Exhibit 99.1

FOR IMMEDIATE RELEASE January 22, 2019 | |

|

CenterState Bank Corporation Announces

Fourth Quarter 2018 Earnings Results

(all amounts are in thousands, except per share data, or unless otherwise noted)

WINTER HAVEN, FL. – January 22, 2019 - CenterState Bank Corporation (Nasdaq: CSFL) (the “Company” or “CenterState”) reported net income of $50,651, or diluted earnings per share of $0.52, for the fourth quarter of 2018, compared to net income of $1,912, or diluted earnings per share of $0.03, for the fourth quarter of 2017. Highlights for the period ended December 31, 2018 and selected performance metrics are set forth below.

| o | Tangible book value per share, including three closed acquisitions, increased 11% in 2018 |

| o | Entered into a definitive agreement in November 2018 to acquire National Commerce Corporation (“NCC”) which provides deeper market penetration into the core growth markets of Orlando, Tampa, Jacksonville and Atlanta |

| o | Subsequently announced on January 18, 2019, a quarterly cash dividend on its common stock of $0.11 per share, a 10% increase compared to prior quarter |

| • | Net Interest Margin, tax equivalent (“NIM”) (Non-GAAP(1)): |

| o | NIM increased to 4.37% for the current quarter compared to 4.31% for the previous quarter |

| o | Excluding all loan accretion, NIM decreased 1 basis points (“bps”) compared to the previous quarter and increased 7 bps compared to the fourth quarter of 2017 |

| o | Cost of total deposits increased 9 bps to 0.51%; total deposit (including non-interest bearing DDA) beta equal to 36% from the previous quarter and 15% since the tightening cycle began in the third quarter 2015 |

| o | Non-interest income to average assets of 1.05% compared to 0.96% in the previous quarter with continued growth in correspondent banking and mortgage revenue |

| o | Adjusted efficiency ratio (Non-GAAP(2)) remained flat at 50.3% compared to 50.0% in the previous quarter |

| o | Full cost savings from the Charter acquisition, including system conversion, are expected to be integrated by the end of first quarter of 2019 |

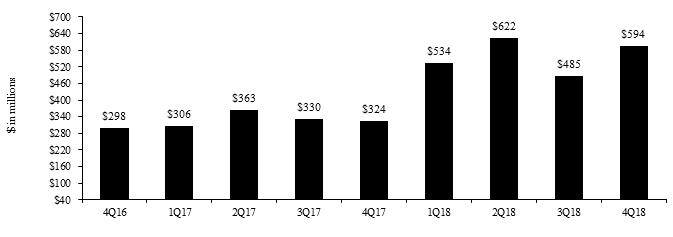

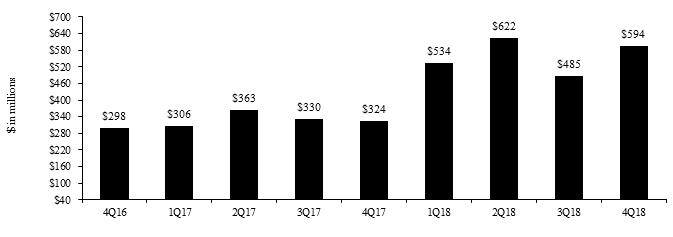

| o | Total loans increased 6% (annualized) during the current quarter; new loan production increased to $594 million during the current quarter versus $485 million in previous quarter |

| o | Non-performing assets as a percentage of total assets decreased to 0.22% during the current quarter compared to 0.23% in the previous quarter and 0.30% for the fourth quarter of 2017; net charge-offs were 0.02% of average non-PCI loans for the current year |

| o | Non-CD deposits increased approximately 2% (annualized); checking account balances represent 50% of total deposits |

| o | Loan to deposit ratio of 88% |

| | Three Months Ended December 31, | | | Twelve Months Ended December 31, |

| | 2018 | | | 2017 | | | 2018 | | | 2017 |

| | | | Adjusted (2) | | | | | Adjusted (2) | | | | | Adjusted (2) | | | | | Adjusted (2) |

| | Reported | | (Non-GAAP) | | | Reported | | (Non-GAAP) | | | Reported | | (Non-GAAP) | | | Reported | | (Non-GAAP) |

Net income | | $50,651 | | $51,913 | | | $1,912 | | $21,492 | | | $156,435 | | $182,571 | | | $55,795 | | $82,434 |

Return on average assets | | 1.64% | | 1.68% | | | 0.11% | | 1.23% | | | 1.43% | | 1.67% | | | 0.88% | | 1.30% |

Return on average tangible equity (Non-GAAP)(1) | | 19.8% | | 20.2% | | | 1.7% | | 13.9% | | | 17.7% | | 20.5% | | | 10.1% | | 14.6% |

Earnings per share diluted | | $0.52 | | $0.54 | | | $0.03 | | $0.35 | | | $1.76 | | $2.06 | | | $0.95 | | $1.41 |

Efficiency ratio, tax equivalent (Non-GAAP)(1) | | 53.4% | | 50.3% | | | 59.7% | | 55.9% | | | 60.0% | | 51.4% | | | 60.9% | | 55.5% |

| (1) | See reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

| (2) | Performance metrics presented above are adjusted for merger-related expenses, which for the three months ended December 31,2018, represent direct severance, system terminations, and legal and professional fees, that are not duplicative of current operations, and other items. See reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

Condensed Consolidated Income Statement (unaudited)

Condensed consolidated income statements (unaudited) are shown below for the periods indicated.

| | Three Months Ended | | | Twelve Months Ended |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Interest income | | | | | | | | | | | | | | | |

Loans | | $116,754 | | $101,555 | | $97,642 | | $89,930 | | $59,982 | | | $405,881 | | $219,972 |

Investment securities | | 13,516 | | 11,746 | | 11,884 | | 11,976 | | 7,382 | | | 49,122 | | 27,922 |

Federal Funds sold and other | | 1,911 | | 1,362 | | 1,103 | | 1,253 | | 1,058 | | | 5,629 | | 3,432 |

Total interest income | | 132,181 | | 114,663 | | 110,629 | | 103,159 | | 68,422 | | | 460,632 | | 251,326 |

Interest expense | | | | | | | | | | | | | | | |

Deposits | | 12,360 | | 9,096 | | 6,668 | | 5,136 | | 3,385 | | | 33,260 | | 11,079 |

Securities sold under agreement to repurchase | | 203 | | 169 | | 138 | | 122 | | 89 | | | 632 | | 246 |

Other borrowed funds | | 3,289 | | 2,966 | | 2,771 | | 2,419 | | 977 | | | 11,445 | | 3,108 |

Corporate debentures | | 647 | | 579 | | 523 | | 464 | | 352 | | | 2,213 | | 1,350 |

Interest expense | | 16,499 | | 12,810 | | 10,100 | | 8,141 | | 4,803 | | | 47,550 | | 15,783 |

Net interest income | | 115,682 | | 101,853 | | 100,529 | | 95,018 | | 63,619 | | | 413,082 | | 235,543 |

Provision for loan losses | | 2,100 | | 1,950 | | 2,933 | | 1,300 | | 968 | | | 8,283 | | 4,958 |

Net interest income after loan loss provision | | 113,582 | | 99,903 | | 97,596 | | 93,718 | | 62,651 | | | 404,799 | | 230,585 |

| | | | | | | | | | | | | | | |

Loss on sale of securities available for sale | | — | | — | | — | | (22) | | (7) | | | (22) | | (7) |

Gain on sale of deposits | | — | | 611 | | — | | — | | — | | | 611 | | — |

Gain on sale of trust department | | — | | — | | — | | — | | 1,224 | | | — | | 1,224 |

All other non interest income | | 32,396 | | 26,493 | | 22,589 | | 23,060 | | 15,741 | | | 104,538 | | 63,958 |

Total non interest income | | 32,396 | | 27,104 | | 22,589 | | 23,038 | | 16,958 | | | 105,127 | | 65,175 |

| | | | | | | | | | | | | | | |

Merger related expenses | | 1,668 | | 10,395 | | 14,140 | | 8,709 | | 2,718 | | | 34,912 | | 13,046 |

All other non interest expense | | 77,852 | | 66,944 | | 65,472 | | 67,287 | | 46,293 | | | 277,555 | | 173,439 |

Total non interest expense | | 79,520 | | 77,339 | | 79,612 | | 75,996 | | 49,011 | | | 312,467 | | 186,485 |

| | | | | | | | | | | | | | | |

Income before income tax | | 66,458 | | 49,668 | | 40,573 | | 40,760 | | 30,598 | | | 197,459 | | 109,275 |

Income tax provision (1) | | 15,807 | | 11,683 | | 8,410 | | 5,124 | | 28,686 | | | 41,024 | | 53,480 |

Net income | | $50,651 | | $37,985 | | $32,163 | | $35,636 | | $1,912 | | | 156,435 | | 55,795 |

Net income allocated to common shares | | $50,619 | | $37,957 | | $32,137 | | $35,606 | | $1,909 | | | $156,319 | | $55,675 |

| | | | | | | | | | | | | | | |

Earnings per share - Basic | | $0.53 | | $0.43 | | $0.38 | | $0.43 | | $0.03 | | | $1.78 | | $0.97 |

Earnings per share - Diluted | | $0.52 | | $0.43 | | $0.38 | | $0.42 | | $0.03 | | | $1.76 | | $0.95 |

Dividends per share | | $0.10 | | $0.10 | | $0.10 | | $0.10 | | $0.06 | | | $0.40 | | $0.24 |

Average common shares outstanding (basic) | | 95,603 | | 87,814 | | 83,870 | | 83,140 | | 60,001 | | | 87,641 | | 57,245 |

Average common shares outstanding (diluted) | | 96,450 | | 88,811 | | 85,007 | | 84,601 | | 61,276 | | | 88,759 | | 58,341 |

Common shares outstanding at period end | | 95,680 | | 95,636 | | 84,120 | | 83,758 | | 60,161 | | | 95,680 | | 60,161 |

Effective tax rate (1) | | 23.78% | | 23.52% | | 20.73% | | 12.57% | | 93.75% | | | 20.78% | | 48.94% |

| (1) | Due the reduction of the federal corporate tax rate to 21% effective January 1, 2018, the Company revalued its DTA at December 31, 2017 and recorded a charge to DTA of $18,575 as additional income tax expense during the fourth quarter of 2017. Excluding the DTA write down of $18,575, the effective tax rates were 33.04% and 31.94% for the three and twelve months ended December 31, 2017. |

2

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

Presented below are condensed consolidated balance sheets for the periods indicated.

| | Ending Balance |

Condensed Consolidated Balance Sheets | | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 |

Assets | | | | | | | | | | |

Cash and due from banks | | $135,352 | | $118,179 | | $85,589 | | $108,352 | | $85,562 |

Fed funds sold and Fed Res Bank deposits | | 231,981 | | 488,152 | | 307,375 | | 294,267 | | 195,057 |

Trading securities | | 1,737 | | — | | 1,848 | | 428 | | 6,777 |

Investment securities: | | | | | | | | | | |

Available for sale | | 1,727,348 | | 1,536,842 | | 1,528,270 | | 1,530,539 | | 1,060,143 |

Held to maturity | | 216,833 | | 219,850 | | 223,839 | | 227,966 | | 232,399 |

Total investment securities | | 1,944,181 | | 1,756,692 | | 1,752,109 | | 1,758,505 | | 1,292,542 |

Loans held for sale | | 40,399 | | 39,554 | | 36,366 | | 28,485 | | 19,647 |

Loans: | | | | | | | | | | |

Originated loans | | 4,108,656 | | 3,762,396 | | 3,503,443 | | 3,125,563 | | 2,919,350 |

Acquired loans | | 4,072,877 | | 4,293,025 | | 3,362,427 | | 3,558,618 | | 1,689,713 |

Purchased Credit Impaired ("PCI") loans | | 158,971 | | 167,671 | | 173,950 | | 193,183 | | 164,158 |

Total gross loans | | 8,340,504 | | 8,223,092 | | 7,039,820 | | 6,877,364 | | 4,773,221 |

Allowance for loan losses | | (39,770) | | (38,811) | | (37,484) | | (34,429) | | (32,825) |

Loans, net of allowance | | 8,300,734 | | 8,184,281 | | 7,002,336 | | 6,842,935 | | 4,740,396 |

Premises and equipment, net | | 227,454 | | 224,506 | | 191,229 | | 189,954 | | 141,527 |

Goodwill | | 802,880 | | 802,880 | | 605,232 | | 609,720 | | 257,683 |

Core deposit intangible | | 66,225 | | 69,133 | | 51,754 | | 53,944 | | 24,063 |

Bank owned life insurance | | 267,820 | | 267,979 | | 211,676 | | 210,302 | | 146,739 |

OREO | | 2,909 | | 4,643 | | 5,376 | | 6,814 | | 3,987 |

Deferred income tax asset, net | | 51,462 | | 60,839 | | 60,868 | | 63,004 | | 37,725 |

Other assets | | 264,454 | | 257,527 | | 224,965 | | 181,286 | | 172,270 |

Total Assets | | $12,337,588 | | $12,274,365 | | $10,536,723 | | $10,347,996 | | $7,123,975 |

| | | | | | | | | | |

Liabilities and Stockholders' Equity | | | | | | | | | | |

Deposits: | | | | | | | | | | |

Non-interest bearing | | $2,923,640 | | $3,094,652 | | $2,892,091 | | $2,969,854 | | $1,999,901 |

Interest bearing | | 1,811,006 | | 1,702,467 | | 1,439,839 | | 1,381,888 | | 1,058,985 |

Total checking accounts | | 4,734,646 | | 4,797,119 | | 4,331,930 | | 4,351,742 | | 3,058,886 |

Money market accounts | | 2,216,571 | | 2,103,884 | | 1,777,468 | | 1,730,259 | | 1,167,940 |

Savings deposits | | 704,159 | | 711,235 | | 664,517 | | 731,415 | | 501,014 |

Time deposits | | 1,821,960 | | 1,862,288 | | 1,447,893 | | 1,298,582 | | 832,683 |

Total deposits | | $9,477,336 | | $9,474,526 | | $8,221,808 | | $8,111,998 | | $5,560,523 |

Federal funds purchased | | 294,360 | | 272,002 | | 234,212 | | 285,652 | | 331,490 |

Other borrowings | | 451,187 | | 463,639 | | 415,039 | | 362,754 | | 253,272 |

Other liabilities | | 143,361 | | 151,039 | | 125,416 | | 69,746 | | 73,940 |

Common stockholders’ equity | | 1,971,344 | | 1,913,159 | | 1,540,248 | | 1,517,846 | | 904,750 |

Total Liabilities and | | | | | | | | | | |

Stockholders' Equity | | $12,337,588 | | $12,274,365 | | $10,536,723 | | $10,347,996 | | $7,123,975 |

3

SELECTED CONSOLIDATED FINANCIAL DATA

The table below summarizes selected financial data for the periods presented.

| | Three Months Ended | | | Twelve Months Ended |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Selected financial data | | | | | | | | | | | | | | | |

Return on average assets (annualized) | | 1.64% | | 1.38% | | 1.24% | | 1.41% | | 0.11% | | | 1.43% | | 0.88% |

Adjusted return on average assets (annualized) (Non-GAAP) (1) | | 1.68% | | 1.65% | | 1.66% | | 1.68% | | 1.23% | | | 1.67% | | 1.30% |

| | | | | | | | | | | | | | | |

Return on average equity (annualized) | | 10.38% | | 9.00% | | 8.44% | | 9.57% | | 0.83% | | | 9.41% | | 6.81% |

Adjusted return on average equity (annualized) (Non-GAAP) (1) | | 10.64% | | 10.77% | | 11.27% | | 11.36% | | 9.29% | | | 10.98% | | 10.06% |

| | | | | | | | | | | | | | | |

Return on average tangible equity (annualized) (Non-GAAP) (1) | | 19.78% | | 16.73% | | 15.69% | | 17.98% | | 1.67% | | | 17.68% | | 10.06% |

Adjusted return on average tangible equity (annualized) (Non-GAAP) (1) | | 20.25% | | 19.85% | | 20.67% | | 21.19% | | 13.92% | | | 20.49% | | 14.63% |

| | | | | | | | | | | | | | | |

Efficiency ratio (tax equivalent) (Non-GAAP) (1) | | 53.4% | | 59.7% | | 64.3% | | 64.0% | | 59.7% | | | 60.0% | | 60.9% |

Adjusted efficiency ratio, tax equivalent (Non-GAAP) (1) | | 50.3% | | 50.0% | | 51.1% | | 54.7% | | 55.9% | | | 51.4% | | 55.5% |

| | | | | | | | | | | | | | | |

Dividend payout | | 19.2% | | 23.3% | | 26.3% | | 23.8% | | 200.0% | | | 22.7% | | 25.3% |

Loan / deposit ratio | | 88.0% | | 86.8% | | 85.6% | | 84.8% | | 85.8% | | | | | |

Stockholders’ equity (to total assets) | | 16.0% | | 15.6% | | 14.6% | | 14.7% | | 12.7% | | | | | |

Common equity per common share | | $20.60 | | $20.00 | | $18.31 | | $18.12 | | $15.04 | | | | | |

Tangible common equity per common share (Non-GAAP) (1) | | $11.49 | | $10.86 | | $10.49 | | $10.19 | | $10.35 | | | | | |

Common tangible equity (to total tangible assets) (Non-GAAP) (1) | | 9.6% | | 9.1% | | 8.9% | | 8.8% | | 9.1% | | | | | |

Tier 1 capital (to average assets) | | 10.1% | | 11.0% | | 9.6% | | 9.4% | | 9.8% | | | | | |

(1) | See reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

4

Loan Portfolio

The table below summarizes the Company’s loan portfolio over the most recent five-quarter ends.

| | Ending Balance |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 |

Real estate loans | | | | | | | | | | |

Residential | | $1,760,918 | | $1,775,600 | | $1,592,064 | | $1,600,958 | | $1,085,278 |

Commercial | | 4,541,434 | | 4,487,795 | | 3,810,461 | | 3,802,603 | | 2,638,934 |

Land, development and construction loans | | 642,590 | | 652,840 | | 471,450 | | 423,197 | | 242,472 |

Total real estate loans | | 6,944,942 | | 6,916,235 | | 5,873,975 | | 5,826,758 | | 3,966,684 |

Commercial loans | | 1,188,974 | | 1,109,871 | | 1,004,213 | | 917,855 | | 697,945 |

Consumer and other loans | | 203,895 | | 194,889 | | 160,739 | | 131,931 | | 107,772 |

Total loans before unearned fees and costs | | 8,337,811 | | 8,220,995 | | 7,038,927 | | 6,876,544 | | 4,772,401 |

Unearned fees and costs | | 2,693 | | 2,097 | | 893 | | 820 | | 820 |

| | | | | | | | | | |

Total Loans | | $8,340,504 | | $8,223,092 | | $7,039,820 | | $6,877,364 | | $4,773,221 |

Loan production

DEPOSITS

| | Ending Balance |

Deposit mix | | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 |

Checking accounts | | | | | | | | | | |

Non-interest bearing | | $2,923,640 | | $3,094,652 | | $2,892,091 | | $2,969,854 | | $1,999,901 |

Interest bearing | | 1,811,006 | | 1,702,467 | | 1,439,839 | | 1,381,888 | | 1,058,985 |

Savings deposits | | 704,159 | | 711,235 | | 664,517 | | 731,415 | | 501,014 |

Money market accounts | | 2,216,571 | | 2,103,884 | | 1,777,468 | | 1,730,259 | | 1,167,940 |

Time deposits | | 1,821,960 | | 1,862,288 | | 1,447,893 | | 1,298,582 | | 832,683 |

Total deposits | | $9,477,336 | | $9,474,526 | | $8,221,808 | | $8,111,998 | | $5,560,523 |

| | | | | | | | | | |

Non time deposits as percentage of total deposits | | 81% | | 80% | | 82% | | 84% | | 85% |

Time deposits as percentage of total deposits | | 19% | | 20% | | 18% | | 16% | | 15% |

Total deposits | | 100% | | 100% | | 100% | | 100% | | 100% |

5

NET INTEREST MARGIN

The Company’s NIM increased 6 bps from 4.31% in the previous quarter to 4.37% during the current quarter due to an increase on loan yields. Loan accretion increased approximately $3.2 million to $13.4 million for the fourth quarter of 2018 compared to $10.1 million for the third quarter of 2018. The increase is mainly attributable to loan accretion for a full quarter from the Charter acquisition compared to one month in the prior quarter.

The tax equivalent yield on new loan production increased by 11 bps from 5.08% in the prior quarter to 5.19% during the current quarter while the tax equivalent yield on the entire originated loan portfolio increased by 6 bps. The tax equivalent yield on security portfolio increased by 18 bps from 2.73% in the prior quarter to 2.91% during the current quarter due to the reinvestment of the Charter portfolio.

Cost of deposits increased 9 bps during the fourth quarter of 2018 compared to the prior quarter.

The table below summarizes yields and costs by various interest earning asset and interest bearing liability account types for the current quarter, the previous calendar quarter and the same quarter last year.

| Three Months Ended |

| Dec. 31, 2018 | | | Sep. 30, 2018 | | | Dec. 31, 2017 |

| Average | | Interest | | Average | | | Average | | Interest | | Average | | | Average | | Interest | | Average |

| Balance | | Inc/Exp | | Rate | | | Balance | | Inc/Exp | | Rate | | | Balance | | Inc/Exp | | Rate |

Originated loans (1) | $3,997,730 | | $48,036 | | 4.77% | | | $3,654,508 | | $43,429 | | 4.71% | | | $2,830,470 | | $31,125 | | 4.36% |

Acquired loans (1) | 4,170,721 | | 59,720 | | 5.68% | | | 3,641,692 | | 50,828 | | 5.54% | | | 1,732,614 | | 22,104 | | 5.06% |

PCI loans | 162,813 | | 9,448 | | 23.02% | | | 167,640 | | 7,682 | | 18.18% | | | 161,165 | | 7,608 | | 18.73% |

Taxable securities | 1,665,809 | | 11,833 | | 2.82% | | | 1,540,686 | | 10,145 | | 2.61% | | | 969,456 | | 6,000 | | 2.46% |

Tax-exempt securities (1) | 216,936 | | 1,964 | | 3.59% | | | 208,663 | | 1,874 | | 3.56% | | | 195,490 | | 2,007 | | 4.07% |

Fed funds sold and other | 343,049 | | 1,911 | | 2.21% | | | 225,465 | | 1,362 | | 2.40% | | | 220,105 | | 1,058 | | 1.91% |

Tot. interest earning assets (1) | $10,557,058 | | $132,912 | | 4.99% | | | $9,438,654 | | $115,320 | | 4.85% | | | $6,109,300 | | $69,902 | | 4.54% |

| | | | | | | | | | | | | | | | | | | |

Non-interest earnings assets | 1,681,312 | | | | | | | 1,507,319 | | | | | | | 799,012 | | | | |

Total assets | $12,238,370 | | | | | | | $10,945,973 | | | | | | | $6,908,312 | | | | |

| | | | | | | | | | | | | | | | | | | |

Interest bearing deposits | $6,456,452 | | $12,360 | | 0.76% | | | $5,611,103 | | $9,096 | | 0.64% | | | $3,537,298 | | $3,385 | | 0.38% |

Fed funds purchased | 235,696 | | 1,499 | | 2.52% | | | 229,948 | | 1,192 | | 2.06% | | | 282,834 | | 941 | | 1.32% |

Other borrowings | 326,337 | | 1,993 | | 2.42% | | | 359,370 | | 1,943 | | 2.15% | | | 53,479 | | 125 | | 0.93% |

Corporate debentures | 39,816 | | 647 | | 6.45% | | | 35,248 | | 579 | | 6.52% | | | 26,162 | | 352 | | 5.34% |

Total interest bearing liabilities | $7,058,301 | | $16,499 | | 0.93% | | | $6,235,669 | | $12,810 | | 0.82% | | | $3,899,773 | | $4,803 | | 0.49% |

| | | | | | | | | | | | | | | | | | | |

Non-interest bearing deposits | 3,091,289 | | | | | | | 2,900,679 | | | | | | | 2,011,700 | | | | |

All other liabilities | 153,628 | | | | | | | 135,852 | | | | | | | 79,346 | | | | |

Shareholders' equity | 1,935,152 | | | | | | | 1,673,773 | | | | | | | 917,493 | | | | |

Total liabilities and shareholders' equity | $12,238,370 | | | | | | | $10,945,973 | | | | | | | $6,908,312 | | | | |

| | | | | | | | | | | | | | | | | | | |

Net Interest Spread (1) | | | | | 4.06% | | | | | | | 4.03% | | | | | | | 4.05% |

Net Interest Margin (1) | | | | | 4.37% | | | | | | | 4.31% | | | | | | | 4.23% |

| | | | | | | | | | | | | | | | | | | |

Cost of Total Deposits | | | | | 0.51% | | | | | | | 0.42% | | | | | | | 0.24% |

| (1) | Tax equivalent yield (Non-GAAP); see reconciliation tables starting on page 9, Explanation of Certain Unaudited Non-GAAP Financial Measures. |

The table below summarizes accretion income for the periods presented.

| Three Months Ended | | | Twelve Months Ended |

| Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

PCI accretion | $7,187 | | $5,371 | | $8,546 | | $5,277 | | $5,060 | | | $26,381 | | $22,217 |

Non-PCI accretion | 6,177 | | 4,762 | | 5,976 | | 5,475 | | 1,496 | | | 22,390 | | 6,479 |

Total loan accretion | $13,364 | | $10,133 | | $14,522 | | $10,752 | | $6,556 | | | $48,771 | | $28,696 |

The table below compares the unpaid principal balance and the carrying balance (book balance) of the Company’s total Acquired and PCI loans at December 31, 2018.

| | Principal Balance | | Carrying Balance | | Difference | | Percentage |

Acquired loans | | $4,121,353 | | $4,072,877 | | ($48,476) | | 1.2% |

PCI loans | | 221,140 | | 158,971 | | (62,169) | | 28.1% |

Total purchased loans | | $4,342,493 | | $4,231,848 | | ($110,645) | | 2.5% |

6

NON INTEREST INCOME

Non interest income increased $5,292 to $32,396 during the current quarter compared to $27,104 in the previous quarter. The increase is mainly attributable to an increase in correspondent banking revenue due to higher interest rate swap revenue, an increase in mortgage banking revenue, and revenue from the Charter acquisition for a full quarter compared to one month in the previous quarter offset by non-recurring gain on sale of deposits in the previous quarter. The table below summarizes the Company’s non-interest income for the periods indicated.

Condensed Consolidated Non Interest Income (unaudited)

| | Three Months Ended | | | Twelve Months Ended |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Correspondent banking revenue | | $9,893 | | $8,296 | | $7,076 | | $8,123 | | $6,616 | | | $33,388 | | $28,341 |

Mortgage banking revenue | | 4,204 | | 3,188 | | 2,616 | | 2,602 | | 579 | | | 12,610 | | 1,511 |

SBA revenue | | 497 | | 1,020 | | 1,027 | | 988 | | 333 | | | 3,532 | | 775 |

Wealth management related revenue | | 725 | | 676 | | 640 | | 616 | | 856 | | | 2,657 | | 3,554 |

Service charges on deposit accounts | | 7,349 | | 5,787 | | 4,861 | | 4,834 | | 3,719 | | | 22,831 | | 14,986 |

Debit, prepaid, ATM and merchant card related fees | | 5,149 | | 3,869 | | 3,498 | | 3,727 | | 2,319 | | | 16,243 | | 9,035 |

Other service charges and fees | | 4,579 | | 3,657 | | 2,871 | | 2,170 | | 1,319 | | | 13,277 | | 5,756 |

Subtotal | | $32,396 | | $26,493 | | $22,589 | | $23,060 | | $15,741 | | | $104,538 | | $63,958 |

Loss on sale of securities available for sale | | — | | — | | — | | (22) | | (7) | | | (22) | | (7) |

Gain on sale of deposits | | — | | 611 | | — | | — | | — | | | 611 | | — |

Gain on sale of trust department | | — | | — | | — | | — | | 1,224 | | | — | | 1,224 |

Total Non Interest Income | | $32,396 | | $27,104 | | $22,589 | | $23,038 | | $16,958 | | | $105,127 | | $65,175 |

Note: Certain prior period amounts have been reclassified to conform to the current period presentation format.

NON INTEREST EXPENSES

Excluding merger-related expenses, non interest expense increased $10,908 in the fourth quarter to $77,852 compared to the previous quarter. The Company incurred the three-month carrying costs of the Charter acquisition compared to one month during the prior quarter. Approximately $1,100 of additional legal settlement costs occurred during the current quarter compared to the prior quarter. The table below summarizes the Company’s non-interest expense for the periods indicated.

Condensed Consolidated Non Interest Expense (unaudited)

| | Three Months Ended | | | Twelve Months Ended |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Salaries, wages and employee benefits | | 48,044 | | 41,698 | | 40,683 | | 41,893 | | 29,698 | | | 172,318 | | 109,412 |

Occupancy expense | | 5,633 | | 5,428 | | 4,968 | | 4,868 | | 3,324 | | | 20,897 | | 12,777 |

Depreciation of premises and equipment | | 2,752 | | 2,439 | | 2,322 | | 2,275 | | 1,884 | | | 9,788 | | 7,247 |

Marketing expenses | | 1,903 | | 1,493 | | 1,425 | | 1,414 | | 1,044 | | | 6,235 | | 3,929 |

Data processing expenses | | 3,621 | | 2,729 | | 3,453 | | 4,505 | | 2,185 | | | 14,308 | | 8,436 |

Legal, auditing and other professional fees | | 2,599 | | 1,301 | | 1,332 | | 931 | | 970 | | | 6,163 | | 3,644 |

Bank regulatory related expenses | | 1,299 | | 1,367 | | 1,209 | | 1,010 | | 767 | | | 4,885 | | 3,051 |

Debit, ATM and merchant card related expenses | | 1,657 | | 972 | | 860 | | 764 | | 644 | | | 4,253 | | 2,746 |

Credit related expenses | | 165 | | 688 | | 32 | | 617 | | (23) | | | 1,502 | | 2,035 |

Amortization of intangibles | | 2,989 | | 2,480 | | 2,240 | | 2,309 | | 1,129 | | | 10,018 | | 4,066 |

Impairment on bank property held for sale | | 80 | | 247 | | 891 | | 1,449 | | 12 | | | 2,667 | | 519 |

Other expenses | | 7,110 | | 6,102 | | 6,057 | | 5,252 | | 4,659 | | | 24,521 | | 15,577 |

Subtotal | | 77,852 | | 66,944 | | 65,472 | | 67,287 | | 46,293 | | | 277,555 | | 173,439 |

Merger-related expenses | | 1,668 | | 10,395 | | 14,140 | | 8,709 | | 2,718 | | | 34,912 | | 13,046 |

Total Non Interest Expense | | 79,520 | | 77,339 | | 79,612 | | 75,996 | | 49,011 | | | 312,467 | | 186,485 |

Note: Certain prior period amounts have been reclassified to conform to the current period presentation format.

7

CREDIT QUALITY AND ALLOWANCE FOR LOAN LOSSES

Non-performing assets (“NPAs”) totaled $26,826 at December 31, 2018, compared to $28,619 at September 30, 2018. NPAs as a percentage of total assets declined to 0.22% at December 31, 2018, compared to 0.23% at September 30, 2018.

The table below summarizes selected credit quality data for the periods indicated.

| | Ending Balance | | | | | |

Non-Performing Assets (1) | | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | | | |

Non-accrual loans | | 23,567 | | $23,450 | | $23,071 | | $23,096 | | $17,288 | | | | | |

Past due loans 90 days or more | | | | | | | | | | | | | | | |

and still accruing interest | | — | | — | | — | | — | | — | | | | | |

Total non-performing loans (“NPLs”) | | 23,567 | | 23,450 | | 23,071 | | 23,096 | | 17,288 | | | | | |

Other real estate owned (“OREO”) | | 2,909 | | 4,643 | | 5,376 | | 6,814 | | 3,987 | | | | | |

Repossessed assets other than real estate | | 350 | | 526 | | 107 | | 187 | | 147 | | | | | |

Total non-performing assets | | $26,826 | | $28,619 | | $28,554 | | $30,097 | | $21,422 | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | Twelve Months Ended |

Asset Quality Ratios (1) | | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Non-performing loans as percentage of total loans | | 0.29% | | 0.29% | | 0.34% | | 0.34% | | 0.38% | | | | | |

Non-performing assets as percentage of total assets | | 0.22% | | 0.23% | | 0.27% | | 0.29% | | 0.30% | | | | | |

Non-performing assets as percentage of loans and | | | | | | | | | | | | | | | |

OREO plus other repossessed assets | | 0.33% | | 0.36% | | 0.42% | | 0.45% | | 0.46% | | | | | |

Loans past due 30 thru 89 days and accruing interest | | | | | | | | | | | | | | | |

as a percentage of total loans | | 0.45% | | 0.35% | | 0.37% | | 0.40% | | 0.30% | | | | | |

Allowance for loan losses as percentage of NPLs | | 168% | | 165% | | 161% | | 148% | | 188% | | | | | |

Net charge-offs (recoveries) | | $1,131 | | $623 | | ($122) | | ($229) | | ($28) | | | $1,403 | | ($760) |

Net charge-offs (recoveries) as a percentage of average | | | | | | | | | | | | | | | |

loans for the period on an annualized basis | | 0.05% | | 0.03% | | (0.01)% | | (0.01)% | | (0.00)% | | | 0.02% | | (0.02)% |

The allowance for loan losses (“ALLL") totaled $39,770 at December 31, 2018, compared to $38,811 at September 30, 2018, an increase of $959 due to loan loss provision expense of $2,100 and net charge-offs of $1,141. The changes in the Company’s ALLL components between December 31, 2018 and September 30, 2018 are summarized in the table below (unaudited).

| | December 31, 2018 | | September 30, 2018 | | Increase (Decrease) |

| | Loan | ALLL | | | Loan | ALLL | | | Loan | ALLL | |

| | Balance | Balance | % | | Balance | Balance | % | | Balance | Balance | |

Originated loans | | $4,096,828 | $36,105 | 0.88% | | $3,748,984 | $35,207 | 0.94% | | $347,844 | $897 | (6) bps |

Impaired originated loans | | 11,828 | 878 | 7.42% | | 13,412 | 1081 | 8.06% | | (1,584) | (203) | (64) bps |

Total originated loans | | 4,108,656 | 36,983 | 0.90% | | 3,762,396 | 36,288 | 0.96% | | 346,260 | 694 | (6) bps |

| | | | | | | | | | | | |

Acquired loans (1) | | 4,069,005 | 1,858 | 0.05% | | 4,289,269 | 1,975 | 0.05% | | (220,264) | (116) | – bp |

Impaired acquired loans (2) | | 3,872 | 738 | 19.06% | | 3,756 | 332 | 8.84% | | 116 | 406 | 1022 bps |

Total acquired loans | | 4,072,877 | 2,596 | 0.06% | | 4,293,025 | 2,307 | 0.05% | | (220,148) | 290 | 1 bp |

| | | | | | | | | | | | |

Total non-PCI loans | | 8,181,533 | 39,579 | | | 8,055,421 | 38,595 | | | 126,112 | 984 | |

PCI loans | | 158,971 | 191 | | | 167,671 | 216 | | | (8,700) | (25) | |

Total loans | | $8,340,504 | $39,770 | | | $8,223,092 | $38,811 | | | $117,412 | $959 | |

| (1) | Performing acquired loans recorded at estimated fair value on the related acquisition dates. The total net unamortized fair value adjustment at December 31, 2018 was approximately $48,355 or 1.2% of the aggregate outstanding related loan balances. |

| (2) | These are loans that were acquired as performing loans that subsequently became impaired. |

8

Explanation of Certain Unaudited Non-GAAP Financial Measures

This press release contains financial information determined by methods other than U.S. Generally Accepted Accounting Principles (“GAAP”), including adjusted net income, adjusted net income per share diluted, adjusted return on average assets, adjusted return on average equity, return on average tangible equity, adjusted return on average tangible equity, adjusted efficiency ratio, adjusted non-interest income, adjusted non-interest expense, adjusted net-interest income, tangible common equity, tangible common equity to tangible assets, common tangible equity per common share, tax equivalent yields on loans, securities and earning assets, and tax equivalent net interest spread and margin, which we refer to “Non-GAAP financial measures.” The tables below provide reconciliations between these Non-GAAP measures and net income, interest income, net interest income and tax equivalent basis interest income and net interest income, return on average assets, return on average equity, the efficiency ratio, total stockholders’ equity and tangible common equity, as applicable.

Management uses these Non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and enhance investors’ understanding of the Company’s core business and performance without the impact of merger-related expenses. Accordingly, management believes it is appropriate to exclude merger-related expenses because those costs are specific to each acquisition, vary based upon the size, complexity and other specifics of each acquisition, and are not indicative of the costs to operate the Company’s core business.

Non-GAAP measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. The Company provides reconciliations between GAAP and these Non-GAAP measures. These disclosures should not be considered an alternative to GAAP.

Reconciliation of GAAP to non-GAAP Measures (unaudited):

| | Three months ended | | | Twelve months ended |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Adjusted net income (Non-GAAP) | | | | | | | | | | | | | | | |

Net income (GAAP) | | $50,651 | | $37,985 | | $32,163 | | $35,636 | | $1,912 | | | $156,435 | | $55,795 |

Loss on sale of securities available for sale, net of tax | | — | | — | | — | | 17 | | 5 | | | 17 | | 5 |

Gain on sale of trust department, net of tax | | — | | — | | — | | — | | (820) | | | — | | (820) |

Gain on sale of deposits, net of tax | | — | | (465) | | — | | — | | — | | | (465) | | — |

Merger-related expenses, net of tax | | 1,262 | | 7,915 | | 10,760 | | 6,647 | | 1,820 | | | 26,584 | | 8,879 |

Deferred tax asset write down | | — | | — | | — | | — | | 18,575 | | | — | | 18,575 |

Adjusted net income (Non-GAAP) | | $51,913 | | $45,435 | | $42,923 | | $42,300 | | $21,492 | | | $182,571 | | $82,434 |

| | | | | | | | | | | | | | | |

Adjusted net income per share - Diluted | | | | | | | | | | | | | | | |

Earnings per share - Diluted (GAAP) | | $0.52 | | $0.43 | | $0.38 | | $0.42 | | $0.03 | | | $1.76 | | $0.95 |

Effect to adjust for loss on sale of securities available for sale, net of tax | | — | | — | | — | | — | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | — | | — | | (0.01) | | | — | | (0.01) |

Effect to adjust for gain on sale of deposits, net of tax | | — | | (0.01) | | — | | — | | — | | | (0.01) | | — |

Effect to adjust for merger-related expenses, net of tax | | 0.02 | | 0.09 | | 0.12 | | 0.08 | | 0.03 | | | 0.31 | | 0.15 |

Effect to adjust for deferred tax asset write down | | — | | — | | — | | — | | 0.30 | | | — | | 0.32 |

Adjusted net income per share - Diluted (Non-GAAP) | | $0.54 | | $0.51 | | $0.50 | | $0.50 | | $0.35 | | | $2.06 | | $1.41 |

| | | | | | | | | | | | | | | |

Adjusted return on average assets (Non-GAAP) | | | | | | | | | | | | | | | |

Return on average assets (GAAP) | | 1.64% | | 1.38% | | 1.24% | | 1.41% | | 0.11% | | | 1.43% | | 0.88% |

Effect to adjust for loss on sale of securities available for sale, net of tax | | — | | — | | — | | — | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | — | | — | | (0.05)% | | | — | | (0.01)% |

Effect to adjust for gain on sale of deposits, net of tax | | — | | (0.02)% | | — | | — | | — | | | — | | — |

Effect to adjust for merger-related expenses, net of tax | | 0.04% | | 0.29% | | 0.42% | | 0.27% | | 0.10% | | | 0.24% | | 0.14% |

Effect to adjust for deferred tax asset write down | | — | | — | | — | | — | | 1.07% | | | — | | 0.29% |

Adjusted return on average assets (Non-GAAP) | | 1.68% | | 1.65% | | 1.66% | | 1.68% | | 1.23% | | | 1.67% | | 1.30% |

9

Explanation of Certain Unaudited Non-GAAP Financial Measures (continued)

| | Three months ended | | | Twelve months ended |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 | | | Dec. 31, 2018 | | Dec. 31, 2017 |

Adjusted return on average equity (Non-GAAP) | | | | | | | | | | | | | | | |

Return on average equity (GAAP) | | 10.38% | | 9.00% | | 8.44% | | 9.57% | | 0.83% | | | 9.41% | | 6.81% |

Effect to adjust for loss on sale of securities available for sale, net of tax | | — | | — | | — | | — | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | — | | — | | (0.35)% | | | — | | (0.10)% |

Effect to adjust for gain on sale of deposits, net of tax | | — | | (0.11)% | | — | | — | | — | | | (0.03)% | | — |

Effect to adjust for merger and acquisition related expenses, net of tax | | 0.26% | | 1.88% | | 2.82% | | 1.79% | | 0.78% | | | 1.60% | | 1.08% |

Effect to adjust for deferred tax asset write down | | — | | — | | — | | — | | 8.03% | | | — | | 2.27% |

Adjusted return on average equity (Non-GAAP) | | 10.64% | | 10.77% | | 11.26% | | 11.36% | | 9.29% | | | 10.98% | | 10.06% |

| | | | | | | | | | | | | | | |

Return on average tangible equity (non-GAAP) | | | | | | | | | | | | | | | |

Net income (GAAP) | | $50,651 | | $37,985 | | $32,163 | | $35,636 | | $1,912 | | | $156,435 | | $55,795 |

Amortization of intangibles, net of tax | | 2,278 | | 1,888 | | 1,705 | | 1,762 | | 756 | | | 7,937 | | 2,767 |

Adjusted net income for average tangible equity (Non-GAAP) | | $52,929 | | $39,873 | | $33,868 | | $37,398 | | $2,668 | | | $164,372 | | $58,562 |

| | | | | | | | | | | | | | | |

Average stockholders' equity (GAAP) | | $1,935,152 | | $1,673,773 | | $1,527,983 | | $1,509,556 | | $917,493 | | | $1,662,815 | | $819,626 |

Average goodwill | | (802,880) | | (669,682) | | (608,092) | | (609,719) | | (257,683) | | | (673,115) | | (213,892) |

Average core deposit intangible | | (67,648) | | (57,306) | | (53,112) | | (55,668) | | (24,727) | | | (58,463) | | (22,508) |

Average other intangibles | | (2,947) | | (1,497) | | (823) | | (649) | | (959) | | | (1,504) | | (925) |

Average tangible equity (Non-GAAP) | | $1,061,677 | | $945,288 | | $865,956 | | $843,520 | | $634,124 | | | $929,733 | | $582,301 |

| | | | | | | | | | | | | | | |

Return on average tangible equity (annualized) (Non-GAAP) | | 19.78% | | 16.73% | | 15.69% | | 17.98% | | 1.67% | | | 17.68% | | 10.06% |

| | | | | | | | | | | | | | | |

Adjusted return on average tangible equity (non-GAAP) | | | | | | | | | | | | | | | |

Return on average tangible equity (Non-GAAP) | | 19.78% | | 16.73% | | 15.69% | | 17.98% | | 1.67% | | | 17.68% | | 10.06% |

Effect to adjust for loss on sale of securities available for sale, net of tax | | — | | — | | — | | 0.01% | | — | | | — | | — |

Effect to adjust for gain on sale of trust department, net of tax | | — | | — | | — | | — | | (0.51)% | | | — | | (0.14)% |

Effect to adjust for gain on sale of deposits, net of tax | | — | | (0.20)% | | — | | — | | — | | | (0.05)% | | — |

Effect to adjust for merger-related expenses, net of tax | | 0.47% | | 3.32% | | 4.98% | | 3.20% | | 1.14% | | | 2.86% | | 1.52% |

Effect to adjust for deferred tax asset write down | | — | | — | | — | | — | | 11.62% | | | — | | 3.19% |

Adjusted return on average tangible equity (Non-GAAP) | | 20.25% | | 19.85% | | 20.67% | | 21.19% | | 13.92% | | | 20.49% | | 14.63% |

| | | | | | | | | | | | | | | |

Efficiency ratio (tax equivalent) (Non-GAAP) | | | | | | | | | | | | | | | |

Non interest income (GAAP) | | $32,396 | | $27,104 | | $22,589 | | $23,038 | | $16,958 | | | $105,127 | | $65,175 |

Gain on sale of deposits | | — | | (611) | | — | | — | | — | | | (611) | | — |

Gain on sale of trust department | | — | | — | | — | | — | | (1,224) | | | — | | (1,224) |

Adjusted non interest income (Non-GAAP) | | $32,396 | | $26,493 | | $22,589 | | $23,038 | | $15,734 | | | $104,516 | | $63,951 |

| | | | | | | | | | | | | | | |

Net interest income before provision (GAAP) | | $115,682 | | $101,853 | | $100,529 | | $95,018 | | $63,619 | | | $413,082 | | $235,543 |

Total tax equivalent adjustment | | 731 | | 657 | | 657 | | 652 | | 1,480 | | | 2,521 | | 5,716 |

Adjusted net interest income (Non-GAAP) | | $116,413 | | $102,510 | | $101,186 | | $95,670 | | $65,099 | | | $415,603 | | $241,259 |

| | | | | | | | | | | | | | | |

Non interest expense (GAAP) | | $79,520 | | $77,339 | | $79,612 | | $75,996 | | $49,011 | | | $312,467 | | $186,485 |

Amortization of intangibles | | (2,989) | | (2,480) | | (2,240) | | (2,309) | | (1,129) | | | (10,018) | | (4,066) |

Merger and acquisition related expenses | | (1,668) | | (10,395) | | (14,140) | | (8,709) | | (2,718) | | | (34,912) | | (13,046) |

Adjusted non interest expense (Non-GAAP) | | $74,863 | | $64,464 | | $63,232 | | $64,978 | | $45,164 | | | $267,537 | | $169,373 |

| | | | | | | | | | | | | | | |

Efficiency ratio (tax equivalent) (Non-GAAP) | | 53.4% | | 59.7% | | 64.3% | | 64.0% | | 59.7% | | | 60.0% | | 60.9% |

| | | | | | | | | | | | | | | |

Adjusted efficiency ratio, tax equivalent (Non-GAAP) | | 50.3% | | 50.0% | | 51.1% | | 54.7% | | 55.9% | | | 51.4% | | 55.5% |

10

Explanation of Certain Unaudited Non-GAAP Financial Measures (continued)

| | Ending Balance |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Jun. 30, 2018 | | Mar. 31, 2018 | | Dec. 31, 2017 |

Tangible common equity (Non-GAAP) | | | | | | | | | | |

Total stockholders' equity (GAAP) | | $1,971,344 | | $1,913,159 | | $1,540,248 | | $1,517,846 | | $904,750 |

Goodwill | | (802,880) | | (802,880) | | (605,232) | | (609,720) | | (257,683) |

Core deposit intangible | | (66,225) | | (69,133) | | (51,754) | | (53,944) | | (24,063) |

Other intangibles | | (2,953) | | (2,925) | | (923) | | (749) | | (551) |

Tangible common equity (Non-GAAP) | | $1,099,286 | | $1,038,221 | | $882,339 | | $853,433 | | $622,453 |

| | | | | | | | | | |

Total assets (GAAP) | | $12,337,588 | | $12,274,365 | | $10,536,723 | | $10,347,996 | | $7,123,975 |

Goodwill | | (802,880) | | (802,880) | | (605,232) | | (609,720) | | (257,683) |

Core deposit intangible | | (66,225) | | (69,133) | | (51,754) | | (53,944) | | (24,063) |

Other intangibles | | (2,953) | | (2,925) | | (923) | | (749) | | (551) |

Total tangible assets (Non-GAAP) | | $11,465,530 | | $11,399,427 | | $9,878,814 | | $9,683,583 | | $6,841,678 |

| | | | | | | | | | |

Tangible common equity to tangible assets (Non-GAAP) | | 9.6% | | 9.1% | | 8.9% | | 8.8% | | 9.1% |

Common tangible equity per common share (Non-GAAP) | | $11.49 | | $10.86 | | $10.49 | | $10.19 | | $10.35 |

Common shares outstanding at period end | | 95,680 | | 95,636 | | 84,120 | | 83,758 | | 60,161 |

| | | | | | | | | | |

| | Three months ended | | | | |

| | Dec. 31, 2018 | | Sep. 30, 2018 | | Dec. 31, 2017 | | | | |

Tax equivalent yields (Non-GAAP) | | | | | | | | | | |

Originated loans | | $47,624 | | $43,045 | | $30,270 | | | | |

Acquired loans | | 59,682 | | 50,828 | | 22,104 | | | | |

PCI loans | | 9,448 | | 7,682 | | 7,608 | | | | |

Taxable securities | | 11,834 | | 10,145 | | 6,000 | | | | |

Tax -exempt securities | | 1,682 | | 1,601 | | 1,382 | | | | |

Fed funds sold and other | | 1,911 | | 1,362 | | 1,058 | | | | |

Interest income (GAAP) | | $132,181 | | $114,663 | | $68,422 | | | | |

Tax equivalent adjustment for originated loans | | 411 | | 367 | | 854 | | | | |

Tax equivalent adjustment for acquired loans | | 38 | | 17 | | 1 | | | | |

Tax equivalent adjustment for tax-exempt securities | | 282 | | 273 | | 625 | | | | |

Tax equivalent adjustments | | 731 | | 657 | | 1,480 | | | | |

Interest income (tax equivalent) (Non-GAAP) | | $132,912 | | $115,320 | | $69,902 | | | | |

| | | | | | | | | | |

Net interest income (GAAP) | | $115,682 | | $101,853 | | $63,619 | | | | |

Tax equivalent adjustments | | 731 | | 657 | | 1,480 | | | | |

Net interest income (tax equivalent) (Non-GAAP) | | $116,413 | | $102,510 | | $65,099 | | | | |

| | | | | | | | | | |

Yield on originated loans | | 4.73% | | 4.67% | | 4.24% | | | | |

Effect from tax equivalent adjustment | | 0.04% | | 0.04% | | 0.12% | | | | |

Yield on originated loans - tax equivalent (Non-GAAP) | | 4.77% | | 4.71% | | 4.36% | | | | |

| | | | | | | | | | |

Yield on acquired loans | | 5.68% | | 5.54% | | 5.06% | | | | |

Effect from tax equivalent adjustment | | — | | — | | — | | | | |

Yield on acquired loans - tax equivalent (Non-GAAP) | | 5.68% | | 5.54% | | 5.06% | | | | |

| | | | | | | | | | |

Yield on tax exempted securities | | 3.07% | | 3.04% | | 2.80% | | | | |

Effect from tax equivalent adjustment | | 0.52% | | 0.52% | | 1.27% | | | | |

Yield on tax exempted securities - tax equivalent (Non-GAAP) | | 3.59% | | 3.56% | | 4.07% | | | | |

| | | | | | | | | | |

Yield on interest earning assets (GAAP) | | 4.96% | | 4.82% | | 4.44% | | | | |

Effect from tax equivalent adjustments | | 0.03% | | 0.03% | | 0.10% | | | | |

Yield on interest earning assets - tax equivalent (Non-GAAP) | | 4.99% | | 4.85% | | 4.54% | | | | |

| | | | | | | | | | |

Net interest spread (GAAP) | | 4.03% | | 4.00% | | 3.95% | | | | |

Effect for tax equivalent adjustments | | 0.03% | | 0.03% | | 0.10% | | | | |

Net interest spread (Non-GAAP) | | 4.06% | | 4.03% | | 4.05% | | | | |

| | | | | | | | | | |

Net interest margin (GAAP) | | 4.35% | | 4.28% | | 4.13% | | | | |

Effect from tax equivalent adjustments | | 0.02% | | 0.03% | | 0.10% | | | | |

Net interest margin - tax equivalent (Non-GAAP) | | 4.37% | | 4.31% | | 4.23% | | | | |

11

About CenterState Bank Corporation

CenterState operates as one of the largest community bank franchises headquartered in the state of Florida. Both the Company and its nationally chartered bank subsidiary are based in Winter Haven, Florida, between Orlando and Tampa. With over $12 billion in assets, the Bank provides traditional retail, commercial, mortgage, wealth management and SBA services throughout its Florida, Georgia and Alabama branch network and customer relationships in neighboring states. The Bank also has a national footprint, serving clients coast to coast through its correspondent banking division.

For additional information contact John C. Corbett (CEO), Stephen D. Young (COO) or Jennifer L. Idell (CFO) at 863-293-4710.

About National Commerce Corporation

National Commerce Corporation (Nasdaq: NCOM) (“NCC”), a Delaware corporation, is a financial holding company headquartered in Birmingham, Alabama. Its wholly-owned subsidiary, National Bank of Commerce, provides a broad array of financial services for commercial and consumer customers through seven full-service banking offices in Alabama, twenty-five full service banking offices in Florida and five full-service banking offices in the Atlanta, Georgia metro area. National Bank of Commerce conducts business under a number of trade names unique to its local markets, including United Legacy Bank, Reunion Bank of Florida, Private Bank of Buckhead, Private Bank of Decatur, PrivatePlus Mortgage, Patriot Bank, FirstAtlantic Bank, Premier Community Bank of Florida and First Landmark Bank. Additionally, National Bank of Commerce owns a majority stake in Corporate Billing, LLC, a transaction-based finance company headquartered in Decatur, Alabama that provides factoring, invoicing, collection and accounts receivable management services to transportation companies and automotive parts and service providers throughout the United States and parts of Canada. NCC files periodic reports with the U.S. Securities and Exchange Commission (the “SEC”). Copies of its filings may be obtained through the SEC’s website at www.sec.gov or at www.nationalbankofcommerce.com. More information about NCC and National Bank of Commerce may be obtained at www.nationalbankofcommerce.com.

Forward Looking Statements

Information in this press release, other than statements of historical facts, may constitute forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about the benefits of the proposed merger of CenterState and NCC, whereby NCC will be merged with and into CenterState (the “Merger”), including future financial and operating results (including the anticipated impact of the transaction on CenterState's earnings and tangible book value), statements related to the expected timing of the completion of the NCC merger, the combined company's plans, objectives, expectations and intentions, and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as "may," "will," "should," "scheduled," "plans," "intends," "anticipates," "expects," "believes," estimates," "potential," or "continue" or negatives of such terms or other comparable terminology. All forward-looking statements are subject to risks, uncertainties and other facts that may cause the actual results, performance or achievements of CenterState or NCC to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customer, supplier, employee or other business partner relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement with NCC, (4) the risk of successful integration of NCC’s businesses into CenterState, (5) the failure to obtain the necessary approvals by the stockholders of NCC with respect to the Merger or the shareholders of CenterState with respect to the issuance of CenterState common stock in connection with the Merger, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by CenterState to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing the Merger, (10) the risk that the integration of NCC’s operations into the operations of CenterState will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by CenterState’s issuance of additional shares of its common stock in the Merger, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in CenterState's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, or NCC's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC's website at http://www.sec.gov. CenterState and NCC disclaim any obligation to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise.

12

Additional Information About the NCC Merger and Where to Find It

CenterState has filed with the Securities and Exchange Commission a Registration Statement on Form S-4 (No. 333-229159) to register the shares of CenterState's common stock that will be issued to NCC's stockholders in connection with the transaction. The registration statement includes a joint proxy statement of CenterState and NCC and a prospectus of CenterState. A definitive joint proxy statement/prospectus is being submitted to the stockholders of each of CenterState and NCC in connection with the proposed merger transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION (AND ANY OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY/PROSPECTUS) BECAUSE SUCH DOCUMENTS CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by CenterState on its website at www.centerstatebanks.com and by NCC on its website at www.nationalbankofcommerce.com.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and security holders of CenterState and NCC are urged to read carefully the entire registration statement and joint proxy statement/prospectus available, including any amendments thereto, because they contain important information about the proposed transaction. Free copies of these documents may be obtained as described above.

CenterState, NCC and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of NCC and CenterState in connection with the Merger. Information regarding the directors and executive officers of CenterState and NCC and other persons who may be deemed participants in the solicitation of the stockholders of NCC or of CenterState in connection with the Merger are included in the joint proxy statement/prospectus for NCC’s special meeting of stockholders, and CenterState’s special meeting of stockholders filed by CenterState with the SEC. Information about the directors and officers of CenterState and their ownership of CenterState common stock can also be found in CenterState's definitive proxy statement in connection with its 2018 annual meeting of stockholders, as filed with the SEC on March 12, 2018, and other documents subsequently filed by CenterState with the SEC. Information about the directors and officers of NCC and their ownership of NCC common stock can also be found in NCC's definitive proxy statement in connection with its 2018 annual meeting of stockholders, as filed with the SEC on April 20, 2018, and other documents subsequently filed by NCC with the SEC. Additional information regarding the interests of such participants are included in the proxy statement/prospectus and other relevant documents regarding the Merger filed with the SEC.

13