FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of April 2009

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes | No _X_ |

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes | No X |

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

Yes | No X |

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b): Not Applicable

Table of Contents

| Item | |

| 1. | Summarized audited annual accounts for the year ended March 31, 2009 |

| 2. | Press Release on Performance Review dated April 25, 2009 |

| 3. | Press Release on changes to the Board of Directors dated April 25, 2009 |

| 4. | Investor presentation on ICICI Bank's Q4-2009 results |

Item 1

Registered Office: Landmark, Race Course Circle, Vadodara - 390 007.

Corporate Office: ICICI Bank Towers, Bandra-Kurla Complex, Bandra (East), Mumbai 400 051.

Web site: http://www.icicibank.com

AUDITED UNCONSOLIDATED FINANCIAL RESULTS

(Rupees in crore)

| Sr. | Three months ended | Year ended | |||

| No. | Particulars | March 31, 2009 | March 31, 2008 | March 31, 2009 | March 31, 2008 |

| (Unaudited) | (Unaudited) | (Audited) | (Audited) | ||

| 1. | Interest earned (a)+(b)+(c)+(d) | 7,529.69 | 8,029.27 | 31,092.55 | 30,788.34 |

| a) Interest/discount on advances/bills | 5,199.84 | 5,826.20 | 22,323.83 | 22,600.99 | |

| b) Income on investments | 1,873.98 | 2,008.82 | 7,403.06 | 7,466.01 | |

| c) Interest on balances with Reserve Bank of India | |||||

| and other inter-bank funds | 105.38 | 116.58 | 518.71 | 611.99 | |

| d) Others | 350.49 | 77.67 | 846.95 | 109.35 | |

| 2. | Other income | 1,673.67 | 2,361.65 | 7,603.72 | 8,810.77 |

| 3. | TOTAL INCOME (1)+(2) | 9,203.36 | 10,390.92 | 38,696.27 | 39,599.11 |

| 4. | Interest expended | 5,390.85 | 5,949.81 | 22,725.93 | 23,484.24 |

| 5. | Operating expenses (e) + (f) + (g) | 1,657.05 | 2,150.45 | 7,045.11 | 8,154.18 |

| e) Employee cost | 457.42 | 466.64 | 1,971.70 | 2,078.90 | |

| f) Direct marketing expenses | 53.13 | 358.35 | 528.92 | 1,542.74 | |

| g) Other operating expenses | 1,146.50 | 1,325.46 | 4,544.49 | 4,532.54 | |

| 6. | TOTAL EXPENDITURE (4)+(5) | ||||

| (excluding provisions and contingencies) | 7,047.90 | 8,100.26 | 29,771.04 | 31,638.42 | |

| 7. | OPERATING PROFIT (3) – (6) | ||||

| (Profit before provisions and | |||||

| contingencies) | 2,155.46 | 2,290.66 | 8,925.23 | 7,960.69 | |

| 8. | Provisions (other than tax) and contingencies | 1,084.54 | 947.49 | 3,808.26 | 2,904.59 |

| 9. | Exceptional items | .. | .. | .. | .. |

| 10. | PROFIT / (LOSS) FROM ORDINARY | ||||

| ACTIVITIES BEFORE TAX (7)–(8)–(9) | 1,070.92 | 1,343.17 | 5,116.97 | 5,056.10 | |

| 11. | Tax expense (h) + (i) | 327.16 | 193.33 | 1,358.84 | 898.37 |

| h) Current period tax | 382.09 | 375.57 | 1,830.51 | 1,611.73 | |

| i) Deferred tax adjustment | (54.93) | (182.24) | (471.67) | (713.36) | |

| 12. | NET PROFIT / (LOSS) FROM ORDINARY | ||||

| ACTIVITIES (10) – (11) | 743.76 | 1,149.84 | 3,758.13 | 4,157.73 | |

| 13. | Extraordinary items (net of tax expense) | .. | .. | .. | .. |

| 14. | NET PROFIT / (LOSS) FOR THE PERIOD | ||||

| (12) – (13) | 743.76 | 1,149.84 | 3,758.13 | 4,157.73 | |

| 15. | Paid-up equity share capital (face value Rs. 10/-) | 1,113.29 | 1,112.68 | 1,113.29 | 1,112.68 |

| 16. | Reserves excluding revaluation reserves | 48,419.73 | 45,357.53 | 48,419.73 | 45,357.53 |

| 17. | Analytical ratios | ||||

| i) Percentage of shares held by Government of | |||||

| India | .. | .. | .. | .. | |

| ii) Capital adequacy ratio | 15.53% | 13.97% | 15.53% | 13.97% | |

| iii) Earnings per share (EPS) for the period | |||||

| a) Basic EPS before and after extraordinary | |||||

| items net of tax expenses (not annualised for | |||||

| quarter) (in Rs.) | 6.68 | 10.33 | 33.76 | 39.39 | |

| b) Diluted EPS before and after extraordinary | |||||

| items net of tax expenses (not annualised for | |||||

| quarter) (in Rs.) | 6.68 | 10.27 | 33.70 | 39.15 | |

Sr. | Three months ended | Year ended | |||

| No. | Particulars | March 31, 2009 | March 31, 2008 | March 31, 2009 | March 31, 2008 |

| (Unaudited) | (Unaudited) | (Audited) | (Audited) | ||

| 18. | NPA Ratio | ||||

| i) Gross non-performing advances (net of | |||||

technical write-off)1 | 9,649.31 | 7,579.54 | 9,649.31 | 7,579.54 | |

ii) Net non-performing advances1 | 4,553.94 | 3,490.55 | 4,553.94 | 3,490.55 | |

iii) % of gross non-performing advances (net of | |||||

technical write-off) to gross advances (net of write-off) | 4.32% | 3.30% | 4.32% | 3.30% | |

| iv) % of net non-performing advances to net | |||||

advances2 | 2.09% | 1.55% | 2.09% | 1.55% | |

| 19. | Return on assets (annualised) | 0.80% | 1.14% | 0.98% | 1.12% |

| 20. | Public shareholding | ||||

| i) No. of shares | 1,113,250,642 | 1,112,687,495 | 1,113,250,642 | 1,112,687,495 | |

| ii) Percentage of shareholding | 100 | 100 | 100 | 100 | |

| 21. | Promoter and promoter group shareholding | ||||

| i) Pledged/encumbered | |||||

| a) No. of shares | .. | .. | .. | .. | |

| b) Percentage of shares (as a % of the total | |||||

| shareholding of promoter and promoter group) | .. | .. | .. | .. | |

| c) Percentage of shares (as a % of the total | |||||

| share capital of the bank) | .. | .. | .. | .. | |

| ii) Non-encumbered | |||||

| a) No. of shares | .. | .. | .. | .. | |

| b) Percentage of shares (as a % of the total | |||||

| shareholding of promoter and promoter group) | .. | .. | .. | .. | |

| c) Percentage of shares (as a % of the total | |||||

| share capital of the bank) | .. | .. | .. | .. | |

| 22. | Deposits | 218,347.82 | 244,431.05 | 218,347.82 | 244,431.05 |

| 23. | Advances | 218,310.85 | 225,616.08 | 218,310.85 | 225,616.08 |

| 24. | Total assets | 379,300.96 | 399,795.08 | 379,300.96 | 399,795.08 |

| 1. | At December 31, 2008, the gross non performing advances (net of technical write-off) were Rs. 8,988.08 crore and the net non performing advances were Rs. 4,400.23 crore. |

| 2. | The percentage of gross non-performing customer assets to gross customer assets (includes advances and credit substitutes) was 4.06% and net non-performing customer assets to net customer assets (includes advances and credit substitutes) was 1.96% at March 31, 2009. |

CONSOLIDATED FINANCIAL RESULTS

| (Rupees in crore) |

| Sr. | Three months ended | Year ended | ||||

| No. | Particulars | March 31, 2009 | March 31, 2008 | March 31, 2009 | March 31, 2008 | |

| (Unaudited) | (Unaudited) | (Audited) | (Audited) | |||

| 1. | Interest earned (a)+(b)+(c)+(d) | 8,968.84 | 9,075.15 | 36,250.71 | 34,094.95 | |

| a) | Interest/discount on advances/bills | 6,027.08 | 6,268.55 | 25,190.72 | 24,068.36 | |

| b) | Income on investments | 2,315.21 | 2,448.63 | 9,369.03 | 8,904.54 | |

| c) Interest on balances with Reserve Bank of | ||||||

| India and other interbank funds | 139.84 | 196.33 | 768.54 | 874.77 | ||

| d) | Others | 486.71 | 161.64 | 922.42 | 247.28 | |

| 2. | Other Income | 8,026.75 | 8,744.23 | 27,902.37 | 25,958.13 | |

| 3. | TOTAL INCOME (1) + (2) | 16,995.59 | 17,819.38 | 64,153.08 | 60,053.08 | |

| 4. | Interest expended | 6,251.19 | 6,502.09 | 26,487.25 | 25,766.97 | |

| 5. | Operating expenses (e) + (f) | 8,506.63 | 9,667.17 | 28,185.79 | 27,043.41 | |

| e) Payments to and provisions for employees | 854.88 | 1,040.33 | 3,904.30 | 3,969.80 | ||

| f) | Other operating expenses | 7,651.75 | 8,626.84 | 24,281.49 | 23,073.61 | |

| TOTAL EXPENDITURE (4)+(5) | ||||||

| 6. | (excluding provisions and contingencies) | 14,757.82 | 16,169.26 | 54,673.04 | 52,810.38 | |

| 7. | OPERATING PROFIT (3) - (6) | 2,237.77 | 1,650.12 | 9,480.04 | 7,242.70 | |

| (Profit before provisions and contingencies) | ||||||

| 8. | Provisions (other than tax) and contingencies | 1,308.37 | 989.50 | 4,511.69 | 3,017.75 | |

| 9. | Exceptional items | .. | .. | .. | .. | |

| PROFIT / (LOSS) FROM ORDINARY | ||||||

| 10. | ACTIVITIES BEFORE TAX (7)–(8)–(9) | 929.40 | 660.62 | 4,968.35 | 4,224.95 | |

| 11. | Tax expense (g) + (h) | 193.47 | 149.31 | 1,588.93 | 1,109.68 | |

| g) Current period tax | 383.21 | 403.29 | 2,207.78 | 2,043.82 | ||

| h) Deferred tax adjustment | (189.74) | (253.98) | (618.85) | (934.14) | ||

| 12. | Share of (profits)/losses of minority shareholders | (12.51) | (124.81) | (197.53) | (282.96) | |

| 13. | NET PROFIT / (LOSS) FROM ORDINARY | |||||

| ACTIVITIES (10) – (11) – (12) | 748.44 | 636.12 | 3,576.95 | 3,398.23 | ||

| 14. | Extraordinary items (net of tax expense) | .. | .. | .. | .. | |

| 15. | NET PROFIT / LOSS FOR THE PERIOD (13)–(14) | 748.44 | 636.12 | 3,576.95 | 3,398.23 | |

| 16. | Paid-up equity share capital (face value Rs. 10/-) | 1,113.29 | 1,112.68 | 1,113.29 | 1,112.68 | |

| 17. | Analytical Ratios | |||||

| Earnings per share for the period | ||||||

| (not annualised for quarter) (in Rs.) (basic) | 6.72 | 5.72 | 32.13 | 32.19 | ||

| Earnings per share for the period | ||||||

| (not annualised for quarter) (in Rs.) (diluted) | 6.72 | 5.68 | 32.07 | 32.00 | ||

(Rupees in crore)

| Sr. | Particulars | Three months ended | Year ended | |

| No. | March 31, 2009 | March 31, 2009 | March 31, 2008 | |

| (Unaudited) | (Audited) | (Audited) | ||

| 1. | Segment Revenue | |||

| a | Retail Banking | 5,175.91 | 23,015.21 | 24,418.54 |

| b | Wholesale Banking | 5,652.79 | 24,807.71 | 24,949.35 |

| c | Treasury | 7,603.42 | 29,742.13 | 29,326.50 |

| d | Other Banking | 1,036.74 | 4,528.09 | 2,815.24 |

| e | Life Insurance | 5,744.18 | 16,507.43 | 14,396.83 |

| f | General Insurance | 706.79 | 2,662.40 | 2,206.19 |

| g | Venture Fund Management | 49.26 | 345.65 | 271.54 |

| h | Others | 548.59 | 3,216.00 | 2,437.26 |

| Total | 26,517.68 | 104,824.62 | 100,821.45 | |

| Less: Inter Segment Revenue | 9,522.09 | 40,671.54 | 40,768.37 | |

| Income from Operations | 16,995.59 | 64,153.08 | 60,053.08 | |

| 2. | Segmental Results (Profit before tax and minority interest) | |||

| a | Retail Banking | (433.07) | 58.05 | 947.24 |

| b | Wholesale Banking | 528.86 | 3,413.31 | 3,574.68 |

| c | Treasury | 929.85 | 1,306.94 | 536.64 |

| d | Other Banking | 116.41 | 607.91 | 148.95 |

| e | Life Insurance | (106.71) | (859.56) | (1,514.18) |

| f | General Insurance | (7.54) | 0.27 | 130.22 |

| g | Venture Fund Management | 8.46 | 202.08 | 127.12 |

| h | Others | (75.59) | 589.35 | 655.21 |

| Total segment results | 960.67 | 5,318.35 | 4,605.88 | |

| Less: Inter segment adjustment | 31.27 | 350.00 | 380.93 | |

| Unallocated expenses | .. | .. | .. | |

| Profit before tax and minority interest | 929.40 | 4,968.35 | 4,224.95 | |

| 3. | Capital Employed (Segment Assets – Segment Liabilities) | |||

| a | Retail Banking | (15,889.85) | (15,889.85) | (4,045.54) |

| b | Wholesale Banking | 24,549.79 | 24,549.79 | (11,423.26) |

| c | Treasury | 22,688.03 | 22,688.03 | 47,135.31 |

| d | Other Banking | 6,432.87 | 6,432.87 | 4,005.61 |

| e | Life Insurance | 1,455.33 | 1,455.33 | 1,307.90 |

| f | General Insurance | 1,429.25 | 1,429.25 | 1,011.19 |

| g | Venture Fund Management | 71.90 | 71.90 | 23.44 |

| h | Others | 1,816.53 | 1,816.53 | 1,514.55 |

| i | Unallocated | 4,573.68 | 4,573.68 | 5,543.54 |

| Total | 47,127.53 | 47,127.53 | 45,072.74 | |

Notes on segmental results

| 1. | The disclosure on segmental reporting has been prepared in accordance with Reserve Bank of India (RBI) circular no. DBOD.No.BP.BC.81/21.04.018/2006-07 dated April 18, 2007 on guidelines on enhanced disclosure on ”Segmental Reporting” which is effective from the reporting period ended March 31, 2008. Segmental results for the three months ended March 31, 2008 as per these revised guidelines have not been prepared. |

| 2. | “Retail Banking” includes exposures of ICICI Bank Limited (“the Bank”) which satisfy the four criteria of orientation, product, granularity and low value of individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document “International Convergence of Capital Measurement and Capital Standards: A Revised Framework”. |

| 3. | “Wholesale Banking” includes all advances to trusts, partnership firms, companies and statutory bodies, by the Bank which are not included under Retail Banking. |

| 4. | “Treasury“ includes the entire investment portfolio of the Bank, ICICI Eco-net Internet and Technology Fund, ICICI Equity Fund, ICICI Emerging Sectors Fund and ICICI Strategic Investments Fund. |

| 5. | “Other Banking” includes hire purchase and leasing operations and other items not attributable to any particular business segment of the Bank. Further, it includes the Bank’s banking subsidiaries i.e. ICICI Bank UK PLC, ICICI Bank Canada and its subsidiary, namely ICICI Wealth Management Inc. and ICICI Bank Eurasia LLC. |

| 6. | “Life Insurance” represents ICICI Prudential Life Insurance Company Limited. |

| 7. | “General Insurance” represents ICICI Lombard General Insurance Company Limited. |

| 8. | “Venture Fund Management” represents ICICI Venture Funds Management Company Limited. |

| 9. | “Others” comprises the consolidated entities of the Bank, not covered in any of the segments above. |

| 10. | Capital employed of life insurance segment includes restricted reserve of Rs. 717.33 crore (March 31, 2008 : Rs. 537.85 crore. |

| 1. | During the three months ended March 31, 2009, the Bank has not allotted any equity shares. |

| 2. | Status of equity investors’ complaints / grievances for the three months ended March 31, 2009: |

Opening balance | Additions | Disposals | Closing balance |

| 0 | 52 | 52 | 0 |

| 3. | Provision for current period tax includes Rs. 4.98 crore towards provision for fringe benefit tax for the three months ended March 31, 2009 (Rs. 34.20 crore for the year ended March 31, 2009). |

| 4. | RBI vide its circular DBOD.No.BP.BC.90/20.06.001/2006-07 dated April 27, 2007 had advised banks having operational presence outside India to compute capital adequacy ratio (CAR) as per the revised capital adequacy framework (Basel II) effective March 31, 2008. |

| 5. | ICICI Bank UK PLC, a subsidiary of the Bank, has reclassified certain investments from the ‘held for trading’ category to the ‘available for sale’ category and from ‘available for sale’ category to ‘loans and receivables’ category, in accordance with amendments made to the applicable accounting standards in October 2008. If these reclassifications had not been made, ICICI Bank UK’s pre-tax profit would have been lower by USD 58.5 million (Rs. 268.77 crore) and unrealised losses, as deducted from reserves (pre-tax), on ‘available for sale’ securities would have increased by USD 10.5 million (Rs. 53.26 crore). |

| 6. | The Board of Directors has recommended a dividend of Rs. 11.00 per equity share for the year ended March 31, 2009 (previous year dividend Rs. 11.00 per equity share). The declaration and payment of dividend is subject to requisite approvals. The Board of Directors has also recommended a dividend of Rs. 100 per preference share on 350 preference shares of the face value of Rs. 1 crore each for the year ended March 31, 2009. |

| 7. | Previous period / year figures have been regrouped / reclassified where necessary to conform to current period/year classification. |

| 8. | The above financial results have been approved by the Board of Directors at its meeting held on April 25, 2009. |

| 9. | The above unconsolidated and consolidated financial results are audited by the statutory auditors, B S R & Co., Chartered Accountants. |

| 10. | Rs. 1 crore = Rs. 10 million. |

| Place : Mumbai | Chanda D. Kochhar |

| Date : April 25, 2009 | Joint Managing Director & CFO |

Item 2

| |

| News Release | April 25, 2009 |

Performance Review – Year ended March 31, 2009

| • | Dividend of Rs. 11 per share proposed, same as previous year |

| • | Profit before tax of Rs. 5,117 crore for the year ended March 31, 2009 compared to Rs. 5,056 crore for the year ended March 31, 2008 |

| • | 12% year-on-year increase in operating profit for the year ended March 31, 2009 |

| • | 14% year-on-year reduction in costs due to cost rationalization measures |

| • | Current and savings account (CASA) ratio increased to 28.7% at March 31, 2009 from 26.1% at March 31, 2008 |

| • | Increase of Rs. 5,286 crore in CASA deposits in quarter ended March 31, 2009 |

| • | Strong capital adequacy ratio of 15.5% and Tier-1 capital adequacy ratio of 11.8% after proposed dividend; Tier-1 capital adequacy ratio highest among large Indian banks |

The Board of Directors of ICICI Bank Limited (NYSE: IBN) at its meeting held at Mumbai today, approved the audited accounts of the Bank for the year ended March 31, 2009.

Profit & loss account

| • | Profit before tax for the year ended March 31, 2009 (FY2009) was Rs. 5,117 crore (US$ 1,009 million), compared to Rs. 5,056 crore (US$ 997 million) for the year ended March 31, 2008 (FY2008). |

| • | Profit after tax for FY2009 was Rs. 3,758 crore (US$ 741 million) compared to Rs. 4,158 crore (US$ 820 million) for FY2008 due to the higher effective tax rate on account of lower proportion of income taxable as dividends and capital gains. |

| • | Net interest income increased 15% from Rs. 7,304 crore (US$ 1,440 million) for FY2008 to Rs. 8,367 crore (US$ 1,650 million) for FY2009. While the advances declined marginally year-on-year, the net interest income increased due to improvement in net interest margin from 2.2% in FY2008 to 2.4% in FY2009. |

| |

| • | Operating expenses (including direct marketing agency expenses) decreased 14% to Rs. 6,835 crore (US$ 1,348 million) in FY2009 from Rs. 7,972 crore (US$ 1,572 million) in FY2008. The cost/average asset ratio for FY2009 was 1.8% compared to 2.2% for FY2008. |

| • | Profit before tax for the quarter ended March 31, 2009 (Q4-2009) was Rs. 1,071 crore (US$ 211 million) compared to Rs. 1,343 crore (US$ 265 million) for the quarter ended March 31, 2008 (Q4-2008), primarily due to lower level of fee income at Rs. 1,343 crore (US$ US$ 265 million) in Q4-2009 compared to Rs. 1,928 crore (US$ 380 million) in Q4-2008, partly offset by lower operating expenses and higher net interest income. The lower level of fee income was due to reduced investment and acquisition financing activity in the corporate sector and lower level of fees from distribution of retail financial products, reflecting the adverse conditions in global and Indian financial markets. |

| • | Profit after tax for Q4-2009 was Rs. 744 crore (US$ 147 million) compared to Rs. 1,150 crore (US$ 227 million) for Q4-2008. |

Balance sheet

During the year, the Bank has pursued a strategy of prioritizing capital conservation, liquidity management and risk containment given the challenging economic environment. This is reflected in the Bank’s strong capital adequacy and its focus on reducing its wholesale term deposit base and increasing its CASA ratio. The Bank is maintaining excess liquidity on an ongoing basis. The Bank has also placed strong emphasis on efficiency improvement and cost rationalization. The Bank continues to invest in expansion of its branch network to enhance its deposit franchise and create an integrated distribution network for both asset and liability products.

In line with the above strategy, the total deposits of the Bank were Rs. 218,348 crore (US$ 43.0 billion) at March 31, 2009, compared to Rs. 244,431 crore (US$ 48.2 billion) at March 31, 2008. The reduction in term deposits by Rs. 24,970 crore (US$ 4.9 billion) was primarily due to the Bank’s conscious strategy of paying off wholesale deposits. During Q4- 2009, total deposits increased by Rs. 9,283 crore (US$ 1.8 billion), of which Rs. 5,286 crore (US$ 1.0 billion), or about 57%, was in the form of CASA deposits. The CASA ratio improved to 28.7% of total deposits at March 31, 2009 from 26.1% at March 31, 2008.

2

| |

The branch network of the Bank has increased from 755 branches at March 31, 2007 to 1,438 branches at April 24, 2009. The Bank is also in the process of opening 580 new branches which would expand the branch network to about 2,000 branches, giving the Bank a wide distribution reach in the country.

In line with the strategy of prioritizing capital conservation and risk containment, the loan book of the Bank decreased marginally to Rs. 218,311 crore (US$ 43.0 billion) at March 31, 2009 from Rs. 225,616 crore (US$ 44.5 billion) at March 31, 2008.

Capital adequacy

The Bank’s capital adequacy at March 31, 2009 as per Reserve Bank of India’s revised guidelines on Basel II norms was 15.5% and Tier-1 capital adequacy was 11.8%, well above RBI’s requirement of total capital adequacy of 9.0% and Tier-1 capital adequacy of 6.0%. The above capital adequacy takes into account the impact of dividend recommended by the Board.

Asset quality

At March 31, 2009, the Bank’s net non-performing asset ratio was 1.96%. During the year the Bank restructured loans aggregating to Rs. 1,115 crore (US$ 220 million).

Dividend on equity shares

The Board has recommended a dividend of Rs. 11 per equity share (equivalent to US$ 0.43 per ADS) for FY2009. The declaration and payment of dividend is subject to requisite approvals. The record/book closure dates will be announced in due course.

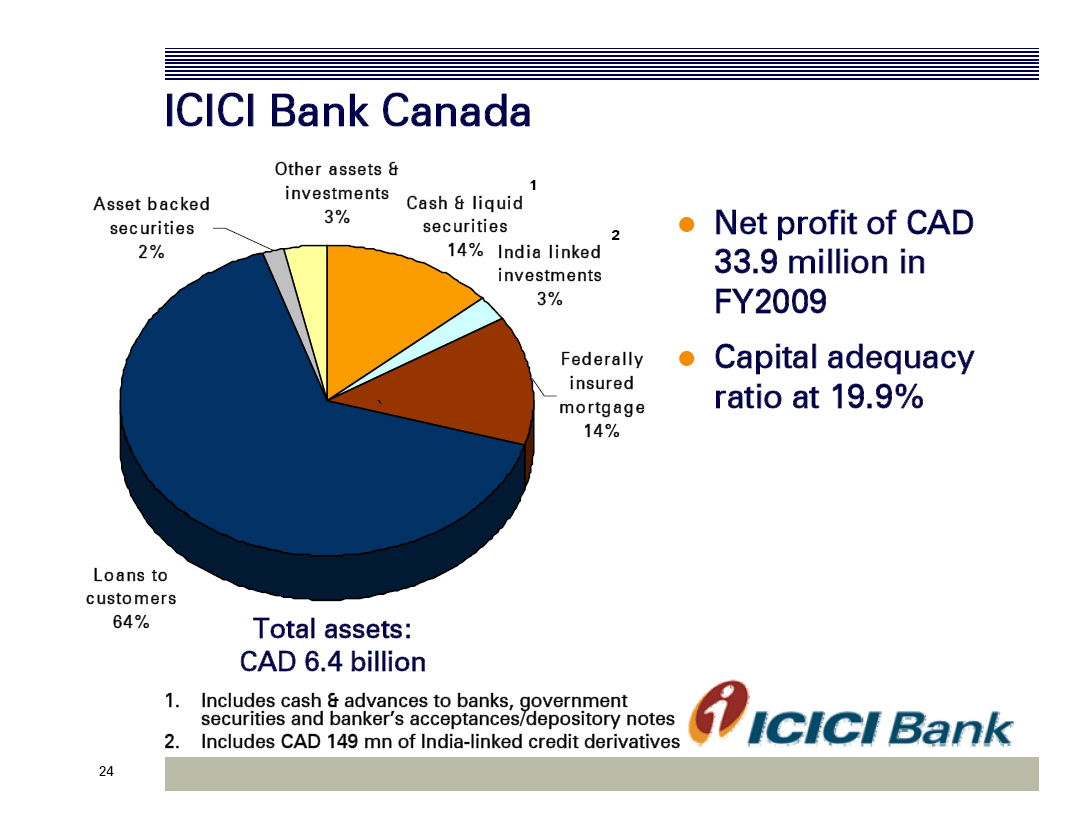

Overseas banking subsidiaries

ICICI Bank Canada saw an increase of about CAD 1.75 billion in term deposits during FY2009 while its customer accounts increased from about 200,000 at March 31, 2008 to over 280,000 at March 31, 2009. ICICI Bank Canada continued to maintain liquidity of about CAD 850.0 million. ICICI Bank Canada’s profit after tax for FY2009 was CAD 33.9 million. ICICI Bank Canada’s capital position continued to be strong with a capital adequacy ratio of 19.9% at March 31, 2009.

ICICI Bank UK saw an increase of about USD 1.80 billion in retail term deposits during FY2009 due to which the proportion of retail term

deposits in total deposits increased from 16% at March 31, 2008 to 58% at March 31, 2009. ICICI Bank UK’s customer base increased from about 210,000 at March 31, 2008 to over 310,000 customers at March 31, 2009. ICICI Bank UK continued to maintain liquidity of about USD 1.0 billion. After accounting for the gains on buyback of bonds and mark-to-market and impairment provisions on the investment portfolio, ICICI Bank UK’s profit after tax for FY2009 was USD 6.8 million. ICICI Bank UK’s capital position continued to be strong with a capital adequacy ratio of 18.4% at March 31, 2009.

Insurance subsidiaries

ICICI Prudential Life Insurance Company (ICICI Life) maintained its market leadership in the private sector with an overall market share of 11.8% based on retail new business weighted received premium during April 2008-February 2009. ICICI Life’s total premium increased by 13% to Rs. 15,356 crore (US$ 3.0 billion) in FY2009. ICICI Life’s renewal premium increased by 61%, reflecting the long term sustainability of the business. ICICI Life’s unaudited New Business Profit (NBP) in FY2009 was Rs. 1,004 crore (US$ 198 million). Due to the business set-up and customer acquisition costs, which are not amortised, and reserving for actuarial liability, ICICI Life’s statutory accounting results reduced the consolidated profit after tax of ICICI Bank by Rs. 577 crore (US$ 114 million) in FY20091 (compared to Rs. 1,032 crore (US$ 203 million) in FY2008). The expense ratio has decreased from 14.9% in FY2008 to 11.8% in FY2009. Assets held at March 31, 2009 were Rs. 32,788 crore (US$ 6.5 billion) compared to Rs. 28,578 crore (US$ 5.6 billion) at March 31, 2008.

ICICI Lombard General Insurance Company (ICICI General) maintained its leadership in the private sector with an overall market share of 11.7% during April 2008-February 2009. ICICI General’s premiums increased 3% on a year-on-year basis to Rs. 3,457 crore (US$ 682 million) in FY2009. ICICI General’s profit after tax for FY2009 was Rs. 24 crore (US$ 5 million).

1 Life insurance companies worldwide make accounting losses in initial years due to business set-up and customer acquisition costs in the initial years and reserving for actuarial liability. Further, in India, amortization of acquisition costs is not permitted. These factors have resulted in statutory losses for ICICI Life since the company’s inception, as its business has grown rapidly year on year. If properly priced, life insurance policies are profitable over the life of the policy, but at the time of sale, there is a loss on account of non-amortized expenses and commissions, generally termed as new business strain that emerges out of new business written during the year. New Business Profit (NBP) is an alternate measure of the underlying business profitability (as opposed to the statutory profit or loss) and relevant in the case of fast expanding companies like ICICI Life. NBP is the present value of the profits of the new business written during the year. It is based on standard economic and non-economic assumptions including risk discount rates, investment returns, mortality, expenses and persistency assumptions. Disclosure on economic assumptions is available in the annual report for the year ended March 31, 2008.

4

| |

Consolidated profit after tax of the Bank increased by 18% from Rs. 636 crore (US$ 125 million) in Q4-2008 to Rs. 748 crore (US$ 147 million) in Q4-2009 and by 5% from Rs. 3,398 crore (US$ 670 million) in FY2008 to Rs. 3,577 crore (US$ 705 million) at FY2009.

Summary Profit and Loss Statement (as per unconsolidated Indian GAAP accounts)

| Rs. crore |

| Q4-2008 | Q4-2009 | FY2008 | FY2009 | |||||||||||||

Net interest income1 | 2,079 | 2,139 | 7,304 | 8,367 | ||||||||||||

| Non-interest income | 2,362 | 1,674 | 8,811 | 7,604 | ||||||||||||

| - Fee income | 1,928 | 1,343 | 6,627 | 6,524 | ||||||||||||

| - Lease and other income | 270 | 117 | 1,369 | 637 | ||||||||||||

| - Treasury income | 164 | 214 | 815 | 443 | ||||||||||||

| Less: | ||||||||||||||||

| Operating expense | 1,746 | 1,552 | 6,429 | 6,306 | ||||||||||||

| Expenses on direct market | ||||||||||||||||

agents (DMAs) 2 | 358 | 53 | 1,543 | 529 | ||||||||||||

| Lease depreciation | 46 | 52 | 182 | 210 | ||||||||||||

| Operating profit | 2,291 | 2,156 | 7,961 | 8,925 | ||||||||||||

| Less: Provisions | 948 | 1,085 | 2,905 | 3,808 | ||||||||||||

| Profit before tax | 1,343 | 1,071 | 5,056 | 5,117 | ||||||||||||

| Less: Tax | 193 | 327 | 898 | 1,359 | ||||||||||||

| Profit after tax | 1,150 | 744 | 4,158 | 3,758 | ||||||||||||

| 1. | Net of premium amortisation on government securities of Rs. 240 crore in Q4- 2008, Rs. 898 crore in FY2008, Rs. 162 crore in Q4-2009 and Rs. 725 crore in FY2009. |

| 2. | Represents commissions paid to direct marketing agents (DMAs) for origination of retail loans. These commissions are expensed upfront. |

| 3. | Prior period figures have been regrouped/re-arranged where necessary. |

Summary Balance Sheet

Rs. crore |

| March 31, | March 31, | |||||||

| 2008 | 2009 | |||||||

| Assets | ||||||||

| Cash & bank balances | 38,041 | 29,966 | ||||||

| Advances | 225,616 | 218,311 | ||||||

| Investments | 111,454 | 103,058 | ||||||

| Fixed & other assets | 24,684 | 27,966 | ||||||

| Total | 399,795 | 379,301 | ||||||

| Liabilities | ||||||||

| Networth | 46,470 | 49,533 | ||||||

| - Equity capital | 1,113 | 1,113 | ||||||

| - Reserves | 45,357 | 48,420 | ||||||

| Preference capital | 350 | 350 | ||||||

| Deposits | 244,431 | 218,348 | ||||||

| CASA ratio | 26.1% | 28.7% | ||||||

| Borrowings | 86,399 | 92,805 | ||||||

| Other liabilities | 22,145 | 18,265 | ||||||

| Total | 399,795 | 379,301 | ||||||

All financial and other information in this press release, other than financial and other information for specific subsidiaries where specifically mentioned, is on an unconsolidated basis for ICICI Bank Limited only unless specifically stated to be on a consolidated basis for ICICI Bank Limited and its subsidiaries. Please also refer to the statement of audited unconsolidated, consolidated and segmental results required by Indian regulations that has, along with this release, been filed with the stock exchanges in India where ICICI Bank’s equity shares are listed and with the New York Stock Exchange and the US Securities Exchange Commission, and is available on our website www.icicibank.com.

Except for the historical information contained herein, statements in this release which contain words or phrases such as 'will', ‘expected to’, etc., and similar expressions or variations of such expressions may constitute 'forward-looking statements'. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results, opportunities and growth potential to differ materially from those suggested by the forward-looking statements. These risks and uncertainties include, but are not limited to, the actual growth in demand for banking and other financial products and services in the countries that we operate or where a material number of our customers reside, our ability to successfully implement our strategy, including our use of the Internet and other technology, our rural expansion, our exploration of merger and acquisition opportunities, our ability to integrate recent or future mergers or acquisitions into our operations and manage the risks associated with such acquisitions to achieve our strategic and financial objectives, our ability to manage the increased complexity of the risks we face following our rapid international growth, future

levels of impaired loans, our growth and expansion in domestic and overseas markets, the adequacy of our allowance for credit and investment losses, technological changes, investment income, our ability to market new products, cash flow projections, the outcome of any legal, tax or regulatory proceedings in India and in other jurisdictions we are or become a party to, the future impact of new accounting standards, our ability to implement our dividend policy, the impact of changes in banking regulations and other regulatory changes in India and other jurisdictions on us, including on the assets and liabilities of ICICI, a former financial institution not subject to Indian banking regulations, the bond and loan market conditions and availability of liquidity amongst the investor community in these markets, the nature of credit spreads, interest spreads from time to time, including the possibility of increasing credit spreads or interest rates, our ability to roll over our short-term funding sources and our exposure to credit, market and liquidity risks as well as other risks that are detailed in the reports filed by us with the United States Securities and Exchange Commission. ICICI Bank undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof.

For further press queries please call Charudatta Deshpande at 91-22-2653 8208 or e- mail: charudatta.deshpande@icicibank.com.

For investor queries please call Rupesh Kumar at 91-22-2653 7126 or email at ir@icicibank.com.

1 crore = 10.0 million

US$ amounts represent convenience translations at US$1= Rs. 50.72

7

Item 3

| |

| News Release | April 25, 2009 |

As previously announced, Mr. N. Vaghul would retire as non-executive Chairman of the Board of Directors of ICICI Bank Limited (NYSE: IBN) on April 30, 2009. Mr. K. V. Kamath would retire as the Managing Director & CEO of ICICI Bank on April 30, 2009 and assume office as non-executive Chairman of the Board effective May 1, 2009. Ms. Chanda Kochhar would assume office as Managing Director & CEO of ICICI Bank effective May 1, 2009. Approvals of Reserve Bank of India and the shareholders of the Bank have been received for these appointments.

Ms. Chanda Kochhar has also been appointed as non-executive Chairperson of ICICI Prudential Life Insurance Company (ICICI Life), ICICI Lombard General Insurance Company (ICICI General), ICICI Prudential Asset Management Company (ICICI AMC), ICICI Securities, ICICI Bank UK PLC and ICICI Bank Canada.

The Board of Directors of ICICI Bank and the Boards of Directors of ICICI Life and ICICI General at their respective meetings held at Mumbai today, approved the following appointments:

| • | Mr. V. Vaidyanathan, Executive Director, ICICI Bank has been appointed as Managing Director & CEO of ICICI Life. |

| Ms. Shikha Sharma has tendered her resignation as Managing Director & CEO of ICICI Life and would step down on April 30, 2009. The Boards of ICICI Bank and ICICI Life placed on record their deep appreciation of Ms. Sharma’s contribution to the ICICI Group and in particular her leadership of ICICI Life, which has consistently been the number one private sector life insurer in India. | |

| • | Mr. Sandeep Bakhshi, Managing Director & CEO, ICICI General has been appointed as Executive Director of ICICI Bank. He will be responsible for retail and rural banking. |

| • | Mr. Bhargav Dasgupta, Executive Director, ICICI Life has been appointed as Managing Director & CEO of ICICI General |

The appointments of Mr. Vaidyanathan, Mr. Bakhshi and Mr. Dasgupta would be effective May 1, 2009 and would be subject to necessary approvals.

The Board of Directors of ICICI Bank has appointed Mr. M. S. Ramachandran (former Chairman of Indian Oil Corporation) as a non- executive Director. Mr. Ramachandran joined Indian Oil Corporation in 1969 and worked in several areas before being appointed Director (Planning & Business Development) in 2000. He was Chairman of Indian Oil Corporation from 2002 to 2005.

For further press queries please call Charudatta Deshpande at 91-22-2653 8208 or e- mail: charudatta.deshpande@icicibank.com.

For investor queries please call Rupesh Kumar at 91-22-2653 7126 or email at ir@icicibank.com.

Item 4

| [GRAPHIC OMITTED] Performance Review: FY2009 April 25, 2009 |

| Certain statements in these slides are forward-looking statements. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those included in these statements due toa variety of factors. More information about these factors is contained in ICICI Bank's filings with the Securities and Exchange Commission. All financial and other information in these slides, other than financial and other information for specific subsidiaries where specifically mentioned, is on an unconsolidated basis for ICICI Bank Limited only unless specifically stated to be on a consolidated basis for ICICI Bank Limited and its subsidiaries. Please also refer to the statementof audited unconsolidated, consolidated and segmental results required by Indian regulations that has, along with these slides, been filed with the stock exchanges in India where ICICI Bank�s equity shares are listed and with the New York Stock Exchange and the US Securities Exchange Commission, and is available on our website www.icicibank.com. Further details will be published as a part of our annual reportfor the financial year 2009 [GRAPHIC OMITTED] |

| [GRAPHIC OMITTED] |

|

[GRAPHIC OMITTED]

Overview: FY2009

o Profit before tax for FY2009 was Rs. 51.17 bn compared to Rs. 50.56 bn for

FY2008

o Profit after tax for FY2009 was Rs. 37.58 bn compared to Rs. 41.58 bn

for FY2008 due to the higher effective tax rate on account of lower

proportion of income taxable as dividends and capital gains

o 15% increase in net interest income from Rs. 73.04 bn in FY2008 to Rs. 83.67

bn in FY2009

o NIM increased from 2.2% in FY2008 to 2.4% in FY2009

o Fee income decreased marginally from Rs. 66.27 bn in FY2008 to Rs. 65.24 bn

in FY2009

o Lower corporate fees in H2-2009 due to slowdown in corporate activity

o Reduced third party distribution and low disbursals impacted retail fees

|

|

Overview: FY2009

o Operating expenses (including direct marketing agency expenses) decreased

14% to Rs. 68.35 bn in FY2009 from Rs. 79.72 bn in FY2008

o The cost/average asset ratio for FY2009 was 1.8% compared to 2.2% for

FY2008

o Operating profit increased 12% from Rs. 79.61 bn in FY2008 to Rs. 89.25 bn

in FY2009 as lower treasury & other income were offset by higher net

interest income and lower operating & DMA expenses

|

|

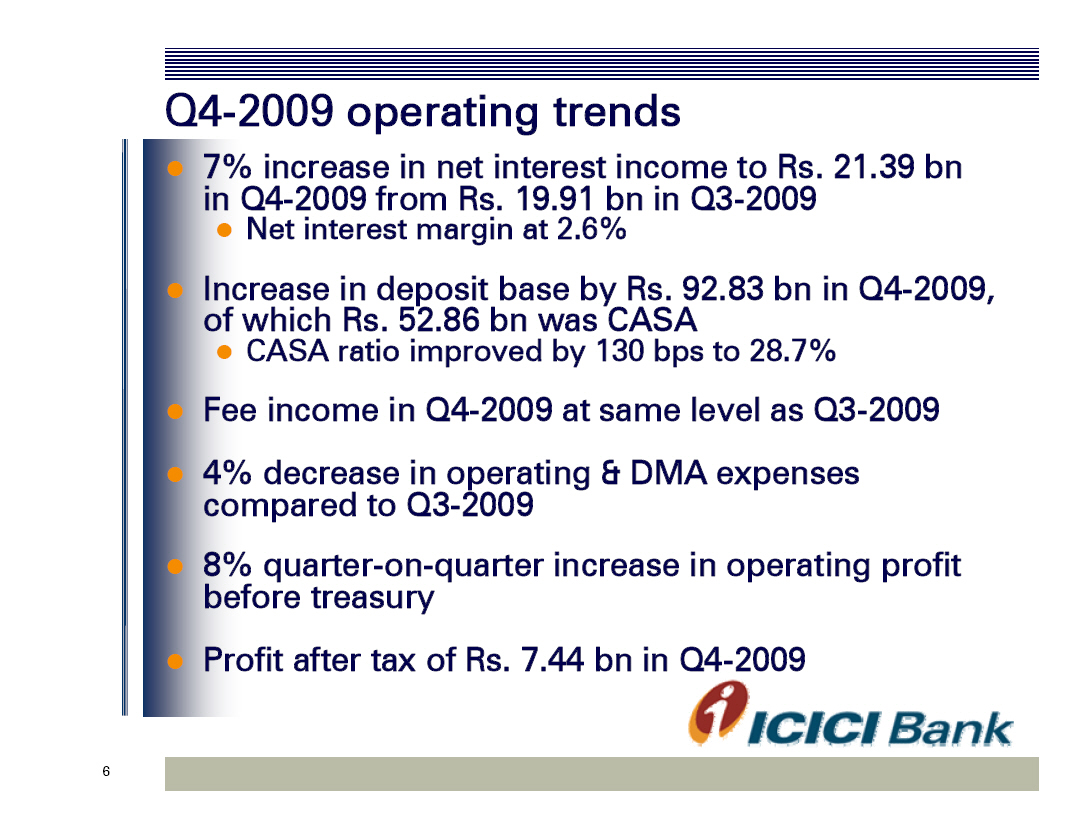

Q4-2009 operating trends

o 7% increase in net interest income to Rs. 21.39 bn in Q4-2009 from Rs. 19.91

bn in Q3-2009

o Net interest margin at 2.6%

o Increase in deposit base by Rs. 92.83 bn in Q4-2009,of which Rs. 52.86 bn

was CASA

o CASA ratio improved by 130 bps to 28.7%

o Fee income in Q4-2009 at same level as Q3-2009

o 4% decrease in operating & DMA expensescompared to Q3-2009

o 8% quarter-on-quarter increase in operating profitbefore treasury

o Profit after tax of Rs. 7.44 bn in Q4-2009

|

|

Balance sheet highlights

o Continued focus on capital, liquidity and risk containment

o Total capital adequacy of 15.5% and Tier-1 capital adequacy of 11.8% as

per RBI's revised Basel II framework

o Maintained high liquidity levels in domestic business and overseas

subsidiaries

o Decrease in loan book by 3.2% (decline of 8.4% excluding impact of

exchange rates)

o Increase in CASA ratio to 28.7% at March 31, 2009 compared to 27.4% at

December 31, 2008 and 26.1% at March 31, 2008

o Net NPA ratio of 1.96% at March 31, 2009 compared to 1.95% at December 31,

2008

|

|

Focus for the year ahead

o Increasing CASA ratio and rebalancing funding mix

o Selective lending and proactive management of existing portfolio

o Leveraging expanded branch network as integrated channel for deposit

mobilisation, selected retail asset origination and fee income

o Continuing emphasis on cost efficiency

o Maintaining high capitalisation levels

Positioning the balance sheet for next phase of growth

|

|

Unconsolidated Financials

|

|

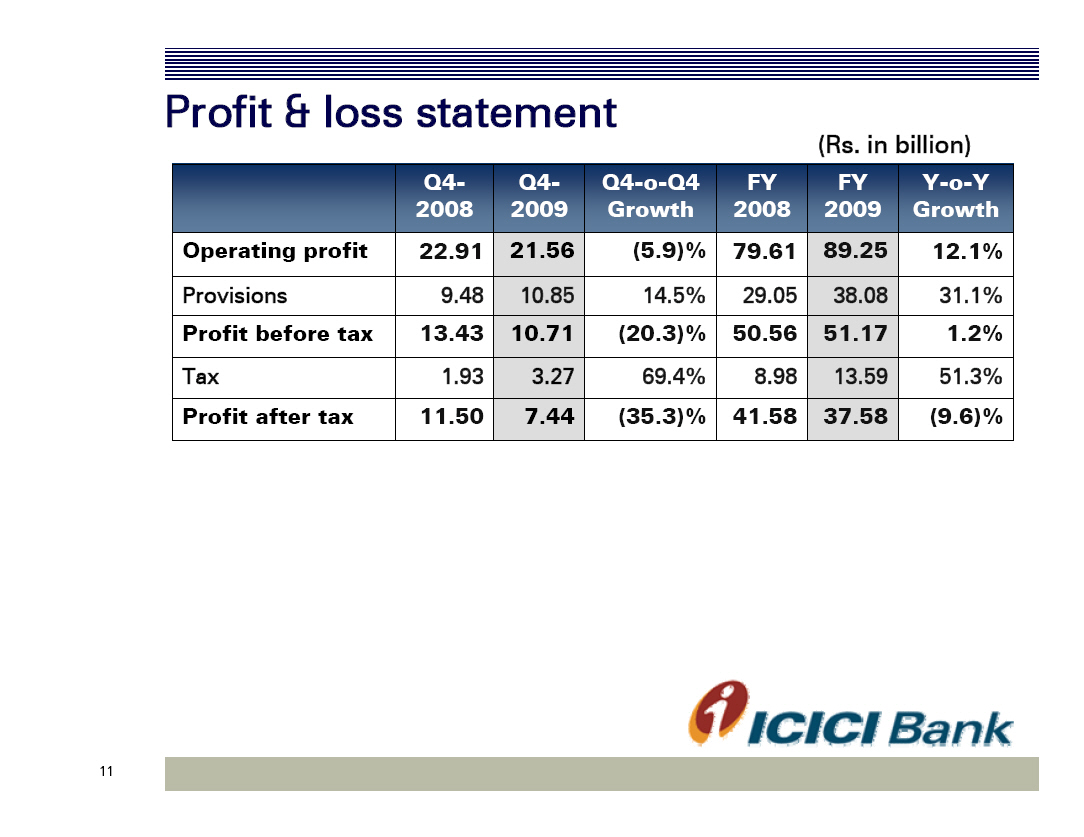

Profit & loss statement

(Rs. in billion)

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

Q4 Q4 Q4-o-Q4 FY FY Y-o-Y

2008 2009 Growth 2008 2009 Growth

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

NII 20.79 21.39 2.9% 73.04 83.67 14.6%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

Non-interest inc. 23.62 16.74 (29.1)% 88.11 76.04 (13.7)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

- -Fee income 19.28 13.43 (30.3)% 66.27 65.24 (1.6)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

- -Treasury income 1.64 2.14 30.5% 8.15 4.43 (45.6)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

- -Dividend income1 2.61 0.61 (76.6)% 11.52 3.35 (70.9)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

- -Others 0.09 0.56 - 2.17 3.02 39.2%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

Total income 44.41 38.13 (14.1)% 161.15 159.70 (0.9)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

Operating expenses 17.46 15.52 (11.1)% 64.29 63.06 (1.9)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

DMA expenses 3.58 0.53 (85.2)% 15.43 5.29 (65.7)%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

Lease depreciation 0.46 0.52 13.0% 1.82 2.10 15.4%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

Operating profit 22.91 21.56 (5.9)% 79.61 89.25 12.1%

- --------------------------- -------- ---------- ------------ --------- ----------- ----------

1. Includes Rs. 1.67 bn and Rs. 7.88 bn of income from funds managed by ICICI Venture in Q4-2008 and

FY2008 respectively

|

|

Profit & loss statement

(Rs. in billion)

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

Q42008 Q42009 Q4-o-Q4 Growth FY 2008 FY 2009 Y-o-Y Growth

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

Operating profit 22.91 21.56 (5.9)% 79.61 89.25 12.1%

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

Provisions 9.48 10.85 14.5% 29.05 38.08 31.1%

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

Profit before tax 13.43 10.71 (20.3)% 50.56 51.17 1.2%

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

Tax 1.93 3.27 69.4% 8.98 13.59 51.3%

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

Profit after tax 11.50 7.44 (35.3)% 41.58 37.58 (9.6)%

- ---------------------- -------- -------- ---------------- --------------- ------------ ---------------

|

|

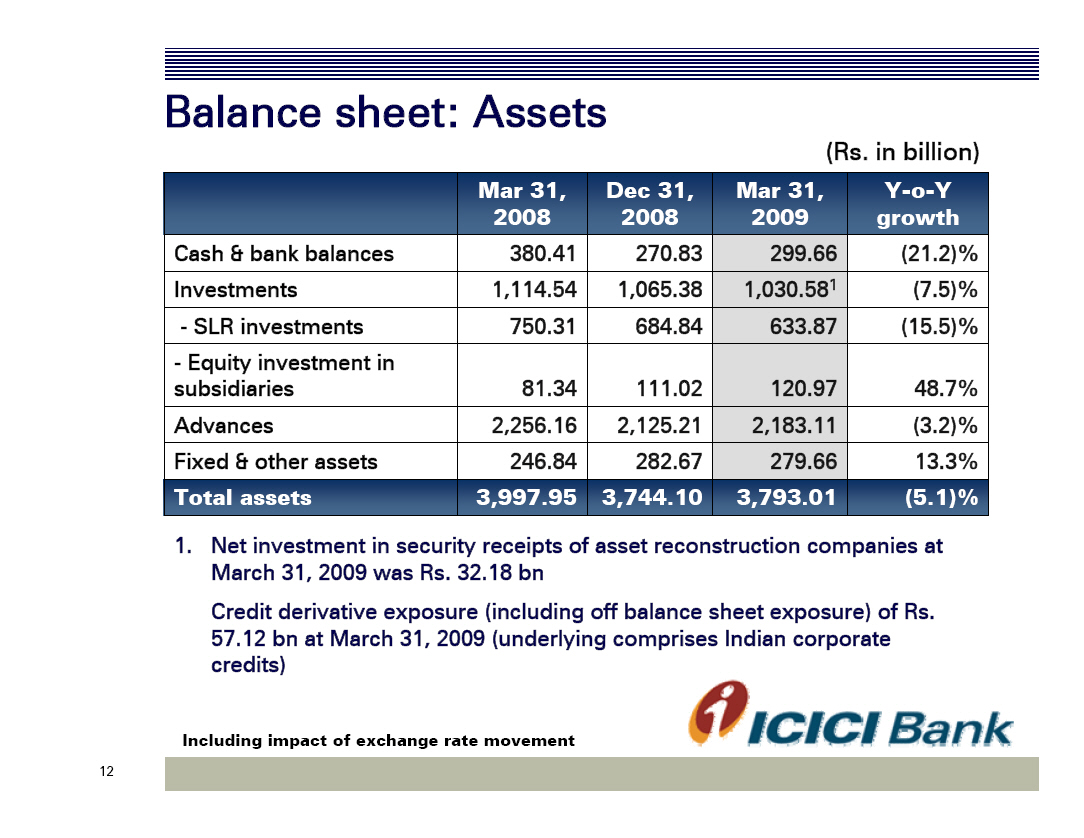

Balance sheet: Assets

(Rs. in billion)

- --------------------------- --------------- --------------- ---------------- ----------------

Mar 31, 2008 Dec 31, 2008 Mar 31, 2009 Y-o-Y growth

- --------------------------- --------------- --------------- ---------------- ----------------

Cash & bank balances 380.41 270.83 299.66 (21.2)%

- --------------------------- --------------- --------------- ---------------- ----------------

Investments 1,114.54 1,065.38 1,030.581 (7.5)%

- --------------------------- --------------- --------------- ---------------- ----------------

- -SLR investments 750.31 684.84 633.87 (15.5)%

- --------------------------- --------------- --------------- ---------------- ----------------

- -Equity investment in

subsidiaries 81.34 111.02 120.97 48.7%

- --------------------------- --------------- --------------- ---------------- ----------------

Advances 2,256.16 2,125.21 2,183.11 (3.2)%

- --------------------------- --------------- --------------- ---------------- ----------------

Fixed & other assets 246.84 282.67 279.66 13.3%

- --------------------------- --------------- --------------- ---------------- ----------------

Total assets 3,997.95 3,744.10 3,793.01 (5.1)%

- --------------------------- --------------- --------------- ---------------- ----------------

1. Net investment in security receipts of asset reconstruction companies at

March 31, 2009 was Rs. 32.18 bn

Credit derivative exposure (including off balance sheet exposure) of Rs.

57.12 bn at March 31, 2009 (underlying comprises Indian corporate credits)

Including impact of exchange rate movement [GRAPHIC OMITTED]

|

|

Composition of loan book: Mar 31, 2009

STPL 0.4%

Credit cards 7%

Home 54%

Overseas branches 25%

Rural 10%

corporate 12%

Total loan book: Rs. 2,183 bn Total retail loan book: Rs. 1,062 bn

1. STPL: Small ticket personal loans

2. Vehicle loans includes auto loans 13%, commercial business 14% and two

wheelers 2%

3. Retail business group includes builder loans and dealer funding of Rs. 32.83

bn

|

|

Equity investment in subsidiaries

- ----------------------------------------------- ------------------ ------------------

Rs. bn Mar-08 Mar-09

- ----------------------------------------------- ------------------ ------------------

ICICI Prudential Life Insurance 27.82 35.90

- ----------------------------------------------- ------------------ ------------------

ICICI Lombard General Insurance 7.17 10.96

- ----------------------------------------------- ------------------ ------------------

ICICI Bank Canada 13.53 33.50

- ----------------------------------------------- ------------------ ------------------

ICICI Bank UK 18.55 23.25

- ----------------------------------------------- ------------------ ------------------

ICICI Home Finance 7.97 11.12

- ----------------------------------------------- ------------------ ------------------

ICICI Bank Eurasia LLC 3.00 3.00

- ----------------------------------------------- ------------------ ------------------

ICICI Securities Primary Dealership 1.64 1.58

- ----------------------------------------------- ------------------ ------------------

ICICI Securities Limited 0.87 0.87

- ----------------------------------------------- ------------------ ------------------

ICICI AMC 0.61 0.61

- ----------------------------------------------- ------------------ ------------------

ICICI Venture Funds 0.05 0.05

- ----------------------------------------------- ------------------ ------------------

Others 0.14 0.14

- ----------------------------------------------- ------------------ ------------------

Total 81.34 120.97

- ----------------------------------------------- ------------------ ------------------

|

|

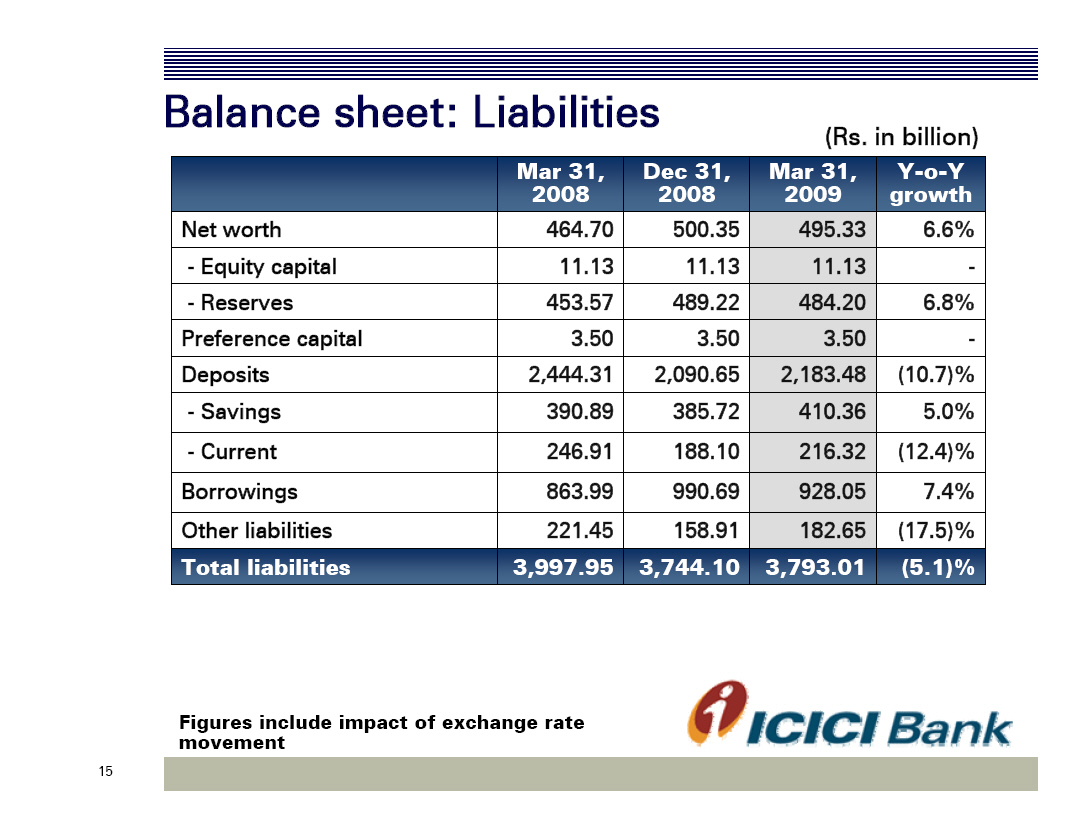

Balance sheet: Liabilities

(Rs. in billion)

- --------------------------- ---------------- ---------------- ------------------ ---------------

Mar 31, 2008 Dec 31, 2008 Mar 31, 2009 Y-o-Y growth

- --------------------------- ---------------- ---------------- ------------------ ---------------

Net worth 464.70 500.35 495.33 6.6%

- --------------------------- ---------------- ---------------- ------------------ ---------------

- -Equity capital 11.13 11.13 11.13 -

- --------------------------- ---------------- ---------------- ------------------ ---------------

- -Reserves 453.57 489.22 484.20 6.8%

- --------------------------- ---------------- ---------------- ------------------ ---------------

Preference capital 3.50 3.50 3.50 -

- --------------------------- ---------------- ---------------- ------------------ ---------------

Deposits 2,444.31 2,090.65 2,183.48 (10.7)%

- --------------------------- ---------------- ---------------- ------------------ ---------------

- -Savings 390.89 385.72 410.36 5.0%

- --------------------------- ---------------- ---------------- ------------------ ---------------

- -Current 246.91 188.10 216.32 (12.4)%

- --------------------------- ---------------- ---------------- ------------------ ---------------

Borrowings 863.99 990.69 928.05 7.4%

- --------------------------- ---------------- ---------------- ------------------ ---------------

Other liabilities 221.45 158.91 182.65 (17.5)%

- --------------------------- ---------------- ---------------- ------------------ ---------------

Total liabilities 3,997.95 3,744.10 3,793.01 (5.1)%

- --------------------------- ---------------- ---------------- ------------------ ---------------

Figures include impact of exchange rate movement

|

|

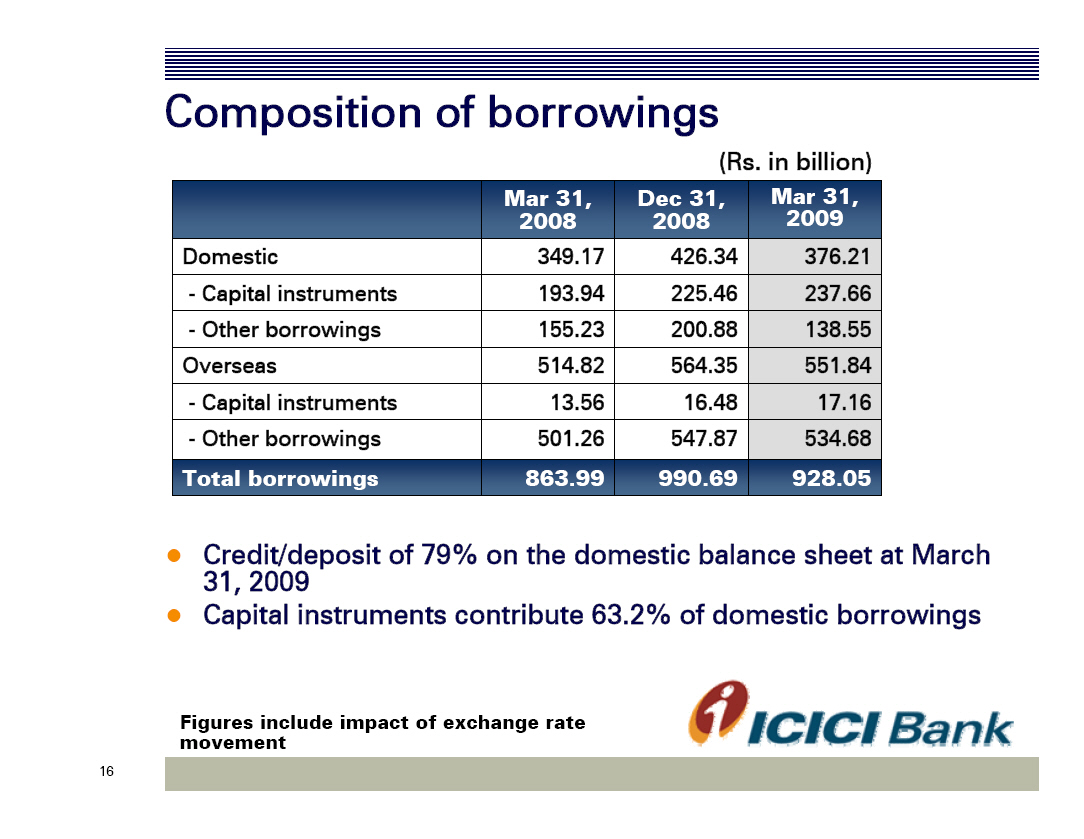

Composition of borrowings

(Rs. in billion)

- ------------------------- ---------------------- ----------------------- ----------------------

Mar 31, 2008 Dec 31, 2008 Mar 31, 2009

- ------------------------- ---------------------- ----------------------- ----------------------

Domestic 349.17 426.34 376.21

- ------------------------- ---------------------- ----------------------- ----------------------

- -Capital instruments 193.94 225.46 237.66

- ------------------------- ---------------------- ----------------------- ----------------------

- -Other borrowings 155.23 200.88 138.55

- ------------------------- ---------------------- ----------------------- ----------------------

Overseas 514.82 564.35 551.84

- ------------------------- ---------------------- ----------------------- ----------------------

- -Capital instruments 13.56 16.48 17.16

- ------------------------- ---------------------- ----------------------- ----------------------

- -Other borrowings 501.26 547.87 534.68

- ------------------------- ---------------------- ----------------------- ----------------------

Total borrowings 863.99 990.69 928.05

- ------------------------- ---------------------- ----------------------- ----------------------

o Credit/deposit of 79% on the domestic balance sheet at March 31, 2009

o Capital instruments contribute 63.2% of domestic borrowings

Figures include impact of exchange rate movement

|

|

Capital adequacy (Basel II)

- ----------------------- --------------------------- ---------------------------- ----------------------------

Rs. billion except % Mar 31, 2008 Dec 31, 2008 Mar 31, 2009

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

Total Capital 500.59 14.0% 558.51 15.6% 553.69 15.5%

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

- -Tier I 421.72 11.8% 433.57 12.1% 422.11 11.8%

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

- -Tier II 78.86 2.2% 124.94 3.5% 131.59 3.7%

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

Total RWA 3,584.56 3,585.29 3,564.63

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

- -On b/s 2,770.45 2,710.07 2,758.15

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

- -Off b/s 814.11 875.22 806.48

- ----------------------- ----------- --------------- ------------ --------------- ------------ --------------

As per Reserve Bank of India�s revised Basel II guidelines

|

|

Key ratios

(Percent)

- ------------------------------------------------- --------- ---------- --------------- ---------------

Q42008 Q42009 FY 2008 FY 2009

- ------------------------------------------------- --------- ---------- --------------- ---------------

Return on average networth1 10.0 6.1 11.1 7.7

- ------------------------------------------------- --------- ---------- --------------- ---------------

Weighted avg EPS (Rs.) 41.6 27.1 39.4 33.8

- ------------------------------------------------- --------- ---------- --------------- ---------------

Book value (Rs.) 418 445 418 445

- ------------------------------------------------- --------- ---------- --------------- ---------------

Net interest margin 2.4 2.6 2.2 2.4

- ------------------------------------------------- --------- ---------- --------------- ---------------

Cost to income (incl. DMA expenses) 47.9 42.7 50.0 43.4

- ------------------------------------------------- --------- ---------- --------------- ---------------

Cost to average assets (incl. DMA expenses) 2.2 1.8 2.2 1.8

- ------------------------------------------------- --------- ---------- --------------- ---------------

CASA ratio 26.1% 28.7%

- ------------------------------------------------- --------- ---------- --------------- ---------------

1. Based on quarterly average net worth

|

|

Asset quality and provisioning

(Rs. in billion)

- -------------------------------- ------------------ ------------------ ----------------

Mar 31, 2008 Dec 31, 2008 Mar 31, 2009

- -------------------------------- ------------------ ------------------ ----------------

Gross NPAs 83.50 96.40 99.29

- -------------------------------- ------------------ ------------------ ----------------

Less: Cumulative provisions 47.86 51.75 53.10

- -------------------------------- ------------------ ------------------ ----------------

Net NPAs 35.64 44.65 46.19

- -------------------------------- ------------------ ------------------ ----------------

Net NPA ratio 1.49% 1.95% 1.96%

- -------------------------------- ------------------ ------------------ ----------------

o Gross retail NPLs at Rs. 71.42 bn and net retail NPLs at Rs. 31.26 bn at

March 31, 2009

o 55% of net retail NPLs are from unsecured products

o Assets restructured during FY2009 amounted to Rs. 11.15 bn

o In addition, applications for restructuring of loans aggregating to Rs.

20.03 bn had been received up to March 31, 2009

1. Gross NPAs and cumulative provisions include technical write-offs of Rs.

1.26 bn at March 31, 2009

|

|

Overseas subsidiaries

|

|

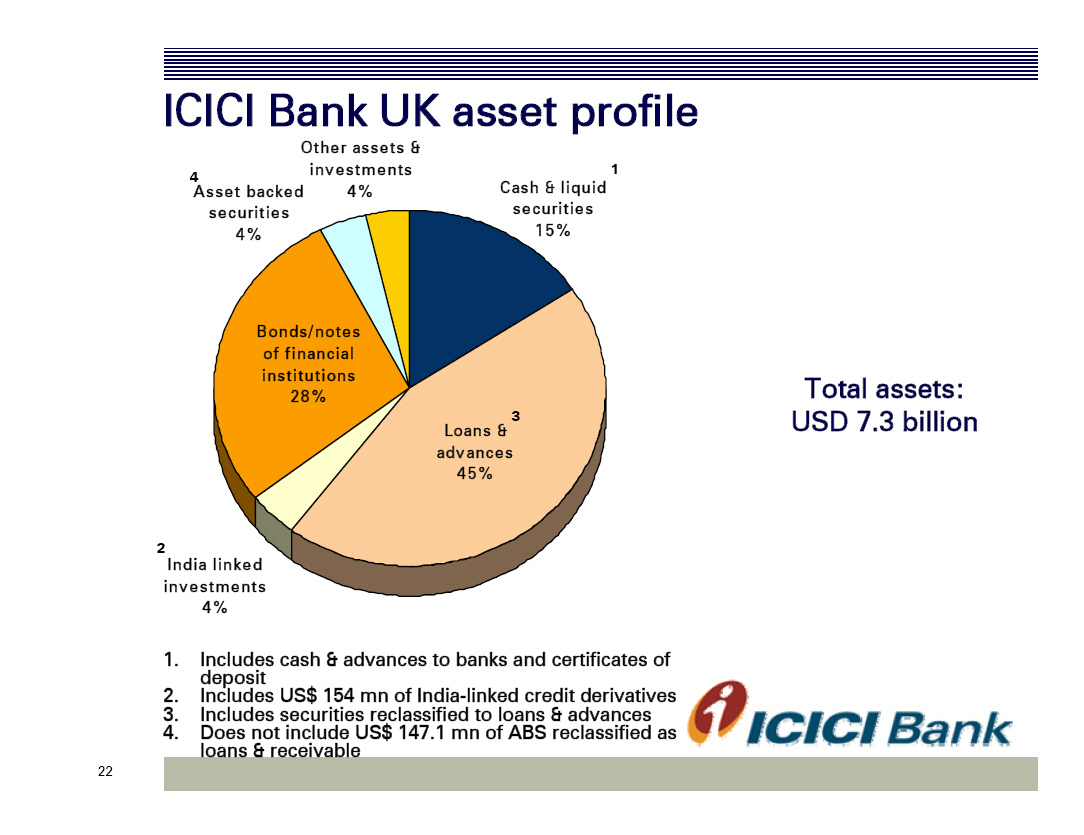

ICICI Bank UK

o Net profit of USD 6.8 million in FY2009

o Net MTM impact of USD 163.9 million (post-tax) in reserves in FY2009

o Capital adequacy ratio at 18.4%

o Certain investments were reclassified from the 'held for trading' (HFT)

category to the 'available for sale' (AFS) category and from AFS category to

'loans and receivables' category, in accordance with amendments made to the

applicable accounting standards in October 2008

o If these reclassifications had not been made, pre-tax profit would have

been lower by USD 58.5 million and unrealised losses, as deducted from

reserves (pre-tax), on AFS securities would have increased by USD 10.5

million

|

| ICICI Bank UK asset profile Other assets & investments 4 Cash & liquid 1 Asset backed 4% Total assets: USD 7.3 billion 4% 1. Includes cash & advances to banks and certificates of deposit 2. Includes US$ 154 mn of India-linked credit derivatives 3. Includes securities reclassified to loans & advances 4. Does not include US$ 147.1 mn of ABS reclassified as loans & receivable |

|

ICICI Bank UK liability profile

Total liabilities: USD 7.3 billion

38%

o Proportion of retail term deposits in total deposits increased from 16% at

March 31, 2008 to 58% at March 31, 2009

|

| ICICI Bank Canada Other assets & investments 3% Asset backed securities 2% Cash & liquid securities 14% India linked investments 3% Net profit of CAD 33.9 million in FY2009 Capital adequacy ratio at 19.9% Federally insured mortgage ` 14% Loans to customers64% Total assets: CAD 6.4 billion 1. Includes cash & advances to banks, government securities and banker�s acceptances/depository notes 2. Includes CAD 149 mn of India-linked credit derivatives |

|

ICICI Bank Canada liability profile

Networth 15%

Other liabilities 4%

Borrowings 1%

Demand deposits 10%

Total liabilities: CAD 6.4 billion

o ICICI Bank Canada balance sheet funded largely out of retail term deposits

|

|

ICICI Bank Eurasia

o Total assets of USD 441 million at March 31, 2009 compared to USD 772

million at December 31, 2007

o Total borrowings of USD 357 million at March 31, 2009

o Capital adequacy of 15.1% as on March 31, 2009

o Net profit of USD 2.0 million for the year ended December 31, 2008

As per IFRS

Figures include impact of exchange rate movement

|

|

ICICI Bank Eurasia asset profile

Other assets 3%

Retail loans 18%

Loans to corporates & banks 51%

Total assets: USD 441 million

Cash & liquid securities 20%

Corporate bonds 8%

1. Includes cash & advances to banks, balances with central bank and nostro

balances

|

|

Key non-banking subsidiaries

|

|

ICICI Life

(Rs. in billion)

- ---------------------------------- --------------- -------------

FY2008 FY2009

- ---------------------------------- --------------- -------------

APE 65.16 53.02

- ---------------------------------- --------------- -------------

Renewal premium 55.26 88.72

- ---------------------------------- --------------- -------------

Total premium 135.61 153.56

- ---------------------------------- --------------- -------------

New Business Profit (NBP) 12.54 10.04

- ---------------------------------- --------------- -------------

NBP margin 19.2% 18.9%

- ---------------------------------- --------------- -------------

Statutory Loss (13.95) (7.80)

- ---------------------------------- --------------- -------------

Assets Under Management 285.78 327.88

- ---------------------------------- --------------- -------------

Expense ratio 14.9% 11.8%

- ---------------------------------- --------------- -------------

o Continued market leadership in private sector with overall market share of

11.8%1

1. For the period April 2008 -February 2009 on new business weighted received

premium basis

|

|

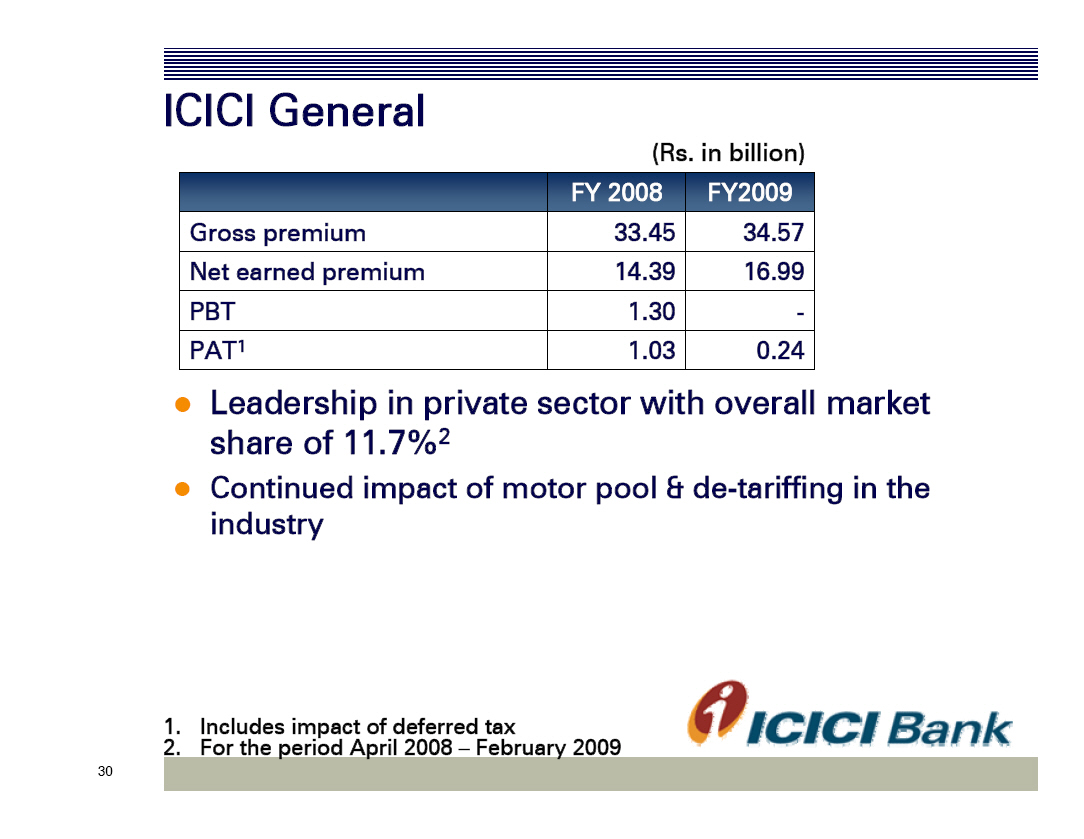

ICICI General

(Rs. in billion)

- -------------------------- ----------------------- ---------------------

FY 2008 FY2009

- -------------------------- ----------------------- ---------------------

Gross premium 33.45 34.57

- -------------------------- ----------------------- ---------------------

Net earned premium 14.39 16.99

- -------------------------- ----------------------- ---------------------

PBT 1.30 -

- -------------------------- ----------------------- ---------------------

PAT1 1.03 0.24

- -------------------------- ----------------------- ---------------------

o Leadership in private sector with overall market share of 11.7%2

o Continued impact of motor pool & de-tariffing in the industry

1. Includes impact of deferred tax

2. For the period April 2008 - February 2009

|

|

Other subsidiaries

(Rs. billion)

- ----------------------------------------------- ----------------- --------------

Profit after tax FY2008 FY2009

- ----------------------------------------------- ----------------- --------------

ICICI Securities Ltd. 1.50 0.04

- ----------------------------------------------- ----------------- --------------

ICICI Securities PD 1.40 2.72

- ----------------------------------------------- ----------------- --------------

ICICI Venture 0.90 1.48

- ----------------------------------------------- ----------------- --------------

ICICI Prudential Asset Management Company 0.82 0.01

- ----------------------------------------------- ----------------- --------------

ICICI Home Finance Company 0.70 1.43

- ----------------------------------------------- ----------------- --------------

Consolidated profit after tax increased by 5% to Rs. 35.77 billion in FY2009

compared to Rs. 33.98 billion in FY2008

|

|

Thank you

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| ICICI Bank Limited | |||||

| Date: April 25, 2009 | By: | /s/ Ranganath Athreya | |||

| Name: | Ranganath Athreya | ||||

| Title: | General Manager Joint Company Secretary & Head Compliance for Non Banking Subsidiaries | ||||

2