UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Rule 13e-100)

Transaction Statement under Section 13(e) of the Securities

Exchange Act of 1934 and Rule 13e-3 thereunder

Rule 13e-3 Transaction Statement under Section 13(e) of the

Securities Exchange Act of 1934

Tsingyuan Brewery Ltd.

(Name of Issuer)

DINGYOU ZHANG

(Name of Persons Filing Statement)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

89853G 105

(CUSIP Number of Class of Securities)

Dingyou Zhang

Linpan Industrial Park

Linyi County, Shandong Province

P.R. China 251500

+86-534-505-4799

| Woon-Wah Siu, Esq. | Stephen R. Rusmisel |

| Pillsbury Winthrop Shaw Pittman LLP | Pillsbury Winthrop Shaw Pittman LLP |

| Suite 4201, Bund Center | 1540 Broadway |

| 222 Yan An Road East, Huangpu District | New York, NY 10036-4039 |

| Shanghai, China 200002 | +1-212-858-1442 |

| +86-21-61377999 | |

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing Person)

This statement is filed in connection with (check the appropriate box):

| [ ] | a. | The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| [ ] | b. | The filing of a registration statement under the Securities Act of 1933. |

| [ ] | c. | A tender offer. |

| [X] | d. | None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: [ ]

Check the following box if the filing is a final amendment reporting the results of the transaction: [ ]

CALCULATION OF FILING FEE

| Transaction Valuation* | Amount of Filing Fee** |

| $788,793 | $90.40 |

* | Calculated solely for the purpose of determining the filing fee in accordance with Rule 0-11(b)(1) under the Securities Exchange Act of 1934, as amended. The filing fee is calculated based on the aggregate cash payment of RMB 4,975,745 (approximately $788,793) for the proposed private purchase of 8,205,724 shares of common stock by the Filing Person). |

| |

| | |

** | The filing fee, calculated in accordance with Rule 0-11(b)(1) of the Securities Exchange Act of 1934 and the Securities and Exchange Commission Fee Rate Advisory #2 for Fiscal Year 2012, is calculated by multiplying the Transaction Valuation by 0.0001146. |

| |

| | |

[ ] | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

Amount Previously Paid: N/A

Form or Registration No.: N/A

Filing Party: N/A

Date Filed: N/A

NEITHER THE SECURITIES EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS: APPROVED OR DISAPPROVED OF THE TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| | Page |

| | |

| SUMMARY TERM SHEET | 1 |

| | |

| Purposes of the Private Purchase | 1 |

| Principal Terms of the Private Purchase | 1 |

| Affiliate Parties to the Private Purchase | 1 |

| The Filing Person’s Position on the Fairness of the Private Purchase | 1 |

| Consequences of the Private Purchase | 2 |

| Where You Can Find More Information | 2 |

| | |

| INTRODUCTION | 2 |

| | |

| SPECIAL FACTORS | 3 |

| | |

| PURPOSES, ALTERNATIVES, REASONS, AND EFFECTS | 3 |

| | |

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | 4 |

| | |

| FAIRNESS OF THE PRIVATE PURCHASE | 6 |

| | |

| REPORTS, OPINIONS, APPRAISALS, AND NEGOTIATIONS | 6 |

| | |

| TRANSACTION STATEMENT | 6 |

| | |

| Item 1. Summary Term Sheet | 6 |

| Item 2. Subject Company Information | 6 |

| Item 3. Identity and Background of Filing Person | 8 |

| Item 4. Terms of the Transaction | 9 |

| Item 5. Past Contacts, Transactions, Negotiations and Agreements | 10 |

| Item 6. Purposes of the Transaction and Plans or Proposals | 14 |

| Item 7. Purposes, Alternatives, Reasons, and Effects | 14 |

| Item 8. Fairness of the Transaction | 15 |

| Item 9. Reports, Opinions, Appraisals, and Negotiations | 15 |

| Item 10. Source and Amount of Funds or Other Consideration | 15 |

| Item 11. Interest in Securities of the Subject Company | 16 |

| Item 12. The Solicitation or Recommendation | 16 |

| Item 13. Financial Statements | 16 |

| Item 14. Persons/Assets, Retained, Employed, Compensated or Used | 17 |

| Item 15. Additional Information | 18 |

| Item 16. Exhibits | 18 |

| | |

| ANNEX A - ANNUAL REPORT ON FORM 10-K OF TSINGYUAN FOR YEAR ENDED DECEMBER 31, 2010 | A-1 |

| ANNEX B - QUARTERLY REPORT ON FORM 10-Q OF TSINGYUAN FOR QUARTER ENDED MARCH 31, 2011 | B-1 |

| ANNEX C - QUARTERLY REPORT ON FORM 10-Q OF TSINGYUAN FOR QUARTER ENDED JUNE 30, 2011 | C-1 |

| ANNEX D - QUARTERLY REPORT ON FORM 10-Q OF TSINGYUAN FOR QUARTER ENDED SEPTEMBER 30, 2011 | D-1 |

i

SUMMARY TERM SHEET

This “Summary Term Sheet” summarizes the material information contained in the remainder of this Transaction Statement on Schedule 13E-3 regarding the proposed private purchase involving Tsingyuan Brewery Ltd., referred to herein as “Tsingyuan”. It does not contain all of the information that may be important to you. You should read this entire Schedule 13E-3 and the other documents to which this Schedule 13E-3 refers for a more complete understanding of the transactions being contemplated and how they may affect you. The Filing Person may be deemed to be required to file this Schedule 13E-3 pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended, referred to herein as the Securities Exchange Act, and Rule 13e-3 thereunder. References to “Dollars” or “$” in this Schedule 13E-3 are to United States Dollars and references to “RMB” or “renminbi” are to Chinese Renminbi (RMB).

Purposes of the Private Purchase (Page 1)

Mr. Dingyou Zhang, Chairman and Chief Executive Officer of Tsingyuan, intends to close the private purchase of approximately 6.5% of the issued and outstanding shares of common stock of Tsingyuan due to his belief that the terms of this transaction are favorable to him and are fair to the Sellers (referred to below), and this transaction may enable him to potentially enter into a transaction or transactions with other stockholders, including unaffiliated stockholders, of Tsingyuan, that may cause the shares of common stock, par value $0.0001 per share, of Tsingyuan to become eligible for termination of registration under Rule 12g-4 (a “Take Private Transaction”). This transaction is sometimes referred to as the “private purchase.”

Principal Terms of the Private Purchase (Page 1)

The Private Purchase

Mr. Dingyou Zhang has entered into a Purchase Agreement, dated as of February 10, 2012, with certain sellers (the “Sellers”) (the “Purchase Agreement”) under which Mr. Zhang will privately purchase approximately 6.5% of the outstanding shares of common stock of Tsingyuan for a total of RMB 4,975,745. Mr. Zhang intends to pay for the shares with cash on hand.

Affiliate Parties to the Private Purchase (Page1)

“Filing Person” refers to Dingyou Zhang, who is described in more detail in Item 3 “Identity and Background of Filing Person” beginning on page 8 of this Schedule 13E-3:

Mr. Dingyou Zhang may be deemed to be the beneficial owner of 68,096,633 shares of Tsingyuan’s common stock, or approximately 53.7% of the outstanding shares of Tsingyuan common stock as of February 9, 2012. Mr. Dingyou Zhang’s principal occupation is Chairman and Chief Executive Officer of Tsingyuan.

The Filing Person’s Position on the Fairness of the Private Purchase (Page 1)

Rule 13e-3 under the Securities Exchange Act could be deemed to require the Filing Person to make certain statements regarding, among other things, his belief as to the fairness of the private purchase to the unaffiliated stockholders of Tsingyuan (that is, any Tsingyuan stockholder other than the Filing Person or any director or executive officer of Tsingyuan). The Filing Person is making these statements solely for the purpose of complying with the requirements of Rule 13e-3 and related rules under the Securities Exchange Act, to the extent that they apply.

The Filing Person believes that the proposed private purchase has been negotiated on an arms-length basis between the Filing Person and the Sellers and the terms of this transaction are favorable to him and are fair to the Sellers. The Filing Person believes that the private purchase may enable him to potentially enter into a Take Private Transaction. If the Filing Person effects a Take Private Transaction, he intends that the Take Private Transaction will be both substantively and procedurally fair to the unaffiliated stockholders of Tsingyuan.

1

Consequences of the Private Purchase (Page 2)

Completion of the private purchase will result in the Filing Person owning beneficially approximately 60.1% of the issued and outstanding shares of common stock of Tsingyuan.

If the Purchase Agreement is terminated, the Filing Person will determine whether to propose an alternative transaction, but has not made any determinations in this regard as of this time.

Where You Can Find More Information (Page 2)

More information regarding Tsingyuan is available from its public filings with the Securities and Exchange Commission. See also Item 2 “Subject Company Information” and Item 3 “Identity and Background of Filing Person” beginning on pages 6 and 8, respectively, of this Schedule 13E-3.

INTRODUCTION

This Transaction Statement on Schedule 13E-3 is being filed by the Dingyou Zhang, an individual, referred to as the “Filing Person”:

The Filing Person may be required to file this Schedule 13E-3 pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended, referred to herein as the “Securities Exchange Act”, and Rule 13e-3 thereunder.

This Schedule 13E-3 is being filed in connection with the proposed private purchase by Mr. Dingyou Zhang of approximately 6.5% of the issued and outstanding shares of common stock of Tsingyuan, from the Sellers pursuant to the Purchase Agreement. The closing date of the private purchase is expected to occur no sooner than the 31st day following the date of the filing of this Schedule 13E-3, or such later date as may be required to comply with Rule 13e-3 under the Securities Exchange Act and all other applicable laws.

As of February 9, 2012, there were issued and outstanding 126,857,289 shares of common stock of Tsingyuan, $0.0001 par value per share, and approximately 1,283 stockholders of record as of February 9, 2012.

Under the Delaware General Corporation Law, referred to herein as the “DGCL”, no action is required by the board of directors or the stockholders of Tsingyuan for the private purchase to become effective.

There are no issued and outstanding options or warrants to acquire any capital stock of Tsingyuan.

Cautionary Note Regarding Forward-Looking Statements

This Schedule 13E-3 and the documents incorporated by reference in this Schedule 13E-3 include certain forward-looking statements. These statements appear throughout this Schedule 13E-3 and include statements regarding the intent, belief, or current expectations of the Filing Person, including any statements concerning the Filing Person’s actions following completion of the private purchase. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors, such as positions and strategies of competitors; cash availability/liquidity; and the risks inherent with predicting cash flows, revenue and earnings outcomes as well as all other risk factors described in Tsingyuan’s filings with the Securities and Exchange Commission, or the SEC, from time to time.

2

SPECIAL FACTORS

PURPOSES, ALTERNATIVES, REASONS, AND EFFECTS OF THE PRIVATE PURCHASE

Purposes

The purpose of the private purchase is to enable Mr. Dingyou Zhang to increase his holdings of the issued and outstanding common stock of Tsingyuan on terms which he believes are favorable. Mr. Zhang believes that the terms of the transaction are both favorable to him and fair to the Sellers. Mr. Zhang also believes that the private purchase may facilitate a Take Private Transaction should he determine to pursue such a transaction.

Alternatives

Mr. Zhang considered increasing his holdings of shares of Tsingyuan by acquiring the shares of other unaffiliated stockholders. Because the holdings of most of the other unaffiliated stockholders are small, Mr. Zhang believes that it would be difficult or impossible to acquire their shares other than by means of a public tender offer, which would be costly and which would not guarantee that significant additional shares would be acquired. He believes that acquiring approximately 6.5% shares from the Sellers will be much more cost efficient and less time-consuming than a public tender offer for the shares of the other unaffiliated stockholders. Mr. Zhang believes an increase in his stockholding may enable him to enter into one or more transactions with other stockholders, including unaffiliated stockholders that will result in Tsingyuan “going private.”

Reasons

The Filing Person has determined it to be in his interest to conduct the private purchase in view of his determination that the shares of common stock of Tsingyuan are undervalued in the public market for such shares.

Effects

General

The beneficial ownership of the Filing Person in the outstanding shares of Tsingyuan common stock immediately prior to the consummation of the private purchase amounts to approximately 53.7% in the aggregate. Upon completion of the private purchase, the Filing Person’s beneficial ownership of the shares will be approximately 60.1% . Upon completion of the private purchase, the Filing Person’s interest in Tsingyuan’s net book value (approximately $35.1 million on September 30, 2011), and net income attributable to Tsingyuan (approximately $8.3 million for the fiscal year ended December 31, 2010) will increase from approximately 53.7% to 60.1% of those amounts.

Stockholders

Unaffiliated Stockholders that Do Not Participate

Upon completion of the private purchase, unaffiliated stockholders of Tsingyuan that do not participate in the private purchase will retain their shares with any rights that may be associated with them under Tsingyuan’s charter documents and the DGCL.

3

Unaffiliated Stockholders that Participate

The unaffiliated stockholders that are voluntarily participants as the Sellers in the private purchase hold in aggregate approximately 6.5% of the issued and outstanding shares of Tsingyuan. They will no longer have an interest in, and will not be stockholders of, Tsingyuan and therefore will not be able to participate in any future earnings and potential growth of Tsingyuan, but will also no longer bear the risk of any decreases in the value of Tsingyuan. In addition, the Sellers will not share in any distribution of proceeds after future sales of businesses of Tsingyuan, if any. Any and all other incidents of stock ownership with respect to such unaffiliated stockholders, such as the rights to vote on certain corporate decisions, to elect directors, to receive distributions upon the liquidation of Tsingyuan and to receive appraisal rights upon certain mergers or consolidations of Tsingyuan will be extinguished upon completion of the private purchase. Further, the receipt of the payment for their shares will be a taxable transaction for United States federal income tax purposes. See “Certain U.S. Federal Income Tax Consequences of the Private Purchase,” beginning on page 4 of this Schedule 13E-3.

Upon completion of the private purchase, the unaffiliated stockholders of Tsingyuan that participate in the private purchase will have liquidity, in the form of the purchase consideration, in place of an ongoing equity interest in Tsingyuan.

Affiliates

Other than the Filing Person, the private purchase is not expected to have any material effect on any affiliates of Tsingyuan.

Tsingyuan

The private purchase is not expected to have any material effect on Tsingyuan. It will not cause the common stock to be eligible for termination of registration under the Exchange Act or to be lose any eligibility it may otherwise have to have its shares listed on an over-the-counter quotation service or a national securities exchange. However, with a larger holding after the private purchase, Mr. Zhang may be in a better position to enter into a Take Private Transaction.

Plans After the Private Purchase

After the Private Purchase and depending on market conditions, Mr. Zhang may explore a Take Private Transaction and may discuss a Take Private Transaction with other stockholders and/or third parties. There is no assurance that Mr. Zhang will determine to enter into a Take Private Transaction. Other than disclosed herein, Mr. Zhang has no present plans as to the use of the shares to be purchased pursuant to the private purchase, or any plans, proposals or negotiations that relate to or would result in any extraordinary transactions, purchases, sales or transfers of assets, material changes in the present dividend rate or policy, or indebtedness or capitalization, change in the board of directors or management, or other material change in corporate structure or business, or cause the shares to cease to be authorized for quotation on an automated quotations system operated by a national securities association, or cause the shares to become eligible for termination or suspension of registration under the Securities Exchange Act, the acquisition or disposition of shares by any person, or any changes in the charter instruments of Tsingyuan.

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a summary of the material U.S. federal income tax consequences of the private purchase to certain Sellers. This summary is based upon the provisions of the Internal Revenue Code of 1986, as amended, referred to herein as the “Code”, and the laws, regulations, rulings, and decisions in effect on the date of this Transaction Statement, all of which are subject to change (possibly with retroactive effect) and to differing interpretations. In addition, this discussion only applies to Sellers that are U.S. persons (as defined below) that beneficially own shares as capital assets, and does not address tax consequences that may be relevant to Sellers that may be subject to special tax treatment under the Code, such as Sellers who are brokers, dealers or traders in securities or foreign currency, traders in securities that elect to apply a mark-to-market method of accounting, insurance companies, tax-exempt organizations, banks, financial institutions, broker-dealers, real estate investment trusts, regulated investment companies, grantor trusts, or holders who hold the shares as part of a hedge, straddle, conversion, or other risk reduction transaction. Finally, the following discussion does not address the tax consequences under U.S. federal estate and gift tax laws, state, local or non-U.S. tax laws, or the tax consequences of transactions occurring prior to, concurrently with or after the private purchase (whether or not such transactions are in connection with the private purchase).

4

Neither Mr. Zhang nor Tsingyuan has requested a ruling from the Internal Revenue Service (the “IRS”) in connection with the private purchase or related transactions. Accordingly, the discussion below neither binds the IRS nor precludes it from adopting a contrary position. Furthermore, no opinion of counsel has been or will be rendered with respect to the tax consequences of the private purchase or related transactions.

For purposes of this discussion, a ‘‘U.S. person’’ is any person that is:

a citizen or individual resident of the United States;

a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States or any political subdivision thereof;

an estate the income of which is subject to U.S. federal income tax regardless of its source; or

a trust if either (i) the trust is subject to the primary supervision of a court within the United States and one or more U.S. persons as described in Section 7701(a)(30) of the Code have the authority to control all substantial decisions of the trust or (ii) the trust has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

If a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) is a Seller of shares, the tax treatment of a partner in such partnership will generally depend on the status of the partner and the activities of the partnership. A partnership selling shares, or a partner in such partnership should consult their tax advisors as to the particular U.S. federal income tax consequences of the private purchase.

The receipt of cash by a Seller pursuant to the private purchase will be a taxable transaction for U.S. federal income tax purposes. In general, a Seller will recognize gain or loss for U.S. federal income tax purposes equal to the difference between the amount of cash that the Seller receives in the private purchase and that Seller’s adjusted tax basis in that Seller’s shares. Such gain or loss will be capital gain or loss if the Seller holds the shares as a capital asset, and generally will be long-term capital gain or loss if, at the time of the private purchase, the Seller has held the shares for more than one year.

The cash payments made to a Seller may be subject to backup withholding unless the Seller provides his, her or its tax identification number (social security number or employer identification number) and certifies that such number is correct, or unless an exemption from backup withholding applies. The amount of any backup withholding from a payment to a Seller will be allowed as a credit against such Seller’s U.S. federal income tax liability and may entitle such Seller to a refund, provided that the required information is furnished to the IRS. Sellers should consult their tax advisors regarding their qualification for exemption from backup withholding and the procedure for obtaining such an exemption.

THE U.S. FEDERAL INCOME TAX CONSEQUENCES SET FORTH ABOVE ARE INCLUDED FOR GENERAL INFORMATION PURPOSES ONLY AND ARE BASED UPON CURRENT LAW. BECAUSE INDIVIDUAL CIRCUMSTANCES MAY BE DIFFERENT, EACH SELLER IS URGED TO CONSULT SUCH SELLER’S TAX ADVISOR AS TO THE SPECIFIC TAX CONSEQUENCES TO EACH SUCH SELLER IN THE PRIVATE PURCHASE, INCLUDING THE APPLICATION OF STATE, LOCAL, FOREIGN AND OTHER TAX LAWS.

5

FAIRNESS OF THE PRIVATE PURCHASE

Position of the Filing Person as to the Fairness of the Transaction

Under SEC rules, the Filing Person could be deemed to be engaged in a “going private” transaction, which either has the purpose or, either by itself or in a series of transactions, if consummated, will result in, the removal of Tsingyuan common stock from the OTCQB and the termination of SEC reporting obligations of Tsingyuan and its affiliates. Rule 13e-3 of the Securities Exchange Act may require the Filing Person to provide certain information regarding his position as to the substantive and procedural fairness of the proposed private purchase to the unaffiliated stockholders. The Filing Person is making the statements included in this section solely for the purpose of complying with the requirements of Rule 13e-3 and related rules under the Securities Exchange Act, to the extent that they apply.

As used in this Schedule 13E-3, the term “unaffiliated stockholders of Tsingyuan” means any stockholder other than the Filing Person or any director or executive officer of Tsingyuan. To the knowledge of the Filing Person, other than the Filing Person, the other directors and executive officers of Tsingyuan that hold Tsingyuan common stock are Dingfu Zhang, Chief Operating Officer and Director, and Mingxia Yuan, Chief Financial Officer and Director. To the extent there are any directors or executive officers of Tsingyuan, other than the Filing Person, who hold Tsingyuan common stock, such persons will not participate in the private purchase, and, to the knowledge of the Filing Person, will be affected, if at all, in the same manner and to the same extent as the unaffiliated stockholders of Tsingyuan that are not participating in the private purchase.

The Filing Person has determined that the terms of the private purchase are favorable to him and fair to Sellers. If Mr. Zhang enters into a Take Private Transaction, he intends the terms of such transaction to be both substantively and procedurally fair to the unaffiliated stockholders of Tsingyuan, based on circumstances relevant at the time.

Factors Considered In Determining Fairness

The Filing Person believes that the proposed private purchase is fair to the Sellers because the transaction was negotiated between the parties on an arms-length basis.

REPORTS, OPINIONS, APPRAISALS, AND NEGOTIATIONS

The Filing Person has not engaged any third parties to perform any financial analysis of, or prepare any reports, opinions, or appraisals concerning the private purchase or value of the shares and, accordingly, the Filing Person has not received any report, opinion, or appraisal from an outside party relating to the fairness of the private purchase price being offered to the unaffiliated stockholders voluntarily participating in the private purchase or the fairness of the private purchase to Tsingyuan, the Filing Person, or to the non-participating unaffiliated stockholders.

TRANSACTION STATEMENT

Item 1. Summary Term Sheet

See the Section above captioned “Summary Term Sheet” beginning on page 1 of this Schedule 13E-3.

Item 2. Subject Company Information

Name and Address

The name of the subject company is Tsingyuan Brewery Ltd., a Delaware corporation (“Tsingyuan”). The principal executive offices of Tsingyuan are located at Linpan Industrial Park, Linyi County, Shandong Province, P.R. China 251500 and its telephone number is +86-534-505-4799.

6

Tsingyuan is subject to the informational reporting requirements of the Securities Exchange Act and in accordance therewith is required to file reports, proxy statements, and other information with the SEC relating to its business, financial condition, and other matters. Such reports, proxy statements and other information are available for inspection and copying at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies may be obtained from the SEC’s principal office at 450 Fifth Street, N.W., Washington, D.C. 20549. The SEC also maintains a web site that contains reports, proxy, and information statements, and other information regarding registrants that file electronically with the SEC at http://www.sec.gov.

Securities

The exact title of the class of equity securities subject to the private purchase is common stock, par value $0.001 per share, of Tsingyuan. There are 126,857,289 shares outstanding as of February 9, 2012. There are no outstanding options or warrants to purchase shares or other capital stock of Tsingyuan.

Trading Market and Price

Tsingyuan’s common stock is quoted on the OTCQB under the trading symbol “BEER”. Prior to January 19, 2011, its common stock was quoted on the OTCQB under the trading symbol “SBRD”. On February 9, 2012, the last date on which Tsingyuan common stock traded prior to the filing date of the initial Schedule 13E-3, the last trading price per share was $0.40. The following table sets forth the high and low bid prices of Tsingyuan’s common stock, as reported by Bloomberg, for each quarter since January 1, 2010. The quotations reflect inter-dealer prices, without retail mark-up, markdown or commission, and may not represent actual transactions.

| Quarter Ended | | High Bid | | | Low Bid | |

| | | | | | | |

| March 31, 2010 | $ | 0.263 | | $ | 0.150 | |

| June 30, 2010 | $ | 0.500 | | $ | 0.011 | |

| September 30, 2010 | $ | 0.500 | | $ | 0.020 | |

| December 31, 2010 | $ | 0.510 | | $ | 0.026 | |

| | | | | | | |

| March 31, 2011 | $ | 0.72 | | $ | 0.02 | |

| June 30, 2011 | $ | 1.01 | | $ | 0.17 | |

| September 30, 2011 | $ | 0.99 | | $ | 0.25 | |

| December 31, 2011 | $ | 0.99 | | $ | 0.12 | |

| | | | | | | |

| March 31, 2012 (through February 9, 2012) | $ | 0.85 | | $ | 0.12 | |

STOCKHOLDERS ARE URGED TO OBTAIN A CURRENT MARKET QUOTATION FOR THEIR SHARES.

Dividends

To the knowledge of the Filing Person, Tsingyuan has never declared or paid any dividends in respect of the shares. According to Tsingyuan’s Annual Report on Form 10-K for its fiscal year ended December 31, 2010, Tsingyuan states that it does not intend to pay dividends on the shares in the foreseeable future and that if Tsingyuan ever determines to pay a dividend, Tsingyuan may be unable to effect dividends due to restrictions on dividend payments by PRC companies, and it may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of such dividends from the profits of its operating subsidiaries in the People’s Republic of China.

7

Prior Public Offerings

Neither the Filing Person nor, to the knowledge of the Filing Person, Tsingyuan, has made an underwritten public offering of the shares for cash during the past three years that was registered under the Securities Act of 1933, as amended, or exempt from registration thereunder pursuant to Regulation A.

Prior Stock Purchases

During the fiscal quarter ended September 30, 2010, the Filing Person purchased 60,000,000 shares for $0.0068 per share. During the same quarter, the Filing Person received 46,820,000 shares in exchange for all of the shares of common stock that he held of Tsingyuan Holding, Inc., a Delaware corporation and a wholly-owned subsidiary of Tsingyuan. No other purchases were made during this quarter, therefore the average purchase price was $0.0068 per share, including only purchases for cash.

During the fiscal quarter ended March 31, 2011, Mr. Zhang received 10,041,947 shares as a third-party beneficiary pursuant to a settlement agreement and release in consideration of the release of certain claims. No other purchases were made during this quarter, therefore no average purchase price for cash is reportable.

The Filing Person has not purchased any other Tsingyuan shares during the past two years.

Item 3. Identity and Background of Filing Person

Dingyou Zhang

Name and Address.The principal business address of Mr. Zhang is Linpan Industrial Park, Linyi County, Shandong Province 251500, People’s Republic of China, and his telephone number is +86-534-505-4799.

Business and Background of Entity.Not applicable.

Business and Background of Natural Persons.Since September 2010, Mr. Zhang has served as the Chairman and Chief Executive Officer of Tsingyuan. During September 2010, Mr. Zhang also served as Chief Financial Officer of Tsingyuan. In March 2004 Mr. Zhang organized Linyi Henchang Brewer’s Malt Co., Ltd., or Linyi Malt, a variable interest entity of Tsingyuan, where he has since been employed as Legal Representative and Chief Executive Officer. Mr. Zhang has also filled those roles for Shandong Qingyuan Beer Co., Ltd., or Qingyuan Beer, a variable interest entity of Tsingyuan, since December 2005. In 2000, Mr. Zhang organized the Linyi Hengchang Industrial and Trading Co., Limited, which became the highest earning company in the Linyi Hengchang Industrial District. Previously Mr. Zhang was employed for eight years as General Manager of Shandong Xinwen Mineral Bureau. Mr. Zhang is a member of the Linyi County Standing Committee of the Dezhou Business Committee. Mr. Zhang has a law degree from the Shandong Governmental Law School and attended executive training programs at Tsinghua University School of Business, Beijing. The principal address of each of Tsingyuan, Linyi Malt and Qingyuan Beer is Linpan Industrial Park, Linyi County, Shandong Province 251500, People’s Republic of China, and its telephone number is +86-534-505-4799. Mr. Zhang is a citizen of the PRC.

Mr. Zhang has not been convicted in a criminal proceeding during the past five years (excluding traffic violations or similar misdemeanors) and has not been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining the filing person from future violations of, or prohibiting activities subject to, federal or state securities laws or finding any violation of such laws.

8

Item 4. Terms of the Transaction

Material Terms

Pursuant to the Purchase Agreement between the Filing Person and certain unaffiliated stockholders of Tsingyuan, the Filing Person has agreed to purchase an aggregate of 8,205,724 shares for an aggregate purchase price of RMB 4,975,745 (approximately $788,793), or approximately RMB 0.61 (approximately $0.10) per share. The Filing Person has agreed to pay RMB 0.5 million (approximately $79,440) on or before February 11, 2012 and RMB 2,500,000 (approximately $397,199) on or before February 16, 2012 to the Sellers. The Filing Person will also wire the balance of the purchase price, RMB 1,975,745 (approximately $313,906), to, and the Sellers will deposit the shares with, certain escrow agents on or before February 16, 2012. The closing of the transaction, including payment of the remainder of purchase price and transfer of the shares to the Filing Person, will occur on the later of the 31st day following the filing of a Schedule 13E-3 with the SEC or the date of the clearance of any comments of the SEC to the Schedule 13E-3. The Purchase Agreement will terminate if closing does not occur within 50 calendar days following the filing of a Schedule 13E-3 by the Filing Person, subject to comments on the Schedule 13E-3 by the staff of the SEC if the Schedule 13E-3 is filed as soon as practicable following the date of the agreement. This description of the Purchase Agreement is qualified in its entirety by reference to the agreement which is attached as Exhibit (d) to this Schedule 13E-3.

If the Purchase Agreement is terminated, the Filing Person will determine whether to propose an alternative transaction, but has not made any further determinations in this regard as of this time.

The Filing Person entered into the Purchase Agreement and desires to consummate the transaction because he believes that the terms of the transaction are favorable to him and fair to the Sellers. No board of directors or stockholder vote is required for approval of the transaction.

The Sellers will sell their shares pursuant to the above terms. Stockholders of Tsingyuan that are not parties to the Purchase Agreement will not receive any consideration and will not be required to transfer or otherwise dispose of their shares.

Purchases

Neither the Filing Person nor any of his affiliates has any agreement to purchase any shares from any officer, director or affiliate of Tsingyuan.

Different Terms

Stockholders of Tsingyuan will be treated as described in this Item 4 under “Material Terms” above.Appraisal Rights Stockholders of Tsingyuan do not have appraisal rights with respect to the private purchase.

Provisions for Unaffiliated Stockholders

The Filing Person does not intend to grant the unaffiliated stockholders of Tsingyuan special access to Tsingyuan’s records in connection with the private purchase. The Filing Person does not intend to obtain counsel or appraisal services for the unaffiliated stockholders of Tsingyuan.

Eligibility for Listing or Trading

Not applicable.

9

Item 5. Past Contacts, Transactions, Negotiations and Agreements

(a) Transactions.

On September 13, 2010, the Filing Person purchased 60,000,000 shares, or 99% of the issued and outstanding shares of Tsingyuan at the time, for $0.0068 per share for a total purchase price of $408,000 pursuant to a stock purchase agreement with Corporate Services International, Inc. Pursuant to the stock purchase agreement, the Filing Person was elected as a member of Tsingyuan’s board of directors and the other former director resigned, leaving the Filing Person as sole director of Tsingyuan. The Filing Person as sole director then elected himself to serve as Chief Executive Officer and Chief Financial Officer of Tsingyuan.

On September 24, 2010, the Filing Person entered into and consummated a share exchange agreement with Tsingyuan and C. Mark Tang. Pursuant to this share exchange agreement, the Filing Person received 46,820,000 shares in exchange for all of the shares of common stock that he held of Tsingyuan Holding, Inc., a Delaware corporation and a wholly-owned subsidiary of Tsingyuan. The Filing Person then assigned 48,765,314 shares to 186 persons. The transfer of the shares was effected after certain administrative delays.

On January 21, 2011, World Technology Ventures, LLC, USA and Qingyuan (Green Source) Group Co., Ltd., an affiliate of the Filing Person, entered into a settlement agreement and release in consideration of the release of certain claims, pursuant to which the Filing Person received 10,041,947 shares as a third-party beneficiary.

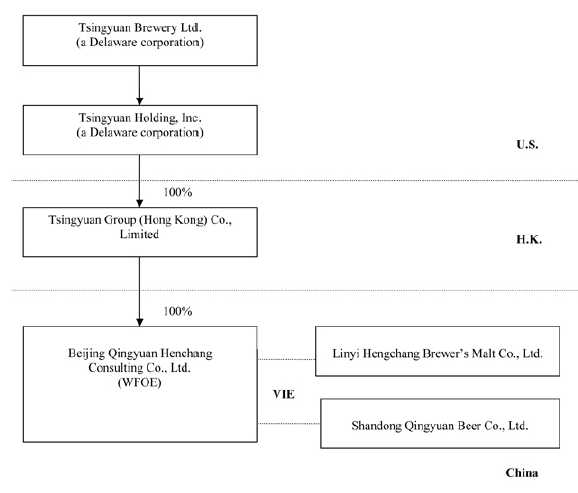

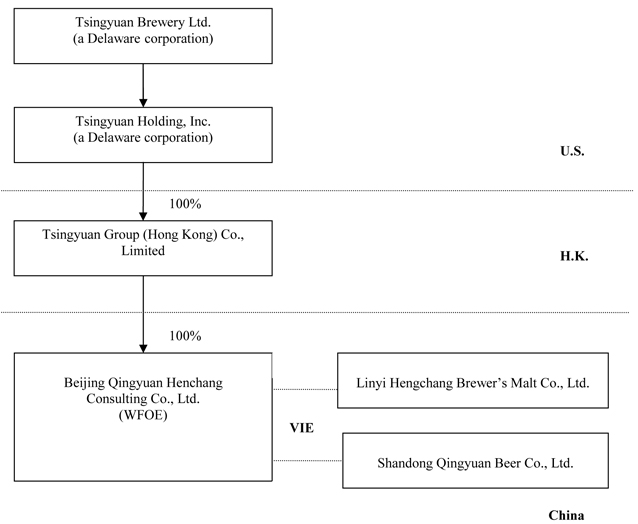

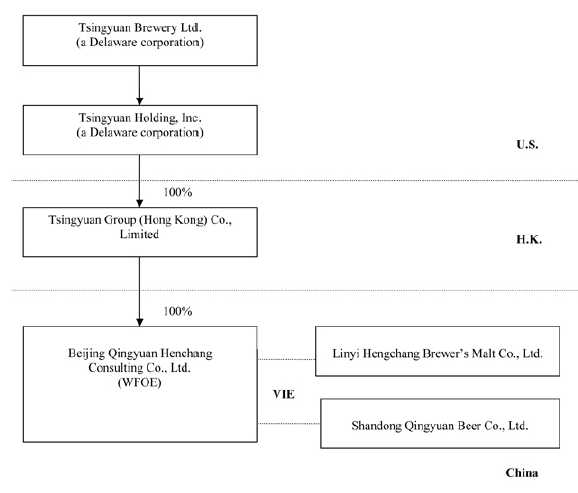

Tsingyuan owns 100% of Tsingyuan Holding, Inc., a Delaware corporation (“Tsingyuan Holding”). Tsingyuan Holding owns all of the registered share capital of Tsingyuan Group (Hong Kong) Co., Limited, a limited liability company incorporated under the laws of the Hong Kong Special Administrative Region (“Tsingyuan HK”). Tsingyuan HK owns all of the registered share capital of Beijing Qingyuan Hengchang Consulting, Co., Ltd., a PRC company (“Qingyuan Management”). Qingyuan Management is deemed a wholly-foreign owned enterprise, or WFOE, under PRC laws. The principal purpose of Qingyuan Management is to manage, hold and own rights in and to the businesses and profits of Linyi Malt and Qingyuan Beer (collectively, the “Tsingyuan Group”), through a series of contractual arrangements described below.

Tsingyuan does not own any equity interests in any constituent company of the Tsingyuan Group, but controls and receives the economic benefits of their respective business operations through contractual arrangements. Through Qingyuan Management, Tsingyuan has contractual arrangements with each Tsingyuan Group company and their respective owners pursuant to which Tsingyuan provides consulting, information technology and other general business operation services. Through these contractual arrangements, which are described below, Tsingyuan also has the ability to substantially influence their daily operations and financial affairs, since Tsingyuan is able to appoint their senior executives and approve all matters requiring approval of the equity owners. As a result of these contractual arrangements, which enable Tsingyuan to control each Tsingyuan Group company and to receive, through Qingyuan Management, all of their profits, Tsingyuan is considered the primary beneficiary of the Tsingyuan Group. Accordingly, Tsingyuan consolidates the Tsingyuan Group’s results, assets and liabilities in its financial statements.

Other than activities relating to its contractual arrangements with the Tsingyuan Group, Qingyuan Management has no other separate operations of its own.

Tsingyuan’s relationships with its two Tsingyuan Group companies and their owners are governed by a series of contractual arrangements that they have entered into with Tsingyuan’s WFOE, Qingyuan Management. PRC regulations on foreign investment currently permit foreign companies to establish or invest in WFOEs or joint ventures that engage in the brewery business in China. However, PRC laws and regulations prevent direct foreign investment in certain other industries, and to protect Tsingyuan’s shareholders from possible future foreign ownership restrictions, following the formation of Qingyuan Management, Qingyuan Management entered into certain contractual arrangements with Linyi Malt and Qingyuan Beer. The contractual arrangements with Linyi Malt and Qingyuan Beer enable Tsingyuan to bypass future ownership restrictions, if any, since neither Tsingyuan nor its WFOE, Qingyuan Management, own equity interests in these companies, while at the same time, Tsingyuan retains control of its respective businesses by virtue of the contractual arrangements.

10

Under PRC laws, Qingyuan Management (Tsingyuan’s WFOE), Linyi Malt and Qingyuan Beer are each an independent business entity not exposed to the liabilities incurred by any of the other two entities. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. Other than pursuant to these contractual arrangements as described below, the two Tsingyuan Group companies cannot transfer any funds generated from their respective operations.

Contractual Arrangements between Qingyuan Management and Tsingyuan Group Companies

On June 26, 2010, Qingyuan Management entered into the following contractual arrangements with the two Tsingyuan Group companies and their respective owners (the “Owners”):

Exclusive Technical Service and Business Consulting Agreements. Pursuant to an exclusive technical service and business consulting agreement executed with each of Linyi Malt and Qingyuan Beer, Qingyuan Management has the exclusive right to provide them with general business operation services, including advice and strategic planning, as well as consulting services related to their current and future operations (the “Services”). Additionally, Qingyuan Management owns the intellectual property rights developed or discovered through research and development, in the course of providing the Services, or derived from the provision of the Services. Linyi Malt and Qingyuan Beer shall each pay a monthly service fee in RMB to Qingyuan Management that is equal to RMB10,000 plus one hundred percent (100%) of its gross profits for such month, if any. The agreement will remain effective until both parties provide written agreement to terminate it in advance.

Share Pledge Agreements. Pursuant to a share pledge agreement executed with each Tsingyuan Group company, the Owners pledge all of their equity interests in the Tsingyuan Group companies to Qingyuan Management in order to secure the rights of Qingyuan Management prior to the acquisition by Qingyuan Management of all the equity interests in Linyi Malt and Qingyuan Beer and to guarantee the two Tsingyuan Group companies’ performance of their respective obligations under the technical service and business consulting agreements. The Owners have agreed not to transfer or dispose of or otherwise encumber the pledged equity interests of the Tsingyuan Group company without the prior written consent of Qingyuan Management. During the term of the pledge, Qingyuan Management shall be entitled to dispose of the pledged assets in the event that shareholders of the Tsingyuan Group companies do not perform their obligation under the Loan Agreements and Tsingyuan Group companies fail to pay the exclusive technology consulting service fee. On January 6, 2011, due to the equity transfer of the 66.8% interest in Qingyuan Beer from Linyi Malt to Mr. Dingyou Zhang, the parties entered into an Amended and Restated Share Pledge Agreement to reflect the change of the pledgors from the original Qingyuan Beer shareholders to the current ones, i.e., Mr. Dingyou Zhang and Ms. Mingxia Yuan.

Call Option Agreements. Pursuant to the exclusive option agreements executed with the Tsingyuan Group companies, the Owners irrevocably grant Qingyuan Management or its designee an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests of the Tsingyuan Group companies at a price to be set forth in the relevant transfer documents. Qingyuan Management or its designee has sole discretion to decide when to exercise any of the purchase options, whether in part or in full, and to determine whether the payment price thereof may be refunded to Qingyuan Management in accordance with applicable PRC law. Upon the exercise of a purchase option by Qingyuan Management, each of the Owners and Linyi Malt will be under noncompetition and nonsolicitation obligations in respect of the relevant Tsingyuan Group company. The option agreement will generally terminate only when the call option under this agreement has been transferred to Qingyuan Management or its designated entities or natural persons. On January 6, 2011, due to the equity transfer of the 66.8% interest in Qingyuan Beer from Linyi Malt to Mr. Dingyou Zhang, the parties entered into an Amended and Restated Call Option Agreement to reflect the change of one of the parties, i.e., from Linyi Malt to Mr. Zhang.

11

Proxy Agreements. Pursuant to the proxy agreements executed with the Owners for each Tsingyuan Group company, the Owners irrevocably grant a Qingyuan Management designee the right to exercise their voting and other ownership rights in the Tsingyuan Group companies, including the rights to attend any meeting of the Owners in accordance with applicable PRC laws and the Tsingyuan Group companies’ organizational documents. Pursuant to the proxy agreements, if any Owner transfers its equity interest of each Tsingyuan Group company with the consent of Qingyuan Management, the obligation and commitment of the Owner under the agreements will terminate without affecting other Owners’ obligations and commitments. On January 6, 2011, due to the equity transfer of the 66.8% interest in Qingyuan Beer from Linyi Malt to Mr. Dingyou Zhang, the parties entered into an Amended and Restated Proxy Agreement to reflect the change of one of the parties, i.e., from Linyi Malt to Mr. Zhang.

The three owners of Linyi Malt are Mr. Zhang, who is also the Chairman of the Board and Chief Executive Officer of our company (89.9%), Mr. Dingfu Zhang (6.2%), who is also Chief Operating Officer and a director of Tsingyuan, and Ms. Mingxia Yuan, who is also the Chief Financial Officer and a director of Tsingyuan (3.9%) . The business of Linyi Malt is the manufacture and sale of brewer’s malt used in the production of beer. Prior to January 6, 2011, the shareholders of Qingyuan Beer were Linyi Malt (66.8%), Mr. Dingyou Zhang (16.6%) and Ms. Yuanmin Xia (16.6%) . On January 6, 2011, Linyi Malt transferred all of its equity interest in Qingyuan Beer to Mr. Dingyou Zhang and therefore after the equity transfer the current two shareholders of Qingyuan Beer are Mr. Dingyou Zhang (83.3%) and Ms. Mingxia Yuan (16.7%) . The business of Qingyuan Beer is the production of various types of affordably-priced branded beers and the distribution of such beers throughout northern and eastern China.

Tsingyuan’s corporate organization chart is set forth below.

12

Between 2006 and 2009, Qingyuan Beer entered into multiple loan agreements with Weihai Hengchang Fuel Group Co., Ltd., a PRC company majority-owned by the Filing Person (“Weihai”), pursuant to which Weihai loaned Qingyuan Beer an aggregate of $2.7 million. Each loan agreement was for one year and did not bear interest. As of December 31, 2010, all such loans from Weihai were repaid.

During 2010, Linyi Malt borrowed an aggregate of $5,968,337 from the Filing Person. The loan was not subject to a written agreement, did not bear interest and was due on demand. As of December 31, 2010, such loans from Mr. Zhang were repaid.

In June 2010, the Filing Person loaned RMB 11,460,000 to Linyi Malt. The loan was subject to a written agreement, did not bear interest and was payable on demand. As of December 31, 2010, $519,381 of such loan remained outstanding and payable to the Filing Person. The loan was fully repaid during the first quarter of 2011.

Tsingyuan does not have a related-party transactions policy.

(b) Significant Corporate Events.

Other than as described in this Schedule 13E-3, there have been no negotiations, transactions or material contacts that occurred during the past two years between (i) the Filing Person and (ii) Tsingyuan or its affiliates concerning any merger, consolidation, acquisition, tender offer for or other acquisition of any class of Tsingyuan’s securities, election of Tsingyuan’s directors or sale or other transfer of a material amount of assets of Tsingyuan.

13

(c) Negotiations or Contacts.

Since it became a reporting company under the Securities Exchange Act, Tsingyuan was approached by various parties regarding potential private placement or public offering of Tsingyuan common stock. Tsingyuan discussed such matters preliminarily with such parties and did not enter into any definitive contracts relating to any such transaction with any such party. Other than as described in this Schedule 13E-3, there have been no negotiations or material contacts that occurred during the past two years concerning the matters referred to in paragraph (b) of this Item between (i) any affiliates of Tsingyuan or (ii) Tsingyuan or any of its affiliates and any person not affiliated with Tsingyuan who would have a direct interest in such matters.

(d) Conflicts of Interest.

Not applicable.

(e) Agreements Involving the Subject Company’s Securities.

The Filing Person is party to the Purchase Agreement with the following other parties: C. Mark Tang, Shaomei Guo, Tang Xiao, Graham Reed, Lan Chen, Shaofeng Guo, Leyun Yu, and Tang Wei, and Leyun Yu and Helen Huo for limited purposes as escrow agents. A description of the material provisions of the Purchase Agreement is included in “Transaction Statement – Item 4. Terms of the Transaction – Material Terms” on page 9. There are no other agreements, arrangements or understandings, whether or not legally enforceable, between the Filing Person and any other person with respect to any securities of Tsingyuan.

Item 6. Purposes of the Transaction and Plans or Proposals

Use of Securities Acquired.

The Filing Person presently intends to retain the shares acquired in the private purchase.

Plans.

Other than as stated above, the Filing Person has no present plans as to the use of the shares to be purchased pursuant to the private purchase, or any plans, proposals or negotiations that relate to or would result in any extraordinary transactions, purchases, sales or transfers of assets, material changes in the present dividend rate or policy, or indebtedness or capitalization, change in the board of directors or management, or other material change in corporate structure or business, or cause the shares to cease to be authorized for quotation on an automated quotations system operated by a national securities association, or cause the shares to become eligible for termination or suspension of registration under the Securities Exchange Act, the acquisition or disposition of shares by any person, any changes in the charter instruments, of Tsingyuan.

Item 7. Purposes, Alternatives, Reasons, and Effects

See “Special Factors—Purposes, Alternatives, Reasons, and Effects of the Private Purchase” beginning on page 3 of this Schedule 13E-3.

14

Item 8. Fairness of the Transaction

See “Special Factors—Fairness of the Private Purchase” beginning on page 6 of this Schedule 13E-3.

Item 9. Reports, Opinions, Appraisals, and Negotiations

See “Special Factors—Reports, Opinions, Appraisals, and Negotiations” beginning on page 6 of this Schedule 13E-3.

Item 10. Source and Amount of Funds or Other Consideration

Source of Funds

The Filing Person will use cash on hand to pay the total private purchase price of RMB 4,975,745 (approximately $788,793).

Conditions

There are no conditions to the financing of the private purchase. There are no alternative financing arrangements or plans.

Expenses

Tsingyuan has not paid and will not be responsible for paying any expenses in connection with the private purchase. Helen Huo, an employee of Tsingyuan, will act as an escrow agent for the private purchase, and certain other employees of Tsingyuan may assist in the private purchase transaction as necessary, but none will receive additional payments by Tsingyuan in connection with these services.

The Filing Person will not pay any fees or commissions to any broker or dealer in connection with the private purchase.

The following is an estimate of fees and expenses to be incurred by the Filing Person in connection with the private purchase:

| | | Fees | |

| Legal Fees and Expenses | $ | 30,600 | |

| Miscellaneous fees and expenses | $ | 5,000 | |

| Total | $ | 35,600 | |

orrowed Funds

Not applicable

15

Item 11. Interest in Securities of the Subject Company

Securities Ownership

Prior to the consummation of the private purchase, the Filing Person will be the holder of an aggregate of 68,096,633 shares, representing approximately 53.7% of the outstanding shares of Tsingyuan. The Filing Person does not beneficially own any other shares of Tsingyuan.

Mr. Dingfu Zhang, an executive officer and director of Tsingyuan and the brother of the Filing Person, owns 5,520,130 shares, or approximately 4.3% of the issued and outstanding shares. None of Mr. Zhang’s other associates beneficially own any shares of Tsingyuan.

Securities Transactions

There were no transactions in the shares effected during the past 60 days by the Filing Person.

Item 12. The Solicitation or Recommendation

Not Applicable.

Item 13. Financial Statements

Financial Information

The information set forth under the following captions is incorporated herein by reference:

“ANNEX A - ANNUAL REPORT ON FORM 10-K OF TSINGYUAN FOR YEAR ENDED DECEMBER 31, 2010”

“ANNEX B - QUARTERLY REPORT ON FORM 10-Q OF TSINGYUAN FOR QUARTER ENDED MARCH 31, 2011”

“ANNEX C - QUARTERLY REPORT ON FORM 10-Q OF TSINGYUAN FOR QUARTER ENDED JUNE 30, 2011”

“ANNEX D - QUARTERLY REPORT ON FORM 10-Q OF TSINGYUAN FOR QUARTER ENDED SEPTEMBER 30, 2011”

Pro Forma Information

Not Applicable.

Summary Financial Information

Set forth below is certain selected consolidated financial information with respect to Tsingyuan excerpted or derived by the Filing Person from the audited consolidated financial statements of Tsingyuan contained in Tsingyuan’s Form 10-K for the fiscal year ended December 31, 2010 and the unaudited consolidated financial statements of Tsingyuan contained in Tsingyuan’s Form 10-Q for the quarterly period ended September 30, 2011. More comprehensive financial information is included in documents filed by Tsingyuan with the SEC, and the following financial information is qualified in its entirety by reference to Tsingyuan’s reports and other documents and all of the financial information (including any related notes) contained therein or incorporated therein by reference.

The selected financial information presented below as of and for the fiscal years ended December 31, 2009 and December 31, 2010 have been derived from Tsingyuan’s audited consolidated financial statements. The selected financial information as of and for the nine-month period ended September 30, 2011 are derived from Tsingyuan’s unaudited consolidated financial statements. The selected financial information should be read in conjunction with the consolidated financial statements, related notes and other financial information incorporated by reference therein.

16

SELECTED CONSOLIDATED FINANCIAL DATA

(In thousands, except share data)

| | | | | | | | | As of | |

| | | | | | | | | September | |

| | | | | | | | | 30, | |

| | | As of December 31, | | | (unaudited) | |

| | | 2010 | | | 2009 | | | 2011 | |

| BALANCE SHEET | | | | | | | | | |

| Current Assets | | 6,437 | | | 4,807 | | | 12,193 | |

| Plant and equipment, net of accumulated depreciation, and other assets | | 18,905 | | | 18,327 | | | 29,237 | |

| Current Liabilities | | 4,168 | | | 10,880 | | | 6,290 | |

| Noncurrent Liabilities | | - | | | - | | | - | |

| Book Value per Share | | 0.17 | | | 0.10 | | | 0.28 | |

| | | | | | | | | Nine | |

| | | | | | | | | Months | |

| | | | | | | | | Ended | |

| | | | | | | | | September | |

| | | Fiscal Year Ended | | | 30, | |

| | | December 31, | | | (unaudited) | |

| | | 2010 | | | 2009 | | | 2011 | |

| STATEMENT OF OPERATIONS | | | | | | | | | |

| Net Sales | | 52,303 | | | 11,919 | | | 63,822 | |

| Gross Profit | | 11,792 | | | 2,646 | | | 14,492 | |

| Income from Operations | | 10,990 | | | 2,332 | | | 12,883 | |

| Income per Share from Operations (basic and diluted) | | 0.09 | | | 0.02 | | | 0.10 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net Income | | 8,254 | | | 1,676 | | | 10,051 | |

| Net Income Attributable to Company | | 8,254 | | | 1,676 | | | 10,051 | |

| Earnings per Share (basic and diluted) | | 0.07 | | | 0.01 | | | 0.08 | |

| Basic and Diluted Net Income per Share | | 0.07 | | | 0.01 | | | 0.08 | |

| | | | | | | | | | |

| Ratio of Earnings to Fixed Charges(1) | | 93.07 | | | 3.51 | | | (1 | ) |

______________________

(1) The ratio of earnings to fixed charges is determined by dividing (i) income before income taxes plus interest expenses by (ii) interest expenses. The Company did not have interest expenses during the nine months ended September 30, 2011.

Item 14. Persons/Assets, Retained, Employed, Compensated or Used

Solicitations or Recommendations

There are no persons or classes of persons who are directly or indirectly employed, retained, or to be compensated to make solicitations or recommendations in connection with the private purchase.

17

Employees and Corporate Assets

Other than as described in this Schedule 13E-3, no officers, class of employees, or corporate assets of Tsingyuan has been or will be employed by or used by the Filing Person in connection with the private purchase.

Three employees of Tsingyuan, two of whom are shared with certain affiliates of the Filing Person and who divide their services with Tsingyuan and with such affiliates of the Filing Person, contributed their services to the Filing Person in connection with matters relating to the private purchase.

Item 15. Additional Information

| (b) | Golden Parachute Compensation. Not applicable. |

| | |

| (c) | Other Material Information. Not applicable. |

Item 16. Exhibits

SIGNATURES

After due inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this Schedule 13E-3 is true, complete and correct.

Dated: February 10, 2012

| | DINGYOU ZHANG |

| | /s/ Dingyou Zhang |

| | |

| SIGNATURE PAGE TO SCHEDULE 13E-3 |

18

ANNEX A - ANNUAL REPORT ON FORM 10-K OF TSINGYUAN FOR YEAR ENDED DECEMBER 31, 2010

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2010

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ____________

Commission File Number 000-53905

Tsingyuan Brewery Ltd.

(Exact name of registrant as specified in its charter)

| Delaware | 65-1714523 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| Linpan Industrial Park, | |

| Linyi County, Shandong Province, P.R. China | 251500 |

| (Address of principal executive offices) | (Zip Code) |

+86-534-5054799 (China)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

Non-accelerated filer (Do not check if smaller reporting company) | [ ] | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $253,871 as of June 30, 2010, based on the closing price of the Company’s common stock of $0.50 on such date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 126,857,289 shares of common stock were issued and outstanding as of March 31, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

TSINGYUAN BREWERY LTD.

Annual Report on Form 10-K

For the Year Ended December 31, 2010

| | | Page No. |

| | Forward Looking Statements and Associated Risk | 1 |

| | Conventions and General Matters | 2 |

| Part I | | |

| Item 1. | Business. | 3 |

| Item 1A. | Risk Factors. | 19 |

| Item 1B. | Unresolved Staff Comments. | 19 |

| Item 2. | Properties. | 19 |

| Item 3. | Legal Proceedings. | 19 |

| Item 4. | (Removed and Reserved.) | 20 |

| Part II | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 20 |

| Item 6. | Selected Financial Information. | 22 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 23 |

| Item 7A. | Quantitative and Qualitative Disclosure About Market Risk. | 30 |

| Item 8. | Financial Statements and Supplementary Data | 30 |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | 31 |

| Item 9A. | Controls and Procedures. | 31 |

| Item 9B. | Other Information. | 33 |

| Part III | | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 34 |

| Item 11. | Executive Compensation. | 35 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 37 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 38 |

| Item 14. | Principal Accountant Fees and Services. | 39 |

| Part IV | | |

| Item 15. | Exhibits, Financial Statement Schedules. | 43 |

FORWARD-LOOKING STATEMENTS AND ASSOCIATED RISK

Certain statements in this Report, and the documents incorporated by reference herein, constitute “forward-looking statements”. Such forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this Report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors and matters described in this report generally and other potential risks and uncertainties, including such factors as:

| | | The market acceptance of the products we sell; |

| | | Problems that we may face in marketing and distributing the products we sell; |

| | | Errors in business planning attributable to insufficient market size or segmentation data; |

| | | Downturns in the economy of the People’s Republic of China; |

| | | Changes in the laws of the People's Republic of China that affect our operations; |

| | | Our ability to obtain and maintain all necessary government certifications and/or licenses to conduct our business; |

| | | Development of a public trading market for our securities; |

| | | Our inability to raise additional capital when needed; |

| | | Problems with important suppliers and strategic business partners; |

| | | The cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; and |

| | | The other factors referenced in this Report, including, without limitation, under the sections entitled “Business,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements in this Report speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent as required by applicable law.

CONVENTIONS AND GENERAL MATTERS

The official currency of the People’s Republic of China is the Chinese “Yuan” or “Renminbi” (“yuan,” “Renminbi” or “RMB”). For the convenience of the reader, amounts expressed in this report as RMB have been translated into United States dollars (“US$” or “$”) at the rate quoted byhttp://www.oanda.com as of December 31, 2010, which was RMB 6.591 to $1.00. The RMB is not freely convertible into foreign currencies and the quotation of exchange rates does not imply convertibility of RMB into U.S. Dollars or other currencies. No representation is made that the RMB or U.S. Dollar amounts referred to herein could have been or could be converted into U.S. Dollars or RMB, as the case may be, at any particular rate or at all. On April 11, 2011, the rate quoted byhttp://www.oanda.com was RMB 6.5361 to $1.00.

The “Company,” “we,” “us,” “our” and similar words refer to Tsingyuan Brewery Ltd., and its direct and indirect, wholly-owned subsidiaries and the variable interest entities, or VIEs, Linyi Hengchang Brewer’s Malt Co., Ltd. and Shandong Qingyuan Beer Co., Ltd.

BUSINESS

General

We are principally engaged in the production and distribution of brewer’s malt and beer products in The People’s Republic of China (the “PRC”). Our brewers malt product line consists of a wide variety of malts that are typically custom made to our customer’s specifications from blends of domestic or imported barleys. Our malts are either used in the production of our own beer products or are sold on a wholesale basis to other breweries through our direct sales force. At December 31, 2010, our beer line included eight full-flavored, affordably-priced beers that are marketed under the “Qinglin,” “Qingyi” or “Qingyuan” trade names to middle-class consumers in second- and third-tier cities throughout northern and eastern China. Our malt and beer production facilities, which are located in Shandong Province in the PRC, have an aggregate annual malt processing capacity of approximately 120,000 metric tons, based upon two 8-hour shifts each working day, and an aggregate annual beer processing capacity of approximately 200,000 metric tons, based upon a 7-day work week and 20 hours each working day.

In the production and marketing of our beers, we target the middle class consumer in the PRC as we believe the middle market for full-flavored, but moderately-priced beers has been under-exploited in China. With the rapid growth of the middle class in the PRC, we believe the demand for well-crafted beer is likewise expanding and will continue to grow. Nevertheless, approximately 90% of the beer produced in the PRC today remains the low-quality, low-priced beer developed to meet the demands of a less-developed economy. Significant improvements in beer technology in the past 20 years have enabled low-cost production of generic beer, which has prompted most established brewers to compete on the basis of price. This phenomenon has resulted in reducing margins across the industry, preventing most brewers from capturing a significant portion of the market outside their own province. All but a few of the beer manufacturers in China sell their products only locally, where they hold market position on the basis of familiarity.

The majority of the new beers entering the market in the PRC are directed to the mid- and upper-priced level, where it remains possible to garner a significant profit. However, because China’s economic growth has focused on its larger cities, and because prestige is a dominant factor in the development of brand consciousness in the larger cities, the majority of new brands entering the market have been high-priced, finely-crafted beers. While these are attractive to urbanites seeking to develop a cosmopolitan image, we believe most Chinese residents cannot afford to drink these beers on a daily basis.

Our revenue has increased significantly in recent years, from $8.0 million in 2008 to $52.3 million in 2010, which represented a compound annual revenue growth rate of 339% during 2010 and cumulative growth of 557% from 2008 to 2010. In 2010, sales of our malt products represented 65% and our beer products represented 35% of our net revenues compared to 75% and 25%, respectively, in 2009. In 2010, we produced 74,843 metric tons of malt products and 74,736 metric tons of beer products compared to 18,213 metric tons and 13,122 metric tons, respectively, in 2009. Over the next few years, we expect our revenue growth to be driven primarily by increases in sales of our beer products and that sales of our beer products will represent an increasing percentage of our net revenues during such periods. To increase our beer sales, we intend to expand our beer bottling and canning facilities and to consider acquisition opportunities in the beer industry to increase our beer production capacity and our annual yield to meet what we believe will be increasing customer demand for our products.

Our History and Corporate Structure

We were originally incorporated in Florida on July 25, 1996 under the name “Environmental Digital Services, Inc.” with a principal business objective of providing environmental contamination remediation products and services. We conducted no substantial business and in 2007 our operations were reorganized in judicial proceedings conducted in Palm Beach County, Florida. In July 2008, we were re-incorporated in Delaware and our corporate name was changed to “Sabre International, Inc.” as part of a plan to continue our operations as a public “shell” company.

On September 13, 2010, our current Chairman of the Board and Chief Executive Officer, Mr. Dingyou Zhang, purchased 60,000,000 shares of our common stock for $408,000 from Corporate Services International, Inc. (“CSI”), an entity controlled by Michael Anthony, our sole officer and director at that time. In connection with such transaction, CSI exchanged its remaining shares of our common stock for a new class of our convertible preferred stock, which shares were convertible into 0.9% of our fully-diluted shares of common stock within 30 days of our ceasing to be a “shell” company. As a result of those transactions, Mr. Zhang became the majority stockholder of our company.

On September 24, 2010, we entered into a Share Exchange Agreement (the “Share Exchange”) with Tsingyuan Holding, Inc., a holding company organized under the laws of the State of Delaware (“Tsingyuan Holding”) that controls operating entities in the PRC through its direct ownership of Qingyuan Management (as defined below). In accordance with the Share Exchange, we issued 65,107,671 shares of our common stock to the stockholders of Tsingyuan Holding for 100% of the equity of Tsingyuan Holding. On September 28, 2010, CSI, the holder of our then-outstanding preferred stock, converted such shares into 1,141,716 shares of our common stock. As a result of the Share Exchange, Tsingyuan Holding became our wholly-owned subsidiary.

On January 19, 2011, we changed our corporate name to “Tsingyuan Brewery Ltd.” and our trading symbol to “BEER”.

Tsingyuan Holding, Inc.

Tsingyuan Holding is a corporation organized under the laws of Delaware on March 30, 2010. It has initiated no business activity, except that Tsingyuan Holding is the sole registered owner of the outstanding capital stock of registered capital of Tsingyuan Group (Hong Kong) Co., Limited, which is the only asset of Tsingyuan Holding.

Tsingyuan Group (Hong Kong) Co., Limited

Tsingyuan Group (Hong Kong) Co., Limited (“Tsingyuan HK”) is a limited liability company incorporated under the laws of the Hong Kong Special Administrative Region on April 22, 2010. Tsingyuan HK is the sole stockholder of Beijing Qingyuan Henchang Consulting Co., Ltd.

Beijing Qingyuan Henchang Consulting Co., Ltd.

Beijing Qingyuan Hengchang Consulting, Co., Ltd. (“Qingyuan Management”) was organized in the PRC on June 17, 2010. Because all of its issued and outstanding capital stock is held by Tsingyuan HK, a Hong Kong company, Qingyuan Management is deemed a wholly-foreign owned enterprise, or WFOE, under PRC laws. The principal purpose of Qingyuan Management is to manage, hold and own rights in and to the businesses and profits of Linyi Hengchang Brewer’s Malt Co., Ltd. and Shandong Qingyuan Beer Co., Inc. (collectively, the “Tsingyuan Group”), through a series of contractual arrangements.

We do not own any equity interests in any constituent company of the Tsingyuan Group, but control and receive the economic benefits of their respective business operations through contractual arrangements. Each Tsingyuan Group company has the licenses and approvals necessary to operate its businesses in China. Through Qingyuan Management, we have contractual arrangements with each Tsingyuan Group company and their respective owners pursuant to which we provide consulting, information technology and other general business operation services. Through these contractual arrangements, we also have the ability to substantially influence their daily operations and financial affairs, since we are able to appoint their senior executives and approve all matters requiring approval of the equity owners. As a result of these contractual arrangements, which enable us to control each Tsingyuan Group company and to receive, through Qingyuan Management, all of their profits, we are considered the primary beneficiary of the Tsingyuan Group. Accordingly, we consolidate its results, assets and liabilities in our financial statements.

Other than activities relating to its contractual arrangements with the Tsingyuan Group, Qingyuan Management has no other separate operations of its own.

Linyi Hengchang Brewer’s Malt Co., Ltd.