0 EarthLink Overview Second Quarter 2012 Results August 2012

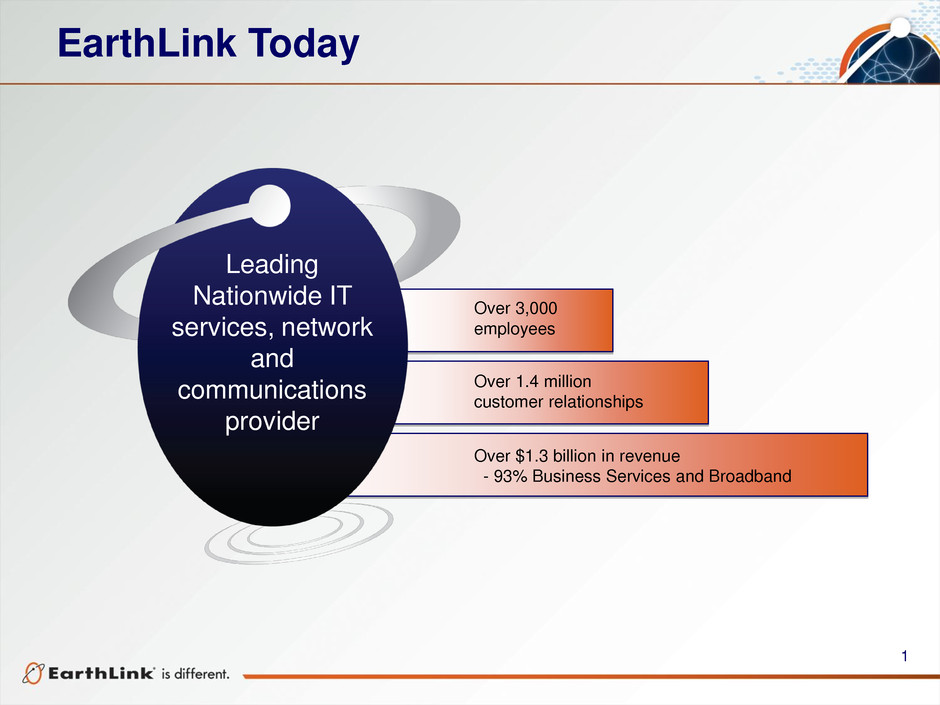

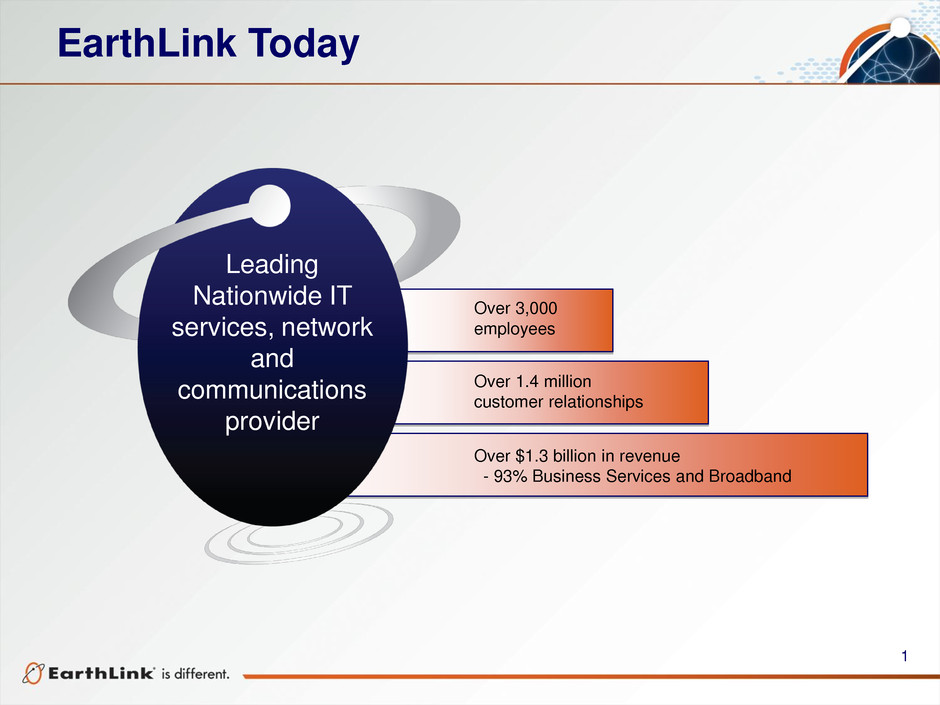

1 EarthLink Today Over 1.4 million customer relationships Over $1.3 billion in revenue - 93% Business Services and Broadband Over 3,000 employees Leading Nationwide IT services, network and communications provider

2 Investment Thesis • Improving revenue trajectory – Differentiated IT services offering in growing marketplace – Nationally recognized and trusted brand • Substantial cash flow • Strong balance sheet and significant tax assets • Attractive valuation

3 Opportunity Beyond Current Valuation Current valuation offers meaningful opportunity for shareholders (1) Enterprise Value/EBITDA is calculated using Enterprise Value based on market capitalization as of 8/7/12 less Q1 ‘12 Ending Cash minus Debt divided by FY ‘12 consensus for EBITDA. All data sourced from Thomson Reuters. (2) Theoretical share price sensitivity with (1)% - 0% organic revenue decline. See slide 26 for potential revenue growth information and assumptions. Not intended to predict future share price. Adjusted EBITDA is a non-GAAP measure. See appendix for additional information on non-GAAP measures Enterprise Value/EBITDA(1) 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 RAX EQIX CCOI INAP LVLT Peer Avg TWTC CTL WIN FTR ELNK CBEY 15.5 12.1 10.1 8.7 8.5 8.4 8.4 6.5 6.1 5.2 3.9 3.0 EarthLink Share Price Sensitivity(2) EV/EBITDA Multiple(1) 5.0x 5.5x 6.0x 6.5x Theoretical Share Price based on ‘12 EBITDA Consensus(2) $9.81 $11.15 $12.49 $13.84 (1)% - 0% Sequential Organic Revenue Growth

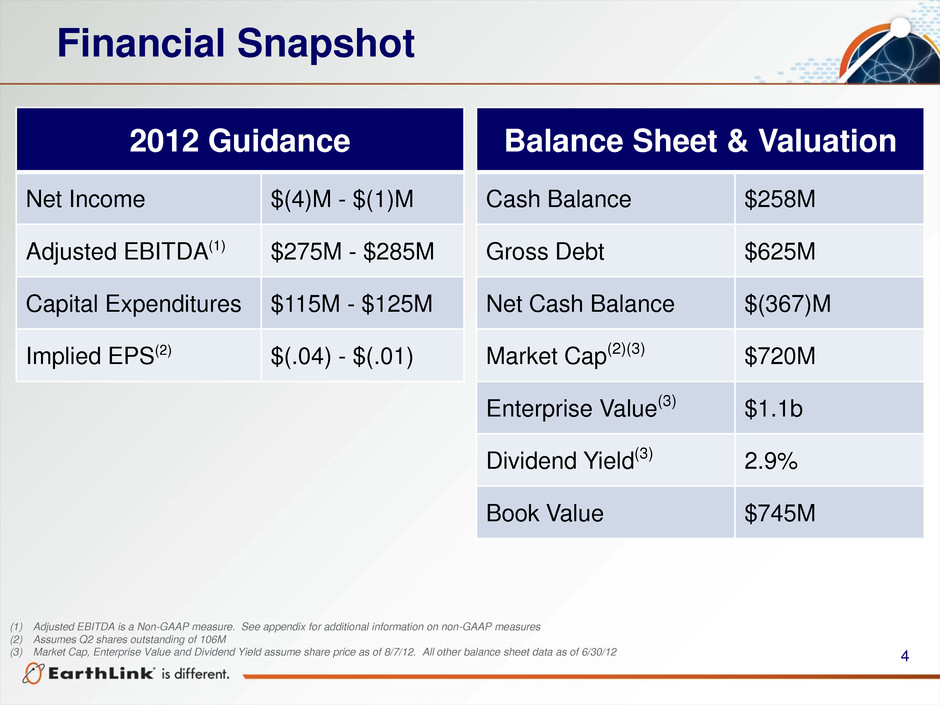

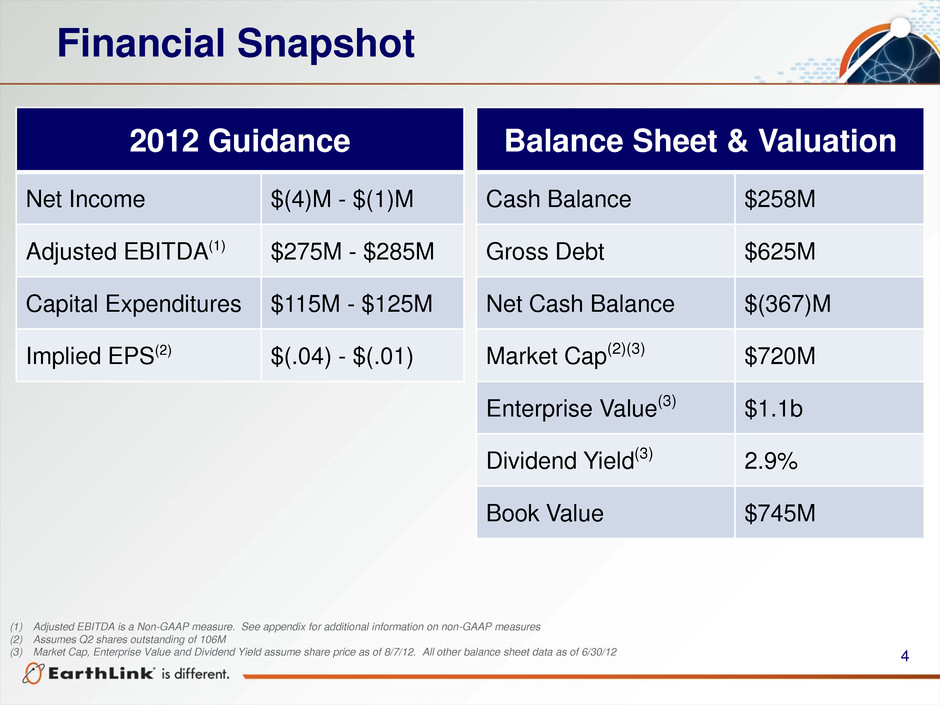

4 Financial Snapshot 2012 Guidance Net Income $(4)M - $(1)M Adjusted EBITDA(1) $275M - $285M Capital Expenditures $115M - $125M Implied EPS(2) $(.04) - $(.01) Balance Sheet & Valuation Cash Balance $258M Gross Debt $625M Net Cash Balance $(367)M Market Cap(2)(3) $720M Enterprise Value(3) $1.1b Dividend Yield(3) 2.9% Book Value $745M (1) Adjusted EBITDA is a Non-GAAP measure. See appendix for additional information on non-GAAP measures (2) Assumes Q2 shares outstanding of 106M (3) Market Cap, Enterprise Value and Dividend Yield assume share price as of 8/7/12. All other balance sheet data as of 6/30/12

5 Market Opportunity

6 The market for IT Services is large. EarthLink’s product portfolio will enable the company to compete for $100 Billion of the $177 Billion in Mid Market/Enterprise opportunity Market Opportunity for EarthLink $326 Billion Nationwide IT Spend Market Fortune 1000, $33b Mid Market/ Enterprise, $177b Small Business, $116b Source: EarthLink customer revenue and analysis, D&B industry segmentation, TNS spend / opportunity sizing, and Computer Economics Annual IT Budget Benchmark Survey, December 2010

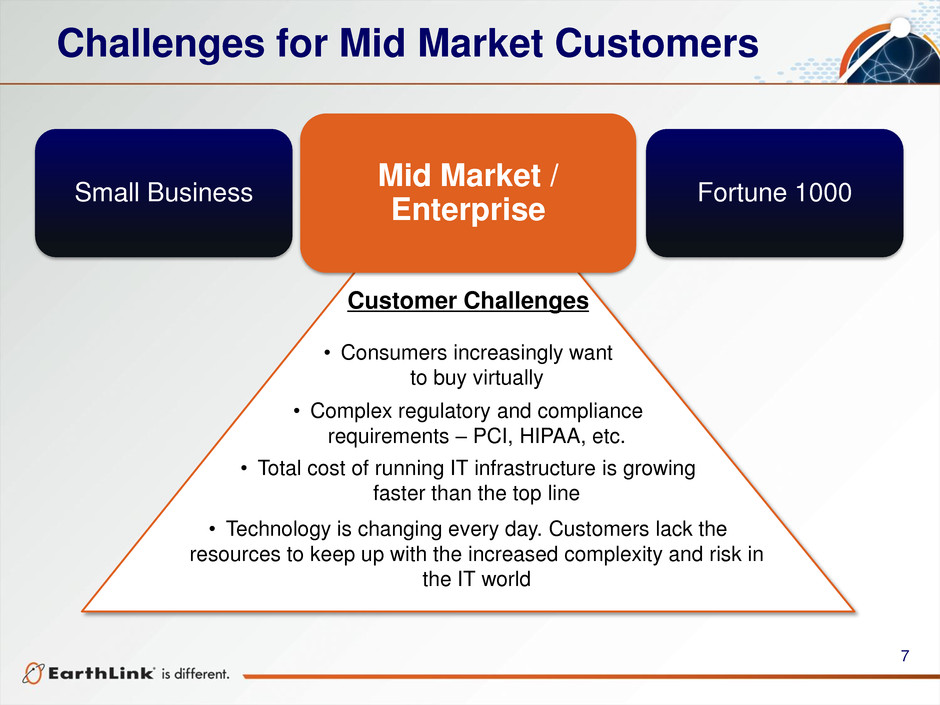

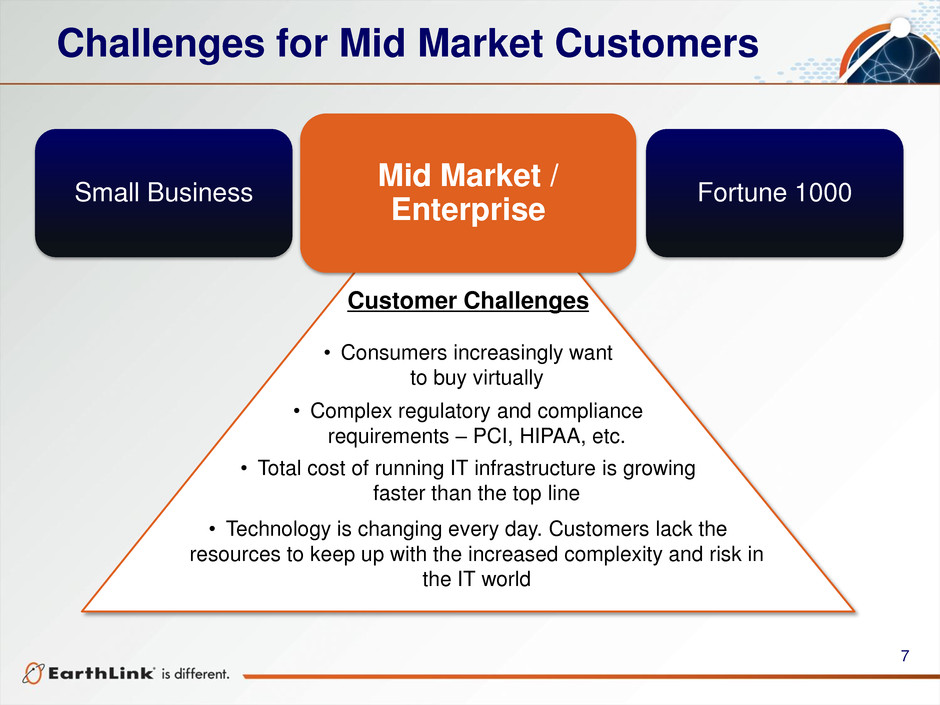

7 Challenges for Mid Market Customers Mid Market / Enterprise Small Business Fortune 1000 Customer Challenges • Consumers increasingly want to buy virtually • Complex regulatory and compliance requirements – PCI, HIPAA, etc. • Total cost of running IT infrastructure is growing faster than the top line • Technology is changing every day. Customers lack the resources to keep up with the increased complexity and risk in the IT world

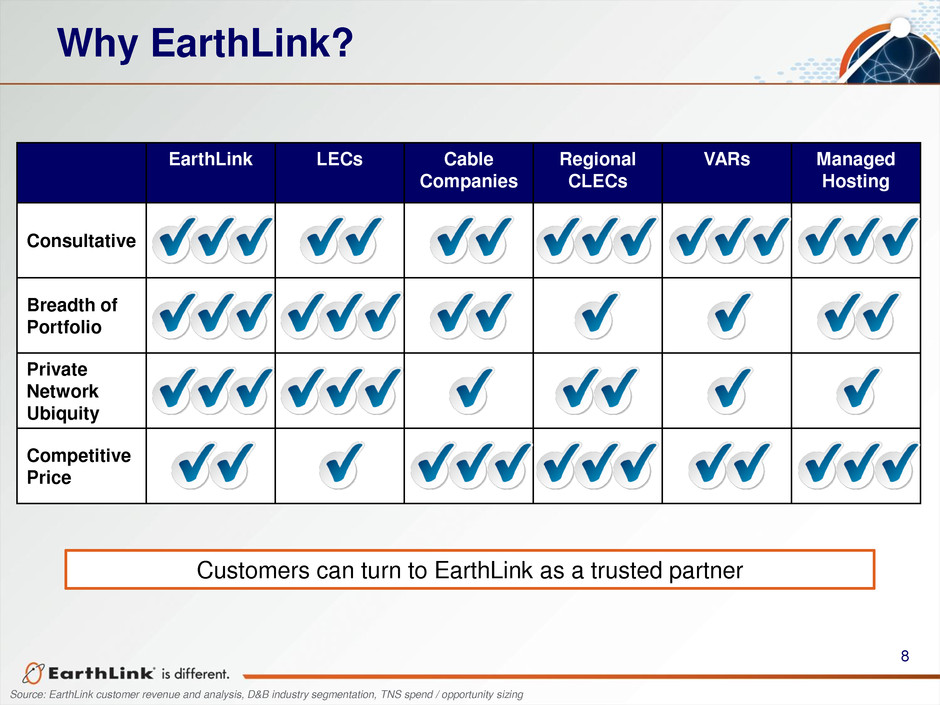

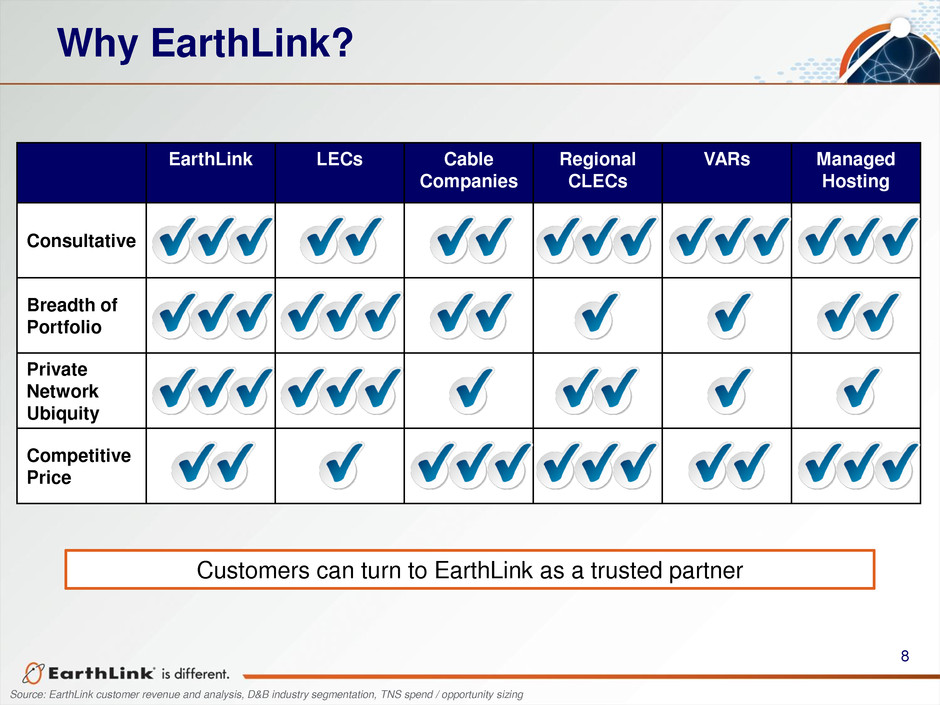

8 Why EarthLink? EarthLink LECs Cable Companies Regional CLECs VARs Managed Hosting Consultative Breadth of Portfolio Private Network Ubiquity Competitive Price Customers can turn to EarthLink as a trusted partner Source: EarthLink customer revenue and analysis, D&B industry segmentation, TNS spend / opportunity sizing

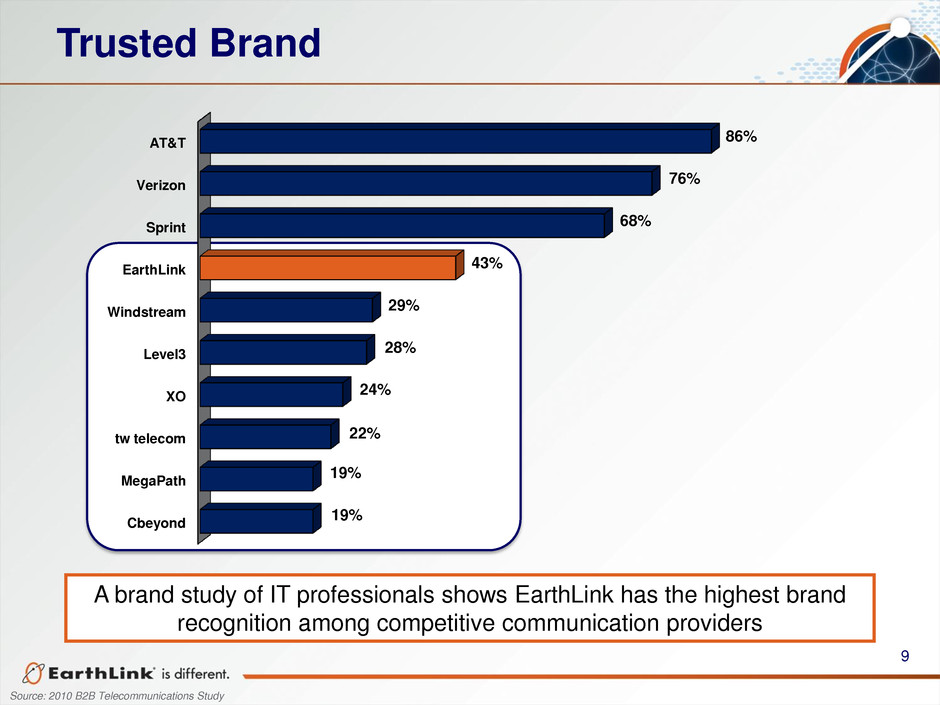

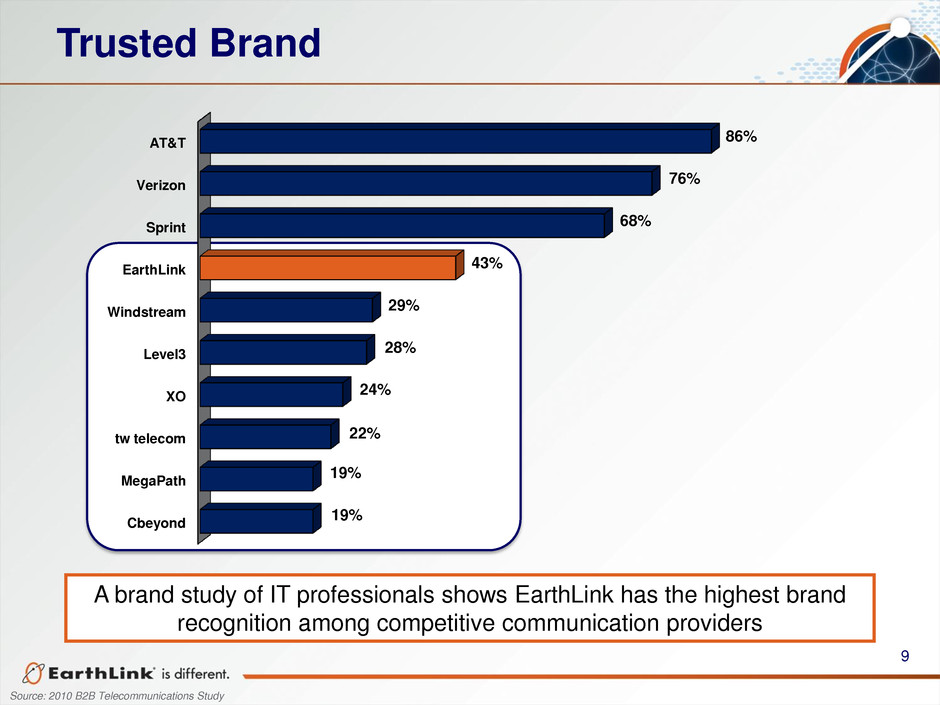

9 A brand study of IT professionals shows EarthLink has the highest brand recognition among competitive communication providers Source: 2010 B2B Telecommunications Study Trusted Brand Cbeyond MegaPath tw telecom XO Level3 Windstream EarthLink Sprint Verizon AT&T 19% 19% 22% 24% 28% 29% 43% 68% 76% 86%

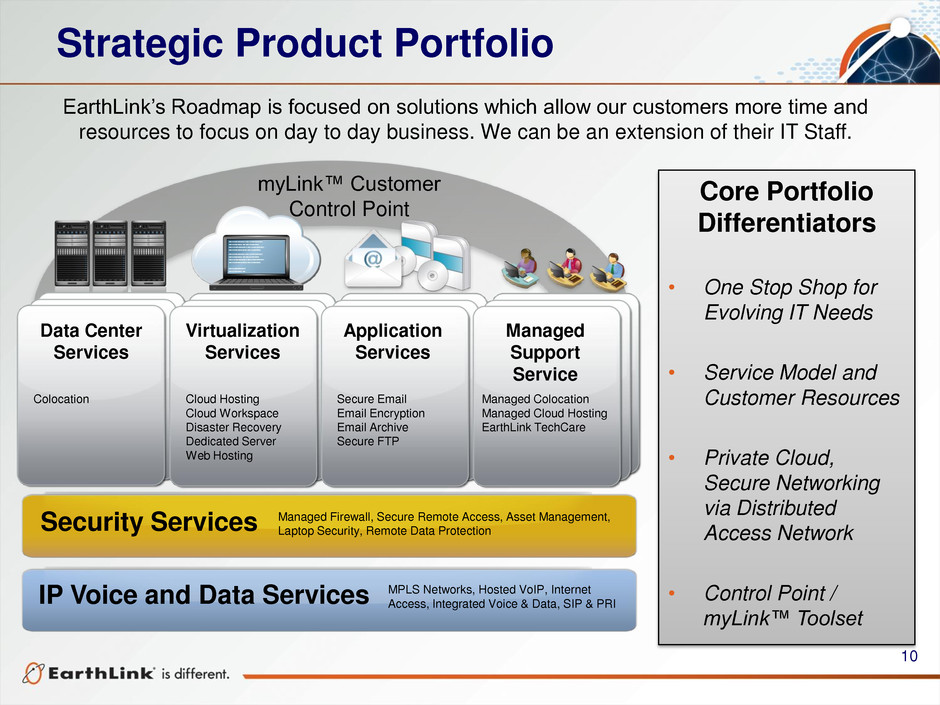

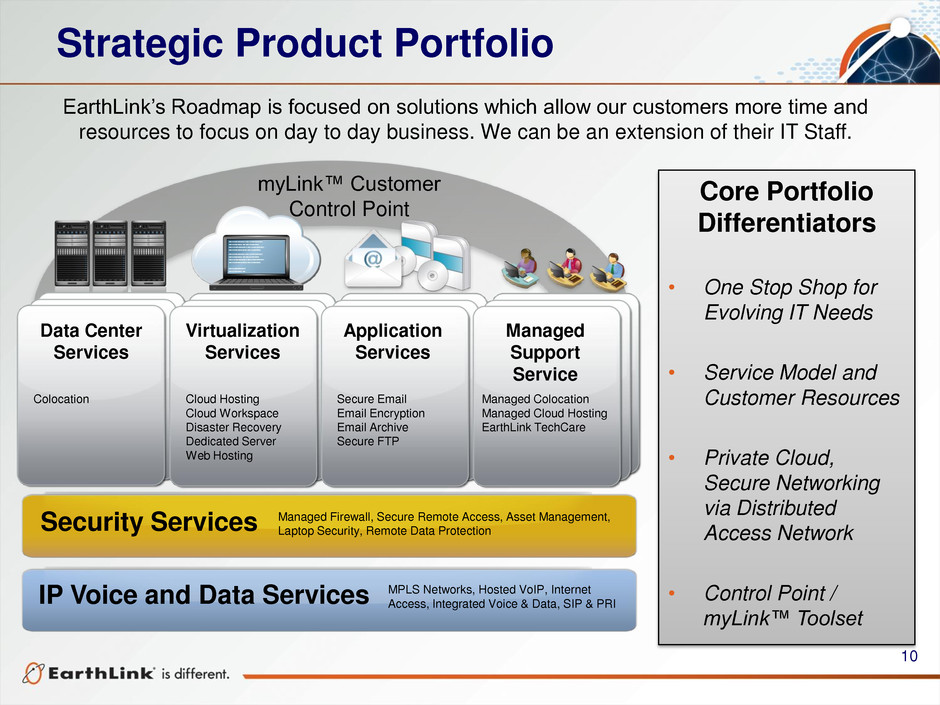

10 Core Portfolio Differentiators • One Stop Shop for Evolving IT Needs • Service Model and Customer Resources • Private Cloud, Secure Networking via Distributed Access Network • Control Point / myLink™ Toolset myLink™ Customer Control Point Virtualization Services Application Services Managed Support Service Data Center Services Security Services IP Voice and Data Services EarthLink’s Roadmap is focused on solutions which allow our customers more time and resources to focus on day to day business. We can be an extension of their IT Staff. Strategic Product Portfolio MPLS Networks, Hosted VoIP, Internet Access, Integrated Voice & Data, SIP & PRI Managed Firewall, Secure Remote Access, Asset Management, Laptop Security, Remote Data Protection Colocation Cloud Hosting Cloud Workspace Disaster Recovery Dedicated Server Web Hosting Secure Email Email Encryption Email Archive Secure FTP Managed Colocation Managed Cloud Hosting EarthLink TechCare

11 Extensive Fiber Network Strong fiber-centric building blocks enable a broad set of solutions

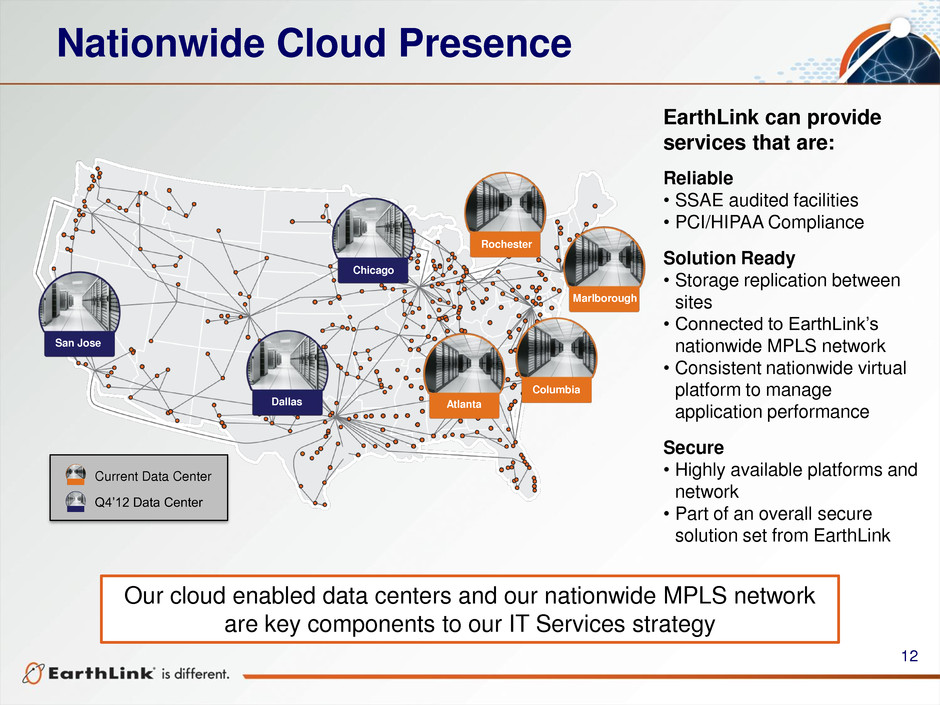

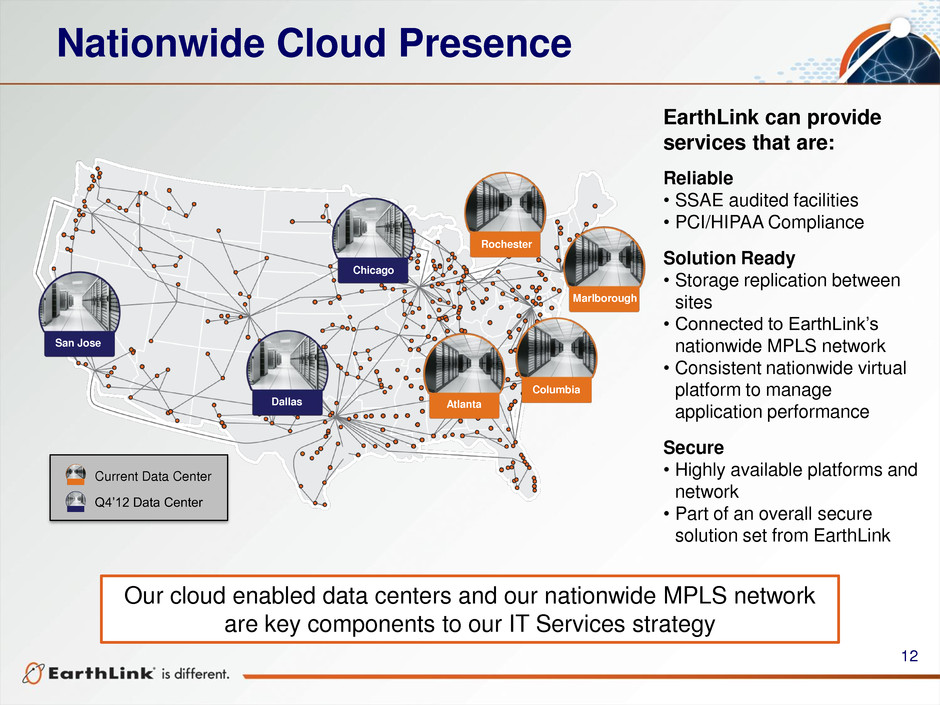

12 Nationwide Cloud Presence Marlborough Columbia Rochester Atlanta San Jose Dallas Chicago Current Data Center Q4’12 Data Center EarthLink can provide services that are: Reliable • SSAE audited facilities • PCI/HIPAA Compliance Solution Ready • Storage replication between sites • Connected to EarthLink’s nationwide MPLS network • Consistent nationwide virtual platform to manage application performance Secure • Highly available platforms and network • Part of an overall secure solution set from EarthLink Our cloud enabled data centers and our nationwide MPLS network are key components to our IT Services strategy

13 Sales & Integration Progress

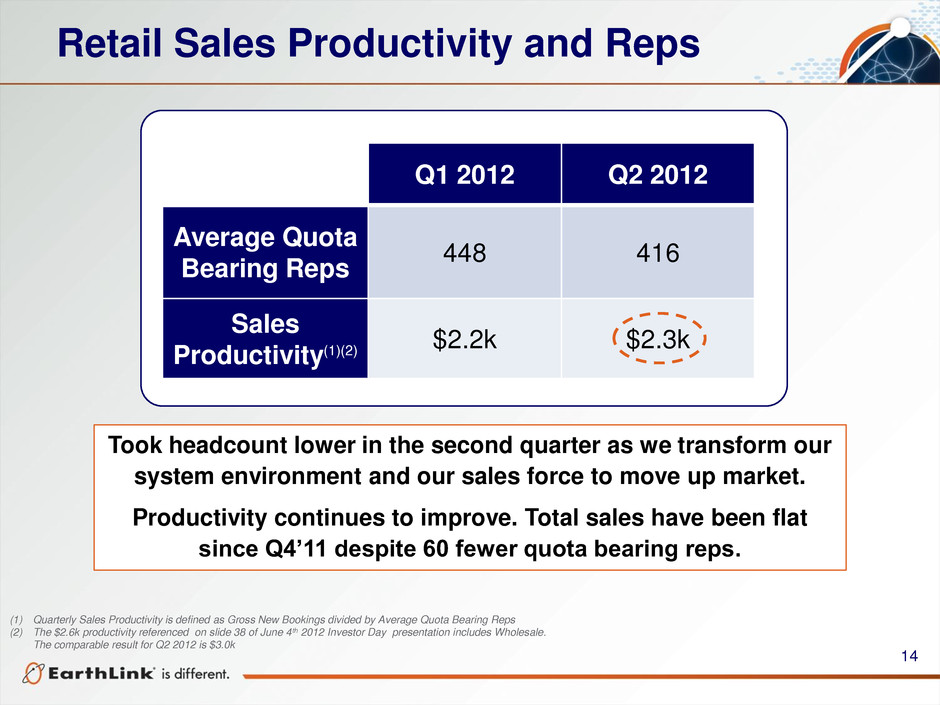

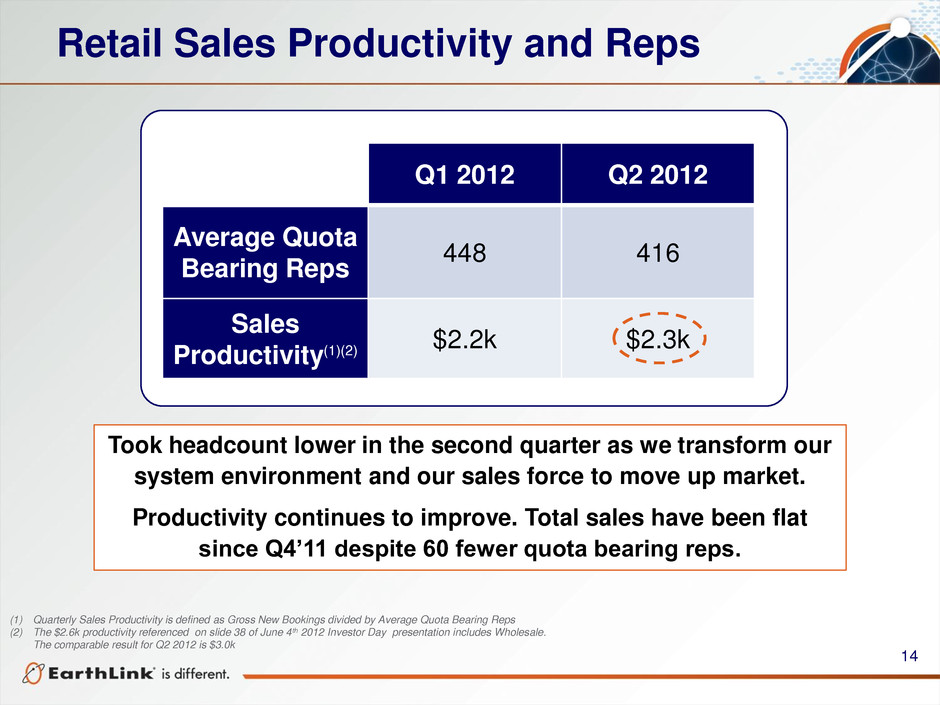

14 Q1 2012 Q2 2012 Average Quota Bearing Reps 448 416 Sales Productivity(1)(2) $2.2k $2.3k Took headcount lower in the second quarter as we transform our system environment and our sales force to move up market. Productivity continues to improve. Total sales have been flat since Q4’11 despite 60 fewer quota bearing reps. (1) Quarterly Sales Productivity is defined as Gross New Bookings divided by Average Quota Bearing Reps (2) The $2.6k productivity referenced on slide 38 of June 4th 2012 Investor Day presentation includes Wholesale. The comparable result for Q2 2012 is $3.0k Retail Sales Productivity and Reps

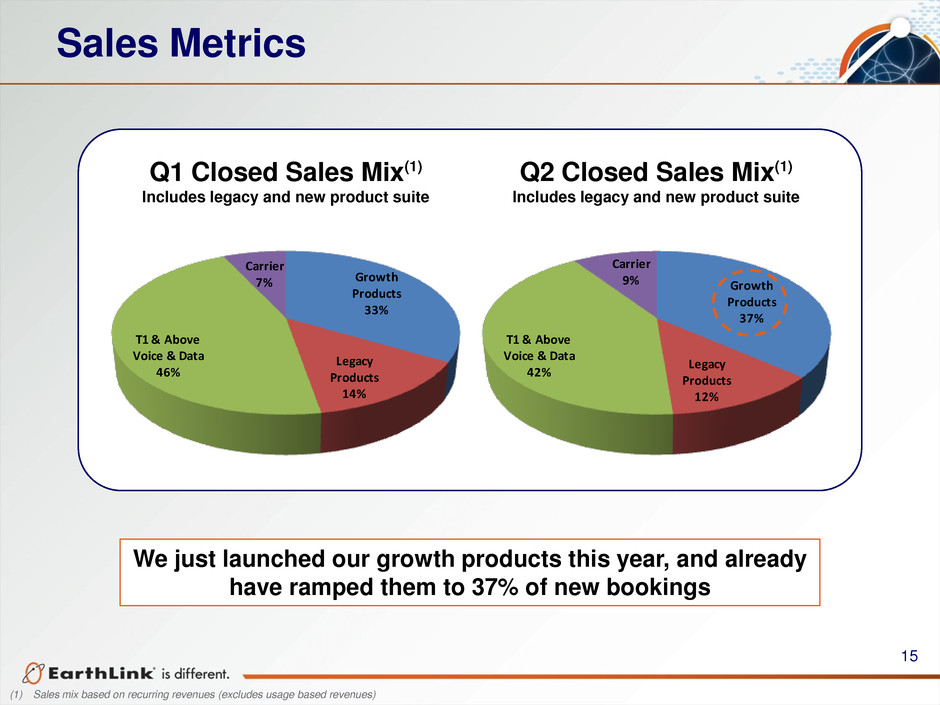

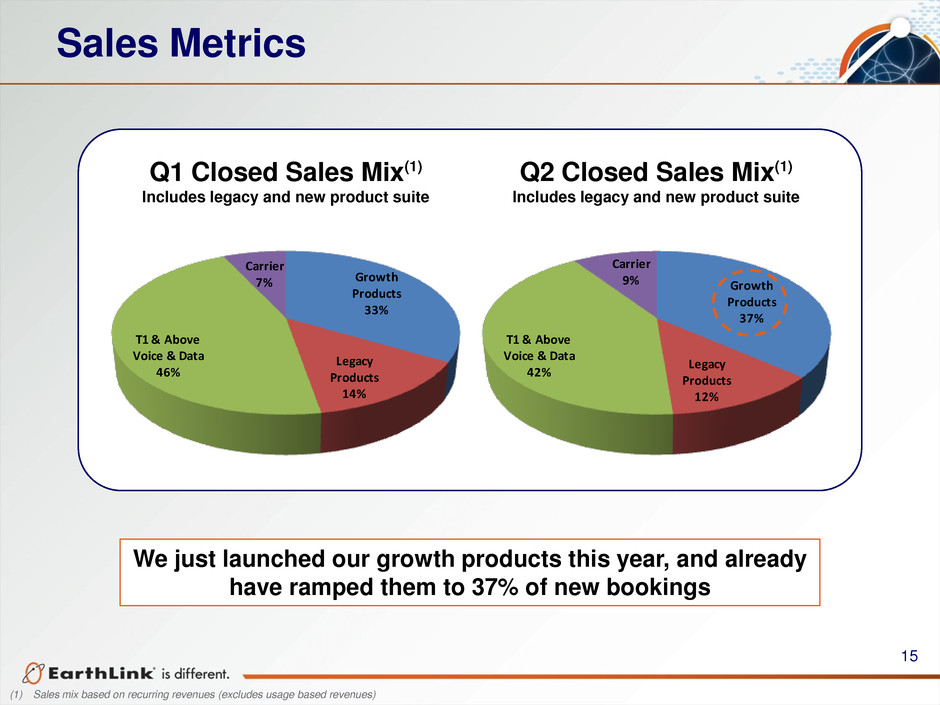

15 Q1 Closed Sales Mix(1) Includes legacy and new product suite Q2 Closed Sales Mix(1) Includes legacy and new product suite We just launched our growth products this year, and already have ramped them to 37% of new bookings Growth Products 37% Legacy Products 12% T1 & Above Voice & Data 42% Carrier 9% Growth Products 33% Legacy Products 14% T1 & Above Voice & Data 46% Carrier 7% Sales Metrics (1) Sales mix based on recurring revenues (excludes usage based revenues)

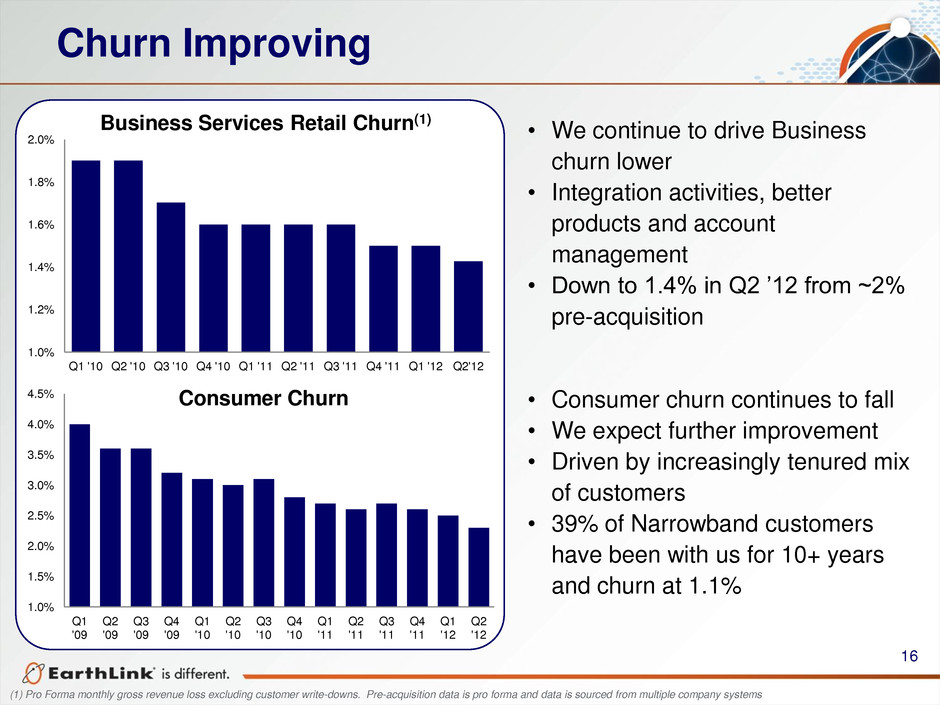

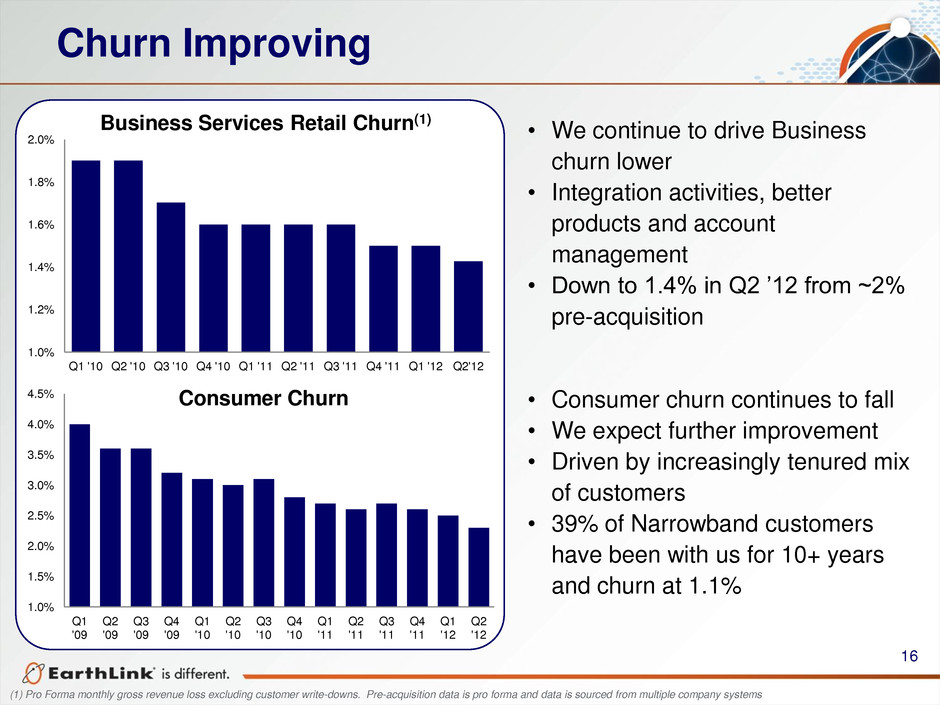

16 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2'12 • We continue to drive Business churn lower • Integration activities, better products and account management • Down to 1.4% in Q2 ’12 from ~2% pre-acquisition Business Services Retail Churn(1) 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% Q1 '09 Q2 '09 Q3 '09 Q4 '09 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Consumer Churn • Consumer churn continues to fall • We expect further improvement • Driven by increasingly tenured mix of customers • 39% of Narrowband customers have been with us for 10+ years and churn at 1.1% (1) Pro Forma monthly gross revenue loss excluding customer write-downs. Pre-acquisition data is pro forma and data is sourced from multiple company systems Churn Improving

17 Business Services Revenue % YoY (1) Total Company Revenue % YoY(1) • Business Services revenue trajectory continues to improve • While quarterly results could be lumpy, we are on a path towards positive growth • Total company revenue trajectory, including Consumer, continues to improve • Business Services may reach flat on a sequential basis in Q3 ‘12 but if not, we expect sequential growth will happen in early 2013 due to seasonally low Q4 revenues (1) Pro-forma for acquisitions and Q1 ’11 normalized for one-time items and accounting presentation -9.5% -8.2% -6.1% -5.8% -5.0% Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 -12.6% -10.9% -9.2% -8.7% -7.9% Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Pro-Forma Revenue Trajectory

18 Completed Milestones Launched integrated Oracle Financials (July ‘12) Launched first phase of new order management platform (Q2 ‘12) Launched uniform sales flow tool (Q2 ‘12) Integrated IT Services into myLink™ (Q2 ‘12) Launched cost mgmt platform (Q2 ‘12) Launched new profit protect platform (Q2 ‘12) Collapsed 3rd and final NOC (Q2 ‘12) Integrated commissions plans for reps (Q2 ‘12) Launched SIP Origination in our Wholesale Segment (Q2 ‘12) Launched our IT services product suite (Q1 ‘12) NE sales management integration (Q1 ‘12) Selected our billing platform (Q1 ‘12) Consolidated network inventory platform (Q1 ‘12) Upcoming Milestones Provisioning and inventory consolidation Unified quoting and single product catalog Unified order management Unified trouble and repair management Additional enhancements to myLink™ • We are 5 quarters into a 3 year integration • Significant systems milestones to be completed over the next few quarters • We completed several key deliverables in the second quarter and continue to see improvements in operational quality and churn metrics Integration

19 Cash Flow & Balance Sheet

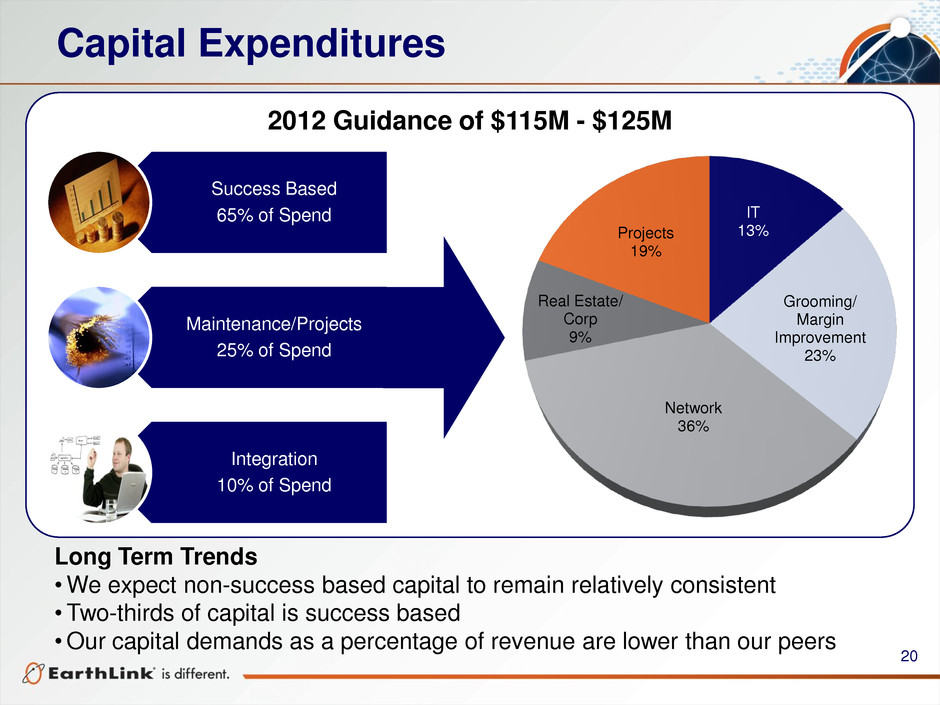

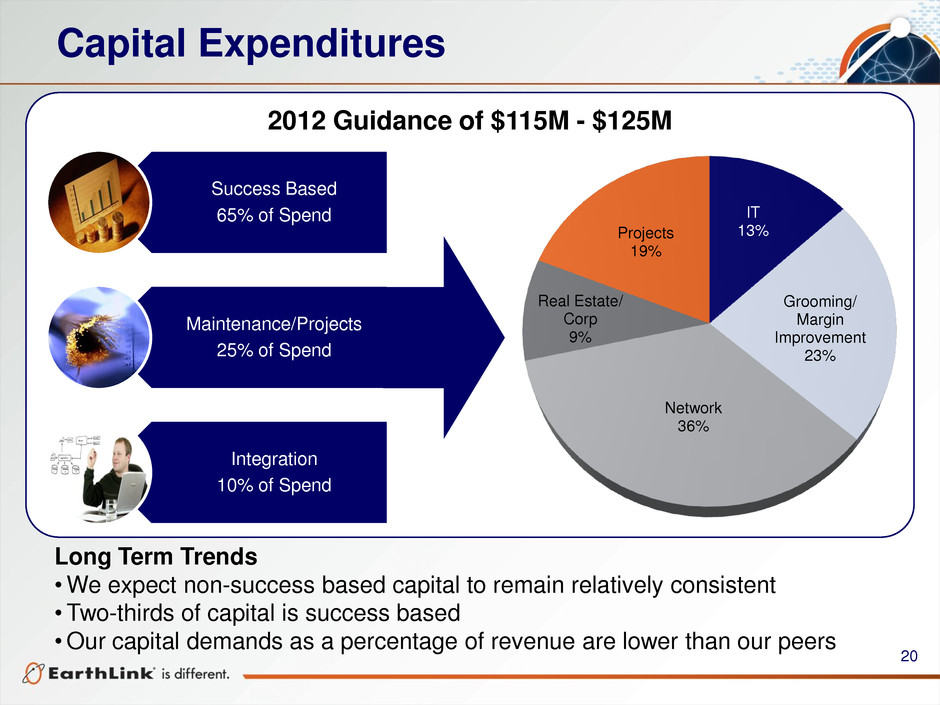

20 Capital Expenditures IT 13% Grooming/ Margin Improvement 23% Network 36% Real Estate/ Corp 9% Projects 19% 2012 Guidance of $115M - $125M Long Term Trends •We expect non-success based capital to remain relatively consistent •Two-thirds of capital is success based • Our capital demands as a percentage of revenue are lower than our peers Success Based 65% of Spend Maintenance/Projects 25% of Spend Integration 10% of Spend

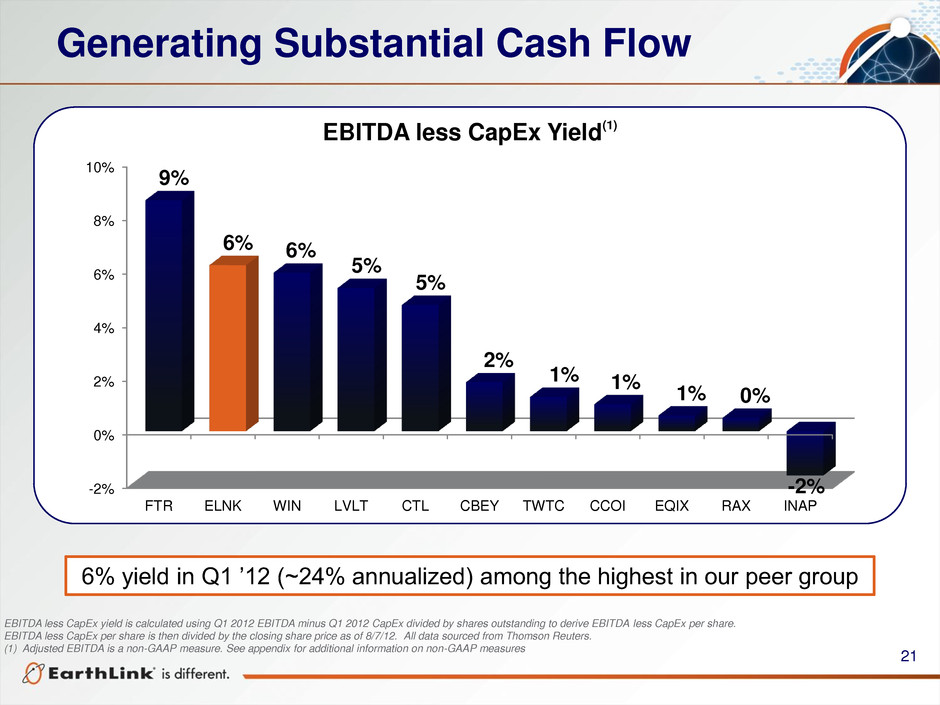

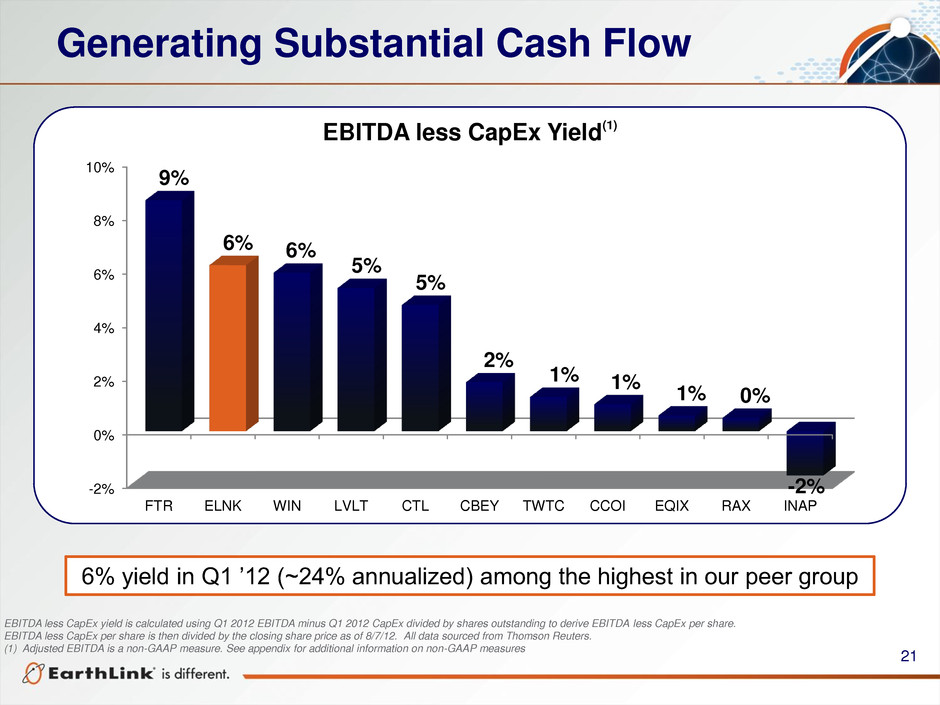

21 Generating Substantial Cash Flow 6% yield in Q1 ’12 (~24% annualized) among the highest in our peer group EBITDA less CapEx yield is calculated using Q1 2012 EBITDA minus Q1 2012 CapEx divided by shares outstanding to derive EBITDA less CapEx per share. EBITDA less CapEx per share is then divided by the closing share price as of 8/7/12. All data sourced from Thomson Reuters. (1) Adjusted EBITDA is a non-GAAP measure. See appendix for additional information on non-GAAP measures -2% 0% 2% 4% 6% 8% 10% FTR ELNK WIN LVLT CTL CBEY TWTC CCOI EQIX RAX INAP 9% 6% 6% 5% 5% 2% 1% 1% 1% 0% -2% EBITDA less CapEx Yield(1)

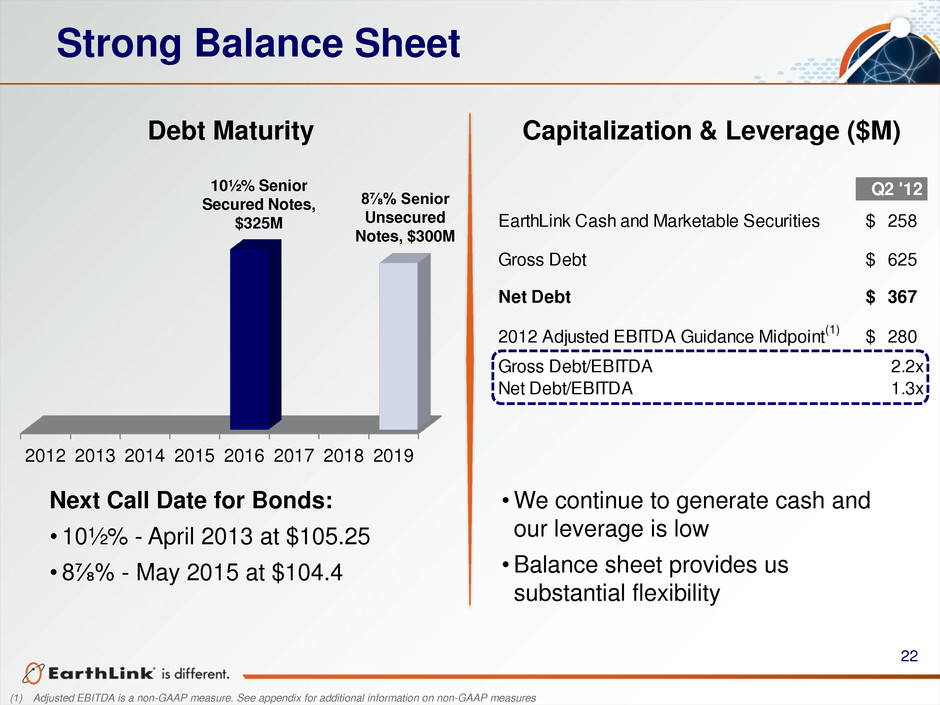

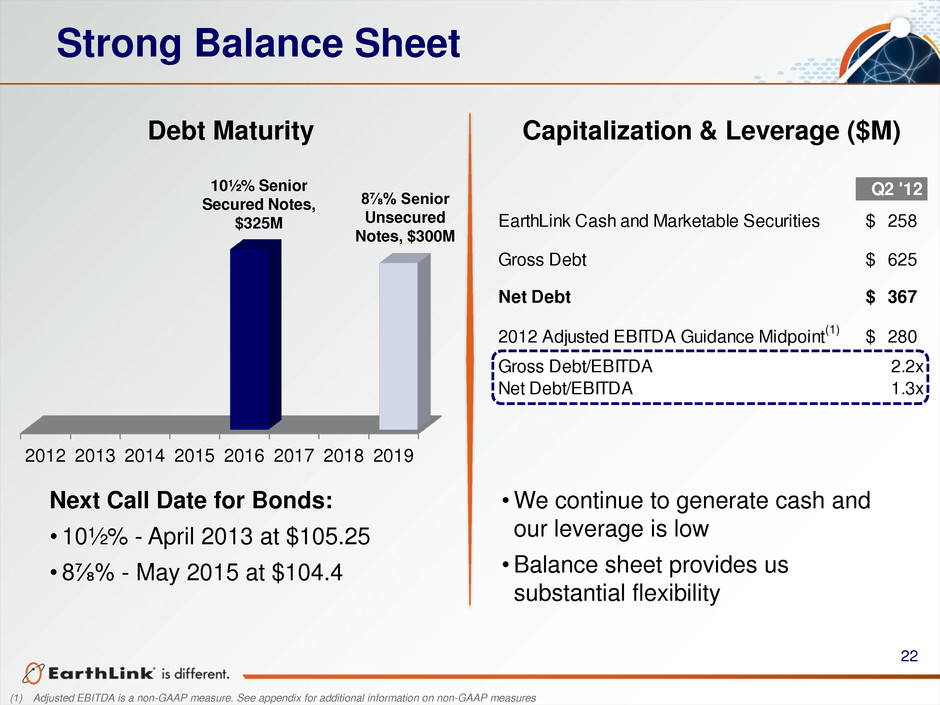

22 Strong Balance Sheet Debt Maturity Capitalization & Leverage ($M) Next Call Date for Bonds: • 10½% - April 2013 at $105.25 • 8⅞% - May 2015 at $104.4 •We continue to generate cash and our leverage is low •Balance sheet provides us substantial flexibility 2012 2013 2014 2015 2016 2017 2018 2019 10½% Senior Secured Notes, $325M 8⅞% Senior Unsecured Notes, $300M (1) Adjusted EBITDA is a non-GAAP measure. See appendix for additional information on non-GAAP measures Q2 '12 EarthLink Cash and Marketable Securities 258$ Gross Debt 625$ Net Debt 367$ 2012 Adjusted EBITDA Guidance Midpoint (1) 280$ Gross Debt/EBITDA 2.2x Net Debt/EBITDA 1.3x

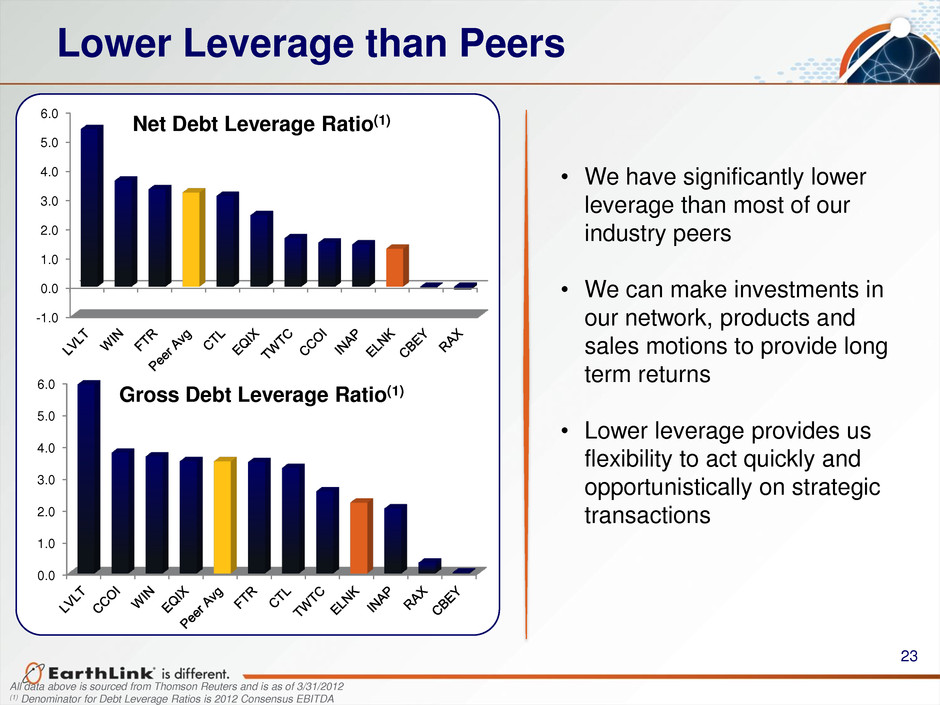

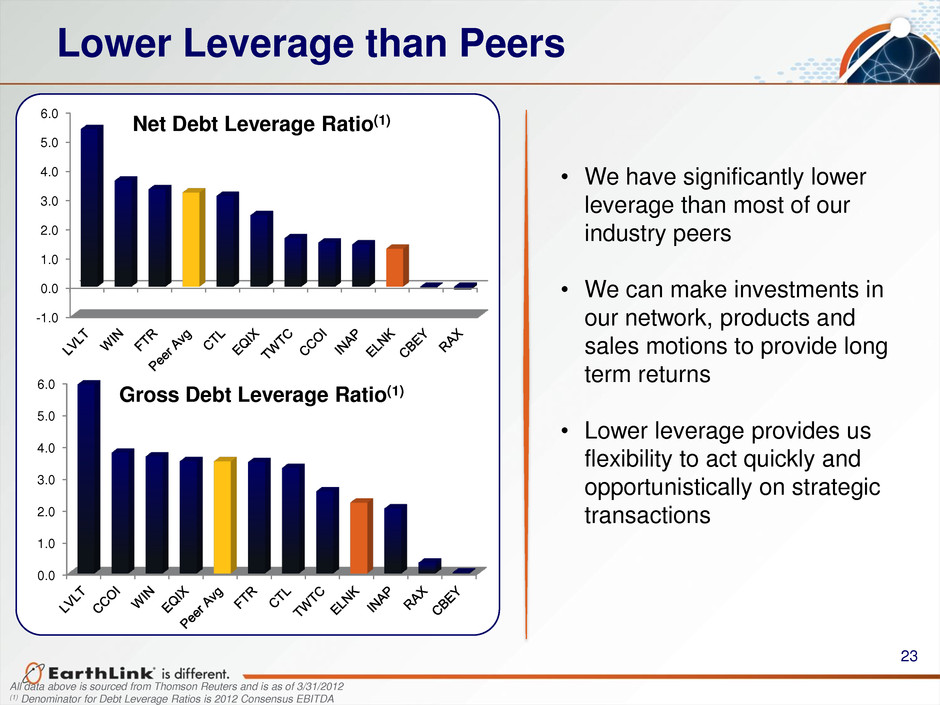

23 Lower Leverage than Peers All data above is sourced from Thomson Reuters and is as of 3/31/2012 (1) Denominator for Debt Leverage Ratios is 2012 Consensus EBITDA • We have significantly lower leverage than most of our industry peers • We can make investments in our network, products and sales motions to provide long term returns • Lower leverage provides us flexibility to act quickly and opportunistically on strategic transactions -1.0 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Net Debt Leverage Ratio(1) 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Gross Debt Leverage Ratio(1)

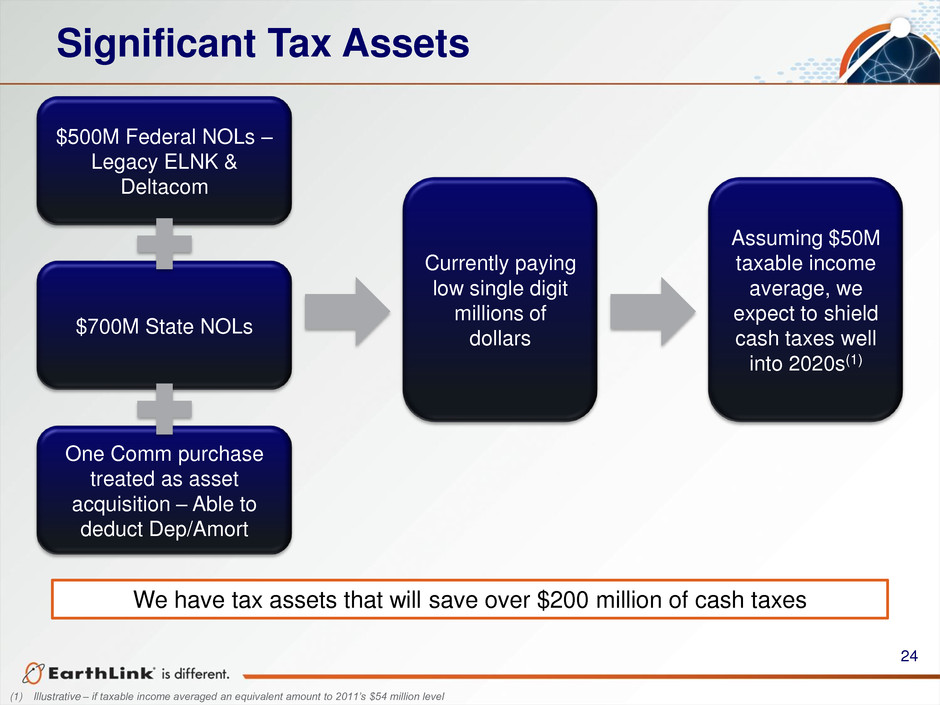

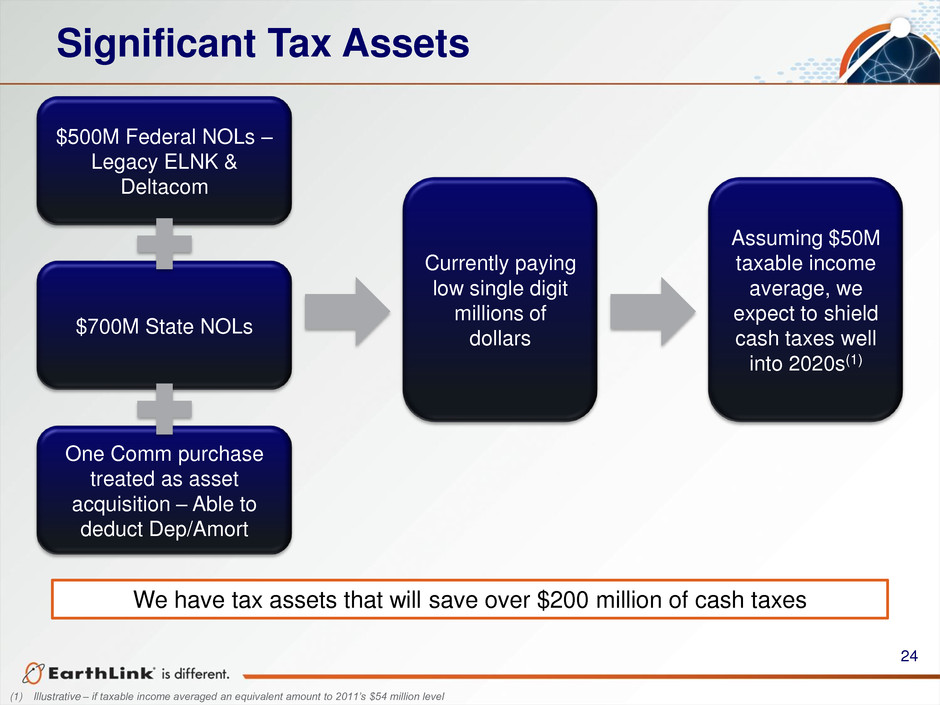

24 Significant Tax Assets We have tax assets that will save over $200 million of cash taxes $500M Federal NOLs – Legacy ELNK & Deltacom $700M State NOLs One Comm purchase treated as asset acquisition – Able to deduct Dep/Amort Currently paying low single digit millions of dollars Assuming $50M taxable income average, we expect to shield cash taxes well into 2020s(1) (1) Illustrative – if taxable income averaged an equivalent amount to 2011’s $54 million level

25 Long Term Opportunity

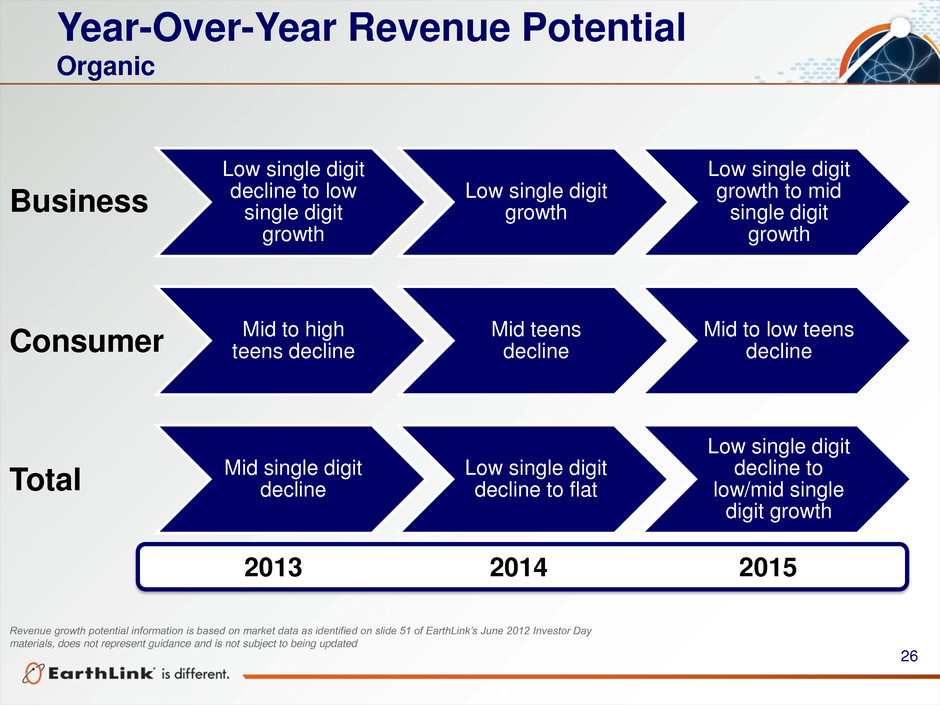

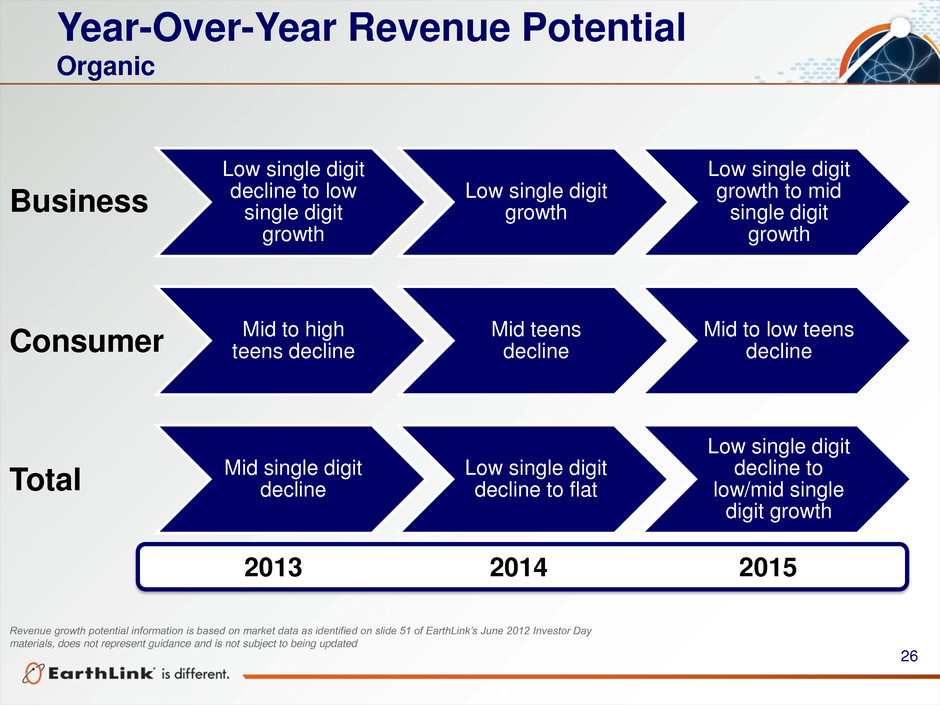

26 Year-Over-Year Revenue Potential Organic Revenue growth potential information is based on market data as identified on slide 51 of EarthLink’s June 2012 Investor Day materials, does not represent guidance and is not subject to being updated Low single digit decline to low single digit growth Low single digit growth Low single digit growth to mid single digit growth 2013 2014 2015 Business Mid to high teens decline Mid teens decline Mid to low teens decline Consumer Mid single digit decline Low single digit decline to flat Low single digit decline to low/mid single digit growth Total

27 Adjusted EBITDA Margin % Total Company Margin Trends Organic Gross Margin % Positive Impacts • Selling solutions not commodities • Price increase opportunities • Network grooming • Arrest decline in network scale Negative Impacts • Consumer to business mix shift • Customer write-downs • Losing scale in immediate term (28% of COR is fixed) Gross Margin was ~53% in Q2 after adjusting for a Q2 regulatory reserve accrual. We expect margins to contract to the low 50s over the next ~2 years, due primarily to the mix of Business and Consumer, with opportunity to subsequently grow as IT services comprise more of the base. Positive Impacts • Synergies • Ongoing operating improvements and efficiencies Negative Impacts • GM declines in near term (see above) • Continuing mix shift from Consumer to Business • Investments in IT Services Adjusted EBITDA Margin was ~22% in Q2 after adjusting for a Q2 regulatory reserve accrual. We expect margins to contract ~150 - ~250 basis points over the next ~2 years. Margins could then begin to expand as we layer on additional operational improvements. Margin potential information does not represent guidance and is not subject to being updated. Based on Revenue growth potential information on slide 26 Adjusted EBITDA is a non-GAAP measure. See appendix for additional information on non-GAAP measures

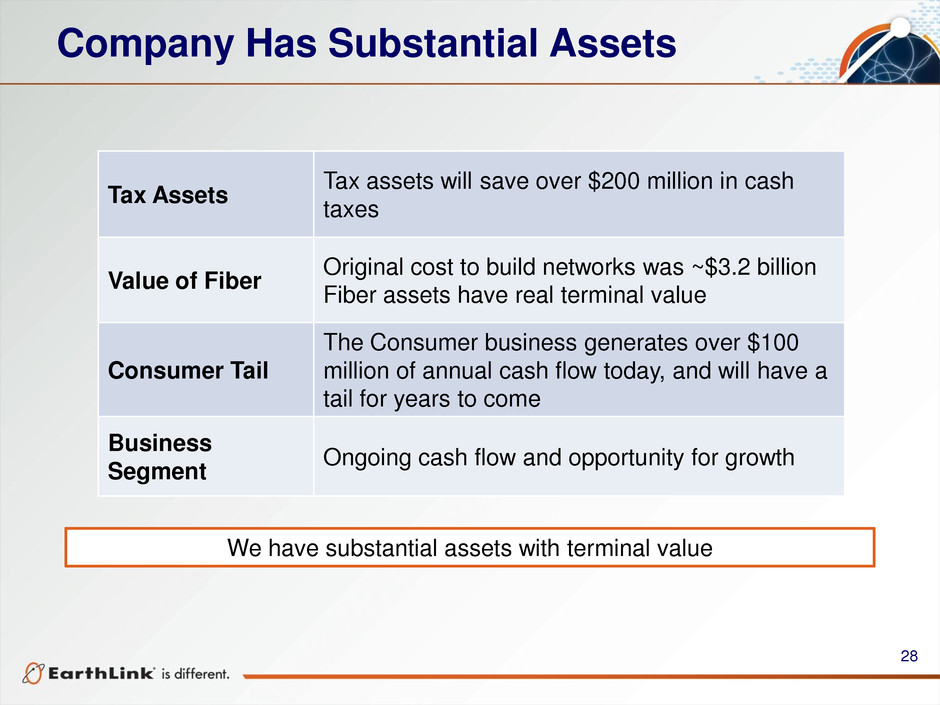

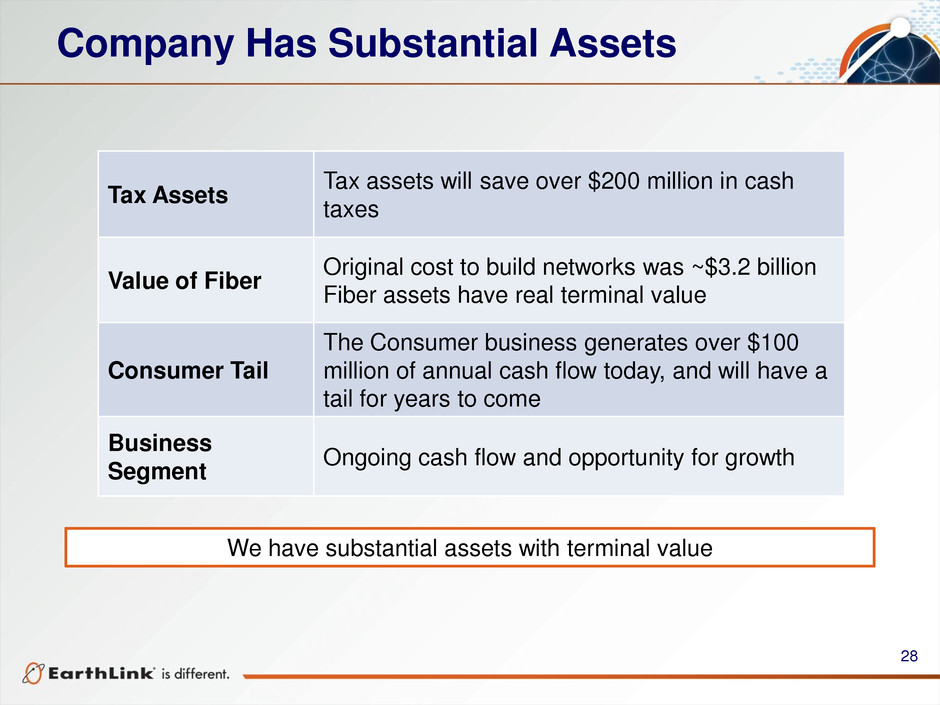

28 Company Has Substantial Assets We have substantial assets with terminal value Tax Assets Tax assets will save over $200 million in cash taxes Value of Fiber Original cost to build networks was ~$3.2 billion Fiber assets have real terminal value Consumer Tail The Consumer business generates over $100 million of annual cash flow today, and will have a tail for years to come Business Segment Ongoing cash flow and opportunity for growth

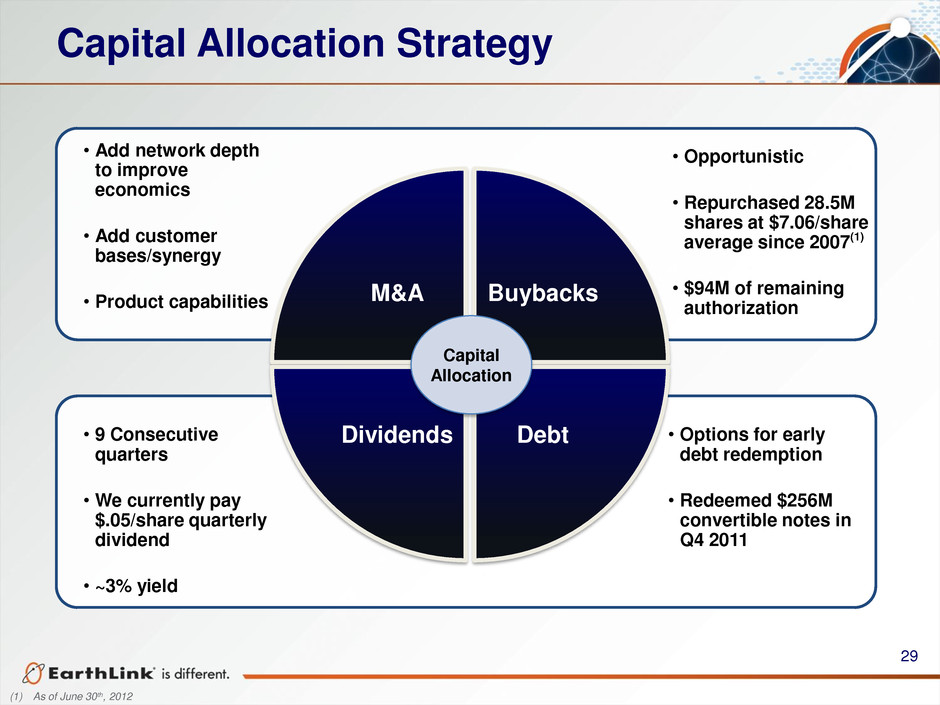

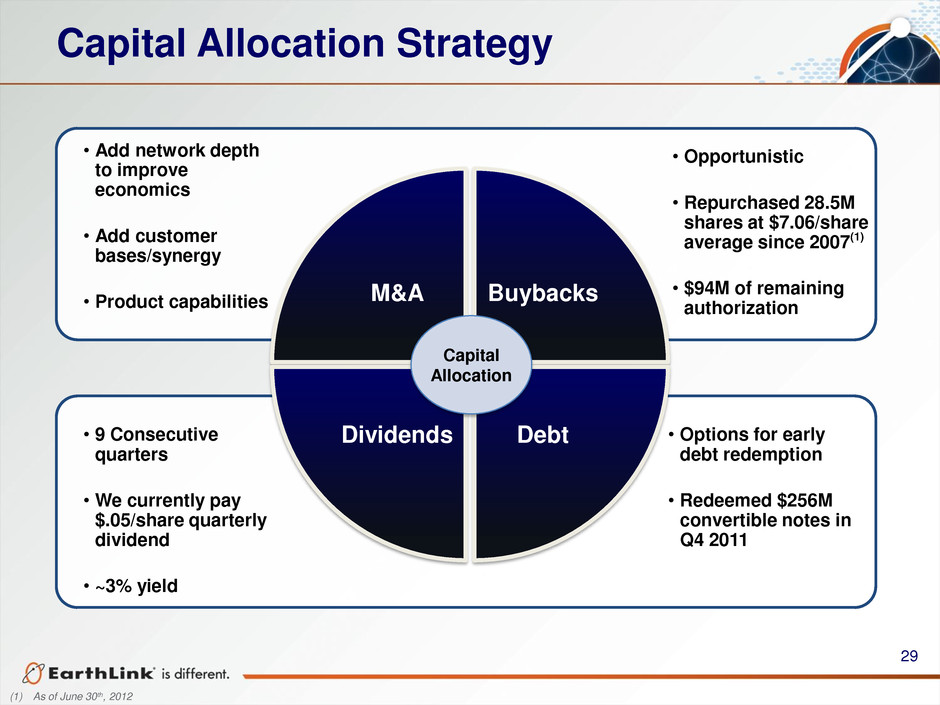

29 Capital Allocation Strategy • Options for early debt redemption • Redeemed $256M convertible notes in Q4 2011 • 9 Consecutive quarters • We currently pay $.05/share quarterly dividend • ~3% yield • Add network depth to improve economics • Add customer bases/synergy • Product capabilities M&A Buybacks Debt Dividends Capital Allocation • Opportunistic • Repurchased 28.5M shares at $7.06/share average since 2007(1) • $94M of remaining authorization (1) As of June 30th, 2012

30 Summary IT Services is an emerging market with tremendous opportunity Integration while ramping sales is complex, but we have a solid plan and are continuing to make progress We are financially strong • We generate cash • We have the financial platform to support our business strategy • We can capitalize on the opportunities ahead We are shareholders, and think like shareholders

31 Appendix

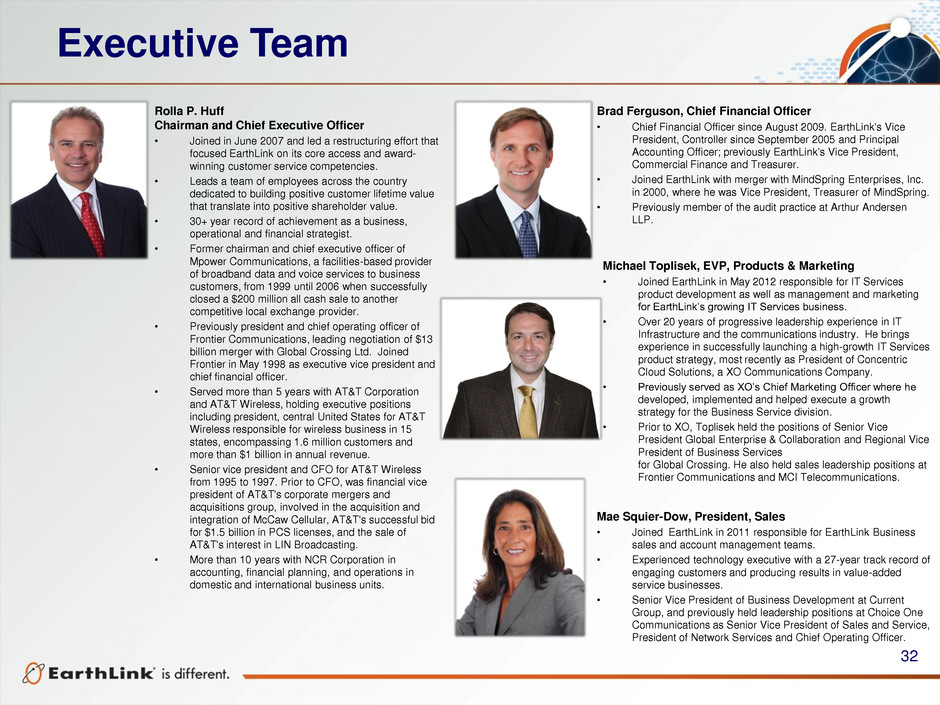

32 Executive Team Rolla P. Huff Chairman and Chief Executive Officer • Joined in June 2007 and led a restructuring effort that focused EarthLink on its core access and award- winning customer service competencies. • Leads a team of employees across the country dedicated to building positive customer lifetime value that translate into positive shareholder value. • 30+ year record of achievement as a business, operational and financial strategist. • Former chairman and chief executive officer of Mpower Communications, a facilities-based provider of broadband data and voice services to business customers, from 1999 until 2006 when successfully closed a $200 million all cash sale to another competitive local exchange provider. • Previously president and chief operating officer of Frontier Communications, leading negotiation of $13 billion merger with Global Crossing Ltd. Joined Frontier in May 1998 as executive vice president and chief financial officer. • Served more than 5 years with AT&T Corporation and AT&T Wireless, holding executive positions including president, central United States for AT&T Wireless responsible for wireless business in 15 states, encompassing 1.6 million customers and more than $1 billion in annual revenue. • Senior vice president and CFO for AT&T Wireless from 1995 to 1997. Prior to CFO, was financial vice president of AT&T's corporate mergers and acquisitions group, involved in the acquisition and integration of McCaw Cellular, AT&T's successful bid for $1.5 billion in PCS licenses, and the sale of AT&T's interest in LIN Broadcasting. • More than 10 years with NCR Corporation in accounting, financial planning, and operations in domestic and international business units. Brad Ferguson, Chief Financial Officer • Chief Financial Officer since August 2009. EarthLink's Vice President, Controller since September 2005 and Principal Accounting Officer; previously EarthLink's Vice President, Commercial Finance and Treasurer. • Joined EarthLink with merger with MindSpring Enterprises, Inc. in 2000, where he was Vice President, Treasurer of MindSpring. • Previously member of the audit practice at Arthur Andersen LLP. Michael Toplisek, EVP, Products & Marketing • Joined EarthLink in May 2012 responsible for IT Services product development as well as management and marketing for EarthLink’s growing IT Services business. • Over 20 years of progressive leadership experience in IT Infrastructure and the communications industry. He brings experience in successfully launching a high-growth IT Services product strategy, most recently as President of Concentric Cloud Solutions, a XO Communications Company. • Previously served as XO’s Chief Marketing Officer where he developed, implemented and helped execute a growth strategy for the Business Service division. • Prior to XO, Toplisek held the positions of Senior Vice President Global Enterprise & Collaboration and Regional Vice President of Business Services for Global Crossing. He also held sales leadership positions at Frontier Communications and MCI Telecommunications. Mae Squier-Dow, President, Sales • Joined EarthLink in 2011 responsible for EarthLink Business sales and account management teams. • Experienced technology executive with a 27-year track record of engaging customers and producing results in value-added service businesses. • Senior Vice President of Business Development at Current Group, and previously held leadership positions at Choice One Communications as Senior Vice President of Sales and Service, President of Network Services and Chief Operating Officer.

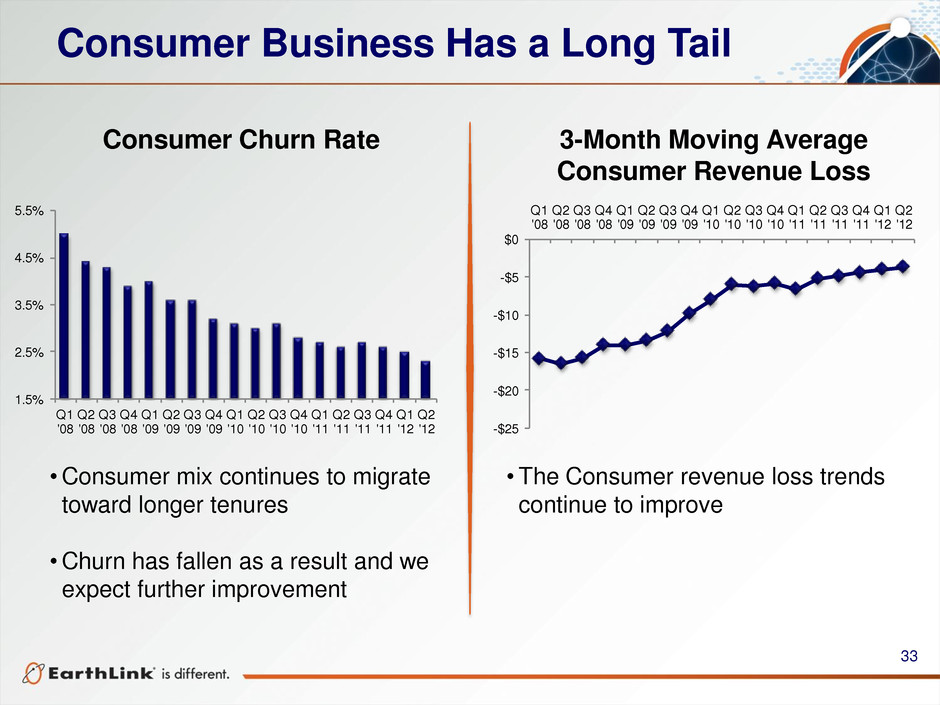

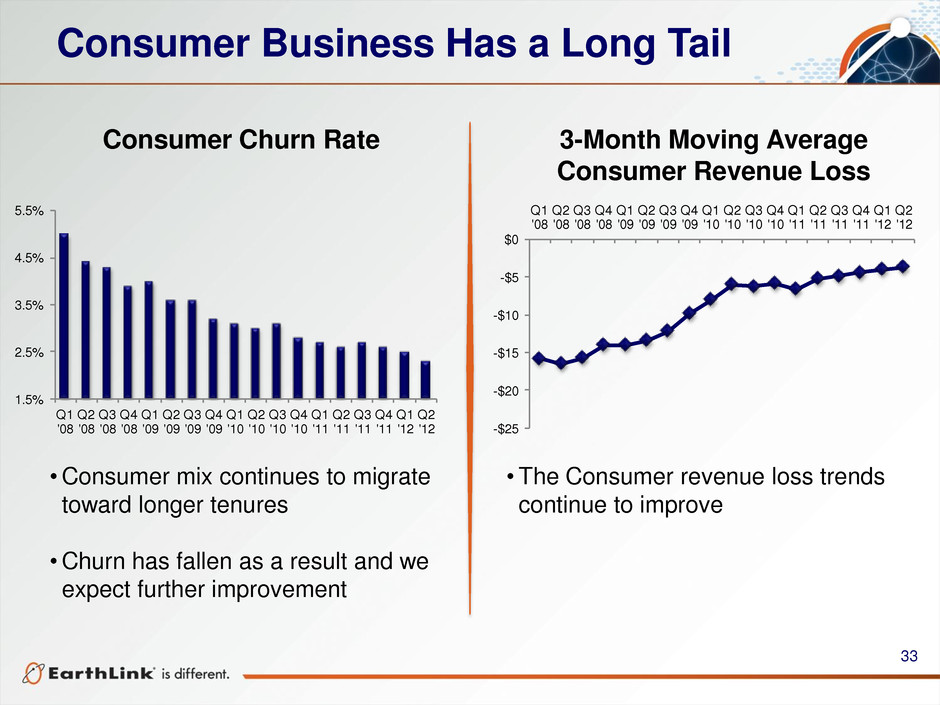

33 Consumer Business Has a Long Tail Consumer Churn Rate 3-Month Moving Average Consumer Revenue Loss •Consumer mix continues to migrate toward longer tenures •Churn has fallen as a result and we expect further improvement •The Consumer revenue loss trends continue to improve 1.5% 2.5% 3.5% 4.5% 5.5% Q1 '08 Q2 '08 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Q3 '09 Q4 '09 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12-$25 -$20 -$15 -$10 -$5 $0 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Q3 '09 Q4 '09 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12

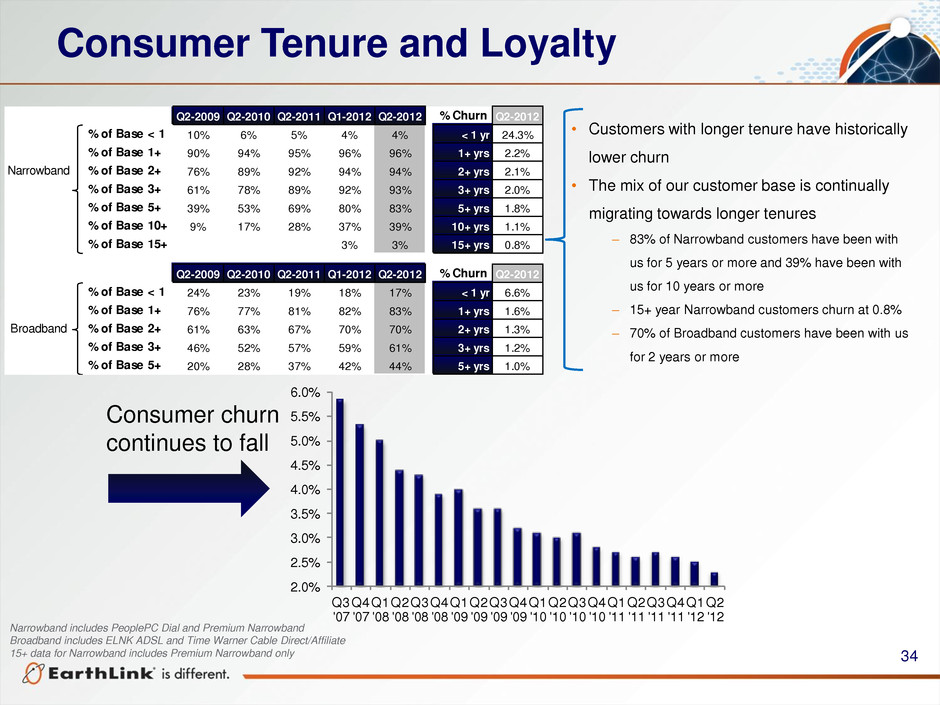

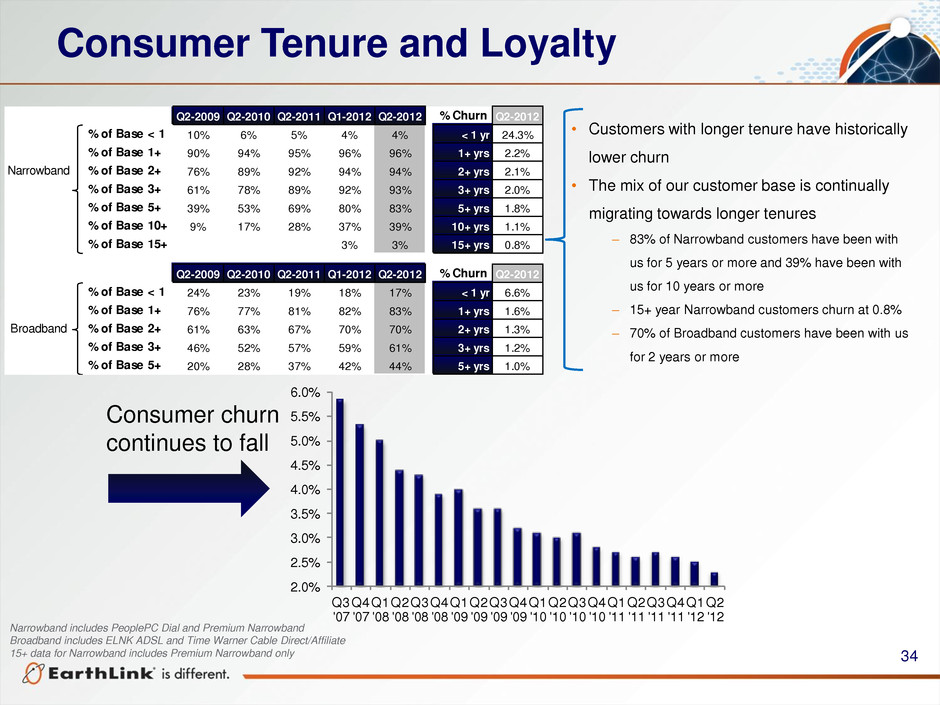

34 Consumer Tenure and Loyalty • Customers with longer tenure have historically lower churn • The mix of our customer base is continually migrating towards longer tenures – 83% of Narrowband customers have been with us for 5 years or more and 39% have been with us for 10 years or more – 15+ year Narrowband customers churn at 0.8% – 70% of Broadband customers have been with us for 2 years or more Narrowband includes PeoplePC Dial and Premium Narrowband Broadband includes ELNK ADSL and Time Warner Cable Direct/Affiliate 15+ data for Narrowband includes Premium Narrowband only Consumer churn continues to fall 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Q3 '09 Q4 '09 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q2-2009 Q2-2010 Q2-2011 Q1-2012 Q2-2012 % Churn Q2-2012 % of Base < 1 10% 6% 5% 4% 4% < 1 yr 24.3% % of Base 1+ 90% 94% 95% 96% 96% 1+ yrs 2.2% % of Base 2+ 76% 89% 92% 94% 94% 2+ yrs 2.1% % of Base 3+ 61% 78% 89% 92% 93% 3+ yrs 2.0% % of Base 5+ 39% 53% 69% 80% 83% 5+ yrs 1.8% % of Base 10+ 9% 17% 28% 37% 39% 10+ yrs 1.1% % of Base 15+ 3% 3% 15+ yrs 0.8% Q2-2009 Q2-2010 Q2-2011 Q1-2012 Q2-2012 % Churn Q2-2012 % of Bas < 1 24% 23% 19% 18% 17% < 1 yr 6.6% % of Ba e 1+ 76% 77% 81% 82% 83% 1+ yrs 1.6% % of Bas 2+ 61% 63% 67% 70% 70% 2+ yrs 1.3% % of B se 3+ 46% 52% 57% 59% 61% 3+ yrs 1.2% % of Base 5+ 20% 28% 37% 42% 44% 5+ yrs 1.0% Narrowband Broadband

35 Cautionary Information Regarding Forward Looking Statements This presentation includes “forward-looking” statements (rather than historical facts) that are subject to risks and uncertainties that could cause actual results to differ materially from those described. Although we believe that the expectations expressed in these forward-looking statements are reasonable, we cannot promise that our expectations will turn out to be correct. Our actual results could be materially different from and worse than our expectations. We disclaim any obligation to update any forward-looking statements contained herein, except as may be required pursuant to applicable law. With respect to forward-looking statements in this press release, the company seeks the protections afforded by the Private Securities Litigation Reform Act of 1995. These risks include: uncertainties (1) that we may not be able to execute our strategy to grow our business services revenue, especially revenue from advanced products, in an expeditious manner, which could adversely impact our results of operations and cash flows; (2) that we may be unsuccessful or experience delays in integrating acquisitions into our business while we develop our Business Services advanced product portfolio, which could result in operating difficulties, losses and other adverse consequences; (3) that we may be unable to successfully identify, manage and assimilate future acquisitions, which could adversely affect our results of operations; (4) that if we are unable to adapt to changes in technology and customer demands, we may not remain competitive, and our revenues and operating results could suffer; (5) that our failure to achieve operating efficiencies will adversely affect our results of operations; (6) that unfavorable general economic conditions could harm our business; (7) that we face significant competition in the communications and managed IT services industry that could reduce our profitability; (8) that decisions by the Federal Communications Commission relieving incumbent carriers of certain regulatory requirements, and possible further deregulation in the future, may restrict our ability to provide services and may increase the costs we incur to provide these services; (9) that if we are unable to interconnect with AT&T, Verizon and other incumbent carriers on acceptable terms, our ability to offer competitively priced local telephone services will be adversely affected; (10) that our operating performance will suffer if we are not offered competitive rates for the access services we need to provide our long distance services; (11) that we may experience reductions in switched access and reciprocal compensation revenue; (12) that failure to obtain and maintain necessary permits and rights-of-way could interfere with our network infrastructure and operations; (13) that we have substantial business relationships with several large telecommunications carriers, and some of our customer agreements may not continue due to financial difficulty, acquisitions, non-renewal or other factors, which could adversely affect our revenue and results of operations; (14) that our commercial and alliance arrangements may not be renewed or may not generate expected benefits, which could adversely affect our results of operations; (15) that our consumer business is dependent on the availability of third-party network service providers; (16) that we face significant competition in the Internet industry that could reduce our profitability; (17) that the continued decline of our consumer access subscribers, combined with the change in mix of our consumer access base from narrowband to broadband, will adversely affect our results of operations; (18) that potential regulation of Internet service providers could adversely affect our operations; (19) that we may be unable to hire and retain sufficient qualified personnel, including Business Services sales personnel, and that the loss of any of our key executive officers could adversely affect us; (20) that privacy concerns relating to our business could damage our reputation and deter current and potential users from using our services; (21) that security breaches could damage our reputation and harm our operating results; (22) that interruption or failure of our network and information systems and other technologies could impair our ability to provide our services, which could damage our reputation and harm our operating results; (23) that our business depends on effective business support systems and processes; (24) that government regulations could adversely affect our business or force us to change our business practices; (25) that our business may suffer if third parties are unable to provide services or terminate their relationships with us; (26) that we may not be able to protect our intellectual property; (27) that we may be accused of infringing upon the intellectual property rights of third parties, which is costly to defend and could limit our ability to use certain technologies in the future; (28) that if we, or other industry participants, are unable to successfully defend against legal actions, we could face substantial liabilities or suffer harm to our financial and operational prospects; (29) that we may be required to recognize additional impairment charges on our goodwill and intangible assets, which would adversely affect our results of operations and financial position; (30) that we may have exposure to greater than anticipated tax liabilities and the use of our net operating losses and certain other tax attributes could be limited in the future; (31) that our indebtedness could adversely affect our financial health and limit our ability to react to changes in our industry; (32) that we may require additional capital to support business growth, and this capital may not be available to us on acceptable terms, or at all; (33) that we may reduce, or cease payment of, quarterly cash dividends; (34) that our stock price may be volatile; and (35) that provisions of our third restated certificate of incorporation, amended and restated bylaws and other elements of our capital structure could limit our share price and delay a change of management. These risks and uncertainties, as well as other risks and uncertainties that could cause our actual results to differ significantly from management’s expectations, are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors included in our Annual Report on Form 10-K for the year ended December 31, 2011.

36 Non GAAP Information EarthLink Non-GAAP Measures Adjusted EBITDA is defined by EarthLink as net income (loss) before interest expense and other, net, income taxes, depreciation and amortization, stock-based compensation expense, impairment of goodwill and intangible assets, and restructuring, acquisition and integration-related costs. Unlevered Free Cash Flow is defined by EarthLink as net income (loss) before interest expense and other, net, income taxes, depreciation and amortization, stock-based compensation expense, impairment of goodwill and intangible assets, and restructuring, acquisition and integration- related costs, less cash used for purchases of property and equipment. Adjusted EBITDA and Unlevered Free Cash Flow are non-GAAP measures and are not determined in accordance with U.S. generally accepted accounting principles. These non-GAAP financial measures are commonly used in the industry and are presented because management believes they provide relevant and useful information to investors. Management uses these non-GAAP financial measures to evaluate the performance of its business, for budget planning purposes and as factors in its employee compensation programs. Management believes that excluding the effects of certain non-cash and non-operating items enables investors to better understand and analyze the current period’s results and provides a better measure of comparability. There are limitations to using these non-GAAP financial measures. Adjusted EBITDA and Unlevered Free Cash Flow are not indicative of cash provided or used by operating activities and may differ from comparable information provided by other companies. Adjusted EBITDA and Unlevered Free Cash Flow should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with U.S. generally accepted accounting principles.

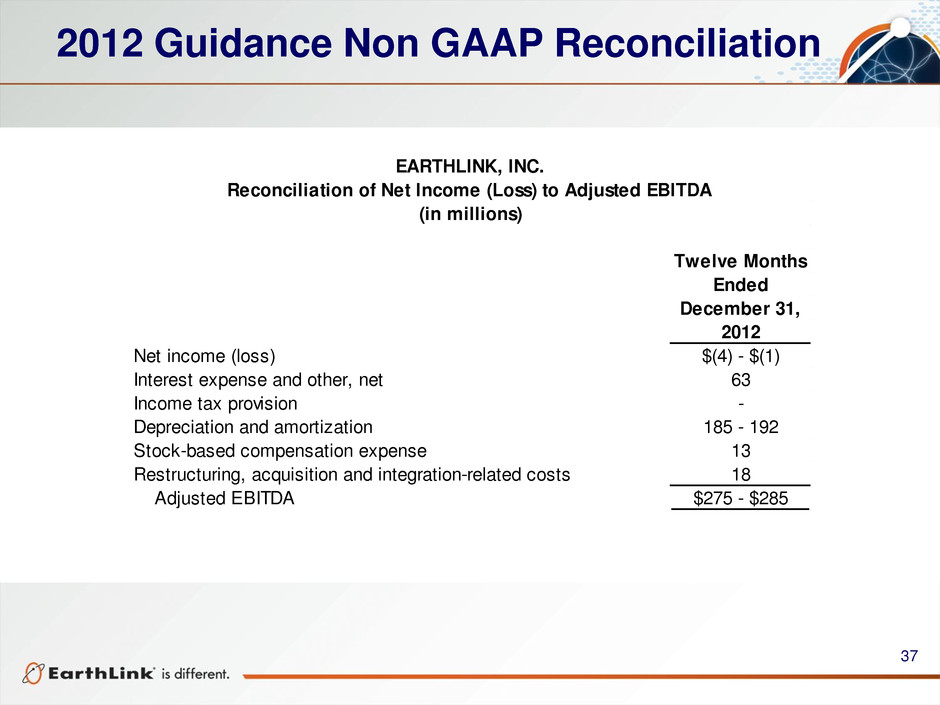

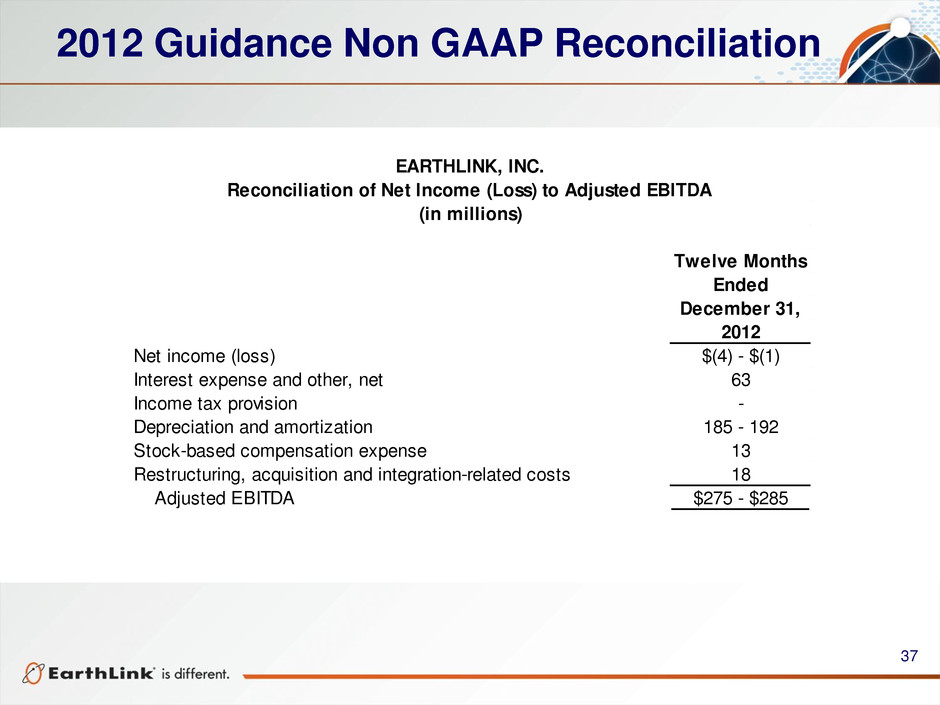

37 2012 Guidance Non GAAP Reconciliation Twelve Months Ended December 31, 2012 Net income (loss) $(4) - $(1) Interest expense and other, net 63 Income tax provision - Depreciation and amortization 185 - 192 Stock-based compensation expense 13 Restructuring, acquisition and integration-related costs 18 Adjusted EBITDA $275 - $285 EARTHLINK, INC. Reconciliation of Net Income (Loss) to Adjusted EBITDA (in millions)

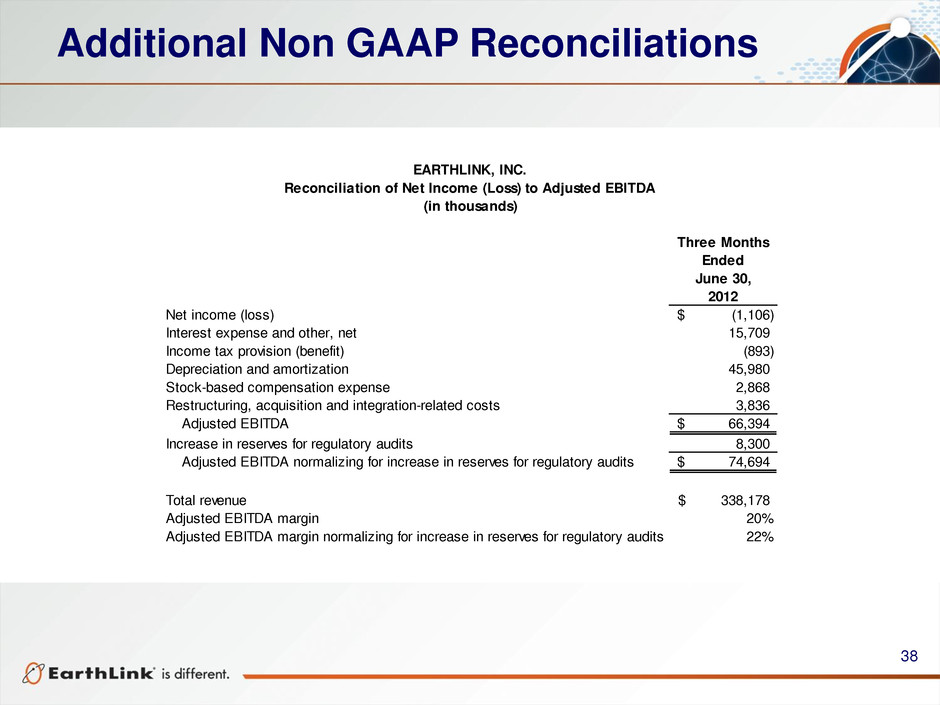

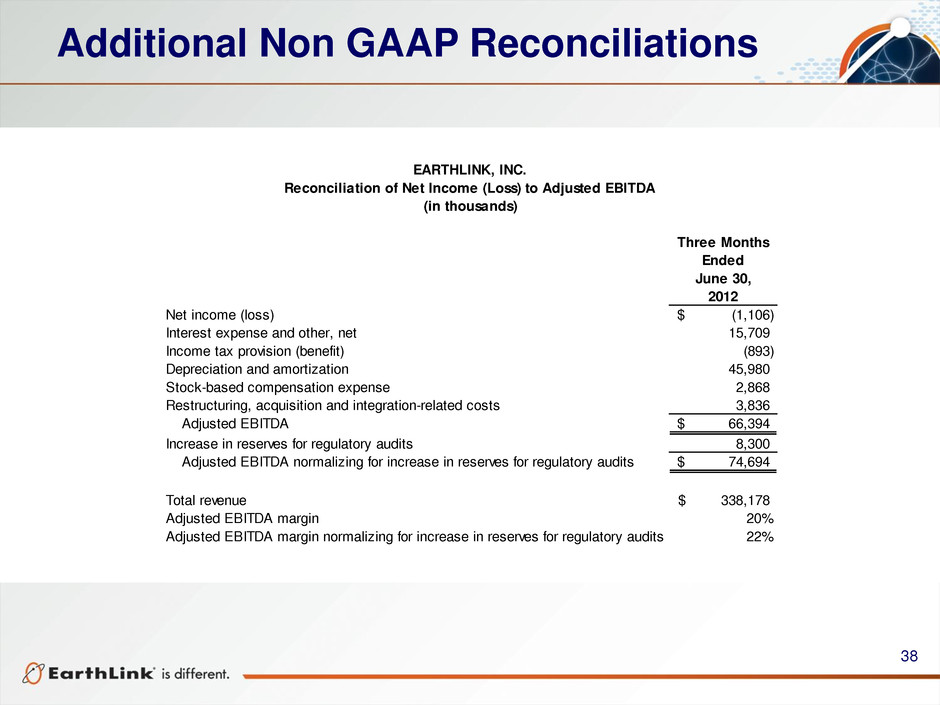

38 Additional Non GAAP Reconciliations Three Months Ended June 30, 2012 Net income (loss) (1,106)$ Interest expense and other, net 15,709 Income tax provision (benefit) (893) Depreciation and amortization 45,980 Stock-based compensation expense 2,868 Restructuring, acquisition and integration-related costs 3,836 Adjusted EBITDA 66,394$ Increase in reserves for regulatory audits 8,300 Adjusted EBITDA normalizing for increase in reserves for regulatory audits 74,694$ Total revenue 338,178$ Adjusted EBITDA margin 20% Adjusted EBITDA margin normalizing for increase in reserves for regulatory audits 22% EARTHLINK, INC. Reconciliation of Net Income (Loss) to Adjusted EBITDA (in thousands)

39 Additional Non GAAP Reconciliations Three Months Ended March 31, 2012 Net cash (used in) provided by operating activities 66,211$ Income tax provision (benefit) 3,174 Non-cash income taxes (1,244) Interest expense and other, net 15,759 Amortization of debt discount, premium and issuance costs 494 Restructuring, acquisition and integration-related costs 3,521 Changes in operating assets and liabilities (9,989) Purchases of property and equipment (31,775) Other, net (284) Unlevered Free Cash Flow 45,867$ Shares outstanding as of June 30, 2012 105,677 Unlevered free cash flow per share 0.43$ Ending share price as of August 7, 2012 6.78$ EBITDA less cap ex yield 6% Net cash used in investing activities (50,212) Net cash used in financing activities (5,779) EARTHLINK, INC. Reconciliation of Net Cash Flows from Operating Activities to Unlevered Free Cash Flow (in thousands)