Acquisition of Charter Financial Corporation April 24th, 2018 Exhibit 99.2

Forward Looking Statements This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on CenterState’s capital ratios. Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customer, supplier, employee or other business partner relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of Charter’s businesses into CenterState, (5) the failure to obtain the necessary approvals by the stockholders of Charter, with respect to the Merger, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by CenterState to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing the Merger, (10) the risk that the integration of Charter’s operations into the operations of CenterState will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by CenterState’s issuance of additional shares of its common stock in the Merger, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in CenterState’s Annual Report on Form 10-K for the year ended December 31, 2017, Charter’s Annual Report on Form 10-K for the year ended September 30, 2017, and other documents subsequently filed by CenterState and Charter with the SEC. Consequently, no forward-looking statement can be guaranteed. CenterState and Charter do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For any forward-looking statements made in this presentation, the exhibits hereto or any related documents, CenterState and Charter claim protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Additional Information CenterState intends to file a registration statement on Form S-4 with the Securities and Exchange Commission to register the shares of CenterState's common stock that will be issued to Charter's shareholders in connection with the transaction. The registration statement will include a proxy statement/prospectus and other relevant materials in connection with the proposed merger transaction involving CenterState and Charter. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY/PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the Securities and Exchange Commission on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the Securities and Exchange Commission by CenterState on its website at www.centerstatebanks.com and by Charter on its website at www.charterbk.com. CenterState, Charter and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from Charter stockholders in connection with the Merger. Information regarding the directors and executive officers of CenterState and Charter and other persons who may be deemed participants in the solicitation of the stockholders of Charter in connection with the Merger will be included in the proxy statement/prospectus for Charter’s special meeting of stockholders, which will be filed by CenterState with the SEC. Information about the directors and officers of CenterState and their ownership of CenterState common stock can also be found in CenterState’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on March 12, 2018, and other documents subsequently filed by CenterState with the SEC. Information about the directors and officers of Charter and their ownership of Charter common stock can also be found in Charter’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on January 5, 2018, and other documents subsequently filed by Charter with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the Merger filed with the SEC when they become available.

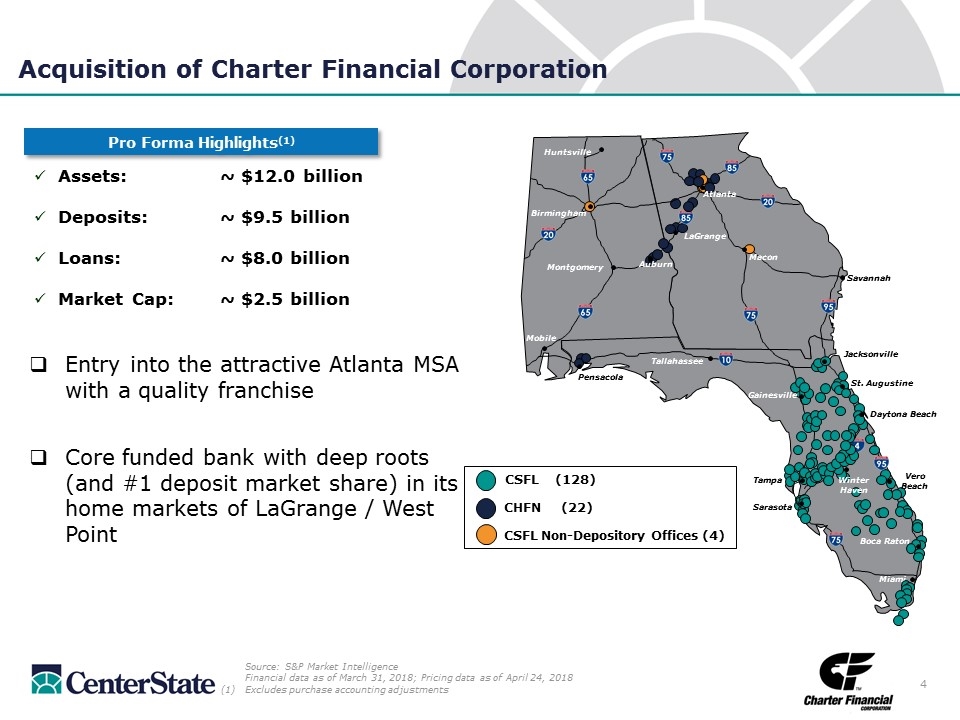

Assets: ~ $12.0 billion Deposits: ~ $9.5 billion Loans: ~ $8.0 billion Market Cap: ~ $2.5 billion Acquisition of Charter Financial Corporation Source: S&P Market Intelligence Financial data as of March 31, 2018; Pricing data as of April 24, 2018 Excludes purchase accounting adjustments Pro Forma Highlights(1) CSFL (128) CHFN (22) CSFL Non-Depository Offices (4) Entry into the attractive Atlanta MSA with a quality franchise Core funded bank with deep roots (and #1 deposit market share) in its home markets of LaGrange / West Point Gainesville Tallahassee Sarasota LaGrange Montgomery Mobile Jacksonville St. Augustine Daytona Beach Pensacola Tampa Miami Winter Haven Boca Raton Vero Beach Savannah Birmingham Huntsville Auburn Macon Atlanta

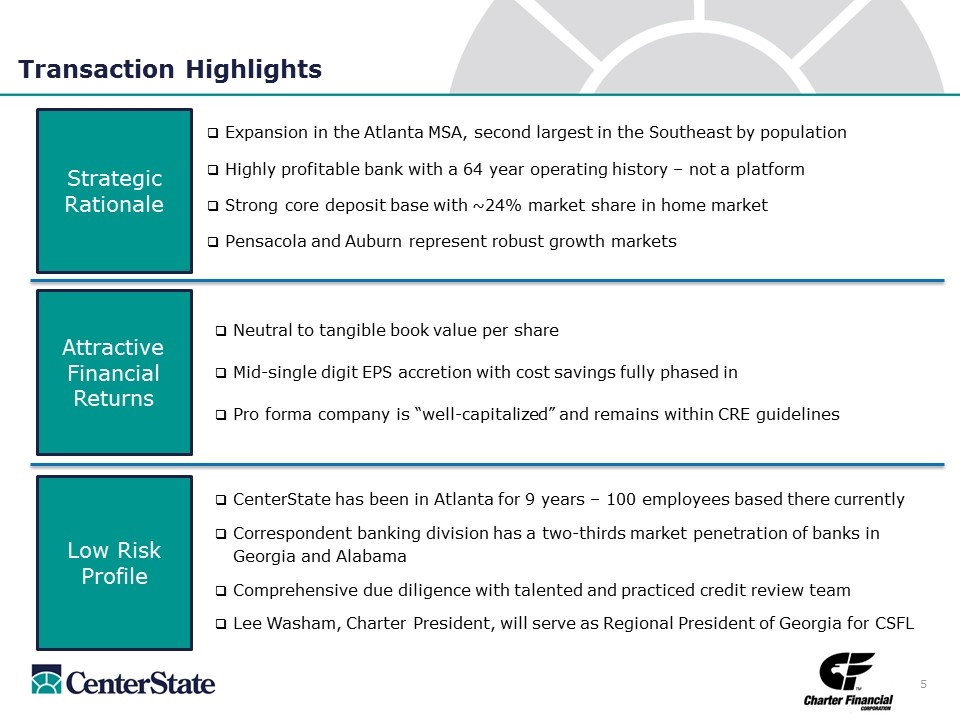

Transaction Highlights Strategic Rationale Low Risk Profile Attractive Financial Returns Expansion in the Atlanta MSA, second largest in the Southeast by population Highly profitable bank with a 64 year operating history – not a platform Strong core deposit base with ~24% market share in home market Pensacola and Auburn represent robust growth markets Neutral to tangible book value per share Mid-single digit EPS accretion with cost savings fully phased in Pro forma company is “well-capitalized” and remains within CRE guidelines CenterState has been in Atlanta for 9 years – 100 employees based there currently Correspondent banking division has a two-thirds market penetration of banks in Georgia and Alabama Comprehensive due diligence with talented and practiced credit review team Lee Washam, Charter President, will serve as Regional President of Georgia for CSFL

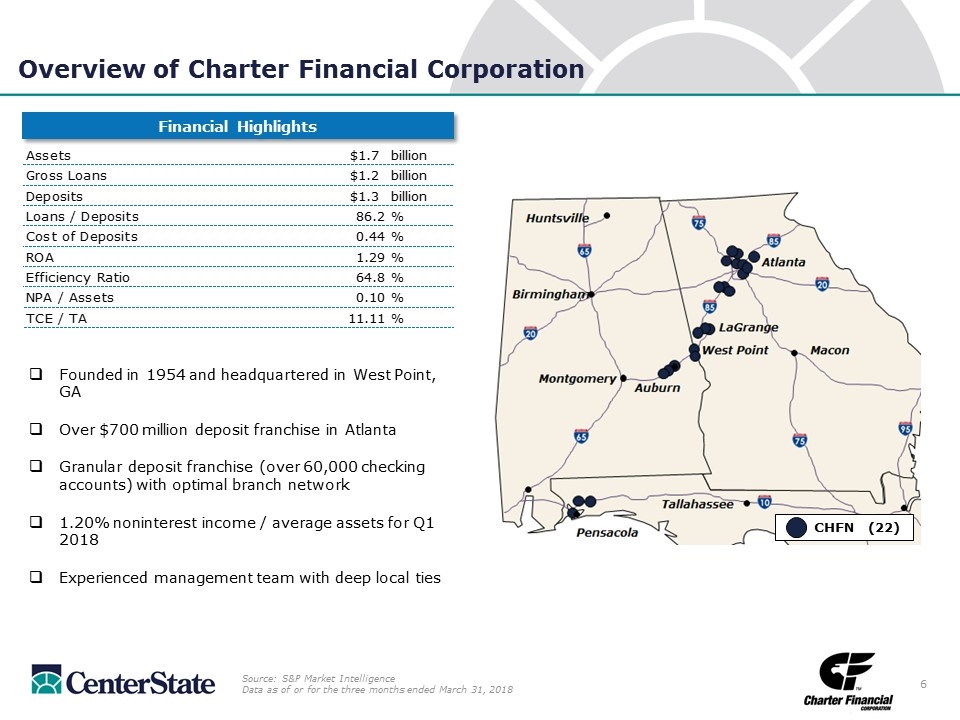

Overview of Charter Financial Corporation Financial Highlights Founded in 1954 and headquartered in West Point, GA Over $700 million deposit franchise in Atlanta Granular deposit franchise (over 60,000 checking accounts) with optimal branch network 1.20% noninterest income / average assets for Q1 2018 Experienced management team with deep local ties Source: S&P Market Intelligence Data as of or for the three months ended March 31, 2018 CHFN (22)

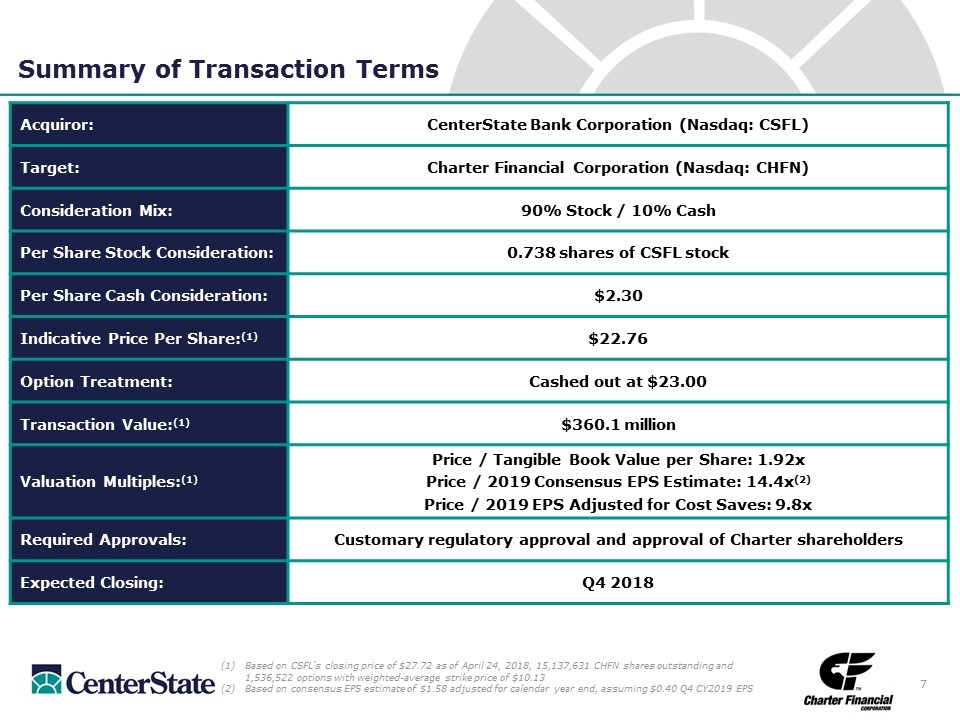

Summary of Transaction Terms Acquiror: CenterState Bank Corporation (Nasdaq: CSFL) Target: Charter Financial Corporation (Nasdaq: CHFN) Consideration Mix: 90% Stock / 10% Cash Per Share Stock Consideration: 0.738 shares of CSFL stock Per Share Cash Consideration: $2.30 Indicative Price Per Share:(1) $22.76 Option Treatment: Cashed out at $23.00 Transaction Value:(1) $360.1 million Valuation Multiples:(1) Price / Tangible Book Value per Share: 1.92x Price / 2019 Consensus EPS Estimate: 14.4x(2) Price / 2019 EPS Adjusted for Cost Saves: 9.8x Required Approvals: Customary regulatory approval and approval of Charter shareholders Expected Closing: Q4 2018 Based on CSFL’s closing price of $27.72 as of April 24, 2018, 15,137,631 CHFN shares outstanding and 1,536,522 options with weighted-average strike price of $10.13 Based on consensus EPS estimate of $1.58 adjusted for calendar year end, assuming $0.40 Q4 CY2019 EPS

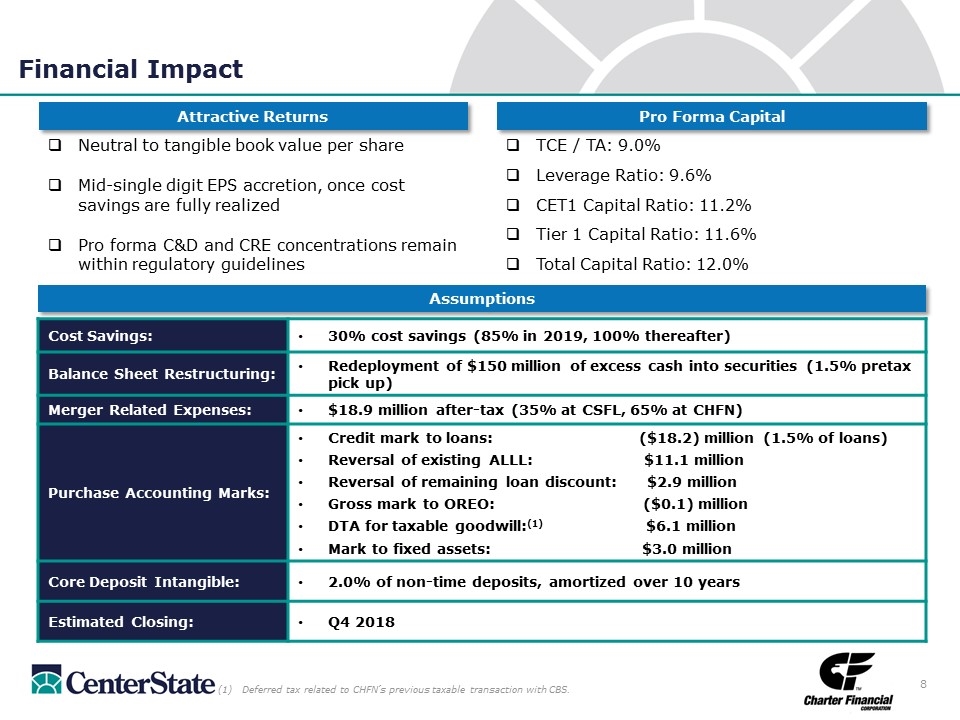

Financial Impact Assumptions Neutral to tangible book value per share Mid-single digit EPS accretion, once cost savings are fully realized Pro forma C&D and CRE concentrations remain within regulatory guidelines Attractive Returns TCE / TA: 9.0% Leverage Ratio: 9.6% CET1 Capital Ratio: 11.2% Tier 1 Capital Ratio: 11.6% Total Capital Ratio: 12.0% Pro Forma Capital Cost Savings: 30% cost savings (85% in 2019, 100% thereafter) Balance Sheet Restructuring: Redeployment of $150 million of excess cash into securities (1.5% pretax pick up) Merger Related Expenses: $18.9 million after-tax (35% at CSFL, 65% at CHFN) Purchase Accounting Marks: Credit mark to loans: ($18.2) million (1.5% of loans) Reversal of existing ALLL: $11.1 million Reversal of remaining loan discount: $2.9 million Gross mark to OREO: ($0.1) million DTA for taxable goodwill:(1) $6.1 million Mark to fixed assets: $3.0 million Core Deposit Intangible: 2.0% of non-time deposits, amortized over 10 years Estimated Closing: Q4 2018 Deferred tax related to CHFN’s previous taxable transaction with CBS.

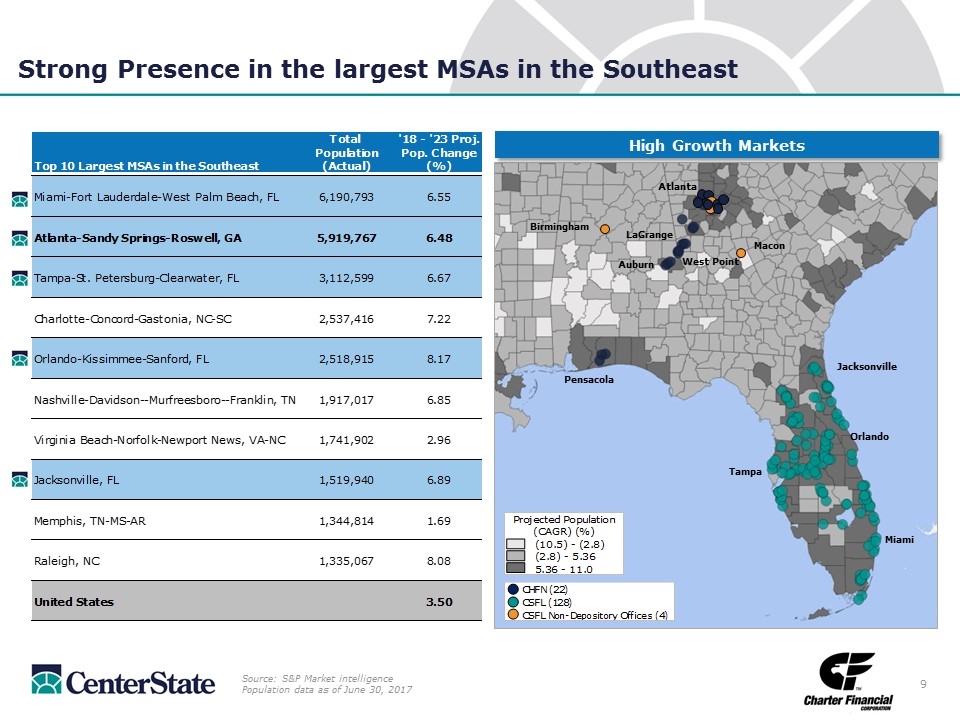

Strong Presence in the largest MSAs in the Southeast Source: S&P Market intelligence Population data as of June 30, 2017 Jacksonville Orlando Miami Pensacola Atlanta LaGrange Auburn Tampa High Growth Markets West Point Macon Birmingham

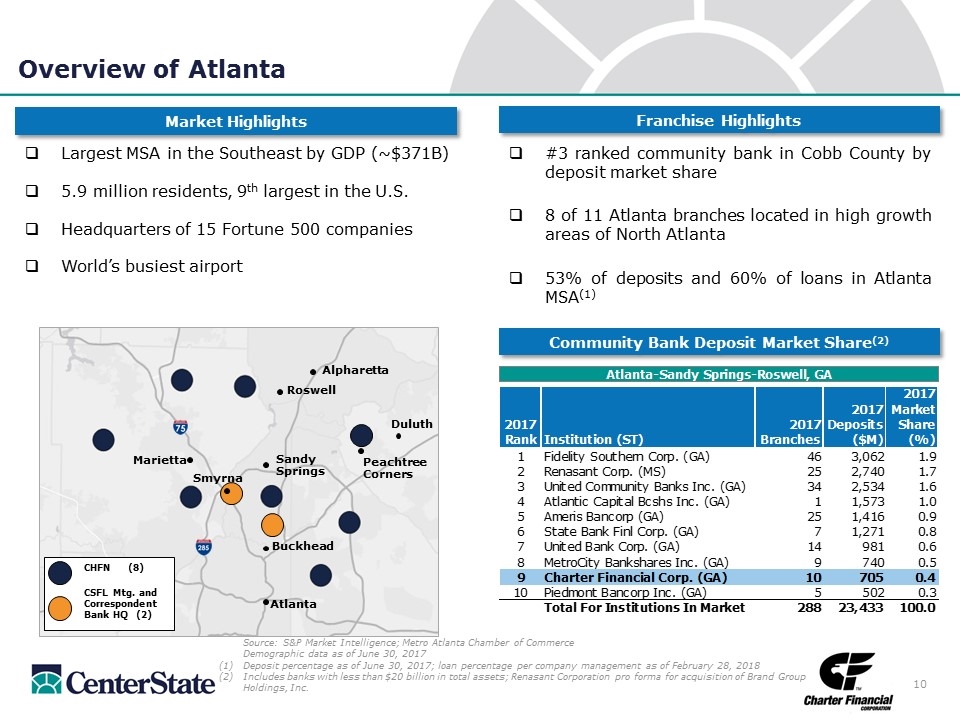

CHFN (8) CSFL Mtg. and Correspondent Bank HQ (2) Atlanta Marietta Alpharetta Roswell Sandy Springs Duluth Buckhead Peachtree Corners Overview of Atlanta Source: S&P Market Intelligence; Metro Atlanta Chamber of Commerce Demographic data as of June 30, 2017 (1) Deposit percentage as of June 30, 2017; loan percentage per company management as of February 28, 2018 (2) Includes banks with less than $20 billion in total assets; Renasant Corporation pro forma for acquisition of Brand Group Holdings, Inc. Largest MSA in the Southeast by GDP (~$371B) 5.9 million residents, 9th largest in the U.S. Headquarters of 15 Fortune 500 companies World’s busiest airport Market Highlights Franchise Highlights Community Bank Deposit Market Share(2) #3 ranked community bank in Cobb County by deposit market share 8 of 11 Atlanta branches located in high growth areas of North Atlanta 53% of deposits and 60% of loans in Atlanta MSA(1) Smyrna

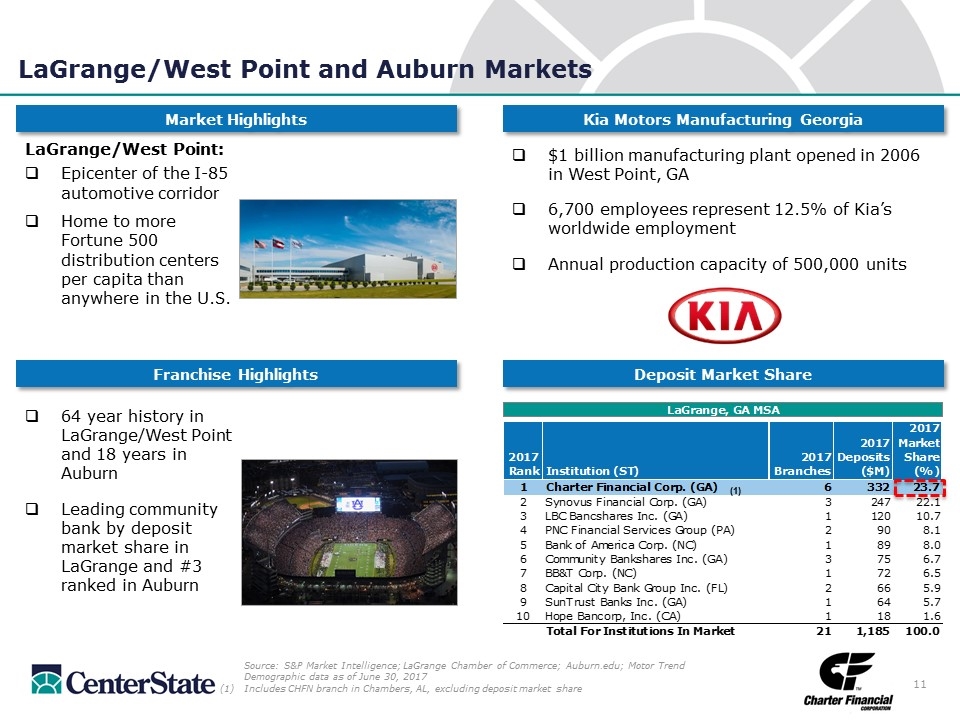

LaGrange/West Point and Auburn Markets Source: S&P Market Intelligence; LaGrange Chamber of Commerce; Auburn.edu; Motor Trend Demographic data as of June 30, 2017 Includes CHFN branch in Chambers, AL, excluding deposit market share 64 year history in LaGrange/West Point and 18 years in Auburn Leading community bank by deposit market share in LaGrange and #3 ranked in Auburn Franchise Highlights Kia Motors Manufacturing Georgia Deposit Market Share $1 billion manufacturing plant opened in 2006 in West Point, GA 6,700 employees represent 12.5% of Kia’s worldwide employment Annual production capacity of 500,000 units (1) Market Highlights LaGrange/West Point: Epicenter of the I-85 automotive corridor Home to more Fortune 500 distribution centers per capita than anywhere in the U.S.

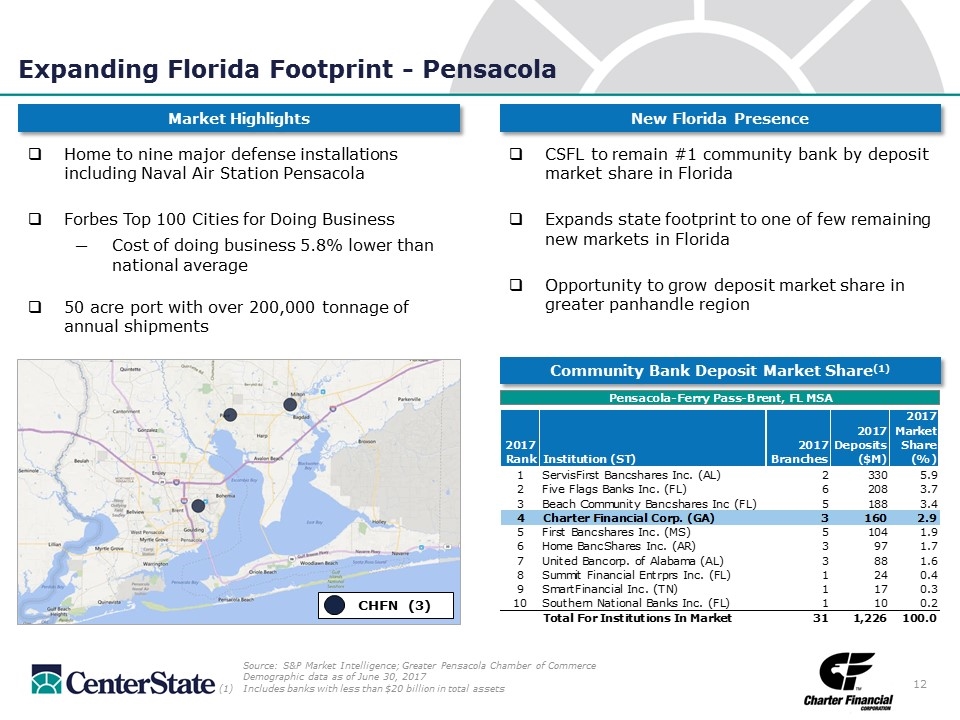

Expanding Florida Footprint - Pensacola Source: S&P Market Intelligence; Greater Pensacola Chamber of Commerce Demographic data as of June 30, 2017 (1)Includes banks with less than $20 billion in total assets Market Highlights Home to nine major defense installations including Naval Air Station Pensacola Forbes Top 100 Cities for Doing Business Cost of doing business 5.8% lower than national average 50 acre port with over 200,000 tonnage of annual shipments Community Bank Deposit Market Share(1) New Florida Presence CSFL to remain #1 community bank by deposit market share in Florida Expands state footprint to one of few remaining new markets in Florida Opportunity to grow deposit market share in greater panhandle region CHFN (3)

Concluding Thoughts Cultural and philosophical alignment is significant and increases the likelihood of a successful merger Addition of commercial banking capabilities complements our existing activities in the attractive Atlanta market Granular deposit base with strong fee income will complement CenterState revenue structure Financially attractive – good earnings accretion while protecting book value

Credit Due Diligence Charter has excellent overall asset quality 0.10% NPAs / assets; 0.15% NPAs / loans & OREO Net recoveries of 0.12% of average loans for the quarter ended March 31, 2018 Loan concentrations within CRE guidelines Experienced credit review team Completed due diligence on 38 banks since 2008 Completed 6 FDIC-assisted deals and 11 whole-bank deals through cycle All banks are outperforming their initial marks Comprehensive review process for loans and OREO portfolios Reviewed 68% of the dollar balance of Commercial Loan Portfolio (100% of loans ≥ $750,000) Reviewed 100% of OREO properties; and 84% of all non-accruing loans and substandard loans Reviewed 90% of TDRs and special mention loans 1,028 loans were reviewed which represents 56% of the total outstanding loan portfolio

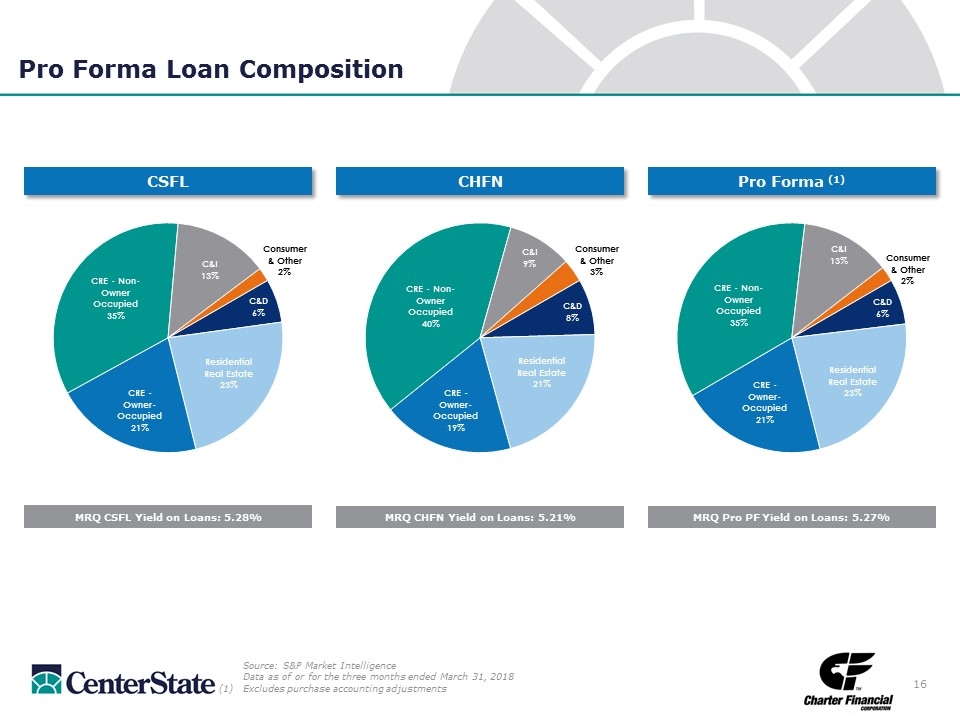

CSFL Pro Forma Loan Composition MRQ CSFL Yield on Loans: 5.28% CHFN MRQ CHFN Yield on Loans: 5.21% Source: S&P Market Intelligence Data as of or for the three months ended March 31, 2018 Excludes purchase accounting adjustments Pro Forma (1) MRQ Pro PF Yield on Loans: 5.27%

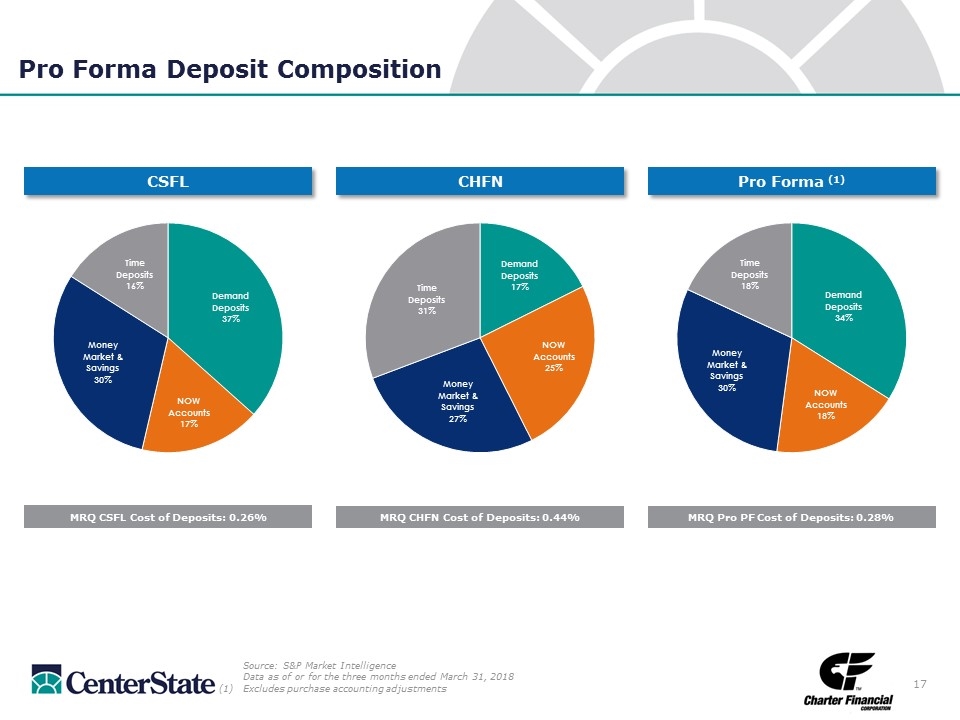

Pro Forma Deposit Composition Source: S&P Market Intelligence Data as of or for the three months ended March 31, 2018 Excludes purchase accounting adjustments CSFL MRQ CSFL Cost of Deposits: 0.26% CHFN MRQ CHFN Cost of Deposits: 0.44% Pro Forma (1) MRQ Pro PF Cost of Deposits: 0.28%

Investor Contacts John Corbett President & CEO jcorbett@centerstatebank.com Jennifer Idell Chief Financial Officer jidell@centerstatebank.com Steve Young Chief Operating Officer syoung@centerstatebank.com Phone Number 863-293-4710