FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of January 2009

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes | No X |

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes | No X |

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

Yes | No X |

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b): Not Applicable

Table of Contents

| Item | |

1. 2. 3. | News release dated January 24, 2009 News release dated January 24, 2009 Investor presentation on ICICI Bank's Q3 results |

Item 1

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

| News Release | January 24, 2009 |

News Release January 24, 2009

The Board of Directors of ICICI Bank Limited (NYSE: IBN) has decided to appoint Mr. N. S. Kannan, presently Executive Director of ICICI Prudential Life Insurance Company (ICICI Life), as Executive Director & Chief Financial Officer on the Board of ICICI Bank effective May 1, 2009, in the vacancy caused by the elevation of Ms. Chanda Kochhar as Managing Director & CEO of the Bank effective that date.

Ms. Madhabi Puri-Buch, presently Executive Director of ICICI Bank will move to ICICI Securities (I-Sec) as its Managing Director & CEO effective February 1, 2009 in place of Mr. S. Mukherji who retires on completion of his term of office on January 31, 2009. The Board placed on record its appreciation of Mr. Mukherji’s contribution as a member of the Board of erstwhile ICICI Limited (ICICI), ICICI Bank and I-Sec.

The Board of Directors has decided to appoint Mr. K. Ramkumar, presently Group Chief Human Resources Officer, as an Executive Director of ICICI Bank effective February 1, 2009, in place of Ms. Madhabi Puri-Buch. Mr. Ramkumar will oversee the operations and credit & treasury middle-office functions currently being overseen by Ms. Puri-Buch, in addition to human resources management.

ICICI Bank has also decided to nominate Mr. Pravir Vohra, Group Chief Technology Officer, as a non-executive Director on the Board of I- Sec in addition to his executive responsibilities.

The appointments to the Board of Directors of ICICI Bank are subject to approval of Reserve Bank of India (RBI) and the shareholders of the Bank.

For further press queries please call Charudatta Deshpande at 91-22-2653 8208 or e-mail: charudatta.deshpande@icicibank.com.

For investor queries please call Rupesh Kumar at 91-22-2653 7126 or email at ir@icicibank.com.

Item 2

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

| News Release | January 24, 2009 |

Performance Review – Quarter ended December 31, 2008

• Profit after tax of Rs. 1,272 crore; 25% increase over second quarter

• 23% year-on-year increase in operating profit for the quarter ended December 31, 2008

• Strong capital adequacy ratio of 15.6%; highest among large Indian banks

• 19% year-on-year reduction in costs due to cost rationalization measures

• Branch network increased to 1,416 branches

The Board of Directors of ICICI Bank Limited (NYSE: IBN) at its meeting held at Mumbai today, approved the audited accounts of the Bank for the quarter ended December 31, 2008 (Q3-2009).

Highlights

• The profit after tax for Q3-2009 was Rs. 1,272 crore (US$ 261 million) which represents an increase of 25% over the profit after tax of Rs. 1,014 crore (US$ 208 million) in the quarter ended September 30, 2008 (Q2-2009). Profit after tax for the quarter ended December 31, 2007 (Q3-2008) was Rs. 1,230 crore (US$ 253 million).

• Operating profit for Q3-2009 was Rs. 2,771 crore (US$ 569 million) which represents an increase of 23% over operating profit of Rs. 2,259 crore (US$ 464 million) for Q3-2008.

• Net interest income for Q3-2009 was Rs. 1,990 crore (US$ 409 million) compared to the net interest income of Rs. 1,960 crore (US$ 402 million) for Q3-2008.

• The Bank earned treasury income of Rs. 976 crore (US$ 200 million) in Q3-2009, primarily by positioning its treasury strategy to benefit from the decline in yields on government bonds.

• Operating expenses decreased 19% to Rs. 1,680 crore (US$ 345 million) in Q3-2009 from Rs. 2,080 crore (US$ 427 million) for Q32008. The cost/average asset ratio for Q3-2009 was 1.8% compared to 2.2% for Q3-2008.

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

Operating Review

During the current year, the Bank has pursued a strategy of lightening the balance sheet and prioritizing capital conservation, liquidity management and risk containment given the challenging economic environment. The Bank has also placed strong emphasis on efficiency improvement and cost rationalization. During Q3-2009, the Bank continued with this strategy, while also taking advantage of market opportunities to increase its treasury income. In line with the above strategy, the loan book of the Bank stood at Rs. 212,521 crore (US$ 43.6 billion) at December 31, 2008. Current and savings account (CASA) deposits constituted 27.4% of total deposits at December 31, 2008 compared to 27.2% at December 31, 2007.

Branch network

The Bank continues to expand its branch network to enhance its deposit franchise and create an integrated distribution network for both asset and liability products. The branch network of the Bank has increased from 755 branches at March 31, 2007 to 1,416 branches at January 23, 2009. The Bank has also received Reserve Bank of India’s approval to set up 580 branches which would expand the branch network to about 2,000 branches, giving the Bank a wide distribution reach in the country.

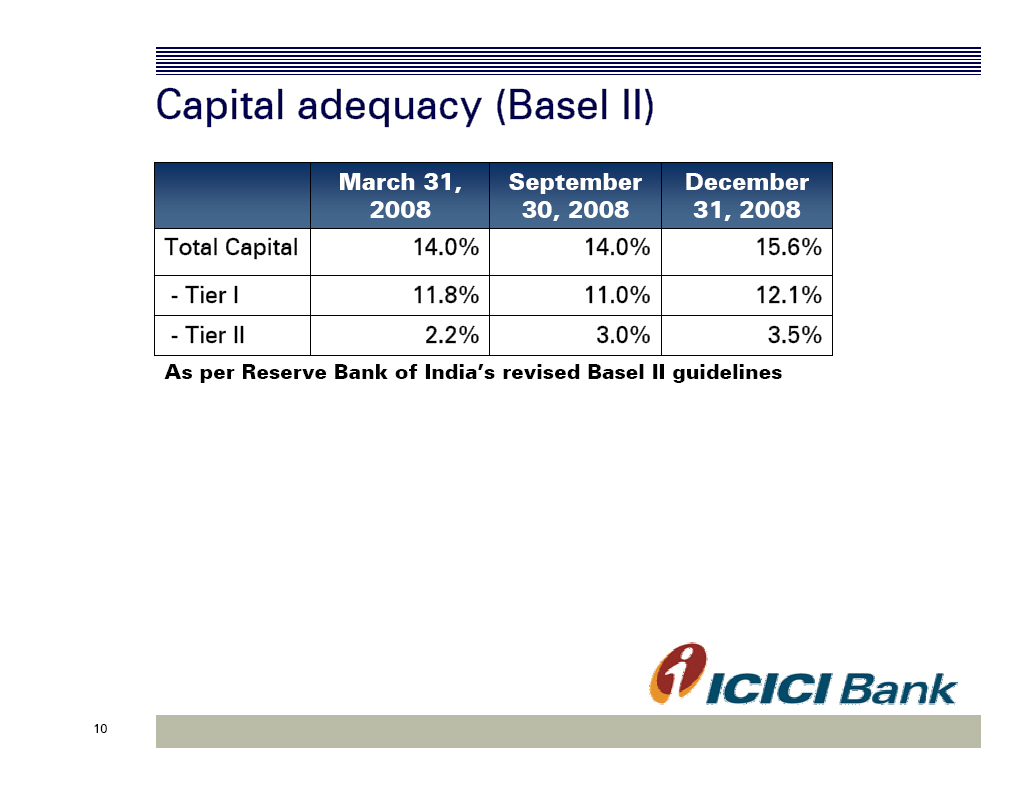

Capital adequacy

The Bank’s capital adequacy at December 31, 2008 as per Reserve Bank of India’s revised guidelines on Basel II norms was 15.6% and Tier-1 capital adequacy was 12.1%, well above RBI’s requirement of total capital adequacy of 9.0% and Tier-1 capital adequacy of 6.0%.

Asset quality

At December 31, 2008, the Bank’s net non-performing asset ratio was 1.95% on an unconsolidated basis. The consolidated net non-performing advances ratio was about 1.73%.

Performance highlights of banking subsidiaries

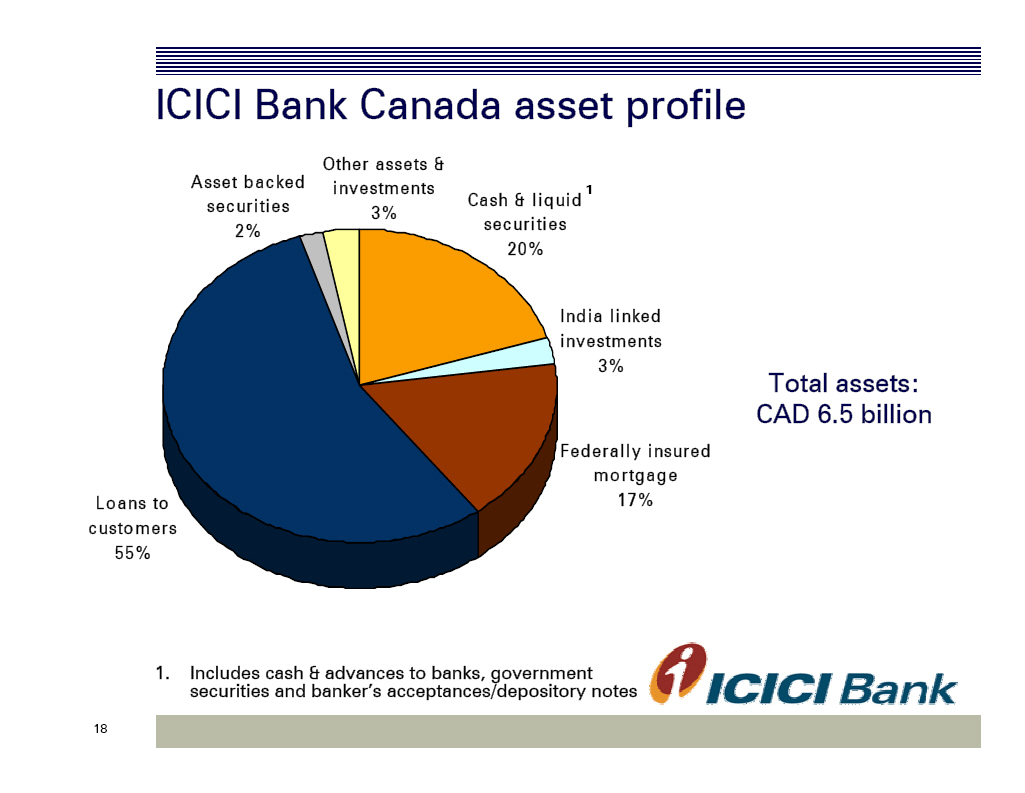

ICICI Bank Canada saw an increase of about CAD 550 million in retail term deposits during Q3-2009. ICICI Bank Canada’s customer base increased from about 270,000 at September 30, 2008 to over 291,000 customers at December 31, 2008. ICICI Bank Canada had liquidity of about CAD 1.1 billion at December 31, 2008. ICICI Bank Canada’s profit after tax for 9M2009 was CAD 32.9 million. ICICI Bank Canada’s capital adequacy ratio was 16.1% at December 31, 2008.

2

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

ICICI Bank UK saw an increase of about USD 530 million in retail term deposits during Q3-2009. ICICI Bank UK’s customer base increased from about 258,000 at September 30, 2008 to over 281,000 customers at December 31, 2008. ICICI Bank UK had liquidity of about USD 1.0 billion at December 31, 2008. After accounting for the gains on buyback of bonds and mark-to-market provisions on the investment portfolio, ICICI Bank UK’s profit after tax for 9M-2009 was USD 1.4 million. ICICI Bank UK’s capital position continued to be strong with a capital adequacy ratio of 18.6% at December 31, 2008.

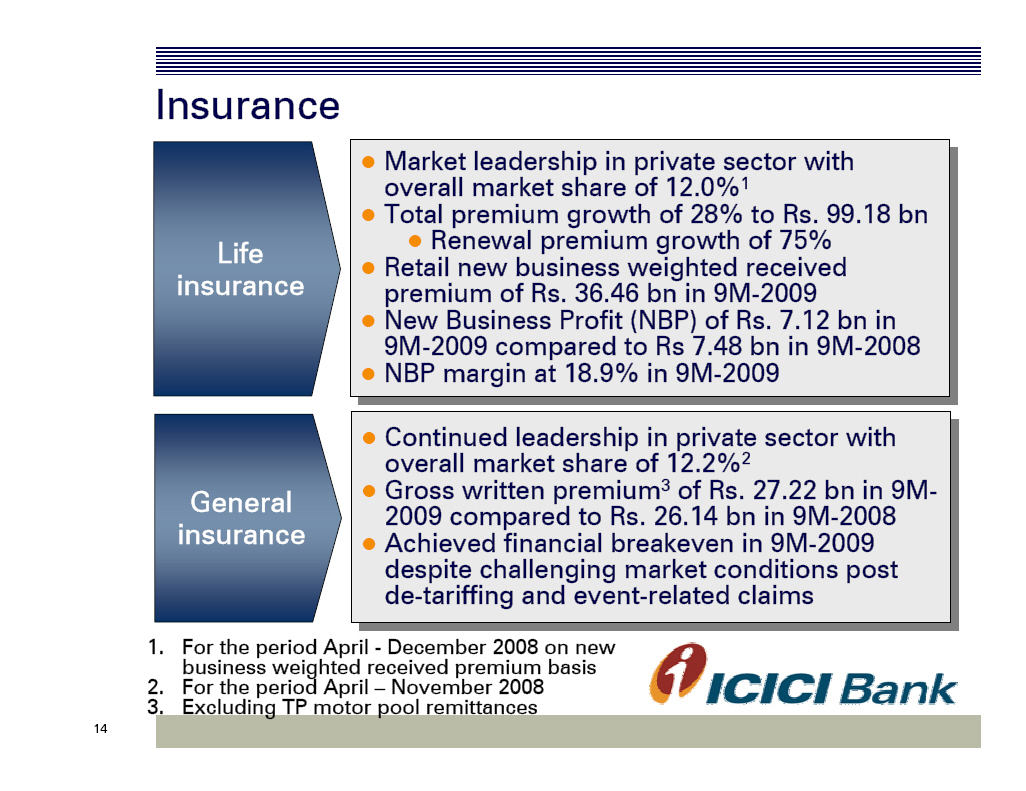

Performance highlights of insurance subsidiaries

ICICI Prudential Life Insurance Company (ICICI Life) maintained its market leadership in the private sector with an overall market share of 12.0% in retail new business weighted received premium during the nine month period ended December 31, 2008 (9M-2009). ICICI Life’s total premium increased by 28% to Rs 9,918 crore (US$ 2.0 billion) in 9M-2009. ICICI Life’s renewal premium increased by 75%, reflecting the long term sustainability of the business. ICICI Life’s unaudited New Business Profit (NBP) in 9M-2009 was Rs. 712 crore (US$ 146 million). Due to the business set-up and customer acquisition costs, which are not amortised, and reserving for actuarial liability, ICICI Life’s statutory accounting results reduced the consolidated profit after tax of ICICI Bank by Rs. 565 crore (US$ 116 million) in 9M-20091. Assets held increased to Rs. 28,445 crore (US$ 5.8 billion) at December 31, 2008.

ICICI Lombard General Insurance Company (ICICI General) maintained its leadership in the private sector with an overall market share of 12.2% during April-November 2008. ICICI General’s premiums increased 4.1% on a year-on-year basis to Rs. 2,722 crore (US$ 559 million) in 9M-2009.

1 Life insurance companies worldwide make accounting losses in initial years due to business set-up and customer acquisition costs in the initial years and reserving for actuarial liability. Further, in India, amortization of acquisition costs is not permitted. These factors have resulted in statutory losses for ICICI Life since the company’s inception, as its business has grown rapidly year on year. If properly priced, life insurance policies are profitable over the life of the policy, but at the time of sale, there is a loss on account of non-amortized expenses and commissions, generally termed as new business strain that emerges out of new business written during the year. New Business Profit (NBP) is an alternate measure of the underlying business profitability (as opposed to the statutory profit or loss) and relevant in the case of fast expanding companies like ICICI Life. NBP is the present value of the profits of the new business written during the year. It is based on standard economic and non-economic assumptions including risk discount rates, investment returns, mortality, expenses and persistency assumptions. Disclosure on economic assumptions is available in the annual report for the year ended March 31, 2008.

3

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

Summary Profit and Loss Statement (as per unconsolidated Indian GAAP accounts)

Rs. crore

| Q3-2008 | Q2-2009 | Q3-2009 | FY2008 | |

Net interest income1 | 1,960 | 2,148 | 1,990 | 7,304 |

| Non-interest income | 2,427 | 1,877 | 2,515 | 8,811 |

| - Fee income | 1,785 | 1,876 | 1,347 | 6,627 |

| - Lease and other income | 360 | 154 | 192 | 1,369 |

| - Treasury income | 282 | (153) | 976 | 815 |

| Less: | ||||

| Operating expense | 1,665 | 1,543 | 1,577 | 6,429 |

Expenses on direct market agents (DMAs) 2 | 416 | 144 | 103 | 1,543 |

| Lease depreciation | 47 | 53 | 54 | 182 |

| Operating profit | 2,259 | 2,285 | 2,771 | 7,961 |

| Less: Provisions | 760 | 924 | 1,008 | 2,905 |

| Profit before tax | 1,498 | 1,361 | 1,763 | 5,056 |

| Less: Tax | 268 | 347 | 491 | 898 |

| Profit after tax | 1,230 | 1,014 | 1,272 | 4,158 |

1. Net of premium amortisation on government securities of Rs. 212 crore in Q32008, Rs. 175 crore in Q2-2009, Rs. 169 crore in Q3-2009 and Rs. 898 crore in FY2008.

2. Represents commissions paid to direct marketing agents (DMAs) for origination of retail loans. These commissions are expensed upfront.

3. Prior period figures have been regrouped/re-arranged where necessary.

4

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

Summary Balance Sheet

| December 31, 2007 | December 31, 2008 | March 31, 2008 | |

| Assets | |||

| Cash & bank balances | 31,002 | 27,083 | 38,041 |

| Advances | 215,517 | 212,521 | 225,616 |

| Investments | 105,312 | 106,538 | 111,454 |

| Fixed & other assets | 24,869 | 28,268 | 24,684 |

| Total | 376,700 | 374,410 | 399,795 |

| Liabilities | |||

| Networth | 46,514 | 50,035 | 46,470 |

| - Equity capital | 1,112 | 1,113 | 1,113 |

| - Reserves | 45,401 | 48,922 | 45,357 |

| Preference capital | 350 | 350 | 350 |

| Deposits | 229,779 | 209,065 | 244,431 |

| CASA ratio | 27.2% | 27.4% | 26.1% |

| Borrowings | 81,627 | 99,069 | 86,399 |

| Other liabilities | 18,430 | 15,891 | 22,145 |

| Total | 376,700 | 374,410 | 399,795 |

All financial and other information in this press release, other than financial and other information for specific subsidiaries where specifically mentioned, is on an unconsolidated basis for ICICI Bank Limited only unless specifically stated to be on a consolidated basis for ICICI Bank Limited and its subsidiaries. Please also refer to the statement of audited unconsolidated, consolidated and segmental results required by Indian regulations that has, along with this release, been filed with the stock exchanges in India where ICICI Bank’s equity shares are listed and with the New York Stock Exchange and the US Securities Exchange Commission, and is available on our website www.icicibank.com.

Except for the historical information contained herein, statements in this release which contain words or phrases such as 'will', ‘expected to’, etc., and similar expressions or variations of such expressions may constitute 'forward-looking statements'. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results, opportunities and growth potential to differ materially from those suggested by the forward-looking statements. These risks and uncertainties include, but are not limited to, the actual growth in demand for banking and other financial products and services in the countries that we operate or where a material number of our customers reside, our ability to successfully implement our strategy, including our use of the Internet and other technology, our rural expansion, our exploration of merger and acquisition opportunities, our ability to integrate recent or future mergers or acquisitions into our operations and manage the risks associated with such acquisitions to achieve our strategic and financial objectives, our ability to manage the increased

5

| ICICI Bank Towers Bandra Kurla Complex Mumbai 400 051 |

complexity of the risks we face following our rapid international growth, future levels of impaired loans, our growth and expansion in domestic and overseas markets, the adequacy of our allowance for credit and investment losses, technological changes, investment income, our ability to market new products, cash flow projections, the outcome of any legal, tax or regulatory proceedings in India and in other jurisdictions we are or become a party to, the future impact of new accounting standards, our ability to implement our dividend policy, the impact of changes in banking regulations and other regulatory changes in India and other jurisdictions on us, including on the assets and liabilities of ICICI, a former financial institution not subject to Indian banking regulations, the bond and loan market conditions and availability of liquidity amongst the investor community in these markets, the nature of credit spreads, interest spreads from time to time, including the possibility of increasing credit spreads or interest rates, our ability to roll over our short-term funding sources and our exposure to credit, market and liquidity risks as well as other risks that are detailed in the reports filed by us with the United States Securities and Exchange Commission. ICICI Bank undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof.

For further press queries please call Charudatta Deshpande at 91-22-2653 8208 or e-mail: charudatta.deshpande@icicibank.com.

For investor queries please call Rupesh Kumar at 91-22-2653 7126 or email at ir@icicibank.com.

1 crore = 10.0 million

US$ amounts represent convenience translations at US$1= Rs. 48.71

6

Performance Review: 9M-2009 January 24, 2009 |  |

Certain statements in these slides are forward-looking statements. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those included in these statements due toa variety of factors. More information about these factors is contained in ICICI Bank's filings with the Securities and Exchange Commission. All financial and other information in these slides, other than financial and other information for specific subsidiaries where specifically mentioned, is on an unconsolidated basis for ICICI Bank Limited only unless specifically stated to be on a consolidated basis for ICICI Bank Limited and its subsidiaries. Please also refer to the statementof audited unconsolidated, consolidated and segmental results required by Indian regulations that has been filed with the stock exchanges in India where ICICI Bank's equity shares are listed and with the New York Stock Exchange and the US Securities Exchange Commission, and is available on our website www.icicibank.com. |  |

ICICI Bank: Highlights

o 25% quarter-on-quarter increase in profit after tax toRs. 12.72 billion in

Q3-2009 from Rs. 10.14 billion in

o Profit after tax of Rs. 12.30 billion in Q3-2008

o 23% year-on-year increase in operating profit to Rs. 27.71 billion in

Q3-2009 from Rs. 22.59 billion in Q3-2008

o Capitalised on opportunities in declining interest rate scenario: treasury

gains of Rs. 9.76 billion in Q3-2009

o 19% year-on-year decrease in operating & direct marketing agency expenses

despite substantialincrease in branches

o Net interest margin maintained at 2.4% in a volatileinterest rate

environment

|  |

Balance sheet highlights

o Strategy of conscious moderation in credit growth

Contraction in standalone loan book during the year to Rs.

2,125.21 billion at December 31, 2008

o Continued enhancement of branch network to strengthen liability franchise

and created an integrateddistribution network for asset and liability

products

o Current branch network at 1,416 branches compared to 755 branches at

March 31, 2007

o New licenses for 580 branches to further enhance the distribution

network

o Capital adequacy ratio of 15.6% at December 31, 2008

o Highest among large Indian Banks

o Net NPA ratio of 1.95% at December 31, 2008

|  |

Profit & loss statement (Rs. in billion) |  |

Profit & loss statement (Rs. in billion) |  |

Balance sheet: Assets (Rs. in billion) 1. Including impact of exchange rate movement |  |

Composition of loan book: Dec 31, 2008

Rural

4%

Total loan book: Rs. 2,125 bn Total retail loan book: Rs. 1,145 bn

1. Small ticket personal loans

2. Vehicle loans includes auto loans 13%, commercial business 13% and two

wheelers 2%

3. Retail business includes builder loans and dealer funding

|  |

Balance sheet: Liabilities (Rs. in billion) 1. Including impact of exchange rate movement |  |

Capital adequacy (Basel II) As per Reserve Bank of India's revised Basel II guidelines |  |

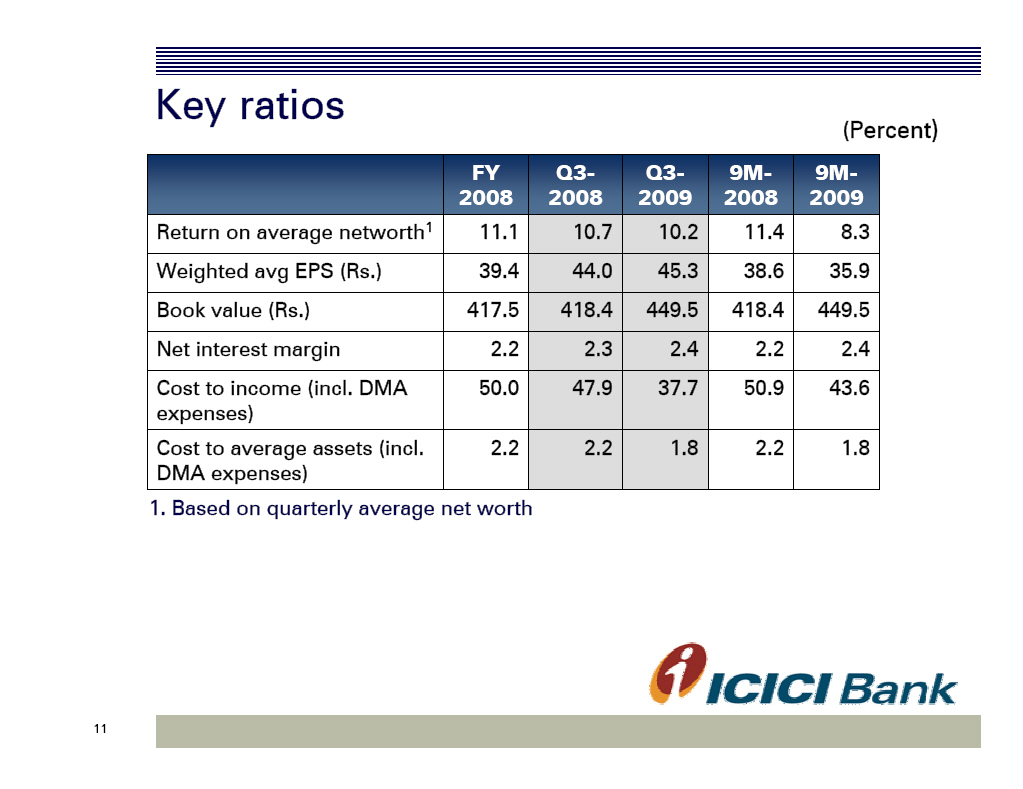

Key ratios (Percent) 1. Based on quarterly average net worth |  |

Asset quality and provisioning

(Rs. in billion)

o Consolidated net non-performing advances ratio of about 1.73%

o Gross retail NPLs at Rs. 65.68 bn and net retail NPLs at Rs. 29.10 bn at

December 31, 2008

o 55% of net retail NPLs are from unsecured products

|  |

Key subsidiaries

|  |

Insurance

1. For the period April -December 2008 on new business weighted received

premium basis

2. For the period April - November 2008

3. Excluding TP motor pool remittances

|  |

ICICI Bank UK

o Total assets of USD 7.6 billion at December 31, 2008

o Total deposits of USD 4.1 billion at December 31,

o Proportion of term deposits at 54%

o Increase of about USD 530 million in retail term deposits during Q3-2009

Net profit of USD 1.4 million in 9M-2009

o Net MTM impact of USD 71 million (post tax) in reserves in Q3-2009

o Capital adequacy ratio at 18.6%

|  |

ICICI Bank UK asset profile

Asset Backed Other assets & Cash & liquid (1)

Securities 6% investments, 5% Securities 16%

India Linked

investments 6%

Total assets: USD 7.6 billion

o 100% of non-India investment portfolio (excl. Lehman Brothers bonds) rated

investment grade; 90% rated A-or higher

1. Includes cash & advances to banks and certificates of deposit

|  |

ICICI Bank Canada

o Total assets of CAD 6.5 billion at December 31, 2008

o Total deposits of CAD 5.4 billion at December 31,

o Proportion of term deposits at 89%

o Increase of about CAD 550 million in retail term deposits during Q3-2009

o Net profit of CAD 32.9 million in 9M-2009

o Capital adequacy ratio at 16.1%

|  |

ICICI Bank Canada asset profile

Other assets &

Asset backed investments 3%

securities 2%

Cash & liquid(1)

Securities 20%

Loans to customers 55%

India linked investments 3%

Total assets: CAD 6.5 billion

Federally insured mortgage 17%

1. Includes cash & advances to banks, government securities and banker�s

acceptances/depository notes

|  |

Other subsidiaries (Rs. billion) Consolidated profit after tax of Rs. 28.28 billion in 9M-2009 |  |

Thank you |  |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| ICICI Bank Limited | ||||||

| Date: | January 24, 2009 | By: | /s/ Mehernosh Kapadia | |||

| Name : | Mehernosh Kapadia | |||||

| Title : | General Manager & Joint Company Secretary | |||||