UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 000-30883

I-MANY, INC.

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 01-0524931 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

| |

399 Thornall Street 12th Floor Edison, New Jersey | | 08837 |

| (Address of principal executive offices) | | (Zip Code) |

(800) 832-0228

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of Each Class: | | Name of Each Exchange on which Registered: |

| Common Stock, $0.0001 par value per share | | Nasdaq Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

| | | | |

Large Accelerated Filer ¨ | | Accelerated Filer x | | Non-Accelerated Filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 7, 2007, 51,901,254 shares of the registrant’s common stock, $0.0001 par value, were issued and outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant (based on the closing price for the common stock on the Nasdaq Global Market on June 30, 2006) was approximately $89.0 million.

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III is incorporated by reference to specified portions of the Registrant’s definitive Proxy Statement to be issued in conjunction with the Registrant’s 2007 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the Registrant’s fiscal year ended December 31, 2006.

I-MANY, INC.

FORM 10-K

DECEMBER 31, 2006

TABLE OF CONTENTS

2

PART I

The information in this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements. Our actual results and the timing of certain events may differ materially from the results expressed or implied in the forward-looking statement. Factors that might cause or contribute to such a discrepancy include, but are not limited to, our critical accounting policies described in Item 7 of this Annual Report on Form 10-K and those factors discussed in Item 1A, “Risk Factors.” Although we may elect to update forward-looking statements in the future, we specifically disclaim any obligation to do so, even if our estimates change, and readers should not rely on our forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

OVERVIEW

We provide software and related professional services that allow our clients to manage important aspects of their contract-based, business-to-business relationships, including:

| | • | | Contract creation, repository, actionable terms tracking, date and event monitoring and reporting |

| | • | | Contract compliance management for verification of compliance and accuracy of orders, shipments, invoices, rebates and payments to ensure error-free operations and proper performance-based incentives |

| | • | | Cash collection, deductions management and dispute resolution, often based on analysis of agreed to contract terms and conditions and |

| | • | | Evaluation of the effectiveness of contracts and business operations. |

In 2006, software license fees comprised 13.4% of our total revenue, and services fees comprised 86.6%. In 2005, software license fees comprised 19.3% of our total revenue, and services fees comprised 80.7%. In 2004, software license fees comprised 29.4% of our total revenue, and services fees comprised 70.6%. This declining trend in annual software license fees is largely a reflection of the growth in our multi-year subscription license sales, which result in greater deferred license revenue than traditional perpetual license sales. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our clients include supply chain participants on both the “buy” side and “sell” side of business transactions across numerous vertical markets, including manufacturers, distributors, demand aggregators, retailers and purchasers.

We operate our business in two segments: our health and life sciences line of business and our other industries (which we call our “industry solutions”) business. The health and life sciences line of business markets and sells our products and services to companies in the life sciences industries, including pharmaceutical and medical product companies, wholesale distributors, hospitals, group purchasing organizations and managed care organizations. Our industry solutions line of business targets all other industries, with an emphasis on consumer products, foodservice, electronics, service providers, disposables, consumer durables, industrial products, chemicals, energy, apparel, and telecommunications. Our primary products and services were originally developed to manage complex contract purchasing relationships in the health and life sciences industry, and we currently count 17 of the largest 20 worldwide pharmaceutical manufacturers, ranked according to 2005 annual pharmaceutical company revenues, as customers. As the depth and breadth of our product suites have expanded, we have added companies in the industry solutions markets to our customer base. Our customers include Bayer,

3

Eli Lilly, AstraZeneca, GlaxoSmithKline, Novartis Pharmaceuticals, Procter & Gamble, Honeywell Aerospace, RONA, Shell Oil, Frito Lay and Cadbury Schweppes, each of which generated more than $150,000 in revenue to us in the year ended December 31, 2006. In 2006, approximately 74% of our revenues were from health and life sciences customers and 26% of our revenues were from industry solutions sources. See Item 8, Note 9 to Consolidated Financial Statements.

We deliver our products chiefly through two means: (1) software licensed for installation on our clients’ computer systems, and (2) to a lesser extent, software licensed and hosted on our servers, which are operated and supported by third-party providers. While some of our software products are focused on customers in our health and life sciences market—I-many Medicaid™ and I-many Government Pricing™, for example—many of our products are useful solutions for companies in both our industry solutions market and our health and life sciences market. See “Products and Services—Products” below.

THE BUSINESS-TO-BUSINESS MARKETPLACE

We believe that the growth of business-to-business trade is characterized, and will continue to be characterized, by the increasing use of contracts between supply chain participants and the need to ensure that terms negotiated in contracts are in fact being observed and tracked for compliance. In our targeted industries—healthcare and life sciences, consumer products, foodservice, industrial products, chemicals, apparel and other industries where complex purchase contracts exist—the process of creating contracts and identifying and resolving contract compliance issues throughout their life cycle are often accomplished through the use of paper-based or legacy computer systems that are unsuitable for managing the volume and complexity of contracts. In addition, these industries employ pricing mechanisms such as chargebacks and rebates to adjust amounts paid by purchasers. Calculating, reconciling and distributing these chargebacks and rebates while simultaneously ensuring pricing compliance with myriad governmental regulations and other tasks associated with them often result in high administrative costs and disputes involving substantial amounts of money.

Supply chain participants frequently use sales and purchasing contracts to facilitate the purchase and sale of goods and services. These contracts—among supply chain participants, such as manufacturers, distributors, retailers, demand aggregators such as buying groups, and the end users of goods and services—allow buyers and sellers to budget, plan and manage funds and agree on prices, discounts and volume rebates. These contracts often establish price and non-price incentives, which can be based upon multiple factors, including:

| | • | | total volume of products purchased |

| | • | | overall sales of particular products |

| | • | | duration of the contract |

| | • | | number of parties to the contract |

| | • | | local, state and federal governmental regulations |

| | • | | number of products covered by the contract and |

| | • | | the purchaser’s demographic characteristics. |

In addition to these incentives, contracts can include any number of other attributes, including requirements for fulfilling shipments within prescribed time periods, advanced shipping notifications, packaging and labeling requirements.

Supply Chain Participants. The business-to-business supply chain includes the following participants:

| | • | | MANUFACTURERS of products that use business-to-business relationships, including contracts, to establish favorable prices, assure a reliable channel of distribution and offer incentives to achieve their sales and marketing goals; |

4

| | • | | DISTRIBUTORS that purchase goods from manufacturers or demand aggregators for resale; |

| | • | | DEMAND AGGREGATORS AND OTHER INTERMEDIARIES representing groups of purchasers, such as group purchasing organizations in the healthcare industry and buying cooperatives in the consumer products and foodservice industries, that aggregate their members’ demand for products to obtain favorable pricing terms. Demand aggregators typically receive monthly fees from their members or receive a percentage of all transactions negotiated on their constituents’ behalf; |

| | • | | PURCHASERS AND RETAILERS of products that buy goods under contracts negotiated on their behalf by demand aggregators or other intermediaries; and |

| | • | | BUSINESS-TO-BUSINESS E-COMMERCE EXCHANGES that allow supply chain participants to establish business relationships using the Internet. |

Complexity of Contract Buying/Selling. In the industries we target, contracts typically contain pricing incentives and other mechanisms designed to meet the particular goals of the trading partners. The price of any particular product or service purchased under a typical contract of our customers may vary substantially, depending upon, among other things, external factors such as a manufacturer’s market share and the purchaser’s demographic characteristics, and highly specific factors such as the number of units of a particular product purchased during a specified time period. Contracts also allow buyers and sellers to budget, plan and manage funds and agree on prices, discounts and volume rebates. Training, maintenance and other non-price incentives can also be based upon multiple factors. Other contract attributes include criteria such as a requirement for fulfilling shipments within prescribed time periods, advanced notifications and packaging and labeling requirements. Contracts contain numerous and varied clauses and other business performance language that must also be internally reviewed, approved and managed by both buyers and sellers. Compliance with this language and the individual financial transactions governed by master contracts must be measured in order to ensure the intended outcome of a contract is achieved or to avoid penalties with commercial trading partners or government entities.

Contracts are often negotiated on behalf of a large number of purchasers and include pricing incentives, which result in different prices for otherwise similarly-situated purchasers, based on the purchasers’ achievement of, or failure to achieve, certain goals (usually volume-related) under the contract.

While many purchase contract variations exist, several fundamental types of pricing mechanisms in purchase contracts are illustrative of the complexity involved. Specific examples include chargeback (also called “deviated billing” or “billbacks,” depending upon the industry) and rebate management. Chargebacks are generally used as an incentive tool in contracts between manufacturers and demand aggregators. Eligible members of a demand aggregator (meaning purchasers who are on a contract of the aggregator, such as a group purchasing organization or buying cooperative) order products either directly from the manufacturer or, more commonly, through a large distributor. When a product is ordered through a distributor, the distributor must sell the item at the price negotiated between the manufacturer and the demand aggregator. Often, the manufacturer asks the distributor to sell to the member at a price below the price the distributor paid the manufacturer. In these cases, the distributor attempts to verify the eligibility of the member to receive the lower contract price and, if the purchaser is eligible, the distributor seeks to recover, or chargeback, from the manufacturer the difference between the distributor’s cost and the lower contract price. Given the large volume of purchases under these contracts, constantly changing membership in demand aggregators, complicated eligibility requirements and disparate information systems involved, it is not uncommon for manufacturers, purchasers, demand aggregators, and distributors to calculate significantly different chargebacks, resulting in disputes among the parties, which require an approved method of adjudication.

A second type of pricing mechanism is a rebate. Typically, rebate provisions entitle a purchaser to a return of a portion of the purchase price based on factors such as the volume of product purchased or increase in market share achieved. Rebate provisions are common in contracts between manufacturers and large volume purchasers. Manufacturers generally adopt this kind of agreement in order to further their marketing objectives. In order to

5

determine rebates based on market share, the parties must refer to external market share data. As with chargeback contracts, the complicated task of administering rebate-based contracts often results in high administrative costs and disputes involving substantial amounts of money.

Many additional mechanisms contained in a purchase contract, sales contract, royalty agreement, or partnering arrangement must also be memorialized and tracked for compliance in order to satisfy contractual commitments or governmental regulations, including the requirements of the Sarbanes-Oxley Act of 2002.

Administrative Demands of Contract Purchasing. As a result of the intricacies of contract purchasing, the administration of sales, purchase and other contracts and agreements can be difficult and expensive. Among other things, each participant in the supply chain must be able to:

| | • | | Target and plan trading partner relationships |

| | • | | Negotiate terms and conditions, including specific language requiring legal review and approval |

| | • | | Plan and monitor the impact of different pricing strategies |

| | • | | Monitor dates or events |

| | • | | Integrate pricing, inventory, market share and other data relevant to the contract with existing enterprise resource planning and other management systems |

| | • | | Validate purchasers’ eligibility for participation in specific contracts or parts of contracts, including the time period in which the purchaser is on the contract, agreed-upon pricing mechanisms, rebates and distributors’ eligibility for chargebacks |

| | • | | Transact or adjudicate transactions relative to the terms and conditions of the contract—often encompassing enormous volumes of data related to invoices, inventory, shipments and market share |

| | • | | Monitor compliance of the contract against specific governmental or industry requirements or regulations |

| | • | | Monitor compliance of individual sale and purchase transactions against the terms and conditions of the master contracts that govern them |

| | • | | Settle disputes associated with contract and non-contract issues such as price discrepancies, non-compliance, misallocation of funds, level of earned incentives, and others, and |

| | • | | Evaluate the performance of completed and in-process contracts based on the original intent of the agreement from the perspective of both buyers and sellers. |

I-MANY’S SOLUTIONS

Broad Offering of Contract Lifecycle Management Capabilities.Our products are designed to address business and process needs related to contract management, which in combination we refer to as “Contract LifeCycle Management.” Contract Lifecycle Management provides organizations with the visibility to ensure compliance and consistency in their contractual relationships. We provide software that allows our clients to optimize their revenue and comply with expenditure limits for critical aspects of their contract-based business-to-business relationships, including:

| | • | | Contract creation, repository and change notifications, including verification and approval of specific language for participants in complex supply chains |

| | • | | Validation of data prior to determining amounts owed under a contract |

| | • | | Verification of compliance with and accuracy of orders, shipments, invoices, rebates and payments to ensure error-free operations and proper performance-based incentives |

| | • | | Settlement and dispute capabilities to resolve payment discrepancies due to contracts, and |

| | • | | Evaluation of the effectiveness of contracts. |

6

Flexible Product Offerings. We deliver our products through several means. We generally license and deliver our products for installation on our clients’ own computer systems. In addition, we can license our products on an application service provider basis, which means that we install the software on servers hosted and supported by third party providers, which our client then accesses over the Internet or over a secure private network. In 2004 we began to license our solutions as subscriptions, typically for a three year term. We believe that these delivery and licensing alternatives provide our clients with flexibility in terms of how they choose to pay for our products, and the level of internal information technology support resources they need to optimize the use.

PRODUCTS AND SERVICES

Products. To date, a significant portion of our revenues has come from the sale of software licenses and related professional services to healthcare manufacturers, distributors, group purchasing organizations and other companies in the life and health sciences customer base, representing altogether 73% of our revenues in 2004, 76% of our revenues in 2005, and 74% of our revenues in 2006. In 2006, no single customer accounted for greater than 10% of total net revenue. Our license fees are based on a number of factors, including the nature and number of modules being licensed, the number of users, the term of the license and the size of the client. For a discussion of our product market segments, see Note 9 to the financial statements contained in Item 8 of this Annual Report on Form 10-K.

The following are brief descriptions of products within our Contract Lifecycle Management, Revenue Optimization for Health and Life Sciences, and Revenue Commitment Management Suites:

I-many Contract Lifecycle Management Solution Suite:

| | • | | I-many Contract Manager™: Centralizes contract content and terms in an enterprise class repository for rapid search and view capabilities. Also provides the ability to create contracts from existing templates and clauses, with collaborative workflow and an auditable approval process. Enables compliance and monitoring of specific dates and other identified events. |

| | • | | I-many Compliance Manager™: Enables companies to compare actual transaction results against the terms and conditions of a contract to determine if the transaction conducted was in compliance with the original intent of the contract. It also reduces “maverick” procurement and sales orders by ensuring transactions are tied back to the contract. |

| | • | | I-many Self Service™:Enables companies to easily create a pre-approved, fill-in-the-blank form to create an agreement, such as a non-disclosure agreement, by following a step-by-step process. I-many Self Service allows companies to create or request a contract anytime, from anywhere, with virtually no training, and without legal involvement. |

I-many Revenue Optimization for Health and Life Sciences Solution Suite:

| | • | | I-many Contract Manager™: Described above under “I-many Contract Lifecycle Management Solution Suite.” |

| | • | | I-many CARS®: Provides comprehensive, end-to-end management of mission critical, incentive-driven contract and program processes. |

| | • | | I-many Medicaid™: Processes data, calculates rebates and creates payments for both federal and state rebate programs. |

| | • | | I-many Medicaid State Supplemental™: Streamlines I-many Medicaid’s product contract setup and invoice processing. Key components include a Non-Standard Rebate Per Unit Calculator Pack and Supplemental Claim Processing. |

| | • | | I-many Medicaid Analytics™:Enables companies to optimize, enhance and dramatically streamline the Medicaid contract analysis process. I-many Medicaid Analytics allows companies to perform various “what if” analyses on Medicaid, supplemental and state programs. |

7

| | • | | I-many Government Pricing™: Enables companies to quickly and efficiently monitor and comply with all government-mandated pricing and reporting requirements established by the Medicaid Drug Rebate Program, the Federal Supply Schedule and the Veteran’s Health Care Act of 1992. |

| | • | | I-many Compliance Manager™: Described above under “I-many Contract Lifecycle Management Solution Suite.” |

| | • | | I-many Validata™: Enables companies to ensure the validity and accuracy of the billions of dollars in managed care and Medicaid rebates that pharmaceutical manufacturers process and pay each year. I-many Validata provides manufacturers with the ability to validate prescription-level claims for the Medicare drug rebate program and the new state and supplemental programs. |

I-many Revenue Commitment Management Solution Suite:

| | • | | I-many Deductions Manager™: Works in real time with enterprise resource planning, or ERP, systems and other essential back-office systems to increase deduction collections by automating and streamlining customer communications and follow-up. Deductions Manager speeds resolution through the use of automated, user-defined action steps and provides detailed deduction reporting and deduction tracking history. |

| | • | | I-many Collections Manager™:Improves cash flow and reduces days sales outstanding, or DSO, by streamlining and automating collections processes. The solution is web-based and optimized for global organizations that can benefit from user-defined workflows. |

Professional Services. Our professional services group provides consulting services, deployment services, business analysis services, and training and customer support services. At December 31, 2006, this group was comprised of 85 employees. The group is augmented by outside consultants whom we have trained, working as subcontractors or through strategic relationship agreements.

| | • | | CONSULTING SERVICES. We work with our clients before, during and after installation of our solutions to optimize the capabilities of our solutions. These services include project planning and management, business process analysis, technical services including integration with the clients’ enterprise resource planning systems, and quality assurance. |

| | • | | DEPLOYMENT SERVICES. Our deployment services include pre-installation planning, on-site installation, upgrade services, system testing, database administration support and professional service support. |

| | • | | BUSINESS ANALYSIS AND TRAINING SERVICES. We offer business analysis services and training programs for those persons within the client organization responsible for using our solutions, such as contract administrators. In addition, we offer user group meetings to enable customers to learn about product directions and influence our future products. |

| | • | | TECHNICAL SERVICES. We offer comprehensive maintenance and support services, including telephone hotline service (available during business hours or, for additional fees, up to 24 hours a day, 7 days a week), documentation updates and new software releases. |

CUSTOMERS

Approximately 74% of our revenue in 2006 was derived from companies in the health and life sciences industries, including pharmaceutical and medical product companies, wholesale distributors and managed care organizations. We also have sold our solutions to companies in other industries such as consumer products, foodservice, disposables, consumer durables, industrial products, chemicals, apparel and others. In 2006, no single customer accounted for greater than 10% of total net revenue. Revenues from customers based outside the United States, primarily the United Kingdom and the Netherlands, comprised 8.4%, 9.3%, and 12.2% of our total revenues in 2004, 2005 and 2006, respectively. At December 31, 2006, 3.2% of our total tangible assets were located outside the United States, primarily in the United Kingdom.

8

SALES AND MARKETING

We market our software and services primarily through a direct sales force. As of December 31, 2006, our worldwide sales force consisted of a total of 21 employees, including 9 full-time account executives, 2 sales directors who both carry an individual quota and have supervision responsibilities, and 10 persons who were sales management or sales support employees. We intend to continue to evaluate the size and structure of our sales force. As of December 31, 2006, we employed 7 marketing employees. We also intend to evaluate the use of third party resellers of our products and services as a supplement to our own direct sales efforts.

TECHNOLOGY AND PRODUCT DEVELOPMENT

As of December 31, 2006, we employed 52 people in our product development organization. This group is augmented by a significant number of outside consultants, most of which are based off-shore. This organization is responsible for the design, development and release of our products. The group is organized into five disciplines: development, quality assurance, documentation, product management and project engineering. Members from each discipline form separate product teams to work closely with our sales, marketing, services, client and prospects organizations to better understand market needs and user requirements. Each product team also hosts a series of user focus groups, and representatives attend our user conference. We also use third parties to expand the capacity and technical expertise of our internal product development organization. Periodically, we have licensed third-party technology and we have acquired companies with products and technologies that are complementary to our existing products. We believe this approach shortens our time to market without compromising our competitive position or product quality, and we plan to continue to draw on third-party resources as needed in the future. Research and development expenses totaled $11.9 million, $11.3 million and $12.6 million, respectively, in 2004, 2005 and 2006.

COMPETITION

The contract management software market continues to be subject to rapid change. Competitors vary in size and in the scope and breadth of the products and services offered. We still encounter competition primarily from internal information systems departments of potential or current customers that develop custom software, software companies that target the contract management markets, and professional services organizations.

We believe that the principal competitive factors affecting our market include product reputation, functionality, ease-of-use, ability to integrate with other products and technologies, quality, performance, price, customer service and support and the vendors’ reputation. Although we believe that our products currently compete favorably with regard to such factors, we cannot assure you that we can maintain our competitive position against current and potential competitors. Increased competition may result in price reductions, less beneficial contract terms, reduced gross margins and loss of market share, any of which could materially and adversely affect our business, operating results and financial condition.

Many of our competitors and potential competitors have greater resources than we do, and may be able to respond more quickly and efficiently to new or emerging technologies, programming languages or standards, or to changes in customer requirements or preferences. Many of our competitors can devote greater managerial or financial resources than we can to develop, promote and distribute contract management software products and provide related consulting, training and support services. We cannot assure you that our current or future competitors will not develop products or services that may be superior in one or more respects to ours or that may gain greater market acceptance. Some of our competitors have established or may establish cooperative arrangements or strategic alliances among themselves or with third parties, thus enhancing their abilities to compete with us. It is likely that new competitors will emerge and rapidly acquire market share. We cannot assure you that we will be able to compete successfully against current or future competitors or that the competitive pressures faced by us will not materially and adversely affect our business, operating results and financial condition. See “Risk Factors—We have many competitors and potential competitors and we may not be able to compete effectively.”

9

INTELLECTUAL PROPERTY AND LICENSES

We rely primarily on a combination of copyright, trademark and trade secrets laws, as well as confidentiality agreements to protect our proprietary rights. Our trademarks include our corporate name and the names of our products. In addition, we have filed applications for patent protection with respect to certain aspects of our products; to date, no patents have been issued to us.

From time to time, we license software from third parties for use with our products. We believe that no such license agreement to which we are presently a party is individually material and that if any such license agreement were to terminate for any reason, we would be able to obtain a license or otherwise acquire other comparable technology or software on terms and on a timetable that would not be materially adverse to us.

EMPLOYEES

As of December 31, 2006, we had a total of 185 employees, of whom 45 were based in Portland, Maine, 51 were based in Redwood City, California, 28 were based at our headquarters in Edison, New Jersey, 5 were based at our international headquarters in London, England, and 56 worked at other offices and remote locations. Of the total, 52 were in research and development, 28 were in sales and marketing, 85 were in professional and support services, and 20 were in administration and finance. Our future performance depends in significant part upon the continued service of our key technical, sales and marketing and senior management personnel and our continuing ability to attract and retain highly qualified technical, sales and marketing and managerial personnel. Competition for such personnel is strong and we cannot assure you that we will be successful in attracting or retaining such personnel in the future. None of our employees is represented by a labor union or is subject to a collective bargaining agreement. We have not experienced any work stoppages and consider our relations with our employees to be good.

COMPANY BACKGROUND

We were originally incorporated in Massachusetts as Systems Consulting Company, Inc., or SCC, on June 5, 1989. On April 2, 1998, SCC Technologies, Inc., a Delaware corporation, was formed as a holding company and acquired all the stock of SCC. In January 2000, SCC Technologies, Inc. changed its name to I-many, Inc., and SCC merged into I-many, Inc. Our Internet website address iswww.imany.com. We are not including the information contained in our website as part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available, free of charge through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file these materials with, or otherwise furnish them to, the Securities and Exchange Commission, or SEC.

WE HAVE INCURRED SUBSTANTIAL LOSSES IN RECENT YEARS AND OUR RETURN TO PROFITABILITY IS UNCERTAIN

We incurred net losses of $7.3 million in the year ended December 31, 2004, $9.3 million in the year ended December 31, 2005 and $15.8 million in the year ended December 31, 2006, and we had an accumulated deficit at December 31, 2006 of $150.2 million. Our recent results have been impacted by a number of factors, including decisions to defer revenue associated with one of our software products and relatively high research and development expense related to our efforts to resolve deficiencies in that product, and we cannot assure you that we will not be affected by these or other factors in future periods. We cannot assure you that we will achieve sufficient revenues to become profitable in the future.

10

IT IS DIFFICULT FOR US TO PREDICT WHEN OR IF SALES WILL OCCUR AND WHEN WE WILL RECOGNIZE THE REVENUE FROM OUR FUTURE SALES

Our clients view the purchase of our software applications and related professional services as a significant and strategic decision. As a result, clients carefully evaluate our software products and services, often over long periods. The license of our software products may be subject to delays if the client has lengthy internal budgeting, approval and evaluation processes, which are quite common in the context of introducing large enterprise-wide technology solutions. The length of this evaluation process varies from client to client. Our clients have also shown a growing interest in licensing our software on a subscription basis, which results in deferral of payments and revenues that would otherwise be reportable if a traditional perpetual license were executed. Our revenue forecasts and internal budgets are based, in part, on our best assumptions about the mix of future subscription licenses versus perpetual licenses. If we enter into a larger proportion of subscription agreements than planned, we may experience an unplanned shortfall in revenues or cash during that quarter. A significant percentage of our expenses, particularly personnel costs and rent, are fixed costs and are based in part on expectations of future revenues. We may be unable to reduce spending in a timely manner to compensate for any significant fluctuations in revenues and cash. Accordingly, shortfalls in current revenues, as we experienced in recent quarters, may cause our operating results to be below the expectations of public market analysts or investors, which could cause the value of our common stock to decline.

WE CANNOT GUARANTEE THAT OUR DEFERRED REVENUE WILL BE RECOGNIZED AS PLANNED

In 2005 we became aware of certain deficiencies in the then-current version of one of our software products, which had first been shipped to customers in the fourth quarter of 2004. These deficiencies, which were not identified in pre-release product testing, affected the performance of the software for a portion of our customers, depending on each customer’s particular implementation environment and its intended use of the software. We have generally not recognized revenue from sales of this software product and related implementation services beginning in the third quarter of 2005, except in limited cases. As of December 31, 2006, we have deferred $3.5 million of otherwise-recognizable license and professional service revenue. We intend to continue deferring revenue in connection with license sales and implementation services for this software product until it has been demonstrated at customer sites that the new release of the software is free of significant performance deficiencies. If we are not successful in resolving these deficiencies on a timely basis, we may not be able to recognize this deferred revenue as we have projected.

OUR CASH POSITION HAS DECLINED AND WILL LIKELY CONTINUE TO DECLINE UNTIL WE RETURN TO SUSTAINED PROFITABILITY

Our future long-term capital needs will depend significantly on the rate of growth of our business, our profitability, the mix of subscription licensing arrangements versus perpetual licenses sold, possible acquisitions, the timing of expanded product offerings and the success of these offerings if and when they are launched. Accordingly, our future long-term cash needs and cash flows are subject to substantial uncertainty. If our current balance of cash and cash equivalents is insufficient to satisfy our long-term liquidity needs, we may seek to sell additional equity or debt securities to raise funds, and those future securities may have rights, preferences or privileges senior to those of the rights of our common stock. In connection with a sale of stock, our stockholders would experience dilution. In addition, we cannot be certain that additional financing will be available to us on favorable terms when required, or at all.

WE NEED TO GROW IN MARKETS OTHER THAN THE HEALTH AND LIFE SCIENCES MARKET FOR OUR FUTURE GROWTH

Our business plan has been to reduce our reliance on the health and life sciences market, which has traditionally been the primary source of our revenues, by increasing sales in our Industry Solutions line of business, our non-health and life sciences business. Revenues from the Industry Solutions segment have comprised 27.3%, 24.4% and 26.0%, respectively, of our consolidated revenues for the years ended December 31, 2004, 2005 and 2006. We have not been successful in generating the revenue growth we expected from these markets and we cannot assure you that we will be

11

successful in the future. One of our key software products in the Industry Solutions segment has experienced certain deficiencies which we are working to resolve, and with respect to sales of which we have deferred revenue. See “We cannot guarantee that our deferred revenue will be recognized as planned.”

WE MAY NOT BE SUCCESSFUL IN DEVELOPING OR ACQUIRING NEW TECHNOLOGIES OR BUSINESSES AND THIS COULD HINDER OUR EXPANSION EFFORTS

Despite our intentions to reduce our product research and development efforts to levels more customary for our industry, in the near term we may continue our product research and development efforts at levels similar to current expenditures. We have had quality issues with one of our software products, which have affected our sales and have caused us to defer revenue recognition, and these issues may continue. We may consider additional acquisitions of or new investments in complementary businesses, products, services or technologies. We cannot assure you that we will be successful in our product development efforts or that we will be able to identify appropriate acquisition or investment candidates. Even if we do identify suitable candidates, we cannot assure you that we will be able to make such acquisitions or investments on commercially acceptable terms. Furthermore, we may incur debt or issue equity securities to pay for any future acquisitions. The issuance of equity securities could be dilutive to our existing stockholders and the issuance of debt could limit our available cash and accordingly restrict our activities.

WE HAVE MANY COMPETITORS AND POTENTIAL COMPETITORS AND WE MAY NOT BE ABLE TO COMPETE EFFECTIVELY

The market for our products and services is competitive and subject to rapid change. We encounter significant competition for the sale of our contract management software from the internal information systems departments of existing and potential clients, software companies that target the contract management markets and professional services organizations. Our competitors vary in size and in the scope and breadth of products and services offered. We anticipate increased competition for market share and pressure to reduce prices and make sales concessions, particularly in our Industry Solutions segment, which could materially and adversely affect our revenues and margins.

WE HAVE MULTIPLE FACILITIES AND WE MAY EXPERIENCE DIFFICULTIES IN OPERATING FROM THESE DIFFERENT LOCATIONS

We operate out of our corporate headquarters in Edison, New Jersey, engineering offices in Redwood City, California and Portland, Maine, and an office facility in London, England. The geographic distance between our offices makes it more challenging for our management and other employees to collaborate and communicate with each other than if they were all located in a single facility, and, as a result, increases the strain on our managerial, operational and financial resources. Also, a significant number of our sales and professional services employees work remotely out of home offices, which adds to this strain.

WE MAY NOT BE SUCCESSFUL IN RETAINING AND ATTRACTING TALENTED AND KEY EMPLOYEES

We depend on the services of our senior management and key technical personnel. The loss of the services of key employees, and the inability to attract new employees to fill crucial roles, could have a material adverse effect on our business, financial condition and results of operations.

WE EXPERIENCED CHANGES OF SENIOR MANAGEMENT IN 2005 AND 2006, WHICH MAY AFFECT OUR BUSINESS, PARTICULARLY IN THE SHORT TERM

In August 2005, we announced the departure of our Chief Executive Officer and Chief Operating Officer and the appointment of a new Chairman of the Board with certain executive powers and a new Acting President and Chief Executive Officer. In February 2006, our Acting President and Chief Executive Officer resigned, and our Chairman of the Board assumed his duties on an interim basis. In August 2006, our acting President and Chief Executor Officer was appointed to these duties on a permanent basis. Changes of this nature can create a level of uncertainty and potential

12

disruption to relationships with customers, prospective customers, employees and business partners, particularly in the short term. Our leadership will need time to become more familiar with the Company and its culture. This leadership change could have an adverse effect on our business, financial condition and results of operations.

OUR EFFORTS TO PROTECT OUR INTELLECTUAL PROPERTY MAY NOT BE FULLY EFFECTIVE, AND WE MAY INADVERTENTLY INFRINGE ON THE INTELLECTUAL PROPERTY OF OTHERS

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain the use of information that we regard as proprietary. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the United States. We cannot assure investors that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar technology.

We are not aware that any of our products infringe the proprietary rights of third parties. We cannot assure investors, however, that third parties will not claim infringement by us with respect to current or future products. We expect that software product developers will increasingly be subject to infringement claims as the number of products and competitors in our industry segment grows and the functionality of products in different industry segments overlaps. Any such claims, with or without merit, could be time-consuming, result in costly litigation, cause product shipment delays or require us to enter into royalty or licensing agreements. Such royalty or licensing agreements, if required, may not be available on terms acceptable to us or at all, which could have a material adverse effect upon our business, operating results and financial condition.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not Applicable

We lease approximately 15,400 square feet of office space in Edison, New Jersey under a lease expiring in 2009, for use by executive, professional services and administrative personnel in both our business segments. A portion of our development, customer support and administrative offices for both market segments are located in approximately 10,700 square feet of leased office space located in Portland, Maine under a lease expiring December 31, 2008. Also, we lease approximately 10,400 square feet of office space in Redwood City, California under a lease expiring in 2008, for use by development, sales and marketing personnel in primarily our other industries market segment. In addition, we lease approximately 20,500 square feet of office space in Chicago, Illinois under a lease expiring in 2011, all of which is subleased under terms expiring in 2011; and 3,900 square feet of office space in London, England under a lease expiring in 2011, of which approximately one-half is subleased under terms expiring in 2011.

We are involved in contractual disputes, litigation and potential claims arising in the ordinary course of business. We do not believe that the resolution of these matters will have a material adverse effect on our financial position or results of operations. We are not a party to any material pending legal proceedings.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITYHOLDERS |

Not Applicable

| ITEM 4A. | EXECUTIVE OFFICERS OF THE REGISTRANT |

The following sets forth the names and certain biographical information regarding the executive officers of the Company.

JOHN A. RADE, age 72, has served as a director since July 2005, as Chairman of the Board since August 8, 2005, and as our President and Chief Executive Officer since August 15, 2006. Mr. Rade was the President and

13

CEO of AXS-One, Inc., formerly Computron Software, Inc., a publicly-traded software company, from 1997 until his retirement in 2004. Before joining Computron, he managed the pharmaceutical industry practice for American Management Systems, Inc., a management consulting and information technology company. He was a founder of S-Cubed, Inc., a developer and marketer of advanced software development tools. Mr. Rade’s career in software and information technology includes international management postings, spans several decades and includes leadership roles in other software development companies, management consulting and industrial automation. Mr. Rade holds a BS in Physics from John Carroll University.

KEVIN M. HARRIS, age 44, has served as I-many’s Chief Financial Officer since June 2003. From January 2001 to April 2003, Mr. Harris served as division controller for Hewlett Packard’s middleware division. From March 2000 to January 2001, Mr. Harris served as the corporate controller for Bluestone Software. From October 1998 to December 1999, Mr. Harris worked for Marketing Specialists, a food sales and marketing organization, as executive vice president of their mid-Atlantic division. From November 1996 to October 1998, Mr. Harris worked for Rogers-American Company, a food sales and marketing organization, as vice president/general manager of their Philadelphia office. Mr. Harris holds B.S. and M.B.A. degrees from Drexel University.

DAVID L. BLUMBERG, age 45, has served as I-many’s Executive Vice President of Fulfillment Services since May 2006. From July 2005 through April 2006, Mr. Blumberg served as President of David Blumberg and Associates, a consulting firm in the Life Sciences Industries. From August 1990 through June 2005, Mr. Blumberg worked at Accenture, LLP in a number of roles, including managing partner, global account partner and industry lead partner in the Pharmaceutical and Medical Products practice. Mr. Blumberg holds an M.B.A. from the Wharton School and a B.S. in Mechanical Engineering from the Ohio State University.

A. TODD SHYTLE, age 46, has served as our Senior Vice President of Sales since March 2007 and as Vice President of Sales since July 2004. He has been with the Company since 1999 and has served in sales management roles since January 2004, including as Vice President of Sales for Life Sciences. Prior to joining I-many, Mr. Shytle was responsible for sales and market development in the life sciences industry for Manugistics, Inc., a provider of software and services for supply chain management. He has also served in various sales roles at Johnson & Johnson, United States Surgical Corporation, and Eastman Kodak. Mr. Shytle holds an M.B.A. from the School of Business at Queens College in Charlotte, North Carolina.

MICHAEL T. ZUCKERMAN, age 50, has served as I-many’s Senior Vice President of Marketing since February 2007. From March 2006 through December 2006, Mr. Zuckerman served as Senior Vice President & General Manager of Immersion Corporation’s 3D Business Unit. From October 2004 through March 2006, Mr. Zuckerman served as the Senior Vice President & General Manager of Immersion Corporation’s Industrial Business Unit. From October 2003 through October 2004, Mr. Zuckerman served as Immersion Corporation’s Senior Vice President, Marketing. From June 2000 through June 2003, Mr. Zuckerman served as Vice President of Marketing for Verity, Inc. From July 2003 through September 2003, he served as Verity’s Vice President of Sales for America’s West. Prior to joining Verity, Inc. Mr. Zuckerman served as Vice President of Sales and Marketing at Sensar, Inc., a provider of network security products. Mr. Zuckerman holds a B.S. in Electrical Engineering from the University of Maryland.

ROBERT G. SCHWARTZ, JR., age 41, has served as I-many’s Vice President, General Counsel and Secretary since September 2001. From April 2000 through August 2001, Mr. Schwartz was vice president, general counsel, secretary and a director of Emptoris, Inc., a developer of strategic sourcing software. From September 1999 through April 2000, Mr. Schwartz served as assistant general counsel of Cambridge Technology Partners, a publicly-held software integration services provider. From February 1997 through August 1999, Mr. Schwartz served as vice president, general counsel and secretary of Astea International Inc., a publicly-held developer of customer relationship management software. Mr. Schwartz holds a B.A. from Amherst College and a J.D. from Harvard Law School.

14

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock trades on the Nasdaq Global Market under the symbol “IMNY.” The following table sets forth the high and low closing sales prices per share for our common stock as reported on the Nasdaq Global Market for each full quarterly period within the two most recent fiscal years. As of March 1, 2007, there were 240 holders of record of our common stock.

| | | | | | |

| | | Price Range of

Common Stock |

| |

Three Months Ended | | High | | Low |

December 31, 2006 | | $ | 2.00 | | $ | 1.63 |

September 30, 2006 | | | 2.43 | | | 1.82 |

June 30, 2006 | | | 2.40 | | | 1.55 |

March 31, 2006 | | | 1.78 | | | 1.36 |

December 31, 2005 | | | 1.54 | | | 1.28 |

September 30, 2005 | | | 1.70 | | | 1.28 |

June 30, 2005 | | | 1.77 | | | 1.51 |

March 31, 2005 | | | 1.68 | | | 1.46 |

We have never paid dividends and do not anticipate paying dividends in the foreseeable future.

15

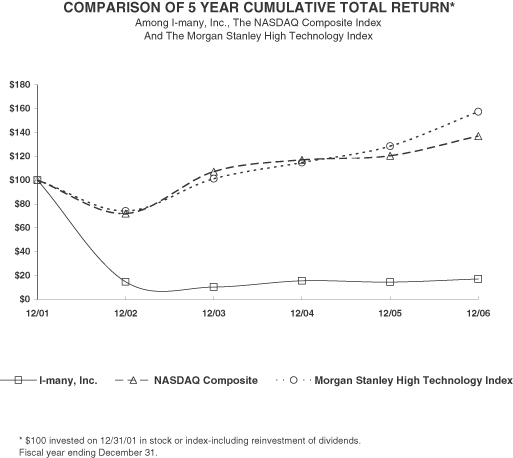

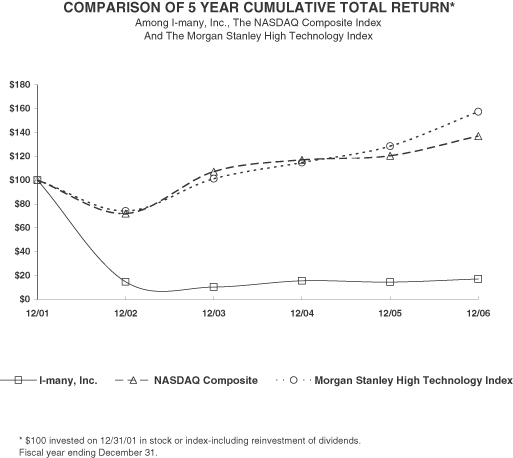

STOCK PRICE PERFORMANCE GRAPH

The graph below compares the cumulative total return on I-many’s common stock with The Nasdaq Global Market Index (U.S. companies) and Morgan Stanley High Tech Index for the period from January 1, 2002 to December 31, 2006. The comparison assumes that $100 was invested on January 1, 2001 in I-many’s common stock and in each of the comparison indices, and assumes reinvestment of dividends, where applicable. Stock price performance, presented for the period from January 1, 2002 through December 31, 2006, is not necessarily indicative of future results. This stock price performance information is “furnished” and not “filed” and shall not be deemed “soliciting material” or subject to Regulation 14A, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended.

| | | | | | | | | | | | |

Stock/Index | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 |

I-many Common Stock | | 100.00 | | 14.72 | | 10.36 | | 15.54 | | 14.51 | | 17.10 |

Nasdaq Global Market Index | | 100.00 | | 71.97 | | 107.18 | | 117.07 | | 120.50 | | 137.02 |

Morgan Stanley High Tech Index | | 100.00 | | 74.17 | | 101.20 | | 114.80 | | 128.57 | | 157.48 |

16

| ITEM 6. | SELECTED CONSOLIDATED FINANCIAL DATA |

The selected condensed financial data presented below as of and for each of the years in the five-year period ended December 31, 2006 are derived from our financial statements. Historical results are not necessarily indicative of future results. The following selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and notes to those statements and other financial information included elsewhere in this report.

| | | | | | | | | | | | | | | | | | | | |

| | | YEAR ENDED DECEMBER 31, | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | |

| | | (IN THOUSANDS, EXCEPT PER SHARE DATA) | |

STATEMENT OF OPERATIONS DATA: | | | | | | | | | | | | | | | | | | | | |

Total net revenues | | $ | 54,746 | | | $ | 39,412 | | | $ | 38,413 | | | $ | 32,576 | | | $ | 29,575 | |

Net loss | | | (27,293 | ) | | | (39,491 | ) | | | (7,290 | ) | | | (9,305 | ) | | | (15,815 | ) |

Net loss per share | | | (0.69 | ) | | | (0.98 | ) | | | (0.18 | ) | | | (0.21 | ) | | | (0.33 | ) |

| |

| | | AS OF DECEMBER 31, | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | |

| | | (IN THOUSANDS) | |

BALANCE SHEET DATA: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 35,979 | | | $ | 8,914 | (1) | | $ | 6,098 | (1) | | $ | 16,805 | | | $ | 17,232 | |

Short-term investments and available for sale securities | | | — | | | | 14,969 | (1) | | | 14,610 | (1) | | | — | | | | — | |

Working capital | | | 32,462 | | | | 20,269 | | | | 14,645 | | | | 9,407 | | | | 3,047 | |

Total assets | | | 84,564 | | | | 49,569 | | | | 44,198 | | | | 38,472 | | | | 36,985 | |

Capital lease obligation, including current portion | | | 808 | | | | 837 | | | | 160 | | | | 21 | | | | 394 | |

Total stockholders’ equity | | | 66,216 | | | | 29,155 | | | | 25,870 | | | | 18,356 | | | | 11,454 | |

| (1) | Restated, pursuant to the Company’s determination that its method of classifying investments in certain auction rate securities as cash and cash equivalents in its 2003 and 2004 financial statements was in error. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and related notes. In addition to historical information, the following discussion and other parts of this report contain forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated by such forward-looking statements due to various factors, including, but not limited to, those set forth under “Risk Factors” and elsewhere in this report. Management does not believe that inflation or changing prices has had a material effect on our revenues and income from continuing operations.

OVERVIEW

We provide software and related services that allow our clients to more effectively manage their contract-based, business-to-business relationships through the entirety of the contract management lifecycle. We operate our business in two segments: health and life sciences and industry solutions. The health and life sciences line of business markets and sells our products and services to companies in the life sciences industries, including pharmaceutical and medical product companies, wholesale distributors and managed care organizations. The industry solutions line of business targets all other industries, with an emphasis on consumer products, foodservice, disposables, oil/gas/energy, consumer durables, industrial products, chemicals, apparel, and telecommunications.

Our primary products and services were originally developed to manage complex contract purchasing relationships in the healthcare industry. Our software is currently licensed by 17 of the 20 largest world-wide

17

pharmaceutical manufacturers, ranked according to 2005 annual pharma revenues. As the depth and breadth of our product suites have expanded, we have added companies in the industry solutions markets to our customer base.

We have generated revenues from both products and services. Product revenues, comprised of fees generated from licenses of our Contract Life Cycle Management Software Suites, accounted for 13.4% of net revenues in 2006 versus 19.3% of net revenues in 2005. Service revenues include maintenance and support fees directly related to our licensed software products, professional service fees derived from consulting, installation, business analysis and training services related to our software products and hosting fees. Service revenues accounted for 86.6% of net revenues in 2006 versus 80.7% of net revenues in 2005.

We implemented a number of employee headcount reductions and office downsizings during the period June 2001 through March 2004, after which our aggregate quarterly spending on cost of products and services, sales and marketing, research and development and general and administrative expenses (excluding amortization and noncash stock compensation) remained fairly steady—ranging from $9.2 million to $10.4 million—through the first quarter of 2006. In early 2006, we increased our spending, primarily on research and development and professional services, in order to (i) accelerate development of future releases of our product offerings in the health and life sciences segment, (ii) work on resolving defects in one of our software products, as explained in further detail in “Critical Accounting Policies—Revenue Recognition” in this Item 7, and (iii) augment staff levels at a number of professional services engagements, primarily in connection with implementations of the software product with performance defects at customer sites. We expect that our spending on research and development will continue at high levels relative to our revenues for much of 2007. Our total employee headcount has increased from 170 at March 31, 2004 and 164 at December 31, 2005 to 185 at December 31, 2006.

On March 31, 2005, the shareholders of the Company voted to reject a proposed merger among the Company, Selectica, Inc. and a subsidiary of Selectica. As a result, the merger agreement among the parties terminated. Under the terms of the merger agreement, Selectica would have paid $1.55 per share in cash for all outstanding shares of our common stock, for a total transaction value of approximately $70.0 million.

In August 2005, the Company announced the departure of its Chief Executive Officer, A. Leigh Powell, and its Chief Operating Officer, Terrence M. Nicholson. In connection with the resignation of these executives, we incurred $350,000 in future severance and benefit costs in 2005. Also, Yorgen Edholm was appointed Acting President and Chief Executive Officer, and John A. Rade was appointed Chairman of the Board of Directors with certain executive powers. In February 2006, Mr. Edholm resigned as Acting President and Chief Executive Officer while remaining on the Board of Directors, and Mr. Rade assumed the position of Acting President and Chief Executive Officer on an interim basis. In August 2006, Mr. Rade was appointed President and Chief Executive Officer on a permanent basis.

On November 6, 2006, we completed a private placement of our securities, issuing 3,535,566 shares of our common stock and common stock purchase warrants to purchase up to an additional 1,060,663 shares of common stock. The per unit price of the private placement offering was $1.98, with each unit comprised of one share of common stock and a warrant to purchase three-tenths of a share of common stock. The warrants are exercisable at $2.11 per share until November 2011. Net proceeds to the Company were approximately $6.5 million, after deducting commissions and other fees.

CRITICAL ACCOUNTING POLICIES

Revenue Recognition

We generate revenues from licensing our software and providing professional services, training and maintenance and support services. Software license revenues are attributable to the addition of new customers and the expansion or renewal of existing customer relationships through licenses covering additional users, licenses of additional software products and license renewals.

18

We recognize software license fees upon execution of a signed license agreement and delivery of the software to customers, provided there are no significant post-delivery obligations, the payment is fixed or determinable and collection is probable. In multiple-element arrangements, we allocate a portion of the total fee to professional services, training and maintenance and support services based on the fair value of those elements, which is defined as the price charged when those elements are sold separately. The residual amount is then allocated to the software license fee. In cases where we agree to deliver unspecified additional products in the future, the license fee is recognized ratably over the term of the arrangement beginning with the delivery of the first product. In cases where we agree to deliver specified additional products or upgrades in the future, recognition of the entire license fee, including any related maintenance and support fees, is deferred until after the specified additional products or upgrades are delivered and made generally available to all customers. If an acceptance period is required, revenues are deferred until customer acceptance. In cases where collection is not deemed probable, we recognize the license fee as payments are received. In cases where significant production or customization is required prior to attaining technological feasibility of the software, license fees are recognized on a percentage-of-completion basis and are credited to research and development expenses as a funded development arrangement. After the software attains technological feasibility, recognizable license fees are reported as product revenue.

Service revenues include professional services, training and maintenance and support services and reimbursable out-of-pocket expenses. Professional service revenues are recognized as the services are performed. If conditions for acceptance exist, professional service revenues are recognized upon customer acceptance. For fixed fee professional service contracts, we provide for anticipated losses in the period in which the loss is probable and can be reasonably estimated. Training revenues are recognized as the services are provided. Included in training revenues are registration fees received from participants in our off-site user training conferences.

Maintenance and customer support fees are recognized ratably over the term of the maintenance contract, which is generally twelve months. When maintenance and support is included in the total license fee, we allocate a portion of the total fee to maintenance and support based upon the price paid by the customer when sold separately, generally as renewals in the second year.

Payments received from customers at the inception of a maintenance period are treated as deferred service revenues and recognized ratably over the maintenance period. Payments received from customers in advance of product shipment or revenue recognition are treated as deferred product revenues and recognized when the product is shipped to the customer or when otherwise earned.

We offer current and prospective customers the option to enter into a subscription agreement as an alternative to our standard license contract model. Management believes its subscription offering has expanded the market to customers that find regular subscription payments an easier and more flexible implementation of our software, and subscription arrangements have the potential to provide us with smoother and more predictable revenue growth. The standard subscription arrangement is presently a fixed fee agreement over three to five years, covering license fees, unspecified new product releases and maintenance and support, generally payable in equal quarterly installments commencing upon execution of the agreement. In most agreements that have been executed to date, the subscription arrangement converts free-of-charge to a perpetual license after the completion of the initial term plus any extensions, generally after five years, after which time the customer would have the option of paying for the continuation of maintenance and support. We recognize all revenue from subscription based arrangements ratably over the term of the subscription agreement commencing upon delivery of the initial product. Subscription installment amounts that are not yet contractually billable to customers are not reflected in deferred revenues on our consolidated balance sheet. A portion of the periodic subscription fee revenue, generally 13 to 17 percent, is allocated to service revenue based on the relationship of our standard annual maintenance and support renewal rates to the related perpetual license fees, with the balance of the subscription fee revenue classified as product revenue in our financial statements.

19

Subscription arrangements, including perpetual license arrangements with rights to unspecified additional products that are treated as subscriptions for accounting purposes, now represent a significant proportion of our new licenses. In 2006, 17 of the 29 license deals (minimum value of $50,000) that were sold are being treated as subscription arrangements for accounting purposes. During 2006 and 2005, we recognized $2.4 million and $961,000, respectively, in product revenue related to such agreements. See the reconciliation table that follows under “Results of Operations—Year Ended December 31, 2006 Compared to Year Ended December 31, 2005—Net Revenues” in this Item 7. For 2007, we anticipate that subscription revenues will continue to increase and that such arrangements will represent a significant proportion of new license sales.

During the third quarter of 2005, we became aware of certain defects in the then-current version of one of our software products, which was first shipped to customers in the fourth quarter of 2004. These defects, which were not identified in pre-release product testing, affected the performance of the software for a portion of our customers depending on each customer’s particular implementation environment and its intended use of the software. Because certain concessions have been made to customers in connection with these defects, we have generally not recognized revenue from sales of this software product and related implementation services beginning in the third quarter of 2005, except in those cases in which it was determined that the customer was not likely to be affected by the known, unresolved software defects. During 2006, new versions of the software were released, but we continued to experience problems with implementations at several customer sites. In the first quarter of 2007, we plan to complete development of a major new release of the software which has been designed to resolve known performance defects. We intend to continue deferring revenue in connection with license sales, maintenance and support, and implementation services for this software product until it has been demonstrated at multiple customer sites that the new release of the software is free of significant performance defects. As of December 31, 2005 and 2006, we have reversed and deferred cumulative amounts of $1.6 million and $3.5 million, respectively, of otherwise-recognizable product and service revenue, based in part on our estimate of the fair value of concessions to be made until the remaining defect is resolved, and partly on our determination that license fees were not fixed and determinable because of the possibility of future concessions. Also, see Risk Factor entitled “We Cannot Guarantee That Our Deferred Revenue Will Be Recognized as Planned” in item 1A of this filing.

Stock-based Compensation:

On January 1, 2006, we adopted Statement of Financial Accounting Standards (“FAS”) No. 123 (revised 2004) (“FAS 123(R)”), “Share-based Payment.” Under FAS 123(R), we measure and record the compensation cost of employee and director services received in exchange for stock option grants and other equity awards based on the grant-date fair value of the awards. The values of the portions of the awards that are ultimately expected to vest are recognized as expense over the requisite service periods. We account for stock options and awards granted to non-employees other than directors using the fair-value method.

We adopted FAS 123(R) using the modified prospective method, pursuant to which our financial statement for prior reporting periods have not been adjusted to include compensation cost calculated under the fair-value method. Prior to 2006, we used the intrinsic value method to measure compensation expense associated with the grants of stock options or awards to employees and directors. Under the intrinsic value method, compensation associated with such grants and awards was determined as the excess, if any, of the current fair value of the underlying common stock on the date of grant over the price an employee or director must pay to exercise the award.

Under the fair-value method, compensation associated with equity awards is determined based on the estimated fair value of the award itself, measured using either current market data or an established option pricing model. The measurement date for employee and director awards is generally the date of grant. The measurement date for awards granted to non-employees other than directors is generally the date that performance of certain services is complete.

20

The Company’s calculations of the fair value of stock option grant, including valuations for pre-2006 pro forma calculations, were made using the Black-Scholes option pricing model with the following assumptions, and resulted in the following weighted average grant-date fair values of options granted during the years ended December 31:

| | | | | | | | | | | | |

| | | 2004 | | | 2005 | | | 2006 | |

Risk-free interest rates | | | 3.9 | % | | | 4.05-4.54 | % | | | 4.6-5.05 | % |

Expected volatility | | | 125 | % | | | 70-80 | % | | | 60-70 | % |

Expected dividends | | | 0 | % | | | 0 | % | | | 0 | % |

Expected term (in years) | | | 7 | | | | 6.25 | | | | 2.5-10 | |

Weighted average grant-date fair value of options granted during the year | | $ | 1.05 | | | $ | 1.07 | | | $ | 1.16 | |

The Company uses historical volatility of the Company’s common stock to estimate expected volatility. Beginning in 2005, the expected term of options granted is estimated to be equal to the average of the contractual life of the options and the grant’s average vesting period. The risk-free interest rate is derived quarterly from the published US Treasury yield curve, based on expected term, in effect as of the last several days of the quarter.

Allowance for Doubtful Accounts

We record provisions for doubtful accounts based on a detailed assessment of our accounts receivable and related credit risks. In estimating the allowance for doubtful accounts, management considers the age of the accounts receivables, our historical write-off experience, the credit worthiness of customers and the economic conditions of the customers’ industries and general economic conditions, among other factors. Should any of these factors change, the estimates made by management will also change, which could affect the level of our future provision for doubtful accounts. If the assumptions we used to calculate these estimates do not properly reflect future collections, there could be an impact on future reported results of operations. The provisions for doubtful accounts are included in general and administrative expenses in the consolidated statements of operations.

Acquired Intangible Assets

Acquired intangible assets (excluding goodwill) are amortized on a straight-line basis over their estimated useful lives and reviewed for impairment on an annual basis, or on an interim basis if an event or circumstance occurs between annual tests indicating that the assets might be impaired. The impairment test will consist of comparing the cash flows expected to be generated by the acquired intangible asset to its carrying amount. If the asset is considered to be impaired, an impairment loss will be recognized in an amount by which the carrying amount of the asset exceeds its fair value.

Goodwill

Goodwill is tested for impairment at the reportable segment level using a two-step approach. The first step is to compare the fair value of a reporting unit to its carrying amount, including goodwill. If the fair value of the reporting unit is greater than its carrying amount, goodwill is not considered impaired and the second step is not required. If the fair value of the reporting unit is less than its carrying amount, the second step of the impairment test measures the amount of the impairment loss, if any, by comparing the implied fair value of goodwill to its carrying amount. If the carrying amount of goodwill exceeds its implied fair value, an impairment loss is recognized equal to that excess. The implied fair value of goodwill is calculated in the same manner that goodwill is calculated in a business combination, whereby the fair value of the reporting unit is allocated to all of the assets and liabilities of that unit (including any unrecognized intangible assets), with the excess “purchase price” over the amounts assigned to assets and liabilities representing the implied fair value of goodwill. Goodwill is tested for impairment at least annually, or on an interim basis if an event occurs or circumstances

21

change that would likely reduce the fair value of a reporting unit below its carrying value. If the assumptions we used to estimate fair value of goodwill change, there could be an impact on future reported results of operations.

Deferred Tax Assets

A deferred tax asset or liability is recorded for temporary differences in the bases of assets and liabilities for book and tax purposes and loss carry forwards based on enacted tax rates expected to be in effect when these temporary items are expected to reverse. Valuation allowances are provided to the extent it is more likely than not that all or a portion of the deferred tax assets will not be realized.

Product Indemnification