Forward-Looking Statements + 2024 ICR Conference | 01.08.24 2 This presentation contains forward-looking statements, including statements regarding: anticipated benefits of the Company’s global platform and strategic transformation, including profitable growth, investments in brand-building capability; factors that are expected to contribute to growth trends; preliminary 2023 fourth quarter and fiscal year results, estimated debt pay-down and inventory as of year-end; the strategic process for the Sperry brand; and aspirational growth targets and bank-defined debt leverage ratio. In addition, words such as "estimates," "anticipates," "believes," "forecasts," "step," "plans," "predicts," "focused," "projects," "outlook," "is likely," "expects," "intends," "should," "will," "confident," variations of such words, and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions ("Risk Factors") that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. Risk Factors include, among others: changes in general economic conditions, employment rates, business conditions, interest rates, tax policies, inflationary pressures and other factors affecting consumer spending in the markets and regions in which the Company’s products are sold; the inability for any reason to effectively compete in global footwear, apparel and consumer-direct markets; the inability to maintain positive brand images and anticipate, understand and respond to changing footwear and apparel trends and consumer preferences; the inability to effectively manage inventory levels; increases or changes in duties, tariffs, quotas or applicable assessments in countries of import and export; foreign currency exchange rate fluctuations; currency restrictions; supply chain or other capacity constraints, production disruptions, quality issues, price increases or other risks associated with foreign sourcing; the cost and availability of raw materials, inventories, services and labor for contract manufacturers; labor disruptions; changes in relationships with, including the loss of, significant wholesale customers; risks related to the significant investment in, and performance of, the Company’s consumer-direct operations; risks related to expansion into new markets and complementary product categories; the impact of seasonality and unpredictable weather conditions; changes in general economic conditions and/or the credit markets on the Company’s manufacturers, distributors, suppliers, joint venture partners and wholesale customers; changes in the Company’s effective tax rates; failure of licensees or distributors to meet planned annual sales goals or to make timely payments to the Company; the risks of doing business in developing countries, and politically or economically volatile areas; the ability to secure and protect owned intellectual property or use licensed intellectual property; the impact of regulation, regulatory and legal proceedings and legal compliance risks, including compliance with federal, state and local laws and regulations relating to the protection of the environment, environmental remediation and other related costs, and litigation or other legal proceedings relating to the protection of the environment or environmental effects on human health; the potential breach of the Company’s databases or other systems, or those of its vendors, which contain certain personal information, payment card data or proprietary information, due to cyberattack or other similar events; problems affecting the Company’s supply chain or distribution system, including service interruptions at shipping and receiving ports; strategic actions, including new initiatives and ventures, acquisitions and dispositions, including the disposition of the Keds® business, Hush Puppies® intellectual property in China, Hong Kong and Macau, and the new operating model for Merrell and Saucony businesses in China, and the Company’s success in integrating acquired businesses, and implementing new initiatives and ventures; risks related to stockholder activism; the potential effects of outbreaks of COVID-19 or future health crises on the Company’s business, operations, financial results and liquidity; the risk of impairment to goodwill and other intangibles; changes in future pension funding requirements and pension expenses; and additional factors discussed in the Company’s reports filed with the Securities and Exchange Commission and exhibits thereto. The foregoing Risk Factors, as well as other existing Risk Factors and new Risk Factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these or other risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Furthermore, the Company undertakes no obligation to update, amend, or clarify forward-looking statements. Non-GAAP Information Measures referred to in this release as “adjusted” financial results and the financial results of the "ongoing business" are non-GAAP measures. Adjusted financial results exclude environmental and other related costs net of recoveries, impairment of long-lived assets, reorganization costs, debt modification costs, gain on the sale of businesses, trademarks and intangible assets, Sperry® store closure costs, costs associated with divestitures. The financial results of the ongoing business exclude financial results from the Keds business, Wolverine Leathers business and reflect an adjustment for the transition of our Hush Puppies North America business to a licensing model in the second half of 2023. The Company believes these non-GAAP measures provide useful information to both management and investors because they increase the comparability of current period results to prior period results by adjusting for certain items that may not be indicative of core operating results and enable better identification of trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis. Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. The Company has provided a reconciliation of the non-GAAP revenue financial measure to the directly comparable GAAP financial measure at the end of the release. The Company is not providing a reconciliation of its forward-looking full year and fourth quarter, fiscal 2023 non-GAAP preliminary expected results with respect to adjusted gross margin and adjusted pretax earnings because it does not currently have sufficient information to accurately estimate all of the variables and individual adjustments for such reconciliation. As such, the Company cannot, without unreasonable effort, estimate on a forward-looking basis the impact these variables and individual adjustments will have on its reported results. The Company has provided fiscal 2023 expected adjusted pre-tax earnings as the final tax provision is not compete.

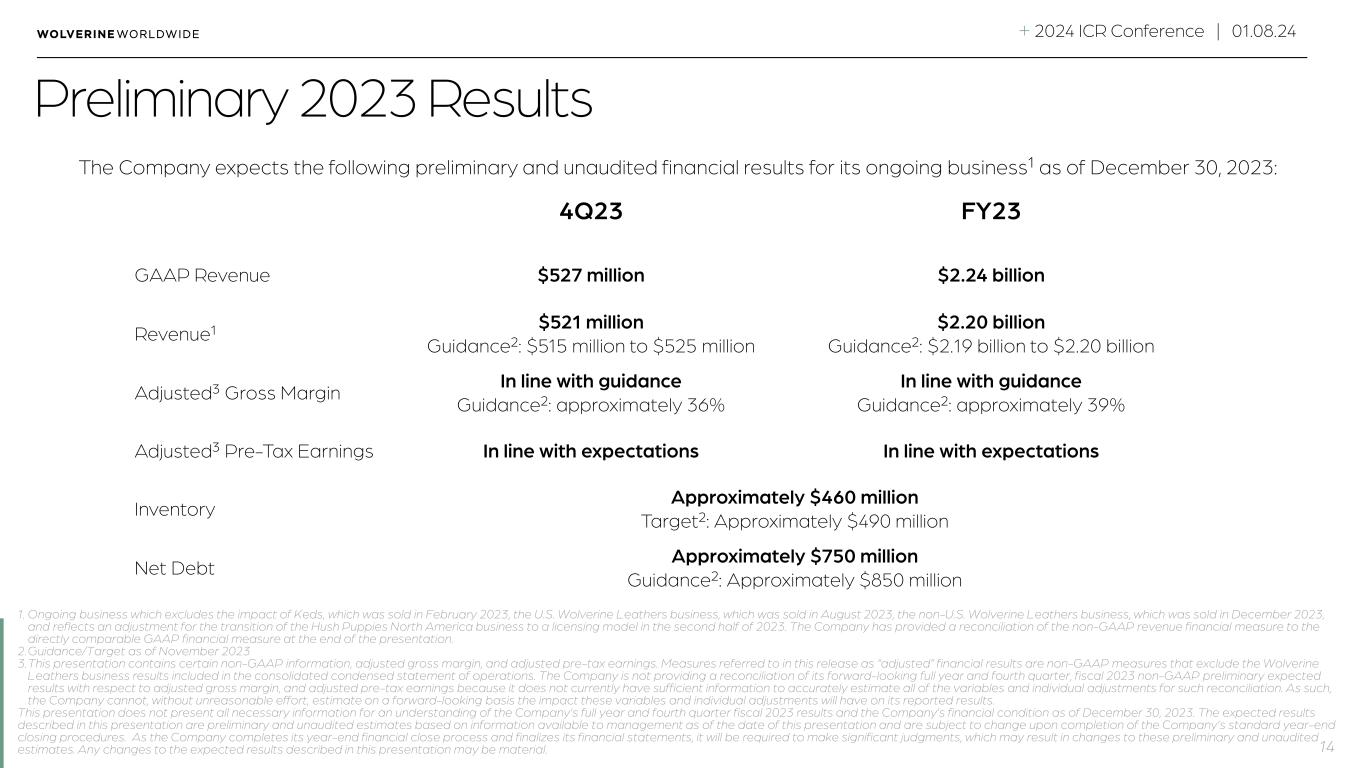

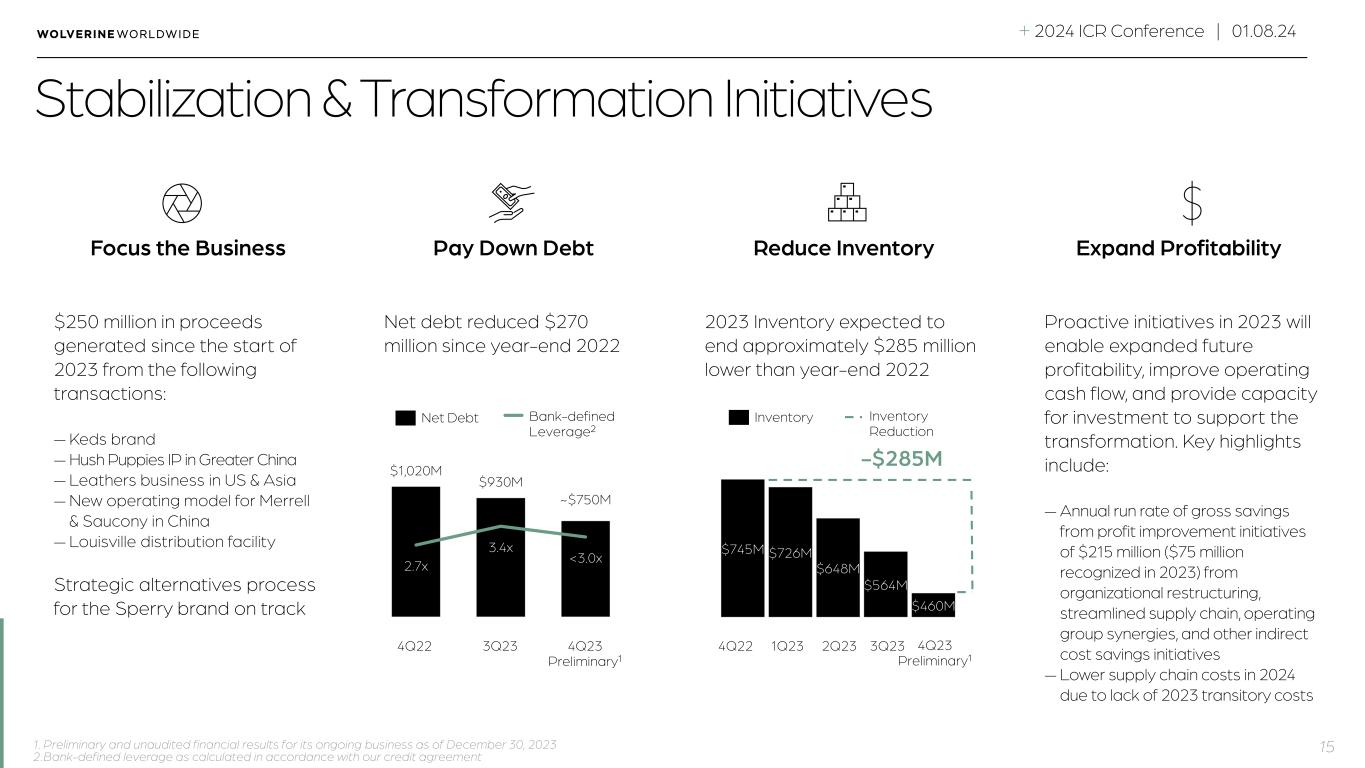

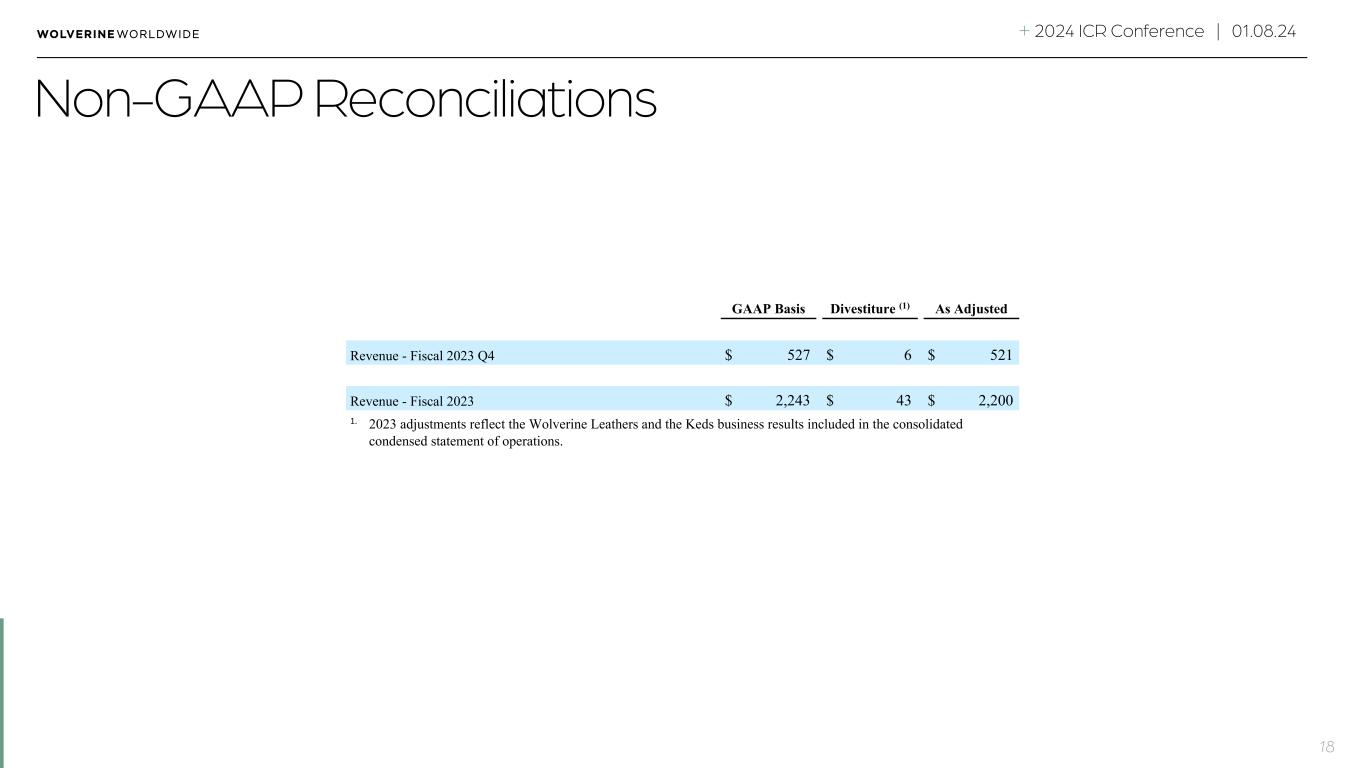

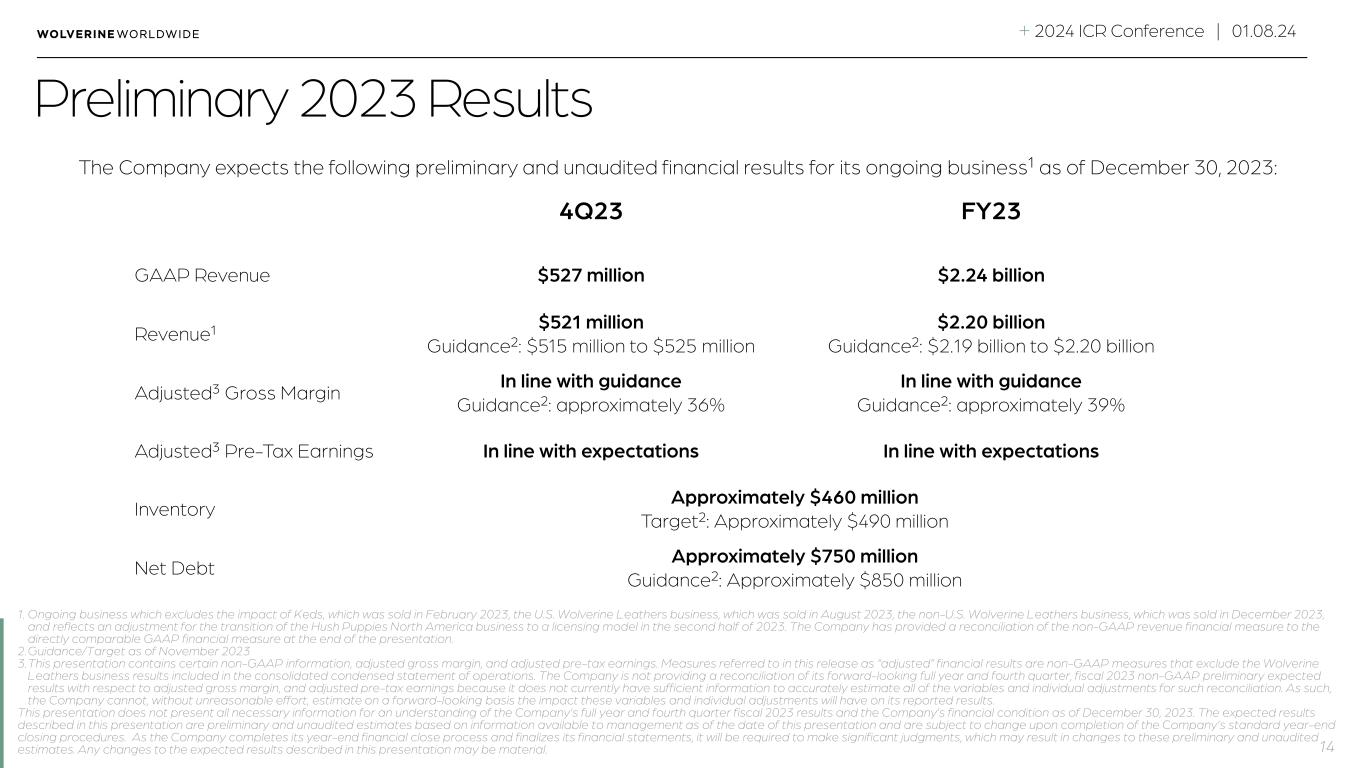

Preliminary 2023 Results + 2024 ICR Conference | 01.08.24 14 The Company expects the following preliminary and unaudited financial results for its ongoing business¹ as of December 30, 2023: 4Q23 FY23 GAAP Revenue $527 million $2.24 billion Revenue¹ $521 million Guidance²: $515 million to $525 million $2.20 billion Guidance²: $2.19 billion to $2.20 billion Adjusted³ Gross Margin In line with guidance Guidance²: approximately 36% In line with guidance Guidance²: approximately 39% Adjusted³ Pre-Tax Earnings In line with expectations In line with expectations Inventory Approximately $460 million Target²: Approximately $490 million Net Debt Approximately $750 million Guidance²: Approximately $850 million 1. Ongoing business which excludes the impact of Keds, which was sold in February 2023, the U.S. Wolverine Leathers business, which was sold in August 2023, the non-U.S. Wolverine Leathers business, which was sold in December 2023, and reflects an adjustment for the transition of the Hush Puppies North America business to a licensing model in the second half of 2023. The Company has provided a reconciliation of the non-GAAP revenue financial measure to the directly comparable GAAP financial measure at the end of the presentation. 2.Guidance/Target as of November 2023 3.This presentation contains certain non-GAAP information, adjusted gross margin, and adjusted pre-tax earnings. Measures referred to in this release as “adjusted” financial results are non-GAAP measures that exclude the Wolverine Leathers business results included in the consolidated condensed statement of operations. The Company is not providing a reconciliation of its forward-looking full year and fourth quarter, fiscal 2023 non-GAAP preliminary expected results with respect to adjusted gross margin, and adjusted pre-tax earnings because it does not currently have sufficient information to accurately estimate all of the variables and individual adjustments for such reconciliation. As such, the Company cannot, without unreasonable effort, estimate on a forward-looking basis the impact these variables and individual adjustments will have on its reported results. This presentation does not present all necessary information for an understanding of the Company’s full year and fourth quarter fiscal 2023 results and the Company’s financial condition as of December 30, 2023. The expected results described in this presentation are preliminary and unaudited estimates based on information available to management as of the date of this presentation and are subject to change upon completion of the Company’s standard year-end closing procedures. As the Company completes its year-end financial close process and finalizes its financial statements, it will be required to make significant judgments, which may result in changes to these preliminary and unaudited estimates. Any changes to the expected results described in this presentation may be material.