Exhibit 99.2

KOBEX MINERALS INC. Annual General and Special Meeting to be held on July 8, 2013 Notice of Annual General and Special Meeting and Information Circular June 6, 2013 |

| |

KOBEX MINERALS INC.

Suite 1700 – 700 West Pender Street

Vancouver, B.C.

V6C 1G8

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual general and special meeting (the “Meeting”) of the shareholders of Kobex Minerals Inc. (the “Company”) will be held at Unit 950 – 609 Granville Street, Vancouver, British Columbia on Monday July 8, 2013, at 2:00 p.m. At the Meeting, the shareholders will consider resolutions to:

1. elect directors for the ensuing year;

| 2. | appoint KPMG LLP, Chartered Accountants, as auditor of the Company for the ensuing year and authorize the directors to determine the remuneration to be paid to the auditor; |

| 3. | approve the Company’s stock option plan, pursuant to the requirement by the policies of the TSX Venture Exchange; |

| 4. | consider and, if deemed appropriate, approve by ordinary resolution, the ratification and approval of an advance notice policy adopted by the board of directors, as more particularly set out in the section of the information circular entitled “Particulars of Matters to be Acted Upon - Ratification and Approval of Advance Notice Policy”; and |

| 5. | transact such other business as may properly be put before the Meeting. |

All shareholders are entitled to attend and vote at the Meeting in person or by proxy. The Board of Directors (the “Board”) requests that all shareholders who will not be attending the Meeting in person read, date and sign the accompanying proxy and deliver it to Computershare Investor Services Inc. (“Computershare”). If a shareholder does not deliver a proxy to Computershare, Attention: Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, by 10:00 a.m. (Vancouver, British Columbia time) on Thursday, July 4, 2013 (or before 48 hours, excluding Saturdays, Sundays and holidays before any adjournment of the meeting at which the proxy is to be used) then the shareholder will not be entitled to vote at the Meeting by proxy. Only shareholders of record at the close of business on May 14, 2013 will be entitled to vote at the Meeting.

A circular and a form of proxy accompany this notice.

DATED at Vancouver, British Columbia, the 6th day of June, 2013.

ON BEHALF OF THE BOARD OF

KOBEX MINERALS INC.

(signed) “Alfred Hills”

Alfred Hills

President and Chief Executive Officer

KOBEX MINERALS INC.

Suite 1700 – 700 West Pender Street

Vancouver, B.C.

V6C 1G8

INFORMATION CIRCULAR

(as at June 6, 2013 except as otherwise indicated)

SOLICITATION OF PROXIES

This information circular (the “Circular”) is provided in connection with the solicitation of proxies by the Management of Kobex Minerals Inc. (the “Company”). The form of proxy which accompanies this Circular (the “Proxy”) is for use at the annual general and special meeting of the shareholders of the Company to be held on Monday, July 8, 2013 (the “Meeting”), at the time and place set out in the accompanying notice of Meeting (the “Notice of Meeting”). The Company will bear the cost of this solicitation. The solicitation will be made by mail, but may also be made by telephone.

APPOINTMENT AND REVOCATION OF PROXY

The persons named in the Proxy have been approved by the management of the Company. A registered shareholder who wishes to appoint some other person to serve as their representative at the Meeting may do so by striking out the printed names and inserting the desired person’s name in the blank space provided. The completed Proxy should be delivered to Computershare Investor Services Inc. (“Computershare”) by 10:00 a.m. (local time in Vancouver, British Columbia) on Thursday, July 4, 2013, or before 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting at which the Proxy is to be used.

The Proxy may be revoked by:

| (a) | signing a proxy with a later date and delivering it at the time and place noted above; |

| (b) | signing and dating a written notice of revocation and delivering it to Computershare or by transmitting a revocation by telephonic or electronic means, to Computershare, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of it, at which the Proxy is to be used, or delivering a written notice of revocation and delivering it to the Chairman of the Meeting on the day of the Meeting or adjournment of it; or |

| (c) | attending the Meeting or any adjournment of the Meeting and registering with the scrutineer as a shareholder present in person. |

Provisions Relating to Voting of Proxies

The shares represented by Proxy in the form provided to shareholders will be voted or withheld from voting by the designated holder in accordance with the direction of the registered shareholder appointing him. If there is no direction by the registered shareholder, those shares will be voted for all proposals set out in the Proxy and for the election of directors and the appointment of the auditors as set out in this Circular. The Proxy gives the person named in it the discretion to vote as such person sees fit on any amendments or variations to matters identified in the Notice of Meeting, or any other matters which may properly come before the Meeting. At the time of printing of this Circular, the management of the Company (the “Management”) knows of no other matters which may come before the Meeting other than those referred to in the Notice of Meeting.

Advice to Beneficial Holders of Common Shares

The information set forth in this section is of significant importance to many shareholders, as a substantial number of shareholders do not hold common shares in their own name. Shareholders who hold their common shares through their brokers, intermediaries, trustees or other persons, or who otherwise do not hold their common shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only proxies deposited by shareholders who appear on the records maintained by the Company’s registrar and transfer agent as registered holders of common shares will be recognized and acted upon at the Meeting. If common shares are listed in an account statement provided to a Beneficial Shareholder by a broker, then those common shares will, in all likelihood, not be registered in the shareholder’s name. Such common shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for CDS, Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms). In the United States, the vast majority of such common shares are registered under the name of Cede & Co., the registration name for The Depository Trust Company, which acts as nominee for many United States brokerage firms. Common shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted or withheld at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholder meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. The form of instrument of proxy supplied to a Beneficial Shareholder by its broker (or the agent of the broker) is substantially similar to the instrument of proxy provided directly to registered shareholders by the Company. However, its purpose is limited to instructing the registered shareholder (i.e., the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The vast majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. (“Broadridge”) in Canada. Broadridge typically prepares a machine-readable voting instruction form (“VIF”), mails those forms to Beneficial Shareholders and asks Beneficial Shareholders to return the VIFs to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting. A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote common shares directly at the Meeting. The VIFs must be returned to Broadridge (or instructions respecting the voting of common shares must otherwise be communicated to Broadridge) well in advance of the Meeting in order to have the common shares voted. If you have any questions respecting the voting of common shares held through a broker or other intermediary, please contact that broker or other intermediary for assistance.

The Notice of Meeting, Circular, Proxy and VIF, as applicable, are being provided to both registered shareholders and Beneficial Shareholders. Beneficial Shareholders fall into two categories - those who object to their identity being known to the issuers of securities which they own (“OBOs”) and those who do not object to their identity being made known to the issuers of the securities which they own (“NOBOs”). Subject to the provisions of National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), issuers may request and obtain a list of their NOBOs from intermediaries directly or via their transfer agent and may obtain and use the NOBO list for the distribution of proxy-related materials directly (not via Broadridge) to such NOBOs. If you are a Beneficial Shareholder and the Company or its agent has sent these materials directly to you, your name, address and information about your holdings of common shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding the common shares on your behalf.

Pursuant to the provisions of NI 54-101, the Company is providing the Notice of Meeting, Circular and Proxy or VIF, as applicable, to both registered owners of the securities and non-registered owners of the securities. If you are a non-registered owner, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. By choosing to send these materials to you directly, the Company (and not the intermediary holding common shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the VIF. As a result, if you are a non-registered owner of the securities, you can expect to receive a scannable VIF from Computershare. Please complete and return the VIF to Computershare in the envelope provided or by facsimile. In addition, telephone voting and internet voting instructions can be found on the VIF. Computershare will tabulate the results of the VIFs received from the Company’s NOBOs and will provide appropriate instructions at the Meeting with respect to the common shares represented by the VIFs they receive.

The Company’s OBOs can expect to be contacted by Broadridge or their brokers or their broker’s agents as set out above. The Company does not intend to pay for intermediaries to deliver the Notice of Meeting, Circular and VIF to OBOs and accordingly, if the OBO’s intermediary does not assume the costs of delivery of those documents in the event that the OBO wishes to receive them, the OBO may not receive the documentation.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting common shares registered in the name of his broker, a Beneficial Shareholder may attend the Meeting as proxyholder for the registered shareholder and vote the common shares in that capacity. NI 54-101 allows a Beneficial Shareholder who is a NOBO to submit to the Company or an applicable intermediary any document in writing that requests that the NOBO or a nominee of the NOBO be appointed as proxyholder. If such a request is received, the Company or an intermediary, as applicable, must arrange, without expenses to the NOBO, to appoint such NOBO or its nominee as a proxyholder and to deposit that proxy within the time specified in this Circular, provided that the Company or the intermediary receives such written instructions from the NOBO at least one business day prior to the time by which proxies are to be submitted at the Meeting, with the result that such a written request must be received by 10:00 a.m. (Vancouver time) on the day which is at least three business days prior to the Meeting. A Beneficial Shareholder who wishes to attend the Meeting and to vote their common shares as proxyholder for the registered shareholder, should enter their own name in the blank space on the VIF or such other document in writing that requests that the NOBO or a nominee of the NOBO be appointed as proxyholder and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker.

All references to shareholders in the Notice of Meeting, Circular and the accompanying Proxy are to registered shareholders of the Company as set forth on the list of registered shareholders of the Company as maintained by the registrar and transfer agent of the Company, Computershare, unless specifically stated otherwise.

Financial Statements

The audited financial statements of the Company for the year ended December 31, 2012, together with the auditor’s report on those statements and Management’s Discussion and Analysis, will be presented to the shareholders at the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As at May 14, 2013, being the record date for the Meeting, the Company’s authorized capital consists of unlimited common shares without par value, of which 46,082,413 are issued and outstanding, and 100,000,000 Preferred shares without par value, of which 18,283,053 have been designated as Preferred Series 1 and none are issued and outstanding. All common shares in the capital of the Company carry the right to one vote.

Shareholders registered as at the close of business on Tuesday, May 14, 2013, are entitled to attend and vote at the Meeting. Shareholders who wish to be represented by proxy at the Meeting must, to entitle the person appointed by the Proxy to attend and vote, deliver their Proxies at the place and within the time set forth in the notes to the Proxy. To the knowledge of the directors and executive officers of the Company, as of the date of this Circular, the following persons beneficially own, directly or indirectly, or exercise control or direction over, directly or indirectly, 10% or more of the issued and outstanding common shares of the Company:

Shareholder | Number of Shares | Percentage of Issued Capital |

Sprott Inc and Exploration Capital Partners 2006 Limited Partnership | 8,477,353 | 18.4 |

ELECTION OF DIRECTORS

The directors of the Company are elected annually and hold office until the next annual general meeting of the shareholders or until their successors are elected or appointed. As determined at a meeting of the Company’s directors on May 24, 2013, management of the Company proposes to nominate the persons listed below for election as directors of the Company to serve until their successors are elected or appointed. In the absence of instructions to the contrary, Proxies given pursuant to the solicitation by the Management will be voted for the nominees listed in this Circular. Management does not contemplate that any of the nominees will be unable to serve as a director. The number of directors of the Company was set at five at the Company’s last annual general meeting.

Pursuant to the Advance Notice Policy adopted by the board of directors of the Company on March 12, 2013 and discussed in further detail below, any additional director nominations for the Meeting must be received by the Company in compliance with the Advance Notice Policy no later than the close of business on Friday, June 7, 2013. At the time of printing this Circular to Shareholders no such nominations were received by the Company prior to such date, and therefore management’s nominees for election as directors set forth below shall be the only nominees eligible to stand for election at the Meeting.

The following table sets out the names of five nominees for election as directors, the offices they hold within the Company (if applicable), their occupations, the length of time they have served as directors of the Company, and the number of shares of the Company and its subsidiaries which each beneficially owns, directly or indirectly, or over which control or direction is exercised, as of the date of this Circular.

Name, province or state and country of residence and positions, current and former, if any, held in the Company | Principal occupation for last five years | Served as director since | Number of common shares beneficially owned, directly or indirectly, or controlled or directed as of the date of the circular(1) |

MICHAEL ATKINSON(2) British Columbia, Canada Director | President of Maverick Projects Inc. from July 2008 to the present. | December 9, 2008 | Nil |

PAUL van EEDEN(2)(3) Ontario, Canada Director | President of Cranberry Capital Inc. from February 2006 to the present. Director of Miranda Gold Corp., Evrim Resources Corp. and Synodon Inc. | March 13, 2013 | 3,586,500(4) |

E. KENNETH PAUL(3) Colorado, USA Proposed Director | Director of Evrim Resources Corp. (“Evrim”) from December 2010 to present. Chairman of Evrim from September 2012 to present. President of Springdale Mineral Resources, LLC from January 2010 to present. Director of Exploration of Newmont Mining Corporation from September 2004 to December 2009. | Nominee | Nil |

DAVID SCHMIDT(2) British Columbia, Canada Proposed Director | Self- Employed consultant to mineral exploration companies from 2000 to present. Chief Executive Officer, President and Director of Ryan Gold Corp. from 2010 to present. Chief Executive Officer, President and Director of Oceanside Capital Corp. from 2010 to 2011. | Nominee | Nil |

A. MURRAY SINCLAIR(3) British Columbia, Canada Proposed Director | Chairman of Sprott Resource Lending Corp. (“Sprott”) from May 2009 to present. Co-Chairman of Sprott from January 2008 to May 2009. Director of Katanga Mining Limited from May 1998 to July 2009. | Nominee | Nil |

Notes:

| (1) | The information as to common shares beneficially owned or controlled has been provided by the nominees themselves |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

| (4) | Held indirectly in the name of 2260761 Ontario Inc., a private company controlled by Paul van Eeden. |

The Company does not have an executive committee of its board of directors. No proposed director is being elected under any arrangement or understanding between the proposed director and any other person or company except the directors and executive officers of the Company acting solely in such capacity.

Corporate Cease Trade Orders or Bankruptcies

Other than set out below, none of the persons nominated as a director of the Company is, or within the ten years prior to the date of this Circular has been, a director or executive officer of any company, including the Company, that while that person was acting in that capacity:

| (a) | was the subject of a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days; or |

| (b) | was subject to an event that resulted, after the director ceased to be a director or executive officer of the company being the subject of a cease trade order or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

| (c) | within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. |

On February 22, 2002, February 25, 2002 and March 15, 2002, Katanga Mining Limited (formerly Balloach Resources Ltd. and New Inca Gold Ltd.) (“Katanga”) was issued cease trade orders by the Ontario, British Columbia and Alberta Securities Commissions, respectively, for failing to file financial statements and pay filing fees within their prescribed times. These orders were rescinded on September 20, 2002, October 1, 2003 and October 23, 2003, respectively, following the filing of the financial statements and payment of the outstanding fees. A. Murray Sinclair was a director of Katanga from May 1, 1998 to July 10, 2009.

Individual Bankruptcies

None of the persons nominated as a director of the Company has, within the ten years prior to the date of this Circular, become bankrupt or made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

Penalties or Sanctions

Other than set out below, none of the persons nominated as a director of the Company have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority, has entered into a settlement agreement with a securities regulatory authority or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable security holder making a decision about whether to vote for the proposed director.

On February 27, 2002 the British Columbia Securities Commission (“BCSC”) issued an order regarding a private placement of Etrion Corporation (formerly PetroFalcon Corporation and Prettium Industries Inc.) (“Etrion”) to Quest Ventures Ltd., a private company in which A. Murray Sinclair was a director from November 28, 2001 to June 4, 2003. The BCSC considered it to be in the public interest to remove the applicability of certain exemptions from the prospectus and registration requirements of the Securities Act (British Columbia) for Etrion until a shareholders meeting of Etrion was held. In addition, the BCSC removed the applicability of the same exemptions for Quest Ventures Ltd. in respect of the common shares received pursuant to the private placement. Approval of shareholders was received on May 23, 2002 and the BCSC reinstated the applicability of the exemptions from the prospectus and registration requirements for both companies shortly thereafter.

EXECUTIVE COMPENSATION

Named Executive Officers

During the financial year ended December 31, 2012, the Company had three Named Executive Officers (“NEOs”) of the Company, being: Alfred Hills, Chief Executive Officer (“CEO”) and President, Dr. Roman Shklanka, Chairman, and Geoffrey Bach, Chief Financial Officer (“CFO”).

“Named Executive Officer” means: (a) each Chief Executive Officer, (b) each Chief Financial Officer, (c) each of the three most highly compensated executive officers of the company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the Chief Executive Officer and Chief Financial Officer, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000; and (d) each individual who would be a Named Executive Officer under paragraph (c) but for the fact that the individual was neither an executive officer of the company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year.

COMPENSATION DISCUSSION & ANALYSIS

Compensation Discussion & Analysis

The compensation of the Company’s NEOs is determined by the Company’s Compensation Committee, a committee of the Company’s Board of Directors. The members of the Compensation Committee are currently Michael Atkinson, James C. O’Rourke, Paul van Eeden and Dr. Peter Bradshaw. Following the Meeting, it is anticipated that Paul van Eeden, E. Kenneth Paul and A. Murray Sinclair will comprise the Compensation Committee.

The Company’s compensation program is designed to provide competitive levels of compensation, a significant portion of which is dependent upon individual and corporate performance and contribution to increasing shareholder value. The Company recognizes the need to provide a total compensation package that will attract and retain qualified and experienced executives as well as align the compensation level of each executive to that executive’s level of responsibility. In general, a NEO’s compensation is comprised of salary and share option grants.

The objectives and reasons for this system of compensation are generally to allow the Company to remain competitive compared to its peers in attracting experienced personnel. The salaries and/or consulting fees are set on a basis of a review and comparison of compensation paid to executives at similar companies. Share option grants are designed to reward the NEOs for success on a similar basis as the shareholders of the Company, but these rewards are highly dependent upon the volatile stock market, much of which is beyond the control of the NEOs.

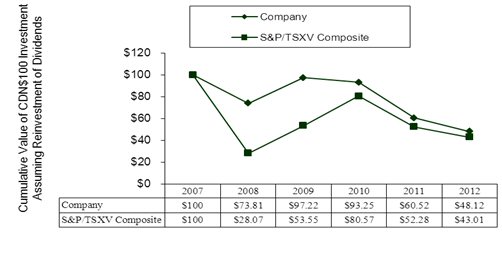

Share Performance

The Company’s shares have outperformed the Standard and Poor’s TSX Venture Composite Stock Index (the “Index”) over the 5 year period ending December 31, 2012. Unlike the Toronto Stock Exchange, the TSX Venture Exchange does not have a separate Metals and Mining Index. The Index thus may not be indicative of the performance of its industry peers on the Index.

NEO Compensation

NEO total compensation reported for 2007 and 2008 is not necessarily reflective of Company performance in those periods or easily comparable to compensation in subsequent years as during that period, the Company did not employ any full-time executives since the business was still in its start-up phase. NEO total compensation reported for the year ended 2009 increased significantly due largely to a $1.2 million termination payment paid to the previous President and Executive Officer of the Company as a result of the business combination amongst the Company (formerly known as IMA Exploration Inc.), International Barytex Resources Ltd. and Kobex Resources Ltd. Factoring out the termination payment paid in 2009, NEO total compensation for 2010 remained at a comparable level to 2009. NEO compensation remained at similar levels for 2011. Compensation in 2012 to the CFO, engaged in late 2011 as a consultant, was lower versus 2011 when the predecessor incumbent was an employee of the Company. Compensation of the two other NEOs remained at similar levels for 2012.

Option-Based Awards

Share option grants are made on the basis of the number of share options currently held, position, overall individual performance, anticipated contribution to the Company’s future success and the individual’s ability to influence corporate and business performance. The purpose of granting such share options is to assist the Company in compensating, attracting, retaining and motivating the officers, directors, employees and consultants of the Company and to closely align the personal interest of such persons to the interest of the shareholders.

The recipients of incentive share options and the terms of the share options granted are determined from time to time by the Compensation Committee, who is responsible for administering the Company’s stock option plan. The exercise price of the share options granted is generally determined by the market price at the time of grant. For further information on the Company’s share option plan, see “Confirmation of Stock Option Plan” below.

Compensation Governance and Risk Management

The Compensation Committee has responsibility for oversight of the Company’s overall human resources policies and procedures as well as review of executive and key employee compensation and compensation of the Company’s independent directors. The Compensation Committee meets at least twice a year and otherwise as required.

The current and proposed members of the Compensation Committee have direct experience which is relevant to their responsibilities as Compensation Committee members. All members hold or have held senior roles within public companies, and all current and proposed members have a good understanding of compensation programmes. They also have good financial understanding which allows them to assess the costs versus benefits of compensation plans. The members’ combined experience in the resource sector provides them with the understanding of the Company’s success factors and risks, which is very important when determining metrics for measuring success.

Neither the Board nor the Compensation Committee has proceeded to a formal evaluation of the implications of the risks associated with the Corporation’s compensation policies and practices. Risk management is a consideration of the Board when implementing its compensation programme, and the Board and the Compensation Committee does not believe that the Company’s compensation programme results in unnecessary or inappropriate risk taking including risks that are likely to have a material adverse effect on the Corporation.

The Company’s NEOs and directors are not permitted to purchase financial instruments, including for greater certainty, prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

SUMMARY COMPENSATION TABLE

Set out below is a summary of compensation paid or accrued during the Company’s three most recently completed financial years to the Company’s NEOs.

Summary Compensation Table

Name and principal position | Year | Salary ($) | Share- based awards ($) | Option- based awards ($)(1) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total compensation ($) |

Annual incentive plans | Long- term incentive plans |

Alfred Hills CEO & President | 2012 2011 2010 | 225,000 225,000 225,000 | Nil Nil Nil | Nil 44,048 240,274 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | 225,000 269,048 465,274 |

Name and principal position | Year | Salary ($) | Share- based awards ($) | Option- based awards ($)(1) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total compensation ($) |

Annual incentive plans | Long- term incentive plans |

Roman Shklanka(1) Chairman | 2012 2011 2010 | 150,000 150,000 150,000 | Nil Nil Nil | Nil 44,048 195,856 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | 150,000 194,048 345,856 |

Geoffrey Bach CFO | 2012 2011 | Nil Nil | Nil Nil | Nil 18,492 | Nil Nil | Nil Nil | Nil Nil | 126,850 8,775 | 126,850 27,267 |

| (1) | Dr. Shklanka resigned as Executive Chairman of the Company on May 31, 2013 but continues as Chairman of the Board of Directors |

Narrative Discussion

Effective October 1, 2009, the Company entered into an employment agreement with Dr. Roman Shklanka to provide services as the Company’s executive chairman. That agreement was terminated by a Settlement Agreement with the Company dated May 31, 2013 due to a change of control of the Company that occurred on May 24, 2013. Under the employment agreement, Dr. Shklanka received an annual salary of $150,000, and was also eligible for the Company’s benefit plan and stock option plan. During the year ended December 31, 2012, Dr. Shklanka was paid $150,000. Pursuant to the terms of the employment agreement, in the event the employment agreement is terminated by the Company within one year of change of control, Dr. Shklanka’s entitlement to severance pay is an amount equal to two years’ base salary, $10,000 in lieu of relocation costs, plus the cost of two years’ benefits other than incentive share options.

Effective November 9, 2009, the Company entered into an employment agreement with Mr. Alfred Hills to provide services in the capacity of the Company’s Chief Executive Officer. Under this agreement, Mr. Hills receives an annual salary of $225,000, and is also eligible for the Company’s benefit plan and stock option plan. During the year ended December 31, 2012, Mr. Hills was paid $225,000 under this agreement. Pursuant to the terms of this agreement, in the event the agreement is terminated by the Company within one year of change of control, or if Mr. Hills resigns within one year of change of control, Mr. Hills’ entitlement to severance pay will be an amount equal to two years’ base salary, $10,000 in lieu of relocation costs, plus the cost of two years’ benefits other than incentive share options, but including bonus (averaged up to three years as applicable).

There are no provisions in the consulting engagement agreement dated October 28, 2011 with Mr. Geoffrey Bach (CFO of the Company) with respect to entitlements to severance pay in the event the agreement is terminated by the Company.

INCENTIVE PLAN AWARDS

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth the outstanding option-based awards held by the NEOs of the Company at the end of the most recently completed financial year:

| | Option-based Awards | Share-based Awards |

| Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the- money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) |

Alfred Hills, CEO & President | 100,000 150,000 400,000 18,416 4,604 | 0.80 0.96 0.82 1.09 6.73 | Nov 8, 2016 Nov 1, 2015 Oct 26, 2014 Feb 25, 2014 Feb 5, 2013 | Nil | Nil | Nil |

Roman Shklanka, Chairman | 100,000 100,000 400,000 38,237 13,812 4,604 | 0.80 0.96 0.82 0.53 1.09 6.73 | Nov 8, 2016 Nov 1, 2015 Oct 26, 2014 Feb 26, 2014 Feb 25, 2014 Feb 5, 2013 | Nil | Nil | Nil |

Geoffrey Bach, CFO | 60,000 | 0.80 | Nov 8, 2016 | Nil | Nil | Nil |

| (1) | “In-the-Money Options” means the option exercise price is less than the market price per share of the Company’s common share on December 31, 2012 which was $0.49 per share. The value of “In-the-Money Options” is the number of “In-the-Money Options” multiplied by the excess of the market price for the Company’s common share on December 31, 2012 over the option exercise price. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth details of the value vested or earned for all incentive plan awards during the most recently completed financial year by each NEO:

Value Vested or Earned for Incentive Plan Awards During the Most

Recently Completed Financial Year

| Name | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

Alfred Hills, CEO & President | Nil | Nil | Nil |

Roman Shklanka, Chairman | Nil | Nil | Nil |

| Name | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

Geoffrey Bach, CFO | Nil | Nil | Nil |

| (1) | All options granted to the NEOs vested on the date of grant and the exercise price of such options was equal to the closing price of the Company’s shares as of the date of grant. |

The Company does not have a pension plan that provides for payments or benefits to the NEOs at, following, or in connection with retirement.

TERMINATION AND CHANGE OF CONTROL BENEFITS

Pursuant to the terms of the employment agreement with Dr. Roman Shklanka, the agreement was terminated by the Company on May 31, 2013 due to the change of control of the Company on May 24, 2013. Dr. Shklanka’s entitlement to severance pay was an amount equal to two years’ base salary plus $10,000 in lieu of re-location costs and the cost of two years’ benefits other than incentive share options and amounted to $327,031.

Pursuant to the terms of the employment agreement with Mr. Alfred Hills, in the event the agreement is terminated by the Company within one year of change of control, or if Mr. Hills resigns within one year of change of control, Mr. Hills’ entitlement to severance pay will be an amount equal to two years’ base salary plus $10,000 in lieu of re-location costs and the cost of two years’ benefits other than incentive share options, but including bonus (averaged up to three years as applicable). Also pursuant to the terms of the employment agreement with Mr. Hills, in the event Mr. Hills’ employment is terminated by the Company without just cause, Mr. Hills’ entitlement to severance pay will be an amount equal to one year’s base salary plus $10,000 in lieu of re-location costs and the cost of one year’s benefits other than incentive share options, but including bonus (averaged up to three years as applicable).

There is no provision in the consulting engagement agreement with Mr. Bach with respect to entitlements to severance pay in the event the agreement is terminated by the Company.

The table below sets out the amounts payable to the NEOs assuming the Named Executive Officer resigned or was terminated on December 31, 2012 following a change of control.

| Name | Base Salary ($) | Bonus ($) | Option-Based Awards ($) | All Other Compensation ($) | Total ($) |

Alfred Hills, CEO & President | 450,000 | Nil | Nil | 31,425 | 481,425 |

Roman Shklanka, Chairman | 300,000 | Nil | Nil | 27,031 | 327,031 |

Geoffrey Bach, CFO | Nil | Nil | Nil | Nil | Nil |

The table below sets out the estimated payments due to each of the NEO’s assuming termination by the Company without just cause on December 31, 2012.

| Name | Base Salary ($) | Bonus ($) | Option-Based Awards ($)(1) | All Other Compensation ($) | Total ($) |

Alfred Hills, CEO & President | 225,000 | Nil | Nil | 20,713 | 245,713 |

Roman Shklanka, Chairman | 150,000 | Nil | Nil | 18,516 | 168,516 |

Geoffrey Bach CFO | Nil | Nil | Nil | Nil | Nil |

DIRECTOR COMPENSATION

The following table sets forth the details of compensation provided to the directors, other than the Named Executive Officers during the Company’s most recently completed financial year:

Director Compensation Table

| Name | Fees Earned ($) | Share- based Awards ($) | Option- based Awards ($) | Non-Equity Incentive Plan Compensation ($) | Pension Value ($) | All Other Compensation ($) | Total ($) |

| Michael Atkinson | 50,000 | Nil | Nil | Nil | Nil | Nil | 50,000 |

Alexander Davidson(1) | 50,000 | Nil | Nil | Nil | Nil | Nil | 50,000 |

| James O’Rourke | 50,000 | Nil | Nil | Nil | Nil | Nil | 50,000 |

| (1) | Alexander Davidson resigned as a director of the Company effective December 31, 2012. |

Narrative Discussion

Directors of the Company who are also NEOs are not compensated for their services in their capacity as directors, although directors of the Company are reimbursed for their expenses incurred in connection with their services as directors. In addition, each of the independent directors received $50,000 in fees during the year ended December 31, 2012.

Option-based awards to the directors are granted pursuant to the terms of the Company’s stock option plan. The options are always granted at market price or higher. The valuation of the fair value of the options at the time of the grant is based on the Black Scholes model and includes the following assumptions: weighted average risk free rate, weighted average expected life, expected volatility and dividend yield.

There were no employment or consulting agreements entered into with the Company during the financial year ended December 31, 2012 with directors who are not a NEO of the Company.

INCENTIVE PLAN AWARDS

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth the outstanding share-based awards and option-based awards held by the directors of the Company who are not also NEOs at the end of the most recently completed financial year:

Outstanding Share-Based Awards and

Option-Based Awards

| | Option-based Awards | Share-based Awards |

| Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in- the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share- based awards that have not vested ($) |

| Michael Atkinson | 200,000 50,000 35,000 | 0.82 0.96 0.80 | Oct 26, 2014 Nov 1, 2015 Nov 8, 2016 | - - - | Nil | Nil |

Alexander Davidson(2) | 200,000 50,000 35,000 | 0.82 0.96 0.80 | Mar 31, 2013 Mar 31, 2013 Mar 31, 2013 | - - - | Nil | Nil |

| James O’Rourke | 38,237 200,000 50,000 35,000 | 0.53 0.82 0.96 0.80 | Feb 26, 2014 Oct 26, 2014 Nov 1, 2015 Nov 8, 2016 | - - - - | Nil | Nil |

Notes

| (1) | “In-the-Money Options” means the option exercise price is less than the market price per share of the Company’s common share on December 31, 2012 which was $0.49 per share. The value of “In-the-Money Options” is the number of “In-the-Money Options” multiplied by the excess of the market price for the Company’s common share on December 31, 2012 over the option exercise price. |

| (2) | Alexander Davidson resigned as a director of the Company effective December 31, 2012. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth details of the value vested or earned for all incentive plan awards during the most recently completed fiscal year by each director:

Value Vested or Earned for Incentive Plan Awards during the Most

Recently Completed Financial Year

| Name | Option-based awards Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

| Michael Atkinson | Nil | Nil | Nil |

Alexander Davidson(1) | Nil | Nil | Nil |

| James O’Rourke | Nil | Nil | Nil |

| Roman Shklanka | Nil | Nil | Nil |

| Alfred Hills | Nil | Nil | Nil |

Notes:

(1) Alexander Davidson resigned as a director of the Company effective December 31, 2012.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets out those securities of the Company which have been authorized for issuance under equity compensation plans as at December 31, 2012.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

Equity compensation plans approved by the security holders | 2,968,127 | $0.89 | 1,640,114 |

Equity compensation plans not approved by the security holders | Nil | Nil | Nil |

| Total | 2,968,127 | $0.89 | 1,640,114 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

A former director of Kobex Resources Ltd., a subsidiary of the Company, is indebted to such subsidiary in the amount of $16,413 at December 31, 2012. The loan was made in order to permit the former director to exercise share options of Kobex Resources Ltd. Other than this indebtedness, none of the current or former directors, executive officers, employees of the Company or its subsidiaries, the proposed nominees for election to the board of directors of the Company, or their respective associates or affiliates, are or have been indebted to the Company or its subsidiaries since the beginning of the last completed financial year of the Company.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company or any proposed nominee of management of the Company for election as a director of the Company, nor any associate or affiliate of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, since the beginning of the Company’s last financial year in matters to be acted upon at the Meeting.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

None of the persons who were directors or executive officers of the Company or a subsidiary of the Company at any time during the Company's last financial year, the proposed nominees for election to the board of directors of the Company, any person or company who beneficially owns, directly or indirectly, or who exercises control or direction over (or a combination of both) more than 10% of the issued and outstanding common shares of the Company, nor any associate or affiliate of those persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any transaction or proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

MANAGEMENT CONTRACTS

There are no management functions of the Company or its subsidiaries which are to any substantial degree performed by a person or company other than the directors or senior officers (or private companies controlled by them, either directly or indirectly) of the Company or its subsidiaries.

APPOINTMENT OF AUDITOR

Auditor

The management of the Company intends to nominate KPMG LLP (“KPMG”), Chartered Accountants, for appointment as auditor of the Company. Forms of proxy given pursuant to the solicitation by the management of the Company will, on any poll, be voted as directed and, if there is no direction, for the appointment of KPMG, Chartered Accountants, as auditor of the Company to hold office until the close of the next annual general meeting of the Company, at a remuneration to be fixed by the directors. KPMG is the former auditor of Barytex and Kobex Resources and was first appointed auditor of the Company on October 5, 2009 in connection with the Business Combination.

AUDIT COMMITTEE

The Company is required to have an audit committee comprised of not less than three directors, all of whom are, subject to certain exceptions, independent and financially literate (as such terms are defined in National Instrument 52-110 Audit Committees) (“NI 52-110”). On December 31, 2012, Mr. Alex Davidson resigned as a Director of the Company and as a member of the audit committee. Until the appointment of Mr. Van Eeden as a Director and member of the audit committee, the committee was comprised of two directors. As a consequence, the Company relied on the exemption in Section 3.5 of NI 52-110 (Death, Disability or Resignation of Audit Committee Member) for the period from December 31, 2012 until March 12, 2013. The Company's current audit committee consists of Michael Atkinson, James O’Rourke and Paul van Eeden. Following the Meeting, it is anticipated that the members of the Company’s audit committee will be Michael Atkinson, Paul van Eeden and David Schmidt.

Audit Committee Charter

The text of the audit committee’s charter is attached as Schedule “A” to this Circular.

Composition of Audit Committee and Independence

National Instrument 52-110 Audit Committees, (“NI 52-110”) provides that a member of an audit committee is “independent” if the member has no direct or indirect material relationship with the Company, which could, in the view of the Company’s board of directors, reasonably interfere with the exercise of the member’s independent judgement. In the opinion of the Company, all three members of the audit committee are independent.

Financial Literacy, Relevant Education and Experience

NI 52-110 provides that an individual is “financially literate” if he or she has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements. In the opinion of the Company, all three members of the Company’s current audit committee, and David Schmidt, a proposed member of the Company’s audit committee, are financially literate.

Mr. Atkinson (Current Member) is a director of the Company and is currently President of Maverick Projects Inc., a private consulting company focusing on merchant banking opportunities. He has over 15 years of investment and venture capital industry experience including assisting in forming Quest Capital Corp.

Mr. O’Rourke (Current Member) is a director of the Company and is President and Chief Executive Officer of Copper Mountain Mining Corporation. He is a mining engineer with over 35 years of mine development and operating experience including positions as former President of Huckleberry Mines Limited and Princeton Mining Corporation.

Mr. Van Eeden (Current Member) has significant business experience and is currently President of an investment holding company. Mr. Van Eeden serves on the board of three other public companies and is experienced in reading financial statements.

Mr. Schmidt (Proposed Member) is a nominee director of the Company and is a self-employed consultant to mineral exploration companies. For the last 13 years he has assisted companies with financing, corporate and financial disclosure, and corporate development. Mr. Schmidt completed his Bachelor of Applied Science (Mining) at the University of British Columbia in May 2000.

In these positions, each member of the Audit Committee has been responsible for receiving financial information relating to the various companies which they have acted for. Additionally, each member has obtained an understanding of financial position statements, comprehensive income statements and statements of cash flows and how these statements are integral in assessing the financial position of the Company and its operational results. Each member of the Audit Committee has an understanding of the business in which the Company is engaged in and has an appreciation for the relevant accounting principles for the business of the Company.

Reliance on Certain Exemptions

The Company relied on the exemption in Section 3.5 of NI 52-110 (Death, Disability or Resignation of Audit Committee Member) for the period from December 31, 2012 until March 12, 2013 (see the “Audit Committee” section above).

Since the commencement of the Company’s most recently completed financial year, the Company has not relied on:

| (a) | the exemption in section 2.4 (De Minimis Non-audit Services) of NI 52-110; |

| (b) | the exemption in section 3.2 (Initial Public Offerings) of NI 52-110; |

| (c) | the exemption in section 3.4 (Events Outside the Control of Member) of NI 52-110; |

| (d) | the exemption in subsection 3.3(2) (Controlled Companies) of NI 52-110; ; |

| (e) | the exemption in section 3.6 (Temporary Exemption for Limited and Exceptional Circumstances) of NI 52-110; |

| (f) | the exemption in section 3.8 (Acquisition of Financial Literacy) of NI 52-110; or |

| (g) | an exemption from NI 52-110, in whole or in part, granted under Part 8 (Exemptions). |

Audit Committee Oversight

Since the commencement of the Company’s most recently completed financial year, the audit committee of the Company has not made any recommendations to nominate or compensate an external auditor which were not adopted by the board of directors of the Company.

Pre-Approval Policies and Procedures

The audit committee has adopted a policy of pre-approving the engagement of any non-audit services with the Company’s Auditors.

Audit Fees

The following table sets forth the aggregate fees billed to the Company by KPMG LLP, Chartered Accountants, for services rendered in the last two fiscal years:

| | 2012 | | 2011 |

| | |

Audit fees(1) | $60,996 | | $50,800 |

Audit-related fees(2) | Nil | | Nil |

Tax fees(3) | 20,731 | | 11,732 |

| All other fees | NIL | | Nil |

| Total | $81,727 | | $62,532 |

Notes:

| (1) | “Audit fees” include aggregate fees billed by the Company’s external auditor in each of the last two fiscal years for audit fees. |

| (2) | “Audited related fees” include the aggregate fees billed in each of the last two fiscal years for assurance and related services by the Company’s external auditor that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “Audit fees” above. The services provided include employee benefit audits, due diligence assistance, accounting consultations on proposed transactions, internal control reviews and audit or attest services not required by legislation or regulation. |

| (3) | “Tax fees” include the aggregate fees billed in each of the last two fiscal years for professional services rendered by the Company’s external auditor for tax compliance, tax advice and tax planning. The services provided include tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from tax authorities. |

| (4) | “All other fees” include the aggregate fees billed in each of the last two fiscal years for products and services provided by the Company’s external auditor, other than “Audit fees”, “Audit related fees” and “Tax fees” above |

CORPORATE GOVERNANCE DISCLOSURE

National Instrument 58-101, Disclosure of Corporate Governance Practices, requires all companies to provide certain annual disclosure of their corporate governance practices with respect to the corporate governance guidelines (the “Guidelines”) adopted in National Policy 58-201. These Guidelines are not prescriptive, but have been used by the Company in adopting its corporate governance practices. The Company’s approach to corporate governance is set out below.

The Board of Directors

Management is nominating five individuals to the Board, two of whom are current directors of the Company.

The Board of Directors has responsibility for the stewardship of the Company, specifically to oversee the operation of the Company and to supervise management.

The actions of the Board are governed by the requirements under the Business Corporations Act (British Columbia) to act honestly, in good faith and in the best interests of the shareholders of the Company and to exercise care, diligence and skill in doing so.

The Board endeavours to ensure that its composition complies with the Company’s constating documents, applicable securities rules and regulations of Canada and the U.S. Securities and Exchange Commission and the policies of the TSX Venture Exchange and the OTCQB.

The Board currently consists of six directors, the majority of whom would be considered “independent” in that the person has no direct or indirect material relationship with the Company which, in the view of the Board, would be reasonably expected to interfere with the exercise of the director’s independent judgement.

In determining if a person is independent, the Board has compiled, reviewed and discussed the existence, nature and materiality of any direct or indirect relationship between the member and the Company. Of the current board of directors, Messrs. Michael Atkinson, James O’Rourke, Paul van Eeden and Dr. Peter Bradshaw are independent directors. Mr. Alfred Hills is a member of management and therefore would not be considered independent. On May 31, 2013, Mr. Roman Shklanka resigned as the Executive Chairman of the Company but continues to serve as Chairman. As he previously served as an officer of the Company, Mr. Roman Shklanka is not considered to be independent.

Following the Meeting, the members of the Board are anticipated to be Michael Atkinson, Paul van Eeden, E. Kenneth Paul, David Schmidt and A. Murray Sinclair, all of whom are independent.

The Board considers that, given the entrepreneurial nature of the Company, and the current stage of the Company’s development, the present number and composition of directors is appropriate. The Board as presently constituted, and as constituted following the Meeting, includes considerable experience in the mining industry as well as financial experience.

The current Chief Executive Officer and President of the Company, Mr. Alfred Hills, is a member of management and a director of the Company. Prior to, or following, the Meeting, it is anticipated that Mr. Hills will cease to be an officer and director of the Company. However, the Board anticipates that any newly appointed Chief Executive Officer may also serve on the Board. In view of the size of the Company, management representation on the Board, and the nature of its business, it is essential that those having an intimate knowledge of the Company’s operations be present during most important Board discussions. Notwithstanding the foregoing, when the Board considers it appropriate, the independent directors meet without management present at the meeting. The Board is of the view that it can function independently of management when required to do so.

The following table identifies the name of each director or proposed director of the Company and any company, which is a reporting issuer in Canada or the United States, and for which such director currently serves as a director:

| Name of Director of Proposed Director | | Directorship(s) in Other Reporting Issuers |

| | | |

| Roman Shklanka | | Pacific Imperial Mines Inc. |

| | | Delta Gold Corporation |

| | | |

| Michael Atkinson | | Petra Petroleum Corp. |

| | | Sypher Resources Ltd. |

| | | Kircaldy Capital Corp. |

| | | Legend Power Systems Inc. |

| | | Watusi Capital Corp. |

| | | Knol Resources Corp. |

| | | |

| James C. O’Rourke | | Copper Mountain Mining Corp |

| | | Compliance Energy Corp. |

| | | Madison Pacific Properties Inc. |

| | | Gold Mountain Mining Corporation |

| | | |

| Paul van Eeden | | Miranda Gold Corp. |

| | | Evrim Resources Corp. |

| | | Synodon Inc. |

| | | |

| Peter Bradshaw | | Aquila Resources Ltd. |

| | | First Point Minerals Corp. |

| | | |

| E. Kenneth Paul | | Evrim Resources Corp. |

| David Schmidt | | Crest Petroleum Corp. |

| | | Nanton Nickel Corp. |

| | | Oceanside Capital Corp. |

| | | Ryan Gold Corp. |

| | | Waymar Resources Ltd. |

| | | |

| A. Murray Sinclair | | Sprott Resource Lending Corp. |

| | | Elgin Mining Inc. |

| | | Nebo Capital Corp. |

| | | Ram Power, Corp. |

| | | Sprott Resource Corp. |

| | | Dundee Corp. |

The information below sets out the Board meetings held and the attendance for the year ended December 31, 2012.

| Director | Board Meetings Attended |

| Roman Shklanka | 9 of 9 |

| Alfred Hills | 9 of 9 |

Alexander Davidson(1) | 9 of 9 |

| James O’Rourke | 9 of 9 |

| Michael Atkinson | 9 of 9 |

Note:

| (1) | Alexander Davidson resigned as a director of the Company effective December 31, 2012. |

Board Mandate

Every director takes part in the process of establishing policies for the Company. The Board of Directors has assumed the responsibility for developing the Company’s approach to governance and responding to current governance guidelines. To that end, the Board has adopted the following mandate and objectives:

| (a) | The Strategic Planning Process |

The Board participates in the Company’s strategic planning by considering and, if deemed appropriate, adopting plans as proposed and developed by management, with management having the primary responsibility for initially developing a strategic plan.

The Board considers the risks inherent in the mining industry and receives periodic assessments from management and others as to these risks and the Company’s strategies to manage those risks.

The Board reviews and approves key policy statements, codes of conduct or practices developed by management to promote ethical business conduct, regulatory compliance and public disclosure practices, among others, and monitors or oversees compliance with those policies, codes or practices.

The Board is responsible for appointing and reviewing the mandate and composition of any Committee of the Board and considering and approving any changes to the composition, charter or mandate of any Committee of the Board.

The Board is responsible for establishing appropriate structures and procedures so that the Board and its Committees can function independently of management.

| (f) | Compensation Practices |

The Board will review the recommendations of the Compensation Committee regarding the Company’s compensation practices including share option grants.

| (g) | Material Agreements and Documents |

The Board will approve or ratify significant projects, investments, dispositions, acquisitions or other material agreements proposed to be entered into by the Company and review and approve all documents required by law to be reviewed and approved by the Board, including annual audited financial statements, Management’s Discussion and Analysis of financial results, Information Circulars to be disseminated in connection with any meeting of shareholders and any prospectus, registration statement or other similar documents.

The Board reviews the personnel needs of the Company from time to time, having particular regard to succession issues relating to senior management. The training and development of personnel is generally left to management. The Board appoints the President, Chief Executive Officer and Chairman, as well as the officers of the Company.

| (i) | Communications Policy |

The Board assesses the effectiveness of the Company’s communications with shareholders and has established a Disclosure and Insider Trading Policy to ensure that material matters are disseminated in a timely manner.

| (j) | Integrity of Internal Controls |

The Board, through the Audit Committee and in conjunction with its auditors, assesses the adequacy of the Company’s internal control systems and has instituted the controls required by the U.S. Sarbanes-Oxley Act of 2002, as applicable. The internal control review process is undertaken on an annual basis during the year-end financial audit. The Audit Committee also reviews and assesses the financial statements on a quarterly basis and annually reviews the adequacy of the Company’s Disclosure and Insider Trading Policy.

The Board will generally assume such responsibility and authorities as the Board sees fits, consistent with its duties and responsibilities to the Company and its shareholders.

The Board has approved written mandates for its two standing Committees, namely, the Audit Committee and Compensation Committee. In order to foster a corporate culture of excellence, the Board has also adopted a written Code of Business Conduct and Ethics applicable to all directors, officers, employees, and consultants.

The Board has not adopted a formal system which would enable an individual director to engage an outside advisor at the expense of the Company. If such an engagement were deemed appropriate, it is anticipated that such a request would be brought by the particular director to the Board or Audit Committee for consideration.

Position Descriptions

The Company has not formally developed position descriptions for the directors, Chairman of the Board, the Chairman of each standing committee of the Board or the Chief Executive Officer. However, the Board is satisfied that the directors and senior management are fully aware of their responsibilities and those matters that are within their authority.

Orientation and Education of Directors

The Company does not have a formal process of orientation and education for new members of the Board. The independent Board members currently have considerable experience as members of the boards of other public companies. Senior management regularly provides updates to all directors on material developments in the Company’s business.

Ethical Business Conduct

The Board has adopted a written Code of Business Conduct and Ethics (the “Code”) and a Whistle-Blower Policy and Procedures. A copy of the Code and Whistle-Blower Policy can be found on the Company website at http://www.kobexminerals.com under the Corporate Governance section. The Board has appointed a Compliance Officer who is responsible for monitoring compliance with the Code, investigating and resolving all reported complaints and allegations concerning violations of the Code. The Compliance Officer has direct access to the Audit Committee and the Board and the Compliance Officer is required to report to the Board at least annually on compliance activity. Where any director has an interest, direct or indirect in a material contract or material transaction relating to the Company, the Business Corporations Act (British Columbia) requires that the director disclose his or her interest to the Board in advance and thereafter abstain from voting as a director on that matter. The Code adopted by the Board goes further by imposing more stringent disclosure and approval requirements than those imposed under the Business Corporations Act (British Columbia).

Where a director has a material interest in a transaction or agreement concerning the Company, the Board takes such steps as may be prudent to isolate and eliminate or reduce the potential for such a conflict of interest to interfere with the Board’s exercise of independent judgment. This may include requiring the director to excuse himself or herself from deliberations of the Board or referring that matter for consideration by a committee of independent directors of the Board.

Nomination of Directors

The Board has not constituted a separate nominating committee to propose new nominees to the Board or for assessing directors’ performance as the Board considers the Company too small to justify a more formal process. The Board as a whole from time to time discusses potential candidates for the Board, taking into account the overall composition, skills and experience of the Board as a whole.

Compensation

The Compensation Committee has responsibility for oversight of the Company’s overall human resources policies and procedures as well as review of executive and key employee compensation and compensation of the Company’s independent directors. The Compensation Committee is also responsible for the administration of the Stock Option Plan. The Compensation Committee members are currently Michael Atkinson, James O’Rourke, Paul van Eeden and Dr. Peter Bradshaw all of whom are independent within the meaning of NI 52-110. Following the meeting, it is anticipated that the members of the Compensation Committee will be Paul van Eeden, E. Kenneth Paul and A. Murray Sinclair. The Compensation Committee meets at least twice a year and otherwise as required. For determining compensation, the Compensation Committee also has the authority to retain independent advisors as it may deem necessary or appropriate to allow it to discharge its responsibilities.

Other Board Committees

Other than the Audit Committee and the Compensation Committee, the Board has no other standing committees.

Assessments

The Chairman of the Board has responsibility for ensuring the effective operation of the Board and its committees and for ensuring the Board’s directors are performing effectively.

PARTICULARS OF MATTERS TO BE ACTED UPON

Confirmation of Stock Option Plan

Shareholders are being asked to confirm approval of the Stock Option Plan, as amended. The Stock Option Plan was last approved at the annual general meeting of Company held on June 20, 2012. The Stock Option Plan is subject to approval by the Exchange.

The following information is intended as a brief description of the Stock Option Plan and is qualified in its entirety by the full text of the Stock Option Plan, which will be available for review at the Meeting.

| 1. | The maximum number of shares that may be issued upon the exercise of share options granted under the Stock Option Plan shall not exceed 10% of the issued and outstanding common shares of the Company at the time of grant, the exercise price of which, as determined by the Board in its sole discretion, shall not be less than the closing price of the Company’s shares traded through the facilities of the Exchange on the date prior to the date of grant, less allowable discounts, in accordance with the policies of the Exchange or, if the shares are no longer listed for trading on the Exchange, then such other exchange or quotation system on which the shares are listed or quoted for trading. |

| 2. | Board shall not grant options to any one person in any 12 month period which will, when exercised, exceed 5% of the issued and outstanding shares of the Company or to any one consultant or to those persons employed by the Company who perform investor relations services which will, when exercised, exceed 2% of the issued and outstanding shares of the Company. |

| 3. | Upon expiry of an option, or in the event an option is otherwise terminated for any reason, the number of shares in respect of the expired or terminated option shall again be available for the purposes of the Stock Option Plan. All options granted under the Stock Option Plan may not have an expiry date exceeding ten years from the date on which the Board grants and announces the granting of the option. |

| 4. | In the event that an option holder ceases to hold his or her position with the Company other than by reason of death or disability, the expiry date of the option shall be the 90th day following the date the option holder ceases to hold such position. |

| 5. | In the event of the death of the option holder, the options shall pass to the personal representative of the option holder and shall be exercisable by such personal representative on or before the date which is the earlier of 12 months following the date of death and the original expiry date. |

| 6. | In the event the option holder ceases to hold a position with the Company as the result of disability, the options shall be exercisable on or before the date which is the earlier of 12 months following the date of termination and the original expiry date. |

| 7. | All options will be subject to such vesting requirements as may be required by the Exchange or as may be imposed by the board. |

| 8. | Subject to any required regulatory approvals, the board (or a committee of the board) may from time to time amend any existing option or the Stock Option Plan or the terms and conditions of any option thereafter to be granted provided that where such amendment relates to an existing option and it would: (a) materially decrease the rights or benefits accruing to an option holder; or (b) materially increase the obligations of an option holder, then, unless otherwise excepted by a provision of the Stock Option Plan, the written consent of the option holder must be obtained. |

In accordance with the policies of the Exchange, a plan with a rolling 10% maximum must be confirmed by shareholders at each annual general meeting.

Accordingly, at the Meeting, the shareholders will be asked to pass the following resolution:

“IT IS RESOLVED THAT the Stock Option Plan is hereby approved and confirmed.”

Ratification and Approval of Advance Notice Policy

Effective March 12, 2013, the Board adopted an advance notice policy (the “Advance Notice Policy”) with immediate effect, a copy of which is attached as Schedule “B” to this Circular. In order for the Advance Notice Policy to remain in effect following termination of the Meeting, the Advance Notice Policy must be ratified and approved at the Meeting.

Purpose of the Advance Notice Policy

The Board is committed to facilitating an orderly and efficient process for the nomination of directors at shareholder meetings, ensuring that all shareholders receive adequate notice of director nominations and sufficient information with respect to all nominees to register an informed vote.

The purpose of the Advance Notice Policy is to provide shareholders, directors and management of the Company with a clear framework for nominating directors. The Advance Notice Policy fixes a deadline prior to any shareholders’ meeting called for the election of directors by which a registered shareholder may submit director nominations to the Company, and sets forth the information that the nominating shareholder must include in the notice to the Company in order for a nominee to be eligible for election.

Terms of the Advance Notice Policy

The following information is intended as a brief description of the Advance Notice Policy and is qualified in its entirety by the full text of the Advance Notice Policy. Briefly, the Advance Notice Policy:

| ● | provides that advance notice to the Company must be given where nominations of persons for election to the board of directors are made by shareholders of the Company other than pursuant to: (i) a requisition made in accordance with section 167 of the Act; or (ii) a ‘proposal’ made in accordance with section 188 of the Act; |

| ● | fixes a deadline by which a registered shareholder may submit director nominations to the Company prior to any annual or special general meeting and sets out the specific information that must be included in the written notice to the Company for an effective nomination to occur; |

| ● | provides that, in the case of an annual meeting, notice to the Company must be given no fewer than 30 days nor more than 65 days prior to the date of the meeting; provided that if the meeting is to be held on a date that is fewer than 50 days after the date on which the first public announcement of the date of the meeting was made, notice may be given no later than the close of business on the 10th day following such public announcement; |

| ● | provides that in the case of a special general meeting that is not also an annual meeting, notice to the Company must be made no later than the close of business on the 15th day following the day on which the first public announcement of the date of the special meeting was made; and |

| ● | provides that the Board, in its sole discretion, may waive any requirement of the Advance Notice Policy. |

Ratification and Approval of Advance Notice Policy by Shareholders

If the Advance Notice Policy is ratified and approved by the shareholders at the Meeting, it will be subject to an annual review by the Board. The Board will update the Advance Notice Policy to reflect any changes required by securities regulatory authorities and applicable stock exchanges or as otherwise determined to be in the best interests of the Company and its shareholders.

Accordingly, at the Meeting, the shareholders will be asked to consider, and if thought appropriate, to pass, with or without amendment, an ordinary resolution as follows:

“IT IS RESOLVED, as an ordinary resolution that:

| | (a) | the Company’s Advance Notice Policy (the “Advance Notice Policy”), a copy of which is attached as Schedule “B” to the information circular of the Company dated March 12, 2013, be and is hereby ratified and approved; |

| | (b) | the board of directors of the Company be and is authorized in its absolute discretion to administer the Advance Notice Policy and to amend or modify the Advance Notice Policy to the extent needed to reflect changes required by securities regulatory authorities and applicable stock exchanges, or as otherwise determined to be in the best interests of the Company and its shareholders; and |

| | (c) | any one director or officer of the Company be and is hereby authorized and directed to do all such acts and things and to execute and deliver all such documents, instruments and assurances as in the opinion of such director or officer may be necessary or desirable to give effect to the foregoing resolutions.” |

Under the Articles of the Company and the Act, the ordinary resolution to ratify and approve the Advance Notice Policy must be approved by at least a simple majority of 50% plus one vote of the votes cast by the shareholders present in person or by proxy at the Meeting.

The Board has determined that the Advance Notice Policy is in the best interests of the Company and its shareholders, and unanimously recommends that shareholders vote in favour of the resolution ratifying and approving the Advance Notice Policy. In the absence of contrary directions, the management designees of the Company intend to vote proxies in the accompanying form of proxy in favour of the ordinary resolution ratifying and approving the Advance Notice Policy.

General Matters