ATLANTA MARKET MEDIA INFORMATION Forward Looking Statements Presentation - Our Pro Forma Company - Pro Forma Florida, Georgia and Alabama Footprint - Premier Southeast Franchise - Pro Forma Loan Composition - Pro Forma Deposit Composition Executive Profile History and Story Expanded Presence in Atlanta MSA Additional Information Exhibit 99.1 Presentation Material for Client and Advisory Board Meeting Luncheon in Atlanta, GA

Forward Looking Statements This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on CenterState’s capital ratios. Forward looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customer, supplier, employee or other business partner relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of NCOM’s businesses into CenterState, (5) the failure to obtain the necessary approvals by the stockholders of NCOM, with respect to the Merger, or the shareholders of CenterState with respect to the issuance of CenterState common stock in connection with the Merger, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by CenterState to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing the Merger, (10) the risk that the integration of NCOM’s operations into the operations of CenterState will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by CenterState’s issuance of additional shares of its common stock in the Merger, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in CenterState’s Annual Report on Form 10-K for the year ended December 31, 2017, NCOM’s Annual Report on Form 10-K for the year ended December 31, 2017, and other documents subsequently filed by CenterState and NCOM with the SEC. Consequently, no forward-looking statement can be guaranteed. CenterState and NCOM do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

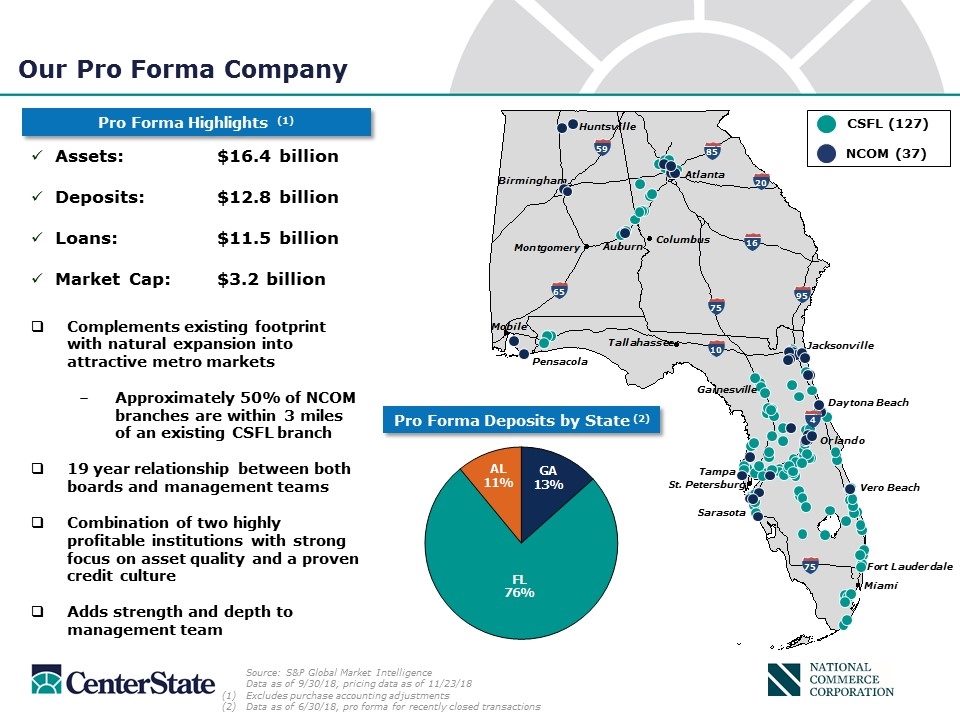

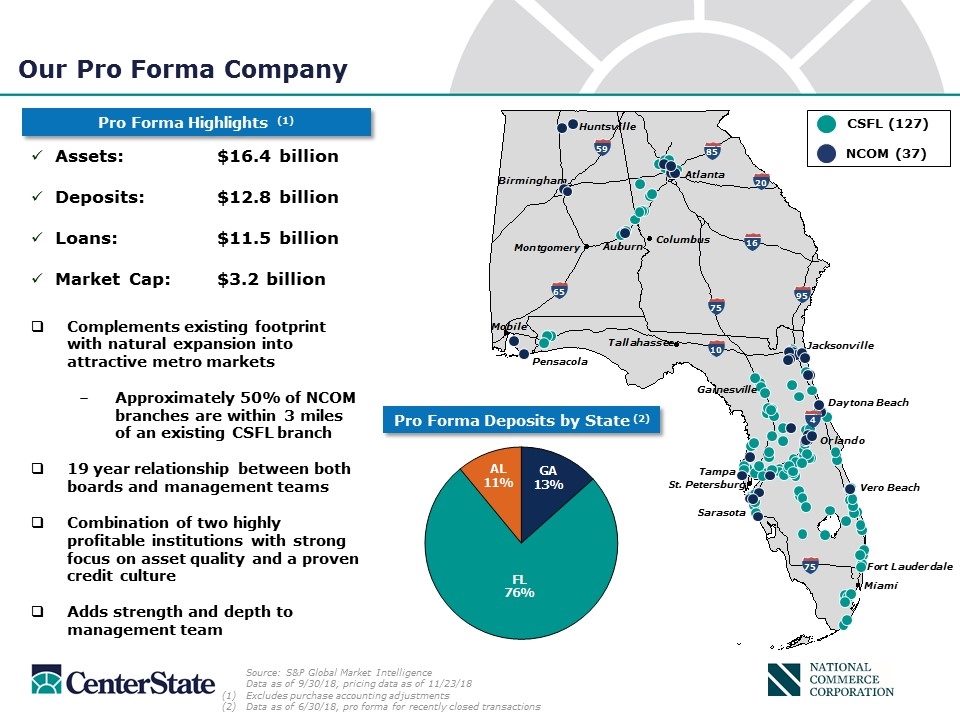

Assets: $16.4 billion Deposits: $12.8 billion Loans: $11.5 billion Market Cap: $3.2 billion Our Pro Forma Company Source: S&P Global Market Intelligence Data as of 9/30/18, pricing data as of 11/23/18 Excludes purchase accounting adjustments Data as of 6/30/18, pro forma for recently closed transactions Pro Forma Highlights (1) CSFL (127) NCOM (37) Complements existing footprint with natural expansion into attractive metro markets Approximately 50% of NCOM branches are within 3 miles of an existing CSFL branch 19 year relationship between both boards and management teams Combination of two highly profitable institutions with strong focus on asset quality and a proven credit culture Adds strength and depth to management team Pro Forma Deposits by State (2) Auburn Sarasota Vero Beach Daytona Beach 85 20 95 16 65 59 75 10 75 4 Pensacola Gainesville

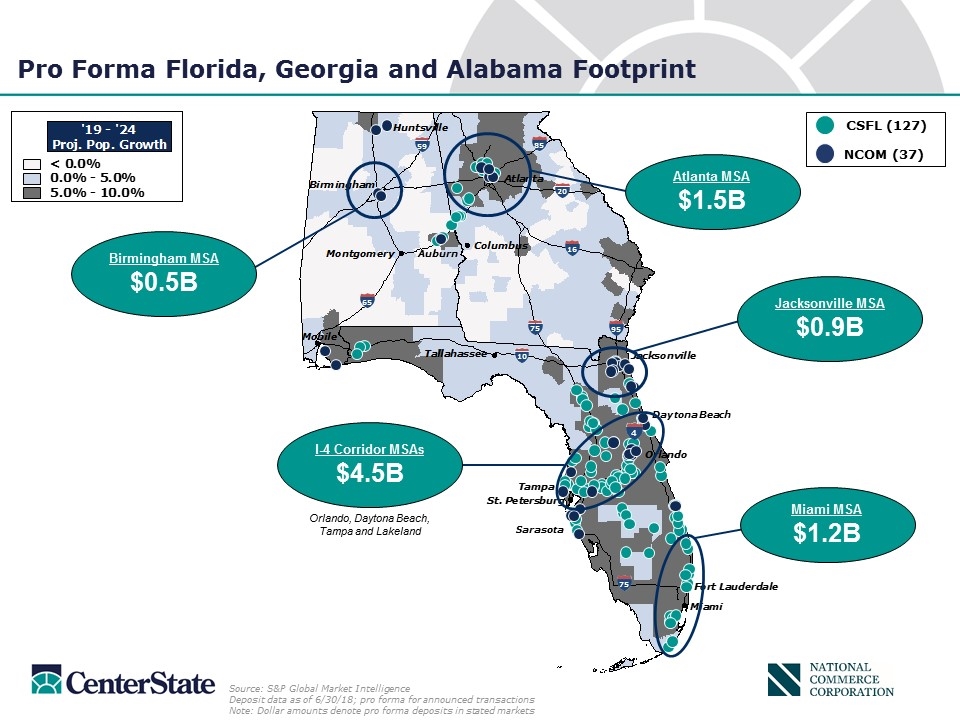

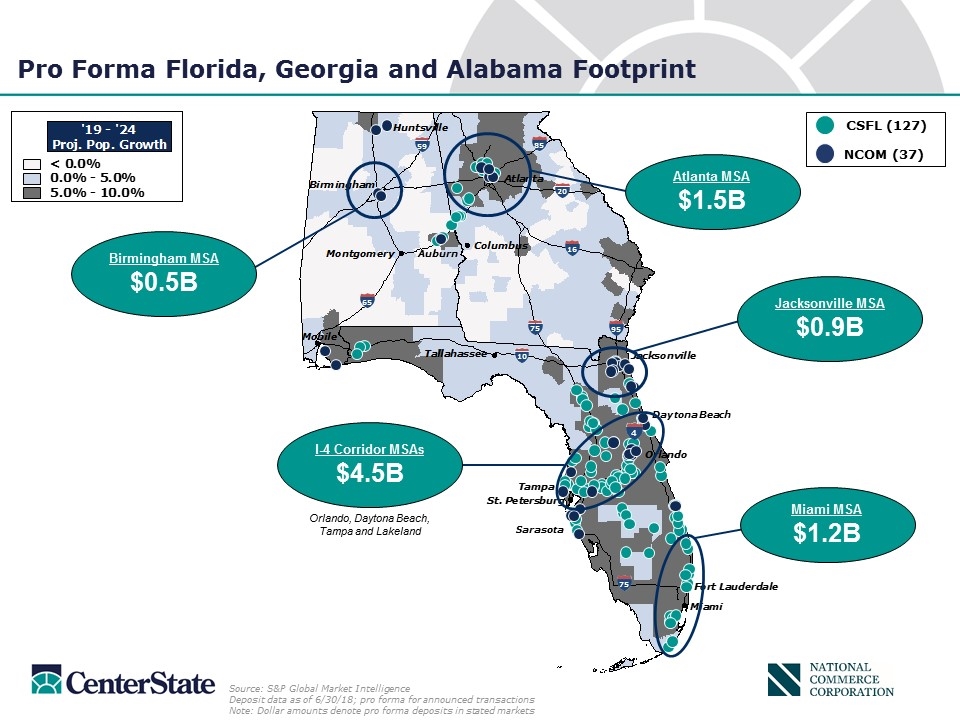

Pro Forma Florida, Georgia and Alabama Footprint Auburn Sarasota Daytona Beach Source: S&P Global Market Intelligence Deposit data as of 6/30/18; pro forma for announced transactions Note: Dollar amounts denote pro forma deposits in stated markets CSFL (127) NCOM (37) 20 95 16 65 59 75 10 75 85 Atlanta MSA $1.5B Jacksonville MSA $0.9B Miami MSA $1.2B Birmingham MSA $0.5B I-4 Corridor MSAs $4.5B Orlando, Daytona Beach, Tampa and Lakeland 4

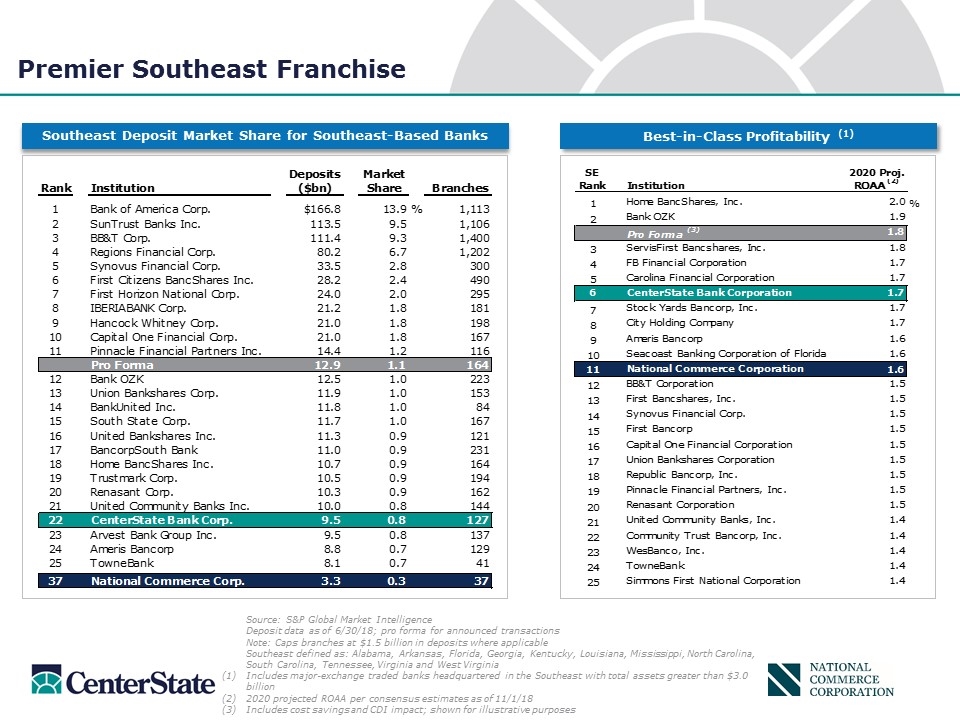

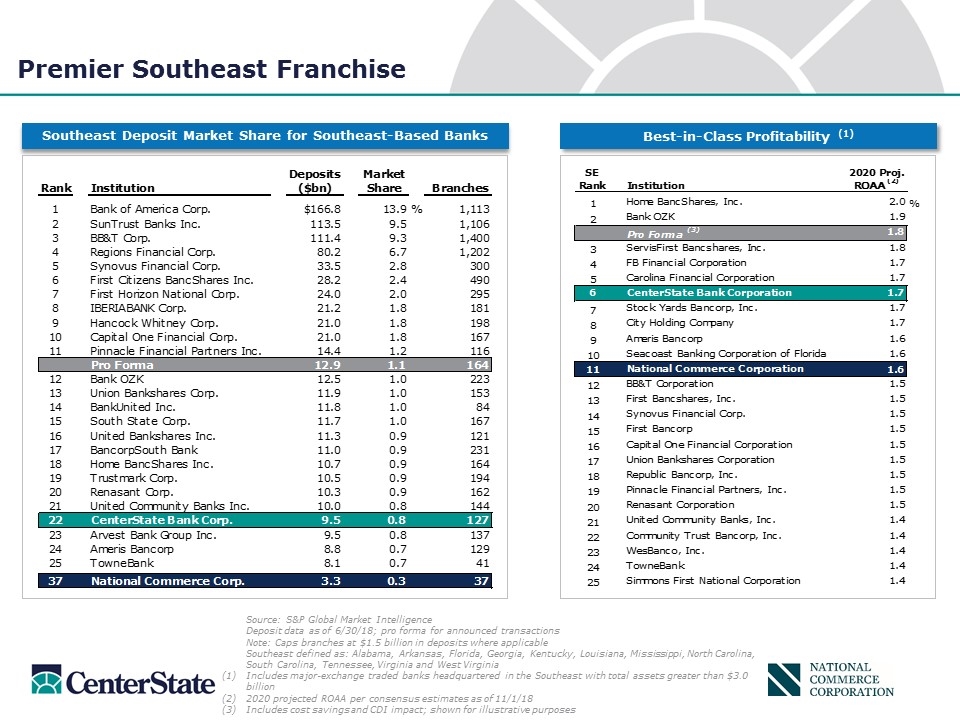

Southeast Deposit Market Share for Southeast-Based Banks Premier Southeast Franchise Source: S&P Global Market Intelligence Deposit data as of 6/30/18; pro forma for announced transactions Note: Caps branches at $1.5 billion in deposits where applicable Southeast defined as: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia and West Virginia Includes major-exchange traded banks headquartered in the Southeast with total assets greater than $3.0 billion (2) 2020 projected ROAA per consensus estimates as of 11/1/18 (3) Includes cost savings and CDI impact; shown for illustrative purposes Best-in-Class Profitability (1)

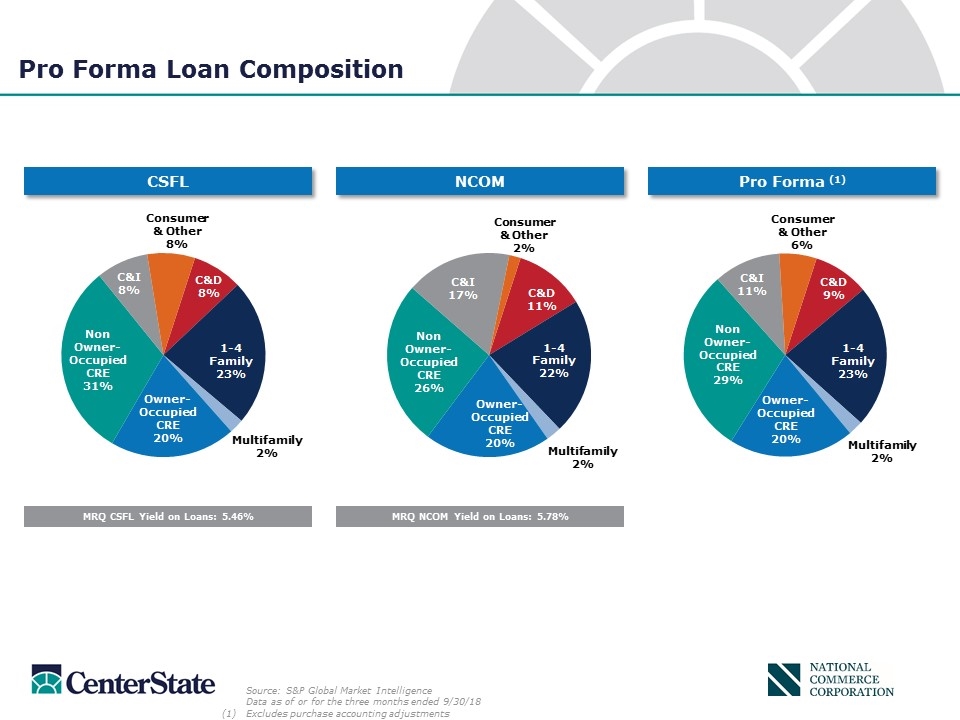

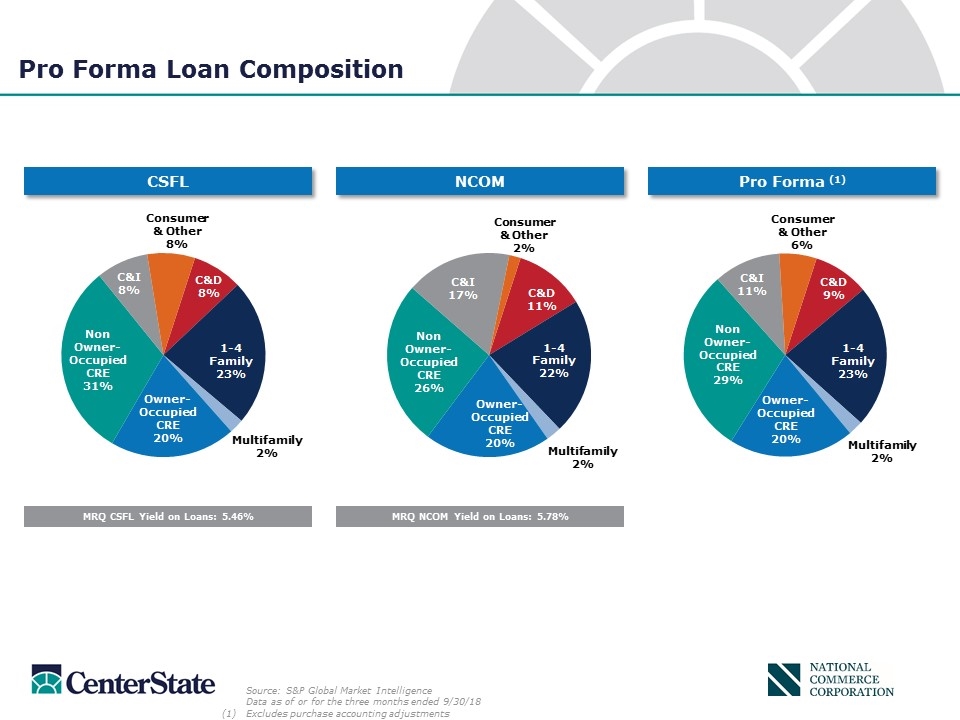

Pro Forma Loan Composition MRQ CSFL Yield on Loans: 5.46% MRQ NCOM Yield on Loans: 5.78% Source: S&P Global Market Intelligence Data as of or for the three months ended 9/30/18 Excludes purchase accounting adjustments CSFL NCOM Pro Forma (1)

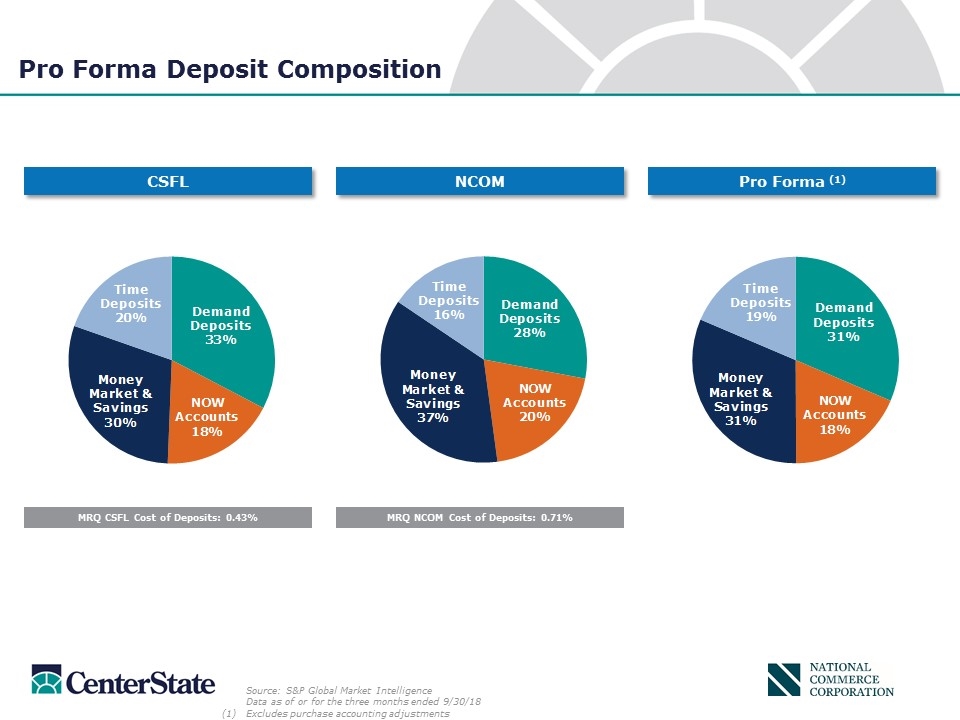

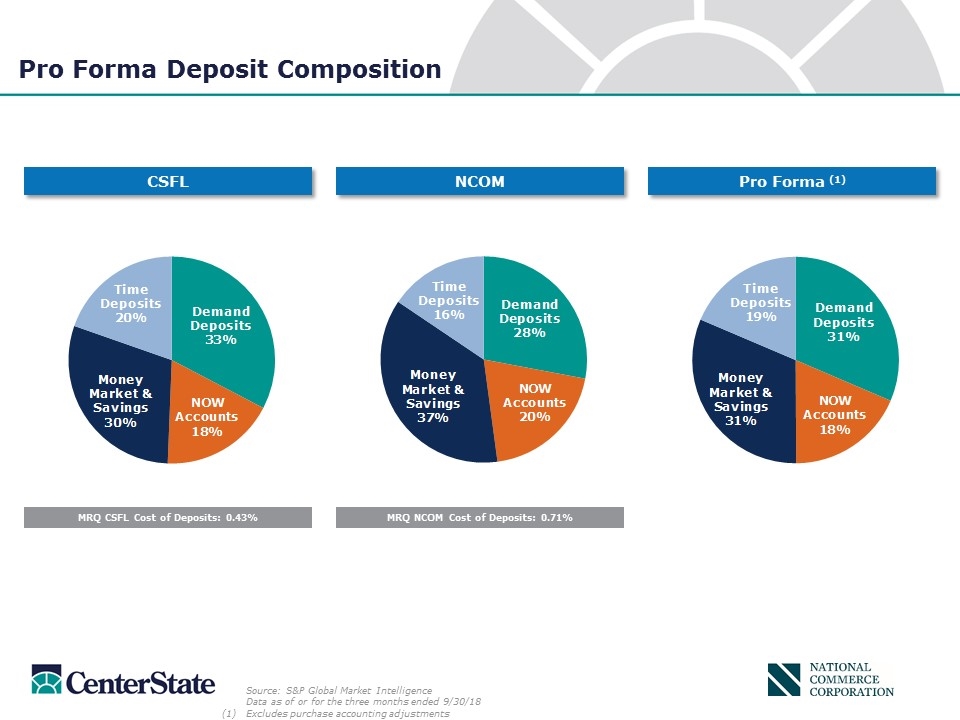

Pro Forma Deposit Composition Source: S&P Global Market Intelligence Data as of or for the three months ended 9/30/18 Excludes purchase accounting adjustments CSFL NCOM Pro Forma (1) MRQ CSFL Cost of Deposits: 0.43% MRQ NCOM Cost of Deposits: 0.71%

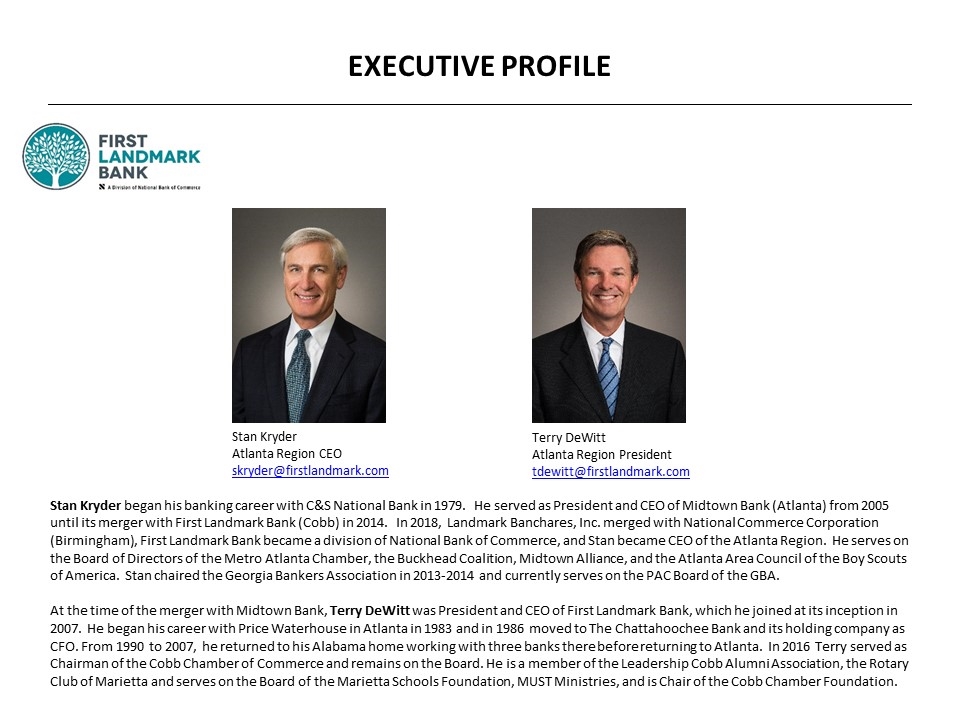

EXECUTIVE PROFILE Stan Kryder Atlanta Region CEO skryder@firstlandmark.com Terry DeWitt Atlanta Region President tdewitt@firstlandmark.com Stan Kryder began his banking career with C&S National Bank in 1979. He served as President and CEO of Midtown Bank (Atlanta) from 2005 until its merger with First Landmark Bank (Cobb) in 2014. In 2018, Landmark Banchares, Inc. merged with National Commerce Corporation (Birmingham), First Landmark Bank became a division of National Bank of Commerce, and Stan became CEO of the Atlanta Region. He serves on the Board of Directors of the Metro Atlanta Chamber, the Buckhead Coalition, Midtown Alliance, and the Atlanta Area Council of the Boy Scouts of America. Stan chaired the Georgia Bankers Association in 2013-2014 and currently serves on the PAC Board of the GBA. At the time of the merger with Midtown Bank, Terry DeWitt was President and CEO of First Landmark Bank, which he joined at its inception in 2007. He began his career with Price Waterhouse in Atlanta in 1983 and in 1986 moved to The Chattahoochee Bank and its holding company as CFO. From 1990 to 2007, he returned to his Alabama home working with three banks there before returning to Atlanta. In 2016 Terry served as Chairman of the Cobb Chamber of Commerce and remains on the Board. He is a member of the Leadership Cobb Alumni Association, the Rotary Club of Marietta and serves on the Board of the Marietta Schools Foundation, MUST Ministries, and is Chair of the Cobb Chamber Foundation.

Richard Murray Chairman of the Board (To be CEO of CenterState Bank) rmurray@nationalbankofcommerce.com Richard Murray serves as Chairman and Chief Executive Officer of National Commerce Corporation (NCOM) and National Bank of Commerce (NBC). He was appointed President and Chief Operating Officer of both NCOM and NBC when they were founded in 2010. In June 2012, Mr. Murray was appointed CEO of NBC and, in May 2017, was appointed CEO of NCOM. He previously served as President and Chief Operating Officer of Alabama National Bancorporation from 2000 until it was acquired in 2008, and then as Regional President (Alabama and Florida) of RBC Bank (USA) from February 2008 until July 2009. He has 34 years of commercial banking experience in the markets currently served by NCOM. Mr. Murray holds a B.S. in Economics from Vanderbilt University and an M.B.A. from Samford University. Will Matthews serves as President and Chief Financial Officer of National Commerce Corporation (NCOM) and National Bank of Commerce (NBC). He was appointed Executive Vice President and Chief Financial Officer of both NCOM and NBC in November 2011. From June 2012 until August 2018, Mr. Matthews served as Vice Chairman of NCOM, and in August 2018, he was appointed President and CFO of both NCOM and NBC. From March 2009 until October 2011, Mr. Matthews was a Partner at New Capital Partners, a private equity firm. He served as Chief Financial Officer with RBC Bank (USA) from February 2008 until March 2009. Preceding his tenure with RBC, from 1998 until 2008 he served as Executive Vice President and Chief Financial Officer of Alabama National BanCorporation (ANB), holding the same titles at First American Bank, ANB’s largest subsidiary. Mr. Matthews holds an A.B. in economics from Princeton University and an M.B.A. from The Wharton School, University of Pennsylvania. (National Commerce Corporation – Nasdaq: NCOM) Will Matthews President and Chief Financial Officer (To be CFO of CSFL and CenterState Bank) wmatthews@nationalbankofcommerce.com

John Corbett CSFL President and Chief Executive Officer jcorbett@centerstatebank.com Born in Miami, John Corbett began his banking career with First Union in Florida. In 1999 he helped organize CenterState Bank and has been the CEO since June of 2003. John has been named Community Banker of the Year by the American Banker (2012) and Banker of the Year by the Florida Bankers Association (2013). He has held various positions within the Florida Bankers Association and Independent Community Bankers of America, as well as being actively involved in his church and the Winter Haven community. Under John’s leadership, CenterState has grown to over $12 billion in assets, with offices throughout Florida, Georgia and Alabama as well as a thriving Correspondent Division. John is a graduate of Bob Jones University. Steve Young serves as an Executive Vice President and Chief Operating Officer with CenterState Bank. He joined CenterState in 2002 holding various roles through his tenure of Controller, CFO and COO. In his current role, Steve is responsible for various lines of business including Correspondent Banking, Mortgage, Wealth Management, and Prepaid Card divisions. Steve serves as the primary investor relations contact as well as the liaison responsible for working with Investment Bankers. Prior to joining the Bank, Steve was a Senior Auditor at Deloitte and Touche in Greenville, SC. Steve earned a B.S. in Accounting from Bob Jones University and is a licensed CPA. (CenterState Bank Corporation – Nasdaq: CSFL) Steve Young CSFL and CenterState Bank Chief Operating Officer syoung@centerstatebank.com

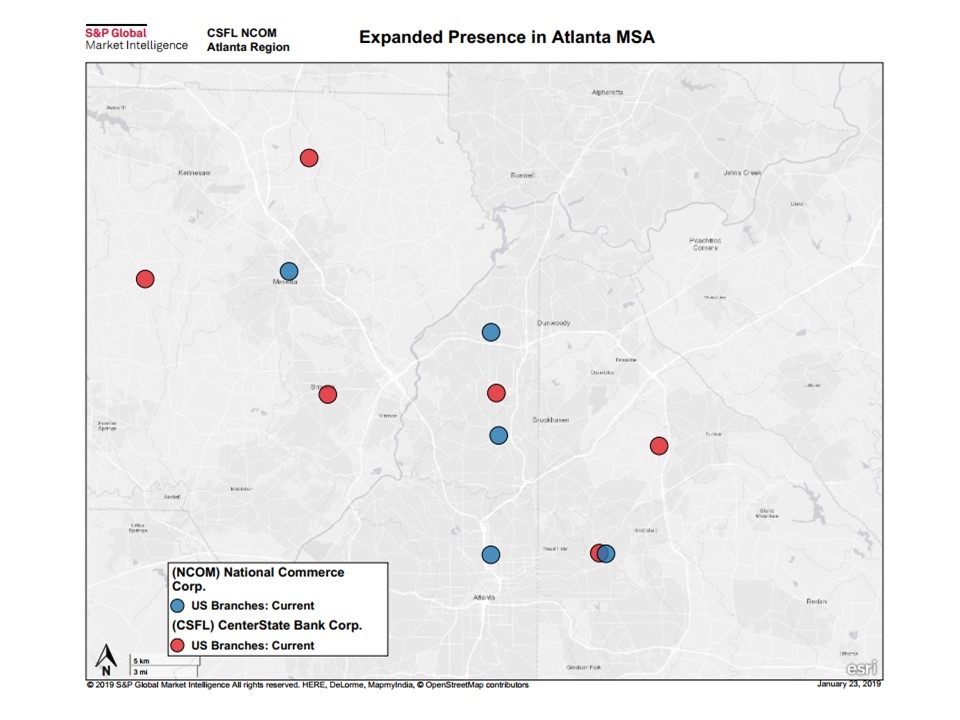

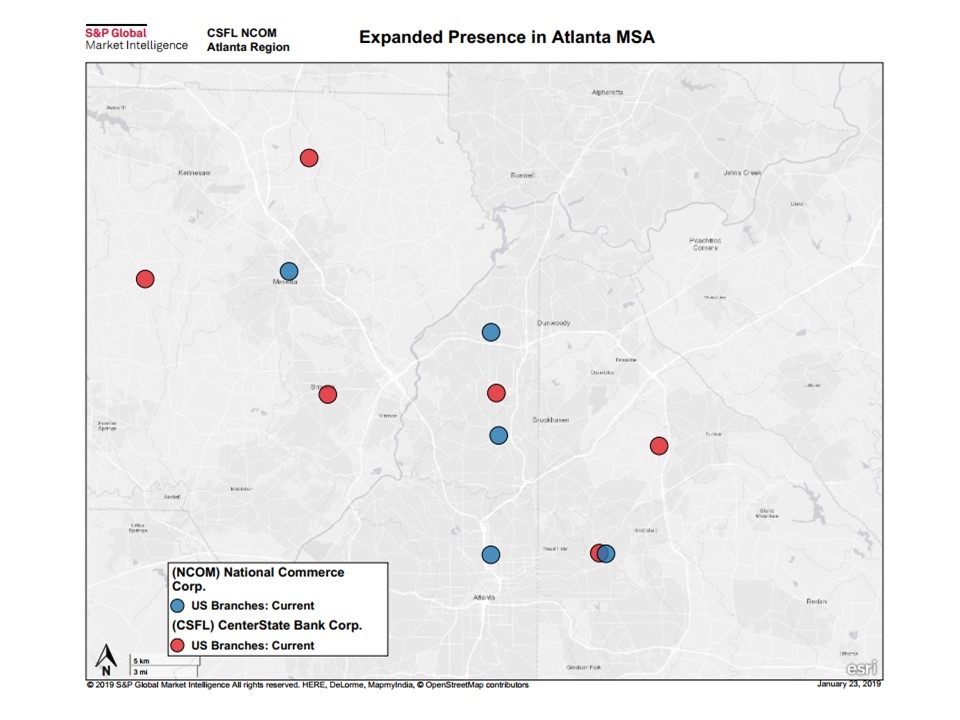

1999CenterState Bank (Winter Haven, FL) forms as a de novo (CSFL) and selects Alabama National Bancorporation (ALAB) and its lead subsidiary bank, led by John Holcomb, Richard Murray and Will Matthews (Birmingham, AL), as their correspondent bank partner 2008ALAB is acquired by RBC and, based on a long-term relationship, ALAB facilitates the transition of its correspondent banking and other non-bank divisions and teams to CSFL 2010 Legacy ALAB executive team, led by John Holcomb, Richard Murray and Will Matthews, acquires controlling interest in Birmingham-based Red Mountain Bank, renaming it National Bank of Commerce (NBC); NBC selects CSFL as their correspondent bank partner 2010-2017CSFL, led by John Corbett, and National Commerce Corporation (NCOM), parent company of NBC, led by John Holcomb, Richard Murray and Will Matthews, grow organically and through acquisitions, and executive relationships between the two continue to grow 2017NCOM acquires PRIVATE BANK OF BUCKHEAD (headquartered in Atlanta, GA) Locations in BUCKHEAD | DECATUR 2018NCOM acquires FIRST LANDMARK BANK (headquartered in Marietta, GA) Locations in MIDTOWN | SANDY SPRINGS | MARIETTA 2018CSFL acquires CHARTERBANK (headquartered in West Point, GA) Metro Atlanta Locations in BUCKHEAD | DECATUR | SMYRNA | MARIETTA | TUCKER NOV 2018CSFL and NCOM jointly announce merger, with merger closing anticipated 2Q 2019 THE HISTORY THE STORY Having entered the Atlanta banking market with its purchase of CharterBank in 2018, CenterState Bank is focused on growing its franchise in metro Atlanta. National Bank of Commerce, which had recently purchased Private Bank of Buckhead and First Landmark Bank, was an attractive acquisition for CenterState, providing an additional five north metro Atlanta locations. Following the closing of the merger (which is anticipated in the second quarter of 2019, subject to stockholder and regulatory approvals and the satisfaction of other closing conditions), Stan Kryder and Terry DeWitt will lead CenterState Bank’s Atlanta Region, which will include the metro Atlanta banking markets of First Landmark Bank, Private Bank of Buckhead and CharterBank, all under the name of CenterState following the banking systems conversion.

Following the merger, CenterState’s resulting Atlanta presence is expected to be: 375 employees 10 Banking offices; 2 Mortgage offices; 1 Correspondent Banking office; 2 SBA offices $1.5 billion MSA deposits First Landmark Bank, a Division of National Bank of Commerce MIDTOWN | SANDY SPRINGS | COBB (Marietta) | COMING SOON: North Fulton (Alpharetta) Private Bank of Buckhead and Decatur, a Division of National Bank of Commerce BUCKHEAD | DECATUR National Bank of Commerce Mortgage BUCKHEAD National Bank of Commerce SBA Lending ATLANTA CharterBank, a Division of CenterState Bank ATLANTA | BUCKHEAD | DECATUR | MARIETTA | TUCKER Current CenterState Presence in Atlanta: CenterState Correspondent Banking Division Headquartered in ATLANTA CenterState Mortgage Division - Headquartered in ATLANTA

Additional Information CenterState has filed a registration statement on Form S-4 with the SEC to register the shares of CenterState’s common stock that will be issued to NCC’s stockholders in connection with the proposed merger. The registration statement includes a joint proxy statement of CenterState and NCC and a prospectus of CenterState. A definitive joint proxy statement-prospectus will be sent to the stockholders of each of CenterState and NCC in connection with the proposed merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND DEFINITIVE JOINT PROXY STATEMENT-PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT-PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by CenterState on its website at www.centerstatebanks.com and by NCC on its website at www.nationalbankofcommerce.com. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and security holders of CenterState and NCC are urged to read carefully the entire registration statement and definitive joint proxy statement-prospectus when it becomes available, including any amendments thereto, because these documents will contain important information about the proposed merger. Free copies of these documents may be obtained as described above. CenterState, NCC and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of CenterState and NCC in connection with the proposed merger. Information regarding the directors and executive officers of CenterState and NCC and other persons who may be deemed participants in the solicitation of the stockholders of CenterState or of NCC in connection with the proposed merger will be included in the definitive joint proxy statement-prospectus for each of CenterState’s and NCC’s special meeting of stockholders, which will be filed by CenterState and NCC with the SEC. Information about the directors and officers of CenterState and their ownership of CenterState common stock can also be found in CenterState’s definitive proxy statement in connection with its 2018 annual meeting of stockholders, as filed with the SEC on March 12, 2018, and other documents subsequently filed by CenterState with the SEC. Information about the directors and officers of NCC and their ownership of NCC common stock can also be found in NCC’s definitive proxy statement in connection with its 2018 annual meeting of stockholders, as filed with the SEC on April 20, 2018, and other documents subsequently filed by NCC with the SEC. Additional information regarding the interests of such participants will be included in the definitive joint proxy statement-prospectus and other relevant documents regarding the proposed merger filed with the SEC when they become available.