- MTRN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K/A Filing

Materion (MTRN) 8-K/ARegulation FD Disclosure

Filed: 26 Aug 04, 12:00am

EXHIBIT 99.1

| Brush Engineered Materials Inc. Profile Publicly traded since 1956: NYSE-listed since 1972. Founded 1931 as Brush Beryllium Company. Building off earlier pioneering technical work at Brush Laboratories Initial scope was development of commercial markets With onset of WW II and post war period, significant growth in defense and eventually, aerospace applications Mid-70s: major expansion of new commercial markets. Today, commercial markets represent 90% + of revenues |

| A leading manufacturer of high performance engineered materials Operations, service centers and major office locations in North America, Europe and Asia Serving long-term growth oriented global markets: Telecommunications and computers Automotive electronics Optical media Industrial components Aerospace and defense Appliance Brush Engineered Materials Inc. Profile |

| BEM Materials are found in a wide range of critical and demanding applications requiring: - Strength - Reliability - Thermal & electrical - Miniaturization conductivity - Weight reduction - Corrosion resistance - Reflectivity Brush Engineered Materials Inc. "Advancing the World's Technologies" |

| Brush Engineered Materials Inc. End Uses Optical Media Industrial products Life enhancing devices Cellular phones and other wireless communications Notebook and network computers Electronic components in cars and trucks |

| Investment Highlights and Strengths Unique Status as Fully Integrated Provider of Beryllium-Containing Products Global Sales and Distribution Network Sales Based on End User Specifications Strong Value Proposition in Served Markets Broad Metallurgical Capabilities in Precious and Non-precious Metals Global Leader in High Performance Engineered Materials Positive Market Trends Capacity to Support Profitable Market Growth Strategic Customer Relationships Strong and Improving Sales and Margins Significant Technical Capabilities High Barriers to Entry |

| Metal Systems Alloy Products Beryllium Products Technical Materials, Inc. Microelectronics Electronic Products Williams Advanced Materials Inc. Brush Engineered Materials Inc. Organized into Two Separate Reportable Segments |

| Metal Systems Group (2003 Sales: $239 million) 2003 Sales: $35.2 million Pure beryllium and aluminum-beryllium composites for high- performance applications, principally for aerospace and defense applications where stiffness, strength, lightweight, dimensional stability and reflectivity are critical 2003 Sales: $41.9 million Engineered material systems, including clad, plated and electron beam welded metals used in demanding connector applications Combines precious and non-precious metals in strip form for use in complex electrical components for telecommunications systems, computers and automotive electronics 2003 Sales: $162.3 million Copper and nickel-based alloy materials, most of which incorporate beryllium Strip products are used in electronic connectors including PDA's, wireless communications equipment, notebook and network computers and automotive electronics that require high strength, formability and electrical conductivity Bulk products are rod, bar, tube and plate products for industrial and aerospace bushings and bearings, oil & gas components and plastic mold materials where strength, corrosion and wear resistance, thermal conductivity and lubricity are critical performance requirements Technical Materials, Inc. (TMI) Beryllium Products Alloy Products |

| Microelectronics Group (2003 Sales: $157 million) Williams Advanced Materials (WAM) Electronic Products 2003 Sales: $127.8 million Precious metal and specialty alloys for high reliability applications Products include precious and non-precious metal vapor deposition targets, frame lid assemblies, clad and precious metal preforms, high-temperature braze materials and ultra fine wire Industries served include optical media, semi- conductor, data storage, performance film and wireless 2003 Sales: $29.5 million Products include beryllia ceramic materials, electronic packaging and thick-film circuitry Products designed to meet exacting performance requirements of target customers Industries served include wireless telecommunications, medical laser, aerospace, defense and automotive |

| Fully Integrated Beryllium Producer Beryllium and beryllium alloys are critical to many high performance applications Strong Lightweight Good formability Operate the only active bertrandite ore mine in the developed world 7,500 acres in Juab County, Utah Approximately 100 years of proven reserves Bertrandite Ore Mining & Extraction High reliability Thermal and electrical conductivity Corrosion and wear resistant Delta, UT Casting, Rolling & Finishing Elmore, OH Thin Gauge Rolling & Finishing Reading, PA Service & Distribution Centers Global Network |

| Global Sales and Distribution Network Operations in the U.S. and seven foreign countries Significant recent expansion to China and Taiwan International sales are 33% and growing ?-------------- Asia / Pacific ------------? ? ---------------- Europe -------------- ? ? - Exports from USA -? Singapore Japan Hong Kong UK Germany Philippines Taiwan |

| Corporate Structure |

| In 2001, the Computer and Telecom Market Decline Drove Sales back to Mid-90's Levels In 2003, Growth Began to Return to Historical Rates 92 93 94 95 96 97 98 99 0 1 2 3 Sales 265 295 346 370 376 434 410 456 564 473 373 401 % Growth 0.11 0.17 0.07 0.02 0.15 -0.05 0.11 0.24 -0.16 -0.21 0.05 Historic Growth Rates 1992 - 1997 10.4% 1992 - 1999 8.2% Computer & Telecom market decline Year Returning to Historical Growth Rates |

| The Decline in Telecom/Computer Market Resulted in a 50% Drop in the Market Segment's Revenue Comparing 2003 to 2000 $ in millions 2000 2003 Change Telecom/Computer $277 $139 (138) Automotive 62 53 (9) Industrial 62 42 (20) Optical media 56 53 (3) Defense/Aerospace 34 37 3 Appliance 19 27 8 All Other 54 50 ( 4) $564 $401 $(163) |

| The portion of Brush's revenue from the telecom/ computer market has declined from nearly 50% to slightly more than 35% Automotive Telecom/Computer Other Defense Industrial Optical Media Appliance East 0.11 0.49 0.11 0.06 0.11 0.1 0.02 49% 11% 10% 11% 6% 11% Automotive Telecom/ Computer Other Aerospace/ Defense Industrial Optical media 2000 2003 Automotive Telecom/Computer Other Defense Industrial Optical Media Appliance East 0.14 0.35 0.11 0.09 0.11 0.13 0.07 Automotive Optical media Industrial Other Telecom/ Computer 35% 14% 7% 13% 11% 11% Aerospace/ Defense $564 Million $401 Million 2% Appliance 9% Appliance |

| Brush experienced a major downturn in Q-2 and Q3 2001, with revenue remaining flat through 2002. 2003 was stronger than 2002 and 2004 to date is stronger than 2003 2000 2001 2002 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 143.9 147.2 145.5 128.2 106.2 92.4 89.6 100.8 93.5 89 99.5 101.8 94.2 105.6 125.9 128.6 2003 2004 |

| Positive Market Trends Electronic component manufacturers are being driven by end user demands to produce products that are smaller, lighter and faster Increased electronic component performance characteristics require materials that have enhanced mechanical, electrical and thermal properties Growing opportunity for thin film physical vapor deposition (PVD) products in the DVD, LCD, data storage and semiconductor markets Spending and conditions in the telecommunications and computer market are improving Brush has generated year-over-year sales growth in six consecutive quarters |

| Capacity to Support Profitable Market Growth $140 million invested between 1996 and 2000 Operating with significant available excess capacity Significant productivity gains in recent years Capital spending in 2002 and 2003 averaged $6 million per year Well-positioned to support rapid sales growth without significant incremental cash investment |

| Our Improvement Programs are Centered Around Five Key Areas Reducing debt through improved working capital management and limiting capital spending Reducing overhead costs Continued improvement in margins through operational efficiency Lean manufacturing Six Sigma Broaden the base - revenue from new products and applications Improvement in demand from the telecom/computer market |

| Financial and Operational Initiatives Expanding the revenue base New products New applications Improving margins through increased operating efficiency Six Sigma and Lean Manufacturing Reducing overhead costs Reducing debt Positioning for global market growth and economic recovery Improve quality, cost, speed and service Our performance improvement initiatives have been focused on five key areas New markets New geographies |

| Expand and Diversify Revenue Base New Products Alloy 390 - Telecom & Auto PM Plated Strip - Telecom & Auto Toughmet - Bushings & Bearings MoldMax XL - Plastic Molds Welded Tube - Oil & Gas Silver DVD Alloy (Silx) - DVD Visi-Lid - Telecom & Military New End Use Markets Alloy Heavy Equipment Oil & Gas Components Plastic Tooling WAM Semiconductors Data Storage Magnetic Media Thin Film Transistor/Liquid Crystal Display New High-Growth Regions Singapore Taiwan Hong Kong Korea China Since 2000, BEM has aggressively worked to broaden its base with initiatives targeted at new products, new end use markets and new high-growth regions |

| Increase Operating Efficiency Reduced manufacturing cycle times 18% Improved manufacturing inventory turns 48% Raised yields 11% Shipped 23% more pounds per manufacturing employee Lean Manufacturing and Six Sigma initiatives enabled Brush's Alloy Products business to improve operational efficiency and reduce costs in 2003 |

| Reduce Overhead Note: Total Overhead = Total fixed costs (manufacturing overhead + SG&A + interest). Breakeven point in 2004 may be higher due to currency, increased metal prices and product mix shifts. $417 $428 $520 Breakeven Sales $175 $171 $208 Total Overhead 42.0% 40.3% 40.0% Contribution Rate 2003 2002 2001 Overhead Reduction Brush has significantly lowered its breakeven point ($ in millions) |

| Reduce Debt Total debt has fallen 33% from 2000 levels $59.6 $11.5 $19.8 Off-Balance Sheet Inventory Financing $77.6 $14.2 $13.8 Key Off-Balance Sheet Leases $68.7 $99.1 $104.1 Balance Sheet Debt 4Q00 4Q03 2Q04 ($ in millions) $205.9 $124.8 $137.7 Total |

| Improving Margins Our efforts to improve margins have succeeded, despite the fall in revenue Year Gross Margin % 2000 21.0% 2002 12.9% Thru Q2-2004 23.0% |

| 23% 21% 14% 13% 18% 19% $129 $401 $373 $473 $564 $102 0% 5% 10% 15% 20% 25% 2000 2001 2002 2003 Q2 2003 Q2 2004 $0 $100 $200 $300 $400 $500 $600 Gross Margin Sales Improve Margins Historical Gross Margin Trends Margin % Sales ($MM) Margins have improved through cost reduction and productivity improvement initiatives |

| Programs to improve profitability had a significant impact in 2003 and to date in 2004 2002 2003 2004 Q-3 Q-4 Q-1 Q-2 Q-3 Q-4 Q1 Q2 Net Sales $93.5 $89.0 $99.5 $101.8 $94.2 $105.6 125.9 128.6 Oper. Profit (3.9) (10.9) (2.1) 1.0 (2.4) (5.8) 6.1 9.1 Q-4 2002 includes the impact of the Electronic Products' restructuring and asset write down charge of $5.1 million. Excluding this charge operating profit would have been ($5.8) million. Q-4 2003 includes the impact of the $6.0 million refinancing charge. Excluding the charge operating profit would have been $0.2 million. $ Millions |

| Investment Highlights and Strengths Unique Status as Fully Integrated Provider of Beryllium-Containing Products Global Sales and Distribution Network Sales Based on End User Specifications Strong Value Proposition in Served Markets Broad Metallurgical Capabilities in Precious and Non-precious Metals Global Leader in High Performance Engineered Materials Positive Market Trends Capacity to Support Profitable Market Growth Strategic Customer Relationships Strong and Improving Sales and Margins Significant Technical Capabilities High Barriers to Entry |

| Segment Sales Review 2003 Q1 2003 Q2 2003 Q3 2003 Q4 2003 $ % sales $ % sales $ % sales $ % sales Metal Systems Group 61 62% 61 60% 54 57% 63 59% Alloy 40 40% 42 41% 37 39% 43 41% Beryllium Products 12 12% 11 11% 9 10% 10 9% TMI 9 9% 8 8% 8 9% 10 9% Microelectronics Group 38 38% 38 37% 39 41% 42 40% WAM 30 30% 30 29% 32 34% 36 34% Electronic Products 8 8% 8 8% 7 7% 6 6% Other 0 0% 3 3% 1 1% 1 1% TOTAL 99 100% 102 100% 94 100% 106 100% $ in millions |

| Segment Sales Review 2004 Q1 2004 Q2 2004 $ % sales $ % sales Metal Systems Group 76.0 60% 77.1 60% Alloy 52.5 42% 54.7 43% Beryllium Products 9.7 8% 7.8 6% TMI 13.8 11% 14.6 11% Microelectronics Group 49.9 40% 51.5 40% WAM 42.1 33% 43.5 34% Electronic Products 7.8 6% 8.0 6% Other 0 0% 0 0% TOTAL 126 100% 129 100% $ in millions |

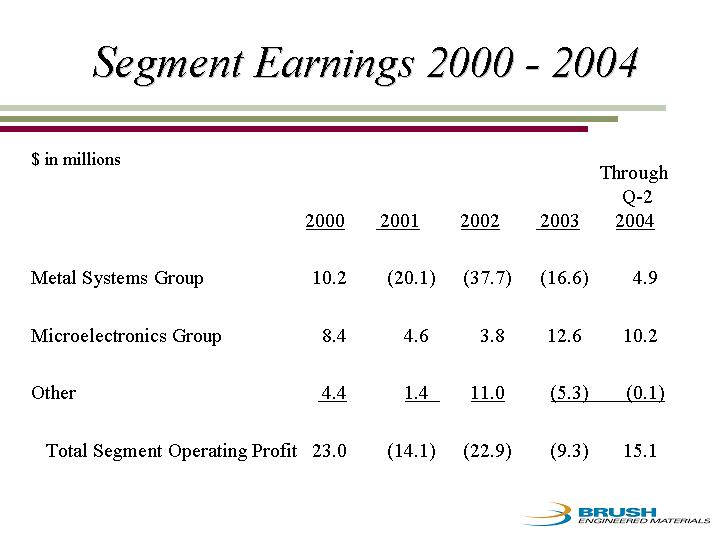

| Segment Earnings 2000 - 2004 Through Q-2 2000 2001 2002 2003 2004 Metal Systems Group 10.2 (20.1) (37.7) (16.6) 4.9 Microelectronics Group 8.4 4.6 3.8 12.6 10.2 Other 4.4 1.4 11.0 (5.3) (0.1) Total Segment Operating Profit 23.0 (14.1) (22.9) (9.3) 15.1 $ in millions |

| Brush Wellman Alloy Vision Brush Wellman is a leading supplier of High Performance Copper Alloys worldwide, providing manufacturing excellence in the form of high reliability products and services to satisfy our customers most demanding applications. We provide these services in a culture of local support and global teamwork. BRUSHWELLMAN Engineered Materials |

| Alloy Products Markets Strip Markets (coils) Telecommunications Computers Automotive Electronics Appliance Bulk Markets (rod, bar, tube, plate) Plastic molds Undersea cable amplifiers Aerospace landing gear bearings Oil and gas drilling equipment Heavy Equipment - New Bearings - New Bulk (30%) Strip (70%) BRUSHWELLMAN Engineered Materials |

| Sales Based on End User Specifications Connector Manufacturing Stamping Connector Manufacturing Sourcing Demand Generator Distribution Sales Marketing Brush Engineered Materials Specifications Products |

| 9 Strip Alloy Applications (strength, conductivity, spring characteristics) Current Carrying Springs and Relays Integrated Circuitry Sockets Electrical and Electronic Connectors Air Bag Sensors Pressure Responsive Devices Fire Extinguisher Sprinkler Heads |

| Alloy Products Strip Products - Strategy Maintain focus on 4 major end-use markets Computer Telecommunications Automotive Appliance Defend leadership in traditional alloy strip, rod & wire Reduce total cost of manufacture to allow penetration of mid-range alloy applications Enhance product properties to provide additional value to customers Introduce new alloys to meet needs of targeted market opportunities. Brush 60, ToughMet Strip, Alloy 390 Focus on new non-connector markets Deep Offshore Oil and Gas, Bearings, Instrumentation Tubing, Heat Exchanger Tubing Geographic Growth Expand commercial operations in Asia Pacific BRUSHWELLMAN Engineered Materials |

| Strip Capacity Expansion Elmore and Reading Facilities $140 Million (1996 - 1998) Added casting, hot rolling, annealing and cold rolling capacity at Elmore Added light gauge strip and mill hardening capacity at Reading 50% to 100% capacity increase depending upon product depending upon product depending upon product depending upon product depending upon product depending upon product depending upon product depending upon product depending upon product BRUSHWELLMAN Engineered Materials |

| Strong Value Proposition in Served Markets (Formability, Conductivity, Stress Relax) $ per Pound $0 $10 Performance Parameter High Low Traditional Copper- Beryllium Alloys 390 Brush 60 Alloy 174 CuNiSi HS Phos Bronze Phos Bronze Brass Brush Value Proposition Unique, high-performance materials Technical design capabilities Outstanding service Global marketing, sales and distribution Competitive Alloy Comparison Copper-beryllium alloys, while premium priced, provide best-in-class performance Note: Blue denotes Brush Engineered Materials' alloys; beige represents competitive materials. |

| Automotive Electronics Definition: power and signal distribution in passenger cars and light trucks - connectors, switches and relays BRUSHWELLMAN Engineered Materials |

| Automotive Applications Potential New Applications: Infotronics/telematics - in car multimedia systems and mobile communication systems, navigational, global positioning, internet based services. Powertrain electronics - in vehicle networks, drive-by-wire systems, continuously variable transmission, intelligent braking Safety systems - intelligent air bag systems, driver alertness monitoring, adaptive cruise control, frontal collision warning, intelligent highway vehicle systems, automatic emergency notification 42 Volt Powernet - increase number of terminals, switches and relays used in a vehicle; shift mix of components size toward miniaturization due to smaller current and increase the number of performance critical systems in a vehicle. BRUSHWELLMAN Engineered Materials |

| Computer Definition: Brush Wellman's high performance alloys are sold to the computer industry in strip and wire forms for connectors, contacts, and shielding. End use applications include servers, workstations, notebook and desk top computers, personal digital assistants (PDAs), and data storage devices. BRUSHWELLMAN Engineered Materials |

| Computer Applications Examples of specific end-use product applications Fingerstock shielding used in servers and data storage. Power connectors used in server power supplies manufactured by Sun, HP, Compaq, and Intel. Microprocessor socket connectors. PDA ID connector and battery contacts. VHDM connector system for EMC data storage systems. Examples of future target product applications Intel and AMD's Pentium 5 microprocessor connectors. Power connectors for multi-chip module interfaces as well as backpanel power applications in high end servers. High pin count and high density flex circuit interface connectors for high resolution flat panel displays. BRUSHWELLMAN Engineered Materials |

| Telecommunications Definition: Brush Wellman's high performance alloys are sold to the telecommunications industry in strip and wire forms for connectors, contacts, shielding, switches and relays. End use applications include wireless base stations, cell phones, pagers, telecom switching equipment, transmission equipment and communication networks. BRUSHWELLMAN Engineered Materials |

| Telecommunication Applications Examples of specific end-use product applications Handheld and portable device battery clips, antenna clips, I.O. connectors, board to board connectors, SIM card connectors & display connectors. Category 6 modular jacks for connecting data networks. Shielding gaskets and clips for EMI protection. Coaxial switches for cable company central office switches. VHDM connector system used in backpanel connector systems for fast Ethernet and Gigabit Ethernet switches and routers. Examples of future target product applications Category 7 modular jacks for data networks. Low profile board to board connectors for wireless handsets and high speed mezzanine connectors for network switches and routers. BRUSHWELLMAN Engineered Materials |

| Cellphone Connector Applications BRUSHWELLMAN Engineered Materials |

| Rear of Circuit Board Battery Contacts Brush Wellman Alloy Vibrator Motor Contacts Brush Wellman Alloy Battery Clips Brush Wellman Alloy Antenna Contact Brush Wellman Alloy |

| Front of Circuit Board Hands Free Set Connector Brush Wellman Alloy and other material BRUSHWELLMAN Engineered Materials |

| 10 Bulk Alloy Applications (strength, corrosion resistance, non-galling, conductivity) Plastic Injection Molds Aircraft Landing Gear Bushings Undersea Repeater Housings - Telecom Oilfield Drill Collars & Anti- Friction Bushings Heavy Equipment Bearing and Wear Applications |

| Alloy Products Bulk Products - Strategy Maintain focus on traditional end-use markets Oil & Gas Aerospace Plastics Undersea Introduce new alloys or product forms to meet needs of targeted market opportunities. MoldMax XL ToughMet and improved ToughMet products (CD ToughMet) Alloy 310 RWMA class 3 Focus on new non-traditional growth markets Bearings, Oil & Gas completions, Heavy Equipment & Mining, Pumps, Marine, Heat Exchangers Geographic Growth Expand commercial operations in Asia Pacific, improve customer awareness and distribution BRUSHWELLMAN Engineered Materials |

| Plastics - Moldmax XL Similar properties to dominant tooling materials and standard Moldmax Conductivity similar to Moldmax (CuBe) of 30% No EH&S issues Value proposition includes machinability >5X steels adding cost benefits to offset increased material costs Value proposition - no added cost for faster cycles and lower cost manufacturing BRUSHWELLMAN Engineered Materials |

| Lorain Casting Facility Spinodal and EquacastTM Technology-Winning! Strength and hardness found in CuBe products Thermal conductivity The value proposition differentiates: No EH&S issues Corrosion resistance Superb tribological properties (low friction coefficient, excellent wear resistance - without lube) adding value in Reliability,Uptime, and Less Mtce. Machinability and Design Simplicity adding cost benefits to offset increased material costs Casting capability including size, shapes, tubes and quality Lorain Technology Expanding Brush Wellman market and application reach Developing Applications in the markets we are strong: Mold Tooling, Aircraft Parts, Drilling Equipment High performance Copper based engineered materials: Developing markets/applications where technology is strong: Oil Well Completion Equipment, Mining, Heavy Equipment, Hydraulic Systems, Marine Hardware, Engine Bearings. BRUSHWELLMAN Engineered Materials |

| BRUSHWELLMAN Engineered Materials ToughMetTM Industrial Components Results: |

| ToughMetTM Industrial Components Results: BRUSHWELLMAN Engineered Materials |

| Brush International Inc. Global Sales, Marketing, Distribution & Tech Service Brush International Inc. S. Freeman ?-------------- Asia / Pacific ------------? ? ---------------- Europe -------------- ? ? - Emerging Markets -? BWS BWT BWC BWJ BWK BWL BWG BWG BWG EXPORTS FROM USA Singapore Taiwan China Japan Korea U.K. Germany Italy Spain T. Ong J. Tien J. Oei K. Hase Y.J. Kim G. Shapland K.L. Rausch A. Danielli F. Aguirre W. Zeder Singapore Brush International Service Centers Korea Tokyo / Fukaya Shanghai Hong Kong Reading Stuttgart |

| Brush International, Inc. Alloy Sales by Region 2003 Asia Rest of World Europe 51 3 46 Asia 51% Rest of World 3% Europe 46% |

| Brush International, Inc. 2003 Historical Sales by Market Segment Strip Products 87% Bulk Products 13% |

| Brush Wellman Beryllium Products Products Beryllium Metal - One of the lightest metals known - Family of vacuum hot and hot/cold isostatically pressed powder-derived metals AlBeMet? - Family of lightweight alloy composites - Extruded, rolled sheet and hot isostatically pressed powder-derived metals |

| Brush Wellman Beryllium Products Products - Cont. E-Materials - Family of low expansion, lightweight electronic packaging materials - Composites of beryllium metal and beryllium oxide Beryllium Oxide/ Chemicals - Ceramic-grade beryllium oxide powder - Specialty beryllium-containing chemicals |

| Brush Wellman Beryllium Products Facilities Elmore, Ohio Fremont, California |

| Key Product Attributes Be/AlBeMet(tm) Light Weight (Density) High Stiffness (Elastic Modulus) High Thermal Conductance/Capacity Low Thermal Expansion Be Transparent to X-Rays Neutron Reflector |

| Brush Wellman Beryllium Products Primary Competition...Alternative Materials Organic Composites (e.g. Carbon epoxy) Metal Matrix Composites (e.g. Al - silicon carbide) Pyrolytic graphite Titanium Aluminum (high strength grades) |

| Major Defense/Aerospace Applications for Brush Wellman Beryllium Products Optics Optical substrate and support structure for visual and infrared target acquisition systems (fighter aircraft, helicopters, tanks), surveillance systems and astronomical telescopes. Satellites Structures and sensors for defense and commercial telecommunications satellites. Electronics Electronic packaging for defense avionics, radar and electronic countermeasures systems for helicopters and fighter aircraft. Applications include circuit boards, covers and packages. |

| Major Commercial Applications for Brush Wellman Beryllium Products X-ray Windows Radiographic tube components for ? medical diagnostic equipment (x-ray, mammography, CAT-scan), and ? industrial x-ray equipment Optical Scanners Mirrors for laser scanners used in reprographic and other high- performance laser applications. Motion control Structural components for high-precision semiconductor processing and industrial robotic equipment |

| TMI - From a Customer Perspective WHAT TMI provides our customers the ability to demand varied performance (electrical, thermal, or mechanical) from a metal surface area or section. WHO We provide this "service" to the telecommunication, automotive, computer, semiconductor and other industries. HOW By offering various forms of strip metal products: clad metals, plated metals, electron beam welded, solder plated, reflowed or printed-on, milled and/or skived metal strip or various combinations of the above. |

| Our Major Markets Automotive Telecommunications Computer Jewelry Semiconductor Appliances Medical Aircraft Automotive Telecom Computer Misc. 44 24 26 6 Misc. Telecom Computer Automotive |

| Our Major Applications Capacitors Coins and Tokens Connectors Contact Probes Fuses Leadframes Micro Motor Microwave Potentiometers Relays Sensors Solder Clips Switches Air Bag Sensor Leadframe Connectors |

| Electroplating Precious and non-precious metals Overall and selective stripe capabilities Combination with current TMI technologies |

| Stripe Plating Application Cellular Phone Battery Contact Base Material: BeCu Overall Ni plating Selective Au (one side) Selective SnPb (both sides) Base Material |

| Competitive Advantage Quality QS 9000 / ISO 9002 State-of-the-art equipment Vision Systems / PLC Systems for consistent quality Design Support Technical knowledge Engineering expertise Overall Capabilities Slitting and leveling Inlay / Electron-Beam Welding / Solder / Milling / Skiving / Plating Any combination of the above processes Large coil handling capability |

| Strategic Concept Total capability under one roof Make it easy for our customers to get what they need to satisfy their customers' requirements Make our customers competitive with reliable products Solve problems for our customers with engineered strip metal solutions Explore and develop new markets and geographic regions for manufacturing (China). |

| Growth in Electroplating Precious and non-precious metals Overall and selective stripe plating capabilities Combination with other TMI technologies Proprietary closed contact plating technology Building additional lines to further increase capacity |

| Summary From 1992-2000 TMI sales more than quadrupled. 2001 through 2003 proved to be extremely difficult years due to major served markets being severely depressed; however, TMI remained profitable all three years. We have added major new technical capabilities using state of the art equipment in precious metal electroplating to better serve worldwide customer demand (both technical & capacity). We are ISO and QS registered. Additional Plating technology and capacity have been added to better service market demands. We are making further inroads into new markets (energy) and other markets (consumer, medical, appliance, construction),and new products for current markets in order to broaden our served market base and will have a much different served market profile by 2005/2006. |

| Our focus is on materials, circuitry, subassemblies and packaging for the wireless & fiber-optic telecom market, specifically the signal amplifiers... Signal amplifiers transmit signals through air (wireless) or optical fiber media by boosting signal strength while maintaining integrity. Thermal management and reliability properties are of paramount importance. Signal amplifiers are critical active components located in base stations for wireless (cellular) and in regenerator stations along fiber-optic (Internet) links. |

| Our Overall Strategy Vertically integrate materials to subsystem assembly, providing customized solutions Meet the Customer's needs Materials or subassemblies Fast Flexible Manufacturing Systems Responsive to market needs |

| Business Groups Packaging Electronic Packaging Products Circuitry Circuits Processing Technology Materials Brush Ceramic Products |

| Electronic Packaging Products Located in Newburyport, MA Products RF Power Packages for base stations in cellular phone & wireless data networks, for cellular handsets, for military radar applications and for digital TV Automotive Components for ignition systems in cars and trucks Power Circuit Assemblies for DC motor controls |

| Circuits Processing Technology (CPT) Located in Oceanside, CA Products High Frequency Military and Aerospace Circuitry used in military radar and missile guidance High Frequency Wireless circuitry for satellite communications Fiber Optic Package components for amplifiers in fiber optic networks |

| Brush Ceramic Products Located in Tucson, AZ Products RF Power Package Components for cellular base stations, high definition television, and cable TV Fiber Optic Package components for amplifiers in fiber optic networks Gas Laser Components for medical and research applications Automotive components for ignition systems |

| Williams Advanced Materials Overview Williams is a supplier of high-purity, specialty metals serving the wireless, photonics, data storage, high temperature joining, traditional microelectronics and performance film markets. Established 1918. Subsidiary of Brush Engineered Materials Business Groups Packaging Material Products - Solder preforms, bonding wire, FLA's, clad material and refining. These materials are used in photonic, wireless, traditional semiconductor and hybrid microelectronic packaging applications. Specialty Alloy Products - Braze materials and structural alloys. These materials are used in electron tube, photonic and aerospace applications. PVD (Physical Vapor Deposition) products - Precious metal and non-precious metal sputtering and evaporation materials, refining and related services. These materials are used in wireless, photonic, thin film heads, optical media, hybrid microelectronic and performance film applications. |

| WAM Headquarters Buffalo, NY USA - Manufacturing Facility 100,000 sq. ft. overall, 6,500 sq. ft. of cleanroom, state-of-the-art machining/ milling/rolling/stamping/ cladding centers, hydrostatic wire extrusion, high purity refining/recycling, metals casting, automated plating, full analytical capabilities, product Research & Development |

| Far East Operations Singapore - WAM Far East Pte. Ltd. 5,000 sq. ft., 2,500 sq. ft. of cleanroom, automated assembly operations, hydrostatic wire process, product development. PVD bonding operation. |

| Far East Operations Subic Bay, Philippines Combo-Lid(r), low-cost lids and preform - assembly, inspection and packaging |

| Far East Operations Taiwan Target bonding services. Low cost production capabilities. |

| Specialty Alloys Operations Wheatfield, NY USA- Williams Specialty Alloys 30,000 sq. ft. with volume vacuum casting, rolling, annealing, powder atomizing and machining. 10 acres for expansion |

| WAM Thin Film Products Operations Brewster, NY USA - WAM TFP 35,000 sq. ft. with vacuum melting, hot-pressing, milling, Hot & cold rolling automated machining and target bonding capabilities. Acreage to more than double our facility as needed. |

| Target Bonding Centers Buffalo, NY Brewster, NY Santa Clara, CA Limerick, Ireland Singapore Taiwan |

| Williams Advanced Materials Service and Support Regional Offices (Sales and Applications Engineering support) Santa Clara, CA Manila, Philippines London, England Buffalo, NY Singapore Boston, MA Guadalajara, Mexico Dallas, TX Brewster, NY Tucson , AZ Taipei, Taiwan Worldwide Representatives Florida France Israel Korea India China Japan Italy Germany |

| Solder preforms and clad materials Hybrid Microelectronic Device Williams Advanced Materials Packaging Material Products Products Markets Wireless, Photonics and Hybrid/ Traditional Microelectronic Devices Typical End-uses Cell phones, LEDs, fiber-optic networks, PC's, military electronics, avionics, medical electronics, appliances Combo-Lids(r) - Frame/lid assembly Hermetic sealing Clad Materials Thermal management Bonding Wire Electronic interconnect Solder Preforms Component attachment Refining Scrap recovery Markets |

| Electron Tube WAMBRAZETM Materials Williams Advanced Materials Specialty Alloy Products Products Markets Braze materials Powder, ribbon and preform Structural Alloys Monel Cupronickel Nickel Tunsten Markets Electron Tube, Photonics, Aerospace, microelectronic packaging Typical End-uses Cellular base stations, lasers, x-ray machines, industrial microwaves |

| Cellular Phone (wireless) Sputtering Targets Williams Advanced Materials Physical Vapor Deposition(PVD) Products Products Precious Metal Sputtering Targets and Evaporation Materials Precious Metal Refining Services Non-precious Metal Sputtering Targets and Evaporation Materials Markets Wireless microelectronics, Optical media, Photonics, thin film heads, glass, decorative, wear resistance, performance film Typical End-uses Wireless and fiber optic components, Recordable CDs, DVDs, Architectural glass, Hard Disks, faucets, automotive glass Markets |

| Williams Strategic Leverage Ensuring Distinctive Abilities Translate to Maximum Returns Over 80 years of metal management and fabrication experience Ability to efficiently manage precious metals critical to customers One-stop Shopping Comprehensive product offering Allows customer to reduce supplier base Industry leading lead times Reduces Total Cost to Customer - Inventory turns Alleviates planning "headaches" Fully Integrated Operations In house fabrication, refining and analysis Reduced cycle times and single point of contact for metal needs Service WAM provides a unique, coordinated response to customers We help our customers do their jobs - sales, engineering, accounting, etc. We also prepare our customers for the future |

| Beryllium Health and Safety Improved worker protection programs in place Rates of sensitization down among new workers CBD litigation claims have declined to 13 cases Strong focus on regulations related to beryllium exposure Brush has continued to make progress on issues related to beryllium health and safety |

| Litigation Caseload has dropped dramatically in recent years Total Plaintiffs Total Cases Pending (including spouses) 12/31/02 33 70 12/31/03 15 33 03/31/04 14 34 07/02/04 13 32 |