Filed Pursuant to Rule 424(B)(3)

Registration Statement No. 333-102099

Dear Vari-L Shareholder:

You are cordially invited to attend a special meeting of shareholders of Vari-L Company, Inc. to be held on Monday, April 28, 2003 at 2:00 p.m. local time at 4895 Peoria Street, Denver, CO 80239. At the special meeting, Vari-L is seeking your approval of the sale of substantially all of its assets to Sirenza Microdevices, Inc., as described in the asset purchase agreement (in the form ofAnnex A to the proxy statement/prospectus), and the change of Vari-L’s corporate name and the dissolution of Vari-L through the adoption of the plan of dissolution (in the form ofAnnex Bto the proxy statement/prospectus). Pursuant to the asset purchase agreement, a subsidiary of Sirenza will purchase substantially all of the tangible and intangible assets of Vari-L and assume specified liabilities of Vari-L. In return, Vari-L will receive aggregate cash and Sirenza common stock consideration of $13,650,000, to be decreased by the amount of any indebtedness in excess of $1,353,862 owed to Sirenza by Vari-L as of the closing date of the asset sale pursuant to the existing loan facility provided by Sirenza to Vari-L, and to be further increased or decreased by the amount of the net asset adjustment described elsewhere in this proxy statement/prospectus. Forty-five percent of the net amount of the consideration described above will be paid to Vari-L in cash, and the remaining 55% shall be paid in shares of Sirenza common stock, which will be valued solely for such purpose at $1.44 per share. Following the asset sale, Vari-L intends to pay all of its outstanding liabilities and obligations in accordance with applicable law and the plan of dissolution. Although there is no guarantee that any assets will remain after the satisfaction of all claims and obligations, any remaining assets would be available for distribution to Vari-L shareholders. Based upon the assumptions described under “The Plan of Dissolution—Liquidating Distributions; Nature; Amount; Timing,” Vari-L believes that the maximum proceeds shareholders could receive over time is up to $0.64 per share (after giving effect to the issuance of 2 million shares of Vari-L’s common stock in connection with the anticipated settlement of Vari-L’s shareholder class action lawsuit described under “The Vari-L Business—Legal Proceedings”). However, if such assumptions prove to be incorrect or if Vari-L were to incur unanticipated liabilities, the proceeds that Vari-L’s shareholders may receive may be substantially less or none at all. Vari-L is unable at this time to predict the precise nature, amount and timing of any distributions. Vari-L does not plan to resolicit shareholder approval for the plan of dissolution even if the value of the consideration distributed to shareholders changes significantly from the foregoing estimate.

Vari-L’s board of directors has also considered Vari-L’s anticipated prospects assuming completion of the asset sale. After due consideration of all other alternatives available to Vari-L, including the cessation of Vari-L’s business and the initiation of bankruptcy proceedings, the board of directors concluded the completion of the asset sale and implementation of the plan of dissolution of Vari-L was the only alternative reasonably likely to enable Vari-L to satisfy its outstanding obligations and to offer its shareholders the potential of receiving value for their shares. The other directors and I urge you to vote FOR each of the proposals, which we have approved after careful consideration. Your vote is extremely important, and your early response will be greatly appreciated.

| | | Sincerely, |

|

| | | /s/ CHARLES R. BLAND

|

| | | Charles R. Bland President and Chief Executive Officer |

Denver, Colorado

April 4, 2003

For a discussion of significant matters that should be considered before voting at the special meeting of Vari-L shareholders, see“Risk Factors” beginning on page 26.

Sirenza’s common stock is listed on the Nasdaq National Market under the symbol “SMDI.” Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Sirenza common stock issuable to Vari-L as part of the asset sale or determined whether the proxy statement/prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

The proxy statement/prospectus is dated March 28, 2003 and is first being mailed to shareholders of Vari-L on or about April 4, 2003.

VARI-L COMPANY, INC.

4895 Peoria Street

Denver, CO 80239

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held On April 28, 2003

TO THE SHAREHOLDERS OF VARI-L COMPANY, INC.:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders of Vari-L Company, Inc., a Colorado corporation, will be held on Monday, April 28, 2003 at2:00 p.m. local time at 4895 Peoria Street, Denver, CO 80239 for the following purposes:

1. To consider and vote upon the sale by Vari-L of substantially all of Vari-L’s tangible and intangible assets to Olin Acquisition Corporation, a Delaware corporation and a wholly owned subsidiary of Sirenza Microdevices, Inc., a Delaware corporation, pursuant to the Asset Purchase Agreement, dated as of December 2, 2002, by and among Vari-L, Olin Acquisition Corporation and Sirenza Microdevices, Inc., in the form ofAnnex Aattached to the proxy statement/prospectus.

2. To consider and vote upon the adoption of the plan of dissolution of Vari-L, including the change of Vari-L’s corporate name and the dissolution of Vari-L, in the form ofAnnex B attached to the proxy statement/prospectus.

3. To consider and vote upon any motion to adjourn to a later time to permit further solicitation of proxies if necessary to establish a quorum or to obtain additional votes in favor of the foregoing items.

4. To transact such other business as may properly come before the special meeting or any adjournment or postponement thereof.

The foregoing items of business are more completely described in the proxy statement/prospectus accompanying this Notice. The board of directors of Vari-L recommends that you vote in favor of each of Proposals 1, 2 and 3 above. Under the terms of the asset purchase agreement, Vari-L, Olin Acquisition Corporation and Sirenza Microdevices, Inc. are obligated to complete the transactions contemplated by the asset purchase agreement only if the shareholders of Vari-L, by the affirmative vote of a majority of the outstanding shares of common stock as of the record date, approve each of Proposals 1 and 2 above and certain other conditions are met. In addition, the plan of dissolution will only be implemented if the asset purchase agreement is approved by the shareholders of Vari-L. Accordingly, failure to approve the dissolution of Vari-L in accordance with the plan of dissolution may have the effect of preventing the completion of the asset sale, and failure to approve the asset sale will have the effect of preventing the completion of the dissolution of Vari-L pursuant to the plan of dissolution. If either the asset sale or the dissolution is not approved and if Vari-L is unable to quickly identify an alternative source of working capital or an alternative business combination transaction in connection with the repayment of Vari-L’s loan facility with Sirenza, it is likely that Vari-L would file for, or would be forced to resort to, bankruptcy protection. Approval of Proposal 3 by the majority of the shares represented at the special meeting and entitled to vote will permit further solicitation of proxies if necessary to establish a quorum or to obtain additional votes in favor of Proposals 1 and 2.

The board of directors of Vari-L has fixed the close of business on March 7, 2003 as the record date for the determination of shareholders entitled to notice of and to vote at the special meeting and at any adjournment or postponement thereof.

By Order of the Vari-L Company, Inc. Board of Directors |

|

/s/ RICHARD P. DUTKIEWICZ

|

Richard P. Dutkiewicz |

Secretary |

Denver, Colorado

April 4, 2003

ALL SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE SPECIAL MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE SPECIAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE SPECIAL MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE SPECIAL MEETING. PLEASE NOTE, HOWEVER, THAT ATTENDANCE AT THE SPECIAL MEETING WILL NOT BY ITSELF REVOKE A PROXY. FURTHERMORE, IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE SPECIAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

TABLE OF CONTENTS

i

ii

iii

iv

v

QUESTIONS AND ANSWERS ABOUT THE ASSET SALE AND PLAN OF DISSOLUTION

| Q: | | WHAT AM I BEING ASKED TO VOTE ON AT THE SPECIAL MEETING? (SEE PAGE 45) |

A: You are being asked to approve the following proposals:

| | • | | The asset sale (Proposal 1)—the sale of substantially all of Vari-L’s tangible and intangible assets to Olin Acquisition Corporation, a subsidiary of Sirenza, on the terms described in the asset purchase agreement attached to this proxy statement/prospectus asAnnex A; and |

| | • | | The plan of dissolution (Proposal 2)—the adoption of the plan of dissolution, including the change of Vari-L’s corporate name and the dissolution of Vari-L, in the form attached to this proxy statement/prospectus asAnnex B; and |

| | • | | The adjournment (Proposal 3)—any motion to adjourn the special meeting to a later time to permit further solicitation of proxies if necessary to establish a quorum or to obtain additional votes in favor of Proposals 1 and 2; and |

| | • | | If applicable, such other business as may properly come before the special meeting or any adjournment or postponement thereof. |

| Q: | | WHY IS VARI-L PROPOSING TO ENTER INTO THE ASSET SALE? (SEE PAGE 58) |

A: After due consideration of all other alternatives available to Vari-L, the Vari-L board of directors concluded that the completion of the asset sale and the subsequent dissolution and winding up of Vari-L was the alternative most reasonably likely to enable Vari-L to satisfy its outstanding obligations and to make distributions to its shareholders.

| Q: | | WHAT WILL VARI-L RECEIVE IN THE ASSET SALE? (SEE PAGE 76) |

A: Vari-L will receive aggregate cash and Sirenza common stock consideration of $13,650,000, to be decreased by the amount of any indebtedness in excess of $1,353,862 owed to Sirenza by Vari-L as of the closing date of the asset sale pursuant to the existing loan facility provided by Sirenza to Vari-L, and to be further increased or decreased by theamount of the net asset adjustment described elsewhere in this proxy statement/ prospectus. Forty- five percent of the net amount of the consideration described above will be paid to Vari-L in cash, and the remaining 55% will be paid in shares of Sirenza common stock, which will be valued for such purpose at $1.44 per share (the 15-day trailing average closing price of Sirenza’s common stock as quoted on the Nasdaq National Market as of the execution date of the asset purchase agreement), although solely for purposes of accounting for the asset purchase on Sirenza’s books using the purchase method, the value of Sirenza common stock to be issued to Vari-L as consideration will be based on market prices a few days before the closing date of this transaction.

As of the date of this proxy statement/prospectus, the amount of principal and accrued interest under the Sirenza loan facility in excess of $1,353,862 was approximately $3,796,014. The closing price of Sirenza’s common stock on such date was $1.56 per share. The net asset adjustment, if calculated on February 28, 2003, would have decreased the purchase price by approximately $569,000. Thus, assuming the closing had taken place on the date of this proxy statement/prospectus and that the amount of the net asset adjustment as of such date decreased the purchase price by $569,000, Vari-L would have received approximately $4.2 million in cash and 3.5 million shares of Sirenza common stock with a market value of $5.5 million (as of such date) for total cash and stock consideration of $9.7 million. However, the value of the cash and stock consideration to be received by Vari-L at the closing of the asset sale may be more or less than $9.7 million depending upon the amount of indebtedness under the Sirenza loan facility as of the closing, the value of Sirenza’s common stock as of the closing and the amount of the net asset adjustment. In particular, the amount of indebtedness under the Sirenza loan facility is likely to increase between the date of this proxy statement/prospectus and the closing date due to accrued interest and Vari-L’s expectation that it will continue to borrow under the Sirenza loan facility during such time period, assuming that it continues to have access to such facility.

| Q: | | HOW DOES THE NET ASSET ADJUSTMENT WORK? (SEE PAGES 76-77) |

A: If the net asset balance of Vari-L as of the closing date, determined using an agreed upon

1

procedure, is less than or greater than $8,447,000, the proceeds of the asset sale otherwise payable to Vari-L will be increased or decreased by the same amount.

| Q: | | WILL I RECEIVE ANY SHARES OF SIRENZA STOCK? (SEE PAGE 100) |

A: Maybe. If the asset sale is approved, and the transactions contemplated by the asset purchase agreement are completed, subject to the limitations provided by the asset purchase agreement and applicable law described below, Vari-L will have the choice of selling the Sirenza shares received in the transaction for cash or distributing such shares to its shareholders following the closing.

| Q: | | ARE THERE RESTRICTIONS ON MY ABILITY TO SELL ANY SIRENZA SHARES I MAY RECEIVE IN A DISTRIBUTION FROM VARI-L? (SEE PAGES 83-84) |

A: Any shares of Sirenza common stock issued in connection with the asset sale that you receive from Vari-L in a later distribution will be freely tradable, unless you are an affiliate of Vari-L or Sirenza. Generally, persons who are deemed to be affiliates of Vari-L or Sirenza must comply with Rule 145 under the Securities Act of 1933 if they wish to resell such shares. If you are an officer, director, employee or consultant of Sirenza following the asset sale, you will also be subject to Sirenza’s insider trading policy.

| Q: | | WHAT HAPPENS IF THE ASSET SALE IS NOT COMPLETED? (SEE PAGES 29-30) |

A: If the transactions contemplated by the asset purchase agreement do not close for any reason, Vari-L will attempt to identify other transactions or arrangements to meet its working capital requirements, but it may not be able to meet all of its future liabilities and obligations. While the loan facility provides for up to $5.3 million of credit to be made available to Vari-L through September 2003, Vari-L has defaulted on a loan covenant requiring its rolling three-month net operating loss not to exceed $1,585,000 as of December 31, 2002. Vari-L has also defaulted on a covenant requiring its rolling three-month cash used in operations not to exceed $1,174,000 as of February 28, 2003. Each of these defaults gives Sirenza the right to discontinue funding and accelerate Vari-L’s obligation to repay the loans outstanding thereunder. While Sirenza hasnot exercised its rights to date, it has reserved the right to do so in the future. If Vari-L were unable to secure an alternative source of working capital sufficient to pay off the Sirenza loan facility and to meet its ongoing working capital needs, or to enter into an alternative business combination transaction, Vari-L likely would be forced to resort to bankruptcy protection. Vari-L’s obligation to negotiate exclusively with Sirenza regarding a proposed acquisition, and Sirenza’s right of first refusal on competing acquisition offers for Vari-L, each as contained in the right of first refusal and exclusivity agreement entered into in connection with the loan facility, may continue for some time after the termination of the asset purchase agreement, which could make it more difficult for Vari-L to complete an alternative business combination transaction.

| Q: | | WHEN WILL THE ASSET SALE BE COMPLETED? (SEE PAGES 87-88) |

A: The parties are working toward completing the transaction as quickly as possible. In addition to approval of the asset sale and the plan of dissolution by Vari-L’s shareholders at the special meeting of Vari-L shareholders on April 28, 2003, the Sirenza common stock issuable to Vari-L in connection with the closing of the transaction must be registered, and each of Sirenza and Vari-L must satisfy or waive, to the extent possible, all of the closing conditions contained in the asset purchase agreement. Such conditions include the court’s approval of the stipulation of settlement regarding Vari-L’s class action as described under “The Vari-L Business—Legal Proceedings—Private Securities Class Action.” The settlement of the securities class action lawsuit is subject to several conditions and uncertainties and Vari-L cannot predict the exact date upon which the court might approve the stipulation of settlement, if at all. However, Vari-L anticipates that any such approval, if such approval is forthcoming, would occur within several weeks of the fairness hearing regarding the stipulation of settlement. The court has scheduled such a hearing on March 28, 2003. The parties anticipate that the asset sale will close as promptly as practicable following the special meeting; provided that each of the closing conditions contained in the asset purchase agreement, including the approval of the asset sale and plan of dissolution by Vari-L’s shareholders and the court’s approval of the stipulation of settlement regarding Vari-L’s class action, has been satisfied or waived at the conclusion

2

of the special meeting. Vari-L will resolicit shareholder approval if it waives any of the material conditions to its obligation to close under the asset purchase agreement.

| Q: | | WHAT DOES THE PLAN OF DISSOLUTION ENTAIL? (SEE PAGES 97-106) |

A: The plan of dissolution provides for the orderly liquidation of Vari-L’s remaining assets following the closing of the asset sale, the winding-up of Vari-L’s business and operations and the dissolution of Vari-L. Colorado law provides that, following the approval of the plan of dissolution by Vari-L’s shareholders,

Vari-L’s board of directors may take such actions as it deems necessary in furtherance of the dissolution of Vari-L and the wind up of its operations and affairs. In connection with the foregoing, Vari-L will pay, or provide for the payment of, all of its liabilities and obligations. If there are any remaining assets after the payment, or the provision for the payment, of all of its liabilities and obligations, Vari-L will distribute any remaining assets to its shareholders in one or more distributions. Pursuant to the terms of the asset purchase agreement, Vari-L will be retaining certain rights, assets and liabilities in connection with the asset sale, including its cash and cash equivalents, life insurance policies, marketable securities, salary obligations to employees and related taxes, leasehold improvements and security deposits on Vari-L’s leased properties. Under the terms of the plan of dissolution, if, notwithstanding the approval of the dissolution and the adoption of the plan of dissolution by the shareholders of Vari-L, the board of directors of Vari-L determines that it would be in the best interests of Vari-L’s shareholders or creditors for Vari-L not to dissolve, the dissolution of Vari-L may be abandoned or delayed until a future date to be determined by Vari-L’s board of directors. Regardless of whether Vari-L dissolves, Vari-L will not continue to exist as an operating entity following the closing of the asset sale.

| Q: | | WILL ANY DISTRIBUTIONS BE MADE TO VARI-L’S SHAREHOLDERS? (SEE PAGE 26) |

A: Although the Vari-L board of directors believes that the completion of the asset sale and the subsequent dissolution and winding up of Vari-L is the alternative available to Vari-L that is most reasonably likely to enable Vari-L to satisfy Vari-L’soutstanding obligations and to make distributions to its shareholders, at this time Vari-L cannot determine the precise amount of any such distributions. Vari-L expects that, upon receiving the consideration at the closing of the asset sale, it will have sufficient cash to pay all of its known, current and determinable liabilities and obligations, which would allow for a distribution to Vari-L’s shareholders. However, the amount of unknown or contingent liabilities cannot be quantified and could decrease or eliminate any remaining assets available for distribution to shareholders. The amount of any distributions to Vari-L’s shareholders will be affected by the amount Vari-L draws down on the Sirenza loan facility, the amount of the net asset adjustment, if any, the amount of Vari-L’s retained liabilities, changes in the value of Sirenza’s common stock and the timing of any distributions. Based upon the assumptions described under “The Plan of Dissolution— Liquidating Distributions; Nature; Amount; Timing,” Vari-L believes that the proceeds shareholders could receive over time is up to $5.9 million in the aggregate (or $0.64 per share after giving effect to the issuance of 2 million shares of Vari-L’s common stock in connection with the anticipated settlement of Vari-L’s shareholder class action lawsuit described in “The Vari-L Business—Legal Proceedings”). However, if such assumptions prove to be incorrect or if Vari-L were to incur unanticipated liabilities, the proceeds that Vari-L’s shareholders may receive may be substantially less or none at all. Vari-L is unable at this time to predict the precise nature, amount and timing of any distributions. Vari-L does not plan to resolicit shareholder approval for the plan of dissolution even if the value of the consideration distributed to shareholders changes significantly from the foregoing estimate. If there are assets remaining following the completion of the winding-up of Vari-L, shareholders of Vari-L will receive a portion of those assets in one or more distributions, which will be equal to each shareholder’s pro rata share, based on the number of Vari-L shares owned at such time.

| Q: | | WHEN WILL ANY DISTRIBUTIONS BE MADE TO VARI-L’S SHAREHOLDERS? (SEE PAGES 82-83 and 100) |

A: At this time, Vari-L cannot set a precise timetable for any distributions, and the amount of any distributions to be made to its shareholders is uncertain. The timetable will depend on the timing of

3

the completion of the asset sale, whether and when the plan of dissolution is implemented by Vari-L’s board of directors, and Vari-L’s ability to pay, or provide for the payment of, its liabilities and obligations. As a result of Vari-L’s obligation to retain a portion of the proceeds of the asset sale to secure its indemnification obligations under the asset purchase agreement, the plan of dissolution cannot be completed, and any final distributions to shareholders cannot be made, prior to the later of March 31, 2004 and the date that all indemnification claims made by Sirenza and its related parties prior to March 31, 2004 have been resolved. In addition, if Vari-L is subject to any other contingent liabilities, this could require it to establish a reserve that could further delay any distribution to Vari-L’s shareholders until the liabilities are resolved. Assuming Vari-L does not incur any unanticipated liabilities between the date of this proxy statement prospectus and the date of distribution, and subject to the restrictions contained in the asset purchase agreement, Vari-L anticipates making an initial distribution to its shareholders within thirty to sixty days following the closing. No such distribution would take place prior to Vari-L having issued shares of its common stock in connection with the anticipated settlement of

Vari-L’s shareholder class action lawsuit described under “The Vari-L Business—Legal Proceedings.”

| Q: | | ARE THERE RESTRICTIONS ON THE AMOUNT AND TIMING OF DISTRIBUTIONS? (SEE PAGE 82) |

A: Yes. The asset purchase agreement provides that Vari-L may not distribute proceeds of the asset sale to its shareholders unless it has satisfied in full or, in the reasonable judgment of the board of directors of Olin Acquisition Corporation, made adequate provision to satisfy in full, each amount owed to a creditor of Vari-L, including any amounts expected to be incurred by Vari-L after the closing of the asset sale and prior to Vari-L’s final dissolution. Vari-L has also agreed to reserve and not distribute to its shareholders 25% of the $13,650,000 consideration to be paid in the asset sale (as adjusted for the net asset adjustment), 45% of which shall consist of cash and 55% of which shall consist of Sirenza common stock, for the satisfaction of any indemnification claims Sirenza and its related parties may make under the asset purchase agreement, through the later of March 31, 2004 and the date at which all such indemnification claims have been resolved.

| Q: | | ARE THERE RESTRICTIONS ON VARI-L’S ABILITY TO SELL SIRENZA SHARES RECEIVED IN THE ASSET SALE? (SEE PAGES 83-84) |

A: Yes. The Sirenza common stock issued to Vari-L in connection with the asset sale will be subject to the resale restrictions of Rule 145 under the Securities Act. Generally, Vari-L may not sell any such shares except pursuant to an effective registration statement under the Securities Act of 1933 covering the resale of those shares or pursuant to a resale exemption contained in Rule 145 under the Securities Act of 1933. Sirenza intends to file a registration statement on Form S-3 to cover such resales by Vari-L and to request that the SEC declare such resale registration statement effective as soon as possible following the closing of the acquisition. In addition, Vari-L may not sell, in any consecutive 30 day period, more than the greater of 10% of the number of shares of Sirenza common stock issued pursuant to the asset purchase agreement or the number of shares of Sirenza common stock that is equal to 66% of the average weekly reported volume of trading in Sirenza’s shares during the four calendar weeks immediately preceding the first date of such proposed sale (excluding from such calculations shares sold by Vari-L during such four-week period). These restrictions would not apply to any shares distributed to Vari-L shareholders.

| Q: | | WHEN WILL THE WINDING-UP OF VARI-L’S BUSINESS BE COMPLETED? (SEE PAGE 99) |

A: The winding-up of Vari-L’s business will be completed after Vari-L has paid for, or provided for the payment of, all of its liabilities and obligations, and distributed any remaining assets to its shareholders. The wind-up will not be completed before the later of March 31, 2004 and the date at which all indemnification claims by Sirenza and its related parties under the asset purchase agreement have been resolved.

| Q: | | WHAT VOTE OF VARI-L SHAREHOLDERS IS REQUIRED TO APPROVE THESE MATTERS? (SEE PAGE 46) |

A: Both the asset sale (Proposal 1) and the plan of dissolution (Proposal 2) require the approval of the

4

holders of a majority of the outstanding common stock of Vari-L as of the record date for the special meeting of shareholders. The adjournment (Proposal 3) requires the approval of the holders of a majority of the common stock of Vari-L represented at the special meeting and entitled to vote.

| Q: | | WHAT HAPPENS IF VARI-L’S SHAREHOLDERS APPROVE THE ASSET SALE OR THE PLAN OF DISSOLUTION, BUT NOT BOTH? |

A: If Vari-L’s shareholders approve the asset sale but not the plan of dissolution, Vari-L and Sirenza will not be obligated to complete the transactions contemplated by the asset purchase agreement. In such event, absent a waiver of such condition by Sirenza and Vari-L, the asset sale will not be completed. If Vari-L’s shareholders approve the plan of dissolution but not the asset sale, the transactions contemplated by the asset purchase agreement will not be completed under any circumstances and Vari-L will not implement the plan of dissolution. In either event, if the Sirenza loan facility was no longer available or otherwise became due and payable and Vari-L was unable to secure an alternative source of working capital sufficient to pay off the Sirenza loan facility and to meet its ongoing working capital needs, or to enter into an alternative business combination transaction, Vari-L likely would be forced to resort to bankruptcy protection.

| Q: | | DOES THE BOARD OF DIRECTORS OF VARI-L RECOMMEND THAT I VOTE IN FAVOR OF THE ASSET SALE AND THE DISSOLUTION? (SEE PAGES 96 and 106) |

A: Yes. After careful consideration, the board of directors of Vari-L unanimously recommends that you vote in favor of each of Proposals 1 and 2.

| Q: | | DID VARI-L’S FINANCIAL ADVISOR RENDER A FAIRNESS OPINION IN CONNECTION WITH THE ASSET SALE? (SEE PAGES 62-67) |

A: Yes. In deciding to approve the terms of the asset purchase agreement and the asset sale, one factor Vari-L’s board of directors considered was the opinion of Vari-L’s financial advisor, Green Manning & Bunch Ltd., or GMB. GMB rendered an opinion to Vari-L’s board of directors that, as ofDecember 2, 2002, and subject to the considerations set forth in the opinion, the consideration to be received by Vari-L in the asset sale was fair to Vari-L from a financial point of view. The full text of GMB’s opinion, dated December 2, 2002, which sets forth the qualifications, assumptions made, matters considered, limitations on the review undertaken in connection with the opinion, and circumstances where the opinion should not be relied upon, is attached asAnnex C to this proxy statement/prospectus and you are urged to read GMB’s fairness opinion in its entirety.

| Q: | | DO PERSONS INVOLVED IN THE ASSET SALE HAVE INTERESTS DIFFERENT FROM MINE? (SEE PAGE 88) |

A: Yes. When considering the recommendation of Vari-L’s board of directors, you should be aware that certain Vari-L officers and directors have interests in the asset sale or the dissolution that are different from, or in addition to, your own. These include the following:

| | • | | each of Messrs. Charles R. Bland, Richard P. Dutkiewicz, Daniel J. Wilmot, Timothy G. Schamberger and Larry Romero amended their existing employment agreements with Vari-L by signing termination letters that are effective upon the closing of the asset sale and provide for certain post-termination payments, which could, in the aggregate, be as large as approximately $765,000; |

| | • | | each of Messrs. Bland, Dutkiewicz, Schamberger and Wilmot entered into employment offer letters with Sirenza that are effective upon the closing of the asset sale, and it is anticipated that they will receive future option grants from Sirenza in such capacity; and |

| | • | | in addition to amounts payable under his amended employment agreement with Vari-L and his offer letter with Sirenza, Mr. Dutkiewicz will receive a bonus payment of $60,000 from Vari-L upon the closing of the asset sale. |

| Q: | | WHAT DO I NEED TO DO NOW? (SEE PAGE 46) |

A: You should read this proxy statement/prospectus carefully in its entirety, including its annexes, to

5

consider how the matters discussed will affect you. You should mail your signed proxy card in the enclosed return envelope or otherwise vote in a manner described in this proxy statement/prospectus as soon as possible so that your shares will be represented at the special meeting of Vari-L shareholders.

| Q: | | WHAT HAPPENS IF I DO NOT RETURN A PROXY CARD? (SEE PAGE 46) |

A: The failure to return your proxy card will have the same effect as voting AGAINST approval of the asset sale and the plan of dissolution.

| Q: | | WHAT HAPPENS IF I RETURN A SIGNED PROXY CARD BUT DO NOT INDICATE HOW TO VOTE MY PROXY? (SEE PAGE 46) |

A: If you do not include instructions on how to vote your properly signed and dated proxy, your shares will be voted FOR approval of the asset sale, the plan of dissolution and the adjournment.

| Q: | | MAY I VOTE IN PERSON? (SEE PAGE 45) |

A: Yes. You may attend the special meeting and vote your shares in person, rather than signing and returning your proxy card.

| Q: | | MAY I CHANGE MY VOTE AFTER I HAVE MAILED MY SIGNED PROXY CARD (SEE PAGE 47) |

A: Yes. You may change your vote at any time before your proxy card is voted at the special meeting. You can do this in one of three ways. First, you can send a written, dated notice stating that you would like to revoke your proxy. Second, you can complete, date and submit a new proxy card. Third, you can attend the special meeting and vote in person. Your attendance alone will not revoke your proxy. If you have instructed a broker to vote your shares, you must follow directions received from your broker to change those instructions.

| Q: | | IF MY SHARES ARE HELD IN “STREET NAME” BY MY BROKER, WILL MY BROKER VOTE MY SHARES FOR ME? |

A: Your broker will not be able to vote your shares without instructions from you. You should instructyour broker to vote your shares by following the procedure provided by your broker. The failure to provide such voting instructions to your broker will have the same effect as voting AGAINST approval of the asset sale and the plan of dissolution.

| Q: | | SHOULD I SEND IN MY VARI-L STOCK CERTIFICATES? |

A: No. Please do not mail in your Vari-L stock certificates. If the asset sale and the plan of dissolution are approved, Vari-L will provide instructions regarding surrendering your stock certificates if and when the dissolution of Vari-L has been completed.

| Q: | | CAN I STILL SELL MY SHARES OF VARI-L COMMON STOCK? (SEE PAGE 106) |

A: Yes. Vari-L’s common stock is currently traded on the Over the Counter Bulletin Board. After the dissolution is completed, there will be no further trading in Vari-L’s common stock.

| Q: | | HOW WILL THE DISSOLUTION OF VARI-L AFFECT MY STATUS AS A SHAREHOLDER? (SEE PAGES 97-106) |

A: Vari-L will not dissolve until its assets, if any, that remain after payment or provision for payment of Vari-L’s liabilities and obligations are either distributed to its shareholders or transferred to a liquidating trust, and Vari-L files articles of dissolution that are accepted by the Secretary of State of the State of Colorado or files with the Secretary of State of the State of Colorado a court order declaring Vari-L dissolved. In implementing the plan of dissolution, Vari-L contemplates closing its stock transfer books and no longer recording transfers of shares of its common stock upon the occurrence of certain events. Subject to the restrictions set forth in the asset purchase agreement, Vari-L may establish a liquidating trust for the sole purpose of liquidating any remaining assets of Vari-L, paying or providing for the payment of Vari-L’s remaining liabilities and obligations, and making distributions to Vari-L’s shareholders. If a liquidating trust is established, you will receive beneficial interests in the assets transferred to the liquidating trust in proportion to the number of Vari-L’s shares owned by you at such time.

6

| Q: | | AM I ENTITLED TO DISSENTERS’ RIGHTS? (SEE PAGE 47) |

A: Yes. Any Vari-L shareholder who objects to the asset sale has the right under Colorado law to obtain payment of the fair value of his, her or its shares of Vari-L common stock. This “dissenters’ right” is subject to a number of restrictions and technical requirements. Generally, in order to exercise dissenters’ rights, among other things, a dissenting shareholder must not vote in favor of the asset sale and must send to Vari-L a written objection to the asset sale stating that his, her or its right to dissent will be exercised if the asset sale is effected BEFORE the vote on the asset sale. Merely voting against the asset sale will not preserve a shareholder’s right to dissent.Annex E to this proxy statement/prospectus contains a copy of the Colorado statute relating to dissenters’ rights. Failure to follow all of the steps required by this statute will result in a loss of dissenters’ rights.

| Q: | | IS SIRENZA STOCKHOLDER APPROVAL REQUIRED? |

A: No. Sirenza stockholder approval is not required in connection with the asset sale or the plan of dissolution.

| Q: | | WHO CAN HELP ANSWER MY ADDITIONAL QUESTIONS? |

A: Shareholders who would like additional copies, without charge, of this proxy statement/prospectus or have additional questions about the transaction, including the procedures for voting Vari-L’s shares, should contact:

Corporate Secretary

Vari-L Company, Inc.

4895 Peoria Street

Denver, CO 80239

Telephone: (303) 371-1560

Vari-L shareholders should also contact the following proxy solicitor with any additional questions relating to the solicitation of shareholder proxies:

Regan & Associates, Inc.

505 Eighth Avenue, Floor 12A

New York, New York 10018

Phone: (212) 587-3005

Fax: (212) 587-3006

7

FORWARD-LOOKING INFORMATION

This proxy statement/prospectus contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements include, among others, statements regarding the amount of cash and Sirenza common stock consideration expected to be payable to Vari-L upon the closing of the asset purchase, the expected timeline of the asset sale, the dissolution, and the satisfaction of Vari-L’s liabilities, the amount and timing of distributions to be made to Vari-L shareholders in connection with the dissolution, the expected future operating results of the combined company, the anticipated benefits to Sirenza of the asset purchase and the integration of Vari-L’s employees, management, products, and technology with those of Sirenza. These forward-looking statements are subject to risks and uncertainties that could cause actual results and events to differ materially. For a detailed discussion of these risks and uncertainties, see the “Risk Factors” section of this proxy statement/prospectus. These and many other factors could affect the future financial and operating results of Sirenza or Vari-L.

RECENT DEVELOPMENTS

On March 28, 2003, the United States District Court for the District of Colorado held a fairness hearing regarding the settlement of Vari-L’s shareholder class action lawsuit as described under “The Vari-L Business— Legal Proceedings” on page 179 and elsewhere in this proxy statement/prospectus. At such hearing, the court approved the settlement of the shareholder class action as fair and reasonable to the members of the class. Following such hearing, the court entered its final judgment and order of dismissal of the actions with prejudice. Less than 1% of the Vari-L shareholders comprising the plaintiff class have opted out of the settlement.

8

SUMMARY OF THE PROXY STATEMENT/PROSPECTUS

This summary, together with the matters discussed under “Questions and Answers About the Asset Sale and Plan of Dissolution,” highlights the material terms of the transaction and may not contain all of the information that is important to you. You should read carefully this entire proxy statement/prospectus and the documents referred to in this proxy statement/prospectus for a more complete description of the matters on which you are being asked to vote. The asset purchase agreement is attached asAnnex A to this proxy statement/prospectus. You are encouraged to read the asset purchase agreement as it is the legal document that governs the asset sale on which you are being asked to vote. The plan of dissolution of Vari-L is attached to this proxy statement/prospectus asAnnex B. You are encouraged to read the plan of dissolution as it is the legal document that would govern the dissolution of Vari-L that you are being asked to approve. Also attached asAnnexes C through F are certain agreements and other materials relating to the transactions contemplated by the asset purchase agreement. You are encouraged to read those materials as well. This summary is qualified in its entirety by the asset purchase agreement and the plan of dissolution and the more detailed information appearing elsewhere in this document. This summary includes page references in parentheses to direct you to a more complete description of the topics presented in this summary.

Sirenza has supplied all information contained in this proxy statement/prospectus relating to Sirenza and its subsidiaries and Vari-L has supplied all information contained in this proxy statement/prospectus relating to Vari-L. Unless otherwise indicated, references to Sirenza include Sirenza and its subsidiaries, including Olin Acquisition Corporation.

The Companies

Vari-L Company, Inc.

4895 Peoria Street

Denver, CO 80239

(303) 371-1560

Vari-L Company, Inc., designs, manufactures and markets a wide variety of radio frequency and microwave signal processing components and devices used in the wireless communications industry. Vari-L went public on April 20, 1994. Its stock is traded on the Over the Counter Bulletin Board under the symbol “VARL.OB.”

Sirenza Microdevices, Inc.

522 Almanor Avenue

Sunnyvale, CA 94085

(408) 616-5400

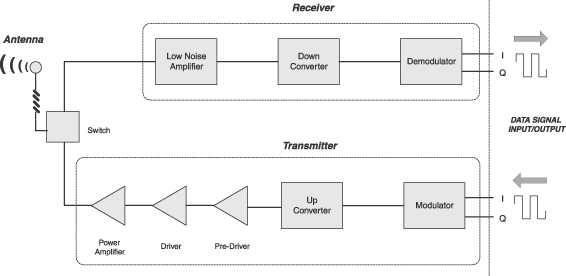

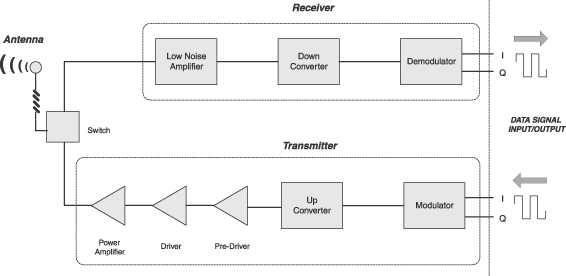

Sirenza Microdevices, Inc., is a leading designer of high performance radio frequency, or RF, components for communications equipment manufacturers. Sirenza’s products are used primarily in wireless communications equipment to enable and enhance the transmission and reception of voice and data signals, and are also utilized in broadband wireline and terminal applications. Sirenza held its initial public offering of common stock on May 25, 2000. Its common stock is traded on the Nasdaq National Market under the symbol “SMDI.”

Olin Acquisition Corporation

522 Almanor Avenue

Sunnyvale, CA 94085

(408) 616-5400

Olin Acquisition Corporation is a wholly owned subsidiary of Sirenza that was formed by Sirenza for the sole purpose of participating in the asset sale transaction with Vari-L.

9

Asset Sale and Related Transactions (Pages 74 and 93)

A subsidiary of Sirenza will purchase substantially all of the tangible and intangible assets of Vari-L and assume specified liabilities of Vari-L. In return, Vari-L will receive aggregate cash and Sirenza common stock consideration of $13,650,000, to be decreased by the amount of any indebtedness in excess of $1,353,862 owed to Sirenza by Vari-L as of the closing date of the asset sale pursuant to the existing loan facility provided by Sirenza to Vari-L, and to be further increased or decreased by the amount of the net asset adjustment described elsewhere in this proxy statement/prospectus. Forty-five percent of the net amount of the consideration described above will be paid to Vari-L in cash, and the remaining 55% shall be paid in shares of Sirenza common stock.

Reasons for the Purchase and Sale of Assets

Sirenza (Page 60)

Sirenza’s board of directors determined that the purchase of the assets from Vari-L is consistent with and in furtherance of the long-term business strategy of Sirenza and fair to, and in the best interests of, Sirenza and its stockholders, and has unanimously approved the asset purchase and asset purchase agreement. In reaching its determination, Sirenza’s board of directors considered a number of factors, including the following:

| | • | | the strategic rationale for the asset purchase and the benefits of the transaction structure; |

| | • | | future projections and historical information concerning Sirenza’s and Vari-L’s respective businesses, the respective financial conditions of Sirenza and Vari-L before and after giving effect to the asset purchase and the asset purchase’s short- and long-term effect on Sirenza stockholder value; |

| | • | | the consideration that Sirenza is offering to Vari-L in the asset purchase; |

| | • | | the belief that the terms of the asset purchase agreement, including the parties’ representations, warranties, covenants, and conditions to their respective obligations are reasonable; |

| | • | | the possibility that the asset purchase might not be consummated; |

| | • | | the substantial charges to be incurred in connection with the asset purchase; |

| | • | | the difficulties and risks of integrating Vari-L’s business and management; and |

| | • | | the opinion of Sirenza’s financial advisor that the aggregate consideration to be paid by Sirenza in the asset purchase was fair to Sirenza’s stockholders from a financial point of view. |

Following the execution of the asset purchase agreement, Sirenza and Vari-L publicly made forward-looking statements that are consistent with financial projections considered by Sirenza’s board of directors in their review and evaluation of the asset purchase. These forward-looking statements, as well as the risks associated with placing undue reliance on such statements, are discussed in detail beginning on page 26 of this proxy statement/prospectus.

Vari-L (Page 58)

The Vari-L board of directors has unanimously determined that the asset sale and the asset purchase agreement are fair to and in the best interests of Vari-L and its shareholders, and has unanimously approved the asset purchase agreement and the asset sale. In reaching its determination, the Vari-L board of directors considered a number of factors, including the following:

| | • | | the present and anticipated business environment of the wireless telecommunications market, which has experienced a severe downturn and has ultimately led to Vari-L’s incurring cash operating losses during its most recently completed fiscal year; |

| | • | | the board’s determination that, absent the Sirenza loan facility, Vari-L would not be able to continue to operate effectively in light of the significant losses it was incurring, nor would it be able to raise the capital necessary to permit it to succeed in the wireless telecommunications market in light of Vari-L’s increasingly precarious cash flow position; |

10

| | • | | the results of efforts of Vari-L and its financial advisor to solicit indications of interest from third parties regarding a potential purchase of or investment in Vari-L; |

| | • | | the terms and conditions of the asset purchase agreement, the consideration to be received in the asset sale and the likelihood that Vari-L would be able to distribute a portion of such consideration to its shareholders; |

| | • | | the risk that the transaction might not be completed; |

| | • | | the opinion of Vari-L’s financial advisor that the consideration to be received by Vari-L in that asset sale was fair to Vari-L from a financial point of view; and |

| | • | | the availability of dissenters’ rights under Colorado law to any holders of Vari-L’s common stock that disapprove of the asset sale. |

Conditions to the Asset Sale (Pages 84-85)

The obligations of each of Sirenza and Vari-L to complete the asset sale are subject to the satisfaction of specified conditions set forth in the asset purchase agreement, including the approval of the asset sale by the holders of a majority of the outstanding shares of Vari-L common stock.

Termination of the Asset Purchase Agreement (Pages 86-87)

Each of Sirenza and Vari-L is entitled to terminate the asset purchase agreement under specified conditions, including, among others, mutual written consent of the parties; if the asset sale has not been completed by May 31, 2003; if a court or governmental entity issues a final and nonappealable order that prohibits the asset sale; if the Vari-L shareholders do not approve the asset sale; certain breaches of the asset purchase agreement; or (in the case of Sirenza) if a triggering event occurs, such as the failure of the board of directors of Vari-L to recommend approval of the asset sale to Vari-L shareholders or the approval or endorsement by the board of directors of Vari-L of an alternative acquisition proposal.

Limitation on Considering Other Acquisition Proposals (Pages 81-82)

Vari-L has agreed not to consider a business combination or other similar transaction with another party while the asset sale is pending unless the other party has made an unsolicited, bona fide written offer to the Vari-L board of directors to purchase a majority of the outstanding shares of Vari-L common stock or all or substantially all of the assets of Vari-L on terms that the Vari-L board of directors determines to be materially more favorable to its shareholders from a financial point of view than the terms of the asset sale, and the transaction is reasonably capable of being consummated.

Loan Facility (Page 93)

In October 2002, Sirenza agreed to provide Vari-L with up to $5.3 million to support general working capital requirements pursuant to a loan facility. Loans under the loan facility are secured by substantially all of the tangible and intangible assets of Vari-L. Vari-L made an initial draw of $1,353,862 to pay off Vari-L’s previous lender concurrently with entering into the Sirenza facility, and Sirenza has agreed to forgive this amount in the event of the closing of the asset sale. Any amount of loan facility principal and interest outstanding as of the closing date of the asset sale in excess of the initial draw amount will reduce the purchase price otherwise payable to Vari-L on a dollar-for-dollar basis. Loans under the loan facility bear interest at an annual rate of 25%, which increases to 30% during the existence of an event of default. Vari-L anticipates continuing to draw down on the Sirenza loan facility through the closing. While the loan facility provides for up to $5.3 million of credit to be made available to Vari-L through September 2003, Vari-L defaulted on a loan covenant requiring its rolling three-month net operating loss not to exceed $1,585,000 as of December 31, 2002. Vari-L has also defaulted on a covenant requiring its rolling three-month cash used in operations not to exceed $1,174,000 as of February 28, 2003. Each of these defaults gives Sirenza the right to discontinue funding and accelerate Vari-L’s obligation to repay the loans outstanding thereunder. While Sirenza has not exercised its rights to date, it has reserved the right to do so in the future. As of the date of this proxy statement/prospectus, there is

11

approximately $5.1 million of indebtedness outstanding (including accrued interest) under the loan facility that, if it remains outstanding at the closing, will be assumed by Olin Acquisition Corporation as part of the assumed liabilities. The purchase price payable to Vari-L will be reduced to the extent that the amount of such indebtedness exceeds $1,353,862. To the extent that there are additional borrowings after the date of this proxy statement/prospectus that remain outstanding at the closing date of the asset sale, the purchase price will be reduced dollar for dollar. The loan facility also has many other important terms that you are urged to review and consider.

Stockholder Support Agreements (Pages 93-94)

Pursuant to stockholder support agreements and related irrevocable proxies executed by Vari-L’s executive officers and directors, 123,607 outstanding shares of Vari-L common stock (which excludes shares subject to stock options) beneficially owned by them and their affiliates as of the record date (representing approximately 1.7% of the total number of shares of Vari-L common stock outstanding or beneficially owned at that date), will be voted for approval of the asset sale and the dissolution. Sirenza may be deemed to beneficially own shares of Vari-L common stock representing approximately 30.0% of Vari-L, a substantial portion of which is attributable to shares of common stock which are issuable pursuant to Sirenza’s convertible note. However, the note is not currently convertible and Sirenza will not be able to vote such shares at the special meeting except to the extent the note becomes convertible and Sirenza converts the note prior to the record date for the special meeting.

Non-Competition Agreements (Page 96)

Contemporaneously with the execution and delivery of the asset purchase agreement, those key employees of Vari-L that have entered into employment agreements with Sirenza also entered into non-competition agreements with Sirenza. Each agreed with Sirenza, subject to the closing of the asset sale and until the one year anniversary of the cessation of his employment, that he will not engage in any business activity competitive with Sirenza, solicit, encourage, or take any other action which isintended to induce any existing employee, contractor or consultant of Sirenza to terminate his or her employment with Sirenza, or interfere in any manner with the contractual or employment relationship between Sirenza and any of its employees, contractors, customers, or suppliers.

Expenses and Termination Fee (Pages 86-87)

The asset purchase agreement provides that regardless of whether the asset sale is completed, all expenses incurred by the parties shall be borne by the party incurring such expenses. In addition, upon termination of the asset purchase agreement in certain cases a $1,000,000 termination fee may be payable to Sirenza by Vari-L.

Material Federal Income Tax Consequences (Pages 89-92)

For federal income tax purposes, the transaction with Sirenza will be treated as a taxable asset acquisition, with Vari-L as the seller, and Sirenza as the buyer. Accordingly, Vari-L will recognize taxable gain or loss in the transaction. Vari-L expects that at least most, and possibly all, of its gain attributable to the transaction will be offset by available net operating loss carryforwards. The acquisition will not be taxable directly to the shareholders of Vari-L. The board of directors of Vari-L has also adopted a plan of dissolution, which, subject to approval of Vari-L shareholders, provides for liquidation and distribution of Vari-L’s assets to its shareholders. The liquidation of Vari-L will be a taxable transaction both for Vari-L and its shareholders. Vari-L will recognize gain or loss equal to the difference between the fair market values and the adjusted basis of the assets distributed in liquidation. The Vari-L shareholders will recognize gain or loss on the difference between the fair market values of their share of the assets (net of liabilities) distributed to them and their adjusted basis in their Vari-L stock. Because of the expected nature of the assets and liabilities of Vari-L after the acquisition, the plan of dissolution provides for potential distribution of Vari-L’s assets and liabilities to a liquidation trust. If a liquidating trust is used, the Vari-L shareholders will be deemed to have received their share of the assets distributed to such trust (net of liabilities assumed by it), and the tax treatment of the liquidation described above will not be materially

12

affected, except that income, gains and losses subsequently recognized by the trust will also be taxable to the Vari-L shareholders. If the liquidation is not completed, Vari-L and its shareholders may be exposed to greater tax liabilities with respect to any non-liquidating distributions or with respect to any increases in the value of assets that are subsequently sold, exchanged or distributed (whether or not in liquidation).

Tax matters can be complicated and the tax consequences of the transaction discussed in this proxy statement/prospectus to you will depend on the facts of your own situation. You should consult with your own tax advisor to fully understand the tax consequences of the asset sale and dissolution of Vari-L to you.

Anticipated Accounting Treatment (Page 92)

The asset sale is expected to be accounted for by Sirenza as a business combination using the purchase method. Under this method, the purchase price will be allocated to the identifiable assets acquired andwill be recorded on Sirenza’s books at their respective fair values. A portion of the purchase price may be identified as in-process research and development. This amount, if any, will be charged to Sirenza’s consolidated results of operations in the quarter the asset sale is completed. The remaining purchase price will be recorded as intangible assets and goodwill.

Regulatory Matters Relating to the Asset Sale (Page 89)

Neither Vari-L nor Sirenza is aware of any regulatory or governmental approvals required to complete the asset sale.

Regulatory Matters Relating to the Dissolution (Page 97)

Vari-L is not aware of any regulatory or governmental requirements that must be complied with or approvals that must be obtained in connection with the dissolution.

13

SIRENZA SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following consolidated selected historical financial data should be read in conjunction with the Sirenza Microdevices, Inc. audited consolidated financial statements and related notes, and “Sirenza Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this proxy statement/prospectus. The consolidated statement of operations data for the years ended December 31, 2000, 2001 and 2002 and the consolidated balance sheet data as of December 31, 2001 and 2002 have been derived from consolidated financial statements that have been audited by Ernst & Young LLP, independent auditors, included elsewhere in this proxy statement/prospectus. The consolidated statement of operations data for the years ended December 31, 1998 and 1999 and the consolidated balance sheet data as of December 31, 1998, 1999 and 2000 have been derived from audited consolidated financial statements not included in this proxy statement/prospectus. The consolidated statement of operations data presented below are not necessarily indicative of results for any future period.

| | | Year Ended December 31,

| |

| | | 1998

| | | 1999

| | | 2000

| | | 2001

| | | 2002

| |

| | | (in thousands, except per share data) | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net revenues: | | | | | | | | | | | | | | | | | | | | |

Product revenues | | $ | 7,417 | | | $ | 17,248 | | | $ | 34,427 | | | $ | 19,821 | | | $ | 20,710 | |

Contract manufacturing revenues | | | 814 | | | | 817 | | | | 222 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total net revenues | | | 8,231 | | | | 18,065 | | | | 34,649 | | | | 19,821 | | | | 20,710 | |

Cost of revenues: | | | | | | | | | | | | | | | | | | | | |

Cost of product revenues | | | 4,854 | | | | 9,996 | | | | 14,651 | | | | 17,440 | | | | 8,749 | |

Amortization of deferred stock compensation | | | — | | | | 140 | | | | 153 | | | | 140 | | | | 138 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total cost of revenues | | | 4,854 | | | | 10,136 | | | | 14,804 | | | | 17,580 | | | | 8,887 | |

Gross profit | | | 3,377 | | | | 7,929 | | | | 19,845 | | | | 2,241 | | | | 11,823 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Research and development (exclusive of amortization of deferred stock compensation of $31, $290, $257 and $196 for the years ended December 31, 1999, 2000, 2001 and 2002, respectively | | | 932 | | | | 2,274 | | | | 7,964 | | | | 8,752 | | | | 6,960 | |

Sales and marketing (exclusive of amortization of deferred stock compensation of $56, $301, $279 and $262 for the years ended December 31, 1999, 2000, 2001 and 2002, respectively | | | 1,107 | | | | 2,951 | | | | 5,940 | | | | 5,828 | | | | 5,043 | |

General and administrative (exclusive of amortization of deferred stock compensation of $61, $573, $722 and $419 for the years ended December 31, 1999, 2000, 2001 and 2002, respectively | | | 965 | | | | 2,089 | | | | 4,744 | | | | 4,435 | | | | 4,914 | |

Amortization of deferred stock compensation | | | — | | | | 148 | | | | 1,164 | | | | 1,258 | | | | 877 | |

In-process research and development(1) | | | — | | | | — | | | | — | | | | — | | | | 2,200 | |

Amortization of acquisition related intangible assets(1) | | | — | | | | — | | | | — | | | | — | | | | 48 | |

Restructuring and special charges(1) | | | — | | | | 2,990 | | | | (282 | ) | | | 2,670 | | | | 279 | |

Impairment of investment in GCS(1) | | | — | | | | — | | | | — | | | | — | | | | 2,900 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total operating expenses | | | 3,004 | | | | 10,452 | | | | 19,530 | | | | 22,943 | | | | 23,221 | |

Income (loss) from operations | | | 373 | | | | (2,523 | ) | | | 315 | | | | (20,702 | ) | | | (11,398 | ) |

Interest and other income (expense), net | | | (84 | ) | | | 17 | | | | 2,353 | | | | 3,452 | | | | 893 | |

Provision for income taxes | | | 10 | | | | 48 | | | | 800 | | | | 2,336 | | | | 59 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) applicable to common stockholders | | | 279 | | | | (2,554 | ) | | | 1,868 | | | | (19,586 | ) | | | (10,564 | ) |

Accretion of mandatorily redeemable convertible preferred stock | | | — | | | | (21,857 | ) | | | (25,924 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) applicable to common stockholders | | $ | 279 | | | $ | (24,411 | ) | | $ | (24,056 | ) | | $ | (19,586 | ) | | $ | (10,564 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Basic and diluted net income (loss) per share applicable to common stockholders | | $ | 0.02 | | | $ | (1.63 | ) | | $ | (1.09 | ) | | $ | (0.67 | ) | | $ | (0.35 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Shares used to compute basic and diluted net income (loss) per share applicable to common stockholders | | | 15,000 | | | | 15,000 | | | | 22,032 | | | | 29,133 | | | | 29,856 | |

14

| | | As of December 31,

|

| | | 1998

| | | 1999

| | | 2000

| | 2001

| | 2002

|

| | | (in thousands) |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 217 | | | $ | 10,965 | | | $ | 37,683 | | $ | 15,208 | | $ | 12,874 |

Working capital (deficit) | | | (854 | ) | | | 7,746 | | | | 52,972 | | | 36,811 | | | 21,923 |

Total assets | | | 3,806 | | | | 19,719 | | | | 82,306 | | | 64,043 | | | 53,964 |

Long term obligations, less current portion | | | 813 | | | | 1,299 | | | | 1,010 | | | 401 | | | 143 |

Mandatorily redeemable convertible preferred stock | | | — | | | | 38,857 | | | | — | | | — | | | — |

Total stockholders’ equity (net capital deficiency) | | | 10 | | | | (27,912 | ) | | | 68,624 | | | 54,013 | | | 44,977 |

| (1) | | See Sirenza Notes to Consolidated Financial Statements beginning on page F-8 of this proxy statement/prospectus. |

15

VARI-L SELECTED HISTORICAL FINANCIAL DATA

The following selected historical financial data should be read in conjunction with the Vari-L audited financial statements and related notes, and “Vari-L Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this proxy statement/prospectus. Certain fiscal year 2001 amounts have been reclassified to conform to the fiscal year 2002 presentation. The statement of operations data for the years ended June 30, 2001 and 2002 and the balance sheet data as of June 30, 2001 and 2002 have been derived from financial statements that have been audited by KPMG LLP, independent auditors, included elsewhere in this proxy statement/prospectus. The balance sheet data as of June 30, 2000 has been derived from financial statements that have been audited by KPMG LLP not included in this proxy statement/prospectus. The statement of operations data for the six months ended December 31, 2001 and 2002 and the balance sheet data as of December 31, 2002 have been derived from unaudited condensed financial statements included elsewhere in this proxy statement/prospectus and, in the opinion of Vari-L, include all adjustments, consisting of normal recurring adjustments, which are necessary for a fair presentation of this information when read in conjunction with the Vari-L audited financial statements and related notes included elsewhere in this proxy statement/ prospectus. Vari-L has been informed by its independent auditors that they could not express unqualified audit opinions for periods prior to June 30, 2000, based on their determination that the internal controls over inventory accounting and management systems prior to June 30, 2000 were not sufficiently reliable to enable them to audit the inventory quantities, and that they are unable to apply alternative auditing procedures to the inventory balances for periods prior to June 30, 2000. Due to the unauditable condition of Vari-L’s financial statements for periods prior to June 30, 2000 resulting from Vari-L’s insufficient internal controls over inventory accounting and management systems during such periods, shareholders are cautioned not to place undue reliance upon numbers relating to or affected by inventory for such periods, including costs of goods sold, net income or loss and equity. Accordingly, Vari-L’s management has determined that it is advisable to phase out the use of financial statements for periods prior to June 30, 2000. The statement of operations data for the year ended December 31, 1999, six months ended June 30, 2000 and twelve months ended June 30, 2000 and the balance sheet data as of December 31, 1999 have been derived from unaudited financial statements not included in this proxy statement/prospectus and, other than with respect to numbers relating to or affected by inventory as discussed in the preceding sentence, in the opinion of Vari-L, include all adjustments, consisting of normal recurring adjustments, which are necessary for a fair presentation of this information when read in conjunction with the Vari-L audited financial statements and related notes included elsewhere in this proxy statement/prospectus. Reliable information prior to January 1, 1999 cannot be prepared without unreasonable effort and expense because Vari-L’s system for internal controls over inventory accounting and management systems under prior management was inadequate during such periods. For more detail about these circumstances, please see “Vari-L Changes In and Disagreements with Accountants on Accounting and Financial Disclosure” and “The Vari-L Business—Legal Proceedings.” The statement of operations data presented below is not necessarily indicative of results for any future period.

16

| | | Year

Ended December 31, 1999

| | | Six Months Ended June 30, 2000

| | | Year Ended June 30,

| | | Six Months Ended December 31,

| |

| | | | | 2000

| | | 2001

| | | 2002

| | | 2001

| | | 2002

| |

| | | (in thousands of dollars, except share and per share data) | |

Statement of Operations Data(1): | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 24,212 | | | $ | 17,158 | | | $ | 30,597 | | | $ | 41,377 | | | $ | 21,348 | | | $ | 11,283 | | | $ | 8,291 | |

Cost of goods sold | | | 12,811 | | | | 10,311 | | | | 17,540 | | | | 21,747 | | | | 13,647 | | | | 6,750 | | | | 6,128 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 11,401 | | | | 6,847 | | | | 13,057 | | | | 19,630 | | | | 7,701 | | | | 4,533 | | | | 2,163 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selling | | | 3,166 | | | | 1,948 | | | | 3,636 | | | | 4,268 | | | | 2,925 | | | | 1,282 | | | | 1,360 | |

General and administrative | | | 3,651 | | | | 2,440 | | | | 4,436 | | | | 9,664 | | | | 6,418 | | | | 3,380 | | | | 2,973 | |

Research and development | | | 4,852 | | | | 3,003 | | | | 5,646 | | | | 4,021 | | | | 2,669 | | | | 1,308 | | | | 1,568 | |

Expenses relating to workforce reductions and the proposed transaction with Sirenza | | | — | | | | — | | | | — | | | | — | | | | — | | | | 101 | | | | 876 | |

Expenses relating to accounting restatements and related legal matters, net of recoveries(2) | | | — | | | | 469 | | | | 469 | | | | 2,387 | | | | 1,805 | | | | 34 | | | | 30 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total operating expenses | | | 11,669 | | | | 7,860 | | | | 14,187 | | | | 20,340 | | | | 13,817 | | | | 6,105 | | | | 6,807 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating (loss) | | | (268 | ) | | | (1,013 | ) | | | (1,130 | ) | | | (710 | ) | | | (6,116 | ) | | | (1,572 | ) | | | (4,644 | ) |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 262 | | | | 315 | | | | 460 | | | | 416 | | | | 48 | | | | 29 | | | | 9 | |

Interest expense | | | (879 | ) | | | (453 | ) | | | (873 | ) | | | (1,062 | ) | | | (199 | ) | | | (98 | ) | | | (385 | ) |

Other, net | | | (32 | ) | | | (28 | ) | | | (35 | ) | | | (43 | ) | | | 12 | | | | (7 | ) | | | (52 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other income (expense) | | | (649 | ) | | | (166 | ) | | | (448 | ) | | | (689 | ) | | | (139 | ) | | | (76 | ) | | | (428 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net (loss) | | $ | (917 | ) | | $ | (1,179 | ) | | $ | (1,578 | ) | | $ | (1,399 | ) | | $ | (6,255 | ) | | $ | (1,648 | ) | | $ | (5,072 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Loss per share, basic and diluted | | $ | (0.16 | ) | | $ | (0.17 | ) | | $ | (0.25 | ) | | $ | (0.20 | ) | | $ | (0.87 | ) | | $ | (0.23 | ) | | $ | (0.70 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Weighted average shares outstanding, basic and diluted | | | 5,680,287 | | | | 7,042,247 | | | | 6,232,964 | | | | 7,083,866 | | | | 7,152,342 | | | | 7,125,980 | | | | 7,252,008 | |

| | | As of December 31, 1999

| | As of June 30,

| | As of December 31, 2002

| |

| | | | 2000

| | 2001

| | 2002

| |

| | | (in thousands of dollars) | |

Balance Sheet Data at Period End(1): | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 14,721 | | $ | 11,030 | | $ | 2,013 | | $ | 553 | | $ | 138 | |

Working capital (deficit) | | | 7,520 | | | 6,742 | | | 7,093 | | | 1,999 | | | (1,977 | ) |

Total assets | | | 30,240 | | | 32,571 | | | 20,454 | | | 13,394 | | | 10,915 | |

Notes payable and current installments of long-term obligations | | | 11,159 | | | 11,566 | | | 1,764 | | | 1,611 | | | 3,505 | |

Long-term obligations | | | 102 | | | 92 | | | 1,321 | | | 55 | | | 27 | |

Total stockholders’ equity | | | 14,373 | | | 14,685 | | | 13,829 | | | 7,739 | | | 2,680 | |

| (1) | | Reliable information prior to January 1, 1999 cannot be prepared without unreasonable effort and expense because Vari-L’s system for internal controls over inventory accounting and management systems under prior management was inadequate during such periods. |

| (2) | | See Vari-L’s Notes to Financial Statements beginning on page F-64 of this proxy statement/prospectus. |

17

SIRENZA HISTORICAL QUARTERLY FINANCIAL DATA

The following table presents a summary of Sirenza’s consolidated results of operations for its eight most recent quarters ended December 31, 2002. The summarized historical quarterly financial data should be read in conjunction with Sirenza’s audited consolidated financial statements and related notes, and “Sirenza Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this proxy statement/prospectus. The information for each of these quarters is unaudited and has been prepared on a basis consistent with Sirenza’s audited consolidated financial statements appearing elsewhere in this proxy statement/prospectus. This information includes all adjustments, consisting only of normal recurring adjustments, that Sirenza considers necessary for a fair presentation of this information when read in conjunction with its audited consolidated financial statements and related notes appearing elsewhere in this proxy statement/prospectus. Results of operations for any quarter are not necessarily indicative of results for any future period.

| | | Three Months Ended

| |

| | | March 31, 2001

| | | June 30, 2001

| | | September 30, 2001(3)

| | | December 31, 2001

| |

| | | (In thousands, except per share data) | |

Net revenues | | $ | 7,800 | | | $ | 5,355 | | | $ | 3,188 | | | $ | 3,478 | |

Gross profit (loss) | | | 3,863 | | | | 1,602 | | | | (4,312 | ) | | | 1,088 | |

Amortization of deferred stock compensation | | | 304 | | | | 297 | | | | 440 | | | | 217 | |

Restructuring charges(1) | | | — | | | | — | | | | — | | | | 2,670 | |

Loss from operations | | | (1,662 | ) | | | (3,260 | ) | | | (10,344 | ) | | | (5,436 | ) |

Net loss applicable to common stockholders | | | (580 | ) | | | (1,470 | ) | | | (12,438 | ) | | | (5,098 | ) |

Basic and diluted net loss per share applicable to common stockholders | | $ | (0.02 | ) | | $ | (0.05 | ) | | $ | (0.42 | ) | | $ | (0.17 | ) |

Shares used to compute basic and diluted net loss per share applicable to common stockholders | | | 28,271 | | | | 29,270 | | | | 29,447 | | | | 29,545 | |

|

| | | Three Months Ended

| |

| | | March 31, 2002

| | | June 30, 2002

| | | September 30, 2002

| | | December 31, 2002

| |

| | | (In thousands, except per share data) | |

Net revenues | | $ | 4,870 | | | $ | 4,863 | | | $ | 5,206 | | | $ | 5,771 | |

Gross profit(2) | | | 3,159 | | | | 2,891 | | | | 2,757 | | | | 3,016 | |

Amortization of deferred stock compensation | | | 208 | | | | 208 | | | | 265 | | | | 196 | |

In-process research and development(1) | | | — | | | | — | | | | 2,200 | | | | — | |

Amortization of acquired intangible assets(1) | | | — | | | | — | | | | — | | | | 48 | |

Restructuring charges(1) | | | — | | | | — | | | | (112 | ) | | | 391 | |

Impairment of investment in GCS(1) | | | — | | | | — | | | | — | | | | 2,900 | |

Loss from operations | | | (999 | ) | | | (1,235 | ) | | | (3,970 | ) | | | (5,194 | ) |

Net loss applicable to common stockholders | | | (752 | ) | | | (973 | ) | | | (3,738 | ) | | | (5,101 | ) |

Basic and diluted net loss per share applicable to common stockholders | | $ | (0.03 | ) | | $ | (0.03 | ) | | $ | (0.13 | ) | | $ | (0.17 | ) |

Shares used to compute basic and diluted net loss per share applicable to common stockholders | | | 29,780 | | | | 29,862 | | | | 29,869 | | | | 29,912 | |

| (1) | | See Sirenza Microdevices, Inc.’s Notes to Consolidated Financial Statements beginning on page F-8 of this proxy statement/prospectus. |

| (2) | | In the first, second, third and fourth quarters of 2002, Sirenza sold inventory products that had been previously written-down of approximately $563,000, $566,000, $726,000 and $716,000, respectively. As the cost basis for previously written-down inventory is less than the original cost basis when such products are sold, cost of revenues associated with the sale is lower, which results in a higher gross margin on that |

18

| | sale. A significant majority of the previously written-down inventory products that were sold in the first, second, third and fourth quarters of 2002 related to a small number of products within two product lines. Sirenza recorded provisions for excess inventories for these parts as a result of a rapidly declining demand for these products due to customer program cancellations. Subsequently, Sirenza began receiving new orders for these products, which were not anticipated at the time Sirenza made the decision to record provisions for excess inventories. Sirenza expects to sell previously written-down inventory products in future periods. See the Sirenza Microdevices, Inc. Notes to Consolidated Financial Statements beginning on page F-8 and “Sirenza’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 139 of this proxy statement/prospectus. |