P.O. Box 370

Kirkland Lake, ON P2N 3J7

| July 18, 2007 | Symbol – TSX & AIM: KGI |

New South Mine Complex Year End Reserves and Resources Show Substantial Growth; Drifting on New South Zone Now In Progress – 160 Feet of2.08 Ounces of Gold per Ton over 9.7 Feet (uncut).

Kirkland Lake Gold Inc. (the “Company”) is pleased to announce a year end update on the reserves and resources for its “New South Mine Complex” discovered to the south of the historic Main Break. The New South Mine Complex consists of 16 or more mineralized gold zones, five of which have been defined over strike lengths in excess of 1,000 feet. These zones, which are open in all directions, are the focus of exploration programs including diamond drilling and access drifting on the 5000 and 5300 foot levels.

Successful exploration in the 2007 fiscal year has resulted in Proven and Probable Reserves plus Measured and Indicated Resources increase in the South Mine Complex over the past year by 249% to 502,500 ounces of gold, and inferred resources were increased by 97% to 526,000 ounces of gold at a drilling cost per new ounce found of C$3.30. The exploration budget for the next fiscal year has been increased to C$7.1 million dollars and will concentrate on expanding the New South Mine Complex zones.

“This first reserve and resource presentation of the New South Mine Complex with revised cutting factors is intentionally conservative and still utilizes the historic cut-off levels of 3.5 ounces for many of the zones, well below those recommended by the Company’s geological consultants” said Brian Hinchcliffe, President and CEO of the Company. He added, “Development and early mining on very high grade, wide ore structures such as the New South Zone, will start to enhance our production profile over the next two quarters.”

An updated estimate for the new ore system reflecting the substantial drilling success over the last year is shown below:

RESERVES & RESOURCES IN SOUTH MINE COMPLEX

| | As at April 30, 2006 | As at April 30, 2007 | % |

Tons | Grade | Ounces | Tons | Grade | Ounces | Increase |

Reserves: | | |

| Proven | - | - | - | 52,000 | 0.73 | 38,000 | 249% |

| Probable | 246,000 | 0.56 | 136,000 | 433,000 | 0.74 | 320,000 |

Resources: | |

| Measured | - | - | - | 2,000 | 0.24 | 500 |

| Indicated | 22,000 | 0.39 | 8,000 | 211,000 | 0.68 | 144,000 |

| Inferred | 399,000 | 0.67 | 267,000 | 622,000 | 0.85 | 526,000 | 97% |

The reserves and resources disclosed in this news release were completed internally by the Company’s personnel, of which the 2006 reserves and resources have been audited by Glenn R. Clark & Associates Limited (an independent geological and mining consulting firm). The 2007 reserves and resources are currently being audited by Glenn R. Clark & Associates Limited and an update for all of the Company’s properties will be announced when that report has been completed. For details on the calculation of reserves and resources, including the key assumptions, parameters and methodology, please refer to the disclosure in the Company’s press release dated August 2, 2006. To the Company’s knowledge, none of the estimates of resources and reserves are affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other issues.

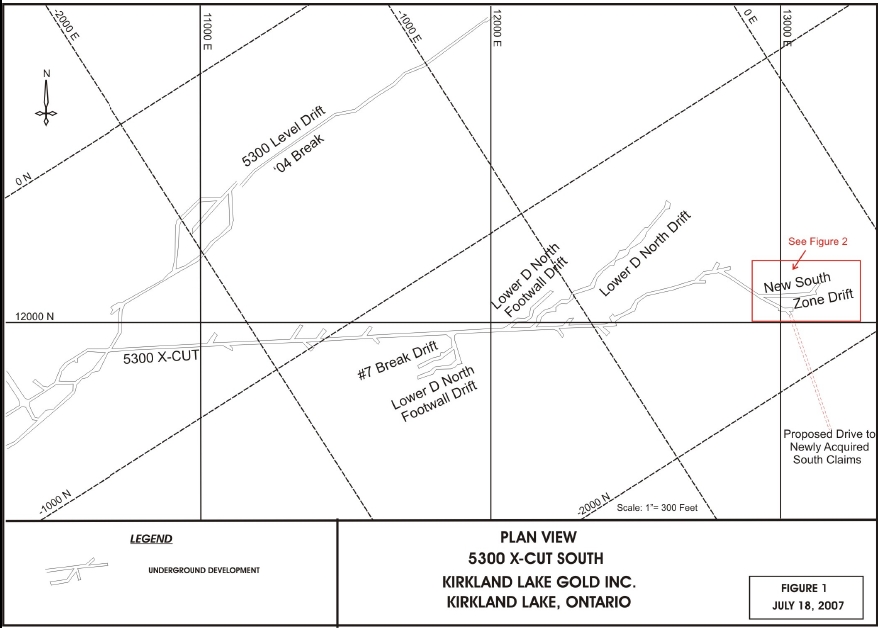

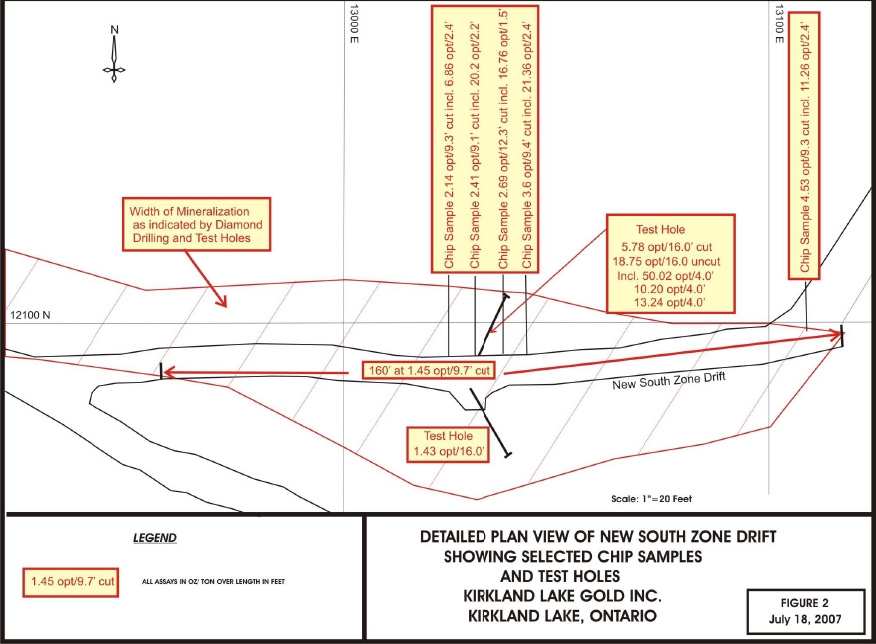

Access development drifting is currently in progress on the New South Zone. A total of 160 feet of drifting on the New South Zone has thus far assayed (from chip samples) 1.45 ounces of gold per ton (“opt”) over 9.7 feet cut (2.08 opt uncut) with drifting progressing to the east. The mineralization extends across the entire drift and into both drift walls. The drifting is in the vicinity of hole 50-627W1, which assayed 1.43 opt over a core length of 124.5 feet with an estimated true width of 37.3 feet (see press releases dated August 15, 2005 and November 22, 2005). A test hole into the north wall returned assays of 18.75 opt uncut (7.78 opt cut) over 16.0 feet and a test hole to the south assayed 1.43 opt over 16 feet. Close-spaced definition drilling will be implemented to ascertain the true dimensions. (See figures 1 and 2).

Highlights of the current results:

| · | Proven, probable, measured and indicated resources on the New South Mine Complex have increased over the past fiscal year by 249% and now total 502,500 ounces at an average grade of 0.72 opt. Inferred resources have increased by 97% and now total 526,000 ounces of gold at an average grade of 0.85 opt. |

| · | Initial investigation by the Company’s geological staff indicated that the historic cutting factor of 3.5 opt was understating the grade of mineralization for the South Mine Complex. The consulting firm of Scott Wilson Roscoe Postle Associates was retained to investigate, by statistical analysis, 10 of the larger mineralized zones forming part of the South Mine Complex. They concluded that there were sufficient data points for a statistical analysis of seven of the 10 zones reviewed by Glenn Clark, the Company’s independent geological consultant. As a result, the Company has implemented various higher grade cutting factors for four of the seven zones. These include the New South Zone (7.2 opt), Lower D North (9.3 opt), Lower D North Footwall (4.8 opt), the #7 and #7 Hangingwall Zones (6.4 opt) and are now being used on both drill hole assays and underground chip assays. |

| · | The revised cutting factors are considered to be conservative (mean plus one standard deviation) and are lower than those recommended by Scott Wilson RPA. Accordingly, the factors may be subject to upward revision as more data points are generated. For example, after implementation of the new cutting factors, 33-35% of drill hole intersections on the #7 Break and New South Zone returned assays greater than the new cutting factors. Revised factors for the other mineralized zones including the Lower D, White, YYZ, Freewill and Limelight will be implemented as more assay data are derived. |

| · | A total of 160 feet of drifting on the New South Zone has to date assayed (from chip samples) 2.08 opt over 9.7 feet uncut (1.45 opt cut) with drifting progressing to the east. Some of the individual chip assays include 6.86 opt over 2.4 feet, 20.20 opt over 2.2 feet, 16.76 opt over 1.5 feet and 21.36 opt over 2.4 feet. One test hole to the north assayed 18.75 opt uncut (7.78 opt cut) over 16.0 feet. The New South Zone has, to date, been defined over a strike length of 2,100 feet by diamond drilling. |

| · | The new muck pass system from 5000 level to 5600 level has been completed. This new pass will allow for greater flexibility in handling both ore and waste from the zones to the south and allow for the 5300 level cross cut to be extended south towards the recently acquired “South Claims” (see press release dated April 17, 2007) |

The figures referred to in this release may be viewed at the Company’s website at www.klgold.com and will provide context to the above statements.

Figure 1 is a plan view showing development and drifting on mineralization to the south.

Figure 2 is a detailed plan view showing grades derived from drifting to date on the New South Zone.

About the Company

The Company purchased the Macassa Mine and the 1,500 ton per day mill along with four former producing gold properties – Kirkland Lake, Teck-Hughes, Lake Shore and Wright Hargreaves – in December 2001. These properties, which have historically produced some 22 million ounces of gold, extend over seven kilometres between the Macassa Mine on the east and Wright Hargreaves on the west and, for the first time, are being developed and explored under one owner. This camp is located in the Abitibi Southern Greenstone Belt of Kirkland Lake, Ontario, Canada.

The results of the Company’s underground diamond drilling program have been reviewed, verified (including sampling, analytical and test data) and compiled by the Company's geological staff (which includes a ‘qualified person’, Michael Sutton P.Geo., the Company’s Chief Geologist, for the purpose of National Instrument 43-101, Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators). Mr. Sutton also supervised the preparation of the information that forms of the basis of the technical disclosure in this release.

The Company has implemented a quality assurance and control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the best possible practices. The drill core is sawn in half with half of the core samples shipped to the Swastika Laboratories in Swastika, Ontario or to the Macassa mine laboratory for analysis. The other half of the core is retained for future assay verification. Other QA/QC includes the insertion of blanks, and the regular re-assaying of pulps/rejects at alternate certified labs (Polymet, Accurassay). Gold analysis is conducted by fire assay using atomic absorption or gravimetric finish. The laboratory re-assays at least 10% of all samples and additional checks may be run on anomalous values.

The Company’s Macassa Mine Property is the subject of reserve reports prepared by:

| · | Glenn R. Clark, P. Eng., entitled Review of Resources and Reserves of Macassa Mine, Kirkland Lake, Ontario dated July 18, 2006. |

| · | Stewart Carmichael, P.Geo., the Company’s Chief Exploration Geologist, entitled Interim Report On Reserves and Resources On South Mineralization, Macassa Mine, For Kirkland Lake Gold Inc. dated January 24, 2007. |

Both of these technical reports have been filed on SEDAR (www.sedar.com).

For further information, please contact:

Brian Hinchcliffe President Phone 1 705 567 5208 Fax 1 705 568 6444 E-mail: bhinchcliffe@klgold.com | Scott Koyich Investor Relations Phone 1 403 215 5979 E-mail: info@klgold.com |

Chelsea Hayes Pelham Public Relations Phone +020 7743 6675 E-mail: chelsea.hayes@pelhampr.com | NOMAD: Canaccord Adams Limited Email: Robin.Birchall@canaccordadams.com |

Website- www.klgold.com |

Neither the Toronto Stock Exchange nor the AIM Market of the London Stock Exchange has reviewed and neither accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward Looking Statements

This Press Release may contain statements which constitute ‘forward-looking statements’ within the meaning of the Private Securities Litigation Reform Act of 1995 of the United States of America, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities and operating performance of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities or performance and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors. Such risks, uncertainties and factors are described in the Company’s periodic filings with the Securities and Exchange Commission, including the Company’s annual report on Form 20-F and current report on Form 6-K, which may be viewed on EDGAR at www.sec.gov, and its periodic filings with the Canadian securities regulatory authorities, including the Company’s Annual Information Form and quarterly and annual Management’s Discussion & Analysis, which may be viewed on SEDAR at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms is press release, such as “measured,” “indicated,” and “inferred” ”resources,” that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20F, File No. 01-31380, which may be secured from us, or from the SEC’s website at http://www.sec.gov/edgar.sht.

Cautionary Note to U.S. investors concerning estimates of Measured and Indicated Resources

This news release uses the terms “measured” and “indicated resources.” We advise U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Cautionary Note to U.S. investors concerning estimates of Inferred Resources

This news release uses the term “inferred resources.” We advise U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.