Filed by Frontier Oil Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Frontier Oil Corporation

Commission File No.:1-7627

The following communication was distributed to Frontier employees on Friday, June 24, 2011.

| HollyFrontier |  |

Weekly Communiqué #15—Merger Update

June 24, 2011

We are only one week away from our anticipated close date and Day One Celebration. I know that many of you are tired, but I remain confident that excitement, adrenaline and opportunity will carry us to the close. Thanks to each of you for your patience, diligence, energy, focus and performance these past few months.

This week, in our second to last weekly Communiqué, we have much to share. We have Video Four, we are Spotlighting Holly Asphalt Company, we have the newly branded Mission & Values document and a few FAQ’s.

VIDEO FOUR—

Today’s release (“Video Four”) affords us the opportunity to address six questions:

(1) “After close, how can employees contribute to the Vision, Next Steps or Early Wins of HollyFrontier?”

(2) “After close, what will be the role of current Holly Corporation CEO, Matt Clifton?”

(3) “For those who have not met you, how would you describe your leadership style?”

(4) “Dave, how would you describe Mike?”

(5) “Mike, how would you describe Dave’s role in what will be HollyFrontier?”

(6) “As you look to the future, what excites you?”

| Holly Corporation & Frontier Oil Corporation, Weekly Communiqué—Merger Update #15, Video Four Produced as one in a series of internal communications to their respective organizations, Frontier CEO Mike Jennings and Holly President Dave Lamp address six questions: (1) “After close, how can employees contribute to the Vision, Next Steps or Early Wins of HollyFrontier?” (2) “After close, what will be the role of current Holly Corporation CEO, Matt Clifton?” (3) “For those who have not yet met you, how would you describe your leadership style?” (4) “Dave, how would you describe Mike?” (5) “Mike, how would you describe Dave’s role in what will be HollyFrontier?” (6) “As you look to the future, what excites you?” (Video Runtime: 00:07:13. To ensure an optimal viewing experience, please allow time for the video to fully load before playing.) We are sending (under separate cover) a site-specific intranet URL link so the video may be viewed at work. In the likelihood you wish to share this video with family or friends, it can also be found in the public domain here: http://vimeo.com/25499727 |

Holly Asphalt, Leadership

Holly Asphalt, Leadership continued

Holly Asphalt, Leadership continued

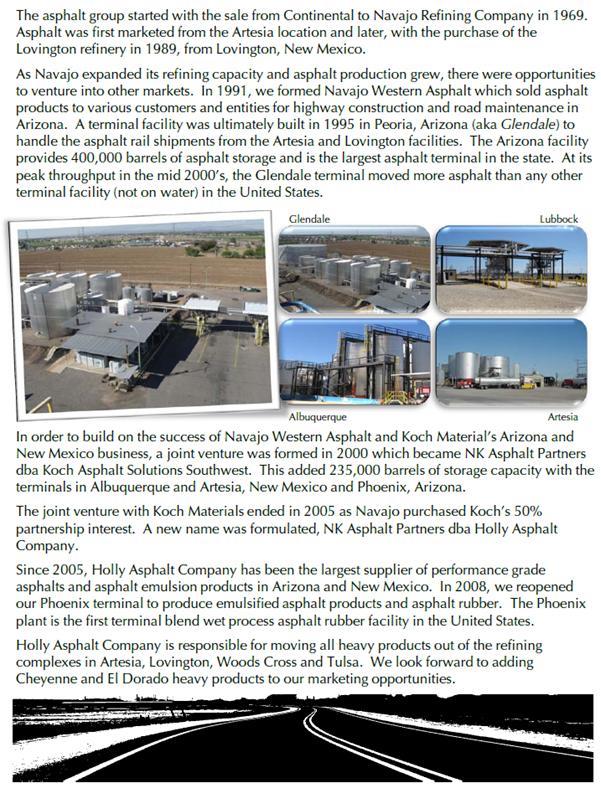

Holly Asphalt Spotlight 1

1 Special thanks to David Blair and the Holly Asphalt team for a great Spotlight!

Rebranded Mission & Values Document

Employee FAQs

| Employee FAQ | Integration Team Response |

| What changes can we expect, if any, on a daily operational level beside benefits and things of this nature, or will most change occur at the corporate level? | For Holly operations folks, there will be minimal change—with the exception, yes, of things like benefits. For Frontier operations, some may see slightly more change, particularly with regard to SAP. HR policies, while similar between the two organizations, are constantly evolving to meet the needs of our growing workforce. Channel HFC, forthcoming and replacing Communiqués, will include “going forward” changes and announcements. Keep your eyes open for more about this in coming weeks… For each of us, there will be increased opportunities for growth, increased opportunities to learn best practices from additional locations, and more stability from an even stronger company. |

| As part of the integration process, will there be any new, cool apparel (e.g., “swag”) with the HollyFrontier logo on it? Will we receive any of this apparel? | We are ordering new ballcaps and mouse pads for everyone at HollyFrontier. We will also make hard hat stickers available for those who request them. |

| Will there be a blackout period for sales/purchases of HollyFrontier stock after the merger closes? | After closing, we will follow Holly’s current blackout policy which appears at the end of the communiqué. Directors and officers have a different policy that requires pre-clearance for trades. |

| What can we expect as part of the “Day One Celebration?” I heard my boss might serve cake…. | Each location will be throwing a “Day One” celebration in their own style. We have caps on order with our new logo and hope to have mouse pads with our mission and values as well. Enjoy! |

Submitting Questions or Suggestions to our Integration Team

For those of you who have questions, suggestions or concerns about the Integration process—or have heard rumors and would like to surface these for a response, please continue submitting them to Penny Newmark (PNewmark@Frontieroil-den.com) who will, in turn, share them with our Integration Team as necessary. Please share what’s on your mind. We would like to hear from you.

That’s all for this week! We’re looking forward to next week with a Spotlight on Lubes and a successful closing day. Again, thank you each for your continued support.

Mike Jennings

Chairman, President & CEO

Frontier Oil Corporation

Insider Trading Policy

July 1, 2011

Following the closing of the merger of Holly Corporation and Frontier Oil Corporation, employees of HollyFrontier Corporation (“HFC”) and/or Holly Logistic Services, LLC. ("HLS") should be aware of the following requirements and restrictions relating to transactions in HollyFrontier stock and Holly Energy Partners, L.P. ("HEP") units.

INSIDER TRADING POLICY - APPLICABLE TO ALL EMPLOYEES

Under Rule 10b-5 promulgated under the Securities and Exchange Act of 1934 (the "Exchange Act"), you cannot purchase or sell HollyFrontier stock or HEP units if you are aware of material information about HollyFrontier, HEP, or any of their affiliates that has not been publicly disclosed. As you are aware, HollyFrontier and/or HEP at times have material matters in progress for which public disclosure would be premature, and if you are aware of any such matters, you will be precluded from purchasing or selling HollyFrontier stock or HEP units until the matter is publicly disclosed. In addition, it is the policy of HollyFrontier and HEP to avoid not only the impropriety itself, but also the appearance of impropriety. In general, it does not matter that you may have decided to engage in a transaction before learning of the undisclosed material information, that you may have reasons to trade that are completely unrelated to the undisclosed information, or that delaying your proposed transaction might result in economic loss.

A fact is "material" if there is a substantial likelihood that a reasonable person would consider it important in making an investment decision. Generally, a matter will not be considered "publicly disclosed" unless it has appeared in a press release or filing with the SEC and, in the case of newly disclosed information, there has been sufficient time for the information to be assimilated by the public. In general, our policy is that, prior to trading, you should wait one full trading day following the day of the public disclosure of material information. If you have any questions about whether certain matters would be viewed as material, or whether a matter has been publicly disclosed, you should contact the General Counsel. You should know that the question of whether a matter is material is one of fact, and even if you conclude that a matter is not material, a government authority could disagree.

Also, if you possess inside or non-public information that has not been publicly disclosed, you generally may not pass that information along to anyone else - that is, a "tippee." If you do, and the tippee trades in HollyFrontier stock or HEP units, you may incur liability as a result of the tippee's transaction, even though you receive no monetary benefit.

There is a limited exception to the insider trading policy for certain advance authorizations of trades. Please contact the General Counsel if you would like more information. There are detailed rules you must follow qualify for this exception.

This policy also applies to (1) any purchases or sales of HollyFrontier stock or HEP units that you might direct for any employee benefit plan account, and (2) the sale of any HollyFrontier stock or HEP units you may acquire through the exercise of options.

PENALTIES FOR VIOLATIONS OF RULES

Please note that there are both criminal and civil penalties for violations of these trading rules. If you are found liable for insider trading, you could face penalties of up to three times the profit gained or loss avoided, a criminal fine of up to $5 million and up to 20 years in prison. In addition to these potential criminal and civil liabilities, in certain circumstances Section 16 insiders may be required to pay to HollyFrontier or HEP all profits made by the insider from trading in HollyFrontier's or HEP’s securities, plus other damages. HollyFrontier and/or HEP could also be harmed through penalties if there is a finding that HollyFrontier or HEP has failed to take adequate steps to see that directors and employees do not violate the insider trading laws as well as through a potential loss of confidence in HollyFrontier and its stock and/or HEP and its units on the part of the public and the securities markets.

For these reasons, this Insider Trading Policy requires your strict adherence. Needless to say, violation of this policy will constitute grounds for disciplinary action, including dismissal.

If you have any questions, please contact the Chief Executive Officer or the General Counsel.

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The issuance of Holly Corporation (“Holly���) common stock in connection with the proposed merger has been submitted to Holly’s stockholders for their consideration, and the proposed merger has been submitted to shareholders of Frontier Oil Corporation (“Frontier”) for their consideration. Holly has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that includes a joint proxy statement to be used by Holly and Frontier to solicit the required approval of their shareholders in connection with the proposed merger and constituted a prospectus of Holly, which the SEC has declared effective. Holly and Frontier may also file other documents with the SEC concerning the proposed merger. INVESTORS AND SECURITY HOLDERS OF HOLLY AND FRONTIER ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus and other documents containing important information about Holly and Frontier through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Holly are available free of charge on Holly’s website at www.hollycorp.com under the tab “Investors” or by contacting Holly’s Investor Relations Department at (214) 871-3555. Copies of documents filed with the SEC by Frontier are available free of charge on Frontier’s website at www.frontieroil.com under the tab “Investor Relations” and then under the tab “SEC Filings” or by contacting Frontier’s Investor Relations Department at (713) 688-9600.

Holly, Frontier and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Holly and shareholders of Frontier in connection with the proposed transaction. Information about the directors and executive officers of Holly is set forth in its proxy statement for its 2011 annual meeting of stockholders, which was filed with the SEC on March 31, 2011. Information about the directors and executive officers of Frontier is set forth in its proxy statement for its 2011 annual meeting of shareholders, which was filed with the SEC on March 21, 2011. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These include statements regarding the effects of the proposed merger and statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “estimates,” or similar expressions. Forward looking statements relating to expectations about future results or events are based upon information available to Holly and Frontier as of today’s date, and are not guarantees of the future performance of Holly, Frontier or the combined company, and actual results may vary materially from the results and expectations discussed. For instance, there is no assurance that the proposed merger will be consummated. The merger agreement will terminate if the companies do not receive the necessary approval of Holly’s stockholders or Frontier’s shareholders or government approvals or if either Holly or Frontier fails to satisfy conditions to closing. Additional risks and uncertainties related to the proposed merger include, but are not limited to, the successful integration of Holly’s and Frontier’s businesses and the combined company’s ability to compete in the highly competitive refining and marketing industry. The revenues, earnings and business prospects of Holly, Frontier and the combined company and their ability to achieve planned business objectives will be subject to a number of risks and uncertainties. These risks and uncertainties include, among other things, risks and uncertainties with respect to the actions of actual or potential competitive suppliers of refined petroleum products in Holly’s, Frontier’s and the combined company’s markets; the demand for and supply of crude oil and refined products; the spread between market prices for refined products and market prices for crude oil; the possibility of constraints on the transportation of refined products; the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines; effects of governmental and environmental regulations and policies; the availability and cost of financing; the effectiveness of capital investments and marketing strategies; efficiency in carrying out construction projects; the ability to acquire refined product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations; the possibility of terrorist attacks and the consequences of any such attacks; and general economic conditions.

Holly and Frontier caution that the foregoing list of risks and uncertainties is not exclusive. Additional information concerning these and other risks is contained in Holly’s and Frontier’s most recently filed Annual Report on Form 10-K, subsequent Quarterly Report on Form 10-Q, recent Current Reports on Form 8-K and other SEC filings. All subsequent written and oral forward-looking statements concerning Holly, Frontier, the proposed merger or other matters and attributable to Holly or Frontier or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Neither Holly nor Frontier undertake any obligation to publicly update any of these forward-looking statements to reflect events or circumstances that may arise after the date hereof.