July 1, 2015

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Attn: Carlos Pacho, Senior Assistant Chief Accountant

RE: Time Warner Inc.

File Number: 001-15062

Form 10-K: For the Fiscal Year Ended December 31, 2014

Filed February 26, 2015

Response Dated May 26, 2015

Dear Mr. Pacho:

Set forth below is Time Warner Inc.’s (“Time Warner” or the “Company”) response to the Securities and Exchange Commission Staff’s (“SEC” or the “Staff”) comment given by letter (the “Comment Letter”) dated June 19, 2015 regarding the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 (the “2014 Form 10-K”).

Form 10-K for the Year Ended December 31, 2014

Note 8. Film Tax-Advantaged Arrangements, page 99

Comment No. 1: We note your response to comment 1. To enable us to better understand your film tax-advantage arrangements, please provide us with the following information.

| a) | Provide for us a robust explanation of the nature of the arrangements including the parties involved, all significant terms, the legal rights transferred and received, legal obligations assumed, and the reasons for entering into such arrangements. This explanation should address the nature and terms of any arrangements between Time Warner and the Bank and between SPE and the Bank. |

| b) | Accompany this explanation with a diagram that illustrates a typical arrangement including the identity of the entities involved in such arrangement and the cash flows. |

| c) | Tell us what accounts were debited and credited including the accounting for the cash involved in the arrangements. |

| d) | Describe for us all the cash flows under the arrangements and how you report them in your statements of cash flows. Specifically tell us if the total amount paid in the “sale” is received first by Time Warner or is the payment made directly to a third party bank. |

| e) | Tell us how the $2.9 billion total capitalization of the SPEs was determined and why you disclosed it. |

| f) | Quantify the total amount held on deposit in connection with these arrangements and the total amount recorded as a reduction in film assets reported on your balance sheet. |

| g) | Tell us the extent Time Warner entered into foreign tax-advantaged arrangements during 2013 and 2014. |

| h) | Explain to us in detail your analysis of the factors you considered in concluding that the SPEs were not variable interest entities that required to be consolidated. |

| i) | If true, please confirm the Company has not guaranteed any cash payments to be made to the third party entities by the bank. Also confirm that you do not control any deposit accounts or have any influence over the administration of funds. |

Response 1a: Although the arrangements addressed in Note 8, Film Tax-Advantaged Arrangements can differ in form, their substance involved unrelated third parties in foreign jurisdictions paying the Company a fee for the right to use certain attributes associated with certain of the Company’s film productions produced principally outside the United States. It is our understanding that the third parties involved in these arrangements were able to obtain tax benefits, principally through deferred tax payments in their foreign jurisdictions, under regulations designed to incentivize local film production. However, the Company is not involved with the third parties’ tax information. Time Warner entered into these arrangements in order to subsidize the cost of the films without relinquishing control over the distribution and exploitation of such films, including maintaining all economic rights.

From a contractual perspective, the arrangements commonly take the legal form of a sale-leaseback transaction that consists of three main steps, all of which are executed simultaneously, as required by the terms of the contractual agreements. In the first step, a third party purchases the master negative or copyright and licenses the distribution and exploitation rights related to a foreign-produced film from a Time Warner subsidiary in exchange for cash. The payment for the master negative or copyright and distribution and exploitation rights is typically based on the cost to produce the film, including related overhead costs, and is paid at closing by the third party and deposited into an account at a specified bank that is a party to the arrangement (the defeasance bank). In the second step of the transaction, a separate Time Warner subsidiary leases from the third party the master negative or copyright (as applicable) and sub-licenses all of the distribution and exploitation rights for the film in exchange for payments over the lease term (the “lease payments”). In satisfaction of the lease payment obligation, an amount equal to the net present value of the payments to be made by the second Time Warner subsidiary is taken directly out of the proceeds in step one and left on deposit with the bank. Additionally, the bank issues a letter of credit for the benefit of the third party whereby the bank agrees to make the required payments to the third party over the lease term. In the third step, Time Warner receives a net fee as consideration for entering into the transaction which is equal to the difference between the cash deposited into the bank in step one and the cash that remains on deposit with the bank in step two. Each of the three steps described above is contingent upon the closing of the other steps in the transaction and all cash movements are made pursuant to irrevocable payment directions.

After the simultaneous steps described above are completed, the third party’s rights do not have any significant economic value other than the tax benefits obtained through the transaction because the third party does not control the distribution or exploitation rights associated with the film and the third party has no right to create any derivative works. The terms of the agreements also provide Time Warner with the right to repurchase the master negative or copyright (as applicable) at the conclusion of the lease term for a de minimis payment.

There are a number of considerations related to the legal terms of these transactions that are relevant to the Company’s accounting treatment for the transactions. The most significant considerations are as follows:

Because irrevocable payment directions are in place under the agreements before the payment is made by the third party in step one, the Company never has control over the entire cash payment made by the third parties involved in these transactions. Pursuant to the irrevocable payment directions, all cash involved in the arrangement, with the exception of the Company’s consideration in the transaction, is left on deposit in a bank account that the Company has no control over and from which the bank agrees to make the required lease payments to the third parties over the lease term.

The Company does not control the administration of such bank account, although in some cases, the bank account is legally held in the name of the Company. More specifically, in all cases, the Company does not have (i) an ability to access the cash in the bank account or (ii) an ability to instruct the bank to make payments from the account to a party other than the third party during the term of the lease.

The bank, which has control over the deposit, has agreed to (i) make the lease payments to the third party from the amounts on deposit in the account and (ii) issue a letter of credit for the benefit of the third party in the amount of the lease payments.

The Company also does not have an obligation to the bank or the third party to fund any shortfall in the bank account if the amount deposited into the account is not sufficient to make the required lease payments. The amount of the deposit is equal to the net present value of both the lease payments and the corresponding payment obligations of the bank under the letter of credit. If the amount is not sufficient to make the required lease payments, the third party does not have recourse to the Company.

As a result of security arrangements applied to the cash deposited with the bank, the full amount of the account must automatically be paid to the third party as lease payments or to the bank as reimbursement of any letter of credit payments, in each case without any involvement of the Company.

The Company's legal entities that are parties to these transactions were established in a bankruptcy remote fashion, and the Company has been advised by legal counsel that if any such entity were to be involved in a Time Warner bankruptcy proceeding, the bank accounts involved in these transactions (i.e., those holding the deposit for payment to the third party over the lease term) would not be available to satisfy obligations to Time Warner’s creditors in a bankruptcy proceeding.

Pursuant to the agreements, the third parties do not have a contractual right to pursue the Company for the lease payments once the deposit is made with the bank upon closing. Since the transactions have been closed, there have been no instances where the Company has paid or agreed to pay the third party any incremental lease payments associated with the leaseback.

Although Time Warner issued a guarantee to the third party covering the Time Warner subsidiaries’ performance under the agreements described above, the guarantee does not extend to the payment of the lease payments.

The third party involved in these arrangements, being the beneficiary of the payments from the bank over the lease term, participated in the structuring of the transactions, including the nature of the security for the lease payments.

From an accounting perspective, the Company views the substance of these arrangements as the sale of attributes that may enable a third party to obtain tax benefits in a foreign jurisdiction, in exchange for consideration. For accounting purposes, the Company does not view these arrangements as sales of film assets based on both the rationale for entering into these arrangements and the fact that the Company maintains control over the use and exploitation of its film asset and maintains its economic risks and rewards in the films throughout their life cycle. Additionally, unlike traditional leaseback transactions, there is no financing element to these transactions given the fact that we are contractually obligated to deposit all funds that are required under the leaseback and sub-license transactions at closing and we have no control or access to the cash. Further, as noted in our prior response, ASC 840 does not apply to licenses of intangibles such as motion picture films. Accordingly, because the Company (i) did not view the arrangement as a sale of the film asset for accounting purposes, (ii) never controlled or had access to the entire cash amount received from the third party, and (iii) satisfied its payment obligation to the third party with the deposit into the bank account at closing, the Company does not believe a substantive obligation existed on an ongoing basis for the leaseback and sub-license. As such, the Company concluded that accounting for these arrangements based on their substance was appropriate and provided the most meaningful financial information to users of its financial statements. Additionally, it is important to note that the vast majority of these transactions occurred prior to 2008 and since that time the substantial majority of those transactions have been legally defeased (see Response 1f).

As a result, the Company’s accounting reflected the net consideration received by Time Warner as a reduction to the Company’s capitalized film asset. In terms of the appropriate presentation of the net fee received by the Company, the Company analogized to the guidance in what was prior to the accounting standards codification known as EITF 89-20 “Accounting for Cross Border Tax Benefit Leases” as well as the investment tax credit guidance in ASC 740, Income Taxes. The Company believes that this accounting treatment is appropriate because the generation of the consideration in these arrangements cannot be separated from the costs of producing the film.

It is also important to note that the financial accounting position taken for these transactions is consistent with the position taken by the Company for U.S. tax purposes, which is that these transactions did not in substance represent a sale-leaseback transaction, and our tax position is supported by relevant U.S. tax case precedent.

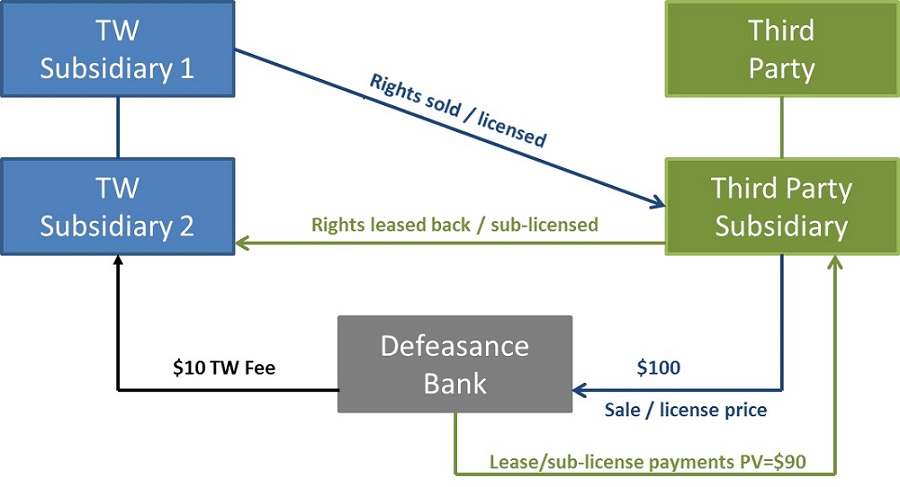

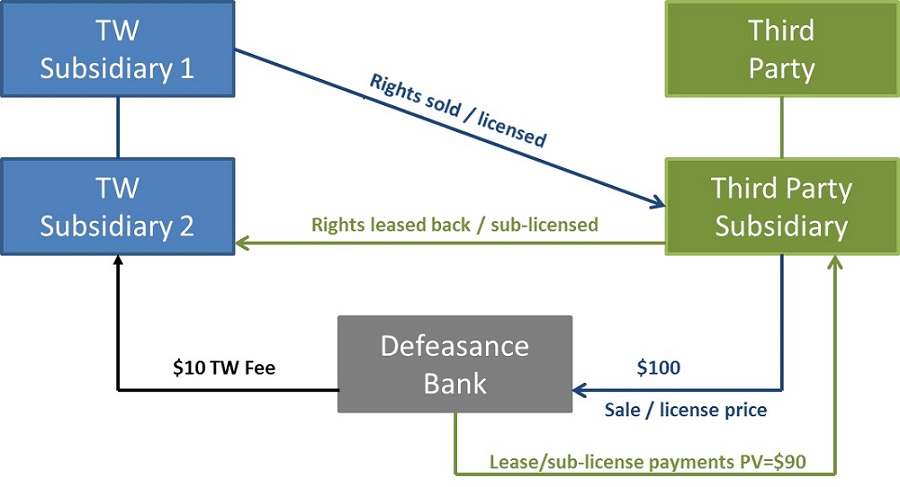

Response 1b: The following chart illustrates an example of the three main steps of the arrangements. In the first step, a Time Warner subsidiary sells the master negative or copyright and licenses the distribution and exploitation rights related to a foreign-produced film to a third party for $100. The $100 cash is deposited into a bank account held at the defeasance bank. In step two of the transaction, a separate Time Warner subsidiary leases the master negative or copyright (as applicable) and sub-licenses the distribution and exploitation rights back from the third party. Time Warner’s lease payment obligations for step two are satisfied by the $90 left on deposit with the defeasance bank and the bank’s commitment to make the required lease payments to the third party. In the third step, the $10 residual is paid to Time Warner as its fee for entering into the transaction.

Response 1c: The Company debited cash, in the amount of its fee, and credited the film asset (i.e., Noncurrent inventories and theatrical film and television production costs) on its consolidated balance sheet. The Company recorded this entry in the period the transaction closed.

Response 1d: In its statement of cash flows, the Company recorded its fee as a cash inflow from operating activities resulting from the credit recorded to the film asset in the period the transaction closed. The cash received from the third party that was simultaneously deposited into the bank account for the benefit of the third party pursuant to the arrangement was not reflected in the Company's statement of cash flows since the Company never controlled the inflow or outflow of these funds.

Response 1e: The $2.9 billion total capitalization included in the Company's disclosure was estimated using information derived from the contractual transaction prices and projected lease payments in each arrangement as well as an estimate of the third party’s tax benefits. The Company's intention in providing

the disclosure related to these arrangements was to provide visibility to the economic benefits obtained by the Company as a result of these tax-advantaged transactions. Additionally, because we concluded that consolidation of the third party entities that had been created for these transactions was not appropriate, and because of our decision to account for these transactions based on their substance versus their legal form, the magnitude of the capitalization of the counterparties involved was also disclosed.

Response 1f: The vast majority of these transactions occurred prior to 2008 and since that time all but 10 transactions have been legally defeased. As of December 31, 2014 and 2013, there was approximately $300 million and $325 million, respectively, held on deposit in bank accounts related to arrangements that have not been legally defeased. Such amounts represent less than 1% of the Company’s total assets at each respective period. However, as previously noted, the Company does not have access to these accounts and does not have any obligation to cover any shortfalls in the accounts, and the deposit is precisely calculated to fund exactly the scheduled lease payments. Additionally, if the bank fails to pay the third party as required under the bank agreement, the third party does not have any recourse against the Company.

As of December 31, 2014 and 2013, for all transactions closed prior to such dates, the total unamortized amount recorded as a reduction in film assets on the Company's balance sheet was approximately $5.2 million and $6.3 million, respectively.

Response 1g: During the year ended December 31, 2014, Time Warner did not enter into any such foreign tax-advantaged arrangements. During the year ended December 31, 2013, Time Warner entered into one such foreign tax-advantaged arrangement. The total benefit retained by Time Warner from that arrangement was approximately $4.7 million at December 31, 2014 and is reflected as a reduction of the associated film asset at December 31, 2014, because the associated film had not been released as of that date. The 2013 transaction was legally defeased at the closing of the transaction.

Response 1h: Based on our understanding of the structure of the third party’s special purpose entities, it is likely that these entities are variable interest entities. The Company considered the purpose of the special purpose entities and the risks that they were designed to address and pass to variable interest holders (as described in Response 1a) and concluded that it was not appropriate for the Company to consolidate the entities because the Company does not have the power to direct the activities of the special purpose entities; does not have the obligation to absorb losses that could potentially be significant to the special purpose entities; nor does it have the right to receive benefits from the special purpose entities that could potentially be significant to the entities such that it would be deemed to be the primary beneficiary of the entity under ASC 810. Further, even if such entities were deemed to be voting interest entities, the Company concluded it did not have a controlling voting interest in the entities.

Response 1i: The Company has not guaranteed any cash payments to be made to the third party entities by the bank. Further, we confirm that we do not control any of the deposit accounts established in connection with the transactions or have any influence over the administration of funds in the deposit accounts.

* * *

We hereby acknowledge on behalf of the Company that:

the Company is responsible for the adequacy and accuracy of the disclosures in the 2014 Form 10-K;

Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the 2014 Form 10-K; and

the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please let us know if you have any questions.

Sincerely,

/s/ Douglas E. Horne Douglas E. Horne | /s/ Nick Vayias Nick Vayias |

| Senior Vice President and Controller | Vice President and Assistant Controller |

| Time Warner Inc. | Time Warner Inc. |

| (212) 484-6685 | (212) 484-8964 |