Exhibit 99.1

FOR IMMEDIATE RELEASE July 24, 2018 | |

|

CenterState Bank Corporation Announces

Second Quarter 2018 Earnings Results

(all amounts are in thousands, except per share data, or unless otherwise noted)

WINTER HAVEN, FL. – July 24, 2018 - CenterState Bank Corporation (Nasdaq: CSFL) reported net income of $32,163, or diluted earnings per share of $0.38, for the second quarter of 2018, compared to net income of $15,233, or diluted earnings per share of $0.26, for the second quarter of 2017. Highlights for the period ended June 30, 2018 and selected performance metrics are set forth below.

| o | Entered into a definitive agreement in April 2018 to acquire Charter Financial Corporation which provides an attractive entry point into the Atlanta MSA |

| o | Completed the system conversion of Harbor Community Bank resulting in the consolidation of 23 offices which were in close proximity to existing offices |

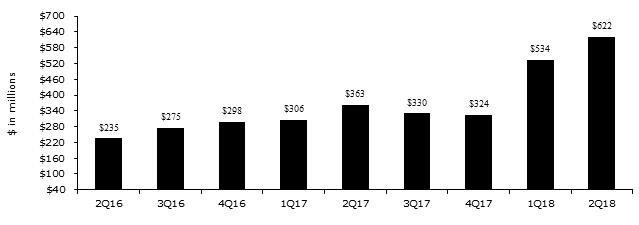

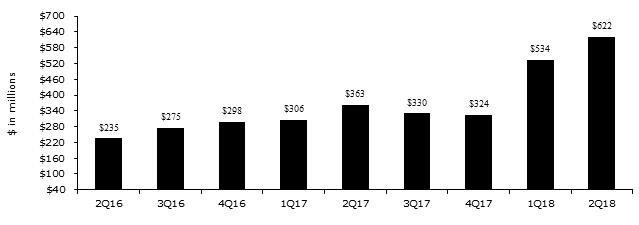

| o | 9.5% annualized net loan growth during the second quarter of 2018 with record loan production of $622 million |

| o | Loan to deposit ratio of 86% |

| o | 5.4% annualized deposit growth during the second quarter of 2018 |

| o | Checking account balances represent 53% of total deposits; 35% of total deposits are non-interest bearing deposits |

| • | Net Interest Margin, tax equivalent (“NIM”) (Non-GAAP(1)): |

| o | Increased to 4.51% for the current quarter, which includes $4.0 million of income recognized due to prepayments on one purchased credit impaired (“PCI”) loan relationship, compared to 4.38% for the second quarter of 2017 |

| o | Cost of deposits during the current quarter equaled 0.33% |

| o | Total deposit (including non-interest bearing DDA) beta equal to 28% from the previous quarter and 9% since the tightening cycle began in the third quarter 2015 |

| o | Non-interest income increased $5,615 compared to the second quarter of 2017 due to improvement in mortgage banking revenue of $2,319 and SBA revenue of $848, in addition to the acquisitions completed since the second quarter of 2017 |

| o | Non-interest income to average assets of 87 basis points (bps) |

| o | CenterState Bank was named the top bank in Florida on Forbes first-ever “Best-in-State Banks” listing. |

| | | | | | | | | | | |

| | | Three Months Ended June 30, | |

| | | 2018 | | | 2017 | |

| | | | | Adjusted (2) | | | | | Adjusted (2) | |

| | | Reported | | (Non-GAAP) | | | Reported | | (Non-GAAP) | |

| Net income | | $32,163 | | $42,923 | | | $15,233 | | $22,002 | |

| Return on average assets | | 1.24% | | 1.66% | | | 0.95% | | 1.37% | |

| Return on average tangible equity (Non-GAAP)(2) | | 15.7% | | 20.7% | | | 11.0% | | 15.7% | |

| Earnings per share diluted | | $0.38 | | $0.50 | | | $0.26 | | $0.37 | |

| Efficiency ratio, tax equivalent (Non-GAAP)(2) | | 64.3% | | 51.1% | | | 68.9% | | 55.7% | |

| | | | | | | | | | | |

| (1) | See reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

| (2) | Performance metrics presented above are adjusted for merger-related expenses, which for the three months ended June 30, represent direct severance, system terminations, and legal and professionsl fees, that are not duplicative of current operations, and other items. See reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

Condensed Consolidated Income Statement (unaudited)

Condensed consolidated income statements (unaudited) are shown below for the periods indicated.

| | Three Months Ended | | | Six Months Ended |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Interest income | | | | | | | | | | | | | | | |

Loans | | $97,642 | | $89,930 | | $59,982 | | $59,122 | | $56,619 | | | $187,572 | | $100,868 |

Investment securities | | $11,884 | | 11,976 | | 7,382 | | 7,048 | | 7,289 | | | 23,860 | | 13,492 |

Federal Funds sold and other | | 1,103 | | 1,253 | | 1,058 | | 887 | | 836 | | | 2,356 | | 1,487 |

Total interest income | | 110,629 | | 103,159 | | 68,422 | | 67,057 | | 64,744 | | | 213,788 | | 115,847 |

Interest expense | | | | | | | | | | | | | | | |

Deposits | | 6,668 | | 5,136 | | 3,385 | | 3,178 | | 2,619 | | | 11,804 | | 4,516 |

Securities sold under agreement to repurchase | | 138 | | 122 | | 89 | | 80 | | 47 | | | 260 | | 77 |

Other borrowed funds | | 2,771 | | 2,419 | | 977 | | 866 | | 728 | | | 5,190 | | 1,265 |

Corporate debentures | | 523 | | 464 | | 352 | | 347 | | 333 | | | 987 | | 651 |

Interest expense | | 10,100 | | 8,141 | | 4,803 | | 4,471 | | 3,727 | | | 18,241 | | 6,509 |

Net interest income | | 100,529 | | 95,018 | | 63,619 | | 62,586 | | 61,017 | | | 195,547 | | 109,338 |

Provision for loan losses | | 2,933 | | 1,300 | | 968 | | 1,096 | | 1,899 | | | 4,233 | | 2,894 |

Net interest income after loan loss provision | | 97,596 | | 93,718 | | 62,651 | | 61,490 | | 59,118 | | | 191,314 | | 106,444 |

| | | | | | | | | | | | | | | |

Total non interest income | | 22,589 | | 23,038 | | 16,958 | | 16,741 | | 16,974 | | | 45,627 | | 31,476 |

| | | | | | | | | | | | | | | |

Merger related expenses | | 14,140 | | 8,709 | | 2,718 | | - | | 9,458 | | | 22,849 | | 10,328 |

All other non interest expense | | 65,472 | | 67,287 | | 46,293 | | 44,622 | | 45,351 | | | 132,759 | | 82,524 |

Total non interest expense | | 79,612 | | 75,996 | | 49,011 | | 44,622 | | 54,809 | | | 155,608 | | 92,852 |

| | | | | | | | | | | | | | | |

Income before income tax | | 40,573 | | 40,760 | | 30,598 | | 33,609 | | 21,283 | | | 81,333 | | 45,068 |

Income tax provision (1) | | 8,410 | | 5,124 | | 28,686 | | 11,559 | | 6,050 | | | 13,534 | | 13,235 |

Net income | | $32,163 | | $35,636 | | $1,912 | | $22,050 | | $15,233 | | | $67,799 | | 31,833 |

Net income allocated to common shares | | $32,137 | | $35,606 | | $1,909 | | $22,003 | | $15,200 | | | $67,743 | | $31,759 |

| | | | | | | | | | | | | | | |

Earnings per share - Basic | | $0.38 | | $0.43 | | $0.03 | | $0.37 | | $0.26 | | | $0.81 | | $0.58 |

Earnings per share - Diluted | | $0.38 | | $0.42 | | $0.03 | | $0.36 | | $0.26 | | | $0.80 | | $0.57 |

Dividends per share | | $0.10 | | $0.10 | | $0.06 | | $0.06 | | $0.06 | | | $0.20 | | $0.12 |

Average common shares outstanding (basic) | | 83,870 | | 83,140 | | 60,001 | | 59,907 | | 58,307 | | | 83,507 | | 54,490 |

Average common shares outstanding (diluted) | | 85,007 | | 84,601 | | 61,276 | | 61,115 | | 59,370 | | | 84,894 | | 55,397 |

Common shares outstanding at period end | | 84,120 | | 83,758 | | 60,161 | | 60,053 | | 60,003 | | | 84,120 | | 60,003 |

Effective tax rate (1) | | 20.73% | | 12.57% | | 93.75% | | 34.39% | | 28.43% | | | 16.64% | | 29.37% |

| (1) | Due the reduction of the federal corporate tax rate to 21% effective January 1, 2018, the Company revalued its DTA at December 31, 2017 and recorded a charge to DTA of $18,575 as additional income tax expense during the fourth quarter of 2017. Excluding the DTA write down of $18,575, the effective tax rate was 33.04% for the three months ended December 31, 2017. |

2

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

Presented below are condensed consolidated balance sheets for the periods indicated.

| | Ending Balance |

Condensed Consolidated Balance Sheets | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 |

Assets | | | | | | | | | | |

Cash and due from banks | | $85,589 | | $108,352 | | $85,562 | | $119,233 | | $108,614 |

Fed funds sold and Fed Res Bank deposits | | 307,375 | | 294,267 | | 195,057 | | 182,996 | | 211,037 |

Trading securities | | 1,848 | | 428 | | 6,777 | | 2,973 | | 1,934 |

Investment securities: | | | | | | | | | | |

Available for sale | | 1,528,270 | | 1,530,539 | | 1,060,143 | | 866,657 | | 868,334 |

Held to maturity | | 223,839 | | 227,966 | | 232,399 | | 237,874 | | 238,798 |

Total investment securities | | 1,752,109 | | 1,758,505 | | 1,292,542 | | 1,104,531 | | 1,107,132 |

Loans held for sale | | 36,366 | | 28,485 | | 19,647 | | 12,243 | | 8,959 |

Loans: | | | | | | | | | | |

Originated loans | | 3,503,443 | | 3,125,563 | | 2,919,350 | | 2,756,847 | | 2,610,859 |

Acquired loans | | 3,362,427 | | 3,558,618 | | 1,689,713 | | 1,760,745 | | 1,856,310 |

Purchased Credit Impaired (“PCI”) loans | | 173,950 | | 193,183 | | 164,158 | | 163,975 | | 179,364 |

Total gross loans | | 7,039,820 | | 6,877,364 | | 4,773,221 | | 4,681,567 | | 4,646,533 |

Allowance for loan losses | | (37,484) | | (34,429) | | (32,825) | | (31,828) | | (30,132) |

Loans, net of allowance | | 7,002,336 | | 6,842,935 | | 4,740,396 | | 4,649,739 | | 4,616,401 |

Premises and equipment, net | | 191,229 | | 189,954 | | 141,527 | | 141,605 | | 140,820 |

Goodwill | | 605,232 | | 609,720 | | 257,683 | | 257,683 | | 257,683 |

Core deposit intangible | | 51,754 | | 53,944 | | 24,063 | | 25,140 | | 26,217 |

Bank owned life insurance | | 211,676 | | 210,302 | | 146,739 | | 145,755 | | 115,234 |

OREO | | 5,376 | | 6,814 | | 3,987 | | 5,904 | | 6,422 |

Deferred income tax asset, net | | 60,868 | | 63,004 | | 37,725 | | 56,160 | | 58,841 |

Other assets | | 224,965 | | 181,286 | | 172,270 | | 118,899 | | 108,185 |

Total Assets | | $10,536,723 | | $10,347,996 | | $7,123,975 | | $6,822,861 | | $6,767,479 |

| | | | | | | | | | |

Liabilities and Stockholders' Equity | | | | | | | | | | |

Deposits: | | | | | | | | | | |

Non-interest bearing checking | | $2,892,091 | | $2,969,854 | | $1,999,901 | | $1,915,662 | | $1,926,047 |

Interest bearing checking | | 1,439,839 | | 1,381,888 | | 1,058,985 | | 996,861 | | 990,242 |

Total checking accounts | | 4,331,930 | | 4,351,742 | | 3,058,886 | | 2,912,523 | | 2,916,289 |

Money market accounts | | 1,777,468 | | 1,730,259 | | 1,167,940 | | 1,156,217 | | 1,178,109 |

Savings deposits | | 664,517 | | 731,415 | | 501,014 | | 511,286 | | 519,964 |

Time deposits | | 1,447,893 | | 1,298,582 | | 832,683 | | 845,444 | | 861,093 |

Total deposits | | $8,221,808 | | $8,111,998 | | $5,560,523 | | $5,425,470 | | $5,475,455 |

Federal funds purchased | | 234,212 | | 285,652 | | 331,490 | | 335,531 | | 256,611 |

Other borrowings | | 415,039 | | 362,754 | | 253,272 | | 72,234 | | 73,089 |

Other liabilities | | 125,416 | | 69,746 | | 73,940 | | 80,004 | | 72,066 |

Common stockholders’ equity | | 1,540,248 | | 1,517,846 | | 904,750 | | 909,622 | | 890,258 |

Total Liabilities and | | | | | | | | | | |

Stockholders' Equity | | $10,536,723 | | $10,347,996 | | $7,123,975 | | $6,822,861 | | $6,767,479 |

3

SELECTED CONSOLIDATED FINANCIAL DATA

The table below summarizes selected financial data for the periods presented.

| | Three Months Ended | | | Six Months Ended |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Selected financial data | | | | | | | | | | | | | | | |

Return on average assets (annualized) | | 1.24% | | 1.41% | | 0.11% | | 1.29% | | 0.95% | | | 1.33% | | 1.10% |

Adjusted return on average assets (annualized) (Non-GAAP) (1) | | 1.66% | | 1.68% | | 1.23% | | 1.29% | | 1.37% | | | 1.67% | | 1.35% |

| | | | | | | | | | | | | | | |

Return on average equity (annualized) | | 8.44% | | 9.57% | | 0.83% | | 9.71% | | 7.27% | | | 9.00% | | 8.83% |

Adjusted return on average equity (annualized) (Non-GAAP) (1) | | 11.27% | | 11.36% | | 9.29% | | 9.71% | | 10.51% | | | 11.32% | | 10.86% |

| | | | | | | | | | | | | | | |

Return on average tangible equity (annualized) (Non-GAAP) (1) | | 15.69% | | 17.98% | | 1.67% | | 14.68% | | 10.99% | | | 16.89% | | 12.39% |

Adjusted return on average tangible equity (annualized) (Non-GAAP) (1) | | 20.67% | | 21.19% | | 13.92% | | 14.68% | | 15.65% | | | 21.00% | | 15.12% |

| | | | | | | | | | | | | | | |

Efficiency ratio (tax equivalent) (Non-GAAP) (1) | | 64.3% | | 64.0% | | 59.7% | | 55.2% | | 68.9% | | | 64.2% | | 64.6% |

Adjusted efficiency ratio, tax equivalent (Non-GAAP) (1) | | 51.1% | | 54.7% | | 55.9% | | 53.8% | | 55.7% | | | 52.9% | | 56.2% |

| | | | | | | | | | | | | | | |

Dividend payout | | 26.3% | | 23.8% | | 200.0% | | 16.7% | | 23.1% | | | 25.0% | | 21.1% |

Loan / deposit ratio | | 85.6% | | 84.8% | | 85.8% | | 86.3% | | 84.9% | | | | | |

Stockholders’ equity (to total assets) | | 14.6% | | 14.7% | | 12.7% | | 13.3% | | 13.2% | | | | | |

Common equity per common share | | $18.31 | | $18.12 | | $15.04 | | $15.15 | | $14.84 | | | | | |

Tangible common equity per common share (Non-GAAP) (1) | | $10.49 | | $10.19 | | $10.35 | | $10.42 | | $10.09 | | | | | |

Common tangible equity (to total tangible assets) (Non-GAAP) (1) | | 8.9% | | 8.8% | | 9.1% | | 9.6% | | 9.3% | | | | | |

Tier 1 capital (to average assets) | | 9.6% | | 9.4% | | 9.8% | | 9.9% | | 10.0% | | | | | |

(1) | See reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

4

Loan Portfolio

The table below summarizes the Company’s loan portfolio over the most recent five quarter ends.

| | Ending Balance |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 |

Real estate loans | | | | | | | | | | |

Residential | | $1,592,064 | | $1,600,958 | | $1,085,278 | | $1,090,475 | | $1,086,192 |

Commercial | | 3,810,461 | | 3,802,603 | | 2,638,934 | | 2,600,673 | | 2,572,570 |

Land, development and construction loans | | 471,450 | | 423,197 | | 242,472 | | 248,742 | | 255,102 |

Total real estate loans | | 5,873,975 | | 5,826,758 | | 3,966,684 | | 3,939,890 | | 3,913,864 |

Commercial loans | | 1,004,213 | | 917,855 | | 697,945 | | 637,476 | | 633,846 |

Consumer and other loans | | 160,739 | | 131,931 | | 107,772 | | 103,413 | | 97,952 |

Total loans before unearned fees and costs | | 7,038,927 | | 6,876,544 | | 4,772,401 | | 4,680,779 | | 4,645,662 |

Unearned fees and costs | | 893 | | 820 | | 820 | | 788 | | 871 |

| | | | | | | | | | |

Total Loans | | $7,039,820 | | $6,877,364 | | $4,773,221 | | $4,681,567 | | $4,646,533 |

Loan production

DEPOSITS

| | Ending Balance |

Deposit mix (unaudited) | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 |

Checking accounts | | | | | | | | | | |

Non-interest bearing | | $2,892,091 | | $2,969,854 | | $1,999,901 | | $1,915,662 | | $1,926,047 |

Interest bearing | | 1,439,839 | | 1,381,888 | | 1,058,985 | | 996,861 | | 990,242 |

Savings deposits | | 664,517 | | 731,415 | | 501,014 | | 511,286 | | 519,964 |

Money market accounts | | 1,777,468 | | 1,730,259 | | 1,167,940 | | 1,156,217 | | 1,178,109 |

Time deposits | | 1,447,893 | | 1,298,582 | | 832,683 | | 845,444 | | 861,093 |

Total deposits | | $8,221,808 | | $8,111,998 | | $5,560,523 | | $5,425,470 | | $5,475,455 |

| | | | | | | | | | |

Non time deposits as percentage of total deposits | | 82% | | 84% | | 85% | | 84% | | 84% |

Time deposits as percentage of total deposits | | 18% | | 16% | | 15% | | 16% | | 16% |

Total deposits | | 100% | | 100% | | 100% | | 100% | | 100% |

5

NET INTEREST MARGIN (“NIM”)

The Company’s NIM increased 13 basis points (“bps”) from 4.38% in the previous quarter to 4.51% during the current quarter due to an increase on loan yields. Cost of deposits increased 7 bps during the second quarter of 2018 compared to the prior quarter.

Net interest margin for the second quarter of 2018 includes accretion income of $14.5 million and average purchase accounting loan discounts of $117 million, compared to accretion income of $8.1 million and average purchase accounting loan discounts of $77 million for the second quarter of 2017. Accretion income increased approximately $3.8 million to $14.5 million for the second quarter of 2018 from $10.8 million for the first quarter of 2018, which is mainly attributable to $4.0 million of income recognized due to prepayments on one PCI loan relationship.

The table below summarizes yields and costs by various interest earning asset and interest bearing liability account types for the current quarter, the previous calendar quarter and the same quarter last year.

| Three Months Ended |

| Jun. 30, 2018 | | | Mar. 31, 2018 | | | Jun. 30, 2017 | |

| Average | | Interest | | Average | | | Average | | Interest | | Average | | | Average | | Interest | | Average | |

| Balance | | Inc/Exp | | Rate | | | Balance | | Inc/Exp | | Rate | | | Balance | | Inc/Exp | | Rate | |

Loans (1) | $6,797,810 | | $86,917 | | 5.13% | | | $6,639,314 | | $82,563 | | 5.04% | | | $4,235,557 | | $48,922 | | 4.63% | |

PCI loans | 183,452 | | 11,096 | | 24.26% | | | 198,665 | | 7,718 | | 15.76% | | | 181,207 | | 8,559 | | 18.95% | |

Taxable securities | 1,552,550 | | 10,325 | | 2.67% | | | 1,605,748 | | 10,419 | | 2.63% | | | 977,856 | | 5,961 | | 2.45% | |

Tax-exempt securities (1) | 205,042 | | 1,845 | | 3.61% | | | 212,959 | | 1,858 | | 3.54% | | | 155,550 | | 1,975 | | 5.09% | |

Fed funds sold and other | 259,534 | | 1,103 | | 1.70% | | | 210,058 | | 1,253 | | 2.42% | | | 180,261 | | 836 | | 1.86% | |

Tot. interest earning assets (1) | $8,998,388 | | $111,286 | | 4.96% | | | $8,866,744 | | $103,811 | | 4.75% | | | $5,730,431 | | $66,253 | | 4.64% | |

| | | | | | | | | | | | | | | | | | | | |

Non-interest earnings assets | 1,369,027 | | | | | | | 1,362,395 | | | | | | | 726,950 | | | | | |

Total Assets | $10,367,415 | | | | | | | $10,229,139 | | | | | | | $6,457,381 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Interest bearing deposits | $5,247,246 | | $6,668 | | 0.51% | | | $5,137,780 | | $5,136 | | 0.41% | | | $3,324,382 | | $2,619 | | 0.32% | |

Fed funds purchased | 268,431 | | 1,300 | | 1.94% | | | 268,509 | | 1,072 | | 1.62% | | | 253,851 | | 692 | | 1.09% | |

Other borrowings | 325,067 | | 1,609 | | 1.99% | | | 327,596 | | 1,469 | | 1.82% | | | 56,414 | | 83 | | 0.59% | |

Corporate debentures | 32,199 | | 523 | | 6.51% | | | 31,864 | | 464 | | 5.91% | | | 26,045 | | 333 | | 5.13% | |

Total interest bearing liabilities | $5,872,943 | | $10,100 | | 0.69% | | | $5,765,749 | | $8,141 | | 0.57% | | | $3,660,692 | | $3,727 | | 0.41% | |

| | | | | | | | | | | | | | | | | | | | |

Non-interest bearing deposits | 2,861,583 | | | | | | | 2,865,614 | | | | | | | 1,891,968 | | | | | |

All other liabilities | 104,906 | | | | | | | 88,220 | | | | | | | 64,668 | | | | | |

Shareholders' equity | 1,527,983 | | | | | | | 1,509,556 | | | | | | | 840,053 | | | | | |

Total liabilities and shareholders' equity | $10,367,415 | | | | | | | $10,229,139 | | | | | | | $6,457,381 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net Interest Spread (1) | | | | | 4.27% | | | | | | | 4.18% | | | | | | | 4.23% | |

Net Interest Margin (1) | | | | | 4.51% | | | | | | | 4.38% | | | | | | | 4.38% | |

| | | | | | | | | | | | | | | | | | | | |

Cost of Total Deposits | | | | | 0.33% | | | | | | | 0.26% | | | | | | | 0.20% | |

| (1) | Tax equivalent yield (Non-GAAP); see reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

The table below summarizes accretion income for the periods presented.

| Three Months Ended | | | Six Months Ended |

| Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

| | | | | | | | | | | | | | |

PCI accretion | $8,546 | | $5,277 | | $5,060 | | $5,157 | | $6,035 | | | $13,823 | | $12,000 |

Non-PCI accretion | 5,976 | | 5,475 | | 1,496 | | 1,613 | | 2,037 | | | 11,451 | | 3,370 |

Total loan accretion | $14,522 | | $10,752 | | $6,556 | | $6,770 | | $8,072 | | | $25,274 | | $15,370 |

The table below compares the unpaid principal balance and the carrying balance (book balance) of the Company’s total Acquired and PCI loans at June 30, 2018.

| | | | | | | | |

| | Unpaid | | | | | | |

| | Principal | | Carrying | | | | |

| | Balance | | Balance | | Difference | | Percentage |

Acquired Loans | | 3,405,223 | | 3,362,427 | | (42,796) | | 1.3% |

PCI loans | | 241,063 | | 173,950 | | (67,113) | | 27.8% |

Total purchased loans | | 3,646,286 | | 3,536,377 | | (109,909) | | 3.0% |

6

NON INTEREST INCOME

Non interest income decreased $449 to $22,589 during the current quarter compared to $23,038 in the previous quarter. The decrease is mainly attributable to a reduction in correspondent banking revenue due to lower fixed income sales. The table below summarizes the Company’s non-interest income for the periods indicated.

Condensed Consolidated Non Interest Income (unaudited)

| | Three Months Ended | | | Six Months Ended |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Correspondent banking revenue | | $7,076 | | $8,123 | | $6,616 | | $7,213 | | $8,063 | | | $15,199 | | $14,512 |

Mortgage banking revenue | | 2,616 | | 2,602 | | 579 | | 404 | | 297 | | | 5,218 | | 528 |

SBA revenue | | 1,027 | | 988 | | 333 | | 249 | | 179 | | | 2,015 | | 193 |

Wealth management related revenue | | 640 | | 616 | | 856 | | 914 | | 891 | | | 1,256 | | 1,784 |

Service charges on deposit accounts | | 4,861 | | 4,834 | | 3,719 | | 3,870 | | 3,822 | | | 9,695 | | 7,397 |

Debit, prepaid, ATM and merchant card related fees | | 3,498 | | 3,727 | | 2,319 | | 2,127 | | 2,324 | | | 7,225 | | 4,589 |

Other service charges and fees | | 2,871 | | 2,170 | | 1,319 | | 1,964 | | 1,398 | | | 5,041 | | 2,473 |

Subtotal | | $22,589 | | $23,060 | | $15,741 | | $16,741 | | $16,974 | | | $45,649 | | $31,476 |

Gain (loss) on sale of securities available for sale | | — | | (22) | | (7) | | — | | — | | | (22) | | — |

Gain on sale of trust department | | — | | — | | 1,224 | | — | | — | | | — | | — |

Total Non Interest Income | | $22,589 | | $23,038 | | $16,958 | | $16,741 | | $16,974 | | | $45,627 | | $31,476 |

Note: Certain prior period amounts have been reclassified to conform to the current period presentation format.

NON INTEREST EXPENSES

Non interest expense increased $3,616 in the second quarter to $79,612 compared to the previous quarter. The Company incurred $14,140 of merger-related expenses during the current quarter, which was attributable to the acquisitions of Harbor and Sunshine. During the current quarter, the Company incurred $891 of impairment on bank property held for sale. The Company also paid $279 in cash bonuses to non-officer employees during the current quarter as a result of the Tax Cuts and Jobs Act of 2017. The table below summarizes the Company’s non-interest expense for the periods indicated.

Condensed Consolidated Non Interest Expense (unaudited)

| | Three Months Ended | | | Six Months Ended |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Salaries, wages and employee benefits | | 40,683 | | 41,893 | | 29,698 | | 28,515 | | 28,317 | | | 82,576 | | 51,199 |

Occupancy expense | | 4,968 | | 4,868 | | 3,324 | | 3,422 | | 3,191 | | | 9,836 | | 6,031 |

Depreciation of premises and equipment | | 2,322 | | 2,275 | | 1,884 | | 1,842 | | 1,837 | | | 4,597 | | 3,521 |

Marketing expenses | | 1,425 | | 1,414 | | 1,044 | | 955 | | 1,078 | | | 2,839 | | 1,930 |

Data processing expenses | | 3,453 | | 4,505 | | 2,185 | | 2,006 | | 2,419 | | | 7,958 | | 4,245 |

Legal, auditing and other professional fees | | 1,332 | | 931 | | 970 | | 854 | | 932 | | | 2,263 | | 1,820 |

Bank regulatory related expenses | | 1,209 | | 1,010 | | 767 | | 666 | | 891 | | | 2,219 | | 1,618 |

Debit, ATM and merchant card related expenses | | 860 | | 764 | | 644 | | 746 | | 741 | | | 1,624 | | 1,356 |

Credit related expenses | | 32 | | 617 | | (23) | | 527 | | 876 | | | 649 | | 1,531 |

Amortization of intangibles | | 2,240 | | 2,309 | | 1,129 | | 1,133 | | 1,042 | | | 4,549 | | 1,804 |

Impairment on bank property held for sale | | 891 | | 1,449 | | 12 | | — | | 430 | | | 2,340 | | 507 |

Other expenses | | 6,057 | | 5,252 | | 4,659 | | 3,956 | | 3,597 | | | 11,309 | | 6,962 |

Subtotal | | 65,472 | | 67,287 | | 46,293 | | 44,622 | | 45,351 | | | 132,759 | | 82,524 |

Merger-related expenses | | 14,140 | | 8,709 | | 2,718 | | — | | 9,458 | | | 22,849 | | 10,328 |

Total Non Interest Expense | | 79,612 | | $75,996 | | $49,011 | | $44,622 | | $54,809 | | | 155,608 | | 92,852 |

Note: Certain prior period amounts have been reclassified to conform to the current period presentation format.

7

CREDIT QUALITY AND ALLOWANCE FOR LOAN LOSSES

Non-performing assets (“NPAs”) totaled $28,554 at June 30, 2018, compared to $30,097 at March 31, 2018. The net decrease in NPAs is mainly attributable to sales of other real estate owned during the quarter. NPAs as a percentage of total assets declined to 0.27% at June 30, 2018, compared to 0.29% at March 31, 2018.

The table below summarizes selected credit quality data for the periods indicated.

| | Ending Balance | | | | | |

Non-Performing Assets (1) | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | | | |

Non-accrual loans | | 23,071 | | $23,096 | | $17,288 | | $19,319 | | $19,916 | | | | | |

Past due loans 90 days or more | | | | | | | | | | | | | | | |

and still accruing interest | | — | | — | | — | | — | | — | | | | | |

Total non-performing loans (“NPLs”) | | 23,071 | | 23,096 | | 17,288 | | 19,319 | | 19,916 | | | | | |

Other real estate owned (“OREO”) | | 5,376 | | 6,814 | | 3,987 | | 5,904 | | 6,422 | | | | | |

Repossessed assets other than real estate | | 107 | | 187 | | 147 | | 47 | | 131 | | | | | |

Total non-performing assets | | $28,554 | | $30,097 | | $21,422 | | $25,270 | | $26,469 | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | Six Months Ended |

Asset Quality Ratios (1) | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Non-performing loans as percentage of total loans | | 0.34% | | 0.34% | | 0.38% | | 0.43% | | 0.45% | | | | | |

Non-performing assets as percentage of total assets | | 0.27% | | 0.29% | | 0.30% | | 0.37% | | 0.39% | | | | | |

Non-performing assets as percentage of loans and | | | | | | | | | | | | | | | |

OREO plus other repossessed assets | | 0.42% | | 0.45% | | 0.46% | | 0.56% | | 0.59% | | | | | |

Loans past due 30 thru 89 days and accruing interest | | | | | | | | | | | | | | | |

as a percentage of total loans | | 0.37% | | 0.40% | | 0.30% | | 0.54% | | 0.27% | | | | | |

Allowance for loan losses as percentage of NPLs | | 161% | | 148% | | 188% | | 163% | | 149% | | | | | |

Net (recoveries) charge-offs | | ($122) | | ($229) | | ($28) | | ($600) | | ($349) | | | ($351) | | ($132) |

Net (recoveries) charge-offs as a percentage of average | | | | | | | | | | | | | | | |

loans for the period on an annualized basis | | (0.01%) | | (0.01%) | | 0.00% | | (0.05%) | | 0.03% | | | (0.01%) | | (0.01%) |

The allowance for loan losses (“ALLL") totaled $37,484 at June 30, 2018, compared to $34,429 at March 31, 2018, an increase of $3,055 due to loan loss provision expense of $2,933 and net recoveries of $122. The changes in the Company’s ALLL components between June 30, 2018 and March 31, 2018 are summarized in the table below (unaudited).

| | June 30, 2018 | | March 31, 2018 | | Increase (Decrease) |

| | Loan | ALLL | | | Loan | ALLL | | | Loan | ALLL | |

| | Balance | Balance | % | | Balance | Balance | % | | Balance | Balance | |

Originated loans | | $3,489,606 | $34,214 | 0.98% | | $3,111,870 | $31,141 | 1.00% | | $377,736 | $3,073 | (2) bp |

Impaired originated loans | | 13,837 | 875 | 6.32% | | 13,693 | 785 | 5.73% | | 144 | 90 | 59 bp |

Total originated loans | | 3,503,443 | 35,089 | 1.00% | | 3,125,563 | 31,926 | 1.02% | | 377,880 | 3,163 | (2) bp |

| | | | | | | | | | | | |

Acquired loans (1) | | 3,357,985 | 2,119 | 0.06% | | 3,552,893 | 2,227 | 0.06% | | (194,908) | (108) | – bps |

Impaired acquired loans (2) | | 4,442 | 1 | 0.02% | | 5,725 | 1 | 0.02% | | (1,283) | — | – bps |

Total acquired loans | | 3,362,427 | 2,120 | 0.06% | | 3,558,618 | 2,228 | 0.06% | | (196,191) | (108) | – bps |

| | | | | | | | | | | | |

Total non-PCI loans | | 6,865,870 | 37,209 | | | 6,684,181 | 34,154 | | | 181,689 | 3,055 | |

PCI loans | | 173,950 | 275 | | | 193,183 | 275 | | | (19,233) | — | |

Total loans | | $7,039,820 | $37,484 | | | $6,877,364 | $34,429 | | | $162,456 | $3,055 | |

| (1) | Performing acquired loans recorded at estimated fair value on the related acquisition dates. The total net unamortized fair value adjustment at June 30, 2018 was approximately $42,706 or 1.3% of the aggregate outstanding related loan balances. |

| (2) | These are loans that were acquired as performing loans that subsequently became impaired. |

8

Explanation of Certain Unaudited Non-GAAP Financial Measures

This press release contains financial information determined by methods other than U.S. Generally Accepted Accounting Principles (“GAAP”), including adjusted net income, adjusted net income per share diluted, adjusted return on average assets, adjusted return on average equity, return on average tangible equity, adjusted return on average tangible equity, adjusted efficiency ratio, adjusted non-interest income, adjusted non-interest expense, adjusted net-interest income, tangible common equity, tangible common equity to tangible assets, common tangible equity per common share, tax equivalent yields on loans, securities and earning assets, and tax equivalent net interest spread and margin, which we refer to “Non-GAAP financial measures.” The tables below provide reconciliations between these Non-GAAP measures and net income, interest income, net interest income and tax equivalent basis interest income and net interest income, return on average assets, return on average equity, the efficiency ratio, total stockholders’ equity and tangible common equity, as applicable.

Management uses these Non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and enhance investors’ understanding of the Company’s core business and performance without the impact of merger-related expenses. Accordingly, management believes it is appropriate to exclude merger-related expenses because those costs are specific to each acquisition, vary based upon the size, complexity and other specifics of each acquisition, and are not indicative of the costs to operate the Company’s core business.

Non-GAAP measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. The Company provides reconciliations between GAAP and these Non-GAAP measures. These disclosures should not be considered an alternative to GAAP.

Reconciliation of GAAP to non-GAAP Measures (unaudited):

| | Three months ended | | | Six months ended |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Adjusted net income (Non-GAAP) | | | | | | | | | | | | | | | |

Net income (GAAP) | | $32,163 | | $35,636 | | $1,912 | | $22,050 | | $15,233 | | | $67,799 | | $31,833 |

Loss (gain) on sale of securities available for sale, net of tax | | — | | 17 | | 5 | | — | | — | | | 17 | | — |

Gain on sale of trust department, net of tax | | — | | — | | (820) | | — | | — | | | — | | — |

Merger-related expenses, net of tax | | 10,760 | | 6,647 | | 1,820 | | — | | 6,769 | | | 17,407 | | 7,295 |

Deferred tax asset write down | | — | | — | | 18,575 | | — | | — | | | — | | — |

Adjusted net income (Non-GAAP) | | $42,923 | | $42,300 | | $21,492 | | $22,050 | | $22,002 | | | $85,223 | | $39,128 |

| | | | | | | | | | | | | | | |

Adjusted net income per share - Diluted | | | | | | | | | | | | | | | |

Earnings per share - Diluted (GAAP) | | $0.38 | | $0.42 | | $0.03 | | $0.36 | | $0.26 | | | $0.80 | | $0.57 |

Effect to adjust for loss (gain) on sale of securities available for sale, net of tax | | — | | — | | — | | — | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | (0.01) | | — | | — | | | — | | — |

Effect to adjust for merger-related expenses, net of tax | | 0.12 | | 0.08 | | 0.03 | | — | | 0.11 | | | 0.20 | | 0.14 |

Effect to adjust for deferred tax asset write down | | — | | — | | 0.30 | | — | | — | | | — | | — |

Adjusted net income per share - Diluted (Non-GAAP) | | $0.50 | | $0.50 | | $0.35 | | $0.36 | | $0.37 | | | $1.00 | | $0.71 |

| | | | | | | | | | | | | | | |

Adjusted return on average assets (Non-GAAP) | | | | | | | | | | | | | | | |

Return on average assets (GAAP) | | 1.24% | | 1.41% | | 0.11% | | 1.29% | | 0.95% | | | 1.33% | | 1.10% |

Effect to adjust for securities available for sale, net of tax | | — | | — | | — | | — | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | -0.05% | | — | | — | | | — | | — |

Effect to adjust for merger-related expenses, net of tax | | 0.42% | | 0.27% | | 0.10% | | — | | 0.42% | | | 0.34% | | 0.26% |

Effect to adjust for deferred tax asset write down | | — | | — | | 1.07% | | — | | — | | | — | | — |

Adjusted return on average assets (Non-GAAP) | | 1.66% | | 1.68% | | 1.23% | | 1.29% | | 1.37% | | | 1.67% | | 1.36% |

9

Explanation of Certain Unaudited Non-GAAP Financial Measures (continued)

| | Three months ended | | | Six months ended | |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 | | | Jun. 30, 2018 | | Jun. 30, 2017 |

Adjusted return on average equity (Non-GAAP) | | | | | | | | | | | | | | | |

Return on average equity (GAAP) | | 8.44% | | 9.57% | | 0.83% | | 9.71% | | 7.27% | | | 9.00% | | 8.83% |

Effect to adjust for gain on sale of securities available for sale, net of tax | | — | | — | | — | | — | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | (0.35%) | | — | | — | | | — | | — |

Effect to adjust for merger and acquisition related expenses, net of tax | | 2.82% | | 1.79% | | 0.78% | | — | | 3.23% | | | 2.31% | | 2.02% |

Effect to adjust for deferred tax asset write down | | — | | — | | 8.03% | | — | | — | | | — | | — |

Adjusted return on average equity (Non-GAAP) | | 11.26% | | 11.36% | | 9.29% | | 9.71% | | 10.50% | | | 11.31% | | 10.85% |

| | | | | | | | | | | | | | | |

Return on average tangible equity (non-GAAP) | | | | | | | | | | | | | | | |

Net income (GAAP) | | $32,163 | | $35,636 | | $1,912 | | $22,050 | | $15,233 | | | $67,799 | | $31,833 |

Amortization of intangibles, net of tax | | 1,705 | | 1,762 | | 756 | | 743 | | 746 | | | 3,792 | | 1,274 |

Adjusted net income for average tangible equity (Non-GAAP) | | $33,868 | | $37,398 | | $2,668 | | $22,793 | | $15,979 | | | $71,591 | | $33,107 |

| | | | | | | | | | | | | | | |

Average stockholders' equity (GAAP) | | $1,527,983 | | $1,509,556 | | $917,493 | | $900,492 | | $840,053 | | | $1,518,820 | | $728,779 |

Average goodwill | | (608,092) | | (609,719) | | (257,683) | | (257,683) | | (232,026) | | | (608,901) | | (169,375) |

Average core deposit intangible | | (53,112) | | (55,668) | | (24,727) | | (25,819) | | (24,118) | | | (54,383) | | (19,698) |

Average other intangibles | | (823) | | (649) | | (959) | | (1,004) | | (962) | | | (737) | | (867) |

Average tangible equity (Non-GAAP) | | $865,956 | | $843,520 | | $634,124 | | $615,986 | | $582,947 | | | $854,799 | | $538,839 |

| | | | | | | | | | | | | | | |

Return on average tangible equity (annualized) (Non-GAAP) | | 15.69% | | 17.98% | | 1.67% | | 14.68% | | 10.99% | | | 16.89% | | 12.39% |

| | | | | | | | | | | | | | | |

Adjusted return on average tangible equity (non-GAAP) | | | | | | | | | | | | | | | |

Return on average tangible equity (Non-GAAP) | | 15.69% | | 17.98% | | 1.67% | | 14.68% | | 10.99% | | | 16.89% | | 12.39% |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | (0.51%) | | — | | — | | | — | | — |

Effect to adjust for merger-related expenses, net of tax | | 4.98% | | 3.20% | | 1.14% | | — | | 4.66% | | | 4.11% | | 2.73% |

Effect to adjust for deferred tax asset write down | | — | | — | | 11.62% | | — | | — | | | — | | — |

Adjusted return on average tangible equity (Non-GAAP) | | 20.67% | | 21.19% | | 13.92% | | 14.68% | | 15.65% | | | 21.00% | | 15.12% |

| | | | | | | | | | | | | | | |

Efficiency ratio (tax equivalent) (Non-GAAP) | | | | | | | | | | | | | | | |

Non interest income (GAAP) | | $22,589 | | $23,038 | | $16,958 | | $16,741 | | $16,974 | | | $45,627 | | $31,476 |

Gain on sale of trust department | | — | | — | | (1,224) | | — | | — | | | — | | — |

Adjusted non interest income (Non-GAAP) | | $22,589 | | $23,038 | | $15,734 | | $16,741 | | $16,974 | | | $45,627 | | $31,476 |

| | | | | | | | | | | | | | | |

Net interest income before provision (GAAP) | | $100,529 | | $95,018 | | $63,619 | | $62,586 | | $61,017 | | | $195,547 | | $109,338 |

Total tax equivalent adjustment | | 657 | | 652 | | 1,480 | | 1,510 | | 1,509 | | | 1,259 | | 2,848 |

Adjusted net interest income (Non-GAAP) | | $101,186 | | $95,670 | | $65,099 | | $64,096 | | $62,526 | | | $196,806 | | $112,186 |

| | | | | | | | | | | | | | | |

Non interest expense (GAAP) | | $79,612 | | $75,996 | | $49,011 | | $44,622 | | $54,809 | | | $155,608 | | $92,852 |

Amortization of intangibles | | (2,240) | | (2,309) | | (1,129) | | (1,133) | | (1,042) | | | (4,549) | | (1,804) |

Merger and acquisition related expenses | | (14,140) | | (8,709) | | (2,718) | | — | | (9,458) | | | (22,849) | | (10,328) |

Adjusted non interest expense (Non-GAAP) | | $63,232 | | $64,978 | | $45,164 | | $43,489 | | $44,309 | | | $128,210 | | $80,720 |

| | | | | | | | | | | | | | | |

Efficiency ratio (tax equivalent) (Non-GAAP) | | 64.3% | | 64.0% | | 59.7% | | 55.2% | | 68.9% | | | 64.2% | | 64.6% |

| | | | | | | | | | | | | | | |

Adjusted efficiency ratio, tax equivalent (Non-GAAP) | | 51.1% | | 54.7% | | 55.9% | | 53.8% | | 55.7% | | | 52.9% | | 56.2% |

10

Explanation of Certain Unaudited Non-GAAP Financial Measures (continued)

| | Ending Balance |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | Sept. 30, 2017 | | Jun. 30, 2017 |

Tangible common equity (Non-GAAP) | | | | | | | | | | |

Total stockholders' equity (GAAP) | | $1,540,248 | | $1,517,846 | | $904,750 | | $909,622 | | $890,258 |

Goodwill | | (605,232) | | (609,720) | | (257,683) | | (257,683) | | (257,683) |

Core deposit intangible | | (51,754) | | (53,944) | | (24,063) | | (25,140) | | (26,217) |

Other intangibles | | (923) | | (749) | | (551) | | (1,035) | | (1,011) |

Tangible common equity (Non-GAAP) | | $882,339 | | $853,433 | | $622,453 | | $625,764 | | $605,347 |

| | | | | | | | | | |

Total assets (GAAP) | | $10,536,723 | | $10,347,996 | | $7,123,975 | | $6,822,861 | | $6,767,479 |

Goodwill | | (605,232) | | (609,720) | | (257,683) | | (257,683) | | (257,683) |

Core deposit intangible | | (51,754) | | (53,944) | | (24,063) | | (25,140) | | (26,217) |

Other intangibles | | (923) | | (749) | | (551) | | (1,035) | | (1,011) |

Total tangible assets (Non-GAAP) | | $9,878,814 | | $9,683,583 | | $6,841,678 | | $6,539,003 | | $6,482,568 |

| | | | | | | | | | |

Tangible common equity to tangible assets (Non-GAAP) | | 8.9% | | 8.8% | | 9.1% | | 9.6% | | 9.3% |

Common tangible equity per common share (Non-GAAP) | | $10.49 | | $10.19 | | $10.35 | | $10.42 | | $10.09 |

Common shares outstanding at period end | | 84,120 | | 83,758 | | 60,161 | | 60,053 | | 60,003 |

| | | | | | | | | | |

| | Three months ended | | | | |

| | Jun. 30, 2018 | | Mar. 31, 2018 | | Jun. 30, 2017 | | | | |

Tax equivalent yields (Non-GAAP) | | | | | | | | | | |

Loans, excluding PCI loans | | $86,546 | | $82,212 | | $48,060 | | | | |

PCI loans | | 11,096 | | 7,718 | | 8,559 | | | | |

Taxable securities | | 10,325 | | 10,419 | | 5,961 | | | | |

Tax -exempt securities | | 1,559 | | 1,557 | | 1,328 | | | | |

Fed funds sold and other | | 1,103 | | 1,253 | | 836 | | | | |

Interest income (GAAP) | | $110,629 | | $103,159 | | $64,744 | | | | |

Tax equivalent adjustment for Non-PCI loans | | 371 | | 351 | | 862 | | | | |

Tax equivalent adjustment for tax-exempt securities | | 286 | | 301 | | 647 | | | | |

Tax equivalent adjustments | | 657 | | 652 | | 1,509 | | | | |

Interest income (tax equivalent) (Non-GAAP) | | $111,286 | | $103,811 | | $66,253 | | | | |

| | | | | | | | | | |

Net interest income (GAAP) | | $100,529 | | $95,018 | | $61,017 | | | | |

Tax equivalent adjustments | | 657 | | 652 | | 1,509 | | | | |

Net interest income (tax equivalent) (Non-GAAP) | | $101,186 | | $95,670 | | $62,526 | | | | |

| | | | | | | | | | |

Yield on Non-PCI loans | | 5.11% | | 5.02% | | 4.55% | | | | |

Effect from tax equivalent adjustment | | 0.02% | | 0.02% | | 0.08% | | | | |

Yield on Non-PCI loans - tax equivalent (Non-GAAP) | | 5.13% | | 5.04% | | 4.63% | | | | |

| | | | | | | | | | |

Yield on securities | | 2.71% | | 2.67% | | 2.58% | | | | |

Effect from tax equivalent adjustment | | 0.07% | | 0.07% | | 0.23% | | | | |

Yield on securities - tax equivalent (Non-GAAP) | | 2.78% | | 2.74% | | 2.81% | | | | |

| | | | | | | | | | |

Yield on interest earning assets (GAAP) | | 4.93% | | 4.72% | | 4.53% | | | | |

Effect from tax equivalent adjustments | | 0.03% | | 0.03% | | 0.11% | | | | |

Yield on interest earning assets - tax equivalent (Non-GAAP) | | 4.96% | | 4.75% | | 4.64% | | | | |

| | | | | | | | | | |

Net interest spread (GAAP) | | 4.24% | | 4.15% | | 4.12% | | | | |

Effect for tax equivalent adjustments | | 0.03% | | 0.03% | | 0.11% | | | | |

Net interest spread (Non-GAAP) | | 4.27% | | 4.18% | | 4.23% | | | | |

| | | | | | | | | | |

Net interest margin (GAAP) | | 4.48% | | 4.35% | | 4.27% | | | | |

Effect from tax equivalent adjustments | | 0.03% | | 0.03% | | 0.11% | | | | |

Net interest margin - tax equivalent (Non-GAAP) | | 4.51% | | 4.38% | | 4.38% | | | | |

11

About CenterState Bank Corporation

CenterState operates as one of the largest community bank franchises headquartered in the state of Florida. Both the Company and its nationally chartered bank subsidiary are based in Winter Haven, Florida, between Orlando and Tampa. With over $10 billion in assets, the Bank provides traditional retail, commercial, mortgage, wealth management and SBA services throughout its Florida branch network and customer relationships in neighboring states. The Bank also has a national footprint, serving clients coast to coast through its correspondent banking division.

For additional information contact John C. Corbett (CEO), Stephen D. Young (COO) or Jennifer L. Idell (CFO) at 863-293-4710.

About Charter Financial Corporation

Charter Financial Corporation is a savings and loan holding company and the parent company of CharterBank, a full-service community bank and a federal savings institution. CharterBank is headquartered in West Point, Georgia, and operates branches in the Metro Atlanta, the I-85 corridor south to Auburn, Alabama, and the Florida Gulf Coast. CharterBank's deposits are insured by the Federal Deposit Insurance Corporation. Investors may obtain additional information about Charter Financial Corporation and CharterBank on the internet at www.charterbk.com under About Us.

Forward Looking Statements:

Information in this press release, other than statements of historical facts, may constitute forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about the benefits of the proposed merger of CenterState and Charter, including future financial and operating results (including the anticipated impact of the transaction on CenterState’s earnings and tangible book value), statements related to the expected timing of the completion of the Charter merger, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “scheduled,” “plans,” “intends,” “anticipates,” “expects,” “believes,” estimates,” “potential,” or “continue” or negative of such terms or other comparable terminology. All forward-looking statements are subject to risks, uncertainties and other facts that may cause the actual results, performance or achievements of CenterState or Charter to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk that the cost savings and any revenue synergies from the Charter merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Charter merger with customers, suppliers, employee or other business partners relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Charter merger agreement, (4) the risk of successful integration of Charter’s businesses into CenterState, (5) the failure to obtain the necessary approvals by the Charter stockholders, (6) the amount of the costs, fees, expenses and charges related to the mergers, (7) the ability by CenterState to obtain required governmental approvals of the Charter merger, (8) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the merger, (9) the failure of the closing conditions in each of the merger agreements to be satisfied, or any unexpected delay in closing the merger, (10) the risk that the integration of Charter’s operations into the operations of CenterState will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by CenterState’s issuance of additional shares of its common stock in the merger transaction, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in CenterState’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, or Charter’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the Securities and Exchange Commission (“SEC”) and available on the SEC’s website at http://www.sec.gov. CenterState and Charter disclaim any obligation to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise.

Additional Information About the Charter Merger and Where to Find It

CenterState has filed with the Securities and Exchange Commission a Registration Statement on Form S-4 (No. 333-225541) and a Definitive Proxy Statement of Charter and a Prospectus of the Company, as well as other relevant documents concerning the proposed Charter transaction. The proposed transaction is being submitted to Charter’s stockholders for their consideration. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION (AND ANY OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE TRANSACTION

12

OR INCORPORATED BY REFERENCE INTO THE PROXY/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the Securities and Exchange Commission on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the Securities and Exchange Commission by CenterState on its website at www.centerstatebanks.com and by Charter on its website at www.charterbk.com.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and security holders of CenterState and Charter are urged to read carefully the entire registration statement and proxy statement/prospectus, including any amendments thereto, because they contain important information about the proposed transaction. Free copies of these documents may be obtained as described above.

CenterState, Charter and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from Charter stockholders in connection with the Merger. Information regarding the directors and executive officers of CenterState and Charter and other persons who may be deemed participants in the solicitation of the stockholders of Charter in connection with the Merger are included in the proxy statement/prospectus for Charter’s special meeting of stockholders filed by CenterState with the SEC. Information about the directors and officers of CenterState and their ownership of CenterState common stock can also be found in CenterState’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on March 12, 2018, and other documents subsequently filed by CenterState with the SEC. Information about the directors and officers of Charter and their ownership of Charter common stock can also be found in Charter’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on January 5, 2018, and other documents subsequently filed by Charter with the SEC. Additional information regarding the interests of such participants are included in the proxy statement/prospectus and other relevant documents regarding the Merger filed with the SEC.

13