UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

¨ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended: December 31, 2001 |

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For The Transition Period From to |

Commission file number: 1-15661

IFCO SYSTEMS N.V.

(Exact name of Registrant as specified in its charter)

The Netherlands

(Jurisdiction of incorporation or organization)

Rivierstaete, Amsteldijk 166,

1079 LH Amsterdam, The Netherlands

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary shares, nominal value €2 per share

(Title of class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary shares issued and outstanding as of December 31, 2001: 43,931,189

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ¨ Item 18 x

| | | | | Page

|

| | 1 |

| | 2 |

|

| | | | | |

|

| Item 1. | | | | 3 |

| Item 2. | | | | 3 |

| Item 3. | | | | 3 |

| | | | | 3 |

| | | | | 5 |

| | | | | 5 |

| | | | | 5 |

| Item 4. | | | | 13 |

| | | | | 13 |

| | | | | 18 |

| | | | | 32 |

| | | | | 32 |

| Item 5. | | | | 35 |

| | | | | 35 |

| | | | | 53 |

| | | | | 64 |

| | | | | 65 |

| Item 6. | | | | 66 |

| | | | | 66 |

| | | | | 67 |

| | | | | 68 |

| | | | | 72 |

| | | | | 72 |

| Item 7. | | | | 72 |

| | | | | 72 |

| | | | | 74 |

| | | | | 81 |

| Item 8. | | | | 81 |

| | | | | 81 |

| | | | | 82 |

| Item 9. | | | | 83 |

| | | | | 83 |

| | | | | 84 |

| | | | | 84 |

| | | | | 85 |

| | | | | 85 |

| | | | | 85 |

| Item 10. | | | | 85 |

| | | | | 85 |

| | | | | 85 |

| | | | | 85 |

| | | | | 86 |

| | | | | 86 |

| | | | | 89 |

| | | | | 90 |

i

| | | | | Page

|

| | | | | 90 |

| | | | | 90 |

| Item 11. | | | | 90 |

| Item 12. | | | | 91 |

|

| | | | | |

|

| Item 13. | | | | 91 |

| Item 14. | | | | 94 |

| Item 15. | | | | 94 |

| Item 16. | | | | 94 |

|

| | | | | |

|

| Item 17. | | | | 94 |

| Item 18. | | | | 94 |

| Item 19. | | | | 95 |

| | 99 |

| | F-1 |

ii

IFCO Systems N.V. is a limited liability company organized under the laws of the Netherlands. Unless otherwise indicated, all references in this report to we, us, our, and similar terms, as well as references to the “Company” and “IFCO Systems,” refer to IFCO Systems N.V. and its subsidiaries after the contribution of the capital shares of the IFCO Companies to IFCO Systems N.V. and to the IFCO Companies and their subsidiaries before that time. As a result of the merger with PalEx, Inc., which subsequently changed its name to IFCO Systems North America, Inc. (and is referred to in this report as PalEx for periods prior to the merger and as IFCO North America for periods after the merger), and other related transactions completed in March 2000, IFCO Systems owns all the stock of the IFCO Companies and IFCO North America. The IFCO Companies are IFCO Systems GmbH (formerly known as IFCO Systems Europe GmbH and, previously, IFCO Europe Beteiligungs GmbH) (“IFCO Europe”) and its predecessors and subsidiaries. At the time of the merger with PalEx, the IFCO Companies also included IFCO International Network Beteiligungsgesellschaft mbH (formerly known as Schoeller International Logistics Beteiligungsgesellschaft mbH) and MTS Ökologistik GmbH, both of which were subsequently merged into IFCO Europe. IFCO North America refers to IFCO North America and its subsidiaries. For purposes of this report, when we describe information on a pro forma basis, unless otherwise indicated, we are giving effect to the merger of PalEx with IFCO Systems, the IPO of IFCO Systems’ ordinary shares, the initial offering of senior subordinated notes by IFCO Systems, initial borrowings under our senior credit facility, other related transactions in March 2000, and the acquisitions of four businesses in July and August 2000.

This report has been prepared in the form required by the U.S. Securities and Exchange Commission for an annual report on Form 20-F and also includes information required to be included in an annual report of a company with shares listed on the SMAX segment of the Amtlicher Handel of the Frankfurt Stock Exchange.

We have elected to use the U.S. dollar as our reporting currency. The euro is the primary functional currency of IFCO Systems and our European operations. Approximate dollar amounts are provided for euro-denominated amounts as set forth in our combined and consolidated financial statements, where applicable. With respect to our combined and consolidated financial statements, all amounts previously reported in Deutsch marks have been restated in euros using the January 1, 1999 fixed exchange rate of DM1 = €0.51129. Otherwise in this report, approximate dollar amounts are provided for euro-denominated amounts based on the Federal Reserve Bank of New York noon buying rate on the date indicated or on June 20, 2002, €1.00 = $0.9646, if no date is indicated. Approximate dollar amounts are provided for Deutsch-mark-denominated amounts based on this euro rate and the fixed conversion rate of €1.00 = DM1.95583, resulting in a rate of DM1 = $0.4932. The exchange rates as of March 8, 2000, the closing date for the merger and the IPO, were €1.00 = $0.9576 and DM1 = $0.4896.

With respect to the translation of euro-denominated and Deutsch-mark-denominated amounts in our combined and consolidated financial statements included elsewhere in this report, see the notes to our combined and consolidated financial statements included in this report.

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this report discuss future expectations, contain projections of results of operations or financial condition of IFCO Systems, or state other forward-looking information. These statements may include financial information and/or statements for periods following the period covered by this report. You can find many of these statements by looking for words like believes, expects, anticipates, estimates, or similar expressions used in this report.

These forward-looking statements may be affected by known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various factors and was derived using numerous assumptions that we believe to be reasonable. Risks and uncertainties include the following: (1) the Company’s significant

indebtedness; (2) the Company’s ability to complete a restructuring of its debt; (3) the cost and availability of financing for operations, capital expenditures, and contemplated growth; (4) the ability to comply with covenants of credit agreements to which IFCO Systems is a party and to make required payments of interest and principal; (5) the ability to comply with covenants of the indenture governing our senior subordinated notes and to make required payments of interest and principal; (6) IFCO Systems’ ability to effectively integrate its operations and achieve its operational and growth objectives; (7) the competitive nature of the container businesses, including returnable plastic containers, or RPCs, and pallets; (8) customer demand and business and economic cycles; (9) seasonality; (10) weather conditions; (11) availability and cost of used pallets; (12) changes in national or international politics and economics; (13) currency exchange rate fluctuations; and (14) changes in capital and financial markets, including the performance of companies listed on the Frankfurt Stock Exchange.

Important factors that could cause our actual results to be materially different from the forward-looking statements are also discussed throughout this report.

2

Item 1. Identity of Directors, Senior Management and Advisors

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

A. Selected financial data

The selected historical financial information presented below for, and as of the end of, each of the years ended December 31, 2000 and 2001 is derived from IFCO Systems’ audited combined and consolidated financial statements, which were audited by Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH. The selected historical financial information presented below for, and as of the end of, each of the years in the three years ended December 31, 1999 is derived from IFCO Systems’ audited combined and consolidated financial statements, which were audited by PwC Deutsche Revision AG, independent accountants. The selected historical financial information is not necessarily indicative of the future results of operations of IFCO Systems. IFCO Systems’ financial statements have been prepared in U.S. dollars in accordance with U.S. GAAP. You should read this selected historical financial information along with Item 5, “Operating and Financial Review and Prospects,” and our combined and consolidated financial statements included in this report.

3

| | | Year ended December 31,

| |

| | | 1997

| | | 1998

| | | 1999

| | | 2000

| | | 2001

| |

| | | | | | (dollars in thousands) | | | | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 118,546 | | | $ | 136,176 | | | $ | 154,726 | | | $ | 286,147 | | | $ | 380,743 | |

| Cost of sales | | | 99,622 | | | | 106,218 | | | | 124,485 | | | | 244,917 | | | | 397,383 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Gross profit (loss) | | | 18,924 | | | | 29,958 | | | | 30,241 | | | | 41,230 | | | | (16,640 | ) |

| Selling, general and administrative expenses | | | 18,328 | | | | 24,289 | | | | 24,511 | | | | 61,063 | | | | 78,405 | |

| Merger and integration costs | | | — | | | | — | | | | 3,519 | | | | — | | | | — | |

| Restructuring costs | | | — | | | | — | | | | — | | | | 941 | | | | 3,695 | |

| Amortization of goodwill and other intangible assets | | | 675 | | | | 383 | | | | 289 | | | | 4,457 | | | | 8,017 | |

| Other operating income, net | | | (840 | ) | | | (864 | ) | | | (639 | ) | | | (1,956 | ) | | | (1,085 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from operations | | | 761 | | | | 6,150 | | | | 2,561 | | | | (23,275 | ) | | | (105,672 | ) |

| Net interest cost | | | (10,415 | ) | | | (10,494 | ) | | | (7,664 | ) | | | (18,943 | ) | | | (26,920 | ) |

| Other income (expense), net | | | 208 | | | | (271 | ) | | | (5,602 | ) | | | 685 | | | | 13,684 | |

| Income tax provision | | | (47 | ) | | | (210 | ) | | | (320 | ) | | | (245 | ) | | | 1,790 | |

| Minority interest | | | — | | | | (1,274 | ) | | | (1,291 | ) | | | — | | | | — | |

| Losses from equity entities, net | | | (2,347 | ) | | | (2,726 | ) | | | (1,738 | ) | | | (286 | ) | | | 76 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Loss from continuing operations before extraordinary loss and cumulative effect of change in accounting principle | | | (11,840 | ) | | | (8,825 | ) | | | (14,054 | ) | | | (42,064 | ) | | | (117,042 | ) |

| Loss from discontinued operations | | | — | | | | — | | | | — | | | | (63,471 | ) | | | (84,236 | ) |

| Extraordinary loss on early extinguishment of debt | | | — | | | | — | | | | — | | | | (5,600 | ) | | | — | |

| Cumulative effect of change in accounting principle | | | — | | | | — | | | | — | | | | 770 | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net loss | | $ | (11,840 | ) | | $ | (8,825 | ) | | $ | (14,054 | ) | | $ | (110,365 | ) | | $ | (201,278 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net loss applicable to ordinary shares(1) | | $ | (11,210 | ) | | $ | (8,913 | ) | | $ | (13,879 | ) | | $ | (110,365 | ) | | $ | (201,278 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Loss from continuing operations per ordinary share(2) | | $ | (.59 | ) | | $ | (.44 | ) | | $ | (.70 | ) | | $ | (1.08 | ) | | $ | (2.66 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net (loss) per ordinary share—basic and diluted(2) | | $ | (.56 | ) | | $ | (.45 | ) | | $ | (.69 | ) | | $ | (2.84 | ) | | $ | (4.58 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

| Weighted average ordinary shares outstanding used in computing loss per share from continuing operations and net loss per share(2) | | | 20,000,000 | | | | 20,000,000 | | | | 20,000,000 | | | | 38,823,105 | | | | 43,931,189 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Dividends declared per ordinary share | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Capital expenditures | | $ | 39,569 | | | $ | 40,195 | | | $ | 53,993 | | | $ | 87,454 | | | $ | 33,993 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

| | | Year ended December 31,

| |

| | | 1997

| | | 1998

| | | 1999

| | | 2000

| | | 2001

| |

| | | (dollars in thousands) | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets | | $ | 10,223 | | | $ | 3,832 | | | $ | (9,664 | ) | | $ | 215,383 | | | $ | 2,112 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total assets | | $ | 249,557 | | | $ | 284,453 | | | $ | 266,621 | | | $ | 780,011 | | | $ | 556,253 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Stockholders’ (deficit) equity | | $ | (19,990 | ) | | $ | (30,873 | ) | | $ | (39,672 | ) | | $ | 215,383 | | | $ | 2,112 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | | Net loss applicable to ordinary shares is net loss plus accretion on redeemable convertible preferred stock, redeemable cumulative participating rights, and participating rights. |

| (2) | | The weighted average outstanding shares for the years ended December 31, 1997, 1998, and 1999 reflect those shares issued just prior to the merger with PalEx in March 2000 in a five-for-one stock split to the existing IFCO Companies’ shareholders and are considered outstanding for this presentation for the years indicated. |

4

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

Risks Relating to Our Business

Our inability to restructure our debt may result in the acceleration of the obligations under our senior subordinated notes and/or our senior credit facility

Our failure to make a €10.625 million, or approximately $10.2 million, interest payment due and payable on March 15, 2002, or within the thirty days thereafter, on our senior subordinated notes has resulted in an event of default under the indenture governing the senior subordinated notes. The nonpayment has also created a cross-default under our amended senior credit facility. We are currently involved in ongoing discussions with the lenders on our amended senior credit facility. After negotiations with an ad hoc committee of noteholders representing the holders of over 70% of the outstanding principal amount of the senior subordinated notes, we reached an agreement in principle on June 27, 2002 to restructure the senior subordinated notes by means of exchanging the senior subordinated notes for ordinary shares in a debt-for-equity swap. The proposed restructuring of the senior subordinated notes agreed in principle between the Company, the ad hoc committee of noteholders, and the Schoeller Group entities, as the Company's principal shareholders, is subject to the execution of a definitive restructuring agreement, approval by the lenders under our amended senior credit facility, approval of the requisite number of noteholders, and approval of certain corporate actions by the requisite number of our shareholders. We cannot assure you that the agreement in principle reached regarding a restructuring of the senior subordinated notes will result in a successful restructuring of this debt.

We hope to complete a restructuring based upon the agreement in principle reached with the ad hoc committee of noteholders and reach an agreement with our senior lenders that will allow us to restructure our balance sheet to reduce our debt and interest burdens resulting from both our senior subordinated notes and our obligations under the amended senior credit facility. If we are unable to complete a restructuring agreement with the ad hoc committee, which is acceptable to our senior lenders, at all or in a timely manner, the entire principal amount of all the senior subordinated notes then outstanding plus accrued interest to the date of acceleration may be accelerated and immediately due and payable at the option of the trustee for the senior subordinated notes or the holders of 25% or more of the aggregate principal amount of the senior subordinated notes. In addition, our senior lenders could accelerate and make immediately due and payable the then outstanding principal balance and accrued interest under the amended senior credit facility. In either event, we would not be able to pay the accelerated amounts due and the senior lenders would then be able to foreclose on our assets that secure the amended senior credit facility.

Delays or uncertainties in reaching a debt restructuring agreement could adversely affect our operations or liquidity

Although we reached an agreement in principle on June 27, 2002 with an ad hoc committee of holders of our senior subordinated notes to restructure our balance sheet to reduce our debt and interest burdens, we cannot be certain when or if we will enter into a definitive restructuring agreement with the holders of our senior subordinated notes. If we are unable to enter into a definitive agreement that restructures our debt and interest burdens under the senior subordinated notes, we may be unable to obtain additional debt or refinance our existing debt. This outcome will have a material adverse effect on our ability to carry on operations, undertake new investments, obtain additional financing on favorable terms, or provide security or guarantees to obtain necessary financing.

5

We have insufficient cash flow to make payments on the debt under our senior subordinated notes. If we are unable to restructure or refinance this debt on more favorable terms pursuant to the agreement in principle, the entire principal amount of all the senior subordinated notes then outstanding plus accrued interest to the date of acceleration may be accelerated and immediately due and payable at the option of the trustee for the senior subordinated notes or the holders of 25% or more of the aggregate principal amount of the senior subordinated notes. In addition, our senior lenders could accelerate and make immediately due and payable the then outstanding principal balance and accrued interest under the amended senior credit facility. In either event, we would not be able to pay the accelerated amounts due and the senior lenders would then be able to foreclose on our assets that secure the amended senior credit facility.

Our capital resources are limited and may not be sufficient to finance our operations and desired level of growth

Our cash from operations and amounts available under our amended senior credit facility may not be sufficient to finance our capital requirements, including current operations, and our desired level of growth. Under the terms of our amended senior credit facility, we currently have no availability for additional borrowing. Even if we are successful in restructuring our debt, we cannot assure you that we will have availability for additional borrowing. Our current level of profitability and cash flow may limit our ability to attract new sources of equity capital that would be favorable to the Company’s current shareholders. Any possible inability to generate sufficient cash from operations, the lack of availability under the amended senior credit facility, or the absence of other sources of debt or equity capital may have a material adverse affect on the Company’s ability to operate and our results of operations for 2002.

Our level of debt could prevent us from fulfilling our objectives and obligations, including obligations under our senior subordinated notes

As of December 31, 2001, we had approximately $328.9 million of net debt, including capital leases, representing approximately 99% of total capitalization. Our level of debt may have important consequences to our investors and noteholders. For example it could:

| | • | | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions, or other purposes; |

| | • | | require us to dedicate a substantial portion of our cash flow to pay our interest expense and debt amortization, which will reduce the funds that would otherwise be available to us for our operations and future business opportunities; |

| | • | | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate; |

| | • | | place us at a competitive disadvantage compared to our competitors that have less debt; |

| | • | | increase our vulnerability to general adverse economic and industry conditions; and |

| | • | | make it more difficult for us to satisfy our obligations with respect to our senior subordinated notes. |

The risks described above could increase if we borrow more money.

The cross-default related to our senior subordinated notes and possible covenant defaults with respect to our senior credit facility could result in the acceleration of the obligations under our senior credit facility

In addition to the cross-default based upon the status of our senior subordinated notes discussed above, there are also certain covenant defaults under our amended senior credit facility. These covenant defaults include (1) exceeding our permitted borrowing base as of May 31, 2002, (2) failure to comply with our minimum net worth

6

covenant as of December 31, 2001, March 31, 2002, and June 30, 2002, primarily as a result of a $70.1 charge for impairment of property, plant and equipment taken in 2001, (3) failure to comply with our total leverage, senior leverage, and interest coverage ratios as of December 31, 2001, which are based on our consolidated EBITDA, and (4) delays in timely compliance with certain financial reporting requirements for 2001 and certain periods in 2002. If no cure period is provided in the credit agreement, a default would immediately constitute an event of default. For most covenant defaults, there is a cure period of 30 days after notice to the Company from the administrative agent or any lender and the default constitutes an event of default only if the default remains unremedied after the cure period expires. If the lenders under our amended senior credit facility do not waive a default or appropriately amend the amended senior credit facility, then there is an event of default, which entitles the lenders to terminate immediately the amended revolver component of the amended senior credit facility and to declare the aggregate principal amount outstanding under both the amended revolver and the amended term loan under the amended senior credit facility, together with all accrued and unpaid interest, immediately due and payable.

Restrictions and covenants in our debt agreements limit our ability to take certain actions and perform some corporate functions

Our debt agreements, which consist of the credit agreement and any ancillary agreements governing our amended senior credit facility and the indenture governing our senior subordinated notes, contain a number of significant covenants that, among other things, limit our ability to:

| | • | | incur additional debt or liens; |

| | • | | pay dividends or make other restricted payments; |

| | • | | make investments including the repurchase or redemption of either capital stock or the senior subordinated notes; |

| | • | | enter into transactions with affiliates; |

| | • | | issue capital stock of a subsidiary or create dividend or other payment restrictions with respect to subsidiaries; |

| | • | | consolidate or merge with any person or transfer or sell all or substantially all of our assets; |

| | • | | make capital investments; and |

In addition, our amended senior credit facility requires us to comply with specific financial ratios and tests, under which we are required to achieve specific financial and operating results. Our ability to comply with these provisions may be affected by events beyond our control. A breach of any of these covenants would result in a default under the amended senior credit facility.

Our results of operations have been impacted by the events of September 11, 2001 and may be impacted in the future by events of a similar nature

Following the events that occurred in the United States on September 11, 2001, our results of operations for 2001 were adversely impacted by lost production days and lower sales volumes, especially with respect to our operations in the United States. While the primary adverse impact was reflected in the fourth quarter of 2001, the continuing impact on our business is uncertain. Both the Company and our customers have also been adversely affected by the negative impact of September 11 on the cost and availability of business insurance coverages. We anticipate that customers may still be reluctant to make business commitments at the same level they did prior to September 11 or may themselves be adversely affected by related decreases in sales volume. In that event, our financial condition and result of operations could continue to be materially adversely affected, especially with respect to our operations in the United States.

7

To the extent that there are any further events of a nature similar to that of September 11, or a prolonged downturn in the U.S. economy, we could experience a disruption of our business or the business of our customers or a material adverse effect on our results of operations.

We are dependent on our relationships with a relatively small number of large retailers

We are dependent on our relationships with a relatively small number of large retailers. Our inability to maintain these relationships or cultivate new relationships on similar terms will impair our ability to remain competitive in the markets in which we operate. The Company’s inability or unwillingness to satisfy its obligations under our senior subordinated notes or our amended senior credit facility, the pendency of debt restructuring negotiations, and/or the failure to complete a debt restructuring at all or in a timely manner may have a material adverse impact upon our relationships with retailers. The loss of one or more of these relationships would have a negative impact on our revenues and profitability.

Weather conditions may reduce demand for our services and products

We provide a significant portion of our services and products to customers who ship agricultural products. Severe weather, particularly during the harvesting seasons, may cause a reduction in demand from agricultural customers, lowering our revenues and profitability. For example, a heavy freeze that damages citrus or other produce crops could have a significant negative impact on our financial condition and results of operations.

Our operating results may fluctuate significantly due to seasonal factors

Our businesses, especially RPCs, are subject to seasonal variations in operations and demand. Accordingly, our performance in any particular quarter may not be indicative of the results that can be expected for any other quarter or for the entire year.

Our RPC revenues vary depending on the fruit and vegetable harvesting season in different countries. Historically, a higher portion of our sales and operating income from RPCs has been recognized in the fourth quarter than in the first quarter, which has historically been the weakest quarter. Revenues in Germany, France, and the United States are highest in summer and fall. Revenues in Southern Europe reach a peak late in fall and throughout winter. Seasonality also has an influence on pricing, as transportation costs incurred during the winter to transport our RPCs from warmer countries in Southern Europe are higher than the costs to transport the RPCs from closer locations in Central Europe. We accordingly charge customers in these Southern European countries higher usage fees.

The pallet services business is subject to two major seasonal business changes during a typical year. At the beginning of each year, retailers, who are our primary suppliers of pallet cores, purge their systems of excess pallets. The timing of this purge is related to the end of the holiday season in the fourth quarter when retailers generally have their lowest inventory levels of the products that they sell. Our pallet demand does not rise during this period—often the first quarter is the second slowest quarter of the year, so we generally have a build-up of pallet cores in the first quarter. The second major seasonal shift occurs during the summer months. Pallet demand is usually much lower due to the end of the produce season in Florida and South Texas. In addition, some of our customers close their manufacturing facilities or run a slower schedule to allow for employees to take vacations and their maintenance groups to perform major repairs and upgrades. This is particularly true in our wood crate business that primarily services the lawn and garden industry.

Our RPC business competes in a highly competitive industry, which may limit our business prospects

We face competition in all geographic markets and each industry sector in which we operate. We expect aggressive competition from packaging industry companies. We also face aggressive competition from the traditional packaging industry. In addition, relatively few barriers prevent entry into the traditional packaging and

8

pallet industries. The effect of this competition could reduce our revenues, limit our ability to grow, increase pricing pressure on our products, and otherwise affect our financial results.

Our RPC business may be affected by the loss of or damage to our RPCs during the product distribution cycle, which may limit our ability to grow or maintain profitability

Despite our experience with container pooling and transport, and the relative durability and reliability of RPCs, our pool of RPCs is subject to shrinkage due to unforeseen loss and damage during transport in the product distribution cycle. Increased loss of or damage to RPCs may increase our costs in maintaining our current RPC pool, thus limiting our ability to grow or maintain profitability.

Our market for pallet repair and recycling services is highly competitive, which may limit our ability to grow or maintain profitability

The market for pallet recycling services is highly fragmented and competitive. As a result, competition on pricing is often intense. Competition for customers and competitive pricing pressure may limit our ability to grow or maintain profitability.

Our pallet services operations, including repair and recycling, are subject to competition from larger competitors, which may limit our ability to grow or maintain revenues and profitability

Other companies with significantly greater capital and other resources than our capital and resources may enter or expand their operations in the pallet services business, including repair and recycling, in the future, which could place us in direct competition with these larger companies in the markets for pallet services. Increased competition from large competitors could reduce our revenues through loss of customers or competitive pricing pressures. Decreases in revenues could have a corresponding effect on profitability.

Our pallet services and pallet pooling operations, including repair and recycling, face competition from other pallet alternatives, which could limit or decrease revenues and profitability

Our pallet services operations, including repair and recycling, and pallet pooling operations face competition from other pallet pooling or other pallet systems providers. Pallet pooling competes currently with recycled pallet sales to the grocery, retailing, and wholesale distribution industries and may expand into other industries in the future. CHEP, with significantly greater resources than us, is currently the dominant pallet pooling company in the world. Other pallet systems may include pallets fabricated from non-wooden components like plastic as cost-effective, durable alternatives to wooden pallets. Increased competition from pallet pooling companies or providers of other alternatives could make it more difficult for us to attract and retain customers or force us to reduce prices. As a result, revenue growth may be limited or may decrease with corresponding effects on our profitability.

Our business models may not succeed in new markets

Our business plans rely on duplicating our business models in new markets, including the United States. Our business models may not be successfully duplicated in these new markets.

We may incur increased costs due to fluctuations in interest rates and foreign currency exchange rates

As a consequence of the global nature of our business, we are exposed to increases in interest rates and changes in foreign currency exchange rates, which may result in decreased profitability. We seek to minimize these risks through regular operating and financing activities and, when appropriate, we will consider the use of currency and interest rate hedges and similar financial instruments, although these measures may not be implemented or be effective. We are also exposed to risks from changes in foreign currency exchange rates as a result of our financial reporting in U.S. dollars.

9

Our international operations may prove more difficult or costly than domestic operations in a single country

Since we have significant operations in a number of countries, including Germany and the United States, we are subject to the risks associated with cross-border business transactions and activities. These risks principally relate to delayed payments from customers in some countries or difficulties in the collection of receivables generally. Political, legal, trade, or economic changes or instability in any of these countries could limit or curtail our business activities and operations. Unexpected changes in regulatory requirements, tariffs and other trade barriers, and price exchange controls in any of these countries could limit operations and make the distribution of products difficult. In addition, the uncertainty of the legal environment in these areas could limit our ability to effectively enforce our rights.

Christoph Schoeller and Martin Schoeller do not devote their full time to IFCO Systems, which may impair our business prospects

Under the terms of an advisory agreement with us, Schoeller Industries provides administrative and management services, but Christoph Schoeller and Martin Schoeller, who are Co-Chairmen of our board of directors, do not devote their full working time to us. Because of other Schoeller family business interests, Christoph Schoeller and Martin Schoeller will continue to be unable to devote their undivided attention to our operations and management. This may impede our management and operations and limit the growth prospects for our business.

We have potential exposure to environmental liabilities, which may increase costs and lower profitability

Our operations are subject to various environmental laws and regulations, including those dealing with handling and disposal of waste products, fuel storage, and air quality. As a result of past and future operations at our subsidiaries’ facilities, we may be required to incur remediation costs and other related expenses. In addition, although we intend to conduct appropriate due diligence with respect to environmental matters in connection with future acquisitions, we may not be able to identify or be indemnified for all potential environmental liabilities relating to any acquired business. One of our subsidiaries currently has potential exposure to environmental liabilities as a result of contaminations at the Zellwood Groundwater Contamination Site in Orange County, Florida. Another of our subsidiaries is subject to claims by the City of Chicago and, potentially, other parties, with respect to an industrial container facility located in Chicago, Illinois. For a description of the potential exposures, see “B. Business overview—Regulation—Industrial Containers” in Item 4, “Information on the Company.” All of our subsidiaries that operated industrial container services business before we disposed of those operations inFebruary 2002 are subject to risks of environmental liabilities as a result of the nature of the businesses they conducted. Steel drum reconditioning requires the use of blast furnaces that must be permitted by environmental regulatory agencies in many instances or involves washing out used steel drums and managing a waste flow stream in accordance with applicable environmental laws and regulations. Although all of these operations have been sold or agreements are in place for their ultimate disposition, claims could be asserted against our subsidiaries under environmental laws or regulations for environmental conditions resulting from these operations during the period our subsidiaries owned or operated the facilities. Environmental liabilities incurred by us or our subsidiaries, if not covered by adequate insurance or indemnification, will increase our costs and have a negative impact on our profitability.

Risks Relating to Our Ordinary Shares

The market price of, and trading volumes in, our ordinary shares may be volatile

The market price of our ordinary shares may be significantly affected by, among others, the following factors:

| | • | | our actual or anticipated results of operations; |

| | • | | the refinancing of our debt or our inability to complete a refinancing of our debt; |

10

| | • | | new services or products offered, or new contracts entered into, by us or our competitors; |

| | • | | changes in, or our failure to meet, securities analysts’ expectations; |

| | • | | legislative and regulatory developments affecting our businesses; |

| | • | | developments and technological innovations in our businesses; and |

| | • | | general market conditions and other factors beyond our control. |

U.S. and non-U.S. stock markets have periodically experienced significant price and volume fluctuations. These changes have often been unrelated to the financial performance of particular companies. These broad market developments may also adversely affect the market price of our ordinary shares. In addition, as a result of the voluntary delisting of our ordinary shares from the Nasdaq National Market in May 2002, the ordinary shares are actively traded on only one trading market, which may increase the exposure of shareholders to shifts in market prices and trading volumes.

We are controlled by a limited number of shareholders, which limits the ability of the public shareholders to influence our affairs

Christoph Schoeller and Martin Schoeller beneficially own, excluding options, approximately 46.6% of our outstanding ordinary shares. They are able to influence our business, policies, and affairs and may be able to block approval of any proposed merger, combination, or sale of substantially all our assets. The anticipated restructuring of the Company’s debt is expected to require shareholder approval of certain corporate actions in order to be completed, and the Schoellers may be in a position to control the outcome of that vote whether in favor of or in opposition to the restructuring plan. Because they have the largest beneficial ownership, the Schoellers may legitimately seek to preserve their control or otherwise protect their own interests and may not have the same interest as smaller shareholders in pursuing strategic investments or business combinations if the result would be a decrease in control or would cause us no longer to exist as a separate entity.

The interests of our current shareholders will be severely diluted and the composition of our board of directors will change after the completion of the restructuring of our debt

The ownership interest of our current shareholders will be severely diluted after a successful completion, if any, of the restructuring of our debt. Under the terms of the agreement in principle reached with the holders of our senior subordinated notes, our current shareholders will retain 10% of our issued and outstanding ordinary shares immediately following the completion of the restructuring. We expect that our current shareholders will also be issued warrants to acquire additional ordinary shares, which together with the ordinary shares currently owned, will represent up to35% of our post-restructuring share capital on a fully-diluted basis (after giving effect to the provision for the issuance of ordinary shares representing 5% of the issued ordinary share capital for a management share incentive plan), depending on the future performance of the Company and based on the equity valuation of the Company on the later of the third anniversary of the closing of the exchange or September 30, 2005. Alternatively, the proposed restructuring may be structured so that our current shareholders receive a new class of Class B ordinary shares of the Company (in lieu of the warrant structure described above) equal to 10% of our issued and outstanding ordinary shares immediately following the completion of the restructuring, with our noteholders receiving Class A ordinary shares of the Company equal to 90% of our issued and outstanding ordinary shares immediately following the completion of the restructuring. Depending on the future performance of the Company and based on the equity valuation of the Company on the later of the third anniversary of the closing of the exchange or September 30, 2005, the Class B ordinary shares held by our current shareholders would be convertible into Class A ordinary shares of the Company representing up to 35% of our post-restructuring share capital on a fully-diluted basis (after giving effect to the provision for the issuance of ordinary shares representing 5% of the issued ordinary share capital for a management share incentive plan).

11

As a result, under either alternative, our noteholders would, if the proposed restructuring is completed successfully, control 90% of our issued and outstanding ordinary shares immediately following the restructuring.

Upon a successful completion, if any, of the restructuring of our debt, our board of directors will be comprised of seven members, three of which would be nominated by our noteholders, three of which will be nominated by the Schoellers, as our principal shareholders, and one of which will be a member of the Company’s management. As a result of this composition, the interests of the Schoellers and our current shareholders generally as now represented on our board of directors will be substantially reduced.

Protecting security holders’ rights may prove more difficult and costly than in a U.S. corporation

Our corporate affairs are governed by our articles of association and by the laws of the Netherlands. The rights of our security holders and creditors and the responsibilities of directors on our board of directors, some of whom may reside outside of the United States, are different than those established under the laws of Delaware or other U.S. jurisdictions. Therefore, our public security holders may have more difficulty and be subject to higher costs in protecting their interests in the face of actions by our management, the board of directors, or controlling security holders than they would as security holders of a corporation incorporated in Delaware or other U.S. jurisdictions. This may include difficulty in effecting service of process within the United States upon us or those persons, or enforcing, in courts outside of the United States, judgments against us or those persons obtained in U.S. courts and based upon the civil liability provisions of the federal securities laws of the United States. Furthermore, since a substantial portion of our assets will be located outside of the United States, any judgment obtained in the United States against those persons or us may not be collectible within the United States. Additionally, there may be doubt as to the enforceability, in original actions in Dutch courts, of liabilities based solely upon the federal securities laws of the United States.

We do not intend to pay cash dividends for the foreseeable future

We intend to retain our earnings, if any, for continued development of our businesses and do not intend to pay cash dividends on our ordinary shares in the foreseeable future. In addition, our amended senior credit facility and the indenture governing the senior subordinated notes include, and any additional credit facilities obtained in the future may include, restrictions on our ability to pay dividends.

Other Risks

The loss of services of Arthur Andersen could cause us significant cost or delay

Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH provides us with auditing services, including an audit report with respect to our financial statements contained in this report. Its affiliate, Arthur Andersen LLP, assists in the auditing services in connection with our U.S. operations and SEC filing requirements. Arthur Andersen LLP is the subject of litigation and has been convicted in a United States federal court of charges of obstruction of justice with respect to its activities in connection with Enron Corp. Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH may merge or operate as an independent entity under a different name and/or Arthur Andersen LLP may fail, may merge with or have its assets sold to a third party or may lose critical personnel. The SEC may decline to accept financial statements audited by Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH if Arthur Andersen LLP or its affiliates is unable to represent to us that the audit was conducted in compliance with professional standards and there was appropriate continuity of Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH and Arthur Andersen LLP personnel working on our audit and availability of national office consultation. In the event that Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH is unable to continue to provide audit services to us, or if the SEC

12

declines to accept financial statements audited by Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft mbH, we could experience significant additional cost or delay in completing our periodic reports required to be filed with the SEC. It is anticipated that effective August 30, 2002, Arthur Andersen LLP will no longer be able to provide auditing services and that the SEC will thereafter no longer accept financial statements audited by Arthur Andersen LLP.

Item 4. Information on the Company

We are a leading international provider in reusable supply chain management services, serving approximately9,000 customers in 29 countries. We believe we:

| | • | | own and manage the largest pool of returnable plastic containers, or RPCs, in Europe based on an independent analysis completed in early 2002; |

| | • | | are the largest provider of recycled pallets in North America based on our pallet industry experience and industry information; and |

| | • | | own and manage a pool of approximately 1.5 million pallets in Canada, the second largest pallet pool in Canada, which also makes it the second largest pool in North America; |

We provide RPCs in a round-trip system. Round-trip means that a container is used for the flow of products through one whole distribution cycle and then is used multiple times. We provide RPCs and related services to growers or manufacturers in order to distribute goods to retailers. Retailers benefit from improved product handling and automation capabilities, in-store display in RPCs, improved space efficiency, and reduction of the amount of packaging from transport. We contract third parties to collect empty RPCs from retailers for inspection and reconditioning by us. The RPCs are then reintroduced into the round-trip system for reuse on a just-in-time basis. Our RPCs, which are based on patented technology, are made of plastic and are collapsible. The RPCs are available in many different standardized sizes and structures depending on the goods to be moved. They are designed to be stacked interchangeably regardless of size. Currently, we have approximately 70.5 million RPCs in circulation worldwide. Our European pool now serves over 4,000 growers supplying produce to thousands of supermarket outlets in Europe. Currently, more than 65 European retailer groups use our round-trip systems.

IFCO North America provides RPC services in the United States with, as of December 31, 2001,5 processing facilities and14 distribution facilities in 8 states in the United States. Currently, we have approximately 6.0 million IFCO RPCs in circulation in the United States.

We also provide a variety of services related to wooden pallets, which come in a variety of shapes and sizes for the movement of various types of goods, including pallet repair and recycling and pallet pooling. We conduct these pallet operations from, as of December 31, 2001, 75 facilities throughout the United States and Canada.

Our revenues from continuing operations for the year ended December 31, 2001, were approximately $380.7 million.

A. History and development of the company

Legal Information

Our legal and commercial name is IFCO Systems N.V. We were incorporated under the laws of the Netherlands on March 31, 1999. Our registered seat is in Amsterdam, the Netherlands, at our principal executive offices located at Rivierstaete, Amsteldijk 166, 1079 LH Amsterdam, the Netherlands. The telephone number for our Amsterdam office is 31-20-504-1772. We also maintain operations headquarters in Munich, Germany and in Houston, Texas in the United States.

13

History

The Merger and Initial Public Offering

In March 2000, we completed the merger of PalEx with and into Silver Oak Acquisition Corp., our wholly owned subsidiary, which initially changed its name to “PalEx, Inc.” PalEx subsequently changed its name to “IFCO Systems North America, Inc.” As a result of the merger and related transactions, we own all of the stock of the IFCO Companies and IFCO North America. In the merger, PalEx stockholders received merger consideration with a total value of $9.00 per share consisting of cash and/or the Company’s ordinary shares for each share of PalEx common stock. The total merger consideration for all the shares of PalEx common stock was $71.4 million in cash and 7.4 million of IFCO’s ordinary shares based on elections by PalEx stockholders and adjustments pursuant to the merger agreement. The total consideration for the merger was $184.5 million for the PalEx common stock plus the assumption of debt of PalEx, which was $153.5 million as of March 8, 2000.

In conjunction with the merger, each option to purchase PalEx common stock that was outstanding on the date of the merger was converted into an option to purchase a certain number of ordinary shares of IFCO Systems, as determined by the definitive agreement providing for the merger. The PalEx options became immediately vested upon completion of the merger and conversion to IFCO Systems options.

In connection with the merger, we also completed an initial public offering of 13.0 million ordinary shares in March 2000 and subsequently issued an additional 1.95 million ordinary shares upon the underwriters’ exercise of their overallotment option. The initial public offering price was €15.50 or $14.90 per share. Our total net proceeds from the IPO, including the exercise of the overallotment option, were $203.2 million. The net proceeds from the IPO were used, along with cash on hand, the net proceeds from the offering of €200.0 million principal amount of 10 5/8% Senior Subordinated Notes Due 2010, and borrowings from our senior credit facility, to repay a substantial portion of the debt of the IFCO Companies and PalEx, to pay the cash portion of the merger consideration to PalEx stockholders, to fund a cash payment due to General Electric Capital Corporation and General Electric Erste Beteiligungs GmbH, and to fund our purchase of the remaining joint venture interest in our U.S. operations, IFCO-U.S., L.L.C.

In connection with the merger, Schoeller Industries and Gebrüder Schoeller Beteiligungsverwaltungs GmbH (“Gebrüder Schoeller”) contributed to IFCO Systems, directly or indirectly, the outstanding capital shares of IFCO Europe, MTS, and IFCO International owned by them.

In addition, we, together with Schoeller Industries, the shareholders of Schoeller Industries, Schoeller Plast Industries GmbH, and Gebrüder Schoeller, entered into the Option Release and IPO–Facilitation Agreement with GE Capital and GE Erste in connection with the merger and the IPO. Pursuant to that agreement, Schoeller Logistic Technologies Holding GmbH issued a DM45.0 million, or approximately $22.2 million, convertible debenture to GE Erste in exchange for the contribution of the preferential share of IFCO Europe owned by GE Erste. We also paid GE Capital and GE Erste €22.0 million, or approximately $21.0 million (as of March 8, 2000), out of the net proceeds of the IPO, the offering of the senior subordinated notes, and the initial borrowings under our senior credit facility in consideration of the release of GE Capital’s and GE Erste’s options and other rights to purchase shares of the IFCO Companies.

The IFCO Companies

The IFCO Companies began the world’s first round-trip systems business. The business was initially founded in 1992 as IFCO International Fruit Container Organization GmbH, an affiliate of Schoeller Industries, which later changed its name to IFCO International Food Container Organization GmbH and then to IFCO GmbH. IFCO GmbH subsequently merged into IFCO Europe.

Since 1992, the IFCO Companies have developed European-wide round-trip systems for fresh fruit and vegetables. The IFCO Companies hold several international patent rights on its RPCs.

14

Schoeller Industries is a family-owned business with its origins in the paper, sugar, wood, and textile industries dating back to the eighteenth century. In 1958, Alexander Schoeller invented, developed, and launched the first plastic beverage crates for use in the German beverage market, and plastic moldings are still one of the Schoeller group’s core businesses. In 1982, Alexander’s sons, Christoph and Martin Schoeller, joined the group and, in 1992, were responsible for the design of the collapsible RPCs and the launch of the IFCO Companies.

In 1994, IFCO International entered into a joint venture with Mitsubishi in Japan, the IFCO Companies’ first market entry outside of Europe. In 1996, IFCO International also entered into a U.S. joint venture. In 1997, GE Capital became an investor in IFCO Europe through its subsidiary, GE Erste. In 1998, IFCO Europe was named one of Europe’s Top 500 Growth Companies by the Association of Dynamic Entrepreneurs in Brussels, Belgium.

IFCO North America (formerly PalEx)

PalEx was formed in January 1996 to create a national provider of pallets and related services. Concurrently with the closing of its initial public offering in March 1997, PalEx acquired three businesses engaged in pallet manufacturing and recycling. Since that time and prior to the merger, PalEx acquired 16 additional pallet companies, making it the largest producer of new pallets and the largest pallet recycler in the United States. In the United States, IFCO North America currently offers pallet management, supply, repair, recycling, and remanufacture services, as well as manufactures custom wood crates. In Canada, IFCO North America conducts pallet pooling operations, as well as offers pallet repair and recycling services, through IFCO Systems Canada, Inc., our Canadian subsidiary, which was formerly known as SMG Corporation.

IFCO North America conducts its pallet operations, as of December 31, 2001, from 66 pallet services facilities in 26 states in the United States and from 9 pallet pooling facilities in 7 Canadian provinces.

IFCO North America also previously manufactured and sold wooden pallets, but in August 2000 we determined to concentrate on our systems and services businesses. We completed the sale of substantially all our new pallet manufacturing operations in October 2001. The proceeds of the sale were $48.1 million and consisted of $46.3 million in cash and a promissory note from the buyer in the amount of $1.8 million. The buyer also issued a warrant to the Company that entitles the Company to purchase up to 1.76% of the buyer’s shares of common stock outstanding on the date of the warrant if the promissory note remained unpaid for more than one year. The promissory note was paid in full in April 2002 and the warrant was cancelled. As a result of the sale, we have reported the new pallet manufacturing business as discontinued operations in this report.

In separate transactions in February 1998, PalEx acquired four leading steel drum reconditioning companies, which formed the base for expanding its operations into the industrial container management industry. As a result of these acquisitions and three subsequent acquisitions, IFCO North America became the largest reconditioner of industrial containers in North America. In 2000, following the merger and the IPO, we purchased an additional industrial container company in a stock purchase. The total purchase price for this acquired company was approximately 61,000 IFCO Systems ordinary shares and approximately $650,000 in cash.

In February 2002, we completed the sale of substantially all of our industrial container services operations. The proceeds of the sale paid at closing were $45.0 million, including $41.5 million in cash and promissory notes from the buyer totaling $3.5 million. In addition to the stated purchase price, the buyer assumed current working capital liabilities of the acquired business. The buyer will also pay the Company up to an additional $11.0 million of cash under an earn-out formula based upon the 2002 EBITDA of the industrial container operations’ central region, which includes the Acme Barrel facility in Chicago, Illinois. The Company provided a $3.75 million letter of credit to the buyer to cover certain insurance costs and agreed to reimburse the buyer for specified insurance costs incurred over a future period by the industrial container services operations’ central region. In addition, the buyer’s promissory notes and $2.0 million of the cash proceeds from the sale were escrowed pending resolution of certain environmental issues. An additional $830,000 of the cash proceeds was delivered to a third party to hold in escrow for the settlement of a Superfund claim relating to one of the Company’s industrial

15

container facilities in California. As a result of the sale, we have reported the industrial container services business as discontinued operations in this report.

Two facilities of the industrial container services operation, the Zellwood, Florida facility and the Acme Barrel facility in Chicago, Illinois, continue to be owned by the Company, through separate subsidiaries, following the February 2002 closing of the asset sale. The Zellwood facility is a single parcel of real property that is subject to a Superfund litigation consent decree, and a subsidiary of the Company will retain title to the assets of this facility pending completion of negotiations between the Buyer and the U.S. Environmental Protection Agency and the Florida Department of Environmental Protection (“FDEP”) for a prospective purchaser’s agreement to protect the buyer from responsibility for current environmental conditions at the Zellwood facility. Until an agreement is completed with EPA and FDEP, the Zellwood facility will sell its products to the buyer, and the buyer will purchase the products for prices intended to reimburse the Company for all costs and expenses related to the operation of the Zellwood facility, while the Company’s subsidiary continues to retain title. The agreement among the buyer, EPA, and FDEP is expected to be completed in the third quarter of 2002, at which time title to the Zellwood assets will be transferred to the buyer and half of the escrowed cash and the escrowed promissory notes will be distributed to the Company. However, if an agreement is not reached with EPA and the FDEP before February 2003, but as an incentive to eventually complete the agreement, either party may exercise an option of closing down the Zellwood facility, transferring title to the buyer and moving the operations to another location. The party that exercises the option will incur punitive costs.

In order to settle claims by the City of Chicago relating to odor and air quality complaints, the Company agreed with the City of Chicago to relocate its Acme Barrel operations before May 31, 2003, to modify its business operations, and to make certain capital improvements to the facility pending its relocation. In accordance with the purchase agreement, as amended, the Acme Barrel facility will cease operations no later than May 31, 2003, and the buyer must take title to the Acme Barrel real property and the facility’s other assets before August 25, 2003 or sell the real property to a third party before that date. The buyer is contractually obligated in the purchase agreement to reimburse us for expenses we incur in connection with any environmental remediation required for the Acme Barrel property to be in compliance with applicable environmental laws. Pending the relocation of the Acme Barrel facility and the transfer of title to the Acme Barrel real property to the buyer or a third party, a subsidiary of the Company continues to operate the Acme Barrel facility and retains title to the Acme Barrel real property and the facility’s other assets. During this period, the Acme Barrel facility will sell its products to the buyer, and the buyer will purchase the products for prices intended to reimburse the Company for all costs and expenses related to the operation of the Acme Barrel facility.

Expansion and Acquisitions

Returnable Plastic Containers

We have operations in the United States for the development and operation of round-trip systems and RPC pools, and we have ownership interests in RPC operations in Argentina and Japan.

In 1996, we entered into an agreement with Intertape Polymer Group, Inc., to form IFCO-U.S., L.L.C. We purchased the Intertape interest in IFCO-U.S. in March 2000 following the completion of the IPO. IFCO-U.S. is now an indirect wholly owned subsidiary of IFCO Systems. IFCO-U.S. has been successful in attracting some large retailers to use our RPCs. It still faces high costs, however, as it works to develop the necessary infrastructure to support an RPC pool.

We entered the market in Argentina in mid-1998, and the Argentina operation began RPC pooling operations in March 1999. In 2001, we sold a controlling interest in the Argentina operation to an unaffiliated third party and now have only a 49% interest.

In Japan, we have a minority interest in a joint venture with Mitsubishi, which began in 1995. The joint venture continues to encounter a very fragmented market and strong cooperative controls.

16

We also began our entry into the market in other parts of Asia in November 2000 by establishing a local company. Start-up operations in Asia have been postponed pending revision of the Company’s global strategy.

Pallets

Since the initial three acquisitions in connection with PalEx’s initial public offering in March 1997, but prior to the merger and the IPO, PalEx purchased 16 pallet companies in separate transactions. The total purchase price for these acquired companies was approximately 5.2 million shares of PalEx common stock, approximately $55.4 million in cash, and approximately $10.0 million principal amount of convertible notes.

In 2000, following the merger and the IPO, we purchased three additional pallet companies in separate asset purchase transactions. The total purchase price for these acquired businesses was approximately 972,000 IFCO Systems ordinary shares, approximately $68.5 million in cash, and approximately $6.6 million principal amount of subordinated notes.

Pursuant to a Purchase Agreement dated as of August 4, 2000, a newly formed wholly owned subsidiary of IFCO North America and a new Mexican partnership acquired substantially all the assets of Texas Pallet, L.P., Interstate Pallet Holding Company, Inc., National Pallet-Oklahoma LLC, Texas Pallet Holding Company, Inc., Texas Pallet Sales Company, L.P., Texas Pallet Freight Company, L.P., Texas Pallet Recovery, Inc., and Texas Pallet De Mexico, S.A. De C.V. The Texas Pallet companies provided pallet systems and logistics services from 11 facilities in Texas, Oklahoma, Mississippi, Louisiana, Tennessee, Alabama, and Ohio. The purchase price for the assets consisted of $47.9 million in cash and 798,000 of our ordinary shares. The agreement included customary representations and warranties and indemnities by the Texas Pallet companies and their respective equity owners. The Texas Pallet companies and their respective equity owners also agreed not to compete with IFCO North America and its affiliates for a period of five years after the acquisition.

Pursuant to an Asset Purchase Agreement dated as of August 25, 2000, a newly formed wholly owned subsidiary of IFCO North America acquired substantially all the assets of Bromley Pallet Recyclers, Inc., Bromley Pallet Recyclers, LLC, Bromley Pallet Recyclers of Tennessee, LLC, Bromley Pallet Recyclers of Alabama, LLC, Bromley Pallet Recyclers of Ohio, LLC, Bromley Pallet Recyclers of Indiana, LLC, and Bromley Pallet Recyclers of Illinois, LLC. The Bromley Pallet companies provided pallet services from more than 15 facilities in Florida, Georgia, South Carolina, North Carolina, Arkansas, Indiana, Kentucky, Illinois, and Ohio. The purchase price for the assets consisted of $20.3 million in cash, 119,318 of our ordinary shares, and an approximate $6.6 million principal amount subordinated note. The agreement included customary representations and warranties and indemnities by the Bromley Pallet companies and their respective equity owners. The equity owners of the Bromley Pallet companies also agreed not to compete with IFCO North America and its affiliates for a period of five years after the acquisition.

In connection with the proposed restructuring of the Company’s debt, and the senior position of both our amended senior credit facility and senior subordinated notes, we determined not to make the payments of principal and interest on the Bromley subordinated note that were due on April 1 and July 1, 2002 totalling $0.9 million. The note is an unsecured obligation of an indirect subsidiary of the Company, is guaranteed by IFCO North America, and is expressly subordinate to indebtedness under our senior credit facility and our senior subordinated notes. The Bromley note accrues interest at the rate of 9% per annum and has an outstanding principal balance of $4.8 million.

We have received a default notice from the holder of the Bromley note. The Bromley note provides, however, for a 180-day standstill in the event of a continuing default under our senior debt, which is defined to include our senior credit facility and our senior subordinated notes. Accordingly, as a result of the continuing default under our senior subordinated notes, the holder of the Bromley note may not exercise any remedy under the note for this 180-day period. The Company and the ad hoc committee of holders of our senior subordinated notes contemplate that the Bromley note will either be reduced and repaid under negotiated terms or otherwise discharged in connection with the Company’s proposed debt restructuring.

17

Capital Expenditures

In 2001, the aggregate amount of capital expenditures, other than the acquisitions discussed above, was approximately $34.0 million, including $20.9 million for RPCs. Capital expenditures currently in progress or anticipated in 2002 total $25.2 million. See “B. Liquidity and capital resources” in Item 5, “Operating and Financial Review and Prospects” for a discussion of our ability to make capital expenditures.

Systems and Services

Returnable Plastic Containers

The IFCO round-trip systems provide a complete system for product flow that minimizes waste and improves customer satisfaction and retailer profitability. The IFCO round-trip systems include delivery of RPCs to producers when needed, collection of empty containers from retailers, cleaning of containers, and quality control. The producers are invoiced for the RPCs on a per-use or a time basis. After cleaning and any necessary repair, the RPCs are reintroduced into the product distribution cycle.

Since we started the RPC pool in Europe in 1992, we believe we have become the leading supplier of RPCs in Europe. Currently, there are approximately 64.5 million of our RPCs in circulation in Europe. Our European RPC pool now serves over 4,000 growers supplying produce to thousands of supermarket outlets in Europe.

Producers and retailers enjoy several advantages with the IFCO round-trip systems compared to the use of traditional, disposable packaging, including lower costs, better product protection, increased handling efficiency, more efficient space utilization during transport, and less waste and environmental impact. We are able to maximize these benefits as a result of experience with container pooling and transport and our network of container depots, which is extensive in Europe.

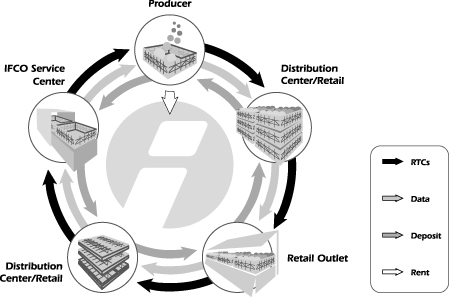

The IFCO round-trip system is illustrated as follows:

This system includes the following steps:

| | • | | producer faxes order for IFCO RPCs to an IFCO container depot; |

18

| | • | | RPCs are delivered from the IFCO container depot to producer; |

| | • | | producer receives an invoice for round-trip services, which include the one-time use of RPCs on either a trip or time basis; |

| | • | | producer also receives an invoice for a deposit for RPCs; |

| | • | | computer asset management generally monitors the flow of RPCs, but does not currently track the location of each individual RPC, except for RPCs used in dry goods distribution; |

| | • | | producer packs RPCs and ships them to retailer’s distribution center or retail outlet, depending on retailer; |

| | • | | in Europe, producer bills the deposit for the RPCs to retailer; |

| | • | | retailer displays the products in the RPCs or removes the products for display; |

| | • | | we contract third parties to collect empty, collapsed RPCs from retailer’s distribution center or retail outlet, depending on retailer, for return to an IFCO container depot; |

| | • | | in Europe, once RPCs are recollected, we return deposit to the retailer; and |

| | • | | we inspect and clean, repair, or recycle, as necessary, empty RPCs at the IFCO container depot to make them ready for their next delivery to a producer. |

The IFCO round-trip systems cover all of the steps in the flow of the goods from delivery to return to depot, including:

| | • | | delivery to customer or first user; |

| | • | | collection of empty containers from retailer; |

| | • | | hygienic cleaning conforming to applicable health and safety guidelines; |

| | • | | storage and delivery to the next customer; and |

| | • | | optional tracking system for dry goods. |

Generally, we invoice customers on a per trip basis in Europe, Japan, and the United States and on a time basis in Argentina.

IFCO RPCs are extremely versatile. Most IFCO RPCs are made of 100% recyclable materials. They are light, yet strong enough to withstand the stresses of long distance travel and handling and significantly reduce produce damage and loss. They are compatible with automated packaging systems and provide an attractive product presentation at the point of sale. The RPCs fold on average to one-fourth of their original volume, dramatically reducing transport and storage costs for empty RPCs.

Because the IFCO RPCs are made of durable plastic, the products packed in RPCs have better protection for handling during transport and bad weather conditions. The RPCs are better able to bear the stress of large loads as compared to corrugated containers. This is especially true with produce and other perishables, which have an increased chance of arriving at the point of sale in prime condition. Produce is then ready for display with minimum handling. Retailers have the option of using the RPCs for display purposes.

We are currently preparing to roll out a new generation of RPCs in Europe and in the United States. The new generation RPCs will generally reflect an improved quality, especially with respect to the closure mechanism and stability, as well as have a lower breakage rate. In addition, our purchase price for the new generation RPCs will be significantly lower and we will have greater warranty protection from our supplier. See “—Suppliers and Raw Materials—Returnable Plastic Containers.”

19

The IFCO RPCs move back and forth among countries based on where crops are being harvested and the countries to which crops will be exported. For example, if Spain were at peak harvest, RPCs from depots outside Spain would be shipped directly to customers in Spain. In our European RPC pool, most packed RPCs end up back in Germany, since Germany imports much more produce than it grows domestically while other European countries tend to be net exporters. The RPCs are generally used between three and 12 times per year, depending on the type of RPC.

We initially developed RPCs for use with fresh produce. We subsequently developed RPC applications for other perishables like fish, eggs, and bakery products. Other current applications for IFCO RPCs include transport and display of food dry goods, bulk transport, postal shipments, transport of products for department stores, and shipment protection for appliances. IFCO RPCs include different sizes of containers in ISO standard dimensions, including 600 mm x 400 mm and 400 mm x 300 mm. These different sizes are stackable interchangeably whether erected or collapsed.

For a breakdown of our RPC revenues for the years ended December 31, 1999, 2000, and 2001, by segments and geographical markets, see Note 13 to our combined and consolidated financial statements included in this report.

The Company continues to work on the development of tracking and tracing technology for its RPCs and the materials movement industry to track the location and the content of shipping platforms. These platforms include primarily RPCs, but could also include pallets and other conveyances. We believe that such a tracking technology can improve supply chain planning and asset utilization, automate warehousing and logistics processes, and provide more current information on new pricing strategies and implementation. Auto identification technology is, in principle, existing and proven, but the Company is still evaluating various technologies for this purpose. With respect to any technology selected for testing and possible implementation, we will consider various factors, including field effectiveness, ease of use, and cost.

Pallet Services