Barclays Global Consumer Staples Conference September 7, 2016 Exhibit 99.2

Brian Gladden EVP and Chief Financial Officer

This presentation contains a number of forward-looking statements. Words, and variations of words, such as “will,” “expect,” “may,” “would,” “aim,” “believe,” “likely,” “plan,” “estimate,” “deliver,” “position,” “potential,” “opportunity,” “target,” “outlook” and similar expressions are intended to identify our forward-looking statements, including, but not limited to, statements about: our future performance, including our future revenue growth, earnings per share, operating income, margins and cash flow; our supply chain transformation; overheads and overhead cost reduction opportunities and initiatives; productivity and productivity initiatives; cash management; efficiency; shared services capability and savings; our investments and the results of those investments; capital expenditures; working capital; media spending; category expansion; innovation; opportunities for growth in our portfolio; the global economy; our well-being portfolio and goals; growth in and revenues from e-commerce; execution of our strategy; prospects for acquisitions and our acquisition strategy; the costs of, timing of expenditures under and completion of our restructuring program; share repurchases; dividends; shareholder value and returns; and our Outlook, including 2016 and 2018 Adjusted Operating Income margin and 2016 and 2018 Free Cash Flow excluding items. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ materially from those indicated in our forward-looking statements. Such factors include, but are not limited to, risks from operating globally and in emerging markets; changes in currency exchange rates, controls and restrictions; continued volatility of commodity and other input costs; weakness in economic conditions; weakness or changes in consumer spending or demand; changes in consumer preferences; pricing actions; unanticipated disruptions to our business; competition; our reputation and brand image; our global workforce; strategic transactions; the restructuring program and our other transformation initiatives not yielding the anticipated benefits; changes in the assumptions on which the restructuring program is based; and tax law changes. Please also see our risk factors, as they may be amended from time to time, set forth in our filings with the SEC, including our most recently filed Annual Report on Form 10-K. Mondelēz International disclaims and does not undertake any obligation to update or revise any forward-looking statement in this presentation, except as required by applicable law or regulation. Forward Looking Statements

Sound strategic and financial rationale for complementary businesses with significant synergies Made a full and fair offer that we believe would have added considerable value for both sets of shareowners Confident in our attractive stand-alone growth and margin expansion prospects No Longer Pursuing Hershey

1 2 3 4 Agenda Strategic Overview Compelling Financial Framework & Total Return Strong Confidence in Long-term Margin Targets Growth Capabilities and Initiatives

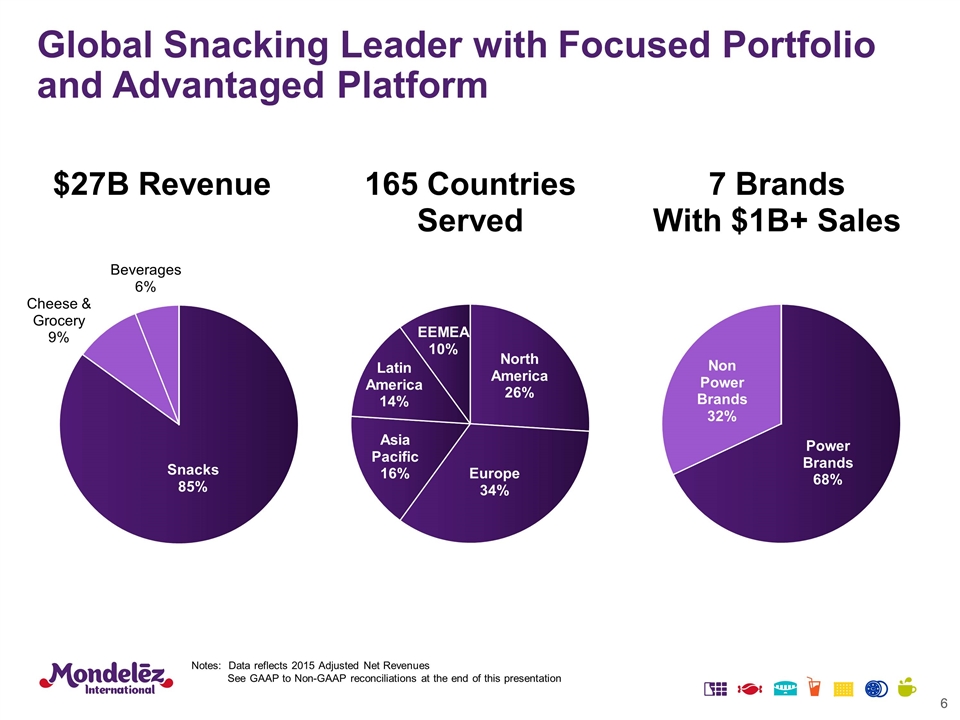

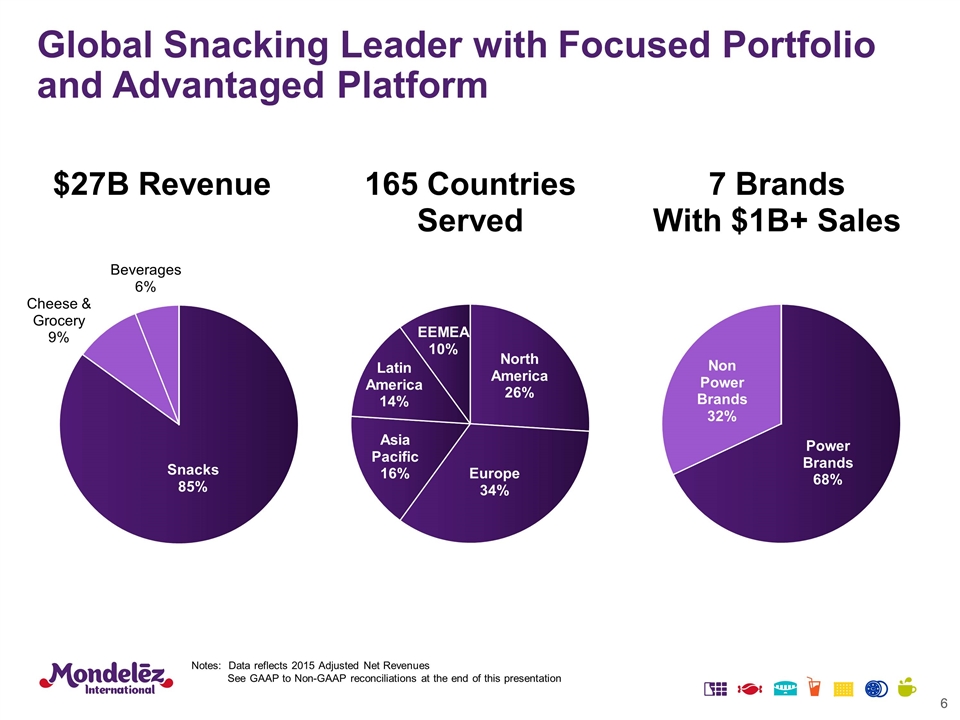

Notes: Data reflects 2015 Adjusted Net Revenues See GAAP to Non-GAAP reconciliations at the end of this presentation $27B Revenue 165 Countries Served 7 Brands With $1B+ Sales Global Snacking Leader with Focused Portfolio and Advantaged Platform

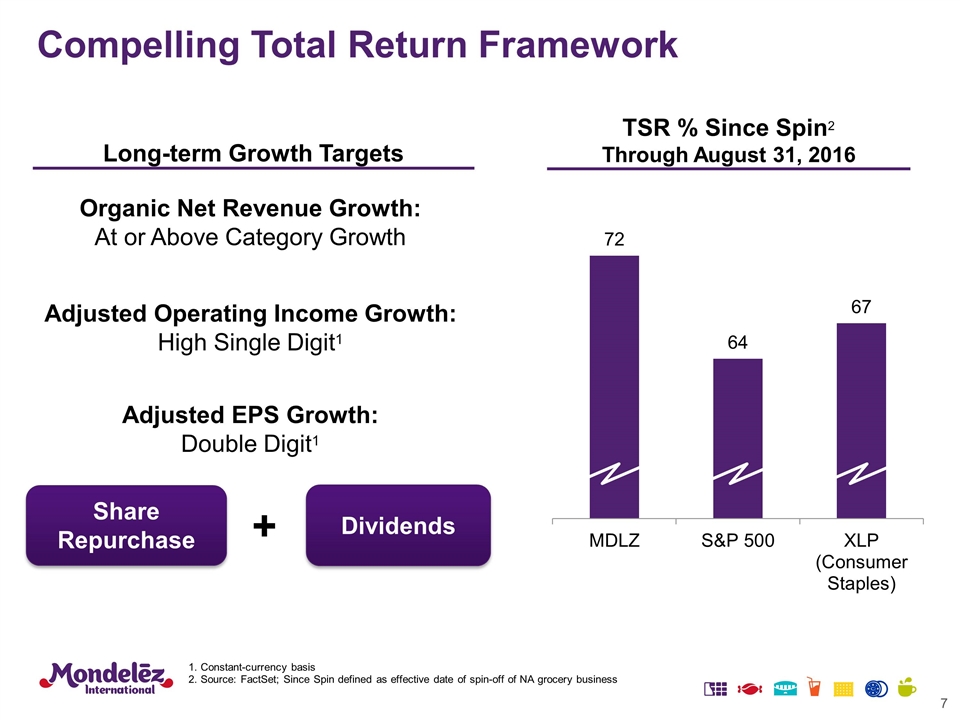

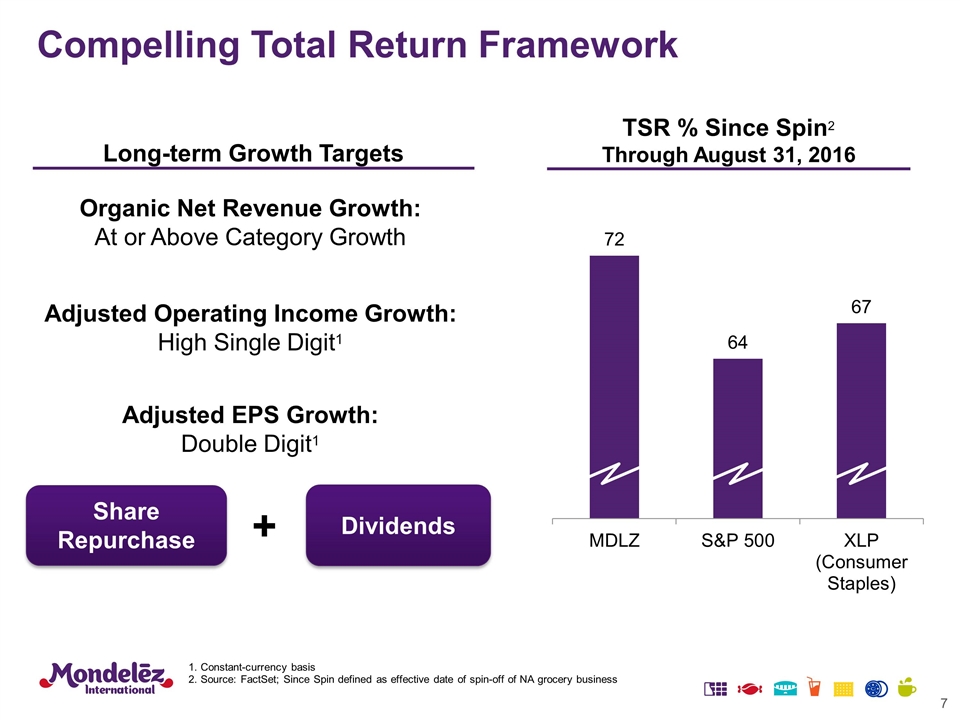

Compelling Total Return Framework Long-term Growth Targets + Share Repurchase Dividends TSR % Since Spin2 Through August 31, 2016 Adjusted EPS Growth: Double Digit1 Organic Net Revenue Growth: At or Above Category Growth Adjusted Operating Income Growth: High Single Digit1 Constant-currency basis Source: FactSet; Since Spin defined as effective date of spin-off of NA grocery business

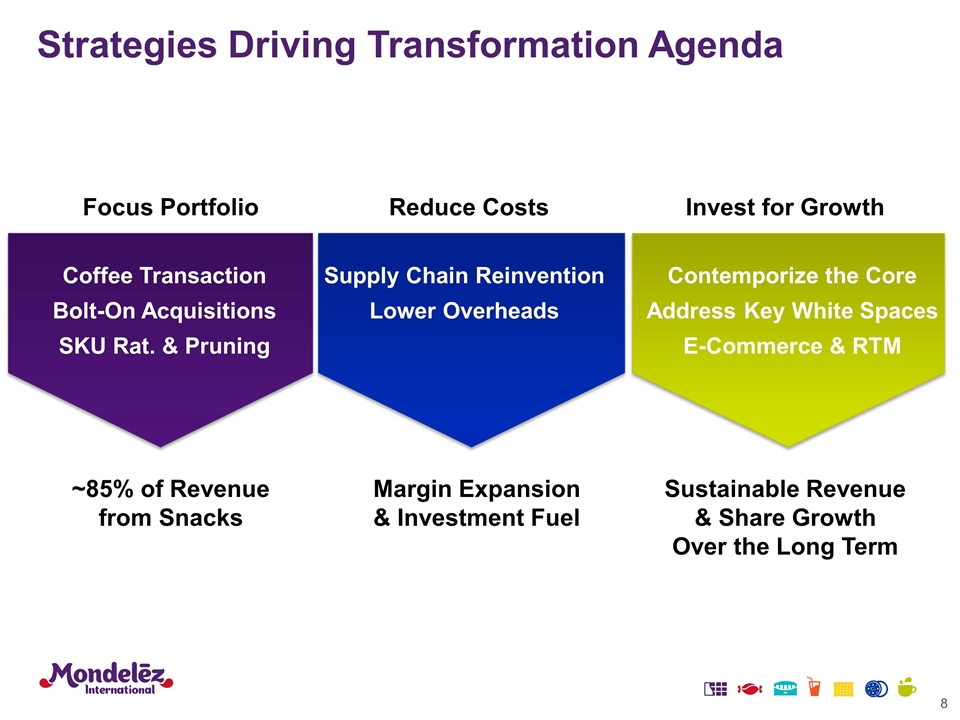

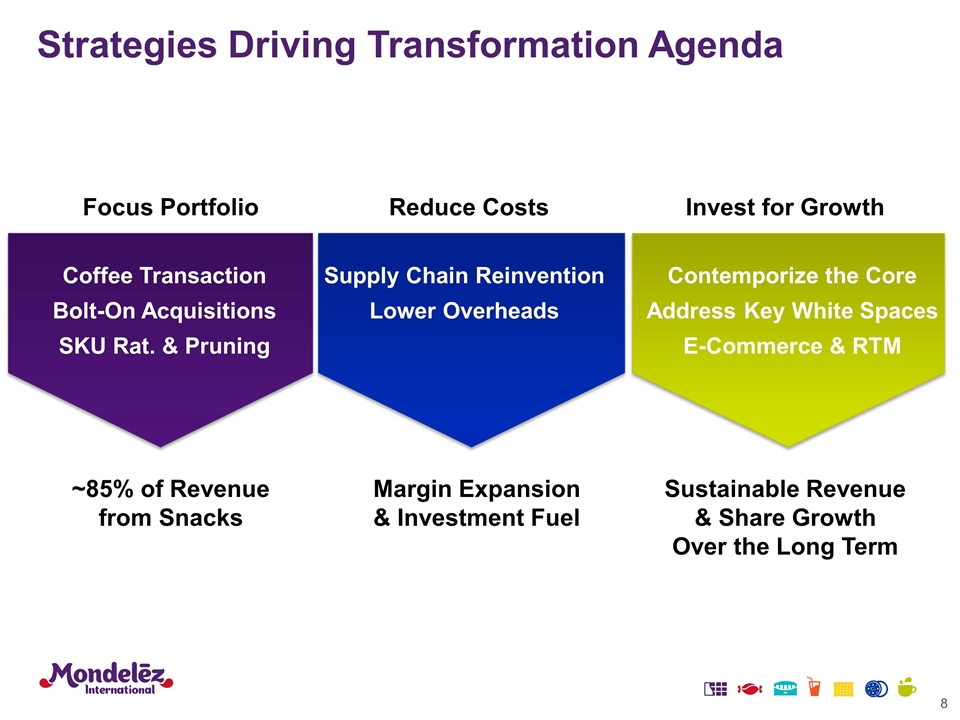

Focus Portfolio Reduce Costs Invest for Growth Coffee Transaction Bolt-On Acquisitions SKU Rat. & Pruning Supply Chain Reinvention Lower Overheads Contemporize the Core Address Key White Spaces E-Commerce & RTM ~85% of Revenue from Snacks Margin Expansion & Investment Fuel Sustainable Revenue & Share Growth Over the Long Term Strategies Driving Transformation Agenda

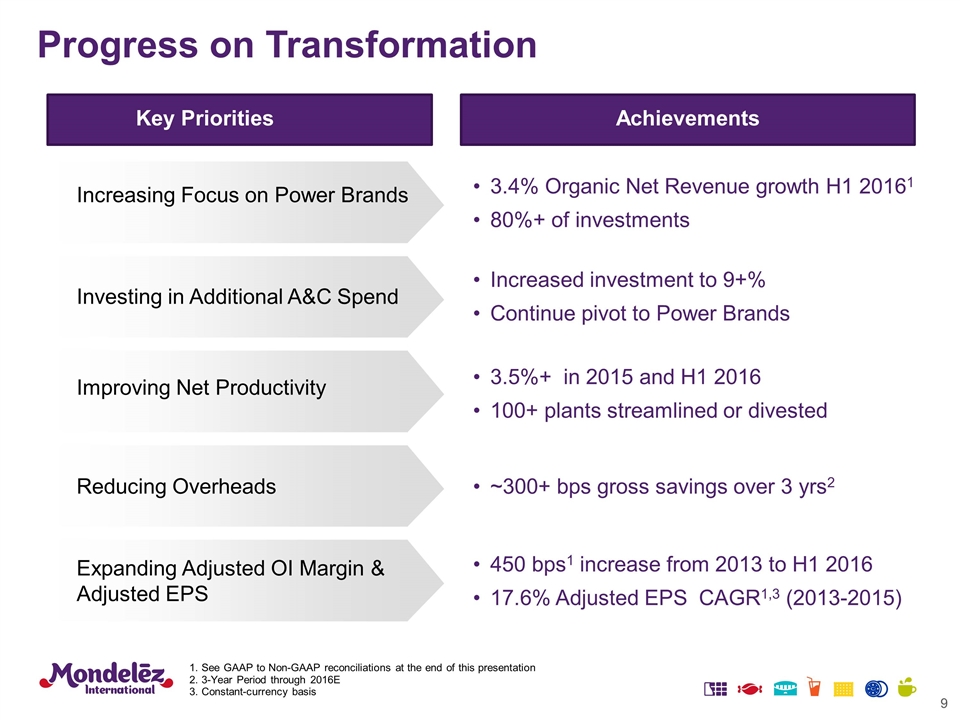

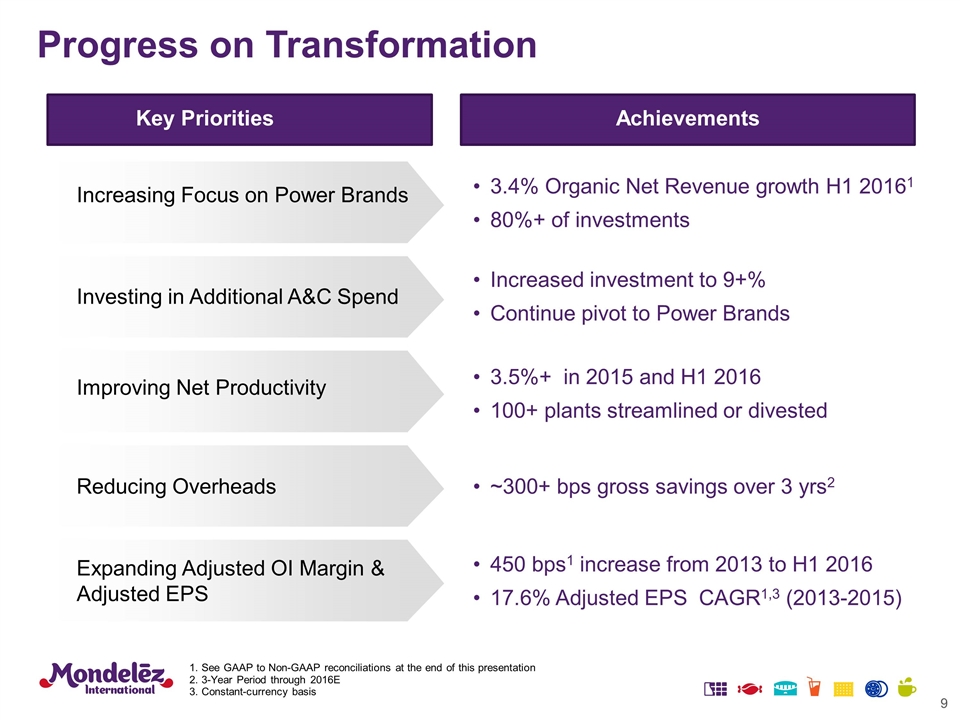

See GAAP to Non-GAAP reconciliations at the end of this presentation 3-Year Period through 2016E Constant-currency basis Key Priorities Achievements Increasing Focus on Power Brands Investing in Additional A&C Spend Improving Net Productivity 3.4% Organic Net Revenue growth H1 20161 80%+ of investments Increased investment to 9+% Continue pivot to Power Brands 3.5%+ in 2015 and H1 2016 100+ plants streamlined or divested Expanding Adjusted OI Margin & Adjusted EPS 450 bps1 increase from 2013 to H1 2016 17.6% Adjusted EPS CAGR1,3 (2013-2015) ~300+ bps gross savings over 3 yrs2 Reducing Overheads Progress on Transformation

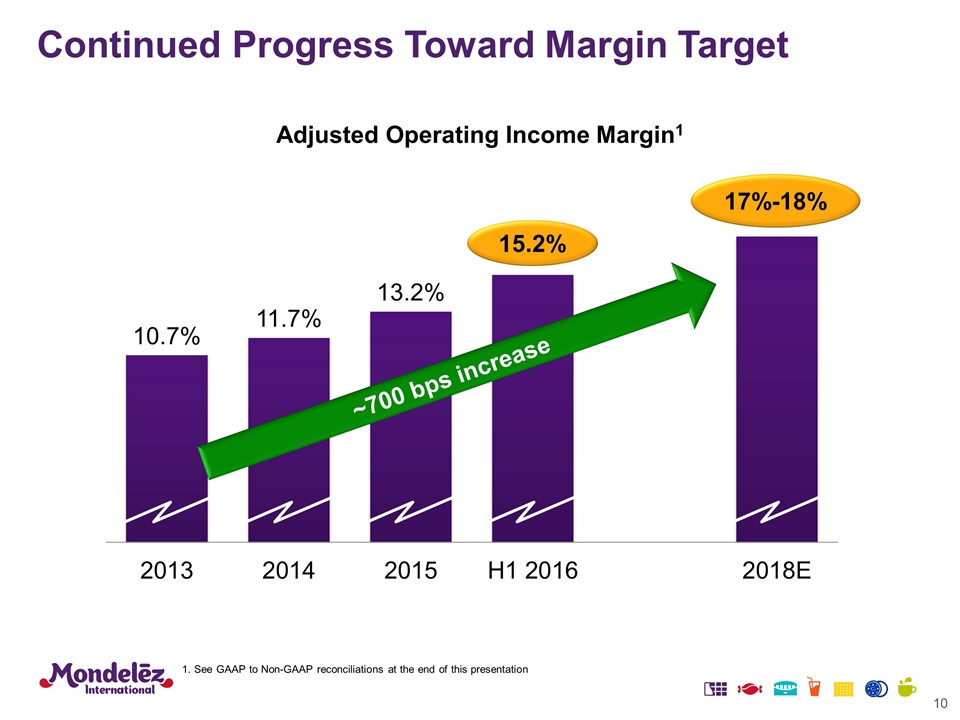

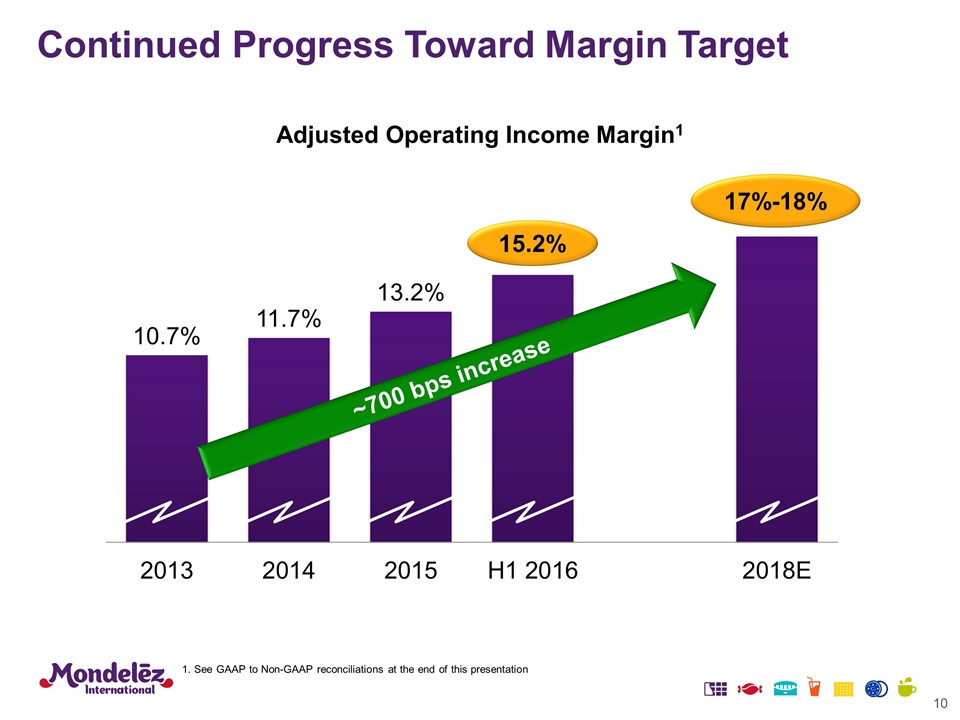

Continued Progress Toward Margin Target Adjusted Operating Income Margin1 17%-18% 15.2% See GAAP to Non-GAAP reconciliations at the end of this presentation ~700 bps increase

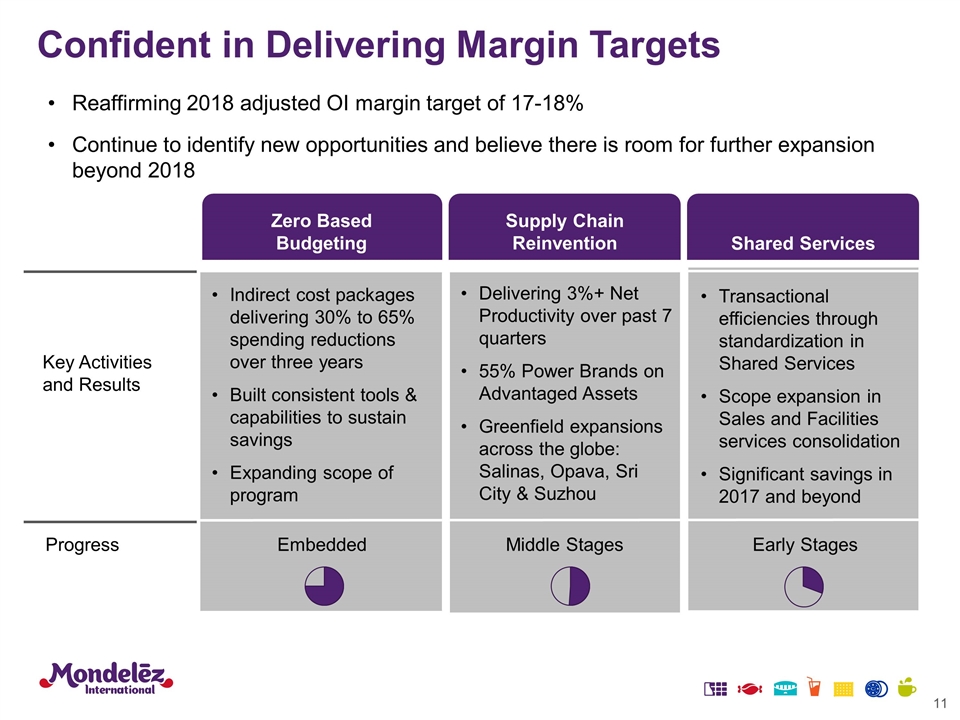

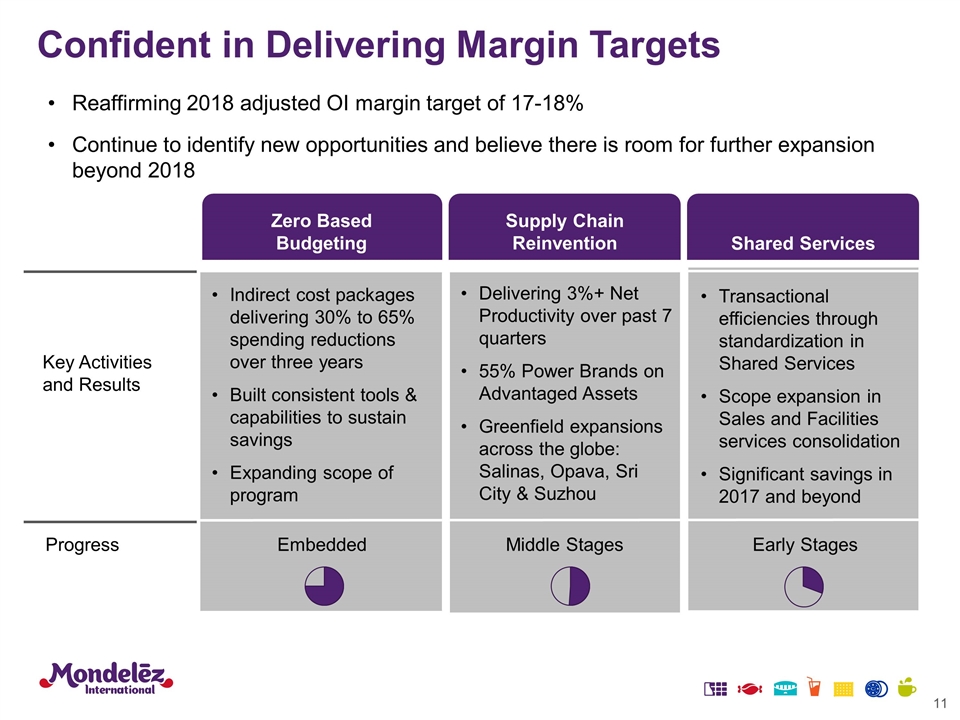

Embedded Middle Stages Early Stages Indirect cost packages delivering 30% to 65% spending reductions over three years Built consistent tools & capabilities to sustain savings Expanding scope of program Supply Chain Reinvention Zero Based Budgeting Shared Services Key Activities and Results Progress Delivering 3%+ Net Productivity over past 7 quarters 55% Power Brands on Advantaged Assets Greenfield expansions across the globe: Salinas, Opava, Sri City & Suzhou Reaffirming 2018 adjusted OI margin target of 17-18% Continue to identify new opportunities and believe there is room for further expansion beyond 2018 Confident in Delivering Margin Targets Transactional efficiencies through standardization in Shared Services Scope expansion in Sales and Facilities services consolidation Significant savings in 2017 and beyond

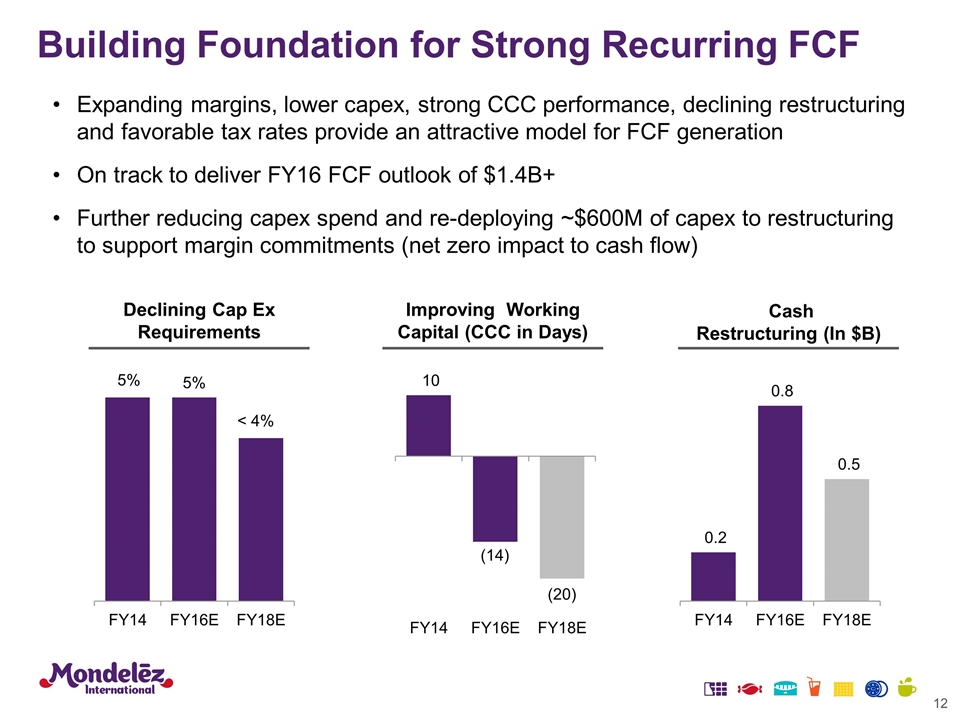

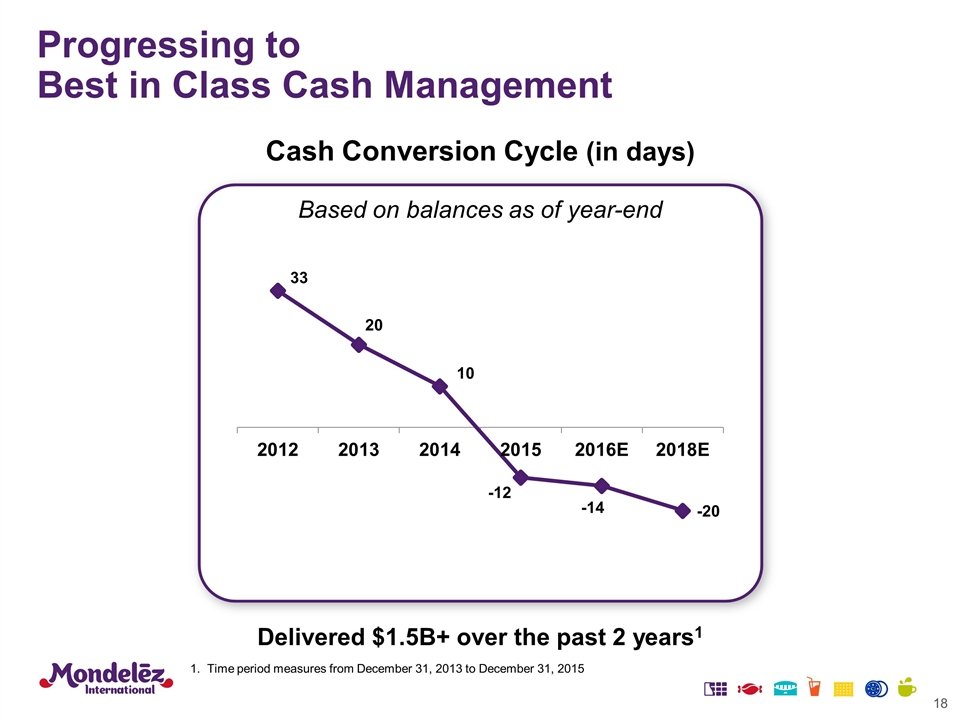

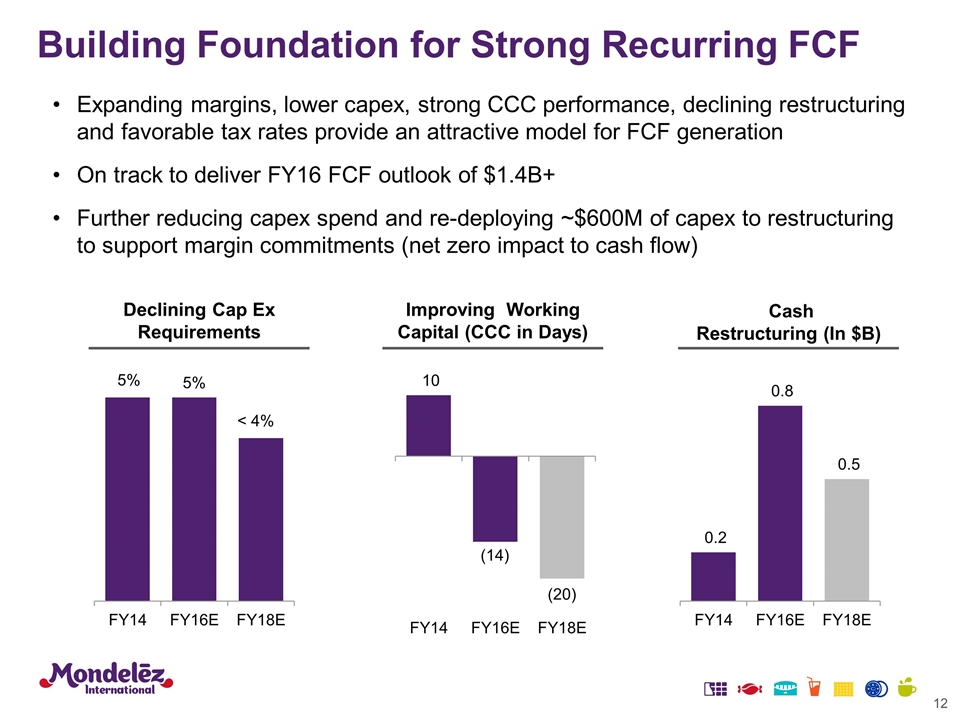

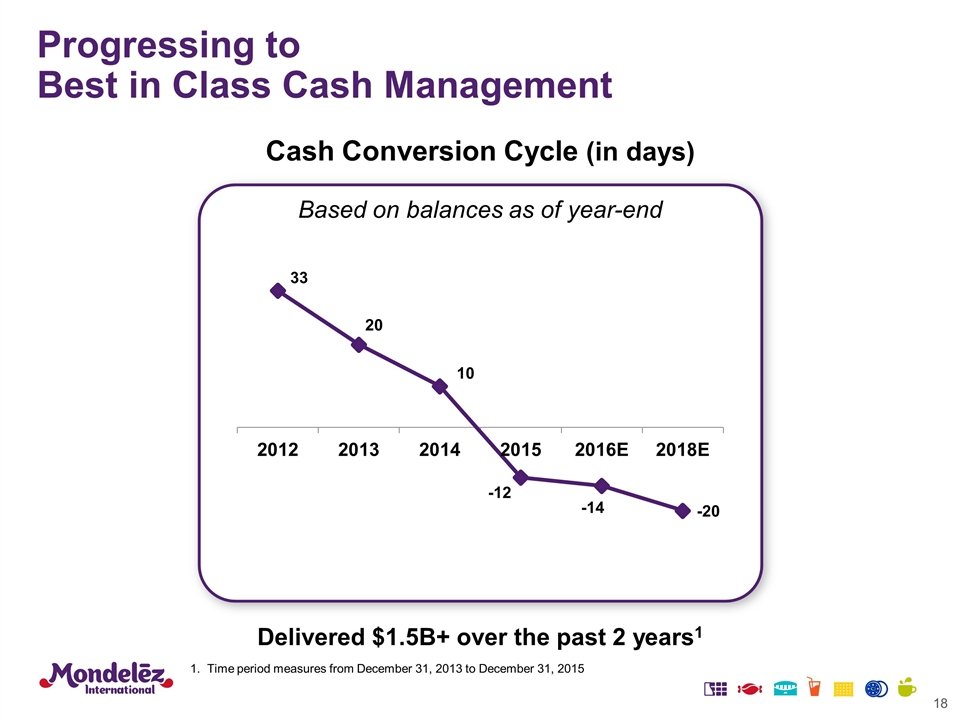

Declining Cap Ex Requirements Cash Restructuring (In $B) Improving Working Capital (CCC in Days) Expanding margins, lower capex, strong CCC performance, declining restructuring and favorable tax rates provide an attractive model for FCF generation On track to deliver FY16 FCF outlook of $1.4B+ Further reducing capex spend and re-deploying ~$600M of capex to restructuring to support margin commitments (net zero impact to cash flow) Building Foundation for Strong Recurring FCF

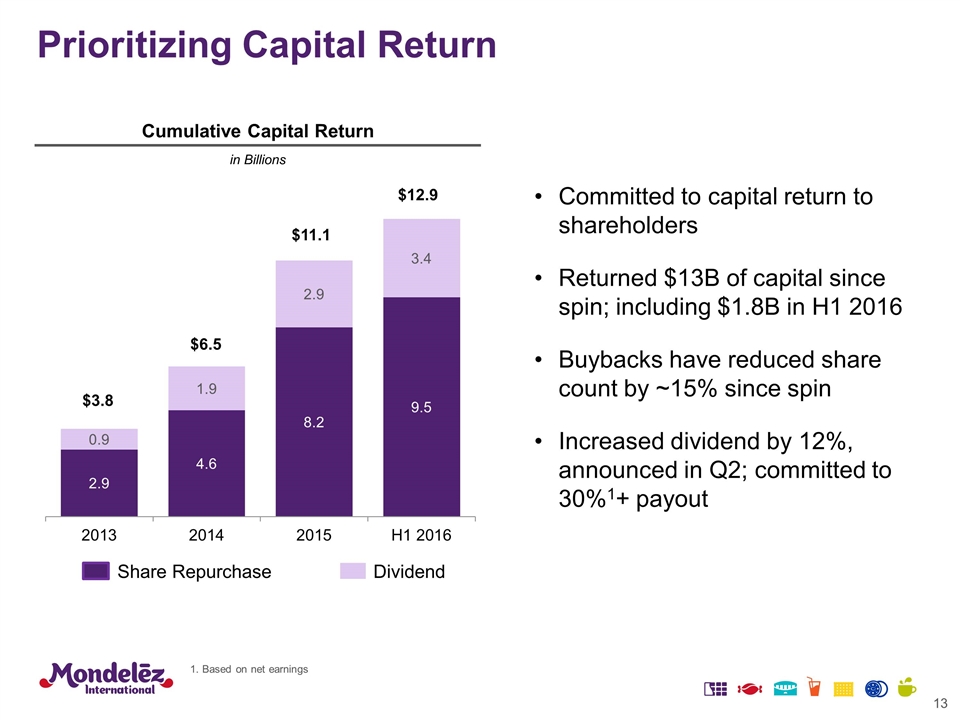

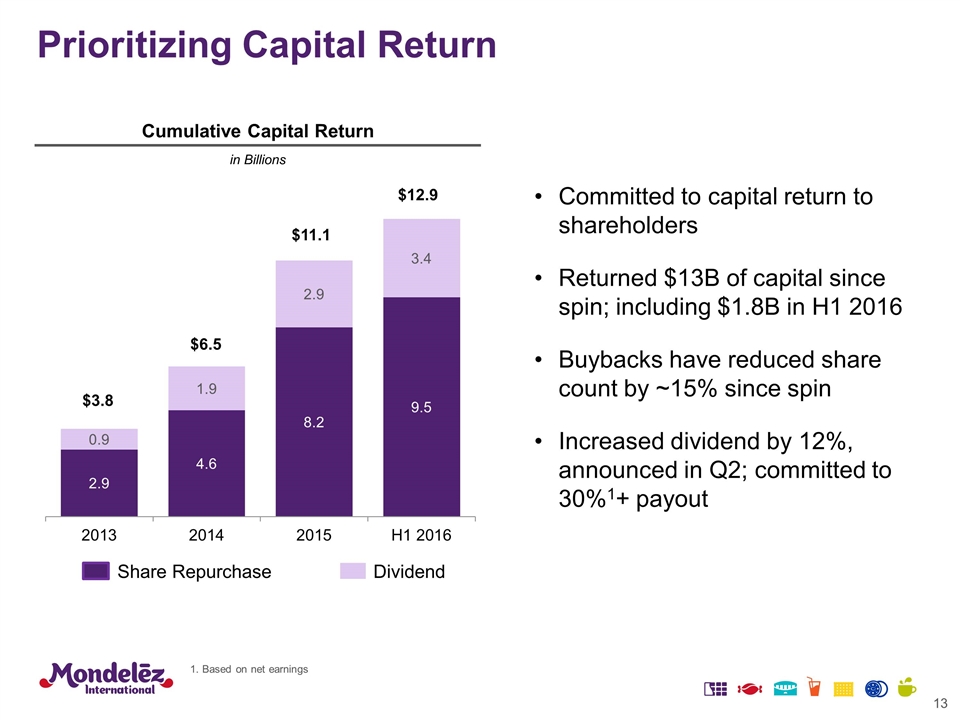

$3.8 $6.5 $11.1 $12.9 Committed to capital return to shareholders Returned $13B of capital since spin; including $1.8B in H1 2016 Buybacks have reduced share count by ~15% since spin Increased dividend by 12%, announced in Q2; committed to 30%1+ payout Cumulative Capital Return in Billions Based on net earnings Prioritizing Capital Return Share Repurchase Dividend

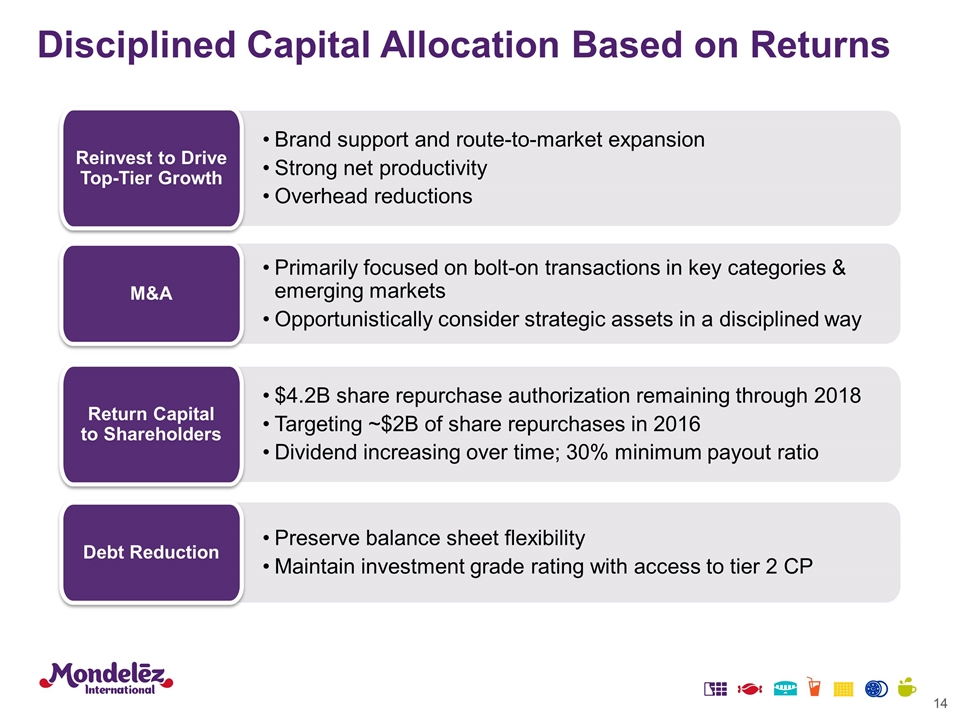

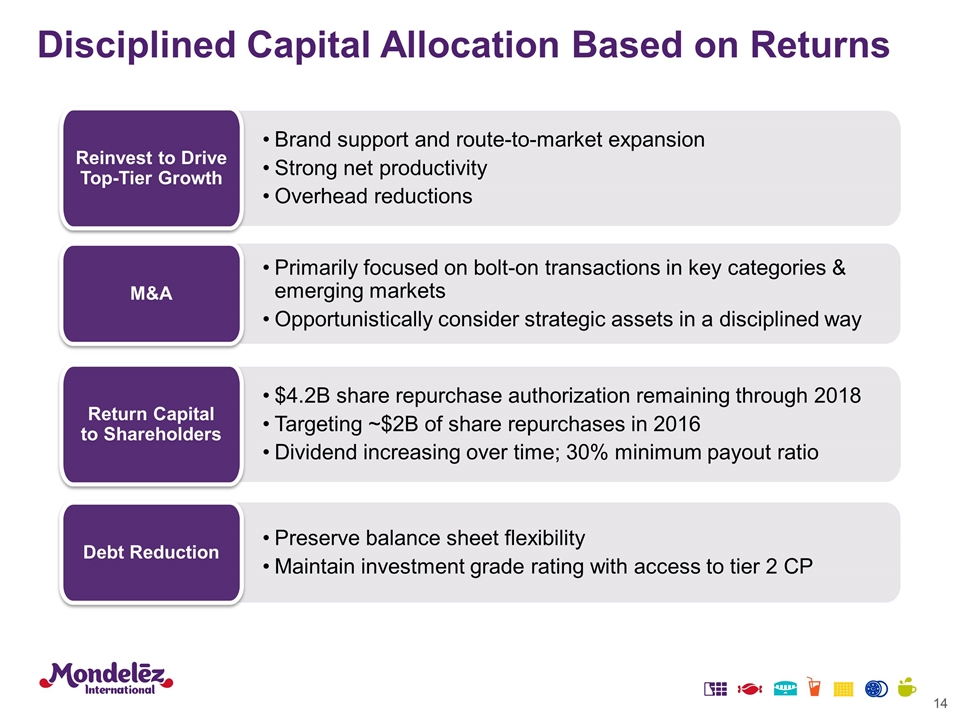

Disciplined Capital Allocation Based on Returns Brand support and route-to-market expansion Strong net productivity Overhead reductions Reinvest to Drive Top-Tier Growth Primarily focused on bolt-on transactions in key categories & emerging markets Opportunistically consider strategic assets in a disciplined way M&A $4.2B share repurchase authorization remaining through 2018 Targeting ~$2B of share repurchases in 2016 Dividend increasing over time; 30% minimum payout ratio Return Capital to Shareholders Preserve balance sheet flexibility Maintain investment grade rating with access to tier 2 CP Debt Reduction

Daniel Myers EVP, Integrated Supply Chain

Three Year Financial Goals 2013-2015 $3B Gross Productivity Cost Savings $1.5B Net Productivity Cost Savings $1B Cash Flow Priorities Step change leadership talent, capability and engagement Innovative global platforms & network transformation Consumer & Customer Driven Supply Chain Drive productivity and cash programs to fuel growth Best-in-class Health, Safety and Sustainability Three Goals. Five Priorities. We Delivered.

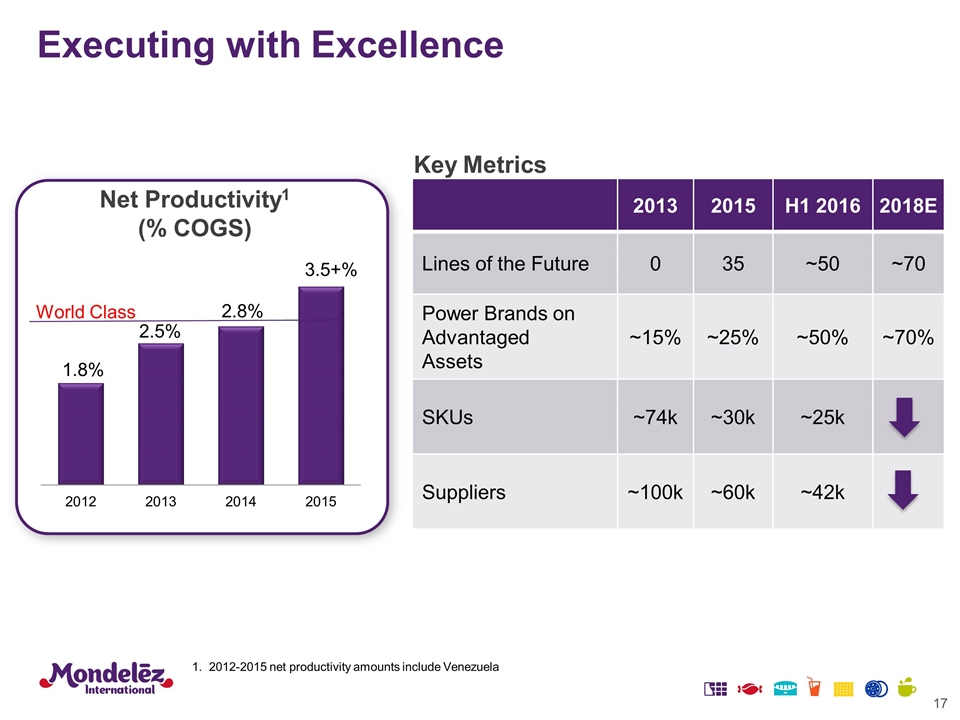

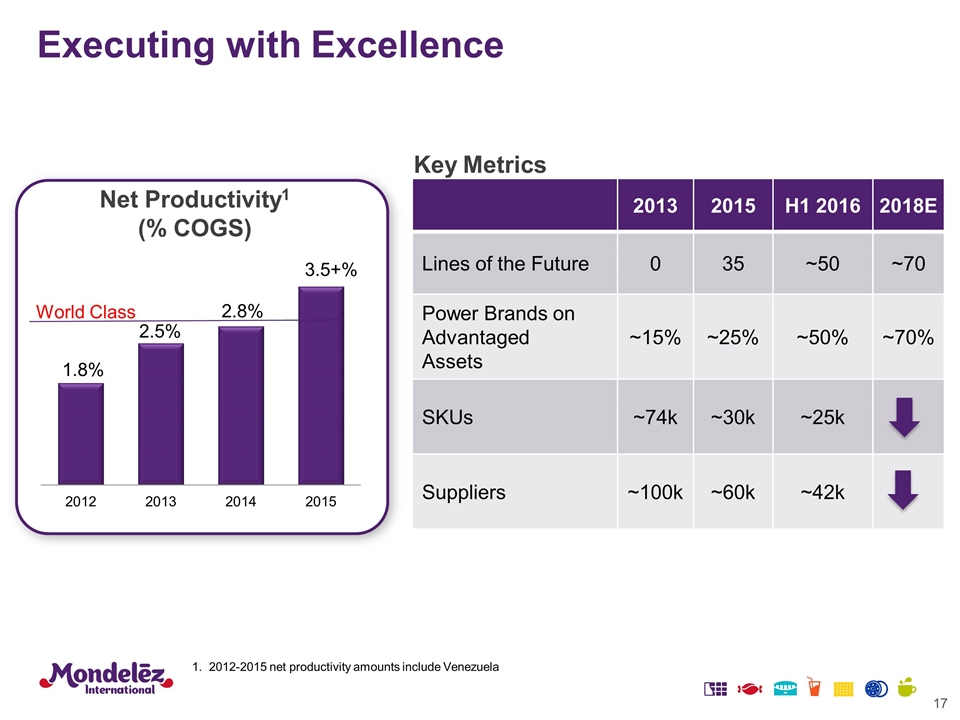

Key Metrics 2013 2015 H1 2016 2018E Lines of the Future 0 35 ~50 ~70 Power Brands on Advantaged Assets ~15% ~25% ~50% ~70% SKUs ~74k ~30k ~25k Suppliers ~100k ~60k ~42k 2.5% 2.8% 1.8% 3.5+% Net Productivity1 (% COGS) 1. 2012-2015 net productivity amounts include Venezuela World Class Executing with Excellence

Cash Conversion Cycle (in days) Based on balances as of year-end Progressing to Best in Class Cash Management Delivered $1.5B+ over the past 2 years1 1. Time period measures from December 31, 2013 to December 31, 2015

Payables Target CCC of -20 days by 2018 Continuing to Drive Cash Management Inventory Receivables

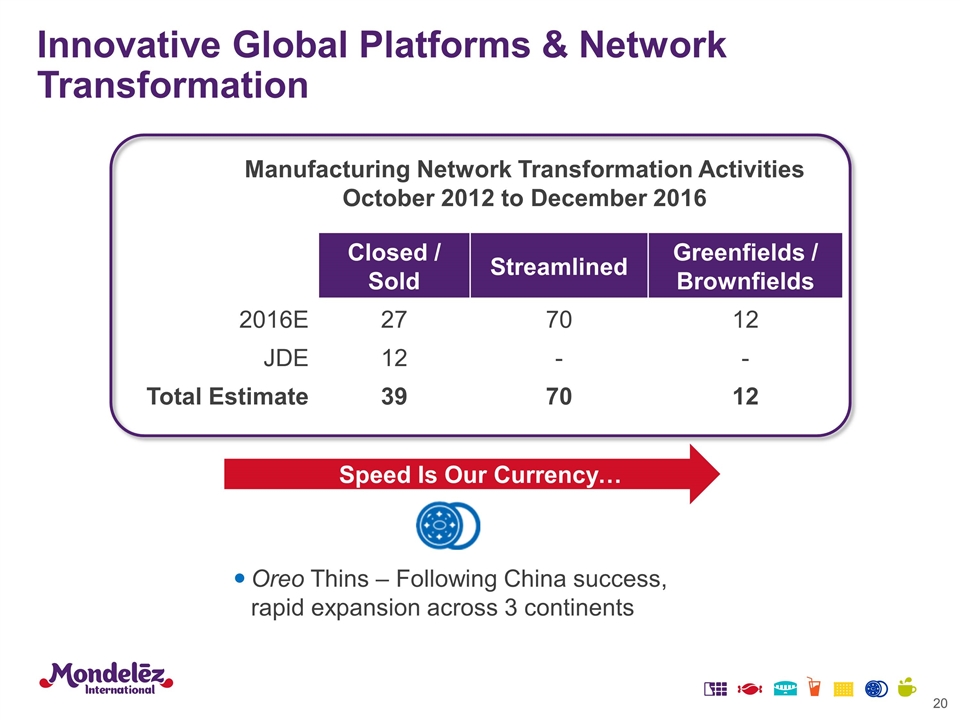

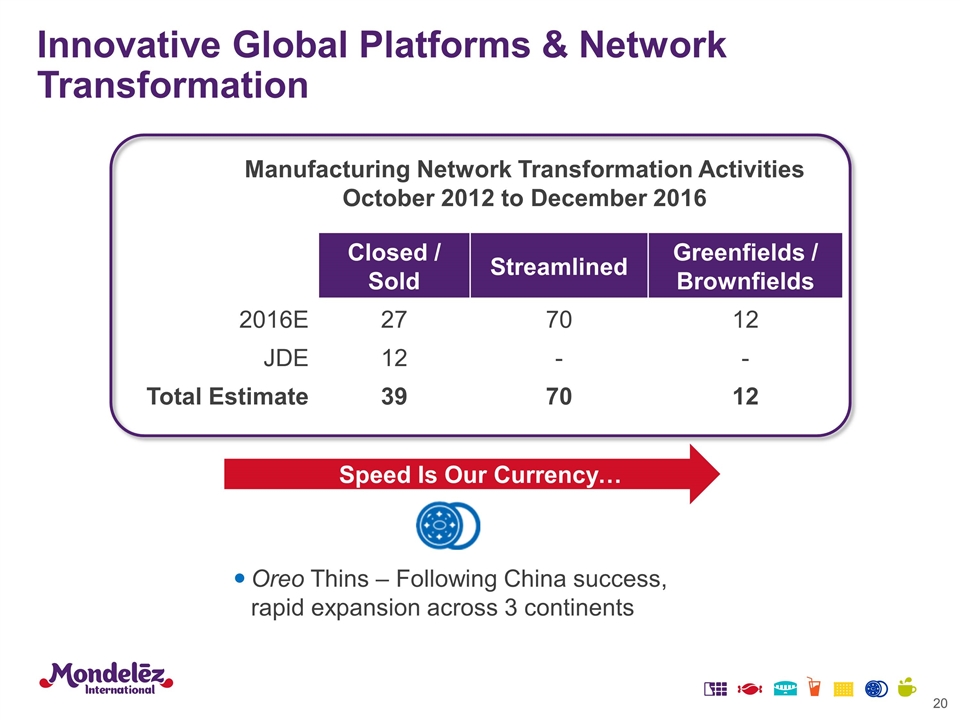

Innovative Global Platforms & Network Transformation Closed / Sold Streamlined Greenfields / Brownfields 2016E 27 70 12 JDE 12 - - Total Estimate 39 70 12 Manufacturing Network Transformation Activities October 2012 to December 2016 Oreo Thins – Following China success, rapid expansion across 3 continents Speed Is Our Currency…

Skarbimierz, Poland

Opava, Czech Republic

Puebla, Mexico

Sri City, India

Insert Video

6_81 Consumer & Customer Driven Supply Chain eCommerce Responsive customer driven supply chain Supply chain capability for rapid eCommerce growth Focused capabilities Price Pack Architecture Increase accessibility via low price point small formats Maximize packaging platforms to expand occasions Grow category and share with family packs Industry Ranking Walmart Supplier of the Year: USA, Brazil, Central America Europe ECR silver medal award with Carrefour

6_81 Integrated Lean Six Sigma Procurement Transformation Simplicity Stepping Up Productivity Delivery

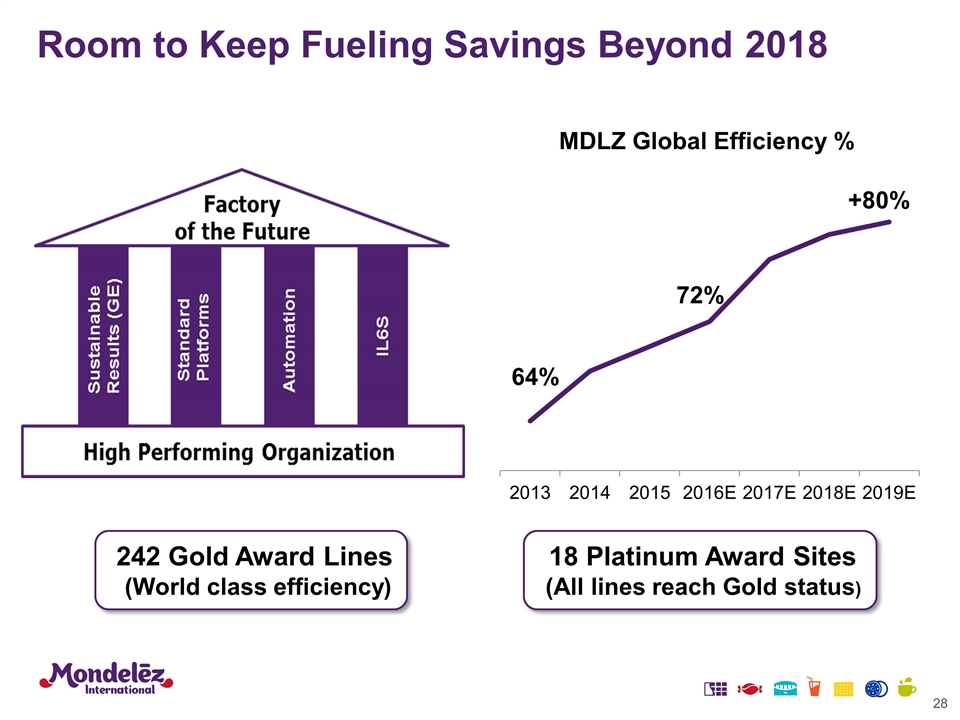

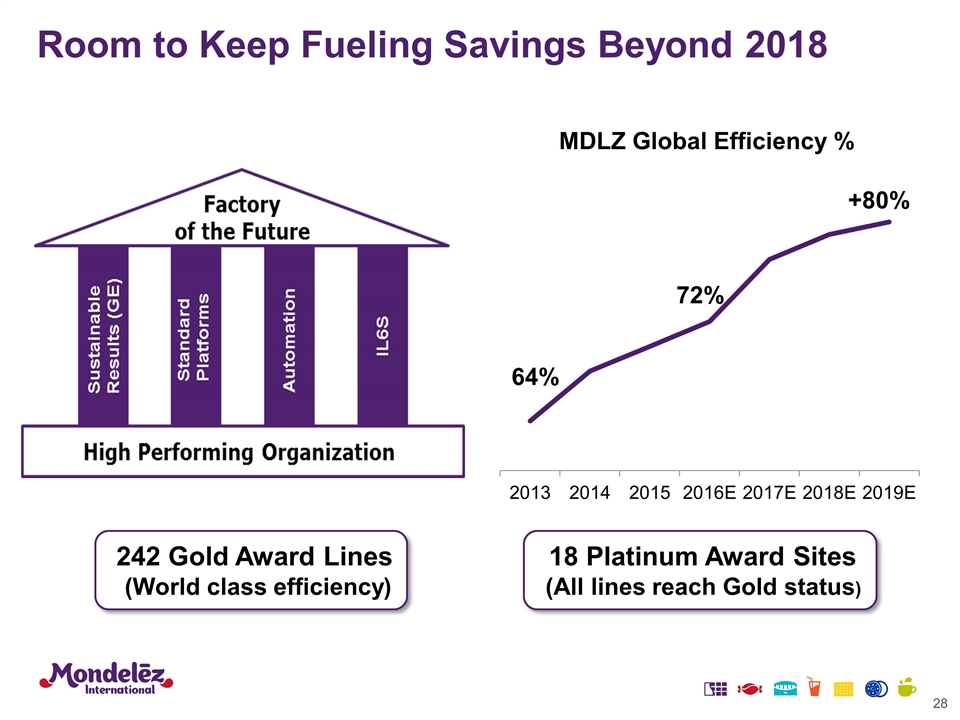

Room to Keep Fueling Savings Beyond 2018 242 Gold Award Lines (World class efficiency) 18 Platinum Award Sites (All lines reach Gold status) MDLZ Global Efficiency % 64% 72% +80%

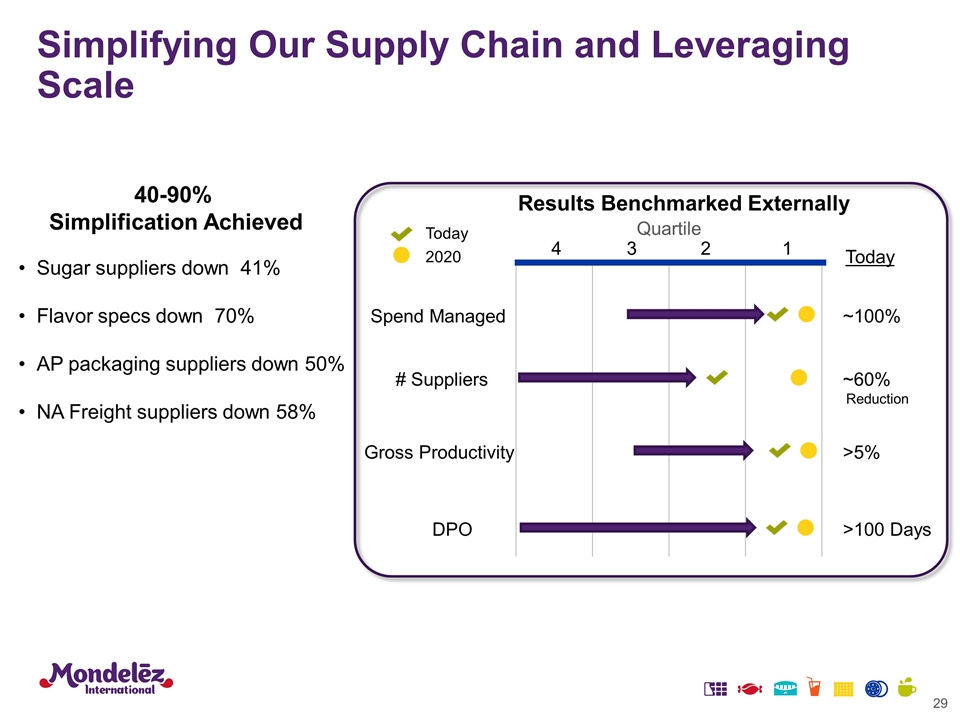

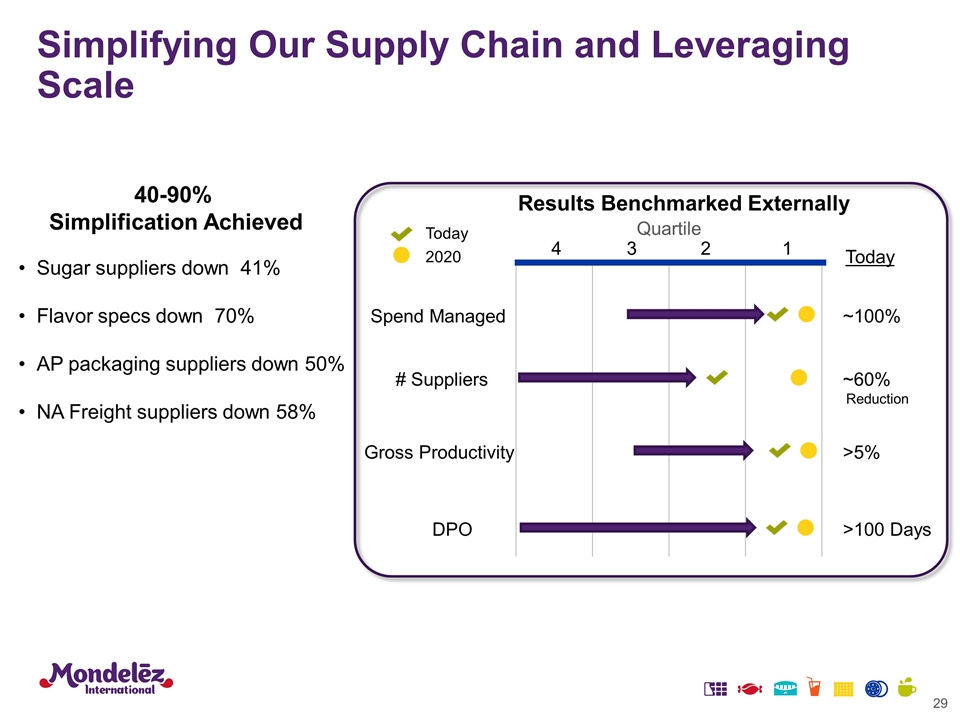

Simplifying Our Supply Chain and Leveraging Scale 40-90% Simplification Achieved Sugar suppliers down 41% Flavor specs down 70% AP packaging suppliers down 50% NA Freight suppliers down 58% Spend Managed # Suppliers Gross Productivity DPO ~100% ~60% Reduction >5% >100 Days 4 3 2 1 Today Results Benchmarked Externally Today 2020 Quartile

2016 Global Award Winner Procurement Transformation

We Delivered. And We’ll Continue to Deliver.

Tim Cofer EVP and Chief Growth Officer

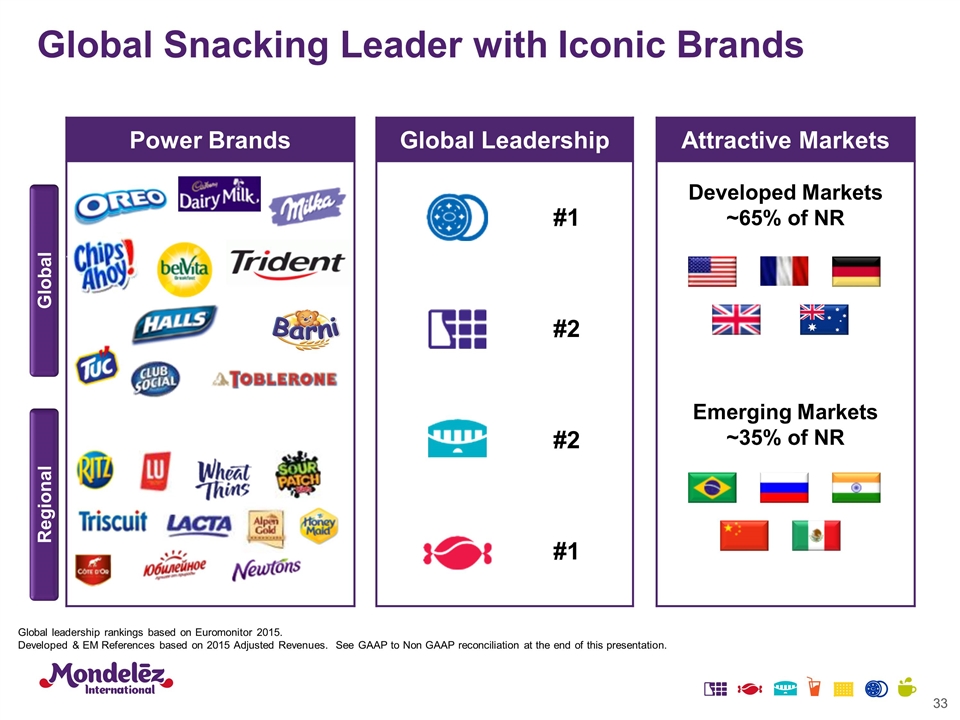

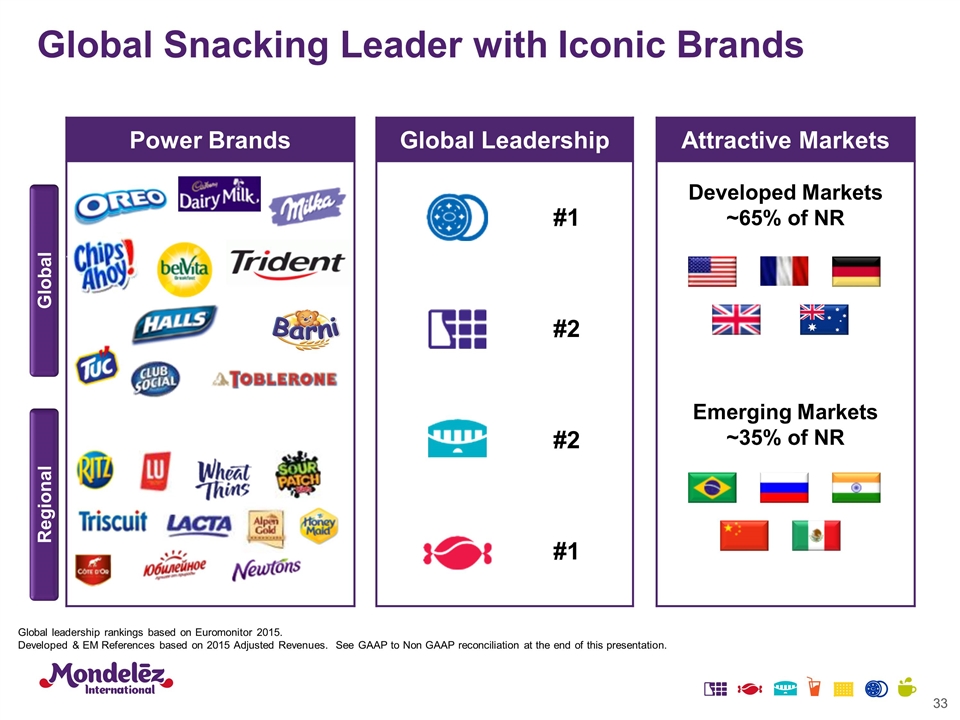

Power Brands Global Leadership Attractive Markets #1 Developed Markets ~65% of NR #2 #2 Emerging Markets ~35% of NR #1 Global Regional Global leadership rankings based on Euromonitor 2015. Developed & EM References based on 2015 Adjusted Revenues. See GAAP to Non GAAP reconciliation at the end of this presentation. Global Snacking Leader with Iconic Brands

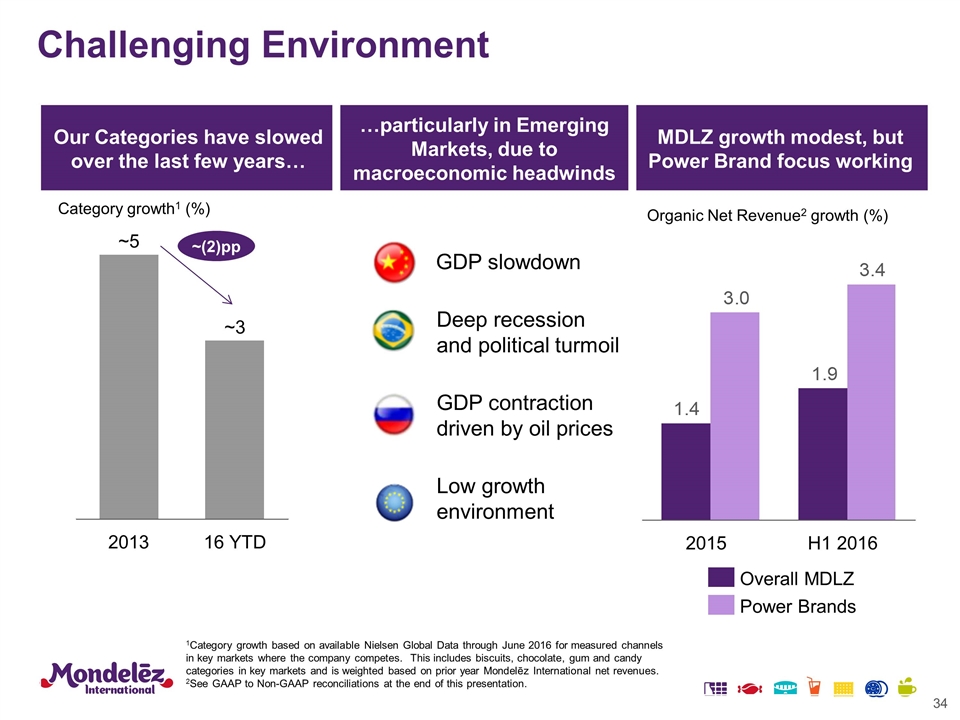

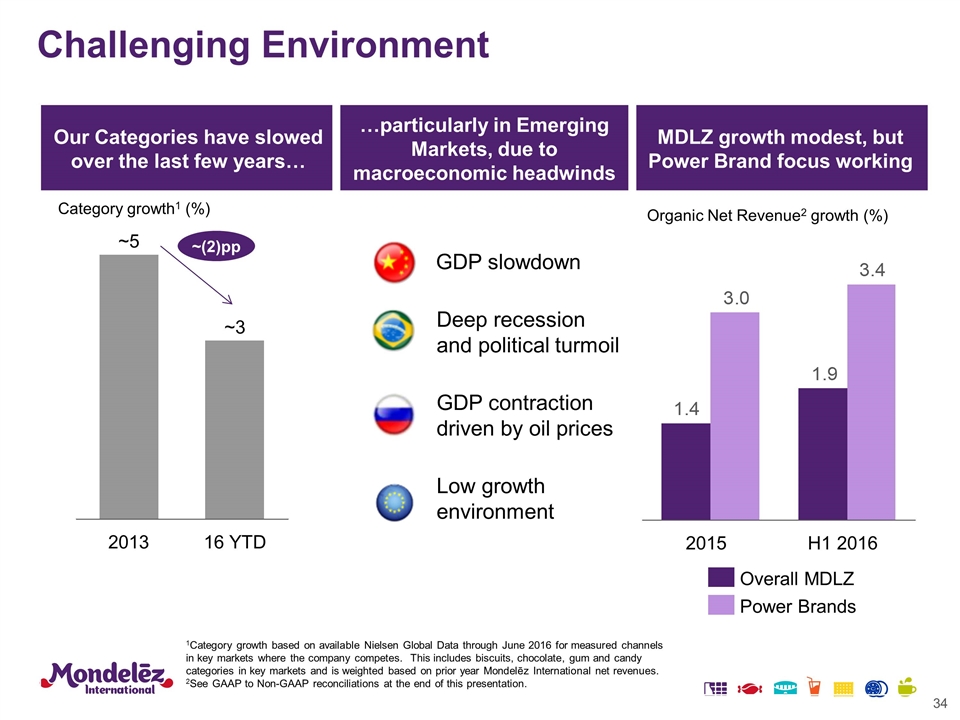

Our Categories have slowed over the last few years… …particularly in Emerging Markets, due to macroeconomic headwinds MDLZ growth modest, but Power Brand focus working GDP slowdown Deep recession and political turmoil GDP contraction driven by oil prices Low growth environment Challenging Environment ~3 ~5 H1 2016 Overall Category growth1 (%) Organic Net Revenue2 growth (%) ~(2)pp 1Category growth based on available Nielsen Global Data through June 2016 for measured channels in key markets where the company competes. This includes biscuits, chocolate, gum and candy categories in key markets and is weighted based on prior year Mondelēz International net revenues. 2See GAAP to Non-GAAP reconciliations at the end of this presentation.

Key Power Shifts Increasing Emphasis on Well-Being Evolving Retail Landscape Time Compression Growing Income Gap Digital Revolution 1 2 3 4 5 Growth Strategy Addresses Rapidly Changing World

Fill Key White Spaces Expand into areas where we are not present today Contemporize Our Core Better connect our portfolio to today’s consumer Fill Key White Spaces Expand into new need states and geographies Drive Selling and Channel Ubiquity Ensure our brands are available whenever and wherever consumers shop 1 2 3 Three Strategies to Drive Accelerated Growth

Fearless Marketing Well-Being Snacking New Occasions Contemporizing Our Core

Fearless Marketing: Wonderfilled Digital Music Digital Music Platform Collaboration with local music stars from Malaysia, Indonesia, Philippines 32 million views on local TV and YouTube Oreo revenue in Southeast Asia increased mid-teens

Fearless Marketing: Content Monetization 12 million views of the live show, digital streams, YouTube, Facebook videos Nearly 1 billion impressions in more than 1,000 media outlets Significant improvement in velocity, distribution & share since the campaign started Heaven Sent

Fearless Marketing: Cadbury Joy Across Channels Omni Channel Joy “Tastes like this feels” among Top 5 most-watched videos on YouTube in UK Customized Facebook posts reached targeted audiences “Cadvent” experiential activation generated mid-teens Christmas sales growth Commuters Parents with kids Students / Post Grads

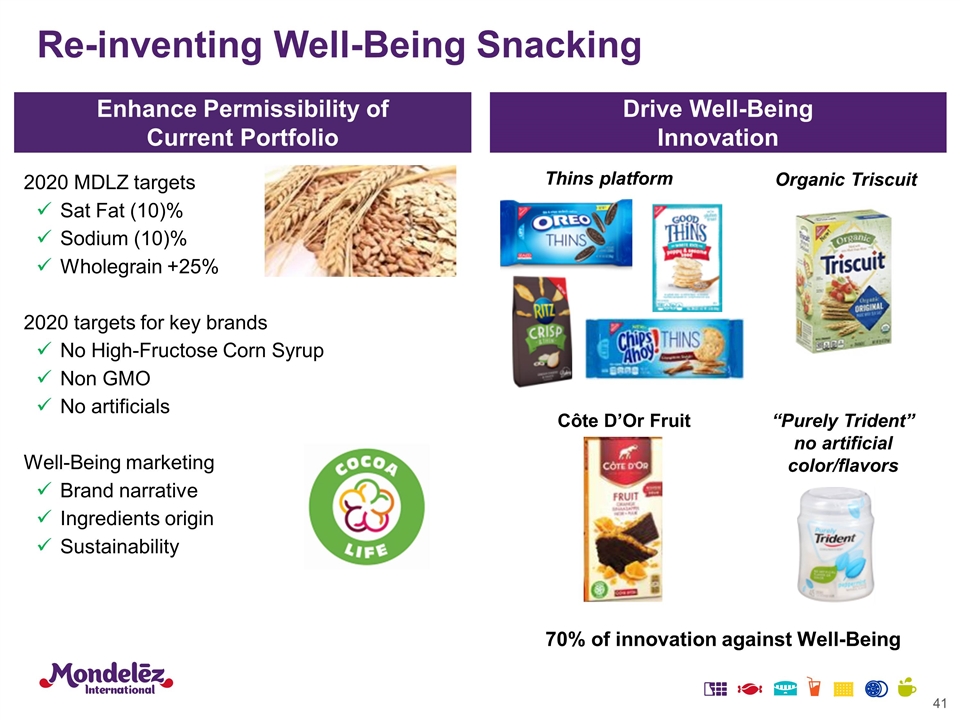

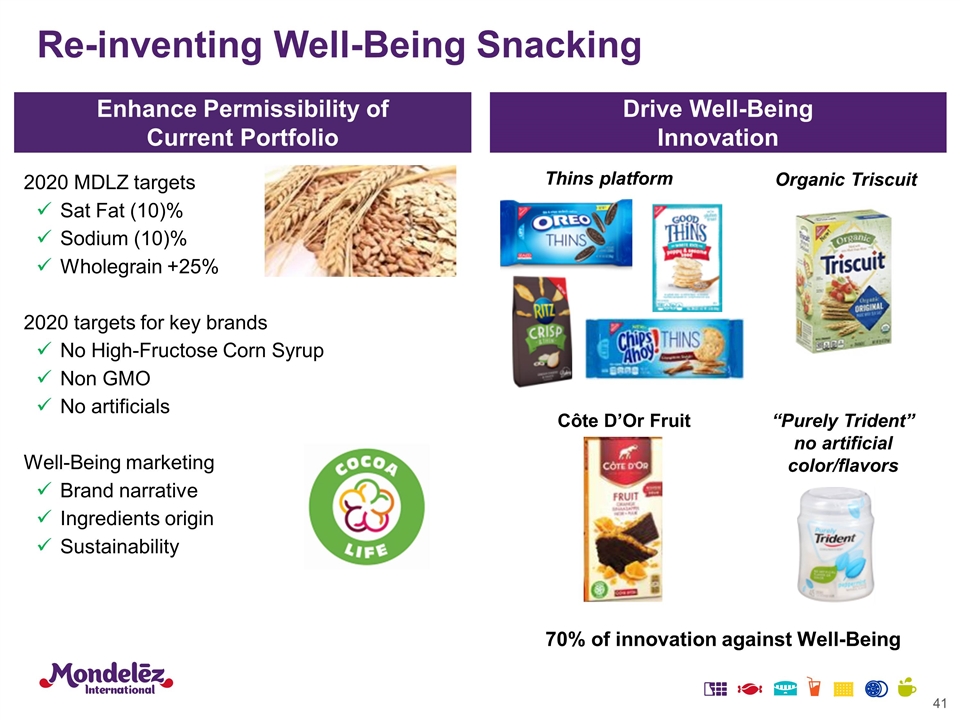

2020 MDLZ targets Sat Fat (10)% Sodium (10)% Wholegrain +25% 2020 targets for key brands No High-Fructose Corn Syrup Non GMO No artificials Well-Being marketing Brand narrative Ingredients origin Sustainability Enhance Permissibility of Current Portfolio 70% of innovation against Well-Being Drive Well-Being Innovation Thins platform Côte D’Or Fruit Organic Triscuit “Purely Trident” no artificial color/flavors Re-inventing Well-Being Snacking

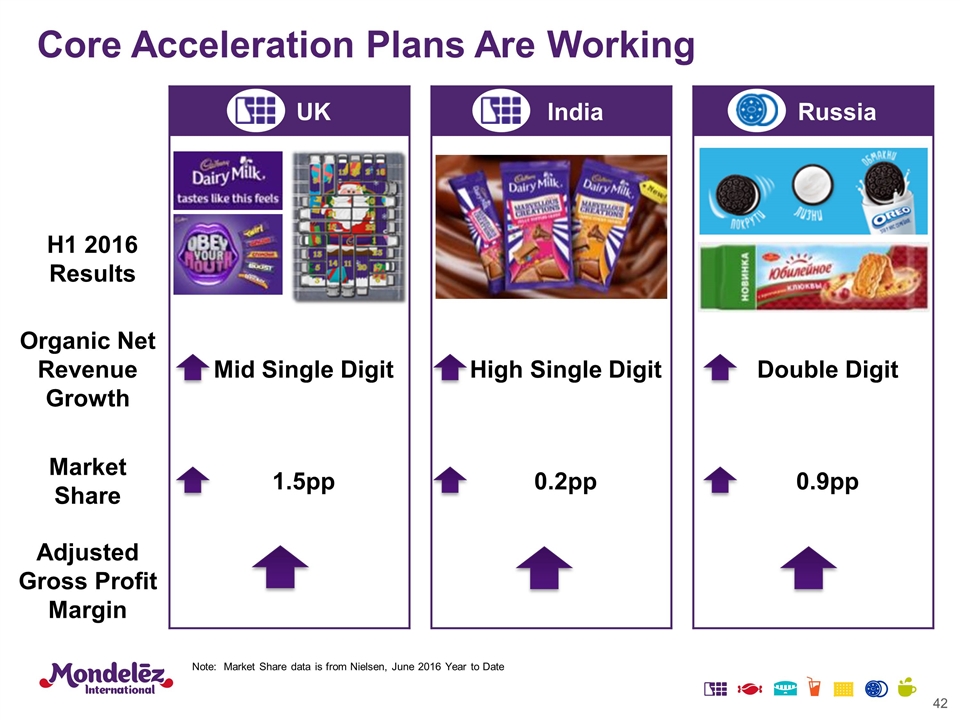

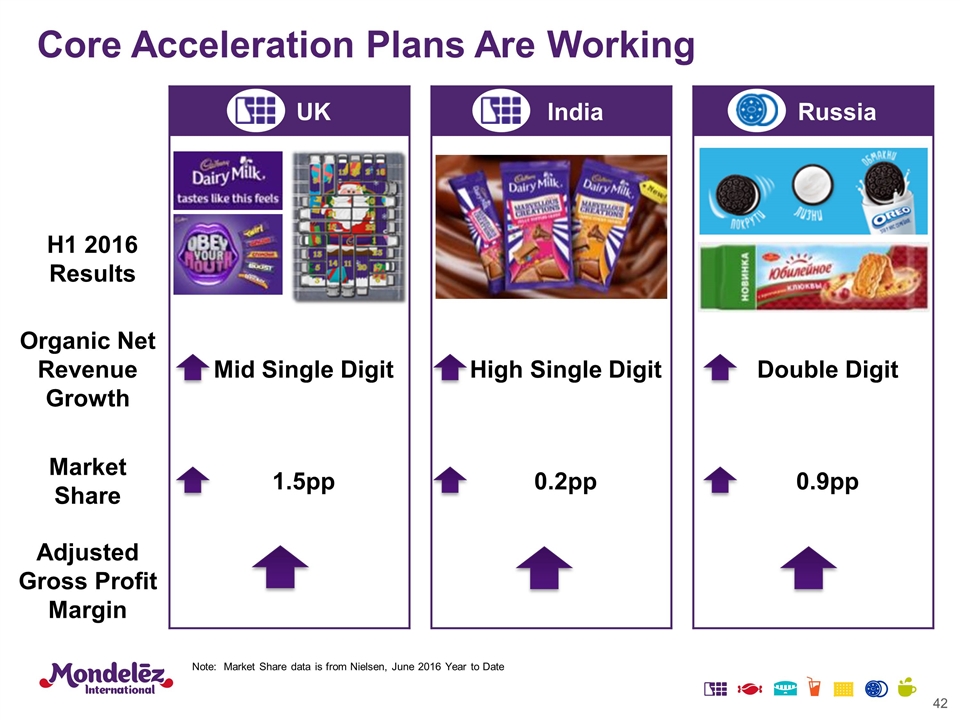

UK India Russia H1 2016 Results Organic Net Revenue Growth Mid Single Digit High Single Digit Double Digit Market Share 1.5pp 0.2pp 0.9pp Adjusted Gross Profit Margin Note: Market Share data is from Nielsen, June 2016 Year to Date Core Acceleration Plans Are Working

Well- Being Premium Affordable Consumer White Space Geographic Expansion 2 1 South-East Asia BRICs Africa Transforming Our Portfolio to Address Key White Spaces

Aspirational and differentiated brand Premium quality, alpine milk credentials Strong local sales and production Leverage MDLZ Biscuits leadership and Gum successful launch $200MM snacking leader Successful Kinh-Do integration Strong share gain in Biscuits & Soft Cakes Significant growth potential in Vietnam and South East Asia China Vietnam Japan Repatriate Oreo, Ritz and Premium Leverage strong local sales execution Opportunity to launch global bundles; enter new consumption occasions Category Expansion in New Geographies

America’s favorite cookie paired with European iconic Chocolate Disruptive cross-category innovation Proven success in other markets Entering the U.S.: The World’s Largest Chocolate Market Green & Black’s Oreo Chocolate Premium with ethically sourced cocoa High-quality, simple ingredients No artificial flavors, colors, preservatives Non-GMO ingredients

Building Capabilities & Infrastructure Accelerating Business Momentum Assortment, price, content, search, traffic Dedicated team, external talent H1 2016 net revenue 30%+ growth; further acceleration in H2 and 2017 Powerful joint-business plan partnerships Building $1B+ eCommerce Snacking Platform

Mid Single Digit High Single Digit High Single Digit Mid Single Digit High Single Digit Mid Single Digit H1 2016 Organic Net Revenue Growth YTD Market Share growing / holding in ~65% of revenues Share performance based on available Nielsen Global Data through August 31, 2016 for measured channels in key markets where the company competes. Share performance defined as percentage of revenues with share either increasing or holding versus the same prior year period. Driving Power Brand Growth Where We Have Invested

Advantaged platform with global footprint, focused portfolio and iconic brands Strong track record of driving cost savings and margin expansion Focused growth strategy: Contemporize Portfolio Fill in Key White Spaces Drive Sales & Channel Ubiquity Improving cash flow generation and opportunity for significant capital return Why MDLZ

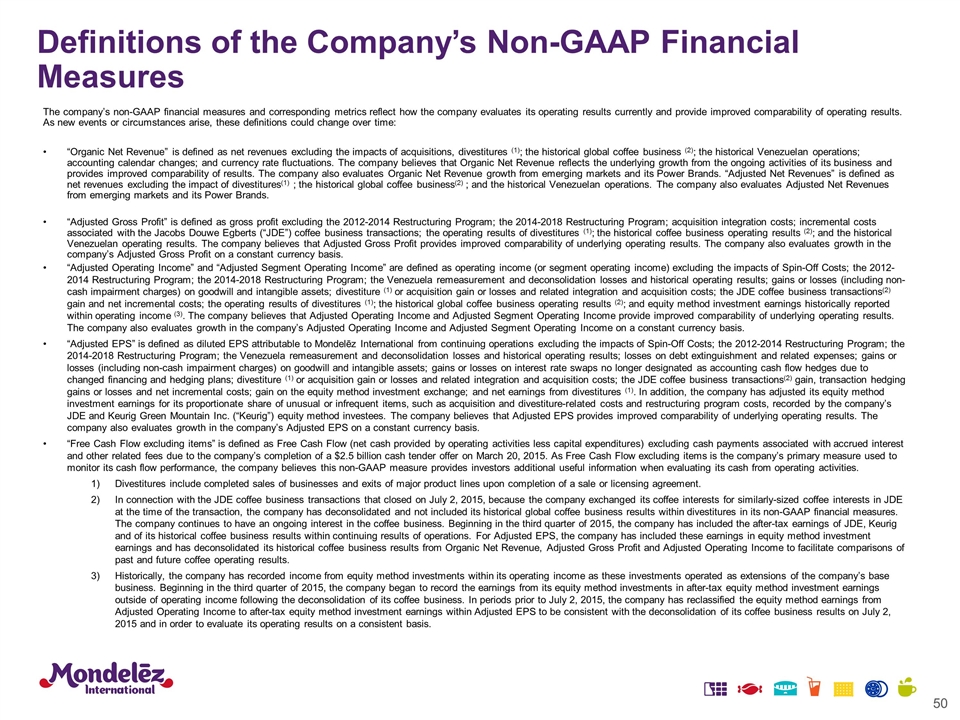

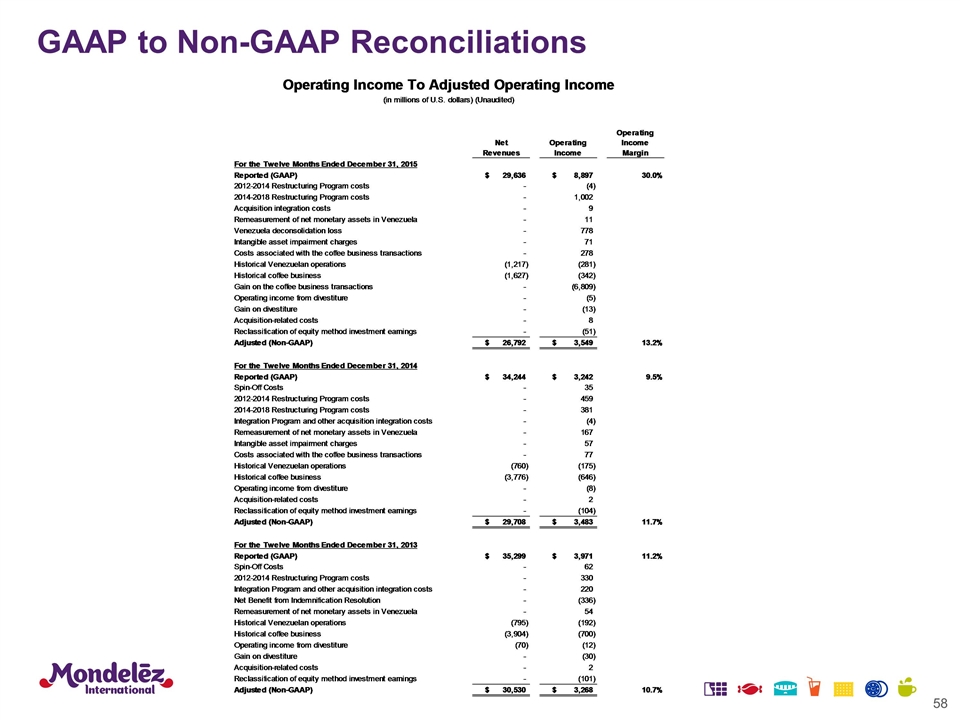

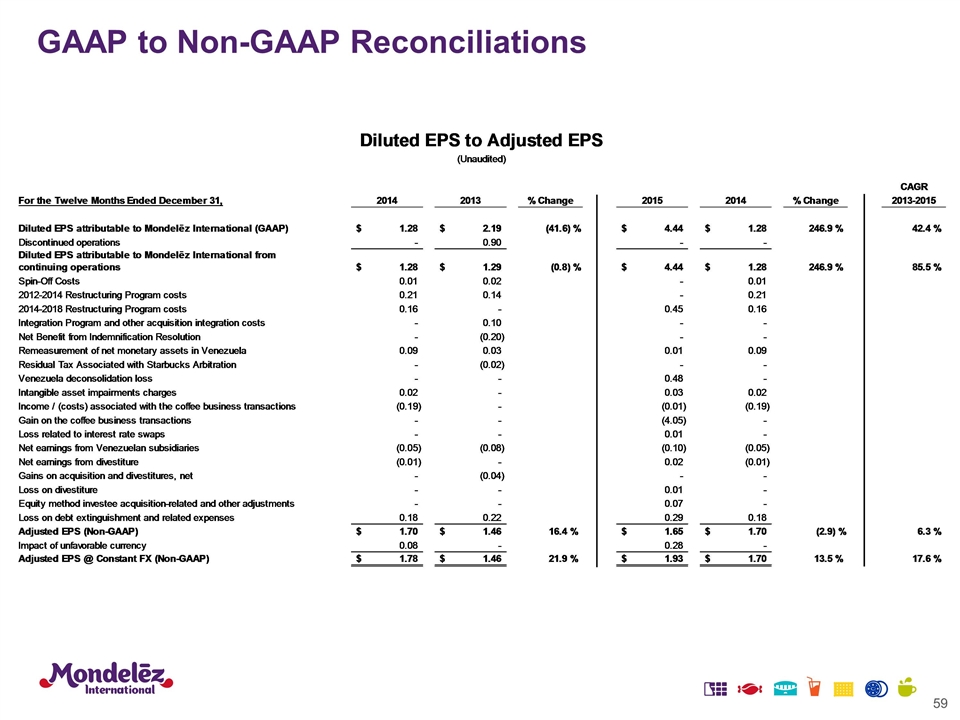

Definitions of the Company’s Non-GAAP Financial Measures The company’s non-GAAP financial measures and corresponding metrics reflect how the company evaluates its operating results currently and provide improved comparability of operating results. As new events or circumstances arise, these definitions could change over time: “Organic Net Revenue” is defined as net revenues excluding the impacts of acquisitions, divestitures (1); the historical global coffee business (2); the historical Venezuelan operations; accounting calendar changes; and currency rate fluctuations. The company believes that Organic Net Revenue reflects the underlying growth from the ongoing activities of its business and provides improved comparability of results. The company also evaluates Organic Net Revenue growth from emerging markets and its Power Brands. “Adjusted Net Revenues” is defined as net revenues excluding the impact of divestitures(1) ; the historical global coffee business(2) ; and the historical Venezuelan operations. The company also evaluates Adjusted Net Revenues from emerging markets and its Power Brands. “Adjusted Gross Profit” is defined as gross profit excluding the 2012-2014 Restructuring Program; the 2014-2018 Restructuring Program; acquisition integration costs; incremental costs associated with the Jacobs Douwe Egberts (“JDE”) coffee business transactions; the operating results of divestitures (1); the historical coffee business operating results (2); and the historical Venezuelan operating results. The company believes that Adjusted Gross Profit provides improved comparability of underlying operating results. The company also evaluates growth in the company’s Adjusted Gross Profit on a constant currency basis. “Adjusted Operating Income” and “Adjusted Segment Operating Income” are defined as operating income (or segment operating income) excluding the impacts of Spin-Off Costs; the 2012-2014 Restructuring Program; the 2014-2018 Restructuring Program; the Venezuela remeasurement and deconsolidation losses and historical operating results; gains or losses (including non-cash impairment charges) on goodwill and intangible assets; divestiture (1) or acquisition gain or losses and related integration and acquisition costs; the JDE coffee business transactions(2) gain and net incremental costs; the operating results of divestitures (1); the historical global coffee business operating results (2); and equity method investment earnings historically reported within operating income (3). The company believes that Adjusted Operating Income and Adjusted Segment Operating Income provide improved comparability of underlying operating results. The company also evaluates growth in the company’s Adjusted Operating Income and Adjusted Segment Operating Income on a constant currency basis. “Adjusted EPS” is defined as diluted EPS attributable to Mondelēz International from continuing operations excluding the impacts of Spin-Off Costs; the 2012-2014 Restructuring Program; the 2014-2018 Restructuring Program; the Venezuela remeasurement and deconsolidation losses and historical operating results; losses on debt extinguishment and related expenses; gains or losses (including non-cash impairment charges) on goodwill and intangible assets; gains or losses on interest rate swaps no longer designated as accounting cash flow hedges due to changed financing and hedging plans; divestiture (1) or acquisition gain or losses and related integration and acquisition costs; the JDE coffee business transactions(2) gain, transaction hedging gains or losses and net incremental costs; gain on the equity method investment exchange; and net earnings from divestitures (1). In addition, the company has adjusted its equity method investment earnings for its proportionate share of unusual or infrequent items, such as acquisition and divestiture-related costs and restructuring program costs, recorded by the company’s JDE and Keurig Green Mountain Inc. (“Keurig”) equity method investees. The company believes that Adjusted EPS provides improved comparability of underlying operating results. The company also evaluates growth in the company’s Adjusted EPS on a constant currency basis. “Free Cash Flow excluding items” is defined as Free Cash Flow (net cash provided by operating activities less capital expenditures) excluding cash payments associated with accrued interest and other related fees due to the company’s completion of a $2.5 billion cash tender offer on March 20, 2015. As Free Cash Flow excluding items is the company’s primary measure used to monitor its cash flow performance, the company believes this non-GAAP measure provides investors additional useful information when evaluating its cash from operating activities. Divestitures include completed sales of businesses and exits of major product lines upon completion of a sale or licensing agreement. In connection with the JDE coffee business transactions that closed on July 2, 2015, because the company exchanged its coffee interests for similarly-sized coffee interests in JDE at the time of the transaction, the company has deconsolidated and not included its historical global coffee business results within divestitures in its non-GAAP financial measures. The company continues to have an ongoing interest in the coffee business. Beginning in the third quarter of 2015, the company has included the after-tax earnings of JDE, Keurig and of its historical coffee business results within continuing results of operations. For Adjusted EPS, the company has included these earnings in equity method investment earnings and has deconsolidated its historical coffee business results from Organic Net Revenue, Adjusted Gross Profit and Adjusted Operating Income to facilitate comparisons of past and future coffee operating results. Historically, the company has recorded income from equity method investments within its operating income as these investments operated as extensions of the company’s base business. Beginning in the third quarter of 2015, the company began to record the earnings from its equity method investments in after-tax equity method investment earnings outside of operating income following the deconsolidation of its coffee business. In periods prior to July 2, 2015, the company has reclassified the equity method earnings from Adjusted Operating Income to after-tax equity method investment earnings within Adjusted EPS to be consistent with the deconsolidation of its coffee business results on July 2, 2015 and in order to evaluate its operating results on a consistent basis.

Outlook The company’s outlook for Adjusted Operating Income margin and Free Cash Flow excluding items are non-GAAP financial measures that exclude or otherwise adjust for items impacting comparability of financial results such as the impact of changes in foreign currency exchange rates, restructuring activities, acquisitions and divestitures. The company is not able to reconcile its full-year 2016 and 2018 projected Adjusted Operating Income margin to its full-year 2016 and 2018 projected reported operating income margin because the company is unable to predict the timing of its Restructuring Program costs and impacts from potential acquisitions or divestitures. The company is not able to reconcile its full-year 2016 and 2018 projected Free Cash Flow excluding items to its full-year 2016 and 2018 projected net cash from operating activities because the company is unable to predict the timing of potential significant items impacting cash flow. Therefore, because of the uncertainty and variability of the nature and amount of future adjustments, which could be significant, the company is unable to provide a reconciliation of these measures without unreasonable effort.

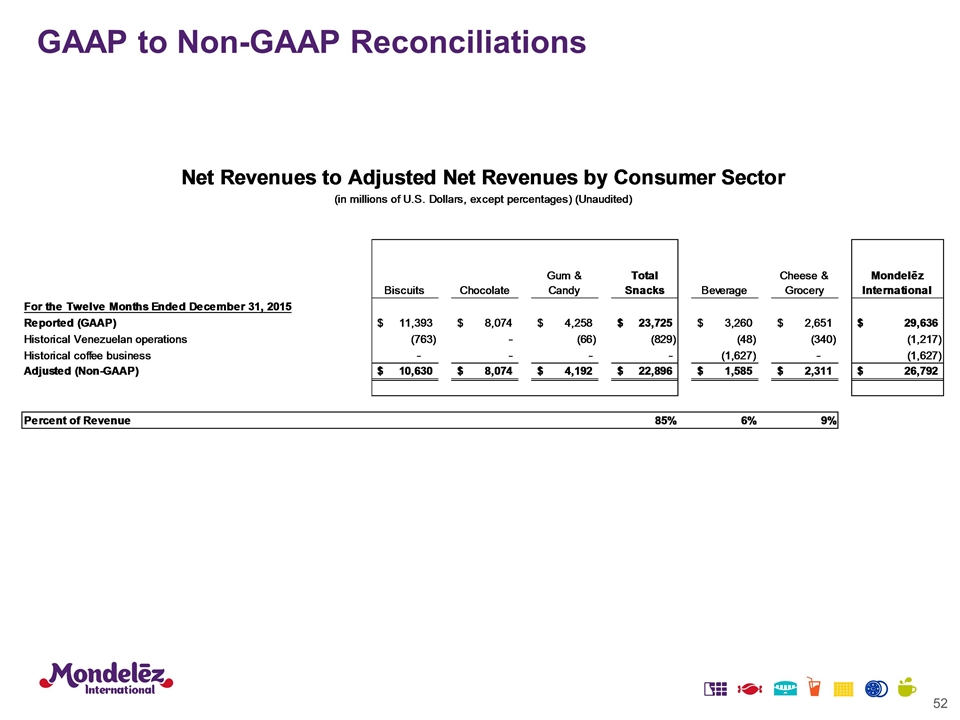

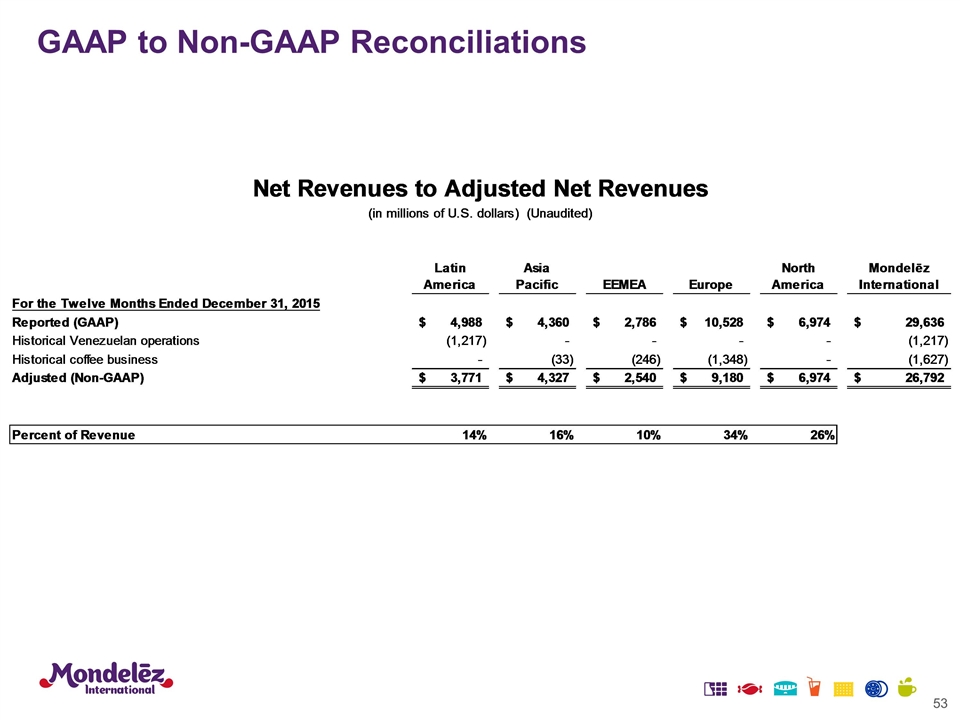

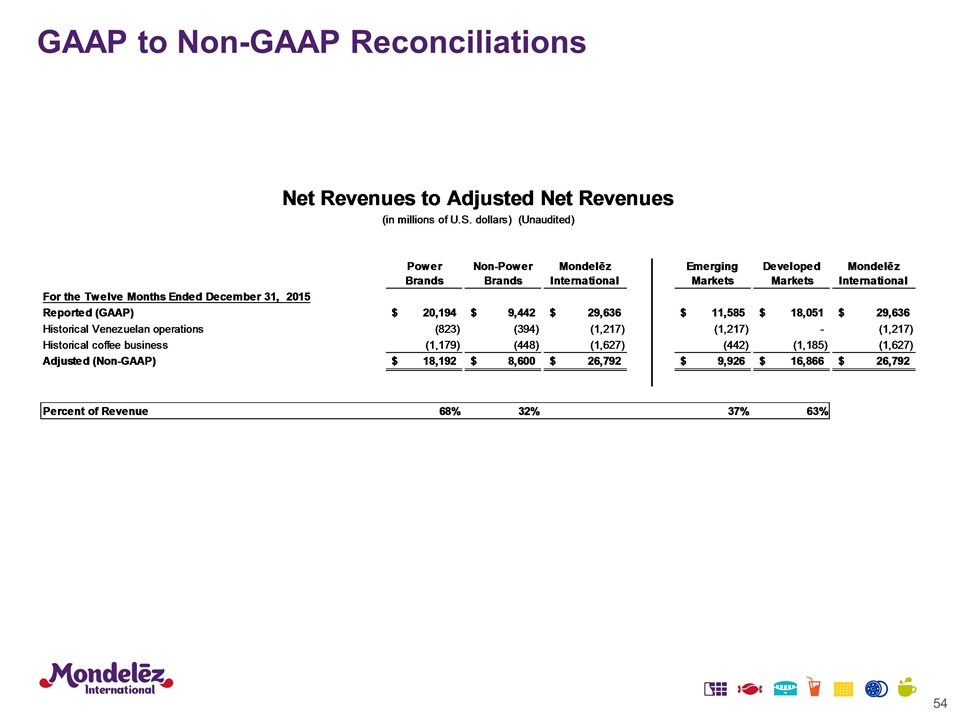

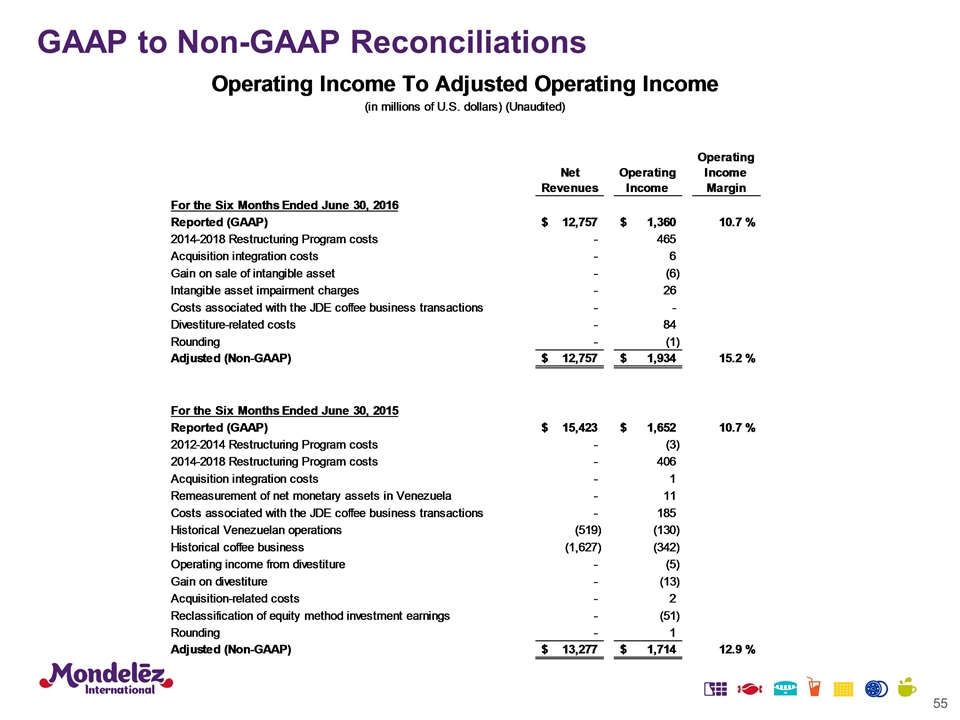

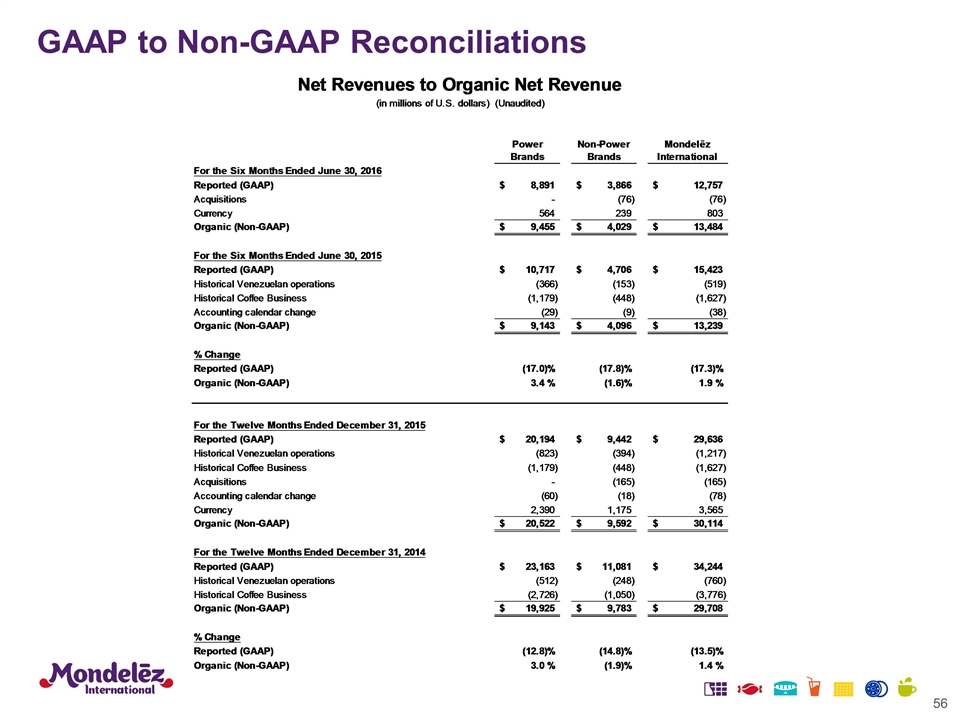

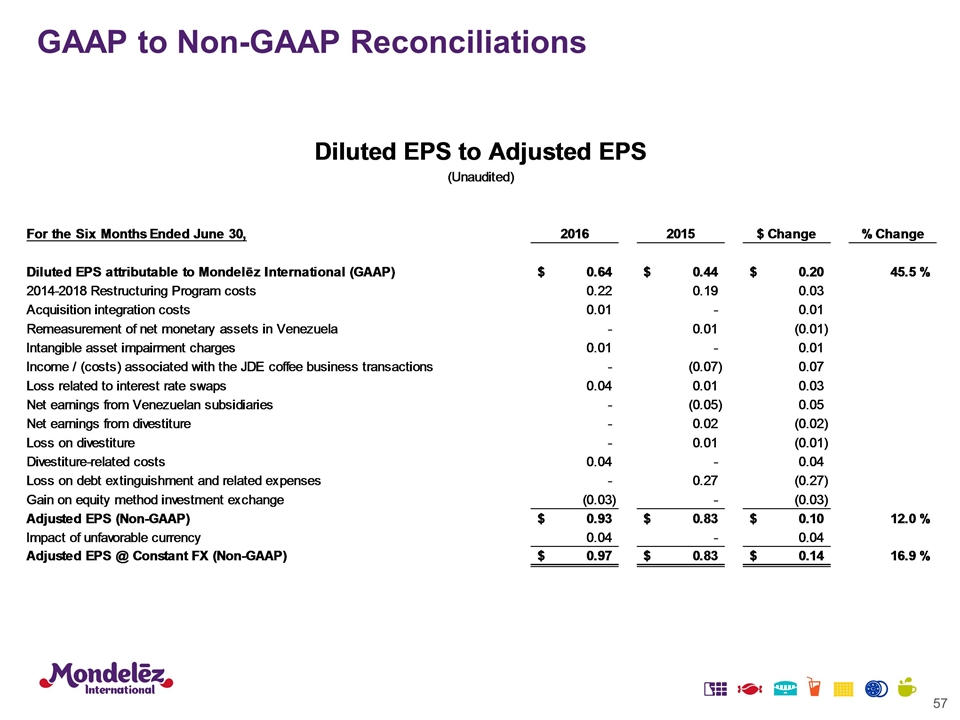

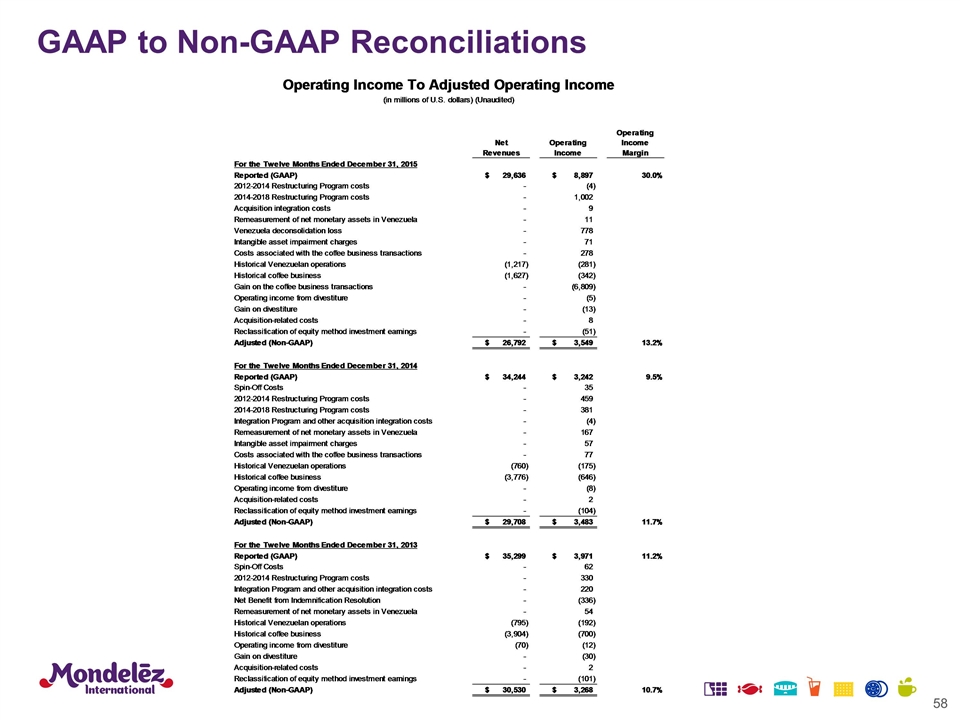

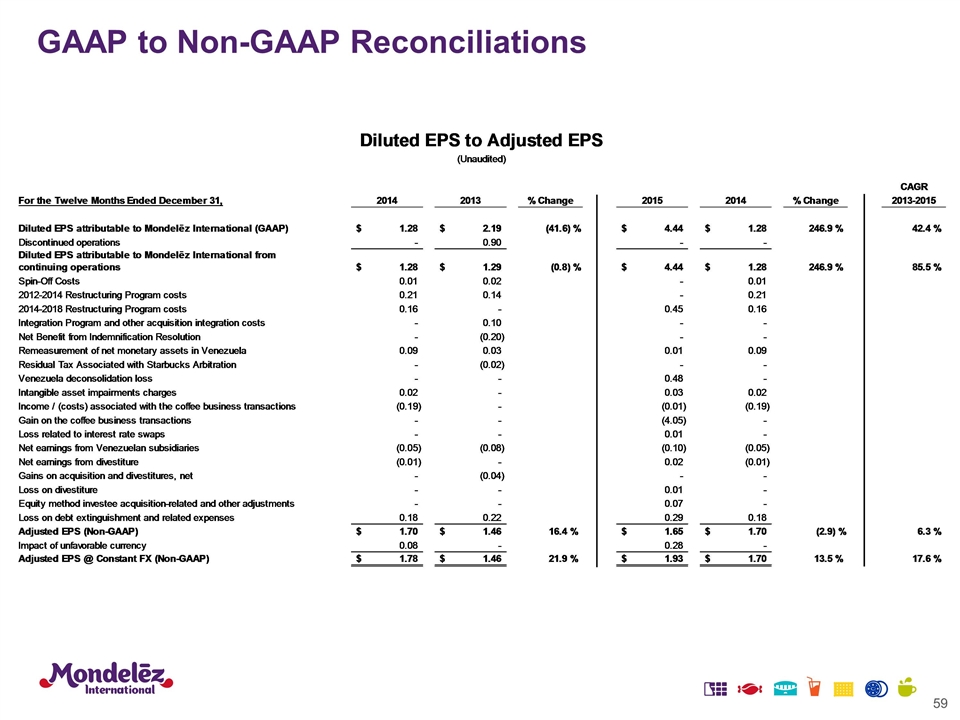

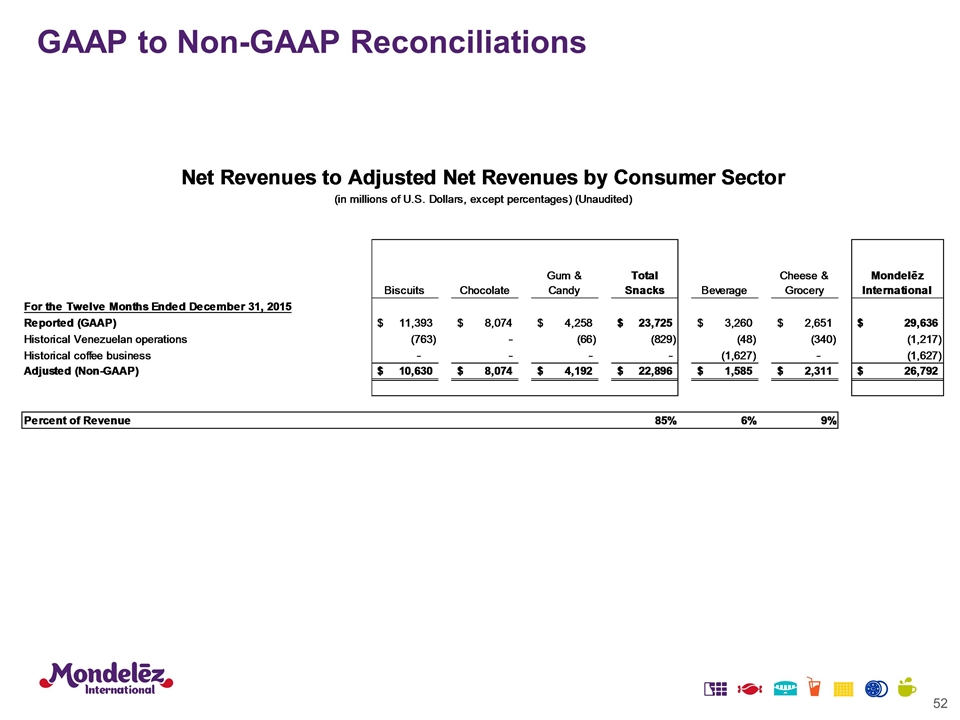

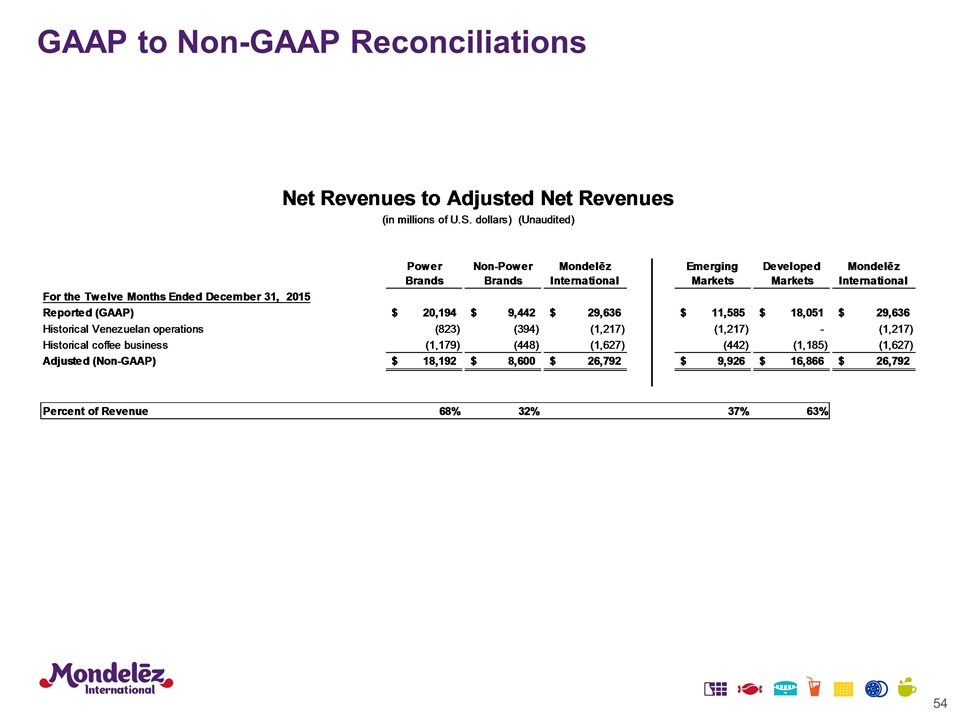

GAAP to Non-GAAP Reconciliations

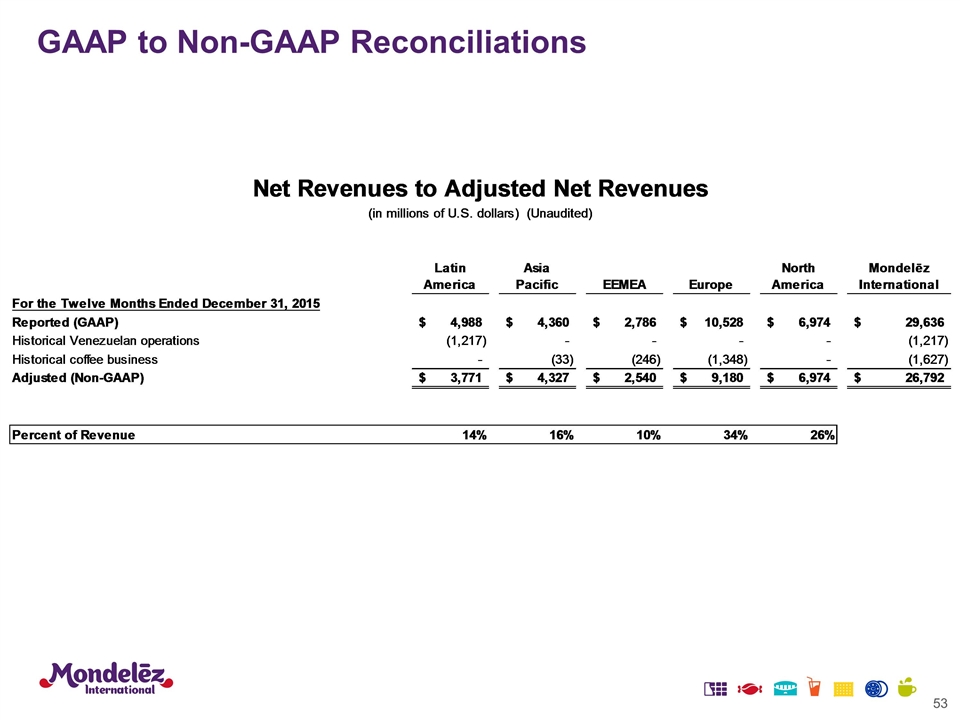

GAAP to Non-GAAP Reconciliations

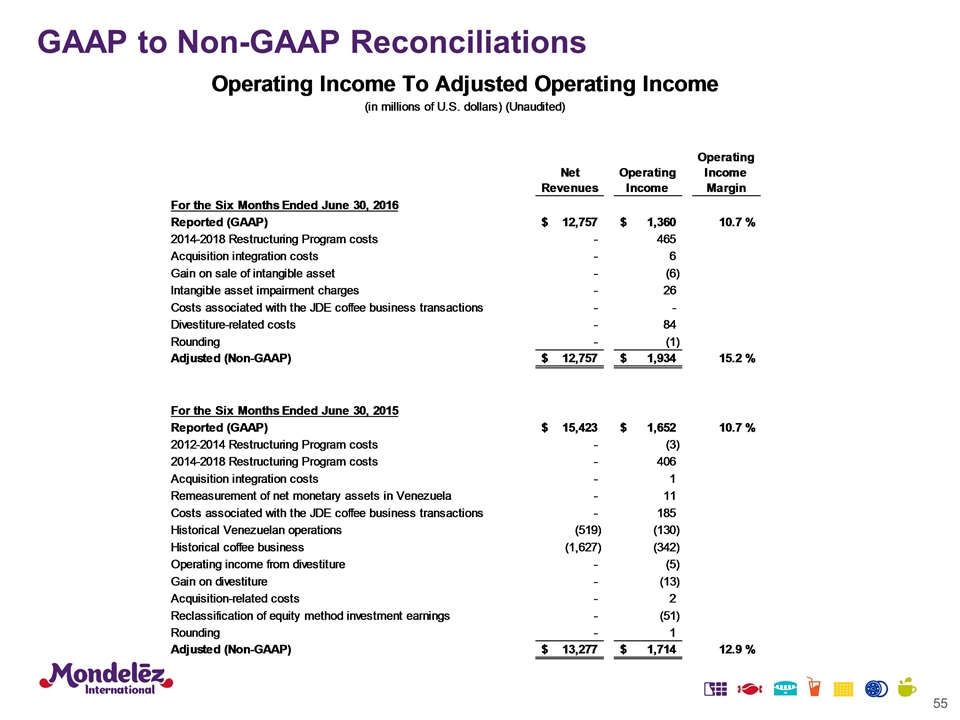

GAAP to Non-GAAP Reconciliations

GAAP to Non-GAAP Reconciliations

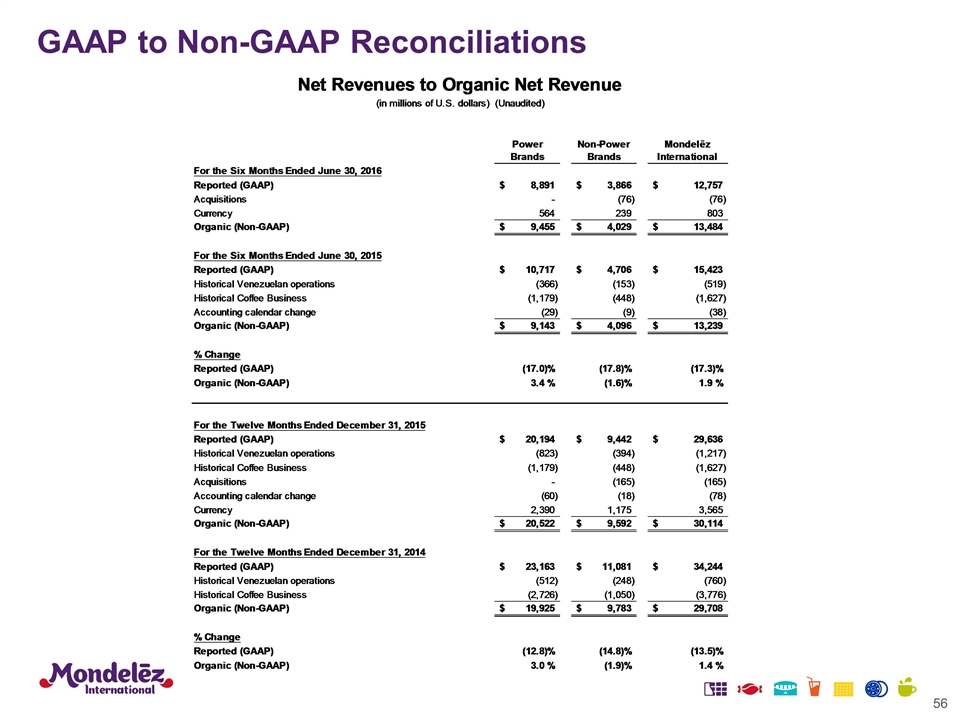

GAAP to Non-GAAP Reconciliations

GAAP to Non-GAAP Reconciliations

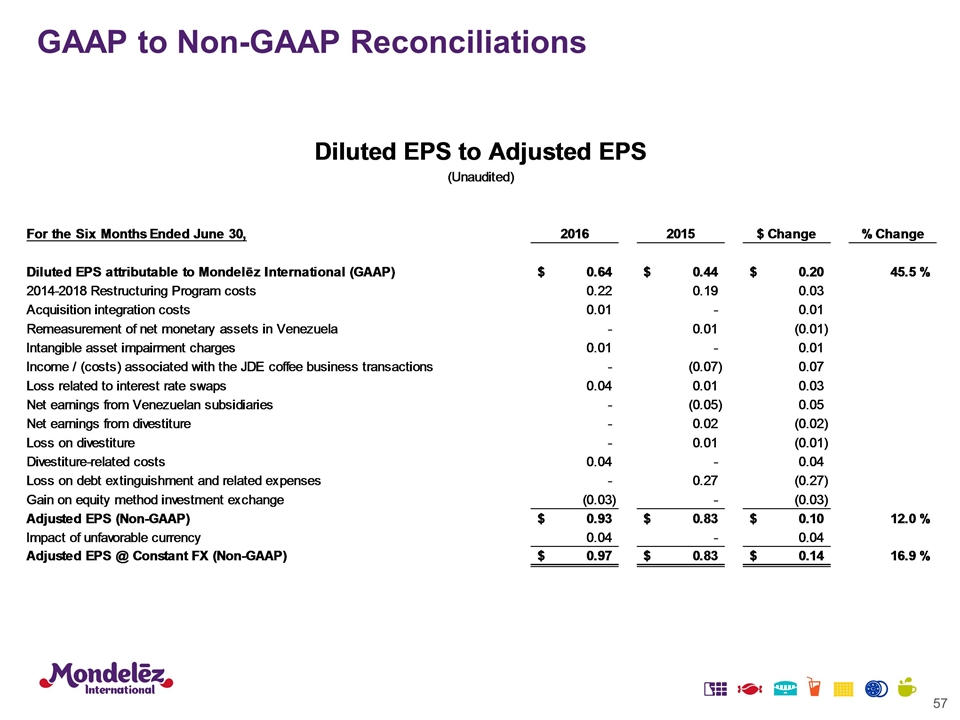

GAAP to Non-GAAP Reconciliations

GAAP to Non-GAAP Reconciliations