QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2007 |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-30229

SONUS NETWORKS, INC.

(Exact name of Registrant as specified in its charter)

| DELAWARE | | 04-3387074 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

7 Technology Park Drive, Westford, Massachusetts 01886

(Address of principal executive offices, including zip code)

(978) 614-8100

(Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| | Name of each exchange on which registered

|

|---|

| Common Stock, par value $0.001 | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "accelerated filer," "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the common stock held by non-affiliates of the Registrant was approximately $2,148,000,000 based on the closing price for the Common Stock on the NASDAQ Global Select Market on June 29, 2007. As of February 15, 2008, there were 270,314,869 shares of common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to shareholders in connection with the 2008 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

SONUS NETWORKS, INC.

FORM 10-K

YEAR ENDED DECEMBER 31, 2007

TABLE OF CONTENTS

Item

| |

| | Page

|

|---|

| Part I | | | | |

| 1. | | Business | | 1 |

|

|

Executive Officers of the Registrant |

|

15 |

1A. |

|

Risk Factors |

|

17 |

1B. |

|

Unresolved Staff Comments |

|

31 |

2. |

|

Properties |

|

31 |

3. |

|

Legal Proceedings |

|

31 |

4. |

|

Submission of Matters to a Vote of Security Holders |

|

35 |

Part II |

|

|

|

|

5. |

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

36 |

6. |

|

Selected Financial Data |

|

38 |

7. |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

39 |

7A. |

|

Quantitative and Qualitative Disclosures about Market Risk |

|

57 |

8. |

|

Financial Statements and Supplementary Data |

|

58 |

9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

103 |

9A. |

|

Controls and Procedures |

|

103 |

9B. |

|

Other Information |

|

108 |

Part III |

|

|

|

|

10. |

|

Directors, Executive Officers and Corporate Governance |

|

109 |

11. |

|

Executive Compensation |

|

109 |

12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

109 |

13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

109 |

14. |

|

Principal Accountant Fees and Services |

|

109 |

Part IV |

|

|

|

|

15. |

|

Exhibits and Financial Statement Schedules |

|

110 |

|

|

Signatures |

|

111 |

|

|

Exhibit Index |

|

112 |

PART I

Item 1. Business

This Annual Report on Form 10-K, as well as all other reports filed with or furnished to the United States Securities and Exchange Commission ("SEC"), are available free of charge through our Internet site (http://www.sonusnet.com) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The public may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Overview

We are a leading provider of voice infrastructure solutions for wireline and wireless service providers. Our products are a new generation of carrier-class infrastructure equipment and software that enables voice services to be delivered over Internet Protocol ("IP") packet-based networks. Our target customers include both traditional and emerging communications service providers, including long distance carriers, local exchange carriers, Internet service providers, wireless operators, cable operators, international telephone companies and carriers that provide services to other carriers. IP packet-based networks, which transport traffic in small bundles, or "packets," offer a significantly more flexible, cost-effective and efficient means for providing communications services than existing circuit-based networks, designed years ago to primarily deliver telephone calls.

Our suite of voice infrastructure solutions allows wireline and wireless operators to build converged voice over IP ("VoIP") networks. Our products are built on the same distributed, IP-based principles embraced by the IP Multimedia Subsystem ("IMS") architecture, as defined by the Third Generation Partnership Project ("3GPP"). This IMS architecture is being accepted by network operators globally as the common approach for building converged voice, data, wireline and wireless networks. The IMS architecture is based primarily on IP packets and the Session Initiation Protocol ("SIP"), which has been the foundation of our products since our formation.

Our IMS-based solution product suite includes the GSX9000™ Open Services Switch, GSX4000™ Open Services Switch, SGX™ Signaling Gateway, the PSX™ Call Routing Server, the ASX™ Call Feature Server, the NBS™ Network Border Switch, the Sonus Insight™ Management System, the IMX® Application Platform and the mobilEdge™ Wireless Access Node. Our products, designed for deployment as the platform of a service provider's voice network, can significantly reduce the cost to build and operate voice services compared to traditional alternatives. Moreover, our products offer a powerful and open platform for network operators to increase their revenues through the creation and delivery of new and innovative voice and data services. Our infrastructure equipment and software can be rapidly and easily deployed, and readily expanded to accommodate growth in traffic volume. Our products also interoperate with network operators' existing telephone infrastructure, allowing them to preserve the investment in their current networks.

We have been recognized by independent market research firms as a worldwide market share leader in several key segments of the carrier-class packet voice infrastructure equipment market. Our announced customers include many of the world's major service providers including: AT&T (including Cingular Wireless, BellSouth and AT&T Inc.), BT Group, Carphone Warehouse, France Telecom, Global Crossing, KDDI, Level 3, Qwest, Softbank Corporation, T-Systems Business Services (a division of Deutsche Telekom Group), Verizon and XO Communications. We sell our products principally through a direct sales force in the United States, Europe, the Middle East and Africa, Japan and Asia-Pacific. We have expanded our access to new geographies and into new markets through our

1

relationships with Motorola, Embarq Logistics and regional channel partners. We also collaborate with our customers to identify and develop new advanced services and applications that they can offer to their customers.

Following a period of restricted spending by communications providers, the telecommunications industry witnessed growth in 2006 and 2007 with the investment in new IP-based and wireless infrastructure technologies. Over the last few years, VoIP has been widely accepted as the protocol on which next generation networks will be built. While the speed and extent of the adoption of carrier packet voice infrastructure products by large carriers remains uncertain, we believe that over time the market opportunity for packet voice solutions is substantial. Synergy Research Group projects that the market for service provider VoIP/IMS infrastructure will approximate $3 billion in 2008. Our objective is to capitalize on our early technology and market lead and build a premier franchise in packet voice infrastructure solutions. The following are key elements of our strategy:

- •

- leverage our technology leadership to achieve key service provider wins;

- •

- continue to extend our technology platform from the core of the network to the access edge;

- •

- embrace the principles outlined by the 3GPP and deliver the industry's most advanced IMS-ready product suite;

- •

- expand and broaden our customer base by targeting specific market segments, such as wireless operators;

- •

- assist our customers' ability to differentiate themselves by offering the industry's most sophisticated application development platform and service creation environment;

- •

- expand our solutions to address emerging IP-based markets, such as network border switching and wireless switching;

- •

- expand our global sales, marketing, support and distribution capabilities;

- •

- grow our base of software applications and development partners;

- •

- actively contribute to the standards definition and adoption process; and

- •

- pursue strategic acquisitions and alliances.

Industry Background

The public telephone network is an integral part of our everyday lives. For most of its history, the telephone industry has been heavily regulated, which has slowed the evolution of its underlying switching and infrastructure technologies, limiting innovation in service offerings and the pricing of telephone services. Two global forces—deregulation and the expansion of the Internet—have revolutionized the public telephone network worldwide.

Deregulation of the telephone industry accelerated with the passage of the Telecommunications Act of 1996. The barriers that once restricted service providers to a specific geography or service offering, such as local or long distance services, are eroding. The opportunity created by accessibility to the telephone services market has encouraged new participants to enter the market and incumbent service providers to expand into new markets, both domestic and international.

Competition between new providers and incumbents is driving down service prices. With limited ability to reduce the cost structure of the public telephone network, profit margins for traditional telephone services have declined. In response, service providers are seeking new, creative and differentiated services as a means to increase revenues and as an opportunity to reduce costs.

2

Simultaneously, the rapid adoption of the Internet and broadband connectivity has driven the dramatic growth of data traffic and the need for service providers to offer more efficient and scalable services to its customers. VoIP networks more efficiently fill available network bandwidth with packets of data and voice from many users. As the volume of data and voice traffic continues to increase with the growth of broadband access, service providers need to build large-scale, more efficient packet networks.

For the first time in the history of the telecommunications industry, both wireless and wireline network operators are converging on a standard architecture designed as a single communications network architecture. The IMS architecture is a set of principles defined by the 3GPP that describes a standard way of building telecommunications networks. In an IMS environment network, switching elements are distributed and applications, including voice, are IP-based.

We believe significant opportunities exist in uniting separate, parallel networks into a new, integrated public network capable of transporting both voice and data traffic on wireless or wireline devices. IP architectures are more efficient at moving data, more flexible and reduce equipment and operating costs. Significant potential savings can be realized by converging voice and data networks, as well as wireless and wireline networks, thereby reducing network operating costs and eliminating redundant or overlapping equipment purchases. Also, combining traditional voice services with Internet or web-based services in a single network is expected to enable new and powerful high-margin, revenue-generating service offerings such as voice virtual private networks, one-number/follow-me services, unified messaging, conferencing, prepaid and postpaid calling card services and sophisticated call centers and other IP voice services.

The public telecommunications network is large, highly complex and generates significant revenues, a substantial majority of which is derived from voice services. Given service providers' substantial investment in, and dependence upon, traditional circuit-switched technology, their transition to VoIP and IMS architectures will be gradual.

Users demand high levels of quality and reliability from the public telephone network and service providers require a cost-efficient network that enables new revenue-generating services. As a result, leading carrier packet voice infrastructure products are being designed to meet some or all of the following requirements:

IMS-ready architecture. Increasingly, carriers recognize the benefit of voice infrastructure solutions that align with the IMS architecture and can serve as the foundation for building next-generation networks. The IMS architecture enables network operators to converge voice, video and other multimedia services to deliver innovative and compelling bundled solutions to consumers. Designed to standardize the delivery of IP services, IMS defines a standard that is distributed and supports interoperability among network components. Accordingly, solutions must allow service providers to seamlessly and cost-effectively migrate to the evolving IMS standards while maximizing their network investment by delivering converged multimedia services over their existing network.

Carrier-class performance. Service providers operate complex, mission-critical networks demanding clear infrastructure requirements, including extremely high reliability, quality and interoperability. For example, service providers typically require equipment that complies with their 99.999% availability standard.

Compatibility with standards and existing infrastructure. New infrastructure equipment and software must support the full range of telephone network standards, including signaling protocols such as SS7

3

or ISDN and international signaling variants, and various physical interfaces such as T1 and E1. It must also support data networking protocols such as IP and asynchronous transfer mode, or ATM, as well as telephony protocols such as SIP, SIP-I, SIP-T, MGCP and H.323. Infrastructure solutions must also seamlessly integrate with service providers' existing operations support systems.

Scalability and density. Carrier voice infrastructure solutions face challenging scalability requirements. Service providers' central offices typically support tens or even hundreds of thousands of simultaneous calls. In order to be economically attractive, the new infrastructure must compare favorably with existing networks in terms of cost per port, space occupied, power consumption and cooling requirements.

Intelligent software in an open and flexible platform. The architecture of packet voice infrastructure solutions decouples the capabilities of traditional circuit-switched equipment into robust hardware elements and highly intelligent software platforms that provide control, signaling and service creation capabilities. This approach is designed to transform the closed, proprietary circuit-switched public telephone network into a flexible, open environment accessible to a wide range of software developers. The objective is to permit service providers and third-party vendors to develop and implement new applications independent of switch vendors. Moreover, the proliferation of independent software providers promises to drive the creation of innovative voice and data services that could expand service provider revenues.

Simple and rapid installation, deployment and support. Infrastructure solutions must be easy to install, deploy, configure and manage. These attributes will enable rapid growth and effective management of dynamic and complex service provider networks.

The Sonus Solution

We develop, market and sell a comprehensive suite of IMS-ready voice infrastructure products with an architecture aligned with the principles of IMS that are purpose-built for the deployment and management of voice and data services over carrier packet networks. The Sonus solution consists of the following carrier-class products:

- •

- GSX9000™ Open Services Switch;

- •

- GSX4000™ Open Services Switch;

- •

- NBS™ Network Border Switch;

- •

- PSX™ Call Routing Server;

- •

- SGX™ Signaling Gateway;

- •

- ASX™ Call Feature Server;

- •

- IMX® Application Platform;

- •

- Sonus Insight Management System; and

- •

- mobilEdge™ Wireless Access Node

These products are designed to offer high reliability, toll-quality voice, improved economics, interoperability, rapid deployment and an open architecture enabling the design and implementation of new services and applications. Like the IMS architecture, our products are based on an open

4

distributed IP-based architecture. As shown in the following diagram, our existing products and products in development offer an IMS-ready solution:

Carrier-class performance. Our products are designed to offer the highest levels of quality, reliability and interoperability, including:

- •

- full redundancy, enabling 99.999% availability;

- •

- voice quality equal or superior to that of today's circuit-switched network;

- •

- system hardware designed for Network Equipment Building Standards, or NEBS Level 3, compliance;

- •

- network monitoring and provisioning designed for Operations System Modifications for the Integration of Network Elements, or OSMINE, compliance;

- •

- a complete set of service features, addressing those found in the existing voice network and extending them to offer greater flexibility; and

- •

- sophisticated network management and configuration capabilities.

Compatibility with industry standards and existing infrastructure. Our products are designed to be compatible with applicable voice and data networking standards and interfaces, including:

- •

- SS7 and other telephone network signaling protocols, including international signaling variants, advanced services and simple call management and routing;

- •

- IP, ATM, Ethernet and optical data networking standards;

- •

- call signaling standards including SIP, SIP-I, SIP-T, MGCP and H.323 and others;

5

- •

- voice coding standards such as G.711 and echo cancellation standard G.168; and

- •

- all common interfaces, including T1, T3, E1 and optical interfaces.

The Sonus solution is designed to interface with legacy circuit-switching equipment, supporting the transparent flow of calls and other information between the circuit and packet networks. As a result, our products allow service providers to migrate to a new packet voice infrastructure, while preserving their significant legacy infrastructure investments.

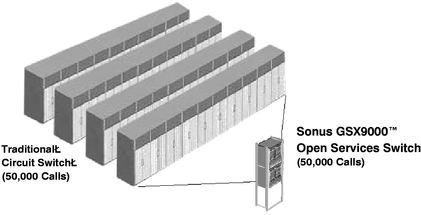

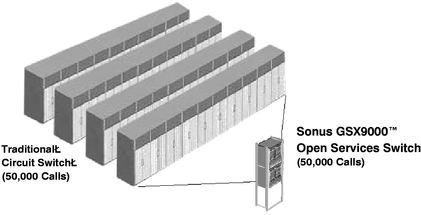

Cost effectiveness and high scalability. The Sonus solution can be used to cost-effectively build packet-based switch configurations supporting a range from a few hundred calls to hundreds of thousands of simultaneous calls. In addition, the capital cost of our equipment is typically lower than that of traditional circuit-switched equipment. At the same time, our GSX Family of Open Services Switches offers unparalleled density, requires significantly less space than needed by typical circuit-switching implementations and requires significantly less power and cooling. This makes possible a significant reduction in expensive central office facilities cost and allows service providers to deploy our equipment in locations where traditional circuit switches would not be an option given the limited space and environmental services.

The GSX Family of Open Services Switches can create central office space savings as shown below.

IMS architecture and flexible platform. The Sonus architecture is built on the basic principles defined by the IMS architecture that is being accepted by network operators globally as the common approach for next generation networks. Our solution is based on a software-centric design and a flexible platform, allowing for the rapid development of new products and revenue-generating services. New services may be developed by us, by network operators themselves or by any number of third parties including software developers and systems integrators. The Sonus IMS architecture also facilitates the creation of services that were previously not possible on the circuit-switched network. In addition, we have partnered with a number of third-party application software developers in our Open Services Partner Alliance, or OSPA®, to stimulate the growth of new applications available for our platform.

Ease of installation and deployment. Our equipment and software can be installed and placed in service by our customers more quickly than circuit-switched equipment. By offering comprehensive testing, configuration and management software, we expedite the deployment process as well as the ongoing management and operation of our products. We believe that typical installations of our solution require just weeks from product arrival to final testing, thereby reducing the cost of deployment and the time to market for new services.

6

The Sonus Strategy

Our objective is to capitalize on our early technology and market lead and build a premier franchise in packet voice infrastructure solutions for wireline and wireless carriers. The following are key elements of our strategy:

Leverage our technology leadership to achieve key service provider wins. As one of the first companies to offer IMS-ready carrier-class packet voice infrastructure products, we have achieved key wins with industry-leading service providers as they develop the architecture for their new voice networks. We expect service providers to select vendors that deliver leading technology and have the ability to maintain that technology leadership. Our equipment is an integral part of the network architecture and achieving these wins will enable us to expand our business as these networks are deployed. By working closely with our customers as they deploy these networks, we gain valuable knowledge regarding their requirements, positioning us to continue to develop product enhancements and extensions that address the evolving requirements of network operators globally.

Continue to extend our technology platform from the core of the network to the access edge. Our robust and sophisticated technology platform has been designed to operate in the core of the largest telecommunications networks in the world. The migration to VoIP began at the core of network operators' networks and is evolving toward the edge (or access segment) of their networks. From our leadership position in the long distance or trunking market, we are expanding into the access segments of the network. We enable network operators to deliver multiple services with a Sonus architecture. These services include long distance/international calling, tandem switching, network border switching, business access, residential access, H.323 termination, direct voice over broadband and enhanced features. This approach will allow our customers to design and execute a coordinated migration and expansion strategy as they build entirely new networks or transition from their legacy circuit-switched infrastructure to a converged, IMS architecture. We have announced the selection of our ASX Feature Server to provide consumer voice services with Alestra, AT&T, BT Group, Qwest, NTT Communications, Jupiter Communications (J:Comm), Cable and Wireless International and Carphone Warehouse.

Embrace the principles outlined by the 3GPP and deliver the industry's most advanced IMS-ready product suite. When we were founded in 1997, a standard architecture for IP-based networks did not yet exist. In order to deliver on the full promise of IP-based technologies, we developed one. Today's IMS architecture leverages many of the same distributed, IP-based principles that we used to develop our product framework. As a result, our customers do not need to undergo architectural upgrades to achieve IMS-compliance, but may stay current with emerging IMS protocols through upgrades to future releases of our software. This evolutionary path is one of our key competitive differentiators. In recognition of our leading position in IMS, Frost and Sullivan awarded us a 2006 Technology Innovation & Leadership of the Year Award.

Expand and broaden our customer base by targeting specific market segments, such as wireless operators. We plan to leverage our early success to penetrate new customer segments. We believe new and incumbent service providers will build out their VoIP infrastructures at different rates. The next-generation service providers, who are relatively unencumbered by legacy equipment, have been among the initial purchasers of our equipment and software. Other newer entrants, including wireless operators, cable operators and Internet service providers, or ISPs, have also been early adopters of our products. Incumbents, including interexchange carriers, Regional Bell Operating Companies and international operators are also adopting packet voice technologies.

Assist our customers' ability to differentiate themselves by offering the industry's most sophisticated application development platform and service creation environment. The competitive landscape in the communications industry has changed dramatically in the wake of the 1996 Telecommunications Act,

7

the introduction of new wireless, broadband and IP-based technologies. Today's communications providers face unprecedented challenges in attracting and retaining customers and driving revenue streams. One approach to win new customers and foster loyalty among existing customers is to introduce new services that redefine how users communicate. Our technology drives down the cost of experimentation, stimulating new innovation. With IP-based technologies and our IMX Application Platform, our customers have powerful tools at their disposal for the development, integration and deployment of exciting new services.

Expand our solutions to address emerging IP-based markets, such as network border switching. There are three primary market factors necessitating enhanced network security features beyond basic Session Border Controllers that offer security and call control where multiple IP-based networks connect. First, network operators looking to grow their markets by expanding their presence or offering new services are pairing with other networks on a much larger scale. Secondly, the recent flurry of mergers and acquisitions among network operators has created heterogeneous networks that need to be integrated in a secure manner. Lastly, more and more network operators are responding to consumer demand for services that connect to the public Internet, which creates a unique set of obstacles. To address these emerging dynamics, we deliver a comprehensive Network Border Switching solution as an integrated element in our network solution that offers enhanced security and control over interconnection, while reducing cost and complexity. Our Network Border Switching solution supports a full range of IP signaling protocols including SIP, SIP-I, SIP-T and H.323 as well as fax interworking and codecs standards. The Sonus Network Border Switch is deployed at several large service providers.

Expand our global sales, marketing, support and distribution capabilities. Becoming the primary supplier of carrier packet voice infrastructure solutions will require a strong worldwide presence. We are broadening our sales, marketing, support and distribution capabilities to address this need. We have established offices throughout the United States, China, India, Japan, Singapore, Germany, the Czech Republic, France and in the United Kingdom. In addition, we have augmented our global direct sales effort by partnering with Embarq Logistics in the United States, international distribution partners in key markets around the world and with our global partner, Motorola. As a carrier-class solution provider, we are making a significant investment in professional services and customer support.

Grow our base of software applications and development partners. We have established and promote a partner program, the Open Services Partner Alliance, or OSPA, which brings together a broad range of development partners to provide our customers with a variety of advanced services, application options and interoperability testing. Our OSPA partners, many of whom have completed interoperability testing with Sonus solutions, include a number of application developers. We have also recently launched a technology certification program in tandem with the University of New Hampshire InterOperability Lab to meet the growing number of requests by third party vendors that wish to integrate with the Sonus platform.

Actively contribute to the standards definition and adoption process. To advance our technology and market leadership, we will continue to lead and contribute to standards bodies such as the IMS Forum, formerly the International Packet Communications Consortium, the Internet Engineering Task Force and the International Telecommunications Union. The definition of standards for carrier packet voice infrastructure is in an early stage and we intend to drive these standards to meet the requirements for an open, accessible, scalable and powerful IMS infrastructure.

Pursue strategic acquisitions and alliances. On April 13, 2007, we acquired privately held Zynetix Limited ("Zynetix"), a designer of innovative Global System for Mobile Communications ("GSM") infrastructure solutions. (See "Recent Developments" of Management's Discussion and Analysis of Financial Condition and Results of Operations and Note 4, "Acquisition of Zynetix Limited" of the Notes to the Financial Statements.) We intend to expand our products and services through other select acquisitions and alliances. These may include acquisitions of complementary products,

8

technologies and businesses that further enhance our technology leadership or product breadth. We also believe that teaming with companies providing complementary products or services will enable us to bring greater value to our customers and extend our lead over competitors.

Sonus Products

The GSX9000 Open Services Switch ("GSX9000") enables voice traffic to be transported over packet networks. The GSX9000 is compliant with NEBS Level 3, the requirement for telecommunications equipment used in the North American Public Switched Telecommunications Network. Its carrier-class hardware is designed to provide 99.999% availability with no single point of failure. The GSX9000 offers optional full redundancy and full hot-swap capability and upgrade to replace boards without turning off the equipment. It is powered from - -48VDC sources standard in central offices and attaches to the central office timing network. The basic building block of a GSX9000 is a shelf. Each shelf is 28'' high, mounts in a standard 19'' or 23'' rack and provides 16 slots for server and adapter modules. The first two slots are reserved for management modules, while the other 14 slots may be used for any mix of other module types. It supports the following interfaces:

• T1;

• T3;

• E1;

• OC3;

• 100BaseT;

• 1000BaseT; and

• OC12c/STM-4. | |  |

The GSX9000 is designed to deliver voice quality equal, or superior, to that of the legacy circuit-switched public network. It is designed to support the multiple encoding schemes used in circuit switches such as G.711 and delivers a number of other voice compression algorithms. It also is designed to provide world-class echo cancellation, conforming to the latest G.168 standard, on every circuit port. It automatically disables echo cancellation when it detects a modem signal. The GSX9000 is also designed to minimize delay, further enhancing perceived voice quality. The GSX9000 scales to the very large configurations required by major service providers. A single GSX9000 shelf can support up to 22,000 simultaneous calls. A single GSX9000, consisting of multiple shelves, can support 100,000 or more simultaneous calls. The GSX9000 is designed to operate with our PSX Call Routing Server and with softswitches and network products offered by other vendors.

The GSX4000 Open Services Switch ("GSX4000") is designed to deliver carrier-class functionality, reliability and manageability. The GSX4000 was developed specifically for service providers to enable them to expand the reach of their core VoIP networks into new applications, new geographic regions or to deploy IP-based multimedia services. Based on the award-winning GSX9000, the GSX4000 allows service providers to cost-effectively extend the reach of their network boundaries with the same carrier-class functionality that is the hallmark of our products.

9

The GSX4000 allows service providers to realize the benefits of the GSX9000 on a platform that is right-sized for their immediate needs. By delivering the proven reliability of the GSX9000 in a smaller form factor, service providers are able to cost-effectively support a highly distributed subscriber base or create an initial presence in a large market. The GSX family provides an expansion path from several hundred ports to several million ports to meet the demand of the worldwide market. The GSX4000 was introduced with 24 T1/E1 interfaces. Further, by utilizing advanced digital signal processing (DSP) technology and software deployed extensively in service provider networks, the GSX4000 is purpose-built for deployments within service providers' networks worldwide.

The Network Border Switch ("NBS") is based on the GSX product family and delivers secure connections to other carriers' and enterprises' IP networks. With the proliferation of IP-based networks and industry convergence around IMS architectures, the ability to securely interconnect between networks has become paramount. The NBS is one of the only carrier-class solutions available today that provides IP-to-IP border control and PSTN media gateway capabilities—integrating security, session control and media control.

The PSX Call Routing Server ("PSX") is the primary module of our IMS architecture and plays an integral role in all of our solutions. The PSX, which serves as the policy and database element in the IMS architecture, provides the network intelligence, including call control, service selection and routing. The PSX is based on a modular architecture that is designed for high performance and scalability, as well as interoperability with third-party gateways, devices and services. The PSX supports many industry protocols including SIP, SIP-I, SIP-T and H.323 for communications with a variety of IP network devices. By supporting the H.323 protocol, the PSX can control and access H.323-based gateways and networks. The PSX supports third-party application servers using the SIP protocol and third-party softswitches with the SIP-T and SIP-I protocols.

The SGX Signaling Gateway ("SGX") provides an integrated SS7 solution for our IMS architecture. The SGX is a SS7/C7 signaling gateway that interconnects Sonus-based packet solutions with legacy SS7 networks. SS7/C7 signaling is the global standard for telecommunications procedures and protocol by which network elements in the public switched telephone network exchange information over a digital signaling network to effect wireless and wireline call setup, routing and control. The SGX is deployed on a NEBS-compliant computing platform with T1, E1 and V.35 interfaces and supports a variety of international signaling variants. The SGX can be deployed separately or with the GSX9000 and the PSX in configurations that meet a wide range of network requirements.

The ASX Call Feature Server ("ASX") provides functionality that extends our IMS architecture to the access part of the network. The ASX is a call agent that handles call setup and basic call features. The ASX provides local area calling features for residential and enterprise markets and regulatory features such as emergency services and lawful intercept. The ASX connects to and can control a variety of network endpoints, such as Integrated Access Devices, gateways, next-generation Digital Loop Carriers and other IP endpoints. The ASX allows the same features to run over many different transport technologies including analog lines, Ethernet, voice over DSL, voice over cable or fixed wireless infrastructure. This flexibility enables a multitude of applications including residential access, cable access and business services such as Centrex and voice virtual private networks. The ASX also

10

enables new features available only on packet-based networks such as unified messaging, multimedia conferencing and desktop integration capabilities.

The IMX Application Platform ("IMX") is a web-based multimedia environment that enables wireline and wireless service providers to develop, integrate, launch and manage enhanced telecommunication applications and services. The IMX combines Internet and telephony application models, enabling the creation and delivery of voice, video and data services in a scalable, standards-based platform. By providing the ability to integrate with a service provider's wireline or wireless network, this platform facilitates the development of new revenue-generating applications, improves time to market and streamlines the delivery of existing or third-party next-generation services.

The Sonus Insight Management System ("Sonus Insight") is a complete, web-based management system designed to simplify the operation of carrier-class packet voice networks. Sonus Insight includes the Element Management System, the DataStream Integrator, the Subscriber Management System, the Network Traffic Manager and the Sonus Insight Developer's Kit, that together provide comprehensive configuration, provisioning, security, alarm reporting, performance data and billing mediation capabilities. Sonus Insight integrates with service providers' existing back-office systems, and offers many tools that enhance and consolidate management functions, allowing service providers to streamline many of today's labor-intensive processes. Sonus Insight scales to support hundreds of switches and concurrent users, and is based on industry standards and protocols to facilitate management from any location worldwide.

The mobilEdge Wireless Access Node ("mobilEdge") integrates with GSM networks, enabling operators to deliver voice, video, data and mobility services over existing high-speed data networks and expand their wireless network coverage. mobilEdge serves as an anchor node, bridging femtocell and picocell access networks, high-speed wireless data networks and IP-based core wireless networks. mobilEdge supports 2G GSM and 3G UMTS femtocell and picocell access points for residential and enterprise use, including both in-building coverage and outdoor in-fill applications. Mobility management, roaming, seamless call hand-off and other features of mobilEdge allow wireless subscribers with single-mode mobile handsets to move between femtocell/picocell and macro network coverage. The mobilEdge platform leverages the mobile switching technology developed by Zynetix and our own GSX switching platform.

Customer Support and Professional Services

Our comprehensive SonusCARESM technical customer support and professional services capabilities are an important element of our solution for customers. SonusCARE covers the full network lifecycle: planning, design, installation and operations. We help our customers create or revise their business plans and design their networks and also provide the following:

- •

- turnkey network installation services;

- •

- system integration and testing;

- •

- 24-hour technical support; and

- •

- educational services to customer personnel on the installation, operation and maintenance of our equipment.

11

We have technical assistance centers in Westford, Massachusetts, Tokyo, Japan and Prague, Czech Republic. The technical assistance centers provide customers with around-the-clock technical support, as well as periodic updates to our software and product documentation. We offer our customers a variety of service plans. We also have established customer test and support centers in Richardson, Texas and Bangalore, India, and have established a customer support center in Prague, Czech Republic.

A key differentiator of our support activities is our professional services group, many members of which hold advanced technical degrees in electrical engineering or related disciplines. We offer a broad range of professional services, including sophisticated network deployment, assistance with logistics and project management support. We also maintain a customer support laboratory in which customers can test our products for their specific applications and in which they can gain an understanding of the applications enabled by the converged network. Our approach to professional services is designed to ensure that our products are integrated into our customers' networks to meet their specific needs and that these customers realize the maximum value from their networking technology investments. At December 31, 2007, our customer support and professional services organization consisted of 238 employees.

Customers

Our target customer base includes all communications providers, such as long distance carriers, local exchange carriers, Internet Service Providers, wireless operators, cable operators, international telephone companies and wholesale operators. We have been selected for network deployments with operators including AT&T, BT Group, Cable and Wireless International, Carphone Warehouse, France Telecom, Global Crossing, KDDI, Level 3, NTT Communications, Qwest, Softbank Corporation, T-Systems Business Services (a division of Deutsche Telekom Group), Verizon and XO Communications.

For the year ended December 31, 2007, one customer, AT&T, accounted for approximately 32% of our revenue. There were no other customers in 2007 that contributed more than 10% of our revenue. For the year ended December 31, 2006, three customers, Cingular Wireless (part of AT&T as of January 1, 2007), KDDI and Level 3 each accounted for more than 10% of our revenue, or approximately 43% of our revenue in the aggregate. For the year ended December 31, 2005, one customer, Cingular Wireless (part of AT&T as of January 1, 2007), accounted for 28% of our revenue. There were no other customers in 2005 that contributed more than 10% of our revenue.

Sales and Marketing

We sell our products principally through a direct sales force and, in some markets, through or with the assistance of distributors and resellers, such as IBIL (Malaysia), Nissho Electronics Corporation (Japan), Sumitomo Corporation (Japan) and TNN (Israel). For geographic information, including revenue and long-lived assets, see our consolidated financial statements included in this Form 10-K, including Note 21 thereto. In 2004, we established an original equipment manufacturer relationship with Motorola, Inc. In 2006, we established a reseller relationship with Embarq Logistics to resell our products in the United States. We intend to establish additional relationships with selected original equipment manufacturers and other marketing partners in order to serve particular markets or geographies and provide our customers with opportunities to purchase our products in combination with related services and products.

At December 31, 2007, our sales and marketing organization consisted of 155 employees located in sales and support offices in the United States and around the world.

12

Research and Development

We believe that strong product development capabilities are essential to our strategy of enhancing our core technology, developing additional applications, incorporating that technology into new products and maintaining comprehensive product and service offerings. Our research and development process is driven by the availability of new technology, market data and customer feedback. We have invested significant time and resources in creating a structured process for undertaking all product development projects. In 2007, we delivered product enhancements in our trunking and access products, network border switching, wireless and network management. We are developing and plan to introduce new products to address market and customer needs. Our research and development expenses were $79.1 million, $55.4 million and $47.6 million for the years ended December 31, 2007, 2006 and 2005, respectively.

We have assembled a team of highly skilled engineers with significant telecommunications and networking industry experience. Our engineers have experience in, and have been drawn from, leading wireline and wireless telecommunications equipment suppliers, computer data networking and multimedia companies. At December 31, 2007, we had 410 employees responsible for research and development, of which 376 were software and quality assurance engineers and 18 were hardware engineers. Our engineering effort is focused on wireless product development, new applications and network access features, new network interfaces, improved scalability, interoperability, quality, reliability and next generation technologies. We maintain research and development offices in Massachusetts, New Jersey, Texas and Virginia in the United States, Swindon, United Kingdom and Bangalore, India. We have made, and intend to continue to make, a substantial investment in research and development.

Competition

The market for carrier packet voice infrastructure solutions is intensely competitive worldwide, subject to rapid technological change and significantly affected by new product introductions, changing customer demands, industry consolidation and other market activities of industry participants. We expect competition to persist and intensify in the future. Our primary sources of competition include vendors of networking and telecommunications equipment, such as Ericsson, Alcatel-Lucent, NEC, Nortel Networks, Nokia Siemens, Huawei and Cisco Systems. Some of our competitors have significantly greater financial resources than we have and are able to devote greater resources to the development, promotion, sale and support of their products. In addition, these competitors have more extensive customer bases and broader customer relationships than we have, including relationships with our potential customers. Other smaller private and public companies are also focusing on similar market opportunities.

In order to compete effectively, we must deliver innovative products that:

- •

- provide extremely high network reliability and voice quality;

- •

- scale easily and efficiently;

- •

- interoperate with existing network designs and other vendors' equipment;

- •

- provide effective network management;

- •

- are accompanied by comprehensive customer support and professional services; and

- •

- provide a cost-effective and space-efficient solution for service providers.

Intellectual Property

Our success and ability to compete are dependent on our ability to develop and maintain our technology and operate without infringing on the proprietary rights of others. We rely on a combination

13

of patent, trademark, trade secret and copyright law and contractual restrictions to protect the proprietary aspects of our technology. These legal protections afford only limited protection for our technology. We presently hold nine U.S. patents with expiration dates ranging from April 2016 through May 2024, and have twenty-three patent applications pending in the United States. In addition, we hold five foreign patents, each of which expires in June 2019, and have twenty-three patent applications pending abroad. We cannot be certain that additional patents will be granted based on these pending applications. We seek to protect our intellectual property by:

- •

- protecting our source and object code for our software, documentation and other written materials under trade secret and copyright laws;

- •

- licensing our software pursuant to signed license agreements, which impose restrictions on others' ability to use our software; and

- •

- seeking to limit disclosure of our intellectual property by requiring employees and consultants with access to our proprietary information to execute confidentiality agreements.

We have incorporated third-party licensed technology into our current products. From time to time, we may be required to license additional technology from third parties to develop new products or product enhancements. Third-party licenses may not be available or continue to be available to us on commercially reasonable terms. The inability to maintain or re-license any third-party licenses required in our current products, or to obtain any new third-party licenses to develop new products and product enhancements, could require us to obtain substitute technology of lower quality or performance standards or at greater cost, and delay or prevent us from making these products or enhancements, any of which could seriously harm the competitiveness of our products.

Manufacturing

Currently, we outsource the manufacturing of our products. Our contract manufacturer provides comprehensive manufacturing services, including assembly and certain tests of our products and procurement of component materials on our behalf. We believe that outsourcing our manufacturing will enable us to conserve working capital, allow for greater flexibility in meeting changes in demand and to be more responsive in delivering products to our customers. At present, we purchase products from our outside contract manufacturer on a purchase order basis.

We and our contract manufacturer currently purchase several key components of our products, including commercial digital signal processors, from single or limited sources. We purchase these components on a purchase order basis.

In 2006, we consolidated our manufacturing to a single contract manufacturer and implemented measures to lower our total cost of manufacturing. At December 31, 2007, we had 26 employees responsible for supply chain management, business process improvement, worldwide procurement, order fulfillment, product quality and technical operations.

Employees

At December 31, 2007, we had a total of 926 employees, including 410 in research and development, 155 in sales and marketing, 238 in customer support and professional services, 26 in manufacturing, 53 in finance and 44 in administration. Our employees are not represented by any collective bargaining agreement. We believe our relations with our employees are good.

Geographic Information

Information regarding the geographic components of our revenue is provided in Note 21 of the Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K. Information

14

regarding the geographic components of our tangible long-lived assets is provided in Note 8 of the Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K.

Additional Information

We were incorporated in August 1997 as a Delaware corporation. Our principal executive offices are located at 7 Technology Park Drive, Westford, MA 01886. Our telephone number is 978-614-8100 at our principal executive offices.

Executive Officers of the Registrant

Our executive officers as of February 15, 2008 were as follows:

Name

| | Age

| | Position

|

|---|

| Hassan M. Ahmed | | 50 | | President, Chief Executive Officer and Chairman of the Board of Directors |

Richard J. Gaynor |

|

48 |

|

Chief Financial Officer |

Paul K. McDermott |

|

46 |

|

Vice President of Finance, Corporate Controller and Chief Accounting Officer |

Matt Dillon |

|

47 |

|

Vice President, Global Services |

Mohammed Shanableh |

|

38 |

|

Vice President, Worldwide Sales |

Chuba Udokwu |

|

52 |

|

Vice President, Worldwide Engineering |

Hassan M. Ahmed has been our Chief Executive Officer and a member of our board of directors since November 1998, Chairman of our board of directors since April 2004 and President since August 2007, which title he resumed. He had previously been President from November 1998 to April 2004. Mr. Ahmed was Executive Vice President and General Manager of the Core Switching Division of Ascend Communications, Inc., a provider of wide area network switches and access data networking equipment, and from July 1997 to July 1998 was a Vice President and General Manager of the Core Switching Division. From June 1995 to July 1997, Mr. Ahmed was Chief Technology Officer and Vice President of engineering for Cascade Communications Corp., a provider of wide area network switches. From 1993 to June 1995, Mr. Ahmed was a founder and president of WaveAccess, Inc., a supplier of wireless communications. Prior to that, he was an Associate Professor at Boston University, Engineering Manager at Analog Devices, Inc., a chip manufacturer, and director of VSLI Systems at Motorola Codex, a supplier of communications equipment. Mr. Ahmed holds a B.S. and an M.S. in engineering from Carleton University and a Ph.D. in engineering from Stanford University.

Richard J. Gaynor has served as our Chief Financial Officer since October 2007. Prior to that, he served as Chief Financial Officer, Vice President of Finance and Administration, Treasurer and Assistant Secretary of Sycamore Networks, Inc., a provider of intelligent bandwidth management solutions for fixed line and mobile network operators worldwide. From January 2001 to September 2004, Mr. Gaynor was Vice President, Corporate Controller and Principal Accounting Officer of Manufacturers' Services Ltd., a global provider of sub-contract electronic manufacturing services. From January 2000 to January 2001, Mr. Gaynor was Chief Financial Officer of Evans and Sutherland Computer Corporation, a developer and manufacturer of flight simulation hardware and software. From March 1994 to December 1999, Mr. Gaynor was Vice President of Finance and Operations Controller at Cabletron Systems, Inc., a global provider of enterprise networking products. Mr. Gaynor is a graduate of the National University of Ireland and holds an M.B.A. from Trinity College in Dublin, Ireland.

15

Paul K. McDermott has been our Vice President, Finance and Corporate Controller since August 2005. From 2002 to 2005, Mr. McDermott was the Chief Financial Officer, Treasurer and Secretary at Network Intelligence Corporation, a provider of appliance-based security event management products. From 1999 to 2002, he served as the Chief Financial Officer, Vice President of Finance & Administration, Treasurer and Secretary of Firepond, Inc., a provider of interactive sales software solutions. Mr. McDermott holds a bachelor's degree in accounting from Duquesne University and an M.B.A. from the University of Pittsburgh and is a licensed certified public accountant.

Matt Dillon has been our Vice President, Global Services since 2001. Prior to joining Sonus, from 1987 to 2000, he was a founding member of Boston Technology (later purchased by Comverse), which created the de-facto standard in scalable central office-based voicemail platforms for Bell Atlantic. From 1984 to 1987, Mr. Dillon was Vice President of Operations for Technology Enterprises.

Mohammed Shanableh joined Sonus in September 2004. He has been our Vice President, Worldwide Sales, since August 2007. From October 2006 to July 2007, he was Vice President, Sales Engineering, and was Vice President, Network Technology Solutions, from September 2004 to October 2006. Mr. Shanableh was Director, Carrier Strategy at Telica, a developer of intelligent multi-service broadband switching systems for next generation service providers from January 2002 to September 2004. He co-founded Valiant Networks, where he was served as Vice President, Professional Services, from December 1999 to December 2001. Mr. Shanableh holds both a B.S. and M.S. in Electrical Engineering from the University of Kansas.

Chuba Udokwu has been our Vice President, Worldwide Engineering since January 2006. Prior to that, he was Senior Director MPLS/RSVP development at Cisco Systems, Inc., a provider of IP-based networking and related products and services, from June 2005 to January 2006. From May 2004 through February 2005, Mr. Udokwu was Vice President, Engineering, of Seranoa Networks (which was acquired by White Rock Networks), a provider of carrier-class service edge solutions. Mr. Udokwu was Vice President, Engineering Optical Networking Division, of Alcatel from April 2002 to February 2004, after it acquired Astral Point Communications, Inc., where he was Vice President, Engineering since January 2001. Mr. Udokwu holds a B.S. in Materials Science and an M.S. in Operations Research from Columbia University School of Engineering.

16

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below before buying our common stock. If any of the following risks actually occurs, the trading price of our common stock could decline and you may lose all or part of your investment.

We expect that a majority of our revenue will be generated from a limited number of customers and we will not be successful if we do not grow our customer base.

To date, we have shipped our products to a limited number of customers. We expect that in the foreseeable future, the majority of our revenues will continue to depend on sales of our products to a limited number of customers. One customer contributed approximately 32% of our revenue in fiscal 2007. Three customers each contributed more than 10% of our revenue in fiscal 2006, or approximately 43% of our revenue in the aggregate. One customer contributed approximately 28% of our revenue in fiscal 2005. Our future success will depend on our ability to attract additional customers beyond our current limited number. The growth of our customer base could be adversely affected by:

- •

- acquisitions of or by our customers;

- •

- customer unwillingness to implement our new voice infrastructure products or renew contracts as they expire;

- •

- potential customer concerns with selecting an emerging telecommunications equipment vendor;

- •

- delays or difficulties that we may incur in completing the development and introduction of our planned products or product enhancements;

- •

- further deterioration in the general financial condition of service providers, including additional bankruptcies, or inability to raise capital;

- •

- new product introductions by our competitors;

- •

- failure of our products to perform as expected; or

- •

- difficulties we may incur in meeting customers' delivery requirements.

The loss of any of our significant customers or any substantial reduction in orders or contractual commitments from these customers could materially and adversely affect our financial position and results of operations. If we do not expand our customer base to include additional customers that deploy our products in operational commercial networks, our business, operating results and financial position could be materially and adversely affected.

If we fail to compete successfully against incumbent telecommunications equipment companies, our ability to increase our revenues and sustain profitability will be impaired.

Competition in the telecommunications market is intense. This market has historically been dominated by large incumbent telecommunications equipment companies, such as Alcatel-Lucent, NEC, Nortel Networks, Nokia Siemens, Huawei and Ericsson, all of which are our direct competitors. We also face competition from other large telecommunications and networking companies, including Cisco Systems, some of which have entered our market by acquiring companies that design competing products. Alcatel and Lucent completed their merger. Siemens has combined its networking business with Nokia's networking business. Other competitors may merge, intensifying competition. Additional competitors with significant financial resources also may enter our markets and further intensify competition.

Many of our current and potential competitors have significantly greater selling and marketing, technical, manufacturing, financial and other resources. Further, some of our competitors sell

17

significant amounts of other products to our current and prospective customers and have the ability to offer lower prices to win business. Our competitors' broad product portfolios, coupled with already existing relationships, may cause our customers to buy our competitors' products or harm our ability to attract new customers.

To compete effectively, we must deliver innovative products that:

- •

- provide extremely high reliability and voice quality;

- •

- scale easily and efficiently;

- •

- interoperate with existing network designs and other vendors' equipment;

- •

- provide effective network management;

- •

- are accompanied by comprehensive customer support and professional services;

- •

- provide a cost-effective and space efficient solution for service providers; and

- •

- meet price competition from low cost equipment providers.

If we are unable to compete successfully against our current and future competitors, we could experience price reductions, order cancellations, loss of customers and revenues and reduced gross profit margins.

We may face risks associated with our international expansion that could impair our ability to grow our international revenues.

International revenues approximated $85 million, $78 million and $48 million in fiscal 2007, fiscal 2006 and fiscal 2005, respectively, and we intend to expand our sales in international markets. This expansion will require significant management attention and financial resources to successfully develop direct and indirect international sales and support channels. In addition, we may not be able to develop international market demand for our products, which could impair our ability to grow our revenues. We have limited experience marketing, distributing and supporting our products internationally and, to do so, we expect that we will need to develop versions of our products that comply with local standards. Furthermore, international operations are subject to other inherent risks, including:

- •

- reliance on distributors and resellers;

- •

- greater difficulty collecting accounts receivable and longer collection cycles;

- •

- difficulties and costs of staffing and managing international operations;

- •

- the impact of differing technical standards outside the United States;

- •

- the impact of recessions in economies outside the United States;

- •

- changes in regulatory requirements and currency exchange rates;

- •

- certification requirements;

- •

- reduced protection for intellectual property rights in some countries;

- •

- potentially adverse tax consequences; and

- •

- political and economic instability.

Consolidation in the telecommunications industry could harm our business.

The industry has experienced consolidation and we expect this trend to continue. Consolidation among our customers may cause delays or reductions in capital expenditure plans and/or increased

18

competitive pricing pressures as the number of available customers declines and their relative purchasing power increases in relation to suppliers. Any of these factors could adversely affect our business.

We face risks related to securities litigation that could result in significant legal expenses and settlement or damage awards.

We have been named as a defendant in a number of securities class action and derivative lawsuits. We are generally obliged, to the extent permitted by law, to indemnify our current and former directors and officers who are named as defendants in these lawsuits. Defending against existing and potential litigation may require significant attention and resources of management. Regardless of the outcome, such litigation will result in significant legal expenses. On November 7, 2007, the Company and the plaintiff in the 2004 Restatement Litigation agreed to a settlement in the amount of $40.0 million, which reached the insurance coverage limit. The settlement is subject to approval by he court. If our defenses in any of our pending litigation are ultimately unsuccessful, or if we are unable to achieve a favorable settlement, we could be liable for large damage awards that could have a material adverse effect on our business, results of operations and financial position.

The investigation of our historical stock option practices and the restatement of our prior financial statements required us to incur substantial expenses and diverted our management's attention from our business, which may continue to impact our business, financial position and results of operations and the trading price of our common stock.

Our internal review and our Audit Committee's investigation into our historical stock option practices and accounting required us to incur substantial expenses for legal, accounting, tax and other professional services, diverted management's attention from our business, and could in the future harm our business, financial condition and results of operations.

While we believe we have made appropriate judgments in determining the correct measurement dates for our stock option grants, the SEC may disagree with the manner in which we have accounted for and reported, or not reported, the financial impact. Accordingly, there is a risk we may have to further restate our historical financial statements, amend prior filings with the SEC, or take other actions not currently contemplated.

Matters related to the investigation into our historical stock option granting practices and the restatement of our financial statements may result in additional litigation, regulatory proceedings and government enforcement actions for which we may be required to pay damages or penalties or have other remedies imposed.

Our historical stock option granting practices and the restatement of our financial statements have exposed us to greater risks associated with litigation, regulatory proceedings and government enforcement action. We have provided the results of our internal review and investigation to the SEC, which has notified us of a formal order of private investigation. We have responded to requests for documents and additional information and we intend to continue to cooperate with the SEC. No assurance can be given regarding the outcomes from litigation, regulatory proceedings or government enforcement actions relating to our past stock option practices. The resolution of these matters will be time-consuming, expensive, and may distract management from the conduct of our business. Furthermore, if we are subject to adverse findings in litigation, regulatory proceedings or government enforcement actions, we could be required to pay damages or penalties or have other remedies imposed, which could harm our business, financial condition, results of operations and cash flows.

19

We have identified material weaknesses in our internal control over financial reporting, which, if not remedied effectively, could have an adverse effect on the trading price of our common stock and impair our ability to timely file our SEC reports and otherwise seriously harm our business.

Through the documentation, testing and assessment of our internal control over financial reporting pursuant to the rules promulgated by the SEC under Section 404 of the Sarbanes-Oxley Act of 2002 and Item 308 of Regulation S-K, management has concluded that our disclosure controls and procedures and our internal control over financial reporting had material weaknesses as of December 31, 2007. Our inability to remedy such material weaknesses promptly and effectively could have a material adverse effect on our business, results of operations and financial condition, as well as impair our ability to meet our quarterly and annual reporting requirements in a timely manner. Prior to the elimination of these material weaknesses, there remains risk that the transitional controls on which we currently rely will fail to be sufficiently effective, which could result in a material misstatement of our financial position or results of operations and require a restatement. In addition, even if we are successful in strengthening our controls and procedures, such controls and procedures may not be adequate to prevent or identify irregularities or facilitate the fair presentation of our financial statements or SEC reporting.

Failure or circumvention of our controls and procedures could impair our ability to report accurate financial results and could seriously harm our business.

Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, and not absolute, assurances that the objectives of the system are met. The failure or circumvention of our controls, policies and procedures could impair our ability to report accurate financial results and could have a material adverse effect on our business, results of operations and financial position.

The limitations of our director and officer liability insurance may require us to pay significant legal expenses and settlement or damage awards.

Our director and officer liability insurance policies provide only limited liability protection relating to the securities class action and derivative lawsuits against us and certain of our officers and directors. If these policies do not adequately cover expenses and certain liabilities relating to these lawsuits, our results of operations and our financial position could be materially harmed. We have agreed to pay an amount in excess of available insurance coverage to settle the 2004 Restatement Litigation. To resolve an insurance coverage dispute with our insurer regarding the coverage provided by one of our policies, we have purchased additional coverage for a one-time premium payment of $770,000. The facts underlying the lawsuits have made director and officer liability insurance extremely expensive for us, and may make such insurance coverage unavailable for us in the future. Increased premiums could materially harm our financial results in future periods. The inability to obtain this coverage due to its unavailability or prohibitively expensive premiums would make it more difficult to retain and attract officers and directors and potentially expose us to self-funding any future liabilities ordinarily mitigated by director and officer liability insurance.

If we are not current in our SEC filings, we will face several adverse consequences.

From August 9, 2006 through August 2, 2007, we were not current in our SEC filings. If we are unable to remain current in our SEC filings, we will not be able to have a registration statement under the Securities Act of 1933, covering a public offering of securities, declared effective by the SEC, and we will not be able to make offerings pursuant to existing registration statements (including registration statements on Form S-8 covering employee stock plans), or pursuant to certain "private placement" rules of the SEC under Regulation D to any purchasers not qualifying as "accredited investors." In addition, our affiliates will not be able to sell our securities pursuant to Rule 144 under the Securities

20

Act. Finally, we will not be eligible to use a "short form" registration statement on Form S-3 until September 1, 2008 and we have lost our status as a "well known seasoned issuer," including the registration advantages associated with such status. These restrictions may impair our ability to raise capital in the public markets should we desire to do so, and to attract and retain key employees.

Our common stock may be delisted from the NASDAQ Global Select Market and transferred to the National Quotation Service Bureau ("Pink Sheets"), which may, among other things, reduce the price of our common stock and the levels of liquidity available to our stockholders.

On August 2, 2007, we filed the Quarterly Report on Form 10-Q for the quarter ended June 30, 2006 (the "Second Quarter Form 10-Q"), the Quarterly Report on Form 10-Q for the quarter ended September 30, 2006 (the "Third Quarter Form 10-Q"), the Annual Report on Form 10-K for the year ended December 31, 2006 (the "2006 Form 10-K") and the Quarterly Report on Form 10-Q for the quarter ended March 31, 2007 (the "First Quarter Form 10-Q") with the SEC. The filing of these reports remedied our non-compliance with Marketplace Rule 4310(c)(14). However, if the SEC disagrees with the manner in which we have accounted for and reported, or not reported, the financial impact of past stock option grants, there could be further delays in filing subsequent SEC reports or other actions that might result in the delisting of our common stock from the NASDAQ Global Select Market.

In addition, if we fail to timely file all of our future periodic reports under the Exchange Act, our common stock may be delisted from the NASDAQ Global Select Market and subsequently would trade on the Pink Sheets. The trading of our common stock on the Pink Sheets may reduce the price of our common stock and the levels of liquidity available to our stockholders. Our delisting from the NASDAQ Global Select Market and transfer to the Pink Sheets may also result in other negative implications, including the potential loss of confidence by suppliers, customers and employees, the loss of institutional investor interest and fewer business development opportunities.

We have a limited number of shares available to issue to our employees, which could impact our ability to attract, retain and motivate key personnel.

We historically have used stock options as a significant component of our employee compensation program in order to align employees' interests with the interests of our stockholders, encourage employee retention, and provide competitive compensation packages. In 2007, our shareholders approved a new stock incentive plan which includes a limited amount of shares to be granted under the plan. The limited number of shares available for use as equity incentives to employees may make it more difficult for us to attract, retain and motivate key personnel.

The market for voice infrastructure products for the public network is new and evolving and our business will suffer if it does not develop as we expect.