Viking Investments Group, Inc.

65 Broadway, Seventh Floor

New York, New York 10006

February 27, 2013

Securities and Exchange Commission

Attn: Lyn Shenk; Aamira Chaudhry

Division of Corporation Finance

Washington, D.C. 20549

RE: Viking Investments Group, Inc. (the “Company”)

Form 10-K for Fiscal Year Ended December 31, 2011

Filed April 16, 2012

File No. 001-29219

Dear Ms. Shenk and Ms. Chaudhry,

In response to your letter dated December 21, 2012, we respectfully submit the following responses:

Form 10-K for Fiscal Year Ended December 31, 2011

Item 8. Financial Statements and Supplementary Data

Note 1. Nature of Business and Going Concern, page F-10

| 1. | We note that you acquired from Viking Nevis 566,813 shares of China Wood, Inc. stock in exchange for 14,481,420 shares of your common stock. Subsequent to this transaction, Viking Nevis owned approximately 78% of your outstanding common stock giving them substantial ownership. Based on the above, it appears that this was a reverse acquisition transaction with Viking Nevis being the accounting acquirer. Please tell us how you accounted for this transaction and the authoritative accounting guidance you relied upon. |

RESPONSE: Topic 805 defines a reverse acquisition as:

An acquisition in which the entity that issues the securities (the legal acquirer) is identified as the acquiree for accounting purposes based on the guidance in paragraph 805-10-55-11 through 55-15. The entity whose equity interests are acquired (the legal acquiree) must be the acquirer for accounting purposes for the transaction to be considered a reverse acquisition.

SEC Response Letter

Viking Investments Group, Inc.

February 27, 2013

Page 2

See ASC 805-40-25-1.A. In a reverse acquisition, the accounting acquiree (the legal acquirer or “Parent” hereinafter) issues so many of its shares to the former owners of another entity, the accounting acquirer (the legal acquiree or “Subsidiary” hereinafter), in exchange for their ownership interests of the Subsidiary, that those former owners obtain control of the consolidated enterprise. See Joanne M. Flood et. al., Wiley GAAP 2011: Interpretation and Application of Generally Accepted Accounting Principles 691–92 (2013) (“A reverse acquisition is a stock transaction that occurs when one entity (the legal acquirer) issues so many of its shares to the former owners of another entity (the legal acquiree) that those former owners become the majority owners of the resultant consolidated enterprise. . . . The reverse acquisition is effected when the shareholders of the legal acquiree obtain control of the postacquisition consolidated enterprise . . . . Based on the application of ASC 801-10-55-11 through 55-15, and as a result of the change in control effected by the exchange of stock, the legal acquiree is identified as the accounting acquirer of the legal acquirer/accounting acquiree.”).

This was not a reverse acquisition as (1) Viking Investments Group, LLC (“Viking Nevis”), the ostensible legal acquiree/accounting acquirer, did not transfer any ownership interest of Viking Nevis to Viking Investments Group, Inc. f/k/a SinoCubate, Inc. (the ostensible legal acquirer/accounting acquiree) (“SinoCubate” to avoid confusion), and (2) Viking Nevis was the majority owner of SinoCubate prior to this transaction and had been since 2008. See SinoCubate’s 2009-2011 Form 10-K’s (each disclosing that Viking Nevis owned 63.5% of SinoCubate’s equity). Additionally, neither management nor SinoCubate’s line of business changed as a result of this transaction (contrary to a reverse acquisition, where the Parent typically continues the Subsidiary’s line of business, and the consolidated financial statements are presented as a continuation of the Subsidiary’s business). See Wiley GAAP 2011 at 692.

Because SinoCubate did not legally acquire Viking Nevis in this transaction (or, in fact, any ownership interest of Viking Nevis from its owners), SinoCubate could not have been the “legal acquirer” and Viking Nevis could not have been the “legal acquiree.” Likewise, neither Viking Nevis nor its owners acquired control of SinoCubate by virtue of this transaction, and therefore, Viking Nevis could not be considered the “accounting acquirer” nor SinoCubate the “accounting acquiree.” For these reasons, this transaction could not be considered a reverse acquisition.

| 2. | It appears that you estimated the value of the long-term investment assets, which you recorded as a result of the transaction discussed in the comment above, based upon a guarantee by Viking Nevis to buy back this stock at $4.00 per share. However, based on the above it appears that this guarantee is not from an independent third party but instead from your accounting acquirer. Please tell us how you determined that it was appropriate to value the investment based on this guarantee. |

RESPONSE: As stated previously, Viking Nevis was not our “accounting acquirer”—it had majority control of the Company both before and after the transaction. In any event, we did not value the stock based solely on the guarantee. We valued the stock at $4/share based on a combination of the following:

(1) Valuations based on quoted prices in active markets:

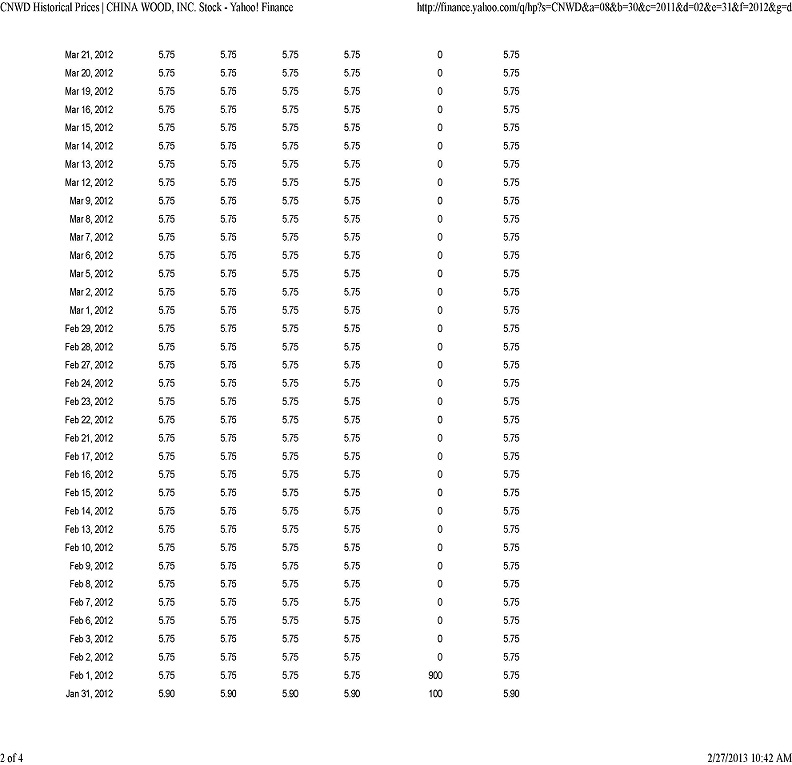

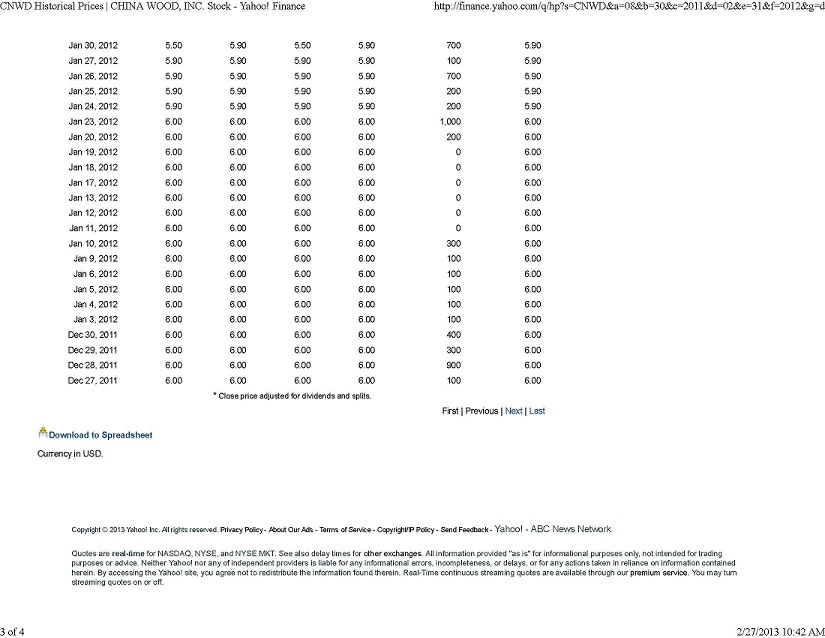

The recent trading prices of China Wood stock as at December 31, 2011 and for the following three months was $6.00/share and never fell below $4.00/share, averaging substantially in excess of $4.00/share (see China Wood trading price history attached hereto as Exhibit “A”).

SEC Response Letter

Viking Investments Group, Inc.

February 27, 2013

Page 3

(2) A third-party buyer repurchase guarantee:

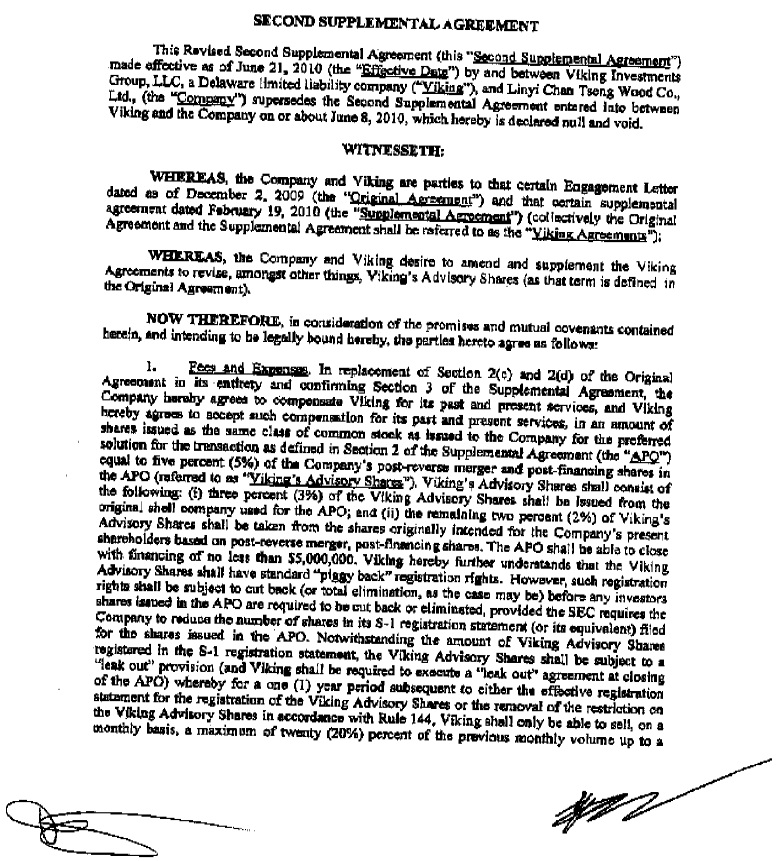

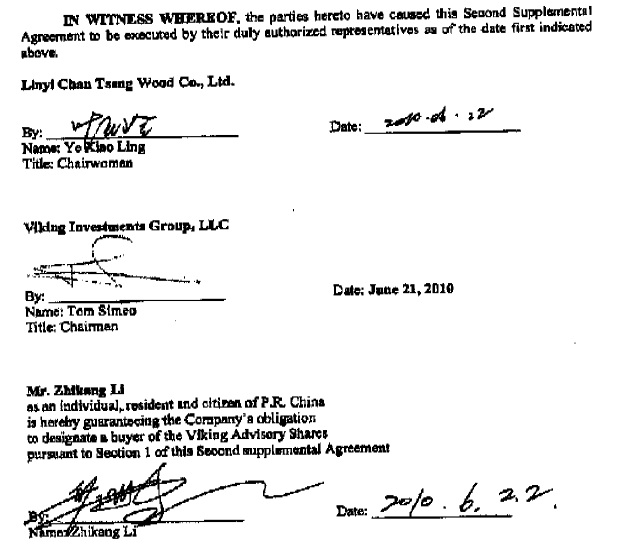

Viking Nevis’ right, pursuant the agreement of its subsidiary, Viking Investments Group, LLC, a Delaware LLC (“Viking Delaware”), with China Wood’s predecessor-in-interest, the Linyi Chan Tseng Wood Co., to require Zhikang Li, China Wood’s Chairman, to locate a buyer to repurchase the China Wood shares from Viking Delaware at the then-average closing bid price of the China Wood shares for the proceeding three months (see last paragraph of Section 1 of the Second Supplemental Agreement attached hereto as Exhibit “B”). As the price range for the China Wood shares in the 3 months following the close of our 2011 fiscal year was between $5.75-6.00, valuing the China Wood shares at $4/share in part based on a third-party guaranteed price substantially in excess of $4/share was reasonable.

and

(3) The Viking Nevis guarantee to repurchase the China Wood shares at $4.00 per share.

According to ASC 820-10-05-1B, fair value is a market-based measurement. For some assets and liabilities, observable market transactions or market information might be available. For other assets and liabilities, observable market transactions and market information might not be available. However, the objective of a fair value measurement in both cases is the same—to estimate the price at which an orderly transaction to sell the asset or to transfer the liability would take place between market participants at the measurement date under current market conditions.

Observable market transactions that are traded in an active market are available for the China Wood shares. The shares are, however, subject to a “leak-out” provision whereby Viking shall only be able to sell on a monthly basis up to a maximum of 50,000 shares per month. Therefore, we did not think it appropriate to use the quoted market prices directly to value the China Wood shares. Instead, we compared the quoted market prices, the third party repurchase price guaranteed by China Wood, and the repurchase price guaranteed by Viking Nevis, and considered the price of $4.00/share to be an appropriate fair value for the China Wood shares.

| 3. | We note that China Wood went public in April 2012 and has since filed no quarterly or annual reports and no Form 8-K’s communicating information to investors about its operating results or status, or lack thereof. We also note that there is essentially no trading activity in the shares of China Wood. Based on the above, it is not clear how you were able to conclude your shares had a fair value of $4.00 each, or $2,267,252 in the aggregate. Please advise. |

RESPONSE: As stated previously, we valued the stock based on the combination of Viking Nevis repurchase guarantee, Mr. Li’s guarantee to locate a third-party buyer for the shares, and the recent trading prices of China Wood common stock at the time.

Exhibit 10

| 4. | Please amend your filing to file the Guaranty and Repurchase Agreement with Viking Investment Group, LLC as an exhibit. |

RESPONSE: We will amend our filing to file the Guaranty and Repurchase Agreement with Viking Investment Group, LLC as an exhibit as instructed.

SEC Response Letter

Viking Investments Group, Inc.

February 27, 2013

Page 4

Exhibit 31.1

| 5. | Please amend your filing including your Form 10-Qs for the quarters ended March 31, 2012, June 30, 2012 and September 30, 2012 to conform the language in the certification to exactly as it is stated in item 601(B)(31)(i). |

RESPONSE: We will amend our filings as instructed.

| 6. | Please amend your filing to file a certification for your principal financial officer. |

RESPONSE: We will file a certification for our principal financial officer as instructed.

Form 10-Q for Fiscal Quarter Ended September 30, 2012

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Continuing Operations, page 6

| 7. | We note that you recorded revenues of $47,070 related to preliminary audit services. Please tell us in further detail the nature of the services you provided, to whom they were provided, and when you provided the services. |

RESPONSE: We provided financial consultant pre-audit services to Zhejiang Xiujin Group Co. Ltd. and its subsidiaries (“Zhejiang”) to (1) evaluate if its financial statements for the fiscal years ended December 31, 2011 and 2010 were in in conformity with accounting principles generally accepted in the United States of America, and (2) provide preliminary merger and acquisition accounting and business consulting services. After we performed the pre-audit consulting services, Zhejiang decided not to seek a US listing via reverse merger with an existing US public company. Our services were performed during the summer of 2012 and ended August 15, 2012.

We thank you for your patience. If you have any questions or concerns, please feel free to contact our counsel, Vincent & Rees, via telephone at (801) 303-5737. Thank you for your assistance and review.

Sincerely,

VIKING INVESTMENTS GROUP, INC.

| /s/ Tom Simeo | |

| Tom Simeo | |

| Chief Executive Officer | |