Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Kraft Foods Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

KRAFT FOODS INC.

| IRENE B. ROSENFELD | THREE LAKES DRIVE | |||

| CHAIRMAN OF THE BOARD AND | NORTHFIELD, ILLINOIS 60093 | |||

| CHIEF EXECUTIVE OFFICER | ||||

| MARCH 31, 2009 |

Dear Fellow Shareholder:

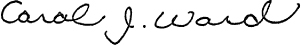

You are cordially invited to attend the 2009 Annual Meeting of Shareholders of Kraft Foods Inc. We will hold the Annual Meeting at 9:00 a.m. CDT on Wednesday, May 20, 2009, at the North Shore Center for the Performing Arts in Skokie, Illinois. The center will open at 8:00 a.m. CDT.

At the Annual Meeting, you will elect directors; vote on Kraft Foods’ Amended and Restated 2005 Performance Incentive Plan, the ratification of the selection of independent auditors, and a shareholder proposal; and consider any other business properly presented at the meeting. We will also report on our business and provide time for your questions and comments.

I am pleased to tell you that we are taking advantage of the U.S. Securities and Exchange Commission rule allowing companies to furnish proxy materials to shareholders via the Internet. This process, known as “e-proxy,” has several benefits: (1) it gets proxy materials to you more quickly, (2) it reduces the environmental impact of our Annual Meeting, and (3) it lowers our costs. We have also decided against producing a glossy annual report. This will significantly reduce printing and production costs, and it has an added sustainability benefit because it requires less paper. You will find comprehensive information about our performance in the Annual Report on Form 10-K for the year ended December 31, 2008.

On March 31, 2009, we mailed to our shareholders a Notice containing instructions on how to access and review our 2009 Proxy Statement and Annual Report on Form 10-K and to vote online. If you would like to receive a paper copy of our proxy materials, follow the instructions for requesting these materials in the Notice.

Only shareholders of record at the close of business on March 12, 2009 are entitled to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

You may vote your shares via the Internet or by calling a toll-free number. If you received a paper copy of the proxy card or voting instruction form by mail, you may sign, date, and mail your properly executed proxy card or voting instruction form. Or you may vote in person at the Annual Meeting. We include instructions about each option in the attached Proxy Statement and on the enclosed proxy card or voting instruction form. Your vote is important to us. Whether or not you plan to attend the Annual Meeting, I encourage you to vote promptly.

Please register in advance if you would like to attend the Annual Meeting. The pre-registration directions are provided in the attached Proxy Statement.

On behalf of the Board of Directors, thank you for your continued interest and support.

Sincerely,

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

Kraft Foods Inc. Proxy Statement and Annual Report on Form 10-K are available athttp://materials.proxyvote.com/50075N. |

Table of Contents

KRAFT FOODS INC.

Three Lakes Drive

Northfield, Illinois 60093

NOTICE OF 2009 ANNUAL MEETING OF SHAREHOLDERS

OF KRAFT FOODS INC.

| TIME AND DATE: | 9:00 a.m. CDT on Wednesday, May 20, 2009. | |

| PLACE: | North Shore Center for the Performing Arts in Skokie 9501 Skokie Boulevard Skokie, Illinois 60077 | |

| ITEMS OF BUSINESS: | (1) To elect ten directors; | |

(2) To approve the Amended and Restated 2005 Performance Incentive Plan; | ||

(3) To ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2009; | ||

(4) To act on a shareholder proposal regarding special shareholder meetings; and | ||

(5) To transact other business properly presented at the meeting. | ||

| BOARD RECOMMENDATION: | The Board recommends that shareholders votefor Items 1, 2, and 3 andagainst Item 4. | |

| WHO MAY VOTE: | Shareholders of record at the close of business on March 12, 2009. | |

DATE OF DISTRIBUTION: | We began mailing our Notice of Internet Availability of Proxy Materials on or about March 31, 2009. For shareholders who elect to receive paper copies, we began mailing the Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2008, and the proxy card on or about March 31, 2009. | |

MATERIALS AVAILABLE ATwww.kraftfoodscompany.com: | This Notice of Meeting, the Proxy Statement, and our Annual Report on Form 10-K for the year ended December 31, 2008, are available atwww.kraftfoodscompany.com/investor. Information included on our Web site, other than these materials, is not part of the proxy soliciting materials. | |

Carol J. Ward

Vice President and Corporate Secretary

March 31, 2009

Table of Contents

i

Table of Contents

| Page | ||

| 55 | ||

| 55 | ||

| 60 | ||

| 61 | ||

| 62 | ||

| 62 | ||

| 62 | ||

EXHIBIT A: ANNEX A TO KRAFT FOODS INC. BOARD OF DIRECTORS’ CORPORATE GOVERNANCE GUIDELINES | A-1 | |

EXHIBIT B: KRAFT FOODS INC. AMENDED AND RESTATED 2005 PERFORMANCE INCENTIVE PLAN | B-1 | |

EXHIBIT C: EXCERPT FROM KRAFT FOODS INC. AMENDED AND RESTATED BY-LAWS | C-1 | |

EXHIBIT D: GAAP TO NON-GAAP RECONCILIATIONS | D-1 | |

ii

Table of Contents

KRAFT FOODS INC.

Three Lakes Drive

Northfield, Illinois 60093

March 31, 2009

PROXY STATEMENT

FOR 2009 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 20, 2009

THE ANNUAL MEETING AND VOTING

| 1. | When and where is the Annual Meeting? |

Kraft Foods Inc. will hold its 2009 Annual Meeting of Shareholders on Wednesday, May 20, 2009, at 9:00 a.m. CDT at the North Shore Center for the Performing Arts in Skokie, 9501 Skokie Boulevard, Skokie, Illinois 60077. The center will open at 8:00 a.m. CDT. Directions to the center are included at the end of this Proxy Statement.

| 2. | Why am I receiving these proxy materials? |

We are providing you these proxy materials in connection with our Board of Directors’ (the “Board”) solicitation of proxies to be voted at our 2009 Annual Meeting of Shareholders or at any adjournments or postponements of the meeting (the “Annual Meeting”). These materials describe the voting procedures and the matters to be voted on at the Annual Meeting.

| 3. | How is Kraft Foods distributing proxy materials? |

Under rules recently adopted by the U.S. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of proxy materials to each shareholder. On or about March 31, 2009, we began mailing to our shareholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2008 (the “Form 10-K”) online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in this Proxy Statement and the Form 10-K. The Notice also instructs you on how you may submit your proxy via the Internet. If you received a Notice by mail and would like to receive a copy of our proxy materials, follow the instructions contained in the Notice about how you may request to receive your materials electronically or in printed form on a one-time or ongoing basis.

We will send copies of this Proxy Statement, the Form 10-K and/or the proxy card (proxy materials) free of charge to any shareholder who requests copies using one of the following methods:

| • | In writing to: Wells Fargo Shareowner Services, For Kraft Foods Inc., P.O. Box 64874, St. Paul, Minnesota 55164-0874; |

| • | By telephone: Call free of charge 1-866-697-9377 in the U.S. and Canada or 1-651-450-4064 from outside the U.S. and Canada; |

| • | Via the Internet: Access the Internet and go towww.ematerials.com/kft and follow the instructions to login and order copies; or |

| • | Via e-mail: Send us an e-mail atep@ematerials.com with “KFT Materials Request” in the subject line. Your e-mail must include the following information: |

| • | the 3-digit company number and the 11-digit control number located in the box in the upper right-hand corner of your Notice; |

1

Table of Contents

| • | your preference to receive printed materials via mail – or – to receive an e-mail with links to the electronic materials; |

| • | if you choose e-mail delivery, you must include an e-mail address; and |

| • | if you would like this election to apply to the delivery of materials for all future meetings, write the word “Permanent” and include the last 4 digits of your tax identification number in the e-mail. |

We also provide these materials on our Web site atwww.kraftfoodscompany.com/investor.

| 4. | Who is entitled to vote at the Annual Meeting? |

Our Board established March 12, 2009, as the record date (the “Record Date”) for the Annual Meeting. Shareholders owning our common stock at the close of business on the Record Date are entitled to (a) receive notice of the Annual Meeting, (b) attend the Annual Meeting and (c) vote on all matters that properly come before the Annual Meeting.

At the close of business on the Record Date, 1,472,416,560 shares of our common stock were outstanding and entitled to vote. Each share is entitled to one vote on each matter to be voted upon at the Annual Meeting.

| 5. | What proposals are being presented for shareholder vote at the Annual Meeting? |

Four proposals are scheduled for vote at the Annual Meeting:

ITEM 1. Election of Directors: THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR ALL NOMINEES TO THE BOARD, EACH FOR A TERM EXPIRING AT THE 2010 ANNUAL MEETING OF SHAREHOLDERS OR UNTIL HIS OR HER SUCCESSOR HAS BEEN DULY CHOSEN AND QUALIFIED:

| • | Ajay Banga |

| • | Myra M. Hart |

| • | Lois D. Juliber |

| • | Mark D. Ketchum |

| • | Richard A. Lerner, M.D. |

| • | John C. Pope |

| • | Fredric G. Reynolds |

| • | Irene B. Rosenfeld |

| • | Deborah C. Wright |

| • | Frank G. Zarb |

You can find information about the Board’s nominees, including each of their business backgrounds, under the heading “Item 1: Election of Directors” in this Proxy Statement.

ITEM 2. Approval of the Amended and Restated 2005 Performance Incentive Plan: THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE TOAPPROVE THE AMENDED AND RESTATED 2005 PERFORMANCE INCENTIVE PLAN.

You can find information about the Amended and Restated 2005 Performance Incentive Plan under the heading “Item 2. Approval of the Amended and Restated 2005 Performance Incentive Plan” in this Proxy Statement.

ITEM 3. Ratification of the Selection of Independent Auditors: THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE TORATIFY THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS KRAFT FOODS’ INDEPENDENT AUDITORS FOR THE YEAR 2009.

You can find information about our relationship with PricewaterhouseCoopers LLP under the headings “Audit Committee Matters” and “Item 3: Ratification of the Selection of Independent Auditors” in this Proxy Statement.

2

Table of Contents

ITEM 4. Shareholder Proposal Regarding Special Shareholder Meetings: THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTEAGAINST THE SHAREHOLDER PROPOSAL.

You can find information about the shareholder proposal under the heading “Item 4. Shareholder Proposal Regarding Special Shareholder Meetings” in this Proxy Statement.

Management does not know of any matters, other than those described in this Proxy Statement, that may be presented for action at the Annual Meeting. If any other matters properly come before the meeting, the persons named as proxies will vote on them in accordance with their best judgment.

| 6. | What is the quorum requirement? |

A quorum of shareholders is necessary to validly hold the Annual Meeting. A quorum will be present if a majority of the outstanding shares of our common stock on the Record Date are represented at the Annual Meeting, either in person or by proxy. Your shares will be counted for purposes of determining a quorum if you vote via the Internet, by telephone or by submitting a properly executed proxy card or voting instruction form by mail, or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted for determining whether a quorum is present for the Annual Meeting.

| 7. | What are the voting choices on Item 1, the election of directors? |

You may vote FOR all nominees, vote AGAINST all nominees, vote FOR specific nominees, or vote AGAINST specific nominees. You may also ABSTAIN, which will have no effect on the election of directors.

| 8. | What vote is needed to elect directors? |

Our Amended and Restated By-Laws (“By-Laws”) provide that, to be elected at this Annual Meeting, a director nominee must receive more FOR votes than AGAINST votes. Abstentions and broker non-votes are not considered as FOR votes or AGAINST votes for the nominees and will not have an effect on the outcome of the voting for directors.

To implement our majority voting By-Law, our Corporate Governance Guidelines provide that, in an uncontested election, any nominee for director who receives a greater number of AGAINST votes than FOR votes must tender his or her resignation for consideration by the Board’s Nominating and Governance Committee. The Nominating and Governance Committee then recommends to the Board whether to accept or reject the resignation.

Under our Corporate Governance Guidelines and in accordance with Virginia law, if an incumbent director nominated for re-election is not elected at the Annual Meeting, the director must tender his or her resignation but will continue to serve until the Board decides whether to accept the resignation. The Board will publicly disclose its decision and rationale within 90 days after certification of the election results. If the Board does not accept the director’s resignation, the director will continue to serve until the next annual meeting and until the director’s successor is elected and qualified.

In contested elections the vote standard is a plurality of votes cast.

| 9. | What are the voting choices on Item 2, approval of the Amended and Restated 2005 Performance Incentive Plan, Item 3, the ratification of the selection of the independent auditors, and Item 4, the shareholder proposal regarding special shareholder meetings? |

You may vote FOR, AGAINST or ABSTAIN on each of Items 2, 3, and 4.

| 10. | What vote is needed to approve each proposal? |

Approval of the ratification of the selection of independent auditors (Item 3) and adoption of the shareholder proposal (Item 4) each require that the number of votes cast FOR exceed the number of the votes cast AGAINST. Abstentions and broker non-votes are not considered as voting FOR or AGAINST these proposals and will have no effect on the outcome of the proposals.

3

Table of Contents

The New York Stock Exchange (“NYSE”) rules do not permit brokers discretionary authority to vote on the approval of the Amended and Restated 2005 Performance Incentive Plan (Item 2) or the shareholder proposal (Item 4). Therefore, if you hold shares of our common stock in street name (see Question 12) and do not provide voting instructions to your broker, your shares will not be voted on these matters.

Under the NYSE rules, the approval of the Amended and Restated 2005 Performance Incentive Plan (Item 2) requires an affirmative vote of the majority of the votes cast on the proposal, provided that the total votes cast on the proposal represent over 50% of the total outstanding shares of our common stock (the “Outstanding Votes”). Votes FOR and AGAINST and abstentions count as votes cast, while broker non-votes do not count as votes cast but count as Outstanding Votes. Therefore, the sum of votes FOR, votes AGAINST, and abstentions (the “NYSE Votes Cast”) must be greater than 50% of the total Outstanding Votes. Further, the number of votes FOR the proposal must be greater than 50% of the NYSE Votes Cast. Therefore, abstentions have the same effect as a vote against the proposal. As described above, brokers do not have discretionary authority to vote shares on the Amended and Restated 2005 Performance Incentive Plan without direction from the beneficial owner. As a result, broker non-votes could impair our ability to satisfy the requirement that the NYSE Votes Cast represent more than 50% of the Outstanding Votes.

| 11. | What other matters may arise at the Annual Meeting? |

Other than the matters described in this Proxy Statement, we do not expect any matters to be presented for a vote at the Annual Meeting. The Chairman of the Annual Meeting may refuse to allow the presentation of a proposal or a nomination for the Board at the Annual Meeting if it is not properly submitted. The requirements for shareholders to properly submit proposals and nominations at the 2009 Annual Meeting were described in our 2008 Proxy Statement. They are similar to those described under the heading “2010 Annual Meeting of Shareholders” in this Proxy Statement.

| 12. | What is the difference between holding shares as a registered shareholder and holding shares in street name? |

If your shares are owned directly in your name with our transfer agent, Wells Fargo Bank, N.A., you are considered a registered shareholder with respect to those shares.

If your shares are held in a brokerage account or by a bank or other nominee, you hold the shares in street name.

| 13. | How do I vote my shares? |

If you are a registered shareholder, you may vote:

| • | Via the Internet atwww.eproxy.com/kft. The Internet voting system will be available 24 hours a day until 12:00 p.m. CDT on Tuesday, May 19, 2009; |

| • | By telephone, if you are located within the U.S. and Canada. Call 1-800-560-1965 (toll-free) from a touch-tone telephone. The telephone voting system will be available 24 hours a day until 12:00 p.m. CDT on Tuesday, May 19, 2009; |

| • | By returning a properly executed proxy card. Your proxy card must be received before the polls close at the Annual Meeting on Wednesday, May 20, 2009; or |

| • | In person at the Annual Meeting. Please pre-register to attend the Annual Meeting by following the pre-registration directions in Question 26. |

If you hold your shares in street name, you may vote:

| • | Via the Internet atwww.proxyvote.com (12-digit control number is required), by telephone, or by returning a properly executed voting instruction form by mail, depending upon the method(s) your broker, bank, or other nominee makes available; or |

| • | In person at the Annual Meeting. To do so, you must request a legal proxy from your broker or bank and present it at the Annual Meeting. Please pre-register to attend the Annual Meeting by following the pre-registration directions in Question 26. |

4

Table of Contents

| 14. | I am a current/former Kraft Foods employee and have investments in the Kraft Foods Stock Fund(s) of the Kraft Foods Inc. Thrift/TIP 401(k) Plans(s) and/or the Kraft Foods Canada Optional Pension Plan(s)/Employee Savings Plan. Can I vote? If so, how do I vote? |

Yes, you are entitled to vote. For voting purposes, your proxy card includes all shares allocated to your Kraft Foods Stock Fund account(s), shares you may hold at our transfer agent as a registered shareholder, and any shares of restricted stock you may hold. When you submit your proxy, you are directing the plan(s) trustee(s) how to vote the shares allocated to your Kraft Foods Stock Fund account(s) in addition to directing the voting of all other shares included on your proxy card.

In order to direct the plan(s) trustee(s) how to vote the shares held in your Kraft Foods Stock Fund account(s), you must vote the shares by 11:59 p.m. CDT on Monday, May 18, 2009. If your voting instructions are not received by that time, the trustee(s) will vote the shares allocated to your account(s) in the same proportion as the respective plan shares for which voting instructions have been received, unless contrary to the Employee Retirement Income Security Act of 1974 (ERISA). Please follow the instructions for registered shareholders under Question 13 to cast your vote. Although you may attend the Annual Meeting, you may not vote shares held in your Kraft Foods Stock Fund account(s) at the meeting.

| 15. | I am a current/former Kraft Foods employee and hold restricted stock. Can I vote my restricted stock holding? If so, how do I vote those shares? |

Yes. If you hold shares of restricted stock, you should follow the instructions for registered shareholders under Question 13 to vote your shares. If you do not vote your shares, they will not be voted. For voting purposes, your proxy card includes your shares of restricted stock, shares you may hold in a Kraft Foods Stock Fund account(s), and any shares you may hold at our transfer agent as a registered shareholder.

| 16. | How do I vote if I participate in Kraft Foods’ Direct Purchase Plan? |

If you hold shares in the Direct Purchase Plan, you should follow the instructions for registered shareholders under Question 13 to vote your shares. When you vote those shares, you will be voting all the shares you hold at our transfer agent as a registered shareholder. If you do not vote your shares, they will not be voted.

| 17. | May I change my vote? |

Yes. If you are a registered shareholder and would like to change your vote after submitting your proxy but prior to the Annual Meeting, you may do so by (a) signing and submitting another proxy with a later date, (b) voting again by telephone or the Internet, or (c) voting at the Annual Meeting. Alternatively, if you would like to revoke your proxy, you may submit a written revocation of your proxy to our Corporate Secretary at Kraft Foods Inc., Three Lakes Drive, Northfield, Illinois 60093.

If your shares are held in street name, contact your bank, broker or other nominee for specific instructions on how to change or revoke your vote. Please refer to Question 13 for additional details about voting.

| 18. | How are my shares voted by the proxies? |

The persons named on the proxy card must vote your shares as you have instructed. If you do not give a specific instruction on any proposal scheduled for vote at the Annual Meeting but you have authorized the proxies generally to vote, they will vote in accordance with the Board’s recommendation on that matter. Your authorization would exist, for example, if you merely sign, date, and return your proxy card.

| 19. | Will my shares be voted if I do not provide my proxy? |

If you are a registered shareholder or if you hold restricted stock, your shares will not be voted unless you vote as instructed in Question 13.

If you hold your shares in street name, under the NYSE rules, your brokerage firm may vote on your behalf on routine matters if you do not furnish voting instructions. For the Annual Meeting, the election of directors (Item 1) and the ratification of the selection of independent auditors (Item 3) are considered routine matters. However, the approval of the

5

Table of Contents

Amended and Restated 2005 Performance Incentive Plan (Item 2) and the shareholder proposal (Item 4) are not considered routine matters. As a result, if you hold shares of our common stock in street name and do not provide voting instructions to your broker, your shares will not be voted on Items 2 and 4.

In addition, if you are a current or former employee and had investments in the Kraft Foods Stock Fund(s) of the Kraft Foods Inc. Thrift/TIP 401(k) Plan(s) and/or the Kraft Foods Canada OPP/ESP on the Record Date, you can direct the plan(s) trustee(s) how to vote the shares allocated to your account(s). If your instructions are not received by 11:59 p.m. CDT on Monday, May 18, 2009, the trustee(s) will vote the shares allocated to your account(s) in the same proportion as the respective plan shares for which instructions have been received. Please refer to Question 14 for additional details about voting shares held in the Kraft Foods Stock Fund(s).

| 20. | Is it safe to vote via the Internet or telephone? |

Yes. The Internet and telephone voting procedures were designed to authenticate shareholders’ identities and to confirm that their instructions have been properly recorded.

| 21. | Who will bear the cost of soliciting votes for the Annual Meeting? |

We bear the cost of soliciting your vote. In addition to mailing these proxy materials, our directors, officers, or employees may solicit proxies or votes in person, by telephone, or by electronic communication. They will not receive any additional compensation for these solicitation activities.

We will enlist the help of banks and brokerage firms in soliciting proxies from their customers and reimburse the banks and brokerage firms for related out-of-pocket expenses.

We retained Georgeson Shareholder Communications Inc. to aid in soliciting votes for the Annual Meeting for a total fee of $17,500 plus reasonable expenses.

| 22. | What is “Householding”? |

Unless you advised otherwise, if you hold your shares in street name and you and other residents at your mailing address share the same last name and own shares of our common stock in an account at the same brokerage firm or bank, we delivered a single Notice or set of proxy materials to your address. This method of delivery is known as householding. Householding reduces the number of mailings you receive, as well as our printing and postage costs. Shareholders who participate in householding will continue to receive separate voting instruction forms. If you would like to opt out of this practice, please contact your broker or bank.

If you are a registered shareholder, we sent you and each registered shareholder at your address separate Notices or sets of proxy materials.

| 23. | Are my votes confidential? |

Yes. Your votes will not be disclosed to our directors, officers, or employees, except (a) as necessary to meet applicable legal requirements and to assert or defend claims for or against us, (b) in the case of a contested proxy solicitation, (c) if you provide a comment with your proxy or otherwise communicate your vote to us, or (d) as necessary to allow the independent inspector of election to certify the results.

| 24. | Who counts the vote? |

Wells Fargo Bank, N.A. will receive and tabulate the proxies. IVS Associates, Inc. will act as the independent inspector of election and will certify the results.

| 25. | How do I find out the voting results? |

We will announce preliminary voting results at the Annual Meeting. We will disclose the final voting results in our second quarter Form 10-Q to be filed with the SEC on or before August 10, 2009. The Form 10-Q will be available atwww.kraftfoodscompany.com/investor.

6

Table of Contents

| 26. | What do I need to do if I would like to attend the Annual Meeting? |

If you would like to attend the Annual Meeting, please pre-register by 11:59 p.m. CDT on Sunday, May 17, 2009. Due to space limitations, you may bring only one guest. If you wish to bring a guest, you must indicate that when you pre-register.You and your guest, if any, must present valid government-issued photographic identification, such as a driver’s license, to be admitted into the Annual Meeting.

If you are a registered shareholder, please indicate that you intend to attend the Annual Meeting by:

| • | Checking the appropriate box(es) on the Internet voting site; |

| • | Following the prompts on the telephone voting site; or |

| • | Checking the appropriate box(es) on your proxy card. |

If you hold your shares in street name, please notify us in writing that you will attend and whether you intend to bring a guest. In this written notification, please include a proof of ownership of our common stock (such as a letter from your bank or broker, a photocopy of your current account statement, or a copy of your voting instruction form); please also provide a way for us to reach you if there is a problem with your notification. Send your notification by mail, fax, or e-mail to:

Mail: | Fax: | |||

Kraft Foods Inc. | (877) 260-0406 (toll-free within the U.S.) | ccinek@georgeson.com | ||

c/o Georgeson Inc. | (212) 440-9009 (from outside the U.S.) | |||

Attention: Christopher Cinek | Attention: Christopher Cinek | |||

199 Water Street, 26th Floor | ||||

New York, NY 10038 |

For your comfort, security, and safety, we will not allow any large bags, briefcases, packages, or backpacks into the Annual Meeting site. All bags will be subject to search. We also will not allow electronic devices into the Annual Meeting. These include, but are not limited to, cellular and digital phones, cameras, audio and video recorders, laptops, and pagers. We welcome assistance animals for the disabled, but do not allow pets.

| 27. | May I ask questions at the Annual Meeting? |

Yes. Shareholders may ask questions and make remarks related to the matters being voted on as those matters are presented. The Chairman will entertain shareholders’ questions and comments of a more general nature following the voting.

7

Table of Contents

Corporate Governance Guidelines

Our corporate governance practices are firmly grounded in our belief that governance best practices are critical to our goal of driving sustained shareholder value. The Board adopted written Corporate Governance Guidelines (the “Guidelines”) that articulate our corporate governance philosophy, practices, and policies.

Code of Business Conduct and Ethics for Directors and Code of Conduct for Compliance and Integrity

We have a Code of Business Conduct and Ethics for Directors (the “Ethics Code”). It focuses on areas of ethical risk, guides directors in recognizing and handling ethical issues, provides mechanisms to report unethical conduct, and fosters a culture of honesty and integrity.

We also have a Code of Conduct that applies to all of our employees. It was updated in March 2009. The Code of Conduct contains important rules our employees must follow in conducting business. The Code of Conduct reflects our company’s values. We strive to speak truthfully, to honor our commitments, and to treat people fairly. We believe we must earn and keep the trust of our consumers, business partners, employees, shareholders, and those who live in the communities where we operate. By complying with the Code of Conduct, we believe we will enhance not only our integrity, but also our financial performance.

We will disclose on our Web site atwww.kraftfoodscompany.com any amendments to our Ethics Code or Code of Conduct and any waiver granted to an executive officer or director under these codes.

Corporate Governance Materials Available atwww.kraftfoodscompany.com/investorand from our Corporate Secretary

Shareholders and others can access our corporate governance materials, including our Articles of Incorporation, our By-Laws, the Guidelines, Board committee charters, the Ethics Code and Code of Conduct, and other related corporate governance materials on our Web site atwww.kraftfoodscompany.com/investor. We will also provide copies of these materials free of charge to any shareholder who sends a written request to our Corporate Secretary at Kraft Foods Inc., Three Lakes Drive, Northfield, Illinois 60093.

The information on our Web site is not, and shall not be deemed to be, a part of this Proxy Statement or incorporated into any of our other filings with the SEC.

The Guidelines require that at least 75% of the directors on our Board meet the NYSE’s listing standards’ “independence” requirements. For a director to be considered independent, the Board must affirmatively determine, after reviewing all relevant information, that a director has no direct or indirect material relationship with Kraft Foods. To assist in this determination, the Board adopted categorical standards of director independence, which conform to the independence criteria specified by the NYSE. These standards are listed in the Guidelines and are attached to this Proxy Statement as Exhibit A. These standards specify the criteria by which the Board determines the independence of our directors, including whether a director or a member of the director’s immediate family has any current or past employment or affiliation with Kraft Foods or our independent registered public accountants.

After considering these categorical standards and the NYSE’s listing standards, the Board determined that Ajay Banga, Myra M. Hart, Lois D. Juliber, Mark D. Ketchum, Richard A. Lerner, M.D., John C. Pope, Fredric G. Reynolds, Deborah C. Wright, and Frank G. Zarb are independent. Irene B. Rosenfeld is not considered an independent director because she is an executive officer of Kraft Foods. The Board also determined that Jan Bennink, who is not standing for re-election, is independent and Mary L. Schapiro, a former director, was independent during the time that she served as a director.

In evaluating and determining the independence of the non-management directors, the Board considered that Mr. Banga is Citigroup Inc.’s Chief Executive Officer, Asia Pacific. We purchase banking services from Citigroup Inc. in the ordinary course of business. Also, from time to time, we engage investment banks, including Citigroup Inc., to provide financial advisory services. The Board also considered Mr. Reynolds’ position as Executive Vice President and Chief Financial Officer of CBS Corporation, a television broadcast company from which we purchase advertising in the ordinary course of business.

8

Table of Contents

Executive Sessions of the Board

The Board’s Lead Director, Mark D. Ketchum, presides over executive sessions of the non-management directors. These sessions are typically held at each regular Board meeting. The Lead Director also presides over any Board meeting at which the Chairman is not present. The Lead Director has other authority and responsibilities. They are described in the Guidelines.

Mary L. Schapiro served as Lead Director during 2008 and until her resignation, effective January 15, 2009.

We expect directors to attend all Board meetings, the Annual Meeting, and all meetings of the committees on which they serve. But, we understand that occasionally a director may be unable to attend a meeting. The Board held nine meetings in 2008 and acted by unanimous consent one time. All nominees who were serving as directors at the time of the 2008 Annual Meeting of Shareholders attended that meeting, except for Fredric G. Reynolds and Frank G. Zarb, who could not attend because of previous business commitments. All individuals who served as directors in 2008 attended at least 75% of the aggregate number of meetings of the Board and all committees on which they served except Jan Bennink. He was absent for good cause and with the Board’s concurrence and is not standing for re-election.

Shareholders and other interested parties can communicate with the Lead Director, the Board, or non-management directors, individually or as a group, by writing to them at:

Board of Directors (or specific director)

c/o Corporate Secretary

Kraft Foods Inc.

Three Lakes Drive

Northfield, Illinois 60093

Shareholders and other interested parties may also communicate with one or more members of the Board by sending an e-mail toKraft-Board@kraft.com.

The Corporate Secretary forwards communications relating to matters within the Board’s purview to the independent directors; communications relating to matters within a Board committee’s area of responsibility to the chair of the appropriate committee; and communications relating to ordinary business matters, such as suggestions, inquiries and consumer complaints, to the appropriate Kraft Foods executive or employee. The Corporate Secretary does not forward solicitations, junk mail, and obviously frivolous or inappropriate communications, but makes them available to any independent director who requests them.

Our Board designates the members and chairs of committees based on the Nominating and Governance Committee’s recommendations. Until December 2008, the Board had four standing committees: Audit, Compensation, Nominating and Governance, and Public Affairs. During this period, committee membership was:

2008 Committee Membership

Name | Audit | Compensation | Nominating and Governance | Public Affairs | ||||

Ajay Banga | - | Chair | X | - | ||||

Jan Bennink | X | - | - | X | ||||

Myra M. Hart | - | X | X | - | ||||

Lois D. Juliber | - | X | - | X | ||||

Mark D. Ketchum | - | X | X | - | ||||

Richard A. Lerner, M.D. | - | - | X | X | ||||

John C. Pope | Chair | - | X | - | ||||

Fredric G. Reynolds | X | - | - | X | ||||

Mary L. Schapiro | X | - | Chair | - | ||||

Deborah C. Wright | - | X | - | Chair | ||||

Frank G. Zarb | X | - | - | X | ||||

Number of Meetings in 2008 | 12 | 6 | 7 | 5 | ||||

9

Table of Contents

In December 2008, the Board established the Finance Committee. At that time, Mr. Pope rotated from the Nominating and Governance Committee to serve on the Finance Committee; Mr. Reynolds rotated from the Public Affairs Committee to serve on the Finance Committee; and Mr. Zarb serves as Chair of the Finance Committee. The Finance Committee met once during December 2008.

Current committee membership is:

2009 Committee Membership

Name | Audit | Finance | Human Resources and Compensation(1) | Nominating and Governance | Public Affairs | |||||

Ajay Banga | - | - | Chair | X | - | |||||

Jan Bennink | X | - | - | - | X | |||||

Myra M. Hart | - | - | X | Chair | - | |||||

Lois D. Juliber | - | - | X | - | X | |||||

Mark D. Ketchum | - | - | X | X | - | |||||

Richard A. Lerner, M.D. | - | - | - | X | X | |||||

John C. Pope | Chair | X | - | - | - | |||||

Fredric G. Reynolds | X | X | - | - | - | |||||

Deborah C. Wright | - | - | X | - | Chair | |||||

Frank G. Zarb | X | Chair | - | - | X |

| (1) | In January 2009, the committee changed its name from the “Compensation Committee” to the “Human Resources and Compensation Committee” to better reflect its full-range of responsibilities. |

The Board adopted a written charter for each committee. The charters define each committee’s roles and responsibilities. All committee charters are available atwww.kraftfoodscompany.com/investor. We will provide copies of these charters free of charge to any shareholder who sends a written request to the Corporate Secretary at Kraft Foods Inc., Three Lakes Drive, Northfield, Illinois 60093.

PUBLIC AFFAIRS COMMITTEE MATTERS

The Public Affairs Committee was established effective February 2008. The committee is responsible for discharging the Board’s responsibilities relating to public policy issues. In carrying out its duties, the Public Affairs Committee:

| • | monitors public policy and social trends affecting us; |

| • | monitors issues and practices relating to our social accountability; |

| • | periodically examines our business practices that are of special interest to policy-makers and the public at large; |

| • | monitors programs and activities aimed at enhancing our global communication, media relations, and community relations; |

| • | monitors programs and activities related to emergency preparedness and business continuity planning; |

| • | reviews the impact of business operations and business practices on communities where we do business; |

| • | monitors our corporate citizenship programs and activities, including charitable contributions; and |

| • | reviews and makes recommendations to the Board regarding shareholder proposals related to public issues. |

The Finance Committee was established effective December 2008. The Finance Committee is responsible for considering and making recommendations to the Board on the management of our financial resources and transactions. The Finance Committee reviews and makes recommendations to the Board on financial matters, including:

| • | our annual and long-term financing plans, including our projected financial structure and funding requirements, capital expenditures, and share repurchases; |

10

Table of Contents

| • | issuances of equity and debt securities and other financing transactions; |

| • | our external dividend policy and dividend recommendations; |

| • | proposed major investments, restructurings, joint ventures, significant asset sales or purchases, acquisitions, divestitures, and other significant business opportunities; and |

| • | financial risk management activities, such as foreign exchange, commodities, interest rate exposure, insurance programs, and terms of customer financing. |

NOMINATING AND GOVERNANCE COMMITTEE MATTERS

The Board determined that all of the Nominating and Governance Committee members are independent within the meaning of the NYSE’s listing standards. The Nominating and Governance Committee’s responsibilities include, among other duties:

| • | identifying qualified individuals to become Board members consistent with criteria approved by the Board; |

| • | considering the performance and suitability of incumbent directors in determining whether to nominate them for re-election; |

| • | recommending to the Board its determinations of director independence; |

| • | recommending to the Board the appropriate size, function, needs, and composition of the Board and its committees; |

| • | recommending to the Board directors to serve as members of each committee; |

| • | monitoring compliance by directors with our stock ownership guidelines; |

| • | reviewing and evaluating opportunities for Board members to engage in continuing education; and |

| • | advising the Board on corporate governance matters, including developing and recommending to the Board our corporate governance guidelines. |

Process for Nominating Directors

The Nominating and Governance Committee is responsible for identifying and evaluating nominees for director and recommending to the Board nominees for election at the Annual Meeting of Shareholders. The committee relies on nominee suggestions from the directors, shareholders, management, and others. From time to time, the committee retains executive search and board advisory consulting firms to assist in identifying and evaluating potential nominees. During 2008, the committee retained Heidrick & Struggles for this purpose.

In evaluating potential nominees for Board membership, the Nominating and Governance Committee may consider many factors, including whether the individual meets the Board’s requirements for independence, the individual’s understanding of our global businesses and markets, the individual’s professional expertise and educational background, and other factors that promote diversity of views and experience. The committee evaluates each individual in the context of the Board as a whole, with the objective of recommending for nomination a group of directors that can best perpetuate our success and represent shareholder interests. In determining whether to recommend a director for re-election, the Nominating and Governance Committee also considers the director’s past attendance at meetings and participation in and contributions to Board and committee activities. In evaluating potential nominees, the committee may identify certain skills or attributes (e.g., financial experience, global business experience) as being particularly desirable to help meet specific Board needs.

The Nominating and Governance Committee will consider any candidate suggested for election to the Board who is properly presented by a shareholder. The committee evaluates candidates suggested by shareholders and then will make a recommendation to the Board using the same criteria described above. After the Board’s full consideration of a shareholder’s suggestion for election to the Board, the Corporate Secretary will notify that shareholder of the Board’s conclusion. For a description of how shareholders may nominate a candidate for election to the Board, see “2010 Annual Meeting of Shareholders” in this Proxy Statement.

11

Table of Contents

The Board currently consists of 11 directors, each subject to annual election. Shareholders elected all of the current directors at the 2008 Annual Meeting. All current directors, except for Jan Bennink, are standing for re-election. On March 12, 2009, the Board amended our By-Laws to set the size of our Board at ten directors, effective with the Annual Meeting or any adjournments or postponements of the meeting.

The Nominating and Governance Committee recommended to the Board, and the Board approved, the nomination of these ten director nominees, each for a term ending at the 2010 Annual Meeting of Shareholders or until his or her successor has been duly chosen and qualified:

| • | Ajay Banga |

| • | Myra M. Hart |

| • | Lois D. Juliber |

| • | Mark D. Ketchum |

| • | Richard A. Lerner, M.D. |

| • | John C. Pope |

| • | Fredric G. Reynolds |

| • | Irene B. Rosenfeld |

| • | Deborah C. Wright |

| • | Frank G. Zarb |

If the enclosed proxy card is properly executed and timely received, the persons named in the proxy card intend to vote the shares represented FOR or AGAINST the persons nominated for election as directors or ABSTAIN from voting, as instructed. If a nominee should become unavailable to serve as a director, an event that we do not anticipate occurring, the persons named in the proxy card will vote the shares for the person whom the Board may designate to replace that nominee. In lieu of naming a substitute, the Board may amend our By-Laws to reduce the number of directors.

On November 7, 2007, we entered into an agreement with one of our shareholders, Trian Fund Management, L.P., certain funds managed by it, and certain of its affiliates (collectively, “Trian”). In the agreement, we confirmed the Board’s intention to appoint Ms. Juliber and Mr. Zarb as directors, and to include each of them as nominees at our 2008 and 2009 Annual Meetings. Trian confirmed, among other matters, that they would support the Board’s full list of nominees at our 2008 and 2009 Annual Meetings, and agreed to a standstill agreement with us. A copy of the agreement with Trian was included in our Current Report on Form 8-K that we filed with the SEC on November 7, 2007.

None of the nominees is related to another or to any executive officer of Kraft Foods by blood, marriage, or adoption.

The following is information regarding each nominee as of March 29, 2009:

| Ajay Banga

Chief Executive Officer, Asia Pacific, Citigroup Inc.

Director since January 2007

Age: 49 | Since March 2008, Mr. Banga has been Chief Executive Officer of Citigroup’s Asia Pacific region. Citigroup is a global financial services company. Mr. Banga previously served as Chairman and Chief Executive Officer of Citigroup’s Global Consumer Group–International, Executive Vice President of Citigroup’s Global Consumer Group, and President of Citigroup’s Retail Banking North America. Since joining Citigroup in 1996, Mr. Banga has worked as business head for CitiFinancial and the U.S. Consumer Assets Division and as division executive for the consumer bank in Central/Eastern Europe, Middle East, Africa, and India. Mr. Banga is on the Board of Trustees of the Asia Society. | ||

| Myra M. Hart

Professor, Harvard Business School (Retired)

Director since December 2007

Age: 68 | Dr. Hart joined the Harvard Business School in 1995 and has recently retired to its senior faculty. From 1985 until 1990, Dr. Hart served on the founding team of Staples, Inc., an office supply retail store chain, leading operations, strategic planning, and growth implementation in new and existing markets. She serves on the boards of Office Depot Inc., Nina McLemore Inc., and Summer Infant, Inc. Dr. Hart is a director of the Center for Women’s Business Research and a Trustee of Babson College. She is also a Trustee Emeritus of Cornell University. | ||

12

Table of Contents

| Lois D. Juliber

Former Vice Chairman and Chief Operating Officer, Colgate- Palmolive Company

Director since November 2007

Age: 60 | Ms. Juliber served as a Vice Chairman of the Colgate-Palmolive Company, a global consumer products company, from July 2004 until April 2005. She served as Colgate-Palmolive’s Chief Operating Officer from March 2000 to July 2004, Executive Vice President–North America and Europe from 1997 until March 2000, and President of Colgate North America from 1994 to 1997. Ms. Juliber serves on the boards of Goldman Sachs Group Inc. and E.I. du Pont De Nemours and Company. She is Chairman of the MasterCard Foundation. Ms. Juliber is a Trustee of Wellesley College and a director of Women’s World Banking. | ||

| Mark D. Ketchum

President and Chief Executive Officer, Newell Rubbermaid Inc.

Director since April 2007

Age: 59 | Mr. Ketchum has been President and Chief Executive Officer of Newell Rubbermaid Inc., a global marketer of consumer and commercial products, since October 2005. From 1999 to 2004, Mr. Ketchum was President, Global Baby and Family Care of The Procter & Gamble Company, a global marketer of consumer products. Mr. Ketchum joined Procter & Gamble in 1971, and thereafter served in a variety of roles, including Vice President and General Manager–Tissue/Towel from 1990 to 1996 and President–North American Paper Sector from 1996 to 1999. | ||

| Richard A. Lerner, M.D.

President, The Scripps Research Institute

Director since January 2005

Age: 70 | Dr. Lerner has been President of The Scripps Research Institute, a private, non-profit biomedical research organization, since 1986. He serves on the boards of Opko Health, Inc.; Sequenom, Inc.; Xencor, Inc.; and Intra-Cellular Therapies, Inc. Dr. Lerner is a member of numerous scientific associations, including the National Academy of Science and the Royal Swedish Academy of Sciences. | ||

| John C. Pope

Chairman, PFI Group, LLC

Director since July 2001

Age: 59 | Mr. Pope has served as Chairman of PFI Group, LLC, a financial management firm that invests primarily in private equity opportunities, since July 1994. From December 1995 to November 1999, Mr. Pope was Chairman of the Board of MotivePower Industries, Inc., a NYSE-listed manufacturer and remanufacturer of locomotives and locomotive components. Prior to joining MotivePower Industries, Inc., Mr. Pope served in various capacities with United Airlines and its parent, UAL Corporation, including as a Director, Vice Chairman, President, Chief Operating Officer, Chief Financial Officer, and Executive Vice President, Marketing and Finance. He serves on the boards of Con-way, Inc.; Dollar Thrifty Automotive Group, Inc.; R.R. Donnelley and Sons Co.; and Waste Management, Inc. where he is also non-executive Chairman of the Board. | ||

| Fredric G. Reynolds

Executive Vice President and Chief Financial Officer, CBS Corporation

Director since December 2007

Age: 58 | Mr. Reynolds has served as Executive Vice President and Chief Financial Officer of CBS Corporation, a mass media company, since January 2006. From 2001 until assuming his current position, Mr. Reynolds served as President and Chief Executive Officer of Viacom Television Stations Group and Executive Vice President and Chief Financial Officer of the businesses that comprised Viacom Inc. Mr. Reynolds is a certified public accountant and a Trustee of the University of Miami. | ||

13

Table of Contents

| Irene B. Rosenfeld

Chairman and Chief Executive Officer, Kraft Foods Inc.

Director since June 2006

Age: 55 | Ms. Rosenfeld was appointed Chief Executive Officer of Kraft Foods in June 2006 and Chairman of the Board in March 2007. Prior to that, she had been Chairman and Chief Executive Officer of Frito-Lay, a division of PepsiCo, Inc., a food and beverage company, from September 2004 to June 2006. Previously, Ms. Rosenfeld had been employed continuously by Kraft Foods and its predecessor, General Foods Corporation, in various capacities from 1981 until 2003, including President of Kraft Foods North America and, before that, President of Operations, Technology, Information Systems and Kraft Foods Canada, Mexico and Puerto Rico. Ms. Rosenfeld is a Trustee of Cornell University. | ||

| Deborah C. Wright

Chairman, President and Chief Executive Officer, Carver Bancorp, Inc.

Director since July 2001

Age: 51 | Ms. Wright has been President and Chief Executive Officer of Carver Bancorp, Inc., the holding company for Carver Federal Savings Bank, a federally chartered savings bank, since 1999. She was elected Chairman in 2005. Previously, she served as President and Chief Executive Officer of the Upper Manhattan Empowerment Zone Development Corporation from 1996 to 1999. She serves on the board of Time Warner Inc. Ms. Wright also is a member of the Board of Managers of Memorial Sloan-Kettering Cancer Center, and she serves on the boards of the Partnership for New York City, the Children’s Defense Fund, and The Sesame Workshop. | ||

| Frank G. Zarb

Managing Director, Hellman & Friedman LLC

Director since November 2007

Age: 74 | Mr. Zarb has been a Managing Director of Hellman & Friedman LLC, a private equity firm, since 2002. He is non-executive Chairman of Promontory Financial Group, LLC. Previously, he served as Chairman and Chief Executive Officer of NASD and The Nasdaq Stock Market, Inc. from 1997 to 2001. Mr. Zarb is a Trustee of Hofstra University. | ||

The Board recommends a vote FOR the election of each of the nominees.

14

Table of Contents

ITEM 2. APPROVAL OF THE AMENDED AND RESTATED

2005 PERFORMANCE INCENTIVE PLAN

The Human Resources and Compensation Committee (the “Compensation Committee”) of our Board is responsible for assessing our equity compensation policies. As more specifically discussed under “Compensation Discussion and Analysis” in this Proxy Statement, the Compensation Committee believes that equity-based awards should be a significant part of our long-term compensation program, which is designed to drive top-tier performance, align our management’s interests with shareholders’ interests, and underscore our commitment to shareholders while rewarding performance. In March 2009, as part of the Compensation Committee’s ongoing evaluation of our compensation program, the committee reviewed the Kraft Foods Inc. 2005 Performance Incentive Plan. The plan was originally approved by our shareholders on April 26, 2005 and was amended twice by the Board to incorporate certain technical changes (related to the change in control provisions and compliance with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”)) into the plan as currently in effect (the “Current Plan”). Following its review of the Current Plan, the Compensation Committee recommended amending the plan to include several additional terms and limitations that it believes are consistent with the long-term interests of our shareholders. On March 12, 2009, upon recommendation of the Compensation Committee, our Board approved the Kraft Foods Inc. Amended and Restated 2005 Performance Incentive Plan, as amended and restated as of May 20, 2009 (the “Amended Plan”), subject to the approval of our shareholders. A copy of the Amended Plan is attached as Exhibit B to this Proxy Statement. If approved by shareholders, the Amended Plan will update and supersede the Current Plan.

The Amended Plan includes a number of specific terms and limitations that the Board believes reflect our pay-for-performance philosophy and are consistent with the long-term interests of our shareholders and sound corporate governance practices. These include:

| • | No evergreen provision. The Amended Plan provides for a fixed reserve of shares of our common stock and does not provide for any annual increase of available shares. |

| • | Conservative share-counting provisions. The Amended Plan provides that upon exercise of stock-settled stock appreciation rights (“SARs”) and similar awards based on Spread Value (as defined below), the full number of shares of our common stock with respect to which the award is measured is deemed distributed for purposes of determining the number of shares of our common stock remaining available for issuance under the plan. The Amended Plan also prohibits shares tendered to pay the exercise price of an award or shares withheld for payment of taxes to be added back to the number of shares remaining available for issuance under the plan. |

| • | Limits on dividends and dividend equivalents. The Amended Plan prohibits the issuance of dividends and dividend equivalents on stock options and SARs. In addition, the Amended Plan prohibits the current payment of dividend equivalents on performance shares in which any applicable performance objectives have not been achieved. |

| • | Limited terms. The Amended Plan sets the maximum term for options and SARs at ten years. The Amended Plan will terminate in 2019. |

| • | No stock option repricings. The Amended Plan expressly prohibits the repricing of stock options and SARs without the approval of shareholders. |

| • | Vesting restrictions. The Amended Plan contains minimum vesting periods for awards based upon performance objectives and, subject to certain exceptions, awards conditioned on continued employment or the passage of time. |

| • | No discounted stock options or SARs. The Amended Plan requires the exercise price of stock options and SARs to be not less than the fair market value of our common stock on the date of grant. |

| • | Change in control definition limited. The Amended Plan contains a change in control definition that triggers payments to executives only when an actual change in control occurs. Awards vest upon a change in control and only if an acquiring company does not assume the awards or if employment is terminated (“double trigger”). |

Under the Current Plan, our prior employee stock plan, and current and prior director stock plans, as of March 12, 2009, we had a total of 69,526,353 shares subject to outstanding awards, consisting of a total of 54,119,664 options with a weighted average exercise price of $24.43 and weighted average remaining contractual term of 5.94 years, and 15,406,689 shares subject to full-value awards. As of that date, we also had 73,699,882 shares available for future awards under the Current Plan and 416,998

15

Table of Contents

shares available for future awards under our 2006 Stock Compensation Plan for Non-Employee Directors. Under the Amended Plan, the number of shares of our common stock available for issuance under the plan would be increased by 18,000,000 shares. Therefore, if approved by shareholders, as of March 12, 2009, we would have had 91,699,882 shares available for future awards under the Amended Plan, of which no more than 30%, or 27,509,964 shares, may be granted as full-value awards. See “Shares Reserved for Awards.”

The Amended Plan is being submitted for approval by shareholders in accordance with the NYSE listing requirements and, among other reasons, to ensure that certain awards granted under the Amended Plan may qualify as “performance-based compensation” under Section 162(m) of the Code. We believe the Amended Plan will enable us to continue to provide a clear link to financial performance and total shareholder value, while allowing us the flexibility to meet future needs, in order to continue to provide incentives that motivate superior performance by participants, provide participants with an ownership interest in Kraft Foods, and attract and retain the services of outstanding employees.

The following is a summary of the material terms of the Amended Plan. This summary is not intended to be a complete description of all of the Amended Plan’s provisions, and is qualified in its entirety by the full text of the Amended Plan, which is attached as Exhibit B to this Proxy Statement.

Eligibility and Limits on Awards. Our salaried employees who are responsible for or contribute to our management, growth, and profitability will be eligible to receive awards under the Amended Plan. Approximately 3,000 employees, including the current 12 executive officers, could be eligible to participate in the Amended Plan. The Compensation Committee has not made a determination as to which of these employees will receive awards under the Amended Plan.

The Amended Plan limits the amount of awards granted to a single employee as follows:

| • | the total number of shares of common stock subject to stock options and SARs awarded during a calendar year may not exceed 3,000,000 shares; |

| • | awards of restricted stock, restricted or deferred stock units, or other stock-based awards not based on Spread Value (as defined below) may not exceed 1,000,000 shares in a calendar year; |

| • | the value of an employee’s annual incentive award, taking into account the cash and the fair market value of any common stock payable with respect to the award, may not exceed $10,000,000 with respect to any performance cycle; and |

| • | individual long-term incentive awards are limited to 400,000 shares multiplied by the number of years in the performance cycle and, in the case of awards expressed in currency, $8,000,000 multiplied by the number of years in the performance cycle, with respect to any performance cycle. |

Administration. The Compensation Committee or a subcommittee thereof will administer the Amended Plan. The Compensation Committee will select the eligible employees to receive awards and set the terms of the awards, including any performance goals applicable to annual and long-term incentive awards. The Compensation Committee has the authority to permit or require the deferral of payment of awards. The Compensation Committee may delegate its authority under the Amended Plan to officers of Kraft Foods, subject to its guidelines, with respect to awards to be granted to employees who are not subject to either Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or Section 162(m) of the Code.

Shares Reserved for Awards. The number of shares of our common stock reserved and available for awards under the Amended Plan will be 168,000,000, which consists of 150,000,000 shares that were approved in 2005 and 18,000,000 shares that will be added under the Amended Plan. Under the Current Plan, as of March 12, 2009, the number of shares subject to outstanding awards was 59,018,287 and number of shares available for future awards was 73,699,882.

If any award under the Amended Plan is exercised or cashed out, terminates or expires, or is forfeited, without payment being made in the form of common stock, the shares subject to the award that were not so paid, if any, will again be available for distribution under the Amended Plan. If a SAR or similar award based on the Spread Value of shares of common stock is exercised, the full number of shares of common stock with respect to which the award is measured will be considered

16

Table of Contents

distributed for purposes of determining the number of shares remaining available under the Amended Plan. Similarly, any shares of common stock that are used by an employee to pay withholding taxes or as payment for the exercise price of an award will be considered distributed for purposes of determining the number of shares remaining available for issuance under the Amended Plan. Following approval of the Amended Plan, no more than 27,509,964 of the shares issuable under the Amended Plan may be awarded as restricted stock, restricted stock units, deferred stock units or pursuant to incentive awards or other stock-based awards (as described below and excluding from this limitation awards the value of which is based solely on Spread Value). Awards granted prior to the effective date of the Amended Plan will not count towards this limit.

In the event of any transaction or event that affects our common stock, including but not limited to a merger, share exchange, reorganization, consolidation, recapitalization, reclassification, distribution, stock dividend, stock split, reverse stock split, split-up, spin-off, or issuance of rights or warrants, the Compensation Committee will make adjustments or substitutions with respect to the Amended Plan or our prior stock plan, the 2001 Performance Incentive Plan (the “2001 Plan”), and awards granted thereunder. The permitted adjustments are only those the Compensation Committee determines are appropriate to reflect the occurrence of the transaction or event, including but not limited to adjustments in the number and kind of securities reserved for issuance; in the award limits on individual awards; in the performance goals or performance cycles of any outstanding awards; and to the number and kind of securities subject to outstanding awards; and, if applicable, to the grant amounts, exercise prices or Spread Value of the awards. The Compensation Committee also may make awards in substitution of awards held by individuals who are, previously were, or become employees of Kraft Foods in connection with the transaction. Notwithstanding the generally applicable provisions of the Amended Plan, a substituted award may be on such terms as the Compensation Committee deems appropriate.

In connection with events described in the previous paragraph, the Compensation Committee is authorized, with respect to the 2001 Plan and the Amended Plan to:

| • | grant awards (including stock options, SARs, and other stock-based awards) with a grant price that is less than fair market value on the date of grant in order to preserve an existing gain under any similar type of award previously granted by Kraft Foods or another entity to the extent that the existing gain would otherwise be diminished without payment of adequate compensation to the holder of the award for such diminution; |

| • | cancel or adjust the terms of an outstanding award (except as otherwise provided under an award agreement), if appropriate to reflect a substitution of an award of equivalent value granted by another entity; |

| • | make certain adjustments in connection with a spin-off or similar transaction, including (1) imposing restrictions on a distribution with respect to restricted stock or similar awards and (2) substituting comparable stock options to purchase the stock of another entity or substituting comparable SARs, restricted stock units, deferred stock units, or other stock-based awards denominated in the stock of another entity (in which case such stock of another entity will be treated in the same manner as common stock under the Amended Plan), which may be settled in cash, our common stock, stock of another entity or other securities or property, as determined by the Compensation Committee; and |

| • | provide for payment of outstanding awards in cash (including cash in lieu of fractional awards), provided that any payment is exempt from or complies with Section 409A of the Code. |

Any adjustments, substitutions, or other actions described above that are made or taken in connection with corporate transactions or events described above and that affect outstanding awards previously granted under the 2001 Plan shall be deemed made pursuant to the 2001 Plan and from shares of common stock reserved under the 2001 Plan rather than from those available for awards under the Amended Plan.

Annual and Long-Term Incentive Awards. Annual and long-term incentive awards may be granted under the Amended Plan. These awards will be earned only if corporate, business unit or individual performance objectives over the performance cycles established by or under the direction of the Compensation Committee are met. For a discussion of performance objectives, see “Performance Objectives” below. Incentive awards may be paid in the form of cash, shares of common stock, or in any combination thereof, as determined by the Compensation Committee.

Stock Options. The Amended Plan permits the granting to eligible employees of incentive stock options (“ISOs”), which qualify for special tax treatment, and non-qualified stock options. The exercise price for any stock option will not be less than the fair market value of our common stock on the date of grant. No stock option may be exercised more than ten years after the grant date. Unless otherwise determined by the Compensation Committee, payment of the exercise price may be made in the form of

17

Table of Contents

our common stock already owned by the employee, provided that the shares were not acquired by the employee within six months following the exercise of a stock option or SAR, within six months after the vesting of restricted stock, or within six months after the receipt of common stock from Kraft Foods, whether in settlement of any award or otherwise.

SARs.SARs may be granted either singly or in combination with underlying stock options. SARs entitle the holder upon exercise to receive an amount in any combination of cash or shares of common stock (as determined by the Compensation Committee) equal in value to the excess of the fair market value of the shares covered by such right over the grant price (“Spread Value”). The grant price for SARs will not be less than the fair market value of our common stock on the date of grant. No SARs may be exercised more than ten years after the grant date.

Restricted Stock. Shares of restricted common stock may also be awarded. The restricted stock will vest and become transferable upon the satisfaction of conditions set forth in the applicable restricted stock award agreement. Restricted stock awards may be forfeited if, for example, the recipient’s employment terminates before the award vests. Except as specified in the applicable restricted stock award agreement, while the holder of a restricted stock award may not sell, assign, transfer, pledge, or otherwise encumber the shares during the restricted period, he or she will have all other rights of a holder of common stock on his or her restricted shares.

Restricted Stock Units and Deferred Stock Units. Restricted stock units and deferred stock units may be granted under the Amended Plan. Restricted stock units and deferred stock units represent the right to receive shares of common stock, cash, or a combination of both, upon satisfaction of conditions set forth in the applicable award agreement. Restricted and deferred stock unit awards may be forfeited if, for example, the recipient’s employment terminates before the award vests. Except as specified in the applicable award agreement, the recipient may not sell, assign, transfer, pledge, or otherwise encumber the shares during the restricted period and will have none of the rights of a holder of common stock unless and until shares of common stock are actually delivered in satisfaction of the restrictions and other conditions of such units.

Other Stock-Based Awards.The Amended Plan also provides for awards that are denominated in, valued by reference to, or otherwise based on or related to, our common stock. These awards may include, without limitation, performance shares that entitle the recipient to receive, upon satisfaction of performance goals or other conditions, a specified number of shares of our common stock or the cash equivalent thereof. When the value of such stock-based award is based on the difference between the fair market value of the shares covered by such award and the exercise price, the grant price for the award will not be less than the fair market value of our common stock on the date of grant.

Vesting.Awards granted under the Amended Plan will vest at such time or times as determined by the Compensation Committee. However, no condition relating to the vesting of an award that is based upon performance objectives will be based on a performance cycle of less than one year, and no condition that is based upon continued employment or the passage of time alone will provide for vesting of an award more rapidly than in installments over three years from the date the award is made, except:

| • | upon the death, disability or retirement of the participant; |

| • | upon a Change in Control (as defined in the Amended Plan); |

| • | for stock options and SARs; |

| • | for any award paid in cash; and |

| • | for up to 5% of the total shares authorized under the Amended Plan, or 8,400,000 shares, of common stock that may be subject to awards without any minimum vesting period (limit includes shares subject to awards granted prior to May 20, 2009). |

Change in Control Provisions. The Amended Plan provides that any awards, other than incentive awards, that are either assumed by a successor corporation or an affiliate or replaced with equity awards that preserve the existing value of the awards at the time of a “Change in Control” (as defined in the Amended Plan) and provide for payout in accordance with the same or more favorable performance goals and vesting schedule will remain outstanding according to the terms of such awards. However, if, within two years after the Change in Control, the participant’s employment is terminated without “cause” or, for a participant eligible to participate in our Change in Control Plan for Key Executives, the participant terminates his or her employment for “good reason” (each as defined in the Amended Plan), the participant’s outstanding options and SARs will become fully vested and immediately exercisable and restrictions applicable to restricted stock awards, restricted and deferred stock unit awards, and other stock-based awards will lapse, and such awards will become fully vested.

18

Table of Contents

If awards, other than incentive awards, are not assumed by the successor corporation or an affiliate or replaced as described above, outstanding options and SARs will become fully vested and immediately exercisable and restrictions applicable to restricted stock awards, restricted and deferred stock unit awards, and other stock-based awards will lapse, and such awards will become fully vested. However, alternatively, the Board may provide for the cancellation of any such awards outstanding at the time of the Change in Control and, upon the consummation of the Change in Control, payment of an amount to each affected participant that is at least equal to the excess (if any) of the value of the consideration paid to Kraft Foods’ shareholders in connection with the Change in Control over the exercise or purchase price (if any) for the award.

In addition, incentive awards for which the right to payment has been earned in prior performance cycles but not paid out will become immediately payable in cash. Also, each participant holding an incentive award will be deemed to have earned a pro rata portion of the target amount payable to the participant under the award determined by dividing the number of months (full or partial) elapsed in the performance cycle prior to the Change in Control by the total number of months in the performance cycle.

Except as otherwise specified in an award agreement, any of the Change in Control provisions discussed above that change the timing of payment of an award will not be applicable to an award subject to Section 409A of the Code.

Plan Amendment and Termination. The Board may at any time and from time to time amend the Amended Plan in whole or in part. However, our shareholders must approve any amendment to the Amended Plan that would:

| • | materially increase the benefits accruing to the participants; |

| • | materially increase the number of securities that may be issued under the Amended Plan; |

| • | materially modify the requirements for participation in the Amended Plan; or |