SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

December 3, 2002

IFCO SYSTEMS N.V.

(Translation of registrant’s name into English)

Rivierstaete, Amsteldijk 166

1079 LH Amsterdam, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A.

Annual Report and Annual Accounts

The registrant’s annual report for the year ended December 31, 2000 prepared in accordance with Dutch law and the registrant’s Articles of Association, which includes the 2000 Annual Accounts prepared in accordance with Dutch generally accepted accounting principles or GAAP (the “Dutch GAAP Annual Report”), is attached to this report as Appendix A. The Dutch GAAP Annual Report was adopted by a General Meeting of shareholders of the registrant held in Amsterdam on November 28, 2002. The Dutch GAAP Annual Report, which was timely submitted to the Handelsregister van de Kamer van Koophandel en Fabrieken voor Amsterdam (the “Dutch Trade Register”) for filing on December 2, 2002, is publicly available from the Dutch Trade Register. The registrant previously filed in 2001 a 2000 Annual Report with the Frankfurt Stock Exchange and an Annual Report on Form 20-F for the year ended December 31, 2000 with the Securities and Exchange Commission, both of which reports were based on U.S. GAAP.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | IFCO SYSTEMS N.V. |

| | | (Registrant) |

|

| Date: December 4, 2002 | | By: | | /S/ MICHAEL W. NIMTSCH |

| | | | |

|

| | | | | Michael W. Nimtsch |

| | | | | Senior Executive Vice President and |

| | | | | Chief Financial Officer |

APPENDIX A

[Each page, except for final signature page, stamped “Ernst & Young Accountants”]

Annual Report for the year

ended December 31, 2000

IFCO Systems N.V.

Amsterdam

2

Table of contents (continued)

3

IFCO Systems N.V. is a limited liability company organized under the laws of The Netherlands. Unless otherwise indicated, all references in this report to we, us, our, and similar terms, as well as references to the “Company” and “IFCO Systems,” refer to IFCO Systems N.V. and its subsidiaries after the contribution of the capital shares of the IFCO Companies to IFCO Systems N.V. and to the IFCO Companies and their subsidiaries before that time. As a result of the merger with PalEx, Inc., which subsequently changed its name to IFCO Systems North America, Inc. (and is referred to in this report as PalEx for periods prior to the merger and as IFCO North America for periods after the merger), and other related transactions completed in March 2000, IFCO Systems owns all the stock of the IFCO Companies and IFCO North America. The IFCO Companies are IFCO Systems Europe GmbH (formerly known as IFCO Europe Beteiligungs GmbH) and its subsidiaries. At the time of the merger with PalEx, the IFCO Companies also included IFCO International Network Beteiligungsgesellschaft mbH (formerly known as Schoeller International Logistics Beteiligungsgesellschaft mbH), which was subsequently merged into IFCO Europe, and MTS Ökologistik GmbH, which subsequently became a wholly owned subsidiary of IFCO Europe. IFCO North America refers to IFCO North America and its subsidiaries. For purposes of this report, when we describe information on a pro forma basis, unless otherwise indicated, we are giving effect to the merger of PalEx with IFCO Systems, the IPO of IFCO Systems’ ordinary shares, the initial offering of senior subordinated notes, initial borrowings under our senior credit facility, other related transactions in March 2000, and the acquisitions of four businesses in July and August 2000. These four acquisitions are sometimes referred to as the “2000 Purchased Companies” in this report.

This report is for the year ended December 31, 2000. It includes information from the Company’s 2000 Annual Report (Revised) as filed with the Frankfurt Stock Exchange and the Company’s Annual Report on Form 20-F for the year ended December 31, 2000 (As Amended) as filed with the United States Securities and Exchange Commission. Except to the extent necessary to comply with the laws and regulations of the Kingdom of the Netherlands and Dutch generally accepted accounting principles, the disclosures included herein have not been updated or revised from the disclosures appearing in the 2000 Annual Report (Revised) and the Annual Report on Form 20-F for the year ended December 31, 2000 (As Amended). For more current information regarding the Company, you should review the Company’s 2001 Annual Report, First Quarterly Report 2002, and Second Quarterly Report 2002 as filed with the Frankfurt Stock Exchange, which are available on the Internet world-wide web site maintained by the Frankfurt Stock Exchange at www.smax.de, and the Company’s Annual Report on Form 20-F for the year ended December 31, 2001, and other filings made with the SEC in 2002, which are available on the Internet world-wide web site maintained by the SEC at www.sec.gov.

4

| 1.2 | | Cautionary Note Regarding Forward-looking Statements |

Some of the statements contained in this report discuss future expectations, contain projections of results of operations or financial condition of IFCO Systems, or state other forward-looking information. These statements may include financial information and/or statements for periods following the period covered by this report. You can find many of these statements by looking for words like believes, expects, anticipates, estimates, or similar expressions used in this report.

These forward-looking statements may be affected by known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various factors and was derived using numerous assumptions that we believe to be reasonable. Risks and uncertainties include the following: (1) our ability to effectively integrate our operations and achieve our operational and growth objectives; (2) the competitive nature of the container businesses, including returnable plastic containers (or RPCs), pallets, and industrial containers; (3) customer demand and business and economic cycles; (4) the ability to finance capital expenditures and growth; (5) conditions in lumber markets; (6) seasonality; (7) weather conditions; (8) the ability to sell the new pallet manufacturing operations and the terms of that sale; (9) changes in national or international politics and economics; (10) currency exchange rate fluctuations; and (11) changes in capital and financial markets including the performance of companies listed on the Frankfurt Stock Exchange or the Nasdaq National Market.

Important factors that could cause our actual results to be materially different from the forward-looking statements are also discussed throughout this report.

We have elected the U.S. dollar as our reporting currency. The euro is the primary functional currency of IFCO Systems and our European operations. Approximate dollar amounts are provided for euro-denominated amounts as set forth in our combined and consolidated financial statements, where applicable. With respect to our combined and consolidated financial statements, all amounts previously reported in Deutsch-marks have been restated in euros using the January 1, 1999 fixed exchange rate of DM1 = €0.51129. Otherwise in this report, approximate dollar amounts are provided for euro-denominated amounts based on the Federal Reserve Bank of New York noon buying rate on the date indicated or on June 15, 2001, €1.00 = $0.8628, if no date is indicated. Approximate dollar amounts are provided for Deutsch-mark-denominated amounts based on this euro rate and the fixed conversion rate of €1.00 = DM1.95583, resulting in a rate of DM1 = $0.4411. The exchange rates as of March 8, 2000, the closing date for the merger and the IPO, were €1.00 = $0.9576 and DM1 = $0.4896.

The selected historical financial information presented below for, and as of the end of, the year ended December 31, 2000 is derived from IFCO Systems’ audited combined and consolidated financial statements, which were audited by Arthur Andersen

5

Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH. The selected historical financial information presented below for, and as of the end of, each of the years in the three years ended December 31, 1999 is derived from IFCO Systems’ audited combined and consolidated financial statements, which were audited by PwC Deutsche Revision AG, independent accountants. The selected historical financial information for the year ended December 31, 1996 is derived from IFCO Systems’ unaudited combined and consolidated financial statements. The selected historical financial information is not necessarily indicative of the future results of operations of IFCO Systems. IFCO Systems’ financial statements have been prepared in U.S. dollars in accordance with Dutch GAAP. You should read this selected historical financial information along with “Operating and Financial Review and Prospects” and our combined and consolidated financial statements included in this report.

6

| | | Year ended December 31,

| |

| | | 1996

| | | 1997

| | | 1998

| | | 1999

| | | 2000

| |

| | | (dollars in thousands) | |

| | | | (unaudited) | | | | | | | | | | | | | | | | | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 122,959 | | | $ | 118,546 | | | $ | 136,176 | | | $ | 154,726 | | | $ | 372,155 | |

| Cost of sales | | | 118,354 | | | | 99,622 | | | | 106,218 | | | | 124,485 | | | | 315,064 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Gross profit | | | 4,605 | | | | 18,924 | | | | 29,958 | | | | 30,241 | | | | 57,091 | |

| Selling, general and administrative expenses | | | 21,798 | | | | 18,328 | | | | 24,289 | | | | 24,511 | | | | 72,042 | |

| Merger and integration costs | | | — | | | | — | | | | — | | | | 3,519 | | | | — | |

| Amortization of goodwill and other intangible assets | | | 236 | | | | 675 | | | | 383 | | | | 289 | | | | 6,709 | |

| Other operating (income), net | | | (5,371 | ) | | | (840 | ) | | | (864 | ) | | | (639 | ) | | | (1,956 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from operations | | | (12,058 | ) | | | 761 | | | | 6,150 | | | | 2,561 | | | | (19,704 | ) |

| Net interest cost | | | (7,751 | ) | | | (10,415 | ) | | | (10,494 | ) | | | (11,934 | ) | | | (27,609 | ) |

| Other income (expense), net | | | 267 | | | | 208 | | | | (271 | ) | | | (1,332 | ) | | | 4,774 | |

| Income tax provision | | | — | | | | (47 | ) | | | (210 | ) | | | (320 | ) | | | (245 | ) |

| Minority interest | | | — | | | | — | | | | (1,274 | ) | | | (1,291 | ) | | | — | |

| Losses from equity entities, net | | | — | | | | (2,347 | ) | | | (2,726 | ) | | | (1,738 | ) | | | (286 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Loss from continuing operations before extraordinary loss and cumulative effect of change in accounting principle | | | (19,542 | ) | | | (11,840 | ) | | | (8,825 | ) | | | (14,054 | ) | | | (43,070 | ) |

| Loss from discontinued operations | | | — | | | | — | | | | — | | | | — | | | | (62,465 | ) |

| Extraordinary loss on early extinguishment of debt | | | — | | | | — | | | | — | | | | — | | | | (5,600 | ) |

| Cumulative effect of change in accounting principle | | | — | | | | — | | | | — | | | | — | | | | 770 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net loss | | $ | (19,542 | ) | | $ | (11,840 | ) | | $ | (8,825 | ) | | $ | (14,054 | ) | | $ | (110,365 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net loss applicable to ordinary share (1) | | $ | (19,542 | ) | | $ | (11,210 | ) | | $ | (8,913 | ) | | $ | (13,879 | ) | | $ | (110,365 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Loss from continuing operations per ordinary share (2) | | $ | (.98 | ) | | $ | (.59 | ) | | $ | (.44 | ) | | $ | (.70 | ) | | $ | (1.11 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net (loss) per ordinary share – diluted (2) | | $ | (.98 | ) | | $ | (.56 | ) | | $ | (.45 | ) | | $ | (.69 | ) | | $ | (2.84 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

| Weighted average ordinary shares outstanding used in computing, loss per share from continuing operations and net loss per share (2) | | | 20,000,000 | | | | 20,000,000 | | | | 20,000,000 | | | | 20,000,000 | | | | 38,823,105 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Dividends declared per ordinary share | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Capital expenditures (3) | | $ | — | | | $ | 39,569 | | | $ | 40,195 | | | $ | 30,767 | | | $ | 79,339 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | Year ended December 31,

|

| | | 1996

| | | 1997

| | | 1998

| | | 1999

| | | 2000

|

| | | (in thousands) (unaudited) |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

| Net assets | | $ | 4,957 | | | $ | 10,223 | | | $ | 3,832 | | | $ | (9,664 | ) | | $ | 215,383 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| Total assets | | $ | 254,893 | | | $ | 249,557 | | | $ | 284,453 | | | $ | 266,621 | | | $ | 784,789 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| Stockholders’ (deficit) equity | | $ | (462 | ) | | $ | (19,990 | ) | | $ | (30,873 | ) | | $ | (39,672 | ) | | $ | 215,383 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | (1) | | Net loss applicable to ordinary shares is net loss plus accretion on redeemable convertible preferred stock, redeemable cumulative participating rights, and participating rights. |

| | (2) | | The weighted average outstanding shares for the years ended December 31, 1996, 1997, 1998, and 1999 reflect those shares issued just prior to the merger with PalEx in March 2000 in a five-for-one stock split to the existing IFCO Companies’ shareholders and are considered outstanding for this presentation for the years indicated. |

7

| | (3) | | Our historical combined capital expenditure information is not available for the year ended December 31, 1996. |

Our capital resources are limited and may not be sufficient to finance our operations and desired level of growth

Our cash from operations and amounts available under our amended senior credit facility may not be sufficient to finance our capital requirements, including current operations, and our desired level of growth. Under the terms of our amended senior credit facility, we have limited availability for additional borrowing and we do not have the ability to borrow for additional acquisitions. Our current level of profitability and cash flow may limit our ability to attract new sources of equity capital that would be favorable to the Company’s current shareholders. Any possible inability to generate sufficient cash from operations, the lack of availability under the amended senior credit facility, or the absence of other sources of debt or equity capital may have a material adverse affect on the Company’s ability to operate and our results of operations for 2001.

Our level of debt could prevent us from fulfilling our objectives and obligations, including obligations under our senior subordinated notes

As of December 31, 2000, we had approximately $362.6 million of net debt, including capital leases, representing approximately 64% of total capitalization. Our level of debt may have important consequences to our investors and noteholders. For example it could:

| | • | | limit our ability to obtain additional financing for acquisitions, working capital, capital expenditures, or other purposes; |

| | • | | require us to dedicate a substantial portion of our cash flow to pay our interest expense and debt amortization, which will reduce the funds that would otherwise be available to us for our operations and future business opportunities; |

| | • | | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate; |

| | • | | place us at a competitive disadvantage compared to our competitors that have less debt; |

| | • | | increase our vulnerability to general adverse economic and industry conditions; and |

| | • | | make it more difficult for us to satisfy our obligations with respect to our senior subordinated notes. |

The risks described above could increase if we borrow more money through our amended senior credit facility.

The operational and financial benefits expected from the merger may not be realized

Schoeller Logistics Industries GmbH and PalEx entered into the merger agreement with the expectation that the merger would produce substantial operational and financial

8

benefits for both the IFCO Companies and PalEx, including the use of PalEx’s North American infrastructure to accelerate the expansion of the IFCO Companies’ business in the United States. The integration of two large companies, incorporated in different countries, with geographically dispersed operations, and with significant differences in business plans, business cultures, and compensation structures, continues to present significant challenges and requires substantial attention from management. The diversion of management’s attention and any difficulties encountered in the transition and integration process could reduce revenues, increase levels of expenses, and impair operating results of the combined company. In addition, we may not be successful in using the IFCO North America’s pallet and industrial container locations in connection with our North American RPC business.

Restrictions and covenants in our debt agreements limit our ability to take certain actions and perform some corporate functions

Our debt agreements, which consist of the credit agreement and any ancillary agreements governing our amended senior credit facility and the indenture governing our senior subordinated notes, contain a number of significant covenants that, among other things, limit our ability to:

| | • | | incur additional debt or liens; |

| | • | | pay dividends or make other restricted payments; |

| | • | | make investments including the repurchase or redemption of either capital stock or the senior subordinated notes; |

| | • | | consummate asset sales; |

| | • | | enter into transactions with affiliates; |

| | • | | issue capital stock of a subsidiary or create dividend or other payment restrictions with respect to subsidiaries; |

| | • | | consolidate or merge with any person or transfer or sell all or substantially all of our assets; |

| | • | | make capital investments; and |

In addition, our senior amended credit facility requires us to comply with specific financial ratios and tests, under which we are required to achieve specific financial and operating results. Our ability to comply with these provisions may be affected by events beyond our control. A breach of any of these covenants would result in a default under the amended senior credit facility.

9

Our business models may not succeed in new markets

Our business plans rely on duplicating our business models in new markets, including the United States. Our business models may not be successfully duplicated in these new markets.

Our international operations may prove more difficult or costly than our domestic operations

Since we have significant operations outside of Germany and the United States, we are subject to the risks associated with cross-border business transactions and activities. These risks principally relate to delayed payments from customers in some countries or difficulties in the collection of receivables generally. Political, legal, trade, or economic changes or instability could limit or curtail our business activities and operations in Asia and South America. Unexpected changes in regulatory requirements, tariffs and other trade barriers, and price exchange controls could limit operations and make the distribution of products difficult. In addition, the uncertainty of the legal environment in these areas could limit our ability to effectively enforce our rights.

We may incur increased costs due to fluctuations in interest rates and foreign currency exchange rates

As a consequence of the global nature of our business, we are exposed to increases in interest rates and changes in foreign currency exchange rates, which may result in decreased profitability. We seek to minimize these risks through regular operating and financing activities and, when appropriate, we will consider the use of currency and interest rate hedges and similar financial instruments, although these measures may not be implemented or be effective. We are also exposed to risks from changes in foreign currency exchange rates as a result of our financial reporting in U.S. dollars.

We are dependent on our relationships with a relatively small number of large retailers

We are dependent on our relationships with a relatively small number of large retailers. Our inability to maintain these relationships or cultivate new relationships on similar terms will impair our ability to remain competitive in the markets in which we operate. The loss of one or more of these relationships would have a negative impact on our revenues and profitability.

The market price of, and trading volumes in, our ordinary shares may be volatile

The market price of our ordinary shares may be significantly affected by, among others, the following factors:

| | • | | our actual or anticipated results of operations; |

10

| | • | | new services or products offered, or new contracts entered into, by us or our competitors; |

| | • | | changes in, or our failure to meet, securities analysts’ expectations; |

| | • | | legislative and regulatory developments affecting our businesses; |

| | • | | developments and technological innovations in our businesses; and |

| | • | | general market conditions and other factors beyond our control. |

U.S. and non-U.S. stock markets have periodically experienced significant price and volume fluctuations. These changes have often been unrelated to the financial performance of particular companies. These broad market developments may also adversely affect the market price of our ordinary shares.

Weather conditions may reduce demand for our services and products

We provide a significant portion of our services and products to customers who ship agricultural products. Severe weather, particularly during the harvesting seasons, may cause a reduction in demand from agricultural customers, lowering our revenues and profitability. For example, a heavy freeze that damages citrus or other produce crops could have a significant negative impact on our financial condition and results of operations.

Our operating results may fluctuate significantly due to seasonal factors

Our businesses are subject to seasonal variations in operations and demand. Our operations experience the greatest demand for RPCs, new pallets, and reconditioned industrial containers during the citrus and produce harvesting seasons, generally October through May, with significantly lower demand from the citrus and produce industries in the summer months. Moreover, yearly results can also fluctuate significantly. Fluctuations are the result of the size of the citrus and produce harvests, which, in turn, largely depend on the occurrence and severity of inclement weather. Accordingly, our performance in any particular quarter may not be indicative of the results that can be expected for any other quarter or for the entire year.

If we are able to pursue acquisitions, we still may not be able to achieve our growth objectives.

If we are able to pursue acquisitions, we will be required to spend significant time and effort in evaluating, completing, and integrating acquired businesses. Acquisitions may involve a number of operational risks, including:

| | • | | integration of acquisitions may not be successful or may not be possible without substantial costs, delays, or other problems, in either case reducing any positive impact on our revenues and profitability or actually decreasing profitability; |

11

| | • | | adverse short-term effects on reported operating results, which will result in lower profitability; |

| | • | | diversion of management’s attention from operations, which could result in decreased profitability or limit internal growth; and |

| | • | | dependence on retention, hiring, and training of key personnel, which may impair our ability to integrate acquisitions successfully or may prevent us from seizing future growth opportunities, both internally and through acquisitions. |

To the extent we are unable to manage our growth effectively, or are unable to attract and retain qualified management, our ability to grow or maintain our level of revenues and profitability, or to implement our business plan, could be materially limited.

In addition, we may not be able to identify or acquire additional businesses. We could also experience increased competition for acquisitions of desirable companies, which could increase the amounts paid for acquisitions or reduce the number of acquisition candidates, resulting in reduced growth opportunities.

Our RPC business competes in a highly competitive industry, which may limit our business prospects

We face competition in all geographic markets and each industry sector in which we operate. We expect aggressive competition from packaging industry companies. We also face aggressive competition from the traditional packaging industry. In addition, relatively few barriers prevent entry into the traditional packaging and pallet industries. The effect of this competition could reduce our revenues, limit our ability to grow, increase pricing pressure on our products, and otherwise affect our financial results.

Our RPC business may be affected by the loss of or damage to our RPCs during the product distribution cycle, which may limit our ability to grow or maintain profitability

Despite our experience with container pooling and transport, and the relative durability and reliability of RPCs, our pool of RPCs is subject to shrinkage due to unforeseen loss and damage during transport in the product distribution cycle. Increased loss of or damage to RPCs may increase our costs in maintaining our current RPC pool, thus limiting our ability to grow or maintain profitability.

Our markets for pallet recycling services and industrial container reconditioning services are highly competitive, which may limit our ability to grow or maintain profitability

The markets for pallet recycling services and drum reconditioning services are highly fragmented and competitive. As a result, competition on pricing is often intense. Competition for customers and competitive pricing pressure may limit our ability to grow or maintain profitability.

12

Our pallet services operations, including recycling, are subject to competition from larger competitors, which may limit our ability to grow or maintain revenues and profitability

Other companies with significantly greater capital and other resources than our capital and resources may enter or expand their operations in the pallet services business, including recycling, in the future, which could place us in direct competition with these larger companies in the markets for pallet services. Increased competition from large competitors could reduce our revenues through loss of customers or competitive pricing pressures. Decreases in revenues could have a corresponding effect on profitability.

Our pallet services operations, including recycling, face competition from other pallet alternatives, which could limit or decrease revenues and profitability

Our pallet services operations, including recycling, face competition from pallet leasing or other pallet systems providers. Pallet leasing competes currently with recycled pallet sales to the grocery, retailing, and wholesale distribution industries and may expand into other industries in the future. CHEP, with significantly greater resources than us, is currently the dominant pallet leasing company in the world. Other pallet systems may include pallets fabricated from non-wooden components like plastic as cost-effective, durable alternatives to wooden pallets. Increased competition from pallet leasing companies or providers of other alternatives could make it more difficult for us to attract and retain customers or force us to reduce prices. As a result, revenue growth may be limited or may decrease with corresponding effects on our profitability.

We are controlled by a limited number of shareholders, which limits the ability of the public shareholders to influence our affairs

Christoph Schoeller and Martin Schoeller beneficially own, excluding options, approximately 45.7% of our outstanding ordinary shares. They are able to influence our business, policies, and affairs and may be able to block approval of any proposed merger, combination, or sale of substantially all our assets. Because they have the largest beneficial ownership, the Schoellers may legitimately seek to preserve their control and may not have the same interest as smaller shareholders in pursuing strategic investments or business combinations if the result would be a decrease in control or would cause us no longer to exist as a separate entity.

Christoph Schoeller and Martin Schoeller do not devote their full time to IFCO Systems, which may impair our business prospects

Under the terms of an advisory agreement with us, Schoeller Industries provides administrative and management services, but Christoph Schoeller and Martin Schoeller, who are Co-Chairmen of our board of directors, do not devote their full working time to us. Because of other Schoeller family business interests, Christoph Schoeller and Martin Schoeller will continue to be unable to devote their undivided attention to our operations

13

and management. This may impede our management and operations and limit the growth prospects for our business.

We have potential exposure to environmental liabilities, which may increase costs and lower profitability

Our operations are subject to various environmental laws and regulations, including those dealing with handling and disposal of waste products, fuel storage, and air quality. As a result of past and future operations at our subsidiaries’ facilities, we may be required to incur remediation costs and other related expenses. In addition, although we intend to conduct appropriate due diligence with respect to environmental matters in connection with future acquisitions, we may not be able to identify or be indemnified for all potential environmental liabilities relating to any acquired business. One of our subsidiaries currently has potential exposure to environmental liabilities as a result of contamination at the Zellwood Groundwater Contamination Site in Orange County, Florida. For a description of the potential exposure, see “Business overview–Regulation–Industrial Containers” in “Information on the Company.” Environmental liabilities incurred by us or our subsidiaries, if not covered by adequate insurance or indemnification, will increase our costs and have a negative impact on our profitability.

Our cost of goods sold may be subject to increases because of unmanageable changes in the cost or availability of lumber, the largest raw material cost for pallets

The largest component of cost of goods sold for our wooden pallets is lumber. Any increase in the cost of lumber or decrease in the availability of lumber will materially increase cost of goods sold resulting in decreased profitability unless there is a corresponding increase in the prices we charge our customers. This risk primarily affects our new pallet manufacturing operations and may impact our results of operations as long as we continue to own the new pallet business. We may be limited in how much of a cost increase, if any, we are able to pass along to customers or how quickly we are able to pass along a cost increase to customers. In addition, increases in prices may result in a decrease in sales. The majority of the lumber used in the pallet industry is hardwood, which is only grown in some regions of the United States.

If the demand for lumber is greater than the supply, the price will increase and our cost for lumber will increase. The factors affecting supply and demand are outside our control, including:

| | • | | competing demand from other pallet manufacturers and other industries that use similar grades and types of lumber; |

| | • | | governmental limits on logging on public lands or for environmental reasons; and |

| | • | | governmental agreements limiting lumber imports into the United States or Canada. |

Since lumber is difficult to harvest in adverse weather, adverse weather may also decrease the supply, resulting in price increases. We may not be able to secure adequate lumber supplies in the future at prices we consider reasonable.

14

Our new pallet manufacturing operations may also be subject to competition from lumber mills, which could decrease our profitability

As long as we continue to own our new pallet manufacturing operations, we will compete with lumber mills in the sale of new pallets. These mill competitors typically view pallet manufacturing as an opportunity to use the lower grade lumber that would otherwise be waste. As a result, they are able to manufacture and sell low-cost pallets. This depresses pallet prices overall, which could decrease our profitability.

We may not be able to negotiate with union employees and may be subject to work stoppages

Approximately 300 employees of our drum reconditioning segment are members of various labor unions. If we are unable to negotiate acceptable contracts with these unions as existing agreements expire, strikes or other work stoppages by the affected workers could occur and increased operating costs due to higher wages or benefits paid to union members may result. If the unionized employees engage in a strike or other work stoppage, or other employees become unionized, we could experience a significant disruption of our operations and higher ongoing labor costs. This could result in decreased revenues and/or lower profitability than otherwise could have been achieved.

Protecting security holders’ rights may prove more difficult and costly than in a U.S. corporation

Our corporate affairs are governed by our articles of association and by the laws of The Netherlands. The rights of our security holders and creditors and the responsibilities of directors on our board of directors, some of whom may reside outside of the United States, are different than those established under the laws of Delaware or other U.S. jurisdictions. Therefore, our public security holders may have more difficulty and be subject to higher costs in protecting their interests in the face of actions by our management, the board of directors, or controlling security holders than they would as security holders of a corporation incorporated in Delaware or other U.S. jurisdictions. This may include difficulty in effecting service of process within the United States upon us or those persons, or enforcing, in courts outside of the United States, judgments against us or those persons obtained in U.S. courts and based upon the civil liability provisions of the federal securities laws of the United States. Furthermore, since a substantial portion of our assets will be located outside of the United States, any judgment obtained in the United States against those persons or us may not be collectible within the United States. Additionally, there may be doubt as to the enforceability, in original actions in Dutch courts, of liabilities based solely upon the federal securities laws of the United States.

We do not intend to pay cash dividends for the foreseeable future

We intend to retain our earnings, if any, for continued development of our businesses and do not intend to pay cash dividends on our ordinary shares in the foreseeable future. In

15

addition, our amended senior credit facility and the indenture governing the senior subordinated notes include, and any additional credit facilities obtained in the future may include, restrictions on our ability to pay dividends.

1.4.2 | | Information on the Company |

We are a leading international provider in reusable supply chain management services, serving over 9,000 customers in 32 countries. We believe we:

| | • | | own and manage the largest pool of returnable plastic containers, or RPCs, in Europe based on 1997 market information, which we believe is still reliable; |

| | • | | own and manage a rental pool of over 1.6 million pallets in Canada, making us the second largest pallet rental pool owner and manager in North America; |

| | • | | are the largest provider of new and recycled pallets in North America based on our pallet industry experience and industry information; and |

| | • | | are the largest provider of industrial container reconditioning services in North America based on our 1998 volume and our estimate of the total number of industrial containers reconditioned in the United States each year using information obtained from the Reusable Industrial Packaging Association. |

Round-trip means that a container is used for the flow of products through one whole distribution cycle and then is used multiple times. We provide RPCs and related services to growers or manufacturers in order to distribute goods to retailers. Retailers benefit from improved product handling and automation capabilities, in-store display in RPCs, improved space efficiency, and reduction of the amount of packaging from transport. We contract third parties to collect empty RPCs from retailers for inspection and reconditioning by us. The RPCs are then reintroduced into the round-trip system for reuse on a just-in-time basis. Our RPCs, which are based on patented technology, are made of plastic and are collapsible. The RPCs are available in many different standardized sizes and structures depending on the goods to be moved. They are designed to be stacked interchangeably regardless of size. Currently, we have approximately 70.6 million RPCs in circulation worldwide. Our European pool now serves over 4,000 growers supplying produce to approximately 20,000 supermarket outlets throughout Western Europe. Currently, more than 80 European retailer groups use our round-trip systems.

As a result of the merger with PalEx, and the acquisition of the remaining interest in IFCO-U.S., L.L.C., IFCO North America provides RPC services in the United States with, as of December 31, 2000, 28 operating facilities in 9 states in the United States. Currently, we have approximately 6.1 million IFCO RPCs in circulation in the United States.

We also rent and recycle wooden pallets in a variety of shapes and sizes for the movement of various types of goods. We conduct these pallet operations from, as of December 31, 2000, 62 facilities throughout the United States and Canada. We also recondition industrial container products, which include steel closed top drums, steel drums with fully

16

removable heads, plastic drums, and industrial bulk containers, from, as of December 31, 2000, 13 facilities in the United States.

We also manufacture and sell wooden pallets, but in August 2000 we determined to concentrate on our systems and services business. We negotiated with a limited number of buyers starting in late December 2000 regarding the sale of our new pallet manufacturing business, and we expect to complete a sale in the third quarter of 2001. As a result, we have reported the new pallet manufacturing business as discontinued operations in this report.

On a pro forma basis, our revenuesfor the year ended December 31, 2000, were approximately $494.3 million.

1.4.2.1 | | History and Development of the Company |

Legal Information

Our legal and commercial name is IFCO Systems N.V. We were incorporated under the laws of The Netherlands on March 31, 1999. Our registered seat is in Amsterdam, The Netherlands, at our principal executive offices located at Rivierstaete, Amsteldijk 166, 1079 LH Amsterdam, The Netherlands. The telephone number for our Amsterdam office is 31-20-504-1772. We also maintain operations headquarters in Munich, Germany and in Houston, Texas and Bartow, Florida in the United States.

History

The Merger and Initial Public Offering

In March 2000, we completed the merger of PalEx with and into Silver Oak Acquisition Corp., our wholly owned subsidiary, which initially changed its name to “PalEx, Inc.” PalEx subsequently changed its name to “IFCO Systems North America, Inc.” As a result of the merger and related transactions, we own all of the stock of the IFCO Companies and IFCO North America. In the merger, PalEx stockholders received merger consideration with a total value of $9.00 per share consisting of cash and/or the Company’s ordinary shares for each share of PalEx common stock. The total merger consideration for all the shares of PalEx common stock was $71.4 million in cash and 7.4 million of IFCO’s ordinary shares based on elections by PalEx stockholders and adjustments pursuant to the merger agreement. The total consideration for the merger was $184.5 million for the PalEx common stock plus the assumption of debt of PalEx, which was $153.5 million as of March 8, 2000.

In conjunction with the merger, each option to purchase PalEx common stock that was outstanding on the date of the merger was converted into an option to purchase a certain number of ordinary shares of IFCO Systems, as determined by the definitive agreement providing for the merger. The PalEx options became immediately vested upon completion of the merger and conversion to IFCO Systems options.

17

In connection with the merger, we also completed an initial public offering of 13.0 million ordinary shares in March 2000 and subsequently issued an additional 1.95 million ordinary shares upon the underwriters’ exercise of their overallotment option. The initial public offering price was €15.50 or $14.90 per share. Our total net proceeds from the IPO, including the exercise of the overallotment option, were $203.2 million. The net proceeds from the IPO were used, along with cash on hand, the net proceeds from the offering of €200.0 million principal amount of 10 ?% Senior Subordinated Notes Due 2010, and borrowings from our senior credit facility, to repay a substantial portion of the debt of the IFCO Companies and PalEx, to pay the cash portion of the merger consideration to PalEx stockholders, to fund a cash payment due to General Electric Capital Corporation and General Electric Erste Beteiligungs GmbH, and to fund our purchase of the remaining joint venture interest in our U.S. operations, IFCO-U.S.

In connection with the merger, Schoeller Logistics Industries GmbH and Gebrüder Schoeller Beteiligungsverwaltungs GmbH contributed to IFCO Systems, directly or indirectly, the outstanding capital shares of IFCO Europe, MTS, and IFCO International owned by them.

In addition, we, together with Schoeller Industries, the shareholders of Schoeller Industries, Schoeller Plast Industries GmbH, and Gebrüder Schoeller, entered into the Option Release and IPO-Facilitation Agreement with GE Capital and GE Erste in connection with the merger and the IPO. Pursuant to that agreement, Schoeller Logistic Technologies Holding GmbH issued a DM45.0 million, or approximately $19.8 million, convertible debenture to GE Erste in exchange for the contribution of the preferential share of IFCO Europe owned by GE Erste. We also paid GE Capital and GE Erste €22.0 million, or approximately $21.0 million (as of March 8, 2000), out of the net proceeds of the IPO, the offering of the senior subordinated notes, and the initial borrowings under our senior credit facility in consideration of the release of GE Capital’s and GE Erste’s options and other rights to purchase shares of the IFCO Companies.

The IFCO Companies

The IFCO Companies began the world’s first round-trip systems business. The business was initially founded in 1992 as IFCO International Fruit Container Organization GmbH, an affiliate of Schoeller Industries, which later changed its name to IFCO International Food Container Organization GmbH. Today, known as IFCO GmbH, it is the operating company for IFCO Europe.

Since 1992, the IFCO Companies have developed European-wide round-trip systems for fresh fruit and vegetables. The IFCO Companies hold several international patent rights on its RPCs.

Schoeller Industries is a family-owned business with its origins in the paper, sugar, wood, and textile industries dating back to the eighteenth century. In 1958, Alexander Schoeller invented, developed, and launched the first plastic beverage crates for use in the German beverage market, and plastic moldings are still one of the Schoeller group’s core businesses. In 1982, Alexander’s sons, Christoph and Martin Schoeller, joined the group

18

and, in 1992, were responsible for the design of the collapsible RPCs and the launch of the IFCO Companies.

In 1994, IFCO International entered into a joint venture with Mitsubishi in Japan, the IFCO Companies’ first market entry outside of Europe. In 1996, IFCO International also entered into a U.S. joint venture. In 1997, GE Capital became an investor in IFCO Europe through its subsidiary, GE Erste. In 1998, IFCO Europe was named one of Europe’s Top 500 Growth Companies by the Association of Dynamic Entrepreneurs in Brussels, Belgium.

IFCO North America (formerly PalEx)

PalEx was formed in January 1996 to create a national provider of pallets and related services. Concurrently with the closing of its initial public offering in March 1997, PalEx acquired three businesses engaged in pallet manufacturing and recycling. Since that time and prior to the merger, PalEx acquired 16 additional pallet companies, making it the largest producer of new pallets and the largest pallet recycler in the United States. In the United States, IFCO North America provides a broad variety of pallet products and related services, including the manufacture and distribution of new pallets, the recycling of pallets, including used pallet retrieval, repair, remanufacture, and secondary marketing, and the processing and marketing of various wood-based by-products derived from pallet recycling operations. In Canada, IFCO North America conducts pallet rental and repair operations and pallet pooling management services through IFCO Systems Canada, Inc., our Canadian subsidiary, which was formerly known as SMG Corporation.

We also manufacture and sell wooden pallets, but in August 2000 we determined to concentrate on our systems and services business. We negotiated with a limited number of buyers starting in late December 2000 regarding the sale of our new pallet manufacturing business, and we expect to complete a sale in the third quarter of 2001. As a result, we have reported the new pallet manufacturing business as discontinued operations in this report.

IFCO North America conducts its pallet services operations, as of December 31, 2000, from 62 facilities in 21 states in the United States and 7 Canadian provinces.

In separate transactions in February 1998, PalEx acquired four leading steel drum reconditioning companies, which formed the base for expanding its operations into the industrial container management industry. As a result of these acquisitions and three subsequent acquisitions, IFCO North America is now the largest reconditioner of industrial containers in North America. IFCO North America’s container group is also engaged in drum and intermediate bulk container leasing operations. Its container group operates from, as of December 31, 2000, 13 facilities in 11 states in the United States.

IFCO North America conducts it discontinued new pallet manufacturing operations from, as of December 31, 2000, 17 facilities in 10 states in the United States.

19

Expansion and Acquisitions

Returnable Plastic Containers

We have operations in the United States and Argentina for the development and operation of round-trip systems and RPC pools, have entered the market in Asia, other than in Japan, and have an interest in a joint venture in Japan.

In 1996, we entered into an agreement with Intertape Polymer Group, Inc., to form IFCO-U.S. IFCO-U.S. has been successful in attracting some large retailers to use our RPCs. It still faces high costs, however, as it works to develop the necessary infrastructure to support an RPC pool. We purchased the Intertape interest in IFCO-U.S. in March 2000 following the completion of the IPO. IFCO-U.S. is now an indirect wholly owned subsidiary of IFCO Systems.

We entered the market in Argentina in mid-1998. The Argentina operation began RPC pooling operations in March 1999. We are currently in the process of reorganizing the Argentina operation, which is still in a start-up phase. We also began start-up initiatives in Uruguay, Chile, and Mexico, but determined in 2000 to terminate those initiatives.

We entered the market in Asia, other than Japan, in November 2000. We will begin RPC pooling operations in 2001.

In Japan, we have a minority interest in a joint venture with Mitsubishi, which began in 1995. The joint venture continues to encounter a very fragmented market and strong cooperative controls.

Pallets

Since the initial three acquisitions in connection with PalEx’s initial public offering in March 1997, but prior to the merger and the IPO, PalEx purchased 16 pallet companies in separate transactions. The total purchase price for these acquired companies was approximately 5.2 million shares of PalEx common stock, approximately $55.4 million in cash, and approximately $10.0 million principal amount of convertible notes.

In 2000, following the merger and the IPO, we purchased three additional pallet companies in separate asset purchase transactions. The total purchase price for these acquired businesses was approximately 972,000 IFCO Systems ordinary shares, approximately $68.5 million in cash, and approximately $6.6 million principal amount of subordinated notes.

Pursuant to a Purchase Agreement dated as of August 4, 2000, a newly formed wholly owned subsidiary of IFCO North America and a new Mexican partnership acquired substantially all the assets of Texas Pallet, L.P., Interstate Pallet Holding Company, Inc., National Pallet-Oklahoma LLC, Texas Pallet Holding Company, Inc., Texas Pallet Sales Company, L.P., Texas Pallet Freight Company, L.P., Texas Pallet Recovery, Inc., and Texas Pallet De Mexico, S.A. De C.V. The Texas Pallet companies provided pallet systems and logistics services from 11 facilities in Texas, Oklahoma, Mississippi, Louisiana, Tennessee, Alabama, and Ohio. The purchase price for the assets consisted of

20

$47.9 million in cash and 798,000 of our ordinary shares. The agreement included customary representations and warranties and indemnities by the Texas Pallet companies and their respective equity owners. The Texas Pallet companies and their respective equity owners also agreed not to compete with IFCO North America and its affiliates for a period of five years after the acquisition.

Pursuant to an Asset Purchase Agreement dated as of August 25, 2000, a newly formed wholly owned subsidiary of IFCO North America acquired substantially all the assets of Bromley Pallet Recyclers, Inc., Bromley Pallet Recyclers, LLC, Bromley Pallet Recyclers of Tennessee, LLC, Bromley Pallet Recyclers of Alabama, LLC, Bromley Pallet Recyclers of Ohio, LLC, Bromley Pallet Recyclers of Indiana, LLC, and Bromley Pallet Recyclers of Illinois, LLC. The Bromley Pallet companies provided pallet services from more than 15 facilities in Florida, Georgia, South Carolina, North Carolina, Arkansas, Indiana, Kentucky, Illinois, and Ohio. The purchase price for the assets consisted of $20.3 million in cash, 119,318 of our ordinary shares, and approximately $6.6 million principal amount of subordinated notes. The agreement included customary representations and warranties and indemnities by the Bromley Pallet companies and their respective equity owners. The equity owners of the Bromley Pallet companies also agreed not to compete with IFCO North America and its affiliates for a period of five years after the acquisition.

Industrial Containers

In February 1998, IFCO Industrial Container Systems Holding Company, formerly PalEx Container Systems, Inc., one of our wholly owned subsidiaries, acquired five companies in separate transactions. Since that time, but prior to December 31, 1998, IFCO Container Systems completed three additional acquisitions of reconditioning companies. The total purchase price for these acquisitions consisted of approximately 4.5 million shares of PalEx common stock and approximately $29.9 million in cash.

We made no industrial container acquisitions during 1999.

In 2000, following the merger and the IPO, we purchased an additional industrial container company in a stock purchase. The total purchase price for this acquired company was approximately 61,000 IFCO Systems ordinary shares and approximately $650,000 in cash.

Capital Expenditures

In 2000, the aggregate amount of capital expenditures, other than the acquisitions discussed above, was approximately $79.3 million, including $50.3 million for RPCs. Capital expenditures currently in progress or anticipated in 2001 total $10.3 million for RPC refurbishing equipment and handling equipment. See “Liquidity and capital resources” in “Operating and Financial Review and Prospects” for a discussion of our ability to make capital expenditures.

21

Systems and Services

Returnable Plastic Containers

The IFCO round-trip systems provide a complete system for product flow that minimizes waste and improves customer satisfaction and retailer profitability. The IFCO round-trip systems include delivery of RPCs to producers when needed, collection of empty containers from retailers, cleaning of containers, and quality control. The producers are invoiced for the RPCs on a per-use or a time basis. After cleaning and any necessary repair, the RPCs are reintroduced into the product distribution cycle.

Since we started the RPC pool in Europe in 1992, we believe we have become the leading supplier of RPCs in Europe. Currently, there are approximately 63.0 million RPCs in circulation in Europe. Our European RPC pool now serves over 4,000 growers supplying produce to approximately 20,000 supermarket outlets throughout Western Europe.

Producers and retailers enjoy several advantages with the IFCO round-trip systems compared to the use of traditional, disposable packaging, including lower costs, better product protection, increased handling efficiency, more efficient space utilization during transport, and less waste and environmental impact. We are able to maximize these benefits as a result of experience with container pooling and transport and our network of container depots, which is extensive in Europe and growing in other regions.

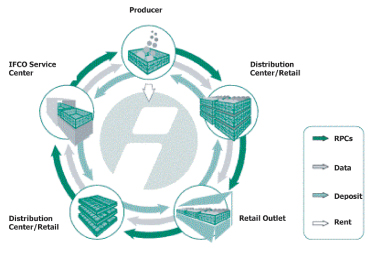

The IFCO round-trip system is illustrated as follows:

This system includes the following steps:

| | • | | producer faxes order for IFCO RPCs to an IFCO container depot; |

| | • | | RPCs are delivered from the IFCO container depot to producer; |

22

| | • | | producer receives an invoice for round-trip services, which include the one-time use of RPCs on either a trip or time basis; |

| | • | | producer also receives an invoice for a deposit for RPCs; |

| | • | | computer tracking system generally monitors the flow of RPCs, but does not currently track the location of each individual RPC, except for RPCs used in dry goods distribution; |

| | • | | producer packs RPCs and ships them to retailer’s distribution center or retail outlet, depending on retailer; |

| | • | | producer bills the deposit for the RPCs to retailer; |

| | • | | retailer displays the products in the RPCs or removes the products for display; |

| | • | | we contract third parties to collect empty, collapsed RPCs from retailer’s distribution center or retail outlet, depending on retailer, for return to an IFCO container depot; |

| | • | | once RPCs are recollected, we return deposit to the retailer; and |

| | • | | we inspect and clean, repair, or recycle, as necessary, empty RPCs at the IFCO container depot to make them ready for their next delivery to a producer. |

The IFCO round-trip systems cover all of the steps in the flow of the goods from delivery to return to depot, including:

| | • | | delivery to customer or first user; |

| | • | | collection of empty containers from retailer; |

| | • | | hygienic cleaning conforming to applicable health and safety guidelines; |

| | • | | storage and delivery to the next customer; and |

| | • | | optional tracking system. |

Generally, we invoice customers on a per trip basis in Europe, Japan, and the United States and on a time basis in Argentina.

IFCO RPCs are extremely versatile. Most IFCO RPCs are made of 100% recyclable materials. They are light, yet strong enough to withstand the stresses of long distance travel and handling and significantly reduce produce damage and loss. They are compatible with automated packaging systems and provide an attractive product presentation at the point of sale. The RPCs fold on average to one-fourth of their original volume, dramatically reducing transport and storage costs for empty RPCs.

Because the IFCO RPCs are made of durable plastic, the products packed in RPCs have better protection for handling during transport and bad weather conditions. The RPCs are better able to bear the stress of large loads as compared to corrugated containers. This is especially true with produce and other perishables, which have an increased chance of

23

arriving at the point of sale in prime condition. Produce is then ready for display with minimum handling. Retailers have the option of using the RPCs for display purposes.

The IFCO RPCs move back and forth among countries based on where crops are being harvested and the countries to which crops will be exported. For example, if Spain were at peak harvest, RPCs from depots outside Spain would be shipped directly to customers in Spain. In our European container pool, most packed RPCs end up back in Germany, since Germany imports much more produce than it grows domestically while other European countries tend to be net exporters. The RPCs are generally used between three and 12 times per year, depending on the type of RPC.

We initially developed RPCs for use with fresh produce. We subsequently developed RPC applications for other perishables like fish, eggs, and bakery products. Other current applications for IFCO RPCs include transport and display of food dry goods, bulk transport, postal shipments, transport of products for department stores, and shipment protection for appliances. IFCO RPCs include different sizes of containers in ISO standard dimensions, including 600 mm x 400 mm and 400 mm x 300 mm. These different sizes are stackable interchangeably whether erected or collapsed.

For a breakdown of our RPC revenues for the years ended December 31, 1998, 1999, and 2000, by segments and geographical markets, see Note 13 to our combined and consolidated financial statements included in this report.

Pallet Services

We offer pallet rental, repair, remanufacture, and recycling services in the United States and Canada. We believe that these systems and services present the greatest opportunity for future growth in the pallet industry.

Many new pallets are discarded by pallet users after one trip. However, pallets can be recovered, repaired, if necessary, and reused. Pallet repair and recycling operations begin with the retrieval or purchase of used pallets from a variety of sources. The condition and size of these pallets vary greatly. Once obtained, the pallets are sorted by size and condition. A portion of the pallets may require no repair and can be resold or returned immediately. Repairable pallets have their damaged boards replaced with salvaged boards or boards from new stock inventoried at the repair facility. Pallets that cannot be repaired are dismantled, and the salvageable boards are recovered for use in repairing and building other pallets. Unsalvageable boards may be ground into wood fiber, which we sell for use as landscaping mulch, fuel, animal bedding, gardening material, and other uses. Despite recent increasing automation, pallet recycling remains a labor intensive process.

Pallet pooling and reconditioning represented the following approximate percentages of revenues of PalEx or IFCO Systems for the historical and pro forma periods as indicated:

24

| | | North America

|

| PalEx Historical Year Ended December 27, 1998 | | 17% |

| PalEx Historical Year Ended December 26, 1999 | | 16% |

| IFCO Systems Pro Forma Combined Year Ended December 31, 1999 | | 11% |

| IFCO Systems Historical Year Ended December 31, 2000 | | 36% |

Industrial Containers

We offer drum reconditioning services in the United States. Although the drum reconditioning process varies slightly throughout the industry, two basic processes are used to recondition steel drums, depending on whether the drums to be reconditioned are closed top drums or open top drums. Closed top drums have secure tops that are an integral part of the drum’s construction and have 2 inch and 3/4 inch head openings in the top of the drum. A steel drum with a fully removable head is referred to as an open top drum. Closed top drums are typically used to transport and store oils, solvents, and flowable resins. Closed top drums are reconditioned by cleaning the interior of the drum at a series of high-pressure alkaline and acid flush-and-rinse stations. Pneumatic machinery reshapes the drum by removing dents and restoring chimes (the top and bottom lid seals). Pressure tests required by U.S. Department of Transportation regulations are then performed to check each drum for leakage. The old exterior coatings are stripped from the drums with an alkaline solution and steel-shot blasting. Next, new decorative coatings are applied and baked on to provide a new durable exterior finish. The thermal treatment used on open top drums cannot be used on closed top drums unless the drum heads are removed.

An open top drum is used for a number of agricultural and industrial applications, including storing and shipping citrus products, berries, foodstuffs, adhesives, and coatings. Open top drums are reconditioned using a thermal process. This process involves passing drums through a furnace that is heated to approximately 1,200 degrees Fahrenheit, which vaporizes residual materials inside the drums. Residual chemicals and compounds created from this process are drawn into an afterburner and destroyed by temperatures approaching 1,850 degrees Fahrenheit. Steel-shot blasting then strips old finishes from both the interiors and exteriors of drums. After this process, the drums pass through a series of hydraulic and pneumatic equipment to restore each drum’s shape and integrity. Finally, new interior protective and exterior decorative coatings are baked onto the drums.

When closed top drums contain residues that cannot be purged through the standard procedures described above, the drums are converted to open top drums by cutting off the heads of the drums. The drums are then reconditioned as open top drums and are used as converted open top drums or reseamed and have new heads installed so that they can be re-used as a slightly shorter closed top drum.

Waste separated from drums in the reconditioning process is packaged and shipped to appropriate landfills or incinerated in accordance with strict environmental controls. Worn

25

out drums that can no longer be reconditioned are subjected to reconditioning cleaning processes so that they are acceptable raw material for scrap metal processors.

Like pallet recycling, drum reconditioning remains a labor-intensive process despite advances in reconditioning methods. Drum reconditioning represented the following approximate percentages of revenues of PalEx or IFCO Systems for the historical and pro forma periods as indicated:

| | | United States

|

| PalEx Historical Year Ended December 27, 1998 | | 27% |

| PalEx Historical Year Ended December 26, 1999 | | 27% |

| IFCO Systems Pro Forma Combined Year Ended December 31, 1999 | | 19% |

| IFCO Systems Historical Year Ended December 31, 2000 | | 23% |

Container Management

We are continuing our development and promotion of container management systems and services. Container management is the process of providing a combination of services related to a customer’s pallet or drum usage, including the manufacture, repair, retrieval, delivery, and storage of pallets or the reconditioning, retrieval, delivery and storage of drums, as well as the disposal of unusable pallets or drums and component parts. In a typical arrangement, we will contract with a customer to remove all pallets or drums from a particular location and transport them to our repair or reconditioning facility. The pallets or drums are sorted and repaired or reconditioned as needed at one of our depots and sold to third parties, returned to either the customer or its supplier or placed in storage and made available for return to service. We may contract with a customer to perform any or all of the management services available. We believe there are significant opportunities to manage customers’ entire shipping container and platform requirements and that we are in a unique position to develop and offer these services. We have not, however, yet generated any significant revenues from container management.

IFCO Online

We intend to develop tracking and tracing technology in the materials movement industry through our IFCO Online AG subsidiary. All industries have to improve their supply chains in order to deal with shorter product life cycles, a broader spectrum of product offerings, and cost and competitive pressures. The supply chain management processes, therefore, need to be improved with new methods such as collaborative planning, build-to-order, cross-docking, merge-in-transit, and just-in-time deliveries. Today’s logistics systems, however, lack online supply chain data. Tracking and tracing systems based on radio frequency identification, or RFID, tools can provide online information throughout the entire flow of goods.

RFID tools will be a component part of platforms that move products through the supply chain and may be used to track the location and the content of shipping platforms. These platforms include primarily RPCs, but could also include pallets and other conveyances.

26

The usage of that technology can improve supply chain planning and asset utilization, automate warehousing and logistics processes, and provide more current information on new pricing strategies and implementation.

IFCO Online has evaluated tracking and tracing systems and RFID technology carefully, both from a process and technical standpoint. We have selected the leading provider of RFID technology as our partner for the development and implementation. A pilot program for our tracking and tracing system with one or a few select customers is planned for 2001. After completion of that pilot we intend to select target markets for further implementation. In the future, we intend to add tracking and tracing services to our current product offerings.

Discontinued Operations—New Pallet Manufacturing

We manufacture and sell new pallets in the United States, but in August 2000 we determined to concentrate on our systems and services business. We have reported the pallet manufacturing business as discontinued operations in this report.

The manufacturing process at our new pallet facilities is generally the most capital intensive part of the pallet business, with the majority of assembly and construction being automated. New pallets are manufactured from an assortment of wood products, varying in type and quality, with construction specifications being determined by the pallet’s end use. We believe approximately 70% of the wood used in new pallets manufactured in North America consists of hardwoods, including oak, poplar, alder, and gum, with the balance consisting of pine or other softwoods.

We use sawing equipment that cuts large wood sections to specification. The cut wood is then transported to assembly points where employees load the side boards and deck boards into nailing machines that nail the pallets together. After construction is completed, pallets are transported to a stacker for shipment or storage. More customized or smaller orders may be manufactured by hand on assembly tables by two laborers using pneumatic nailers. We typically manufacture pallets upon receipt of customer orders and generally do not maintain a significant inventory of completed pallets.

New pallet manufacturing represented the following approximate percentages of revenues for the historical and pro forma periods indicated:

| | | United States

|

| PalEx Historical Year Ended December 27, 1998 | | 54% |

| PalEx Historical Year Ended December 26, 1999 | | 54% |

| IFCO Systems Pro Forma Combined Year Ended December 31, 1999 | | 38% |

Fiscal 1999 included, for the full period, revenues from a crate manufacturing business acquired in August 1998. For 2000, the new pallet manufacturing business is presented as discontinued operations.

27

Seasonality

For a discussion of the seasonality of our operations, see “Operating Results—Seasonality” in “Operating and Financial Review and Prospects.”

Sales and Marketing

Returnable Plastic Containers

We currently maintain a broad range of customers located throughout Europe, Japan, the United States, and Argentina. Our RPC sales and marketing department is comprised of approximately 70 people and is headquartered in Germany, with eight regional offices in Western Europe, one in Argentina and one in the United States. Our sales process is managed by direct salespersons, supplemented with high-level discussions between our top management and the retail chains. The marketing and sales strategy focuses primarily on:

| | • | | developing and enhancing relationships with retailer groups; |

| | • | | encouraging retailers to request their suppliers to use the IFCO round- trip systems; and |

| | • | | working closely with new and existing customers, whether growers or manufacturers, to implement IFCO round-trip systems for the customer and expand their use. |

Because we seek to generate the majority of our business through retailers, our marketing strategy focuses on large retail chains. Our marketing objective is to convince retailers of the advantages of the IFCO round-trip systems, which will then, in turn, lead the retailers to encourage producers to use the IFCO round-trip systems. This marketing strategy results in a well-defined target group of approximately 150 retail chains worldwide as compared to a large and highly fragmented group of producers. The current consolidation trend in the retail industry favors this marketing strategy.

Our pricing is different in each country and is based on the distance between the customer and the retailer. Generally, pricing is reviewed on a yearly basis, except if there are changes in raw materials or taxes or other exceptional events occur.

We place a significant emphasis on marketing. We maintain a large advertising presence in relevant industry publications in order to increase our international profile and create a strong brand name. Another successful marketing tool that we utilize is attendance at trade fairs, where we market our services to retailers and growers. Additionally, we have a comprehensive and regularly updated website and also produce an array of product brochures and other marketing materials.

Our future growth prospects are largely dependent upon an internationally recognized brand name, which will expand our existing customer base and further advance the acceptance of round-trip systems by the retail sector.

28

Pallets and Industrial Containers

We currently sell to pallet and industrial container customers within the various geographic regions in which we have operations. Our primary sales and marketing activities involve direct selling by our sales force and by members of senior management to local and regional customers at the plant level and to large accounts and target industries more broadly on a geographic basis. Because pricing is a function of regional material and delivery costs, pricing is established at the regional level. Because many of our customers need pallets and/or container management services on a national scale, we continue the development and implementation of our national sales and marketing plan to provide these services at many locations throughout the United States. We seek to continue to develop a network of facilities that will allow these customers to:

| | • | | centralize purchases of recycled pallets, reconditioned drums, and container management services; |

| | • | | obtain convenient and dependable service and a consistent supply of uniform quality pallets, reconditioned drums, and container management services; |

| | • | | achieve greater efficiencies in their shipping platform and container use; and |

| | • | | meet corporate recycling goals. |

We have developed relationships with several national customers and intend to provide services to these and numerous other customers on a local, regional, and national basis. The shipping platform and container management needs of national companies are not uniform, and we intend to tailor our national programs for each customer. These programs include a combination of sourcing, retrieving, repairing, and recycling pallets and drums according to individual customer requirements.

Customers

Returnable Plastic Containers

Although the direct customers of IFCO round-trip systems are producers, the demand is driven mainly by the large retail chains and their product transport requirements. Our top twenty grower customers for RPCs accounted for approximately 12% of RPC revenues for 2000. No grower customer accounted for more than 2% of our 2000 revenues, and we do not materially rely on any single grower customer. The top ten retailer groups using IFCO RPCs accounted for approximately 85% of the recollection of RPCs in 2000.

Currently, over 80 European retailer groups are using IFCO round-trip systems, including major retailers such as Tengelmann, Edeka, Rewe, and Metro in Germany, Coop and Migros in Switzerland, and Waitrose in the United Kingdom. In 1998, we added Coop of Switzerland as a new large retail chain using IFCO RPCs. There has been a trend towards consolidation of grocery retailers in Europe. For example, Allkauf and Kriegbaum were acquired by Metro, and Wertkauf and Interspar were acquired by Wal-Mart in Germany.

29

This trend is expected to continue and has had a positive effect on us as we are able to obtain more volume through existing relationships.

Outside of Europe, our international operations are still largely in the development stage. Major retailers in Japan using the IFCO round-trip systems include Jusco, Coop-Kobe, York Benimaru, Ito-Yokado, Inageya, Izumiya, and Coop Tokyo. In the United States, major retailers who have started to adopt the IFCO round-trip systems include Wal-Mart and H.E. Butt. In Argentina, the major retailers now using the IFCO round-trip systems are Norte, Disco, Coto, Jumbo, Carrefour, Wal-Mart, La Anonima, and Libertad.