0 Q3 2012 Earnings Highlights October 30th, 2012

1 Participants Rolla Huff Chairman & Chief Executive Officer Joe Wetzel President & Chief Operating Officer Louis Alterman Senior Vice President Finance Brad Ferguson Chief Financial Officer

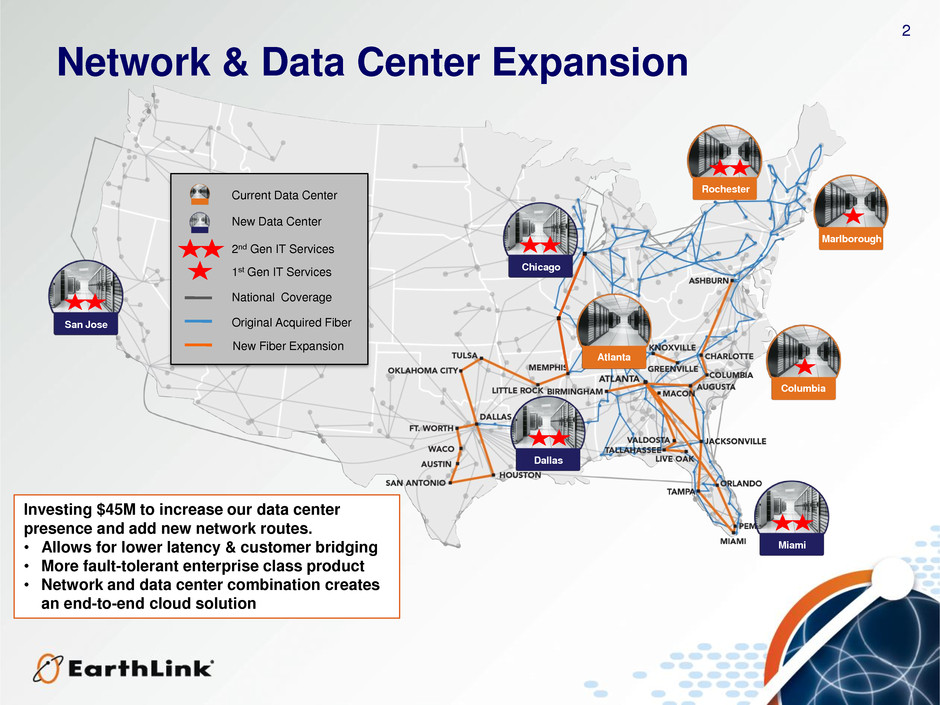

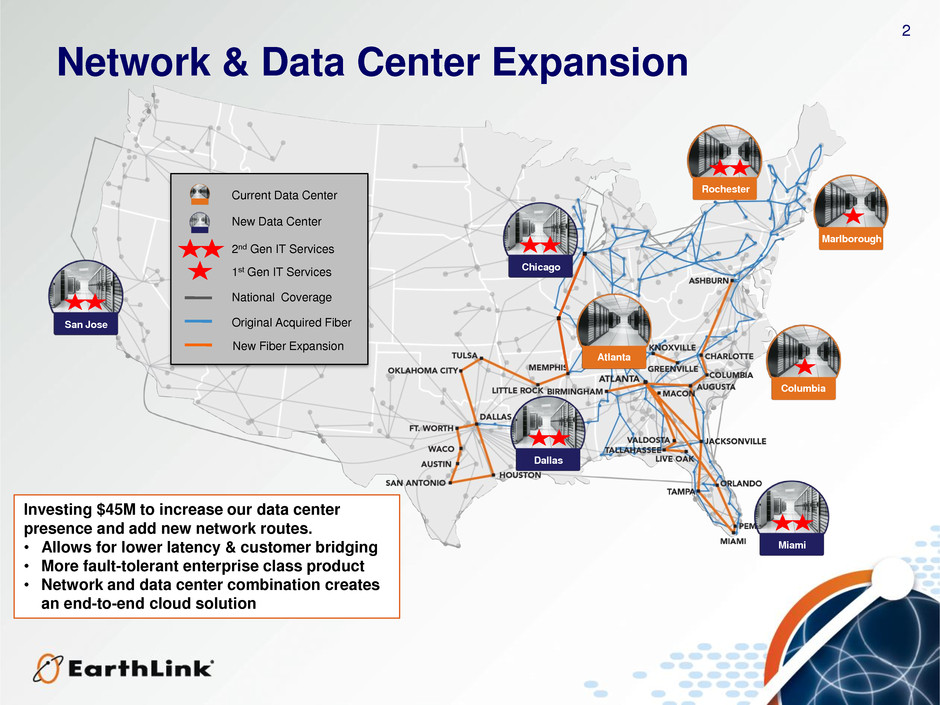

2 Network & Data Center Expansion Investing $45M to increase our data center presence and add new network routes. • Allows for lower latency & customer bridging • More fault-tolerant enterprise class product • Network and data center combination creates an end-to-end cloud solution San Jose Chicago Atlanta Dallas Rochester Miami Columbia Marlborough Current Data Center New Data Center 2nd Gen IT Services 1st Gen IT Services National Coverage Original Acquired Fiber New Fiber Expansion

3 Business Services Revenue % YoY (1) Total Company Revenue % YoY(1) • Business Services revenue trajectory continues to improve • While quarterly results could be lumpy, we are on a path towards positive growth • Total company revenue trajectory, including Consumer, continues to improve Pro-Forma Revenue Trajectory (1) Pro-forma for acquisitions and normalized for one-time items and accounting presentation -9.5% -8.2% -6.1% -5.8% -5.0% -4.6% Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 -12.6% -10.9% -9.2% -8.7% -7.9% -7.3% Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12

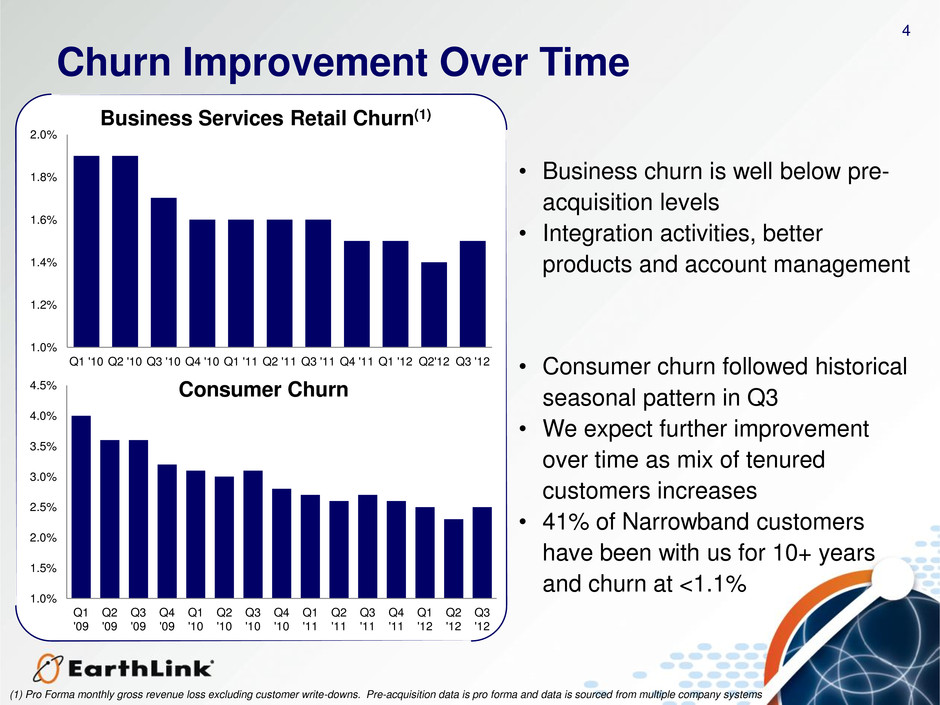

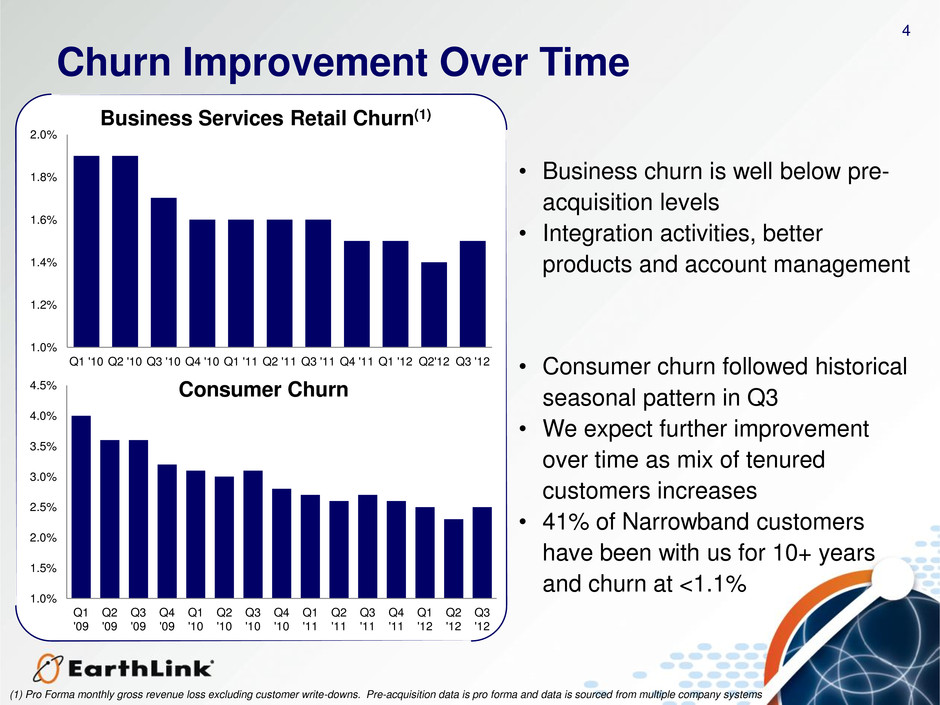

4 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2'12 Q3 '12 • Business churn is well below pre- acquisition levels • Integration activities, better products and account management Churn Improvement Over Time Business Services Retail Churn(1) 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% Q1 '09 Q2 '09 Q3 '09 Q4 '09 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Consumer Churn • Consumer churn followed historical seasonal pattern in Q3 • We expect further improvement over time as mix of tenured customers increases • 41% of Narrowband customers have been with us for 10+ years and churn at <1.1% (1) Pro Forma monthly gross revenue loss excluding customer write-downs. Pre-acquisition data is pro forma and data is sourced from multiple company systems

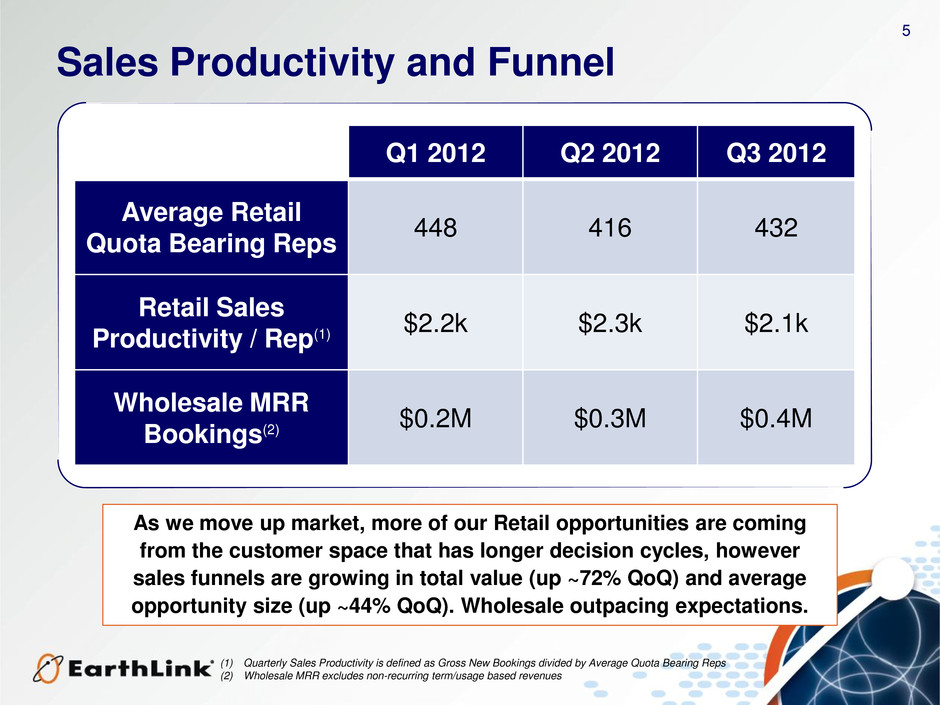

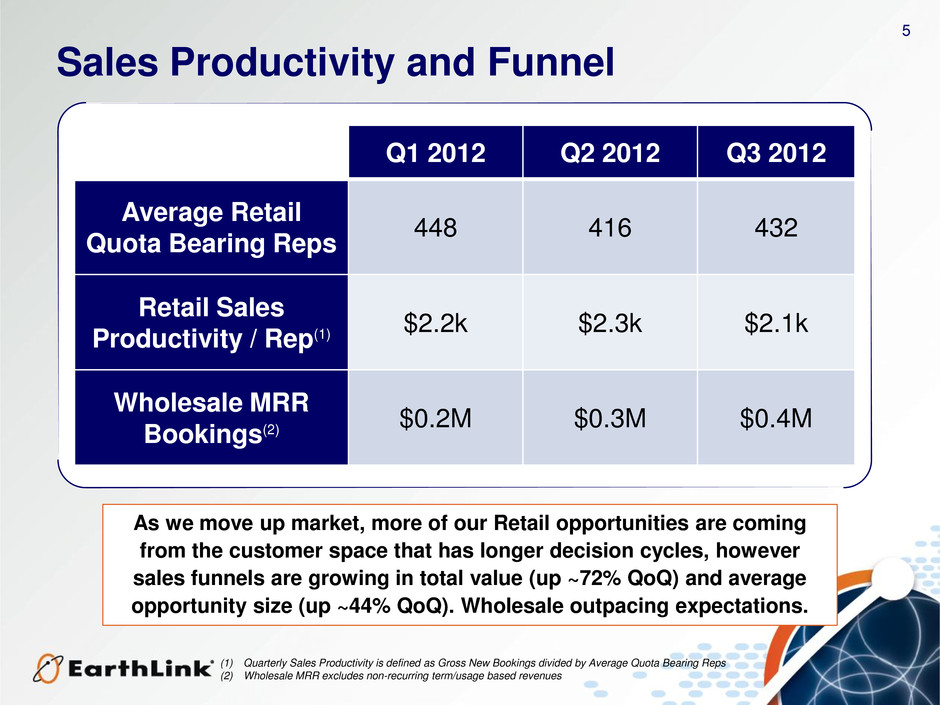

5 Sales Productivity and Funnel As we move up market, more of our Retail opportunities are coming from the customer space that has longer decision cycles, however sales funnels are growing in total value (up ~72% QoQ) and average opportunity size (up ~44% QoQ). Wholesale outpacing expectations. Q1 2012 Q2 2012 Q3 2012 Average Retail Quota Bearing Reps 448 416 432 Retail Sales Productivity / Rep(1) $2.2k $2.3k $2.1k Wholesale MRR Bookings(2) $0.2M $0.3M $0.4M (1) Quarterly Sales Productivity is defined as Gross New Bookings divided by Average Quota Bearing Reps (2) Wholesale MRR excludes non-recurring term/usage based revenues

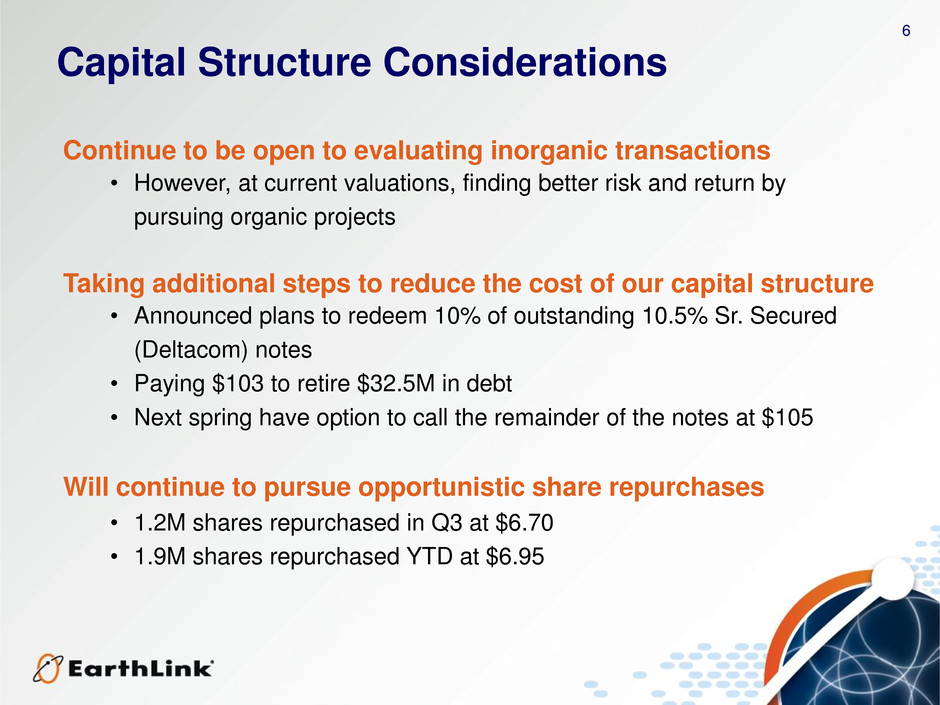

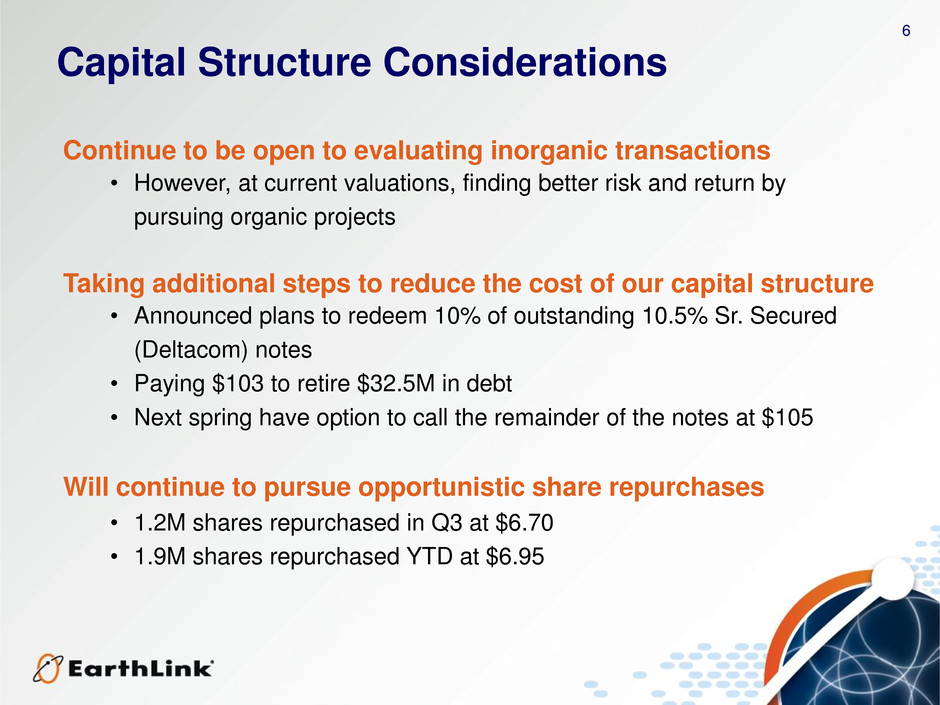

6 Capital Structure Considerations Continue to be open to evaluating inorganic transactions • However, at current valuations, finding better risk and return by pursuing organic projects Taking additional steps to reduce the cost of our capital structure • Announced plans to redeem 10% of outstanding 10.5% Sr. Secured (Deltacom) notes • Paying $103 to retire $32.5M in debt • Next spring have option to call the remainder of the notes at $105 Will continue to pursue opportunistic share repurchases • 1.2M shares repurchased in Q3 at $6.70 • 1.9M shares repurchased YTD at $6.95

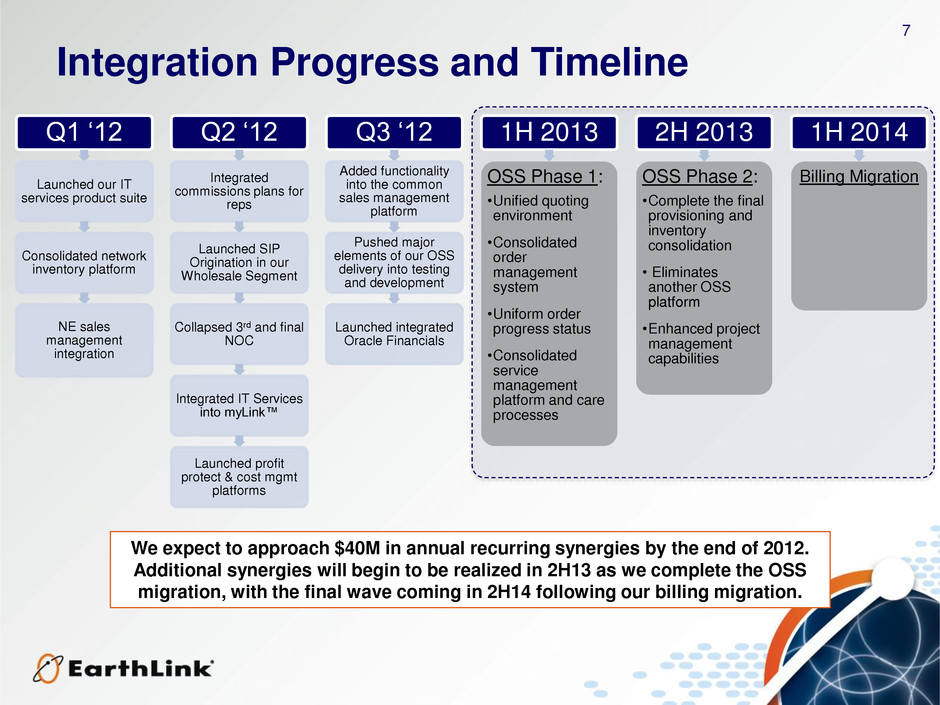

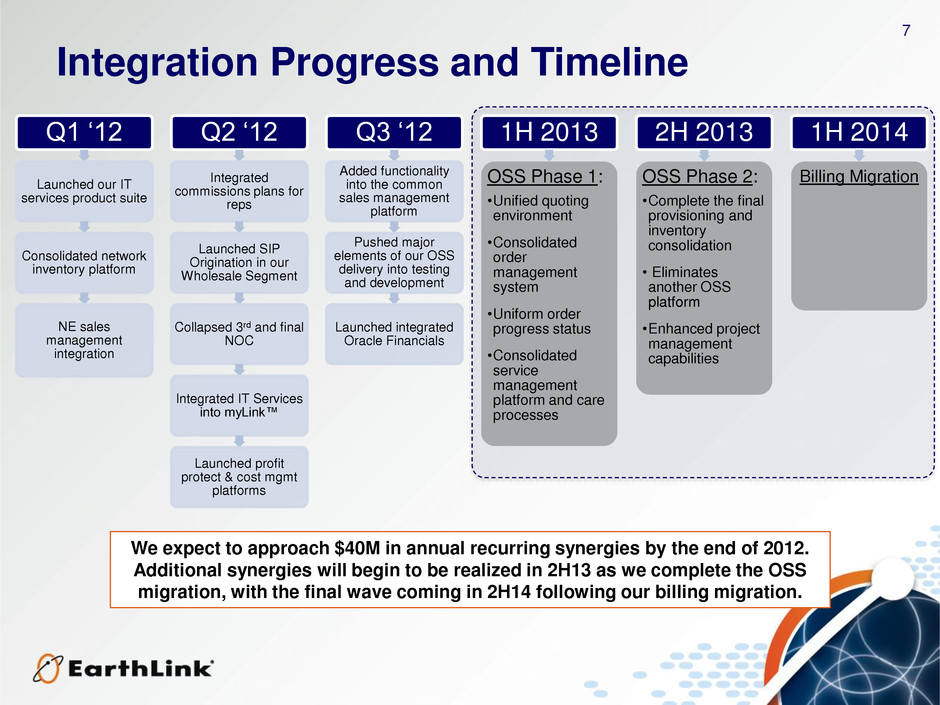

7 Integration Progress and Timeline We expect to approach $40M in annual recurring synergies by the end of 2012. Additional synergies will begin to be realized in 2H13 as we complete the OSS migration, with the final wave coming in 2H14 following our billing migration. Q1 ‘12 Launched our IT services product suite Consolidated network inventory platform NE sales management integration Q2 ‘12 Integrated commissions plans for reps Launched SIP Origination in our Wholesale Segment Collapsed 3rd and final NOC Integrated IT Services into myLink™ Launched profit protect & cost mgmt platforms Q3 ‘12 Added functionality into the common sales management platform Pushed major elements of our OSS delivery into testing and development Launched integrated Oracle Financials 1H 2013 OSS Phase 1: •Unified quoting environment •Consolidated order management system •Uniform order progress status •Consolidated service management platform and care processes 2H 2013 OSS Phase 2: •Complete the final provisioning and inventory consolidation • Eliminates another OSS platform •Enhanced project management capabilities 1H 2014 Billing Migration

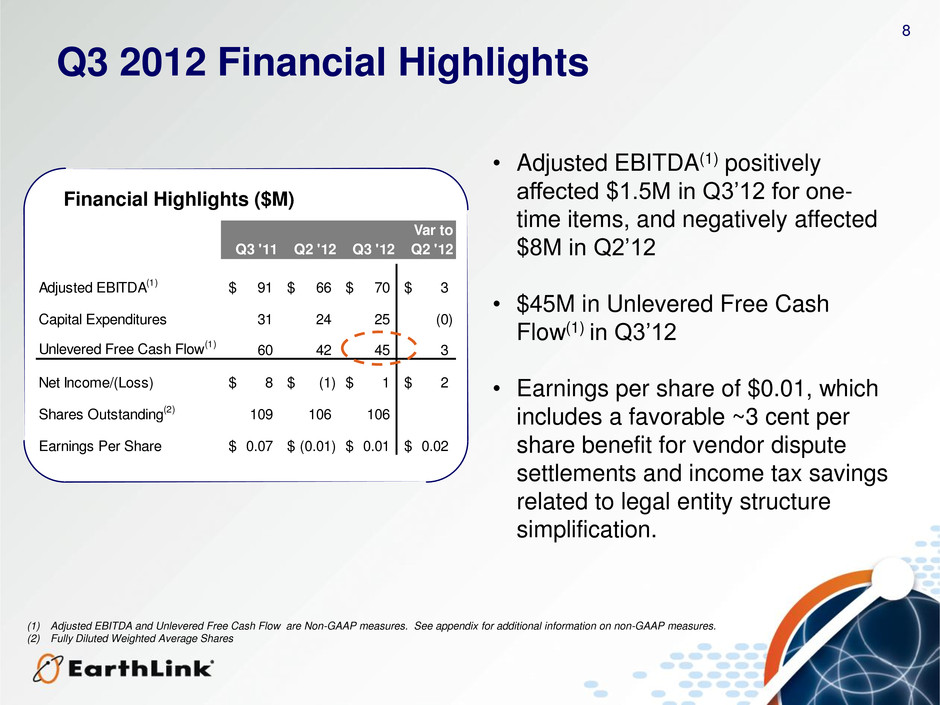

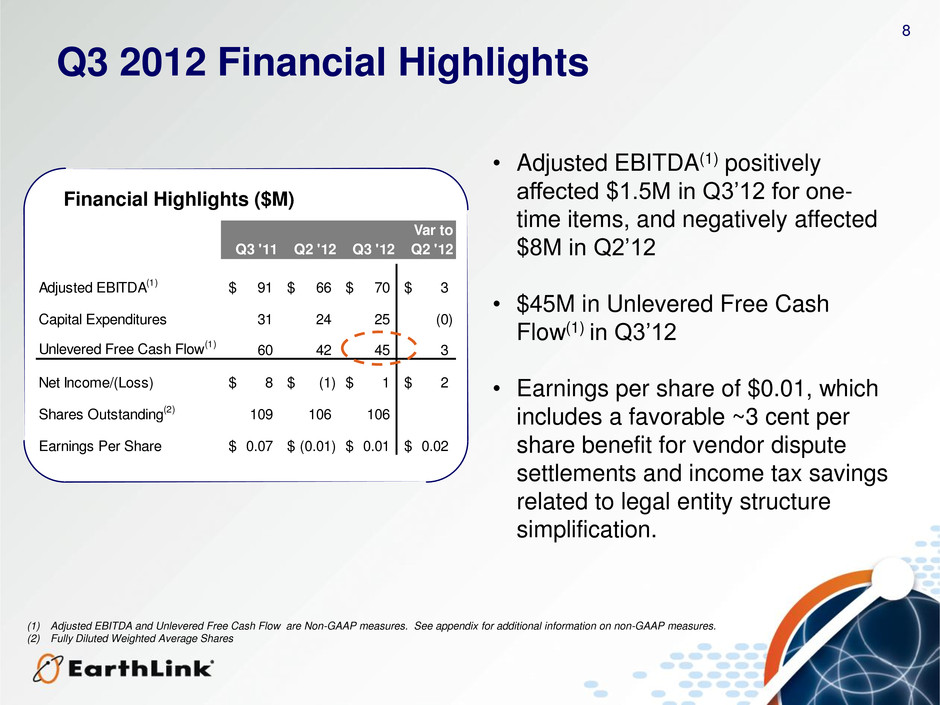

8 Q3 2012 Financial Highlights • Adjusted EBITDA(1) positively affected $1.5M in Q3’12 for one- time items, and negatively affected $8M in Q2’12 • $45M in Unlevered Free Cash Flow(1) in Q3’12 • Earnings per share of $0.01, which includes a favorable ~3 cent per share benefit for vendor dispute settlements and income tax savings related to legal entity structure simplification. (1) Adjusted EBITDA and Unlevered Free Cash Flow are Non-GAAP measures. See appendix for additional information on non-GAAP measures. (2) Fully Diluted Weighted Average Shares Financial Highlights ($M) Q3 '11 Q2 '12 Q3 '12 Var to Q2 '12 Adjusted EBITDA(1) 91$ 66$ 70$ 3$ Capital Expenditures 31 24 25 (0) U levered Free Cash Flow(1) 60 42 45 3 Net Income/(Loss) 8$ (1)$ 1$ 2$ Shares Outstanding(2) 109 106 106 Earnings Per Share 0.07$ (0.01)$ 0.01$ 0.02$

9 Balance Sheet Highlights Balance Sheet Summary ($M) Balance sheet provides us substantial flexibility • Under-levered relative to peers (1.1x net leverage) • Announced intention to redeem $32.5M of senior secured notes • Repurchased 1.2M shares at $6.70 - $86M of share repurchase authorization remaining (1) Adjusted EBITDA is a Non-GAAP measure. See appendix for additional information on non-GAAP measures Q3 '12 EarthLink Cash and Marketable Securities 310$ 10.5% Senior Secured Deltacom Notes due 2016 325$ 8.875% Senior Unsecured Notes due 2019 300$ $150M Revolving Credit Facility (undrawn) -$ Gross Debt 625$ Gross Debt Expected after 10% Note Redemption 593$ Net Debt 315$ 2012 Adjusted EBITDA Guidance Midpoint(1) 280$ Gross Debt/EBITDA 2.2x Gross Debt/EBITDA (after 10% redemption) 2.1x Net Debt/EBITDA 1.1x

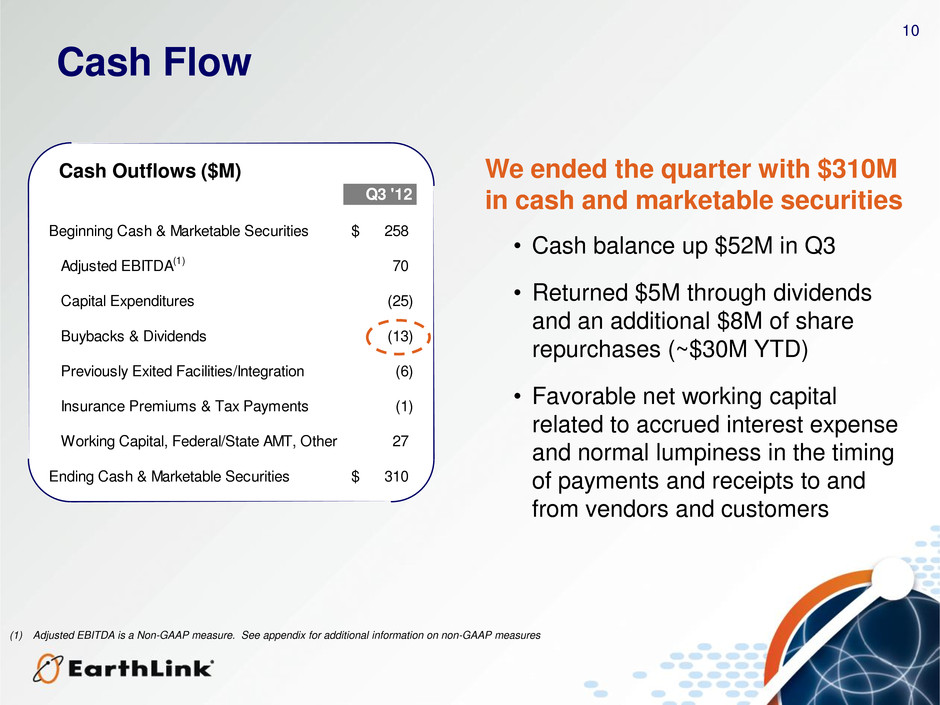

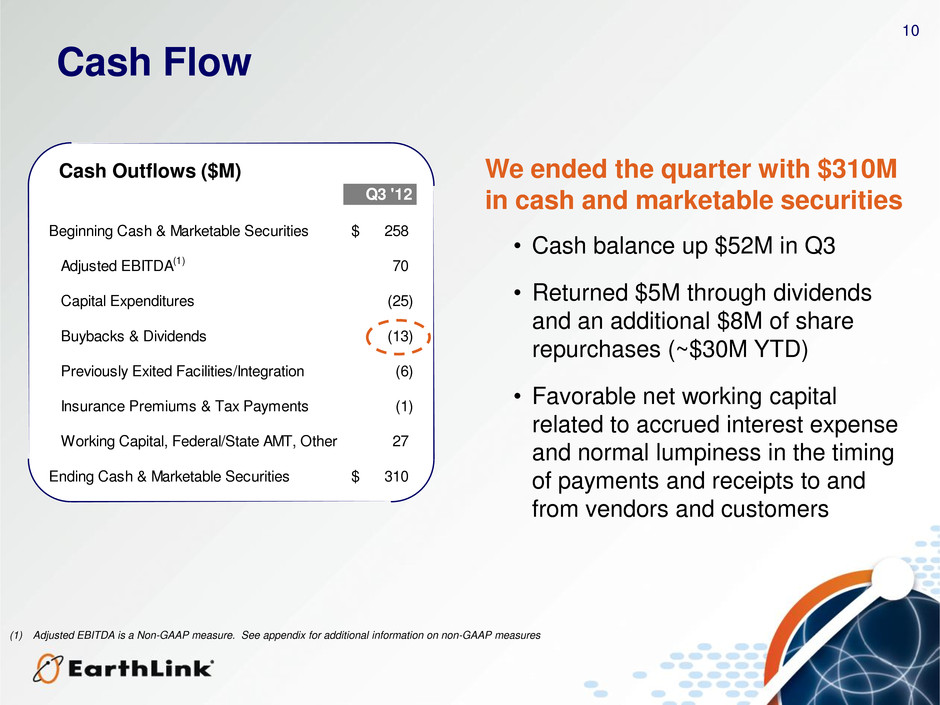

10 Cash Flow We ended the quarter with $310M in cash and marketable securities • Cash balance up $52M in Q3 • Returned $5M through dividends and an additional $8M of share repurchases (~$30M YTD) • Favorable net working capital related to accrued interest expense and normal lumpiness in the timing of payments and receipts to and from vendors and customers Cash Outflows ($M) (1) Adjusted EBITDA is a Non-GAAP measure. See appendix for additional information on non-GAAP measures Q3 '12 Beginning Cash & Marketable Securities 258$ Adjusted EBITDA(1) 70 Capital Expenditures (25) Buybacks & Dividends (13) Previously Exited Facilities/Integration (6) Insurance Premiums & Tax Payments (1) Working Capital, Fed ral/State AMT, Other 27 Ending Cash & Marketable Securities 310$

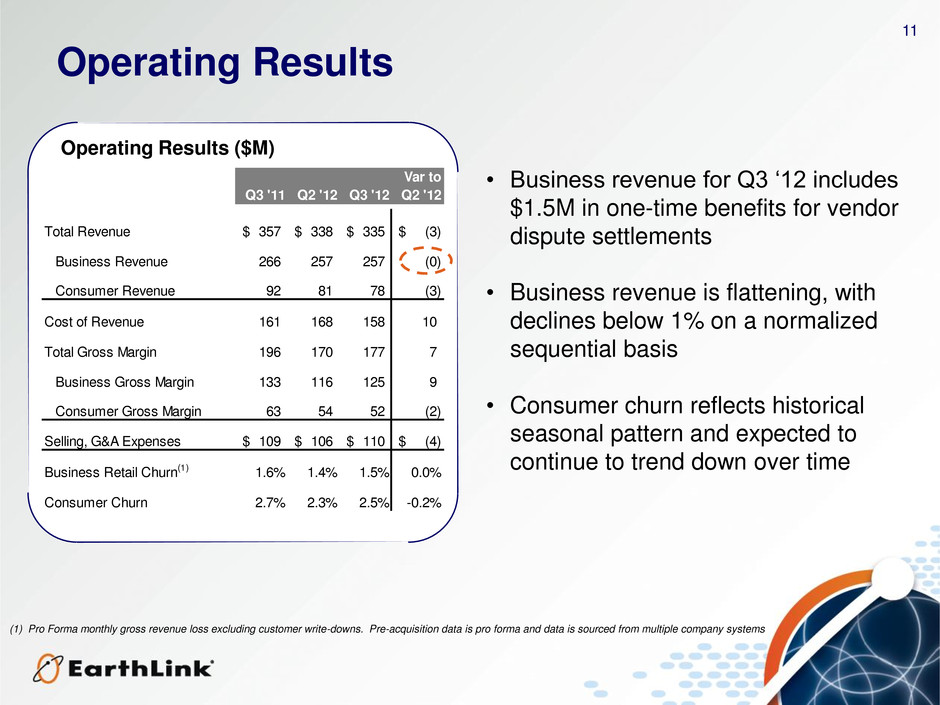

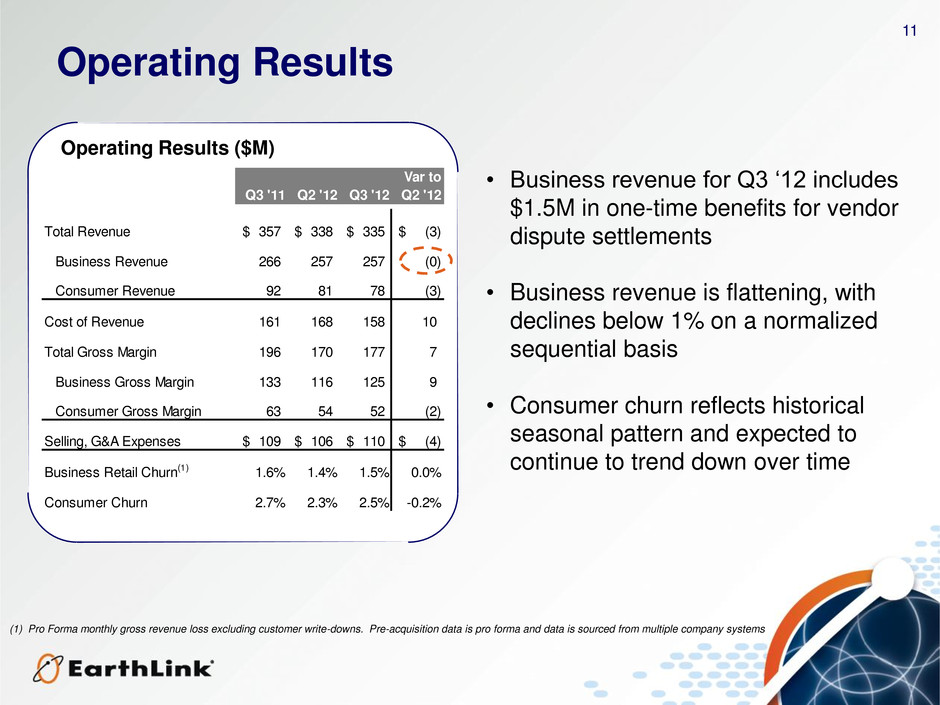

11 Operating Results • Business revenue for Q3 ‘12 includes $1.5M in one-time benefits for vendor dispute settlements • Business revenue is flattening, with declines below 1% on a normalized sequential basis • Consumer churn reflects historical seasonal pattern and expected to continue to trend down over time Operating Results ($M) (1) Pro Forma monthly gross revenue loss excluding customer write-downs. Pre-acquisition data is pro forma and data is sourced from multiple company systems Q3 '11 Q2 '12 Q3 '12 Var to Q2 '12 Total Revenue 357$ 338$ 335$ (3)$ Business Revenue 266 257 257 (0) Consumer Revenue 92 81 78 (3) Cost of Revenue 161 168 158 10 Total Gross Margin 196 170 177 7 Business Gross Margin 133 116 125 9 Consumer Gross Margin 63 54 52 (2) Selling, G&A Expenses 109$ 106$ 110$ (4)$ Business Retail Churn(1) 1.6% 1.4% 1.5% 0.0% Consumer Churn 2.7% 2.3% 2.5% -0.2%

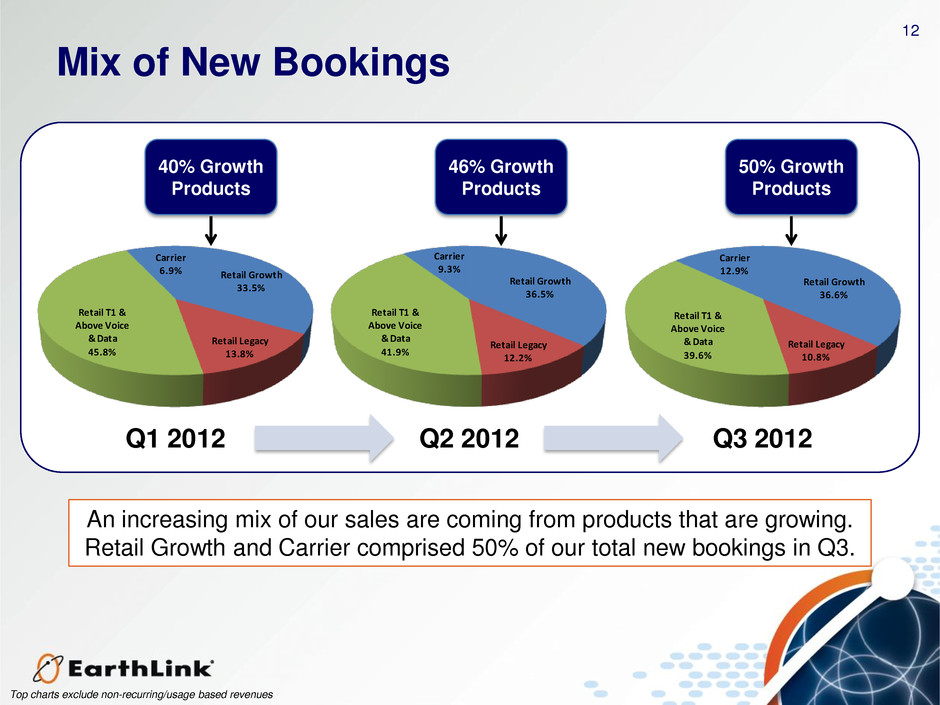

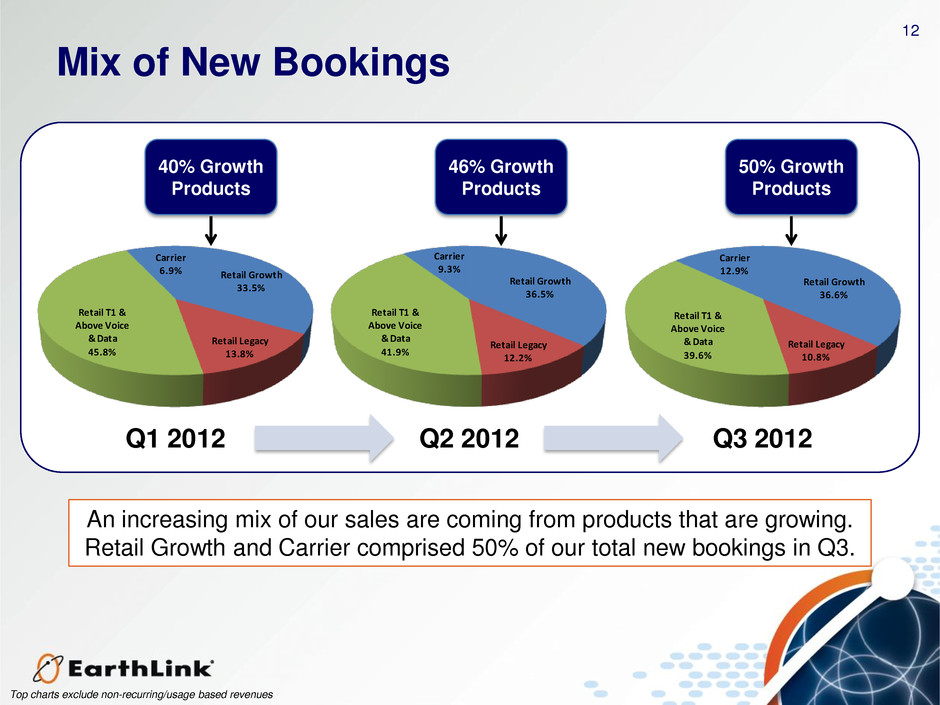

12 Mix of New Bookings Q1 2012 An increasing mix of our sales are coming from products that are growing. Retail Growth and Carrier comprised 50% of our total new bookings in Q3. Top charts exclude non-recurring/usage based revenues 40% Growth Products 46% Growth Products 50% Growth Products Q2 2012 Q3 2012 Retail Growth 33.5% Retail Legacy 13.8% Retail T1 & Above Voice & Data 45.8% Carrier 6.9% Retail Growth 36.5% Retail Legacy 12.2% Retail T1 & Above Voice & Data 41.9% Carrier 9.3% Retail Growth 36.6% Retail Legacy 10.8% Retail T1 & Above Voice & Data 39.6 Carrier 12.9%

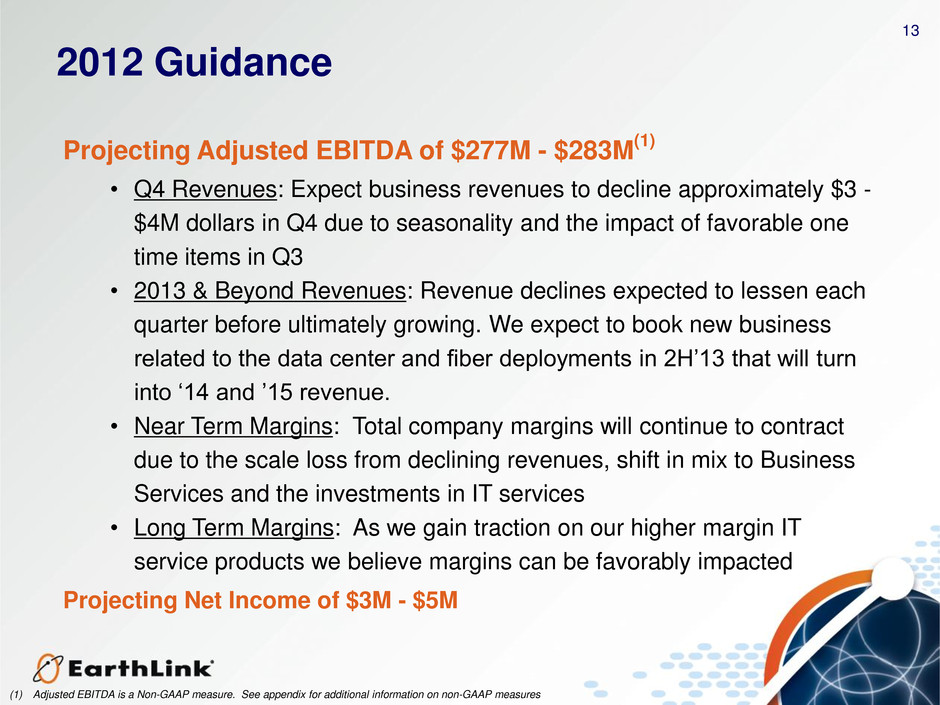

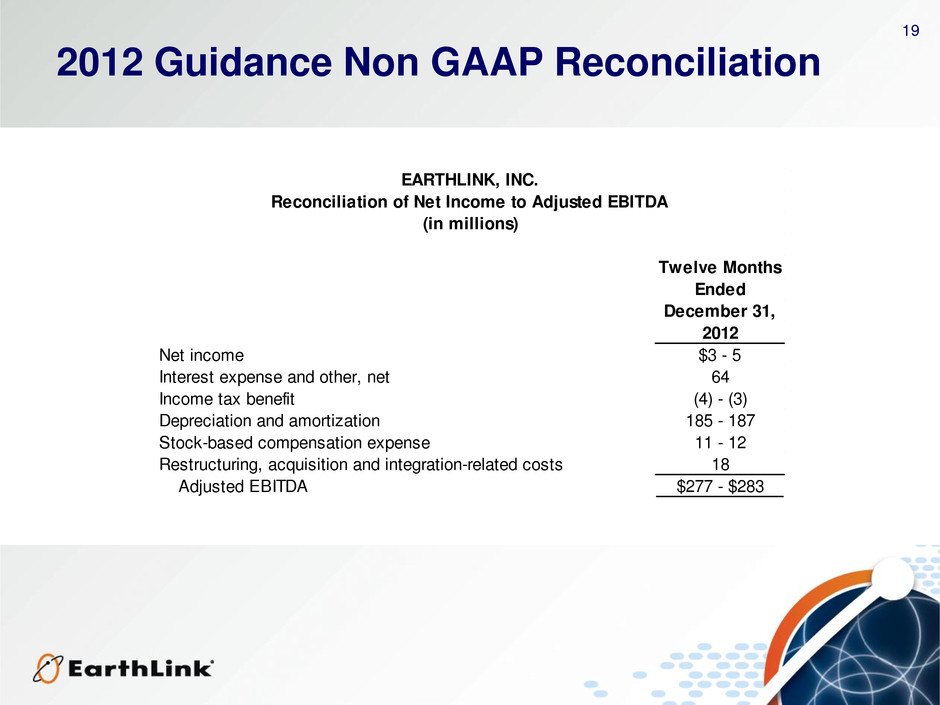

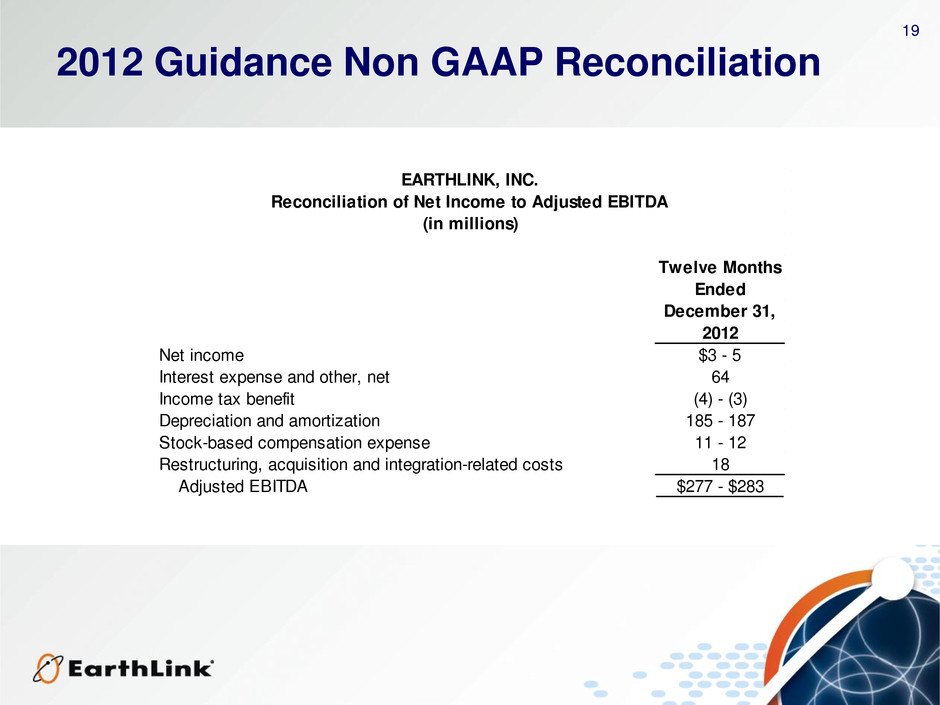

13 2012 Guidance Projecting Adjusted EBITDA of $277M - $283M (1) • Q4 Revenues: Expect business revenues to decline approximately $3 - $4M dollars in Q4 due to seasonality and the impact of favorable one time items in Q3 • 2013 & Beyond Revenues: Revenue declines expected to lessen each quarter before ultimately growing. We expect to book new business related to the data center and fiber deployments in 2H’13 that will turn into ‘14 and ’15 revenue. • Near Term Margins: Total company margins will continue to contract due to the scale loss from declining revenues, shift in mix to Business Services and the investments in IT services • Long Term Margins: As we gain traction on our higher margin IT service products we believe margins can be favorably impacted Projecting Net Income of $3M - $5M (1) Adjusted EBITDA is a Non-GAAP measure. See appendix for additional information on non-GAAP measures

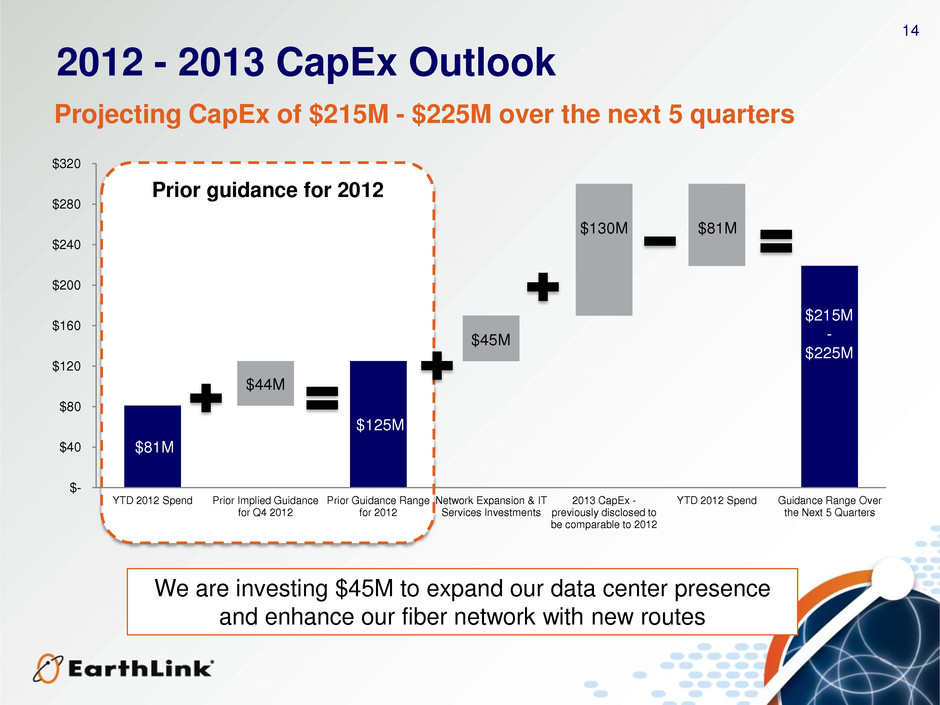

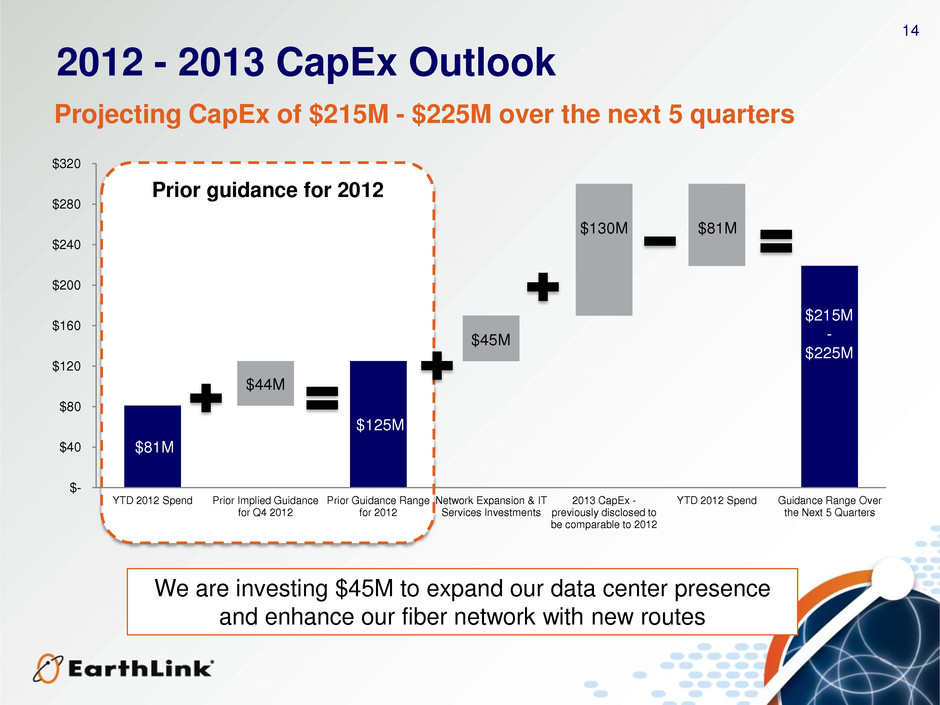

14 $81M $125M $- $40 $80 $120 $160 $200 $240 $280 $320 YTD 2012 Spend Prior Implied Guidance for Q4 2012 Prior Guidance Range for 2012 Network Expansion & IT Services Investments 2013 CapEx - previously disclosed to be comparable to 2012 YTD 2012 Spend Guidance Range Over the Next 5 Quarters 2012 - 2013 CapEx Outlook We are investing $45M to expand our data center presence and enhance our fiber network with new routes Prior guidance for 2012 $44M $45M $215M - $225M $130M $81M Projecting CapEx of $215M - $225M over the next 5 quarters

15

16 Appendix

17 Selected Q3 2012 Customer Wins IT Services Plus Connectivity •Retail •Hosted Exchange, MPLS & Voice •Selected based on ability to update and enhance the customer’s environment with minimal CapEx IT Services Plus Connectivity •Manufacturing / Retail •Hosting, management & maintenance of server & network infrastructure •Selected based on consultative approach, product & service breadth, and trusted relationship IT Services Plus Connectivity •Healthcare •Managed Firewall, Hosted PBX, MPLS & Internet •Selected based on breadth of service portfolio IT Services •Communications • IT Workspace •Selected based on ability to serve remote workers in a highly secure environment Data •Financial Services •Disaster Recovery Services, Data, MPLS & Web Conferencing •Growth of services with existing EarthLink customer Data & Hosted Voice •Gaming – 45 locations •MPLS, Hosted Voice & DIA •Selected based on flexible access options & nationwide reach Data & Voice •Healthcare – 25 locations •Multi-location MPLS & Voice •Selected based on technical capabilities & nationwide reach Data •Financial Services •Blended access MPLS, Hosted IP, DSL redundancy •Selected based on technical capabilities These deals add over $175k in new incremental monthly recurring revenue

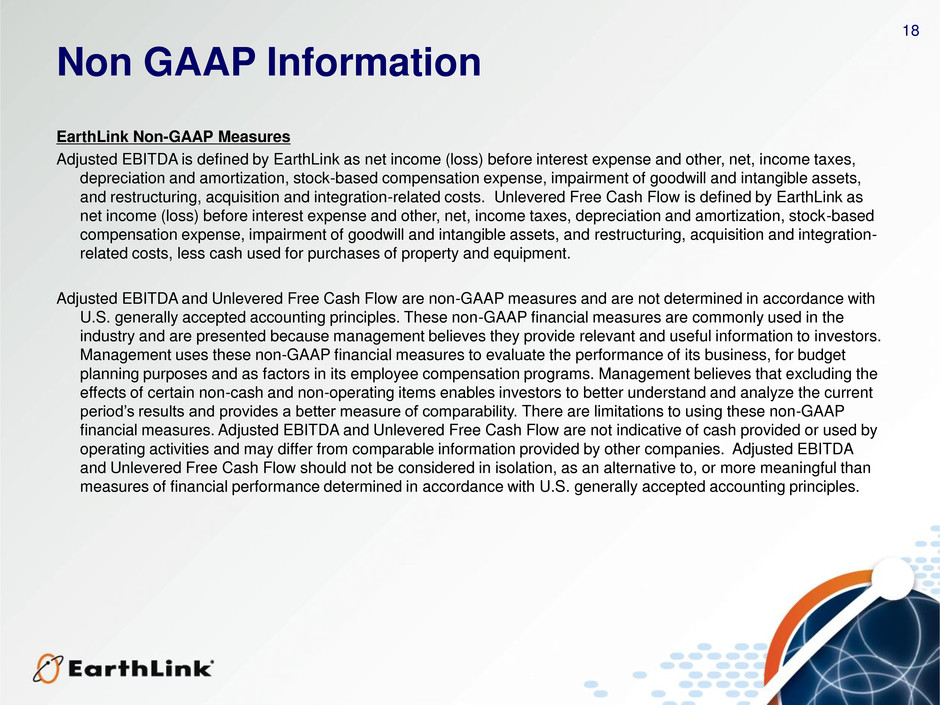

18 Non GAAP Information EarthLink Non-GAAP Measures Adjusted EBITDA is defined by EarthLink as net income (loss) before interest expense and other, net, income taxes, depreciation and amortization, stock-based compensation expense, impairment of goodwill and intangible assets, and restructuring, acquisition and integration-related costs. Unlevered Free Cash Flow is defined by EarthLink as net income (loss) before interest expense and other, net, income taxes, depreciation and amortization, stock-based compensation expense, impairment of goodwill and intangible assets, and restructuring, acquisition and integration- related costs, less cash used for purchases of property and equipment. Adjusted EBITDA and Unlevered Free Cash Flow are non-GAAP measures and are not determined in accordance with U.S. generally accepted accounting principles. These non-GAAP financial measures are commonly used in the industry and are presented because management believes they provide relevant and useful information to investors. Management uses these non-GAAP financial measures to evaluate the performance of its business, for budget planning purposes and as factors in its employee compensation programs. Management believes that excluding the effects of certain non-cash and non-operating items enables investors to better understand and analyze the current period’s results and provides a better measure of comparability. There are limitations to using these non-GAAP financial measures. Adjusted EBITDA and Unlevered Free Cash Flow are not indicative of cash provided or used by operating activities and may differ from comparable information provided by other companies. Adjusted EBITDA and Unlevered Free Cash Flow should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with U.S. generally accepted accounting principles.

19 2012 Guidance Non GAAP Reconciliation Twelve Months Ended December 31, 2012 Net income $3 - 5 Interest expense and other, net 64 Income tax benefit (4) - (3) Depreciation and amortization 185 - 187 Stock-based compensation expense 11 - 12 Restructuring, acquisition and integration-related costs 18 Adjusted EBITDA $277 - $283 EARTHLINK, INC. Reconciliation of Net Income to Adjusted EBITDA (in millions)

20 Historical Non GAAP Reconciliations Three Months Three Months Three Months Ended Ended Ended September 30, June 30, September 30, 2011 2012 2012 Net income (loss) 7,505$ (1,106)$ 1,372$ Interest expense and other, net 22,161 15,709 16,792 Income tax provision (benefit) 1,937 (893) (3,370) Depreciation and amortization 46,567 45,980 45,665 Stock-based compensation expense 3,369 2,868 2,663 Restructuring, acquisition and integration-related costs 8,966 3,836 6,379 Adjusted EBITDA 90,505$ 66,394$ 69,501$ EARTHLINK, INC. Reconciliation of Net Income (Loss) to Adjusted EBITDA (in thousands)

21 Additional Non GAAP Reconciliations Three Months Three Months Three Months Ended Ended Ended September 30, June 30, September 30, 2011 2012 2012 Net income (loss) 7,505$ (1,106)$ 1,372$ Interest expense and other, net 22,161 15,709 16,792 Income tax provision (benefit) 1,937 (893) (3,370) Depreciation and amortization 46,567 45,980 45,665 Stock-based compensation expense 3,369 2,868 2,663 Restructuring, acquisition and integration-related costs 8,966 3,836 6,379 Purchases of property and equipment (30,528) (24,450) (24,504) Unlevered Free Cash Flow 59,977$ 41,944$ 44,997$ EARTHLINK, INC. Reconciliation of Net Income (Loss) to Unlevered Free Cash Flow (in thousands) Three Months Three Months Three Months Ended Ended Ended September 30, September 30, September 30, 2011 2012 2012 Net cash provided by operating activities 71,007$ 22,251$ 90,0$ Income tax provision (be efit) 1,937 (89 ) (3,370) Non-c h income taxes (1,018) ,8 8 1,4 8 Interest xpens and other, net 22,161 15,709 16,7 2 Amortization of debt discount, premium and issuance costs (3,533) 479 497 Restructuring, acquisition and integration-related costs 8,966 3,836 6,379 Changes in operating assets and liabilities (6,416) 21,919 (42,008) Purchases of property and equipment (30,528) (24,450) (24,504) Other, net (2,599) 245 (313) Unlevered Free Cash Flow 59,977$ 41,944$ 44,997$ (in thousands) EARTHLINK, INC. Reconciliation of Net Cash Flows from Operating Activities to Unlever d Free Cash Flow

22 Cautionary Information Regarding Forward Looking Statements This presentation includes “forward-looking” statements (rather than historical facts) that are subject to risks and uncertainties that could cause actual results to differ materially from those described. Although we believe that the expectations expressed in these forward-looking statements are reasonable, we cannot promise that our expectations will turn out to be correct. Our actual results could be materially different from and worse than our expectations. With respect to such forward-looking statements, we seek the protections afforded by the Private Securities Litigation Reform Act of 1995. These risks include (1) that we may not be able to execute our strategy to grow our business services revenue, especially revenue from advanced products, in an expeditious manner, which could adversely impact our results of operations and cash flows; (2) that we may be unsuccessful or experience delays in integrating acquisitions into our business while we develop our Business Services advanced product portfolio, which could result in operating difficulties, losses and other adverse consequences; (3) that we may be unable to successfully identify, manage and assimilate future acquisitions, which could adversely affect our results of operations; (4) that if we are unable to adapt to changes in technology and customer demands, we may not remain competitive, and our revenues and operating results could suffer; (5) that our failure to achieve operating efficiencies will adversely affect our results of operations; (6) that unfavorable general economic conditions could harm our business; (7) that we face significant competition in the communications and managed IT services industry that could reduce our profitability; (8) that decisions by the Federal Communications Commission relieving incumbent carriers of certain regulatory requirements, and possible further deregulation in the future, may restrict our ability to provide services and may increase the costs we incur to provide these services; (9) that if we are unable to interconnect with AT&T, Verizon and other incumbent carriers on acceptable terms, our ability to offer competitively priced local telephone services will be adversely affected; (10) that our operating performance will suffer if we are not offered competitive rates for the access services we need to provide our long distance services; (11) that we may experience reductions in switched access and reciprocal compensation revenue; (12) that failure to obtain and maintain necessary permits and rights-of-way could interfere with our network infrastructure and operations; (13) that if we are unable to renew our wholesale agreements with telecommunications carriers, our wholesale revenue and results of operations could be materially and adversely affected; (14) that we obtain a majority of our network equipment and software from a limited numbers of third-party suppliers; (15) that our consumer services commercial and alliance arrangements may not be renewed or may not generate expected benefits, which could adversely affect our results of operations; (16) that our consumer business is dependent on the availability and affordability of third-party network service providers; (17) that we face significant competition in the Internet industry that could reduce our profitability; (18) that the continued decline of our consumer access subscribers, combined with the change in mix of our consumer access base from narrowband to broadband, will adversely affect our results of operations; (19) that potential regulation of Internet service providers could adversely affect our operations; (20) that we may be unable to hire and retain sufficient qualified personnel, including Business Services sales personnel, and that the loss of any of our key executive officers could adversely affect us; (21) that privacy concerns relating to our business could damage our reputation and deter current and potential users from using our services; (22) that security breaches could damage our reputation and harm our operating results; (23) that interruption or failure of our network and information systems and other technologies could impair our ability to provide our services, which could damage our reputation and harm our operating results; (24) that our business depends on effective business support systems and processes; (25) that government regulations could adversely affect our business or force us to change our business practices and that we are subject to regulatory audit; (26) that our business may suffer if third parties are unable to provide services or terminate their relationships with us; (27) that we may not be able to protect our intellectual property; (28) that we are subject to claims that we have infringed upon the intellectual property rights of third parties, which are costly to defend, could result in our having to make significant payments and could limit our ability to use certain technologies in the future; (29) that if we are unable to successfully defend against legal actions, we could face substantial liabilities or suffer harm to our financial and operational prospects; (30) that we may be required to recognize additional impairment charges on our goodwill and intangible assets, which would adversely affect our results of operations and financial position; (31) that we may have exposure to greater than anticipated tax liabilities and the use of our net operating losses and certain other tax attributes could be limited in the future; (32) that our indebtedness could adversely affect our financial health and limit our ability to react to changes in our industry; (33) that we may require additional capital to support business growth, and this capital may not be available to us on acceptable terms, or at all; (34) that we may reduce, or cease payment of, quarterly cash dividends; (35) that our stock price may be volatile; and (36) that provisions of our third restated certificate of incorporation, amended and restated bylaws and other elements of our capital structure could limit our share price and delay a change of control of the company. These risks and uncertainties, as well as other risks and uncertainties that could cause our actual results to differ significantly from management’s expectations, are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors included in our Annual Report on Form 10-K for the year ended December 31, 2011.