UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission file number001-15062

TIME WARNER INC.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 13-4099534 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

One Time Warner Center

New York, NY 10019-8016

(Address of Principal Executive Offices)(Zip Code)

(212)484-8000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | New York Stock Exchange |

| 1.95% Notes due 2023 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of RegulationS-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to this Form10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule12b-2 of the Exchange Act.

| | |

Large accelerated filer ☑ | | Accelerated filer ☐ |

Non-accelerated filer ☐ | | Smaller reporting company ☐ |

Emerging growth company ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). Yes ☐ No ☑

As of the close of business on April 20, 2018, there were 782,319,431 shares of the registrant’s Common Stock outstanding. The aggregate market value of the registrant’s voting andnon-voting common equity securities held bynon-affiliates of the registrant (based upon the closing price of such shares on the New York Stock Exchange on June 30, 2017) was approximately $78.17 billion.

EXPLANATORY NOTE

On February 22, 2018, Time Warner Inc. (the “Company” or “Time Warner”) filed its Annual Report on Form10-K for the fiscal year ended December 31, 2017 (the “2017 Form10-K”). This Amendment No. 1 (the “Amendment”) amends Part III, Items 10 through 14, of the 2017 Form10-K to include information previously omitted from the 2017 Form10-K in reliance on General Instruction G(3) to Form10-K. General Instruction G(3) to Form10-K provides that registrants may incorporate by reference certain information from a definitive proxy statement which involves the election of directors if such definitive proxy statement is filed with the Securities and Exchange Commission (“SEC”) within 120 days after the end of the fiscal year. Due to the pending merger between Time Warner and AT&T Inc., the Company will not file a definitive proxy statement that involves the election of directors by April 30, 2018 (i.e., within 120 days after the end of the Company’s 2017 fiscal year). Accordingly, Part III of the 2017 Form10-K is hereby amended to add the information set forth below.

In addition, as required by Rule12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), certifications by the Company’s principal executive officer and principal financial officer are filed as exhibits to this Amendment under Item 15 of Part IV. The certifications are filed with this Amendment as Exhibits 31.1 and 31.2. Because no financial statements are included in this Amendment and this Amendment does not contain or amend any disclosures with respect to Items 307 or 308 of RegulationS-K, paragraphs 3, 4 and 5 of the certifications have been omitted. This Amendment does not include the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 because no financial statements are included in this Amendment.

Except as stated herein, this Amendment does not reflect events occurring after the filing of the 2017 Form10-K with the SEC on February 22, 2018 and no attempt has been made in this Amendment to modify or update other disclosures contained in the 2017Form 10-K.

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Executive Officers

For information relating to the Company’s executive officers, see Part I, “Executive Officers of the Company” in the 2017Form 10-K.

Board of Directors

Set forth below is information regarding the members of the Board of Directors of the Company (the “Board”), including their ages as of April 26, 2018 and their key skills and professional qualifications. The Board and the Nominating and Governance Committee (the “Nominating Committee”) believe that the depth and breadth of qualifications, skills and experiences of the directors, all of whom are seasoned leaders, have contributed to an effective and well-functioning Board and that, individually and as a whole, the directors possess the necessary qualifications to provide effective oversight of and advice to the Company’s management and businesses.

The Board has three standing committees: the Audit and Finance Committee (the “Audit Committee”), the Nominating Committee and the Compensation and Human Development Committee (the “Compensation Committee”). All members of the committees are independent and satisfy the standards of independence applicable to the respective committee.

1

| | |

William P. Barr | | |

| | Former Attorney General of the United States Of Counsel of Kirkland & Ellis LLP– March 2017 to present Director since 2009 Age: 67 Independent Director Board Committees:Compensation (Chair); Nominating |

| | Prior Professional Experience: Mr. Barr served as Of Counsel of Kirkland & Ellis LLP from January 2009 to July 2009; Executive Vice President and General Counsel of Verizon Communications Inc. from June 2000 to December 2008; Executive Vice President and General Counsel of GTE Corporation from 1994 to June 2000; a partner of Shaw, Pittman, Potts & Trowbridge (now Pillsbury Winthrop Shaw Pittman LLP) from 1993 to 1994; the 77th Attorney General of the United States from 1991 to 1993; Deputy Attorney General of the United States from 1990 to 1991; Assistant Attorney General for the Office of Legal Counsel from 1989 to 1990; and a partner of Shaw, Pittman, Potts & Trowbridge from 1984 to 1989. Other Public Company Boards: Dominion Energy, Inc. During the past five years, Mr. Barr served as a director ofOch-Ziff Capital Management Group LLC and Selected Funds, and a trustee of Clipper Funds. Key Skills and Qualifications: Mr. Barr, who is Chair of the Company’s Compensation Committee, brings leadership experience in government as a former Attorney General of the United States and head of the U.S. Department of Justice. He also has more than 14 years of leadership and senior management experience in major corporations in the media and telecommunications industries, as the former Executive Vice President and General Counsel of Verizon Communications Inc. and its predecessor, GTE Corporation. As a former senior executive at Verizon Communications Inc. and GTE Corporation, Mr. Barr has knowledge of and experience in broadband and mobile distribution systems, including the distribution of video content, as well as experience in consumer-focused businesses with international operations. As a former Attorney General of the United States, General Counsel and partner of a major law firm, Mr. Barr has a strong background in a wide range of legal, regulatory and government relations matters, including intellectual property and antitrust policy, as well as overseeing the negotiation of and obtaining regulatory approvals for significant mergers and acquisitions, such as the Bell Atlantic Corporation and GTE Corporation merger that formed Verizon Communications Inc. and Verizon Communications Inc.’s subsequent acquisitions of MCI Communications Corporation and Alltel Corporation. As a former director of Selected Funds, where he was a director or trustee of three separate investment companies in the fund complex, Mr. Barr has knowledge of and experience in finance and investments. |

2

| | |

Jeffrey L. Bewkes | | |

| | Chairman of the Board and Chief Executive Officer of the Company – January 2009 to present Director since 2007 Age: 65 |

| | Prior Professional Experience: Mr. Bewkes served as President and Chief Executive Officer of the Company from January 2008 through December 2008; President and Chief Operating Officer of the Company from January 2006 through December 2007; Chairman, Entertainment & Networks Group, of the Company from July 2002 through December 2005; Chairman and Chief Executive Officer of the Home Box Office division of the Company from 1995 to July 2002; and President and Chief Operating Officer of the Home Box Office division of the Company from 1991 to 1995. Other Public Company Boards: Mr. Bewkes served as a director of Time Inc. for many years, resigning on June 6, 2014 in connection with the legal and structural separation of Time Inc. from the Company. Time Inc. became a public company on May 9, 2014. Other Boards: Mr. Bewkes is a Trustee of the Yale Corporation of Yale University. He is a member of the board of the Partnership for New York City and the advisory board of the Creative Coalition. Key Skills and Qualifications: Mr. Bewkes has more than 30 years of experience at the Company and its subsidiaries, including 27 years of leadership and senior management experience serving as the Chief Executive Officer or in other senior executive positions at the Company and Home Box Office. His unique,in-depth knowledge of the Company’s history and businesses, including his deep understanding of the Company’s operations and strategy and the media and entertainment industry, provide him a strong foundation for leading the Board, as Chairman, and facilitating effective communication between management and the Board. |

3

| | |

Robert C. Clark | | |

| | Distinguished Service Professor at Harvard University – July 2003 to present Director since 2004 Age: 74 Lead Independent Director Board Committees: Audit; Nominating (Chair) |

| | Prior Professional Experience: Mr. Clark served as the Dean and Royall Professor of Law at Harvard Law School from 1989 to 2003; a professor at Harvard Law School since 1978; a professor at Yale Law School from 1974 to 1978; and an associate at Ropes & Gray from 1972 to 1974. Other Public Company Boards: Omnicom Group, Inc. Other Boards: During the past five years, Mr. Clark was a trustee of Teachers Insurance and Annuity Association (TIAA), a life insurance company focused on serving the retirement needs of the higher education community. Key Skills and Qualifications: Mr. Clark has 14 years of leadership experience as a former Dean of Harvard Law School. Mr. Clark’s expertise and insights in the areas of corporate law (including mergers and acquisitions and corporate governance), finance and regulation are useful to the Nominating Committee, which he chairs, as well as to the rest of the Board. His experience serving on the boards of directors of other companies provides him with knowledge of a number of industries, including the advertising industry. As a former trustee of a life insurance company, Mr. Clark also brings his understanding of finance, investments and the views of pension funds and other institutional shareholders. |

4

| | |

Mathias Döpfner | | |

| | Chairman and Chief Executive Officer of Axel Springer SE, an integrated multimedia company based in Berlin, Germany – January 2002 to present Director since 2006 Age: 55 Independent Director Board Committees: Compensation |

| | Prior Professional Experience: Mr. Döpfner has been with Axel Springer SE since 1998, initially aseditor-in-chief ofDie Welt and since 2000 as a member of the Management Board. Prior to joining Axel Springer SE, Mr. Döpfner held various positions in media companies, includingeditor-in-chief of the newspapersWochenpost andHamburger Morgenpost and as a Brussels-based correspondent forFrankfurter Allgemeine Zeitung. Other Public Company Boards: Vodafone Group Plc. During the past five years, Mr. Döpfner served as a supervisory board member of RHJ International SA (now known as BHF Kleinwort Benson Group). Key Skills and Qualifications: Mr. Döpfner brings more than 18 years of leadership and senior management experience serving as Chairman and Chief Executive Officer of Axel Springer SE, a leading digital publisher in Europe. He has a deep understanding of the global media and entertainment industry, including the development of new business models to address and capitalize on technological changes within the industry. |

5

| | |

Jessica P. Einhorn | | |

| | Former Dean of the Paul H. Nitze School of Advanced International Studies (SAIS) at The Johns Hopkins University Director since 2005 Age: 70 Independent Director Board Committees: Audit; Nominating |

| | Prior Professional Experience:Ms. Einhorn served as Dean of the Paul H. Nitze School of Advanced International Studies (SAIS) at The Johns Hopkins University from June 2002 through June 2012; a consultant at Clark & Weinstock, a strategic communications and public affairs consulting firm, from 2000 to 2002; a Visiting Fellow at the International Monetary Fund from 1998 to 1999; and in various executive positions (including Managing Director for Finance and Resource Mobilization) at The World Bank from 1978 to 1979 and 1981 to 1999. |

| | Other Public Company Boards: BlackRock, Inc. |

| | Other Boards:Ms. Einhorn serves as a director of the Peterson Institute for International Economics and the National Bureau of Economic Research. Ms. Einhorn is also Resident Senior Advisor and a member of the advisory board of The Rock Creek Group. |

| | Key Skills and Qualifications:Ms. Einhorn brings leadership experience in international organizations and education administration, including 10 years as Dean of the Paul H. Nitze School of Advanced International Studies (SAIS) at The Johns Hopkins University and more than 18 years serving in various staff and executive positions at The World Bank. Ms. Einhorn has extensive knowledge of policies and practices in international finance, economic development and government relations through her roles at the International Monetary Fund and The World Bank, membership on the boards of research and public policy institutions and her ongoing research interest in finance. As a member of the board of a major investment firm, BlackRock, Inc., and as an advisory board member of The Rock Creek Group, a global alternative asset manager, she also brings the perspective and experience of investment firms. |

6

| | |

Carlos M. Gutierrez | | |

| | Co-Chair of Albright Stonebridge Group, a global strategy firm – February 2014 to present Director since 2013 Age: 64 Independent Director Board Committees: Audit |

| | Prior Professional Experience: Mr. Gutierrez served as Vice Chair of Albright Stonebridge Group from April 2013 to February 2014; Vice Chairman of the Institutional Clients Group at Citigroup Inc. from January 2011 to February 2013; Chairman of the Global Political Strategies division of APCO Worldwide Inc., a communications and public affairs consulting firm from January 2010 to January 2011; the 35th U.S. Secretary of Commerce from February 2005 to January 2009; Kellogg Company’s Chairman of the Board (from April 2000 to February 2005), Chief Executive Officer (from April 1999 to February 2005) and President (from 1998 to September 2003); and in various executive and non-executive positions at Kellogg Company from 1975 to 1998. |

| | Other Public Company Boards: MetLife, Inc. and Occidental Petroleum Corporation. |

| | Key Skills and Qualifications: Mr. Gutierrez brings nearly 30 years of experience in leading, managing and growing international business operations at Kellogg Company, a global consumer-focused company with international operations. At Kellogg Company, Mr. Gutierrez was responsible for major consumer brands in a complex worldwide business. As a result of this experience, Mr. Gutierrez brings significant knowledge of brand management, marketing and product development. He also brings leadership experience and knowledge of international commerce and government relations as former U.S. Secretary of Commerce. |

7

| | |

Fred Hassan | | |

| | Special Limited Partner at Warburg Pincus LLC, a private equity firm – July 2017 to present Director since 2009 Age: 72 Independent Director Board Committees: Compensation; Nominating |

| | Prior Professional Experience: Mr. Hassan served as Partner and Managing Director at Warburg Pincus from January 2011 to July 2017; Senior Advisor at Warburg Pincus from November 2009 through December 2010; Chairman and Chief Executive Officer of Schering Plough Corporation (now part of Merck & Co., Inc.) from 2003 to November 2009; Chairman and Chief Executive Officer of Pharmacia Corporation from 2001 to 2003; Chief Executive Officer of Pharmacia Corporation from 2000 to 2001; and Chief Executive Officer of Pharmacia & Upjohn, Inc. from 1997 to 2000. Other Public Company Boards: Amgen, Inc. and Intrexon Corporation. During the past five years, Mr. Hassan served as a director of Valeant Pharmaceuticals International, Inc. Key Skills and Qualifications: Mr. Hassan brings more than 12 years of leadership and senior management experience as a former Chairman and/or Chief Executive Officer of major pharmaceutical companies with intellectual-property based business models and international operations, which provided him with strong and relevant operational and strategic experience. Because the pharmaceutical business is a highly regulated field, Mr. Hassan also has knowledge and experience in regulatory matters and government relations. As a Special Limited Partner at Warburg Pincus, Mr. Hassan also brings his knowledge of finance and investments to the Board. Mr. Hassan also brings his significant experience with large mergers and acquisitions to the Board. As Chairman and Chief Executive Officer of Schering Plough Corporation, he oversaw Schering Plough’s merger with Merck & Co., Inc., and as Chairman and Chief Executive Officer of Pharmacia Corporation, he oversaw its sale to Pfizer, Inc. |

8

| | |

Paul D. Wachter | | |

| | Founder and Chief Executive Officer of Main Street Advisors, Inc., a private company that provides investment and financial advisory services to businesses and high net worth individuals – 1997 to present Director since 2010 Age: 61 Independent Director Board Committees: Compensation |

| | Prior Professional Experience: Mr. Wachter served as Managing Director of Schroder & Co. Incorporated from 1993 to 1997; Managing Director of Kidder Peabody from 1987 to 1993; an investment banker at Bear, Stearns & Co., Inc. from 1985 to 1997; and an attorney at Paul, Weiss, Rifkind, Wharton and Garrison from 1982 to 1985. Other Public Company Boards: During the past five years, Mr. Wachter served as a director of Avalanche Biotechnologies, Inc. and Virgin America, Inc. Other Boards: Mr. Wachter serves in the noted capacities at the following privately held companies: a director of Haworth Marketing and Media Company, Oak Productions, Inc. and Content Partners LLC(Co-Chairman). Mr. Wachter also serves as Chairman of the Board of After-SchoolAll-Stars, a nationalnon-profit organization that provides comprehensive after-school programs. Key Skills and Qualifications: Mr. Wachter brings his knowledge of and experience in finance, investments and banking as the founder and Chief Executive Officer of Main Street Advisors, through serving as the former Chairman of the Investment Committee of the Board of Regents of the University of California, and as a former Managing Director at several investment banks. Mr. Wachter also has a background in the media and entertainment industry as a former investment banker focusing on the media and entertainment industry, a former member of the board of managers of Beats Electronics, LLC and Beats Music, LLC (companies focused on headphones and related products and music streaming services, respectively, both now part of Apple Inc.), and a director of Content Partners LLC (a company that acquires profit participations in films, television shows and music). Mr. Wachter also has experience in regulatory matters and government relations through his former service on the Board of Regents of the University of California, as an adviser to the former Governor of California and through his work as a tax attorney at a major law firm. |

9

| | |

Deborah C. Wright | | |

| | Former Chairman of Carver Bancorp, Inc. Director since 2005 Age: 60 Independent Director Board Committees:Audit (Chair) |

| | Prior Professional Experience: Ms. Wright served asNon-Executive Chairman of Carver Bancorp, Inc. from January 2015 through December 2016; a Senior Fellow in the Economic Opportunity and Assets Division of the Ford Foundation from January 2015 through June 2016; Chairman and Chief Executive Officer of Carver Bancorp, Inc. from February 2005 through December 2014; President and Chief Executive Officer of Carver Bancorp, Inc. and Carver Federal Savings Bank from 1999 to 2005; President and Chief Executive Officer of the Upper Manhattan Empowerment Zone Development Corporation from 1996 to 1999; Commissioner of the Department of Housing Preservation and Development from 1994 to 1996; a member of the New York City Housing Authority Board from 1992 to 1994; and a member of the New York City Planning Commission from 1990 to 1992. Other Public Company Boards: Citigroup Inc. and Voya Financial, Inc. During the past five years, Ms. Wright served as director of Carver Bancorp, Inc. Key Skills and Qualifications: Ms. Wright brings to the Board and to her role as Chair of the Audit Committee leadership, senior management and financial experience through her 17 years of service as the Chairman and/or Chief Executive Officer of Carver Bancorp, Inc. and Carver Federal Savings Bank and approximately 11 years of leadership roles atnon-profit organizations or governmental bodies. Ms. Wright also brings to the Board her experience with businesses that provide products or services directly to customers gained through her service at Carver Bancorp, Inc. and Carver Federal Savings Bank, as well as her prior long-term service as a director of Kraft Foods Inc. Ms. Wright also has extensive experience in regulatory matters and government relations through her senior roles in government andnon-profit organizations. |

10

Board Leadership

The current leadership structure consists of one individual serving as Chairman of the Board and CEO and an independent director serving as Lead Independent Director with meaningful responsibilities and authority, who serve as part of a Board consisting of nine engaged and effective directors, eight of whom are independent. The Lead Independent Director’s authority and responsibilities include:

| | ● | | Presiding at meetings of the Board at which the Chairman of the Board is not present and at executive sessions of the Board (unless the matter under consideration is within the jurisdiction of one of the Board’s committees, in which case, the Chairman of the relevant committee presides) |

| | ● | | Authority to call meetings of independent directors |

| | ● | | Serving as the liaison between the Chairman of the Board and the other directors |

| | ● | | Authority to approve the agenda (including the time allocated to items) and information for Board meetings |

| | ● | | Advising the Chairman of the Board with respect to consultants who may report directly to the Board |

| | ● | | Serving as interim Chairman of the Board in the event of the death or incapacitation of the Chairman of the Board |

| | ● | | Availability, as appropriate, for communication with the Company’s shareholders |

The Board’s Policy on Determining the Leadership Structure of the Board of Directors requires the Nominating Committee and the Board to conduct an annual review of the Board’s leadership structure. In its annual review in January 2018, the Board determined that the current leadership structure is effective and continues to be the optimal structure for the Company. The report on the Board’s determination of its leadership structure is posted on the Company’s website atwww.timewarner.com/leadership.

| | |

|

Current Leadership Structure |

| Chairman of the Board and CEO | | Jeffrey L. Bewkes |

| Lead Independent Director | | Robert C. Clark |

| Independent Directors | | 8 of 9 directors are independent |

| Board Committees | | All members are independent |

Audit Committee

The members of the Audit Committee are Robert C. Clark, Jessica P. Einhorn, Carlos M. Gutierrez and Deborah C. Wright (Chair). The Board has determined that all members of the Audit Committee are independent, satisfy the standards of independence applicable to the committee and are financially literate in accordance with the listing standards of the New York Stock Exchange (the “NYSE”). In addition, the Board has determined that each of Ms. Wright and Messrs. Clark and Gutierrez is an “audit committee financial expert” as defined under SEC rules.

11

Corporate Governance Documents and Website

The following documents are available on the Company’s website atwww.timewarner.com/governance and are also available in print to any shareholder who requests them by writing to the Office of the Corporate Secretary, Time Warner Inc., One Time Warner Center, New York, New York 10019-8016:

| | ● | | Corporate Governance Policy |

| | ● | | Charters of the Board’s three standing committees |

| | ● | | Policy and Procedures Governing Related Person Transactions |

| | ● | | Policy Statement Regarding Director Nominations |

| | ● | | Most recent report on Determination of Current Board Leadership Structure |

| | ● | | Standards of Business Conduct, which apply to the Company’s employees, including the NEOs (as defined below) |

| | ● | | Code of Ethics for Our Senior Executive and Senior Financial Officers (the “Code of Ethics”), which applies to certain senior executives of the Company, including the Chief Executive Officer, Chief Financial Officer and Controller, and serves as a supplement to the Standards of Business Conduct |

| | ● | | Guidelines forNon-Employee Directors, which serves as a code of conduct for the Company’snon-employee directors |

There were no waivers in 2017 under either the Code of Ethics or the Standards of Business Conduct with respect to any of the Time Warner senior executives covered by the Code of Ethics.

The references to the Company’s website in this Amendment are solely for the information of investors. The Company does not intend these addresses to be active links or to incorporate any information included on or accessible through its website into this Amendment or the 2017 Form10-K.

Communicating with the Board of Directors

The Board has established processes to facilitate communications by the shareholders with the Board, any of its committees, or an individual member of the Board. Communications can be addressed to the Board, any of the Board’s committees, thenon-employee directors as a group, the Chairman of the Board or any individualnon-employee director in care of the Office of the Corporate Secretary, Time Warner Inc., One Time Warner Center, New York, NY 10019-8016.

Section 16(a) Beneficial Ownership Compliance

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC and the NYSE. Officers, directors and greater than 10% shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to the Company, or written representations that no such filings were required, the Company believes that its officers, directors and greater than 10% shareholders complied with all applicable Section 16(a) filing requirements in a timely manner during 2017.

12

| Item 11. | Executive Compensation. |

Compensation Discussion and Analysis (“CD&A”)

This CD&A describes the Company’s executive compensation principles and programs, with a focus on the Compensation Committee’s decisions regarding 2017 compensation for the Company’s named executive officers (“NEOs”) in the context of having entered into the Agreement and Plan of Merger with AT&T Inc. (“AT&T”) in October 2016 (the “Merger Agreement”). The NEOs for 2017 are:

| | |

| Name | | Position with the Company During 2017 |

| Jeffrey L. Bewkes | | Chairman and Chief Executive Officer |

| Howard M. Averill | | Executive Vice President and Chief Financial Officer |

| Paul T. Cappuccio | | Executive Vice President and General Counsel |

| Gary L. Ginsberg | | Executive Vice President, Corporate Marketing & Communications |

| Carol A. Melton | | Executive Vice President, Global Public Policy |

Table of Contents

Section 1 – Overview of Company and Executive Compensation Decisions

This section provides an overview of the Company’s businesses, its strategy, the continued execution of such strategy in 2017, how the merger with AT&T is expected to advance the Company’s strategy, the Company’s strong 2017 financial performance, and the Compensation Committee’s key compensation decisions as part of the regular annual compensation review and in connection with the merger.

Time Warner’s Businesses

Time Warner is a global leader in media and entertainment that owns and operates television networks and produces and distributes television programming, films, games and other high-quality video content worldwide on a multi-platform basis. The Company has three operating divisions: Turner, Home Box Office and Warner Bros.

| | | | |

| |  | |  |

Leading domestic and international television networks and related digital properties in entertainment, sports, kids and news 2017 Revenues:$12.1 billion; 38% of Company’s total revenues | | Leading global premium pay television services – HBO and Cinemax 2017 Revenues:$6.3 billion; 20% of Company’s total revenues | | Largest integrated television, film and game studio in the world 2017 Revenues: $13.9 billion; 42% of Company’s total revenues |

13

Time Warner’s Strategy

During 2017, while the Company took actions to obtain the necessary shareholder and regulatory approvals, satisfy the other conditions required to close the merger with AT&T, and plan for integrating the companies following the closing, the Company also continued to execute its longstanding strategy of using its leading brands, distinctive intellectual property and global scale to capitalize on the growing demand for high-quality video content around the world. First, the Company invests in a concentrated portfolio of leading television networks, compelling television programming, top Hollywood movies, games and other forms of video and digital content that appeal to audiences globally and across distribution platforms. Second, the Company uses its scale and technology to meet consumer demand for the Company’s networks and content in the evolving TV ecosystem, including delivering content directly to consumers. Third, the Company continues to expand its businesses internationally with a focus on increasing scale in territories with strong long-term growth potential. Finally, the Company’son-going focus on operating and capital efficiency delivers healthy profits and helps fund investments for future growth while providing attractive returns to shareholders. The Board engages with management throughout the year in overseeing the execution of the Company’s strategy, as well as evaluating and refining the strategy to address changes in the industry.

The Company believes that combining its content with AT&T’s distribution capabilities will accelerate the execution of the Company’s strategy of offering consumers more choice and value in television network bundles, developing and launching innovative video services delivered directly to consumers over the internet and on mobile devices, and providing more value to advertisers and consumers through targeted advertising.

Strong Financial Performance in 2017

The Company delivered strong financial performance in 2017, including 7% growth in revenues, 5% growth in Operating Income and 34% growth in Diluted Income per Common Share from Continuing Operations (“EPS”), as it continued to execute its strategy and worked to close the merger.

Executive Compensation Program for 2017

The Company’s executive compensation program for 2017 was shaped by the Compensation Committee’s decisions in October 2016 in connection with entering into the Merger Agreement. The Committee recognized that the merger would present unique retention and incentive challenges, including due to the extended time period it could take to complete the merger, the significant amount of work associated with closing the merger, and the uncertainty associated with working at a company in the process of undertaking a fundamental change. In addition, the Committee faced further challenges in providing appropriate incentives arising from the fact that the Company’s equity plan would expire in August 2017. Although in October 2016, when the Merger Agreement was signed, the Company expected the merger would be completed byyear-end 2017, the potential existed (and the Merger Agreement reflected) that the merger might not be closed until sometime in 2018. Taking into consideration these factors, on October 22, 2016, the Committee approved a transaction-related program with cash and equity components to provide targeted incentives to certain employees, including the NEOs (but, with respect to the cash component, excluding Mr. Bewkes), to support the closing of the merger, the continued focus on the delivery of strong operating results and the retention of key employees. The transaction-related program took the place of the Company’s traditional long-term incentive program for the NEOs in 2017 and also has done so for 2018. For more information on the transaction-related program see “Key Executive Compensation Decisions for 2017—Transaction-Related Program.” In addition, in connection with entering into the Merger Agreement, the Compensation Committee approved extending the term of the employment agreements for each NEO (other than Mr. Bewkes) through 2019, and entering into new employment agreements with Mr. Ginsberg and Ms. Melton, both with a term through 2019. For more information on these employment agreements, see “Key Executive Compensation Decisions for 2017—Extension of Terms of Employment Agreements.” The Committee subsequently followed its regular process in setting performance goals under the annual bonus program in January 2017, and approved bonus payouts for the NEOs at the end of 2017.

14

Executive Compensation Program Designed to Support Sustained Performance and Achievement of Key Goals

Compensation Principles and Programs SupportPay-for-Performance Approach.The Compensation Committee is guided by the following key principles in making compensation decisions: the executive compensation program should (i) support the NEO’s accountability for the Company’s and the NEO’s individual performance; (ii) promote alignment of the NEO’s and shareholders’ interests; (iii) help attract, retain and motivate talent; and (iv) be determined by an independent committee responsible for making compensation decisions. The executive compensation program design has been informed by the Company’s engagement with shareholders, as described in more detail in “Section 5 – Shareholder Engagement on Executive Compensation.”

The Committee historically has applied these principles in the following manner to support sustained performance and tie compensation earned to the performance achieved:

| | ● | | Structure executive compensation so the vast majority is variable and performance-based and a substantial portion is equity-based |

| | ● | | Use a balanced mix of long-term and short-term performance measures that tie to Company financial performance and support execution of the Company’s long-range plans to generate sustained financial performance and shareholder value |

| | ● | | Set challenging financial and strategic goals at the beginning of each performance period |

When the Company entered into the Merger Agreement, the Committee adapted its approach, while applying the same compensation principles, to take into account the unique circumstances presented by the merger, as discussed above and in more detail below. The Committee implemented the transaction-related program in October 2016 to support the closing of the merger and provide incentives for employees in key positions to continue to focus on delivering strong results before and after the merger.

Compensation Mix that Ties Pay to Performance.The Compensation Committee believes that the NEOs’ compensation should be structured so that the vast majority is variable and performance-based. In addition, a substantial portion of their compensation should be equity-based to align with shareholder interests and further support the Company’s long-range plans and enterprise-wide value creation. However, taking into account the expected timing to close the merger, the Committee determined in October 2016 to implement the transaction-related program, which has taken the place of the long-term incentive program for 2017 (and for 2018). The decision reflected the Committee’s conclusion that granting time-vesting restricted stock units (“RSUs”) would represent the most effective approach to long-term incentive compensation given that the Company had agreed to undertake a fundamental change and be acquired by another company in the near term. Accordingly, to address the unique circumstances presented by the merger, the Committee determined in October 2016 to grant RSUs to the NEOs for the long-term incentive component of their compensation, rather than the mix of stock options, PSUs and RSUs that had previously been granted to the NEOs.

15

Balanced Mix of Performance Measures.The Compensation Committee has selected a balanced mix of performance measures for the Company’s incentive programs, which support the execution of the Company’s long-range plans, encourage collaboration among businesses, and drive sustained financial performance and shareholder value. The following table summarizes the Company’s performance-based incentive compensation components, the performance measure(s) used in each and the performance delivered in 2017 and resulting payouts.

| | | | | | | | |

| Incentive Component | | Time Horizon | | Performance Measure | | Performance Delivered | | 2017 Payout Linked to Performance |

Annual Cash Bonus | | 1-year | | Financial Performance: 70% • Adjusted Divisional Pre- Tax Income (“ADPTI”)(1) • Free Cash Flow(1) | | $8.2 billion of ADPTI $4.5 billion of

Free Cash Flow(2) | | Financial Performance Rating: 147% |

| | | Individual Performance: 30% • Progress on key long-term strategic objectives | | See “Section 3 – Executive Compensation Decisions—Performance-Based Compensation—Annual Cash Bonus” for individual performance ratings and achievements and amount paid to each NEO |

| PSUs | | 3-year performance period (2015-2017) | | • Cumulative Adjusted

EPS(1) (reduced by using budgeted rather than actual number of shares outstanding) | | Double-digit Adjusted EPS growth each year(3) | | Adjusted EPS Rating: 200% x TSR Modifier: 89% = Payout: 178% of target |

| | | • TSR relative to the

S&P 500 | | 14.4% TSR(4) at 36.3rd percentile | |

Stock Options | | 4-year vesting period | | Company stock price | | 2017: 5% decrease(5) 5-year: 100% increase | | Value based on long-term stock price performance |

| (1) | See “Annex A to theCD&A—Non-GAAP Financial Measures” for definitions of thenon-GAAP financial measures used in this Amendment and reconciliations of thenon-GAAP financial measures to the most directly comparable GAAP financial measures. |

| (2) | Free Cash Flow does not correspond to the Free Cash Flow reflected in the Company’s earnings release for full year 2017 results because Free Cash Flow for the annual cash bonus was determined in late December 2017 based on the Company’s forecasted full-year financial information. Both the forecasted Free Cash Flow amount and the amount reflected in the earnings release exceeded the performance required for the maximum 150% performance rating. |

| (3) | Adjusted EPS for the three-year performance period does not correspond to the Adjusted EPS reflected in the Company’s earnings releases for the same period because of the adjustments described in “Section 3 – Executive Compensation Decisions” below, which reduced the cumulative Adjusted EPS results for the performance stock units’ (“PSUs”) 2015-2017 performance period. |

| (4) | For PSUs, the share price component of Company and S&P 500 TSR is calculated using the average closing price for the 30 trading days ending on the first and last days of the performance period. |

| (5) | The Company’s stock price in the latter part of 2017 was affected by the uncertainty in the timing of the closing of the merger due to the lawsuit filed by the United States Department of Justice (the “DOJ”) under a federal antitrust statute to enjoin the merger. |

16

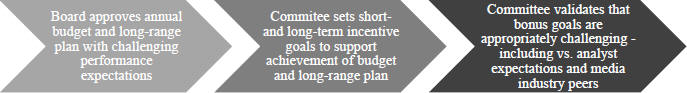

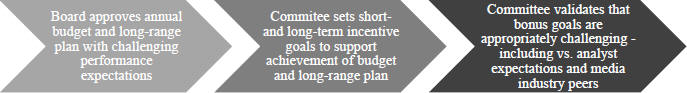

Incentive Payouts Based on Challenging Performance Goals. For many years, the Compensation Committee has followed the rigorous process described below in setting challenging performance goals for the annual bonus and for PSU awards.

Although the Company did not grant PSUs in 2017, the performance goals used in determining payouts for PSUs whose performance period ended in 2017 were set by the Committee at the beginning of 2015 following the same process. The Committee also followed this process in setting Company financial goals for the 2017 annual bonus based on the budget and long-range plan approved by the Board in January 2017, which provided for strong earnings growth during the year. To help assess whether the Company financial goals for the annual bonus, and particularly the relative difficulty of achieving them, were appropriate, the Committee compared the goals to the following information:

| | ● | | Analysts’ expectations regarding the financial performance of the Company and its entertainment industry peers |

| | ● | | The historical performance of the Company and its entertainment industry peers |

The Committee concluded that the goals appropriately reflected the difficulty of achieving the 2017 budget and supported the delivery of the growth reflected in the Company’s 2017 budget and long-range plan.

The Committee also approved individual goals for each NEO that were focused on: supporting the successful completion of the merger; supporting the Company’s key long-term strategic objectives, including strengthening and diversifying the Company’s content slate, executing Turner’s and Home Box Office’s distribution strategies, enhancing technological capabilities, expanding internationally in territories with strong long-term growth potential, and effective capital management; and fostering talent development and diversity.

Key Executive Compensation Decisions for 2017

As noted above, the Company’s executive compensation program for 2017 was shaped by the Compensation Committee’s decisions in October 2016 in connection with entering into the Merger Agreement. On October 22, 2016, the Committee approved a transaction-related program with cash and equity components to provide targeted incentives to certain employees, including the NEOs (but, with respect to the cash component, excluding Mr. Bewkes), to support the closing of the merger, the continued focus on the delivery of strong operating results and the retention of key employees. The equity component of the transaction-related program (including the Transaction RSUs (as defined below) granted to Mr. Bewkes in February 2017) took the place of the Company’s traditional long-term incentive program for the NEOs in 2017 and also has done so for 2018. The Committee also approved extending the term of the employment agreements for each NEO (other than Mr. Bewkes) through 2019, and entering into new employment agreements with Mr. Ginsberg and Ms. Melton, each with a term through 2019.

17

Transaction-Related Program.On October 22, 2016, the Committee approved a transaction-related program with cash and equity components to provide targeted incentives to certain employees.

| | | | |

| Component | | Description | | Objectives |

Cash Program | | ● Participants: Select employees who are most critical to the successful closing of the merger and to Company operations, including the NEOs (but excluding Mr. Bewkes) ● Timing: Payable 50% on the closing of the merger and 50% on thesix-month anniversary of the closing, subject to continued employment through each applicable date ● Amount: For participating NEOs, equal to 50% of their 2017 target bonus | | ● Support successful closing of the merger ● Recognize and reward the significant amount of work involved in closing the merger ● Promote continued focus on the delivery of strong operating results ● Promote retention of key employees during period of uncertainty |

Equity Awards | | ● Participants: Generally granted to employees who typically receive long-term incentive compensation awards, including the NEOs ● Awards: RSUs (“Transaction RSUs”) with a grant date value generally equal to two times the recipient’s target annual long-term incentive compensation ● Impact on 2017/2018 Long-Term Incentive Compensation: For employees who received Transaction RSUs in 2016 (including the NEOs other than Mr. Bewkes), no long-term incentive awards granted in 2017 and no plan to do so in 2018. Transaction RSUs were granted to Mr. Bewkes in February 2017, with no plan to grant Mr. Bewkes any long-term incentive awards in 2018 ● Vesting: Follows the vesting schedules that would have applied to RSUs granted to employees in February 2017 and 2018 o More restrictive vesting conditions to enhance use as a retention tool, including suspension of retirement vesting until after the closing of the merger | |

Extension of Terms of Employment Agreements.The Compensation Committee determined it was in the interest of the Company and its shareholders to provide continuity of senior management through the closing of the merger and the integration process following the closing, and, as a result, on October 22, 2016, approved extending the term of the employment agreements for Messrs. Averill and Cappuccio through 2019. The extensions did not increase their compensation or severance benefits. The Committee also approved the entry into amended and restated employment agreements with Ms. Melton and Mr. Ginsberg. For Ms. Melton, whose employment agreement had a term ending on December 31, 2017, the amended and restated employment agreement extended the term of her employment through December 31, 2019 and did not increase her compensation or benefits. For Mr. Ginsberg, whose employment agreement had a term ending on December 31, 2016, and whose agreement extension and corresponding compensation change the Committee originally planned to review during its regular meeting scheduled for late October, the Committee approved the extension of the term of Mr. Ginsberg’s employment agreement through December 31, 2019. Considering Mr. Ginsberg’s strong ongoing performance in communicating the Company’s strategy and long-term growth plans, the Committee approved in the ordinary course, effective January 1, 2017, an increase in his annual salary to $900,000 and the target value of his annual long-term incentive compensation to $1,250,000.

18

Strong Governance of Executive Compensation

The Company’s compensation governance policies and practices are designed to support effective oversight and implementation of the Company’s executive compensation program, thereby helping to drive the Company’s performance while mitigating compensation-related risk.

| | |

What Time Warner Does | | What Time Warner Doesn’t Do |

✓ Pay-for-Performance: Tie compensation to performance by setting clear and challenging Company financial goals and individual goals and by historically having a majority of total target compensation consist of performance-based components. ✓ Multiple Performance Metrics and Time Horizons: Use different performance measures (e.g., for cash bonuses and PSUs) and short- and long-term vesting or performance periods. ✓ Share Ownership and Retention Requirements: NEOs must comply with share ownership and stock retention requirements. ✓ Regular Shareholder Engagement: The Company engages with shareholders throughout the year regarding executive compensation and corporate governance matters. ✓ Limited Personal Benefits: The Company provides limited personal benefits. ✓ Limit on Equity Dilution:The Compensation Committee maintains a policy limiting annual equity dilution, which caps the maximum annual run rate at 1.5% of the total outstanding Common Stock at December 31 of the preceding year. ✓ Annual Compensation-Related Risk Review: The Company conducts an annual review of compensation-related risks to confirm that any such risks are not reasonably likely to have a material adverse effect on the Company. ✓ Clawback Policy: The Company has a policy on the recovery of previously paid executive compensation. ✓ Use an Independent Compensation Consultant: The Compensation Committee has retained an independent compensation consultant that performs no other consulting services for the Company and has no conflicts of interest. | | ✘ No Guaranteed Bonuses: The Company does not guarantee bonus payments for NEOs. ✘ No Excise TaxGross-Ups: The Company does not provide any excise taxgross-up payments in connection with a change in control. ✘ No Change in Control Severance Agreements: The Company does not have change in control severance agreements with the NEOs and there are no enhancements to the amount of their severance in connection with a change in control. ✘ No Targeting Specific Percentiles: The Compensation Committee does not target a specific percentile of compensation paid to executives at peer companies in setting total compensation levels or individual compensation components. ✘ No TaxGross-Ups for Personal Benefits: The Company does not provide taxgross-ups to NEOs for personal benefits. ✘ No Repricing or Buyouts of Stock Options: The Company’s equity plan that was active during 2017 prohibits repricing or buyouts of underwater stock options. ✘ No Hedging or Pledging: NEOs are prohibited from engaging in hedging transactions with Common Stock, holding Common Stock in a margin account or pledging Common Stock as collateral for a loan. ✘ No Excessive Overhang or Dilution: The Company’s 2017 equity grants (which included the Transaction RSUs granted to Mr. Bewkes) represented less than 0.1% of the total outstanding Common Stock as of December 31, 2016. The Company’s equity plan expired in August 2017. As of February 28, 2018, the total number of equity awards outstanding (assuming vesting of PSUs at 2x target) represented approximately 3% of the outstanding Common Stock. ✘ No Pension Credits for Years not Worked ✘ Value of Equity Awards not included in Pension Calculations |

19

Section 2 – Components of Executive Compensation

The following table describes the components of the compensation program that has historically been used to compensate the NEOs, and the purpose of each component. When the Company entered into the Merger Agreement, to reflect the unique circumstances presented by the merger, the Compensation Committee implemented the transaction-related program, which replaced the long-term incentive component of the compensation program (and included a cash component), as discussed in more detail throughout this CD&A.

| | | | | | | | |

| Component | | Description | | | | Objectives |

| | Base Salary | | ● Represents smallest component of total target direct compensation, consistent withpay-for-performance principles | | | | ● Attract and retain NEOs by providing competitive level of fixed compensation |

| | Annual Cash Bonus | | ● Performance-based annual compensation component linked to Company financial performance and individual performance compared topre-set goals | | | | ● Motivate and reward executives and promote alignment with shareholder interests by determining bonus amounts based on both annual financial performance and progress made during the year on key long-term strategic objectives |

| | Long-Term Incentive Awards | | ● Performance-based multi-year compensation component linked to stock price and Company performance ● Value ultimately earned by NEOs depends on stock price at vesting or exercise and, for PSUs, also on Company financial and relative TSR results over3-year performance period ● Value delivered through stock options, RSUs and PSUs prior to entry into the Merger Agreement and through RSUs thereafter (the Company’s equity plan expired in August 2017) | | | | ● Provide incentives for executives to deliver strong Company stock and financial performance over the long-term ● Reinforce alignment between interests of NEOs and shareholders ● Promote retention |

| | Retirement Programs | | ● A qualified savings plan and nonqualified deferred compensation plans and programs. The Company also has a qualified defined benefit pension plan and a nonqualified defined benefit plan (both now frozen) | | | | ● Enable employees to plan and save for retirement at a reasonable cost to the Company |

| | Personal Benefits | | ● Financial services reimbursement, life insurance benefits and transportation-related services ● No taxgross-up – taxes on personal benefits are sole responsibility of the NEOs | | | | ● Provide a competitive level of benefits at a reasonable cost to the Company ● To improve security and efficiency, provide the Chairman and CEO a car and driver and encourage him to use Company aircraft for business and personal use |

20

Section 3 – Executive Compensation Decisions

This section describes the Compensation Committee’s decisions regarding 2017 compensation for the NEOs in more detail, including decisions made both as part of the regular annual compensation review and those made in connection with the merger.

Considerations in Determining 2017 Compensation

At the beginning of each year (or in connection with the entry into or extension of an employment agreement with an NEO), the Compensation Committee sets target compensation levels for each NEO. In determining target compensation levels, the Committee considers:

| | ● | | Nature and scope of each NEO’s duties |

| | ● | | Terms of each NEO’s employment agreement |

| | ● | | Each NEO’s prior compensation and individual performance |

| | ● | | Information on compensation levels of similarly positioned executives at entertainment industry peers |

| | ● | | Views expressed by shareholders and the results of the advisory vote on NEO compensation at the most recent annual meeting of shareholders |

| | ● | | Internal pay positioning, taking into account each NEO’s pay components and levels relative to other executives with respect to role, length of time the NEO has served in the NEO’s current position, seniority and levels of responsibility |

In addition, for 2017, the Committee considered the actions it approved in October 2016 and the additional context of the merger with AT&T.

Base Salary

The Compensation Committee reviews the NEOs’ base salaries annually and in connection with the entry into or renewal of an employment agreement with an NEO. The Committee determined to keep the base salaries for the NEOs (other than Mr. Ginsberg) unchanged for 2017. Mr. Bewkes’ base salary has been the same since 2010. Mr. Ginsberg’s base salary was increased effective January 1, 2017 in connection with the entry into his amended and restated employment agreement in October 2016. For more information on the amendment of Mr. Ginsberg’s employment agreement, see “Section 1 – Overview of Company and Executive Compensation Decisions—Key Executive Compensation Decisions for 2017—Extension of Terms of Employment Agreements.”

Performance-Based Compensation – Annual Cash Bonuses

| 1. | Set Target Bonuses. The Compensation Committee reviews the NEOs’ target bonuses annually and in connection with the entry into or renewal of employment agreements with NEOs. The Committee determined to keep the 2017 target bonuses for the NEOs (which are expressed as a percentage of their base salaries) unchanged. Mr. Bewkes’ target bonus has been the same since 2010. Bonus payouts are generally capped at a maximum of 150% of the target bonus. |

| 2. | Select Performance Measures. In early 2017, the Compensation Committee selected ADPTI and Free Cash Flow as the financial performance measures for the annual cash bonuses, which are the same measures as have been used for several years. |

21

| | |

Performance Measure | | Reasons for Selection |

Adjusted Divisional Pre-Tax Income (ADPTI) | | ● Encourages earnings growth ● Consistent with Adjusted Operating Income, which is one of the primary measures used by the Board and management (as well as investors) to evaluate the Company’s profitability ● Provides accountability for capital allocation |

| Free Cash Flow | | ● Provides a clear view of the Company’s ability to generate cash that can be used for investments in the Company, returns to shareholders and other actions that enhance shareholder value |

The Committee also approved individual performance goals for the NEOs that were focused on supporting the successful completion of the merger, supporting the Company’s key long-term strategic objectives, and fostering talent development and diversity. In addition, taking into account input from the Company’s shareholders, the Committee approved individual performance goals for Messrs. Bewkes and Averill that again included return on invested capital (“ROIC”) as a measure of their performance on capital allocation goals.

The Committee assigned a 70% weighting to the financial performance measures and a 30% weighting to the individual goals to emphasize the Committee’s view of the importance of achieving strong financial performance while reinforcing individual accountability for each NEO’s performance. The Committee also assigned a weighting of 70% to ADPTI and 30% to Free Cash Flow based on its view of the relative importance of these measures as indicators of the Company’s operating performance over both the short- and long-term.

| 3. | Set Challenging Financial Performance Goals.The Compensation Committee approved challenging financial goals that are consistent with the Company’s 2017 budget and long-range plan. The 2017 goals were set at a level that required the Company to deliver higher ADPTI and Free Cash Flow compared to the goals set for 2016. |

| 4. | Evaluate Company Financial Performance. In late December 2017, the Compensation Committee reviewed the Company’s performance with respect to the financial criteria established by the Committee. The Company delivered approximately $8.2 billion of ADPTI in 2017 and approximately $4.5 billion of Free Cash Flow, and the Committee approved the resulting financial performance rating of 147%. In reaching that conclusion, the Committee considered (i) the Company’s strong financial performance compared to the goals the Committee had set at the beginning of the year, (ii) the significant accomplishments related to the merger, including securing shareholder adoption of the Merger Agreement and all required international regulatory approvals for the merger, obtaining consents from key contractual parties, developing post-closing integration plans and identifying potential growth initiatives and costs synergies, (iii) the Company’s continued progress in executing its strategy, and (iv) the Company’s performance compared to its entertainment industry peers. |

22

| | | | | | | | | | |

Performance Measure ($ in millions) | | % of

Financial Component | | Financial

Performance

Framework(1) | | 2017

Performance(2) | | Performance

Rating |

| | | | | 50% | | 150%(3) | | | | |

ADPTI | | 70% | | $7,535 | | $8,260 | | $8,226 | | 145% |

Free Cash Flow | | 30% | | $3,275 | | $4,300 | | $4,500 | | 150% |

Financial Performance Rating Approved by the Committee | | | | | | | | | | 147% |

| | (1) | If the performance is between the levels shown, payouts are generally determined by interpolation. |

| | (2) | Consistent with the Compensation Committee’s practice of taking into account developments, such as changes in accounting treatment and strategic decisions, that were not known or anticipated when the budget and the financial performance criteria were approved (but that would have been reflected, if known), the ADPTI rating reflects an adjustment for programming impairment charges at Turner, strategic restructurings at Turner and Warner Bros., and the costs of outsourcing certain services at Turner and Home Box Office, which lowered the Company’s 2017 results, but were undertaken to further the Company’s long-term strategic objectives. The Committee believes that adjustments for strategic business decisions appropriately mitigate the adverse impact on bonus payouts of actions that reduce short-term results in order to improve long-term performance. |

| | (3) | Represents the performance required for the maximum rating. Amounts above these levels would not result in a higher rating. |

| 5. | Evaluate Individual Performance. The Committee also evaluated the performance of each NEO in 2017 with respect to his or her individual performance goals. Based on its determination that each of the NEOs delivered strong individual performance during 2017, and taking into account Mr. Bewkes’ recommendations with respect to performance ratings for the other NEOs, the Committee approved individual performance ratings of 147% for Mr. Bewkes, 150% for Messrs. Averill and Cappuccio and 140% for Mr. Ginsberg and Ms. Melton. In determining the individual performance ratings, the Committee considered the individual accomplishments during 2017 that supported the completion of the merger, helped the Company make progress on its key long-term strategic objectives, and fostered talent development and diversity. Some of the significant accomplishments of the NEOs the Committee considered include: |

Mr. Bewkes (Chairman and CEO)

| | ● | | Led the Company’s efforts to complete the merger with AT&T, including planning for integration, identifying innovation-based revenue opportunities and cost synergies, obtaining all required international regulatory approvals for the merger and making extensive efforts to reach an agreement with the DOJ |

| | ● | | Oversaw actions to execute and make significant progress on the Company’s key long-term strategic objectives and initiatives, including (i) strengthening and diversifying the Company’s content slate, (ii) Turner and Home Box Office successfully executing their distribution strategies, including Home Box Office securing affiliate renewals and both expanding their broadband distribution, increasing the distribution of HBO by digital distributors, and Turner and Warner Bros. launching new OTT services, (iii) enhancing technological capabilities, and (iv) expanding internationally in territories with strong long-term growth potential, including new OTT services |

| | ● | | Effectively communicated the Company’s strategy to external constituencies |

| | ● | | Enhanced diversity and strengthened collaboration among the Divisions (e.g., successful launch of Boomerang-branded OTT service by Turner and Warner Bros.) |

| | ● | | Continued to focus on capital allocation efficiency |

| | ● | | Executed capital market opportunities such as debt tender offers in December 2017 |

23

Mr. Averill (EVP and CFO)

| | ● | | Led a number of initiatives related to the merger with AT&T, including the formation of Corporate and Divisional cross-functional integration planning teams, development of revenue growth plans, identification of potential cost synergies and the development of Day 1 readiness plans |

| | ● | | Led the execution of cash tender offers for approximately $4.7 billion aggregate principal amount of high-interest rate debt for a maximum purchase price of $6.0 billion |

| | ● | | Oversaw the successful execution of the budget and planning process |

| | ● | | Maintained effective internal control over financial reporting and enhanced existing internal control processes |

| | ● | | Continued to focus on capital allocation efficiency |

Mr. Cappuccio (EVP and General Counsel)

| | ● | | Successfully obtained shareholder adoption of the Merger Agreement, and secured all required international regulatory approvals for the merger and engaged in sustained efforts to negotiate a consent decree with the DOJ while preparing for trial in the event negotiations were unsuccessful |

| | ● | | Provided effective legal advice and assistance, individually and through the legal department, on significant matters, including (i) cash tender offers for approximately $4.7 billion aggregate principal amount of high-interest rate debt for a maximum purchase price of $6.0 billion, (ii) several planned and potential domestic and international M&A and real estate transactions as well as investments, and (iii) the successful resolution of important litigation matters at the Divisions |

| | ● | | Maintained an effective compliance program, with a continued focused on international operations, including the implementation of a new online training program and new conflicts of interest reporting system |

| | ● | | Collaborated with Public Policy group on a number of government proceedings related to intellectual property matters and with Divisions on strategic matters such as the distribution of programming and networks |

Mr. Ginsberg (EVP, Corporate Marketing & Communications)

| | ● | | Successfully managed the communication strategy related to the merger with AT&T, keeping key stakeholders informed of developments regarding integration planning and the regulatory review process, and educating the media on the benefits of the merger |

| | ● | | Actively supported the Company’s marketing program, including expanding the sharing of consumer data across the Company to better promote and target key Divisional content offerings |

| | ● | | Effectively communicated key Company successes, including CNN’s record-breaking year, the brand refreshes of TNT and TBS, the growth of Home Box Office’s OTT services and the success of Warner Bros.’ film slate |

| | ● | | Continued to strengthen the Company’s efforts to support and cultivate diverse storytellers by investing in their work, facilitating internal and external relationships and providing a platform for them to reach wider audiences |

Ms. Melton (EVP, Global Public Policy)

| | ● | | Managed advocacy efforts with key policymakers in support of the merger, and worked closely with the Time Warner legal department to secure all required international regulatory approvals in connection with the merger |

24

| | ● | | Led a wide range of public policy efforts to promote a regulatory and legislative environment that supports the creation and distribution of high-quality content, including by strengthening the U.S. Copyright office, obtaining the first FAA waiver to conduct drone operations for news coverage, and successfully opposing initiatives that could have harmed the Company’s businesses |

| | ● | | Worked closely with the Time Warner tax department, industry groups and trade associations to support tax legislation that reduced the U.S. corporate tax rate and allows companies to expense domestic film and television production costs |

| | ● | | Led a coordinated, global effort to maintain consistency between business priorities and public policy advocacy across the Company |

| 6. | Reward Performance: Determine Final Bonus Amounts. The Compensation Committee approved final bonus amounts for each NEO that reflect the Company’s strong financial results in 2017 and the NEO’s individual accomplishments, including those related to the merger. The Committee used the bonus framework discussed above and reflected in the table below in determining the NEOs’ bonuses, while retaining discretion in approving the final bonus amounts. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Target

Bonus Amount | | Company Performance Component | | Individual Performance

Component | | 2017 Bonus Amount |

| | | Rating | | Rating Multiplied by 70% of Target

Bonus | | Rating | | Rating Multiplied by 30% of Target Bonus | |

| Jeffrey L. Bewkes | | | $ | 10,000,000 | | | | | 147 | % | | | | $10,290,000 | | | | | 147 | % �� | | | $ | 4,410,000 | | | | $ | 14,700,000 | |

| Howard M. Averill | | | | 3,500,000 | | | | | 147 | % | | | | 3,601,500 | | | | | 150 | % | | | | 1,575,000 | | | | | 5,176,500 | |

| Paul T. Cappuccio | | | | 3,150,000 | | | | | 147 | % | | | | 3,241,350 | | | | | 150 | % | | | | 1,417,500 | | | | | 4,658,850 | |

| Gary L. Ginsberg | | | | 1,800,000 | | | | | 147 | % | | | | 1,852,200 | | | | | 140 | % | | | | 756,000 | | | | | 2,608,200 | |

| Carol A. Melton | | | | 1,387,500 | | | | | 147 | % | | | | 1,427,738 | | | | | 140 | % | | | | 582,750 | | | | | 2,010,488 | |

Long-Term Incentives

In January 2017, the Compensation Committee approved the grant of Transaction RSUs with a target value equal to two times Mr. Bewkes’ $16 million target annual long-term incentive compensation (332,226 Transaction RSUs were granted in February 2017). The other NEOs had been granted Transaction RSUs in October 2016 with a target value equal to two times their respective 2017 target annual long-term incentive compensation as part of the Committee’s actions taken in connection with entering into the Merger Agreement and were not granted any long-term incentive awards in 2017. There is no plan to grant long-term incentive compensation awards to the NEOs in 2018.

PSUs Granted in Prior Periods.

| | ● | | PSU Program Design.The PSUs granted in February each year from 2012 through 2016 had (or have) a three-year performance period. At the end of the three-year performance period, a percentage between 0% and 200% is determined based on the cumulative Adjusted EPS achieved (the “EPS Factor”) as compared to the goal established by the Compensation Committee at the start of the performance period. The EPS Factor is then multiplied by a modifier ranging from 80% to 120% (the “TSR Modifier”), depending on the Company’s TSR percentile for the performance period relative to the TSR of the other companies in the S&P 500 Index for the performance period. The number of shares that can be earned is capped at 200% of the target number of PSUs awarded. The Adjusted EPS calculation is based on the budgeted number of shares outstanding in the long-range plan approved by the Board at the beginning of the performance period, so that the performance rating and payout are not advantaged if share repurchases during the performance period are higher |

25

| | than expected when goals are set. In determining the cumulative Adjusted EPS achieved, the Committee may take into account the impact of unusual or nonrecurring items (such as unplanned strategic decisions, regulatory changes and external developments) and other factors the Committee deems appropriate. |

The chart below illustrates how the two measures are used to determine the final payout of shares for the PSUs. For example, if 100 target PSUs were awarded and after the three-year performance period (i) the Company’s cumulative Adjusted EPS is at a level that would result in a payout of 100% of the target PSUs and (ii) the relative TSR of the Common Stock is at the 75th percentile, the final PSU payout would be calculated by multiplying the 100 target PSUs by an EPS Factor of 100% and a TSR Modifier of 120%, resulting in a payout of 120 shares of Common Stock.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Relative TSR Performance(1) | | TSR Modifier | | 0% | | 50% | | 100% | | 150% | | 200% | | | | Payout Based on EPS Factor Alone (as Percentage of Target) |

| £ 25th Percentile | | | | 80 | % | | | | 0 | % | | | | 40 | % | | | | 80 | % | | | | 120 | % | | | | 160 | % | |  | | Final Payout after Applying TSR Modifier |

| 50th Percentile | | | | 100 | % | | | | 0 | % | | | | 50 | % | | | | 100 | % | | | | 150 | % | | | | 200 | % | | |

| ³ 75th Percentile | | | | 120 | % | | | | 0 | % | | | | 60 | % | | | | 120 | % | | | | 180 | % | | | | 200 | % | | |

| | (1) | If Relative TSR performance is between the levels shown, the TSR Modifier is generally determined by interpolation. |

The Compensation Committee considered a number of potential designs, as well as views of the Company’s shareholders, when it approved the PSU program design and performance measures. The PSU program rewards Adjusted EPS performance based on goals set by the Committee at the beginning of the performance period and relative TSR, which provides a clear incentive for executives to drive shareholder value. With the TSR Modifier in the program design, strong performance on the Adjusted EPS goal is fully rewarded only if it also results in above average shareholder returns. These performance measures were selected because: (i) Adjusted EPS is one of the primary measures the Company and investors use to assess the Company’s performance, (ii) relative TSR is an important measure for shareholders and (iii) PSU recipients have a clear line of sight into how superior performance affects Adjusted EPS.

Adjusted EPS and relative TSR of the Company either would not be meaningful or could not reliably be measured for periods following a change in control of the Company. As a result, the PSU program design provides for measuring the Company’s performance at the time of a change in control that occurs prior to the end of the three-year performance period for the PSUs (which the Company expects will be the case in connection with the merger for the PSUs granted in 2016, which have a performance period ending December 31, 2018). For the same reasons, the Compensation Committee determined not to grant any PSUs after the Company entered into the Merger Agreement.

At the closing of the merger, the vesting of any outstanding PSUs (which are only expected to be the PSUs granted in 2016 with a performance period ending December 31, 2018) will be accelerated and the number of shares earned with respect to each PSU award will be determined by the Compensation Committee based on (a) an EPS Factor determined based on the sum of the Adjusted EPS achieved for each completed year in the performance period and the budgeted Adjusted EPS for any year in the performance period not completed before the closing of the merger, compared to the cumulative goals set at the beginning of the performance period, and (b) a TSR Modifier based on the Company’s relative TSR for the period from the beginning of the performance period through the end of the last fiscal quarter completed on or before the closing of the merger.

26

| | ● | | PSUs Granted in 2015 with Performance Period Ended December 31, 2017.In January 2018, the Compensation Committee reviewed the Company’s performance for the 2015-2017 performance period compared to goals established by the Committee in January 2015 based on the Board-approved long-range plan for 2015-2017 (the “2015 LRP”) and approved a final payout of 178%. The Compensation Committee certified the Company’s EPS Factor of 200% based on the cumulative Adjusted EPS achieved (reflecting three consecutive years of double-digit growth) compared to the goals approved by the Committee in 2015. |

| | | | | | | | | | | | |

| | | Cumulative Adjusted EPS Goals (2015-2017)(1)(2) | | 2015-2017 Performance |

| EPS Factor | | 0% | | 50% | | 100% | | 150% | | 200% | | 200% |

| Cumulative Adjusted EPS | | $15.39 | | $15.96 | | $16.58 | | $17.12 | | $17.60 | | $17.77 (3) |

| | (1) | If cumulative Adjusted EPS performance is between the levels shown, the EPS Factor is generally determined by interpolation. The cumulative Adjusted EPS goals reflect adjustments for acquisitions, investments and dispositions that were not known or anticipated when the goals were approved, which had the impact of decreasing the performance range. |