Searchable text section of graphics shown above

Small-to-Medium Enterprises

Bill Heys

Executive Vice President & President, Value and Small-to-Medium Enterprises

[LOGO] EarthLink We revolve around you TM

1

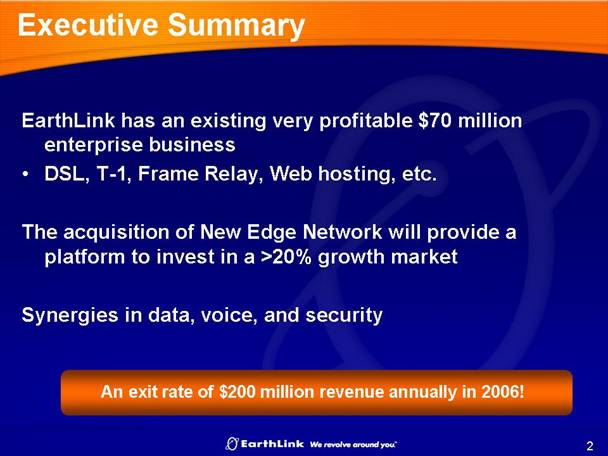

Executive Summary

EarthLink has an existing very profitable $70 million enterprise business

• DSL, T-1, Frame Relay, Web hosting, etc.

The acquisition of New Edge Network will provide a platform to invest in a >20% growth market

Synergies in data, voice, and security

An exit rate of $200 million revenue annually in 2006!

2

Complementary Product Offerings

Building a Portfolio of SME Products in Attractive Growth Markets

Market Segment | Access | Value Added Services |

Single Site Soho<5 | ELNK Small Biz | VPN | Web Hosting | Security (Aluria) | Voice

(VoIP) | On-site Services (2006) |

Multi Site

Small/Medium

Enterprise

<200 | New Edge

Networks | 2006 | 2006 | 2006 | 2006 |

3

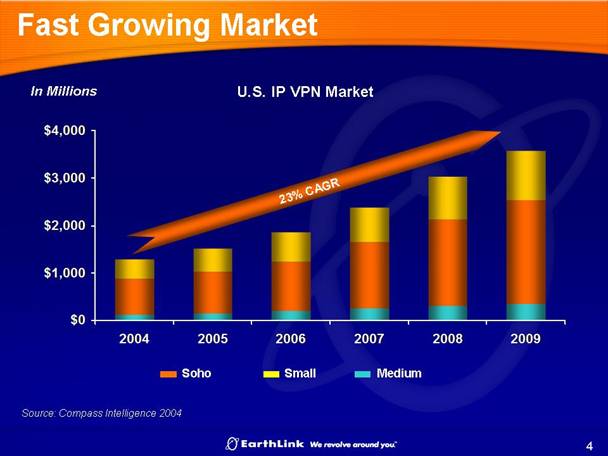

Fast Growing Market

[GRAPH]

4

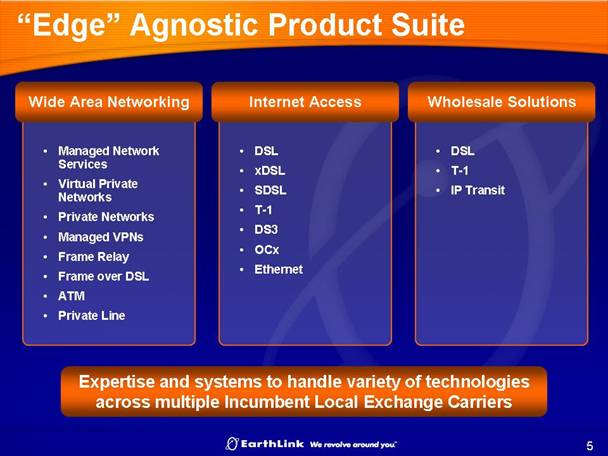

“Edge” Agnostic Product Suite

Wide Area Networking | | Internet Access | Wholesale Solutions |

| | | | | |

• | Managed Network | • | DSL | • | DSL |

| Services | | | | |

| | • | xDSL | • | T-1 |

• | Virtual Private | | | | |

| | • | SDSL | • | IP Transit |

| Networks | | | | |

| | • | T-1 | | |

• | Private Networks | | | | |

| | • | DS3 | | |

• | Managed VPNs | | | | |

| | • | OCx | | |

• | Frame Relay | | | | |

| | • | Ethernet | | |

• | Frame over DSL | | | | |

| | | | | |

• | ATM | | | | |

| | | | | |

• | Private Line | | | | |

Expertise and systems to handle variety of technologies across multiple Incumbent Local Exchange Carriers

5

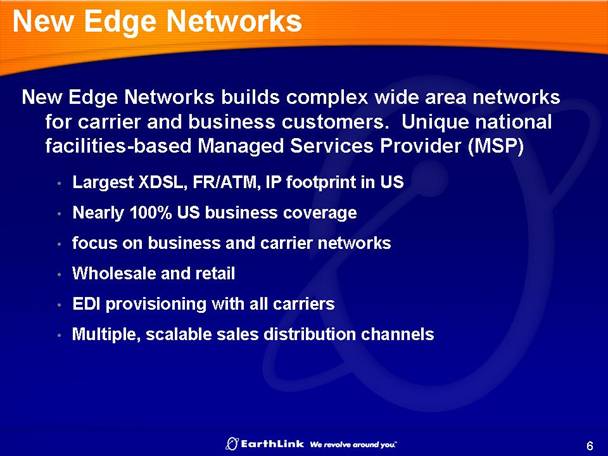

New Edge Networks

New Edge Networks builds complex wide area networks for carrier and business customers. Unique national facilities-based Managed Services Provider (MSP)

• Largest XDSL, FR/ATM, IP footprint in US

• Nearly 100% US business coverage

• focus on business and carrier networks

• Wholesale and retail

• EDI provisioning with all carriers

• Multiple, scalable sales distribution channels

6

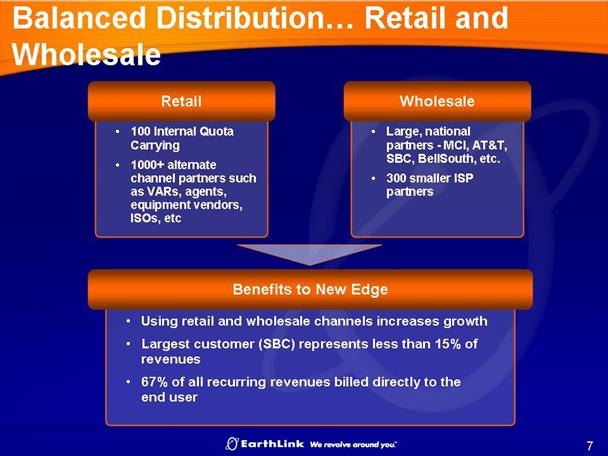

Balanced Distribution… Retail and Wholesale

| Retail | | Wholesale |

• | 100 Internal Quota | • | Large, national |

| Carrying | | partners -MCI, AT&T, |

| | | SBC, BellSouth, etc. |

• | 1000+ alternate | | |

| channel partners such | • | 300 smaller ISP |

| as VARs, agents, | | partners |

| equipment vendors, | | |

| ISOs, etc | | |

Benefits to New Edge

• Using retail and wholesale channels increases growth

• Largest customer (SBC) represents less than 15% of revenues

• 67% of all recurring revenues billed directly to the end user

7

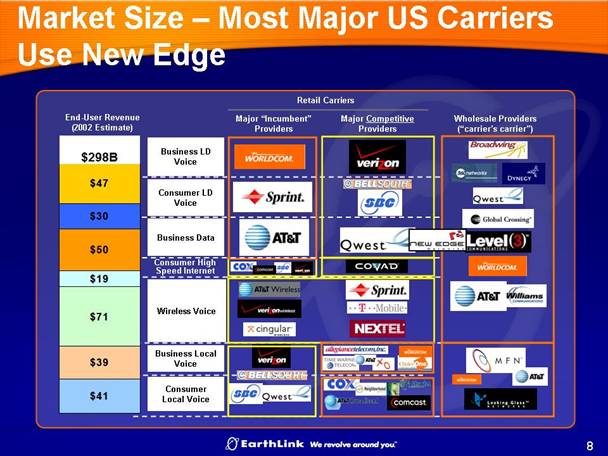

Market Size — Most Major US Carriers Use New Edge

[CHART]

8

Some New Edge Enterprise Customers

[CHART]

9

Customer Examples

Wholesale — BellSouth

• New Edge Network Solution - out-of-region, out-of-franchise DSL/frame relay access

• Ex. North Carolina Court System — Sprint territory

• 384kbs DSL @ $ per location

• Two year term

Retail — Build A Bear! — signed 1/16/06

• 200 retail locations growing by 30-50 stores a year

• Current network - Sprint 56k frame relay

• New Edge Network Solution — Network VPN with Dial Back-up and Managed Network Services package

• 384kbs DSL @ $ per location

• Two year term

• Applications — point of sale

10

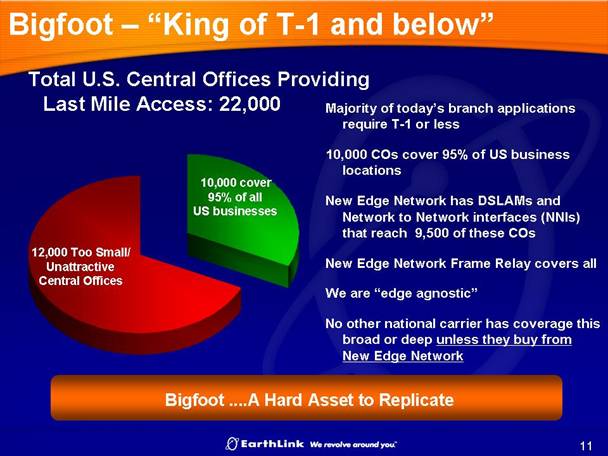

Bigfoot — “King of T-1 and below”

Total U.S. Central Offices Providing Last Mile Access: 22,000

[GRAPH] | Majority of today’s branch applications require T-1 or less10,000 COs cover 95% of US business locationsNew Edge Network has DSLAMs and Network to Network interfaces (NNIs) that reach 9,500 of these COsNew Edge Network Frame Relay covers allWe are “edge agnostic”No other national carrier has coverage this broad or deep unless they buy from New Edge Network |

Bigfoot .....A Hard Asset to Replicate

11

Diversified Market Opportunity

Segment | HQ | Sites | Avg. |

| | | |

Retail | 7,015 | 233,087 | 33 |

| | | |

Bus. Services | 5,415 | 70,129 | 13 |

| | | |

Prof. Services | 4,998 | 41,686 | 8 |

| | | |

Banking | 4,785 | 72,293 | 15 |

| | | |

Medical | 1,330 | 19,217 | 14 |

| | | |

Lodging | 479 | 6,456 | 13 |

Many attractive channel opportunities

12

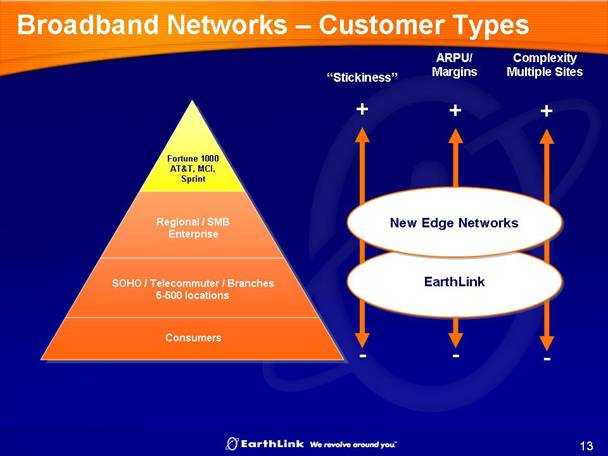

Broadband Networks — Customer Types

[GRAPH]

13

Retail is current focus…

Segment | HQ | Sites | Avg. |

Retail | 7,015 | 233,087 | 33 |

| | | |

Bus. Services | 5,415 | 70,129 | 13 |

| | | |

Prof. Services | 4,998 | 41,686 | 8 |

| | | |

Banking | 4,785 | 72,293 | 15 |

| | | |

Medical | 1,330 | 19,217 | 14 |

| | | |

Lodging | 479 | 6,456 | 13 |

...but we will be investing to drive deeper in retail and

expand into the other verticals

14

How do they do it...

Example: the “Retail Broadband Alliance”

New Edge has created a nationwide alliance of Retailers to focus on their specific needs for

• Software, Hardware, Security, Payment processing, applications, networks, etc.

Creating these best-practice sharing groups provides insight into the latest technology developments and helps to marry them to the latest customer needs

Keeps New Edge on the forefront of opportunities

15

The Retail Profile

Why do they buy?

EmailFaster transactionsExpand payment optionsIn store ATM and KiosksMarket basket analysis | Real-Time inventory Workforce Management Online training Video security Cheaper than dial-up! |

16

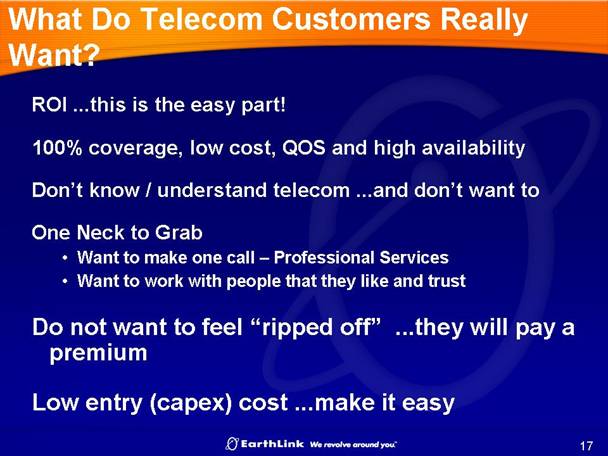

What Do Telecom Customers Really Want?

ROI ....this is the easy part!

100% coverage, low cost, QOS and high availability

Don’t know / understand telecom ...and don’t want to

One Neck to Grab

• Want to make one call — Professional Services

• Want to work with people that they like and trust

Do not want to feel “ripped off” ...they will pay a premium

Low entry (capex) cost ...make it easy

17

Key Takeaways

Fast growing, attractive market

Difficult to replicate national broadband network “Bigfoot”

Logical extension of existing EarthLink business

Significant cross-selling opportunities

Leveraging combined strengths in a fragmented, fast growing market

19