QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

National Technical Systems, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

NATIONAL TECHNICAL SYSTEMS, INC.

24007 Ventura Boulevard

Calabasas, California 91302

NOTICE OF ANNUAL MEETING

To the Shareholders:

Notice is hereby given that the annual meeting of shareholders of National Technical Systems, Inc., a California corporation, will be held at the Company's Los Angeles Test Facility, 5320 West 104th Street, Los Angeles, California 90045 on Monday, June 28, 2004 at 10:00 a.m. for the purpose of considering and acting upon the following:

- 1.

- To elect four directors for terms expiring in 2007;

- 2.

- To ratify Ernst & Young LLP as auditors for the year ending January 31, 2005; and

- 3.

- To transact such other business and to consider and take action upon any and all matters that may properly come before the meeting or any adjournment or adjournments thereof. Management has no information of any such other matters.

Pursuant to the provisions of the Company's Bylaws, the Board of Directors has fixed the close of business on May 14, 2004 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting or any adjournment thereof.

Financial information concerning the Company is contained in the Annual Report for the fiscal year ended January 31, 2004, which accompanies this Notice of Annual Meeting.

If you are unable to attend the meeting in person, please execute the enclosed Proxy and return it in the enclosed self-addressed, stamped envelope. If you later find that you can be present, you may, if you wish, vote in person, or you may revoke your proxy or file a new proxy bearing a later date with the Secretary at any time before the voting.

|

|

|

| | | By Order of the Board of Directors |

|

|

|

| | |

Andrea Korfin

Secretary |

May 27, 2004 |

|

|

NATIONAL TECHNICAL SYSTEMS, INC.

24007 Ventura Boulevard,

Calabasas, California 91302

PROXY STATEMENT

SOLICITATION

The accompanying Proxy is solicited by the Board of Directors for use at the annual meeting of shareholders to be held on Monday, June 28, 2004, or any adjournment thereof. A Proxy may be revoked by the person giving it at any time before it is exercised, either by giving another proxy bearing a later date or by notifying the Secretary of the Company in writing of such revocation. The giving of the Proxy will not affect your right to vote in person if you later should find it convenient to attend the meeting. The Proxy will be voted in accordance with the specifications made. If no instructions are indicated on the Proxy, the Proxy will be voted "for" the election of the Board of Directors' nominees, "for" the ratification of Ernst & Young LLP as auditors, and in accordance with the recommendations of the Board of Directors as to any other matter that may properly come before the Annual Meeting or an adjournment or postponement thereof.

The Company will bear the entire cost of preparing, assembling, printing, and mailing this Proxy Statement, the Proxy, and any additional material which may be furnished to shareholders by the Company. Copies of solicitation material may be furnished to brokerage houses, fiduciaries, and custodians to forward to their principals, and the Company may reimburse them for their expenses in so doing. The Company does not expect to pay any commission or remuneration to any person for solicitation of proxies.

This Proxy Statement and the Proxy are being mailed to shareholders on or about May 27, 2004.

Solicitation may be made by mail, personal interview, telephone, e-mail and other electronic communication by officers and regular employees of the Company.

The close of business on May 14, 2004, has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. The outstanding voting securities of the Company at May 14, 2004, consisted of 8,880,887 shares of no par value Common Stock. Shareholders representing a majority of outstanding Common Stock must be present in person or by proxy to constitute a quorum at the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting, including, without limitation, a motion to adjourn the Annual Meeting to another time or place in order to solicit additional proxies approving matters recommended by the Board of Directors.

In voting for the election of Directors, shareholders do not have the right to cumulate their votes.

A plurality of the votes cast in person or by proxy and entitled to vote at the Annual Meeting is required for the election of directors. The affirmative vote of a majority of votes cast at the Annual Meeting is required for ratification of Ernst & Young LLP as auditors for the year ending January 31, 2005 and the approval of such other matters as may properly come before the Annual Meeting.

Each shareholder is entitled to one vote, in person or by proxy, for each share of common stock standing in his or her name on the books of the Company as of the record date on any matter submitted to the shareholders. Shareholders do not have the right to cumulate their votes. Abstentions and broker non-votes have no effect on the election of directors or approval of other proposals. A broker non-vote occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tabulation indicates as of May 14, 2004, those persons known to the Company to be beneficial owners of five percent or more of the Company's Common Stock.

Name and Address of Beneficial Owner

| | Number of Shares

Beneficially

Owned

| | Percent of

Class

| |

|---|

Aaron Cohen

24007 Ventura Boulevard

Calabasas, California 91302 | | 1,332,043 | (1) | 14.9 | % |

Jack Lin

24007 Ventura Boulevard

Calabasas, California 91302 |

|

1,182,127 |

(1) |

13.1 |

% |

Marvin Hoffman

24007 Ventura Boulevard

Calabasas, California 91302 |

|

831,516 |

(1) |

9.3 |

% |

- (1)

- Includes shares covered by options that are exercisable within 60 days as follows: Cohen 63,567, Lin 134,633 and Hoffman 39,250.

To the knowledge of management, no other person owns beneficially as much as 5% of the outstanding stock of the Company. The tabulation under "Nomination and Election of Directors" indicates the number of shares owned beneficially by each nominee as of the record date. The directors and executive officers of the Company, as a group (18 persons), owned beneficially as of the record date a total of 3,391,732 shares, or 38.2% of the outstanding stock.

2

Proposal 1. ELECTION OF DIRECTORS

The Board of Directors of the Company currently consists of twelve members, who are divided into three classes of four directors. Directors are elected for terms of three years. At the Annual Meeting, the term of office of the Class II directors will expire and four directors will be elected to serve for a term of three years and until their respective successors are elected.

The Board intends to cause the nomination of the four persons named below for election as Class II directors. The directors will be elected by the holders of the Common Stock. The persons named as proxy holders in the accompanying form of proxy have advised the Company that they intend at the Annual Meeting to vote the shares covered by proxies held by them for the election of the nominees named below. If any or all of such nominees should for any reason become unable to serve or for good cause will not serve, the persons named in the accompanying form of proxy may vote for the election of such substitute nominees, and for such lawful term or terms, as the Board may propose. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter. The Board of Directors has no reason to believe the nominees named, or any of them, will be unable to serve if elected.

All of the Class II nominees, except Dan Yates, were elected members of the Board of Directors by the shareholders at the 2001 annual meeting of shareholders. Mr. Yates was appointed to the Board by the Directors on September 19, 2003, to fill a vacancy. No arrangement or understanding exists between any of the nominees and any other person or persons pursuant to which any nominee was or is to be selected as a director or nominee.

The names of the nominees for Class II directors and the Class I and Class III directors who will continue in office after the Annual Meeting until the expiration of their respective terms, together with certain information regarding them, including the amount of Common Stock beneficially owned by each of them, are as follows:

Name

| | Age

| | Position or Office

| | Director Since

| | Year Term Will Expire

| | Common Stock

Of The Company

Beneficially Owned as of

May 14, 2004(1)

| | Percent of Class

|

|---|

| Class II Directors | | | | | | | | | | | | |

| Ralph Clements(2) | | 71 | | President of Clements and Associates | | 1975 | | 2007 | * | 15,665 | | ** |

Aaron Cohen |

|

67 |

|

Vice Chairman of the Board and SeniorVice President, Corporate Development |

|

1997 |

(3) |

2007 |

* |

1,332,043 |

|

14.9 |

Donald Tringali(2) |

|

46 |

|

President of Augusta Advisory Group |

|

1999 |

|

2007 |

* |

54,370 |

|

** |

Dan Yates(2) |

|

42 |

|

President and Chief Executive Officer of Regents Bank |

|

2003 |

|

2007 |

* |

— |

|

|

3

Directors Continuing in Office

Name

| | Age

| | Position or Office

| | Director Since

| | Year Term Will Expire

| | Common Stock

Of The Company

Beneficially Owned as of

May 14, 2004(1)

| | Percent of Class

|

|---|

| Class I Directors | | | | | | | | | | | | |

| Marvin Hoffman | | 70 | | Vice Chairman of the Board, Senior Vice President and Chief Information Officer of the Company | | 1999 | | 2006 | | 831,516 | | 9.3 |

George Kabouchy(2) |

|

64 |

|

President of GFK & Associates |

|

2001 |

|

2006 |

|

13,795 |

|

** |

William McGinnis |

|

45 |

|

President and Chief Operating Officer of the Company |

|

1994 |

|

2006 |

|

199,786 |

|

2.2 |

John Gibbons(2) |

|

55 |

|

Chief Executive Officer and Vice Chairman of TMC Communications |

|

2003 |

|

2006 |

|

— |

|

** |

Class III Directors |

|

|

|

|

|

|

|

|

|

|

|

|

Sheldon Fechtor(2) |

|

71 |

|

Retired Chief Executive Officer of Fechtor, Detwiler & Co. |

|

2001 |

|

2005 |

|

17,343 |

|

** |

Jack Lin |

|

71 |

|

Chairman of the Board and Chief Executive Officer of the Company |

|

1975 |

|

2005 |

|

1,182,127 |

|

13.1 |

Robert Lin |

|

46 |

|

President and Chief Executive Officer of MTI Marketing Techniques, Inc. |

|

1988 |

|

2005 |

|

124,630 |

|

1.4 |

Norman Wolf(2) |

|

56 |

|

President of Quantum Leaders, Inc. |

|

2001 |

|

2005 |

|

13,350 |

|

** |

- *

- If elected at the annual meeting

- **

- Less than 1%

- (1)

- Includes shares covered by options exercisable within 60 days, as follows: Clements, 12,656; Cohen, 63,567; Fechtor, 12,343; Hoffman, 39,250; Kabouchy, 8,125; J. Lin, 134,633; R. Lin, 20,625; McGinnis, 140,000; Tringali, 36,250 and Wolfe 11,250.

- (2)

- Independent directors. The Company has determined the independence of its directors in accordance with Nasdaq rules 4200A(a)(15) and applicable rules of the Securities and Exchange Commission.

- (3)

- Mr. Cohen previously served as a Director of the Company during the period 1972-1988.

Mr. Clements has been President of Clements and Associates, a Sherman Oaks, California financial and economics consulting firm, for more than five years.

Mr. Cohen is a founder, Vice Chairman of the Board and Senior Vice President, Corporate Development of the Company. He has been associated with the Company since 1961.

Mr. Fechtor is the founder and was for over 36 years the Chief Executive Officer of Fechtor, Detwiler & Co., a New England-based regional investment banking and brokerage firm. Mr. Fechtor retired in 2000.

4

Mr. Hoffman is Vice Chairman of the Board, Senior Vice President and Chief Information Officer of the Company. He has been associated with the Company since 1998. Mr. Hoffman is the President of XXCAL, Inc., a subsidiary of the Company, with which he has been associated since 1977. Mr. Hoffman is a director of Rainbow Technologies, Inc., a publicly-traded manufacturer of computer network security products.

Mr. Kabouchy is President of GFK & Associates, a management consulting firm specializing in telecommunications and transportation projects, and has been associated with GFK & Associates for more than five years.

Dr. Jack Lin is Chairman of the Board and Chief Executive Officer of the Company and has been associated with the Company continuously since 1961. Jack Lin is the father of Robert Lin.

Mr. Robert Lin has for more than five years been the President and Chief Executive Officer of MTI-Marketing Techniques, Inc., a privately-owned manufacturer and distributor of products for the advertising specialty and premium markets. Robert Lin is the son of Jack Lin.

Mr. McGinnis is President and Chief Operating Officer of the Company. He has been associated with the Company continuously since 1980.

Mr. Yates is President and Chief Executive Officer of Regents Bank, based in San Diego, which he helped establish in 2001. Mr. Yates was previously Regional Vice President of Mellon 1st Bank.

Mr. Gibbons is Chief Executive Officer and Vice Chairman of TMC Communications, a reseller of telecommunications services, a position he has held since 2000. Prior to assuring his current position, Mr. Gibbons was President and Chief Executive Officer of The Sports Club Company, a publicly-traded developer and operator of sports and fitness clubs.

Mr. Tringali is President of the Augusta Advisory Group, a management consulting company since 2001. Prior to forming Augusta Advisory Group, Mr. Tringali was for more than five years the Executive Vice President of Telemundo Network Group, LLC.

Mr. Wolfe is President of Quantum Leaders, Inc., a management consulting firm. Prior to joining Quantum Leaders, Inc. in January 2002, Mr. Wolfe was Vice President of Operations of Select University Technologies, Inc. for more than five years.

The Board of Directors of the Company held four meetings during the last fiscal year. Each director attended at least 75% of the meetings of the Board and each Committee on which he served during Fiscal 2004.

The Company's Board of Directors has an Audit Committee consisting of Messrs. Clements, Fechtor, Tringali and Gibbons. Mr. Fechtor is Chairman of the Audit Committee. The function of the Audit Committee is to meet with the independent certified public accountants engaged by the Company to review (a) the scope and findings of the annual audit, (b) accounting policies and procedures and the Company's financial reports, and (c) the internal controls employed by the Company. The Audit Committee held eight meetings during the year. The Board of Directors has determined that John Gibbons qualifies as an "audit committee financial expert" under the rules of the Securities and Exchange Commission. A copy of the written charter of the Audit Committee, adopted by the Board of Directors, is attached hereto as Appendix A. For further information, see "Report of the Audit Committee" on page 15.

The Compensation Committee of the Board of Directors administers the Company's stock option plans, including reviewing and granting stock options to officers and other employees under the plans. The Compensation Committee operates under a written charter adopted by the Board of Directors. A copy of the Compensation Committee's Charter is attached to this Proxy Statement as Appendix B. The Compensation Committee also considers and makes recommendations to the Board of Directors

5

on salaries, bonuses, and other forms of compensation for the Company's executive officers. The Compensation Committee consists of Messrs. Clements, Yates and Tringali. Mr. Tringali is Chairman of the Compensation Committee. The Compensation Committee met three times during the year. For further information, see "Report of the Compensation Committee on Executive Compensation" on page 9.

The Governance and Nominating Committee, which consists of Messrs. Wolfe, Gibbons, Fechtor and Kabouchy selects nominees for election to the Board of Directors. Mr. Wolfe is Chairman of the Governance and Nominating Committee. The Governance and Nominating Committee met twice during the year. The Governance and Nominating Committee which is comprised of independent directors, considers and makes recommendations on matters related to the practices, policies and procedures of the Board and takes a leadership role in shaping the corporate governance of the Company. The Governance and Nominating Committee operates under a written charter adopted by the Board of Directors that is attached to this Proxy Statement as Appendix C. As part of its duties, the Governance and Nominating Committee assesses the size, structure and composition of the Board and board committees, coordinates evaluation of board performance and reviews Board compensation. For further information see "Report of the Governance and Nominating Committee" on this page 6.

Employee-directors receive no additional compensation for serving on the Board. Each of the non-employee directors receives an annual retainer of $24,000, with the exception of the members of the Audit Committee, each of whom receives $30,000 in annual retainer fees. Directors are also reimbursed for expenses which they reasonably incur in the performance of their duties as directors of the Company.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE FOR ITS NOMINEES FOR CLASS II DIRECTORS.

REPORT OF THE GOVERNANCE AND NOMINATING COMMITTEE

The Governance and Nominating Committee is composed of four members, each of whom is an independent director in accordance with Nasdaq requirements and the rules of the SEC. The Committee operates under a written charter adopted by the Board of Directors.

The Committee assists the Board in overseeing the implementation and effectiveness of the Corporate Governance Guidelines and the Code of Ethics and making recommendations to the Board for modifications thereto. The Committee also reviews the overall corporate governance of the Company and recommends improvements when necessary.

The Committee recommended to the Board and the Board adopted a Code of Ethics covering Standards of Conduct for Directors, a Code of Ethics for Chief Executive Officer and Senior Financial Officers and Executives, and a Code of Business Ethics and Professional Conduct.

The Committee also assists the Board in the selection of nominees for election to the Board. The Committee has established selection criteria and qualifications of director nominees as well as a formal process for identification and review of candidates. This process also includes consideration of candidates submitted by shareholders. The selection criteria is reviewed and updated to best meet the needs of the Board and the Company at the time nominees are considered.

The Committee identified and selected two new Board members during this past year, Messrs. Gibbons and Yates. Among the selection criteria used were:

- •

- High personal integrity.

- •

- High business ethics.

- •

- Strong interpersonal skills.

6

- •

- Problem solving skills—use of analytical, experiential and intuitive approaches.

- •

- Ability to keep abreast of changes in best business and governance practices.

- •

- Independent thinking—can challenge thinking but not be contentious.

- •

- Ability to gain the respect of the Chairman.

- •

- Ability to be a contributor to the decisions of the Chairman/CEO, President and the Board—will add new perspectives.

- •

- Contacts and relationships that can be of value to the Company.

- •

- Experience in the Compliance industry desirable.

- •

- Experience in a senior leadership position with a $200+million company.

- •

- Previous Board experience desirable.

- •

- Financially literate and understands business metrics.

- •

- Supplements the existing skills of the current Board.

- •

- International

- •

- Debt/Equity Deal Structure

- •

- Governance

The Committee received candidate recommendations from a variety of sources, including recommendations from the Chairman, other Board members, Company management, outside auditors, bankers and shareholders. In total, the Committee reviewed 10 candidates. The Chairman of the Committee and each of the members of the Committee met with each candidate, as did the Chairman and Chief Executive Officer and the President of the Company. After careful review, Messrs. Gibbons and Yates were recommended to the Board and each was appointed by the Directors to fill a vacancy on the Board.

Other Executive Officers of the Company

Name

| | Age

| | Position

|

|---|

| Lloyd Blonder | | 64 | | Senior Vice President and Chief Financial Officer, Treasurer. He has been associated with the Company since 1983. |

Doug Briskie |

|

40 |

|

Vice President, Western Operations. He has been associated with the Company since 1987. |

Martin Dresser |

|

57 |

|

Vice President, Marketing. He has been associated with the Company since 1999. |

Andrea Korfin |

|

57 |

|

Corporate Secretary, President, Technical Staffing. She has been associated with the Company since 1982. |

Raffy Lorentzian |

|

48 |

|

Vice President, Chief Accounting Officer. He has been associated with the Company since 1997. |

Dwight Moore |

|

41 |

|

Vice President, Eastern Operations. He has been associated with the Company since 1997. |

7

EXECUTIVE COMPENSATION

The following information is furnished with respect to the Chief Executive Officer and the four other most highly compensated executive officers of the Company (the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long Term Compensation

|

|---|

| |

| | Annual Compensation

| |

|

|---|

| |

| |

| | Awards

| | Payouts

|

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation

($)(1)(2)

| | Restricted

Stock

Award(s)($)

| | Options/

SARs

(#)

| | LTIP

Payouts

($)

| | All Other

Compensation

($)

|

|---|

Jack Lin

Chairman of the Board and Chief Executive Officer | | 2004

2003

2002 | | 366,246

360,940

282,528 | | 51,833

14,390

0 | | 0

0

62,472 | | 0

0

0 | | 0

0

0 | | 0

0

0 | | 0

0

0 |

William C. McGinnis

President and Chief Operating Officer/Director |

|

2004

2003

2002 |

|

264,579

236,847

172,000 |

|

58,899

9,823

0 |

|

0

0

48,000 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

Lloyd Blonder

Senior Vice President and Chief Financial Officer |

|

2004

2003

2002 |

|

194,587

170,580

136,472 |

|

32,930

7,072

0 |

|

0

0

26,457 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

Richard Short (3)

Senior Vice President/Director |

|

2004

2003

2002 |

|

211,390

208,107

158,455 |

|

26,958

8,306

0 |

|

0

0

57,696 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

Marvin Hoffman

Vice Chairman of the Board, Vice President, Chief Information Officer/Director |

|

2004

2003

2002 |

|

228,322

228,540

200,001 |

|

36,675

8,970

0 |

|

0

0

48,999 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

|

0

0

0 |

- (1)

- Does not include perquisites or personal benefits which are the lesser of $50,000 or 10% of total annual salary and bonus reported for the named Executive Officer.

- (2)

- The number of shares of National Technical Systems, Inc. common stock taken in lieu of Compensation as follows: Lin, 49,581; McGinnis, 38,095; Blonder, 20,997; Short, 45,791 and Hoffman, 38,888.

- (3)

- Mr. Short resigned as a director and executive officer of the Company on March 18, 2004. He continues as Senior Vice President of NTS Technical Systems, a wholly owned subsidiary of the Company.

8

REPORT OF THE COMPENSATION COMMITTEE

During the fiscal year ended January 31, 2004, the Compensation Committee of the Board of Directors (the "Compensation Committee") was composed of Messrs. Tringali, Clements and Yates (who became a member of the Compensation Committee on September 19, 2003, replacing Mr. Kabouchy), each of whom is an independent, non-employee director. See the description of the Compensation Committee functions above.

Compensation Policies—Policies governing the compensation of the Company's executives are established and monitored by the Compensation Committee. All decisions relating to the compensation of the Company's executives during 2004 were made by the Compensation Committee.

In administering its compensation program, the Compensation Committee follows its belief that compensation should reflect the value created for shareholders while supporting the Company's strategic goals. In doing so, the compensation programs reflect the following themes:

- 1.

- The Company's compensation programs should be effective in attracting, motivating, and retaining key executives;

- 2.

- There should be a correlation among the compensation awarded to an executive, the performance of the Company as a whole, and the executive's individual performance;

- 3.

- The Company's compensation programs should provide the executives a financial interest in the Company similar to the interests of the Company's shareholders; and

- 4.

- The Company's compensation program should strike an appropriate balance between short term and long term performance objectives.

Elements of Compensation Programs

At least annually, the Committee reviews the Company's executive officer compensation programs to ensure that pay levels and incentive opportunities are competitive and reflect the performance of the Company. The three basic components of the program, each of which is intended to serve the overall compensation philosophy, are as follows:

Base Salary—Base salary levels are, in part, established through comparisons with companies of similar size engaged in the same or similar business as that of the Company. Actual salaries are based on individual performance of the executive officer within the salary range reflecting job evaluation and market comparisons. Base salary levels for executive officers are reviewed annually and established within a range deemed by the Committee to be reasonable and competitive. The Committee recommended increases in base salary for certain executive officers in fiscal 2004.

Annual Incentives—The Company's executive officers are eligible to participate in the annual incentive compensation program whose awards are based on the attainment of certain operating and individual goals. The objective of this program is to provide competitive levels of compensation in return for the attainment of certain financial objectives that the Committee believes are primary factors in the enhancement of shareholder value. In particular, the program seeks to focus the attention of executive officers towards earnings growth. Bonuses for executive officers of the Company under this program are intended to be consistent with targeted awards of companies of similar size and engaged in the same or similar business as that of the Company. Actual awards are subject to adjustment up or down, at the discretion of the Committee, based on the Company's overall performance. For fiscal 2004, the Compensation Committee awarded bonuses to executive officers as indicated in the Summary Compensation Table above.

Long-term Incentives—As an important element in retaining and motivating the Company's senior management, the Committee believes that those persons who have substantial responsibility for the

9

management and growth of the Company should be provided with an opportunity to increase their ownership of Company stock. Therefore, executive officers and other key employees are eligible to receive stock options from time to time, giving them the right to purchase shares of Common Stock of the Company at a specified price in the future. The number of stock options granted to executive officers is based on various factors, including the respective scope of accountability, strategic and operational goals and anticipated performance and contributions of the individual executive.

Chief Executive Officer's Compensation

Dr. Lin's compensation is determined pursuant to the principles noted above. The Committee, in considering his compensation for fiscal 2004, reviewed his existing compensation arrangements, comparable compensation for chief executive officers of other companies and the performance of both Dr. Lin and the Company. The Committee did not make any changes to Dr. Lin's salary. Dr. Lin did receive a cash bonus of $51,833.

|

|

|

| | | COMPENSATION COMMITTEE |

|

|

|

| | | Ralph Clements

Donald Tringali

Dan Yates |

Policy with Respect to Internal Revenue Code Section 162(m).

In 1993, the Internal Revenue Code of 1986 (the "Code") was amended to add Section 162(m). Section 162(m), and regulations hereunder adopted in 1995, place a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to certain of the Company's most highly compensated officers. Section 162(m) does not, however, disallow a deduction for qualified "performance-based compensation" the material terms of which are disclosed to and approved by shareholders. At the present time, the Company's executive officer compensation levels are substantially below the $1,000,000 pay limit and the Company believes that it will most likely not be affected by the regulation in the near future. Where appropriate in light of specific compensation objectives, the Board intends to take necessary actions in the future to minimize the loss of tax deductions related to compensation.

10

INFORMATION CONCERNING STOCK OPTIONS

The following table sets forth certain information at January 31, 2004 and for the fiscal year then ended with respect to stock options granted to the individuals named in the Summary Compensation Table above. No stock appreciation rights have been granted and no options have been granted at an option price below fair market value on the date of the grant.

OPTION GRANTS IN THE LAST FISCAL YEAR

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Appreciation for the Option Term(1)

|

|---|

| | Individual Grants

|

|---|

| | Number of

Securities

Underlying

Options/SAR's

Granted

| | % of total

Options/

SAR's

Granted to all

Employees

| |

| |

|

|---|

Name of Executive

| | Exercise or

Base Price

Per Share

| | Expiration

Date

| | At 5%

Annual

Growth

Rate

| | At 10%

Annual

Growth

Rate

|

|---|

| Jack Lin | | 22,000 | | 6.31 | % | $ | 4.895 | | 06/27/2013 | | $ | 67,629 | | $ | 171,550 |

William McGinnis |

|

22,000 |

|

6.31 |

% |

$ |

4.450 |

|

06/27/2013 |

|

$ |

61,481 |

|

$ |

155,955 |

Marvin Hoffman |

|

11,000 |

|

3.16 |

% |

$ |

4.895 |

|

06/27/2013 |

|

$ |

33,815 |

|

$ |

85,775 |

Richard Short |

|

11,000 |

|

3.16 |

% |

$ |

4.450 |

|

06/27/2013 |

|

$ |

30,741 |

|

$ |

77,977 |

Lloyd Blonder |

|

16,000 |

|

4.59 |

% |

$ |

4.450 |

|

06/27/2013 |

|

$ |

44,714 |

|

$ |

113,422 |

- (1)

- All options become exercisable 25% per year commencing on the first anniversary of the date of the option grant.

The potential realizable dollar value of any given option is the difference between (i) the fair market value of the stock underlying such option as of the date of grant, adjusted to reflect hypothetical 5% and 10% annual growth rates simple interest from the date of grant of such option until the expiration date of such option, and (ii) the exercise price for such option. The 5% and 10% are hypothetical growth rates prescribed by the SEC for illustration purposes only and are not a forecast or prediction as to future stock prices. The actual amount that a named executive officer may realize will depend on various factors on the date the option is exercised, so there is no assurance that the value realized by a named executive officer will be at or near the value set forth above in the chart.

The following table sets forth information concerning the exercise of stock options during the fiscal year ended January 31, 2004 by each of the named executive officers and the fiscal year end spread on unexercised "in-the-money" options.

11

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FY-END OPTION/SAR VALUE

| |

| |

| | Number of Securities

Underlying

Unexercised

Options/SARs

at FY-End(1)

| | Value of Unexercised

In-the-money

Options

at FY-End($)(2)

|

|---|

Name of Executive

| | Shares

Acquired

on Exercise

| | Value

Realized

($)(3)

| | Jan-31-04

Exercisable

| | Jan-31-04

Unexercisable

| | Jan-31-04

Excercisable

| | Jan-31-04

Unexercisable

|

|---|

| Jack Lin | | 5,000 | | 10,875 | | 134,633 | | 43,750 | | 219,968 | | 88,696 |

William C. McGinnis |

|

— |

|

— |

|

140,000 |

|

45,500 |

|

257,187 |

|

95,813 |

Marvin Hoffman |

|

— |

|

— |

|

39,250 |

|

27,250 |

|

94,225 |

|

65,010 |

Richard Short |

|

— |

|

— |

|

115,750 |

|

19,750 |

|

194,758 |

|

39,730 |

Lloyd Blonder |

|

— |

|

— |

|

99,750 |

|

19,750 |

|

150,555 |

|

34,293 |

- (1)

- These amounts represent the total number of shares subject to stock options held by the named executives at January 31, 2004. These options were granted on various dates during the years 1994 through 2003.

- (2)

- These amounts represent the difference between the exercise price of the stock options and the closing price of the Company's common stock on January 31, 2004.

- (3)

- This amount represents the difference between the exercise price of the stock options and the market price of the options on the date of exercise.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following is a summary as of January 31, 2004 of all equity compensation plans of the Company that provide issuance of equity securities as compensation. See the Company's Annual Report on Form 10-K for the year ended January 31, 2004, Note 5 to Financial Statements—Stock Option and Pension Plans, for additional discussion.

Plan Category

| | Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

(a)

| | Weighted-Average Exercise

Price of Outstanding

Options, Warrants and

Rights

(b)

| | Number of Securities Remaining

Available for Future Issuance

Under Equity Compensation Plans

(Excluding Securities Reflected

in Column (a))

(c)

| |

|---|

| Equity Compensation Plans Approved by Security Holders | | 2,192,196 | | $ | 3.47 | | 454,300 | (1) |

| Equity Compensation Plans Not Approved by Security Holders | | — | | | — | | — | |

| Total | | 2,192,196 | | $ | 454,300 | (1) | 454,300 | (1) |

- (1)

- Represents shares of Company Common Stock which may be issued pursuant to future awards under The National Technical Systems, Inc. 2002 Stock Option Plan.

12

EMPLOYMENT AGREEMENT

The Company has entered into an employment agreement with Mr. Hoffman to serve as Vice Chairman, Senior Vice President and Chief Information Officer for an indefinite term at a base annual salary of $228,322, as adjusted for cost of living increases. Mr. Hoffman will be eligible for a bonus at the discretion of the Board of Directors, based on a recommendation of the Compensation Committee. Under the agreement, the Company also pays premiums on certain life insurance policies with the beneficiaries designated by Mr. Hoffman.

In the event Mr. Hoffman's employment as an "at will" employee is terminated, other than "for cause," as defined in the agreement, after July 31, 2002, he will receive a severance benefit equal to 12 months of base salary.

Pursuant to the agreement, the Company has an option to purchase all, but not less than all, of the shares of the Company's Common Stock owned by Mr. Hoffman, at the greater of (a) $4.50 per share, or (b) 10% less than the average per share closing price of the Company's Common Stock for the five trading days preceding the Company's election to exercise its option.

13

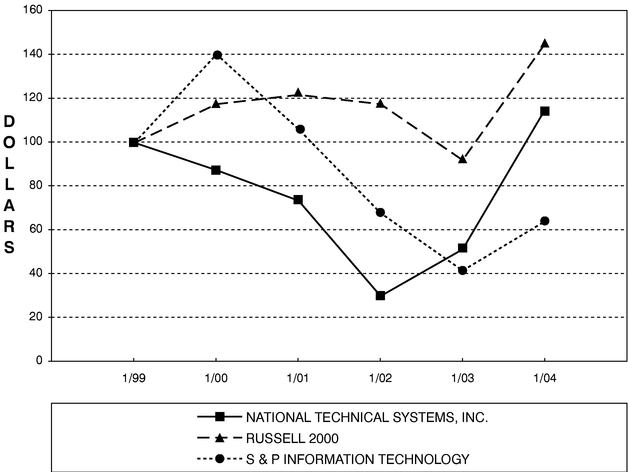

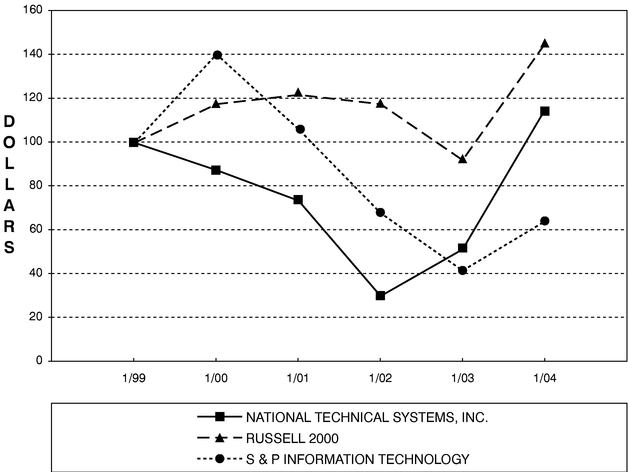

STOCK PRICE PERFORMANCE GRAPH

The following graph shows a five-year comparison of cumulative total returns on investment for the Company, the Russell 2000 Index and the S&P Technology Sector (formerly S&P High Tech Composite) Index.

The stock price performance shown on the graph below is not necessarily indicative of future price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG NATIONAL TECHNICAL SYSTEMS, INC., THE RUSSELL 2000 INDEX

AND THE S & P INFORMATION TECHNOLOGY INDEX

* $100 invested on 1/31/99 in stock or index-including reinvestment of dividends. Fiscal year ending January 31.

Copyright © 2002, Standard & Poor's, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm

14

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

The Company's officers, directors and consultants are required to file initial reports of ownership and reports of change in ownership with the Securities and Exchange Commission. Officers and directors are required by Commission regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on information provided to the Company by individual officers and directors, the Company believes that during fiscal 2004 all filing requirements applicable to officers and directors have been complied with.

REPORT OF THE AUDIT COMMITTEE

The Report of the Audit Committee of the Board of Directors shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The Audit Committee of the Board of Directors is composed of four directors who are independent directors as defined under the rules of the National Association of Securities Dealers, Inc. The Audit Committee operates under a written charter adopted by the Board of Directors in 2000, a copy of which is included as Appendix A to this Proxy Statement.

The Audit Committee recommends to the Board of Directors the appointment of the independent auditors, reviews the scope of audits, reviews significant changes to the Company's accounting principles and practices, reviews significant issues encountered in the course of audit work related to the adequacy of internal controls.

The Audit Committee reviewed and discussed the audited financial statements with management of the Company and representatives of Ernst & Young LLP. The discussions with Ernst & Young LLP included the matters required to be discussed by Statement on Auditing Standards No. 61. In addition, the Audit Committee received the written disclosures and the letter regarding independence from Ernst & Young LLP as required by Independence Standards Board Standard No. 1 and discussed with Ernst & Young LLP their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended January 31, 2004 for filing with the Securities and Exchange Commission.

The Audit Committee also recommended to the Board, and the Board has appointed, Ernst & Young LLP to audit the corporation's financial statements for fiscal 2005, subject to shareholder ratification of that appointment.

15

Proposal 2. RATIFICATION OF AUDITORS

Based on the recommendation of the Audit Committee, the Board of Directors has selected Ernst & Young LLP as auditors for the Company for the year ending January 31, 2005. That firm became auditors for the Company during the fiscal year ended January 31, 1990.

Representatives of Ernst & Young LLP, the independent auditors for the Company for fiscal 2004, will be present at the Annual Meeting and will have an opportunity to make a statement and to respond to appropriate questions.

The Company paid the following fees to Ernst & Young LLP during fiscal 2004 and 2003:

| | 2004

| | 2003

|

|---|

| Audit Fees | | $ | 254,000 | | $ | 239,007 |

| Audit-related fees | | | 0 | | | 0 |

| Tax-related fees | | | 0 | | | 0 |

| All other fees | | | 29,931 | | | 32,388 |

The audit fees for the years ended January 31, 2004 and January 31, 2003 were for professional services rendered for the audits of the consolidated financial statements of the Company, statutory audits, consents and assistance with review of documents filed with the SEC.

The Audit Committee administers the Company's engagement of Ernst &Young LLP and pre-approves all audit and permissible non-audit services on a case-by-case basis. In approving non-audit services, the Audit Committee considers whether the engagement could compromise the independence of Ernst & Young LLP, and whether for reasons of efficiency or convenience it is in the best interest of the Company to engage its independent auditor to perform the services. The Audit Committee has determined that performance by Ernst & Young LLP of the non-audit services related to the fees on the table above did not affect their independence.

Prior to engagement, the Audit Committee pre-approves all independent auditor services. The fees are budgeted and the Audit Committee requires the independent auditor and management to report actual fees versus the budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become necessary to engage the independent auditor for additional services not contemplated in the original pre-approval categories. In those instances, the Audit Committee requires specific pre-approval before engaging the independent auditor.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE FOR THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED FOR THIS PROPOSAL UNLESS SHAREHOLDERS SPECIFY OTHERWISE IN THEIR PROXIES.

OTHER MATTERS

Management is not aware of any other matters to be presented for action at the meeting or any adjournment thereof. However, if any matters come before the meeting, it is intended that shares represented by Proxy will be voted in accordance with the judgment of the persons voting them.

16

SHAREHOLDER PROPOSALS FOR THE NEXT ANNUAL MEETING

SEC rules provide that a shareholder wishing to include a proposal in the proxy statement for the Company's 2005 annual meeting must submit the proposal so that it is received by the Company at its principal executive office, attention Corporate Secretary, at 24007 Ventura Boulevard, Calabasas, California, 91302, no later than January 27, 2005.

Shareholders who wish the Governance and Nominating Committee to consider a candidate for nomination as a director at the 2005 annual meeting must submit advance notice of the nomination to the Committee a reasonable time prior to the mailing date of the proxy statement for the 2005 annual meeting.

A shareholder's notice of a proposed nomination for director to be made at an annual meeting must include the following information:

- •

- the name and address of the shareholder proposing to make the nomination and of the person or persons to be nominated;

- •

- a representation that the holder is a shareholder entitled to vote his or her shares at the annual meeting and intends to vote his or her shares in person or by proxy for the person or persons nominated in the notice;

- •

- a description of all arrangements or understandings between the shareholder(s) supporting the nomination and each nominee;

- •

- any other information concerning the proposed nominee(s) that the Company would be required to include in the proxy statement if the Board of Directors made the nomination; and

- •

- the consent of the nominee(s) to serve as director if elected.

COMMUNICATIONS WITH DIRECTORS

You may communicate with the Chairs of the Audit Committee, the Governance and Nominating Committee or the Compensation Committee, or with the Company's independent Directors as a group, by writing to any such person or group c/o of the Corporate Secretary at 24007 Ventura Boulevard, Calabasas, California 91302.

Communications are distributed to the Board of Directors, or to any individual Director, depending on the facts and circumstances described in the communication. In that regard, the Board of Directors has requested that certain items that are unrelated to the duties and responsibilities of the Board of Directors should be excluded including the following: junk mail and mass mailings; product complaints; product inquiries; new product suggestions; resumes and other forms of job inquiries; surveys; and business solicitations or advertisements. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will not be distributed, with the proviso that any communication that is not distributed will be made available to any independent Director upon that Director's request.

Communications that include information better addressed by the complaint hotline supervised by the Audit Committee will be delivered to the hotline.

CODE OF ETHICS

The Company has adopted a Code of Ethics applicable to the principal executive officer and senior financial executives, including the chief financial officer and the chief accounting officer, of the Company, as well as all employees and directors of the Company. The Code of Ethics is published on the Company's website, at www.ntscorp.com, under "Investor Information." We intend to disclose future amendments to, or waivers from, certain provisions of the Code of Ethics applicable to senior financial executives on our website within two business days following the date of such amendment or waiver.

17

APPENDIX A

Charter of the Audit Committee

of National Technical Systems, Inc.

The Audit Committee (the Committee) is created and appointed by the Board of Directors (the Board) of the Company to assist the Board in fulfilling its responsibilities to oversee management's conduct of the Company's financial reporting.

Specifically, the Committee is responsible for overseeing that:

- •

- the financial statements present, fairly, in all material respects, the financial condition of the Company, in accordance with generally accepted accounting principles;

- •

- the independent auditors have the qualifications, independence and performance as defined by the rules of the Securities and Exchange Commission (the "SEC");

- •

- a system of internal controls is maintained throughout the Company that, on a reasonable and economic basis, protects the assets of the Company and allows for the reasonable recording of transactions to insure the reliability and accuracy of the Company's financial reporting; and

- •

- the Company's compliance with legal and regulatory requirements.

Authority

In discharging its duties, the Committee is empowered to investigate any matter within the scope of its responsibilities or any other matter brought to its attention by the Board, with full access to the Company's books, records, facilities and personnel. The Committee may retain, at the Company's expense, special accounting, legal or other experts it deems necessary to perform its duties.

Membership

The Audit Committee must be comprised of not less than three members of the Board, and the Committee members will meet the independence, experience and other requirements, as defined by the rules of the National Association of Securities Dealers (the "NASD") and the SEC.

Each member of the Committee must be able to read financial statements, including the Company's balance sheet, income statement and cash flow statement. In addition, one member must have past employment experience in finance or accounting, professional certification in accounting, or any other comparable experience or background that results in the individual's financial sophistication, including serving or have served as a chief financial officer or other senior official with financial oversight responsibilities, sufficient to establish the member as a "financial expert" within the meaning of Item 401(h) of Regulation S-K.

Statement

While the function of the Committee is one of oversight, it is management's responsibility for the preparation, presentation and integrity of the Company's financial statements. Management is also responsible for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures designed to ensure compliance with applicable accounting standards and laws and regulations.

The outside auditors have the responsibility to plan and carry out the audit and reviews, in accordance with professional auditing standards, including reviews of the Company's financial statements prior to the filing of each quarterly report on Form 10-Q.

A-1

It should be recognized that the Committee, in fulfilling its duties under this Charter, is made up of members who are not full time employees of the Company and are not and do not represent themselves to be accountants or auditors by profession. As such, it is not the duty nor the responsibility of the Committee or any of its members to perform any "field work" or other types of auditing or accounting reviews or procedures.

Each Committee member shall be entitled to rely on the representations of those persons and organizations within and outside the Company from which it receives information. The Committee is also entitled to rely on the accuracy of the financial and other information provided by such persons and organizations, absent actual knowledge to the contrary.

Responsibilities

In addition to any other responsibilities within the realm of this charter, assigned to it by the Board, the Committee is responsible for the following matters:

Independent (outside) Auditors

- •

- appoint, determine compensation for, retain and oversee the work of an independent auditor, who shall report directly to the Committee;

- •

- review the plan and scope of the audit services, permissible non-audit services and related services to be performed by the independent auditor;

- •

- review and discuss with management and the independent auditor, the annual audited financial statements and the quarterly financial statements, prior to the filing of the Company's Forms 10-K and 10-Q, respectively;

- •

- review and approve any earning releases, conference call scripts and other communications publicizing the financial condition or results of operations of the Company;

- •

- ensure the receipt from the outside auditors of a formal written statement delineating all relationships between the independent auditor and the Company, consistent with Independence Standards Board Standard 1;

- •

- actively discuss with the independent auditor any relationships or services disclosed in the written statement that may affect the objectivity and independence of the independent auditor;

- •

- evaluate the independent auditor's qualifications, independence and performance and present its conclusions and recommendations to the Board;

- •

- obtain and review information from the independent auditors as to:

- •

- their own internal quality control procedures;

- •

- a description of any material issues relating to their internal quality controls raised during any peer review; and

- •

- a description, if any, of any inquiry or investigation by a governmental or professional authority within the last five years, that relates to an independent audit by the auditing firm;

- •

- consider whether the independent auditor satisfies the auditor rotation rules, as they apply, including the lead audit or reviewing partner on the audit management team;

- •

- establish procedures for the advance review and approval of any audit and non-audit services and fees to be provided by the independent auditor, other than "prohibited non-auditing services" and minor audit services, each as specified in the Exchange Act. The Committee shall have the sole authority to make these approvals, although such approval may be delegated to

A-2

Internal Controls & Financial Reporting

- •

- advise management and the outside auditors that they are expected to provide the Committee timely information on any significant generally accepted accounting principles (GAAP) changes or other items that impact the financial statement;

- •

- consider any reports or communications, and management response thereto, submitted to the Committee by the independent auditors required by the Statement on Auditing Standards (SAS) No. 61 (Communications with Audit Committees)

- •

- for example, accounting estimates made by management, the outside auditor's judgment regarding the quality of the Company's accounting principals, as well as any difficulties the auditor encountered, and the Company's response thereto, in the course of the audit;

- •

- discuss with both management and the independent auditor, the Company's disclosures under "Management's Discussion and Analysis of Financial Condition and Resulting Operations"; and

- •

- review the form of opinion the outside auditors propose to issue on the annual financial statement.

Recommendations & Reports

- •

- recommend to the Board of Directors as to whether the audited financial statements should be included in the Company's annual report on Form 10-K for filing with the SEC;

- •

- prepare a report to be included in the annual proxy statement, as required by the SEC;

- •

- review and reassess the adequacy of this charter at least annually and recommend any changes to the Board; and

- •

- establish and oversee procedures for (a) the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and (b) the confidential anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

Complaints

- •

- establish and oversee procedures for (a) the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; and (b) the confidential anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

Other Duties

- •

- perform an annual self-assessment of the Committee's performance for the preceding year;

- •

- review and pre-approve all transactions between the Company and related parties other than compensation transactions; and

- •

- discuss policies and procedures with respect to risk assessment and management.

A-3

APPENDIX B

Charter of the Compensation

Committee of

National Technical Systems, Inc.

Purpose

The purpose of the Compensation Committee (the "Committee") of National Technical Systems, Inc. (the "Company") is to help ensure that the Company compensates its executive officers in a manner that conforms to the compensation strategy of the Company determined by the Board, that is equitable and consistent, that addresses the Company's need to compete in recruiting and retaining qualified executive officers, and that conforms to the requirements of the appropriate regulatory bodies.

Committee Membership and Organization

The Committee shall be comprised of no fewer than three members. Each member of the Committee shall be "independent" as defined by the rules of the National Association of Securities Dealers ("NASD") and the Securities and Exchange Commission ("SEC"). In addition, each member shall be a "Non-employee Director" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 and shall satisfy the requirements of an "outside director" for purposes of Section 162(m) of the Internal Revenue Code. Each member shall be free of any relationship that, in the opinion of the Board, would interfere with his or her individual exercise of independent judgment. The members of the Committee shall be appointed and replaced by the Board. The Board shall appoint one of the members as Chair.

The Committee shall communicate with and work closely with the Board. To foster this communication, the Chairman of the Board and the Chief Executive Officer ("CEO") of the Company may be invited to attend meetings on a non-voting basis.

Committee Responsibilities and Authority Over Compensation of Executive Officers

To carry out its purposes expressed in Paragraph 1 above, the Committee shall have the following responsibilities and authority. Delegation by the Board of responsibilities to the Committee shall not preclude the Board from taking any action permitted to be taken under governing law, rules or regulations applicable to the Company, provided that the Committee shall have sole authority to retain and terminate any consulting firm used to assist in the evaluation of director, CEO or senior executive compensation, including sole authority to approve the consulting firm's fees and other retention terms.

A. Fundamental Role. The members of the Committee are authorized and directed to perform the following duties on behalf of the Board:

(1) Review and approve corporate goals and objectives relevant to compensation of the executive officers.

(2) Evaluate the performance of the executive officers in light of those goals and objectives.

(3) Determine and approve the compensation level of the executive officers based on this evaluation.

(4) Make recommendations to the Board with respect to incentive-compensation plans and equity-based plans.

B-1

B. Specific Duties and Responsibilities. The Committee shall have the following specific duties and responsibilities with respect to compensation of executive officers:

(1) Review from time to time and approve the Company's compensation strategy to ensure that management is rewarded appropriately for its contributions to Company growth and profitability and that the executive compensation strategy supports Company objectives and shareholder interests.

(2) Determine all elements of compensation for the executive officers. The CEO may not be present during voting on or discussion of his or her compensation.

(3) Determine the long-term incentive component of compensation for the executive officers based on the considerations adopted by the Board.

(4) Annually review the performance of the CEO and the executive officers of the Company, and report on the Committee's review to the Board and the CEO.

(5) Produce the annual Board Compensation Committee report to shareholders on the factors and criteria on which the compensation for the CEO and other executive officers in the last year was based, to be included in the Company's proxy statement for its annual meeting or Annual Report on Form 10-K filed with the SEC.

(6) Develop the Company's incentive compensation strategy with respect to the total number of incentive awards to be granted, the relative participation of senior management and other employees, and the types of awards to be granted.

(7) Recommend and approve, subject to submission to shareholders when appropriate, all new equity-related incentive plans.

(8) Determine eligibility for awards under the Company's incentive compensation plans and the terms under which awards are granted.

(9) Allocate awards under the Company's incentive compensation plans, provided that the Committee may delegate to the CEO or another executive officer the authority to allocate stock options among employees who are not executive officers, subject to applicable law and the limits and guidelines established by the Committee.

(10) Assure that the Company's executive incentive compensation program, including the annual and long-term incentive plans, is administered in a manner consistent with the Company's incentive compensation strategy.

(11) Approve annual retainer and meeting fees for directors and members of Board committees, including expense reimbursement limits and per diem allowances, and fix the terms and awards of stock compensation for members of the Board.

(12) Review with the CEO matters relating to management succession.

(13) Review the Company's employee benefit programs and approve changes subject, where appropriate, to shareholder or Board approval.

(14) Obtain advice, assistance, reports or opinions from internal or external legal, accounting or other advisors, including consulting firms, to assist in the evaluation of director, CEO or senior executive compensation.

(15) Such other duties and responsibilities as may be assigned to the Committee, from time to time, by the Board or the Chairman, or as designated in compensation plan documents.

B-2

Administration of the Committee

(1) The Committee will meet at least twice annually and will also meet, as required, in response to the needs of the Board and as necessary to fulfill its responsibilities.

(2) The Committee will make regular written reports to the Board.

(3) The Committee may form and delegate authority to subcommittees, or delegate authority to committee members, when appropriate, provided that such subcommittees will be composed exclusively of members of this Committee and will operate pursuant to a published charter.

(4) The Committee will review and re-examine this Charter at least annually and make recommendations to the Board with respect to any proposed changes.

(5) The Committee will annually report to the full Board regarding its own performance against the responsibilities outlined in this Charter and as otherwise established by the Board.

(6) The Committee will maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

B-3

APPENDIX C

Charter of the

Governance and Nominating

Committee of

National Technical Systems, Inc.

Purpose

The purpose of the Governance and Nominating Committee (the "Committee") of National Technical Systems, Inc. (the "Company") is to help to ensure that the Board of Directors (the "Board") is appropriately constituted to meet its fiduciary obligations to shareholders and the Company, and that the Company has, and follows, appropriate governance standards; and

Committee Membership and Organization

The Committee shall be comprised of no fewer than three members. Each member of the Committee shall be "independent" as defined by the rules of the National Association of Securities Dealers ("NASD") and the Securities and Exchange Commission ("SEC"). In addition, each member shall be a "Non-employee Director" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 and shall satisfy the requirements of an "outside director" for purposes of Section 162(m) of the Internal Revenue Code. Each member shall be free of any relationship that, in the opinion of the Board, would interfere with his or her individual exercise of independent judgment. The members of the Committee shall be appointed and replaced by the Board. The Board shall appoint one of the members as Chair.

The Committee shall communicate with and work closely with the Board. To foster this communication, the Chairman of the Board and the Chief Executive Officer of the Company may be invited to attend meetings on a non-voting basis.

Committee Responsibilities and Authority Over Nominating and Corporate Governance

To carry out its purposes expressed in Paragraph 1 above, the Committee shall have the following responsibilities and authority. Delegation by the Board of responsibilities to the Committee shall not preclude the Board from taking any action permitted to be taken under governing law, rules or regulations applicable to the Company, provided that the Committee shall have sole authority to retain and terminate any search firm to be used to identify director candidates, including sole authority to approve the search firm's fees and other retention terms.

A. Fundamental Role. The members of the Committee are authorized and directed to perform the following duties on behalf of the Board:

(1) Identify individuals qualified to become Board members, consistent with criteria approved by the Board.

(2) Recommend the director nominees to be selected by the Board for the next annual meeting of shareholders.

(3) Develop and recommend to the Board a set of corporate governance principles applicable to the Company.

(4) Oversee the evaluation of the Board and management.

C-1

B. Specific Duties and Responsibilities. The Committee shall have the following specific duties and responsibilities with respect to the composition of the Board:

(1) Evaluate the current composition, organization, size and governance of the Board and its committees; determine future requirements; make recommendations to the Board concerning the appointment of directors to committees of the Board; and recommend the selection of chairs of committees of the Board.

(2) Determine the desired qualifications, expertise and characteristics for potential directors and conduct searches for director candidates that have corresponding attributes. Evaluate, propose and approve nominees for election to the Board, and consider and evaluate shareholder nominees for election to the Board.

(3) Oversee the Board's performance evaluation process, including conducting surveys of director observations, suggestions and preferences. The Committee shall also evaluate the participation of members of the Board in continuing education activities.

(4) Evaluate and recommend termination of service of individual members of the Board as appropriate, in accordance with the Board's governance principles, for cause or for other proper reasons.

(5) Review annually the Company's corporate governance guidelines and make recommendations to the Board with respect to any proposed changes.

(6) Annually report to the full Board regarding its own performance against the responsibilities outlined in this Charter and as otherwise established by the Board.

(7) Obtain advice, assistance, reports or opinions from internal or external legal, accounting or other advisors, including director search firms.

Administration of the Committee

(1) The Committee will meet at least twice annually and will also meet, as required, in response to the needs of the Board and as necessary to fulfill its responsibilities.

(2) The Committee will make regular written reports to the Board.

(3) The Committee may form and delegate authority to subcommittees, or delegate authority to committee members, when appropriate, provided that such subcommittees will be composed exclusively of members of this Committee and will operate pursuant to a published charter.

(4) The Committee will review and re-examine this Charter at least annually and make recommendations to the Board with respect to any proposed changes.

(5) The Committee will annually report to the full Board regarding its own performance against the responsibilities outlined in this Charter and as otherwise established by the Board.

(6) The Committee will maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

C-2

NATIONAL TECHNICAL SYSTEMS, INC.

\/ DETACH PROXY CARD HERE \/

| 1. | Board of Directors recommends a vote FOR the nominees and FOR Proposal 2. | |

| ELECTION OF DIRECTORS | o | FOR all nominees listed below | o | WITHHOLD AUTHORITY

to vote for all nominees listed below | o | FOR ALL EXCEPT

(see instructions below) | |

Nominees: 01 Ralph Clements, 02 Aaron Cohen, 03 Donald Tringali and 04 Dan Yates.

(INSTRUCTION: To withhold authority to vote for any individual nominee, write that nominee's name on the space provided below.) | |

| EXCEPTIONS | | | | | | | |

| | |

| |

2. |

To ratify the selection of Ernst & Young LLP as auditors for the fiscal year ending January 31, 2005. |

|

IF NO SPECIFICATION IS MADE, THIS PROXY WILL

BE VOTED FOR EACH OF THE NOMINEES FOR

DIRECTOR AND RATIFICATION OF THE SELECTION |

|

| o FOR o AGAINST o ABSTAIN | | OF ERNST & YOUNG LLP AS AUDITORS. | |

3. |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | Please Detach Here

< You Must Detach This Portion of the Proxy Card <

Before Returning it in the Enclosed Envelope |

|

|

|

|

|

|

|

|

|

| | | | | | Please sign exactly as your name appears hereon. Please date, and sign and return the Proxy promptly in the enclosed envelope. When signing as attorney, executor, administrator, trustee or guardian, please give full title. If the signature is for a corporation, please sign full corporate name by authorized officer. If the shares are registered in more than one name, all holders must sign. | |

|

|

|

|

|

Dated: , 2004 |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

This proxy is solicited on behalf of the board of directors, and may be revoked by the shareholder delivering it prior to its exercise by filing with the corporate secretary of the company an instrument revoking this proxy or a duly executed proxy bearing a later date or by appearing and voting in person at the meeting. |

|

\/ DETACH PROXY CARD HERE \/

PROXY

NATIONAL TECHNICAL SYSTEMS, INC.

BOARD OF DIRECTORS PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

Monday, June 28, 2004 at 10:00 a.m.

The undersigned hereby appoints Jack Lin and William McGinnis, and each of them, attorneys and agents with power of substitution, to vote, as designated below, all stock of the undersigned at the above meeting and at any adjournment or adjournments thereof.

This proxy is valid only when signed and dated.

See Reverse Side

QuickLinks

NOTICE OF ANNUAL MEETINGPROXY STATEMENTSOLICITATIONSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTProposal 1. ELECTION OF DIRECTORSREPORT OF THE GOVERNANCE AND NOMINATING COMMITTEEEXECUTIVE COMPENSATIONREPORT OF THE COMPENSATION COMMITTEEINFORMATION CONCERNING STOCK OPTIONSOPTION GRANTS IN THE LAST FISCAL YEARAGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION/SAR VALUEEMPLOYMENT AGREEMENTSTOCK PRICE PERFORMANCE GRAPHCOMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* AMONG NATIONAL TECHNICAL SYSTEMS, INC., THE RUSSELL 2000 INDEX AND THE S & P INFORMATION TECHNOLOGY INDEXCOMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934REPORT OF THE AUDIT COMMITTEECharter of the Audit Committee of National Technical Systems, Inc.