Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Kraft Foods Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

| IRENE B. ROSENFELD | THREE LAKES DRIVE | |||

| CHAIRMAN OF THE BOARD AND | NORTHFIELD, ILLINOIS 60093 | |||

| CHIEF EXECUTIVE OFFICER | ||||

| March 30, 2010 |

Dear Fellow Shareholder:

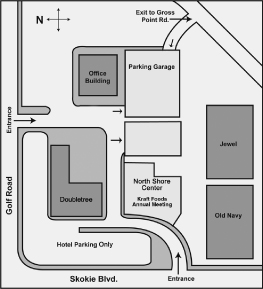

You are cordially invited to attend the Kraft Foods Inc. 2010 Annual Meeting of Shareholders. We will hold the Annual Meeting at 9:00 a.m. CDT on Tuesday, May 18, 2010, at the North Shore Center for the Performing Arts in Skokie, Illinois. The Center will open to shareholders at 8:00 a.m. CDT.

At the Annual Meeting, you will elect directors; vote on the ratification of the selection of independent auditors; if properly presented at the Annual Meeting, vote on a shareholder proposal; and consider any other business properly presented at the meeting. We will also report on our business and provide time for your questions and comments.

I am pleased to tell you that we are again taking advantage of the U.S. Securities and Exchange Commission rule allowing us to furnish proxy materials to shareholders via the Internet. This process, known as “e-proxy,” has several benefits: (1) it provides you with proxy materials more quickly, (2) it reduces the environmental impact of our Annual Meeting, and (3) it lowers our costs.

On March 30, 2010, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our 2010 Proxy Statement and Annual Report on Form 10-K and to vote online. If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials in the Notice.

You will find comprehensive information about our performance in our Annual Report on Form 10-K for the year ended December 31, 2009. We again decided against producing a glossy annual report to reduce costs and use less paper. Instead, we have included with the proxy materials a letter to shareholders highlighting our company’s 2009 financial and business performance.

Only shareholders of record at the close of business on March 11, 2010 are entitled to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting. You may vote your shares via the Internet or by calling a toll-free number. If you received a paper copy of the proxy card or voting instruction form by mail, you may also vote by signing, dating, and mailing your properly executed proxy card or voting instruction form. You may also vote in person at the Annual Meeting. The Proxy Statement and the proxy card or voting instruction form include detailed voting instructions.

Whether or not you plan to attend the Annual Meeting, I encourage you to vote promptly. Under new rules adopted by the New York Stock Exchange governing the voting process, if you hold shares through a broker, bank, or other nominee and you do not instruct your broker, bank, or other nominee how to vote, your shares will not be voted on the election of directors or the shareholder proposal. So please vote your shares. Your vote is important to us.

Please register in advance if you would like to attend the Annual Meeting. The pre-registration instructions are included in the Proxy Statement.

On behalf of the Board of Directors, thank you for your continued interest and support.

Sincerely,

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

Kraft Foods Inc.’s Proxy Statement and Annual Report on Form 10-K are available athttp://materials.proxyvote.com/50075N. |

Table of Contents

KRAFT FOODS INC.

Three Lakes Drive

Northfield, Illinois 60093

NOTICE OF 2010 ANNUAL MEETING OF SHAREHOLDERS

TIME AND DATE: | 9:00 a.m. CDT on Tuesday, May 18, 2010. |

PLACE: | North Shore Center for the Performing Arts in Skokie |

9501 Skokie Boulevard

Skokie, Illinois 60077

ITEMS OF BUSINESS: | (1) | Election of the 12 directors named in the Proxy Statement; |

| (2) | Ratification of the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2010; |

| (3) | If properly presented at the meeting, vote on a shareholder proposal regarding shareholder action by written consent; and |

| (4) | Transaction of other business properly presented at the meeting. |

BOARD RECOMMENDATION: | The Board recommends that shareholders votefor Items 1 and 2 andagainst Item 3. |

WHO MAY VOTE: | Shareholders of record at the close of business on March 11, 2010. |

DATE OF DISTRIBUTION: | We began mailing our Notice of Internet Availability of Proxy Materials on or about March 30, 2010. For shareholders who previously elected to receive paper copies, we began mailing the Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2009, the letter to shareholders, and the proxy card on or about March 30, 2010. |

MATERIALS AVAILABLE ON OUR WEB SITE: | This Notice of Meeting, the Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2009, and the letter to shareholders are available atwww.kraftfoodscompany.com/investor. Information included on our Web site, other than these materials, is not part of the proxy soliciting materials. |

Carol J. Ward

Vice President and Corporate Secretary

March 30, 2010

Table of Contents

| Page | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 11 | ||

| 11 | ||

Code of Business Conduct and Ethics for Non-Employee Directors and Code of Conduct for Employees | 11 | |

| 11 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 16 | ||

| 16 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 21 | ||

Independence of Compensation Consultant to the Human Resources and Compensation Committee | 21 | |

| 22 | ||

| 23 | ||

| 24 | ||

| 25 | ||

Human Resources and Compensation Committee Report for the Year Ended December 31, 2009 | 25 | |

| 26 | ||

| 26 | ||

| 28 | ||

| 31 | ||

| 41 | ||

| 46 | ||

Policy on Recoupment of Executive Incentive Compensation in the Event of Certain Restatements | 49 | |

| 50 | ||

Policy with Respect to Qualifying Compensation for Tax Deductibility | 50 | |

| 51 | ||

| 51 | ||

| 55 | ||

i

Table of Contents

ii

Table of Contents

Please note that the New York Stock Exchange (“NYSE”) recently amended its rules regarding broker discretionary voting. Unlike prior years, the NYSE rules do not give brokers discretionary authority to vote on the election of directors. This means that your broker, bank, or other nominee cannot vote your shares unless you provide it with voting instructions. Therefore, if you hold shares of our common stock in street name and do not provide voting instructions to your broker, bank, or other nominee, your shares will not be voted on the election of directors. Please see “Frequently Asked Questions” in this Proxy Statement for additional information about holding shares in street name and broker discretionary voting.

Process for Nominating Directors

The Nominating and Governance Committee of our Board of Directors (the “Board”) is responsible for identifying, evaluating, and recommending to the Board nominees for election at the 2010 Annual Meeting of Shareholders (and any adjournments or postponements of the meeting) (the “Annual Meeting”). The Nominating and Governance Committee relies on nominee suggestions from the directors, shareholders, management, and others. From time to time, the Nominating and Governance Committee retains executive search and board advisory consulting firms to assist in identifying and evaluating potential nominees. In evaluating potential nominees, the Nominating and Governance Committee may identify certain backgrounds, qualifications, and professional experience (for example, financial or global business experience) as being particularly desirable to help meet specific Board needs. During 2009, the Nominating and Governance Committee retained Heidrick & Struggles to assist in the search and recruitment of directors, resulting in the addition of our two newest directors, Mackey J. McDonald and Jean-François M.L. van Boxmeer.

The Board believes all directors should possess certain necessary characteristics, including integrity, sound business judgment, and vision, to serve on our Board. The Board further believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant blend of experience, knowledge, and abilities that will allow the Board to fulfill its responsibilities. The Nominating and Governance Committee works with the Board to determine the appropriate mix of these backgrounds and qualifications that would establish and maintain a Board that is strong in its collective knowledge. While the Board does not have a written policy to consider diversity when identifying nominees for directors, it strives to assemble a Board composed of individuals that represent a diversity of views, backgrounds, and professional experience.

To create a Board that meets these criteria, the Board has determined that it is important to have individuals with the following skills and experiences, among others, on the Board:

| • | industry knowledge, which is vital in understanding and reviewing our strategy, including the acquisition of businesses that offer complementary products or services; |

| • | significant operating experience as current or former executives, which gives them specific insight into developing, implementing, and assessing our operating plan and business strategy; |

| • | leadership experience, as directors with experience in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others; |

| • | substantial global business experience, which is particularly important given our company’s global presence; |

| • | accounting and financial expertise, which enables directors to evaluate our financial statements and capital structure; |

| • | product development and marketing experience in complementary industries, which is valuable to us as a global food company; |

1

Table of Contents

| • | public company board and corporate governance experience from large publicly traded companies, which generally prepares them to fulfill the Board’s responsibilities of overseeing and providing insight and guidance to management and furthers our goals of greater transparency, accountability for management and the Board, and protection of shareholder interests; and |

| • | academic, research, and philanthropic organization experience, which enhances the diversity of views represented by directors and promotes ethical awareness. |

In addition, when evaluating the suitability of individuals for nomination, the Nominating and Governance Committee considers other factors, including the individual’s satisfaction of independence requirements.

To help the Nominating and Governance Committee determine whether nominees qualify to serve on our Board, based on the criteria discussed above, and would contribute to the Board’s current and future needs, director nominees complete questionnaires regarding their backgrounds, qualifications, and potential conflicts of interest. The Nominating and Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending for nomination a group of individuals that can best perpetuate our success and represent shareholder interests through the exercise of sound business judgment. Additionally, as part of this evaluation and to further our commitment to diversity, the Nominating and Governance Committee assesses whether this group of nominees is comprised of individuals with a diversity of views, backgrounds, and experiences that would enhance the Board’s success at achieving these goals.

In determining whether to recommend a director for re-election, the Nominating and Governance Committee also considers the director’s past attendance at meetings and participation in, and contributions to, Board and committee activities. In addition, under our Corporate Governance Guidelines (the “Guidelines”), the Nominating and Governance Committee will not recommend, and the Board will not approve, the nomination for re-election of an independent director who has reached the age of 75. The Nominating and Governance Committee, however, may recommend, and the Board may nominate, for re-election for an annual term an independent director who has reached this age if the Board determines that nominating the independent director is necessary and in our shareholders’ best interests due to his or her unique capabilities or special circumstances. The Board may nominate for re-election the independent director for up to two annual terms following the director’s 75th birthday, only after making the above determination.

The Board believes that all the current nominees are highly qualified and have specific employment and leadership experiences, knowledge, and skills that qualify them for service on our Board and represent diverse views and backgrounds. The nominees’ individual biographies below contain information regarding each nominee’s experiences, qualifications, and skills.

Our Board currently has 12 directors who are each subject to annual election. Shareholders elected all of the current directors at the 2009 Annual Meeting, except for Mackey J. McDonald and Jean-François M.L. van Boxmeer. The Board appointed Messrs. McDonald and van Boxmeer in December 2009, and they began their service on January 1, 2010. The executive search firm Heidrick & Struggles identified Messrs. McDonald and van Boxmeer to the Nominating and Governance Committee, who in turn recommended them to the Board. All current directors are standing for re-election and have consented to their nominations for re-election. On December 17, 2009, the Board amended our Amended and Restated By-Laws (“By-Laws”) to set the size of our Board at 12 directors (previously ten), effective January 1, 2010.

The Nominating and Governance Committee recommended to the Board, and the Board approved, the nomination of the 12 director nominees listed below, each for a term ending at the 2011 Annual Meeting of Shareholders or until his or her successor has been duly chosen and qualified. In considering whether to recommend for re-election Mr. Zarb, who is 75 years old, the retirement age for independent directors

2

Table of Contents

under the Guidelines, the Nominating and Governance Committee determined, and the Board agreed, that Mr. Zarb’s continued service on the Board would be in our shareholders’ best interests because of his significant financial experience and unique contributions to the Board and the Finance Committee.

If the proxy card is properly executed and timely received, the persons named in the proxy card intend to vote the shares represented FOR or AGAINST the director nominees or ABSTAIN from voting, as instructed. If a director nominee should become unavailable to serve as a director, an event that we do not anticipate occurring, the persons named in the proxy card intend to vote the shares for the person whom the Board may designate to replace that nominee. In lieu of naming a substitute, the Board may amend our By-Laws to reduce the number of directors.

None of the nominees is related to another nominee or to any executive officer of Kraft Foods by blood, marriage, or adoption.

The following table presents information regarding each director nominee as of March 30, 2010, including information about each nominee’s professional experience, educational background, and qualifications that led the Board to nominate each director nominee for re-election. The following also includes information about all public company directorships, as well as relevant private and non-profit board positions, currently held and those held during the past five years by each nominee.

Ajaypal S. Banga

President and Chief Operating Officer, MasterCard Worldwide

Director since January 2007

Committees: • Chair, Human Resources and Compensation • Nominating and Governance

Age: 50 | Professional Experience: Mr. Banga has been President and Chief Operating Officer of MasterCard Worldwide, a global payments solutions company, since August 2009. Prior to that, Mr. Banga spent 13 years at Citigroup Inc., a global financial services company. He most recently served as Chief Executive Officer of Citigroup’s Asia Pacific region from March 2008 until July 2009. Mr. Banga also served as Chairman and Chief Executive Officer of Citigroup’s Global Consumer Group–International, Executive Vice President of Citigroup’s Global Consumer Group, and President of Citigroup’s Retail Banking North America. Prior to joining Citigroup, Mr. Banga spent 13 years at Nestlé S.A. and two years at PepsiCo Restaurants in a variety of sales, marketing, and general management positions.

Education: Mr. Banga received a Bachelor’s Degree in Economics with Honors from Delhi University and is an alumnus of the Indian Institute of Management in Ahmedabad, India.

Non-Profit/Other Boards: Mr. Banga is on the Board of Trustees of the Asia Society. He is also a member of the Council on Foreign Relations and the Economic Club of New York, and he is a fellow of the Foreign Policy Association. Mr. Banga was formerly on the Boards of Trustees of Enterprise Community Partners, Inc., the National Urban League, and the New York Hall of Science. He was also a director of the Council for Economic Education.

Director Qualifications: • Leadership and Operating experience – current President and Chief Operating Officer of a global services company and former Chief Executive Officer of a major business segment of another global services company • Industry Knowledge and Marketing and Global Business experience – held a variety of key roles at global food and beverage companies during a 15-year period | |

3

Table of Contents

Myra M. Hart

Professor, Harvard Business School (Retired)

Director since December 2007

Committees: • Chair, Nominating and Governance • Audit

Age: 69 | Professional Experience: Dr. Hart joined the faculty of the Harvard Business School in 1995 and retired to its senior faculty in 2008. From 1985 until 1990, Dr. Hart served on the founding team of Staples, Inc., an office supply retail store chain, leading operations, strategic planning, and growth implementation in new and existing markets.

Education: Dr. Hart received a Bachelor’s Degree from Cornell University and a Master of Business Administration and a Doctor of Business Administration from Harvard University.

Public Company Boards: Dr. Hart is a director of Office Depot Inc. Dr. Hart was formerly a director of Royal Ahold N.V. and Summer Infant, Inc.

Non-Profit/Other Boards: Dr. Hart is a director of the Center for Women’s Business Research and Nina McLemore, Inc. and a Trustee of Babson College. She is also a Trustee Emeritus of Cornell University and a member of the National Board of the Smithsonian Institution.

Director Qualifications: • Leadership and Operating experience – founding officer of a global products company • Public Company Board and Corporate Governance experience – current and former director of several public companies • Academic experience – retired professor of management practice at a leading business school | |

Lois D. Juliber

Former Vice Chairman and Chief Operating Officer, Colgate-Palmolive Company

Director since November 2007

Committees: • Human Resources and Compensation • Public Affairs

Age: 61 | Professional Experience: Ms. Juliber served as a Vice Chairman of the Colgate-Palmolive Company, a global consumer products company, from July 2004 until April 2005. She served as Colgate-Palmolive’s Chief Operating Officer from March 2000 to July 2004, Executive Vice President–North America and Europe from 1997 until March 2000, and President of Colgate North America from 1994 to 1997.

Education: Ms. Juliber received a Bachelor’s Degree from Wellesley College and a Master of Business Administration from Harvard University.

Public Company Boards: Ms. Juliber is a director of E.I. du Pont De Nemours and Company and Goldman Sachs Group, Inc.

Non-Profit/Other Boards: Ms. Juliber is Chairman of the MasterCard Foundation. She is also on the Board of Trustees of Wellesley College and a director of Women’s World Banking. Ms. Juliber was formerly a director of Girls Inc.

Director Qualifications: • Leadership and Operating experience – former Vice Chairman and Chief Operating Officer of a global consumer products company • Public Company Board and Corporate Governance experience – director of two global public companies • Industry Knowledge and Marketing and Global Business experience – 32 years working in the global consumer products industry | |

4

Table of Contents

Mark D. Ketchum

President and Chief Executive Officer, Newell Rubbermaid Inc.

Director since April 2007

Lead Director since January 2009

Committees: • Human Resources and Compensation • Nominating and Governance

Age: 60 | Professional Experience: Mr. Ketchum has been President and Chief Executive Officer of Newell Rubbermaid Inc., a global marketer of consumer and commercial products, since October 2005 and a member of its board of directors since November 2004. From 1999 to 2004, Mr. Ketchum was President, Global Baby and Family Care of The Procter & Gamble Company, a global marketer of consumer products. Mr. Ketchum joined The Procter & Gamble Company in 1971, where he served in a variety of roles, including Vice President and General Manager–Tissue/Towel from 1990 to 1996 and President–North American Paper Sector from 1996 to 1999.

Education: Mr. Ketchum received a Bachelor’s Degree in Industrial Engineering and Operations Research from Cornell University.

Public Company Boards: Mr. Ketchum is a director of Newell Rubbermaid Inc. He was formerly a director of Hillenbrand Industries, Inc.

Non-Profit/Other Boards: Mr. Ketchum is on the Board of Trustees of Cornell Rowing and a director of Commerce Club of Atlanta.

Director Qualifications: • Leadership and Operating experience – current President and Chief Executive Officer of a global products company • Public Company Board and Corporate Governance experience – current and former director of public companies • Industry Knowledge and Product Development, Marketing, and Global Business experience – held key roles at global consumer products companies for nearly four decades | |

Richard A. Lerner, M.D.

President, The Scripps Research Institute

Director since January 2005

Committees: • Nominating and Governance • Public Affairs

Age: 71 | Professional Experience: Dr. Lerner has been President and a member of the Board of Trustees of The Scripps Research Institute (“Scripps”), a private, non-profit biomedical research organization, since 1986.

Education: Dr. Lerner graduated from Northwestern University and Stanford Medical School. He interned at Palo Alto Stanford Hospital and received postdoctoral training at Scripps Clinic and Research Foundation in experimental pathology.

Public Company Boards: Dr. Lerner is a director of Opko Health, Inc. and Sequenom, Inc.

Non-Profit/Other Boards: Dr. Lerner serves on the Board of Trustees of Scripps and is a director of Intra-Cellular Therapies, Inc. He is a member of numerous scientific associations, including the National Academy of Science and the Royal Swedish Academy of Sciences. Dr. Lerner was formerly a director of Xencor, Inc. He was also formerly on the Scientific Advisory Boards of Dyadic International, Inc. and Senomyx Inc.

Director Qualifications: • Leadership experience – current President of Scripps • Public Company Board and Corporate Governance experience – current director of leading life science-related public companies • Academic, Research and Development, and Scientific experience – credited with over 60 patents and 400 published scientific papers | |

5

Table of Contents

Mackey J. McDonald

Senior Advisor, Crestview Partners

Director since January 2010

Committee: • Audit

Age: 63 | Professional Experience: Mr. McDonald has served as a senior advisor to Crestview Partners, a New York-based private equity firm, since 2008. He served as Chairman of VF Corporation, an apparel manufacturer, from 1998 and as a director from 1993 until he retired in August 2008. He also served as Chief Executive Officer of VF Corporation from 1996 to January 2008 and as President from 1993 to March 1996.

Education: Mr. McDonald received a Bachelor’s Degree in English from Davidson College and a Master of Business Administration from Georgia State University.

Public Company Boards: Mr. McDonald is a director of Hyatt Hotels Corporation and Wells Fargo & Company. Mr. McDonald was formerly a director of The Hershey Company, Tyco International, Ltd., and Wachovia Corporation.

Non-Profit/Other Boards: Mr. McDonald is Chairman of the Board of Trustees of Davidson College.

Director Qualifications: • Leadership, Operating, and Global Business experience – former Chief Executive Officer of a global manufacturing company • Industry Knowledge and Public Company Board and Corporate Governance experience – current and former director of several global public companies, including in the food and consumer products industries | |

6

Table of Contents

John C. Pope

Chairman, PFI Group, LLC

Director since July 2001

Committees: • Chair, Audit • Finance

Age: 61 | Professional Experience: Mr. Pope has served as Chairman of PFI Group, LLC, a financial management firm that invests primarily in private equity opportunities, since July 1994. From December 1995 to November 1999, Mr. Pope was Chairman of the Board of MotivePower Industries, Inc., a NYSE-listed manufacturer and remanufacturer of locomotives and locomotive components. Prior to joining MotivePower Industries, Inc., Mr. Pope served in various capacities with United Airlines and its parent, UAL Corporation, including as Director, Vice Chairman, President, Chief Operating Officer, Chief Financial Officer, and Executive Vice President, Marketing and Finance.

Education: Mr. Pope received a Bachelor’s Degree in Engineering and Applied Science from Yale University and a Master of Business Administration from Harvard University.

Public Company Boards: Mr. Pope is a director of Con-way, Inc., Dollar Thrifty Automotive Group, Inc., R.R. Donnelley and Sons Co., and Waste Management, Inc., where he is also non-executive Chairman of the Board. Mr. Pope was formerly a director of Air Canada, Federal-Mogul Corporation, MotivePower Industries, Inc., and Per-Se Technologies.

Non-Profit/Other Boards: Mr. Pope was formerly Vice Chairman and a member of the Board of Trustees of John G. Shedd Aquarium.

Director Qualifications: • Leadership, Operating, Marketing, and Global Business experience – former key leadership roles, including President, Chief Operating Officer, and Executive Vice President, Marketing and Finance of a global company • Accounting and Financial expertise – Chairman of a financial management firm and former Chief Financial Officer and Executive Vice President, Marketing and Finance of a global company • Public Company Board and Corporate Governance experience – current and former director and audit committee member of several public companies | |

7

Table of Contents

Fredric G. Reynolds

Former Executive Vice President and Chief Financial Officer, CBS Corporation

Director since December 2007

Committees: • Audit • Finance

Age: 59 | Professional Experience: Mr. Reynolds served as Executive Vice President and Chief Financial Officer of CBS Corporation, a mass media company, from January 2006 until his retirement in August 2009. From 2001 until 2006, Mr. Reynolds served as President and Chief Executive Officer of Viacom Television Stations Group and Executive Vice President and Chief Financial Officer of the businesses that comprised Viacom Inc.

Education: Mr. Reynolds received a Bachelor’s Degree in Business Administration in Finance from the University of Miami and is a certified public accountant.

Public Company Boards: Mr. Reynolds is a director of AOL, Inc.

Non-Profit/Other Boards: Mr. Reynolds is a Trustee Emeritus of the University of Miami and a director of The Reader’s Digest Association, Inc.

Director Qualifications: • Leadership and Global Business experience – former Chief Executive Officer and Chief Financial Officer of global media companies • Accounting and Financial expertise – former Chief Financial Officer of mass media company and certified public accountant • Public Company Board and Corporate Governance experience – director of global technology company | |

Irene B. Rosenfeld

Chairman and Chief Executive Officer, Kraft Foods Inc.

Director since June 2006

Age: 56 | Professional Experience: Ms. Rosenfeld was appointed Chief Executive Officer of Kraft Foods in June 2006 and Chairman of the Board in March 2007. Prior to that, she had been Chairman and Chief Executive Officer of Frito-Lay, a division of PepsiCo, Inc., a food and beverage company, from September 2004 to June 2006. Previously, Ms. Rosenfeld was employed continuously by Kraft Foods and its predecessor, General Foods Corporation, in various capacities from 1981 until 2003, including President of Kraft Foods North America and, before that, President of Operations, Technology, Information Systems, and Kraft Foods Canada, Mexico, and Puerto Rico.

Education: Ms. Rosenfeld received a Bachelor’s Degree in Psychology, a Master of Science in Business Administration, and a Doctor of Philosophy in Marketing and Statistics from Cornell University.

Public Company Boards: Ms. Rosenfeld was formerly a director of AutoNation Inc.

Non-Profit/Other Boards: Ms. Rosenfeld is on the Board of Trustees of Cornell University.

Director Qualifications: • Leadership and Operating experience – current Chairman and Chief Executive Officer of Kraft Foods • Public Company Board and Corporate Governance experience – formerly served as a director of another public company • Industry Knowledge and Product Development, Marketing, and Global Business experience – long-time service, including roles at Kraft Foods and other global food and beverage companies | |

8

Table of Contents

Jean-François M. L. van Boxmeer

Chairman of the Executive Board and Chief Executive Officer of Heineken N.V.

Director since January 2010

Committee: • Public Affairs

Age: 48 | Professional Experience: Mr. van Boxmeer has been Chairman of the Executive Board and Chief Executive Officer of Heineken N.V., a brewing company, since 2005 and a member of its Executive Board since 2001. He has been employed continuously by Heineken, in various capacities, since 1984, including General Manager of Heineken Italia from 2000 to 2001.

Education: Mr. van Boxmeer received a Master Degree in Economics at Facultè Universitaires Notre Dame de la Paix S.J.

Director Qualifications: • Leadership and Operating experience – Chairman and Chief Executive Officer of a global brewing company • Product Development, Marketing, and Global Business experience – over two decades in various positions, including in management at a global brewing company | |

Deborah C. Wright

Chairman, President, and Chief Executive Officer, Carver Bancorp, Inc.

Director since July 2001

Committees: • Chair, Public Affairs • Human Resources and Compensation

Age: 52 | Professional Experience: Ms. Wright has been President and Chief Executive Officer of Carver Bancorp, Inc., the holding company for Carver Federal Savings Bank, a federally chartered savings bank, since 1999. She was elected Chairman in 2005. Previously, she served as President and Chief Executive Officer of the Upper Manhattan Empowerment Zone Development Corporation from 1996 to 1999.

Education: Ms. Wright received a Bachelor’s Degree, a Master of Business Administration, and a Juris Doctor degree from Harvard University.

Public Company Boards: Ms. Wright is Chairman of Carver Bancorp, Inc. and is a director of Time Warner Inc.

Non-Profit/Other Boards: Ms. Wright is a member of the Board of Managers and Chair of the Audit Committee of Memorial Sloan-Kettering Cancer Center, and she is a director of the Children’s Defense Fund, the Partnership for New York City, and The Sesame Workshop. Ms. Wright was formerly on the Board of Overseers of Harvard University and Ministers and Missionaries Benefit Board of the American Baptist Churches. Ms. Wright was also a founding member of the Lower Manhattan Development Corporation.

Director Qualifications: • Leadership experience and Financial expertise – current Chairman, President, and Chief Executive Officer of federal bank • Public Board Company and Corporate Governance experience – chairman of a public company and director of a global media company • Academic and Philanthropic Organization experience – years of leadership positions at academic and public sector institutions and philanthropic organizations | |

9

Table of Contents

Frank G. Zarb

Managing Director, Hellman & Friedman LLC

Director since November 2007

Committees: • Chair, Finance • Public Affairs

Age: 75 | Professional Experience: Mr. Zarb has been a Managing Director of Hellman & Friedman LLC, a private equity firm, since 2002. He is non-executive Chairman of Promontory Financial Group, LLC, a consulting firm for global financial services companies. Previously, he served as Chairman, from 1997 to 2001, and Chief Executive Officer, from 1997 to 2000, of the National Association of Securities Dealers (“NASD”) and as Chairman, from 2000 to 2001, and Chief Executive Officer, from 1997 to 2001, of The NASDAQ Stock Market, Inc. (“NASDAQ”).

Education: Mr. Zarb received a Bachelor’s Degree, a Master of Business Administration, and an honorary Doctor of Law degree from Hofstra University.

Public Company Boards: Mr. Zarb was formerly a director of Alexander & Alexander Services Inc., American International Group, Inc., Florida Power & Light Company, NASDAQ, and The Travelers Companies, Inc.

Non-Profit/Other Boards: Mr. Zarb is non-executive Chairman of Promontory Financial Group, LLC and on the Board of Trustees of Hofstra University. He is also a member of the Board of Overseers of Hofstra University School of Medicine, in partnership with North Shore-Long Island Jewish Health. Mr. Zarb was formerly a director of the Lower Manhattan Development Corporation.

Director Qualifications: • Leadership experience and Financial expertise – numerous former governmental leadership positions, including President Ford’s Energy Czar and Chairman and Chief Executive Officer of the NASD and NASDAQ • Public Company Board and Corporate Governance experience – former director of several public companies | |

The Board recommends a vote FOR the election of each of these nominees.

10

Table of Contents

Corporate Governance Guidelines

Our corporate governance practices are firmly grounded in our belief that governance best practices are critical to our goal of driving sustained shareholder value. The Board adopted the written Guidelines that articulate our corporate governance philosophy, practices, and policies.

Code of Business Conduct and Ethics for Non-Employee Directors and Code of Conduct for Employees

We have a Code of Business Conduct and Ethics for Non-Employee Directors (the “Ethics Code”). It focuses on areas of ethical risk, guides non-employee directors in recognizing and handling ethical issues, provides mechanisms to report unethical conduct, and fosters a culture of honesty and integrity.

We also have a Code of Conduct that applies to all of our employees. The Code of Conduct reflects Kraft Foods’ values and contains important rules our employees must follow in conducting business to promote compliance and integrity. We strive to speak truthfully, to honor our commitments, and to treat people fairly. We believe we must earn and keep the trust of our consumers, business partners, employees, and shareholders, and those who live in the communities where we operate. By complying with the Code of Conduct, we believe we will enhance not only our compliance and integrity, but also our financial performance.

We will disclose on our Web site atwww.kraftfoodscompany.com/investor/corporate-governance any amendments to our Ethics Code or Code of Conduct and any waiver granted to an executive officer or director under these codes.

Corporate Governance Materials Available on Our Web Site

Shareholders and others can access our corporate governance materials, including our:

| • | Articles of Incorporation, |

| • | By-Laws, |

| • | Guidelines, |

| • | Board committee charters, and |

| • | Ethics Code |

on our Web site atwww.kraftfoodscompany.com/investor/corporate-governance. Additionally, shareholders and others can access our Code of Conduct on our Web site atwww.kraftfoodscompany.com/responsibility/compliance-integrity.

The information on our Web site is not, and will not be deemed to be, a part of this Proxy Statement or incorporated into any of our other filings with the U.S. Securities and Exchange Commission (“SEC”).

Our Board effectively performs its monitoring and oversight roles by acting as a unified whole. The Board believes that it is in the best interests of Kraft Foods for the Board to periodically evaluate the leadership structure of our company and make a determination regarding whether to separate or combine the roles of Chairman and Chief Executive Officer based on circumstances at the time of its

11

Table of Contents

decision. Ms. Rosenfeld has been the Chief Executive Officer of Kraft Foods since June 2006 and Chairman and Chief Executive Officer since March 2007. In 2007, the Board concluded that the Chief Executive Officer should also serve as Chairman because of Ms. Rosenfeld’s extensive knowledge of Kraft Foods and the food industry, leadership experience, and dedication to working closely with other members of the Board. Ms. Rosenfeld’s first-hand knowledge as Chief Executive Officer facilitates the Board decision-making process because she chairs the Board meetings where the Board discusses strategic and business issues.

Nevertheless, the Board believes that independent Board leadership is important. In 2007, the Board determined that the Chief Executive Officer would be the only member of management to serve on the Board and that Board committees should consist entirely of independent directors. Because one individual serves as Chairman and Chief Executive Officer, in 2007, the Board established the role of Lead Director, an independent director who serves as the principal liaison between the Chairman and the other independent directors. The Board created the Lead Director position to increase the Board’s effectiveness and promote open communication among independent directors. The Lead Director works with the Chairman and other members of the Board to provide independent leadership of the Board’s affairs on behalf of our shareholders. When the Board initially established the Lead Director position, the Board selected the chair of the Nominating and Governance Committee to serve as Lead Director. In 2009, the Nominating and Governance Committee recommended and the Board agreed to separate these two positions to allow the Nominating and Governance Committee chair to focus on the committee’s responsibilities and the Lead Director to focus on his duties related to Board meetings and shareholders. Our current Lead Director is Mark D. Ketchum, whom the Board appointed to that position in 2009.

Under the Guidelines, the Lead Director, in consultation with the other independent directors, is responsible for:

| • | advising the Chairman as to an appropriate schedule of Board meetings; |

| • | reviewing and providing the Chairman with input regarding the agendas and materials for the Board meetings; |

| • | presiding at all Board meetings at which the Chairman is not present, including executive sessions of the independent directors at regularly scheduled Board meetings, and, as appropriate, apprising the Chairman of the topics considered; |

| • | being available for consultation and direct communication with Kraft Foods’ shareholders; |

| • | calling meetings of the independent directors when necessary and appropriate; and |

| • | performing such other duties as the Board may from time to time delegate. |

The Board is responsible for overseeing the overall risk assessment and management processes at Kraft Foods. NYSE listing standards require the Audit Committee to discuss guidelines and policies to govern the process by which Kraft Foods’ management assesses and manages risk. Pursuant to its charter, the Audit Committee reviews and discusses risk assessment and risk management guidelines, policies, and processes by utilizing Kraft Foods’ Enterprise Risk Management (“ERM”) approach. Kraft Foods designed the ERM approach in part to ensure that the Board and relevant committees receive advice about and understand Kraft Foods’ risk management process, the participants in the process, and the information gathered through the approach. Annually, management identifies key risks to Kraft Foods’ business and performance, including strategic, financial, operational, legal, and regulatory risks. Management reviews these risks with the Audit Committee. The Audit Committee allocates responsibility for reviewing the key risks to the Board or a specific committee depending on which is in the best position to review and assess both the risk exposures as well as the steps management has taken to monitor and control those exposures. In particular, the Finance Committee reviews and reports to the Board on financial risk management activities, such as foreign exchange, commodities, interest rate exposure, insurance programs, and

12

Table of Contents

terms of customer financing. The Human Resources and Compensation Committee reviews our compensation policies and practices for employees, including our non-executive and executive officers, as they relate to our risk management practices and risk-taking incentives. The entire Board reviews our food safety policies, procedures, and programs, including those related to our supply chain. In addition, the Board reviews our strategies related to competition, including from private label and customer concentration. Throughout the year, management updates the Board and the relevant committees about factors that affect the key risks. For a discussion about risk oversight relating to our compensation programs, see “Human Resources and Compensation Committee Matters – Analysis of Risk in the Compensation Architecture.”

The Guidelines require that at least 75% of the directors on our Board meet the NYSE listing standards’ “independence” requirements. For a director to be considered independent, the Board must affirmatively determine, after reviewing all relevant information, that a director has no direct or indirect material relationship with Kraft Foods. To assist in this determination, the Board adopted categorical standards of director independence, including whether a director or a member of the director’s immediate family has any current or past employment or affiliation with Kraft Foods or our independent registered public accountants. These categorical standards are listed in the Guidelines, which are available on our Web site atwww.kraftfoodscompany.com/investor/corporate-governance.

The Board determined that, under the Kraft Foods categorical standards and the NYSE listing standards, Ajaypal S. Banga, Myra M. Hart, Lois D. Juliber, Mark D. Ketchum, Richard A. Lerner, M.D., Mackey J. McDonald, John C. Pope, Fredric G. Reynolds, Jean-François M.L. van Boxmeer, Deborah C. Wright, and Frank G. Zarb are independent. Irene B. Rosenfeld is not independent because she is an executive officer of Kraft Foods. The Board also had determined that Jan Bennink and Mary L. Schapiro, both former directors, were independent during the times that they served as directors during 2009.

Certain Relationships and Transactions with Related Persons

The Board has adopted a written policy regarding the review, approval, and ratification of transactions with related persons. In accordance with the policy, the Nominating and Governance Committee reviews Kraft Foods’ transactions in which the amount involved exceeds $120,000 and in which any “related person” had, has, or will have a direct or indirect material interest. In general, “related persons” are our directors and executive officers, shareholders beneficially owning more than 5% of our outstanding common stock, and their immediate family members. The Nominating and Governance Committee approves or ratifies only those transactions that are fair and reasonable to Kraft Foods and in the best interests of Kraft Foods and its shareholders. The chair of the Nominating and Governance Committee reviews and approves or ratifies transactions when it is not practicable or desirable to delay review of a transaction until a committee meeting. The chair reports to the committee any transactions so approved or ratified. The Nominating and Governance Committee, in the course of its review and approval or ratification of a disclosable related person transaction, considers, among other things:

| • | the commercial reasonableness of the transaction; |

| • | the materiality of the related person’s direct or indirect interest in the transaction; |

| • | whether the transaction may involve an actual or the appearance of a conflict of interest; |

| • | the impact of the transaction on the related person’s independence (as defined in the Guidelines and the NYSE listing standards); and |

| • | whether the transaction would violate any provision of our Ethics Code or Code of Conduct. |

Any member of the Nominating and Governance Committee who is a related person with respect to a transaction under review may not participate in the deliberations or decisions regarding the transaction.

13

Table of Contents

Pursuant to Kraft Foods’ policy, the Nominating and Governance Committee determined that no reported transaction qualified as a related person transaction during 2009 except for transactions with McLane Company, Inc. (“McLane”), a grocery supplier and wholly owned subsidiary of Berkshire Hathaway Inc., a beneficial owner of more than 5% of our common stock.

In 2009, McLane purchased food products from us in an amount totaling approximately $288 million. Our relationship with McLane predates Berkshire Hathaway’s disclosure of its acquisition of more than 5% of our common stock in 2008 and Berkshire Hathaway’s acquisition of McLane in 2003. During 2009, our transactions with McLane were in the ordinary course of business and on terms substantially similar to our transactions with comparable third parties. Berkshire Hathaway’s only interest in the transactions was as the owner of McLane. The Nominating and Governance Committee ratified the transactions with McLane after reviewing and discussing the materials related to these transactions.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our executive officers, directors, and persons who own more than 10% of our common stock to report their ownership of our common stock and changes in that ownership. As a practical matter, our Office of the Corporate Secretary assists our directors and executive officers by monitoring their transactions and completing and filing Section 16(a) reports on their behalf.

We reviewed copies of reports filed pursuant to Section 16(a) of the Exchange Act and written representations from reporting persons that all reportable transactions were reported. Based solely on that review, we believe that during the fiscal year ended December 31, 2009, all required filings were timely made in accordance with Exchange Act requirements, except one. In October 2009, a Form 4 was filed on Mr. Zarb’s behalf reporting two purchases of common stock (totaling 600 shares) in February 2008 held for the benefit of his wife and grandson. Due to an administrative error, the changes in Mr. Zarb’s ownership of common stock were not timely reported. Upon discovering the error, we filed, on Mr. Zarb’s behalf, a Form 4 to report the transactions.

We expect directors to attend all Board meetings, the Annual Meeting, and all meetings of the committees on which they serve. We understand, however, that occasionally a director may be unable to attend a meeting. The Board held 16 meetings in 2009. All incumbent directors who served as directors in 2009 attended more than 75% of the aggregate number of meetings of the Board and all committees on which they served. All nominees who were serving as directors at the time of the 2009 Annual Meeting of Shareholders attended that meeting.

Information for shareholders and other parties interested in communicating with the Lead Director, the Board, or our independent directors, individually or as a group, is available on our Web site atwww.kraftfoodscompany.com/investor/corporate-governance/contact_bod. The Corporate Secretary forwards communications relating to matters within the Board’s purview to the independent directors; communications relating to matters within a Board committee’s area of responsibility to the chair of the appropriate committee; and communications relating to ordinary business matters, such as suggestions, inquiries, and consumer complaints, to the appropriate Kraft Foods executive or employee. The Corporate Secretary does not forward solicitations, junk mail, and obviously frivolous or inappropriate communications, but makes them available to any independent director who requests them.

14

Table of Contents

Our Board designates the members and chairs of committees based on the Nominating and Governance Committee’s recommendations. In 2009, the Board had five standing committees: Audit, Finance, Human Resources and Compensation, Nominating and Governance, and Public Affairs. The Board has adopted a written charter for each committee. The charters define each committee’s roles and responsibilities. All committee charters are available on our Web site atwww.kraftfoodscompany.com/investor/corporate-governance.

During 2009, committee membership was:

2009 Committee Membership

Name | Audit | Finance | Human Resources and Compensation | Nominating and Governance | Public Affairs | |||||

Ajaypal S. Banga | — | — | Chair | X | — | |||||

Myra M. Hart | X* | — | X* | Chair | — | |||||

Lois D. Juliber | — | — | X | — | X | |||||

Mark D. Ketchum | — | — | X | X | — | |||||

Richard A. Lerner, M.D. | — | — | — | X | X | |||||

John C. Pope | Chair | X | — | — | — | |||||

Fredric G. Reynolds | X | X | — | — | — | |||||

Deborah C. Wright | — | — | X | — | Chair | |||||

Frank G. Zarb | X* | Chair | — | — | X | |||||

Number of Meetings in 2009 | 13 | 15 | 10 | 7 | 4 | |||||

* As of May 20, 2009, Ms. Hart rotated off the Human Resources and Compensation Committee to replace Mr. Zarb who had rotated off the Audit Committee. | ||||||||||

Current committee membership is:

March 2010 Committee Membership*

| ||||||||||||

Name | Audit | Finance | Human Resources and Compensation | Nominating and Governance | Public Affairs | |||||

Ajaypal S. Banga | — | — | Chair | X | — | |||||

Myra M. Hart | X | — | — | Chair | — | |||||

Lois D. Juliber | — | — | X | — | X | |||||

Mark D. Ketchum | — | — | X | X | — | |||||

Richard A. Lerner, M.D. | — | — | — | X | X | |||||

Mackey J. McDonald | X | — | — | — | — | |||||

John C. Pope | Chair | X | — | — | — | |||||

Fredric G. Reynolds | X | X | — | — | — | |||||

Jean-Francois M.L. van Boxmeer | — | — | — | — | X | |||||

Deborah C. Wright | — | — | X | — | Chair | |||||

Frank G. Zarb | — | Chair | — | — | X | |||||

* The Board periodically reviews committee membership and rotates membership during the year. Accordingly, the membership described in the table may change during 2010. | ||||||||||

15

Table of Contents

The Board established the Audit Committee in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board determined that all members of the Audit Committee are independent within the meaning of the NYSE listing standards and Rule 10A-3 of the Exchange Act. The Board also determined that all Audit Committee members are financially literate within the meaning of the NYSE listing standards and that John C. Pope and Fredric G. Reynolds are“audit committee financial experts” within the meaning of SEC regulations. Because Mr. Pope serves on the audit committees of more than three public companies, the Board reviewed his meeting attendance record and other relevant information and determined that Mr. Pope’s simultaneous service on these audit committees does not impair his ability to serve effectively on our Audit Committee. No Audit Committee member received any payments in 2009 from us other than compensation for service as a director.

Under its charter, the Audit Committee is responsible for overseeing our accounting and financial reporting processes and audits of our financial statements. Among other duties, the Audit Committee is directly responsible for the appointment and oversight of our independent auditors.

The Audit Committee has established procedures for the receipt, retention, and treatment, on a confidential basis, of any complaints Kraft Foods receives. We encourage employees, and individuals and organizations outside of Kraft Foods, to report concerns about our accounting controls, auditing matters, or anything else that appears to involve financial or other wrongdoing. To report such matters, you should e-mail us atKraft-FinancialIntegrity@kraft.com.

Audit Committee Report for the Year Ended December 31, 2009

To our Shareholders:

Management has primary responsibility for Kraft Foods’ financial statements and the reporting process, including the systems of internal control over financial reporting. The Audit Committee monitors the financial reporting processes and systems of internal control over financial reporting, the independence and performance of Kraft Foods’ independent auditors, and the performance of its internal auditor.

Management represented to the Audit Committee that Kraft Foods’ consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The Audit Committee reviewed and discussed the consolidated financial statements with management and the independent auditors. Management also represented that they assessed the effectiveness of Kraft Foods’ internal control over financial reporting as of December 31, 2009 and determined that, as of that date, Kraft Foods maintained effective internal control over financial reporting. The Audit Committee reviewed and discussed with management and the independent auditors this assessment of internal control over financial reporting.

The Audit Committee also discussed with the independent auditors both their evaluation of the accounting principles, practices, and judgments applied by management, and any other items the independent auditors are required to communicate to the Audit Committee in accordance with applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the Audit Committee concerning independence.

The independent auditors delivered to the Audit Committee the written disclosures and the letter describing any relationships with Kraft Foods that may bear on their independence. The Audit Committee discussed with the independent auditors the auditors’ independence from Kraft Foods and its management. The Audit Committee reviewed and approved the independent auditors’ audit fees. The Audit Committee also reviewed non-audit services and fees to assure compliance with regulations prohibiting the independent auditors from performing specified services that might impair their independence, and with Kraft Foods’ and the Audit Committee’s policies.

16

Table of Contents

The Audit Committee discussed with our internal auditor and independent auditors the overall scope and plans for their respective 2010 audits. The Audit Committee met and will meet with our internal auditor and independent auditors, separately, with and without management present, to discuss the financial reporting processes and internal accounting controls. The Audit Committee reviewed significant audit findings prepared by each of the independent auditors and our internal audit function, together with management’s responses.

Based upon the reports and discussions described in this report and without other independent verification, the Audit Committee recommended to the Board, and the Board approved, that the audited consolidated financial statements be included in Kraft Foods’ Annual Report on Form 10-K for the year ended December 31, 2009, which was filed with the SEC on February 25, 2010.

Audit Committee:

John C. Pope, Chair

Myra M. Hart

Mackey J. McDonald

Fredric G. Reynolds

The information contained in the report above will not be deemed to be “soliciting material” or “filed” with the SEC, nor will this information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that Kraft Foods specifically incorporates it by reference in such filing.

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services, and other permissible services. The Audit Committee’s pre-approval authority, which is agreed to annually, details the particular service or category of service and is subject to a specific engagement authorization by management within the pre-approved category spending limits. The Audit Committee requires management to report at committee meetings throughout the year on the actual fees charged by the independent auditors for each category of service.

During the year, circumstances may arise when it may become necessary for Kraft Foods to engage the independent auditors for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee must give specific pre-approval before engaging the independent auditors. The Audit Committee delegated pre-approval authority to its chair for those instances when pre-approval is needed prior to a scheduled committee meeting. The Audit Committee chair must report on such pre-approval decisions at the Audit Committee’s next regular meeting.

The Audit Committee pre-approved all audit and non-audit services provided by the independent auditors during 2009.

Aggregate fees for professional services rendered by our independent auditors, PricewaterhouseCoopers LLP, for 2008 and 2009 were:

| 2009 | 2008 | |||||

Audit Fees | $ | 17,262,000 | $ | 16,073,000 | ||

Audit-Related Fees | 1,961,000 | 2,822,000 | ||||

Tax Fees | 1,637,000 | 1,938,000 | ||||

All Other Fees | 22,000 | 21,000 | ||||

Total | $ | 20,882,000 | $ | 20,854,000 | ||

| • | “Audit Fees” include (a) the integrated audit of our consolidated financial statements, including statutory audits of the financial statements of our affiliates, and our internal control over financial reporting, and (b) the reviews of our unaudited condensed consolidated interim financial statements (quarterly financial statements). |

17

Table of Contents

| • | “Audit-Related Fees” include professional services in connection with employee benefit plan audits, due diligence related to acquisitions and divestitures, and procedures relating to various other audit and special reports. |

| • | “Tax Fees” include professional services in connection with tax compliance and advice. |

| • | “All Other Fees” include professional services in connection with benchmarking studies and seminars. |

| • | All fees above include out-of-pocket expenses. |

NOMINATING AND GOVERNANCE COMMITTEE MATTERS

The Board determined that all of the Nominating and Governance Committee members are independent within the meaning of the NYSE listing standards. The Nominating and Governance Committee’s responsibilities include, among others:

| • | identifying qualified individuals for Board membership consistent with criteria approved by the Board; |

| • | considering the performance and suitability of incumbent directors in determining whether to nominate them for re-election; |

| • | recommending to the Board findings of director independence; |

| • | recommending to the Board the appropriate size, function, needs, and composition of the Board and its committees; |

| • | recommending to the Board the membership of each committee; |

| • | monitoring directors’ compliance with our stock ownership guidelines; |

| • | reviewing and evaluating opportunities for Board members to engage in continuing education; and |

| • | advising the Board on corporate governance matters, including developing and recommending to the Board corporate governance guidelines. |

The Nominating and Governance Committee will consider any candidate who is properly presented by a shareholder for election to the Board in accordance with the procedures set forth in the Guidelines. The Nominating and Governance Committee uses the same criteria to evaluate a candidate suggested by a shareholder as the committee uses to evaluate a candidate it identifies, as described above under “Item 1. Election of Directors – Process for Nominating Directors,” and makes a recommendation to the Board regarding the candidate’s appointment or nomination for election to the Board. After the Board’s consideration of the candidate suggested by a shareholder, the Corporate Secretary will notify that shareholder whether the Board decided to appoint or nominate the candidate.

For a description of how shareholders may nominate a candidate for election to the Board at an annual meeting of shareholders and have that nomination included in the proxy statement for that meeting, see “2011 Annual Meeting of Shareholders” in this Proxy Statement.

18

Table of Contents

The Finance Committee was established effective December 2008. The Finance Committee is responsible for considering and making recommendations to the Board on the management of our financial resources and transactions. The Finance Committee reviews and makes recommendations to the Board on financial matters, including:

| • | our annual and long-term financing plans, including our projected financial structure and funding requirements, components of cash flow, and share repurchases; |

| • | issuances of equity and debt securities and other financing transactions; |

| • | our external dividend policy and dividend recommendations; |

| • | proposed major investments, restructurings, joint ventures, significant asset sales or purchases, acquisitions, divestitures, and other significant business opportunities; and |

| • | financial risk management activities, such as foreign exchange, commodities, interest rate exposure, insurance programs, and terms of customer financing. |

PUBLIC AFFAIRS COMMITTEE MATTERS

The Public Affairs Committee was established effective February 2008. The committee is responsible for discharging the Board’s responsibilities relating to public policy issues as set forth in its charter, which was amended in March 2010. In carrying out its duties, the Public Affairs Committee, among other things:

| • | monitors public policy and social trends affecting us; |

| • | monitors issues and practices relating to our social accountability; |

| • | examines periodically our business practices that are of special interest to policy-makers and the public at large; |

| • | monitors programs and activities aimed at enhancing our global communication, media relations, and community relations; |

| • | reviews the impact of business operations and business practices on communities where we do business; |

| • | monitors our corporate citizenship programs and activities, including charitable contributions; and |

| • | reviews and makes recommendations to the Board regarding shareholder proposals related to public issues. |

19

Table of Contents

HUMAN RESOURCES AND COMPENSATION

COMMITTEE MATTERS

Compensation Committee Interlocks and Insider Participation

The Human Resources and Compensation Committee consists entirely of independent directors who the Board determined to be independent within the meaning of the NYSE listing standards. None of the Human Resources and Compensation Committee’s members:

| • | is or was an officer or employee of Kraft Foods; |

| • | is or was a participant in a “related person” transaction in 2009 (for a description of our policy on related person transactions, see “Corporate Governance – Certain Relationships and Transactions with Related Persons” in this Proxy Statement); or |

| • | is an executive officer of another entity at which one of our executive officers serves on the board of directors. |

The Human Resources and Compensation Committee’s responsibilities are set forth in its charter, which was amended in March 2010. The Human Resources and Compensation Committee’s responsibilities include, among other duties:

| • | assessing the appropriateness and competitiveness of our executive compensation programs; |

| • | reviewing and approving goals and objectives of the Chief Executive Officer, evaluating the performance of the Chief Executive Officer in light of these goals and objectives, and, based upon its evaluation, determining both the elements and amounts of the Chief Executive Officer’s compensation; |

| • | reviewing management’s recommendations for, and approving the compensation of, the Chief Executive Officer’s direct reports; |

| • | determining annual incentive compensation, equity awards, and other long-term incentive awards granted under our equity and long-term incentive plans to eligible participants; |

| • | reviewing our compensation policies and practices for employees, including non-executive and executive officers, as they relate to our risk management practices and risk-taking incentives; |

| • | overseeing the management development and succession planning process (including succession planning for emergencies) for the Chief Executive Officer and his or her direct reports and, as appropriate, evaluating potential candidates; |

| • | reviewing periodically our key human resource policies and practices related to organizational engagement and effectiveness, talent sourcing strategies, and employee development programs; |

| • | monitoring our policies, objectives, and programs related to diversity and reviewing periodically Kraft Foods’ diversity performance in light of appropriate measures; |

| • | assessing the appropriateness of, and advising the Board regarding, the compensation of non-employee directors for service on the Board and its committees; and |

| • | reviewing and discussing with management the Compensation Discussion and Analysis and the committee’s annual report included in our annual proxy statement. |

20

Table of Contents

The Compensation Discussion and Analysis, included in this Proxy Statement, addresses the Human Resources and Compensation Committee’s primary processes for establishing and overseeing executive compensation. Additional processes and procedures include:

| • | Meetings. The Human Resources and Compensation Committee meets several times each year, including ten meetings in 2009, to address our compensation programs, benefit plans, and policies. |

| • | Role of Independent Compensation Consultant. In 2009, the Human Resources and Compensation Committee retained Compensation Advisory Partners, LLC (“Compensation Advisory Partners”) as its independent compensation consultant to assist in evaluating executive compensation programs and to advise regarding the amount and form of executive and director compensation. The use of an independent consultant provides additional assurance that our executive compensation programs are reasonable and consistent with Kraft Foods’ objectives. The independent consultant is engaged directly by the Human Resources and Compensation Committee, regularly participates in committee meetings at which compensation is an agenda item, including executive sessions of the committee, and advises the committee with respect to compensation trends and best practices, plan design, and the reasonableness of compensation awards. In addition, with respect to the Chief Executive Officer, the consultant prepares specific compensation analyses for the Human Resources and Compensation Committee’s consideration. The Chief Executive Officer does not participate in the development of these analyses and has no knowledge of the information in these analyses when they are presented to the Human Resources and Compensation Committee. The independent consultant plays a similar role in analyzing the amount or form of director compensation, as discussed below. |

| • | Role of Executive Officers and Management. Each year, the Chief Executive Officer presents his or her compensation recommendations for each of the other named executive officers, his or her remaining direct reports, and other executive officers (as described under “Compensation Discussion and Analysis”). The Human Resources and Compensation Committee reviews and discusses these recommendations with the Chief Executive Officer and has full discretion over all recommended compensation actions. Executive officers do not play a role in determining or recommending the amount or form of director compensation. |

Independence of Compensation Consultant to the Human Resources and Compensation Committee

In September 2009, after an extensive selection and interview process, the Human Resources and Compensation Committee retained Compensation Advisory Partners as its independent compensation consultant. Prior to that time, Hewitt Associates LLC (“Hewitt”) had served as the committee’s independent compensation consultant since 2006.

During 2009, the compensation consultants provided the Human Resources and Compensation Committee advice and services, which included providing competitive market compensation data for executive positions; conducting periodic reviews of elements of compensation; providing “best practices” about and advice in designing our annual and long-term incentive plans, including selecting metrics; updating the committee on executive compensation trends, issues, and regulatory developments; and participating in meetings of the Human Resources and Compensation Committee at which compensation was an agenda item.

The Human Resources and Compensation Committee believes that its consultant should be able to render advice to the committee independent of management’s influence. Therefore, the Human Resources and Compensation Committee has taken numerous steps to satisfy this objective. The Human Resources and Compensation Committee retained each of Hewitt and Compensation Advisory Partners independent of management. At least annually, the Human Resources and Compensation Committee reviews the types of advice and services provided by the consultants and the fees charged

21

Table of Contents

for those services. The consultants report directly to the Human Resources and Compensation Committee on all executive and director compensation matters; regularly meet separately with the committee outside the presence of management; and speak separately with the committee chair and other committee members between meetings, as necessary or desired. Interactions between the consultants and management are limited to those which the consultants need to provide the Human Resources and Compensation Committee with relevant information and appropriate recommendations.

For the year ended December 31, 2009, Hewitt billed Kraft Foods approximately $192,000 for advice and services to the Human Resources and Compensation Committee, including determining and recommending the amount and form of executive and director compensation. During this period, Hewitt also billed Kraft Foods $4.95 million for other services, including consulting and outsourcing services for Kraft Foods retirement plans, consulting services on Kraft Foods talent and organizational design, and employee communications. Hewitt provided these additional services with the Human Resources and Compensation Committee’s prior knowledge, which were subject to annual review.

To ensure Hewitt’s independence, the Human Resources and Compensation Committee implemented a process generally consistent with the Audit Committee’s process for managing Kraft Foods’ relationship with PricewaterhouseCoopers LLP, Kraft Foods’ independent auditors. Under the process, management could not significantly increase its use of Hewitt for non-executive compensation-related services without the Human Resources and Compensation Committee’s advance knowledge and approval. Further, the Human Resources and Compensation Committee regularly evaluated Hewitt’s consulting services. In addition, Hewitt separated through the use of different teams the executive compensation consulting services provided to the Human Resources and Compensation Committee from services it provided to Kraft Foods management. The team of Hewitt executive compensation professionals who worked on Kraft Foods executive compensation did not work on other consulting assignments for Kraft Foods. Hewitt also confirmed that the professionals who worked on these matters received no compensation for any other services that Hewitt provided to Kraft Foods. Based on the Human Resources and Compensation Committee’s regular discussions on the issue and its evaluation of the procedures Kraft Foods and Hewitt implemented to ensure independence, the Human Resources and Compensation Committee believes that Hewitt provided independent advice during the time it served as the committee’s compensation consultant.

As discussed above, in September 2009, the Human Resources and Compensation Committee replaced Hewitt with Compensation Advisory Partners as its compensation consultant. The committee believed that it was in the best interests of the committee and Kraft Foods to engage a compensation consulting firm that provides no other services to the company. For the year ended December 31, 2009, Compensation Advisory Partners provided no services to Kraft Foods other than executive and director compensation consulting services in support of decisions made by the Human Resources and Compensation Committee.

Analysis of Risk in the Compensation Architecture