SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the registrantþ

Filed by a party other than the registranto

Check the appropriate box:

o Preliminary proxy statement.

o Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2).

þ Definitive proxy statement.

o Definitive additional materials.

o Soliciting material pursuant to Rule 14a-12.

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant) |

Payment of filing fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined.)

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

March 11, 2005

To Our Shareholders:

On behalf of the Board of Directors, I cordially invite all shareholders to attend the Annual Meeting of Frontier Oil Corporation to be held on Thursday, April 14, 2005 at 9:00 a.m. in the offices of Andrews Kurth LLP located at 600 Travis, Suite 4200, Houston, Texas. Proxy materials, which include a Notice of the Meeting, Proxy Statement and proxy card, are enclosed with this letter. The Company’s 2004 Annual Report to shareholders, which is not a part of the proxy materials, is also enclosed and provides additional information regarding the financial results of the Company in 2004.

Even if you plan to attend the meeting, you are requested to sign, date and return the proxy card in the enclosed envelope. If you attend the meeting after having returned the enclosed proxy card, you may revoke your proxy, if you wish, and vote in person. If you would like to attend and your shares are not registered in your own name, please ask the broker, trust, bank or other nominee that holds the shares to provide you with evidence of your share ownership.

Thank you for your support.

| | Sincerely, |

| | |

| | James R. Gibbs |

| | Chairman of the Board, |

| | President and Chief Executive Officer |

10000 Memorial Drive, Suite 600 Houston, Texas 77024-3411 (713) 688-9600 fax (713) 688-0616

10000 Memorial Drive, Suite 600

Houston, Texas 77024-3411

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 14, 2005

To Our Shareholders:

The 2005 Annual Meeting of Shareholders of Frontier Oil Corporation (the “Company”) will be held in the offices of Andrews Kurth LLP located at 600 Travis, Suite 4200, Houston, Texas at 9:00 a.m. on Thursday, April 14, 2005, for the following purposes:

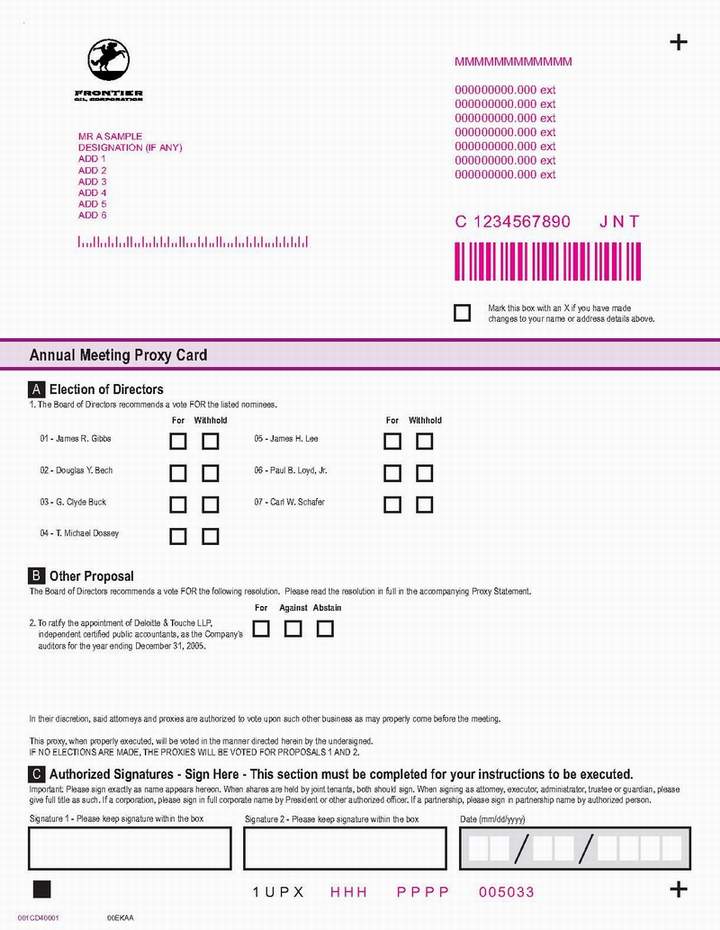

| 1. | To elect seven directors (constituting the entire Board of Directors) to serve until the next Annual Meeting of Shareholders or until their respective successors have been elected or appointed. |

| 2. | To ratify the appointment of Deloitte & Touche LLP, independent certified public accountants, as the Company’s auditors for the year ending December 31, 2005. |

| 3. | To act upon any and all matters incident to the foregoing and to transact such other business as may properly be brought before the meeting or any postponement or adjournment thereof. |

The Board of Directors recommends that you vote FOR each of the first two proposals set forth above. The accompanying Proxy Statement contains information relating to each of such proposals. The holders of record of the Company’s common stock at the close of business on March 1, 2005 are entitled to notice of and to vote at the meeting with respect to all proposals. We urge you to sign and date the enclosed proxy and return it promptly by mail in the enclosed envelope, whether or not you plan to attend the meeting in person. No postage is required if mailed in the United States. If you do attend the meeting in person, you may withdraw your proxy and vote personally on all matters brought before the meeting.

| | By Order of the Board of Directors, |

| | |

| | J. Currie Bechtol |

| | Vice President-General Counsel & Secretary |

Houston, Texas

March 11, 2005

FRONTIER OIL CORPORATION

10000 Memorial Drive, Suite 600

Houston, Texas 77024-3411

PROXY STATEMENT

SOLICITATION AND REVOCABILITY OF PROXIES

This Proxy Statement is furnished by the Board of Directors of Frontier Oil Corporation (the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Shareholders to be held April 14, 2005, and at any postponement or adjournment thereof. The shares represented by the form of proxy enclosed herewith will be voted in accordance with the specifications noted thereon. If no choice is specified, said shares will be voted in favor of the proposals set forth in the notice attached hereto. The form of proxy also confers discretionary authority with respect to amendments or variations to matters identified in the notice of meeting and any other matters, which may properly come before the meeting. This Proxy Statement and the enclosed proxy form are first being sent to shareholders on or about March 11, 2005.

A shareholder who has given a proxy may revoke it as to any motion on which a vote has not already been taken by signing a proxy bearing a later date or by a written notice delivered to the Secretary of the Company in care of Computershare Investor Services LLC, 2 North La Salle, Chicago, Illinois 60602 (“Computershare”) or at the executive offices of the Company, 10000 Memorial Drive, Suite 600, Houston, Texas 77024-3411, at any time up to the meeting or any postponement or adjournment thereof, or by delivering it to the Chairman of the meeting on such date.

The cost of solicitation of these proxies will be paid by the Company, including reimbursement paid to brokerage firms and other custodians, nominees and fiduciaries for reasonable costs incurred in forwarding the proxy material to and soliciting of proxies from the shareholders of record. In addition to such solicitation and the solicitation made hereby, certain directors, officers and employees of the Company may solicit proxies by fax, telephone and personal interview.

VOTING SECURITIES

All shareholders of record as of the close of business on March 1, 2005 are entitled to notice of and to vote at the meeting. On March 1, 2005, the Company had 27,196,579 shares of common stock, without par value (“Common Stock”), outstanding excluding Common Stock held by the Company. The Common Stock is the only class of voting securities of the Company. Shareholders are entitled to one vote, exercisable in person or by proxy, for each share of Common Stock held on the record date. The presence in person or by proxy of the holders of a majority of the issued and outstanding Common Stock, excluding Common Stock held by the Company, is necessary to constitute a quorum at this meeting. In the absence of a quorum at the meeting, the meeting may be postponed or adjourned from time to time without notice, other than announcement at the meeting, until a quorum shall be formed.

In conformity with Wyoming law and the bylaws of the Company, directors shall be elected by a plurality of the votes cast by shareholders entitled to vote in the election at a meeting at which a quorum is present. Cumulative voting for the election of directors is not permitted. Abstentions are counted as “shares present” at the meeting for purposes of determining the presence of a quorum while broker non-votes (which result when a broker holding shares for a beneficial owner has not received timely voting instructions on certain matters from such beneficial owner) are not considered “shares present” with respect to any matter. Accordingly, abstentions will have no effect on the outcome of the election of directors but with respect to any other proposal will operate to prevent the approval of such proposal to the same extent as a vote against such proposal.

ANNUAL REPORT

The annual report to shareholders, including consolidated financial statements, accompanies this Proxy Statement. Such annual report does not form any part of the proxy solicitation materials.

PRINCIPAL SHAREHOLDERS

The following table sets forth, as of March 1, 2005, the beneficial ownership of the Company’s Common Stock, with respect to each person known by the Company to be the beneficial owner of more than five percent of the Company’s outstanding voting securities, excluding Common Stock held by the Company:

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percentage of Shares of Common Stock(1) |

| | | | | |

Ingalls & Snyder LLC 61 Broadway New York, NY 10006 | | 2,305,349(2) | | 8.5 |

OppenheimerFunds, Inc. Two World Financial Center 225 Liberty Street, 11th Floor New York, NY 10281-1008 | | 2,096,500(3) | | 7.7 |

Barclays Global Investors, NA 45 Fremont Street San Francisco, CA 94105 | | 1,664,867(4) | | 6.1 |

Robert L. Gipson C/o Ingalls & Snyder LLC 61 Broadway New York, NY 10006 | | 1,426,600(5) | | 5.2 |

| (1) | Represents percentage of 27,196,579 outstanding shares of the Company as of March 1, 2005. |

| (2) | Ingalls & Snyder LLC (“Ingalls & Snyder”) has filed with the Securities and Exchange Commission (the “Commission”) a Schedule 13G/A, dated February 8, 2005, in which it reports having shared dispositive power with respect to all of the reported shares of Common Stock. |

| (3) | OppenheimerFunds, Inc. (“Oppenheimer”) has filed with the Commission a Schedule 13G/A, dated February 15, 2005, in which it reports having shared dispositive power with respect to all of the reported shares of Common Stock. |

| (4) | Barclays Global Investors, NA, Barclays Global Fund Advisors and Barclays Bank PLC (“Barclays”) have filed jointly as a group with the Commission a Schedule 13G/A dated February 14, 2005. Based on the filing, Barclays has sole voting power with respect to 1,512,775 and sole dispositive power with respect to 1,664,867 of the reported shares of Common Stock. |

| (5) | Robert L. Gipson (“Gipson”) has filed with the Commission a Schedule 13G, dated February 8, 2005. Based on the filing, Gipson has sole voting and sole dispositive power with respect to 251,000 and shared dispositive power with respect to 1,175,600 shares of Common Stock which include securities owned by clients of Ingalls & Snyder. |

COMMON STOCK OWNED BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth, as of March 1, 2005, the amount of Common Stock beneficially owned by: (i) each director of the Company, (ii) the Chief Executive Officer and the four most highly compensated officers other than the Chief Executive Officer and (iii) all directors and executive officers as a group.

Name | | Amount and Nature of Beneficial Ownership | | Percentage of Shares of Common Stock(1) |

| | | | | | |

James R. Gibbs(2) | | 1,012,280 | (3) | | 3.6 |

Douglas Y. Bech(2) | | 50,444 | (4) | | * |

G. Clyde Buck(2) | | 42,750 | (4) | | * |

T. Michael Dossey (2) | | 32,750 | (5) | | * |

James H. Lee(2) | | 40,250 | (6) | | * |

Paul B. Loyd, Jr.(2) | | 42,750 | (7) | | * |

Carl W. Schafer(2) | | 23,750 | (8) | | * |

| Julie H. Edwards | | 447,740 | (9) | | 1.6 |

| W. Reed Williams | | 237,456 | (10) | | * |

| Jon D. Galvin | | 133,496 | (11) | | * |

| Nancy J. Zupan | | 78,084 | (12) | | * |

| Directors and executive officers as a group (13 persons) | | 2,261,958 | | | 7.9 |

* Less than 1%

| (1) | Represents percentage of outstanding shares plus shares issuable upon exercise of all stock options owned by the individual listed that are currently exercisable or that will become exercisable within 60 days of the date for which beneficial ownership is provided in the table, assuming stock options owned by all other shareholders are not exercised. As of March 1, 2005, 27,196,579 shares of Common Stock were outstanding. |

| (3) | Includes 595,000 shares which Mr. Gibbs has the right to acquire under the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table and 9,381 shares of unvested shares of Restricted Stock as to which Mr. Gibbs has voting and dispositive power pursuant to the Restricted Stock Plan described on page 21. Mr. Gibbs owns and has sole voting and sole dispositive power with respect to 417,280 shares. |

| (4) | Includes 28,750 shares which Messrs. Bech and Buck have the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table. |

| (5) | Includes 31,250 shares which Mr. Dossey has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table. |

| (6) | Includes 38,750 shares which Mr. Lee has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table. |

| (7) | Includes 21,250 shares which Mr. Loyd has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table. |

| (8) | Includes 2,500 shares which Mr. Schafer has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table. |

| (9) | Includes 233,750 shares which Ms. Edwards has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table and 5,325 shares of unvested shares of Restricted Stock as to which Ms. Edwards has voting and dispositive power pursuant to the Restricted Stock Plan described on page 21. Ms. Edwards owns and has sole voting power and sole dispositive power with respect to 213,990 shares. |

| (10) | Includes 188,750 shares which Mr. Williams has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table and 3,624 shares of unvested shares of Restricted Stock as to which Mr. Williams has voting and dispositive power pursuant to the Restricted Stock Plan described on page 21. Mr. Williams owns and has sole voting power and sole dispositive power with respect to 48,706 shares. |

| (11) | Includes 54,000 shares which Mr. Galvin has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table and 6,221 shares of unvested shares of Restricted Stock as to which Mr. Galvin has voting and dispositive power pursuant to the Restricted Stock Plan described on page 21. Mr. Galvin owns and has sole voting power and sole dispositive power with respect to 79,496 shares. |

| (12) | Includes 54,400 shares which Ms. Zupan has the right to acquire under one of the Company’s stock option plans within 60 days of the date for which beneficial ownership is provided in the table and 2,117 shares of unvested shares of Restricted Stock as to which Ms. Zupan has voting and dispositive power pursuant to the Restricted Stock Plan described on page 21. Ms. Zupan owns and has sole voting power and sole dispositive power with respect to 23,684 shares. |

PROPOSAL 1:

ELECTION OF DIRECTORS

The Board of Directors recommends that you vote FOR each of the nominees named below. A Board of Directors is to be elected, with each director to hold office until the next Annual Meeting of Shareholders or until his successor shall be elected or appointed. The persons whose names are set forth as proxies in the enclosed form of proxy will vote all shares over which they have control “FOR” the election of the Board of Directors’ nominees, unless otherwise directed. Although the Board of Directors of the Company does not contemplate that any of the nominees will be unable to serve, if such a situation should arise prior to the meeting, the appointed proxies will use their discretionary authority pursuant to the proxy and vote in accordance with their best judgment.

Nominees

All of the persons listed below are members of the present Board of Directors and have consented in writing to be named in this Proxy Statement and to serve as a director, if elected.

Mr. James R. Gibbs (60) joined the Company in February 1982 and has been President and Chief Operating Officer since January 1987. He assumed the additional position of Chief Executive Officer on April 1, 1992 and additionally became Chairman of the Board on April 29, 1999. Mr. Gibbs is a member of the Board of Directors of Smith International, Inc., an oil field service company; an advisory director of Frost National Bank, Houston; a director of Veritas DGC Inc., a seismic service company and serves on the Board of Trustees of Southern Methodist University. Mr. Gibbs was elected a director of the Company in 1985.

Mr. Douglas Y. Bech (59) has been Chairman and Chief Executive Officer of Raintree Resorts International, Inc. (“Raintree”) since August 1997. In November 2003, Teton Club LLC, a private resident club in Jackson, Wyoming owned by Raintree and a non-affiliated third party, Jackson Hole Ski Corp., filed for protection under Chapter 11 and the Teton Club LLC was successfully reorganized in August 2004. From 1994 to 1997, Mr. Bech was a partner in the law firm of Akin, Gump, Strauss, Hauer & Feld, L.L.P. of Houston, Texas. Since 1994, he has also been a managing director of Raintree Capital Company, LLC, a merchant banking firm. From 1993 to 1994, Mr. Bech was a partner of Gardere & Wynne, L.L.P. of Houston, Texas. From 1970 until 1993, Mr. Bech was associated with and a senior partner of Andrews & Kurth L.L.P. of Houston, Texas. Mr. Bech is a member of the Board of Directors of j2 Global Communications, Inc., an internet document communications company. He was appointed a director of the Company in 1993.

Mr. G. Clyde Buck (67) has been a Senior Vice President and Managing Director of the investment banking firm Sanders Morris Harris, Inc. (including predecessor firms) since 1998. From 1983 to 1998, he was a Managing Director of Dain Rauscher Corporation, also an investment banking firm. Mr. Buck is also a member of the Board of Directors of Smith International, Inc., an oilfield service company. He was appointed a director of the Company in 1999.

Mr. T. Michael Dossey (62) has been a management consultant located in Houston, Texas since April 2000. From April 2000 through September 2002, Mr. Dossey was a management consultant affiliated with the Adizes Institute of Santa Barbara, California. Prior to April 2000, Mr. Dossey spent 35 years with the Shell Oil Company and its affiliates. Prior to his retirement from Shell, his last assignment with Shell was General Manager-Mergers and Acquisitions for Equilon Enterprises LLC, an alliance between the domestic downstream operations of Shell and Texaco. He also had been Vice President and Business Manager for Shell Deer Park Refining Company, which was a joint venture operation with Pemex. Previously, he spent several years in Saudi Arabia where he was General Operations Manager for Saudi Petrochemical Company, a joint venture between Shell and the Saudi Arabian government. Earlier in his career, Mr. Dossey’s positions included various business and operational positions in Shell’s refining and petrochemical operations domestically and in Europe. He was appointed a director of the Company in 2000.

Mr. James H. Lee (56) is Managing General Partner and principal owner of Lee, Hite & Wisda Ltd., an oil and gas consulting firm, which he founded in 1984. From 1981 to 1984, Mr. Lee was a Principal with the oil and gas advisory firm of Schroder Energy Associates. He had prior experience in investment management, corporate finance and mergers and acquisitions at Cooper Industries Inc. and at White, Weld & Co. Incorporated. Mr. Lee is a member of the Board of Directors of Forest Oil Corporation, an oil and gas exploration and production company. He was appointed a director of the Company in 2000.

Mr. Paul B. Loyd, Jr. (58) has been Executive-In-Residence for J.P. Morgan Capital Partners and has been Chairman of Penloyd Holdings LLC, a private investment company, since 2002. He served as Chairman of the Board and Chief Executive Officer of R&B Falcon Corporation, the world’s largest offshore drilling company, from December 1997 until its merger in January 2001 with Transocean Sedco Forex. From April 1991 until December 1997, Mr. Loyd was Chairman of the Board and Chief Executive Officer of Reading & Bates Corporation, and prior to that time he had served as Assistant to the president of Atwood Oceanics International, President of Griffin-Alexander Company, and Chief Executive Officer of Chiles-Alexander International, Inc., all of which are companies in the offshore drilling industry. He has served as consultant to the Government of Saudi Arabia, and was a founder and principal of Loyd & Associates, Inc., an investment company focusing on the energy industry. Mr. Loyd is a member of the Board of Directors of Carrizo Oil & Gas, Inc., a public company and Vetco, International, a private company and serves on the Board of Trustees of Southern Methodist University and the Executive Board of the Cox School of Business. He was appointed a director of the Company in 1994.

Mr. Carl W. Schafer (69) has been the President of the Atlantic Foundation, a charitable foundation, since 1990. From 1987 until 1990, Mr. Schafer was a principal of the investment management firm of Rockefeller & Co., Inc. Mr. Schafer currently serves on the Board of Directors of Labor Ready, Inc., a temporary labor company and four fund complexes of registered investment companies, which include a number of investment company directorships. These fund complexes are UBS Global Asset Management (16 directorships), Guardian Life Insurance Company (25 directorships), Harding, Loevner Funds, Inc. (3 directorships) and European Investors (2 directorships). Mr. Schafer was elected a director of the Company in 1984.

The Board has determined that each of the nominees standing for election at the 2005 Annual Shareholders Meeting, other than James R. Gibbs, our Chairman of the Board, President and Chief Executive Officer, is independent within the meaning of New York Stock Exchange director independence standards and otherwise has no material relationship with the Company either directly or as a partner, shareholder or affiliate of an organization that has a relationship with the Company. The Board based this determination on a review of all the relevant facts and circumstances, including the responses of the directors to questions regarding their employment history, compensation, affiliations and family and other relationships.

The Board of Directors and Its Committees

The Board of Directors met seven times (including three telephonic meetings) in 2004, and each incumbent director of the Company attended 75 percent or more of the aggregate number of meetings of the Board of Directors and meetings held by committees of the Board on which he served. The Company does not maintain a formal policy regarding the Board’s attendance at annual shareholder meetings. At the 2004 annual meeting of shareholders, Mr. Gibbs was the only member of the Board present.

The non-management directors of the Board met four times in 2004 without management present. The presiding director of such meetings is chosen by a majority vote of those directors who are present at each such meeting. An interested party may communicate with the non-management directors or the presiding directors directly by mailing such director(s) c/o Investor Relations Department, Frontier Oil Corporation, 10000 Memorial Drive, Suite 600, Houston, Texas 77024-3411.

The Board of Directors has standing audit, compensation, safety & environmental and nominating & corporate governance committees that are composed of directors of the Company.

Audit Committee: The Audit Committee is comprised of three outside directors, currently Messrs. Schafer, Buck and Lee. Each of the members of the Audit Committee is independent as defined by New York Stock Exchange listing requirements and as required by Rule 10A-3 under the Securities Exchange Act of 1934, and the Board of Directors of the Company has determined that Mr. Schafer is an “audit committee financial expert” within the meaning of Item 401 of Regulation S-K under the federal securities laws. The Audit Committee’s responsibilities include (i) engaging independent public accountants, (ii) reviewing with the independent public accountants the plan and results of the audit engagement, (iii) approving professional services provided by the independent public accountants, (iv) reviewing the independence of the independent public accountants, (v) considering the range of audit and non-audit fees and (vi) reviewing the adequacy of the Company’s internal accounting controls. The Audit Committee met eleven times during 2004.

Compensation Committee: The Compensation Committee is comprised of three outside directors, currently Messrs. Bech, Lee and Schafer. The Compensation Committee’s responsibilities include (i) reviewing the performance of corporate officers and approving their salaries and bonuses, (ii) approving compensation plans and awards for officers and key employees and (iii) adopting a plan for the orderly succession of the officers of the Company. Each of the members of the Compensation Committee is independent as defined by the New York Stock Exchange listing requirements. The Compensation Committee met nine times during 2004.

Safety & Environmental Committee: The Safety & Environmental Committee is comprised of three outside Directors, currently Messrs. Buck, Dossey and Loyd. The Safety & Environmental Committee’s functions include the review of reports and information provided by Company management or consultants regarding material regulatory compliance matters arising out of worker safety and health issues and material regulatory compliance matters or legislative developments related to environmental protection concerns. The Safety & Environmental Committee met four times during 2004.

Nominating & Corporate Governance Committee: The Nominating & Corporate Governance Committee is comprised of three outside directors, currently Messrs. Lee, Bech and Schafer. The responsibilities of the committee include (i) reviewing possible candidates for the Board of Directors and recommending nomination of appropriate candidates to the Board, (ii) developing and periodically reviewing the Company’s corporate governance guidelines, (iii) evaluating the structure, operation, size and membership of each committee of the Board, and (iv) evaluating the performance of the Board, its committees and management. Each of the members of the Nominating & Corporate Governance Committee is independent as defined by the New York Stock Exchange listing requirements. The Nominating & Corporate Governance Committee met three times during 2004.

Qualifications for consideration as a board nominee may vary according to the particular areas of expertise being sought as a complement to the existing board composition. However, minimum qualifications include high level leadership experience in business activities, breadth of knowledge about issues affecting our company, experience on other boards of directors and time available for meetings and consultation on our business matters. We seek a diverse group of candidates for nomination as directors for shareholders to consider and vote upon at the annual meeting.

The Nominating and Corporate Governance Committee has established procedures for identifying and evaluating nominees. First, the Committee considers the Board’s needs. For instance, the Committee may determine that, due to vacancies or current developments, the election of a director with a particular specialty (e.g., in a specific industry) would benefit the Board. The Committee then solicits recommendations from the Chief Executive Officer and other Board members and considers recommendations, if any, made by shareholders. The Committee then evaluates these recommendations and identifies prospective nominees to interview. Results from the interview process are reported to the Committee, and the Committee then recommends nominees to the full Board, which, upon approval by the Board, recommends the nominees for election by the shareholders.

The Company receives suggestions for potential director nominees from many sources, including members of the board, advisors, and shareholders. All of the nominees for director recommended for election by the shareholders at the 2005 Annual Meeting are current members of the Board. The Nominating & Corporate Governance Committee will consider nominees recommended by shareholders in the same manner as all other candidates. Pursuant to the Company’s bylaws, nominations for candidates for election to the Board of Directors may be made by any shareholder entitled to vote at a meeting of shareholders called for the election of directors. Nominations made by a shareholder must be made by giving notice in writing to the Secretary of the Company before the later to occur of (i) 60 days prior to the date of the meeting of shareholders called for the election of directors or (ii) ten days after the Board first publishes the date of such meeting. The notice shall include all information concerning each nominee as would be required to be included in a proxy statement soliciting proxies for the election of such nominee under the Securities Exchange Act of 1934. The notice shall also include a signed consent of each nominee to hold office until the next Annual Meeting of Shareholders or until his successor shall be elected or appointed.

Compensation of Directors

In 2004, the Directors’ fees were $2,000 per month and $1,500 for each Board meeting attended (including telephonic meetings), plus $1,500 for any committee meeting attended. Additionally, the chairman of the Audit Committee receives a fee of $10,000 per year and all other committee chairmen receive a fee of $5,000 per year. In 2004 Messrs. Bech, Buck, Dossey, Lee, Loyd and Schafer received 500 shares of common stock under the Company’s Directors’ Stock Grant Plan which is described on page 21. In 2004, Messrs. Bech, Buck, Dossey, Lee, Loyd and Schafer were each granted options to purchase 7,500 shares under the Company’s 1999 Stock Option Plan, which is described on page 19.

No member of the Board of Directors was paid any remuneration in 2004 for his service as a director of the Company other than pursuant to the standard compensation arrangement for directors. Directors who are officers of the Company do not receive any compensation for their services as a director. The Company reimburses its directors for travel expenses incurred in attending Board meetings. In addition to the seven directors elected by shareholders, Mr. James S. Palmer serves as Director Emeritus at the request of the Board. Mr. Palmer joined the Board of Directors of the Company in 1975 and served through the date of the 1999 Annual Meeting. As compensation for his services as Director Emeritus in 2004, Mr. Palmer was paid a retainer of $2,000 per month, $1,500 for each Board meeting attended in person and reimbursement for related travel expenses. See also “Certain Relationships and Related Transactions.”

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF AUDITORS

The Board of Directors recommends that you vote FOR the ratification of the appointment of Deloitte & Touche LLP as independent auditors for the Company for the year ending December 31, 2005. This firm has served in such capacity since March 2002 and is familiar with the Company’s affairs and procedures.

Deloitte & Touche LLP has advised the Company that its representatives will be present at the Annual Meeting to discuss results for the year ended December 31, 2004 and to make a statement if they desire to do so and to respond to appropriate questions.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this Report by reference therein.

March 11, 2005

To the Board of Directors of Frontier Oil Corporation:

We have reviewed and discussed with management the Company’s audited financial statements as of and for the year ended December 31, 2004.

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004.

Members of the Audit Committee

Carl W. Schafer, Chairman

G. Clyde Buck

James H. Lee

Audit Fees

The following table sets forth the fees billed to the Company from its principal independent auditor, Deloitte & Touche LLP, for professional services rendered for the fiscal years ended December 31, 2004 and 2003:

| | | Fiscal 2004 | | Fiscal 2003 | |

| Audit Fees | | $ | 978,850 | | $ | 701,250 | |

| Audit-Related Fees | | | 72,100 | | | 76,250 | |

| Tax Fees | | | 219,900 | | | 214,050 | |

| All Other Fees | | | 0 | | | 15,250 | |

Total | | $ | 1,270,850 | | $ | 1,006,800 | |

Audit Feesfor the fiscal years ended December 31, 2004 and 2003 were for professional services rendered for the audits of the consolidated financial statements of the Company, quarterly reviews of the financial statements included in Frontier’s Quarterly Reports on Form 10-Q, attestation of managements assessment of internal control, as required by Sarbanes-Oxley Act, Section 404, consents, comfort letters and other services related to Commission matters.

Audit-Related Feesfor the fiscal years ended December 31, 2004 and 2003 were for assurance and related services associated with employee benefit plan audits, Sarbanes-Oxley Act, Section 404 advisory services and agreed-upon procedure engagement.

Tax Feesfor the fiscal years ended December 31, 2004 and 2003 were for services related to tax compliance, tax consultation and in 2003 merger due diligence and tax planning.

All Other Feesfor the fiscal year ended December 31, 2003 were for professional time incurred in connection with providing documentation and testimony regarding the Holly lawsuit. No other fees were incurred as of December 31, 2004.

Pre-Approval Policy

All the services performed by the independent auditor in 2004 were pre-approved in accordance with the pre-approval policy and procedures adopted by the Audit Committee. This policy describes the permitted audit, audit-related, tax, and other services (collectively, the “Disclosure Categories”) that the independent auditor may perform. The policy requires that prior to the beginning of each fiscal year, a description of the services (the “Service List”) expected to be performed by the independent auditor in each of the Disclosure Categories in the following fiscal year be presented to the Audit Committee for approval.

Services provided by the independent auditor during the following fiscal year that were included in the Service List were pre-approved following the policies and procedures of the Audit Committee.

Any requests for audit, audit-related, tax, and other services not contemplated on the Service List must be submitted to the Audit Committee for specific pre-approval and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings, but the Chairman of the Audit Committee has authority to grant pre-approval as necessary. The Chairman must update the Audit Committee at the next regularly scheduled meeting of any services that were granted specific pre-approval.

In addition, although not required by the rules and regulations of the SEC, the Audit Committee generally requests a range of fees associated with each proposed service on the Service List and any services that were not originally included on the Service List. Providing a range of fees for a service incorporates appropriate oversight and control of the independent auditor relationship, while permitting the Company to receive immediate assistance from the independent auditor when time is of the essence.

On a quarterly basis, the Audit Committee reviews the status of services and fees incurred year-to-date against the original Service List and the forecast of remaining services and fees for the fiscal year.

OTHER BUSINESS

The Board of Directors of the Company knows of no matters expected to be presented at the Annual Meeting other than those described above; however, if other matters are properly presented to the meeting for action, it is intended that the persons named in the accompanying form of proxy, and acting thereunder, will vote in accordance with their best judgment on such matters.

EXECUTIVE AND OTHER OFFICERS

Set forth below are the executive officers of the Company as of year end 2004 along with their ages as of March 11, 2005 and office held by each officer.

Mr. James R. Gibbs (60) is Chairman of the Board, President and Chief Executive Officer. Information about Mr. Gibbs is included on page 6 with the information on nominees for the Board.

Ms. Julie H. Edwards (46) is Executive Vice President-Finance & Administration. She joined the Company in March 1991 as Vice President-Secretary & Treasurer, and was Senior Vice President-Finance & Chief Financial Officer from August 1994 until April 2000, when she was promoted to her current position. From 1985 to February 1991, she was employed by Smith Barney, Harris Upham & Co. Inc. in the Corporate Finance Department. Prior to 1985, she was employed by Amerada Hess Corporation and American Ultramar, Ltd., which were oil companies, as a geologist. Ms. Edwards is a member of the board of directors of ONEOK, Inc, a diversified energy company involved primarily in oil and gas production, natural gas processing, gathering, storage and transmission and Natco Group Inc., an oilfield service company.

Mr. W. Reed Williams (57) has been Executive Vice President-Refining & Marketing since joining the Company in July 2000. He has over 31 years of experience in refining and marketing. Prior to joining the Company, Mr. Williams was employed by Ultramar Diamond Shamrock beginning in 1993, where his responsibilities included corporate development, operations planning, pipeline operations and product supply and distribution. His final position at Ultramar Diamond Shamrock was Vice President of Logistics Development. Prior to 1993, Mr. Williams was employed by Tesoro Petroleum Corporation for nineteen years (1973 until 1992) where he held numerous positions, including Group Vice President of Refining, Marketing and Supply from 1990 to 1992. During 1992, he was President of Remote Operating Systems, Inc. before joining Ultramar Diamond Shamrock.

Mr. J. Currie Bechtol (63) has been Vice President-General Counsel of the Company since January 1998 and became Secretary of the Company in August 2000. Prior to joining the Company, Mr. Bechtol was in private legal practice for 28 years, most recently with Hutcheson & Grundy L.L.P. from 1984 until joining the Company.

Mr. Jon D. Galvin (51) is Vice President of the Company. He was appointed to this position in July 2000. He has performed special project duties for the Company’s Chief Executive Officer since July 2003. Mr. Galvin served as Vice President-Crude Oil Supply of certain of the Company’s refining subsidiaries from July 2000 until May 2003, Vice President-Controller of the Company from September 1997 until July 2000 and Chief Financial Officer of the Company’s Frontier refining subsidiaries from February 1992 until July 2000.

Mr. Gerald B. Faudel (55) has been Vice President-Corporate Relations and Environmental Affairs of the Company since February 2000. Mr. Faudel had previously been Vice President-Safety and Environmental Affairs and had served in similar capacities since November 1993. From October 1991 through November 1993, Mr. Faudel was Director of Safety, Environmental and External Affairs of the refining subsidiaries of the Company. Mr. Faudel was employed by Frontier Oil Corporation from October 1989 through October 1991 as Director of Safety, Environmental and External Affairs. Prior to October 1989, Mr. Faudel was employed with Tosco Corporation’s Avon Refinery as Manager of Hazardous Waste and Wastewater Program.

Ms. Nancy J. Zupan (50) is Vice President-Controller of the Company. Prior to her appointment to this position in February 2001, Ms. Zupan was Controller for the Company’s subsidiaries from 1991, when Frontier acquired the Cheyenne Refinery. She held the same position for the prior owners of the Cheyenne Refinery from 1987 until the acquisition. Prior to 1986, Ms. Zupan was employed by Husky Oil Company.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

All members of the Compensation Committee are independent, non-employee directors. The Committee regularly reviews and, with any changes it believes appropriate, approves the Company’s executive compensation program. Towers Perrin was retained by the Committee in 2002, 2003, and 2004 to advise the Committee on compensation matters. The Company’s executive compensation program is structured to help the Company achieve its business objectives by:

| | • | setting levels of compensation designed to attract and retain key executives; |

| | • | providing incentive compensation that varies directly with both Company performance and individual contribution to that performance; |

| | • | linking compensation to financial targets that affect short and long term share price performance; and |

| | • | aligning the interests of the executives with that of the shareholders. |

Compensation Program Components

The particular elements of the compensation program for executive officers are further explained below.

Base Salary. Base pay levels are largely determined through comparisons with a peer group of companies of similar size, activity and complexity to the Company as determined by the compensation consultants. Most of the companies included in the Peer Group Index in the graph on page 23 are included in this peer group of companies used for compensation comparisons. The relative stock price performance of the Company compared to the peer group is one factor used in determining compensation. In addition, salaries are based on the Company’s recent performance and on individual performance within a competitive salary range for each position that is established through job evaluation and market comparisons. Base pay levels for the executive officers are generally in the middle of a competitive range of salaries.

Annual Incentive Compensation. The Company’s officers and certain other employees are eligible to participate in an annual incentive compensation plan with awards based primarily on the attainment of certain earnings targets recommended by the executive compensation consultant and approved by the Committee. The objective of this incentive plan is to deliver competitive levels of compensation for the attainment of financial targets that the Committee believes are important determinants of share price over time. In the event the targets are reached, a group of approximately 52 key employees may be awarded a bonus based on a target percentage of the individual’s salary. Approximately 30% of the bonus awarded may be paid in the form of restricted stock. The individuals may also elect to receive all or a portion of their cash incentive award in additional shares of restricted stock, in which case the value of that electively deferred portion of the award will be increased by a 50% “risk premium”. An important additional feature of the incentive compensation plan is that a group of 14 of these individuals must own 1 to 3 times their annual salary in stock (excluding options). This requirement must be met within three years of eligibility for each participant, in most cases by early 2005. Most of these individuals have met this requirement.

In 2002 and 2003 the Company did not meet its earnings targets and no bonuses were paid and no shares of restricted stock were awarded in 2003 or 2004. In 2004 the Company achieved near record results and in recognition of these results in 2004, substantial bonuses were made to a significant number of employees in early 2005, and most of the employees participating in the restricted stock plan described above and on page 21 received a portion of their bonuses in shares of restricted stock of the Company.

Equity-based Incentive Programs. The Committee strongly believes that by providing those persons who have substantial responsibility for the management and growth of the Company with an opportunity to increase their ownership of the Company stock, the best interests of the shareholders and management will be closely aligned. Therefore, executives and managers are eligible to receive stock options and or restricted stock from time to time at the discretion of the Compensation Committee, giving them the right to purchase shares of Common Stock at a specified price in the future or restricted stock if the Company achieves certain performance criteria. The number of stock options or restricted stock granted to executive officers is recommended by the executive compensation consultant and approved by the Compensation Committee.

CEO Compensation

In accordance with the discussion above of the Company’s philosophy for executive compensation, a significant portion of the compensation for the Chief Executive Officer is based upon the Company’s performance. Mr. Gibbs, who has served as Chief Executive Officer since April 1992 and Chairman of the Board since 1999, joined the Company in 1982 and has served in a number of executive positions. A significant portion of Mr. Gibbs’ total cash compensation is tied to the performance of the Company. Since the Company did not attain its earnings targets in 2002 and 2003, Mr. Gibbs did not receive a bonus or any shares of restricted stock in 2003 or 2004 which would have been paid for the prior years performance. Mr. Gibbs was awarded stock options in 2002 and 2003 but none in 2004 (see discussion on Equity-based Incentive Programs on preceding page). Mr. Gibbs received an incentive bonus in early 2005 for 2004 results (see discussion on Annual Incentive Compensation on preceding page). Due to Mr. Gibbs’ efforts and contributions to the Company, Mr. Gibbs did receive an increase in his base pay for 2005. Mr. Gibbs also participated in the Company’s savings plans.

A separate, formal process of evaluating Mr. Gibbs was conducted, and the results of that process were considered in determining his compensation. Specifically, the Committee’s considerations included whether he achieved his goals for fiscal 2004, the Company’s stock performance, the Company’s return on shareholders’ equity, and whether the Company’s earnings improved. The Committee also compared the Company’s financial performance for fiscal 2004 to the Company’s plans. Further, the Committee considered various qualitative factors, including leadership skills and strategic planning. The Committee did not base its considerations on any single factor or specifically assign relative weights to factors.

Members of the Compensation Committee

Douglas Y. Bech, Chairman

James H. Lee

Carl W. Schafer

March 11, 2005

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Compensation

The following table sets forth information regarding compensation earned by the Company’s Chief Executive Officer and the four most highly compensated officers other than the Chief Executive Officer for services rendered in all capacities to the Company and its subsidiaries in the years 2002 through 2004.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | Long Term Compensation | | | |

| | | | | Annual Compensation | | Awards | | Payouts | | | |

| | | | | | | | | Other | | | | Securities | | | | | |

| | | | | | | | | Annual | | Restricted | | Underlying | | | | | |

| | | | | | | | | Compen- | | Stock | | Options/ | | LTIP | | All Other | |

Name and | | | | Salary | | Bonus | | sation | | Awards | | SARS | | Payouts | | Compensation | |

Principal Position | | Year | | ($) | | ($) | | ($) | | ($)(1) | | (#) | | ($) | | ($)(3) | |

| | | | | | | | | | | | | | | | | | | | | | |

| James R. Gibbs | | | 2004 | | | 800,000 | | | 1,200,000 | | | 0 | | | 0 | | | | | | 0 | | | 0 | | | 119,303 | (4) |

| Chairman of the Board, | | | 2003 | | | 770,000 | | | 0 | | | 0 | | | 0 | | | | | | 300,000 | | | 0 | | | 114,527 | | | | |

| President and Chief | | | 2002 | | | 770,000 | | | 0 | | | 0 | | | 0 | | | | | | 270,000 | | | 0 | | | 197,440 | | | | |

| Executive Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Julie H. Edwards | | | 2004 | | | 425,000 | | | 425,000 | | | 0 | | | 0 | | | | | | 0 | | | 0 | | | 45,002 | (5) |

| Executive Vice President - | | | 2003 | | | 395,000 | | | 0 | | | 0 | | | 0 | | | | | | 125,000 | | | 0 | | | 52,111 | | | | |

| Finance & Administration | | | 2002 | | | 395,000 | | | 0 | | | 0 | | | 0 | | | | | | 95,000 | | | 0 | | | 81,677 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| W. Reed Williams | | | 2004 | | | 440,000 | | | 440,000 | | | 0 | | | 132,000 | (2) | | 0 | | | 0 | | | 63,165 | (6) |

| Executive Vice President - | | | 2003 | | | 410,000 | | | 0 | | | 0 | | | 0 | | | | | | 125,000 | | | 0 | | | 59,700 | | | | |

| Refining & Marketing | | | 2002 | | | 410,000 | | | 0 | | | 0 | | | 0 | | | | | | 95,000 | | | 0 | | | 92,575 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jon D. Galvin | | | 2004 | | | 255,000 | | | 255,000 | | | 0 | | | 191,250 | (2) | | 0 | | | 0 | | | 35,503 | (7) |

| Vice President-General | | | 2003 | | | 255,000 | | | 0 | | | 0 | | | 0 | | | | | | 20,000 | | | 0 | | | 35,559 | | | | |

| Counsel & Secretary | | | 2002 | | | 255,000 | | | 0 | | | 0 | | | 0 | | | | | | 19,000 | | | 0 | | | 42,287 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nancy J. Zupan | | | 2004 | | | 240,000 | | | 192,000 | | | 0 | | | 172,800 | (2) | | 0 | | | 0 | | | 28,811 | (8) |

| Vice President-Controller | | | 2003 | | | 195,000 | | | 0 | | | 0 | | | 0 | | | | | | 28,000 | | | 0 | | | 26,886 | | | | |

| | | | 2002 | | | 180,000 | | | 0 | | | 0 | | | 0 | | | | | | 13,400 | | | 0 | | | 29,113 | | | | |

| (1) | Stock Awards are presented in the table at their value as of grant date as defined in the Restricted Stock Plan. Such value changes with the market value of the Company’s common stock. At December 31, 2004, Mr. Gibbs held 9,381 shares of restricted stock having a value of $250,097. Ms. Edwards held 5,325 shares of restricted stock having a value of $141,965 at such date. Mr. Williams held 3,624 shares of restricted stock having a value of $96,616 at such date. Mr. Galvin held 6,221 shares of restricted stock having a value of $165,852 at such date. Ms. Zupan held 2,117 shares of restricted stock having a value of $56,439. Such shares of restricted stock are not entitled to receive dividends declared and paid on the Company’s common stock prior to vesting. |

| (2) | Represents the value of the restricted stock awards which comprise a portion of the 2004 compensation for each of the named executive officers as of the date of the grant of such awards. Such restricted stock awards included 5,106 shares to Mr. Williams, 7,398 shares to Mr. Galvin and 6,685 shares to Ms. Zupan. All of such shares of restricted stock vest according to the following schedule: 25% on the first anniversary of the grant date (March 13, 2006), 25% on the second anniversary of the grant date (March 13, 2007), and 50% on the third anniversary date (March 13, 2008). Of such restricted stock awards 4,439 shares with respect to Mr. Galvin and 3,899 shares with respect to Ms. Zupan were awarded in lieu of a portion of their cash bonus upon the election of each such named executive officer as permitted by the Restricted Stock Plan. |

| (3) | Includes amounts contributed under the Company’s retirement/savings plans, deferred compensation plan and premiums paid by the Company for individual life insurance. Detail is given in notes (4) through (8). |

| (4) | Mr. Gibbs’ Other Compensation includes $21,963 of Company contribution to his retirement/savings plan account, $74,037 of Company contribution to his retirement/savings plan account through a deferred compensation program and $23,303 of life insurance premiums paid by the Company. |

| (5) | Ms. Edwards’ Other Compensation includes $21,963 of Company contribution to her retirement/savings plan account, $15,837 of Company contribution to her retirement/savings plan account through a deferred compensation program and $7,202 of life insurance premiums paid by the Company. |

| (6) | Mr. Williams’ Other Compensation includes $21,963 of Company contribution to his retirement/savings plan account, $30,837 of Company contribution to his retirement/savings plan account through a deferred compensation program and $10,365 of life insurance premiums paid by the Company. |

| (7) | Mr. Galvin’s Other Compensation includes $21,963 of Company contribution to his retirement/savings plan account, $8,637 of Company contribution to his retirement/savings plan account through a deferred compensation program and $4,903 of life insurance premiums paid by the Company. |

| (8) | Ms. Zupan’s Other Compensation includes $21,963 of Company contribution to her retirement/savings plan account, $2,637 of Company contribution to her retirement/savings plan account through a deferred compensation program and $4,211 of life insurance premiums paid by the Company. |

Equity Compensation Plan Information

The following table sets forth the number of shares issuable upon exercise and reserved for future issuance under the Company’s equity compensation plans as of December 31, 2004.

Plan Category | | Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

Equity compensation plans approved by security holders(1) | | 1,930,850 | | | 16.55 | | | 98,750 | |

Equity compensation plans not approved by security holders(2) | | 518,297 | | | 8.94 | | | 639,303 | |

| Total | | 2,449,147 | | | 15.67 | | | 738,053 | |

| (1) | Includes shares to be issued upon exercise of outstanding options under, or available for future issuance under, the Frontier Oil Corporation 1999 Stock Plan. |

| (2) | Includes shares to be issued upon exercise of outstanding options under (or in the case of restricted stock plans, subject to vesting under) or available for future issuance under the following three equity compensation plans: the 1968 Plan, the Frontier Oil Corporation Stock Option Plan, and the Frontier Oil Corporation Restricted Stock Plan. Shares subject to vesting under the restricted stock plans are not included in the weighted average exercise price. |

Stock Options

The Company currently maintains three stock option plans pursuant to which options to purchase shares of Common Stock are outstanding.

The purpose of the stock option plans is to advance the best interests of the Company by providing those persons who have substantial responsibility for the management and growth of the Company with additional incentive by increasing their proprietary interest in the success of the Company. One plan, the Frontier Oil Corporation 1999 Stock Plan, in which directors and other non-employee agents of the Company are eligible to participate, currently has shares of Common Stock available for future grants to eligible employees. As of December 31, 2004 there were 1,930,850 shares of common stock issuable upon exercise of outstanding options, and as of March 1, 2005, there were 98,750 shares of Common Stock available for grant under the Company’s 1999 Stock Plan.

Two older plans, the 1968 Plan and the Frontier Oil Corporation Stock Option Plan, no longer have shares available for grant and will terminate when the last issued and outstanding options from those plans are exercised or expire. As of December 31, 2004, there were 69,350 shares of Common Stock issuable upon exercise of outstanding options under the 1968 Plan and 88,250 shares of Common Stock issuable upon exercise of outstanding options under the Frontier Oil Corporation Stock Option Plan.

OPTION GRANTS IN 2004

Individual Grants | |

Name | Number of Securities Underlying Options Granted (#) | Percent of Total Options Granted to Employees in 2004 | Exercise Price ($/sh) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) |

5% | 10% |

| | | | | | | |

| James R. Gibbs | 0 | 0 | 0 | - | - | - |

| Julie H. Edwards | 0 | 0 | 0 | - | - | - |

| W. Reed Williams | 0 | 0 | 0 | - | - | - |

| Jon D. Galvin | 0 | 0 | 0 | - | - | - |

| Nancy J. Zupan | 0 | 0 | 0 | - | - | - |

| | | | | | | |

| (1) | The Commission requires disclosure of the potential realized value or present value of each grant. The disclosure assumes the options will be held for the full term of the option prior to exercise. Such options may be exercised prior to the end of such term. The actual value, if any, an executive officer may realize will depend on the excess of the stock price over the exercise price or the date the option is exercised. There can be no assurance that the stock price will appreciate at the rates shown in the table. |

AGGREGATE OPTION EXERCISES IN 2004

AND OPTION VALUES AT DECEMBER 31, 2004

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options at Dec. 31, 2004 Exercisable/Unexercisable | Value of Unexercised In-the-Money Options at Dec. 31, 2004 Exercisable/Unexercisable(1) |

| | | | | | | | | |

| James R. Gibbs | 630,000 | | 7,836,750 | | 452,500/217,500 | | $4,281,525/$1,826,175 | |

| Julie H. Edwards | 0 | | 0 | | 293,750/86,250 | | $4,041,938/$739,863 | |

| W. Reed Williams | 75,000 | | 847,875 | | 133,750/86,250 | | $968,338/$739,863 | |

| Jon D. Galvin | 0 | | 0 | | 96,250/14,750 | | $1,552,163/$122,948 | |

| Nancy J. Zupan | 11,000 | | 213,508 | | 44,050/17,350 | | $549,681/$156,254 | |

| | | | | | | | | |

| (1) | Computed based on the difference between aggregate fair market value and aggregate exercise price. The fair market value of the Company’s Common Stock on December 31, 2004 was $26.66 based on the closing sale price on December 31, 2004. |

Restricted Stock Plan

In February 2001, the Board of Directors approved the Frontier Oil Corporation Restricted Stock Plan, which is a component of the Company’s incentive compensation plan utilized by the Compensation Committee. Under the Restricted Stock Plan, 1,000,000 shares of treasury stock of the Company have been reserved (the “Restricted Stock”) for Restricted Stock grants to be made under the incentive compensation program. Effective as of March 13, 2005, 449,101 shares of restricted stock will have been granted and 550,899 shares will be available for grant under the Restricted Stock Plan. Of the 449,101 shares that will have been granted, 88,404 shares are outstanding under the Restricted Stock Plan and 360,692 shares have vested. Restricted Stock granted under the Restricted Stock Plan vests over three years of continuous employment with the Company as follows: 25% on the first anniversary of the grant, 25% on the second anniversary of the grant and the remaining 50% on the third anniversary of the grant. The Restricted Stock Plan also provides that the Restricted Stock Awards will vest automatically upon a change of control of the Company or if the executive’s employment is terminated due to death, disability or by the Company other than for “cause.” The initial filing by the Company of a registration statement in May 2003 regarding the entering into a merger agreement with Holly Corporation constituted a change of control as defined in the Restricted Stock Plan. Following the failure of the merger to occur all of the Company employees, whose unvested restricted stock would have accelerated, executed written agreements waiving any accelerated vesting.

Directors’ Stock Grant Plan

In 1995, the Board of Directors established a stock grant plan for non-employee directors. The purpose of the stock grant plan was to advance the best interests of the Company by increasing the non-employee directors’ proprietary interest in the success of the Company. Under the Directors’ Stock Grant Plan, automatic grants of a fixed number of shares were made on certain predetermined dates out of the Treasury shares owned by the Company. In October 2002, Messrs. Bech, Buck, Dossey, Lee, Loyd and Schafer received 500 shares of common stock. In January 2004, Messrs. Bech, Buck, Dossey, Lee, Loyd and Schafer received 500 shares of common stock. In accordance with its initial terms, this plan expired on December 31, 2004.

Employment Agreements

The Company entered into employment agreements with Mr. Gibbs, Ms. Edwards, Mr. Williams, Mr. Bechtol, Mr. Galvin and Mr. Faudel in December 2000 and with Ms. Zupan in February 2001. These agreements provide that in the event of a change of control of the Company, the executive will remain in his or her position as of the date of the agreement with commensurate duties for a period of three (3) years from the change of control. The initial filing by the Company of a registration statement in May 2003 regarding the entering into a merger agreement with Holly Corporation constituted a change of control as defined in the agreements. Upon a change of control each agreement provides that the executive officer will receive at least the same level of base compensation and other benefits as were being received by such executive officer immediately prior to the change of control. In addition, the agreements each provide for payment of annual performance bonuses determined by percentages of the base salary (75% for Mr. Gibbs, 50% for Ms. Edwards, Messrs. Williams and Galvin, 40% for Ms. Zupan, Messrs. Bechtol and Faudel) in effect during the three-year term. In the event of termination of the executive officer for any reason other than cause during the three-year term of employment, the Company is required to continue to pay the executive officer the stated compensation for the three-year period following termination, including the value of unexercised in-the-money stock options, as provided by the terms of the agreements.

Certain Relationships and Related Transactions

Burnet, Duckworth & Palmer, a law firm of which Mr. Palmer is a partner, is retained by the Company as its counsel for certain Canadian legal matters. The Company has paid Mr. Palmer’s law firm $C252,746 since January 1, 2003 for legal services performed through December 31, 2004.

Committee Charters, Code of Business Conduct and Ethics and Corporate Governance Guidelines

The Company has adopted a Code of Business Conduct and Ethics and Corporate Governance Guidelines. A copy of the Code of Business Conduct and Ethics, the Corporate Governance Guidelines and the charters of the Audit Committee, Nominating & Corporate Governance Committee and Compensation Committee of the Company’s board of directors can be found in the investor relations section of our website atwww.frontieroil.com. In addition, each of these items is available in print from the Company to any shareholder. Requests for print copies should be sent to the Company at the following address: Investor Relations Department, Frontier Oil Corporation, 10000 Memorial Drive, Suite 600, Houston, Texas 77024-3411.

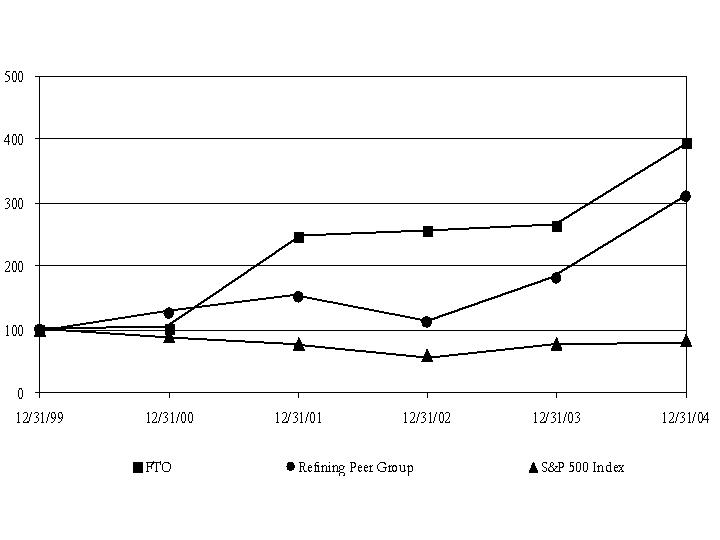

PERFORMANCE GRAPH

Thefollowing graph compares the changes in the Company’s cumulative total shareholder return of a $100 investment in our common stock for the five-year period from December 31, 1999 through December 31, 2004 in comparison to the S&P 500 Index and our peer group. The comparisons are not intended to forecast or be indicative of possible future performance of our Common Stock.

The “Refining Peer Group” includes Ashland Inc., Giant Industries, Holly Corporation, Sunoco Inc., Tesoro Petroleum Corporation and Valero Energy Corporation. The Company’s peer group has changed from prior years due to the 2001 acquisition of Tosco Corporation by another company and the 2001 acquisition of Ultramar Diamond Shamrock (UDS) by Valero Energy Corporation. Therefore, UDS and Tosco are no longer represented in the “Refining Peer Group”.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Members of the Compensation Committee are Messrs. Bech, Lee and Schafer. No member of the Compensation Committee of the Board of Directors of the Company was, during 2004, an officer or employee of the Company or any of its subsidiaries, or was formerly an officer of the Company or any of its subsidiaries or had any relationships requiring disclosure by the Company.

During 2004 no executive officer of the Company served as (i) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served on the Compensation Committee of the Board of Directors, (ii) a director of another entity, one of whose executive officers served on the Compensation Committee of the Company, or (iii) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served as a director of the Company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the Commission and the New York Stock Exchange initial reports of ownership and reports of changes in ownership of Common Stock of the Company. Officers, directors and greater than ten-percent shareholders are required by Commission regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on review of the Company’s copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2004, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten-percent beneficial owners were complied with.

SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be included in the Proxy Statement relating to the Company’s 2006 Annual Meeting of Shareholders (the “2006 Annual Meeting”) pursuant to Rule 14a-8 under the 1934 Act (“Rule 14a-8”) must be received by the Company no later than November 11, 2005 and must otherwise comply with the requirements of Rule 14a-8.

Proposals of shareholders submitted for consideration at the Company’s 2006 Annual Meeting (outside of the Rule 14a-8 process), in accordance with the Company’s bylaws, must be received by the Company by the later of 60 days before the 2006 Annual Meeting or 10 days after notice of such meeting is first published. If such timely notice of a proposal is not given, the proposal may not be brought before the 2006 Annual Meeting.

In order to provide the Company’s shareholders and other interested parties with a direct and open line of communication to the Board of Directors, the Board of Directors has adopted the following procedures for communications to Directors.

Any communications to Directors of the Company should be mailed to the following address: Investor Relations Department, Frontier Oil Corporation, 10000 Memorial Drive, Suite 600, Houston, Texas 77024-3411. All such communications will be reviewed initially by the Company’s Investor Relations Department. The Investor Relations Department will relay all such communications to the appropriate director or directors, unless the Investor Relations Department determines that the communication: does not relate to the business or affairs of the Company or the functioning or constitution of the Board of Directors or any of its committees; relates to routine or insignificant matters that do not warrant the attention of the Board of Directors; is an advertisement or other commercial solicitation or communication; is frivolous or offensive; or is otherwise not appropriate for delivery to directors. The Company’s Investor Relations Department will retain copies of all communications received pursuant to these procedures for a period of at least one year.

The director or directors who receive any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full Board of Directors or one or more of its committees and whether any response to the person sending the communication is appropriate. Any such response will be made through the Company’s Investor Relations Department and only in accordance with the Company’s policies and procedures and applicable law and regulations relating to the disclosure of information.

MISCELLANEOUS

All information contained in this Proxy Statement relating to the occupations, affiliations and securities holdings of directors and officers of the Company and their relationship and transactions with the Company is based upon information received from directors and officers. All information relating to any beneficial owners of more than 5% of the Company’s Common Stock is based upon information contained in reports filed by such owner with the Commission.

| | By Order of the Board of Directors, |

| | |

| | J. Currie Bechtol |

| | Vice President-General Counsel & Secretary |

March 11, 2005

Houston, Texas