Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

|

Commission File Number: 001-15605

EARTHLINK, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 58-2511877 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

1375 Peachtree St., Atlanta, Georgia 30309

(Address of principal executive offices, including zip code)

(404) 815-0770

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation of S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the of the Exchange Act (Check One):

| | | | | | |

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o | | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's outstanding common stock held by non-affiliates of the registrant on June 30, 2008 was $932.6 million.

As of January 30, 2009, 108,872,733 shares of common stock were outstanding.

Portions of the Proxy Statement to be filed with the Securities and Exchange Commission and to be used in connection with the Annual Meeting of Stockholders to be held on May 5, 2009 are incorporated by reference in Part III of this Form 10-K.

Table of Contents

EARTHLINK, INC.

Annual Report on Form 10-K

For the Year Ended December 31, 2008

TABLE OF CONTENTS

| | | | | | |

PART I | |

Item 1. | | Business | | |

1 | |

Item 1A. | | Risk Factors | | |

11 | |

Item 1B. | | Unresolved Staff Comments | | |

22 | |

Item 2. | | Properties | | |

22 | |

Item 3. | | Legal Proceedings | | |

23 | |

Item 4. | | Submission of Matters to a Vote of Security Holders | | |

23 | |

PART II | |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | |

23 | |

Item 6. | | Selected Financial Data | | |

25 | |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operation | | |

26 | |

Item 7A. | | Quantitative and Qualitative Disclosures about Market Risk | | |

54 | |

Item 8. | | Financial Statements and Supplementary Data | | |

56 | |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | |

100 | |

Item 9A. | | Controls and Procedures | | |

100 | |

Item 9B. | | Other Information | | |

100 | |

PART III | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | |

100 | |

Item 11. | | Executive Compensation | | |

101 | |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | |

101 | |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | |

102 | |

Item 14. | | Principal Accounting Fees and Services | | |

103 | |

PART IV | |

Item 15. | | Exhibits, Financial Statement Schedules | | |

103 | |

SIGNATURES | | |

107 | |

Table of Contents

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. The words "estimate," "plan," "intend," "expect," "anticipate," "believe" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are found at various places throughout this report. EarthLink, Inc. disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Although EarthLink, Inc. believes that its expectations are based on reasonable assumptions, it can give no assurance that its targets and goals will be achieved. Important factors that could cause actual results to differ from estimates or projections contained in the forward-looking statements are described under "Risk Factors" in Item 1A of Part I and under "Safe Harbor Statement" in Item 7 of Part II.

PART I

Item 1. Business.

Overview

EarthLink, Inc. is an Internet service provider ("ISP"), providing nationwide Internet access and related value-added services to individual and business customers. Our primary service offerings are dial-up and high-speed Internet access services and related value-added services, such as search, advertising and ancillary services sold as add-on features to our Internet access services. In addition, through our wholly-owned subsidiary, New Edge Networks ("New Edge"), we build and manage private IP-based wide area networks for businesses and communications carriers.

We operate two reportable segments, Consumer Services and Business Services. Our Consumer Services segment provides Internet access and related value-added services to individual customers. These services include dial-up and high-speed Internet access and voice services, among others. Our Business Services segment provides integrated communications services, dedicated Internet access and related value-added services to businesses and communications carriers. These services include managed private IP-based wide area networks, dedicated Internet access and web hosting, among others. See Note 19, "Segment Information," of the Notes to Consolidated Financial Statements in Item 8 of Part II for additional information.

We were formed in February 2000 as a result of the merger of EarthLink Network, Inc. and MindSpring Enterprises, Inc. We were incorporated in 1999 and are a Delaware corporation. Our corporate offices are located at 1375 Peachtree St., Atlanta, Georgia 30309, and our telephone number at that location is (404) 815-0770.

Business Strategy

Our business strategy is to focus on customer retention, operational efficiency and opportunities for growth.

- •

- Customer Retention. We are focused on retaining our existing tenured customers. We believe focusing on the customer relationship increases loyalty and reduces churn. We also believe that these tenured customers provide cost benefits, including reduced call center support costs and reduced bad debt expense. We continue to focus on offering our access services with high-quality customer service and technical support.

- •

- Operational Efficiency. We are focused on improving the cost structure of our business and aligning our cost structure with trends in our revenue, without impacting the quality of services we provide. We are focused on delivering our services more cost-effectively by reducing and more efficiently handling the number of calls to contact centers, managing cost effective outsourcing opportunities, managing our network costs and streamlining our internal processes and operations.

1

Table of Contents

- •

- Opportunities for Growth. In response to changes in our business, we have significantly reduced our sales and marketing spending. However, we continue to seek to add customers that generate an acceptable rate of return and increase the number of subscribers we add through alliances, partnerships and acquisitions from other ISPs. We also continue to evaluate potential strategic transactions that could complement our business.

The primary challenges we face in executing our business strategy are managing the rate of decline in our revenues, responding to competition, reducing churn, implementing cost reduction initiatives, purchasing cost-effective wholesale broadband access and adding customers that generate an acceptable rate of return. The factors we believe are instrumental to the achievement of our business strategy may be subject to competitive, regulatory and other events and circumstances that are beyond our control. Further, we can provide no assurance that we will be successful in achieving any or all of the strategies identified above, that the achievement or existence of such strategies will favorably impact profitability, or that other factors will not arise that would adversely affect future profitability.

Consumer Services Segment

Service Offerings

Narrowband Access

Premium Dial-up Internet Access. Our premium dial-up, or narrowband, access is a subscription-based service that provides customers with access to the Internet and a wide variety of content, features, services, applications, tools and 24/7 customer support. Such features include antivirus and firewall protection, acceleration tools and privacy and safety tools. Revenues primarily consist of monthly fees charged to customers for dial-up Internet access.

Value Dial-up Internet Access. We provide value-priced dial-up access services through our PeoplePC™ Online offering. Our value dial-up access is a subscription-based service that provides customers access to the Internet with limited functionality and support services at comparatively lower prices. We also provide for an additional charge to value-priced dial-up access customers accelerator technology that speeds up customers' page load times by compressing and simplifying web pages. Revenues primarily consist of monthly fees charged to customers for dial-up Internet access.

Broadband Access

High-speed, or broadband, access offers a high speed, always on Internet connection that uses a modem to supply an Internet connection across an existing home phone line or cable connection. The Internet service doesn't interfere with a customer's voice service, so there is no need for a second phone line. We provide high-speed access services via DSL and cable and offer different speeds of service (ranging from 1.5Mbps to 8.0Mbps). Availability for these services depends on the telephone or cable service provider. Our high-speed access service includes the same features and benefits included with our premium dial-up access service, including antivirus and firewall protection, privacy and safety tools and 24/7 customer support. Broadband access revenues consist of monthly fees charged for high-speed access services; activation fees; early termination fees; equipment fees associated with the sale of modems and other access devices to our subscribers; and shipping and handling fees.

VoIP

EarthLink DSL and Home Phone Service is a bundle offer that includes EarthLink high-speed Internet access at speeds up to 8.0Mbps and home phone service. It combines the last mile of traditional telephone copper wiring with the advanced features of voice-over-Internet Protocol ("VoIP") by taking advantage of Digital Subscriber Line Access Multiplexer, or DSLAM, technology. We offer subscription-based service under various plans that include features such as voicemail, call waiting, caller ID, call forwarding and E911 service. We currently offer this service in 12 markets in the U.S. covering

2

Table of Contents

approximately 12.0 million households. Revenues primarily consist of monthly fees charged to customers for VoIP service plans.

Advertising and Other Value-Added Services

We offer services which are incremental to our Internet access services. Our value-added services portfolio includes products for protection, communication and performance, such as security, web acceleration, Internet call waiting, mail storage and home networking, among others. We offer free and fee-based value-added services to both subscribers and non-subscribers.

We also generate advertising revenues by leveraging the value of our customer base and user traffic; through paid placements for searches, powered by the Google™ search engine; fees generated through revenue sharing arrangements with online partners whose products and services can be accessed through our web properties; commissions received from partners for the sale of partners' services to our subscribers; and sales of advertising on our various web properties.

Sales and Distribution

In response to changes in our business and industry, we have significantly reduced our sales and marketing spending. Our marketing efforts are currently focused on retaining tenured customers and adding customers through alliances, partnerships and acquisitions from other ISPs that generate an acceptable rate of return. We offer our products and services primarily through direct customer contact through our call centers, through affinity marketing partners such as AARP and Dell and through marketing alliances such as Time Warner Cable.

Network Infrastructure

We provide subscribers with Internet access primarily through third-party telecommunications service providers. Our main provider for narrowband services is Level 3 Communications, Inc. We have agreements with AT&T Inc. ("AT&T"), Qwest Corporation ("Qwest"), Verizon Communications Inc. ("Verizon") and Covad Communications Group, Inc. ("Covad"), that allow us to provide DSL services. We also have agreements with Time Warner Cable that allows us to provide broadband services over Time Warner Cable's and Bright House Networks' cable network in substantially all their markets and with Comcast Corporation ("Comcast") that allows us to provide broadband services over Comcast's cable network in certain Comcast markets. We rely on Covad's line-powered voice access to provide certain of our VoIP services.

We maintain a leased backbone consisting of a networked loop of connections connecting multiple cities and our technology centers. We maintain data centers in multiple locations with redundant systems to provide service availability and connectivity.

Competition

Internet access services. We operate in the Internet access services market, which is extremely competitive. We compete directly or indirectly with established online services companies, such as AOL and the Microsoft Network (MSN); national communications companies and local exchange carriers, such as AT&T, Qwest and Verizon; cable companies providing broadband access, including Time Warner Cable, Comcast, Charter Communications, Inc. and Cox Communications, Inc.; local and regional ISPs; free or value-priced ISPs, such as United Online which provides services under the brands NetZero and Juno; wireless Internet service providers; content companies, such as Yahoo! and Google; and satellite and fixed wireless service providers. Competition in the market for Internet access services is likely to continue increasing, and competition could impact the pricing of our services, sales and marketing costs to retain existing or acquire new subscribers and the number of customers that discontinue using our services, or churn.

3

Table of Contents

Prices for certain of our consumer access services, particularly our consumer broadband services, have been decreasing. We expect that we may continue to experience pricing pressures due to competition, volume-based pricing and other factors. Some providers have reduced and may continue to reduce the retail price of their Internet access services to maintain or increase their market share, which could cause us to reduce, or prevent us from raising, our prices. We may encounter further market pressures to: migrate existing customers to lower-priced service offering packages; restructure service offering packages to offer more value; reduce prices; and respond to particular short-term, market-specific situations, such as special introductory pricing or new product or service offerings. Any of the above could adversely affect our revenues and profitability.

Current and prospective competitors include many large companies that have substantially greater market presence and greater financial, technical, marketing and other resources than we have. In addition, some of our competitors are able to bundle other content, services and products with Internet access services. These services include various forms of voice, data and video services and wireless communications. The ability to bundle services, as well as the financial strength and the benefits of scale enjoyed by certain of these competitors, enable them to offer services at prices that are below the prices at which we can offer comparable services.

We believe the primary competitive factors in the Internet access service industry are price, speed, features, coverage area and quality of service. While we believe our Internet access services compete favorably based on these factors when compared to many Internet access providers, we are at a competitive disadvantage relative to some or all of these factors with respect to some of our competitors. Our dial-up Internet access services do not compete favorably with broadband services with respect to speed, and dial-up Internet access services no longer have a significant, if any, price advantage over certain broadband services. Most of the largest providers of broadband services, such as cable and telecommunications companies, control their own networks and offer a wider variety of services than we offer, including voice, data and video services. Their ability to bundle services and to offer broadband services at prices below the price that we can profitably offer comparable services puts us at a competitive disadvantage.

Advertising and other value-added services. The companies we compete with for Internet access services also compete with us for subscribers to value-added services, such as email storage and security products. We compete for advertising revenues with major ISPs, content providers, large web publishers, web search engine and portal companies, Internet advertising providers, content aggregation companies, social-networking web sites, and various other companies that facilitate Internet advertising. Competition in the market for advertising services may impact the rates we charge.

VoIP services. Competitors for our VoIP services include established telecommunications and cable companies; Internet access service companies; leading Internet companies; and companies that offer VoIP services as their primary business, such as Vonage. The market for VoIP services is intensely competitive and characterized by technological change.

Business Services Segment

Service Offerings

Private IP-Based Networks

Through New Edge, we provide private IP-based networks for small and medium-sized businesses. Customers can choose a blend of access technologies including DSL, T1 lines, fiber-optic and wireless broadband. During 2007, we began using Multi-Protocol Label Switching ("MPLS") technology, which enables businesses to prioritize voice, video and data on a single private network that optimizes bandwidth. MPLS also enables class of service ("CoS") tagging of network traffic, so administrators may specify which applications should move across the network ahead of others. We also continue to use frame relay to deliver voice, video and data information over our networks. Revenues consist of fees charged for managed

4

Table of Contents

IP-based networks; installation fees; termination fees; fees for equipment; and regulatory surcharges billed to customers.

Secure Public Networks

Through New Edge, we provide hosted virtual private networks ("VPN") and CPE-based VPNs. VPNs are secure, outsourced networks that link multiple customer locations. Our VPN solutions provide businesses with a cost-effective means of creating their own secure networks for their traveling workforce, telecommuters and remote offices. Revenues consist of monthly fees charged for VPNs; installation fees; termination fees; fees for equipment; and regulatory surcharges billed to customers.

Internet Access

We provide high-speed and dial-up Internet access for business customers. We offer various speeds, reliable connectivity, business-class features like static IP addresses, multiple email accounts and customer service that is available 24/7. Revenues primarily consist of monthly fees charged to customers for Internet access; installation fees; and usage fees.

Wholesale Services

Through New Edge, we provide network services to communications carriers, which bundle New Edge services with their own to provide solutions to the end customer. Revenues consist of monthly recurring fees; termination fees; fees for equipment; and usage fees.

Web Hosting

We lease server space and provide web hosting services to companies and individuals wishing to have an Internet or electronic commerce presence. Features include domain names, storage, mailboxes, software tools to build websites, e-commerce applications and 24/7 customer support. Revenues primarily consist of monthly fees charged to customers for web hosting packages.

Other Services

We offer a variety of other services that eliminate the inconvenience and complexity of managing multiple carrier relationships, technologies and geographies. These services enable our business customers to focus on their core business while we manage the broadband network infrastructures. We believe our customers benefit from one seamless network, one provider and one point of contact for their total connection needs. These services include installation programs, managed network services, remote access and disaster recovery, among others.

Sales and Distribution

We sell our services to end user business customers and to wholesale customers. Our end users range from large enterprises with many locations, to small and medium-sized multi-site businesses to business customers with one site, often a home-based location. Our wholesale customers consist primarily of telecommunications carriers. The mix of our business services customer base has shifted towards end users as a result of consolidation in the telecommunications industry. We sell services through direct channels, which include our direct sales force, telephone and web sales groups. We also sell our services indirectly via a variety of third parties such as resellers, sales agents and referral partners.

Network Infrastructure

New Edge's network is comprised of ATM/frame relay/DSL switches in central office co-locations. In addition, New Edge has access under wholesale agreements to additional central offices throughout the U.S. New Edge has interconnection agreements with all major local exchange carriers to lease DSL and T-1 unbundled network elements, as well as commercial services agreements with national communications

5

Table of Contents

companies, competitive local exchange carriers ("CLECs"), and cable and satellite service providers to provide last mile connectivity onto its network. The network provides coverage via frame relay, DSL, and/or T-1 access to service small and medium-sized businesses and carriers.

Competition

We face significant competition in our business segment markets and we expect this competition to intensify. These markets are rapidly changing due to industry consolidation, an evolving regulatory environment and the emergence of new technologies. We compete directly or indirectly with incumbent local exchange carriers ("ILECs"), such as Verizon, Qwest and AT&T; other competitive telecommunications companies, such as Covad, XO Holdings, Level 3 Communications, Inc. ("Level 3") and Megapath; interexchange carriers, such as Sprint Nextel; wireless and satellite service providers; and cable service providers, such as Comcast, Cox Communications, Inc., Time Warner Cable and Charter Communications, Inc. We believe the primary competitive factors in our business markets include price, availability, reliability of service, network security, variety of service offerings, quality of service and reputation of the service provider. While we believe our business services compete favorably based on these factors, we are at a competitive disadvantage relative to some or all of these factors with respect to some of our competitors. The market for telecommunications services, particularly local exchange services, remains dominated by the ILECs, each of which owns the majority of the local exchange network in its respective operating region of the U.S. Each ILEC has significantly more resources available to expand its penetration within the operating regions where we compete. In addition, industry consolidation has resulted in larger competitors that may have greater economies of scale and are likely to result in the combined companies becoming even more formidable competitors. Additionally, new competitors such as VoIP providers and cable companies have entered the market to compete with traditional, facilities-based telecommunications services providers.

We also provide web hosting services to customers wishing to have an Internet or electronic commerce presence. The web hosting market is highly fragmented, has low barriers to entry and is characterized by considerable competition on price and features. We compete directly or indirectly with a number of significant companies, some of which have substantially greater market presence and greater financial, technical, marketing and other resources than we have.

Customer Service and Retention

We believe that quality customer service and technical support increases customer satisfaction, which reduces churn. We also believe that tenured customers provide cost benefits, including reduced call center support costs and reduced bad debt expense. We provide high-quality customer service, invest in loyalty and retention efforts and continually monitor customer satisfaction for our services. Our customer support is available by chat, email, phone as well as through help sites and Internet guide files on our web sites. We have been recognized historically by organizations such as J.D. Power and Associates for ranking high in customer satisfaction for our dial-up and high-speed Internet services.

In addition to our customer support, our free tools offer protection against email viruses, spyware, spam, pop-ups and online scams, as well as dial-up Web acceleration. We believe that providing these tools also increases customer satisfaction, which reduces churn.

Regulatory Environment

Overview

The regulatory environment relating to our business continues to evolve. A number of legislative and regulatory proposals under consideration by federal, state and local governmental entities may lead to the repeal, modification or introduction of laws or regulations which do, or could, affect our business.

6

Table of Contents

Internet Access Regulation

Narrowband Internet Access

The regulatory environment for narrowband Internet access services is well established. Beginning in the 1970s, the Federal Communication Commission's ("FCC's") policy has been to classify narrowband Internet access services as "information services", which are not subject to traditional telecommunications services regulation, such as licensing or pricing regulation. Under this framework, ISPs are assured access to the narrowband telecommunications transmission service of telephone carriers needed to provide narrowband Internet access information services.

One potential risk to our dial-up business would be a change to the rules governing how charges for ISP-bound traffic on telecommunications networks are levied. While Internet traffic is not subject to the FCC's carrier access charge regime, dial-up ISP bound traffic is regulated by the FCC. The FCC has established a uniform, nationwide rate for ISP-bound traffic, but these rules have been criticized by the courts and further judicial scrutiny is expected in 2009. Changes to the rules governing dial-up ISP bound traffic could impact our cost of providing this service.

Broadband Internet Access

The FCC classifies broadband Internet access as a single, commingled information service, whether provided over DSL by telephone companies or over cable modem by cable companies. As a result, cable companies and telephone companies that offer a broadband Internet access information service are not required by the FCC to offer unaffiliated ISPs stand-alone broadband transmission. We have entered into several commercial agreements with cable and telephone companies to offer broadband access to our customers. However, if our contracts with cable companies and telephone companies were to expire and not be replaced, our broadband Internet access customer base and revenues would be adversely affected.

Broadband Internet Access Agreements

We have commercial agreements of varying terms with network providers that provide us with the transmission needed to offer broadband Internet access. Our largest providers of broadband connectivity are AT&T and Time Warner Cable; we also have agreements with other national providers and with regional and local providers. The following summarizes the expiration dates for our agreements:

| | |

Broadband Network Provider | | Contract Expiration |

|---|

AT&T (formerly BellSouth Corporation) | | June 2009 |

Qwest Corporation | | November 2009 |

AT&T (formerly SBC Corporation) | | December 2009 |

Comcast Corporation | | December 2010 |

Verizon Communications Inc. | | March 2011 |

Time Warner Cable/Bright House Networks | | November 2011 |

Covad Communications Group Inc. | | Month-to-Month |

Pursuant to its commitments made in connection with the FCC's approval of the merger of AT&T and BellSouth in 2006, AT&T will continue to offer wholesale DSL to unaffiliated ISPs, such as us, until at least through June 2010. This merger condition obligation applies to both the SBC Corporation and BellSouth Corporation subsidiaries of AT&T. During 2008, we entered into a new wholesale broadband agreement with AT&T (SBC) and are currently negotiating a new contract with AT&T (BellSouth).

Our contract with Covad automatically renews on a month-to-month basis. In the event that Covad elects to terminate the contract, we would have a transition period to transfer our customers to other providers' networks. We are currently discussing a new contract with Covad.

7

Table of Contents

Forbearance

The Communications Act provides the FCC with the authority to not enforce, or "forbear" from enforcing, statutory requirements and regulations if certain public interest factors are satisfied. If the FCC were to forbear from enforcing regulations that have been established to enable competing broadband Internet access and VoIP, our business could be adversely affected.

In December 2007, the FCC denied a petition by Verizon that requested the FCC forbear from certain telephone facilities leasing rules in six major east coast markets, including New York and Philadelphia. In July 2008, the FCC denied a similar forbearance petition filed by Qwest seeking regulatory relief in four major west coast markets, including Seattle and Phoenix. We opposed both the Verizon and Qwest forbearance petitions by arguing that such deregulation would have removed critical facilities necessary to provide competitive broadband access to consumer and business customers. Both Verizon and Qwest have appealed the FCC orders denying their respective requests.

We expect significant reform to the FCC's forbearance review process in the near future. The FCC has initiated a proceeding to establish strict evidentiary and filing procedures for review of forbearance petitions.

Internet Taxation

The Internet Tax Non-Discrimination Act, which is in effect through November 2014, places a moratorium on taxes on Internet access and multiple, discriminatory taxes on electronic commerce. Certain states have enacted various taxes on Internet access and electronic commerce, and selected states' taxes are being contested on a variety of bases. If these state tax laws are not successfully contested, or if future state and federal laws imposing taxes or other regulations on Internet access and electronic commerce are adopted, our cost of providing Internet access services could be increased and our business could be adversely affected.

Universal Service

While current policy exempts broadband access services from the Universal Service Fund ("USF"), in 2009, the Congress and FCC may consider expanding the USF to include broadband Internet access services. This change could allow broadband service providers to receive a subsidy for deploying broadband in rural and underserved areas, but it will most likely require broadband service providers to contribute to the USF as well. If broadband Internet access providers become subject to USF contribution obligations, they would likely impose a USF surcharge on end users. Such a surcharge will raise the effective cost of our broadband services to our customers, and could affect customer satisfaction or our revenues and profitability.

Consumer Protection

Federal and state governments have adopted consumer protection laws and undertaken enforcement actions to address advertising and user privacy. As part of these efforts, the Federal Trade Commission ("FTC") and some state Attorney General offices have conducted investigations into the privacy practices of companies that collect information about individuals on the Internet. The FTC and various state agencies as well as individuals have investigated and asserted claims against, or instituted inquiries into, Internet service providers in connection with marketing, billing, customer retention, cancellation and disclosure practices.

Other Laws and Regulations

Our business also is subject to a variety of other U.S. laws and regulations that could subject us to liabilities, claims or other remedies, such as laws relating to bulk email or "spam," access to various types

8

Table of Contents

of content by minors, anti-spyware initiatives, encryption, data protection, data retention and security breaches. Compliance with these laws and regulations is complex and may require significant costs. In addition, the regulatory framework relating to Internet services is evolving and both the federal government and states from time to time pass legislation that impacts our business. It is likely that additional laws and regulations will be adopted that would affect our business.

Telecommunications Regulation

We offer voice services to our customers through VoIP products. VoIP regulation is generally preempted at the state level and federal law does not require a telecommunications license to provide these services. However, the FCC has placed several regulatory requirements on VoIP services that interconnect with the public switched telephone network (PSTN). Along with these existing and future FCC regulatory requirements, there is also the possibility that states will continue to attempt to assert authority over VoIP services, which presents a business risk for our VoIP services.

Regulatory Classification

In 2004, the FCC initiated a proceeding to determine whether VoIP should be considered an "information service" or a "telecommunications service." This determination remains pending. The classification of VoIP as a telecommunications service would have significant ramifications for all VoIP providers, including us. Classifying VoIP as a telecommunications service would require the service provider to obtain a telecommunications license, comply with numerous legacy telephone regulations, and possibly subject the VoIP traffic to inter-carrier access charges, which could result in increased costs.

Jurisdiction

One regulatory issue that continues to evolve is whether state regulatory agencies have jurisdiction of VoIP services, including our nomadic-style VoIP service and our fixed line VoIP service. If courts determine that states have jurisdiction, several states are expected to levy state universal service fees and other regulatory fees on the intrastate portion of VoIP revenue. This would increase the cost of our services and adversely affect our VoIP business. In addition, if courts determine that states can regulate fixed line VoIP as a telephone service and, among other requirements, subject these services to the carrier access charge regime, our costs of providing this service would increase and our VoIP business would be adversely affected.

Regulatory Obligations

The FCC has imposed seven distinct regulatory obligations on VoIP services that interconnect with the PSTN: (i) access to emergency calling; (ii) compliance with Communications Assistance with Law Enforcement Act (or CALEA); (iii) payments to the federal universal service fund on interstate revenue; (iv) compliance with rules for disability access; (v) payments for regulatory fees; (vi) compliance with customer proprietary network information ("CPNI") procedures; and (vii) compliance with number portability rules.

These obligations are primarily focused on social and law enforcement policies, rather than economic regulation of the service. In each case, our service is, or we expect it will be, in compliance with these regulatory obligations, and none of these obligations materially affect our ability to provide VoIP services.

CLEC Regulation

New Edge is a competitive local exchange carrier (or CLEC) that is licensed in most states and subject to both state and federal telecommunications regulation. CLECs, like New Edge, are dependent on certain provisions of the 1996 Telecommunications Act to procure facilities and services from ILECs that are necessary to provide their services. The business of New Edge is highly dependent on rules and rulings

9

Table of Contents

from the FCC, legislative actions at both the state and federal level, and rulings from the state public utility commissions. New Edge also must contribute to state and federal universal service funds. In addition, New Edge makes use of the special access services and DSL services of ILECs and other CLECs in order to provide New Edge services to its customers.

Proprietary Rights

Our EarthLink, PeoplePC and New Edge Networks trademarks are valuable assets to our business, and are registered trademarks in the United States. In particular, we believe the strength of the EarthLink brand among existing and potential customers is important to the success of our business. Additionally, our EarthLink, PeoplePC and New Edge Networks service marks, proprietary technologies, domain names and similar intellectual property are also important to the success of our business. Although we do have several patents, we do not consider these patents important to our business. We principally rely upon trademark law as well as contractual restrictions to establish and protect our technology and proprietary rights and information. We require employees and consultants and, when possible, suppliers and distributors to sign confidentiality agreements, and we generally control access to, and distribution of, our technologies, documentation and other proprietary information. We will continue to assess appropriate occasions for seeking trademark and other intellectual property protections for those aspects of our business and technology that we believe constitute innovations providing us with a competitive advantage. From time to time, third parties have alleged that certain of our technologies infringe on their intellectual property rights. To date, none of these claims has had an adverse effect on our ability to market and sell our services.

Employees

As of December 31, 2008, we had 754 employees, including 207 sales and marketing personnel, 396 operations and customer support personnel and 151 administrative personnel. None of our employees are represented by a labor union, and we have no collective bargaining agreement.

Available Information

We file annual reports, quarterly reports, current reports, proxy statements and other documents with the Securities and Exchange Commission (the "SEC") under the Securities Exchange Act of 1934, as amended. The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 942-8090. Also, the SEC maintains an Internet web site that contains reports, proxy and information statements, and other information regarding issuers, including EarthLink, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

We also make available free of charge on or through our Internet web site (http://www.earthlink.net) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, as well as Section 16 reports filed on Forms 3, 4 and 5, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our Internet web site is not meant to be incorporated by reference into this Annual Report on Form 10-K.

We also provide a copy of our Annual Report on Form 10-K via mail, at no cost, upon receipt of a written request to the following address:

Investor Relations

EarthLink, Inc.

1375 Peachtree Street

Atlanta, GA 30309

10

Table of Contents

Item 1A. Risk Factors.

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may adversely impact our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows could be materially adversely affected.

The continued decline of our consumer access subscribers, combined with the change in mix of our consumer access subscriber base from narrowband to broadband, will adversely affect our results of operations.

Our consumer access revenues consist primarily of narrowband access revenues and broadband access revenues. Our narrowband subscriber base and revenues have been declining and are expected to continue to decline due to the continued maturation of the market for narrowband access. Consumers continue to migrate to broadband due to the faster connection and download speeds provided by broadband access, the ability to free up their phone lines and the more reliable and "always on" connection. The pricing for broadband services has been declining, making it a more viable option for consumers that continue to rely on dial-up connections for Internet access. In addition, advanced applications such as online gaming, music downloads, videos and social networking require greater bandwidth for optimal performance, which adds to the demand for broadband access. We expect our narrowband subscriber base and revenues to continue to decline, which will adversely affect our profitability and results of operations.

In light of this continued maturation of the market for narrowband access, we refocused our business strategy to significantly reduce our sales and marketing efforts and focus instead on retaining tenured customers and adding customers that have similar characteristics of our tenured customer base and are more likely to produce an acceptable rate of return. This change has resulted in a decrease in gross subscriber additions. If we do not maintain our relationships with current customers or acquire new customers, our revenues will continue to decline and our profitability will be adversely affected. In addition, our results of operations could be adversely affected if we are unable to align operating costs with our revenue trends.

Changes in the mix of our consumer access subscriber base, from narrowband access to broadband access, have also negatively affected our consumer access profitability. Our consumer broadband access revenues have lower gross margins due to the costs associated with delivering broadband services. Our ability to provide these services profitably is dependent upon cost-effectively purchasing wholesale broadband access and managing the costs associated with delivering broadband services. The costs associated with delivering broadband services include recurring service costs such as telecommunications and customer support costs as well as costs incurred to add new broadband customers, such as sales and marketing and installation and hardware costs. While we continuously evaluate cost reduction opportunities associated with the delivery of broadband access services to improve our profitability, our overall profitability would be adversely affected if we are unable to continue to manage and reduce recurring service costs associated with the delivery of broadband services and costs incurred to add new broadband customers. A further change in the mix in our customer base from narrowband access to broadband access would also adversely affect our profitability and results of operations.

We face significant competition that could reduce our profitability.

We face significant competition in the markets in which we operate and we expect this competition to intensify. The intense competition from our competitors could decrease the number of subscribers we are able to add, increase churn of our existing customers, increase operating costs or cause us to reduce prices, which would result in lower revenues and profits.

11

Table of Contents

Consumer Services Segment

Internet access services. We operate in the Internet access services market, which is extremely competitive. We compete directly or indirectly with established online services companies, such as AOL and the Microsoft Network (MSN); national communications companies and local exchange carriers, such as AT&T, Verizon and Qwest; cable companies providing broadband access, including Time Warner Cable, Comcast, Charter Communications, Inc. and Cox Communications, Inc.; local and regional ISPs; free or value-priced ISPs, such as United Online which provides service under the brands NetZero and Juno; wireless Internet service providers; content companies, such as Yahoo! and Google; and satellite and fixed wireless service providers. Competition in the market for Internet access services is likely to continue increasing, and competition could impact the pricing of our services, sales and marketing costs to retain existing or acquire new subscribers and the number of customers that discontinue using our services, or churn.

Prices for certain of our consumer access services, particularly our consumer broadband services, have been decreasing. We expect that we may continue to experience pricing pressures due to competition, volume-based pricing and other factors. Some providers have reduced and may continue to reduce the retail price of their Internet access services to maintain or increase their market share, which could cause us to reduce, or prevent us from raising, our prices. We may encounter further market pressures to: migrate existing customers to lower-priced service offering packages; restructure service offering packages to offer more value; reduce prices; and respond to particular short-term, market-specific situations, such as special introductory pricing or new product or service offerings. Any of the above could adversely affect our revenues and profitability.

Current and prospective competitors include many large companies that have substantially greater market presence and greater financial, technical, marketing and other resources than we have. In addition, some of our competitors are able to bundle other content, services and products with Internet access services. These services include various forms of voice, data and video services and wireless communications. The ability to bundle services, as well as the financial strength and the benefits of scale enjoyed by certain of these competitors, enable them to offer services at prices that are below the prices at which we can offer comparable services.

We believe the primary competitive factors in the Internet access service industry are price, speed, features, coverage area and quality of service. While we believe our Internet access services compete favorably based on these factors when compared to many Internet access providers, we are at a competitive disadvantage relative to some or all of these factors with respect to some of our competitors. Our dial-up Internet access services do not compete favorably with broadband services with respect to speed, and dial-up Internet access services no longer have a significant, if any, price advantage over certain broadband services. Most of the largest providers of broadband services, such as cable and telecommunications companies, control their own networks and offer a wider variety of services than we offer, including voice, data and video services. Their ability to bundle services and to offer broadband services at prices below the price that we can profitably offer comparable services puts us at a competitive disadvantage.

Other services. The companies we compete with for Internet access services also compete with us for subscribers to value-added services, such as email storage and security products. We compete for advertising revenues with major ISPs, content providers, large web publishers, web search engine and portal companies, Internet advertising providers, content aggregation companies, social-networking web sites, and various other companies that facilitate Internet advertising. Competition in the market for advertising services may impact the rates we charge.

Competitors for our VoIP services include established telecommunications and cable companies; Internet access service companies; leading Internet companies; and companies that offer VoIP services as their primary business, such as Vonage. The market for VoIP services is intensely competitive and characterized by technological change.

12

Table of Contents

Business Services Segment

We build and manage private IP-based wide area networks for businesses and communications carriers. We also provide Internet access to small and medium-sized businesses. We face significant competition in these markets and we expect this competition to intensify. These markets are rapidly changing due to industry consolidation, an evolving regulatory environment and the emergence of new technologies. We compete directly or indirectly with ILECs, such as Verizon, Qwest and AT&T; other competitive telecommunications companies, such as Covad, XO Holdings, Level 3 Communications and Megapath; interexchange carriers, such as Sprint Nextel; wireless and satellite service providers; and cable service providers, such as Comcast Corporation, Cox Communications, Inc., Time Warner Cable and Charter Communications, Inc. We believe the primary competitive factors in our business markets include price, availability, reliability of service, network security, variety of service offerings, quality of service and reputation of the service provider. While we believe our business services compete favorably based on these factors, we are at a competitive disadvantage relative to some or all of these factors with respect to some of our competitors. The market for telecommunications services, particularly local exchange services, remains dominated by the ILECs, each of which owns the majority of the local exchange network in its respective operating region of the U.S. Each ILEC has significantly more resources available to expand its penetration within the operating regions where we compete. In addition, industry consolidation has resulted in larger competitors that may have greater economies of scale and are likely to result in the combined companies becoming even more formidable competitors. Additionally, new competitors such as VoIP providers and cable companies have entered the market to compete with traditional, facilities-based telecommunications services providers.

We also provide web hosting services to customers wishing to have an Internet or electronic commerce presence. The web hosting market is highly fragmented, has low barriers to entry and is characterized by considerable competition on price and features. We compete directly or indirectly with a number of significant companies, some of which have substantially greater market presence and greater financial, technical, marketing and other resources than we have.

Adverse economic conditions may harm our business.

Economic conditions have been deteriorating and may remain depressed for the foreseeable future. Unfavorable economic conditions, including recession and recent disruptions to the credit and financial markets, could cause customers to slow spending. Our consumer access services are discretionary and dependent upon levels of consumer spending. In addition, we believe our small and medium-sized business customers are particularly exposed to an economic downturn. If demand for our services decreases, corporate spending for our services decreases or the downsizing by business customers of their businesses increases, our revenues would be adversely affected and churn may increase, and we may not be able to align our cost structure with a decline in our revenue. In addition, during challenging economic times our business customers may face issues gaining timely access to sufficient credit, which may impair the ability of our customers to pay for services they have purchased. Any of the above could cause us to increase our allowance for doubtful accounts and write-offs of accounts receivable, to impair amounts capitalized as intangible assets, including goodwill, or otherwise have a material effect on our business, financial position, results of operations and cash flows.

We are also susceptible to risks associated with the potential financial instability of the vendors and third parties on which we rely to provide services or to which we outsource certain functions. The same economic conditions that may affect our customers also could adversely affect vendors and third parties and lead to significant increases in prices, reduction in quality or the bankruptcy of our vendors or third parties upon which we rely. Any interruption in the services provided by our vendors or by third parties could adversely affect our business, financial position, results of operations and cash flows.

13

Table of Contents

As a result of our continuing review of our business, we may have to undertake further restructuring plans that would require additional charges, including incurring facility exit and restructuring charges.

During 2007 and 2008, we implemented a corporate restructuring plan under which we significantly reduced our workforce and closed or consolidated various facilities. We also completed the divestiture of our municipal wireless broadband operations. We continue to evaluate our business, and these reviews may result in additional restructuring activities. We may choose to divest certain business operations based on our management's assessment of their strategic value to our business. Decisions to eliminate or limit certain business operations in the future could involve the expenditure of capital, consumption of management resources, realization of losses, transition and wind-up expenses, further reduction in workforce, impairment of the value of purchased assets and goodwill, facility consolidation and the elimination of revenues along with associated costs, any of which could cause our operating results to decline and may fail to yield the expected benefits. Engaging in further restructuring activities could result in additional charges and costs, including facility exit and restructuring costs, and could adversely affect our business, financial position, results of operations and cash flows.

If we do not continue to innovate and provide products and services that are useful to subscribers, we may not remain competitive, and our revenues and operating results could suffer.

The market for Internet and telecommunications services is characterized by changing technology, changes in customer needs and frequent new service and product introductions. Our future success will depend, in part, on our ability to use leading technologies effectively, to continue to develop our technical expertise, to enhance our existing services and to develop new services that meet changing customer needs on a timely and cost-effective basis. We may not be able to adapt quickly enough to changing technology, customer requirements and industry standards. Such changes could include acceleration of the adoption of broadband due to government funding to deploy broadband to rural areas. If we fail to use new technologies effectively, to develop our technical expertise and new services, or to enhance existing services on a timely basis, either internally or through arrangements with third parties, our product and service offerings may fail to meet customer needs which could adversely affect our revenues and profitability.

We may be unsuccessful in making and integrating acquisitions and investments into our business, which could result in operating difficulties, losses and other adverse consequences.

We have acquired and invested in businesses in the past, including our acquisition of New Edge. We expect to continue to evaluate and consider potential strategic transactions that we believe may complement our business, including acquisitions of businesses, technologies, services, products and other assets; acquisitions of subscriber bases from ISPs; and investments in companies that offer products and services that are complementary to our offerings or allow us to vertically integrate or grow our business. At any given time, we may be engaged in discussions or negotiations with respect to one or more of such transactions that may be material to our financial condition and results of operations. There can be no assurance that any such discussions or negotiations will result in the consummation of any transaction.

These transactions involve significant challenges and risks including diversion of management's attention from our other businesses; the impact on employee morale and retention; the integration of new employees, business systems and technology; the need to implement controls, procedures and policies or the need to remediate significant control deficiencies that may exist at acquired companies; potential unknown liabilities; or any other unforeseen operating difficulties. These factors could adversely affect our operating results or financial condition.

We may not realize the anticipated benefits of acquisitions or investments, we may not realize them in the time frame expected and our acquisitions and investments may lose value. Additionally, future acquisitions and investments may result in the dilutive issuances of equity securities, use of our cash resources, incurrence of debt or contingent liabilities, amortization expense related to acquired definite

14

Table of Contents

lived intangible assets or the potential impairment of amounts capitalized as intangible assets, including goodwill. Any of these items could have a material effect on our business, results of operations, financial condition and cash flows.

Our business is dependent on the availability of third-party telecommunications service providers.

Our business depends on the capacity, affordability, reliability and security of third-party telecommunications and data service providers. Only a small number of providers offer the network services we require, and the majority of our telecommunications services are currently purchased from a limited number of telecommunications service providers. Our principal provider for narrowband services is Level 3. Our largest providers of broadband connectivity are Time Warner Cable, AT&T, Qwest, Verizon and Covad. We also purchase lesser amounts of services from a wide variety of local, regional and other national providers. Telecommunications service providers have recently merged and may continue to merge, which would reduce the number of suppliers from which we could purchase telecommunications services.

We cannot be certain of renewal or non-termination of our contracts or that legislative or regulatory factors will not affect our contracts. Our results of operations could be materially adversely affected if we are unable to renew or extend contracts with our current network providers on acceptable terms, renew or extend current contracts with our network providers at all, acquire similar network capacity from other network providers, or otherwise maintain or extend our footprint. Additionally, each of our network providers sells network access to some of our competitors and could choose to grant those competitors preferential network access or pricing. Many of our network providers compete with us in the market to provide consumer Internet access. Such events may cause us to incur additional costs, pay increased rates for wholesale access services, increase the retail prices of our service offerings and/or discontinue providing retail access services, any of which could adversely affect our ability to compete in the market for retail access services.

Our commercial and alliance arrangements may not be renewed, which could adversely affect our results of operations.

A significant number of our subscribers have been generated through strategic alliances, including through our marketing alliance with Time Warner Cable and Bright House Networks. Generally, our strategic alliances and marketing relationships are not exclusive and may have a short term. In addition, as our agreements expire or otherwise terminate we may be unable to renew or replace these agreements on comparable terms, or at all. Our inability to maintain our marketing relationships or establish new marketing relationships could result in delays and increased costs in adding paying subscribers and adversely affect our ability to add new customers, which could, in turn, have a material adverse effect on us. The number of customers we are able to add through these marketing relationships is dependent on the marketing efforts of our partners, and a significant decrease in the number of gross subscriber additions generated through these relationships could adversely affect the size of our customer base and revenues.

We utilize third parties for customer service and technical support and certain billing services, and our business may suffer if these third parties are unable to provide these services or terminate their relationships with us.

Our business and financial results depend, in part, on the availability and quality of our customer service and technical support and billing services. We outsource a majority of customer service and technical support functions. As a result, we maintain only a small number of internal customer service and technical support personnel. We are not currently equipped to provide the necessary range of service and support functions in the event that our service providers become unable or unwilling to offer these services to us. Our outsourced contact center service providers utilize internationally geographically dispersed locations to provide us with customer service and technical support services, and as a result, our contact center service providers may become subject to financial, economic, and political risks beyond our or the

15

Table of Contents

providers' control, which could jeopardize their ability to deliver customer service and technical support services. We also utilize third parties for certain billing services. If one or more of our service providers does not provide us with quality services, or if our relationship with any of our third party vendors terminates and we are unable to provide those services internally or identify a replacement vendor in an orderly, cost-effective and timely manner, our business, financial position and results of operations could suffer. In addition, as we continue to scale back our operations, our reliance on third party providers may become more concentrated as fewer providers are needed. Such increased concentration could adversely affect our business, financial position and results of operations if the third party was unable to provide the respective services.

Service interruptions or impediments could harm our business.

We may experience service interruptions or system failures in the future. Any service interruption adversely affects our ability to operate our business and could result in an immediate loss of revenues. If we experience frequent or persistent system or network failures, our reputation and brand could be permanently harmed. We may make significant capital expenditures to increase the reliability of our systems, but these capital expenditures may not achieve the results we expect.

Harmful software programs. Our network infrastructure and the networks of our third party providers are vulnerable to damaging software programs, such as computer viruses and worms. Certain of these programs have disabled the ability of computers to access the Internet, requiring users to obtain technical support in order to gain access to the Internet. Other programs have had the potential to damage or delete computer programs. The development and widespread dissemination of harmful programs has the potential to seriously disrupt Internet usage. If Internet usage is significantly disrupted for an extended period of time, or if the prevalence of these programs results in decreased residential Internet usage, our business could be materially and adversely impacted.

Security breaches. We depend on the security of our networks and, in part, on the security of the network infrastructures of our third party telecommunications service providers, our outsourced customer support service providers and our other vendors. Unauthorized or inappropriate access to, or use of, our network, computer systems and services could potentially jeopardize the security of confidential information, including credit card information, of our subscribers and of third parties. Some consumers and businesses have in the past used our network, services and brand names to perpetrate crimes and may do so in the future. Subscribers or third parties may assert claims of liability against us as a result of any failure by us to prevent these activities. Although we use security measures, there can be no assurance that the measures we take will be implemented successfully or will be effective in preventing these activities. Further, the security measures of our third party network providers, our outsourced customer support service providers and our other vendors may be inadequate. These activities may subject us to legal claims, adversely impact our reputation, and interfere with our ability to provide our services, all of which could have a material adverse effect on our business, financial position and results of operations.

Natural disaster or other catastrophic event. Our operations and services depend on the extent to which our equipment and the equipment of our third party network providers are protected against damage from fire, flood, earthquakes, power loss, telecommunications failures, break-ins, acts of war or terrorism and similar events. We have three technology centers at various locations in the U.S. which contain a significant portion of our computer and electronic equipment. These technology centers host and manage Internet content, email, web hosting and authentication applications and services. Despite precautions taken by us and our third party network providers, a natural disaster or other unanticipated problem that impacts one of our locations or our third party providers' networks could cause interruptions in the services that we provide. Such interruptions in our services could have a material adverse effect on our ability to provide Internet services to our subscribers and, in turn, on our business, financial condition and results of operations.

16

Table of Contents

Government regulations could adversely affect our business or force us to change our business practices.

The regulatory environment relating to our business continues to evolve. A number of legislative and regulatory proposals under consideration by federal, state and local governmental entities may lead to the repeal, modification or introduction of laws or regulations which do, or could, affect our business. Our results of operations could be materially, adversely affected by future changes of legal and regulatory rights or obligations.

Narrowband Internet access. Currently, narrowband Internet access is classified as an "information service" and is not subject to traditional telecommunications services regulation, such as licensing or pricing regulation. Any change to these rules that would apply per-minute carrier access charges to dial-up Internet access traffic would significantly impact our costs for this service. While Internet traffic is not subject to the FCC's carrier access charge regime, dial-up ISP bound traffic is regulated by the FCC. The FCC has established a uniform, nationwide rate for ISP-bound traffic, but these rules have been criticized by the courts and further judicial scrutiny is expected in 2009. Changes to the rules governing dial-up ISP bound traffic could impact our cost of providing this service.

Broadband Internet access. Currently, broadband Internet access is classified as an "information service" and, as a result, cable companies and telephone companies that offer a broadband Internet access information service are not required by the FCC to offer unaffiliated ISPs stand-alone broadband transmission. Accordingly, if our contracts with cable companies and telephone companies were to expire and not be replaced, our broadband Internet access customer base and revenues would be adversely affected.

Forbearance. The Communications Act provides the FCC with the authority to not enforce, or "forbear" from enforcing, statutory requirements and regulations if certain public interest factors are satisfied. If the FCC were to forbear from enforcing regulations that have been established to enable competing broadband Internet access and VoIP, our business could be adversely affected.

Tax. The Internet Tax Non-Discrimination Act, which is in effect through November 2014, places a moratorium on taxes on Internet access and multiple, discriminatory taxes on electronic commerce. Certain states have enacted various taxes on Internet access and electronic commerce, and selected states' taxes are being contested on a variety of bases. If these state tax laws are not successfully contested, or if future state and federal laws imposing taxes or other regulations on Internet access and electronic commerce are adopted, our cost of providing Internet access services could be increased and our business could be adversely affected.

Consumer protection. Federal and state governments have adopted consumer protection laws and undertaken enforcement actions to address advertising and user privacy. As part of these efforts, the Federal Trade Commission ("FTC") and some state Attorney General offices have conducted investigations into the privacy practices of companies that collect information about individuals on the Internet. The FTC and various state agencies as well as individuals have investigated and asserted claims against, or instituted inquiries into, Internet service providers in connection with marketing, billing, customer retention, cancellation and disclosure practices. Our services and business practices, or changes to our services and business practices could subject us to investigation or enforcement actions if we fail to adequately comply with applicable consumer protection laws.

Universal Service. While current policy exempts broadband access services from the Universal Service Fund ("USF"), in 2009, the Congress and FCC may consider expanding the USF to include broadband Internet access services. This change could allow broadband service providers to receive a subsidy for deploying broadband in rural and underserved areas, but it will most likely require broadband service providers to contribute to the Fund as well. If broadband Internet access providers become subject to USF contribution obligations, they would likely impose a USF surcharge on end users. Such a surcharge

17

Table of Contents

will raise the effective cost of our broadband services to our customers, and could affect customer satisfaction or our revenues and profitability.

CLEC regulation. New Edge is a competitive local exchange carrier (or CLEC) that is licensed in most states and subject to both state and federal telecommunications regulation. CLECs, like New Edge, are dependent on certain provisions of the 1996 Telecommunications Act to procure facilities and services from incumbent local exchange carriers (or ILECs) that are necessary to provide their services. The business of New Edge is highly dependent on rules and rulings from the FCC, legislative actions at both the state and federal level, and rulings from the state public utility commissions. New Edge also must contribute to state and federal universal service funds. In addition, New Edge makes use of the special access services and DSL services of ILECs and other CLECs in order to provide New Edge services to its customers.

VoIP. The current regulatory environment for VoIP services remains unclear, as the decision whether VoIP is an "information service" or "telecommunications service" is still pending. Classifying VoIP as a telecommunications service could require us to obtain a telecommunications license, comply with numerous legacy telephone regulations, and possibly subject the VoIP traffic to inter-carrier access charges, which could result in increased costs. In addition, several state regulatory agencies are seeking jurisdiction over VoIP services. If courts determine that states have jurisdiction, several states are expected to levy state universal service fees and other regulatory fees on the intrastate portion of VoIP revenue. This would increase the cost of our services and adversely affect our VoIP business. In addition, if courts determine that states can regulate fixed line VoIP as a telephone service and, among other requirements, subject these services to the carrier access charge regime, our costs of providing this service would increase and our VoIP business would be adversely affected.

Other laws and regulations. Our business also is subject to a variety of other U.S. laws and regulations that could subject us to liabilities, claims or other remedies, such as laws relating to bulk email or "spam," access to various types of content by minors, anti-spyware initiatives, encryption, data protection, data retention and security breaches. Compliance with these laws and regulations is complex and may require significant costs. In addition, the regulatory framework relating to Internet services is evolving and both the federal government and states from time to time pass legislation that impacts our business. It is likely that additional laws and regulations will be adopted that would affect our business. We cannot predict the impact future laws, regulatory changes or developments may have on our business, financial condition, results of operations or cash flows. The enactment of any additional laws or regulations, increased enforcement activity of existing laws and regulations, or claims by individuals could significantly impact our costs or the manner in which we conduct business, all of which could adversely impact our results of operations and cause our business to suffer.

Privacy concerns relating to our business could damage our reputation and deter current and potential users from using our services.

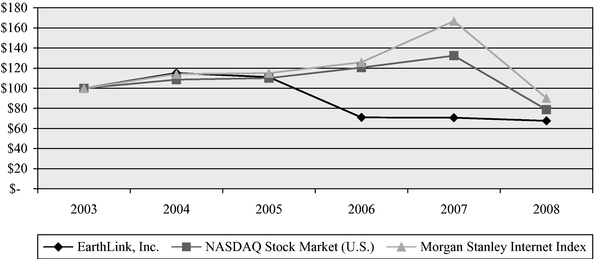

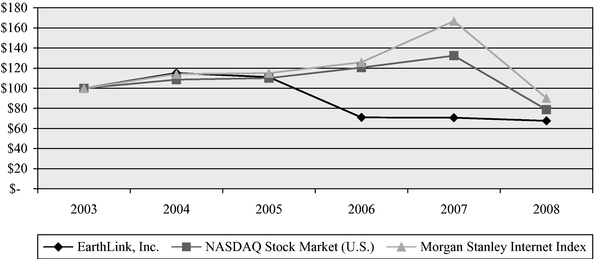

Concerns about our practices with regard to the collection, use, disclosure or security of personal information or other privacy-related matters, even if unfounded, could damage our reputation and operating results. We strive to comply with all applicable data protection laws and regulations, as well as our own posted privacy policies. However, any failure or perceived failure to comply with these laws, regulations or policies may result in proceedings or actions against us by government entities or others, which could potentially have an adverse effect on our business.