Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(MARK ONE)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 0-30961

SOHU.COM INC.

(Exact name of registrant as specified in its charter)

| Delaware | 98-0204667 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Level 18, Sohu.com Media Plaza

Block 3, No. 2 Kexueyuan South Road, Haidian District

Beijing 100190

People’s Republic of China

(Address of principal executive offices)

(011) 8610-6272-6666

(Registrant’s Telephone Number, Including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Common Stock, $0.001 Par Value

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of RegulationS-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to this Form10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant, based upon the last sale price on June 30, 2016 as reported on the NASDAQ Global Select Market, was approximately $917 million.

As of January 31, 2017, there were 38,813,288 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for Sohu’s 2016 Annual Meeting of Stockholders to be filed on or about April 28, 2017 are incorporated into Part III of this report.

Table of Contents

Table of Contents

Table of Contents

As used in this report, references to “us,” “we,” “our,” “our company,” “our Group,” the “Sohu Group,” the “Group,” and “Sohu.com” are to Sohu.com Inc. and, except where the context requires otherwise, our subsidiaries and variable interest entities (“VIEs”) Sohu.com Limited, Sohu.com (Hong Kong) Limited (“Sohu Hong Kong”), All Honest International Limited (“All Honest”), Sohu.com (Game) Limited (“Sohu Game”), Go2Map Inc., Sohu.com (Search) Limited (“Sohu Search”), Sogou Inc. (“Sogou”), Sogou (BVI) Limited (“Sogou BVI”), Sogou Hong Kong Limited (“Sogou HK”), Vast Creation Advertising Media Services Limited (“Vast Creation”), Sogou Technology Hong Kong Limited, Fox Video Investment Holding Limited (“Video Investment”), Fox Video Limited (“Sohu Video”), Fox Video (HK) Limited (“Video HK”), Focus Investment Holding Limited, Sohu Focus Limited, Sohu Focus (HK) Limited, Beijing Sohu New Era Information Technology Co., Ltd. (“Sohu Era”), Beijing Sohu Software Technology Co., Ltd., Beijing Sogou Technology Development Co., Ltd. (“Sogou Technology”), Beijing Sogou Network Technology Co., Ltd (“Sogou Network”), Fox Information Technology (Tianjin) Limited (“Video Tianjin”), Beijing Sohu New Media Information Technology Co., Ltd. (“Sohu Media”), Beijing Sohu New Momentum Information Technology Co., Ltd. (“Sohu New Momentum”), Beijing Century High Tech Investment Co., Ltd. (“High Century”), Beijing Heng Da Yi Tong Information Technology Co., Ltd. (“Heng Da Yi Tong”, formerly known as Beijing Sohu Entertainment Culture Media Co., Ltd.), Beijing Sohu Internet Information Service Co., Ltd. (“Sohu Internet”), Beijing GoodFeel Technology Co., Ltd., Beijing Sogou Information Service Co., Ltd. (“Sogou Information”), Beijing 21 East Culture Development Co., Ltd., Beijing Sohu Donglin Advertising Co., Ltd.(“Donglin”), Beijing Pilot New Era Advertising Co., Ltd. (“Pilot New Era”), Beijing Focus Yiju Network Information Technology Co., Ltd., SohuPay Science and Technology Co., Ltd., Beijing Sohu Dianjin Information Technology Co., Ltd., Beijing Yi He Jia Xun Information Technology Co., Ltd., Tianjin Jinhu Culture Development Co., Ltd. (“Tianjin Jinhu”), Guangzhou Qianjun Network Technology Co., Ltd. (“Guangzhou Qianjun”), Shenzhen Shi Ji Guang Su Information Technology Co., Ltd., Chengdu Sogou Easypay Technology Co., Ltd., Beijing Shi Ji Si Su Technology Co., Ltd., Chongqing Qogir Enterprise Management Consulting Co., Ltd., SendCloud Technology Co., Ltd., Beijing Hua Yang Lian Zhong Advertising Co., Ltd, Beijing Focus Interactive Information Service Co., Ltd., Beijing Focus Xin Gan Xian Information Technology Co., Ltd., Beijing Focus Real Estate Agency Co., Ltd. and our independently-listed majority-owned subsidiary Changyou.com Limited (“Changyou,” formerly known as TL Age Limited) as well as the following direct and indirect subsidiaries and VIEs of Changyou: Changyou.com HK Limited (“Changyou HK”) formerly known as TL Age Hong Kong Limited), Changyou.com Webgames (HK) Limited (“Changyou HK Webgames”), Changyou.com Gamepower (HK) Limited, ICE Entertainment (HK) Limited (“ICE HK”), Changyou.com Gamestar (HK) Limited, Changyou.com Korea Limited, Changyou.com India Private Limited, Changyou BILISIM HIZMETLERI TICARET LIMITED SIRKETI, Kylie Enterprises Limited, Mobogarden Enterprises Limited, Heroic Vision Holdings Limited, TalkTalk Limited, RaidCall (HK) Limited, 7Road.com Limited (“7Road”), 7Road.com HK Limited (“7Road HK”), Changyou.com (TH) Limited, Changyou.com Rus Limited, PT. CHANGYOU TECHNOLOGY INDONESIA, Changyou Middle EastFZ-LLC, Changyou.com Technology Brazil Desenvolvimento De Programas LTDA, Greative Entertainment Limited (formerly known as Greative Digital Limited), Glory Loop Limited (“Glory Loop”), MoboTap Inc. (“MoboTap”, a Cayman Islands company), MoboTap Inc. Limited (“MoboTap HK”), MoboTap Inc. (a Delaware corporation), Dolphin Browser Inc., TMobi Limited (formerly known as Muse Entertainment Limited), Dstore Technology Limited, Mobo Information Technology Pte. Ltd., Changyou Mobo Glint Limited, Global Cool Limited, Beijing AmazGame Age Internet Technology Co., Ltd. (“AmazGame”), Beijing Changyou Skyline Property Management Co. Ltd, Beijing Cruise stars Technology Co., Ltd., Beijing Changyou Chuangxiang Software Technology Co., Ltd., Beijing Changyou Gamespace Software Technology Co., Ltd. (“Gamespace”), ICE Information Technology (Shanghai) Co., Ltd. (“ICE Information”), Beijing Changyou RaidCall Internet Technology Co., Ltd. (“RaidCall”), Beijing Yang Fan Jing He Information Consulting Co., Ltd. (“Yang Fan Jing He”), Shanghai Jingmao Culture Communication Co., Ltd. (“Shanghai Jingmao”), Shanghai Hejin Data Consulting Co., Ltd., Beijing Changyou Jingmao Film & Culture Communication Co., Ltd. (“Beijing Jingmao”), Beijing Gamease Age Digital Technology Co., Ltd. (“Gamease”), Beijing Guanyou Gamespace Digital Technology Co., Ltd. (“Guanyou Gamespace”), Beijing Zhi Hui You Information Technology Co., Ltd., Shanghai ICE Information Technology Co., Ltd. (“Shanghai ICE”), Shenzhen 7Road Network Technologies Co., Ltd. (“7Road Technology”), Beijing Changyou Star Digital Technology Co., Ltd (“Changyou Star”), Beijing Changyou Creation Information Technology Co., Ltd. (formerly known as Beijing Changyoue-pay Co. Ltd.), Shenzhen Brilliant Imagination Technologies Co., Ltd. (“Brilliant Imagination”), Beijing Baina Information Technology Co., Ltd., Baina Zhiyuan (Beijing) Technology Co., Ltd. (“Beijing Baina Technology”), Baina Zhiyuan (Chengdu) Technology Co., Ltd., Chengdu Xingyu Technology Co., Ltd., Baina (Wuhan) Information Technology Co., Ltd. (“Wuhan Baina Information”), Wuhan Xingyu Technology Co., Ltd., Wuhan Hualian Chuangke Technology Co., Ltd., Beijing Global Cool Technology Co., Ltd., Beijing Changyou Creative Technology Co., Ltd., and HongKong New Xinlang Electron Group Limited, and these references should be interpreted accordingly. Unless otherwise specified, references to “China” or “PRC” refer to the People’s Republic of China and do not include the Hong Kong Special Administrative Region, the Macau Special Administrative Region or Taiwan. This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements regarding our expectations, beliefs, intentions or future strategies that are signified by the words “expect,” “anticipate,” “intend,” “believe,” or similar language. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Our business and financial performance are subject to substantial risks and uncertainties. Actual results could differ materially from those projected in the forward-looking statements. In evaluating our business, you should carefully consider the information set forth under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements.

1

Table of Contents

| ITEM 1. | BUSINESS |

OUR COMPANY

Sohu.com Inc. (NASDAQ: SOHU), a Delaware corporation organized in 1996, is a leading Chinese online media, search and game service group providing comprehensive online products and services on PCs and mobile devices in the People’s Republic of China (the “PRC” or “China”). Our businesses are conducted by Sohu.com Inc. and its subsidiaries and VIEs (collectively referred to as the “Sohu Group” or the “Group”). The Sohu Group consists of Sohu, which when referred to in this report, unless the context requires otherwise, excludes the businesses and the corresponding subsidiaries and VIEs of Sogou Inc. (“Sogou”) and Changyou.com Limited (“Changyou”), Sogou and Changyou. Sogou and Changyou are indirect controlled subsidiaries of Sohu.com Inc. Sohu is a leading Chinese language online media content and services provider. Sogou is a leading online search, client software and mobile Internet product provider in China. Changyou is a leading online game developer and operator in China as measured by the popularity of its PC game Tian Long Ba Bu (“TLBB”) and its mobile game TLBB 3D, and engages primarily in the development, operation and licensing of online games for PCs and mobile devices. Most of our operations are conducted through our China-based subsidiaries and VIEs.

In August 1996, we were incorporated in Delaware as Internet Technologies China Incorporated, and in January 1997 we launched our original Website, itc.com.cn. In February 1998, were-launched our Website under the domain name Sohu.com and, in September 1999, we renamed our company Sohu.com Inc. On July 17, 2000, we completed our initial public offering on NASDAQ.

OUR BUSINESS

Through the operation of Sohu, Sogou and Changyou, we generate online advertising revenues (including brand advertising revenues and search and search-related revenues), online games revenues and other revenues. Online advertising and online games are our core businesses. In the year ended December 31, 2016, total revenues generated by Sohu, Sogou and Changyou were approximately $1.65 billion, including:

Sohu:

| • | $408.6 million in brand advertising revenues, of which $181.8 million was from Sohu Media Portal, $123.1 million was from Sohu Video, and $103.7 million was from Focus; and |

| • | $56.0 million in other revenues, mainly attributable to revenues from paid subscription services, interactive broadcasting services,sub-licensing of purchased video content to third parties, content provided through the platforms of the three main telecommunications operators in China, and the filming business. |

Total revenues generated by Sohu were $464.6 million.

Sogou:

| • | $597.1 million in search and search-related revenues; and |

| • | $63.3 million in other revenues, primarily attributable to Sogou’s offering of Internet value-added services (or “IVAS”) with respect to the operation of Web games and mobile games developed by third parties, as well as other services and products provided to users. |

Total revenues generated by Sogou were $660.4 million.

Changyou:

| • | $395.7 million in online game revenues; |

| • | $39.4 million in brand advertising revenues, mainly attributable to Changyou’s 17173.com Website; and |

| • | $90.3 million in other revenues attributable to Changyou’s cinema advertising business and IVAS business. |

Total revenues generated by Changyou were $525.4 million.

For the year ended December 31, 2016, our total brand advertising revenues were $448.0 million, total search and search-related revenues were $597.1 million, total online game revenues were $395.7 million, and total other revenues were $209.6 million.

2

Table of Contents

Sohu’s Business

Brand Advertising Business

Sohu’s main business is the brand advertising business, which offers to users, over our matrices of Chinese language online media, various content, products and services across multiple Internet-enabled devices, such as PCs, mobile phones and tablets. The majority of our products and services are provided through Sohu Media Portal, Sohu Video and Focus.

| • | SohuMediaPortal. Sohu Media Portal is a leading online news and information provider in China. Sohu Media Portal provides users comprehensive content through www.sohu.com for PCs, the mobile phone application Sohu News APP and the mobile portal m.sohu.com; |

| • | SohuVideo. Sohu Video is a leading online video content and service provider in China through tv.sohu.com for PCs and the mobile phone application Sohu Video APP; and |

| • | Focus. Focus (www.focus.cn) is a leading online real estate information and services provider in China. |

Revenues generated by the brand advertising business are classified as brand advertising revenues in our consolidated statements of comprehensive income.

Other Business

Sohu also engages in the other business, which consists primarily of paid subscription services, interactive broadcasting services,sub-licensing of purchased video content to third parties, providing content through the platforms of the three main telecommunications operators in China, and the filming business. Revenues generated by Sohu from the other business are classified as other revenues in our consolidated statements of comprehensive income.

Sogou’s Business

Search and Search-related Business

The search and search-related business primarily offers advertiserspay-for-click services, as well as online marketing services on Web directories operated by Sogou.Pay-for-click services enable advertisers’ promotional links to be displayed on the Sogou search result pages and Sogou Website Alliance members’ Internet properties where the links are relevant to the subject and content of such properties. Bothpay-for-click services and online marketing services on Web directories operated by Sogou expand the distribution of our advertisers’ promotional links and advertisements by leveraging traffic on Sogou Website Alliance members’ Internet properties, including Web content, software and mobile applications. Our search and search-related business benefits from our collaboration with Tencent Holdings Limited (“Tencent”), which provides us access to traffic and content generated from users of products and services provided by Tencent.

Revenues generated by the search and search-related business are classified as search and search-related revenues in our consolidated statements of comprehensive income.

Other Business

Sogou also engages in the other business, primarily by offering IVAS with respect to the operation of Web games and mobile games developed by third parties, as well as other services and products provided to users. Revenues generated by Sogou from the other business are classified as other revenues in our consolidated statements of comprehensive income.

Changyou’s Business

Changyou’s business lines consist of the online game business; the platform channel business, which consists primarily of online advertising and also includes IVAS; and the cinema advertising business.

3

Table of Contents

Online Game Business

Changyou’s online game business offers to game players (a) PC games, which are interactive online games that are accessed and played simultaneously by hundreds of thousands of game players through personal computers and require that localclient-end game access software be installed on the computers used and (b) mobile games, which are played on mobile devices and require an Internet connection. Prior to the sale of Shenzhen 7Road Technology Co., Ltd., or Shenzhen 7Road, in August 2015, Changyou’s online games also included Web games, which became an insignificant part of its online games business following the sale. All of Changyou’s games are operated under the item-based revenue model, meaning that game players can play the games for free, but can choose to pay for virtual items, which arenon-physical items that game players can purchase and use within a game, such as gems, pets, fashion items, magic medicine, riding animals, hierograms, skill books and fireworks. Revenues derived from the operation of online games are classified as online game revenues in our consolidated statements of comprehensive income.

Platform Channel Business

Changyou’s platform channel business consists primarily of the operation of the 17173.com Website, one of the leading information portals in China, which provides news, electronic forums, online videos and other information services on online games to game players. Changyou’s platform channel business also offers a number of software applications for PCs and mobile devices through RaidCall and the Dolphin Browser. RaidCall provides online music and entertainment services, primarily in Taiwan. The Dolphin Browser, which is operated by MoboTap, is a gateway to a host of user activities on mobile devices, with the majority of its users based in Europe, Russia and Japan. As Changyou management had determined that the Dolphin Browser was unable to provide expected synergies with Changyou’s platform channel business, in 2016, Changyou’s Board of Directors approved the disposal of Changyou’s 51% equity interest in MoboTap Inc. (collectively with its subsidiaries and VIEs “MoboTap”), which is the mobile technology developer behind the Dolphin Browser. As of December 31, 2016, Changyou has been negotiating with a potential buyer on the terms of disposal. Accordingly, the assets and liabilities attributable to MoboTap are classified as assets and liabilities held for sale and measured at the lower of their carrying amounts or their fair value, less cost to sell, in our consolidated balance sheet as of December 31, 2016. All revenues generated by the 17173.com Website are classified as brand advertising revenues, IVAS revenues generated by the Dolphin Browser and by RaidCall are classified as other revenues and a relatively small amount of online game revenues generated by the Dolphin Browser are included in online game revenues in our consolidated statements of comprehensive income.

Cinema Advertising Business

Changyou also operates a cinema advertising business, which consists primarily of the acquisition, from operators of movie theaters, and the sale, to advertisers, ofpre-film advertising slots, which are advertisements shown before the screening of a movie in a cinema theatre. Revenues generated by Changyou’s cinema advertising business are classified as other revenues in the Sohu Group’s consolidated statements of comprehensive income.

PRODUCTS AND SERVICES

Sohu’s Business

Brand Advertising Business

Sohu’s main business is the brand advertising business, which offers to users, over our matrices of Chinese language online media, various content, products and services across multiple Internet-enabled devices, such as PCs, mobile phones and tablets. The majority of our products and services are provided through Sohu Media Portal, Sohu Video and Focus.

Sources

Sohu Media Portal

Sohu Media Portal is a leading online news and information provider in China. Sohu Media Portal provides users comprehensive content through www.sohu.com for PCs, the mobile phone application Sohu News APP and the mobile portal m.sohu.com. We provide content by aggregating content from other media organizations and partnering with independent contributors, and also use content generated by ourin-house editorial teams. We use algorithms to recommend to users personalized content that may interest them.

4

Table of Contents

Sohu Video

Sohu Video (tv.sohu.com) is a leading online video content and service provider in China. We deliver premium purchased video content, self-developed video content, and user-generated content (“UGC”). Professional generated content (“PGC”) is asub-category of UGC where the content is made by a large group of professional or semi-professional content studios. We provide users free access to the majority of our extensive and comprehensive video content library, which includes popular domestic and overseas television dramas, variety shows, movies, animations, PGC, documentaries, interactive broadcasting, and self-developed video content. We also offer selectedfee-based content, which includes overseas television dramas, self-developed video content, and movies. Users can access our video content via PCs through tv.sohu.com, or via mobile devices by visiting our mobile video site or installing Sohu Video APP, our mobile video application.

Focus

Focus (www.focus.cn) is a leading online real estate information and services provider in China. Focus provides diversified online content consisting of new homes for sale, properties forre-sale and home furnishing services, and other comprehensive services and solutions for house seekers, homeowners and buyers. Focus membership cards allow potential home buyers to purchase specified properties from real estate developers at a discount greater than the price that Focus charges for the card. Focus has also developed a transaction platform to offer online and offline services that facilitate the purchase of new homes by buyers.

Business Model

In the brand advertising business, we enjoy a strong competitive position as one of the leading Internet companies in China. Through the platforms described above, we have built a sizeable user base through good user experiences provided by our products and services. This user base is appealing to advertisers. Through PCs and mobile devices, we provide advertisement placements to our advertisers on different Internet platforms and in different formats, which include banners, links, logos, buttons, full screen,pre-roll,mid-roll, post-roll video screens, pause video screens, loading page ads, news feed ads andin-feed video infomercial ads. We rely on both direct sales by our internal sales force and sales by advertising agents for advertising on our Internet platforms. Our advertisers include multinational companies and Chinese domesticmedium-sized and small companies.

Currently we have four main types of pricing models, consisting of the Fixed Price model, the Cost Per Impression (“CPM”) model, theE-commerce model, and the Cost Per click (“CPC”) model.

Fixed Price model

Under the Fixed Price model, a contract is signed to establish a fixed price for the advertising services to be provided.

CPM model

Under the CPM model, the unit price for each qualifying display is fixed, but there is no overall fixed price for the advertising services stated in the contract with the advertiser. A qualifying display is defined as the appearance of an advertisement, where the advertisement meets criteria specified in the contract. Advertising fees are charged to the advertisers based on the unit prices and the number of qualifying displays.

E-commerce model

Under thee-commerce model, revenues are mainly generated from sales of membership cards which allow potential home buyers to purchase specified properties from real estate developers at a discount greater than the price that Focus charges for the card. Membership fees are refundable until the potential home buyers use the discounts to purchase properties. Focus recognizes such revenues upon obtaining confirmation that a membership card has been redeemed to purchase a property.

CPC model

Under the CPC model, there is no overall fixed price for advertising services stated in the contract with the advertiser. We charge advertisers on aper-click basis when the users click on the advertisements. The unit price for each click is auction-based.

5

Table of Contents

Other Business

Sohu also engages in the other business, which consists primarily of paid subscription services, interactive broadcasting services,sub-licensing of purchased video content to third parties, providing content through the platforms of the three main telecommunications operators in China, and the filming business. Revenues generated by Sohu from the other business are classified as other revenues in the Sohu Group’s consolidated statements of comprehensive income.

Sogou’s Business

Search and search-related Business

Products and Services for Users

Sogou’s main business is the search and search-related business. Sogou is a leading online search, client software and mobile Internet product provider in China. Sogou offers extensive products and services, including Sogou Search, Sogou Input Method, Sogou Browser and Sogou Web Directory to China’s online users.

Sogou Search

Sogou Search is Sogou’s proprietary search engine and is conducted through Sogou.com on both PCs and mobile devices. Upon a search query, users are taken through an interactive process to reach the most relevant selection of integrated Websites and search results pages based on advanced algorithms. Sogou Search provides users with high updating speed, short response time and accurate search results. We also provide direct answers to search queries that integrate relevant information from massive data. To better serve mobile users, Sogou mobile search supports voice and image search, intuitive display of search results and personalized features. In addition, we have made solid progress in artificial intelligence (AI) technologies, including natural language processing, and voice and image recognition. Such technologies have been applied to optimize our general search results ranking and voice and image search to improve search quality.

Sogou Search is dedicated to providing users with high quality and unique search results. Through our partnership with Tencent, one of Sogou’s major shareholders, Sogou Search allows users to access content on many of Tencent’s social platforms, including content published on Weixin/WeChat accounts, and also empowers users with enhanced vertical search capabilities. As the exclusive search partner of Zhihu Technology Limited (“Zhihu”), which operates an online question and answer-based knowledge and information-sharing platform, we are able to give our users easy access to the content available on Zhihu’s platform. We partner with Microsoft to allow our users to conduct English and academic searches on Microsoft’s Bing search engine. We also collaborate with credible online healthcare information platforms to improve the quality of healthcare search results for our users.

Sogou Input Method

Sogou Input Method isin-house developed software for the input of Chinese characters on PCs and mobile devices. It is among the most popular Internet products in China and has a dominant market share. Sogou Input Method uses search engine technology to capture and generate vocabularies and language models and can present the latest trends in words used by Internet users. In December 2016, Sogou Input Method’s monthly active users on PCs reached 514 million, with a penetration rate over 95% in China, according to iResearch. Sogou Mobile Keyboard, the mobile version of Sogou Input Method, provides tailored features for smart phones, such as multimedia (voice and image) input, handwriting recognition, and vocabulary sync between mobile devices and PCs. In December 2016, Sogou Mobile Keyboard remained the third largest mobile application in China in terms of daily active users, according to iResearch.

Sogou Browser

Sogou Browser is our self-developed browser that is designed with technologies to makeWeb-navigation faster, safer, and easier for PCs and mobile devices. Sogou Browser for PCs has an original dual-core network-layer system and a seven-stage acceleration mechanism, which can accelerate browsing speed for users accessing the Internet. Sogou mobile browser has mobile-specific features, including file transfer from PC to mobile and news feed flow.

Sogou Web Directory

Sogou Web Directory is a popular Chinese Web directory navigation site for both PCs and mobile devices which serves as a key access point to popular and preferred Websites.

6

Table of Contents

Products and Services for Advertisers

Search and search-related services include primarilypay-for-click services, as well as online marketing services on Web directories operated by Sogou.

Pay-for-click Services

Pay-for-click services are services that enable our advertisers’ promotional links to be displayed on Sogou search result pages and on Sogou Website Alliance members’ Internet properties where the links are relevant to the subject and content of such members’ properties. Forpay-for-click services, we introduce Internet users to our advertisers through our auction-basedpay-for-click systems and charge advertisers on aper-click basis when the users click on the displayed links. Revenue forpay-for-click services is recognized on aper-click basis when the users click on the displayed links.

Online Marketing Services on Web Directories Operated by Sogou

Online marketing services on Web directories operated by Sogou mainly consist of displaying advertisers’ promotional links on the Web pages of Web directories. Revenue for online marketing services on Web directories operated by Sogou is normally recognized on a straight-line basis over the contract period, provided our obligations under the contract and all revenue recognition criteria have been met.

Bothpay-for-click services and online marketing services on Web directories operated by Sogou expand the distribution of advertisers’ promotional links or advertisements by leveraging traffic on Sogou Website Alliance members’ Internet properties, including Web content, software and mobile applications. We recognize gross revenue for the amount of fees we receive from advertisers, as we have the primary responsibility for fulfillment and acceptability. Payments made to Sogou Website Alliance members are included in cost of search and search-related revenues as traffic acquisition costs. We pay Sogou Website Alliance members based on either revenue-sharing arrangements, under which we pay a percentage ofpay-for-click revenues generated from clicks by users of their properties, or on apre-agreed unit price.

Other Business

Sogou also engages in the other business, primarily by offering IVAS with respect to the operation of Web games and mobile games developed by third parties, as well as other services and products provided to users. Revenues generated by Sogou from the other business are classified as other revenues in our consolidated statements of comprehensive income.

Changyou’s Business

Online Game Business

Business Model

Changyou’s game players typically access Changyou’s games through personal computers and mobile devices, such as mobile phones and tablets, connected to the Internet. In order to access Changyou’s PC games, game access software must be installed in the computer being used. Game players using PCs can typically download Changyou’s game access software, interim updates and expansion packs directly from its official game Website. Game players access Changyou’s mobile games by downloading its mobile game applications, primarily from third-party mobile application stores or, to a lesser extent, from Changyou’s game Website. Prior to the sale of Shenzhen 7Road in August 2015, Changyou’s online games also included Web games, which became a relatively insignificant part of its online games business following the sale.

Changyou’s online games include a variety of game genres, including massively multiplayer online role-playing games (“MMORPGs”), CCGs, TPSs and other genres. Changyou is also developing, and plans to expand its game portfolio with, new genres such asS-RPGs, MOBAs, SLGs and advanced casual games. MMORPGs are massive multiplayer online role playing games that allow a large number of players to take on the role of a character and interact with one another within a virtual world. CCGs are collectible card games in which players collect cards and compete to win by using card sets with different functions. TPSs are third person shooter games that are structured around shooting, where a player can see and control an avataron-screen in a third-person view.S-RPGs are a new innovative subset of role playing games that place emphasis on their storylines. MOBAs are multiplayer online battle arena games, which allow a player to join a team and work with his or her teammates to compete in a mapped field in order to achieve a common goal. SLGs are simulation games, which allow players to control, manage and use game characters and items and to design and implement their own strategies to win the games.

7

Table of Contents

Changyou’s games are operated under the item-based revenue model, meaning game players can play Changyou’s games for free, but may choose to pay for virtual items, which arenon-physical items that game players can purchase and use within a game, such as gems, pets, fashion items, magic medicine, riding animals, hierograms, skill books and fireworks. Through virtual items, players are able to enhance or personalize their game environments or game characters, accelerate their progress in Changyou’s games and share and trade with friends.

For players who choose to purchase virtual goods, Changyou delivers enhanced gameplay experiences and benefits, such as:

AcceleratedProgress. Many of Changyou’s games offer players the option to purchase items that can accelerate their progress in the game and increase their capabilities, so that they level up more quickly and compete more effectively against others in the game. While Changyou sells many items that accelerate progress in its games, Changyou monitors and carefully balances the disparity in capabilities between paying andnon-paying game players to avoid discouragingnon-paying game players and to keep the game challenging and interesting for paying game players.

EnhancedSocialInteraction. Changyou uses a variety of virtual items to promote interaction and to facilitate relationship-building among game players in its games.

PersonalizedandCustomizedAppearance. Many of Changyou’s games offer players the option to purchase decorative and functional items to customize the appearance of their characters, pets, vehicles, houses and otherin-game possessions to express their individuality.

Gifts. Many of Changyou’s games offer players the option to purchase gift items to send to their friends. Examples of gift items include decorative items and time-limited items for special holiday events and festivals, such as Valentine’s Day, Spring Festival (Chinese New Year) and Christmas.

Changyou’s online game business includes games that it self-operates and games that it licenses out to third-party operators.

Self-Operated Games

For self-operated games, Changyou determines the price of virtual items based on the demand or expected demand for such virtual items. Changyou may change the pricing of certain virtual items based on its consumption patterns. Changyou hosts the games on its own servers and is responsible for sales and marketing of the games as well as customer service. Changyou’s self-operated games include PC games and mobile games developed in house as well as PC games and mobile games that Changyou licenses from or jointly develops with third party developers.

Licensed Out Games

Changyou also authorizes third parties to operate its online games. Changyou currently licenses TLBB to third- party operators, including operators in Hong Kong, Malaysia, Vietnam, and Taiwan. Changyou licenses its mobile games TLBB 3D, Fengyun, Legend of Sword and Fairy 5 to third-party operators, including operators in Hong Kong, Korea, Macau, Malaysia, Vietnam, Singapore, Taiwan, and Thailand. Changyou also licenses some of its games, including Feng Yun, to third-party operators in China.

The licensed-out games include PC games and mobile games developed in house as well as mobile games licensed from and jointly developed with third-party developers. Under Changyou’s licensing arrangements with third-party operators, the operators pay Changyou upfront license fees and Changyou has revenue sharing rights over the terms of the licenses. The licenses are typically for a term of one to three years. Changyou provide updates and expansion packs for the licensed games, typically after it launches the updates and expansion packs in China.

Forlicensed-out games, the third-party operators are responsible for all operations and costs, including marketing and customer service, as well as the leasing and maintenance of servers.

8

Table of Contents

Platform Channel Business

Changyou’s platform channel business consists primarily of the operation of the 17173.com Website. The 17173.com Website, which is one of the leading game information portals in China, provides news, electronic forums, online videos and other information services on online games to game players. Changyou’s platform channel business also offers a number of software applications for PCs and mobile devices through RaidCall and the Dolphin Browser. RaidCall provides online music and entertainment services, primarily in Taiwan. The Dolphin Browser is a gateway to a host of user activities on mobile devices, with the majority of its users based in Europe, Russia and Japan. As Changyou management had determined that the Dolphin Browser was unable to provide expected synergies with Changyou’s platform channel business, in 2016, Changyou’s Board of Directors approved the disposal ofChangyou’s 51% equity interest in MoboTap, which is the mobile technology developer behind the Dolphin Browser. As of December 31, 2016, Changyou has been negotiating with a potential buyer on the terms of disposal. Accordingly, the assets and liabilities attributable to MoboTap are classified as assets and liabilities held for sale and measured at the lower of their carrying amounts or their fair value, less cost to sell, in our consolidated balance sheet as of December 31, 2016. All revenues generated by the 17173.com Website are classified as brand advertising revenues and IVAS revenues generated by the Dolphin Browser and by RaidCall are classified as other revenues in our consolidated statements of comprehensive income. A relatively small amount of online game revenues generated by the Dolphin Browser are included in our online game revenues.

Cinema Advertising Business

Changyou also operates a cinema advertising business, which consists primarily of the acquisition, from operators of movie theaters, and the sale, to advertisers, ofpre-film advertising slots, which are advertisements shown before the screening of a movie in a cinema theatre. Revenues generated by Changyou’s cinema advertising business are classified as other revenues in our consolidated statements of comprehensive income.

COMPETITION

The Internet and Internet-related markets in China are rapidly evolving. We believe the rapid increase in China’s online population will draw more attention to the PRC Internet market from both domestic and multinational competitors. Our existing competitors may in the future achieve greater market acceptance and gain additional market share. It is also possible that new competitors may emerge and acquire significant market share. In addition, our competitors may leverage their existing Internet platforms to cross-sell newly launched products and services. It is also possible that, as a result of deficiencies in legal protections afforded intellectual property in the Internet industry in China, or inadequate enforcement of existing PRC laws protecting such intellectual property, we may not be able to prevent existing or new competitors from accessing and using ourin-house developed Web content or technologies.

In recent years there have emerged three large conglomerates, Tencent, Alibaba Group Holding Limited (“Alibaba”) and Baidu, Inc. (“Baidu”), that have a wide reach in the Internet industry in China, and between them tend to dominate key aspects of the industry through their own operations or through strategic investments in other companies. Each of these companies is in a position to compete very effectively against us. For example, Alibaba alone competes with us in almost every key aspect of our business, competing with us in media through its investment in Sina Corporation (“Sina”); in online video through its subsidiary Youku Tudou Inc. (“Youku Tudou”); and in online search through its subsidiary UCWeb Inc. (“UCWeb”).

During July 2016, Qihoo 360 Technology Co., Ltd. (“Qihoo”), with which we compete in our search and search-related business, has completed a “going private” transaction resulting in the delisting of its shares from the New York Stock Exchange, which could enhance Qihoo’s competitive position relative to ours by giving Qihoo greater flexibility in its business operations and an opportunity to seek high valuations on alternative share exchanges, such as PRC exchanges, which could in turn provide Qihoo with increased capital resources, the ability to offer more valuable equity incentives for purposes of personnel recruiting, and valuable equity to use as consideration for strategic acquisitions.

Sohu’s Business

In the PRC Internet space, competition for brand advertising business is intense and is expected to increase significantly in the future. We compete with our peers and competitors in China primarily on the following basis:

| • | access to financial resources; |

| • | gateway to host of Internet users activities; |

| • | technological advancements; |

| • | attractiveness of products; |

9

Table of Contents

| • | brand recognition; |

| • | volume of traffic and users; |

| • | quality of Internet platforms and content; |

| • | quality and quantity of purchased video content, self-developed video content, and user-generated content; |

| • | strategic relationships; |

| • | quality of services; |

| • | effectiveness of sales and marketing efforts; |

| • | talent of staff; and |

| • | pricing. |

Over time, our competitors may gradually build certain competitive advantages over us in terms of:

| • | greater brand recognition among Internet users and clients; |

| • | better products and services; |

| • | larger user and advertiser bases; |

| • | more extensive and well developed marketing and sales networks; and |

| • | substantially greater financial and technical resources. |

There are a number of existing or new PRC Internet companies, including those controlled or sponsored by private entities and by PRC government entities. As an Internet portal, we compete with various portals, including Tencent, Sina, NetEase.com, Inc. (“NetEase”), TouTiao.com and Phoenix New Media Limited (“Phoenix”), and vertical sites, such as Autohome Inc.(“Autohome”), Bitauto Holdings Limited (“BitAuto”), Youku Tudou, Beijing Xin Lian Xin De Advertising Media Co., Ltd. (“iQIYI”), SouFun Holdings Limited (“SouFun”), Leju Holdings Limited (“Leju”), and YY Inc. (“YY”).

We also compete with traditional forms of media, such as newspapers, magazines, radio and television, for advertisers, advertising revenues and content. Some of these traditional media, such as CCTV, Xinhua News Agency and People’s Daily, have extended their businesses into the Internet market. As a result, we expect to face more intense competition with traditional media companies in both their traditional media and in the Internet-related markets.

Sogou’s Business

Our search and search-related business mainly consists ofpay-for-click services, as well as online marketing services on the Web directories operated by Sogou.Pay-for-click services face intense competition from other search engines, powered by Baidu, Qihoo, UCWeb and Google Inc. (“Google”). Online marketing services on Web directories operated by Sogou also face intense competition from other Chinese Web directories, such as the 360 PersonalStart-up Page of Qihoo and Hao123.com of Baidu.

Moreover, we compete with other technology-driven companies on developing and promotingclient-end software and mobile Internet products. For example, for the Sogou Input Method, we face competition from Baidu, IFLYTEK Co., Ltd. Microsoft and Google. For the Sogou Browser, we compete with Baidu, Alibaba, Qihoo, Cheetah, Microsoft and Google.

Our existing and potential competitors compete with us for users and advertisers on the basis of the quality and quantity of search results, the features, availability and ease of use of products and services, and the number of marketing and distribution channels. They also compete with us for talent with technological expertise, which is critical to the sustained development of our products and services. We also face competition from traditional forms of media.

10

Table of Contents

Changyou’s Business

Online Game Business

In the online game industry, Changyou competes principally with the following three groups of competitors in China:

| • | online game developers and/or operators in China that are publicly traded in the United States and in Hong Kong, including Tencent Holdings Limited, NetEase.com, Inc., Kingsoft Corporation Limited, IGG Inc. and NetDragon Websoft Inc; |

| • | other companies in China devoted to game development and/or operation that are publicly traded in China, such as Kalends Inc., Perfect World Co., Ltd. and Century Cruises (formerly known as Giant Interactive Group Inc.), or privately-held companies, usually backed by venture capital or private equity, including Shulong Technologies (formerly known as Shanda Games Limited); and |

| • | international competitors. |

Platform Channel Business

In the platform channel business, Changyou’s game information portal operated through the 17173.com Website currently competes in China with, among others, the following game information portals:

| • | Duowan.com, operated by YY Inc; and |

| • | game.sina.com.cn, operated by Sina Corporation. |

Cinema Advertising Business

| • | Focus Film, operated by Focus Media Group; and |

| • | China Movie Media Group, operated by Wanda Cinema Line, a Wanda Group company. |

The existing and potential competitors in the online games industry compete with Changyou for talent, game player spending, time spent on game playing, marketing activities, quality of games, and distribution network. The existing and potential competitors in the online advertising industry compete with Changyou for talent, advertiser spending, number of unique visitors, number of page views, visitors’ time spent on Websites, and quality of service. The existing and potential competitors in the cinema advertising industry compete with Changyou for cooperative relationships with operators of movie theaters that are popular among movie-goers, market share of qualitypre-film advertisement slots, advertiser spending, and experienced sales and marketing personnel.

OUR CORPORATE STRUCTURE

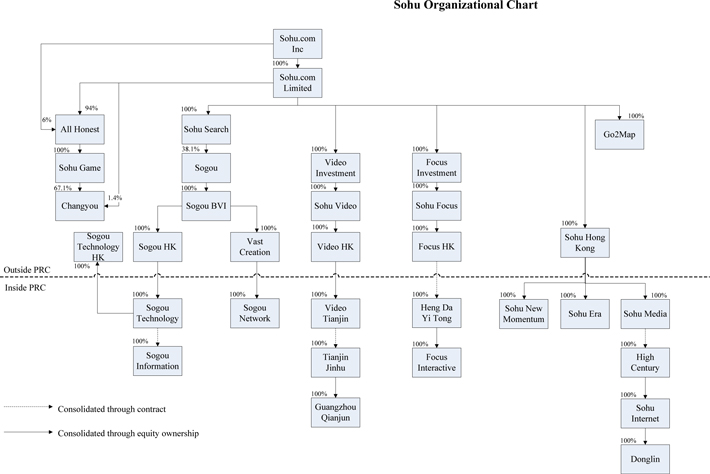

The charts below present the principal consolidated entities of Sohu.com Inc. not including our consolidated Changyou entities, and our principal consolidated Changyou entities.

11

Table of Contents

12

Table of Contents

Principal Subsidiaries

The following are our China-based principal direct or indirect operating subsidiaries, all of which were established as wholly foreign-owned enterprises (or “WFOEs”) under PRC law (collectively the “China-Based Subsidiaries,” or the “PRC Subsidiaries”):

For Sohu’s Business

| • | Sohu Era, established in 2003; |

| • | Sohu Media, established in 2006; |

| • | Sohu New Momentum, established in 2010; and |

| • | Video Tianjin, established in 2011. |

For Sogou’s Business

| • | Sogou Technology, established in 2006; and |

| • | Sogou Network, established in 2012. |

For Changyou’s Business

| • | AmazGame, established in 2007; |

| • | ICE Information, established in 2007 and acquired by Changyou in 2010; |

| • | Gamespace, established in 2009; |

13

Table of Contents

| • | Yang Fan Jing He, established in 2010; |

| • | Shanghai Jingmao, established in 2009 and acquired by Changyou in 2011; |

| • | Beijing Jingmao, established in 2010 and acquired by Changyou in 2011; |

| • | Brilliant Imagination, established in 2014; and |

| • | Beijing Baina Technology, acquired by Changyou in 2014. |

Principal Variable Interest Entities

The following are our principal VIEs, which we established or acquired in China to perform value-added telecommunications services because of PRC restrictions on direct foreign investment in and operation of value-added telecommunications businesses, which restrictions are discussed further below under the heading “Government Regulation and Legal Uncertainties-Specific Statutes and Regulations-Regulation of Foreign Direct Investment in Value-Added Telecommunications Companies.” We entered into contractual arrangements between our VIEs and our PRC Subsidiaries that govern a substantial portion of our operations, including those of the brand advertising business, the search and search-related business, the online game business and the others business. These entities are consolidated in Sohu’s consolidated financial statements, and noncontrolling interest is recognized when applicable.

For Sohu’s Business

| • | High Century, a PRC company that was incorporated in 2001. As of December 31, 2016, Dr. Charles Zhang, our Chairman of the Board and Chief Executive Officer, and Wei Li, one of our employees, held 80% and 20% interests, respectively, in this entity; |

| • | Heng Da Yi Tong, a PRC company that was incorporated in 2002. As of December 31, 2016, Dr. Charles Zhang and Wei Li held 80% and 20% interests, respectively, in this entity; |

| • | Sohu Internet, a PRC company that was incorporated in 2003. As of December 31, 2016, High Century held a 100% interest in this entity; |

| • | Donglin, a PRC company that was incorporated in 2010. As of December 31, 2016, Sohu Internet held a 100% interest in this entity; |

| • | Tianjin Jinhu, a PRC company that was incorporated in 2011. As of December 31, 2016, Xiufeng Deng and Xuemei Zhang, both of whom are our employees, each held a 50% interest in this entity: |

| • | Guangzhou Qianjun, a PRC company that we acquired in November 2014. As of December 31, 2016, Tianjin Jinhu held a 100% interest in this entity; and |

| • | Focus Interactive, a PRC company that was incorporated in July 2014. As of December 31, 2016, Heng Da Yi Tong held a 100% interest in this entity. |

For Sogou’s Business

| • | Sogou Information, a PRC company that was incorporated in 2005. As of December 31, 2016, Xiaochuan Wang, Sogou’s Chief Executive Officer, High Century and Tencent held 10%, 45% and 45% interests, respectively, in this entity. |

For Changyou’s Business

| • | Gamease, a PRC company that was incorporated in 2007. As of December 31, 2016, High Century held a 100% interest in this entity; |

| • | Guanyou Gamespace, a PRC company that was incorporated in 2010. As of December 31, 2016, Beijing Changyou Star Digital Technology Co., Ltd (“Changyou Star”) held a 100% interest in this entity; |

| • | Shanghai ICE, a PRC company that was acquired by Changyou in 2010. As of December 31, 2016, Gamease held a 100% interest in this entity; |

| • | Wuhan Baina Information, a PRC company that Gamease acquired in July 2014. As of December 31, 2016, Changyou Star and Yongzhi Yang, the former chief executive officer of MoboTap, held 60% and 40% interests, respectively, in this entity. |

14

Table of Contents

We have extended interest-free loans to the individual shareholders of the VIEs to fund their capital investment in the VIEs. The loans are secured by pledges of the shareholders’ equity interests in the VIEs, and can only be repaid by the shareholders by surrender of those equity interests to us. We have also entered into a series of agreements with the individual shareholders to transfer their equity interests in the VIEs to us when required to do so.

GOVERNMENT REGULATION AND LEGAL UNCERTAINTIES

The following description of PRC laws and regulations is based upon the opinion of Haiwen & Partners, or Haiwen, our PRC legal counsel. The laws and regulations affecting China’s Internet industry and other aspects of our business are at an early stage of development and are evolving. There are substantial uncertainties regarding the interpretation and enforcement of PRC laws and regulations. We cannot assure you that the PRC regulatory authorities would find that our corporate structure and business operations strictly comply with PRC laws and regulations. If we are found to be in violation of PRC laws and regulations by the PRC government, we may be required to pay fines, obtain additional or different licenses or permits, and/or change, suspend or discontinue our business operations until we are found to comply with applicable laws. For a description of legal risks relating to our ownership structure and business, see “Risk Factors.”

Overview

The Chinese government has enacted an extensive regulatory scheme governing Internet-related areas, such as telecommunications, Internet information services, international connections to computer information networks, online game services, information security and censorship.

Various aspects of the PRC Internet industry are regulated by various PRC governmental authorities, including:

| • | the Ministry of Industry and Information Technology (“MIIT”); |

| • | the Ministry of Culture (“MOC”); |

| • | the Ministry of Public Security (“MPS”); |

| • | the Ministry of Commerce (“MOFCOM”); |

| • | the State Administration of Industry and Commerce (“SAIC”); |

| • | the State Administration of Press, Publication, Radio, Film and Television (“SAPPRFT”), which resulted from the merger of the former General Administration of Press and Publication, or (“GAPP”), with the former State Administration of Radio, Film and Television (“SARFT”), in March 2013. The “SAPPRFT” as used in this report refers to the governmental authority that resulted from the merger, as well as to the GAPP and the SARFT separately for periods prior to the merger; |

| • | the PRC State Council Information Office (“SCIO”); |

| • | the Cyberspace Administration of China ( “CAOC”); and |

| • | the State Administration of Foreign Exchange (“SAFE”). |

Specific Statutes and Regulations

Requirements for Establishment of WFOEs

Under the Law of the People’s Republic of China on Foreign Investment Enterprises (the “Foreign Investment Enterprises Law”), promulgated on April 12, 1986 and amended on October 31, 2000, the establishment of a WFOE was required to be approved by MOFCOM or one of its local branches. On September 3, 2016, the Foreign Investment Enterprises Law was further amended by the Decision of the Standing Committee of the National People’s Congress on Amending Four Laws including the Law of the People’s Republic of China on Wholly Foreign-Owned Enterprises, issued by the Standing Committee of the National People’s Congress, and on October 8, 2016 MOFCOM issued the Interim Measures for the Administration of Filing for Establishment and Change of the Foreign Investment Enterprises (the “Interim Filing Measures”). The Foreign Investment Enterprises Law, as amended, and the Interim Filing Measures provide that, with certain exceptions, the establishment of foreign-invested enterprises is only subject to certain filing requirements with, and no longer requires prior approval by, MOFCOM or its local branches.

15

Table of Contents

Each of our WFOEs established before September 3, 2016 was established with proper approval, and we have not established any WFOEs since September 3, 2016.

Requirements for Obtaining Business Licenses

All China-based companies may commence operations only upon the issuance of a business license by the relevant local branch of the SAIC. All of our China-Based Subsidiaries and VIEs have been issued business licenses by the relevant local branches of the SAIC.

In the opinion of Haiwen, our principal China-Based Subsidiaries and principal VIEs have satisfied the requirements for business licenses.

Regulation of Value-added Telecommunications Services

TheTelecommunicationsRegulationsofthePeople’sRepublicofChina(“TelecomRegulations”), implemented on September 25, 2000 and amended on July 29, 2014, are the primary PRC law governing telecommunication services, and set out the general framework for the provision of telecommunication services by domestic PRC companies. The Telecom Regulations require that telecommunications service providers procure operating licenses prior to commencing operations. The Telecom Regulations draw a distinction between “basic telecommunications services,” which we generally do not provide, and “value-added telecommunications services.” The Telecom Regulations define value-added telecommunications services as telecommunications and information services provided through public networks. TheCatalogueofTelecommunicationsBusiness(“Catalogue”), which was issued as an attachment to the Telecom Regulations and updated in February 2003, identifies online data and transaction processing,on-demand voice and image communications, domestic Internet virtual private networks, Internet data centers, message storage and forwarding (including voice mailbox,e-mail and online fax services), call centers, Internet access, and online information and data search as value-added telecommunications services. We engage in various types of business activities that are value-added telecommunications services as defined and described by the Telecom Regulations and the Catalogue.

On March 1, 2009, the MIIT issued theMeasuresontheAdministrationofTelecommunicationsBusinessOperatingPermits(the“TelecomLicenseMeasures”) , which became effective on April 10, 2009, to supplement the Telecom Regulations and replace the previousAdministrativeMeasuresforTelecommunicationsBusinessOperatingLicenses. The Telecom License Measures confirm that there are two types of telecom operating licenses for operators in China, one for basic telecommunications services and one for value-added telecommunications services. A distinction is also made as to whether a license is granted for “intra-provincial” or “trans-regional” (inter-provincial) activities. An appendix to each license granted will detail the permitted activities of the enterprise to which it was granted. An approved telecommunication services operator must conduct its business (whether basic or value-added) in accordance with the specifications recorded in its Telecommunications Services Operating License.

The business activities of Sohu Internet include providing content to mobile phone users through the platforms of China’s main three telecommunications operators. An insignificant portion of our mobile revenues are currently derived through products such as SMS, RBT and IVR. On April 25, 2004, the MIIT issued a notice stating that China mobile network operators may only provide mobile network access to those mobile Internet service providers which have obtained licenses from the relevant local arm of the MIIT before conducting operations. On the basis of the notice, China Mobile Communication Corporation (“China Mobile”) has required each of its mobile Internet service providers to first obtain a license for trans-regional value-added telecommunications services in order to gain full access to its mobile network, which is a nationwide policy in line with a similar notice issued by the Beijing branch of China Mobile on April 12, 2004.

On August 8, 2014, January 30, 2015, and June 2, 2016, respectively, the MIIT issued to Sohu Internet, Guangzhou Qianjun, and Sogou Information renewed Value-Added Telecommunications Services Operating Licenses, which authorize the provision of trans-regional mobile services classified as value-added telecommunication services. The licenses are subject to annual inspection.

16

Table of Contents

Regulation of Foreign Direct Investment in Value-Added Telecommunications Companies

Various PRC regulations currently restrict foreign-invested entities from engaging in value-added telecommunication services, including providing Internet information services and operating online games. Foreign direct investment in telecommunications companies in China is regulated by theRegulationsfortheAdministrationofForeign-InvestedTelecommunicationsEnterprises(“FITERegulations”), which were issued by the PRC State Council, or State Council, on December 11, 2001, became effective on January 1, 2002 and were amended on September 10, 2008 and February 6, 2016. The FITE Regulations stipulate that foreign invested telecommunications enterprises in the PRC (“FITEs”) must be established as Sino-foreign equity joint ventures. Under the FITE Regulations and in accordance withWTO-related agreements, the foreign party to a FITE engaging in value-added telecommunications services may hold up to 50% of the equity of the FITE, with no geographic restrictions on the FITE’s operations. On June 30, 2016, the MIIT issued anAnnouncementoftheMinistryofIndustryandInformationTechnologyonIssuesconcerningtheProvisionofTelecommunicationServicesintheMainlandbyServiceProvidersfromHongKongandMacao (the “MIIT Announcement”), which provides that investors from Hong Kong and Macau may hold more than 50% of the equity in FITEs engaging in certain specified categories of value-added telecommunications services.

For a FITE to acquire any equity interest in a value-added telecommunications business in China, it must satisfy a number of stringent performance and operational experience requirements, including demonstrating a track record and experience in operating a value-added telecommunications business overseas. FITEs that meet these requirements must obtain approvals from the MIIT and the MOFCOM or their authorized local counterparts, which retain considerable discretion in granting approvals.

On July 13, 2006, the MIIT issued theNoticeoftheMinistryofInformationIndustryonIntensifyingtheAdministrationofForeignInvestmentinValue-addedTelecommunicationsServices(the“MIITNotice”),which reiterates certain provisions of the FITE Regulations. Under the MIIT Notice, if a FITE intends to invest in a PRC value-added telecommunications business, the FITE must be established and must apply for a telecommunications business license applicable to the business. Under the MIIT Notice, a domestic company that holds a license for the provision of Internet content services, or an ICP license, is considered to be a type of value-added telecommunications business in China, and is prohibited from leasing, transferring or selling the license to foreign investors in any form, and from providing any assistance, including providing resources, sites or facilities, to foreign investors to conduct value-added telecommunications businesses illegally in China. Trademarks and domain names that are used in the provision of Internet content services must be owned by the ICP license holder. The MIIT Notice requires each ICP license holder to have appropriate facilities for its approved business operations and to maintain such facilities in the regions covered by its license. In addition, all value-added telecommunications service providers are required to maintain network and information security in accordance with standards set forth in relevant PRC regulations. Our VIEs, rather than our subsidiaries, hold ICP licenses, own our domain names, and hold or have applied for registration in the PRC of trademarks related to our business and own and maintain facilities that we believe are appropriate for our business operations.

In view of these restrictions on foreign direct investment in the value-added telecommunications sector, we established or acquired several domestic VIEs to engage in value-added telecommunications services. For a detailed discussion of our VIEs, please refer to “Our Corporate Structure” above. Due to a lack of interpretative materials from the relevant PRC authorities, there are uncertainties regarding whether PRC authorities would consider our corporate structure and contractual arrangements to constitute foreign ownership of a value-added telecommunications business. See “Risks Related to Our Corporate Structure.” In order to comply with PRC regulatory requirements, we operate our main business through companies with which we have contractual relationships but in which we do not have an actual ownership interest. If our current ownership structure is found to be in violation of current or future PRC laws, rules or regulations regarding the legality of foreign investment in the PRC Internet sector, we could be subject to severe penalties.

In the opinion of Haiwen, subject to the uncertainties and risks disclosed elsewhere in this report under the heading “Risk Factors” and “Government Regulation and Legal Uncertainties”, the ownership structures of our principal PRC Subsidiaries and our principal VIEs comply with all existing laws, rules and regulations of the PRC and each of such companies has the full legal right, power and authority, and has been duly approved, to carry on and engage in the business described in its business license.

Regulation of the Provision of Internet Content

Internet Information Services

On September 25, 2000, the State Council issued theMeasuresfortheAdministrationofInternetInformationServices(“ICPMeasures”). Under the ICP Measures, entities that provide information to online users on the Internet, or ICPs, are obliged to obtain an operating license from the MIIT or its local branch at the provincial or municipal level in accordance with the Telecom Regulations described above.

17

Table of Contents

The ICP Measures further stipulate that entities providing online information services regarding news, publishing, education, medicine, health, pharmaceuticals and medical equipment must procure the consent of the national authorities responsible for such areas prior to applying for an operating license from the MIIT or its local branch at the provincial or municipal level. Moreover, ICPs must display their operating license numbers in conspicuous locations on their home pages. ICPs are required to police their Internet platforms and remove certain prohibited content. Many of these requirements mirror Internet content restrictions that have been announced previously by PRC ministries, such as the MIIT, the MOC, and the SAPPRFT, that derive their authority from the State Council.

Sogou Information, Sohu Internet, Focus Interactive, Guangzhou Qianjun, Shanghai ICE, Guanyou Gamespace, Gamease and Wuhan Baina Information hold Telecommunications and Information Services Operating Licenses (each an “ICP license”), each of which is subject to annual inspection.

In 2000, the MIIT promulgated theInternetElectronicBulletinServiceAdministrativeMeasures (“BBS Measures”). The BBS Measures required ICPs to obtain specific approvals before they provided BBS services, which included electronic bulletin boards, electronic forums, message boards and chat rooms. On September 23, 2014, the MIIT abolished the BBS Measures in aDecisiononAbolishmentandAmendmentCertainRegulationsandRules. However, in practice certain local authorities still require operating companies to obtain approvals or make filings for the operation of BBS services. The ICP licenses held by Sohu Internet, Sogou Information, Focus Interactive, Gamease and Guanyou Gamespace include such specific approval of the BBS services that they provide.

On December 29, 2011, the MIIT issuedSeveralProvisionsforStandardizingtheMarketOrderofInternetInformationServices (the “Several Provisions”) which took effect on March 15, 2012. With the aim of promoting the healthy development of the Internet information services market in China, the Several Provisions strengthen the regulation of the operations of Internet information service providers, including prohibiting Internet information service providers from infringing the rights and interests of other Internet information service providers, regulating evaluations provided by Internet information service providers regarding the services and products of other Internet information service providers, and regulating the installation and running of software by Internet information service providers. The Several Provisions also provide various rules to protect the interests of Internet information users, such as requesting Internet information service providers to take measures to protect the privacy information of their users and prohibiting Internet information service providers from cheating and misleading their users.

Online News Dissemination

On September 25, 2005, theAdministrativeRegulationsforInternetNewsInformationServices (“News Regulations”) were jointly promulgated by the SCIO and the MIIT to replace the previousProvisionalRulesfortheAdministrationoftheOperationofNewsPublicationServicesbyWebSites (“Old News Rules”) issued on November 7, 2000. The News Regulations stipulate that general Websites established bynon-news organizations, such as Sohu, may publish news released by certain official news agencies if such Websites satisfy the requirements set forth in Article 8 of the News Regulations but may not publish news items produced by themselves or other news sources. The News Regulations also require the general Websites ofnon-news organizations to apply to the SCIO at the national level for approval after securing the consent of the SCIO at the provincial level before they commence providing news dissemination services.

Requirements specified in the News Regulations include the following:

| • | non-news organizations’ Websites must comply with the constitution, laws and regulations of the PRC, uphold and not mislead the society’s public opinion, and safeguard national and public interests; |

| • | non-news organizations must have sound administrative rules and regulations concerning Internet news services; |

| • | non-news organizations must have the necessary premises, equipment and legally-raised funds; |

| • | non-news organizations must have ten or more professional news editors, at least five of whom have worked at a news agency for a minimum of three years; |

| • | non-news organizations must be legal persons who have been legally established for at least two years, engaged in the operation of Internet news services and have not had administrative penalties imposed due to violation of laws and regulations on the administration of Internet news services within the last two years; |

18

Table of Contents

| • | if the applicant for the SCIO approval is an entity, its registered capital must not be less than RMB10,000,000 (or approximately $1.5 million); and |

| • | non-news organizations must only republish or disseminate to the public news regarding current events and political affairs that has been published by State news agencies or news agencies directly subordinate to the respective governments of the provinces, autonomous regions or directly-administered municipalities, without distorting the news as reported by those agencies, and indicate the source of such news information; and shall not publish news gathered and edited by themselves. |

In addition, general Websites intending to publish news released by approved agencies must enter into agreements with those agencies and submit copies of those agreements to the relevant administration department.

On July 3, 2016, the CAOC issued a Notice on Further Strengthening the Management and Prevention of Fake News (the “Fake News Notice”). The Fake News Notice requires all providers of online news services, including news applications, Weibo and WeChat, to establish and maintain rigorous internal supervision and management systems and to not provide any news without identifying the sources of the news, invent news, report news based on hearsay or distort facts.

On May 11, 2004, Sohu Internet obtained a permit to engage in online news dissemination services, which was issued by the Information Office of the Beijing Municipal Government (the local arm of the SCIO) under the Old News Rules. On June 6, 2006, the permit was updated by the SCIO in accordance with the News Regulations.

Internet Publishing

On February 4, 2016, the SAPPRFT and MIIT jointly issued the Rules for the Administration for Internet Publishing Services (the “Internet Publishing Rules”) to replace the Provisional Rules for the Administration for Internet Publishing that had been jointly issued by the SAPPRFT and the MIIT on June 27, 2002. The Internet Publishing Rules define “Internet publications” as digital works that are edited, produced or processed to be published and provided to the public through the Internet, including (a) original digital works, such as pictures, maps, games, and comics; (b) digital works with content that is consistent with the type of content that, prior to the Internet age, typically was published in media such as books, newspapers, periodicals, audio-visual products, and electronic publications; (c) digital works in the form of online databases compiled by selecting, arranging and compiling other types of digital works; and (d) other types of digital works identified by the SAPPRFT. Under the Internet Publishing Rules, Web portals such as ours are required to apply to and register with the SAPPRFT before distributing Internet publications.

On December 22, 2010, Sohu Internet obtained an Internet publishing license issued by the SAPPRFT, and has recently applied to the SAPPRFT to have the license renewed. For the details of the Internet publishing licenses held by Changyou’s VIEs, see “Specific Statutes and Regulations - Regulation of Online Game Services –Online Games and Cultural Products.”

Online Audiovisual Transmission Through the Public Internet

On December 20, 2007, the SAPPRFT and the MIIT jointly issuedRulesfortheAdministrationofInternetAudiovisualProgramServices (“Document 56”), which came into effect as of January 31, 2008. Document 56 requires all online audio and video service providers to be either state-owned or state-controlled and to obtain a permit for the Network Transmission of Audiovisual Programs. However, at a press conference held on February 3, 2008 the SAPPRFT and the MIIT clarified that online audio-visual service providers that were already lawfully operating prior to the issuance of Document 56 mayre-register and continue to operate without becoming state-owned or controlled, provided that such providers do not engage in any unlawful activities. This exemption will not be granted to service providers set up after Document 56 was issued. As we were already engaged in online audiovisual transmission prior to the issuance of Document 56, we are presumably exempted from the requirement of being state-owned or state-controlled. Sohu Internet and Guangzhou Qianju currently hold permits, both for PC and for Mobile Apps, for the Network Transmission of Audiovisual Programs.

19

Table of Contents