As filed with the Securities and Exchange Commission on October 29, 2007

Registration Statement No. 333-145356

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3

TO

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NANOSPHERE, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| | | | | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 2835

(Primary Standard Industrial

Classification Code Number) | | 36-4339870

(I.R.S. Employer

Identification Number) |

4088 Commercial Avenue

Northbrook, Illinois 60062

(847) 400-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William P. Moffitt III

President and Chief Executive Officer

Nanosphere, Inc.

4088 Commercial Avenue

Northbrook, Illinois 60062

(847) 400-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | |

Esteban A. Ferrer, Esq.

Ann Lawrence, Esq.

Paul, Hastings, Janofsky & Walker LLP

1055 Washington Boulevard

Stamford, CT 06901

Telephone: (203) 961-7400

Facsimile: (203) 674-7716 | | William J. Whelan III, Esq.

Cravath, Swaine & Moore LLP

Worldwide Plaza

825 Eighth Avenue

New York, NY 10019

Telephone: (212) 474-1000

Facsimile: (212) 474-3700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | |

| | | | | | | Proposed Maximum

| | | Proposed Maximum

| | | |

Title of Each Class of

| | | Amount to

| | | Offering Price

| | | Aggregate Offering

| | | Amount of

|

| Securities to be Registered | | | be Registered(1) | | | Per Share | | | Price | | | Registration Fee(2) |

| Common Stock, $0.01 par value per share | | | 8,050,000 | | | $16.00 | | | $128,800,000 | | | $3,955 |

| | | | | | | | | | | | | |

| | |

| (1) | | Includes 1,050,000 shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

SUBJECT TO COMPLETION, DATED OCTOBER 29, 2007

7,000,000 Shares

Common Stock

Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $14.00 and $16.00 per share. We have applied to list our common stock on the NASDAQ Global Market under the symbol “NSPH”.

We are offering 7,000,000 shares of our common stock. The underwriters have an option to purchase a maximum of 1,050,000 additional shares of common stock to cover over-allotments of shares.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 9.

Brookside Capital Partners Fund, L.P., one of our principal stockholders, has indicated an interest in purchasing $12.5 million of our common stock in this offering at the initial offering price. Brookside Capital Partners Fund, L.P. is not under any obligation to purchase any shares in this offering, and their interest in purchasing shares in this offering is not a commitment to do so.

| | | | | | | | | | | | | |

| | | | | | Underwriting

| | | | |

| | | Price to

| | | Discounts and

| | | Proceeds to

| |

| | | Public | | | Commissions | | | Nanosphere, Inc. | |

| |

| Per Share to Public | | $ | | | | $ | | | | $ | | |

| Per Share to Brookside Capital Partners Fund, L.P. | | $ | | | | $ | | | | $ | | |

| Total | | $ | | | | $ | | | | $ | | |

Delivery of the shares of common stock in book-entry form will be made on or about , 2007.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse

Piper Jaffray

Leerink Swann

Allen & Company LLC

The date of this prospectus is , 2007.

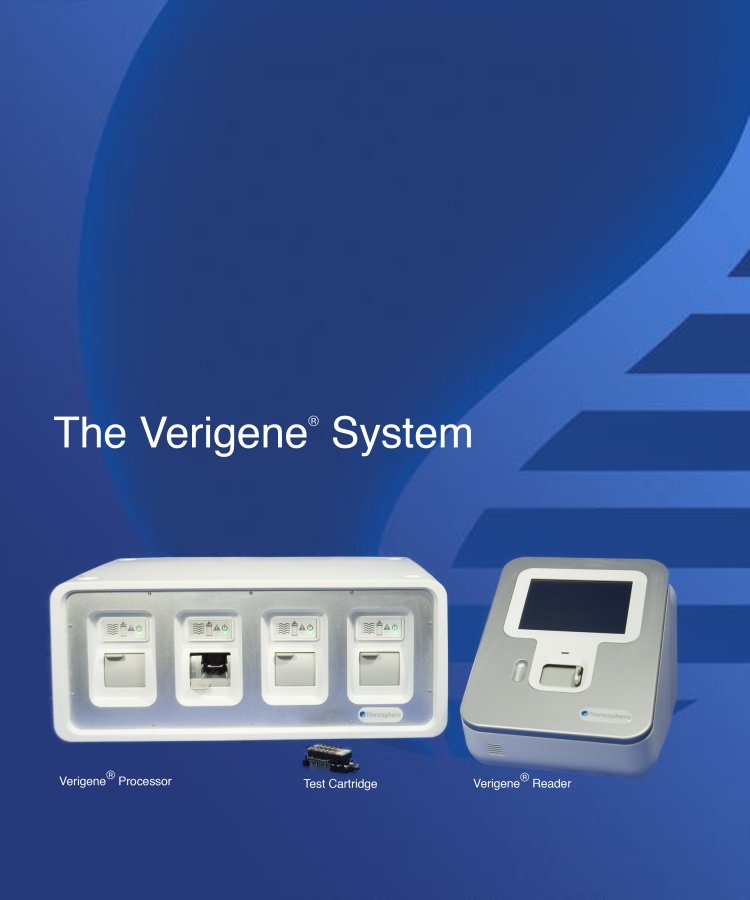

| The Verigene® System Verigene® Processor Test Cartridge Verigene® Reader |

TABLE OF CONTENTS

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information contained in this document is accurate only on the date of this document. Our business, financial condition, results of operations and prospectus may have changed since that date.

Dealer Prospectus Delivery Obligation

Until , 2007 (25 days after the commencement of the offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” beginning on page 9, and the financial statements and notes to those financial statements, before making an investment decision. Unless the context indicates otherwise, the references in this prospectus to “Nanosphere,” “we,” “us” and “our” refer to Nanosphere, Inc. Nanosphere, Inc. does not have any subsidiaries.

Our Company

Nanosphere develops, manufactures and markets an advanced molecular diagnostics platform, the Verigene System, that enables simple, low cost and highly sensitive genomic and protein testing on a single platform. Our proprietary nanoparticle technology simplifies molecular diagnostic testing, achieves ultra-sensitive protein detection at limits beyond current diagnostic technologies, provides the ability to multiplex, or run multiple tests at the same time on the same sample, and enables the development of a broad menu of test assays to be performed on a single platform. We received 510(k) clearance from the United States Food and Drug Administration, or FDA, for the Verigene System and our warfarin metabolism assay on September 17, 2007 and for our hyper-coagulation assay on October 12, 2007. Upon receipt of FDA clearance, we commenced sales to hospital-based laboratories and academic research institutions in the United States, which we believe is the primary market for our products.

We are currently developing diagnostic tests for a variety of medical conditions including cancer, neurodegenerative, cardiovascular and infectious diseases, as well as pharmaco-genomics, or tests for personalized medicine. We anticipate that we will submit applications to the FDA for clearance of tests for cystic fibrosis, herpes, cervical cancer, respiratory illness, recurrent prostate cancer and cardiovascular disease during the next 36 months, and we anticipate we will submit two such tests within the next 12 months. Since our inception, we have had minimal revenues which have been derived from the sale of the Verigene System, including cartridges and related products, to research laboratories pursuant to government contracts.

Our Market Opportunity

According to Boston Biomedical Consultants, the global in vitro diagnostics market was estimated to be $34 billion in 2006. One of the fastest growing segments of the in vitro diagnostics market is the $2.3 billion molecular diagnostics market which, together with our estimated market for our initial protein assays, comprises a more than $3.0 billion current market opportunity. Growth in our market will be driven by the continued conversion of traditional testing methods to molecular methods, an acceleration in the discovery of genomic biomarkers resulting in opportunities for novel tests, the emergence of tests for pharmaco-genomics, the availability of technology for more sensitive protein detection resulting in novel protein tests and the growing understanding of the inter-relationship between genetics and proteins in disease states.

The most widely used method for genomic testing is polymerase chain reaction, or PCR, which involves amplifying, or generating billions of copies of, the DNA sequence in question and then detecting the DNA with the use of fluorescent dyes. Due to the complexity, susceptibility to contamination and significant costs related to PCR and other amplification technologies, the molecular diagnostics market remains limited to reference laboratories, research facilities and laboratories associated with major hospitals, typically at academic teaching institutions, of which there are 200 to 300 in the United States. Moreover, due to the limited capability of many existing technologies, numerous testing platforms are required to perform even a limited menu of tests. PCR and other target amplification technologies also lack the capacity to multiplex in a cost effective manner.

Advances in molecular diagnostics have led to a broad array of new tests to detect genomic markers, however, many diseases are manifested at the protein, rather than the genetic, level. The most widely used method for protein testing is enzyme-linked immunosorbent assay, or ELISA. However, ELISA is often not sufficiently sensitive to detect protein biomarkers until the disease has progressed to an advanced stage and

1

biomarkers for several diseases have not been validated or commercialized because they exist in concentrations too low to be detected by current technologies. While mass spectrometry has emerged as an alternative approach to ELISA for protein detection due to its greater sensitivity, it is extremely costly, requires significant time and effort by highly trained personnel and is unable to detect long peptide chain proteins or misfolded proteins which are biomarkers for diseases such as transmissible spongiform encephalopathy, or mad cow, and Alzheimer’s.

The Verigene System

The Verigene System, recently cleared by the FDA, is a compact, bench-top molecular diagnostics workstation. It allows multiple tests to be performed on a single platform, including both genomic and protein assays, unlike most existing systems, which provide a diagnostic result for one test or specific niche. The Verigene System is comprised of a microfluidics processor, a reader, and disposable test cartridges. With a prepared sample, the Verigene System completes tests in 45 to 90 minutes and requires less than 20 minutes of technician time. The system incorporates several key features which we believe will make it attractive to a wide range of laboratories, including:

| | |

| | • | Low Cost and Complexity. The Verigene System is a low cost platform without the need for sophisticated instrumentation or complex reagent kits. |

| |

| | • | On Demand Testing. The Verigene System allows laboratories to economically run tests at the time they are ordered, unlike other systems where laboratories must wait to process patient samples in batches to control reagent and labor costs. |

| |

| | • | Multiplexing. The Verigene System enables high count multiplexing, or the ability to identify a large number of target molecules on the same sample in a single assay. |

| |

| | • | Direct Genomic Detection. The Verigene System utilizes a proprietary method to detect nucleic acids with greater specificity and without the complexity and risk of contamination inherent in the use of amplification techniques such as PCR, thereby increasing the reliability of test results. |

| |

| | • | Ultra-Sensitive Protein Detection. The Verigene System allows ultra-sensitive detection of proteins with at least 100 times greater sensitivity than current technologies such as ELISA. This may enable earlier detection of disease and the development of completely novel tests. |

We believe that the Verigene System’s ease of use, rapid turnaround times, relatively low cost and ability to support a broad test menu will simplify work flow and reduce costs for laboratories already performing molecular diagnostic testing and allow a broader range of laboratories, including those operated by local hospitals, to perform molecular diagnostic testing.

Our Initial Test Menu

We have received 510(k) clearance from the FDA for two initial assays: the warfarin metabolism test for which clearance was received in September 2007, and the hyper-coagulation test for which clearance was received in October 2007.

| | |

| | • | Hyper-coagulation. This assay is for the detection of genetic mutations associated with an increased risk for the development of blood clots. Hyper-coagulation tests for mutations associated with a pre-disposition to blood clots are currently among the most frequently conducted human genetic tests. Our hyper-coagulation panel consists of a multiplex of three genetic markers associated with a pre-disposition to blood clots. We believe that our assay enables the detection of these markers on a much simpler platform than current alternatives. |

| |

| | • | Warfarin Metabolism. This assay is a pharmaco-genomic test for the detection of genetic mutations that determine an individual’s ability to metabolize the oral anticoagulant warfarin, including Coumadin. Warfarin decreases blood clotting and is the most widely prescribed oral anticoagulant in North America and Europe. Because individuals metabolize warfarin differently, if administration of the drug is not managed carefully, it can lead to serious bleeding complications. Our assay is the first, and |

2

| | |

| | | currently the only, FDA cleared genetic diagnostic test to assess warfarin metabolism. Our test panel detects three genetic markers that play a critical role in metabolizing warfarin. Through detection of these genetic markers, doctors are able to determine the appropriate dosage level in a safer and more efficient manner than current methods. |

We are developing additional genomic assays, including tests for cystic fibrosis and for a range of infectious diseases including herpes simplex virus, human papillomavirus, and respiratory viruses, which we anticipate we will submit to the FDA for 510(k) clearance during the next 36 months.

In addition, we have an active program to develop tests based on established protein biomarkers and to validate new biomarkers where our ultra-sensitive technology may enable earlier detection of a broad range of diseases. We are conducting clinical studies to demonstrate the diagnostic value of our first two ultra-sensitive protein assays, which we anticipate we will submit to the FDA for 510(k) clearance during the next 36 months:

| | |

| | • | Prostate Specific Antigen — Recurrent Prostate Cancer. This assay is being developed to enable the early detection of recurrent prostate cancer in men following prostate removal. Prostate specific antigen, or PSA, is a protein produced by the cells of the prostate gland and may be found in an increased amount in those with prostate cancer. However, current technologies have limited detection capabilities and on average can only diagnose recurrence three and a half years later. We expect that our ultra-sensitive PSA detection assay will detect recurrence within a few months after surgery enabling earlier intervention and treatment. |

| |

| | • | Cardiac Troponin I — Cardiac Risk Stratification. This assay is being developed for the detection of cardiac troponin I in patients suspected of having cardiovascular disease. Troponin I is a protein that is found in cardiac muscle and is released when the heart is injured, for instance during a myocardial infarction. Cardiac troponin tests are used to diagnose a heart attack and evaluate mild to severe heart injury in patients experiencing heart/chest discomfort. However, limitations of current detection levels of cardiac troponin I often result in the failure to accurately diagnose all cases of cardiovascular disease. Our initial clinical tests have demonstrated the ability to reliably identify a rise in cardiac troponin I well below the current limits of detection. |

Through our biomarker validation program, we are also working to validate novel protein targets for Alzheimer’s disease, stroke, sepsis, and kidney disease, which we believe will create new protein-based diagnostic tests.

Other Applications of Our Technology

Our technology is broadly applicable beyond the clinical diagnostics market in both research and industrial applications and we expect to continue to seek opportunities, either directly or through outlicensing arrangements, to commercialize our technology in these markets. For example, for over two years the Verigene System has been in use in research laboratories supporting collaborations and independent research in areas including ovarian cancer, mad cow disease, and HIV. In addition, we are currently working with the FDA on a joint research program to develop an H5N1 avian flu assay. In the industrial market, we have developed and delivered a biosecurity platform for the detection of various bioterrorism agents to the Technical Support Working Group, an agency affiliated with the U.S. Department of Defense.

Our Intellectual Property Portfolio

Our patent portfolio is comprised, on a worldwide basis, of 80 issued patents and 150 pending patent applications which, in either case, we own directly or for which we are the exclusive licensee. We licensed our initial core technology from the International Institute for Nanotechnology at Northwestern University in May 2000. This formed the basis for a sustained relationship with Northwestern whereby we have rights to future developments in the field of biodiagnostics. This relationship provides us with access to ongoing research and innovation which we utilize in our research and development of new applications and products.

3

Our Strategy

Our goal is to establish a new standard in molecular diagnostics characterized by our low cost, easy to use platform for genomic and protein testing and to develop new diagnostic tests where none exist today. To achieve this objective, we intend to:

| | |

| | • | Target Key Customer Segments. We will focus our sales efforts on hospital laboratories, where there is significant demand for molecular diagnostic testing, but where cost, complexity and resource needs of existing technologies have limited their ability to process tests in-house. |

| |

| | • | Employ a Direct Sales Force Model. We are currently marketing and selling the Verigene System through our own sales and marketing organization, which is currently comprised of 19 people, including sales representatives, clinical support staff and product managers. |

| |

| | • | Market FDA Cleared Products. We will seek FDA clearance for all our products. We believe that there is strong market demand for FDA cleared tests versus tests developed in-house by individual laboratories known as “home-brew” tests. FDA cleared tests require less skilled laboratory technician time and do not subject the laboratory to the additional regulatory requirements imposed on laboratories using “home-brew” tests. |

| |

| | • | Establish a Broad Test Menu. We are developing a broad test menu to maximize the value of the Verigene System, generate cartridge sales and support placements of systems in those laboratories that demand a broad testing menu before implementing a new testing platform. |

| |

| | • | Validate New Biomarkers and Commercialize New Tests Using Our Ultra-Sensitive Protein Detection Methods. We are applying our ultra-sensitive protein detection methods to the development of established protein biomarkers and the validation of novel protein targets that may lead to earlier detection of medical conditions in the area of cancer, neurodegenerative disorders including Alzheimer’s disease, sepsis and mad cow disease. |

| |

| | • | Capitalize on Strong Intellectual Property and Development Capabilities. We will continue to develop assays based on both our in-house and in-licensed intellectual property through our ongoing relationship with the International Institute for Nanotechnology at Northwestern University and other third parties to expand the utility of our Verigene System. |

Risk Factors

Our ability to execute our strategy and capitalize on our advantages is subject to a number of risks discussed more fully in the “Risk Factors” section and elsewhere in this prospectus. The principal risks facing our business include, among others:

History of Losses. We have a history of losses, our losses are likely to increase significantly and we may never achieve or maintain profitability.

Acceptance of Verigene System. Our financial results depend on commercial acceptance of the Verigene System, its array of tests, and the development and regulatory clearance of additional tests. If we do not achieve significant product revenue, we may not be able to meet our cash requirements without obtaining additional capital from external sources, and if we are unable to do so, we may have to curtail or cease operations.

Intellectual Property. Third parties may claim we are infringing their intellectual property rights, which could prevent us from selling or commercializing our products unless we obtain a license from such third party. Our products could infringe patent rights of others, which may require costly litigation and, if we are not successful, could cause us to pay substantial damages or limit our ability to commercialize our products.

Competition. We face increasing competition from current and potential competitors, some of which have greater name recognition, more substantial intellectual property portfolios and longer operating histories.

4

Government Regulation. Our products are subject to regulation by the FDA and numerous other federal and state governmental authorities. We may incur significant expenses to comply with, and experience delays in our product commercialization as a result of, these regulations.

Corporate Information

We were founded in September 1998 as Nanosphere LLC, an Illinois limited liability company, by Dr. Robert L. Letsinger and Dr. Chad A. Mirkin, two Professors of Chemistry at Northwestern University. We established Nanosphere, Inc. in December 1999 as a Delaware corporation, into which we merged Nanosphere LLC in January 2000. Our executive offices are located at 4088 Commercial Avenue, Northbrook, IL 60062. Our telephone number at that address is(847) 400-9000 and our website is www.nanosphere.us. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus and should not be considered to be part of this prospectus.

| | | | | |

| Clearread, Verigene, and the | |  | | logo are our registered trademarks. |

Ruggid, Valid and Biobarcode are the subject of pending trademark applications owned by us.

We also have registrations or pending applications for registration of some of our trademarks in other jurisdictions, including Europe, People’s Republic of China, Hong Kong, Japan, Republic of Korea, Taiwan, Canada, Malaysia, and Singapore. All other trademarks, trade names, and service marks appearing in this prospectus are the trademarks of their respective owners.

5

The Offering

| | |

| Issuer | | Nanosphere, Inc. |

| |

| Common stock offered | | 7,000,000 shares |

| | |

| Underwriters’ option to purchase additional shares | | 1,050,000 shares |

| | |

| Common stock to be outstanding after this offering | |

21,064,198 shares, or 22,114,198 shares if the underwriters exercise their over-allotment option in full. |

| | |

| Use of Proceeds | | We estimate that the net proceeds to us in the offering will be approximately $95 million, assuming an initial public offering price of $15.00 per share, which is the midpoint of the range listed on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We expect to use approximately $50 million of the net proceeds of this offering to finance ongoing research and development and the continued investments in and development of our product manufacturing infrastructure and approximately $40 million to fund additional sales, marketing and service personnel and initiatives. We expect to use the remainder of the net proceeds for additional working capital and general corporate purposes. |

| |

| Dividend Policy | | We have never declared or paid any cash dividends on our capital stock and do not expect to pay any dividends for the foreseeable future. |

| |

| NASDAQ Global Market symbol | | NSPH |

The number of shares of common stock to be outstanding upon completion of this offering is based on the following (all as of October 29, 2007): 932,646 shares of common stock, 17,007 shares of Series B Convertible Preferred Stock, 10,050,007 shares of and 16,666 warrants to purchase Series C Convertible Preferred Stock, 128,825,044 shares of and 3,438,690 warrants to purchaseSeries C-2 Convertible Preferred Stock, and 168,392,966 shares of Series D Convertible Preferred Stock, and excludes as of that date:

| | |

| | • | 3,251,548 shares of common stock issuable upon exercise of options outstanding at a weighted average exercise price of $4.98 per share; |

| |

| | • | 1,625,321 shares of common stock reserved for future issuance under our long-term incentive plan in effect immediately prior to the closing of this offering; and |

| |

| | • | 1,307,773 shares of common stock issuable upon exercise of warrants to purchase Series D Convertible Preferred Stock, which will become exercisable for common stock immediately prior to the closing of this offering. |

Except as otherwise indicated, all of the information in this prospectus assumes:

| | |

| | • | no exercise of the underwriters’ option to purchase additional shares; |

| |

| | • | adoption of our amended and restated certificate of incorporation and amended and restated by-laws to be effective upon the consummation of this offering; |

| |

| | • | the conversion on a 10.2-for-one basis of our Series B Convertible Preferred Stock into common stock to be effected immediately prior to the closing of this offering; |

| | |

| | • | the conversion on a 25-for-one basis of our Series C, Series C-2 and Series D Convertible Preferred Stock into common stock including common stock issued in connection with accrued and unpaid dividends which were an aggregate of 700,986 shares as of October 29, 2007 (at an assumed initial public offering price of $15.00 per share which is the midpoint of the range listed on the cover page of this prospectus) to be effected immediately prior to the closing of this offering; |

| | |

| | • | the exercise of all outstanding Series C andSeries C-2 Convertible Preferred Stock warrants, which expire immediately prior to the closing of this offering unless exercised, for an aggregate of 138,205 shares of common stock for an aggregate purchase price of $1,213,542; |

| |

| | • | the conversion of the outstanding warrants to purchase 32,694,562 shares of Series D Convertible Preferred Stock into warrants to purchase 1,307,773 shares of common stock to be effected immediately prior to the closing of this offering; and |

| |

| | • | a 25-for-one reverse stock split of our common stock effected on October 16, 2007. |

6

Summary Financial Data

The following statements of operations data for each of the years ended December 31, 2004, 2005 and 2006 and the six month period ended June 30, 2007 and the balance sheet data at December 31, 2005, December 31, 2006 and June 30, 2007 have been derived from our audited financial statements and related notes which are included elsewhere in this prospectus. The statements of operations data for the six month period ended June 30, 2006 have been derived from our unaudited financial statements and related notes which are included elsewhere in this prospectus. In the opinion of management, the unaudited interim financial statements have been prepared on the same basis as the audited financial statements and include all adjustments necessary for the fair presentation of our financial position and results of operations for these periods. The summary financial data set forth below should be read in conjunction with our financial statements, the related notes, “Risk Factors,” “Use of Proceeds,” “Capitalization,” “Selected Financial Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in the document. The historical results are not necessarily indicative of the results to be expected for any future period. The accompanying financial statements for the years ended December 31, 2004, 2005 and 2006 have been restated. See Note 12 to the financial statements.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Six Month Period

| |

| | | Years Ended December 31, | | | Ended June 30, | |

Statements of Operations Data: | | 2004 | | | 2005 | | | 2006 | | | 2006 | | | 2007 | |

| | | (As restated) | | | (As restated) | | | (As restated) | | | | | | | |

| |

| Revenue: | | | | | | | | | | | | | | | | | | | | |

| Grant and contract revenue | | $ | 2,768,125 | | | $ | 1,777,667 | | | $ | 1,006,351 | | | $ | 438,512 | | | $ | 726,503 | |

| Product sales | | | — | | | | 136,850 | | | | 131,660 | | | | 27,630 | | | | 53,670 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | | 2,768,125 | | | | 1,914,517 | | | | 1,138,011 | | | | 466,142 | | | | 780,173 | |

| | | | | | | | | | | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | | | | | | | | | |

| Cost of product sales | | | — | | | | 125,118 | | | | 31,049 | | | | — | | | | 18,367 | |

| Research and development | | | 10,366,473 | | | | 13,244,872 | | | | 17,447,227 | | | | 7,874,596 | | | | 10,219,047 | |

| Sales, general and administrative | | | 3,131,390 | | | | 4,502,970 | | | | 5,415,525 | | | | 2,663,931 | | | | 5,256,583 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total costs and expenses | | | 13,497,863 | | | | 17,872,960 | | | | 22,893,801 | | | | 10,538,527 | | | | 15,493,997 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from operations | | | (10,729,738 | ) | | | (15,958,443 | ) | | | (21,755,790 | ) | | | (10,072,385 | ) | | | (14,713,824 | ) |

| Change in fair value of convertible derivative liability | | | — | | | | — | | | | (2,916,822 | ) | | | (2,916,822 | ) | | | — | |

| Change in fair value of preferred stock warrants | | | (8,801 | ) | | | (8,314 | ) | | | (119,914 | ) | | | (244,104 | ) | | | (276,612 | ) |

| Foreign exchange loss | | | — | | | | — | | | | — | | | | — | | | | (13,770 | ) |

| Interest expense - related party | | | (204,335 | ) | | | (37,919 | ) | | | (146,550 | ) | | | (146,550 | ) | | | — | |

| Interest expense | | | — | | | | — | | | | (7,506 | ) | | | (1,585 | ) | | | (823,748 | ) |

| Interest income | | | 40,963 | | | | 69,376 | | | | 1,415,001 | | | | 483,755 | | | | 758,433 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | (10,901,911 | ) | | | (15,935,300 | ) | | | (23,531,581 | ) | | | (12,897,691 | ) | | | (15,069,521 | ) |

| Accumulated convertible preferred stock dividends | | | — | | | | — | | | | (4,413,591 | ) | | | (1,350,933 | ) | | | (3,180,329 | ) |

| Convertible preferred stock redemption value adjustment | | | (10,156,393 | ) | | | (2,898,787 | ) | | | (17,737,544 | ) | | | (17,737,544 | ) | | | (608,940 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss attributable to common stock | | $ | (21,058,304 | ) | | $ | (18,834,087 | ) | | $ | (45,682,716 | ) | | $ | (31,986,168 | ) | | $ | (18,858,790 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per common share: | | | | | | | | | | | | | | | | | | | | |

| basic and diluted | | $ | (34.44 | ) | | $ | (30.80 | ) | | $ | (52.78 | ) | | $ | (40.15 | ) | | $ | (20.22 | ) |

| Weighted average number of common shares: | | | | | | | | | | | | | | | | | | | | |

| basic and diluted | | | 611,466 | | | | 611,496 | | | | 865,559 | | | | 796,729 | | | | 932,646 | |

7

| | | | | | | | | | | | | | | | | |

| | | As of December 31, | | | As of June 30, 2007 | |

Balance Sheet Data: | | 2005 | | | 2006 | | | Actual | | | As Adjusted(1) | |

| | | (As restated) | | | (As restated) | | | | | | | |

| |

| Cash and cash equivalents | | $ | 3,641,338 | | | $ | 29,112,429 | | | $ | 26,970,383 | | | $ | 122,833,925 | |

| Working capital | | $ | (2,642,582 | ) | | $ | 27,332,463 | | | $ | 23,894,749 | | | $ | 119,758,291 | |

| Total assets | | $ | 11,346,514 | | | $ | 41,037,834 | | | $ | 40,435,013 | | | $ | 136,298,555 | |

| Long-term debt (net of discount of $0, $0, $1,670,405) | | | — | | | $ | 58,802 | | | $ | 9,302,976 | | | $ | 9,302,976 | |

| Convertible preferred stock | | $ | 51,143,984 | | | $ | 108,868,040 | | | $ | 113,985,907 | | | | — | |

| Stockholders’ equity (deficit)(2) | | $ | (59,961,290 | ) | | $ | (105,238,071 | ) | | $ | (123,241,672 | ) | | $ | 121,339,904 | |

| |

| (1) | On an as adjusted basis giving effect to: (1) the conversion of all outstanding shares of our Series B, Series C, Series C-2 and Series D Convertible Preferred Stock into common stock; (2) the exercise of all outstanding warrants to purchase Series C and Series C-2 Convertible Preferred Stock which expire immediately prior to the closing of this offering unless exercised for an aggregate of 138,205 shares of common stock for an aggregate purchase price of $1,213,542; and (3) to reflect the sale of 7,000,000 shares of our common stock in this offering at an assumed initial public offering price of $15.00 per share, the midpoint of the range on the cover page of this prospectus. Each $1.00 increase or decrease in the assumed initial public offering price of $15.00 per share would increase or decrease cash and cash equivalents, total stockholders’ equity (deficit) by approximately $6.5 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discount and estimated offering expenses payable by us. |

| |

| (2) | Since our incorporation, we have been principally financed through convertible preferred stock equity investments. In accordance with Securities and Exchange Commission, or SEC, rules and regulations, our convertible preferred stock is recorded outside of stockholders’ equity (deficit), while our accumulated deficit, representing our accumulated losses to-date, allocation of convertible preferred stock dividends and convertible preferred stock redemption value adjustments are recorded as reductions to stockholders’ deficit. See Note 8 to the financial statements for more information on our convertible preferred stock and related accounting. |

8

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below together with all of the other information contained in this prospectus, including the financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. If any of the following risks or uncertainties actually occurs, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

We have a history of losses, our losses are likely to increase significantly, and we may never achieve or maintain profitability.

We are a development-stage company with limited operating history. We have incurred significant losses in each fiscal year since our inception, including net losses attributable to common stock of $18.8 million, $45.7 million, and $18.9 million in the years ended December 31, 2005 and 2006, and the six month period ended June 30, 2007, respectively. As of June 30, 2007, we had an accumulated deficit during the development stage of $124.8 million. These losses resulted principally from costs incurred in our research and development programs and from our general and administrative expenses. In recent years, we have incurred significant costs in connection with the development of the Verigene System and its range of tests. We expect our research and development expense levels to remain high for the foreseeable future as we seek to enhance our existing product and develop new products. After we begin selling our products, we expect our losses to continue to increase as a result of ongoing research and development expenses, as well as increased manufacturing, sales and marketing expenses. These losses, among other things, have had and will continue to have an adverse effect on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. If we fail to achieve profitability in the future, the market price of our common stock could decline.

Our financial results depend on commercial acceptance of the Verigene System, its array of tests, and the development of additional tests.

Our future depends on the success of the Verigene System, which depends primarily on its acceptance by hospitals, research institutions, and independent diagnostic laboratories as a reliable, accurate and cost-effective replacement for traditional molecular diagnostic measurement methods. Many hospitals and laboratories already use expensive molecular diagnostic testing instruments in their laboratories and may be reluctant to change their current procedures for performing such analyses.

The Verigene System currently does not process a sufficiently broad menu of tests for some hospitals and laboratories to consider adopting it. Although we continue to develop additional tests to respond to hospitals’ and laboratories’ needs, we cannot guarantee that we will be able to develop enough additional tests quickly enough or in a manner that is cost-effective or at all. The development of new or enhanced products is a complex and uncertain process requiring the accurate anticipation of technological and market trends, as well as precise technological execution. We are currently not able to estimate when or if we will be able to develop, commercialize or sell additional tests or enhance existing products. If we are unable to increase sales of the Verigene System and its tests or to successfully develop and commercialize other products or tests, our revenues and our ability to achieve profitability would be impaired.

The regulatory approval process is expensive, time consuming and uncertain and the failure to obtain such approvals will prevent us from commercializing our future products.

Our products will be subject to approval or clearance by the FDA or foreign governmental entities prior to their marketing for commercial use. The 510(k) clearance and pre-market approval processes as well as the foreign approvals required to initiate sales outside the United States can be expensive, time consuming and uncertain. It generally takes from four to twelve months from submission to obtain 510(k) clearance, and from

9

one to three years from submission to obtain pre-market approval; however, it may take longer, and 510(k) clearance or pre-market approval may never be obtained. Delays in receipt of, or failure to obtain, clearances or approvals for future products, including tests that are currently in development, would result in delayed, or no, realization of revenues from such products and in substantial additional costs which could decrease our profitability. We have limited experience in filing FDA applications for 510(k) clearance and pre-market approval. There are no assurances that we will obtain any required clearance or approval. Any such failure, or any material delay in obtaining the clearance or approval, could harm our business, financial condition and results of operations.

We and our customers are subject to various governmental regulations, and we may incur significant expenses to comply with, and experience delays in our product commercialization as a result of, these regulations.

The products we develop, manufacture and market are subject to regulation by the FDA and numerous other federal, state and foreign governmental authorities. We generally are prohibited from marketing our products in the United States unless we obtain either 510(k) clearance or pre-market approval from the FDA.

In addition, we are required to continue to comply with applicable FDA and other regulatory requirements once we have obtained clearance or approval for a product. These requirements include the Quality System Regulation, labeling requirements, the FDA’s general prohibition against promoting products for unapproved or “off-label” uses and adverse event reporting regulations. Failure to comply with applicable FDA product regulatory requirements could result in warning letters, fines, injunctions, civil penalties, repairs, replacements, refunds, recalls or seizures of products, total or partial suspension of production, the FDA’s refusal to grant future pre-market clearances or approvals, withdrawals or suspensions of current product applications and criminal prosecution. Any of these actions, in combination or alone, could prevent us from selling our products and would likely harm our business.

Our manufacturing facilities are subject to periodic regulatory inspections by the FDA and other federal and state regulatory agencies. The use of our diagnostic products by our customers is also affected by the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and related federal and state regulations that provide for regulation of laboratory testing. CLIA is intended to ensure the quality and reliability of clinical laboratories in the United States by mandating specific standards in the areas of personnel qualifications, administration, participation in proficiency testing, patient test management, quality and inspections. Current or future CLIA requirements or the promulgation of additional regulations affecting laboratory testing may prevent some laboratories from using some or all of our diagnostic products.

The FDA and foreign governmental regulators have made, and may continue to make, changes in approval requirements and processes. We cannot predict what these changes will be, how or when they will occur or what effect they will have on the regulation of our products. Any new regulations, including regulations specifically related to nanotechnology, may impose additional costs or lengthen review times of our products. Delays in receipt of or failure to receive regulatory approvals or clearances for our new products would have a material adverse effect on our business, financial condition and results of operations.

If third-party payors do not reimburse our customers for the use of our clinical diagnostic products or if they reduce reimbursement levels, our ability to sell our products will be harmed.

We intend to sell our products primarily to hospital-based laboratories and academic research institutions, substantially all of which receive reimbursement for the health care services they provide to their patients from third-party payors, such as Medicare, Medicaid and other domestic and international government programs, private insurance plans and managed care programs. Most of these third-party payors may deny reimbursement if they determine that a medical product was not used in accordance with cost-effective treatment methods, as determined by the third-party payor, or was used for an unapproved indication. Third-party payors also may refuse to reimburse for procedures and devices deemed to be experimental.

In the United States, the American Medical Association assigns specific Current Procedural Terminology, or CPT, codes, which are necessary for reimbursement of diagnostic tests. Once the CPT code is established,

10

the Centers for Medicare and Medicaid Services establish reimbursement payment levels and coverage rules under Medicaid and Medicare, and private payors establish rates and coverage rules independently. Although the tests performed by our assays in development have previously assigned CPT Codes, we cannot guarantee that our assays are covered by such CPT codes and are therefore approved for reimbursement by Medicare and Medicaid as well as most third-party payors. Additionally, certain of our future products may not be approved for reimbursement. Third-party payors may choose to reimburse our customers on a per test basis, rather than on the basis of the number of results given by the test. This may result in reference laboratories, public health institutions and hospitals electing to use separate tests to screen for each disease so that they can receive reimbursement for each test they conduct. In that event, these entities likely would purchase separate tests for each disease, rather than products that multiplex.

Third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement for medical products and services. Increasingly, Medicare, Medicaid and other third-party payors are challenging the prices charged for medical services, including clinical diagnostic tests. Levels of reimbursement may decrease in the future, and future legislation, regulation or reimbursement policies of third-party payors may adversely affect the demand for and price levels of our products. If our customers are not reimbursed for our products, they may reduce or discontinue purchases of our products, which would cause our revenues to decline.

We may fail to receive positive clinical results from the diagnostic tests currently in development that require clinical trials, and even if we receive positive clinical results, we may still fail to receive the necessary clearances or approvals to market our products.

We are investing in the research and development of new products to expand the menu of testing options for the Verigene System. In order to commercialize our products, we are required to undertake time consuming and costly development activities, sometimes including clinical trials for which the outcome is uncertain. Products that appear promising during early development and preclinical studies may, nonetheless, fail to demonstrate the results needed to support regulatory approval. Even if we receive positive clinical results, we may still fail to obtain the necessary FDA clearance and approvals.

Our operating results may be variable and unpredictable.

The sales cycles for our products may be lengthy, which will make it difficult for us to accurately forecast revenues in a given period, and may cause revenues and operating results to vary significantly from period to period. In addition to its length, the sales cycle associated with our products is subject to a number of significant risks, including the budgetary constraints of our customers, their inventory management practices and possibly internal acceptance reviews, all of which are beyond our control. Sales of our products will also involve the purchasing decisions of large, medium and small hospitals and laboratories which can require many levels of pre-approvals, further lengthening sales time. As a result, we may expend considerable resources on unsuccessful sales efforts or we may not be able to complete transactions on the scheduled anticipated.

If we do not achieve significant product revenue, we may not be able to meet our cash requirements without obtaining additional capital from external sources, and if we are unable to do so, we may have to curtail or cease operations.

We expect capital outlays and operating expenditures to increase over the next several years as we expand our infrastructure, commercialization, manufacturing, and research and development activities. We anticipate that our current cash and cash equivalents, together with the net proceeds of this offering, will be sufficient to meet our currently estimated needs for at least the next three years. However, we operate in a market that makes our prospects difficult to evaluate, and we may need additional financing to execute on our current or future business strategies. The amount of additional capital we may need to raise depends on many factors, including:

| | |

| | • | the level of research and development investment required to maintain and improve our technology; |

| |

| | • | the amount and growth rate, if any, of our revenues; |

11

| | |

| | • | changes in product development plans needed to address any difficulties in manufacturing or commercializing the Verigene System and enhancements to our system; |

| |

| | • | the costs of filing, prosecuting, defending and enforcing patent claims and other intellectual property rights; |

| |

| | • | competing technological and market developments; |

| |

| | • | our need or decision to acquire or license complementary technologies or acquire complementary businesses; |

| |

| | • | the expansion of our sales force; and |

| |

| | • | changes in regulatory policies or laws that affect our operations. |

We cannot be certain that additional capital will be available when and as needed or that our actual cash requirements will not be greater than anticipated. If we require additional capital at a time when investment in diagnostics companies or in the marketplace in general is limited due to the then prevailing market or other conditions, we may not be able to raise such funds at the time that we desire or any time thereafter. In addition, if we raise additional funds through the issuance of common stock or convertible securities, the percentage ownership of our stockholders could be significantly diluted, and these newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. If we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we raise additional funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our technologies or products, or grant licenses on terms that are not favorable to us.

If our products do not perform as expected or the reliability of the technology on which our products are based is questioned, we could experience lost revenue, delayed or reduced market acceptance of our products, increased costs and damage to our reputation.

Our success depends on the market’s confidence that we can provide reliable, high-quality diagnostics systems. We believe that customers in our target markets are likely to be particularly sensitive to product defects and errors.

Our reputation and the public image of our products or technologies may be impaired if our products fail to perform as expected or our products are perceived as difficult to use. Our products are complex and may develop or contain undetected defects or errors. Any defects or errors could lead to the filing of product liability claims, which could be costly and time-consuming to defend and result in substantial damages. If we experience a sustained material defect or error, this could result in loss or delay of revenues, delayed market acceptance, damaged reputation, diversion of development resources, legal claims, increased insurance costs or increased service and warranty costs, any of which could materially harm our business. We cannot assure you that our product liability insurance would protect our assets from the financial impact of defending a product liability claim. A product liability claim could have a serious adverse effect on our business, financial condition and results of operations.

We rely on third-party license agreements for patents and other technology related to our products, and the termination of these agreements could delay or prevent us from being able to commercialize our products.

We depend on an exclusive license to certain patents and patent applications owned by Northwestern University that are related to nanotechnology and biobarcode technology in the biodiagnostics field. Although this license is irrevocable, we have an obligation to use commercially reasonable efforts to commercialize the subject inventions of the licensed patents, and if we fail to meet this obligation, we could potentially lose exclusivity in the licensed patents. If, in such an event, Northwestern were to provide a license to these patents to one or more of our competitors thereafter, our ability to compete in the market may be diminished.

12

We also depend on non-exclusive patent license agreements. If we fail to comply with our material obligations under these non-exclusive patent license agreements, such licenses may be terminated.

The exclusive and non-exclusive licenses expire at various times, corresponding to the subject patents’ expirations, which currently range from 2009 to 2023. We may also need to license other technology or patents to commercialize future products, but such licenses may not be available to us on commercially reasonable terms or at all.

If we are unable to obtain, maintain and enforce intellectual property protection covering our products, others may be able to make, use, or sell our products, which could adversely affect our ability to compete in the market.

Our success is dependent in part on obtaining, maintaining and enforcing intellectual property rights, including patents. If we are unable to obtain, maintain and enforce intellectual property legal protection covering our products, others may be able to make, use or sell products that are substantially identical to ours without incurring the sizeable discovery, development and licensing costs that we have incurred, which would adversely affect our ability to compete in the market.

We seek to obtain and maintain patents and other intellectual property rights to restrict the ability of others to market products that compete with our products. Currently, our patent portfolio is comprised, on a worldwide basis, of 80 issued patents and 150 pending patent applications which, in either case, we own directly or for which we are the exclusive licensee. However, patents may not issue from any pending or future patent applications owned by or licensed to us, and moreover, issued patents owned or licensed to us now or in the future may be found by a court to be invalid or otherwise unenforceable. Also, even if our patents are determined by a court to be valid and enforceable, they may not be sufficiently broad to prevent others from marketing products similar to ours or designing around our patents, despite our patent rights, nor provide us with freedom to operate unimpeded by the patent rights of others.

Furthermore, we cannot be certain that we were the first to make the invention claimed in our United States issued patents or pending patent applications, or that we were the first to file for protection of the inventions claimed in our foreign issued patents or pending patent applications. We may become subject to interference proceedings conducted in the patent and trademark offices of various countries to determine our entitlement to patents, and these proceedings may conclude that other patents or patent applications have priority over our patents or patent applications. It is also possible that a competitor may successfully challenge our patents through various proceedings and those challenges may result in the elimination or narrowing of our patents, and therefore reduce our patent protection. Accordingly, rights under any of our issued patents, patent applications or future patents may not provide us with commercially meaningful protection for our products or afford us a commercial advantage against our competitors or their competitive products or processes.

We have a number of foreign patents and applications. However, the laws of some foreign jurisdictions do not protect intellectual property rights to the same extent as laws in the United States, and many companies have encountered significant difficulties in protecting and defending such rights in foreign jurisdictions. If we encounter such difficulties or we are otherwise precluded from effectively protecting our intellectual property rights in foreign jurisdictions, our business prospects could be substantially harmed.

We may initiate litigation to enforce our patent rights, which may prompt our adversaries in such litigation to challenge the validity, scope or enforceability of our patents. Patent litigation is complex and often difficult and expensive, and would consume the time of our management and other significant resources. In addition, the outcome of patent litigation is uncertain. If a court decides that our patents are not valid, not enforceable or of a limited scope, we may not have the right to stop others from using the subject matter covered by those patents.

We also rely on trade secret protection to protect our interests in proprietary know-how and for processes for which patents are difficult to obtain or enforce. We may not be able to protect our trade secrets adequately. In addition, we rely on non-disclosure and confidentiality agreements with our employees, consultants and

13

other parties to protect, in part, our trade secrets and other proprietary technology. These agreements may be breached and we may not have adequate remedies for any breach. Moreover, others may independently develop equivalent proprietary information, and third parties may otherwise gain access to our trade secrets and proprietary knowledge. Any disclosure of confidential data into the public domain or to third parties could allow our competitors to learn our trade secrets and use the information in competition against us.

Our products could infringe patent rights of others, which may require costly litigation and, if we are not successful, could cause us to pay substantial damages or limit our ability to commercialize our products.

Our commercial success depends on our ability to operate without infringing the patents and other proprietary rights of third parties. We are aware of third party patents that may relate to our products and technology. There may also be other patents that relate to our products and technology of which we are not aware. We may unintentionally infringe upon valid patent rights of third parties. Although we are currently not involved in any litigation involving patents, a third party patent holder could assert a claim of patent infringement against us in the future. Alternatively, we may initiate litigation against the third party patent holder to request that a court declare that we are not infringing the third party’s patentand/or that the third party’s patent is invalid or unenforceable. If a claim of infringement is asserted against us and is successful, and therefore we are found to infringe, we could be required to pay damages for infringement, including treble damages if it is determined that we knew or became aware of such a patent and we failed to exercise due care in determining whether or not we infringed the patent. If we have supplied infringing products to third parties or have licensed third parties to manufacture, use or market infringing products, we may be obligated to indemnify these third parties for damages they may be required to pay to the patent holder and for any losses they may sustain. We can also be prevented from selling or commercializing any of our products that use the infringing technology in the future, unless we obtain a license from such third party. A license may not be available from such third party on commercially reasonable terms, or may not be available at all. Any modification to include a non-infringing technology may not be possible or if possible may be difficult or time-consuming to develop, and require revalidation, which could delay our ability to commercialize our products.

Any infringement action asserted against us, even if we are ultimately successful in defending against such action, would likely delay the regulatory approval process of our products, harm our competitive position, be expensive and require the time and attention of our key management and technical personnel.

We have limited experience in sales and marketing and may be unable to successfully commercialize our Verigene System, or it may be difficult to build brand loyalty.

We have limited marketing, sales and distribution experience and capabilities. We have only recently established a sales force. Our ability to achieve profitability depends on attracting customers for the Verigene System and building brand loyalty. To successfully perform sales, marketing, distribution and customer support functions ourselves, we will face a number of risks, including:

| | |

| | • | our ability to attract and retain the skilled support team, marketing staff and sales force necessary to commercialize and gain market acceptance for our technology and our products; |

| |

| | • | the ability of our sales and marketing team to identify and penetrate the potential customer base including hospitals, research institutions, and independent diagnostic laboratories; |

| |

| | • | the time and cost of establishing a support team, marketing staff and sales force; and |

| |

| | • | the difficulty of establishing brand recognition and loyalty for our products. |

In addition, we may seek to enlist one or more third parties to assist with sales, distribution and customer support globally or in certain regions of the world. If we do seek to enter into such arrangements, we may not be successful in attracting desirable sales and distribution partners, or we may not be able to enter into such arrangements on favorable terms. If our sales and marketing efforts, or those of any third-party sales and distribution partners, are not successful, our technologies and products may not gain market acceptance, which would materially impact our business operations.

14

We may be unsuccessful in our long-term goal of expanding our product offerings outside the United States.

To the extent we begin to offer our products broadly outside the United States, we expect that we will be dependent on third-party distribution relationships. Distributors may not commit the necessary resources to market and sell our products to the level of our expectations. If distributors do not perform adequately, or we are unable to locate distributors in particular geographic areas, our ability to realize long-term international revenue growth would be materially adversely affected.

Additionally, our products may require regulatory clearances and approvals from jurisdictions outside the United States. These products may not be sold in these jurisdictions until the required clearances and approvals are obtained. We cannot assure you that we will be able to obtain these clearances or approvals on a timely basis, or at all.

Manufacturing risks and inefficiencies may adversely affect our ability to produce products.

We must manufacture or engage third parties to manufacture components of our products in sufficient quantities and on a timely basis, while maintaining product quality and acceptable manufacturing costs and complying with regulatory requirements. In determining the required quantities of our products and the manufacturing schedule, we must make significant judgments and estimates based on historical experience, inventory levels, current market trends and other related factors. Because of the inherent nature of estimates, there could be significant differences between our estimates and the actual amounts of products we require. Additionally, some of the components of the Verigene System are custom-made by only a few outside vendors. We may not be able to meet the demand for our products if one or more of these vendors are not able to supply us with the needed components or components that meet our specifications. We have not arranged for alternate suppliers, and it may be difficult to find alternate suppliers in a timely manner and on terms acceptable to us.

We may experience unforeseen technical complications in the processes we use to develop, manufacture, customize or receive orders for our products. These complications could materially delay or limit the use of products we attempt to commercialize, substantially increase the anticipated cost of our products or prevent us from implementing our processes at appropriate quality and scale levels, thereby causing our business to suffer. In addition, our manufacturing operations use highly technical processes involving unique, proprietary techniques that our manufacturing personnel must continuously monitor and update, especially as we develop more products. In order to be profitable, we must manufacture greater quantities of products than we have to date and we must do this more efficiently than we have in the past. We may not be able to do so.

We will need to develop manufacturing capacity by ourselves or with third parties.

We will need to either continue to build internal manufacturing capacity or contract with one or more manufacturing partners, or both. We currently use a combination of outsourced and internal manufacturing activities. We have not commercially manufactured any instruments, products or supplies. We may encounter difficulties in manufacturing our products and, due to the complexity of our technology and our manufacturing process, we cannot be sure we fully understand all of the factors that affect our manufacturing processes or product performance. We may not be able to build manufacturing capacity internally or find one or more suitable manufacturing partners, or both, to meet the volume and quality requirements necessary to be successful in the market. If our products do not consistently meet our customers’ performance expectations, we may be unable to generate sufficient revenues to become profitable. Significant additional resources, implementation of additional manufacturing equipment and changes in our manufacturing processes and organization may be required for thescale-up of each new product prior to commercialization or to meet increasing customer demand once commercialization begins, and this work may not be successfully or efficiently completed. Any delay in establishing or inability to expand our manufacturing capacity could delay our ability to develop or sell our products, which would result in lost revenue and seriously harm our business, financial condition and results of operations.

15

Our business and future operating results may be adversely affected by events outside of our control.

We develop and manufacture the Verigene System and assays in our facility located in Northbrook, Illinois. This facility and the manufacturing equipment we use would be costly to replace and could require substantial lead time to repair or replace. Our business and operating results may be harmed due to interruption of our manufacturing by events outside of our control, including earthquakes, tornadoes and fires. Other possible disruptions may include power loss and telecommunications failures. In the event of a disruption, we may lose customers and we may be unable to regain those customers thereafter. Our insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, or at all.

We face intense competition from established and new companies in the molecular diagnostics field.

We compete with companies that design, manufacture and market already existing and new molecular diagnostics systems. We anticipate that we will face increased competition in the future as new companies enter the market with new technologies and our competitors improve their current products. One or more of our competitors may offer technology superior to ours and render our technology obsolete or uneconomical. Most of our current competitors, as well as many of our potential competitors, have greater name recognition, more substantial intellectual property portfolios, longer operating histories, significantly greater resources to invest in new technologies and more substantial experience in new product development, regulatory expertise, manufacturing capabilities and the distribution channels to deliver products to customers. If we are not able to compete successfully, we may not generate sufficient revenue to become profitable.

Our success may depend upon how we and our competitors anticipate and adapt to market conditions.

The markets for our products are characterized by rapidly changing technology, evolving industry standards, changes in customer needs, emerging competition and new product introductions. The success of our products will depend on our ability to continue to increase their performance and decrease their price. New technologies, techniques or products could emerge with similar or better price-performance than our system and could exert pricing pressures on our products. It is critical to our success for us to anticipate changes in technology and customer requirements and to successfully introduce enhanced and competitive technology to meet our customers’ and prospective customers’ needs on a timely basis. We may not be able to maintain our technological advantages over emerging technologies in the future and we will need to respond to technological innovation in a rapidly changing industry. If we fail to keep pace with emerging technologies our system will become uncompetitive, our market share will decline and our business, revenue, financial condition and operating results could suffer materially.

We may not be able to manage our anticipated growth, and we may experience constraints or inefficiencies caused by unanticipated acceleration and deceleration of customer demand.

Unanticipated acceleration and deceleration of customer demand for our products may result in constraints or inefficiencies related to our manufacturing, sales force, implementation resources and administrative infrastructure. Such constraints or inefficiencies may adversely affect us as a result of delays, lost potential product sales or loss of current or potential customers due to their dissatisfaction. Similarly, over-expansion or investments in anticipation of growth that does not materialize, or develops more slowly than we expect, we could harm our financial results and result in overcapacity.

To manage our anticipated future growth effectively, we must enhance our manufacturing capabilities and operations, information technology infrastructure, and financial and accounting systems and controls. Organizational growth andscale-up of operations could strain our existing managerial, operational, financial and other resources. Our growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of new products or enhancements of existing products. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our revenue could grow more slowly than expected and we may not be able to achieve our research and

16

development and commercialization goals. Our failure to manage our anticipated growth effectively could have a material adverse effect on our business, operating results or financial condition.

We use hazardous chemicals, biological materials, and infectious diseases in our business. Any claims relating to improper handling, storage or disposal of these materials could be time consuming and costly.

Our research and development and manufacturing processes involve the controlled use of hazardous materials, including chemicals, biological materials and infectious diseases. Our operations produce hazardous waste products. We cannot eliminate the risk of accidental contamination or discharge and any resultant injury from these materials. We may be sued for any injury or contamination that results from our use or the use by third parties of these materials, and our liability may exceed our insurance coverage and our total assets. Federal, state and local laws and regulations govern the use, manufacture, storage, handling and disposal of these hazardous materials and specified waste products, as well as the discharge of pollutants into the environment and human health and safety matters. Compliance with environmental laws and regulations may be expensive, and may impair our research, development and production efforts. If we fail to comply with these requirements, we could incur substantial costs, including civil or criminal fines and penalties,clean-up costs, or capital expenditures for control equipment or operational changes necessary to achieve and maintain compliance. In addition, we cannot predict the impact on our business of new or amended environmental laws or regulations, or any changes in the way existing and future laws and regulations are interpreted and enforced.

If we are unable to recruit and retain key executives and scientists, we may be unable to achieve our goals.

Our performance is substantially dependent on the performance of our senior management and key scientific and technical personnel. The loss of the services of any member of our senior management or our scientific or technical staff could divert management’s attention to transition matters and identification of suitable replacements, if any, and have a material adverse effect on our business, operating results and financial condition. Each of our executive officers and other key employees could terminate his or her relationship with us at any time. We do not maintain key man life insurance on any of our employees.

In addition, our product development and marketing efforts could be delayed or curtailed if we are unable to attract, train and retain highly skilled employees and scientific advisors, particularly our management team, senior scientists and engineers and sales and marketing personnel. To expand our research, product development and sales efforts we need additional people skilled in areas such as protein science, information services, manufacturing, sales, marketing and technical support. Because of the complex and technical nature of our system and the dynamic market in which we compete, any failure to attract and retain a sufficient number of qualified employees could materially harm our ability to develop and commercialize our technology. We may not be successful in hiring or retaining qualified personnel and our failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Healthcare reform and restrictions on reimbursement may adversely affect our profitability.