Washington, D.C. 20549

ARGOS THERAPEUTICS, INC.

ARGOS THERAPEUTICS, INC.

4233 TECHNOLOGY DRIVE

DURHAM, NORTH CAROLINA 27704

(919) 287-6300

PROXY STATEMENT

2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 17, 2015

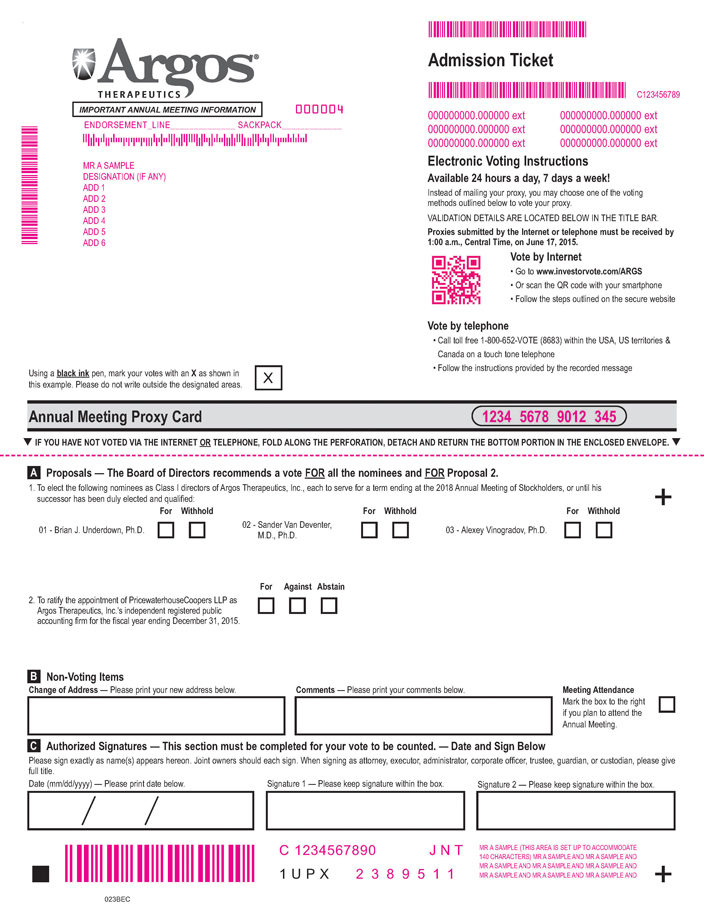

This proxy statement and the enclosed proxy card are being furnished in connection with the solicitation of proxies by the board of directors of Argos Therapeutics, Inc. for use at the 2015 annual meeting of stockholders of Argos Therapeutics, Inc. to be held on Wednesday, June 17, 2015 at 10:00 a.m., Eastern Daylight Time, at the offices of Wilmer Cutler Pickering Hale and Dorr LLP, 7 World Trade Center, 250 Greenwich Street, New York, NY 10007, and at any adjournment thereof. Except where the context otherwise requires, references to “Argos Therapeutics,” “we,” “us,” “our” and similar terms refer to Argos Therapeutics, Inc. and its consolidated subsidiary.

This proxy statement summarizes information about the proposals to be considered at the 2015 annual meeting and other information you may find useful in determining how to vote. The proxy card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

We are mailing this proxy statement and the enclosed proxy card to our stockholders on or about May 18, 2015.

In this mailing, we are also including copies of our annual report to stockholders for the year ended December 31, 2014, or 2014 Annual Report. Our annual report on Form 10-K for the year ended December 31, 2014, as filed with the Securities and Exchange Commission, or the SEC, on March 31, 2015, including our audited financial statements, is included in our 2014 Annual Report and is also available through the SEC’s electronic data system at www.sec.gov.

To request printed copies of our Notice of Annual Meeting, Proxy Statement and 2014 Annual Report, which we will provided free of charge to any stockholder, write to Argos Therapeutics, Inc., 4233 Technology Drive, Durham, North Carolina 27704, Attention: Investor Relations.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Q. Why did I receive these proxy materials?

| A. | Our board of directors has made these materials available to you in connection with the solicitation of proxies for use at our 2015 annual meeting of stockholders to be held at the offices of Wilmer Cutler Pickering Hale and Dorr LLP, 7 World Trade Center, 250 Greenwich Street, New York, NY 10007 on Wednesday, June 17, 2015 at 10:00 a.m., Eastern Daylight Time. As a holder of common stock, you are invited to attend the 2015 annual meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares. |

Q. What is the purpose of the 2015 annual meeting?

A. At the annual meeting, stockholders will consider and vote on the following matters:

| | 1. | The election of three class I directors, each to serve for a three-year term expiring at the 2018 annual meeting of stockholders (proposal 1); |

| | 2. | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015 (proposal 2); and |

| | 3. | The transaction of any other business that may properly come before the meeting or any adjournment thereof. |

Q. Who can vote at the 2015 annual meeting?

| A. | To be entitled to vote, you must have been a stockholder of record at the close of business on May 8, 2015, the record date for our 2015 annual meeting. There were 20,688,802 shares of our common stock outstanding and entitled to vote at the 2015 annual meeting as of the record date. |

Q. How many votes do I have?

| A. | Each share of our common stock that you own as of the record date will entitle you to one vote on each matter considered at the 2015 annual meeting. |

Q. How do I vote?

| A. | If you are the “record holder” of your shares, meaning that your shares are registered in your name in the records of our transfer agent, Computershare Trust Company, N.A., you may vote your shares at the meeting in person or by proxy as follows: |

| | (1) | Over the Internet: To vote over the Internet, please go to the following website: www.investorvote.com/ARGS, and follow the instructions at that site for submitting your proxy electronically. If you vote over the Internet, you do not need to complete and mail your proxy card or vote your proxy by telephone. |

| | (2) | By Telephone: To vote by telephone, please call 1-800-652-VOTE (8683), and follow the instructions provided on the proxy card. If you vote by telephone, you do not need to complete and mail your proxy card or vote your proxy over the Internet. |

| | (3) | By Mail: To vote by mail, you must mark, sign and date the proxy card and then mail the proxy card in accordance with the instructions on the proxy card. If you vote by mail, you do not need to vote over the Internet or by telephone. |

| | (4) | In Person at the Meeting: If you attend the 2015 annual meeting, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the meeting. |

Your proxy will only be valid if you complete and return the proxy card, vote by telephone or vote over the internet at or before the 2015 annual meeting. The persons named in the proxy card will vote the shares you own in accordance with your instructions on your proxy card, in your vote by telephone or in your vote over the internet. If you return the proxy card, vote by telephone or vote over the internet, but do not give any instructions on a particular matter described in this proxy statement, the persons named in the proxy card will vote the shares you own in accordance with the recommendations of our board of directors.

If your shares are held in “street name,” meaning they are held for your account by an intermediary, such as a broker, then although you are deemed to be the beneficial owner of your shares, the broker that actually holds the shares for you is the record holder and is required to vote the shares it holds on your behalf according to your instructions. The proxy materials, as well as voting and revocation instructions, should have been forwarded to you by the broker that holds your shares. In order to vote your shares, you will need to follow the instructions that your broker provides you. Many brokers solicit voting instructions over the Internet or by telephone.

If you do not give instructions to your broker, it will still be able to vote your shares with respect to certain “discretionary” items. The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm (proposal two) is considered a discretionary item. Accordingly, your broker may vote your shares in its discretion with respect to that matter even if you do not give instructions.

However, under applicable stock exchange rules that regulate voting by registered brokerage firms, the election of our nominees to serve as class I directors (proposal one) is not considered to be a discretionary item. Accordingly, if you do not give voting instructions on this proposal, your broker may not vote your shares with respect to this matter and your shares will be counted as “broker non-votes” with respect to this proposal. A “broker non-vote” occurs when shares held by a broker are not voted with respect to a particular proposal because the broker does not have or did not exercise discretionary authority to vote on the matter and has not received voting instructions from its clients.

Regardless of whether your shares are held in street name, you are welcome to attend the meeting. You may not vote shares held in street name in person at the meeting, however, unless you obtain a proxy, executed in your favor, from the holder of record (i.e., your broker).

Q. Can I change my vote?

| A. | If your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the vote is taken at the 2015 annual meeting. To do so, you must do one of the following: |

| | (1) | Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. |

| | (2) | Sign and return a new proxy card. Only your latest dated proxy card will be counted. |

| | (3) | Attend the 2015 annual meeting and vote in person as instructed above. Attending the 2015 annual meeting will not alone revoke your Internet vote, telephone vote or proxy card submitted by mail, as the case may be. |

| | (4) | Give our corporate secretary written notice before or at the meeting that you want to revoke your proxy. |

If your shares are held in “street name,” your bank or brokerage firm should provide you with instructions for changing your vote.

| Q. | How many shares must be represented to have a quorum and hold the 2015 annual meeting? |

| A. | A majority of our shares of common stock outstanding at the record date must be present in person or represented by proxy to hold the 2015 annual meeting. This is called a quorum. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy by mail or that are represented in person at the meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present shares held in “street name” by brokers who indicate on their proxies that they do not have authority to vote those shares. If a quorum is not present, we expect to adjourn the 2015 annual meeting until we obtain a quorum. |

| Q. | What vote is required to approve each matter and how are votes counted? |

A. Proposal 1—Elect Class I Directors

A nominee will be elected as a director at the 2015 annual meeting if the nominee receives a plurality of the votes cast “for” the applicable seat on the board of directors.

Proposal 2—Ratification of the Appointment of Independent Registered Public Accounting Firm

The affirmative vote of the holders of shares of common stock representing a majority of the votes cast on the matter is required for the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ended December 31, 2015.

Shares which abstain from voting and “broker non-votes” with respect to a matter will not be counted as votes in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on the proposals referenced above.

Q. How does the board of directors recommend that I vote on the proposals?

A. Our board of directors recommends that you vote:

FOR the election of the three nominees to serve as class I directors, each for a three-year term; and

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015.

Q. Are there other matters to be voted on at the 2015 annual meeting?

| A. | We do not know of any matters that may come before the 2015 annual meeting other than the election of our class I directors and the ratification of the appointment of our independent registered public accounting firm. If any other matters are properly presented at the 2015 annual meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment on the matter. |

Q. Where can I find the voting results?

| A. | We plan to announce preliminary voting results at the 2015 annual meeting and will report final voting results in a Current Report on Form 8-K filed with the Securities and Exchange Commission, or SEC, within four business days following the end of our 2015 annual meeting. |

Q. What are the costs of soliciting these proxies?

| A. | We will bear the costs of soliciting proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies by telephone, e-mail, facsimile and in person without additional compensation. We may reimburse brokers or persons holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy material to beneficial owners. |

Q. Are annual meeting materials householded?

| A. | Some brokers and other nominee record holders may be “householding” our proxy materials. This means that only a single notice and, if applicable, the proxy materials, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received. We will promptly deliver a separate copy of the notice and, if applicable, the proxy materials, to you if you call or write us at our principal executive offices, 4233 Technology Drive, Durham, North Carolina, Attn: Investor Relations, telephone: (919) 287-6300. In the future, if you want to receive separate copies of the proxy materials, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your broker, or you may contact us at the above address and telephone number. |

Q. What are the implications of being an “emerging growth company”?

| A. | We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may remain an “emerging growth company” for up to five years from the date of our initial public offering. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock, as of April 30, 2015 by:

| · | each of our current directors; |

| · | each of our named executive officers; |

| · | all of our current directors and executive officers as a group; and |

| · | each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of our common stock. |

Beneficial ownership is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to our common stock. Shares of our common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of April 30, 2015 are considered outstanding and beneficially owned by the person holding the options or warrants for the purpose of calculating the percentage ownership of that person but not for the purpose of calculating the percentage ownership of any other person. Except as otherwise noted, the persons and entities in this table have sole voting and investing power with respect to all of the shares of our common stock beneficially owned by them, subject to community property laws, where applicable.

Except as otherwise set forth in the footnotes below, the address of the beneficial owner is c/o Argos Therapeutics, Inc., 4233 Technology Drive, Durham, North Carolina 27704.

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned |

| 5% Stockholders: | | |

Pharmstandard International S.A.(1) | 5,983,549 | 28.92% |

Entities affiliated with Forbion(2) | 2,450,144 | 11.84% |

Wasatch Advisors, Inc.(3) | 2,099,767 | 10.15% |

TVM V Life Science Ventures GmbH & Co. KG(4) | 1,471,091 | 7.11% |

Entities affiliated with Lumira Capital(5) | 1,249,572 | 6.04% |

Entities affiliated with Intersouth Partners(6) | 1,069,979 | 5.17% |

| Directors and Named Executive Officers: | | |

Andrei Petrov(7) | 5,987,215 | 28.94% |

Alexey Vinogradov, Ph.D.(7) | 5,987,215 | 28.94% |

Sander van Deventer, M.D., Ph.D.(8) | 2,453,810 | 11.86% |

Hubert Birner, Ph.D.(9) | 1,474,757 | 7.13% |

Brian J. Underdown, Ph.D.(10) | 1,253,238 | 6.06% |

Jeffrey D. Abbey(11) | 341,385 | 1.72% |

Frederick M. Miesowicz, Ph.D.(12) | 106,662 | 0.53% |

Charles A. Nicolette, Ph.D.(13) | 163,814 | 0.83% |

Philippe Van Holle(14) | 916 | 0.01% |

Jean Lamarre(15) | 7,287 | 0.04% |

All executive officers and directors as a group (12 persons)(16) | 11,938,472 | 55.73% |

| (1) | The address of Pharmstandard International S.A. is 65, Boulevard Grande Duchesse Charlotte, L-1331 Luxembourg, Grand Duchy of Luxembourg. Pharmstandard International S.A. is a wholly owned subsidiary of Public Joint Stock Company “Pharmstandard.” As the parent entity, Public Joint Stock Company “Pharmstandard” has voting and investment control over the shares of the Company held by Pharmstandard International S.A. |

| (2) | The address of Forbion is Gooimeer 2-35 1411 DC Naarden, the Netherlands. Consists of (i) 1,254,388 shares of common stock held by Coöperatieve AAC LS U.A. and (ii) 1,195,756 shares of common stock held by Forbion Co-Investment II Coöperatief U.A. Forbion 1 Management B.V., the director of Cooperatieve AAC LS U.A, has voting and investment power over the shares held by Cooperatieve AAC LS U.A, which are exercised through Forbion 1 Management B.V.’s investment committee, consisting of L.P.A. Bergstein, H. A. Slootweg, M. A. van Osch, G. J. Mulder and Sander van Deventer. None of the members of the investment committee has individual voting and investment power with respect to such shares, and the members disclaim beneficial ownership of such shares except to the extent of their pecuniary interests therein. Forbion 1 Co- II Management B.V., the director of Forbion Co-Investment II Cooperatief U.A., has voting and investment power over the shares held by Forbion Co-Investment II Cooperatief U.A., which are exercised through Forbion 1 Co II Management B.V.’s investment committee, consisting of L.P.A. Bergstein, H. A. Slootweg, M. A. van Osch, G. J. Mulder and Sander van Deventer. None of the members of the investment committee has individual voting and investment power with respect to such shares, and the members disclaim beneficial ownership of such shares except to the extent of their pecuniary interests therein. |

| (3) | The address of Wasatch Advisors, Inc. is 505 Wakara Way, 3rd Floor, Salt Lake City, UT 84108. Reference is hereby made to the Schedule 13G/A filed by Wasatch Advisors, Inc. filed on March 10, 2015 for information about the number of shares held by such reporting person and the nature of its beneficial ownership. Wasatch Advisors, Inc.’s beneficial ownership percentage was calculated using the total number of shares of common stock outstanding as of April 30, 2015. |

| (4) | The address of TVM V Life Science Ventures GmbH &Co. KG is Ottostr. 4, 80333 Munich, Germany. The shares represented here are directly held by TVM V Life Science Ventures GmbH & Co. KG (“TVM V”), the managing limited partner of which is TVM V Life Science Ventures Management GmbH & Co. KG, or TVM V Management, for which Hubert Birner, Stefan Fischer, Alexandra Goll and Alex Polack, each a member of the investment committee of TVM V Management, share voting and investment authority over the shares held by TVM V. Each of TVM V Management, Hubert Birner, Stefan Fischer, Alexandra Goll and Alex Polack disclaims beneficial ownership of these shares, except to the extent of their pecuniary interest therein, if any. |

| (5) | The address of Lumira Capital is 141 Adelaide Street West, Suite 770, Toronto, Ontario, Canada M5H 3L5. The shares represented here are directly and/or beneficially owned by each of, LCC Legacy Holdings Inc., an Ontario corporation, or LCC, Lumira Capital Investment Management Inc., a Canadian corporation, or LCIM, Peter van der Velden, as a member of the Board of Directors of LCC and a member of the investment committee of LCIM, Gerald Brunk, as a member of the investment committee of LCIM, Daniel Hetu, as a member of the investment committee of LCIM, Benjamin Rovinski, as a member of the investment committee of LCIM, Brian J. Underdown, as a member of the investment committee of LCIM and Vasco Larcina, as a member of the investment committee of LCIM. Each of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting Persons.” LCC, acting as the Manager of Lumira Capital I Limited Partnership, or CI, has voting and investment power over the securities held by CI, which is exercised by the investment committee of LCIM. Lumira Capital I (QGP) Inc., which is the general partner of Lumira Capital I Quebec Limited Partnership, or CQ, and a wholly-owned subsidiary of LCC, has voting and investment power over the shares held by CQ; such investment and voting power is exercised based on the recommendations of the investment committee of LCIM. Voting and investment power over the securities held directly by LCC is exercised by the LCC board of directors. CI directly holds 821,016 shares; CQ directly holds 289,323 shares; LCC directly holds 139,233 shares. Each of the Reporting Persons specifically disclaims beneficial ownership of the securities reported herein that are not directly owned by such Reporting Person, except to the extent of their pecuniary interest therein. Beneficial ownership is derived from a Schedule 13D filed on February 21, 2014. |

| (6) | The address for Intersouth Partners is 102 City Hall Plaza, Suite 200, Durham, North Carolina 27701. The shares represented here are directly and/or beneficially owned by each of Intersouth Partners V, L.P., Intersouth Affiliates V, L.P., Intersouth Associates V LLC, Intersouth Partners IV, L.P., Intersouth Associates IV LLC, Mitch Mumma and Dennis Dougherty. Intersouth Affiliates V, L.P. directly holds 32,999 shares; (ii) Intersouth Partners V, L.P. directly holds 721,884 shares; and (iii) Intersouth Partners IV, L.P. directly holds 315,096 shares. Intersouth Associates V LLC, the general partner of each of Intersouth Partners V, L.P. and Intersouth Affiliates V, L.P., and Intersouth Associates IV LLC, the general partner of Intersouth Partners IV, L.P., may be deemed to share voting and dispositive power over the shares held by each of Intersouth Affiliates V, L.P. and Intersouth Partners V, L.P. and Intersouth Partners IV, L.P., respectively. Dennis Dougherty and Mitch Mumma are both Member Managers of Intersouth Associates V LLC, and Intersouth Associates IV LLC, and share voting and investment power over the shares held by Intersouth Affiliates V, L.P., Intersouth Partners V, L.P. and Intersouth Partners IV, L.P. Beneficial ownership is derived from a Schedule 13G filed on February 18, 2014. |

| (7) | Consists of (i) 5,983,549 shares of common stock beneficially owned by Pharmstandard International S.A. as described in footnote (1) above and (ii) 4,583 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (8) | Consists of (i) 2,450,144 shares of common stock beneficially owned by Forbion as described in footnote (2) above and (ii) 4,583 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (9) | Consists of (i) 1,471,091 shares of common stock beneficially owned by TVM V as described in footnote (4) above and (ii) 4,583 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (10) | Consists of (i) 1,249,572 shares of common stock beneficially owned by the Lumira entities as described in footnote 5 above and (ii) 4,583 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (11) | Consists of (i) 3,910 shares of common stock and (ii) 357,563 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (12) | Consists of (i) 1,289 shares of common stock and (ii) 109,856 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (13) | Consists of (i) 8,130 shares of common stock and (ii) 164,935 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (14) | Consists of 1,833 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (15) | Consists of 7,566 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

| (16) | Includes (i) 11,168,428 shares of common stock and (ii) 818,694 shares of common stock issuable upon exercise of options that are exercisable as of April 30, 2015 or will become exercisable within 60 days after such date. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and officers and holders of more than 10% of our common stock to file with the SEC initial reports of ownership of our common stock and other equity securities on a Form 3 and reports of changes in such ownership on a Form 4 or Form 5. Directors and officers and holders of 10% of our common stock are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of our records and representations made by our directors and officers regarding their filing obligations, all Section 16(a) filing requirements were satisfied with respect to 2014.

PROPOSAL 1

ELECTION OF DIRECTORS

Directors and Nominees for Directors

Our board of directors is divided into three classes, with members of each class holding office for staggered three-year terms. There are currently three class I directors (Brian J. Underdown, Sander van Deventer and Alexey Vinogradov), whose terms expire at this 2015 annual meeting of stockholders; two class II directors (Hubert Birner and Jean Lamarre), whose terms expire at the 2016 annual meeting; and three class III directors (Jeffrey D. Abbey, Andrei Petrov and Philippe Van Holle), whose terms expire at the 2017 annual meeting.

Our board of directors, on the recommendation of our nominating and corporate governance committee, has nominated Brian J. Underdown, Sander van Deventer and Alexey Vinogradov for election as class I directors at the 2015 annual meeting. The persons named in the enclosed proxy card will vote to elect Messrs. Underdown, van Deventer and Vinogradov to our board of directors unless you indicate that you withhold authority to vote for the election of any or all nominees. Each Class I director will be elected to hold office until our 2018 annual meeting of stockholders and until their respective successors are elected and qualified or until their respective earlier resignation, death or removal. Each of the nominees is presently a director, and each has indicated a willingness to serve as a director, if elected. If a nominee becomes unable or unwilling to serve, however, the persons acting under the proxy may vote for substitute nominees selected by the board of directors.

Information about our Directors

Below are the names, ages and certain other information for each member of our board as of April 30, 2015, including the nominees for election as class I directors. There are no familial relationships among any of our directors, nominees for director or executive officers. In addition to the detailed information presented below for each of our directors, we also believe that each of our directors is qualified to serve on our board and has the integrity, business acumen, knowledge and industry experience, diligence, freedom from conflicts of interest and the ability to act in the interests of our stockholders.

| | | | |

| Jeffrey D. Abbey | | 53 | | President, Chief Executive Officer and Director |

Hubert Birner, Ph.D.(1)(3) | | 48 | | Chairman of the Board of Directors |

Jean Lamarre(1) | | 61 | | Director |

Andrei Petrov(2)(3) | | 41 | | Director |

Brian J. Underdown, Ph.D.(2)(3) | | 74 | | Director |

| Sander van Deventer M.D., Ph.D. | | 60 | | Director |

Philippe Van Holle(1) (2) | | 60 | | Director |

| Alexey Vinogradov, Ph.D. | | 42 | | Director |

(1) Member of the Audit Committee

(2) Member of the Compensation Committee

(3) Member of the Nominating and Corporate Governance Committee

Class I Directors

Brian J. Underdown, Ph.D. has served as a member of our board of directors since 1999. Dr. Underdown joined Lumira Capital Corp. (formerly MDS Capital Corp.), a venture capital firm, in 1997, and currently serves as a Managing Director. Before joining Lumira, Dr. Underdown served as Assistant Vice President of Research at Pasteur Merieux Connaught from 1994 to 1997. Dr. Underdown has been a member of the board of directors of Vistagen Therapeutics, Inc. since 2009. Dr. Underdown received a Ph.D. from McGill University and undertook post-doctoral studies at Washington University School of Medicine. We believe that Dr. Underdown is qualified to serve on our board of directors due to his experience in the biopharmaceutical industry and his scientific background.

Sander van Deventer, M.D., Ph.D. has served as a member of our board of directors since 2001. Dr. van Deventer has been a General Partner of Forbion Capital Partners (formerly ABN AMRO Capital) since 2006. From 2008 to 2009, he served as the Chief Executive Officer of Amsterdam Molecular Therapeutics, or AMT, a gene therapy company that he co-founded in 1998. He has also served as a member of AMT’s board of directors since 2007. Dr. van Deventer has also served as a Professor of Translational Gastroenterology at Leiden University since 2008. He received an M.D. and Ph.D. from the University of Amsterdam. We believe that Dr. van Deventer is qualified to serve on our board of directors due to his experience as a founder of a biopharmaceutical company and his expertise in clinical development.

Alexey Vinogradov, Ph.D. has served as a member of our board of directors since February 2014. Dr. Vinogradov has served as a Managing Partner of CJSC Kollektsiya, or Inbio Ventures, a management company for Pharmstandard International, S.A., since 2012. Prior to joining Inbio Ventures, from 2009 to 2012, Dr. Vinogradov served as Investment Manager at Bioprocess Capital Partners, Russia’s first venture capital fund, specializing in life sciences and drug discovery. From 2004 to 2009, Dr. Vinogradov was employed by the International Science and Technology Center, where he provided consulting and investment support to early-stage biotechnology companies. From 2002 to 2004, Dr. Vinogradov was employed by Core-Biotech, a private company specialized in industrial biotechnology. Dr. Vinogradov received a Ph.D. in biochemistry from Moscow State University and completed a post-doctoral fellowship at Wageningen University (the Netherlands). We believe that Dr. Vinogradov is qualified to serve on our board of directors due to his experience in the venture capital and biopharmaceutical industries and his scientific background.

Class II Directors

Hubert Birner, Ph.D. has served as the Chairman of our board of directors since 2005 and a member of our board of directors since 2001. Dr. Birner joined the Munich office of TVM Capital, a venture capital firm and affiliate of ours, as an investment manager in 2000 and currently serves as the Managing Partner of the firm. From 1998 to 2000, Dr. Birner served as head of European business development and director of marketing for Germany at Zeneca Agrochemicals, a biopharmaceutical company. Prior to joining Zeneca Agrochemicals, Dr. Birner served as a management consultant in McKinsey & Company’s European healthcare and pharmaceutical practice. Dr. Birner currently has served on the board of directors of Proteon Therapeutics, Inc. since 2006 and of SpePharm Holdings BV since 2007. Dr. Birner previously served on the board of directors of Horizon Pharma, Inc., Bioxell SA, and Evotec AG. Dr. Birner received an M.B.A. from Harvard Business School and a doctorate in biochemistry from Ludwig-Maximilians University in Munich, Germany. His doctoral thesis was honored with the Hoffmann-La Roche prize for outstanding basic research in metabolic diseases. We believe that Dr. Birner is qualified to serve as the Chairman of our board of directors due to his extensive experience with biopharmaceutical companies and his years of experience providing strategic and advisory services to pharmaceutical and biotechnology companies as a lead director and investor.

Jean Lamarre has served as a member of our board of directors since February 2013. Mr. Lamarre is the President of 2856166 Canada Inc., a management consulting firm that he founded in 1992. Mr. Lamarre has been a lead director, the Chairman and from 2008 to 2015, Executive Chairman of Semafo Inc., a gold production company. From 1984 to 1991, Mr. Lamarre served as the Chief Financial Officer of the Lavalin Group, one of the world’s leading design and construction firms. Mr. Lamarre is also a member of the Independent Review Committee of Investor Group Investment Management Ltd. He also serves as Chairman of D-Box Technologies Inc. and a number of private companies. Mr. Lamarre received a B.Comm. in applied economics from HEC Montreal. We believe that Mr. Lamarre is qualified to serve on our board of directors due to his valuable and relevant experience as a senior financial executive.

Class III Directors

Jeffrey D. Abbey has served as our President and Chief Executive Officer and a member of our board of directors since February 2010. Mr. Abbey served in various other positions at our company from September 2002 to February 2010, including as our Vice President of Business Development from February 2004 to January 2009 and as our Chief Business Officer from January 2009 to February 2010. Prior to joining us, Mr. Abbey served as Vice President of Business Development and Finance at Internet Appliance Network, an information technology company, from 1999 to 2001. Mr. Abbey was a partner at Eilenberg and Krause, LLP, a corporate law firm, from 1994 to 1999. Mr. Abbey received an A.B. in mathematical economics from Brown University and an M.B.A. and J.D. from the University of Virginia. We believe that Mr. Abbey is qualified to serve on our board of directors due to his extensive knowledge of our company and our industry.

Andrei Petrov, Ph.D. has served as a member of our board of directors since August 2013. Dr. Petrov has been the Chief Scientific Officer of International Biotechnology at Center Generium, a private scientific research and drug development company, since 2011, and the Chief Executive Officer of CJSC ‘Kollectsiya,’ a venture investment company, since 2013. From 2008 to 2011, Dr. Petrov served as Senior Scientist at CJSC Masterclone, a drug discovery and development company. Dr. Petrov has also served as a member on the board of directors of Affitech A/S since 2010, and as a member on the board of directors of co.don AG since 2012. We believe that Dr. Petrov is qualified to serve on our board of directors due to his extensive experience in drug discovery and development, international collaboration and co-development as well his business development skills in mergers, acquisitions and licensing deals.

Philippe Van Holle has served as a member of our board of directors since November 2014. Mr. Van Holle held various positions at Celgene Corporation from January 2006 through October 2014, including as Senior VP Global Human Resources from January 2013 to October 2014, Chairman International from January 2012 to December 2012, President EMEA from November 2008 to December 2011 and Head of Europe from January 2006 to November 2008. Mr. Van Holle served as Vice President Northern Europe for the Genzyme Corporation from September 2001 to December 2005. Prior to that, he had been Vice President Global Marketing at Baxter International, for the Renal Division, which he joined in 1998. He was Vice President Marketing, Amgen Europe from 1989 to 1997. Mr. Van Holle received his undergraduate degree in Econometrics at the Antwerp University St. Ignatius, Belgium in 1976 and a M.B.A from Cornell University. We believe that Mr. Van Holle is qualified to serve on our board of directors due to his experience in the biopharmaceutical industry and as a senior executive.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF BRIAN J. UNDERDOWN, SANDER VAN DEVENTER AND ALEXEY VINOGRADOV TO SERVE AS CLASS I DIRECTORS.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed the firm of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as independent auditors for the fiscal year ending December 31, 2015. Although stockholder approval of our audit committee’s appointment of PricewaterhouseCoopers LLP is not required by law, our board believes that it is advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the 2015 annual meeting, our audit committee will reconsider its appointment of PricewaterhouseCoopers LLP. Representatives of PricewaterhouseCoopers LLP are expected to be present at the 2015 annual meeting and will have the opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions from our stockholders.

Audit Fees and Services

Audit and other fees billed to us by PricewaterhouseCoopers, LLP for the years ended December 31, 2014 and 2013 are as follows:

| | | | | | | |

| Audit Fees (1) | | $ | 379,974 | | | $ | 639,510 | |

| Audit-Related Fees (2) | | | — | | | | — | |

| Tax Fees (3) | | | — | | | | — | |

| All Other Fees (4) | | | — | | | | — | |

| Total Fees for Services Provided | | $ | 379,974 | | | $ | 639,510 | |

____________________

| (1) | Audit fees include fees associated with the annual audit, reviews of interim financial statements included in our quarterly reports on Form 10-Q and SEC registration statements, accounting and reporting consultations and audits conducted under OMB Circular A-133. |

| (2) | There were no audit-related fees for the fiscal year ended December 31, 2014 or 2013. |

| (3) | There were no tax fees for the fiscal years ended December 31, 2014 or 2013. |

| (4) | All other fees include fees billed for other services rendered not included within Audit Fees, Audit Related Fees or Tax Fees. There were no other fees for the fiscal years ended December 31, 2014 or 2013. |

PricewaterhouseCoopers LLP did not perform any professional services related to financial information systems design and implementation for us in the years ended December 31, 2014 or 2013.

The audit committee has determined in its business judgment that the provision of non-audit services described above is compatible with maintaining PricewaterhouseCoopers LLP’s independence.

In 2014, the audit committee adopted a formal policy concerning approval of audit and non-audit services to be provided to the Company by its independent registered public accounting firm, PricewaterhouseCoopers LLP. The policy requires that all services to be provided by PricewaterhouseCoopers LLP, including audit services and permitted audit-related and non-audit services, must be preapproved by the audit committee, provided that de minimis non-audit services may instead be approved in accordance with applicable SEC rules. The board of directors preapproved all audit and non-audit services provided by PricewaterhouseCoopers LLP during the fiscal years ended December 31, 2014 and 2013.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015.

AUDIT COMMITTEE REPORT

The audit committee has reviewed Argos Therapeutics’ audited financial statements for the fiscal year ended December 31, 2014 and discussed them with the company’s management and the company’s registered public accounting firm, PricewaterhouseCoopers LLP.

The audit committee has also received from, and discussed with, our independent registered public accounting firm various communications that our independent registered public accounting firm is required to provide to the audit committee, including the matters required to be discussed by Auditing Standard No. 16, Communication with audit committees, as adopted by the Public Company Accounting Oversight Board, or PCAOB.

The audit committee has received the written disclosures and the letter from PricewaterhouseCoopers LLP required by applicable requirements of the PCAOB regarding PricewaterhouseCoopers LLP’s communications with the audit committee concerning independence, and has discussed with the company’s registered public accounting firm their independence.

Based on the review and discussions referred to above, the audit committee recommended to the company’s Board of Directors that the audited financial statements be included in the company’s Annual Report on Form 10-K for the year ended December 31, 2014, as filed with the SEC.

By the audit committee of the board of directors of Argos Therapeutics, Inc.

Hubert Birner, Ph.D.

Jean Lamarre

Philippe Van Holle

CORPORATE GOVERNANCE

General

Our board of directors believes that good corporate governance is important to ensure that we are managed for the long-term benefit of stockholders. This section describes key corporate governance guidelines and practices that our board of directors has adopted. Complete copies of our corporate governance guidelines, committee charters and code of conduct are available on the Corporate Governance section of our website, www.argostherapeutics.com.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of the company and our stockholders. These guidelines, which provide a framework for the conduct of our board of directors’ business, provide that:

| · | our board of directors’ principal responsibility is to oversee the management of the company; |

| · | a majority of the members of our board of directors shall be independent directors; |

| · | the independent directors meet regularly in executive session; |

| · | directors have full and free access to officers and employees and, as necessary and appropriate, independent advisors; |

| · | new directors participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis; and |

| · | at least annually, our board of directors and its committees will conduct a self-evaluation to determine whether they are functioning effectively. |

Board Leadership Structure

The positions of chairman of the board of directors and chief executive officer are presently separated and have generally been separated at our company. The duties of the chairman of the board include the following:

| · | chairing meetings of our board and of the independent directors in executive session; |

| · | meeting with any director who is not adequately performing his or her duties as a member of our board or any committees; |

| · | facilitating communications between other members of our board and the chief executive officer; |

| · | determining the frequency and length of board meetings and recommending when special meetings of our board should be held; |

| · | preparing or approving the agenda for each board meeting; and |

| · | reviewing and, if appropriate, recommending action to be taken with respect to written communications from stockholders submitted to our board. |

The board of directors decided to separate the roles of chairman and chief executive officer because it believes that a bifurcated leadership structure offers the following benefits:

| · | increasing the independent oversight of our company and enhancing our board’s objective evaluation of our chief executive officer; |

| · | freeing the chief executive officer to focus on company operations instead of board administration; |

| · | providing the chief executive officer with an experienced sounding board; |

| · | providing greater opportunities for communication between stockholders and our board; |

| · | enhancing the independent and objective assessment of risk by our board; and |

| · | providing an independent spokesman for our company. |

Director Independence

Rule 5605 of the NASDAQ Listing Rules requires a majority of a listed company’s board of directors to be comprised of independent directors within one year of listing. In addition, the NASDAQ Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent, that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act and that compensation committee members also satisfy independence criteria set forth in Rule 10C-1 under the Exchange Act.

Under Rule 5605(a)(2) of the NASDAQ Listing Rules, a director will only qualify as an “independent director” if, in the opinion of our board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, in order to be considered independent for purposes of Rule 10A-3 of the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

In addition, in affirmatively determining the independence of any director who will serve on a company’s compensation committee, Rule 10C-1 under the Exchange Act requires that a company’s board of directors consider all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (i) the source of compensation of the director, including any consulting advisory or other compensatory fee paid by such company to the director; and (ii) whether the director is affiliated with the company or any of its subsidiaries or affiliates.

Our board of directors undertook a review of the composition of our board of directors and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our board of directors has determined that each of Hubert Birner, Brian Underdown, Jean Lamarre, Sander van Deventer, Andrei Petrov, Philippe Van Holle and Alexey Vinogradov is an “independent director” as defined under Rule 5605(a)(2) of the NASDAQ Listing Rules.

Our board of directors also determined that Hubert Birner, Ph.D., Jean Lamarre and Philippe Van Holle, who comprise our audit committee, and Andrei Petrov, Brian J. Underdown, and Philippe Van Holle, who comprise our compensation committee, satisfy the independence standards for such committees established by the SEC and the NASDAQ Listing Rules, as applicable. Our board reached a similar determination with respect to each of David W. Gryska, who served as a director and as a member of the audit committee and the compensation committee in 2014 until his resignation from our board of directors in October 2014, and Brian J. Underdown, who served as a member of the audit committee from October 2014 until February 2015. In making such determinations, our board of directors considered the relationship that each such non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Board and Committee Meetings

Our board of directors held ten meetings during 2014. During 2014, each of the directors then in office attended at least 75% of the aggregate of all meetings of the board of directors and all meetings of the committees of the board of directors on which such director then served. Continuing directors and nominees for election as directors in a given year are expected to attend the annual meeting of stockholders. This is our first annual meeting of stockholders since we became a public company in February 2014.

We have established an audit committee, a compensation committee and a nominating and corporate governance committee. Each of these committees operates under a charter that has been approved by our board of directors. A copy of each charter can be found under the “Corporate Governance” section of our website at www.argostherapeutics.com

Audit Committee

The current members of our audit committee are Hubert Birner, Ph.D., Jean Lamarre and Philippe Van Holle. Mr. Lamarre chairs our audit committee. Mr. Van Holle has served on the committee since February 2015. Mr. Van Holle replaced Brian Underdown, who served as a member of our audit committee from October 2014 until February 2015. In addition, David W. Gryska, a former member of our board of directors, served as a member of our audit committee until October 2014, when he ceased to serve as a member of our board of directors. Our audit committee held nine meetings during 2014.

Our audit committee’s responsibilities include:

| · | appointing, approving the compensation of, and assessing the independence of our registered public accounting firm; |

| · | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from such firm; |

| · | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| · | monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| · | overseeing our internal audit function, if any; |

| · | overseeing our risk assessment and risk management policies; |

| · | establishing policies regarding hiring employees from our independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns; |

| · | meeting independently with our internal auditing staff, our independent registered public accounting firm and management; |

| · | reviewing and approving or ratifying any related person transactions; and |

| · | preparing the audit committee report required by SEC rules. |

All audit and non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

Our board of directors has determined that Mr. Lamarre is an “audit committee financial expert” as defined in applicable SEC rules and qualifies as independent as defined under the applicable NASDAQ rules for audit committee members. We believe that the composition of our audit committee meets all applicable requirements with respect to audit committee composition under the current NASDAQ Global Market and SEC rules and regulations.

Compensation Committee

The current members of our compensation committee are Andrei Petrov, Brian J. Underdown, and Philippe Van Holle. Dr. Underdown chairs our compensation committee. Mr. Van Holle has served on the committee since he joined our board of directors in November 2014. Mr. Van Holle replaced David W. Gryska, a former member of our board of directors, who served as a member of our compensation committee until October 2014 at which time he ceased to serve as a member of our board of directors. Our compensation committee held four meetings during 2014.

Our compensation committee’s responsibilities include:

| · | reviewing and approving, or making recommendations to our board with respect to, the compensation of our chief executive officer and our other executive officers; |

| · | overseeing an evaluation of our senior executives; |

| · | overseeing and administering our cash and equity incentive plans; |

| · | reviewing and making recommendations to our board with respect to director compensation; |

| · | reviewing and discussing annually with management our compensation disclosure required by SEC rules; and |

| · | preparing the annual compensation committee report required by SEC rules. |

We believe that the composition of our compensation committee meets all applicable requirements with respect to compensation committee composition under the current NASDAQ Global Market and SEC rules and regulations.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Hubert Birner, Ph.D., Andrei Petrov and Brian J. Underdown, Ph.D. Dr. Birner chairs our nominating and corporate governance committee. Our nominating and corporate governance committee did not hold any meetings during 2014. The board addressed matters relating to nominations and corporate governance during executive sessions of meetings of the board held by the independent directors.

Our nominating and corporate governance committee’s responsibilities include:

| · | identifying individuals qualified to become members of our board; |

| · | recommending to our board the persons to be nominated for election as directors and to each of our board’s committees; |

| · | reviewing and making recommendations to our board with respect to our board leadership structure; |

| · | reviewing and making recommendations to our board with respect to management succession planning; |

| · | developing and recommending to our board corporate governance principles; and |

| · | overseeing a periodic evaluation of our board. |

Director Nomination Process

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and our board of directors.

In considering whether to recommend any particular candidate for inclusion in our board’s slate of recommended director nominees, our nominating and corporate governance committee applies the criteria set forth in our corporate governance guidelines. Consistent with these criteria, our nominating and corporate governance committee expects every nominee to have the following attributes or characteristics: integrity, business acumen, good judgment, and knowledge of our business and industry. We also value experience on other public company boards of directors and board committees.

The director biographies included herein indicate each nominee’s experience, qualifications, attributes and skills that led our nominating and corporate governance committee and our board of directors to conclude each such director should continue to serve as a director of Argos Therapeutics. Our nominating and corporate governance committee and our board of directors believe that each of the nominees has the individual attributes and characteristics required of each of our directors, and the nominees as a group possess the skill sets and specific experience desired of our board of directors as a whole.

Our nominating and corporate governance committee does not have a policy (formal or informal) with respect to diversity, but believes that our board, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. In this regard, the committee also takes into consideration the value of diversity (with respect to gender, race and national origin) of our board members. The committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

Stockholders may recommend individuals to our nominating and corporate governance committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least one year as of the date such recommendation is made, to Corporate Secretary, Argos Therapeutics, Inc., 4233 Technology Drive, Durham, North Carolina 27704. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our bylaws. Assuming that appropriate biographical and background material has been provided on a timely basis, the committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy card for the next annual meeting.

Stockholders also have the right under our bylaws to directly nominate director candidates, without any action or recommendation on the part of the committee or our board of directors, by following the procedures set forth under “Stockholder Proposals.”

Communications from Stockholders

Our board of directors will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Our chairman of the board, with the advice and assistance from our legal counsel, is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the other directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the chairman of the board considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to our board of directors should address such communications to Board of Directors, Argos Therapeutics, 4233 Technology Drive, Durham, North Carolina.

Oversight of Risk

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board of directors and its committees is to oversee the risk management activities of management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board of directors oversees risk management activities relating to business strategy, acquisitions, capital allocation, organizational structure and certain operational risks; our audit committee oversees risk management activities related to financial controls and legal and compliance risks; our compensation committee oversees risk management activities relating to our compensation policies and practices; and our nominating and corporate governance committee oversees risk management activities relating to board of directors composition and management succession planning. Each committee reports to the full board of directors on a regular basis, including reports with respect to the committee’s risk oversight activities, as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full board of directors discuss particular risks.

Code of Business Conduct and Ethics

We have also adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, or persons performing similar functions. We have posted a current copy of the code on our website, www.argostherapeutics.com. In addition, we intend to post on our website all disclosures that are required by law or NASDAQ stock market listing standards concerning any amendments to, or waivers from, any provision of the code.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our board of directors or our compensation committee. None of the members of our compensation committee is, or has ever been, an officer or employee of our company. The current members of our compensation committee are Andrei Petrov, Brian J. Underdown, and Philippe Van Holle. David W. Gryska, a former member of our board of directors, served as a member of our compensation committee until October 2014, at which time he ceased to serve as a member of our board of directors.

Director Compensation

The form and amount of director compensation is reviewed and assessed from time to time by the compensation committee with changes, if any, recommended to the board of directors for action. Director compensation may take the form of cash, equity, and other benefits ordinarily available to directors.

Our board of directors adopted a formal non-employee director compensation policy that became effective upon the closing of our initial public offering, or IPO, in February 2014. This policy is designed to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders. It provides for non-employee directors to receive an option grant of 11,000 shares upon election to the board, which will vest in equal quarterly installments over a term of three years so long as such person continues to serve as a director; an annual option grant of 5,500 shares upon the annual meeting of stockholders, which will vest in equal quarterly installments over a term of one year so long as such person continues to serve as a director; an annual retainer of $35,000; and a supplemental retainer of $25,000 in the event such director is the chairman or lead director. If the non-employee director is a member of our audit or compensation committee, he or she would receive an additional $5,000 retainer, which would be increased to $10,000 if such director was serving as the chair of such committee. If the non-employee director is a member of our governance and nominating committee, he or she would receive an additional $2,500 retainer, which would be increased to $5,000 if such director was serving as the chair of such committee.

We reimburse each non-employee director for reasonable travel expenses incurred and in connection with attendance at board and committee meetings on our behalf, and for expenses such as supplies.

The form and amount of director compensation is reviewed and assessed from time to time by our Compensation Committee with changes, if any, recommended to our board of directors for action. Director compensation may take the form of cash, equity, and other benefits ordinarily available to directors.

Fiscal 2014 Compensation of Non-Employee Directors

Our non-employee directors received the following aggregate amounts of compensation in respect of the year ended December 31, 2014:

| | | | | | | | | | |

| | | ($) | | ($) | | ($) | | | ($) | |

| Hubert Birner, Ph.D. | | 70,000 | | | | | | | | 70,000 | |

| David Gryska(2) | | 48,917 | | | | | | | | 48,917 | |

| Jean Lamarre | | 50,585 | | | | | | | | 50,585 | |

| Andrei Petrov | | 42,500 | | | | | | | | 42,500 | |

| Brian J. Underdown, Ph.D. | | 50,835 | | | | | | | | 50,835 | |

| Sander van Deventer, M.D., Ph.D. | | 35,000 | | | | 99,084 | | | | 134,084 | |

| Philippe Van Holle (3) | | 5,543 | | | | 73,704 | | | | 79,247 | |

| Alexey Vinogradov, Ph.D. | | 35,000 | | | | 99,084 | | | | 134,084 | |

____________________

| (1) | The amounts shown in this column reflect the aggregate grant date fair value of the stock awards and option awards granted to our non-employee directors computed in accordance with FASB ASC Topic 718. The assumptions made in determining the fair values of our stock awards and option awards are set forth in Notes 2 and 12 to our 2014 Consolidated Financial Statements in Part II, Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2014. |

(2) David Gryska resigned from our board of directors effective October 31, 2014.

(3) Philippe Van Holle joined our board of directors in November 2014.

As of December 31, 2014, our non-employee directors held the following stock options, all of which were granted under the 2014 Plan and the 2008 stock incentive plan:

| |

| Hubert Birner, Ph.D. | 11,000 |

| Jean Lamarre | 16,015 |

| Andrei Petrov | 11,000 |

| Brian J. Underdown, Ph.D. | 11,000 |

| Sander van Deventer, M.D., Ph.D. | 11,000 |

| Philippe Van Holle | 11,000 |

| Alexey Vinogradov, Ph.D. | 11,000 |

TRANSACTIONS WITH RELATED PERSONS

Since January 1, 2014, we have engaged in the following transactions with our directors, executive officers and holders of more than 5% of our voting securities, and affiliates or immediate family members of our directors, executive officers and holders of more than 5% of our voting securities, in which the amount involved in the transaction exceeds $120,000. We believe that these transactions were on terms as favorable as we could have obtained from unrelated third parties. Compensation arrangements for our directors and named executive officers are described in “Executive and Director Compensation.”

In February, 2014, our principal stockholders purchased shares in our IPO at the initial public offering price. The number of shares that each of our principal stockholders purchased and the aggregate purchase price paid for such shares is set forth in the table below.

| | Shares of Common Stock Purchased in our IPO | | | | |

| Entities affiliated with Forbion | | 36,416 | | | 291,328 | |

| Entities affiliated with Intersouth Partners | | 28,841 | | | 230,728 | |

| Entities affiliated with Lumira Capital | | 40,497 | | | 323,976 | |

| TVM V Life Science Ventures GmbH & Co. KG | | 39,873 | | | 318,984 | |

| Pharmstandard International S.A. | | 1,275,000 | | | 10,200,000 | |

Policies and Procedures for Related Person Transactions

Our board of directors has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which our company is a participant, the amount involved exceeds $120,000, and one of our executive officers, directors, director nominees or 5% stockholders, or their immediate family members, each of whom we refer to as a “related person,” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a “related person transaction,” the related person must report the proposed related person transaction to our chief executive officer. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by our audit committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval is not practicable, the committee will review, and, in its discretion, may ratify the related person transaction. The policy also permits the chairman of the committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the committee after full disclosure of the related person’s interest in the transaction. As appropriate for the circumstances, the committee will review and consider:

| · | the related person’s interest in the related person transaction; |

| · | the approximate dollar value of the amount involved in the related person transaction; |

| · | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

| · | whether the transaction was undertaken in the ordinary course of our business; |

| · | whether the terms of the transaction are no less favorable to us than terms that could have been reached with an unrelated third party; |

| · | the purpose of, and the potential benefits to us of, the transaction; and |

| · | any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

The committee may approve or ratify the transaction only if the committee determines that, under all of the circumstances, the transaction is in, or is not inconsistent with, our best interests. The committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by the instructions to the SEC’s related person transaction disclosure rule, our board of directors has determined that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of this policy:

| · | interests arising solely from the related person’s position as an executive officer of another entity (whether or not the person is also a director of such entity), that is a participant in the transaction, where (a) the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, (b) the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive any special benefits as a result of the transaction, and (c) the amount involved in the transaction equals less than the greater of $200,000 dollars or 5% of the annual gross revenues of the other entity that is a party to the transaction; and |

| · | a transaction that is specifically contemplated by provisions of our charter or bylaws. |

The policy provides that transactions involving compensation of executive officers shall be reviewed and approved by the compensation committee in the manner specified in its charter.

EXECUTIVE COMPENSATION

This section describes the material elements of compensation awarded to, earned by or paid to each of our named executive officers in 2014. This section also provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our named executive officers and is intended to place into perspective the data presented in the tables and narrative that follow. Our “named executive officers” for 2014 were:

| · | Jeffrey D. Abbey, our president and chief executive officer; |

| · | Charles A. Nicolette, Ph.D., our vice president of research and development and chief scientific officer; and |

| · | Frederick M. Miesowicz, Ph.D., our vice president of manufacturing and chief operating officer. |

Summary Compensation Table

The following table sets forth information regarding compensation awarded to, earned by or paid to our named executive officers during 2014 and 2013.

Name and Principal Position | | | | | | | | | | | | | All Other Compensation ($)(2) | | | | |

| Jeffrey D. Abbey (3) | | 2014 | | | 379,788 | | | | 163,800 | | | | 482,991 | | | | 16,632 | | | | 1,043,211 | |

| President and Chief Executive Officer | | 2013 | | | 300,000 | | | | 136,800 | | | | 2,112,044 | | | | 3,136 | | | | 2,551,980 | |

| Charles A Nicolette, Ph.D. | | 2014 | | | 294,327 | | | | 88,200 | | | | 202,618 | | | | 8,117 | | | | 593,262 | |

| Vice President of Research and Development and Chief Scientific Officer | | 2013 | | | 250,000 | | | | 71,250 | | | | 891,946 | | | | 3,033 | | | | 1,216,229 | |

| Frederick M. Miesowicz, Ph.D. | | 2014 | | | 284,552 | | | | 72,455 | | | | 104,357 | | | | 13,623 | | | | 474,987 | |

| Vice President of Manufacturing and Chief Operating Officer | | 2013 | | | 261,380 | | | | 74,493 | | | | 504,879 | | | | 3,112 | | | | 843,864 | |

_____________

| (1) | The amounts reported in the “Option Awards” column reflect the aggregate fair value of share-based compensation awarded during the year computed in accordance with the provisions of Financial Accounting Standards Board Accounting Standard Codification, or ASC, Topic 718. See Notes 2 and 12 to our consolidated financial statements appearing in “Item 8. Financial Statements and Supplementary Data” of our Annual Report on Form 10-K for the year ended December 31, 2015 regarding assumptions underlying the valuation of the option awards. |

| (2) | The amounts reported in the “All Other Compensation” column reflect, for each named executive officer, the sum of the incremental cost to us of all perquisites and other personal benefits, which are comprised of post-tax insurance earnings. |

| (3) | Mr. Abbey also serves as a member of our board of directors but does not receive any additional compensation for his service as a director. |

Narrative Disclosure to Summary Compensation Table

We review compensation for our executive officers annually. The material terms of the elements of our executive compensation program for 2014 are described below.

Our compensation committee sets base salaries and bonuses and grants equity incentive awards to our executive officers. In setting base salaries and bonuses and granting equity incentive awards, our compensation committee considers compensation for comparable positions in the market, the historical compensation levels of our executives, individual and corporate performance as compared to our expectations and objectives, our desire to motivate our employees to achieve short- and long-term results that are in the best interests of our stockholders, and a long-term commitment to our company. As part of this process, our Chief Executive Officer prepares performance evaluations for the other executive officers and recommends annual salary increases, annual stock option awards and bonuses to the compensation committee. The compensation committee conducts our Chief Executive Officer’s performance evaluation. Prior to approving compensation for our executive officers, the compensation committee consults with the board of directors.

During the annual compensation review, our compensation committee also consults with its compensation consultant. Our compensation committee engaged Arnosti Consulting, Inc. as its independent compensation consultant to review our executive compensation peer group and program design and assess our executives’ compensation relative to comparable companies. Our compensation committee considered the relationship that Arnosti Consulting, Inc. has with us, the members of our board of directors and our executive officers. Based on the committee’s evaluation, the compensation committee has determined that Arnosti Consulting, Inc. is serving as an independent and conflict-free advisor to the committee.

The primary elements of our executive compensation program are:

| · | annual cash bonuses; and |

We strive to achieve an appropriate mix between the various elements of our compensation program to meet our compensation objectives and philosophy; however, we have not adopted any formal policies or guidelines for allocating compensation among these elements.