SECURITIES AND EXCHANGE COMMISSION

Washington, D.C., 20549

FORM 6-K/A

Report of Foreign Issuer

FOR PERIOD ENDED

January 30, 2003

COMMISSION FILE NUMBER:

01-31380

KIRKLAND LAKE GOLD INC.

(Translation of registrant's name into English)

Suite 300, 570 Granville Street

Vancouver, British Columbia

Canada, V6C 3P1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked indicate the file number assigned to the registrant in connection with Rule 12g3-2(b): 82 - ●.

P.O. Box 370

KIRKLAND LAKE, ON, P2N 3J7

January 30 , 2003

Symbol: TSX-VE :KGI

NEWS RELEASE

Underground Production Re-established at Shaft #3;

Dewatering Reaches 4750 Level

Kirkland Lake Gold Inc., (the “Company”) is pleased to announce the commencement of underground mining on the 3835 and 4250 levels at the Macassa Mine. Hoisting from the 4500 level is being carried out using a “tipper car” loading device that will be employed until the loading pocket at the 5150 level is operational. Once the 4750 level is operational, the Company will have access to four major levels at the Macassa Mine and access east to launch camp-wide exploration programs as described below. In addition, the Company is continuing dewatering to the 5725 level.

The 4750 level is an important level providing the Company with access to an additional 23 proven and probable reserve blocks, and 19 measured and indicated resource blocks. The reserves on the 4750 level consist of 108,000 tons of 0.44 ounces of gold per ton (35,000 proven tons grading 0.39 ounces of gold per ton and 73,000 probable tons grading 0.47 ounces of gold per ton), and 16 of the stopes are open in at least one direction. On all four levels of the Macassa Mine that are now accessible the Company has 49 proven (65,000 tons grading 0.42 ounces of gold per ton) and probable (208,000 tons grading 0.52 ounces of gold per ton) blocks with a total of 273,000 tons grading 0.50 ounces of gold per ton. Also available is a total of 238,000 tons grading 0.31 ounces of gold per ton in measured (57,000 tons grading 0.34 ounces of gold per ton) and indica ted (181,000 tons grading 0.29 ounces of gold per ton) resources. Inferred resources for the four levels are 111,000 tons grading 0.39 ounces of gold per ton. In such amounts, mineral reserves are not included in mineral resources.

Access to the 4750 level is also extremely important from an exploration point of view, as the Company will now have the access to test camp-wide break potential for the first time. Two major mineralized structures are located to the south of, and sub-parallel to, the horizon that has been mined historically in Kirkland Lake (i.e. the ‘04 Break-Main Break complex). These structures are discussed below.

The #6 Break is a 50 degree south-dipping splay off the ’04 Break, located below the 38 level, with a proven strike of at least 2,000 feet. It could be the same #6 Break mined extensively at Teck-Hughes and Kirkland Minerals (up to 6,000 feet to the east). Several ore-grade zones have so far been defined from very limited drilling. Past drilling on this zone has intersected 1.81 ounces of gold per ton over 1.0 foot, 0.87 ounces of gold per ton over 3.5 feet, and 0.41 ounces of gold per ton over 6.5 feet. These intersections are open in up to three directions.

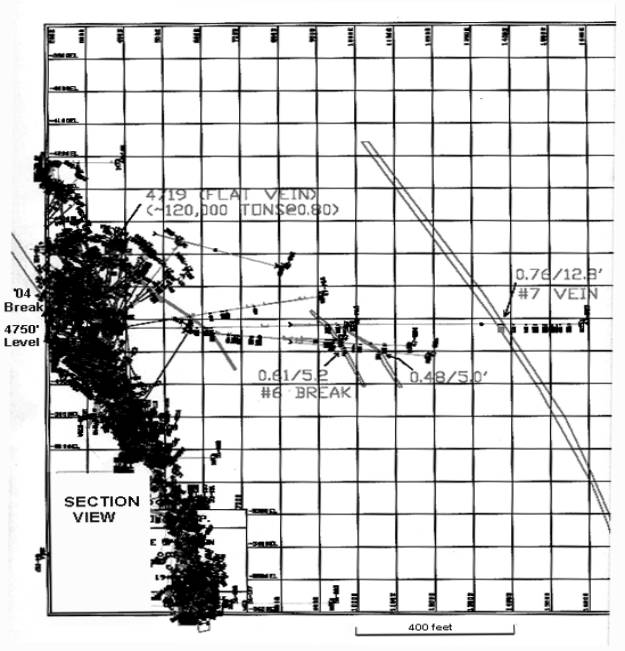

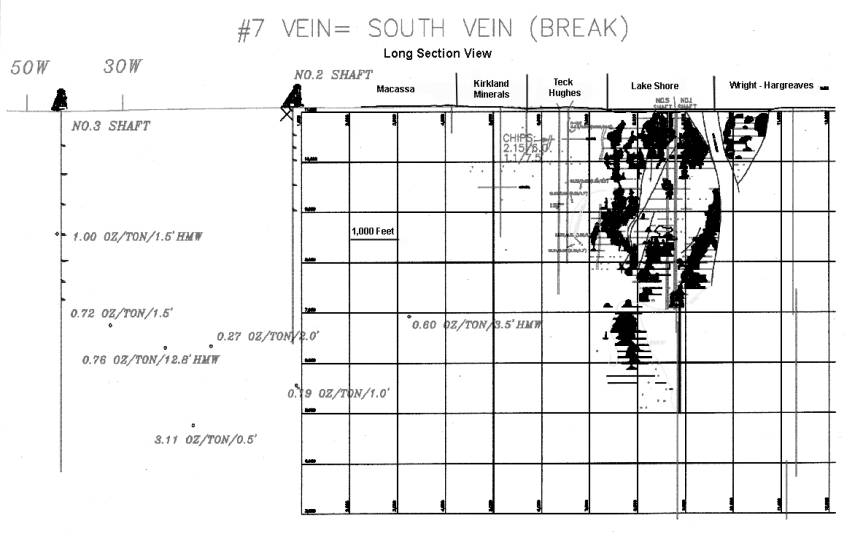

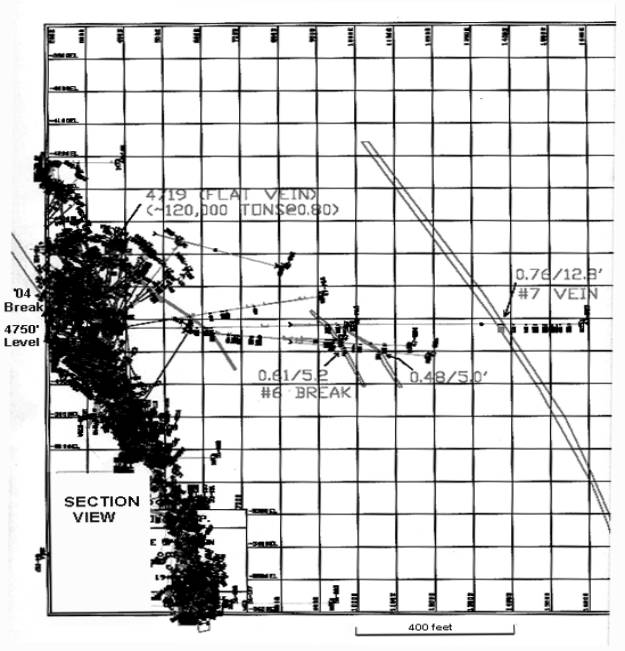

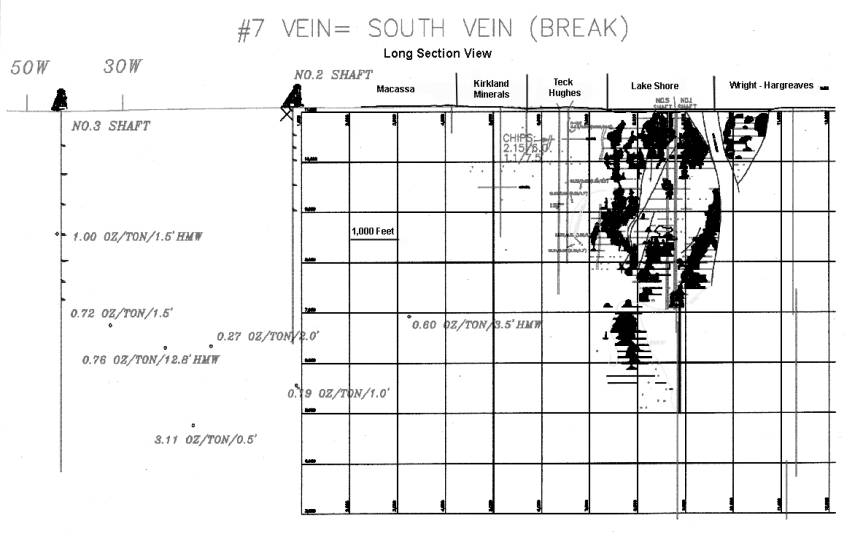

The #7 vein was intersected with the last hole drilled on the property before the mine was shut down in 1999. It returned 0.76 ounces of gold per ton over 12.8 feet (see Fig. 1 Section View). This zone is 1,100 south of the ’04 Break. The only other drill holes this far south all intersected a mineralized zone at 1,100 feet south, with assays up to 0.60 ounces of gold per ton over 3.8 feet, and 3.11 ounces of gold per ton over 0.5 feet. These results are from an area of the mine that is 4,000 feet vertical by 7,000 feet horizontal, and additional drilling will be undertaken to determine if this is a mine-wide structure. On strike, and a further 4,500 feet east, is the South Break at Lake Shore Mine which was mined from surface to the 6000 level (see Fig. 2 Longitudinal Section). Drilling will consist of extending existing holes, along with the d rilling of new holes that will intersect both structures.

During the transition from surface mining to underground mining between December 2002 and January 2003, the Company’s 1,500 tons per day mill was closed and underwent a maintenance and repair program. The mill has been re-started and regular gold pours will re-commence next week. Design enhancements to the underground pumping system have resulted in pumping rates of better than 1.2 million gallons per day during January and December. On the 4750 level, a new booster pump will installed that will support increased pumping from the shaft, which should elevate dewatering to better than 1.5 million gallons per day.

The Company is also pleased to announce the appointment of Robert P. Hinchcliffe as the Company’s Chief Financial Officer. Mr. Hinchcliffe holds a Bachelor of Arts with a Minor in Geology from the University of Arizona and a Master of Business Administration from Georgetown University. Mr. Hinchcliffe served most recently as Senior Vice President at Banco Santander where he was responsible for equity research. Prior to this Mr. Hinchcliffe was an equity analyst covering international mining and steel companies at Prudential Securities and Societe Generale. Before working as an analyst, Mr. Hinchcliffe worked for three years in project development for a Venezuelan mining company.

“In addition to the start of underground production, the Company is excited to be able to drill from the 4750 level and test the potential for larger mine and camp-wide breaks. This was an important part of our purchase and development of these properties” said Brian Hinchcliffe, the Company’s President. “The commitment and drive by Company employees has created immense progress in the last twelve months.”

The technical disclosure contained in this news release has been verified by the Company's Chief Geologist, Michael W. Sutton, P.Geo., who is a ‘qualified person’ for the purpose of NI 43-101,Standards of Disclosure for Mineral Projects. The reserves and resources disclosed in this news release are based on a report prepared by David W. Rennie, P.Eng. and Richard E. Routledge, M.Sc., P.Geol. of Roscoe Postle & Associates Inc. entitledReview of Mineral Resources and Mineral Reserves of the Macassa Mine Property, Kirkland Lake, Ontario Prepared for Kirkland Lake Gold Inc dated December 23, 2002 regarding the reserves and resources as at December 18, 2002 and are subject to the parameters and qualifications contained in the Company’s news release of January 8, 2003.The Company’s Kirkland Lake properties are the subject of a report prepared by Roland H. Ridler, B.A.Sc.(hons.), M.A.Sc., Ph.D.(Econ.Geol.), P.D., entitledKirkland Lake Mineral Properties (Macassa Mine, Kirkland Lake Gold, Teck-Hughes, Lake Shore, Wright-Hargreaves dated November 30, 2001. Copies of both reports have been filed on SEDAR (www.sedar.com <http://www.sedar.com>).

For further information, please contact:

Brian A. Hinchcliffe (705) 567-5208

The TSX Venture Exchange has not reviewed

and does not accept responsibility for the adequacy or accuracy of this news release.

This press release replaces and supercedes the Company’s two news releases dated January 30, 2003 issued earlier today.

Figure 1. Section View of # 7 Vein, #6 Vein and 04' Break

Figure 2. Longitudinal Section of South Vein (#7 Vein)

SIGNATURES

Pursuant to the requirements of theSecurities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

KIRKLAND GOLD

(the Registrant)

Date: |

January 30, 2003 |

By: |

Signed“Sandra Lee” |

| | | | Signature

Sandra Lee, Secretary |

| | | | Name* Title |

*Print name and title under the signature of the signing officer

GENERAL INSTRUCTIONS

A.

Rule as to Use of Form 6-K

This form shall be used by foreign private issuers which are required to furnish reports pursuant to Rule 13a-16 or 15d-16 under theSecurities Exchange Act of 1934.

B.

Information and Document Required to be Furnished

Subject to General Instruction D herein, an issuer furnishing a report on this form shall furnish whatever information, not required to be furnished on Form 40-F or previously furnished, such issuer

(i) makes or is required to make public pursuant to the law of the jurisdiction of its domicile or in which it is incorporated or organized, or

(ii) files or is required to file with a stock exchange on which its securities are traded and which was made public by that exchange, or

(iii) distributes or is required to distribute to its securityholders.

The information required to be furnished pursuant to (i),(ii) or (iii) above is that which is material with respect to the issuer and its subsidiaries concerning: changes in business; changes in management or control; acquisitions or dispositions of assets; bankruptcy or receivership; changes in registrant's certifying accountants; the financial condition and results of operations; material legal proceedings; changes in securities or in the security for registered securities; defaults upon senior securities; material increases or decreases in the amount outstanding of securities or indebtedness; the results of the submission of matters to a vote of security holders; transactions with directors, officers or principal security holders; the granting of options or payment of other compensation to directors or officers; and any other information which the regi strant deems of material importance to securityholders.

This report is required to be furnished promptly after the material contained in the report is made public as described above. The information and documents furnished in this report shall not be deemed to be "filed" for the purposes of Section 18 of the Act or otherwise subject to the liabilities of that section.

If a report furnished on this form incorporates by reference any information not previously filed with the Commission, such information must be attached as an exhibit and furnished with the form.

C.

Preparation and Filing of Report

This report shall consist of a cover page, the document or report furnished by the issuer, and a signature page. Eight complete copies of each report on this form shall be deposited with the Commission. At least one complete copy shall be filed with each United States stock exchange on which any security of the registrant is listed and registered under Section 12(b) of the Act. At least one of the copies deposited with the Commission and one filed with each such exchange shall be manually signed. Unsigned copies shall be conformed.

D.

Translations of Papers and Documents into English

Reference is made to Rule 12b-12(d). Information required to be furnished pursuant to General Instruction B in the form of press releases and all communications or materials distributed directly to securityholders of each class of securities to which any reporting obligation under Section 13(a) or 15(d) of the Act relates shall be in the English language. English versions or adequate summaries in the English language of such materials may be furnished in lieu of original English translations.

Notwithstanding General Instruction B, no other documents or reports, including prospectuses or offering circulars relating to entirely foreign offerings, need be furnished unless the issuer otherwise has prepared or caused to be prepared English translations, English versions or summaries in English thereof. If no such English translations, versions or summary have been prepared, it will be sufficient to provide a brief description in English of any such documents or reports. In no event are copies of original language documents or reports required to be furnished.