August 15, 2013

Unilever N.V.

Form 20-F for the Fiscal Year Ended December 31, 2012

Filed March 8, 2013

Form 6-K

Filed March 8, 2013

Responses dated July 18 and August 1, 2013

File No. 1-4547

Unilever PLC

Form 20-F for the Fiscal Year Ended December 31, 2012

Filed March 8, 2013

Form 6-K

Filed March 8, 2013

Responses dated July 18 and August 1, 2013

File No. 1-4546

Dear Mr. Decker:

Set forth below are the responses of our clients, Unilever N.V. and Unilever PLC (collectively, the “Unilever Group”), to the comments of the Staff of the U.S. Securities and Exchange Commission (the “Staff”) on the Unilever Group’s Form 20-F for the year ended December 31, 2012 filed on March 8, 2013 (the “20-F”), and Unilever Group’s Form 6-K filed on March 8, 2013 (the “6-K”), which were delivered in your letter to the Unilever Group dated August 8, 2013, and contain references to your letter dated July 23, 2013. These responses have been provided to us by management of the Unilever Group and are being transmitted by us to you on their behalf. We set forth below first the Staff’s comments in italics and follow with the Unilever Group’s responses. All page number references in the responses below are to the page numbers in the Annual Report & Accounts filed as an Exhibit to the Unilever Group’s Form 6-K filed March 8, 2013.

General

| | 1. | Where a comment below requests additional disclosures or other revisions to be made, please show us in your supplemental response what the revisions will look like. These revisions should be included in your future filings. |

Response:

The Unilever Group acknowledges the Staff’s comment. Where a comment below requests that additional disclosure or other revision be made, this letter includes the draft of the disclosure or revision within the applicable response. The Unilever Group confirms it will include such disclosure or revision in its future filings, including filings on Form 6-K, as applicable, consistent with the responses outlined below.

Form 20-F for the Year Ended December 31, 2012

Item 5. Operating and Financial Review and Prospects

Non-GAAP Measures, page 11

| | 2. | We note your response to comment three in our letter dated July 23, 2013. In the calculation provided for 2012, we note that the turnover growth percentage is 10.5% whereas the total of the individual growth components is 10.2%. Your explanation indicates that the difference between the two amounts is due to the compounding impact of the growth components, which appears to be mainly due to the currency impact on the other individual growth components. If true, please correspondingly clarify in your disclosures to better explain the differences between the turnover growth percentage and the total of the individual growth components. Please also address in your Form 6-K, as applicable. |

Response:

The Unilever Group acknowledges the Staff’s comments and has updated the disclosure below.

Disclosure:

“Turnover growth is made up of distinct individual growth components namely underlying sales, currency impact, acquisitions and disposals. Turnover growth is arrived at by multiplying these individual components on a compounded basis as there is a currency impact on each of the other components. Accordingly, turnover growth is more than just the sum of the individual components.”

Form 6-K Filed March 8, 2013

Financial Review 2012, page 28

| | 3. | We note your response to comment six in our letter dated July 23, 2013. On a consolidated basis, your core operating profit increased by 773 million Euros from 2011 to 2012. We note that certain segments, including the personal care segment and refreshment segment, appear to have significantly contributed to this increase. Specifically the core operating profit for the personal care segment increased by 365 million Euros from 2011 to 2012 and the core operating profit for the refreshment segment increased by 235 million Euros from 2011 to 2012. Your proposed additional segment disclosures provide an explanation of the factors that impacted your segment core operating profit. We also remind you to quantify the impact of any of these factors if they materially impact your segment core operating profit and core operating profit margin percentage from period to period. For example, the net increase in the core operating profit and corresponding margin for the personal care segment appears to be due to the following factors: turnover growth, the impact of gross margins, and investments in building beauty capabilities and infrastructure. |

Response:

The Unilever Group acknowledges the Staff’s comment and confirms that in its future filings it will expand its consolidated discussion of core operating profit and core operating margin to specifically quantify the impact of the factors that materially impact our segment core operating profit and core operating margin from period to period. For the comparison of 2012 to 2011, the Unilever Group has informed us it will provide the following additional disclosure related to its consolidated results in its Form 20-F for the year ended December 31, 2013.

Consolidated Results Disclosure:

“Absolute turnover grew by €4.9 billion which translated into a core operating profit increase of €773 million and an operating profit increase of €550 million due to cost increases in the following key areas.

Costs of raw and packaging materials and goods purchased for resale increased by €1.7 billion, driven primarily by increased business volume of €1.3 billion and input costs increase of €1.1 billion offset by other items including material cost savings of €0.7 billion during the year. Additionally, distribution costs increased by €180 million. Despite these increases, due to higher selling prices and benefit from customers buying products with higher margins, gross margin improved by 0.1% to 40.0% at constant exchange rates.

Staff costs increased by €0.9 billion due to salary inflation, particularly in emerging markets, higher pensions charge as a result of one-off credits taken in the prior year and higher bonuses.

Advertising and promotional expenses increased by €694 million as we continue to invest behind our brands.

The impact of input costs and investment in advertising and promotional expenses are discussed further in our segmental disclosures, which also provide additional details on the impact of brands, products and subcategories on driving top line growth.

Out of the increase of €773 million in core operating profit, the majority of it was contributed by Personal Care (€365 million) and Refreshments (€235 million).”

Segment Results Disclosure:

“ Personal Care

| | ● | Personal Care turned in yet another year of strong performance with turnover growth of 17%. Underlying sales growth of 10.0% was driven by both underlying volume growth of 6.5% and a positive price contribution of 3.3%. This was spurred by innovations like Dove Nutrium Moisture and the rollout of our brands in new markets like TRESemmé in Brazil and complemented by a strong contribution of the recently acquired brands like Kalina. |

| | ● | Core operating profit at €3 billion was higher by €365 million over the prior year. Out of the €365 million, turnover growth contributed €465m which was offset by €100 million from a reduction in core operating margin by 50bps primarily due to continued investments in building beauty capabilities and infrastructure, while gross margins remained stable. |

Foods

| | ● | Foods turnover grew by 3.3% during the year. Underlying sales growth in Foods was 1.8%. Underlying volume growth was (0.9)%, continuing to reflect the impact of a contracting spreads market and the price rises we took in 2011 to counter significant increases in input prices. Growth was supported by the rollout of innovations such as Knorr jelly bouillon and Knorr baking bags, as well as solid results delivered by our Food Solutions business. |

| | ● | Core operating profit at €2.5 billion increased by €83 million over previous year. This increase was entirely due to increase in turnover. Core operating margin was in line with previous year as the impact of higher commodity costs on gross margins was offset by improved cost discipline and savings delivery. |

Refreshment

| | ● | Refreshment performance improved in growth momentum and profitability. Turnover grew by a strong 10.5% with underlying sales growth of 6.3% reflecting good contribution from underlying volume growth of 2.4% and underlying price growth of 3.9%. In ice cream, growth momentum was driven by powerful performance in Latin America, Asia, North America and Europe and benefited from innovation behind our global brands such as Magnum, which is now a brand with sales in excess of €1 billion. In tea, innovation improved growth momentum in particular in emerging markets, such as Russia, Arabia and India. |

| | ● | Core operating profit at €911 million improved by €235 million over the previous year. Out of the €235 million, turnover growth contributed €70 million while improvement in core operating margin by 170bps contributed €165 million. Core operating margin improvement was driven primarily by higher gross margin arising from a strong savings program and cost discipline. |

Home Care

| | ● | Home Care delivered a strong performance with turnover growth of 10.4% driven by underlying sales growth of 10.3%, balanced between volume growth of 6.2% and price changes contributing 3.9%. We improved our market position in highly competitive markets such as the UK, France, China and South Africa on the back of continued innovation and continuing success of our brands like Omo and Comfort. Household care growth was equally supported by the rollout of new and improved products, driving strong growth momentum for our global brands Domestos, Cif and Sunlight. |

| | ● | Core operating profit at €531 million improved by €90 million over previous year. Out of the €90 million, turnover growth contributed €45 million, while improvement in core operating margin by 50bps contributed €45 million primarily due to better gross margins benefiting from successful new business models.” |

Non-GAAP Measures

Free Cash Flow (FCF), page 34

| | 4. | We note your response to comment eight in our letter dated July 23, 2013. We continue to have difficulty understanding how you determined that free cash flow would not be considered a liquidity measure given that it represents your ability to pay debts utilizing cash and other liquid assets and it is a measure of cash available for distribution amongst all security holders of the Unilever Group or to fund strategic initiatives. You have highlighted certain limitations with this measure; however, it is unclear how these limitations would preclude free cash flow from being considered a liquidity measure. Please advise or revise your disclosures as necessary. |

The Unilever Group acknowledges the Staff’s comment and accordingly revises our proposed disclosure in future Annual Report & Accounts in the manner set forth below.

Disclosure to replace current disclosure on page 34:

“Free cash flow (FCF)

Within the Unilever Group, free cash flow (FCF) is defined as cash flow from operating activities, less income taxes paid, net capital expenditures and net interest payments and preference dividends paid. It does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from FCF. Free cash flow reflects an additional way of viewing our liquidity that we believe is useful to investors because it represents cash flows that could be used for distribution of dividends, repayment of debt or to fund our strategic initiatives, including acquisitions, if any.

The reconciliation of FCF to cash flow from operating activities is as follows:

| | | € million 2012 | | | € million 2011 | | | € million 2010 | |

| Net profit | | | 4,948 | | | | 4,623 | | | | 4,598 | |

| Taxation | | | 1,735 | | | | 1,622 | | | | 1,534 | |

| Share of net profit of joint ventures/associates and other income from non-current investments | | | (91 | ) | | | (189 | ) | | | (187 | ) |

| Net finance costs | | | 397 | | | | 377 | | | | 394 | |

| Depreciation, amortisation and impairment | | | 1,199 | | | | 1,029 | | | | 993 | |

| Changes in working capital | | | 822 | | | | (177 | ) | | | 169 | |

| Pensions and similar provisions less payments | | | (381 | ) | | | (553 | ) | | | (472 | ) |

| Provisions less payments | | | (43 | ) | | | 9 | | | | 72 | |

| Elimination of (profits)/losses on disposals | | | (236 | ) | | | (215 | ) | | | (476 | ) |

| Non-cash charge for share-based compensation | | | 153 | | | | 105 | | | | 144 | |

| Other adjustments | | | 13 | | | | 8 | | | | 49 | |

| | | | | | | | | | | | | |

| Cash flow from operating activities | | | 8,516 | | | | 6,639 | | | | 6,818 | |

| | | | | | | | | | | | | |

| Income tax paid | | | (1,680 | ) | | | (1,187 | ) | | | (1,328 | ) |

| Net capital expenditure | | | (2,143 | ) | | | (1,974 | ) | | | (1,701 | ) |

| Net interest and preference dividends paid | | | (360 | ) | | | (403 | ) | | | (424 | ) |

| Free cash flow | | | 4,333 | | | | 3,075 | | | | 3,365 | |

| | | | | | | | | | | | | |

| Net cash flow (used in)/from investing activities | | | (755 | ) | | | (4,467 | ) | | | (1,164 | ) |

| Net cash flow (used in)/from financing activities | | | (6,622 | ) | | | 411 | | | | (4,609 | ) |

Financial Statements

Consolidated Statement of Changes in Equity, page 87

| | 5. | We note your response to comment nine in our letter dated July 23, 2013. If there are any significant components included in the line items labeled movement during the year in any of your reconciliations, please separately present and discuss the components rather than aggregating all components into one line item. |

Response:

The Unilever Group acknowledges the Staff’s comment and confirms that in the notes to the financial statements in its future filings it will include movements during the year in the components of “other comprehensive income” with references to the other relevant disclosures.

Disclosure:

“Fair value gains/(losses) on financial instruments – movement during the year

| | | € million 2012 | | | € million 2011 | |

| 1 January | | | (94 | ) | | | 74 | |

| Movement during the year | | | (125 | ) | | | (168 | ) |

| | | | | | | | | |

| 31 December | | | (219 | ) | | | (94 | ) |

Refer also to the consolidated statement of comprehensive income on page 87, the consolidated statement of changes in equity on page 87 and note 6C on page 104.

Actuarial gains/(losses) on pension schemes – movement during the year

| | | € million 2012 | | | € million 2011 | |

| 1 January | | | (2,547 | ) | | | (1,304 | ) |

| Movement during the year | | | (644 | ) | | | (1,243 | ) |

| | | | | | | | | |

| 31 December | | | (3,191 | ) | | | (2,547 | ) |

Refer also to the consolidated statement of comprehensive income on page 87, the consolidated statement of changes in equity on page 87, note 4B from page 98 and note 6C on page 104.”

* * *

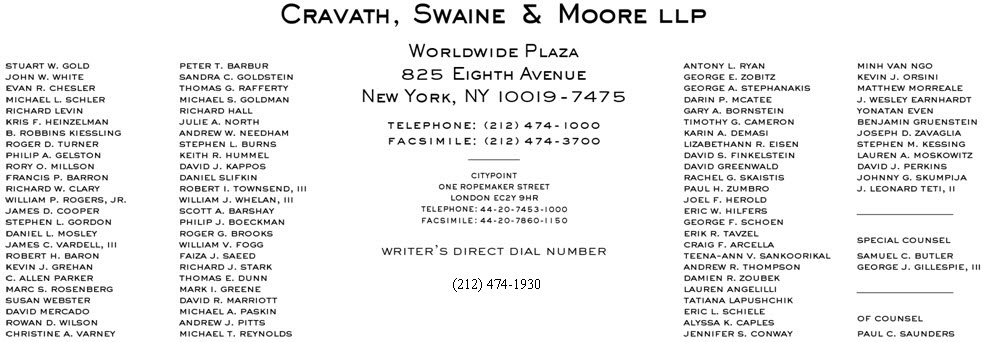

We and the Unilever Group would be happy to discuss any of the matters addressed by this letter. Please feel free to contact LizabethAnn R. Eisen at 212-474-1930 to arrange any follow up discussions.

| | | Very truly yours, /s/ LizabethAnn R. Eisen | |

| | | LizabethAnn R. Eisen | |

Mr. Rufus Decker

U. S. Securities and Exchange Commission

100 F Street, N.E.

Washington D.C. 20549

Copies to:

Mr. Raoul Jean-Marc Sidney Huet

Chief Financial Officer

Unilever N.V. & Unilever PLC

Unilever House, 100 Victoria Embankment

London

EC4Y 0DY

United Kingdom

Tonia Lovell, Esq.

Group Secretary

Unilever PLC

Unilever House, 100 Victoria Embankment

London

EC4Y 0DY

United Kingdom

David A. Schwartz, Esq.

Associate General Counsel – Corporate and Transactions

Unilever United States, Inc.

800 Sylvan Avenue

Englewood Cliffs, NJ 07632

Mr. John Baker

PricewaterhouseCoopers LLP

1 Embankment Place

London

WC2N 6RH

United Kingdom

Mr. Peter van Mierlo

PricewaterhouseCoopers N.V.

Thomas R. Malthusstraat 5

1066 JR Amsterdam

P.O. Box 90357

1006 BJ Amsterdam

The Netherlands

8