SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Current Report pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported) October 4, 2002

AIRSPAN NETWORKS, INC.

(Exact name of registrant as specified in its charter)

Washington

(State or other jurisdiction of incorporation)

000-31031 (Commission file number) | | 75-2743995 (I.R.S. Employer Identification No.) |

777 Yamato Road, Suite 105, Boca Raton, Florida 33431

(Address of principal executive offices) (Zip code)

(561) 893-8670

(Registrant’s telephone number, including area code)

This Amended Current Report on Form 8-K/A amends and supplements the Current Report on Form 8-K filed with the Commission on October 18, 2002. This Amended Current Report provides, among other things, the information required by Item 7- Financial Statements and Exhibits.

Item 2. Acquisition or Disposition of Assets

ACQUISITION OF MARCONI WipLL

As of October 4, 2002, Airspan Communications Limited (the “Purchaser”), a wholly owned subsidiary of the Registrant (“Airspan”), purchased all of the outstanding shares of capital stock and intercompany debt of Marconi Communications (Israel) Ltd. (“Marconi WipLL”) pursuant to a stock purchase agreement (the “Purchase Agreement”) with Marconi Corporation plc (the “Seller”). The name of Marconi WipLL has been changed to Airspan Networks (Israel) Limited (“Airspan Israel”).

Airspan Israel is operating the Seller’s broadband wireless access equipment manufacturing, sales and service business that is commonly known as the Wireless Internet Protocol Local Loop (“WipLL”) business. The products and services marketed by Airspan Israel enable operators in licensed and unlicensed wireless bands to offer high speed, low cost, wireless broadband connections for data and voice over IP.

Subject to the terms and conditions of the Purchase Agreement, the Purchaser has acquired all the intercompany debt owed to Marconi plc by Marconi WipLL and all of the issued and outstanding capital stock of Marconi WipLL in exchange for $3 million of cash. Airspan has provided the Seller and one of its affiliates with a guarantee of the Purchaser’s obligations under the Purchase Agreement and under an equipment sales and servicing agreement with SpeedNet (discussed below), respectively.

WipLL SYSTEM & PRODUCTS

WipLL is a fixed wireless access system that connects residential and business customers to a communications service provider’s or Internet service provider’s network.The end user experiences a transparent connection between the WipLL equipment and the network, and receives performance and features equivalent to a high quality wireline access service. By using WipLL, the service provider acquires an “all-in-one” broadband access solution, supporting data, Voice over IP (“VoIP”) and multimedia applications over a single integrated platform. WipLL can be used to deliver broadband services to residential subscribers, including telecommuters, micro businesses and small businesses.

Airspan believes WipLL could expand Airspan’s market reach in four ways:

| | · | | WipLL provides Airspan with a low cost Internet and VoIP data access product for Airspan’s traditional customer base- operators with 3.5 GHz licensed spectrum; |

| | · | | WipLL provides Airspan with an additional potential customer base - operators like Speednet that have an existing backbone network, and who want to extend the reach of that network to provide economical high speed internet access; |

| | · | | WipLL gives Airspan access to the rural, unlicensed ISPs in the United States who provide access to an estimated 75 million people not currently serviced by cable or traditional DSL; and |

| | · | | WipLL enables Airspan to offer low cost, high-speed connectivity solutions to geographically remote enterprises. |

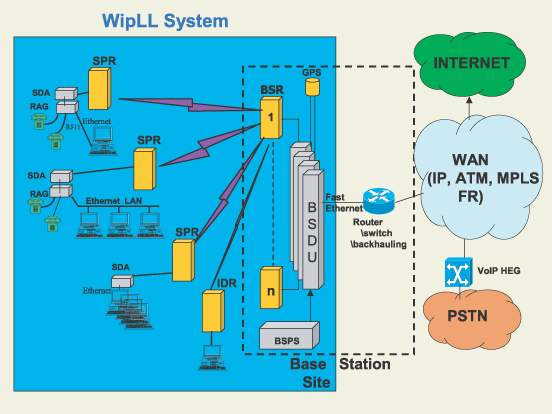

A WipLL network consists of the following equipment and products:

| | · | | Base station equipment: The base station is the connection point between the WipLL network and the Internet or public switched telephone network (“PSTN”). The Base Station equipment |

connects to the service provider’s network via a Wide Area Network (“WAN”) router, switch or backhauling solution, over a Fast Ethernet connection. The Base Station is also wirelessly linked to multiple subscribers.

· | | Subscriber equipment: The subscriber equipment is located at the subscriber’s premises and is wirelessly linked to the Base Station. |

· | | WipManage - WipManage is a network management system that performs and simplifies tasks such as configuration and provisioning of subscribers, performance monitoring and alarm management. |

Below is a diagram of a WipLL system that details the relationship between subscriber equipment, base station equipment and a communication service provider’s or Internet service provider’s network.

Base Station Equipment

Each Base Station includes several Base Station Radios (“BSR”) and Base Station Distribution Units (“BSDUs”) and, may include a Base Station Power System (“BSPS”). A Global Positioning Satellite (“GPS”) unit is also an option in European, African, Asian and Latin American countries.

Base Station Radio (“BSR”)

BSRs are outdoor units, which are capable of servicing up to 60 degrees of coverage. In a typical base station there are six BSRs to provide 360 degrees of coverage. Each BSR provides up to 3.2 Mbps of usable bandwidth to the customers in its sector and each base station can accommodate up to 24 BSRs, subject to radio spectrum availability. At maximum capacity, a base station can provide connectivity to approximately 3,024 subscribers.

Base Station Distribution Units (“BSDU”)

Each BSDU aggregates the transmissions from up to six BSRs and relays the aggregated information to a PSTN or Internet Network over a 100BaseT fast Ethernet interface. Simultaneously, each BSDU also receives transmissions from a PSTN or Internet Network and selectively relays them to the appropriate BSRs. BSDUs also provide synchronization between the BSRs in the same Base Station site using Global Positioning Satellite (GPS) technology. This feature enables all Base Station Sites equipped with this technology to be synchronized with each other. The synchronization feature helps increase the system capacity by coordinating the frequency hopping sequences between the BSRs thus reducing interferences.

Subscriber Premises Equipment

For subscribers requiring only high-speed data connectivity, the subscriber equipment consists primarily of an outdoor Subscriber Premises Radio (“SPR”), which has a data connection with an indoor Subscriber Data Adaptor (“SDA”). SDAs are Ethernet HUBs that provide up to 10 Base T Ethernet connections to host computers or a network located on a subscriber’s premises. For subscribers also requiring telephony connectivity for telephones, facsimile machines or modems, the subscriber equipment also consists of a Residential Access Gateway (“RAG”). For subscribers who have a Base Station located near their premises, an Indoor Data Radio (“IDR”) may be used in place of an SPR and SDA.

WipManage

WipManage is the primary WipLL network management tool that enables a service provider to configure its WipLL network, isolate faults as and when they occur, monitor the performance of the network, and upgrade the software of every WipLL unit remotely. Running as a standalone program on Windows NT or Windows 2000 platforms, WipManage can access and manage each component or piece of equipment in a WipLL system remotely.

WipLL CUSTOMERS

Marconi WipLL was organized in August 1999 and immediately commenced the marketing of WipLL products. Marconi WipLL generally supplied WipLL equipment to affiliates of the Seller, who entered into supply and service contracts for that equipment with their customers. Those contracts were typically on terms and conditions comparable to the terms and conditions Airspan currently extends to its customers.

Airspan believes that as of the closing date of the Purchase Agreement, Marconi WipLL had shipped more than 15,000 subscriber terminals and more than 1,600 base station radios of WipLL equipment to 18 telecommunications operators and Internet Service Providers (“ISPs”) in 12 countries. Those operators and ISPs are using WipLL to provide their subscribers with Internet access and other broadband services. One such operator is SpeedNet Inc. of Japan, an ISP that is believed to have approximately 12,000 subscribers who are receiving services on WipLL equipment purchased from an affiliate (the “Affiliate”) of the Seller under an equipment supply and service contract signed on July 5, 2001 (the “Speednet Contract”). Airspan Israel expects to continue to have the right and obligation indirectly to supply equipment and services to SpeedNet by virtue of an agreement with the Affiliate that mirrors the Speednet Contract.

Marconi WipLL generated revenues of $3.4 million in the quarter ended September 30, 2002. Sales to the Affiliate for the purpose of satisfying the Speednet Contract accounted for approximately 90% and 52% of Marconi WipLL’s revenue for the six-month period ended September 30, 2002 and the year ended March 31, 2002, respectively.

SALES, MARKETING AND CUSTOMER SERVICE

Prior to the close of the Purchase Agreement, affiliates of the Seller marketed and sold products and services supplied by Marconi WipLL primarily in Australia, Indonesia, Japan, New Zealand, Norway, Mexico and the U.K. through their sales forces. Airspan is using its existing sales force to sell WipLL directly to telecom operators and ISPs worldwide, utilizing its existing marketing strategies and techniques. Airspan is in the process of opening a new marketing and service office in Japan to support SpeedNet. Where it is advantageous, Airspan intends to also use the services of the Seller’s affiliates for future sales.

Airspan Israel has 3 employees dedicated to sales, marketing and customer service, who have been integrated with Airspan’s existing staff of over 75 sales, marketing and customer service representatives.

MANUFACTURING

Airspan Israel has continued Marconi WipLL’s practice of outsourcing the manufacture of WipLL products to a contract manufacturer based in Yoknaam, Israel. Airspan Israel has assumed Marconi WipLL’s agreement with the manufacturer pursuant to which the manufacturer is producing and testing a number of different products as orders are submitted for WipLL product from time to time. Airspan Israel is required to provide the manufacturer with raw materials and the use of certain manufacturing equipment under the agreement. Airspan Israel is not required to order any minimum volume of products. The manufacturing agreement has an unlimited term but may be terminated by Airspan Israel or the manufacturer upon two months or six months notice, respectively. If the contract manufacturer is for any reason unable to continue with manufacture and testing of products for Airspan, Airspan may have difficulty in finding an acceptable, replacement manufacturer in Israel.

SUPPLIERS

Airspan Israel relies upon a variety of vendors to provide it with the various components necessary to manufacture its equipment. Except as set forth below, Airspan Israel believes all of the components would, with approximately four months notice, be readily available from a variety of vendors. WipLL has two key components, which are each sourced from a single supplier. If for any reason the suppliers of these components ceased to supply them Airspan’s ability to manufacture and supply the WipLL product could be adversely affected, and it could take Airspan up to twelve months to replace the source of supply.

COMPETITION

Airspan believes that Airspan Israel faces many of the same competitive forces and risks that Airspan’s existing business contends with. Airspan Israel also has some unique and/or product specific competitive considerations.

In the particular frequencies where Airspan Israel sells combined voice and data solutions, Airspan Israel believes it competes most directly with Alvarion as well as with a number of smaller start-up companies. Airspan Israel also competes indirectly with a number of large telecommunication equipment suppliers such as Alcatel, Nera and Nortel.

TECHNOLOGY

WipLL uses a Spread Spectrum Frequency Hopping Code Division Multiple Access (“FH-CDMA”) air interface that works both in the unlicensed 2.4GHz band and in the licensed 3.5GHz band. The FH-CDMA is a field-proven radio technology that is particularly robust in high-interference environments.

WipLL supports Time Division Duplex (“TDD”) operation in the unlicensed band and both Frequency Division Duplex (“FDD”) and TDD modes of operation in the licensed band. This capability gives the operators around the world the flexibility to apply for licenses in both of these modes of operation, as and when they become available.

WipLL utilizes a proprietary Pre-emptive Polling Multiple Access (“PPMA”) air protocol that affords the operators a number of key advantages when compared to similar systems provided by WipLL’s competitors. PPMA protocol has been specifically designed for fixed wireless access applications, and it enables the operators to deliver services to a higher number of subscribers, thus allowing those operators to generate more revenues per base station deployed. PPMA also provides a high degree of communication security among users.

WipLL also provides various mechanisms for bandwidth management, including Bandwidth On Demand, Maximum Information Rate, Committed Information Rate and balanced mode where bandwidth is split evenly between subscribers. These are important features for the service providers because they enable them to offer differentiated services to their subscribers and to apply differential billing based on the amount of bandwidth consumed.

RESEARCH & DEVELOPMENT

During the years ended March 31, 2002 and 2001 Marconi WipLL spent approximately $8.2 million and $8.6 million, respectively, on research and development of products. Airspan Israel will continue to operate Marconi WipLL’s 30,000 square foot research and development facility in Lod, Israel. Airspan Israel has approximately 26 employees dedicated to research and development in Israel.

INTELLECTUAL PROPERTY & PATENTS

Marconi WipLL is believed to have developed the WipLL system. After the close of the Purchase Agreement, Airspan Israel will not license the WipLL technology from anyone or pay royalties to any other entity for use of the system, other than small payments for rights to incorporate third-party software in the final WipLL. As of September 30, 2002, Airspan Israel held two trademarks in Israel, one patent in Israel and the U.S.A., and three patent applications in multiple countries.

RISK FACTORS

Airspan believes that the Airspan Israel business faces many of the same risk factors that have confronted Airspan. Please see the “Risk Factor” section of Airspan’s Form 10-K, which is incorporated herein by reference. As a result of the acquisition of Airspan Israel, the following risk factors should also be considered:

Airspan has limited experience acquiring other companies and, despite its due diligence efforts, may not know all the material risks associated with Airspan Israel’s business. Airspan expects to expend considerable time and resources to integrate the WipLL business with Airspan’s existing business. If Airspan later discovers that the WipLL products and services do not perform as anticipated, that existing WipLL customers are dissatisfied with WipLL products, or that Airspan Israel’s right or ability to manufacture, market, or service WipLL products is less than anticipated, Airspan could be negatively affected. Airspan may have limited recourse against the Seller.

Airspan Israel intends to conduct the following activities, among others, related to the WipLL product in Israel: research and development, design, raw material procurement, and manufacture through a manufacturing sub contractor based in Israel. Airspan Israel’s operations could be negatively affected by the political and military tensions in Israel. Israel has been involved in a number of armed conflicts

with its neighbors since 1948 and a state of hostility, varying in degree and intensity, has led to security and economic problems in Israel. Since September 2000, a continuous armed conflict with the Palestinian authority has been taking place. While these conflicts have had no material adverse effect on Airspan Israel’s operations in the past, conditions in Israel could in future disrupt Airspan Israel’s development, manufacture or distribution of WipLL products.

ABOUT AIRSPAN NETWORKS

Airspan Networks provides wireless DSL systems and solutions to both licensed and unlicensed operators around the world in frequency bands between 900 MHz to 4 GHz, including both PCS and MMDS. The company has deployments with more than 100 operators in more than 50 countries. Airspan’s systems are based on radio technology that delivers excellent area coverage, high security and resistance to fading. Airspan’s systems can be deployed rapidly and cost effectively, providing an attractive alternative to traditional wired communications networks. Airspan also offers radio planning, network installation, integration, training and support services to facilitate the deployment and operation of its systems. Airspan’s main operations are based in Uxbridge, United Kingdom with a WipLL product research and development facility in Lod, Israel, employing approximately 60 people. More information on Airspan can be found athttp://www.airspan.com

Item 7. Financial Statements,Pro FormaFinancial Information and Exhibits

| (a) | | | Financial Statements of Business Acquired |

| | | | a. Report of Independent Accountants |

| | | | b. Financial statements |

| | | | i. BalanceSheets |

| | | | ii. Statements of Operations |

| | | | iii. Statement of changes in stockholders’ deficiency |

| | | | iv. Statements of Cash Flows |

| | | | v. Notes to the Financial Statements |

|

| (b | ) | | Pro Forma Financial Information |

| | | | a. Unaudited Condensed Pro Forma Consolidated Financial Statements |

| | | | b. Unaudited Condensed Pro Forma Consolidated Balance Sheet as of September 29, 2002 |

| | | | c. Unaudited Condensed Pro Forma Consolidated Statement of Operations for the year ended December 31, 2001 |

| | | | d. Unaudited Condensed Pro Forma Consolidated Statement of Operations for the nine months ended September 29, 2002 |

| | | | e. Notes to Unaudited Condensed Pro Forma Consolidated Financial Statements |

|

| (c | ) | | Exhibits |

| 23 | | | Consent of Deloitte & Touche,December 18, 2002 |

| 99.1 | * | | Press Release, dated October 1, 2002, of Airspan |

| * | | Previously filed with the Airspan’s Current Report on Form 8-K filed with the Commission on October 18, 2002. |

FINANCIAL STATEMENTS OF BUSINESS ACQUIRED

AIRSPAN NETWORKS (ISRAEL) LTD.

(FORMERLY MARCONI COMMUNICATIONS ISRAEL LTD.)

FINANCIAL STATEMENTS

AS OF MARCH 31, 2002

| | | Page

|

|

| | 1 |

|

Financial statements: | | |

|

| | 2 |

|

| | 3 |

|

| | 4 |

|

| | 5-6 |

|

| | 7-22 |

INDEPENDENT AUDITORS’ REPORT

To the Shareholders of

Airspan Networks (Israel) Ltd.

(Formerly Marconi Communications Israel Ltd.):

We have audited the accompanying balance sheets of Airspan Networks (Israel) Ltd. (formerly Marconi Communications Israel Ltd.) (“the Company”) as of March 31, 2002 and 2001, and the related statements of operations, changes in stockholders’ deficiency and cash flows for each of the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform an audit to obtain reasonable assurance that the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by the Company’s management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of March 31, 2002 and 2001, and the results of its operations and cash flows for each of the years then ended in conformity with accounting principles generally accepted in Israel.

Accounting principles generally accepted in Israel differ in certain respects from accounting principles generally accepted in the United States of America. The differences between the accounting principles accepted in Israel and those generally accepted in the United States of America as they relate to these financial statements are summarized in Note 21 to the financial statements.

As described in Notes 1D and 7(2), the Company, at the direction of the parent company as of the balance sheet date, reached a decision at the end of the fiscal year to close or sell the Company. Subsequent to that decision, 52% of the Company’s employees were made redundant. As described in Note 1B, on October 4, 2002, all of the outstanding shares and intercompany debt of the Company were sold to a wholly-owned subsidiary of Airspan Networks Inc.

As discussed in Note 2Q, the accompanying financial statements as of March 31, 2002 and 2001 have been restated.

/s/ Brightman Almagor & Co.

Brightman Almagor & Co.

Certified Public Accountants

A member of Deloitte Touche Tohmatsu

Tel Aviv, Israel

December 6, 2002

1

AIRSPAN NETWORKS (ISRAEL) LTD.

(FORMERLY MARCONI COMMUNICATIONS ISRAEL LTD.)

(in thousands of US dollars)

| | | | | March 31,

| |

| | | Note

| | 2002

| | | 2001

| |

A S S E T S | | | | | | | | |

Current assets | | | | | | | | |

| Cash and cash equivalents | | | | 2,121 | | | 3,145 | |

| Trade receivables-related parties (net allowance of $127 and $0) | | 9 | | 1,780 | | | 1,095 | |

| Inventory | | 3 | | 9,274 | | | 6,992 | |

| Other current assets | | 4 | | 238 | | | 203 | |

| | | | |

|

| |

|

|

| Total current assets | | | | 13,413 | | | 11,435 | |

| | | | |

|

| |

|

|

Fixed assets | | 5 | | | | | | |

| Cost | | | | 6,414 | | | 5,485 | |

| Less: accumulated depreciation | | | | 3,683 | | | 1,835 | |

| | | | |

|

| |

|

|

| Total fixed assets | | | | 2,731 | | | 3,650 | |

| | | | |

|

| |

|

|

| Other assets | | 6 | | 445 | | | 21,821 | |

| | | | |

|

| |

|

|

| | | | | 16,589 | | | 36,906 | |

| | | | |

|

| |

|

|

LIABILITIES AND STOCKOLDERS’ DEFICENCY | | | | | | | | |

Current liabilities | | | | | | | | |

| Short-term bank borrowings | | | | 203 | | | 814 | |

| Trade payables | | | | 539 | | | 699 | |

| Other current liabilities | | 7 | | 2,286 | | | 1,618 | |

| | | | |

|

| |

|

|

| Total current liabilities | | | | 3,028 | | | 3,131 | |

| | | | |

|

| |

|

|

Long-term liabilities | | | | | | | | |

| Accrued severance pay, net | | 8 | | 128 | | | 209 | |

| Loans from Parent Company | | 9 | | 73,733 | | | 52,865 | |

| Other | | 10 | | 1,887 | | | 1,837 | |

| | | | |

|

| |

|

|

| Total long-term liabilities | | | | 75,748 | | | 54,911 | |

| | | | |

|

| |

|

|

Commitments and contingent liabilities | | 11 | | | | | | |

Stockholders’ deficiency | | | | | | | | |

| Share capital | | 12 | | 18,993 | | | 18,993 | |

| Additional paid-in capital | | | | 2,588 | | | 2,920 | |

| Deferred stock-based compensation | | | | (64 | ) | | (566 | ) |

| Accumulated deficit | | | | (83,704 | ) | | (42,483 | ) |

| | | | |

|

| |

|

|

| | | | | (62,187 | ) | | (21,136 | ) |

| | | | |

|

| |

|

|

| | | | | 16,589 | | | 36,906 | |

| | | | |

|

| |

|

|

The accompanying notes are an integral part of the financial statements.

2

AIRSPAN NETWORKS (ISRAEL) LTD.

(FORMERLY MARCONI COMMUNICATIONS ISRAEL LTD.)

(in thousands of US dollars, except per-share data)

| | | | | | Year ended March 31,

| |

| | | Note

| | | 2002

| | | 2001

| |

| Revenues | | 14 | | | 6,522 | | | 10,400 | |

| Cost of sales | | 15 | | | 7,771 | | | 8,943 | |

| Write off of inventory | | 3 | | | 1,574 | | | — | |

| | | | | |

|

| |

|

|

Gross profit (loss) | | | | | (2,823 | ) | | 1,457 | |

| Research and development expenses | | 16 | | | 8,230 | | | 8,607 | |

| Selling and marketing expenses | | 17 | | | 2,863 | | | 3,185 | |

| General and administrative expenses | | 18 | | | 4,608 | | | 4,556 | |

| Goodwill impairment | | 6 | | | 17,443 | | | — | |

| Reduction program cost | | 7 | (2) | | 1,111 | | | — | |

| | | | | |

|

| |

|

|

Operating loss | | | | | (37,078 | ) | | (14,891 | ) |

| Financing expenses, net | | | | | 4,143 | | | 2,195 | |

| | | | | |

|

| |

|

|

Loss for the year | | | | | (41,221 | ) | | (17,086 | ) |

| | | | | |

|

| |

|

|

| Loss per share | | | | | (0.52 | ) | | (0.21 | ) |

| | | | | |

|

| |

|

|

| Number of shares used in computing loss per share | | | | | 80,000,000 | | | 80,000,000 | |

| | | | | |

|

| |

|

|

The accompanying notes are an integral part of the financial statements.

3

AIRSPAN NETWORKS (ISRAEL) LTD.

(FORMERLY MARCONI COMMUNICATIONS ISRAEL LTD.)

STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIENCY (in thousands of US dollars)

| | | Share capital

| | Additional paid-in capital

| | | Deferred stock-based compensation

| | | Accumulated deficit

| | | Total

| |

Balance – March 31, 2000 | | 18,993 | | 2,741 | | | (1,003 | ) | | (25,397 | ) | | (4,666 | ) |

| Forfeiture of employee stock-based awards | | — | | (280 | ) | | 280 | | | — | | | — | |

| Grant of employee stock-based awards | | — | | 459 | | | (459 | ) | | — | | | — | |

| Amortization of deferred employee stock-based compensation | | — | | — | | | 616 | | | — | | | 616 | |

| Loss for the year | | — | | — | | | — | | | (17,086 | ) | | (17,086 | ) |

| | |

| |

|

| |

|

| |

|

| |

|

|

Balance – March 31, 2001 | | 18,993 | | 2,920 | | | (566 | ) | | (42,483 | ) | | (21,136 | ) |

| Forfeiture of employee stock-based awards | | — | | (211 | ) | | 211 | | | — | | | — | |

| Employee stock-based compensation | | — | | (121 | ) | | 121 | | | — | | | — | |

| Amortization of deferred employee stock-based compensation | | — | | — | | | 170 | | | — | | | 170 | |

| Loss for the year | | — | | — | | | — | | | (41,221 | ) | | (41,221 | ) |

| | |

| |

|

| |

|

| |

|

| |

|

|

Balance – March 31, 2002 | | 18,993 | | 2,588 | | | (64 | ) | | (83,704 | ) | | (62,187 | ) |

| | |

| |

|

| |

|

| |

|

| |

|

|

The accompanying notes are an integral part of the financial statements.

4

AIRSPAN NETWORKS (ISRAEL) LTD.

(FORMERLY MARCONI COMMUNICATIONS ISRAEL LTD.)

(in thousands of US dollars)

| | | Year ended March 31,

| |

| | | 2002

| | | 2001

| |

CASH FLOWS – OPERATING ACTIVITIES | | | | | | |

| Loss for the period | | (41,221 | ) | | (17,086 | ) |

| Adjustments to present cash flows used in operating activities (Appendix A) | | 24,503 | | | (149 | ) |

| | |

|

| |

|

|

| Net cash used in operating activities | | (16,718 | ) | | (17,235 | ) |

| | |

|

| |

|

|

CASH FLOWS – INVESTING ACTIVITIES | | | | | | |

| Additions to fixed assets | | (485 | ) | | (2,661 | ) |

| | |

|

| |

|

|

| Net cash used in investing activities | | (485 | ) | | (2,661 | ) |

| | |

|

| |

|

|

CASH FLOWS – FINANCING ACTIVITIES | | | | | | |

| Increase (decrease) in short-term bank borrowings | | (611 | ) | | 814 | |

| Proceeds of long-term loans from Parent Company | | 16,790 | | | 22,008 | |

| | |

|

| |

|

|

| Net cash provided by financing activities | | 16,179 | | | 22,822 | |

| | |

|

| |

|

|

| Increase (decrease) in cash and cash equivalents | | (1,024 | ) | | 2,926 | |

| Cash and cash equivalents at beginning of year | | 3,145 | | | 219 | |

| | |

|

| |

|

|

| Cash and cash equivalents at end of year | | 2,121 | | | 3,145 | |

| | |

|

| |

|

|

The accompanying notes are an integral part of the financial statements.

5

AIRSPAN NETWORKS (ISRAEL) LTD.

(FORMERLY MARCONI COMMUNICATIONS ISRAEL LTD.)

STATEMENTS OF CASH FLOWS

(in thousands of US dollars)

Appendix A – Adjustments to present cash flows used in operating activities

| | | Year ended March 31,

| |

| | | 2002

| | | 2001

| |

Depreciation and amortization | | 5,776 | | | 5,090 | |

Impairment of goodwill | | 17,443 | | | — | |

Increase in accrued severance pay, net | | 1,028 | | | 73 | |

Accrued financing expenses on loans from Parent Company | | 4,078 | | | 2,345 | |

Amortization of deferred employee stock-based compensation | | 170 | | | 616 | |

Changes in operating assets and liabilities: | | | | | | |

| Increase in trade receivables-related parties | | (685 | ) | | (1,075 | ) |

| Increase in other current assets | | (30 | ) | | (17 | ) |

| Increase in inventory | | (2,282 | ) | | (5,756 | ) |

| Decrease in trade payables | | (604 | ) | | (1,029 | ) |

| Decrease in other current liabilities | | (440 | ) | | (406 | ) |

| Increase in other long term liabilities | | 50 | | | 12 | |

| | |

|

| |

|

|

| | | (3,908 | ) | | (8,271 | ) |

| | |

|

| |

|

|

| | | 24,503 | | | (149 | ) |

| | |

|

| |

|

|

Appendix B – Supplemental disclosure of cash flow information

| Interest paid | | — | | 4 |

| | |

| |

|

| Taxes Paid | | 79 | | 76 |

| | |

| |

|

| Non-cash transactions-fixed assets purchased on supplier credit | | 641 | | 197 |

| | |

| |

|

The accompanying notes are an integral part of the financial statements.

6

| | A. | | Airspan Networks (Israel) Ltd. (formerly Marconi Communications Israel Ltd.) (“the Company”) was established in Israel in June 1999 as a private company and has since been engaged in the development, manufacture and marketing of wireless voice and data communication systems which constitute a single operating and reporting segment. Through October 4, 2002, the Company was a wholly-owned and controlled subsidiary of Marconi Plc (“Marconi” or “Parent Company”). For the periods presented, substantially all of the Company’s revenues were from sales to Marconi group companies. |

| | B. | | On October 4, 2002 all the outstanding shares and intercompany debt of the Company were sold to a wholly-owned subsidiary of Airspan Networks Inc., for a purchase price of $3 million. On November 18, 2002, the Company’s name was changed from Marconi Communications Israel Ltd. to Airspan Networks (Israel) Ltd. |

| | C. | | Acquisition of assets and operations: |

On June 30, 1999, the Company signed an agreement for the acquisition of the net assets and operations (“the Agreement”) of RDC Communications Ltd. (“the Seller” or “RDC”), effective August 18, 1999, (“Closing Date”). Based on the Agreement, the Company acquired from the Seller all of the intellectual property developed, owned or held by RDC, as well all the fixed assets, inventory and substantially all other assets as set forth in the Agreement, for cash consideration payable to RDC amounting to $38,718. In addition, the Company undertook to pay stock-based awards and bonuses (including cash and non-cash compensation) to certain employees, contingent upon the Company’s success in meeting development milestones. The Company also undertook to pay the royalties to the Ministry of Trade and Industry – Office of the Chief Scientist (“OCS”), for the OCS’s participation in the Seller’s financing of the development (see also Note 10).

The intellectual property acquired consisted primarily of know-how. On the basis of an

7

appraisers’ valuation report prepared for the Company, dated December 6, 2002, based on information available at the time of acquisition, the purchase price was allocated by the Company based on relative fair values, as follows: $15,100 to in-process research and development in connection with wireless internet protocol local loop systems (WipLL), which did not constitute core developed technology (see Note 2B); $520 to patents; $720 to workforce; and $26,030 was recorded as goodwill.

| | D. | | At a meeting of the Company’s management on March 7, 2002, at Marconi Plc’s direction, in light of worldwide business difficulties, it was decided that in the event that a buyer could not be found to acquire the Company, it would be closed. Subsequent to that date, 52% of the employees were made redundant (see Note 7). |

Related parties – as defined in Opinion No. 29 of the Institute of Certified Public Accountants in Israel.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies applied in the preparation of the Company’s financial statements:

| | A. | | Financial statements in US dollars |

The financial statements were prepared in US dollars (“dollars”), the primary currency of the Company’s economic environment. Most of the Company’s sales and purchases of raw materials, as well as the loan from the Parent Company, are denominated in dollars. Accordingly, the dollar is the functional and reporting currency of the Company. Balances and transactions denominated in dollars were included in their original amount while those in other currencies were translated in accordance with principles established in SFAS No. 52 of the US Financial Accounting Standards Board (“FASB”).

The RDC acquisition (see Note 1C) was accounted for by the purchase method of accounting in accordance with Opinion No. 57 of the Institute of Certified Public Accountants in Israel. Opinion No. 57 requires that the purchase cost be allocated based on the fair values of the acquired assets and the assumed liabilities. Any excess of purchase price over the fair value of net assets acquired including identifiable intangible assets represents goodwill (see G below).

Acquired assets to be used in research and development activities that have been determined, based on an appraiser’s valuation report, to have no alternative future use, (in-process research and development), are

8

expensed immediately after the consummation of the business combination in accordance with SFAS No. 2 and FASB Interpretation No. 4.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make various estimates and assumptions. These affect the reported amounts of assets and liabilities, as well as disclosure of contingent assets and liabilities, as of the balance sheet date, and the amounts of reported revenues and expenses. Actual results may differ from these estimates.

| | D. | | Cash and cash equivalents |

Cash and cash equivalents include bank deposits, available for immediate withdrawal, as well as short-term deposits with an original maturity of three months or less.

Inventory is stated at the lower of cost or net realizable value.

The cost of raw materials is determined on the basis of weighted average. The cost of finished goods and work in process is determined on the basis of direct manufacturing cost plus allocable indirect manufacturing expenses.

9

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (Cont.)

Fixed assets are stated at cost, with depreciation calculated by using the straight-line method at annual rates over the assets’ estimated useful lives, as follows:

| | | Years

|

| Leasehold improvements | | 5 |

| Office furniture and equipment | | 5 |

| Computers and auxiliary equipment | | 3 |

| Software | | 3 |

Other assets include acquired patents and an assembled workforce, and the excess of purchase price over fair value of net assets acquired (goodwill) arising in connection with the acquisition of RDC (see Note 1C). Other assets are amortized on a straight-line basis over the expected period to be benefited, as follows:

| | | Years

|

| Goodwill | | 8 |

| Patents | | 5 |

| Assembled workforce | | 4 |

| | H. | | Review of long-lived assets |

The Company evaluates the realizability of long-lived assets when events or changes in circumstances indicate that the asset’s carrying amount may not be recoverable. If the sum of the expected non-discounted future cash flows from the asset is less than the carrying amount of the asset, the Company would recognize an impairment loss in the amount that the asset’s carrying amount exceeds its fair value.

| | I. | | Provision for warranties |

The provision for warranties reflects the Company’s commitment to the quality of its products sold and projects completed. The amount of the provision is based on past experience and management’s estimates.

Revenues from the sale of products are recognized upon delivery, which represents the culmination of the Company’s earnings process. As stated in Note 1A, for the periods presented, substantially all of the Company’s revenues were from sales to Marconi group companies.

10

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| | K. | | Research and development costs |

Research and development costs are charged to operations as incurred. With respect to in-process research and development acquired in connection with the RDC acquisition, see B above.

| | L. | | Employee stock-based compensation |

The Company records the intrinsic value of options granted to its employees to acquire shares of the Parent Company as compensation expense, with a corresponding credit to additional-paid-in-capital. Deferred stock-based compensation is charged as a separate offsetting component in stockholders’ equity. Grants of stock appreciation rights are variable awards and the related compensation is remeasured at each balance sheet date.

Income taxes are calculated using the asset and liability method. Accordingly, deferred income taxes are computed on differences between the bases of assets and liabilities in the financial statements and their bases for tax purposes, as well as for tax loss carryforwards and deductions, based on expected tax rates upon realization. The deferred income tax asset does not include tax benefits whose future realization is not considered more-likely-than-not. Deferred taxes are presented as current or long-term items in accordance with the nature of assets or liabilities as to which they were computed, or according to the expected reversal date of deferred taxes not attributed to an asset or liability.

The Company has recorded a valuation allowance for the entire amount of the tax loss carryforwards and deductions due to the uncertainty of the existence of taxable income in the foreseeable future.

| | N. | | Loss per ordinary share |

Loss per ordinary share is calculated based on the weighted average number of ordinary shares outstanding for each period presented.

| | O. | | Linkage and exchange rates |

Balances linked to the consumer price index (“CPI”) are included, according to the terms of the transactions, on the basis of the last index known as of the balance sheet date (index of February) or the index for the last month in the year (index of March).

Balances denominated in, or linked to, currencies other than the dollar are included on the basis of the exchange rates prevailing on the balance-sheet date.

11

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| | O. | | Linkage and exchange rates (Cont.) |

The following data relates to the exchange rates and the CPI:

| | | Exchange rate NIS/$

| | | CPI (*)

| |

Year ended- | | | | | | |

| March 31, 2002 | | 4.668 | | | 174.95 | |

| March 31, 2001 | | 4.192 | | | 167.74 | |

Change during year ended- | | | | | | |

| March 31, 2002 | | 11.35 | % | | 4.29 | % |

| March 31, 2001 | | 4.12 | % | | 0.76 | % |

(*) Based on the index for the balance sheet month.

| | P. | | Fair value of financial instruments |

The Company’s financial instruments include mainly non-derivative assets (cash and cash equivalents, trade receivables and other current assets) and non-derivative liabilities (bank borrowings, trade payables, other current liabilities, loans from the Parent Company, and other long-term liabilities). Due to their nature, the fair values of the financial instruments do not differ significantly from their book value.

Subsequent to the issuance of the Company’s financial statements as of March 31, 2002 and 2001, the Company corrected its financial statements. The significant adjustments related to: (i) the purchase accounting for the RDC acquisition upon the Company’s obtaining a valuation report appraising that acquisition based on information available at the time of acquisition (see Note 1C); (ii) the fair value determination of the liability to the OCS; and (iii) accounting for employee stock-based compensation. As a result, certain amounts in the Company’s financial statements as of March 31, 2002 and 2001, have been restated from the amounts previously reported to reflect the above matters.

12

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (Cont.)

The following table presents the effect of the restatement on the financial statements as of March 31, 2002 and 2001 and for each of the years then ended:

| | | March 31, 2002

| | | March 31, 2001

| |

| | | As Previously Reported

| | As restated

| | | As Previously Reported

| | As restated

| |

Balance sheet: | | | | | | | | | | |

| Fixed assets | | 2,354 | | 2,731 | | | 3,279 | | 3,650 | |

| Other assets | | 32,032 | | 445 | | | 38,045 | | 21,821 | |

| Total assets | | 47,799 | | 16,589 | | | 52,759 | | 36,906 | |

| Other current liabilities | | 2,519 | | 2,286 | | | 3,314 | | 1,618 | |

| Total current liabilities | | 3,423 | | 3,028 | | | 5,071 | | 3,131 | |

| Deferred stock-based compensation | | — | | (64 | ) | | — | | (566 | ) |

| Additional paid in capital | | — | | 2,588 | | | — | | 2,920 | |

| Total stockholders’ deficiency | | 33,223 | | 62,187 | | | 9,492 | | 21,136 | |

Statement of Operations: | | | | | | | | | | |

| Cost of sales | | 7,448 | | 7,771 | | | 8,739 | | 8,943 | |

| Research and development | | 12,500 | | 8,230 | | | 142,064 | | 8,607 | |

| Selling and Marketing | | 2,535 | | 2,863 | | | 2,746 | | 3,185 | |

| General and administrative | | 942 | | 4,608 | | | 1,154 | | 4,556 | |

| Operating loss | | 18,477 | | 36,996 | | | 16,303 | | 14,891 | |

| Loss for the period | | 23,731 | | 41,221 | | | 18,498 | | 17,086 | |

Certain amounts relating to financial statements of the prior year have been reclassified to conform to the current year’s presentation.

13

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| | S. | | Recent accounting pronouncements |

In July 2001, the Israel Accounting Standards Board (“Israel ASB”) issued Standard No. 11, Segment Reporting. The standard requires inclusion of information regarding business and geographic segments, and prescribes detailed guidelines for identifying those segments. The standard provides for two formats for segment reporting – a primary reporting format and a secondary reporting format – and the disclosure and presentation requirements. Standard No. 11 will be effective for reporting periods commencing January 1, 2002. Management believes that the application of this new standard will not materially affect the Company’s financial statements.

In October 2001, the Israel ASB issued Standard No. 13 (“Effect of Changes in Foreign Currency Exchange Rates”). This standard addresses the translation of transactions denominated in foreign currency, for inclusion in the financial statements of the reporting company. Standard No. 13 will be effective for reporting periods commencing January 1, 2003. Management believes that the application of this new standard will not materially affect the Company’s financial statements.

NOTE 3- INVENTORY

| | | March 31,

|

| | | 2002

| | 2001

|

| Raw materials | | 6,158 | | 3,966 |

| Work in process | | 2,445 | | 1,489 |

| Finished goods | | 671 | | 1,537 |

| | |

| |

|

| | | 9,274 | | 6,992 |

| | |

| |

|

| | B. | | In the year ended March 31, 2002 the Company wrote off inventory of an earlier version of its product in the amount of $1,574. |

14

NOTE 4- OTHER CURRENT ASSETS

| | | March 31,

|

| | | 2002

| | 2001

|

| Government agencies | | 215 | | 177 |

| Other | | 23 | | 26 |

| | |

| |

|

| | | 238 | | 203 |

| | |

| |

|

NOTE 5- FIXED ASSETS

A. | | | | | | | | | | |

| | | Computer and | | Manufacturing | | Leasehold | | Office furniture and | | |

| | | Software

| | equipment

| | improvements

| | equipment

| | Total

|

Cost | | | | | | | | | | |

| Balance at beginning of year | | 1,806 | | 2,193 | | 1,167 | | 319 | | 5,485 |

| Purchases during the year | | 162 | | 704 | | 51 | | 12 | | 929 |

| | |

| |

| |

| |

| |

|

| Balance – March 31, 2002 | | 1,968 | | 2,897 | | 1,218 | | 331 | | 6,414 |

Accumulated depreciation | | | | | | | | | | |

| Balance at beginning of year | | 598 | | 802 | | 374 | | 61 | | 1,835 |

| Depreciation during the year | | 599 | | 789 | | 396 | | 64 | | 1,848 |

| | |

| |

| |

| |

| |

|

| Balance – March 31, 2002 | | 1,197 | | 1,591 | | 770 | | 125 | | 3,683 |

| | |

| |

| |

| |

| |

|

Net book value as of: | | | | | | | | | | |

| March 31, 2002 | | 771 | | 1,306 | | 448 | | 206 | | 2,731 |

| | |

| |

| |

| |

| |

|

| March 31, 2001 | | 1,208 | | 1,391 | | 793 | | 258 | | 3,650 |

| | |

| |

| |

| |

| |

|

B. | | See Note 2F regarding the estimated useful lives of the fixed assets. |

15

NOTE 6- OTHER ASSETS

| | | Goodwill

| | Patents

| | Workforce

| | Total

|

Cost | | | | | | | | |

| Balance March 31, 2001 | | 26,030 | | 520 | | 720 | | 27,270 |

Accumulated amortization | | | | | | | | |

| Balance – March 31, 2001 | | 5,333 | | 170 | | 295 | | 5,798 |

| Amortization during the year | | 3,254 | | 104 | | 180 | | 3,538 |

| | |

| |

| |

| |

|

| Balance – March 31, 2002 | | 8,587 | | 274 | | 475 | | 9,336 |

Impairment | | 17,443 | | 146 | | 245 | | 17,834 |

| | |

| |

| |

| |

|

Net book value, March 31, 2002 | | — | | 100 | | — | | 100 |

| | |

| |

| |

| |

|

Other | | | | | | | | 345 |

| | | | | | | | |

|

Total other assets, March 31, 2002 | | | | | | | | 445 |

| | | | | | | | |

|

NOTE | | 7- OTHER CURRENT LIABILITIES |

| | | March 31,

|

| | | 2002

| | 2001

|

| Wage-related liabilities (1)(2) | | 1,820 | | 1,021 |

| Parent Company | | 162 | | 244 |

| Accrued expenses | | 304 | | 353 |

| | |

| |

|

| | | 2,286 | | 1,618 |

| | |

| |

|

| (1) Includes: | | | | |

| Accrued vacation pay | | 247 | | 313 |

| | |

| |

|

(2) The balance as of March 31, 2002 includes $1,111 for retirement grants and various other payments as part of a cost reduction program (“the Program”). The Company adopted this Program under the direction of the Parent Company in light of worldwide business difficulties (see Note 1D). On March 11, 2002, the Company informed 69 employees (52% of the workforce) that they would be laid off on different dates in the future. The Company has agreed that, in the event of dismissal as part of the Program, the Company will pay the employees at the rate of 200% of the amount of severance pay to which they are actually entitled by law. The accrual included in the financial statements is based upon the number of employees notified. |

NOTE 8 – ACCRUED SEVERANCE PAY, NET

The Company’s severance-pay liability, which is based on the existing labor agreements, is calculated on the basis of the employee’s last salary (including all relevant wage components), multiplied by the number of years of employment. Amounts paid by the Company for insurance policies and pension funds to cover its severance pay commitment are not presented in the financial statements, as they are not under the Company’s custody or management.

NOTE 9 – LOANS FROM PARENT COMPANY

This balance constitutes loans from the Parent Company in US dollars, bearing annual interest of 7%, without fixed repayment dates. The balance includes accrued interest of $7,694.

16

As part of the sale of the Company to a wholly-owned subsidiary of Airspan Networks Inc. (see Note 1B), agreements were signed between the Marconi group companies to assign and offset intercompany balances due at that date. Immediately prior to the agreement the Marconi group forgave $71 million of the $74 million balance. The net amount of the debt sold to the subsidiary of Airspan Networks Inc. amounted to $ 3 million.

NOTE 10 – OTHER LONG-TERM LIABILITIES

This balance represents royalties due to the OCS in connection with participation in financing research and development activities, received from the OCS by RDC through the date that its operations and assets were sold to the Company (see Note 1C). Royalties are to be paid in accordance with the volume of sales of the Company’s products developed with the funds provided by the Chief Scientist, at the rate of 4.5% of those sales. The liability recorded as of the acquisition date, based on a discount rate of 45%, amounted to $1,487, which reflects the discounted present value of the obligation in the amount of $4,618 (undiscounted). The balances as of March 31, 2002 and 2001 $1,887 and $1,837, respectively, reflect the accreted liability to the OCS, net of payments made during the period.

In August 2002, the Company reached an agreement with the OCS, according to which the Company’s development program would be divided into two parts, each part to be attributed to a separate product. The Company’s sales that were attributed to one of the products acquired from RDC ceased in 1999. Accordingly, the liability for royalties in connection with that product was canceled. As a result, the Company will not be required to pay $3,142 of the original undiscounted liability to the OCS.

NOTE 11 – COMMITMENTS AND CONTINGENT LIABILITIES

Commitments

| | 1. | | Regarding royalties (see Notes 1C and 10 above). |

The Company’s 3,100 sq. m. premises are leased under agreements expiring through December 2005 and October 2007 (including extension options). Monthly rentals amount to $35. The agreement gives the Company the right to terminate the lease effective October 31, 2003.

NOTE 12 – SHARE CAPITAL

As of March 31, 2002 and 2001, the Company had 80,000,000 authorized, issued and outstanding Ordinary Shares par value NIS 1.00 each.

NOTE 13 – EMPLOYEE STOCK-BASED COMPENSATION

In connection with the acquisition of RDC in June 1999, stock options received by employees of the Company when employed by RDC were converted into stock appreciation rights of General Electric Corporation, and shortly thereafter such rights were exchanged for stock options excercisable into 253,178 ordinary shares of Marconi Plc., the Company’s parent company at an exercise price of 1.225 pound sterling per share. The options vest one-third annually over a three-year period.

In August 1999, some of the Company’s employees received 68,914 phantom stock options in GEC. Shortly thereafter, those options were exchanged for 68,914 Marconi Plc phantom options, at an exercise price of 4.855 pound sterling. The options are forfeitable 10 years after the grant date.

In November 1999 the Company’s employees were granted 55,000 Marconi Plc stock options at no exercise price. The options vest at the end of three years from the date of grant, subject to the fulfillment of certain performance milestones. The options are forfeitable 7 years after the grant date.

In April 2000, some of the Company’s employees were granted rights to receive a total of 51,432 shares of

17

Marconi Plc, at no exercise price. The rights vest at the end of three years from the date of grant, subject to the fulfillment of certain performance milestones.

In April 2000, some of the Company’s employees were granted 10,964 phantom options for Marconi Plc stock, at an exercise price of 7.08 pound sterling. The options vest 25% at the end of the first year, and at the end of each quarter thereafter, 6.25%.

In November 2000 a Company employee was granted 45,000 phantom options for Marconi Plc stock, at an exercise price of 6.7 pound sterling. The options vest 44% at the end of the first year, 56% at the end of second year. In August 2002 the Parent Company modified the exercise period to 12 months from the date of sale of the Company.

In November 2000 some of the Company’s employees were granted 218,374 Marconi Plc stock options at an exercise price of 6.7 pound sterling. The options vest at the end of three years from the date of grant, subject to the fulfillment of certain performance milestones. The options are forfeitable 10 years after the grant date. In August 2002 the Parent Company waived the performance conditions related to the stock options and modified the exercise period to 12 months from the date of sale of the Company.

In January 2001 some of the employees of the Company were granted 43,750 Marconi Plc stock options at no exercise price. 25% of the options vest subject to the fulfillment of certain performance milestones and the remainder vest one year thereafter.

In November 2001 a Company employee was granted 50,000 Marconi Plc stock options at an exercise price of 0.35 pound sterling. The options vest subject to the fulfillment of certain performance milestones. The options are forfeitable 5 years after the grant date. In August 2002 the Parent Company waived the performance conditions related to the stock options and modified the exercise period to 12 months from the date of sale of the Company.

NOTE 14 – INFORMATION ON GEOGRAPHIC AREAS AND MAJOR CUSTOMERS

A. Sales by Geographic Area (as percentage of total sales)

| | | Year ended March 31,

| |

| | | 2002

| | | 2001

| |

| Far East | | 62 | % | | 9 | % |

| Latin America | | 32 | % | | 5 | % |

| Europe | | 4 | % | | 85 | % |

| North America | | 2 | % | | 1 | % |

| | |

|

| |

|

|

| | | 100 | % | | 100 | % |

| | |

|

| |

|

|

B. Major Customers (as percentage of total sales)

| | | Year ended March 31,

| |

| | | 2002

| | | 2001

| |

| Customer A | | 52 | % | | — | |

| Customer B | | 27 | % | | 10 | % |

| Customer C | | — | | | 84 | % |

18

NOTE 15 – COST OF SALES

| | | Year ended March 31,

| |

| | | 2002

| | | 2001

| |

| Material and subcontractors | | 6,227 | | | 8,752 | |

| Labor and related costs | | 1,675 | | | 1,457 | |

| Other manufacturing expenses | | 613 | | | 711 | |

| Depreciation and amortization | | 920 | | | 456 | |

| | |

|

| |

|

|

| | | 9,435 | | | 11,376 | |

| Increase in inventory | | (1,664 | ) | | (2,433 | ) |

| | |

|

| |

|

|

| Total cost of sales | | 7,771 | | | 8,943 | |

| | |

|

| |

|

|

NOTE 16 – RESEARCH AND DEVELOPMENT EXPENSES

| | | Year ended March 31,

|

| | | 2002

| | 2001

|

| Wages and related costs | | 4,504 | | 4,353 |

| Materials consumed | | 518 | | 668 |

| Subcontracting | | 219 | | 691 |

| Depreciation and amortization | | 928 | | 929 |

| Other | | 2,061 | | 1,966 |

| | |

| |

|

| | | 8,230 | | 8,607 |

| | |

| |

|

NOTE 17 – SELLING AND MARKETING EXPENSES

| | | Year ended March 31,

|

| | | 2002

| | 2001

|

| Wages and related costs | | 1,537 | | 1,575 |

| Advertising and exhibitions | | 5 | | 186 |

| Vehicle maintenance | | 206 | | 163 |

| Travel abroad | | 136 | | 290 |

| Other | | 979 | | 971 |

| | |

| |

|

| | | 2,863 | | 3,185 |

| | |

| |

|

19

NOTE 18 – GENERAL AND ADMINISTRATIVE EXPENSES

| | | Year ended March 31,

|

| | | 2002

| | 2001

|

| Wages and related costs | | 593 | | 649 |

| Depreciation | | 3,671 | | 3,424 |

| Rental fees and office maintenance | | 113 | | 194 |

| Vehicle maintenance | | 48 | | 63 |

| Professional fees | | 97 | | 90 |

| Other | | 86 | | 136 |

| | |

| |

|

| | | 4,608 | | 4,556 |

| | |

| |

|

NOTE 19 – INCOME TAXES

| | A. | | Taxation under Inflationary Conditions |

During years through March 31, 2001, the Company reported for tax purposes in accordance with the Income Tax Law (Taxation under Inflationary Conditions)-1985, under which taxable income is measured in NIS, adjusted for changes in the Israeli CPI.

Beginning with the reporting year, the Company reports tax purposes in accordance with the Income Tax Regulations (Reporting for Foreign-Invested Companies)- 1986, according to which taxable income is measured in NIS, adjusted for changes in the U.S. dollar exchange rate.

The Company has not been assessed since incorporation.

20

NOTE 19 – INCOME TAXES (Cont.)

| | C. | | The Law for the Encouragement of Capital Investments-1959 (“the Law”) |

Concurrent with the acquisition by the Company of RDC’s assets and operations, the Investment Center Administration of the Ministry of Industry and Trade approved the assignments of RDC’s rights and obligations to the Company with regard to investments of $ 1,392 in fixed assets, subject to the fulfillment of certain conditions stipulated in the assignment document.

The Company’s new investment program of $ 1,720 in the expansion of its plant for production of wireless telephone communication systems was approved in accordance with the Law and, in November 2001, the Investment Center approved an additional investment of $ 2,187, bringing the total of the investment program to $ 3,907. The Company has invested $ 3,844 under this program, representing 98.4 % of the aggregate investment planned.

Income derived from the assets of the approved programs will be entitled to exemption from tax over a period of two years starting the first year in which the Company reports taxable income, and a reduced tax rate of 10% over an additional period of eight years, as long as 14 years have not yet elapsed since the approval date or 12 years from the year in which the program commenced operations, whichever comes first. Other income not related to the approved assets will be taxed at 36%.

NOTE 20–BALANCES AND TRANSACTIONS WITH RELATED PARTIES

| | | March 31,

|

| | | 2002

| | 2001

|

Balance sheet data: | | | | |

| Current assets | | 1,780 | | 1,095 |

| Current liabilities – parent company | | 162 | | 244 |

| Long term liabilities | | 73,733 | | 52,865 |

| | | |

| | | Year ended March 31,

|

| | | 2002

| | 2001

|

Statement of operations data: | | | | |

| Revenues | | 6,522 | | 10,400 |

| Cost of sales | | 219 | | 47 |

| Financing expenses, net | | 4,078 | | 3,616 |

21

NOTE | | 21 -EFFECT ON THE FINANCIAL STATEMENTS OF DIFFERENCES BETWEEN ISRAELI AND U.S. GAAP |

With regard to the Company’s financial statements, there are certain differences between GAAP in Israel and in the U.S. See below for the presentation of the Company’s balance sheets and income statements as of March 31, 2002 and 2001 in accordance with U.S. GAAP.

Difference resulting from the presentation of severance liabilities:

The Israeli GAAP financial statements present the severance liability net of amounts invested and held in funds designated solely for the satisfaction of such liabilities. Such offsetting would not be allowed under US GAAP and, accordingly, the asset and liability would be presented gross. The total funded amount as of March 31, 2002 and 2001, amounted to $605 and $371, respectively, and the total gross liability amounts to $733 and $580, respectively.

| | | March 31,

|

| | | 2002

| | 2001

|

| | | US GAAP

| | ISRAEL GAAP

| | US GAAP

| | ISRAEL GAAP

|

Balance sheet data: | | | | | | | | |

| Long term assets | | 1,050 | | 445 | | 22,192 | | 21,821 |

|

| Long term liabilities | | 76,353 | | 75,748 | | 55,282 | | 54,911 |

22

AIRSPAN NETWORKS INC. UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The unaudited condensed pro forma consolidated balance sheet as of September 29, 2002 gives effect to the acquisition of Marconi Communications (Israel) Ltd. (“Marconi WipLL”) as if it occurred on September 29, 2002.

The unaudited condensed pro forma consolidated statement of operations for the year ended December 31, 2001, gives effect to the acquisition as if it occurred on January 1, 2001.

The unaudited condensed pro forma consolidated statement of operations for the nine months ended September 29, 2002, gives effect to the acquisition as if it occurred on January 1, 2002.

The unaudited condensed pro forma consolidated financial statements have been prepared by the mangement of Airspan Networks Inc. based on the historical financial statements of Airspan and Marconi WipLL. These condensed pro forma consolidated financial statements are not necessarily indicative of the consolidated results of operations for future periods or the results of operations that would have occurred had Airspan and Marconi WipLL been consolidated during the periods specified. The unaudited condensed pro forma consolidated financial statements and the related notes should be read in conjunction with the historical financial statements of Airspan and Marconi WipLL.

.

23

PRO FORMA FINANCIAL INFORMATION

AIRSPAN NETWORKS INC. UNAUDITED CONDENSED PRO FORMA

CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | Historical

| | | | | | | | | |

| | | Airspan September 29, 2002

| | | Marconi WipLL October 4, 2002

| | | Pro Forma Adjustments

| | | | | Consolidated Pro Forma

| |

ASSETS | | | | | | | | | | | | | | | | | | |

| Current Assets | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 56,788 | | | $ | 977 | | | $ | (2,896 | ) | | a.b | | $ | 54,869 | |

| Restricted cash | | | 1,494 | | | | — | | | | — | | | | | | 1,494 | |

| Accounts receivable, less allowance for doubtful accounts | | | 17,684 | | | | — | | | | — | | | c | | | 17,684 | |

| Unbilled accounts receivable | | | 694 | | | | — | | | | — | | | | | | 694 | |

| Inventory | | | 13,297 | | | | 3,681 | | | | — | | | | | | 16,978 | |

| Prepaid expenses and other current assets | | | 3,526 | | | | 824 | | | | (166 | ) | | d. | | | 4,184 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total Current Assets | | | 93,483 | | | | 5,482 | | | | (3,062 | ) | | | | | 95,903 | |

| Property, plant and equipment, net | | | 4,579 | | | | 1,815 | | | | (1,713 | ) | | d.e. | | | 4,681 | |

| Goodwill | | | 759 | | | | — | | | | — | | | | | | 759 | |

| Intangible assets, net | | | 25 | | | | 68 | | | | 390 | | | d.e. | | | 483 | |

| Other non-current assets | | | — | | | | 1055 | | | | (211 | ) | | d. | | | 844 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total Assets | | $ | 98,846 | | | $ | 8,420 | | | $ | (4,596 | ) | | | | $ | 102,670 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | | | | | | | |

| Accounts payable | | $ | 6,625 | | | $ | 715 | | | | — | | | | | $ | 7,340 | |

| Accrued taxes | | | 299 | | | | 134 | | | | — | | | | | | 433 | |

| Deferred revenue | | | 1,707 | | | | — | | | | — | | | | | | 1,707 | |

| Other accrued expenses | | | 4,795 | | | | 1,234 | | | $ | 886 | | | d.f. | | | 6,915 | |

| Current portion of long-term debt | | | 1,250 | | | | — | | | | — | | | | | | 1,250 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total Current Liabilities | | | 14,676 | | | | 2,083 | | | | 886 | | | | | | 17,645 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Non Current Liabilities | | | | | | | | | | | | | | | | | | |

| Long-term debt | | | 1,250 | | | | — | | | | — | | | | | | 1,250 | |

| Loan from Parent Company | | | — | | | | 3,000 | | | | (3,000 | ) | | c. | | | — | |

| Long term severance liability | | | — | | | | 855 | | | | — | | | | | | 855 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total Non Current Liabilities | | | 1,250 | | | | 3,855 | | | | (3,000 | ) | | | | | 2,105 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Stockholders’ Equity | | | | | | | | | | | | | | | | | | |

| Common stock | | | 11 | | | | 21,516 | | | | (21,516 | ) | | g. | | | 11 | |

| Note receivable – stockholder | | | (130 | ) | | | — | | | | — | | | | | | (130 | ) |

| Additional paid in capital | | | 214,704 | | | | — | | | | — | | | | | | 214,704 | |

| Accumulated other comprehensive income | | | 1,313 | | | | — | | | | — | | | | | | 1,313 | |

| Accumulated deficit | | | (132,978 | ) | | | (19,034 | ) | | | 19,034 | | | g. | | | (132,978 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total Stockholders’ Equity | | | 82,920 | | | | 2,482 | | | | (2,482 | ) | | | | | 82,920 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total Liabilities and Stockholders Equity | | $ | 98,846 | | | $ | 8,420 | | | $ | (4,596 | ) | | | | $ | 102,670 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

24

AIRSPAN NETWORKS INC. UNAUDITED CONDENSED PRO FORMA

CONSOLIDATED STATEMENT OF OPERATIONS FOR

THE YEAR ENDED DECEMBER 31, 2001

(in thousands except for share and per share data)

| | | Historical

| | | | | | | | | |

| | | Airspan

| | | Marconi WipLL

| | | Pro Forma Adjustments

| | | | | Consolidated Pro Forma

| |

| Revenue | | $ | 37,422 | | | $ | 7,034 | | | | | | | | | $ | 44,456 | |

| Cost of revenue | | | (23,291 | ) | | | (6,911 | ) | | $ | 317 | | | h. | | | (29,885 | ) |

| Inventory provision | | | (1,417 | ) | | | — | | | | | | | | | | (1,417 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Gross profit | | | 12,714 | | | | 123 | | | | 317 | | | | | | 13,154 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Operating expenses: | | | | | | | | | | | | | | | | | | |

| Research and development | | | 14,667 | | | | 9,443 | | | | (529 | ) | | h. | | | 23,581 | |

| Sales and marketing | | | 15,504 | | | | 2,522 | | | | (129 | ) | | h. | | | 17,897 | |

| Bad debt provision | | | 1,207 | | | | — | | | | — | | | | | | 1,207 | |

| General and administrative | | | 10,735 | | | | 1,033 | | | | (69 | ) | | h. | | | 11,699 | |

| Amortization of goodwill | | | 300 | | | | 3,254 | | | | (3,254 | ) | | i. | | | 300 | |

| Amortization of intangibles | | | 125 | | | | 284 | | | | (167 | ) | | i. | | | 242 | |

| Restructuring charge | | | 1,235 | | | | — | | | | — | | | | | | 1,235 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total operating expenses | | | 43,773 | | | | 16,536 | | | | (4,148 | ) | | | | | 56,161 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Loss from operations | | | (31,059 | ) | | | (16,413 | ) | | | 4,465 | | | | | | (43,006 | ) |

| Interest expense | | | (326 | ) | | | (3,193 | ) | | | 3,063 | | | j. | | | (455 | ) |

| Interest and other income | | | 3,052 | | | | — | | | | — | | | | | | 3,052 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Loss before income taxes | | | (28,333 | ) | | | (19,606 | ) | | | 7,529 | | | | | | (40,410 | ) |

| Income tax credit / (charge) | | | 3,018 | | | | — | | | | — | | | | | | 3,018 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Loss before extraordinary item | | | (25,315 | ) | | | (19,606 | ) | | | 7,529 | | | | | | (37,392 | ) |

| Extraordinary item | | | | | | | | | | | | | | | | | | |

| Gain on extinguishment of debt | | | 9,244 | | | | — | | | | — | | | | | | 9,244 | |

| Income tax charge on gain | | | (2,773 | ) | | | — | | | | — | | | | | | (2,773 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Gain net of taxes | | | 6,471 | | | | — | | | | — | | | | | | 6,471 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Net loss | | $ | (18,844 | ) | | $ | (19,606 | ) | | $ | 7,529 | | | | | $ | (30,921 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Earnings per share – basic and diluted | | | | | | | | | | | | | | | | | | |

| Loss before extraordinary item | | $ | (0.73 | ) | | | | | | | | | | | | $ | (1.08 | ) |

| Extraordinary item, net of taxes | | $ | 0.19 | | | | | | | | | | | | | $ | 0.19 | |

| Net loss per share | | $ | (0.54 | ) | | | | | | | | | | | | $ | (0.89 | ) |

| Weighted average shares outstanding | | | | | | | | | | | | | | | | | | |

| -basic and diluted | | | 34,810,311 | | | | | | | | | | | | | | 34,810,311 | |

25

AIRSPAN NETWORKS INC. UNAUDITED CONDENSED PRO FORMA

CONSOLIDATED STATEMENT OF OPERATIONS FOR

THE NINE MONTHS ENDED SEPTEMBER 29, 2002

(in thousands except for share and per share data)

| | | Historical

| | | | | | | | | |

| | | Airspan | | | Marconi WipLL | | | | | | | | | |

| | | September 29, 2002

| | | October 4, 2002

| | | Pro Forma Adjustments

| | | | | Consolidated Pro Forma

| |

| Revenue | | $ | 15,068 | | | $ | 5,628 | | | | — | | | | | $ | 20,696 | |

| Cost of revenue | | | (11,715 | ) | | | (4,259 | ) | | $ | 333 | | | h. | | | (15,641 | ) |

| Inventory provision | | | (2,001 | ) | | | (4,363 | ) | | | — | | | | | | (6,364 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Gross profit | | | 1,352 | | | | (2,994 | ) | | | 333 | | | | | | (1,309 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Operating expenses: | | | | | | | | | | | | | | | | | | |

| Research and development | | | 10,066 | | | | 1,634 | | | | (367 | ) | | h. | | | 11,333 | |

| Sales and marketing | | | 7,513 | | | | 599 | | | | (72 | ) | | h. | | | 8,040 | |

| Bad debt provision | | | 1,518 | | | | — | | | | — | | | | | | 1,518 | |

| General and administrative | | | 6,621 | | | | 279 | | | | (31 | ) | | h. | | | 6,869 | |

| Amortization of goodwill | | | — | | | | 814 | | | | (814 | ) | | i. | | | — | |

| Amortization of intangibles | | | — | | | | 482 | | | | (394 | ) | | i. | | | 88 | |

| | | | — | | | | 17,443 | | | | (17,443 | ) | | i. | | | — | |

| Restructuring charge | | | 445 | | | | 1,454 | | | | — | | | | | | 1,899 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Total operating expenses | | | 26,163 | | | | 22,706 | | | | (19,121 | ) | | | | | 29,747 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Loss from operations | | | (24,811 | ) | | | (22,700 | ) | | | 19,455 | | | | | | (31,057 | ) |

| Interest expense | | | (122 | ) | | | (3,540 | ) | | | 3,396 | | | j. | | | (266 | ) |

| Interest and other income | | | 1,483 | | | | 1,135 | | | | — | | | | | | 1,483 | |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| gLoss before income taxes | | | (23,450 | ) | | | (24,240 | ) | | | 22,851 | | | | | | (29,839 | ) |

| Income tax credit / (charge) | | | (2 | ) | | | — | | | | — | | | | | | (2 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Net loss | | $ | (23,452 | ) | | $ | (24,240 | ) | | $ | 22,851 | | | | | $ | (29,841 | ) |

| | |

|

|

| |

|

|

| |

|

|

| | | |

|

|

|

| Earnings per share – basic and diluted | | | | | | | | | | | | | | | | | | |

| Net loss per share | | $ | (0.67 | ) | | | | | | | | | | | | $ | (0.85 | ) |

| Weighted average shares outstanding | | | | | | | | | | | | | | | | | | |

| -basic and diluted | | | 35,212,453 | | | | | | | | | | | | | | 35,212,453 | |

26

AIRSPAN NETWORKS INC. NOTES TO UNAUDITED CONDENSED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

(in thousands except for share and per share data)

Airspan’s acquisition of Marconi WipLL was completed on October 4, 2002. The cash purchase price paid of $1 dollar net of estimated working capital adjustments of $(104) thousand and the estimated amount of direct acquisition costs incurred, of $420 thousand, are recorded as the cost of acquiring Marconi WipLL, or the purchase price. The purchase price will be allocated to individual assets acquired and liabilities assumed based on their respective fair values. The difference between the purchase price and the fair value of the net assets will be allocated to goodwill. Where the purchase price is less than the fair value of the net assets this will create negative goodwill. Pursuant to SFAS No. 141 negative goodwill will be allocated as a pro rata reduction of fixed assets and intangibles. Airspan also paid $3,000 for the intercompany debt due to Marconi plc by Marconi WipLL.

The following table represents the purchase price and purchase price allocation.

Calculation of purchase price: | | | | |

|

Purchase of intercompany debt owed to Marconi Corporation plc by Marconi WipLL | | | | |

| Cash consideration | | $ | 3,000 | |

| | |

|

|

|

|

Purchase of all outstanding capital stock of Marconi WipLL | | | | |

|

| Cash consideration net of estimated working capital adjustment. | | $ | (104 | ) |

| Acquisition costs | | | 420 | |

| | |

|

|

|

| Purchase Price | | $ | 316 | |