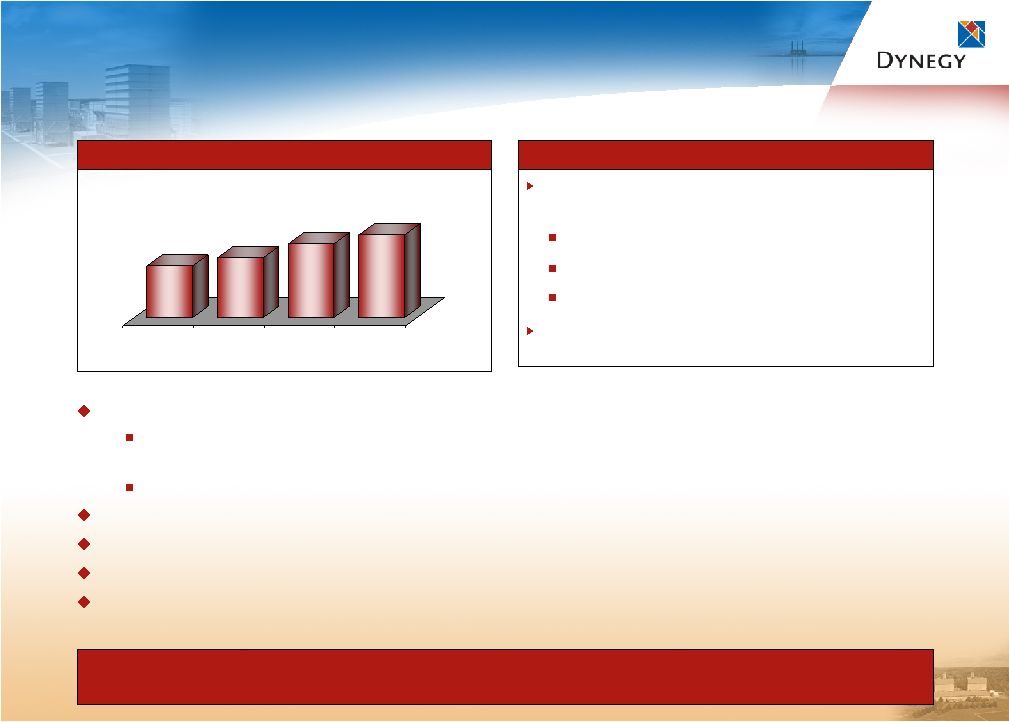

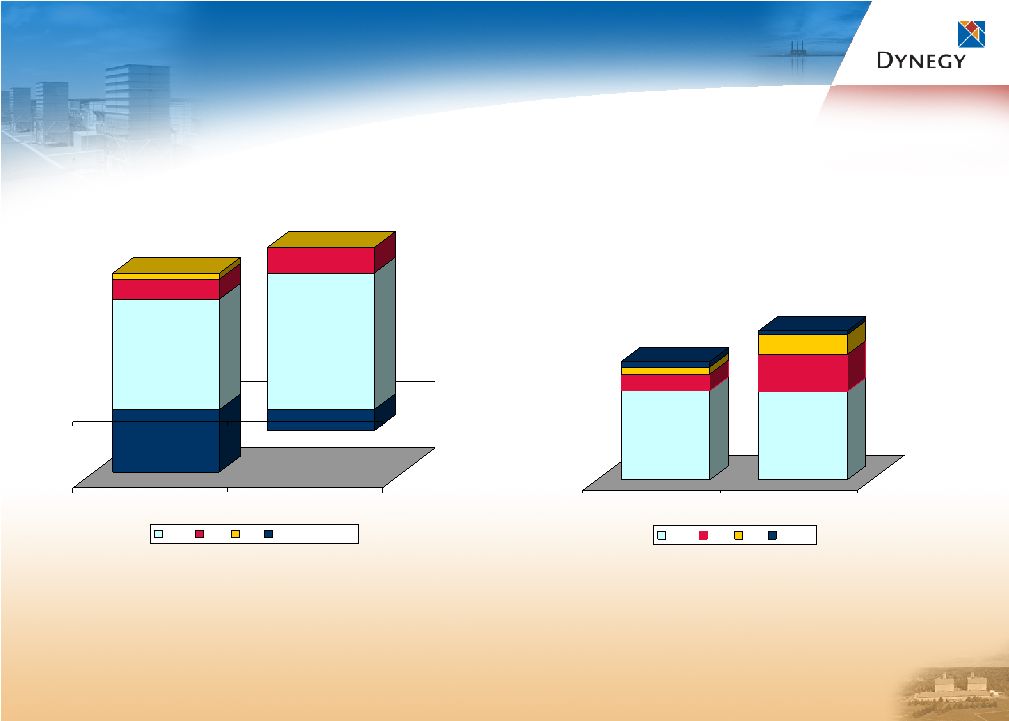

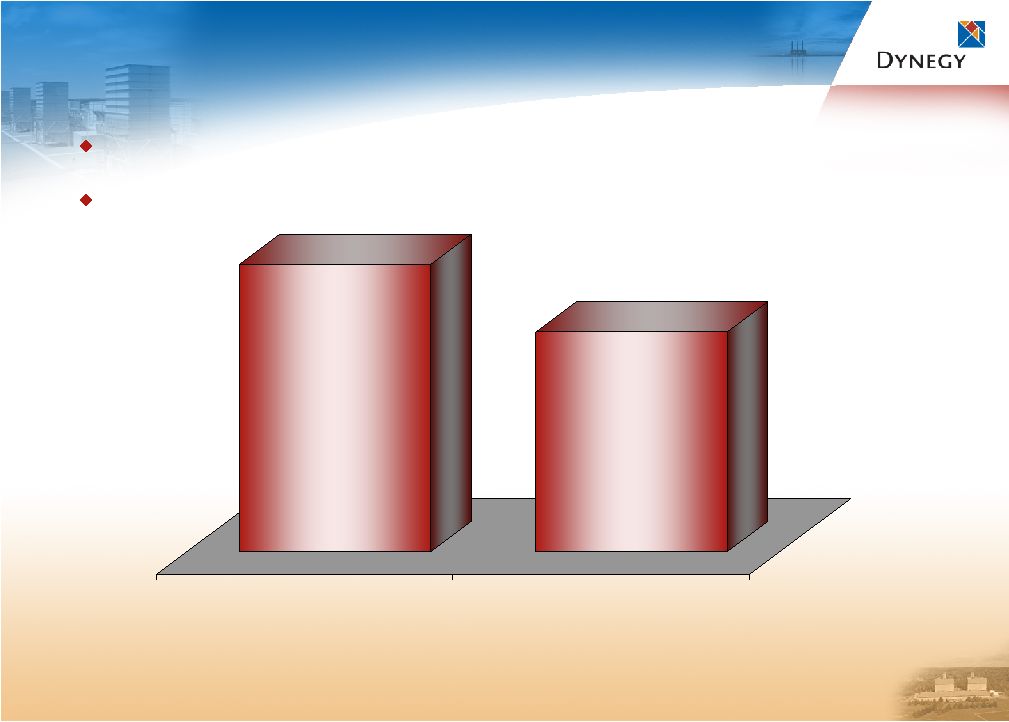

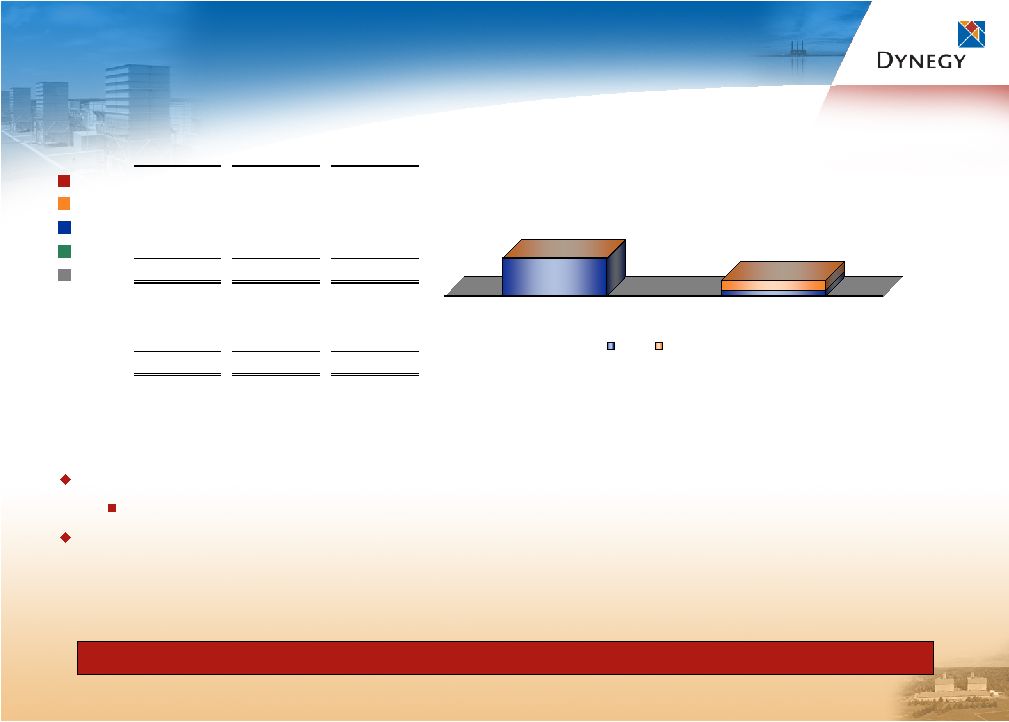

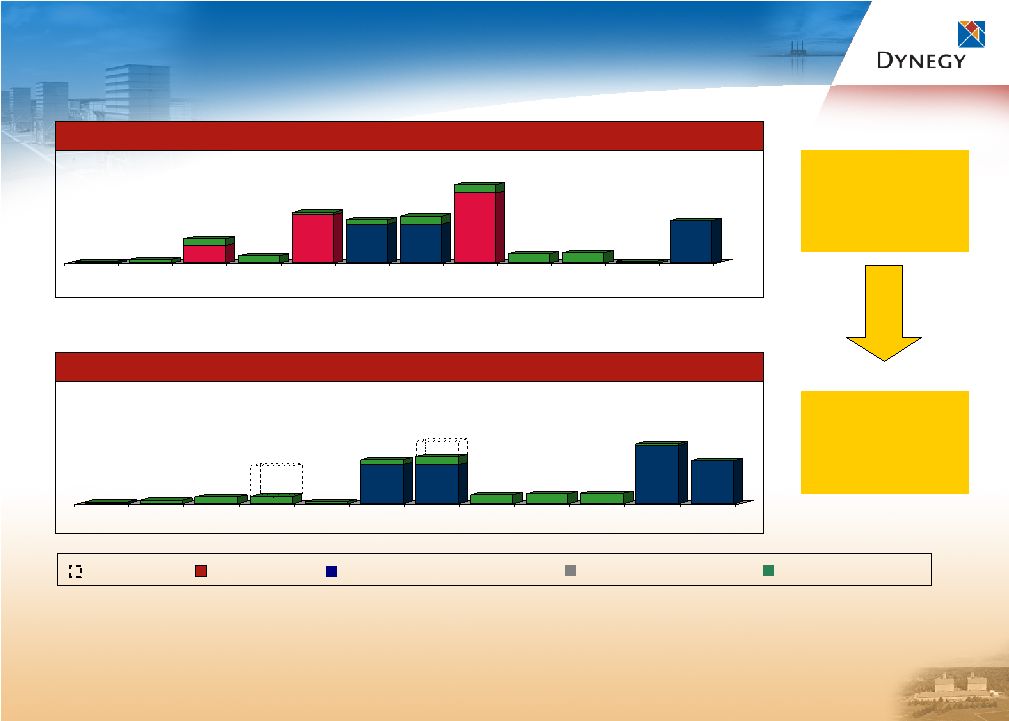

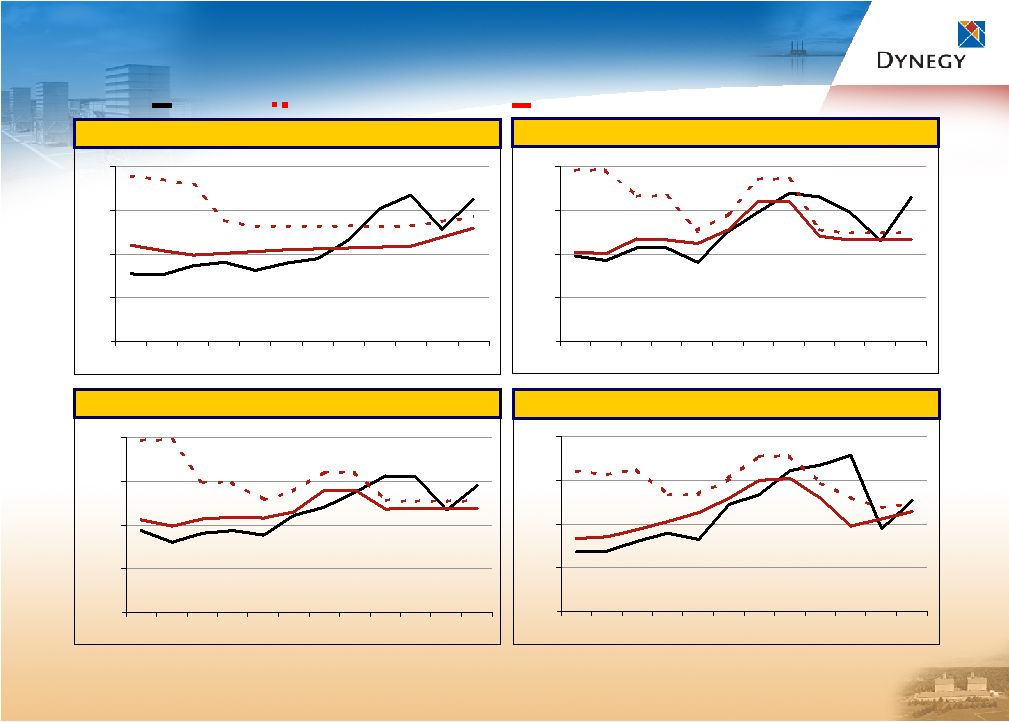

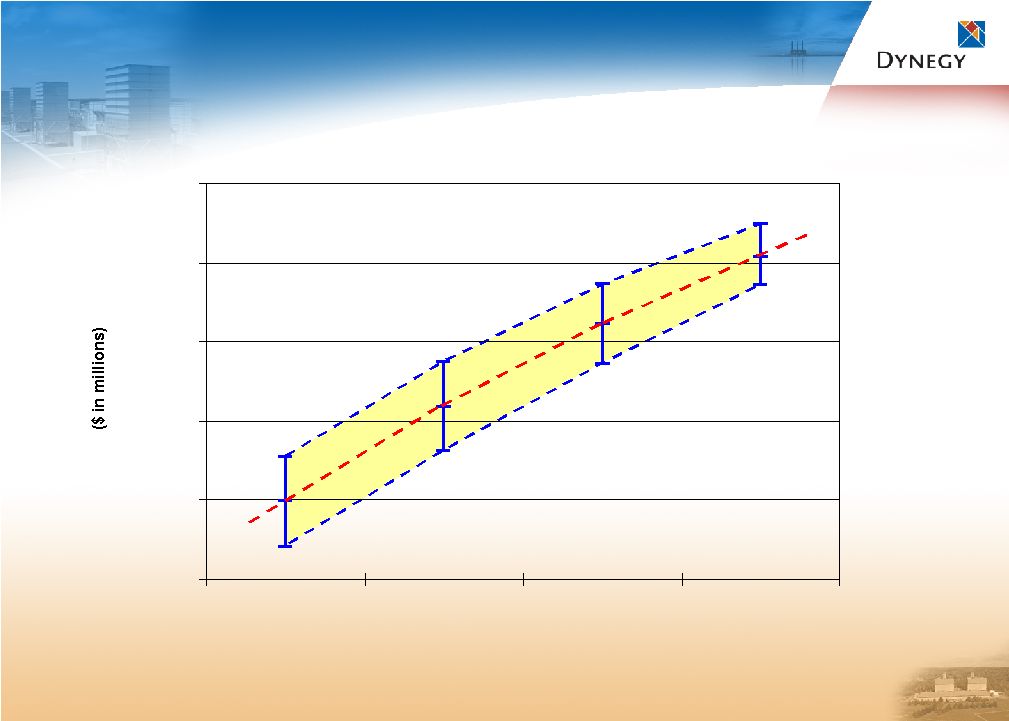

6 Power Generation 12,820 MW 2006E EBITDA: $565 - $660MM Consolidated 2006E EBITDA: $480MM - $585MM DYNEGY IS A PURE PLAY INDEPENDENT POWER PRODUCER DYNEGY IS A PURE PLAY INDEPENDENT POWER PRODUCER Other (Corp.) 2006E EBITDA: $(100) - $(90)MM (1) CRM 2006E EBITDA: $15MM Midwest 7,551 MW (2) 2006E EBITDA: $490 - $540MM 13 facilities in IL, MI, OH and KY Includes 3,452 MW of low production cost generation 3,210 MW coal-fired 242 MW oil-fired Favorable long-term transportation and coal supply contracts Expiration of below market AmerenIP contract at end of 2006 potentially increases EBITDA Net long SO 2 allowances in 2006 – 2009 Completed conversion to PRB coal in 2005 Entered into comprehensive settlement with the EPA (Baldwin Consent Decree) Northeast 2,803 MW 2006E EBITDA: $80 - $115MM 3 facilities serving attractive NY market Danskammer 371 MW coal facility with additional 130 MW gas/oil units Can capture attractive dark spreads in NY Roseton 1,210 MW dual-fuel (oil / gas) facility Can capture significant option value from oil / gas price spreads Sithe Independence (3) 1,092 MW gas-fired facility Low 7,750 heat rate 750 MW long-term capacity contract with ConEd (‘A’ Rated) through 2014 South 2,466 MW (2) 2006E EBITDA: ($5) - $5MM 5 facilities located in TX, NC, GA, LA and NV 1,566 MW gas and 900 MW dual-fuel (gas/oil) New Cogen Lyondell contract beginning 2007 on significantly improved terms Remaining tolling agreement is Kendall, which has been restructured through 2008 Substantive out-of-the-money legacy trading positions expected to roll off by 2007 Represents total G&A which has been significantly reduced to approximately $130 million in 2006 Also includes interest income of approximately $30 million (1) G&A no longer allocated to segments in 2006. (2) Pro Forma for the sale of our interest in West Coast Power and acquisition of the remaining 50% interest in Rocky Road. These transactions are expected to close early 2006. (3) DHI contractual agreements with Independence reflected in CRM for DHI. Diversified portfolio with significant baseload cash flow. |