SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | | | |

Filed by the Registrant | | þ | | |

| Filed by a Party other than the Registrant | | ¨ | | |

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

ARDEA BIOSCIENCES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

ARDEA BIOSCIENCES, INC.

4939 Directors Place

San Diego, California 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 31, 2012

Dear Stockholder:

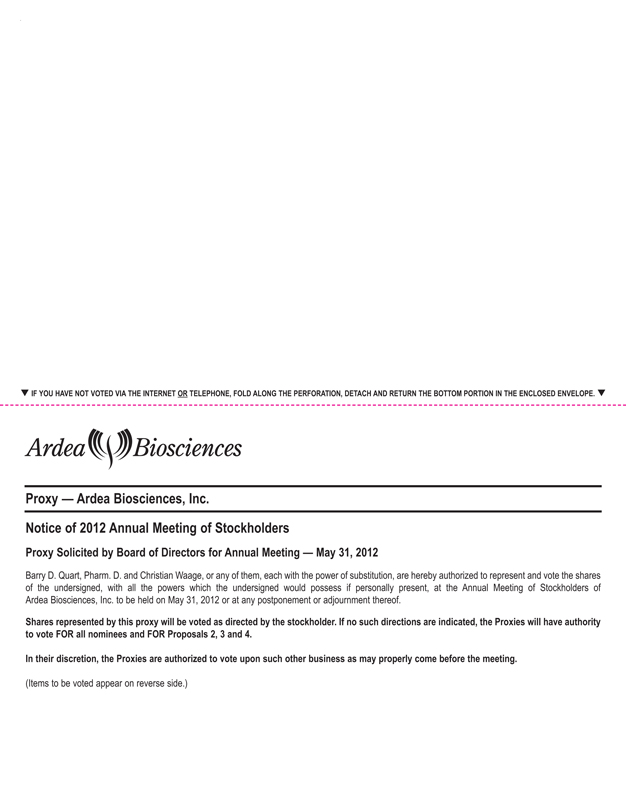

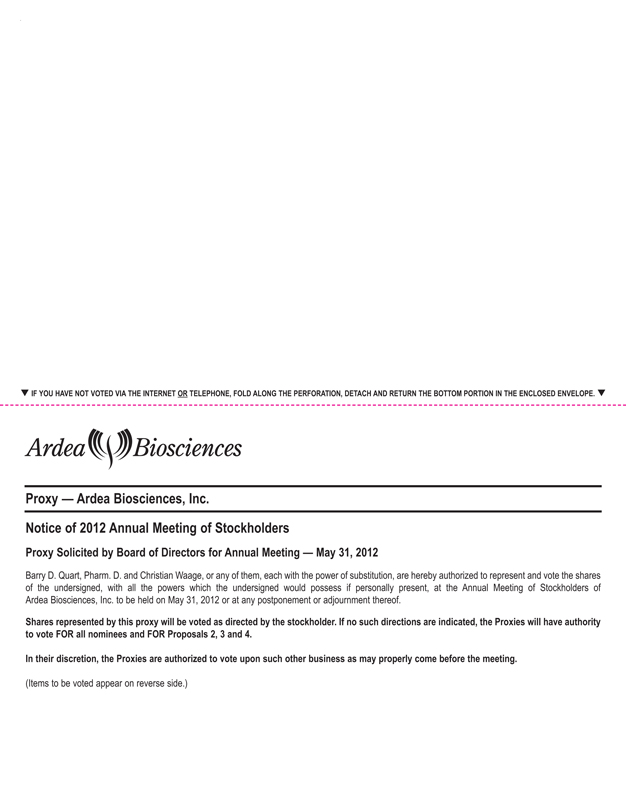

You are cordially invited to attend the 2012 Annual Meeting of Stockholders of Ardea Biosciences, Inc., a Delaware corporation (the “Company”). The meeting will be held on Thursday, May 31, 2012 at 2:00 p.m. Pacific Time at the offices of the Company located at 4939 Directors Place, San Diego, California 92121, for the following purposes:

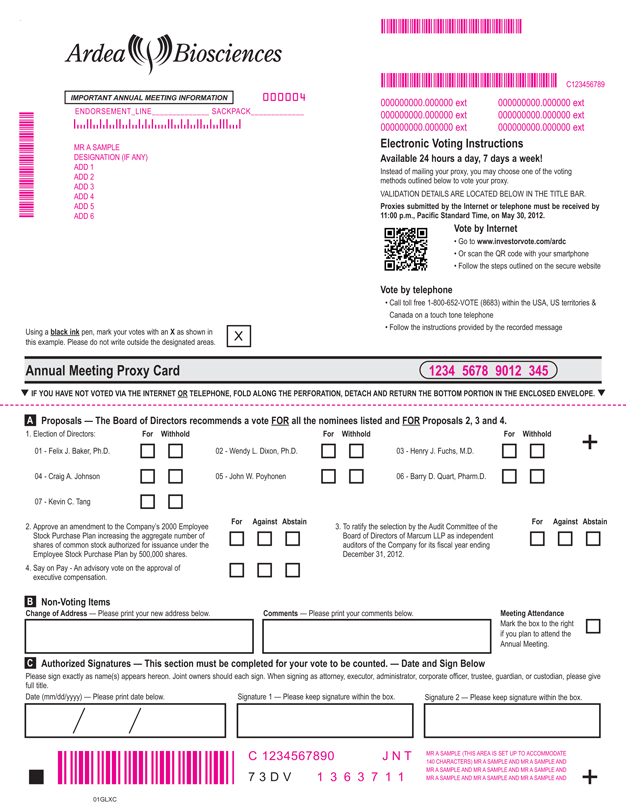

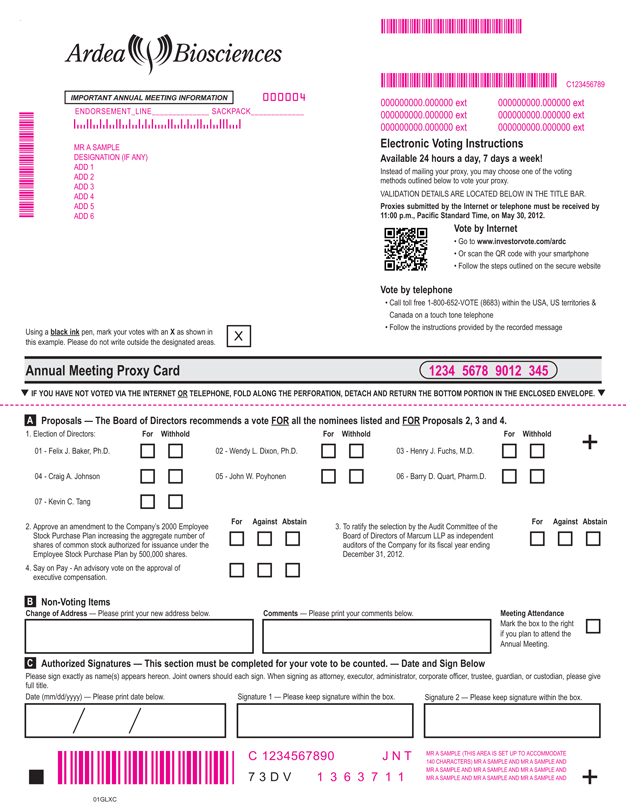

1. To elect the seven nominees for director named herein to serve until the next annual meeting and until their respective successors are elected and qualified.

2. To approve an amendment to the Company’s 2000 Employee Stock Purchase Plan to increase the aggregate number of shares of common stock authorized for issuance under the Employee Stock Purchase Plan by 500,000 shares.

3. To ratify the selection by the Audit Committee of the Board of Directors of Marcum LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2012.

4. To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement.

5. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is April 2, 2012. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors

Barry D. Quart, Pharm.D.

President & Chief Executive Officer

San Diego, California

April 16, 2012

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be

Held on Thursday, May 31, 2012 at 2:00 p.m. Pacific Time at 4939 Directors Place, San Diego, California 92121.

The proxy statement and annual report to stockholders are available at www.ardeabio.com.

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

ARDEA BIOSCIENCES, INC.

4939 Directors Place

San Diego, California 92121

PROXY STATEMENT

FOR THE 2012 ANNUAL MEETING OF STOCKHOLDERS

May 31, 2012

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors (the “Board of Directors” or “Board”) of Ardea Biosciences, Inc. (referred to herein as the “Company” or “Ardea”) is soliciting your proxy to vote at the 2012 Annual Meeting of Stockholders, including adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the internet.

We intend to mail these proxy materials on or about April 16, 2012 to all stockholders of record entitled to vote at the annual meeting.

How do I attend the annual meeting?

The meeting will be held on Thursday, May 31, 2012 at 2:00 p.m. local time at 4939 Directors Place, San Diego, California 92121. Directions to the annual meeting may be found atwww.ardeabio.com. Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 2, 2012 will be entitled to vote at the annual meeting. On this record date, there were 36,759,140 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 2, 2012 your shares were registered directly in your name with Ardea’s transfer agent, Computershare, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 2, 2012 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are four matters scheduled for a vote:

| | • | | Election of seven directors; |

| | • | | Approval of the proposed 500,000 share increase in the number of shares of common stock authorized for issuance under the Company’s 2000 Employee Stock Purchase Plan; |

1

| | • | | Ratification of selection by the Audit Committee of the Board of Directors of Marcum LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2012; and |

| | • | | Advisory approval of the compensation of the Company’s named executive officers, as disclosed in this proxy statement in accordance with Securities and Exchange Commission (“SEC”) rules. |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | • | | To vote over the telephone, dial toll-free 1-800-652-8683 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:00P.M., Pacific Daylight Time on May 30, 2012 to be counted. |

| | • | | To vote through the internet, go to http://www.investorvote.com/ardc to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:00P.M., Pacific Daylight Time on May 30, 2012 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Ardea. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may be able to vote by telephone or over the internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting allows you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

2

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 2, 2012.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking any voting selections, your shares will be voted, as applicable, “For” the election of all seven nominees for director, “For” approval of the amendment to the Company’s 2000 Employee Stock Purchase Plan, “For” ratification of selection by the Audit Committee of the Board of Directors of Marcum LLP as our independent registered public accounting firm and “For” the advisory approval of executive compensation. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | Ø | | You may submit another properly completed proxy card with a later date. |

| | Ø | | You may grant a subsequent proxy by telephone or through the internet. |

| | Ø | | You may send a timely written notice that you are revoking your proxy to Ardea’s Secretary at 4939 Directors Place, San Diego, California 92121. |

| | Ø | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 14, 2012, to the Secretary of the Company, 4939 Directors Place, San Diego, California 92121. If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director, you must do so no sooner than January 31, 2013 but no later than March 2, 2013. You are also advised to review the Company’s Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to other proposals, votes “For” and “Against,” abstentions and broker non-votes. Abstentions will be counted towards the

3

vote total for each proposal and will have the same effect as “Against” votes. Broker non-votes will have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange (“NYSE”), “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, election of directors (even if not contested) and executive compensation, including the advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation.

How many votes are needed to approve each proposal?

| | Ø | | For Proposal 1, the election of directors, the seven nominees receiving the most “For” votes (from the votes of holders of shares of common stock present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| | Ø | | For Proposal 2, the approval of the proposed 500,000 share increase under the Company’s 2000 Employee Stock Purchase Plan, must receive “For” votes from the holders of a majority of shares present and entitled to vote in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| | Ø | | To be approved, Proposal 3, the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2012, must receive “For” votes from the holders of a majority of shares present and entitled to vote in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| | Ø | | For Proposal 4, advisory approval of the compensation of the Company’s named executive officers, will be considered to be approved if it receives “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 36,759,140 shares of common stock outstanding and entitled to vote. Thus, the holders of 18,379,571 shares of voting stock must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares of voting stock present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after

4

the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement, Form 10-K and annual report to stockholders are available atwww.ardeabio.com.

5

PROPOSAL 1

ELECTION OF DIRECTORS

There are currently seven board seats on Ardea’s Board of Directors. There are seven nominees for director: Felix J. Baker, Ph.D., Wendy L. Dixon, Ph.D., Henry J. Fuchs, M.D., Craig A. Johnson, John W. Poyhonen, Barry D. Quart, Pharm.D., and Kevin C. Tang. Each of the nominees is currently a director of the Company who was previously elected by the stockholders.

Proxies cannot be voted for a greater number of persons than the number of nominees named. Each of the nominees listed below was nominated by the Nominating and Corporate Governance Committee of the Board of Directors for election as a director at the 2012 Annual Meeting of Stockholders. It is Ardea’s policy to encourage directors to attend our annual meeting. Messrs. Poyhonen, Johnson and Tang attended the annual meeting held in 2011.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The seven director nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of each of the nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by Ardea. Each person nominated for election has agreed to serve, if elected, until the next annual meeting and until their respective successors are elected and qualified, or until their earlier death, resignation or removal. Our management has no reason to believe that any nominee will be unable to serve.

NOMINEES FOR ELECTION AT THE 2012 ANNUAL MEETING

The following is a brief biography of each nominee for director and a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Nominating and Corporate Governance Committee to recommend that person as a nominee for director, as of the date of this proxy statement.

The Nominating and Corporate Governance Committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Committee views as critical to effective functioning of the Board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Committee to select that person as a nominee. However, each of the members of the Committee may have a variety of reasons why he or she believes a particular person would be an appropriate nominee for the board, and these views may differ from the views of other members.

| | | | | | |

Name | | Age | | | Principal Occupation/ Position Held With the Company |

Felix J. Baker, Ph.D. | | | 43 | | | Co-Managing Member of Baker Brothers Investments / Director |

Wendy L. Dixon, Ph.D. | | | 56 | | | Consultant / Director |

Henry J. Fuchs, M.D. | | | 52 | | | Executive Vice President and Chief Medical Officer of BioMarin Pharmaceutical, Inc. / Director |

Craig A. Johnson | | | 50 | | | Chief Financial Officer of PURE Bioscience, Inc. / Director |

John W. Poyhonen | | | 52 | | | President and Chief Operating Officer of Senomyx, Inc. / Director |

Barry D. Quart, Pharm.D. | | | 55 | | | President and Chief Executive Officer / Director |

Kevin C. Tang | | | 45 | | | Managing Director of Tang Capital Management, LLC / Director |

Felix J. Baker, Ph.D.Dr. Baker was appointed as one of our directors in February 2010. Dr. Baker is a Co-Managing Member of Baker Brothers Investments, which he and his brother, Julian Baker, founded in 2000. Baker Brothers Investments is a family of long-term investment funds for major endowments and foundations,

6

which are focused on publicly traded life sciences companies. Dr. Baker’s career as a fund manager began in 1994 when he co-founded a biotechnology investment partnership with the Tisch Family. Dr. Baker holds a B.S. and a Ph.D. in Immunology from Stanford University, where he also completed two years of medical school. He is also a director of Seattle Genetics, Inc. and Synageva BioPharma, Corp. Dr. Baker is a highly experienced director having served on the boards of directors of numerous public and private biopharmaceutical companies. Dr. Baker’s scientific and medical background, coupled with his investment and leadership experience in the healthcare industry provides relevant expertise in strategic areas, as well as in-depth knowledge of the healthcare industry, providing valuable insight and guidance to the Board for matters such as scientific and corporate strategy, financial and risk management, among others.

Wendy L. Dixon, Ph.D.Dr. Dixon was appointed as one of our directors in April 2011. Since 2009, Dr. Dixon has been a consultant to companies in the biotechnology and pharmaceutical industry and is also a senior advisor to The Monitor Group LP, an international strategic consulting firm. From December 2001 to May 2009, Dr. Dixon was Chief Marketing Officer and President, Global Marketing for Bristol-Myers Squibb, a biopharmaceutical company and served on the CEO’s Executive Committee. From 1996 to 2001, she was Senior Vice President, Marketing at Merck and prior to that she held executive management positions at West Pharmaceuticals, Osteotech, Inc. and Centocor, Inc. and various positions at SmithKline & French Pharmaceuticals (now GlaxoSmithKline) in marketing, regulatory affairs, project management and as a biochemist. Dr. Dixon serves on the boards of directors of Furiex Pharmaceuticals, Inc., Orexigen Therapeutics, Inc., Incyte Corporation and Alkermes, Inc., and was previously a director of DENTSPLY International from 2005 to 2010. Dr. Dixon received her MSc and BSc in Natural Science and her Ph.D. in Biochemistry from the University of Cambridge. Dr. Dixon’s 33-year career in the pharmaceutical and biotechnology business, combining a technical background and experience in drug development and regulatory affairs with commercial responsibilities in building and leading organizations and launching and growing more than 20 pharmaceutical products including Tagamet®, Fosamax®, Singulair®, Plavix®, Abilify®, Reyataz® and Baraclude®, brings to the Board a wealth of broad-ranging and hands-on experience in drug development and new product commercialization.

Henry J. Fuchs, M.D.Dr. Fuchs has served as one of our directors since November 2001. Dr. Fuchs presently serves as Executive Vice President and Chief Medical Officer of BioMarin Pharmaceutical Inc., a position he has held since March 2009. Dr. Fuchs was the Executive Vice President and Chief Medical Officer of Onyx Pharmaceuticals, Inc. from September 2005 to December 2008. He served as our Chief Executive Officer from January 2003 until June 2005. Dr. Fuchs joined us as Vice President, Clinical Affairs in October 1996 and was appointed President and Chief Operating Officer in November 2001. From 1987 to 1996, Dr. Fuchs held various positions at Genentech, Inc. where, among other things, he had responsibility for the clinical program that led to the approval of Pulmozyme® for the treatment of cystic fibrosis. Dr. Fuchs was also responsible for the Phase III development program that led to the approval of Herceptin® for the treatment of metastatic breast cancer. Dr. Fuchs also serves on the board of directors of MethylGene Inc. Dr. Fuchs received an M.D. degree from George Washington University and a B.A. degree in biochemical sciences from Harvard University. Dr. Fuchs’ experience in senior management and the biotechnology industry provide strategic and practical knowledge to our Board related to regulatory, clinical research and other operational areas in our industry.

Craig A. Johnson.Mr. Johnson has served as one of our directors since June 2008. Mr. Johnson is currently the Chief Financial Officer of PURE Bioscience, Inc., a position he has held since August 2011. He previously served as Senior Vice President and Chief Financial Officer of NovaDel Pharma Inc. from June 2010 to July 2011. Mr. Johnson served as Vice President and Chief Financial Officer of TorreyPines Therapeutics, Inc. from 2004 until the company’s sale to Raptor Pharmaceuticals Corp. in October 2009, and then as Vice President of TPTX, Inc., a wholly owned subsidiary of Raptor Pharmaceutical Corp. through March 2010. From 1994 to 2004, he was employed by MitoKor, Inc. and last held the position of Chief Financial Officer and Senior Vice President of Operations. Prior to joining MitoKor, Mr. Johnson served as a senior financial executive for several early-stage technology companies, and he also practiced as a Certified Public Accountant with Price Waterhouse. Currently, Mr. Johnson is a director of Adamis Pharmaceuticals Corporation where he serves as chairman of the audit committee. Mr. Johnson received his B.B.A. in accounting from the University of Michigan and is a certified public accountant. Mr. Johnson’s extensive public accounting, financial and executive management background provide valuable financial and accounting experience and auditing expertise to our Board.

7

John W. Poyhonen.Mr. Poyhonen was appointed as a director in June 2007. Mr. Poyhonen is currently the President and Chief Operating Officer of Senomyx, Inc. He joined Senomyx in October 2003 as Vice President and Chief Business Officer and was promoted in April 2004 to Vice President and Chief Financial and Business Officer. He was promoted to his current position in September 2009. From 1996 until October 2003, Mr. Poyhonen served in various sales and marketing positions for Agouron Pharmaceuticals, a Pfizer, Inc. company, most recently as Vice President of National Sales. Prior to holding this position, Mr. Poyhonen served as Vice President of Marketing and Vice President of National Accounts. Mr. Poyhonen received his B.A. in Marketing from Michigan State University and his M.B.A. from the University of Kansas. Mr. Poyhonen’s understanding of the biotechnology and pharmaceutical industries, coupled with his broad management experience and responsibilities through the course of his career, provide relevant experience to our Board in a number of areas, including corporate and commercial strategy, business development, risk management, and financial and operational areas.

Barry D. Quart, Pharm.D.Dr. Quart was elected as a director and appointed as our President and Chief Executive Officer on December 21, 2006. From 2002 until December 2006, Dr. Quart was President of Napo Pharmaceuticals, Inc., where he was instrumental in bringing the company public on the London Stock Exchange in July 2006. Prior to Napo, Dr. Quart was Senior Vice President, Pfizer Global Research and Development and the Director of Pfizer’s La Jolla Laboratories, where he was responsible for approximately 1,000 employees and an annual budget of almost $300 million. Prior to Pfizer’s acquisition of the Warner-Lambert Company, Dr. Quart was President of Research and Development at Agouron Pharmaceuticals, Inc., a division of the Warner-Lambert Company, since 1999. Dr. Quart joined Agouron in 1993 and was instrumental in the development and registration of nelfinavir (Viracept®), which went from the lab bench to NDA approval in 38 months. Dr. Quart spent over ten years at Bristol-Myers Squibb in both Clinical Research and Regulatory Affairs prior to Agouron and was actively involved in the development and registration of important drugs for the treatment of HIV and cancer, including paclitaxel (Taxol®), didanosine (Videx®), and stavudine (Zerit®). Dr. Quart currently serves as a director of Synageva BioPharma Corp. He has a Pharm.D. from the University of California, San Francisco. With his three decades of experience in the biotechnology and pharmaceuticals industries and years in senior management as described above, Dr. Quart brings critical expertise and knowledge and invaluable experience to the Board and Ardea’s entire organization.

Kevin C. Tang.Mr. Tang has served as one of our directors since May 2003. Mr. Tang is the Managing Director of Tang Capital Management, LLC, a life sciences-focused investment company he founded in August 2002. From September 1993 to July 2001, Mr. Tang held various positions at Deutsche Banc Alex. Brown, Inc., an investment banking firm, most recently serving as Managing Director and head of the firm’s life sciences research group. Mr. Tang currently serves as a director of A.P. Pharma, Inc. He was previously a director of Trimeris, Inc. until 2009 and Penwest Pharmaceuticals Co. until 2010. Mr. Tang received a B.S. degree from Duke University. Mr. Tang’s investment and leadership experience in the healthcare industry provides relevant expertise in strategic areas, as well as in-depth knowledge of the healthcare industry, providing valuable insight and guidance to the Board for matters such as, corporate strategy and financial and risk management, among others.

REQUIRED VOTEAND BOARDOF DIRECTORS RECOMMENDATION

For the election of directors pursuant to Proposal 1, the seven nominees receiving the most “For” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “For” or “Withheld” will affect the outcome.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

8

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

INDEPENDENCEOF THE BOARDOF DIRECTORS

As required under the Nasdaq Stock Market listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent” as affirmatively determined by the Board. The Board of Directors consults with the Company’s outside counsel to ensure that the Board of Directors’ determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board has affirmatively determined that the following six directors are independent directors within the meaning of the applicable Nasdaq listing standards: Dr. Baker, Dr. Dixon, Dr. Fuchs, Mr. Johnson, Mr. Poyhonen and Mr. Tang. In making this determination, the Board found that none of the above directors had a material or other disqualifying relationship with the Company. Dr. Quart is not independent under the Nasdaq rules by virtue of his current employment with the Company.

MEETINGSOFTHE BOARDOF DIRECTORS

During the fiscal year ended December 31, 2011, the Board of Directors held eight meetings, including telephone conference meetings, and acted by unanimous written consent three times. During the fiscal year ended December 31, 2011, each member of the Board of Directors attended 75% or more of the aggregate of the meetings of the Board of Directors and of the committees on which he/she served, held during the period for which he/she was a director or committee member, respectively.

DIRECTOR NOMINATIONS

Qualifications and Process. The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee by majority vote.

Stockholder Nominees. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not

9

intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. The Company’s Board has adopted a written Policy Regarding Stockholder Recommendations of Director Nominees that is available to stockholders on the Company’s website atwww.ardeabio.com. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become Company nominees for election to the Board at annual stockholders meetings must do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 4939 Directors Place, San Diego California 92121, Attn: Secretary, no sooner than 120 days and no later than 90 days prior to the anniversary date of the last Annual Meeting of Stockholders, subject to adjustment as set forth in the Company’s Bylaws. Submissions must include the name and address of the stockholder on whose behalf the submission is made, the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of the Company’s stock, has been a holder for at least one year and the number of Ardea shares beneficially owned by the stockholder. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. Any stockholder who holds in excess of 15% of our outstanding voting stock on an as converted basis may call a special meeting of the stockholders of the Company for any purpose, including the election of directors, by giving notice to the Company identifying the matters to be considered at such meeting. In connection with any such special meeting the policies and procedures described in this paragraph do not apply. The Company is not required to solicit proxies on behalf of the greater than 15% stockholder, nor will the Company or the Company’s Board be required to make any recommendation with respect to any matter to be considered at such meeting.

INFORMATION REGARDING COMMITTEESOFTHE BOARDOF DIRECTORS

The Board of Directors currently has four committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Commercial Committee.

A description of each committee of the Board of Directors follows. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that, except as specifically described below, each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board of Directors to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of, and assesses the qualifications of, the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on the Company’s audit engagement team as required by law; reviews and approves or rejects transactions between the Company and any related persons; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review the Company’s annual audited financial statements and quarterly financial statements with management and the independent auditor, including reviewing the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The Audit Committee is comprised of three directors: Dr. Fuchs and Messrs. Johnson and Poyhonen. The Audit Committee met six times and acted by unanimous written consent one

10

time during 2011. The Audit Committee has adopted a written charter that is available to stockholders on the Company’s website atwww.ardeabio.com.

The Company has an Open Door Policy for Reporting Complaints Regarding Accounting and Auditing Matters that describes how stockholders can communicate with the Audit Committee with respect to accounting and auditing concerns, which is available on the Company’s website atwww.ardeabio.com. All communications directed to the Audit Committee in accordance with this policy will be promptly and directly forwarded to the Audit Committee.

The Board of Directors reviews the Nasdaq listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq listing standards). The Board of Directors has also determined that Mr. Johnson qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board of Directors made a qualitative assessment of Mr. Johnson’s level of knowledge and experience based on a number of factors, including his formal education and 20 years of financial management experience.

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS*

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2011 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the PCAOB regarding the independent accountants’ communication with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

/s/ CRAIG A. JOHNSON

Craig A. Johnson

/s/ HENRY J. FUCHS, M.D.

Henry J. Fuchs, M.D.

/s/ JOHN W. POYHONEN

John W. Poyhonen

COMPENSATION COMMITTEE

The Compensation Committee is composed of three directors: Dr. Baker, Mr. Poyhonen and Mr. Tang. All members of the Company’s Compensation Committee are independent as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards. The Compensation Committee met four times and acted by unanimous written consent two times in 2011 in accordance with the adopted written charter that is available to stockholders on the Company’s website atwww.ardeabio.com.

The Compensation Committee of the Board of Directors acts on behalf of the Board to review, adopt and oversee the Company’s compensation strategy, policies, plans and programs, including:

| | • | | establishment of corporate and individual performance objectives relevant to the compensation of the Company’s executive officers and directors and evaluation of performance in light of these stated objectives; |

| * | The material in this report is not “soliciting material”, is not deemed “filed” with the commission, and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

11

| | • | | review and approval of the compensation and other terms of employment or service, including severance and change-in-control arrangements, of the Company’s Chief Executive Officer and the other executive officers, vice presidents and directors; and |

| | • | | administration of the Company’s equity incentive plans and other similar plans and programs. |

The Compensation Committee also reviews with management the Company’s Compensation Discussion and Analysis and considers whether to recommend that it be included in the Company’s proxy statement for each Annual Meeting of Stockholders.

Compensation Committee Processes and Procedures

The Compensation Committee meets quarterly, or with greater frequency if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, Mr. Poyhonen, in consultation with the Chief Executive Officer and other members of senior management, including human resources. The Compensation Committee also meets regularly in executive session. From time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms.

During the past fiscal year, the Compensation Committee engaged Compensia as independent compensation consultants. The Compensation Committee requested that Compensia:

| | • | | evaluate and recommend a comparative, or peer group, of companies from which to perform analysis of competitive company performance and individual compensation levels for that group; |

| | • | | evaluate the competitiveness of our existing compensation strategy and practices in support of, and reinforcement of, our long-term strategic goals; and |

| | • | | assist in the refinement of our compensation strategy to develop an executive compensation program to execute that strategy. |

In consultation with the Compensation Committee and senior management, Compensia ultimately developed recommendations that were presented to the Compensation Committee for its consideration. Following an active dialogue and modifications resulting from those discussions, the Compensation Committee approved the compensation for the Chief Executive Officer, other executive officers, vice presidents and directors.

Under its charter, the Compensation Committee may delegate authority to subcommittees, as appropriate. The Compensation Committee has formed a Non-Officer Stock Option Committee, or NOSOC, whose sole member is Dr. Quart, the Chief Executive Officer, to grant, within certain guidelines and without any further action required by the Compensation Committee, stock options to our non-officer employees. The purpose of this delegation of authority is to enhance the flexibility of option administration and to facilitate the timely grant of options to non-officer employees, particularly new employees, within specified limits approved by the Compensation Committee. The size of grants made by the NOSOC must be within limits pre-approved by the Compensation Committee. As part of its oversight function, the Compensation Committee reviews on a regular basis the grants made by the NOSOC.

The Compensation Committee will consider matters related to individual compensation, as well as high-level strategic issues, such as the efficacy of the Company’s compensation strategy, potential modifications to

12

that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process would comprise two related elements: the determination of compensation components and levels and the establishment of performance objectives for the current year. For compensation of executives other than the Chief Executive Officer, the Compensation Committee will solicit and consider evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer’s compensation, the evaluation of his performance will be conducted by the Compensation Committee, which recommends to the entire Board of Directors any adjustments to his compensation as well as awards to be granted for final determination. As part of its deliberations with respect to all executives and directors, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, Company stock performance data, analyses of historical executive compensation levels and current company-wide compensation levels, and recommendations of compensation consultants, including analyses of executive and director compensation paid at other companies. The Compensation Committee also takes into account the results of the “say-on-pay” advisory vote of the Company’s stockholders at each annual stockholders meeting.

THESPECIFICDETERMINATIONSOFTHE COMPENSATION COMMITTEEWITHRESPECTTOEXECUTIVECOMPENSATIONFORTHEYEARENDED DECEMBER 31, 2011AREDESCRIBEDINGREATERDETAILINTHE COMPENSATION DISCUSSIONAND ANALYSISSECTIONOFTHISPROXYSTATEMENT.

NOMINATINGAND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, selecting candidates for election to the Board of Directors, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board, and developing a set of corporate governance principles for the Company. The Nominating and Corporate Governance Committee is composed of three directors: Dr. Dixon, Dr. Fuchs and Mr. Tang. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards). The Nominating and Corporate Governance Committee met four times and acted by unanimous written consent one time during 2011. The Nominating and Corporate Governance Committee has adopted a written charter that is available to stockholders on the Company’s website atwww.ardeabio.com.

COMMERCIAL COMMITTEE

The Commercial Committee is responsible for working with management in the direction and investment in the Company’s preparations to commercialize its drug product candidates. The sole member of the Commercial Committee is Dr. Dixon. During the year ended December 31, 2011, the Commercial Committee met with management periodically to help strategize and guide the Company’s commercialization efforts.

BOARD LEADERSHIP STRUCTURE

The Company does not currently have a Chairman of the Board or a lead independent director. Mr. Quart conducts meetings of the Board of Directors and facilitates the formation of an agenda for each meeting based on input from the other directors and our management. Each of the directors, other than Dr. Quart, is independent and the Board of Directors believes that the independent directors have been able to act collaboratively to provide effective oversight of management. Moreover, in addition to feedback provided during the course of Board of Directors meetings, the independent directors have regular executive sessions. Following an executive session of independent directors, the independent directors communicate with Dr. Quart regarding any specific feedback or issues, provide Dr. Quart with input regarding agenda items for Board of Directors and Committee meetings, and coordinate with Dr. Quart regarding information to be provided to the independent directors in performing their duties. The Board of Directors believes that this structure provides a flexible, appropriate and effective approach to management of the Board of Directors’ functions.

13

ROLEOF BOARDIN RISK OVERSIGHT PROCESS

The responsibility for the day-to-day management of risk lies with the Company’s management, while the Board of Directors is responsible for overseeing the risk management process to ensure that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. The Company’s management identifies what it believes are the top individual risks facing the Company. These risks are then discussed and analyzed with the Board of Directors. This enables the Board of Directors to coordinate the risk oversight role, particularly with respect to risk interrelationships. However, in addition to the Board of Directors, the committees of the Board of Directors consider the risks within their areas of responsibility. The Audit Committee oversees the risks associated with the Company’s financial reporting and internal controls, the Compensation Committee oversees the risks associated with the Company’s compensation practices, including an annual review of the Company’s risk assessment of its compensation policies and practices for its employees, the Nominating and Corporate Governance Committee oversees the risks associated with the Company’s overall governance, corporate compliance policies and its succession planning process, and the Commercial Committee oversees risk associated with the Company’s efforts to prepare for commercialization of its drug product candidates.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Company’s Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders who wish to communicate with the Board or an individual director may do so by sending written communications addressed to the Secretary of Ardea at 4939 Directors Place, California 92121. The Company’s Board has adopted a written Process for Stockholder Communications with the Board of Directors that is available to stockholders on the Company’s website atwww.ardeabio.com. All communications will be compiled by the Secretary of the Company, reviewed to determine whether they should be presented to the Board or the individual directors, and submitted to the Board, a committee of the Board or the individual directors on a periodic basis. The purpose of this screening is to allow the Board or individual directors to avoid having to consider irrelevant or inappropriate communications (such as advertisements, solicitations and hostile communications). The screening procedures have been approved by a majority of the independent directors of the Board. All communications directed to the Audit Committee in accordance with the Company’s Open Door Policy for Reporting Complaints Regarding Accounting and Auditing Matters involving the Company will be promptly and directly forwarded to the Audit Committee. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the Chair of the Audit, Compensation, or Nominating and Corporate Governance Committee.

CODE OF ETHICS

We have adopted a Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available on our website atwww.ardeabio.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision thereof to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website. The Code of Business Conduct and Ethics meets the requirements defined by Item 406 of Regulation S-K.

14

PROPOSAL 2

TO APPROVE AN AMENDMENT TO THE ARDEA BIOSCIENCES, INC. 2000 EMPLOYEE STOCK PURCHASE PLAN TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK AVAILABLE FOR ISSUANCE BY 500,000

The Company’s Employee Stock Purchase Plan was approved by the stockholders of the Company at the Annual Meeting held on February 25, 2000 and was amended as of October 8, 2007 (the “Plan”). Proposal 2, if approved by the stockholders, would increase the number of shares of common stock available for purchase under the Plan. There are currently 357,257 shares of our common stock authorized for issuance under the Plan. Under the Plan, 239,346 shares had been issued through December 31, 2011, and 117,911 shares are available for future issuance. This amendment would increase the number of shares of common stock authorized for issuance under the Plan by 500,000 shares. The Board approved this amendment at a meeting held on March 27, 2012, subject to the approval of the Company’s stockholders.

The Board believes the Plan should be amended to increase the number of shares authorized for issuance in order to permit employees to continue to purchase shares of common stock through the Plan, an important component of the Company’s compensation structure. Approval of this proposal requires the affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or by proxy at the Annual Meeting. Abstentions will be counted toward the tabulation of votes cast and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this Proposal 2 has been approved.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 2.

The following is a summary of the material features of the Plan. The Plan is qualified in its entirety by reference to the text of the Plan. You may request a copy of the Plan free of charge by writing to: General Counsel, Ardea Biosciences, Inc., 4939 Directors Place, San Diego, CA 92121. A copy of the plan is also attached hereto as Annex A.

Purpose

The purpose of the Plan is to is to provide a means by which our employees may be given an opportunity to purchase our common stock and to aid the Company in attracting, retaining and motivating personnel and encouraging stock ownership by employees.

Administration

The Plan provides that the Board is responsible for administering the Plan and has the final power to construe and interpret both the Plan and the rights granted under it. The Board has the power, subject to the provisions of the Plan, to determine when and how rights to purchase our common stock will be granted, the provisions of each offering of such rights (which need not be identical), and whether employees of any subsidiary of the Company will be eligible to participate in the Plan.

The Plan also provides that the Board may delegate administration of the Plan to a committee. Accordingly, the Board has delegated administration of the Plan to the Compensation Committee, which consists of three members of the Board of Directors, none of whom are eligible to participate in the Plan. The Compensation Committee is authorized to determine any questions arising in the administration, interpretation and application of the Plan, and is authorized to make such uniform rules as may be necessary to carry out its provisions. As used below with respect to the Plan, the “Board” refers to the Compensation Committee and to the Board.

Offerings

The Plan is implemented by offerings of rights to all eligible employees from time to time as determined by the Board. In October 2007, the Compensation Committee approved the initiation of a new series of offerings, the first of which commenced on November 15, 2007, with a new offering beginning each six months thereafter. Each offering will be 24 months in length, with four purchase dates on each six-month anniversary of the commencement date of the applicable offering.

15

Eligibility

Under the Plan, each person who is an employee of the Company, whose customary employment is for more than 20 hours per week and for more than five months per calendar year and is not a five percent stockholder, is eligible to participate in the Plan.

No employee is eligible to participate in the Plan if, immediately after the grant of purchase rights, the employee would own stock, directly or indirectly, possessing five percent or more of the total combined voting power or value of all classes of stock of the Company or of any subsidiary of the Company (including any stock which such employee may purchase under all outstanding rights and options). In addition, employees may purchase a maximum of $25,000 worth of our common stock (determined at the fair market value of the shares at the time such rights are granted in accordance with the United States Internal Revenue Code of 1986, as amended (the “Code”)) under all employee stock purchase plans of the Company for each calendar year in which such rights are outstanding.

As of March 31, 2012, approximately 111 of our employees were eligible to participate in the Plan, of whom approximately 73 were participating in our current Offering that will end on November 14, 2013.

Plan Participation

Eligible employees enroll in the Plan by delivering to the Company, within the time specified in the offering, a participation agreement authorizing payroll deductions of up to 15% of such employee’s base salary or hourly compensation, subject to certain limitations, during the offering. Generally, employees may end their participation in an offering at any time up to 15 days before a purchase period ends. Their participation ends automatically on termination of their employment or loss of eligible status.

Purchase Price

The purchase price per share at which shares of common stock are sold in an offering under the Plan is the lower of (i) 85% of the fair market value of a share of common stock on first day of the offering or (ii) 85% of the fair market value of a share of common stock on the purchase date, as set by the Board.

Payment of Purchase Price; Payroll Deductions

The purchase price of the shares is accumulated by payroll deductions before or during the offering. At any time during the offering, a participant in the offering may begin, increase, reduce or terminate his or her payroll deductions as the Board provides in the offering. All payroll deductions made for a participant are credited to his or her account under the Plan and deposited with our general funds. A participant may not make additional payments into such account.

Withdrawal

While each participant in the Plan is required to sign an agreement authorizing payroll deductions, the participant may withdraw from a given offering by terminating his or her payroll deductions and by delivering to the Company a notice of withdrawal. The Plan provides that a participant may withdraw from an offering at any time prior to the end of the offering, excluding the 15-day period immediately preceding the purchase date.

Upon any withdrawal from an offering by the employee, we will distribute to the employee his or her accumulated payroll deductions without interest, less any accumulated deductions previously applied to the purchase of shares of our common stock on the employee’s behalf during such offering, and such employee’s interest in the offering will be automatically terminated. The employee is not entitled to again participate in that offering. However, an employee’s withdrawal from an offering will not have any effect upon such employee’s eligibility to participate in subsequent offerings under the Plan.

Termination of Employment

Rights granted pursuant to any offering under the Plan terminate immediately upon cessation of an employee’s employment for any reason, and we will distribute to such employee all of his or her accumulated

16

payroll deductions, without interest, less any accumulated deductions previously applied to the purchase of shares of our common stock on the employee’s behalf during such offering.

Restrictions on Transfer

Rights granted under the Plan are not transferable otherwise than by will or the laws of descent and distribution and may be exercised only by the person to whom such rights are granted. A participant may designate a beneficiary who is to receive any shares and cash, if any, from the participant’s account under the Plan in the event of such participant’s death after the offering but prior to delivery to the participant of the shares and cash, or who is to receive the cash from the participant’s account in the event of such participant’s death during an offering.

Duration, Amendment and Termination

The Board may suspend or terminate the Plan at any time.

The Board may amend the Plan at any time. Any amendment of the Plan must be approved by the stockholders within 12 months of its adoption by the Board if the amendment would (i) increase the number of shares of common stock reserved for issuance under the Plan, (ii) modify the requirements relating to eligibility for participation in the Plan (to the extent such modification requires stockholder approval in order for the Plan to obtain employee stock purchase plan treatment under Section 423 of the Code or to comply with the requirements of Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, or Rule 16b-3); or (iii) modify the Plan in any other way if such modification requires stockholder approval in order for the Plan to obtain employee stock purchase plan treatment under Section 423 of the Code or to comply with the requirements of Rule 16b-3.

Rights granted before amendment or termination of the Plan will not be altered or impaired by any amendment or termination of the Plan without consent of the employee to whom such rights were granted.

Adjustment Provisions

If any change is made in the stock subject to the Plan, or subject to any rights granted under the Plan, due to a change in corporate capitalization and without the receipt of consideration by the Company (through reincorporation, stock dividend, stock split, reverse stock split, combination or reclassification of shares), the Plan will be appropriately adjusted in the class(es) and maximum number of securities subject to the Plan and the outstanding rights will be appropriately adjusted in the class(es) and number of securities and price per share of stock subject to such outstanding rights.

Effect of Certain Corporate Events

In the event of a disposition of all or substantially all of the assets of the Company or specified types of mergers of the Company, the surviving or acquiring corporation either will assume the rights under the Plan or substitute similar rights, or the exercise date of any ongoing offering will be accelerated such that participants’ accumulated payroll deductions will be used to purchase shares of our common stock in the offering immediately prior to any such event.

Stock Subject to Plan

Proposal 2, if approved by the stockholders, would increase the number of shares of common stock available for purchase under the Plan by 500,000 shares. There are currently 357,257 shares of our common stock authorized for issuance under the Plan. Under the Plan, 239,346 shares had been issued through December 31, 2011, and 117,911 shares are available for future issuance.

Certain Federal Income Tax Considerations

The following is a general summary of certain United States income tax consequences based upon the laws as currently in effect, and does not purport to cover possible foreign, state, local, estate, employment or other tax consequences.

17

The Plan, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Section 421 and 423 of the Code. Under these provisions, no income will be taxable to a participant at the time of purchase of shares. Upon disposition of the shares, the participant will be subject to tax and the amount of the tax will depend on the period of time that the participant holds the shares. If the shares are disposed of by the participant at least two years after the beginning of the option period and at least one year from the date the shares are purchased, the lesser of (a) the excess of the fair market value of the shares at the time of such disposition over the purchase price, or (b) 15% of the fair market value of the shares on the first day of the option period, will be treated as ordinary income and any further gain will be taxed at long-term capital gain rates. If the shares are sold after such time and the sale price is less than the purchase price, the participant recognizes no ordinary income but, instead, a capital loss for the difference between the sale price and the purchase price.

If the shares are sold or otherwise disposed of before the expiration of such two-year and one-year periods, the excess of the fair market value of the shares on the exercise date over the purchase price will be treated as ordinary income even if no gain is realized on the sale or if a gratuitous transfer is made. Any additional gain or loss on such sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period.

The Company is not entitled to a deduction for amounts taxed as ordinary income to a participant except to the extent of ordinary income recognized by participants upon disposition of shares within two years from the date of grant or within one year of the date of purchase.

New Plan Benefits

It is not presently possible to determine the benefits or amounts that will be received by any particular employee or groups in the future.

18

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012 and has further directed that management submit the selection of independent registered public accounting firm for ratification by the stockholders at the Annual Meeting.

Stonefield Josephson, Inc. (“Stonefield”) had audited the Company’s financial statements since we engaged them in October 2004. On October 1, 2010, Stonefield combined its practice with Marcum LLP and began practicing in California and Hong Kong as “MarcumStonefield, a division of Marcum LLP”. Accordingly, effective October 1, 2010, Stonefield effectively resigned as the Company’s independent registered public accounting firm and Marcum LLP became the Company’s independent registered public accounting firm. This change in the Company’s independent registered public accounting firm was approved by the Audit Committee of the Company’s Board of Directors on October 1, 2010.

The principal accountant’s reports of Stonefield on the financial statements of the Company as of and for the year ended December 31, 2009 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the year ended December 31, 2009 and through the effective date of the merger between Stonefield and Marcum LLP, there were no disagreements with Stonefield on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which if not resolved to Stonefield’s satisfaction would have caused it to make reference thereto in connection with its reports on the financial statements for such years. During the year ended December 31, 2009 and through October 1, 2010, there were no reportable events of the type described in Item 304(a)(1)(v) of Regulation S-K.

During the year ended December 31, 2009 and through October 1, 2010, the effective date of the merger between Stonefield and Marcum LLP, the Company did not consult with Marcum LLP with respect to any of (i) the application of accounting principles to a specified transaction, either completed or proposed; (ii) the type of audit opinion that might be rendered on the Company’s financial statements; or (iii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K) or an event of the type described in Item 304(a)(1)(v) of Regulation S-K.

Representatives of Marcum LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm. However, the Board is submitting the selection of Marcum LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board in its discretion may direct the appointment of different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

REQUIRED VOTE

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Marcum LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

19

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 3.

PRINCIPAL ACCOUNTANT FEESAND SERVICES

During the fiscal year ended December 31, 2011, the Audit Committee, reviewed and approved all audit and non-audit service engagements, after giving consideration as to whether the provision of such services was compatible with maintaining the independence of Marcum LLP.

The following table represents aggregate fees billed to us for the fiscal years ended December 31, 2011 and December 31, 2010, by Marcum LLP and/or Stonefield Josephson, Inc.

| | | | | | | | |

| | | Fiscal Year Ended | |

| | | 2011 | | | 2010 | |

Audit fees(1) | | $ | 270,920 | | | $ | 279,175 | |

Audit-related fees(2) | | | 100,452 | | | | 47,450 | |

Tax fees | | | — | | | | — | |

All other fees | | | — | | | | — | |

| | | | | | | | |

| | $ | 371,372 | | | $ | 326,625 | |

| | | | | | | | |