 mm in Deposits

August 20, 2010:

FDIC-Assisted Transaction with Loss Sharing Independent National Bank

(Ocala, FL)

4 | | Branches $145 mm in Assets $143 mm in Deposits |

November 1, 2011:

Whole Bank Acquisition Federal Trust Corporation

(Sanford, FL)

5 | | Branches $251 mm in Assets $198 mm in Deposits |

January 27, 2012:

$2.7 bn in Assets (1) $2.3 bn in Deposits (1)

December 31, 2008:

$1.2 bn in Assets $973 mm in Deposits

Growth

Source: SNL Financial; data as of 9/30/11 7

(1) Estimated pro forma for acquisition of Federal Trust Corporation, Central Florida State Bank and First Guaranty Bank and Trust Company of Jacksonville

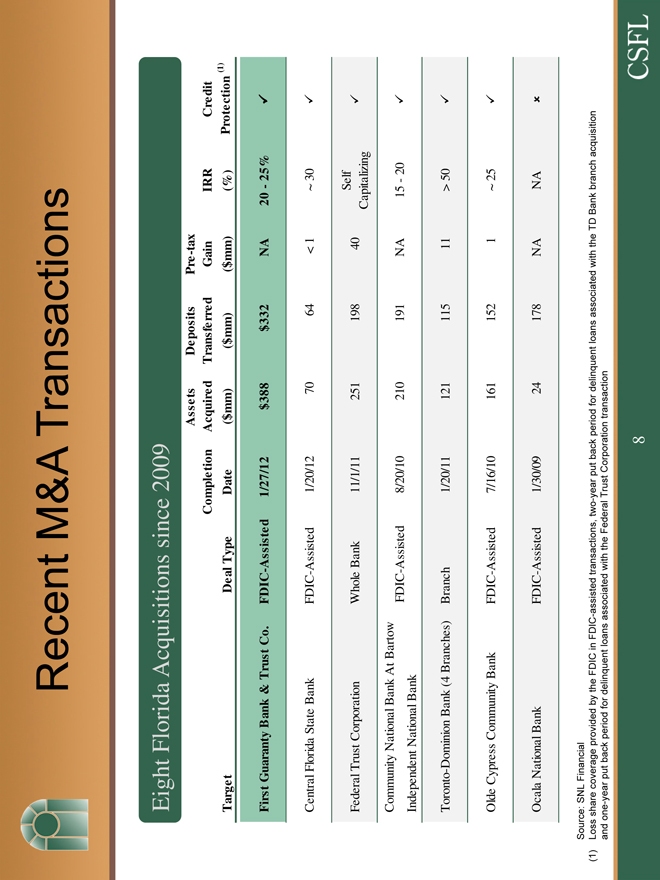

Recent M&A Transactions

Eight Florida Acquisitions since 2009

Assets Deposits Pre -tax

Completion Acquired Transferred Gain IRR Credit

Target Deal Type Date ($mm) ($mm) ($mm) (%) Protection (1)

First Guaranty Bank & Trust Co. FDIC-Assisted 1/27/12 $388 $332 NA 20—25%

Central Florida State Bank FDIC-Assisted 1/20/12 70 64 < 1 ~ 30

Self

Federal Trust Corporation Whole Bank 11/1/11 251 198 40

Capitalizing

Community National Bank At Bartow

FDIC-Assisted 8/20/10 210 191 NA 15—20

Independent National Bank

-Toronto Dominion Bank (4 Branches) Branch 1/20/11 121 115 11 > 50

Olde Cypress Community Bank FDIC-Assisted 7/16/10 161 152 1 ~ 25

Ocala National Bank FDIC-Assisted 1/30/09 24 178 NA NA

Source: SNL Financial

(1) Loss share coverage provided by the FDIC in FDIC-assisted transactions, two-year put back period for delinquent loans associated with the TD Bank branch acquisition and one-year put back period for delinquent loans associated with the Federal Trust Corporation transaction

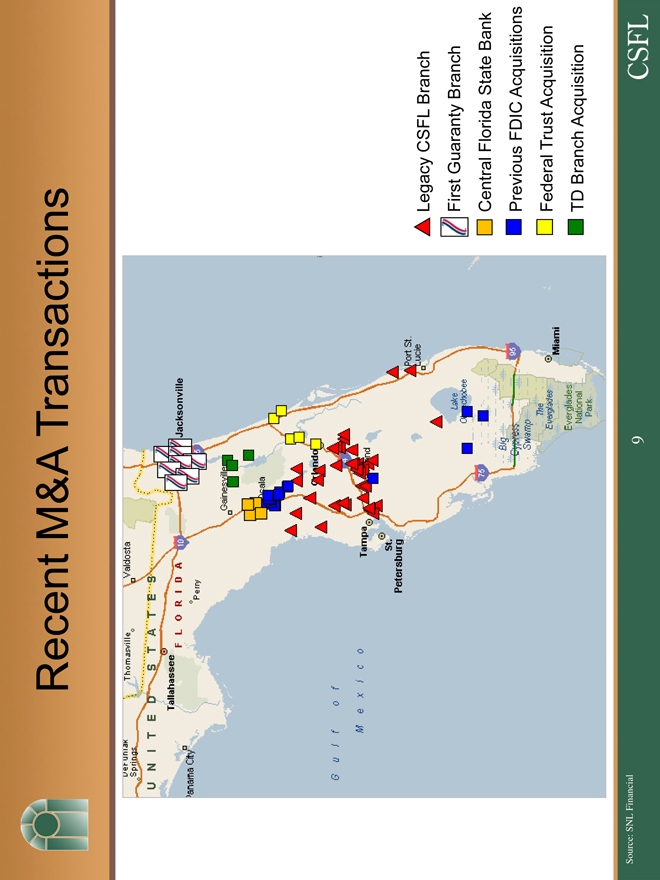

Recent M&A Transactions

Legacy CSFL Branch

First Guaranty Branch Central Florida State Bank

Previous FDIC Acquisitions

Federal Trust Acquisition TD Branch Acquisition

Source: SNL Financial 9

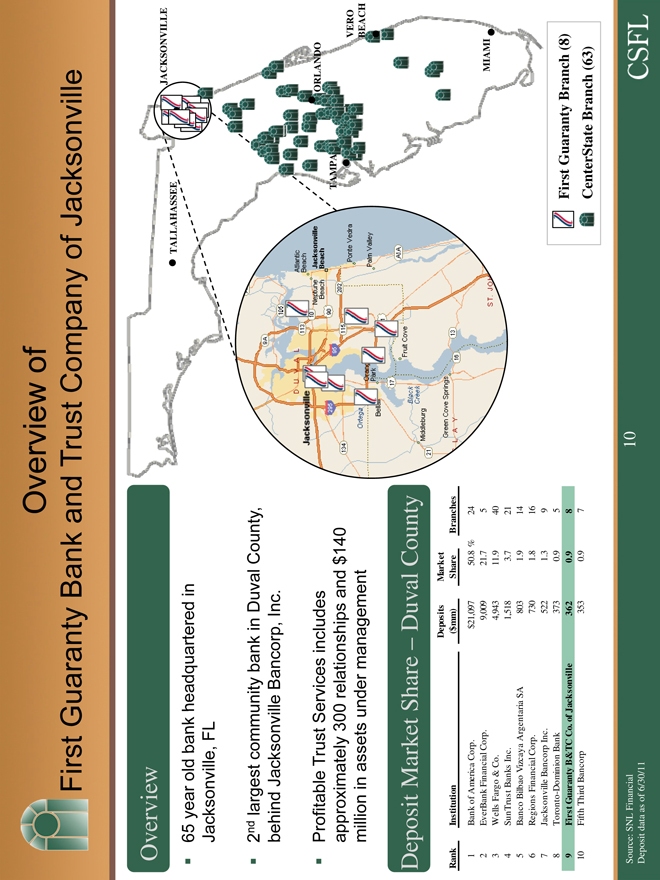

Overview of

First Guaranty Bank and Trust Company of Jacksonville

Rank Institution ($mm) Share Branches

1 Bank of America Corp. $21,097 50.8 % 24

2 EverBank Financial Corp. 9,009 21.7 5

3 Wells Fargo & Co. 4,943 11.9 40

4 SunTrust Banks Inc. 1,518 3.7 21

5 Banco Bilbao Vizcaya Argentaria SA 803 1.9 14

6 Regions Financial Corp. 730 1.8 16

7 Jacksonville Bancorp Inc. 522 1.3 9

8 Toronto-Dominion Bank 373 0.9 5

9 First Guaranty B&TC Co. of Jacksonville 362 0.9 8

10 Fifth Third Bancorp 353 0.9 7

Overview

65 year old bank headquartered in Jacksonville, FL

2nd largest community bank in Duval County, behind Jacksonville Bancorp, Inc.

Profitable Trust Services includes approximately 300 relationships and $140 million in assets under management

JACKSONVILLE TALLAHASSEE

ORLANDO TAMPA

VERO BEACH MIAMI

First Guaranty Branch (8)

CenterState Branch (63)

Source: SNL Financial Deposit data as of 6/30/11

Deposit Market Share — Duval County

Deposits Market

10

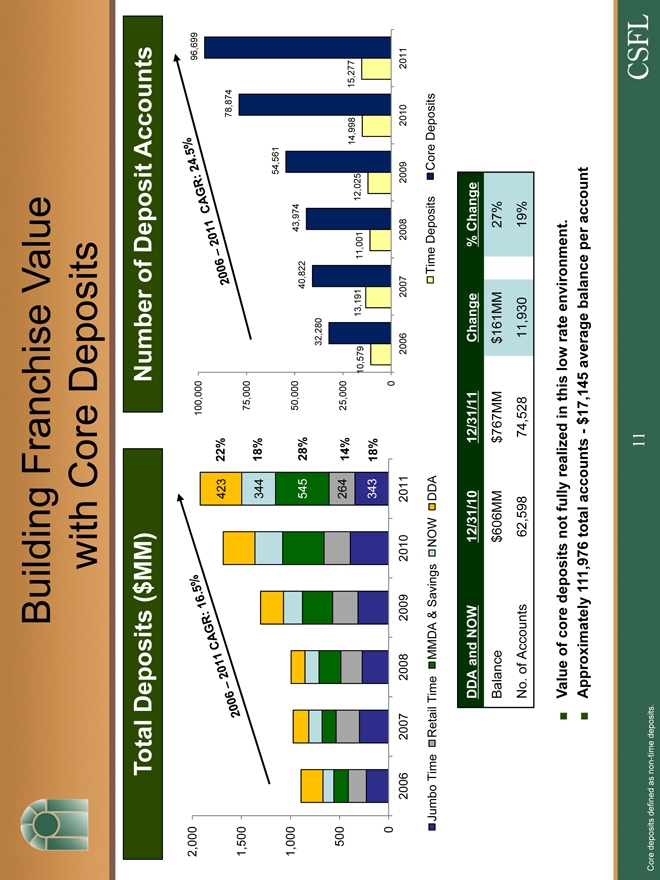

Building Franchise Value with Core Deposits

Total Deposits ($MM)

Number of Deposit Accounts

2,000

423 22%

1,500

344 18%

1,000

545 28%

500 264 14%

343 18%

0

2006 2007 2008 2009 2010 2011

100,000 96,699

78,874

75,000

54,561

50,000 43,974

40,822

32,280

25,000

14,998 15,277

10,579 13,191 11,001 12,025

0

2006 2007 2008 2009 2010 2011

Jumbo Time Retail Time MMDA & Savings NOW DDA Time Deposits Core Deposits

DDA and NOW 12/31/10 12/31/11 Change % Change

Balance $606MM $767MM $161MM 27%

No. of Accounts 62,598 74,528 11,930 19%

Value of core deposits not fully realized in this low rate environment.

Approximately 111,976 total accounts—$17,145 average balance per account

Core deposits defined as non-time deposits.

2006 – 2011 CAGR: 16.5%

2006 – 2011 CAGR: 24.5%

11

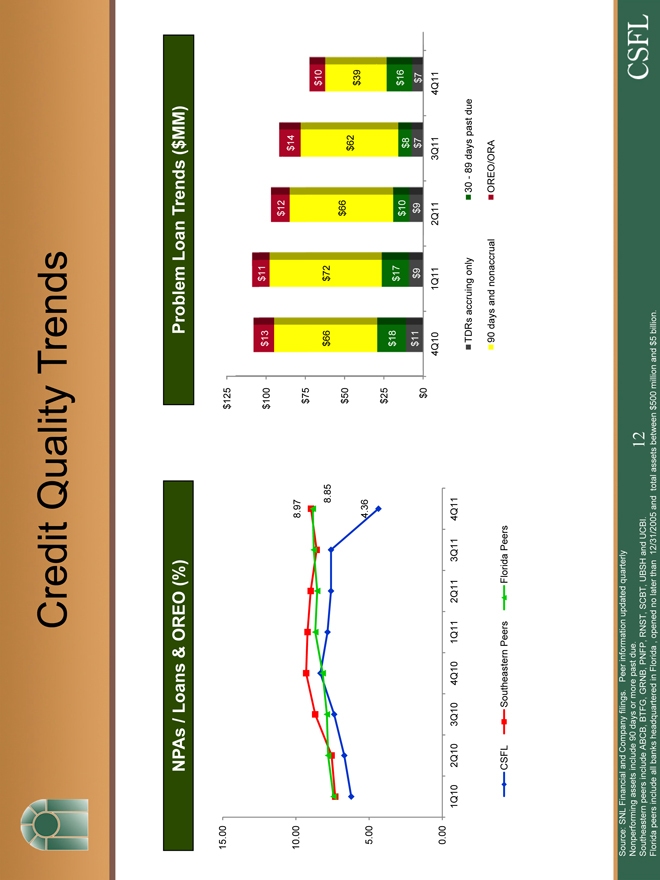

Credit Quality Trends

NPAs / Loans & OREO (%)

15.00

10.00 8.97

8.85

5.00 4.36

0.00

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11

Problem Loan Trends ($MM)

$125

$100 $13 $11

$12

$14

$75

$10

$66 $72

$50 $66 $62

$39

$25

$18 $17

$10 $8 $16

$0 $11 $9 $9 $7 $7

4Q10 1Q11 2Q11 3Q11 4Q11

TDRs accruing only 30—89 days past due

90 days and nonaccrual OREO/ORA

Source: SNL Financial and Company filings. Peer information updated quarterly

Nonperforming assets include 90 days or more past due.

Southeastern peers include ABCB, BTFG, GRNB, PNFP, RNST, SCBT, UBSH and UCBI.

Florida peers include all banks headquartered in Florida , opened no later than 12/31/2005 and total assets between $500 million and $5 billion.

CSFL Southeastern Peers Florida Peers

12

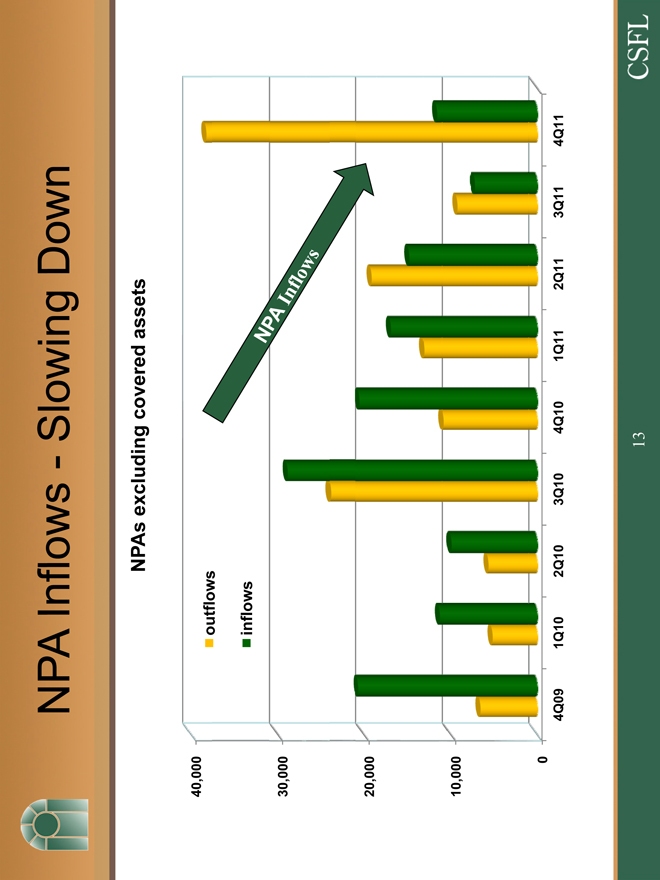

NPA Inflows—Slowing Down

NPAs excluding covered assets

40,000

outflows

inflows

30,000

20,000

10,000

0

4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11

NPA Inflows

13

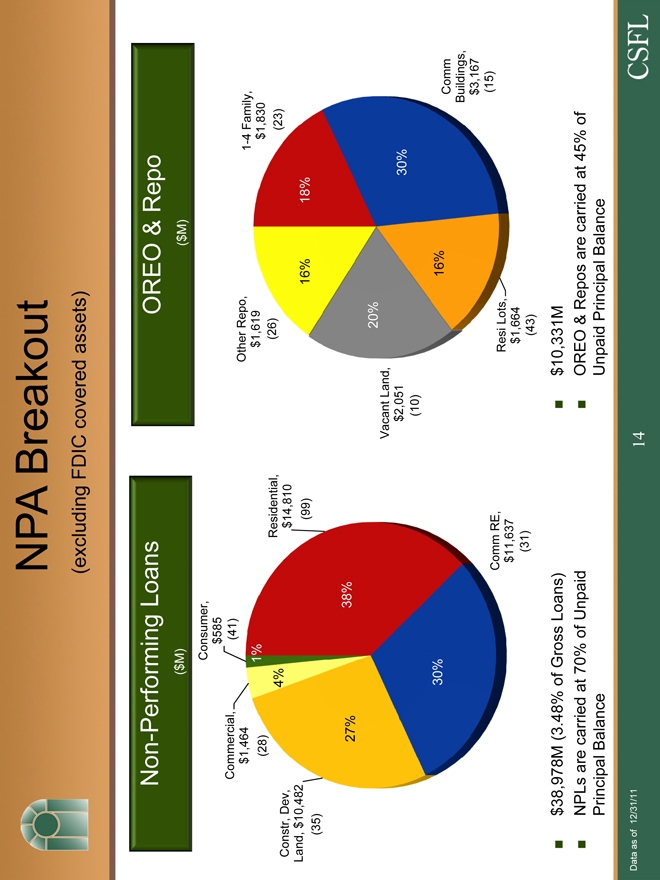

NPA Breakout

(excluding FDIC covered assets)

$38,978M (3.48% of Gross Loans) $10,331M

NPLs are carried at 70% of Unpaid OREO & Repos are carried at 45% of

Principal Balance Unpaid Principal Balance

Data as of 12/31/11

Non-Performing Loans

($M)

OREO & Repo

($M)

Consumer, $585 Commercial, (41) $1,464

Constr, Dev, 4% Residential, Land, $10,482 $14,810

27% 38%

30%

Comm RE, $11,637 (31)

Other Repo, 1-4 Family, $1,619 $1,830 (26) (23)

16% 18%

Vacant Land, 20%

$2,051 30% (10) 16%

Comm Buildings,

$3,167

Resi Lots,

$1,664 (43)

14

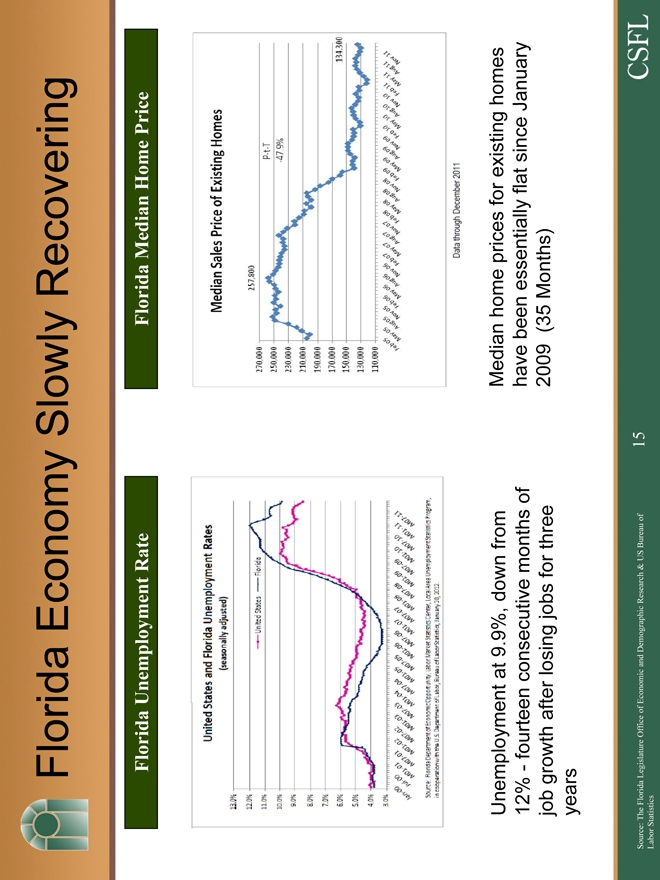

Florida Economy Slowly Recovering

Florida Unemployment Rate

Florida Median Home Price

Unemployment at 9.9%, down from 12%—fourteen consecutive months of job growth after losing jobs for three years

Median home prices for existing homes have been essentially flat since January 2009 (35 Months)

Source: The Florida Legislature Office of Economic and Demographic Research & US Bureau of Labor Statistics

15

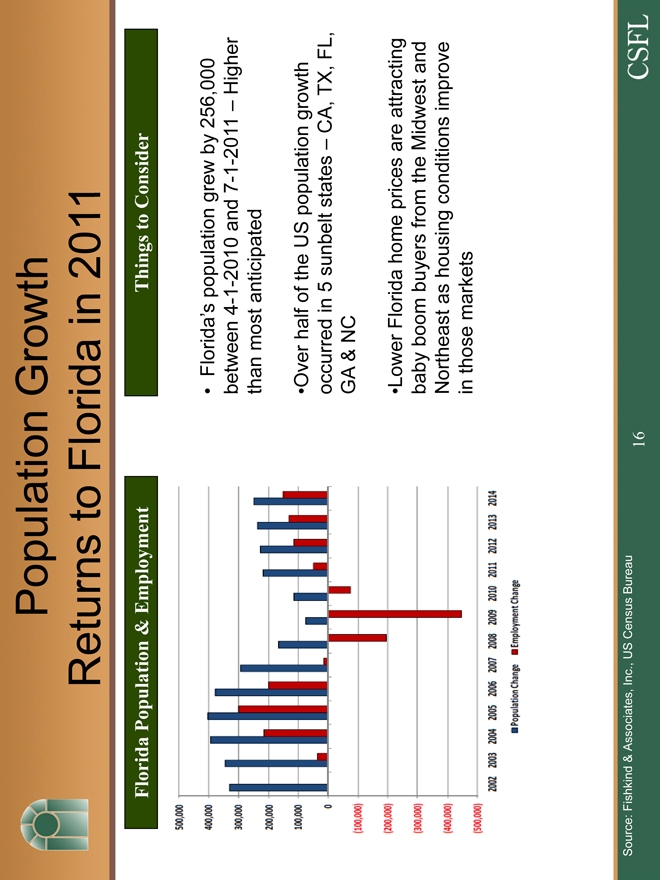

Population Growth Returns to Florida in 2011

Source: Fishkind & Associates, Inc., US Census Bureau

16

Florida Population & Employment

Things to Consider

• Florida ‘s population grew by 256,000 between 4-1-2010 and 7-1-2011 – Higher than most anticipated

•Over half of the US population growth occurred in 5 sunbelt states – CA, TX, FL, GA & NC

•Lower Florida home prices are attracting baby boom buyers from the Midwest and Northeast as housing conditions improve in those markets

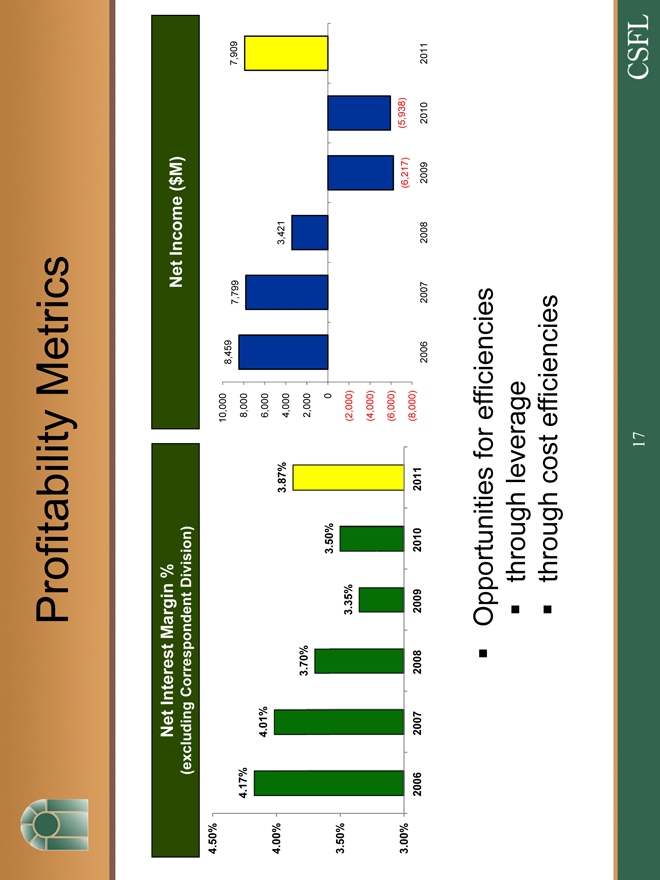

Profitability y Metrics

Opportunities for efficiencies

through leverage

through cost efficiencies

Net Interest Margin %

(excluding Correspondent Division)

Net Income ($M)

4.50%

4.17%

4.01%

4.00% 3.87%

3.70%

3.50%

3.50%

3.35%

3.00%

2006 2007 2008 2009 2010 2011

10,000 8,459

7,799 7,909

8,000

6,000

4,000 3,421

2,000

0

(2,000)

(4,000)

(6,000)

(6,217) (5,938)

(8,000)

2006 2007 2008 2009 2010 2011

17

Summary

Lifetime local bankers with common lineage and vision

Nearly all of the recent growth is guaranteed by the United States Government or a major financial institution

Senior management added in anticipation of growth

Focus on efficiencies in 2012

A consolidator of banks

18

Appendix

History

1989 to 1992

Three community banks formed in Central Florida by James White, former CEO of Flagship Banks, with an emphasis on non-metropolitan markets and led by lifetime, local bankers that had worked together at Flagship

1999

CenterState Bank of Florida N.A. established in Winter Haven by James White as Chairman, Ernie Pinner as CEO and John Corbett as Senior Lender

2000

CenterState Banks, Inc. formed as a NASDAQ publicly-traded holding company for the original three banks

2003

CenterState Banks, Inc. (Holding Company) purchases CenterState Bank of Florida N.A. as its fourth wholly owned subsidiary. Ernie Pinner appointed as Holding Company CEO and John Corbett as Bank CEO

2005

Holding Company raised $35 million from the public markets in a capital raise.

2007

Holding company purchases Valrico State Bank in Hillsborough County. Led by Jerry Ball, who has been with the bank since it was founded in the early 1980’s, the bank has a strong Tier 1 Leverage Ratio at 12-31-10 of 12.74%.

2008

CenterState Bank enters the correspondent banking business with an exclusive focus on bond sales to community banks, fed funds and ALCO consulting.

2009

CenterState Bank purchases Ocala National Bank from the FDIC in a deposit only transaction. In July, the holding company raises $86 million from the public markets to purchase additional failed banks from the FDIC.

2010

CenterState purchases three small FDIC banks within or adjacent to its current markets and entered loss-share agreements with the FDIC providing 80% guarantees on all loan losses.

Holding Company raised $36 million from the public markets in a three-hour capital raise. Holding Company merged three of its subsidiaries together and into the Winter Haven bank.

2011

CenterState purchases four branches from TD bank in Putnam County including $121MM in performing loans at 90% of par with a two year “Put-Back” agreement on any loan that becomes 30 days past due or becomes a classified asset by regulatory standards.

CenterState enters agreement to purchase Federal Trust Bank from The Hartford Insurance Company including $170MM in performing loans at 73% of par with a one year “Put-Back” agreement on any loan that becomes 30 days past due or becomes a classified asset by regulatory standards.

2012

CenterState purchases two FDIC banks; Central Florida State Bank in Belleview, Florida and First Guaranty Bank & Trust in Jacksonville, Florida

20

Executive Management Team

Ernie Pinner – Chairman, President & CEO of the Holding Company; Chairman of the bank

45 years of local banking experience serving as a bank CEO and director for over 30 years. Prior bank experience at Flagship Bank,

First Bankers, First Union & CenterState. Graduate of University of Florida

John Corbett – Director, President & CEO of the bank; Director and EVP of the Holding Company

22 years of local commercial banking experience. Formal credit training at First Union. Graduate of Bob Jones University in Greenville, SC

Jim Antal – Chief Financial Officer and Senior Vice President of the Holding Company

31 years of banking experience. CPA with Deloitte & Touche; SVP & CFO Metropolitan Savings Bank (8 yrs); SVP & CFO Trumbull

Savings & Loan (7 yrs); Current SVP & CFO CenterState Banks (12 yrs). Graduated Summa Cum Laude Youngstown State University

(BSBA); Cleveland State University (MBA)

Steve Young – Chief Operating Officer of the bank; SVP and Treasurer of the holding company

CPA with Deloitte and Touche. Former CFO of CenterState and current head of specialty banking which includes correspondent banking, wealth management and residential originations. Also chairman of the bank ALCO committee. Graduate of Bob Jones

University in Greenville, SC

Rod Anthony – EVP of Operations and Technology

22 years of IT, procurement , logistics and operational experience. Formerly with RMC America in Atlanta, GA.

Robert Dodd – Chief Credit Officer

Over 30 years of local commercial banking and credit administration experience. Prior bank experience at Flagship Bank, First

Bankers, First Union & CenterState. Oversees Special Assets, Credit Administration and Portfolio Management. Graduate of PCC and the Florida School of Banking.

Jennifer Idell – CFO

Prior experience as the CFO of Bank of Florida SW and SE and treasurer of BOFL holding company. Former Controller of CenterState and graduate of Florida Atlantic.

Dan Bockhorst – Chief Risk Officer

Former Chief Credit Officer for Indian River National Bank in Vero Beach and statewide head of Special Assets for RBC Florida.

Andy Beindorf – Regional President of southern region

Former President & CEO of $800 million Indian River National Bank in Vero Beach. Over 30 years of local banking experience in Vero Beach with First Bankers, IRNB & RBC. Graduate of the University of Florida

Tim Pierson – Regional President of northern region

Former President & CEO of $350 million CenterState Bank in Pasco County. Over 30 years of local banking experience in Central Florida with Flagship Bank, Sun Bank & CenterState.

21

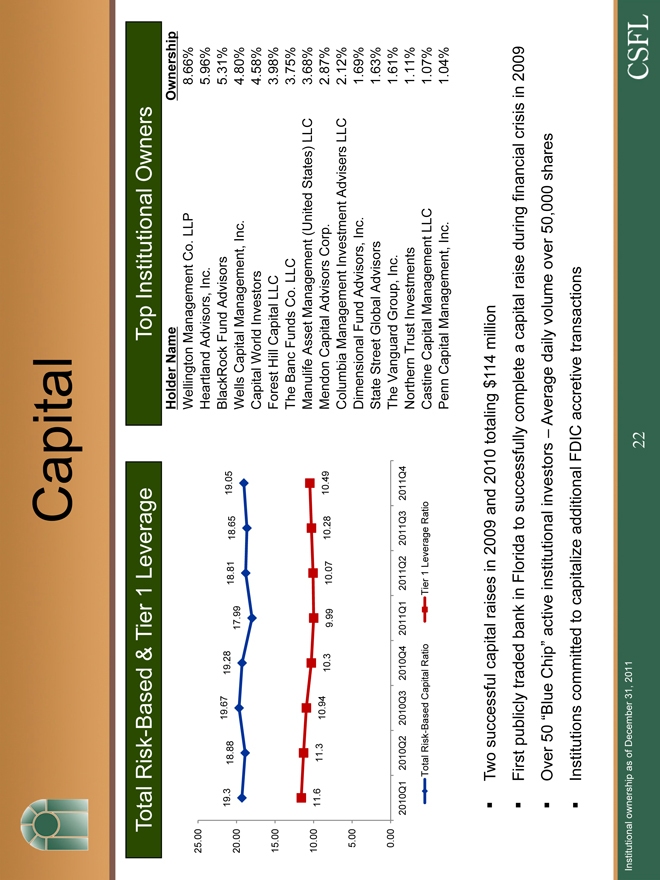

Capital

Total Risk-Based & Tier 1 Leverage Top Institutional Owners

Holder Name Ownership

Wellington Management Co. LLP 8.66%

25.00 Heartland Advisors, Inc. 5.96%

19.3 18.88 19.67 19.28 18.81 18.65 19.05 BlackRock Fund Advisors 5.31%

20.00 17.99 Wells Capital Management, Inc. 4.80%

Capital World Investors 4.58%

15.00 Forest Hill Capital LLC 3.98%

The Banc Funds Co. LLC 3.75%

Manulife Asset Management (United States) LLC 3.68%

10.00 11.6 11.3 10.94 10.3 9.99 10.07 10.28 10.49 Mendon Capital Advisors Corp. 2.87%

Columbia Management Investment Advisers LLC 2.12%

5.00 Dimensional Fund Advisors, Inc. 1.69%

State Street Global Advisors 1.63%

0.00 The Vanguard Group, Inc. 1.61%

2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 Northern Trust Investments 1.11%

Total Risk-Based Capital Ratio Tier 1 Leverage Ratio Castine Capital Management LLC 1.07%

Penn Capital Management, Inc. 1.04%

Two successful capital raises in 2009 and 2010 totaling $114 million

First publicly traded bank in Florida to successfully complete a capital raise during financial crisis in 2009

Over 50 “Blue Chip” active institutional investors – Average daily volume over 50,000 shares

Institutions committed to capitalize additional FDIC accretive transactions

Institutional ownership as of December 31, 2011

22

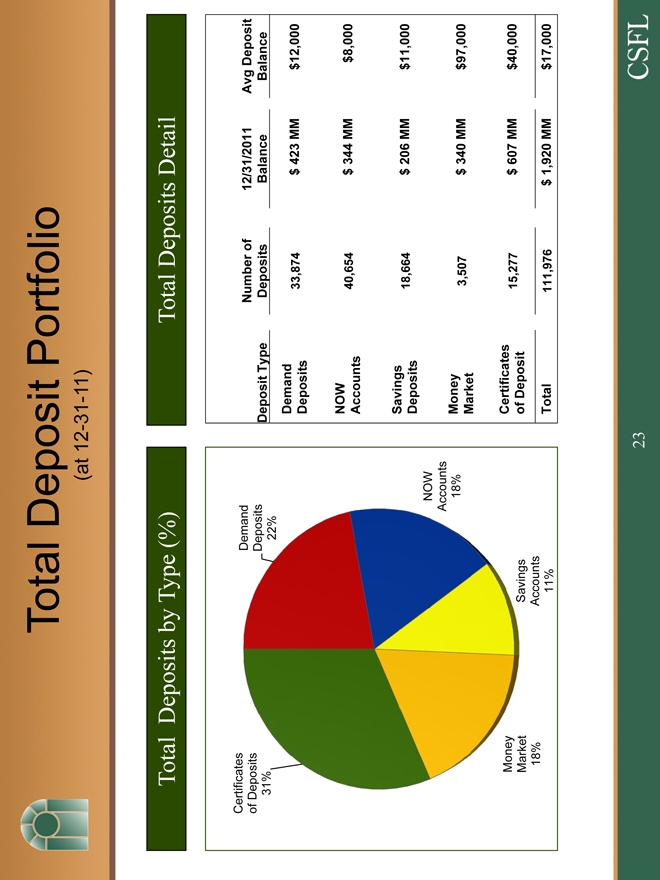

Total Deposit Portfolio

(at 12-31-11)

Total Deposits by Type (%)

Total Deposits Detail

Certificates Demand

of Deposits Deposits

31% 22%

NOW

Accounts

18%

Money

Market Savings

18% Accounts

11%

Number of 12/31/2011 Avg Deposit

Deposit Type Deposits Balance Balance

Demand

Deposits 33,874 $ 423 MM $12,000

NOW

Accounts 40,654 $ 344 MM $8,000

Savings

Deposits 18,664 $ 206 MM $11,000

Money

Market 3,507 $ 340 MM $97,000

Certificates

of Deposit 15,277 $ 607 MM $40,000

Total 111,976 $ 1,920 MM $17,000

23

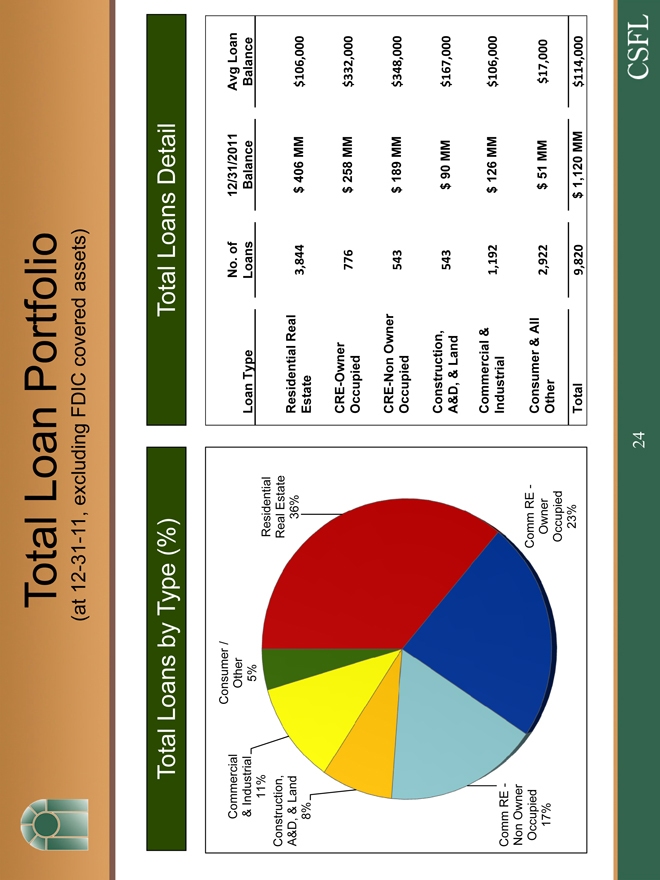

Total Loan Portfolio

(at 12-31-11, excluding FDIC covered assets)

Total Loans by Type (%)

Total Loans Detail

Consumer /

Commercial Other

& Industrial 5%

11% Residential

Construction, Real Estate

A&D, & Land 36%

8%

Comm RE—

Non Owner

Occupied Comm RE -

17% Owner

Occupied

23%

No. of 12/31/2011 Avg Loan

Loan Type Loans Balance Balance

Residential Real

Estate 3,844 $ 406 MM $106,000

CRE-Owner

Occupied 776 $ 258 MM $332,000

CRE-Non Owner

Occupied 543 $ 189 MM $348,000

Construction,

A&D, & Land 543 $ 90 MM $167,000

Commercial &

Industrial 1,192 $ 126 MM $106,000

Consumer & All

Other 2,922 $ 51 MM $17,000

Total 9,820 $ 1,120 MM $114,000

24

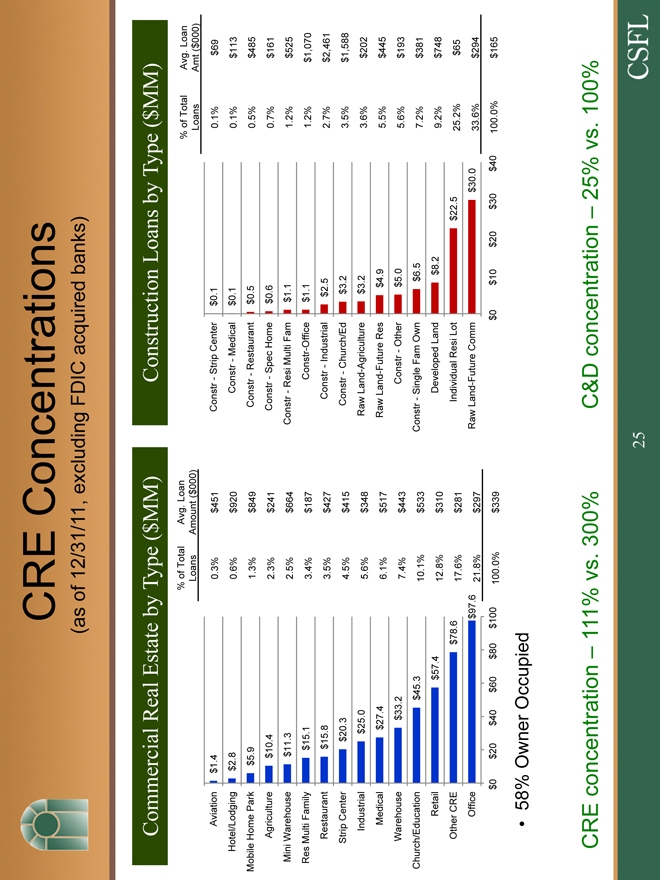

CRE Concentrations

(as of 12/31/11, excluding FDIC acquired banks)

Commercial Real Estate by Type ($MM)

% of Total Avg. Loan

Loans Amount ($000)

Aviation $1.4 0.3% $451

Hotel/Lodging $2.8 0.6% $920

Mobile Home Park $5.9 1.3% $849

Agriculture $10.4 2.3% $241

Mini Warehouse $11.3 2.5% $664

Res Multi Family $15.1 3.4% $187

Restaurant $15.8 3.5% $427

Strip Center $20.3 4.5% $415

Industrial $25.0 5.6% $348

Medical $27.4 6.1% $517

Warehouse $33.2 7.4% $443

Church/Education $45.3 10.1% $533

Retail $57.4 12.8% $310

Other CRE $78.6 17.6% $281

Office $97.6 21.8% $297

$0 $20 $40 $60 $80 $100 100.0% $339

Construction Loans by Type ($MM)

% of Total Avg. Loan

Loans Amt ($000)

Constr—Strip Center $0.1 0.1% $69

Constr—Medical $0.1 0.1% $113

Constr—Restaurant $0.5 0.5% $485

Constr—Spec Home $0.6 0.7% $161

Constr—Resi Multi Fam $1.1 1.2% $525

Constr-Office $1.1 1.2% $1,070

Constr—Industrial $2.5 2.7% $2,461

Constr—Church/Ed $3.2 3.5% $1,588

Raw Land-Agriculture $3.2 3.6% $202

Raw Land-Future Res $4.9 5.5% $445

Constr—Other $5.0 5.6% $193

Constr—Single Fam Own $6.5 7.2% $381

Developed Land $8.2 9.2% $748

Individual Resi Lot $22.5 25.2% $65

Raw Land-Future Comm $30.0 33.6% $294

$0 $10 $20 $30 $40 100.0% $165

58% Owner Occupied

CRE concentration – 111% vs. 300%

C&D concentration – 25% vs. 100%

25