UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: June 2010

Commission File Number: 000-30827

CLICKSOFTWARE TECHNOLOGIES LTD.

(Translation of registrant's name into English)

94 Em Hamoshavot Road

Petach Tikva 49527, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(7): ¨

Indicate by check mark, whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

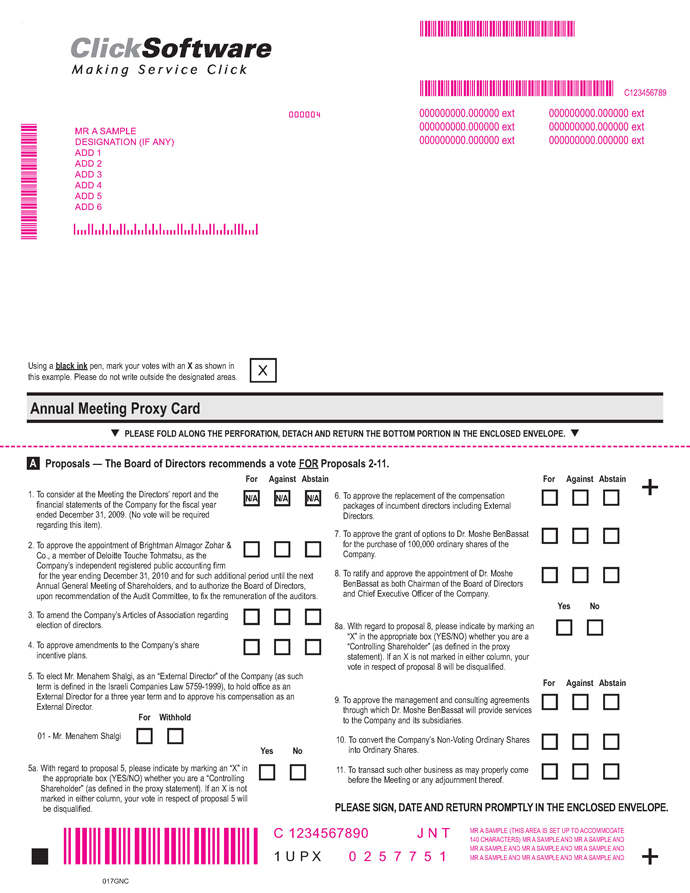

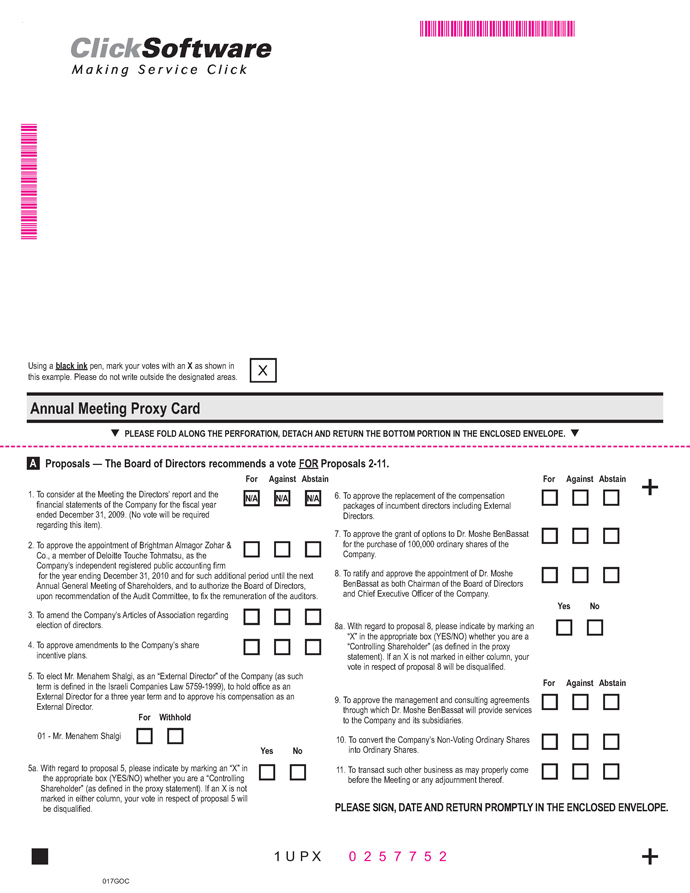

Attached hereto and incorporated by reference herein is the Registrant's Notice of Meeting and Proxy Statement for the Annual General Meeting of Shareholders to be held on July 15, 2010.

Only shareholders of record who hold Ordinary Shares, nominal value NIS 0.02, of the Company at the close of business on June 7, 2010 will be entitled to notice of and to vote at the Meeting and any postponements or adjournments thereof. This Proxy Statement and the proxies solicited thereby will be first sent or delivered to the shareholders on or about June 10, 2010.

The Proxy Statement attached to this Form 6-K of CLICKSOFTWARE TECHNOLOGIES LTD. is incorporated by reference into the Form S-8 registration numbers 333-42000, 333-115003, 333-135435, 333-141307, 333-149825 333-158839 and 333-166028 and Form F-3 registration number 333-166046 of the Company, filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CLICKSOFTWARE TECHNOLOGIES LTD. | |||

| (Registrant) | |||

| By: | /s/ Shmuel Arvatz | ||

| Name: | Shmuel Arvatz | ||

| Title: | Executive Vice President and | ||

| Chief Financial Officer | |||

Date: June 2, 2010

CLICKSOFTWARE TECHNOLOGIES LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on July 15, 2010

Notice is hereby given that the Annual General Meeting of Shareholders of ClickSoftware Technologies Ltd. (the "Company") will be held at the offices of the Company, at Azorim Park, Oren Building, 94 Em Hamoshavot Road, Petach Tikva 49527 Israel, on July 15, 2010 at 4:00 p.m. local time (the "Meeting"). The agenda for the Meeting is as follows:

| 1. | To consider at the Meeting the Directors’ report and the financial statements of the Company for the fiscal year ended December 31, 2009. |

| 2. | To approve the appointment of Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu, as the Company’s independent registered public accounting firm for the year ending December 31, 2010 and for such additional period until the next Annual General Meeting of Shareholders, and to authorize the Board of Directors, upon recommendation of the Audit Committee, to fix the remuneration of the auditors. |

| 3. | To amend the Company’s Articles of Association regarding election of directors. |

| 4. | To approve amendments to the Company's share incentive plans. |

| 5. | To elect Mr. Menahem Shalgi, as an “External Director” of the Company (as such term is defined in the Israeli Companies Law 5759-1999), to hold office as an External Director for a three year term and to approve his compensation as an External Director. |

| 6. | To approve the replacement of the compensation packages of incumbent directors including External Directors. |

| 7. | To approve the grant of options to Dr. Moshe BenBassat for the purchase of 100,000 Ordinary Shares of the Company. |

| 8. | To ratify and approve the appointment of Dr. Moshe BenBassat as both Chairman of the Board of Directors and Chief Executive Officer of the Company. |

| 9. | To approve the management and consulting agreements through which Dr. Moshe BenBassat will provide services to the Company and its subsidiaries. |

| 10. | To convert the Company’s Non-Voting Ordinary Shares into Ordinary Shares. |

| 11. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

1

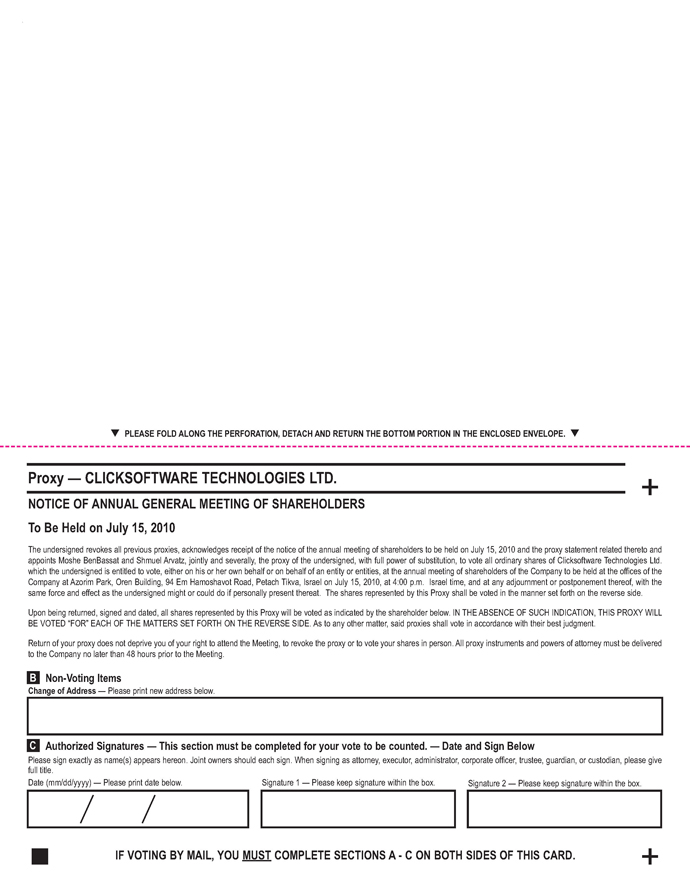

Shareholders of record at the close of business on June 7, 2010 will be entitled to notice of and to vote at the Meeting. Shareholders who do not expect to attend the Meeting in person are requested to mark, date, sign and mail to the Company the enclosed proxy as promptly as possible in the enclosed pre-addressed envelope.

| By Order of the Board of Directors, | CLICKSOFTWARE TECHNOLOGIES LTD. |

| Dr. Moshe BenBassat | |

| Chairman of the Board of Directors and | |

| June 2, 2010 | Chief Executive Officer |

IMPORTANT: YOUR VOTE IS IMPORTANT. IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENVELOPE PROVIDED.

2

CLICKSOFTWARE TECHNOLOGIES LTD.

(the "Company")

94 Em Hamoshavot Road,

Petach Tikva 49527 Israel

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held on July 15, 2010

This Proxy Statement is furnished to the holders of Ordinary Shares, par value NIS 0.02 per share (the "Ordinary Shares"), of the Company, in connection with the solicitation by the Board of Directors of proxies for use at the Company's Annual General Meeting of Shareholders (the "Meeting") to be held on July 15, 2010 at 4:00 p.m. local time at the offices of the Company, 94 Em Hamoshavot Road, Petach Tikva 49527 Israel (tel. +972-3-765-9400), or at any adjournment thereof. This Proxy Statement and the proxies solicited hereby are first being sent or delivered to the shareholders on or about June 10, 2010.

Proxies; Counting of Votes

A form of proxy for use at the Meeting is attached. The completed proxy should be mailed in the pre-addressed envelope provided and received by the Company or its transfer agent, Computershare, Essential Registry Team, 350 Indiana Street, Suite 750, Golden, CO 80401 USA, Tel. 303-262-0678 (attention: Lee Meier), at least forty eight (48) hours before the Meeting. Upon the receipt of a properly executed proxy in the form enclosed herewith, the persons named as proxies therein will vote the Ordinary Shares, covered thereby in accordance with the directions of the shareholder executing such proxy.

Shareholders may revoke the authority granted by their execution of proxies at any time before the exercise thereof by filing with the Company a written notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Shareholders may vote shares directly held in their name in person at the Meeting. If a shareholder holds the shares in street name, such shareholder must request a legal proxy from the broker, bank or other nominee that holds the shares, and must present such legal proxy at the Meeting, in order to vote in person at the Meeting. Attendance at the Meeting will not, by itself, revoke a proxy. A shareholder who holds the Company’s shares under his, her or its name, and who attends the Meeting in person, shall be identified by a copy of an identity card, passport or a certificate of incorporation.

3

Record Date; Solicitation of Proxies

Only shareholders of record at the close of business on June 7, 2010 will be entitled to receive notice of, and to vote at, the Meeting and any adjournment thereof. Proxies will be solicited chiefly by mail; however, certain officers, directors, employees and agents of the Company, none of whom will receive additional compensation therefore, may solicit proxies by telephone, fax or other personal contact. Copies of solicitation materials will be furnished to banks, brokerage firms, nominees, fiduciaries and other custodians holding Ordinary Shares in their names for others to send proxy materials to and obtain proxies from the beneficial owners of such Ordinary Shares. The Company will bear the cost of soliciting proxies, including postage, printing and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of Ordinary Shares. Copies of solicitation materials and the proposed forms of the resolutions to be adopted at the Meeting will be available for shareholders viewing at the Company’s offices during business hours.

To the extent you would like to state your position with respect to any of proposals described in this proxy statement, in addition to any right you may have under applicable law, pursuant to regulations under the Israeli Companies Law 5759 – 1999 (the “Companies Law”), you may do so by delivery of a notice to the Company’s offices located at 94 Em Hamoshavot Road, Petach Tikva 49527 Israel, not later than June 17, 2010. Our Board of Directors may respond to your notice.

Following the Meeting, one or more shareholders holding, at the Record Date, at least five percent (5%) of the total voting rights of the Company, which are not held by Controlling Shareholders (as defined hereunder) of the Company, may review the Proxy Cards submitted to the Company at the Company’s offices during business hours.

Pursuant to the Israeli Companies Law, a “Controlling Shareholder” is defined as any shareholder that has the ability to direct the company’s actions, other than such ability resulting only from serving as a director or other office holder of the Company. Any shareholder holding 50% or more of either the voting rights in the Company or the right to appoint directors or the Company's general manager is deemed to be a Controlling Shareholder.

Quorum and Voting Requirements

Two or more shareholders, present in person or by proxy and holding or representing shares conferring in the aggregate at least 33% of the voting power of the Company, will constitute a quorum at the Meeting. Shares that are voted in person or by proxy “FOR” or “AGAINST” are treated as being present at the Meeting for purposes of establishing a quorum and are also treated as voted at the Meeting with respect to such matters.

Under applicable regulations, a "broker non-vote" occurs on an item when a broker identified as the record holder of shares is not permitted by applicable rules, to vote on that item without instruction from the beneficial owner of the shares and no instruction has been received. For instance, the election of directors is not a "routine" matter for purposes of broker voting. If a shareholder does not instruct the broker how to vote with respect to such item, the broker may not vote with respect to this proposal and those votes will be counted as "broker non-votes." We believe that the matters described in Proposals 4, 5 and 10 are not "routine" matters, and therefore, if a beneficial shareholder does not instruct the broker how to vote with respect to these items, the broker may not vote with respect to these proposals and those votes will be counted as "broker non-votes." It should be noted that it is the intention of the persons appointed as proxies in the accompanying proxy to vote “FOR” the other items on the agenda unless specifically instructed to the contrary, or unless they may be determined not to be “routine” matters, in which case, a broker may not vote on such matters without instructions from the shareholder. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but such abstentions and broker non-votes will not be counted for purposes of determining the number of votes cast with respect to the particular proposal.

4

If a quorum is not present within thirty minutes from the time appointed for the Meeting, the Meeting will be adjourned to the same day on the following week, at the same time and place, or to such day and at such time and place as the Chairman of the Meeting may determine. At such adjourned Meeting, any two shareholders, present in person or by proxy, will constitute a quorum.

The affirmative vote of at least a majority of the votes of shareholders present and voting at the Meeting in person or by proxy is required to constitute approval of each of Proposals 2, 3, 4, 6, 7, 9 and 10. No vote is required for Proposal 1.

The affirmative vote of at least a majority of the votes of shareholders present and voting at the Meeting in person or by proxy is required for approval of Proposal 5; provided, that (i) such majority vote at the Meeting shall include at least one third (1/3) of the total votes of shareholders who are not Controlling Shareholders of the Company, present at the Meeting in person or by proxy (votes abstaining shall not be taken into account in counting the above-referenced shareholders' votes); or (ii) the total number of shares of the shareholders mentioned in clause (i) above that are voted against such proposal does not exceed one percent (1%) of the total voting rights in the Company.

The approval of Proposal 8 requires the affirmative vote of at least a majority of the votes of shareholders present and voting at the Meeting in person or by proxy, provided that (i) such majority vote at the Meeting will include at least two-thirds (2/3) of the total votes of shareholders who are not Controlling Shareholders of the Company, or anyone on their behalf, present in person or by proxy (votes abstaining shall not be taken into account in counting the above-referenced shareholders' votes); or (ii) the total number of shares of the shareholders mentioned in clause (i) above that are voted against such proposal does not exceed one percent (1%) of the total voting rights in the Company.

Each shareholder that attends the Meeting in person or delivers a signed proxy card shall, prior to exercising such shareholder’s voting rights at the Meeting with respect to Proposals 5 and 8, advise the Company whether or not such shareholder is a Controlling Shareholders of the Company.

THE PROXY CARD ENCLOSED WITH THIS PROXY STATEMENT SHALL ALSO

SERVE AS A VOTING INSTRUMENT

AS SUCH TERM IS DEFINED UNDER THE ISRAELI COMPANIES LAW

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE

"FOR" ALL THE PROPOSALS LISTED IN THIS PROXY STATEMENT

5

PROPOSAL 1 - RECEIPT AND CONSIDERATION OF THE

DIRECTOR’S REPORT AND THE CONSOLIDATED FINANCIAL STATEMENTS

OF THE COMPANY FOR THE YEAR ENDED DECEMBER 31, 2009

The Company's Annual Report for the year ended December 31, 2009 is available on its website at the address www.clicksoftware.com. The contents of the Company’s website are not part of this proxy. The Company's Consolidated Financial Statements for the year ended December 31, 2009 are included in such report. At the Meeting, the Company will review the audited financial statements for the year ended December 31, 2009, as presented in the Company's Annual Report for the year ended December 31, 2009 and will answer appropriate questions relating thereto.

No vote will be required regarding this item.

PROPOSAL 2 - APPOINTMENT AND RENUMERATION

OF THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has recommended the appointment of Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu (“Brightman Almagor”), as the Company’s independent registered public accounting firm for the year ending December 31, 2010. Brightman Almagor has been the Company’s independent registered public accounting firm since December 31, 2002 and audited the Company's books and accounts for the year ended December 31, 2009.

It is proposed that the following resolution be adopted at the Meeting:

"RESOLVED, that the appointment of Brightman Almagor as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2010 and for such additional period until the next Annual General Meeting of Shareholders, and that the Board of Directors be, and it hereby is, authorized, upon recommendation of the Audit Committee, to fix the remuneration of such independent registered public accounting firm."

PROPOSAL 3 –AMENDMENT TO THE COMPANY’S ARTICLES OF ASSOCIATION

The Board of Directors of the Company deems it in the best interest of the Company to amend current Articles of Association amended and restated as of July 9, 2007 (the “AOA”) to clarify that, in a situation where there are no nominees to be appointed to specific class of directors at any annual meeting of shareholders, then instead of electing new directors to succeed the directors whose term of office expires at the annual meeting, the shareholders may elect one or more additional External Directors in addition to the minimum number of External Directors required by the Companies Law.

It is proposed that the following resolution be adopted at the Meeting:

“RESOLVED, that the AOA, is hereby amended by adding Article 50(d) to read as follows: “Notwithstanding Article 50(a) above, in the event that there are no nominees to be appointed to a specific class of directors at any annual meeting of shareholders in accordance with Article 50(a) above, then instead of electing directors to succeed the directors whose term of office expires at the annual meeting, the shareholders may elect one or more additional External Directors in addition to the minimum number of External Directors required by the Companies Law”.”

6

PROPOSAL 4 - AMENDMENTS TO THE COMPANY'S

SHARE INCENTIVE PLANS

The Compensation Committee, acting as the administrator of the Company’s equity compensation plans and the Board recommend to amend the 2003 Israeli Option Plan (the “2003 Israeli Option Plan”) and the USA Amended and Restated 2000 Share Option Plan (the “USA Option Plan” and jointly with the 2003 Israeli Option Plan, the “Incentive Plans”) such that Restricted Share Units with respect to Ordinary Shares of the Company (“RSU”) may be granted under the terms of the Incentive Plans, including under section 102 of the Israeli Tax Ordinance and subject to any applicable law. Other than the par value of the Ordinary Shares, no payment of cash shall be required as consideration for RSUs. In addition, it is proposed that the term of the USA Option Plan be extended to December 31, 2020. The form of the proposed amendments to the Incentive Plans are attached hereto as Appendix A (changes relative to the existing Incentive Plans are marked in the text).

The Board believes that the proposed amendments to the Incentive Plans are necessary and in the best interests of the Company and its shareholders in order for the Company to continue to attract and retain capable and experienced directors, officers and employees, as well as to provide incentives to other key service providers.

It is proposed that the following resolution be adopted at the Meeting:

"RESOLVED, to amend and restate the Incentive Plans substantially in the form as set out in the Proxy Statement for the Company’s 2010 annual general meeting of shareholders; and

FURTHER RESOLVED, to extend the terms of the USA Option Plan to May 27, 2020.”

PROPOSAL 5 - ELECTION OF AN ADDITIONAL EXTERNAL DIRECTOR

The Company's Articles of Association provide that the number of Directors shall be not less than 2 and not more than 11. There are currently seven members on the Company’s Board of Directors. The Company’s Board of Directors is classified into three classes of directors. James W. Thanos is the only Class I Director and the term of his office was due to expire at the Meeting. Mr. Thanos resigned from the Board of Directors effective June 30, 2010.

Since there are no nominees to be appointed to the Class I of directors, it is proposed that the shareholders elect an additional External Director (in addition to the two currently serving External Directors, which is the minimum number of External Directors required by the Companies Law) instead of a Class I director. It is proposed that Mr. Menachem Shalgi is elected as an additional External Director.

7

MENACHEM SHALGI served at Amdocs Ltd. as Vice President of Business Development and M&A from 1998 to 2003, and as Vice President and Executive Account Manager from 1993 to 1998, and at various other positions from 1985 to 1993.

Mr. Shalgi has served as an external director of Mind CTI since April 2005. In addition, Mr. Shalgi served as a director in Pilat Media PLC in the UK from 2006 until mid 2009, and has served as the chairman of AfterDox Ltd., an investment house in Israel, since June 2007.

Mr. Shalgi holds a B.A. in Economics and Statistics from Tel-Aviv University and an M.Sc. in Computer Sciences from Weizmann Institute of Science.

It is proposed that the shareholders approve a compensation package to Mr. Shalgi to be effective as of the Meeting which shall consist of: (i) an annual cash compensation of US $22,000, plus VAT, if applicable against a valid invoice, which shall be the full cash compensation due for all of his activities and tasks as a member of the Board of Directors and as member of committees thereof. Such annual fee will be paid in four quarterly equal installments payable in advance; (ii) reimbursement of expenses incurred by such director or External Director in connection with participation in meetings of the Board of Directors and committees thereof, subject to the limitations of Israeli law and in accordance with the Company’s expense reimbursement policy; (iii) subject to approval of Proposals 3 and 4 and the approval of the Israeli Tax Authority (the "ITA") of the Incentive Plans, an initial grant of 8,000 RSUs which shall vest on the first anniversary of the date of grant or the Company's 2011 annual general meeting of shareholders, whichever is earlier, in each case provided that the grantee continues to serve as a director on such date; (iv) subsequent annual grants of 8,000 RSUs which shall vest in twelve (12) equal monthly installments as of its date of grant, provided that the grantee continues to serve as a director on such date(the “New Compensation Package”).

Under the Companies Regulations 2000 (regulations regarding compensation and expenses reimbursement to External Directors), the compensation package of incumbent External Directors may be amended at the time the company appoints an additional External Director, provided that the New Compensation Package is improved in comparison to the Current Compensation Package (as defined hereunder) such incumbent External Directors are entitled to. Proposal 6 hereunder contains a proposal to the shareholders of the Company to approve the New Compensation Package to the incumbent directors and External Directors of the Company. In such case that the shareholders do not approve Proposal 6 hereunder, Mr. Shalgi will be granted the Current Compensation Package.

The current compensation package includes an annual cash compensation of US $ 18,000, plus VAT, if applicable, reimbursement of expenses incurred by such director or External Director in connection with participation in meetings of the Board of Directors and committees thereof, subject to the limitations of Israeli law and in accordance with the Company’s expense reimbursement policy, an initial grant of 30,000 options to purchase Ordinary Shares of the Company (the “Options”) and automatic subsequent annual grants of 7,500 Options (the “Current Compensation Package”).

8

It is proposed that the following resolutions be adopted at the Meeting:

“RESOLVED, that Mr. Menahem Shalgi be elected to the Board of Directors to serve as an External Director for a term of three (3) years in accordance with the Companies Law; and

FURTHER RESOLVED, to approve the New Compensation Package (subject to approval of Proposals 3 and 4 and the approval of the ITA) for Mr. Menahem Shalgi, effective as of the date of the Meeting, and in case Proposal 6 hereunder is not approved, to approve the Current Compensation Package to Mr. Shalgi.”

PROPOSAL 6 - APPROVAL OF THE REPLACEMENT OF THE COMPENSATION

PACKAGE OF INCUMBENT DIRECTORS INCLUDING EXTERNAL DIRECTORS

It is proposed that the shareholders approve replacement of the Current Compensation Package with the New Compensation Package to the incumbent directors of the Company, who are not employees or consultants of the Company, including the incumbent External Directors so that the compensation to all directors of the Company who are not employees or consultants of the Company, will be identical effective as of the Meeting.

In the event that the shareholders approve the grant of the New Compensation Package to the incumbent directors and External Directors, all unvested Options granted to such incumbent External Directors (30,000 Options of Mr. Shai Beilis and Ms. Nira Dror) and all unvested Options granted to the other non-executive directors (30,000 Options of Mr. Shlomo Nass and 7,500 Options of Mr. Roni A. Einav and Mr. Gil Weiser) at the previous annual general meetings will be cancelled.

It is proposed that the following resolution be adopted at the Meeting:

“RESOLVED, that the Current Compensation Package of incumbent directors and External Directors of the Company (namely, Mr. Shai Beilis, Ms. Nira Dror, Mr. Roni A. Einav, Mr. Gil Weiser and Mr. Shlomo Nass) will be replaced by the New Compensation Package (subject to approval of Proposals 3 and 4 and the approval of the ITA), with effect as of the Meeting; and

FURTHER RESOLVED, that all the unvested Options granted to the incumbent External Directors (namely, Mr. Shai Beilis and Ms. Nira Dror) and all unvested Options granted to the other non-executive directors (namely Mr. Roni A. Einav, Mr. Gil Weiser and Mr. Shlomo Nass) at the previous annual general meetings be cancelled effective as of the Meeting. The shareholders confirm that the resolutions are not detrimental to the Company’s interests.”

9

PROPOSAL 7 – PROPOSAL TO APPROVE THE GRANT OF OPTIONS

TO DR. MOSHE BENBASSAT

Under the Companies Law, the terms of compensation to Directors of the Company, including the grant of Options, whether in their capacity as Directors or otherwise, requires shareholder approval. It is proposed that the shareholders approve the recommendation of the Company’s Compensation Committee, Audit Committee and the Board of Directors to grant Options to Dr. Moshe BenBassat.

It is proposed that the following resolution be adopted at the Meeting:

“RESOLVED, to approve the grant of Options to Dr. Moshe BenBassat (or a consulting company through which he provides services the Company) to purchase 100,000 Ordinary Shares according to the USA Option Plan, at an exercise price equal to the closing sale price of the Company’s Ordinary Shares on the trading day immediately preceding the Meeting. The Options will vest as follows: 25% on the first anniversary date of the Options grant and 1/48 at the end of each month thereafter. The Options will expire seven years from the date of grant. The shareholders confirm that this resolution is not detrimental to the Company’s interests.”

PROPOSAL 8 — RATIFICATION AND APPROVAL OF THE APPOINTMENT OF

DR. MOSHE BENBASSAT AS BOTH CHAIRMAN OF THE BOARD OF DIRECTORS

AND CHIEF EXECUTIVE OFFICER

Under the Companies Law, the chief executive officer in a publicly traded company may not serve as chairman of the board of directors, and the powers of the chief executive officer may not be vested in the chairman of the board of directors, unless the shareholders of the company resolve in a general meeting, with respect to a period of not more than three years following such resolution, that the chairman of the board is authorized to hold the position of chief executive officer or exercise its powers.

It is proposed that at the Meeting the following resolution be adopted:

“RESOLVED, that Dr. Moshe BenBassat is authorized to serve in the position of the Chairman of the Board of Directors and Chief Executive Officer of the Company for a period of three years from the Meeting.”

PROPOSAL 9 – APPROVAL OF MANAGEMENT AND CONSULTING

AGREEMENTS THROUGH WHICH DR. MOSHE BENBASSAT WILL PROVIDE

SERVICES TO THE COMPANY AND ITS SUBSIDIARIES

The Company’s most recent annual general meeting of shareholders held on July 23, 2009 the Company’s shareholders authorized and empowered the Company’s Audit Committee and Board of Directors to structure the mechanisms and vehicles of paying Dr. BenBassat's compensation as its CEO (including the possibility of a services provider directly or through a company owned by him, as opposed to an employee arrangement) and to approve any required agreement(s) relating thereto. The following summarizes the proposed new structure:

10

Structure: Dr. BenBassat ("Dr. BenBassat" or the "Consultant") will provide management and consulting services (as more fully described below) as a consultant and not an employee.

There will be two agreements: one agreement will be between the Company and an Israeli company substantially all of whose shares are owned by the Consultant, his wife and family members, for services provided to the Company (The “Israeli Agreement”) and a second agreement between ClickSoftware Europe Limited, the Company's UK subsidiary and a Cypriot company owned by Dr. BenBassat and his wife, for services provided to non-Israeli subsidiaries of the Company (the “EU Agreement” and jointly with the Israeli Agreement, the “Agreements”). The percentage of time devoted to provide services to each entity will be determined on an as-needed basis.

Scope and Services: The Consultant through the relevant company (each, a "Consulting Company") will provide management and consulting services to Company and affiliates and will act as the Chairman and CEO of the Company. These services will be provided exclusively by the Consultant on behalf of the Consulting Company. The Consultant shall devote sufficient time, as needed, to provide consulting services to the business and affairs of the Company and its subsidiaries.

Non-Employee Status: No employer-employee relationship will exist between the Company and its affiliates and the relevant Consulting Company or Consultant and the Consulting Company and the Consultant have undertaken to indemnify the Company and its subsidiaries for any payment and expense actually paid or required to be paid by the Company in connection with any decision to the contrary to the fullest extent permitted by law, up to the amounts actually received by the Consultant Company pursuant to this Agreement, plus reasonable legal expenses relating to any claim.

Term and Termination: The Agreements will be effective as of January 1, 2010 until terminated by a party thereof. Each Agreement may be terminated by a party thereto at any time by providing 90 days’ prior written notice to the other party. In case of Cause (as defined in the Agreements), the Agreements may be terminated without prior notice.

Compensation: The aggregate monthly consulting fee payable under both Agreements is US $ 37,500, plus VAT, if applicable (the "Monthly Fee"). The Monthly Fee is all inclusive (e.g. it includes the cost of all medical insurance, severance pay, company car and all other fringe benefits customarily paid under employment agreements with senior executives) and represents the total cost to the Company and its affiliates and no other compensation is payable to the Consulting Companies and the Consultant except for the performance bonus and reimbursement of expenses mentioned below. For reference, the monthly base salary (excluding benefits) of Dr. BenBassat when he was employed under the employment agreement dated January 1, 2004, as amended (the “Employment Agreement”) was $25,000, and thus the gross up for the “all inclusive” arrangement is 50%.

Performance Bonus: In addition to the Monthly Fee, the Consulting Company may earn an annual performance bonus which will not exceed 133% of the aggregate Monthly Fee paid during the relevant calendar year (the “Bonus”). The amount of the Bonus and the determination of the target milestones upon which the Bonus will be based will both be set by the Company's Compensation Committee after consultation with the Consulting Company. The Bonus may be reviewed annually by the Company's Compensation Committee for possible changes in light of Consulting Company’s performance, subject to required corporate approvals.

11

Reimbursement of Expenses: The Company will reimburse the Consulting Company for (i) reasonable travel, entertainment or other expenses, (ii) professional literature, magazines, conferences and events, and (iii) communication expenses (including internet and landline for the Consultant's office and mobile phone) incurred by the Consultant in the furtherance of or in connection with the provision of the Consulting Services, provided they have been incurred in accordance with the Company's expense reimbursement policy as in effect from time to time, and subject to invoices submitted by the Consulting Company to the Company.

Vacation: The Consultant is entitled to up to 26 vacation days per year. The amount of unutilized vacation days can be accumulated for a period of three (3) years.

Change of Control Benefits: In the event of a “Change of Control” (as defined in the Agreement with the Company) of the Company that occurs prior to the termination of the Agreements, all Options to purchase the Company’s Ordinary Shares held by the Consultant and/or the Consultant Companies will have their vesting accelerated so as to become 100% vested. Thereafter, the Options will continue to be subject to the terms, definitions and provisions of the Company’s share option plan pursuant to which the Options were granted, and the option agreements pursuant to which the Options were granted.

Continuing payments in case of termination and severance: If a Consulting Company’s engagement with the Company terminates other than for "Cause" (as defined in the Agreements), and the applicable Consulting Company complies with its confidentiality, non-compete and non solicitation undertakings under the applicable Agreement, then the Consulting Company shall be entitled to receive continuing payments of its portion of the Monthly Fee (less applicable withholding taxes, if any), as then in effect, for a period of twelve (12) months from the date of such termination. The equivalent provision of the Employment Agreement regarding 12 months severance payment has been incorporated into the Agreements.

Confidentiality and Non-compete: The Agreements contain provisions regarding confidentiality of Company information, ownership of inventions, as well as a twelve-month non-compete and non-solicitation undertaking of the Consultant.

Governing Law: The agreement with the UK company will be governed by English law and the agreement with the Company will be governed by Israeli law.

Taxes: The Consulting Company and the Consultant will be solely responsible for paying all taxes and other compulsory payments with respect to the fees payable in accordance with the agreement and the Company and its subsidiaries will withhold all taxes if and to the extent required (on the basis of legal and tax advice from its advisors).

It is proposed that the following resolution be adopted at the Meeting:

"RESOLVED, that the Management and Consulting Agreements through which Dr. BenBassat will provide services to the Company and in subsidiaries, substantially in the form presented to the shareholders of the Company and attached hereto as Appendix B are hereby approved; and

FURTHER RESOLVED that the Board of Directors of the Company is authorized, upon the recommendation of the Company's Compensation Committee, to change the monthly fee payable to the consulting companies through which Dr. BenBassat provides services to the Company by an amount not exceeding ten percent (10%) in any calendar year. The shareholders confirm that the above resolutions are not detrimental to the Company’s interests.”

12

PROPOSAL 10 – TO CONVERT THE COMPANY’S NON-VOTING

ORDINARY SHARES INTO ORDINARY SHARES

The Company currently has 3,000,000 authorized Non-Voting Ordinary Shares of NIS 0.02 nominal value each ("Non-Voting Ordinary Shares"). In the past, the Company had issued Non-Voting Ordinary Shares under certain of its employee share Incentive Plans. All such shares have been converted into Ordinary Shares. Consequently, as of today, all of the issued and outstanding shares of the Company are Ordinary Shares of a single class.

It is proposed that the following resolution be adopted at the Meeting:

“RESOLVED, that all Non-Voting Ordinary Shares in the registered but unissued share capital of the Company are hereby converted into Ordinary Shares on a one-for-one basis and the Company's AOA shall be amended accordingly such that the number of registered Ordinary Shares in the share capital of the Company shall be 100,000,000 Ordinary Shares”.

OTHER BUSINESS

Management knows of no other business to be transacted at the Meeting. However, if any other matters are properly presented to the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

| By order of the Board of Directors, | |

| Dr. Moshe BenBassat | |

| Chairman of the Board of Directors and | |

| Chief Executive Officer | |

| Petach Tikva, Israel | |

| June 2, 2010 |

13

CLICKSOFTWARE TECHNOLOGIES LTD.

THE 2003 ISRAELI SHARE OPTION

INCENTIVE PLAN

(*In compliance with Amendment No. 132 of the Israeli Tax Ordinance, 2002)

[Amended and Restated as of July 15, 2010]

1

1. PURPOSE OF THE ISOPISIP | 3 |

| 2. DEFINITIONS | 3 |

3. ADMINISTRATION OF THE ISOPISIP | 6 |

| 4. DESIGNATION OF PARTICIPANTS | 8 |

| 5. DESIGNATION OF OPTIONS PURSUANT TO SECTION 102 | 8 |

| 6. TRUSTEE | 9 |

7. SHARES AVAILABLE FOR ISSUANCE UNDER THE ISOPISIP | 10 |

| 8. EXERCISE PRICE | 11 |

| 9. ADJUSTMENTS | 11 |

| 10. TERM AND EXERCISE OF OPTIONS | 13 |

| 11. VESTING OF OPTIONS | 14 |

| 12. PURCHASE FOR INVESTMENT | 14 |

| 13. DIVIDENDS | 15 |

14. RESTRICTED SHARE UNITS | 15 |

15. RESTRICTIONS ON ASSIGNABILITY AND SALE OF OPTIONS | 15 |

1516. EFFECTIVE DATE AND DURATION OF THE ISOPISIP | 16 |

1617. AMENDMENTS OR TERMINATION | 16 |

1718. GOVERNMENT REGULATIONS | 16 |

1819. CONTINUANCE OF EMPLOYMENT | 16 |

1920. GOVERNING LAW & JURISDICTION | 16 |

2021. TAX CONSEQUENCES | 17 |

2122. NON-EXCLUSIVITY OF THE ISOPISIP | 17 |

2223. MULTIPLE AGREEMENTS | 17 |

2

| 1. | PURPOSE OF THE ISOPISIP |

The ISOPISIP is intended to provide an incentive to retain in the employ of the Company and its Affiliates (as defined below) persons of training, experience, and ability; to attract new employees, directors, consultants, service providers and any other entity which the Board shall decide their services are considered valuable to the Company; to encourage the sense of proprietorship of such persons; and to stimulate the active interest of such persons in the development and financial success of the Company by providing them with opportunities to purchase shares in the Company, pursuant to the ISOPISIP.

| 2. | DEFINITIONS |

For purposes of the ISOPISIP and related documents, including the Option Agreement, the following definitions shall apply:

| 2.1 | “Affiliate” means any “employing company” within the meaning of Section 102(a) of the Ordinance. |

| 2.2 | “Approved 102 Option” means an Option granted pursuant to Section 102(b) of the Ordinance and held in trust by a Trustee for the benefit of the Optionee. |

| 2.3 | “Board” means the Board of Directors of the Company. |

| 2.4 | “Capital Gain Option (CGO)” as defined in Section 5.4 below. |

| 2.5 | “Cause” means (i) conviction of any felony involving moral turpitude or adversely affecting the Company or its Affiliates; (ii) embezzlement of funds of the Company or its Affiliates; (iii) any breach of the Optionee’s fiduciary duties or duties of care of the Company or its Affiliates; including without limitation disclosure of confidential information of the Company or its Affiliates; and (iv) any conduct (other than conduct in good faith) reasonably determined by the Board to be materially detrimental to the Company or its Affiliates. |

| 2.6 | “Chairman” means the chairman of the Committee. |

| 2.7 | “Code” means the United States Internal Revenue Code of 1986, as now in effect or as hereafter amended. |

| 2.8 | “Committee” means a share option compensation committee of the Board, designated from time to time by the resolution of the Board. |

| 2.9 | “Company” means ClickSoftware Technologies Ltd., an Israeli company. |

| 2.10 | “Companies Law” means the Israeli Companies Law 5759-1999. |

| 2.11 | “Controlling Shareholder” shall have the meaning ascribed to it in Section 32(9) of the Ordinance. |

| 2.12 | “Date of Grant” means the date of grant of an Option, as determined by the Board or authorized Committee and set forth in the Optionee’s Option Agreement. |

| 2.13 | Employee” means a person who is employed by the Company or its Affiliates, including an individual who serves as a director or an office holder of the Company or its Affiliates, but excluding a Controlling Shareholder. |

| 2.14 | “Exercise Price” means the price for each Share subject to an Option. |

| 2.15 | “Expiration Date” means the date upon which an Option shall expire, as set forth in Section 10.2 of the ISOPISIP. |

| 2.16 | “Fair Market Value” means as of any date, the value of a Share determined as follows: |

(i) If the Shares are listed on any established stock exchange or a national market system, including without limitation the NASDAQ National Market system, or the NASDAQ SmallCap Market of the NASDAQ Stock Market, the Fair Market Value shall be the closing sales price for such Shares (or the closing bid, if no sales were reported), as quoted on such exchange or system for the last market trading day prior to time of determination, as reported in the Wall Street Journal, or such other source as the Board deems reliable.

Without derogating from the above, solely for the purpose of determining the tax liability pursuant to Section 102(b)(3) of the Ordinance, if at the Date of Grant the Company’s shares are listed on any established stock exchange or a national market system or if the Company’s shares will be registered for trading within ninety (90) days following the Date of Grant, the Fair Market Value of a Share at the Date of Grant shall be determined in accordance with the average value of the Company’s shares on the thirty (30) trading days preceding the Date of Grant or on the thirty (30) trading days following the date of registration for trading, as the case may be; (ii) If the Shares are regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value shall be the mean between the high bid and low asked prices for the Shares on the last market trading day prior to the day of determination, or

(iii) In the absence of an established market for the Shares, the Fair Market Value thereof shall be determined in good faith by the Board.

| 2.17 | "Grantee" means a recipient of an RSU. |

| 2.18 | “ISOPISIP” means this 2003 Israeli Share Option Incentive Plan. |

2.1819 | “ITA” means the Israeli Tax Authorities. |

2.1920 | “Non-Employee ” means a consultant, adviser, service provider, Controlling Shareholder or any other person who is not an Employee. |

4

2.2021 | “Ordinary Income Option (OIO)” as defined in Section 5.5 below. |

2.2122 | “Option” means an option to purchase one or more Shares of the Company pursuant to the ISOPISIP. |

2.2223 | “102 Option” means any Option granted to Employees pursuant to Section 102 of the Ordinance. |

2.2324 | “3(i) Option” means an Option granted pursuant to Section 3(i) of the Ordinance to any person who is a Non- Employee. |

2.2425 | “Optionee” means a person who receives or holds an Option under the ISOPISIP. |

2.2526 | “Option Agreement” means the share option agreement between the Company and an Optionee that sets out the terms and conditions of an Option. The Option Agreement is subject to the terms and conditions of this ISOPISIP. |

2.2627 | “Ordinance” means the 1961 Israeli Income Tax Ordinance [New Version] 1961 as now in effect or as hereafter amended. |

2.2728 | “Option Exchange Program” means a program whereby outstanding Options are surrendered or cancelled in exchange for Options of the same type (which may have a lower exercise price or purchase price), of a different type and/or cash. |

2.2829 "RSU" shall have the meaning defined in Section 14 below.

2.30 Section 102” means section 102 of the Ordinance as now in effect or as hereafter amended.

2.2931 | “Shares” means the ordinary shares, NIS 0.02 par value each, of the Company. |

2.3032 | “Successor Company” means any entity the Company is merged into and the Company is not the surviving entity or by which the Company is acquired by, in which the Company is not the surviving entity. |

2.3133 | “Transaction” means (i) merger, acquisition or reorganization of the Company by or with one or more other entities, in which the Company is not the surviving entity, or (ii) a sale of all or substantially all of the shares (including by way of reverse triangular merger or exchange of shares) or assets of the Company, or (iii) such other transaction that is determined by the Committee to be a transaction having a similar effect. |

2.3234 | “Trustee” means any individual appointed by the Company to serve as a trustee and approved by the ITA, all in accordance with the provisions of Section 102(a) of the Ordinance. |

2.3335 | “Unapproved 102 Option” means an Option granted pursuant to Section 102(c) of the Ordinance and not held in trust by a Trustee. |

5

2.3436 | “Vested Option” means any Option, which has already been vested according to the Vesting Dates. |

2.3537 | “Vesting Dates” means, as determined by the Board or by the Committee, the date as of which the Optionee shall be entitled to exercise the Options or part of the Options, as set forth in section 11 of the ISOPISIP. |

| 3. | ADMINISTRATION OF THE ISOPISIP |

| 3.1 | The Board shall have the power to administer the ISOPISIP either directly or upon the recommendation of the Committee, all as provided by applicable law and in the Company’s Articles of Association. Notwithstanding the above, the Board shall automatically have residual authority: (i) if no Committee shall be constituted; (ii) if such Committee shall cease to operate for any reason; or (iii) with respect to the rights not delegated by the Board to the Committee. |

| 3.2 | The Committee shall select one of its members as its Chairman and shall hold its meetings at such times and places as the Chairman shall determine. The Committee shall keep records of its meetings and shall make such rules and regulations for the conduct of its business as it shall deem advisable. |

| 3.3 | The Committee shall have the power to recommend to the Board and the Board shall have the full power and authority to: (i) designate participants; (ii) determine the terms and provisions of the respective Option Agreements, including, but not limited to, the number of Options to be granted to each Optionee, the number of Shares to be covered by each Option, provisions concerning the time and the extent to which the Options may be exercised and the nature and duration of restrictions as to the transferability or restrictions constituting substantial risk of forfeiture and to cancel or suspend awards, as necessary; (iii) determine the Fair Market Value of the Shares covered by each Option; (iv) determine the Exercise Price of the Option; (v) make an election as to the type of Approved 102 Option; (vi) designate the type of Options; (vii) to reduce the exercise price of any Option to the then current Fair Market Value if the Fair Market Value of the Shares covered by such Option shall have declined since the date the Option was granted; and (viii) to institute an Option Exchange Program. |

The Committee shall have full power and authority to: (i) alter any restrictions and conditions of any Options or Shares subject to any Options (ii) interpret the provisions and supervise the administration of the ISOPISIP; (iii) accelerate the right of an Optionee to exercise in whole or in part, any previously granted Option; (iv) prescribe, amend and rescind rules and regulations relating to the ISOPISIP; and (v) make all other determinations deemed necessary or advisable for the administration of the ISOPISIP.

| 3.4 | Unless otherwise permitted by law, the Committee shall not be entitled to grant Options to the Optionees. However, the Committee will be authorized to issue Shares underlying Options which have been granted by the Board and duly exercised pursuant to the provisions herein in accordance with section 112(a)(5) of the Companies Law. |

6

| 3.6 | Formula Option RSU Grants to Outside Directors. Outside Directors (as defined below) shall be automatically granted Options RSU's each year in accordance with the following provisions, and only to the extent an Director elects to receive an automatic grant of Options RSU's under this plan, and not under section 13 of the Company’s Amended and Restated 2000 Share Option Plan. |

| (a) | All Options RSU's granted pursuant to this Section shall, to the fullest extent applicable, be granted in accordance with 102 Options of the Ordinance and, except as otherwise provided herein, shall be subject to the other terms and conditions of the ISOPISIP. |

| (b) | Each Outside Director including Outside Directors who are designated as "External Directors" in accordance with the Companies Law, who is appointed as a director of the Company, afterat or after the Company's 2010 annual general meetingJanuary 1, 2003, and except for Outside Directors who are designated as external directors in accordance with the Companies Law, is automatically granted an option to purchase thirty eight thousand (308,000) shares RSU's (the "First OptionGrant"), upon the date such individual first becomes a director, whether through election by the shareholders of the Company or by appointment by the Board in order to fill a vacancy (the “Anniversary Date”); provided, however, that an inside director who ceases to be an inside director but who remains a director shall not receive a First Option. |

Each Outside Director, including Outside Directors who are designated as eExternal dDirectors in accordance with the Companies Law, is automatically granted an option to purchase seven eight thousand five hundred (7,5008,000) sharesRSU's (the "Subsequent OptionGrant") following each annual meeting of the shareholders of the Company, beginning with the 2010annual general meeting with respect to 2002 and 2003, if on such date he or she shall have served on the Board for at least the preceding six (6) months.

(c) The terms of each First Optioneach RSU granted pursuant to this Section shall be as follows:

| (i) | the term of the First Option RSU shall be ten seven (107) years.; |

| (ii) | the exercise price per Share RSU shall be 100% of the Fair Market Value per Share on the date of grant of the First Optionequal to the nominal value of each Share underlying the RSU.; |

| (iii) | the FirstOption Grant shall vest on the first anniversary of the date of grant, provided that the Grantee continues to serve as a director on such date; and |

| (iv) | each Subsequent Grant shall vest as to 25% of the Shares subject to the First Option on each anniversaryin twelve (12) equal monthly installments as of its date of grant , provided that the Optionee Grantee continues to serve as a director on such date. |

7

| (d) | The terms of each Subsequent Option granted pursuant to this Section shall be as follows: |

| (i) | the term of the Subsequent Option shall be ten (10) years. |

| (ii) | the exercise price per Share shall be 100% of the Fair Market Value per Share on the date of grant of the Subsequent Option. |

| (iii) | the Subsequent Option shall vest as to 100% of the Shares subject to the Subsequent Option on the anniversary of its date of grant provided that the Optionee continues to serve as a director on such date. |

For the purpose of this Section 3.6 an “Outside Director” shall mean the Company’s external directors and all other directors other than employees or consultants of the cCompany or any subsidiary.

| 4. | DESIGNATION OF PARTICIPANTS |

| 4.1 | The persons eligible for participation in the ISOPISIP as Optionees shall include any Employees and Non-Employees of the Company or of any Affiliate; provided, however, that (i) Employees may only be granted 102 Options; (ii) Non-Employees may only be granted 3(i) Options; and (iii) Controlling Shareholders may only be granted 3(i) Options. |

| 4.2 | The grant of an Option hereunder shall neither entitle the Optionee to participate nor disqualify the Optionee from participating in, any other grant of Options pursuant to the ISOPISIP or any other option or share plan of the Company or any of its Affiliates. |

| 4.3 | Anything in the ISOPISIP to the contrary notwithstanding, all grants of Options to directors and office holders shall be authorized and implemented in accordance with the provisions of the Companies Law or any successor act or regulation, as in effect from time to time. |

| 5. | DESIGNATION OF OPTIONS PURSUANT TO SECTION 102 |

| 5.1 | The Company may designate Options granted to Employees pursuant to Section 102 as Unapproved 102 Options or Approved 102 Options. |

| 5.2 | The grant of Approved 102 Options shall be conditioned upon the approval of this ISOPISIP by the ITA as required by Section 102. |

| 5.3 | Approved 102 Options may either be classified as Capital Gain Options (“CGOs”) or Ordinary Income Options (“OIOs”). |

| 5.4 | Approved 102 Options elected and designated by the Company to qualify under the capital gain tax treatment in accordance with the provisions of Section 102(b)(2) shall be referred to herein as CGOs. |

| 5.5 | Approved 102 Options elected and designated by the Company to qualify under the ordinary income tax treatment in accordance with the provisions of Section 102(b)(1) shall be referred to herein as OIOs. |

8

| 5.6 | The Company’s election to designate Approved 102 Options as CGOs or OIOs (the “Election”), shall be appropriately filed with the ITA before the Date of Grant of an Approved 102 Option. Such Election shall become effective beginning the first Date of Grant of an Approved 102 Option under this ISOPISIP and shall remain in effect until the end of the year following the year during which the Company first granted Approved 102 Options. The Election shall obligate the Company to grant only the type of Approved 102 Option it has elected, and shall apply to all Optionees who were granted Approved 102 Options during the period indicated herein, all in accordance with the provisions of Section 102(g) of the Ordinance. For the avoidance of doubt, such Election shall not prevent the Company from granting Unapproved 102 Options simultaneously. |

| 5.7 | All Approved 102 Options must be held in trust by a Trustee, as described in Section 6 below. |

| 5.8 | The designation of Unapproved 102 Options and Approved 102 Options shall be subject to the terms and conditions set forth in Section 102 of the Ordinance and the regulations promulgated thereunder. |

| 5.9 | With regards to Approved 102 Options, the provisions of the ISOPISIP and the Option Agreement shall be subject to the provisions of Section 102 and the Tax Assessing Officer’s permit, and the said provisions and permit shall be deemed an integral part of the ISOPISIP and of the Option Agreement. Any provision of Section 102 or the said permit which is necessary in order to receive or to keep any tax benefit pursuant to Section 102, which is not expressly specified in the ISOPISIP or the Option Agreement, shall be considered binding upon the Company and the Optionees. |

| 6. | TRUSTEE |

| 6.1 | Approved 102 Options which shall be granted under the ISOPISIP, Shares allocated or issued upon exercise of such Approved 102 Options, and any rights distributed with respect to Approved 102 Options or such Shares, including without limitation bonus shares, shall be allocated or issued to the Trustee and held for the benefit of the Optionees for such period of time as required by Section 102 or any regulations, rules or orders or procedures promulgated thereunder (the “Holding Period”). In the case the requirements for Approved 102 Options are not met, then the Approved 102 Options may be treated as Unapproved 102 Options, all in accordance with the provisions of Section 102 and regulations promulgated thereunder. |

| 6.2 | Notwithstanding anything to the contrary, the Trustee shall not release any Shares allocated or issued upon exercise of Approved 102 Options prior to the full payment of the Optionee’s tax liabilities arising from Approved 102 Options which were granted to him and any Shares allocated or issued upon exercise of such Options. |

9

| 6.3 | With respect to any Approved 102 Option, subject to the provisions of Section 102 and any rules or regulation or orders or procedures promulgated thereunder, an Optionee shall not be entitled to sell or release from trust any Share received upon the exercise of an Approved 102 Option or any share received subsequently following any realization of any rights distributed, including without limitation, bonus shares, until the lapse of the Holding Period required under Section 102 of the Ordinance. Notwithstanding the above, if any such sale or release occurs during the Holding Period, the sanctions under Section 102 of the Ordinance and under any rules or regulation or orders or procedures promulgated thereunder shall apply to and shall be borne by such Optionee. |

| 6.4 | Upon receipt of Approved 102 Option, the Optionee will sign an undertaking to release the Trustee from any liability in respect of any action or decision duly taken and bona fide executed in relation with the ISOPISIP, or any Approved 102 Option or Share granted to him thereunder. |

| 7. | SHARES AVAILABLE FOR ISSUANCE UNDER THEISOPISIP; RESTRICTION THEREON |

| 7.1 | The maximum aggregate number of Shares that may be subject to option and sold under the ISOPISIP and the Company’s Amended and Restated 2000 Share Option Plan (the “2000 Plan” and, together, the “Equity Plans”), is 3,000,000 Shares (the “Common Reserve”), subject to (a) adjustment as set forth in Section 9 below and (b) increase pursuant to Section 3 of the 2000 Plan. To the extent options or other awards covering Shares have been or are issued under any Equity Plan, the Common Reserve shall be appropriately reduced by the number of Shares subject to such awards. The Shares may be authorized but unissued, or reacquired. The number of Shares that are subject to Options or other rights outstanding at any time under the ISOPISIP shall not exceed the number of Shares that then remain available for issuance under the Equity Plans. The Company, during the term of the ISOPISIP, shall at all times reserve and keep available sufficient Shares to satisfy the requirements of the ISOPISIP. |

| 7.2 | In the event that any outstanding Option or other right for any reason expires or is canceled or otherwise terminated, the Shares allocable to the unexercised portion of such Option or other right shall again be available for the purposes of the Equity Plans (unless any such Equity Plan has terminated) and shall be added back to the Common Reserve. In the event that Shares issued under the ISOPISIP are reacquired by the Company pursuant to any forfeiture provision, right of repurchase or right of first refusal, such Shares shall again be available for the purposes of the Equity Plans and shall be returned to the Common Reserve, except that the aggregate number of Shares which may be issued upon the exercise of Options shall in no event exceed 3,000,000 (subject to adjustment pursuant to Section 9 below and Section 3 of the 2000 Plan). |

| 7.3 | Each Option granted pursuant to the ISOPISIP shall be evidenced by a written Option Agreement between the Company and the Optionee, in such form as the Board or the Committee shall from time to time approve. Each Option Agreement shall state, among other matters, the number of Shares to which the Option relates, the type of Option granted thereunder (whether a CGO, OIO, Unapproved 102 Option or a 3(i) Option), the Vesting Dates, the Exercise Price per Share, the Expiration Date and such other terms and conditions as the Committee or the Board in its discretion may prescribe, provided that they are consistent with this ISOPISIP. |

10

| 8. | EXERCISE PRICE |

| 8.1 | The Exercise Price of each Share subject to an Option shall be determined by the Board in its sole and absolute discretion in accordance with applicable law, subject to any guidelines as may be determined by the Committee from time to time. Each Option Agreement will contain the Exercise Price determined for each Optionee. |

| 8.2 | The Exercise Price shall be payable upon the exercise of an Option in the following acceptable forms of payment: |

| (i) | cash, check or wire transfer; |

| (ii) | or at the discretion of the Board, through delivery of Shares (including other Shares subject to the Options being exercised) having a Fair Market Value equal as of the date of exercise to the Exercise Price of the Shares purchased and acquired upon exercise of the Option, or through a different form of cashless exercise program through a third party broker as approved by the Board; |

| (iii) | at the discretion of the Board, any combination of the methods of payment permitted by any paragraph of this Section 8.2. |

| 8.3 | The Exercise Price shall be denominated in the currency of the primary economic environment of either the Company or the Optionee (that is, the functional currency of the Company or the currency in which the Optionee is paid) as determined by the Company. |

| 9. | ADJUSTMENTS |

Upon the occurrence of any of the following described events, Optionee's rights to purchase Shares under the ISOPISIP shall be adjusted as hereafter provided:

| 9.1 | In the event of a Transaction, the unexercised Options then outstanding under the ISOPISIP shall be assumed or substituted for options to purchase an appropriate number of shares of each class of shares or other securities of the Successor Company (or a parent or subsidiary of the Successor Company) as were distributed to the shareholders of the Company in connection and with respect to the Transaction. In the case of such assumption or substitution of Options, appropriate adjustments shall be made to the Exercise Price and the number of Options, so as to reflect such action and the vesting schedule and Expiration Date set forth in the Option Agreements shall remain unchanged unless otherwise determined by the Committee or the Board, in their sole discretion. |

| 9.2 | In the event that the Successor Company (or parent or subsidiary of the Successor Company) refuses to assume or substitute for the Options, the holders of unexercised Options shall fully vest in and have the right to exercise the Options as to all of the optioned Shares, including Shares as to which it would not otherwise be vested or exercisable. If an Option becomes fully vested and exercisable in lieu of assumption or substitution in the event of a Transaction, the Company shall notify the Optionee in writing or electronically that the Option shall be fully exercisable for a period of fifteen (15) days from the date of such notice, and the Option shall terminate upon the expiration of such period. |

11

| With respect to Options granted to an Outside Director pursuant to Section 3.6 that are assumed or substituted for, if following such assumption or substitution the Optionee's status as a director of the Company or a director of the Successor Company, as applicable, is terminated other than upon a voluntary resignation by the Optionee, then the Optionee shall fully vest in and have the right to exercise the Option as to all of the optioned Shares, including Shares as to which it would not otherwise be vested or exercisable. |

| 9.3 | For the purposes of section 9.1 above, an Option shall be considered assumed or substituted if, following the Transaction, the Option confers the right to purchase or receive, for each Share underlying an Option immediately prior to the Transaction, the consideration (whether shares, options, cash, or other securities or property) received in the Transaction by holders of shares held on the effective date of the Transaction (and if such holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority of the outstanding shares); provided, however, that if such consideration received in the Transaction is not solely ordinary shares (or their equivalent) of the Successor Company or its parent or subsidiary, the Committee may, with the consent of the Successor Company, provide for the consideration to be received upon the exercise of the Option to be solely ordinary shares (or their equivalent) of the Successor Company or its parent or subsidiary equal in Fair Market Value to the per Share consideration received by holders of a majority of the outstanding shares in the Transaction; and provided further that the Committee may determine, in its discretion, that in lieu of such assumption or substitution of Options for options of the Successor Company or its parent or subsidiary, such Options will be substituted for any other type of asset or property including cash which is fair under the circumstances. |

| 9.4 | In the event of the proposed dissolution or liquidation of the Company, the Company shall notify each holder of unexercised Options as soon as practicable prior to the effective date of such proposed transaction. The Company in its discretion may provide for a holder of unexercised Options to have the right to exercise his or her Option until fifteen (15) days prior to such transaction as to all of the optioned Shares, including Shares as to which the Option would not otherwise be exercisable. To the extent it has not been previously exercised, an Option will terminate immediately prior to the consummation of such proposed action. |

| 9.5 | If the outstanding shares of the Company shall at any time be changed or exchanged by declaration of a share dividend (bonus shares), share split, combination or exchange of shares, recapitalization, or any other like event by or of the Company, and as often as the same shall occur, then the number, class and kind of the Shares subject to the ISOPISIP or subject to any Options therefore granted, and the Exercise Price, shall be appropriately and equitably adjusted so as to maintain the proportionate number of Shares without changing the aggregate Exercise Price, provided, however, that no adjustment shall be made by reason of the distribution of subscription rights (rights offering) on outstanding shares. Upon happening of any of the foregoing, the class and aggregate number of Shares issuable pursuant to the ISOPISIP (as set forth in Section 7 hereof), in respect of which Options have not yet been exercised, shall be appropriately adjusted, all as will be determined by the Board whose determination shall be final. |

12

| 10. | TERM AND EXERCISE OF OPTIONS |

| 10.1 | Options shall be exercised by the Optionee by giving written notice to the Company and to any third party designated by the Company (the “Representative”), in such form and method as may be determined by the Company and when applicable, by the Trustee in accordance with the requirements of Section 102, which exercise shall be effective upon receipt of such notice by the Company and/or the Representative and the payment of the Exercise Price at the Company’s or the Representative’s principal office. The notice shall specify the number of Shares with respect to which the Option is being exercised. |

| 10.2 | Options, to the extent not previously exercised, shall terminate forthwith upon the earlier of: (i) the date set forth in the Option Agreement; and (ii) the expiration of any extended period in any of the events set forth in section 10.4 below. |

| 10.3 | The Options may be exercised by the Optionee in whole at any time or in part from time to time, to the extent that the Options become vested and exercisable, prior to the Expiration Date, and provided that, subject to the provisions of section 10.4 below, the Optionee is employed by or providing services to the Company or any of its Affiliates, at all times during the period beginning with the granting of the Option and ending upon the date of exercise. |

| 10.4 | Unless otherwise determined in the Optionee’s Option Agreement, all Options shall terminate upon termination of employment or service by an Optionee with the Company or its Affiliates. Notwithstanding the foregoing, an Option may be exercised after the date of termination of Optionee's employment or service with the Company or any Affiliates for an additional period of time beyond the date of such termination, but only with respect to the number of Vested Options at the time of such termination, if: |

| (i) | termination is without Cause, in which event any Vested Option still in force and unexpired may be exercised within a period of ninety (90) days after the date of such termination; or- |

| (ii) | termination is the result of death or disability of the Optionee, in which event any Vested Option still in force and unexpired may be exercised within a period of twelve (12) months after the date of such termination; or - |

| (iii) | prior to the date of such termination, the Committee shall authorize an extension of the terms of all or part of the Vested Options beyond the date of such termination for a period not to exceed the period during which the Options by their terms would otherwise have been exercisable. |

For avoidance of any doubt, if termination of employment or service is for Cause, any outstanding unexercised Option (whether vested or non-vested), will immediately expire and terminate, and the Optionee shall not have any right in connection to such outstanding Options.

| 10.5 | Optionees shall not have any of the rights or privileges of shareholders of the Company in respect of any Shares purchasable upon the exercise of any Option, nor shall they be deemed to be a class of shareholders or creditors of the Company for purpose of the operation of sections 350 and 351 of the Companies Law or any successor to such section, until registration of the Optionee as holder of such Shares in the Company’s register of shareholders upon exercise of the Option in accordance with the provisions of the ISOPISIP, but in case of Options and Shares held by the Trustee, subject to the provisions of Section 6 of the ISOPISIP. |

13

| 10.7 | Any form of Option Agreement authorized by the ISOPISIP may contain such other provisions as the Committee may, from time to time, deem advisable. |

| 10.8 | With respect to Unapproved 102 Options, if the Optionee ceases to be employed by the Company or any Affiliate, the Optionee shall extend to the Company and/or its Affiliate a security or guarantee for the payment of tax due at the time of sale of Shares, all in accordance with the provisions of Section 102 and the rules, regulation or orders promulgated thereunder. |

| 11. | VESTING OF OPTIONS |

| 11.1 | Subject to the provisions of the ISOPISIP, each Option shall vest following the Vesting Dates and for the number of Shares as shall be provided in the Option Agreement. However, no Option shall be exercisable after the Expiration Date. |

| 11.2 | Unless the Committee provides otherwise, vesting of Options granted hereunder shall be tolled during any unpaid leave of absence. |

| 11.3 | An Option may be subject to such other terms and conditions on the time or times when it may be exercised, as the Committee may deem appropriate. The vesting provisions of individual Options may vary. |

| 12. | PURCHASE FOR INVESTMENT |

The Company’s obligation to issue or allocate Shares upon exercise of an Option granted under the ISOPISIP is expressly conditioned upon: (a) the Company’s completion of any registration or other qualifications of such Shares under all applicable laws, rules and regulations or (b) representations and undertakings by the Optionee (or his legal representative, heir or legatee, in the event of the Optionee’s death) to assure that the sale of the Shares complies with any registration exemption requirements which the Company in its sole discretion shall deem necessary or advisable. Such required representations and undertakings may include representations and agreements that such Optionee (or his legal representative, heir, or legatee): (a) is purchasing such Shares for investment and not with any present intention of selling or otherwise disposing thereof; and (b) agrees to have placed upon the face and reverse of any certificates evidencing such Shares a legend setting forth (i) any representations and undertakings which such Optionee has given to the Company or a reference thereto and (ii) that, prior to effecting any sale or other disposition of any such Shares, the Optionee must furnish to the Company an opinion of counsel, satisfactory to the Company, that such sale or disposition will not violate the applicable laws, rules, and regulations, whether of the State of Israel or of the United States or any other State having jurisdiction over the Company and the Optionee.

14

| 13. | DIVIDENDS |

With respect to all Shares (but excluding, for avoidance of any doubt, any unexercised Options) allocated or issued upon the exercise of Options purchased by the Optionee and held by the Optionee or by the Trustee, as the case may be, the Optionee shall be entitled to receive dividends in accordance with the quantity of such Shares, subject to the provisions of the Company’s Articles of Association (and all amendments thereto) and subject to any applicable taxation on distribution of dividends, and when applicable subject to the provisions of Section 102.

| 14. | RESTRICTED SHARE UNITS. |

A Restricted Share Unit (an “RSU”) is a right granted to a Grantee under this Plan covering a number of Shares that is settled by issuance of those Shares. An RSU may be awarded to any eligible Grantee, including under Section 102 of the Ordinance. Each grant of RSUs under the Plan shall be evidenced by a written agreement between the Company and the Grantee (the “Restricted Share Unit Agreement”), in such form as the Committee shall from time to time approve. Such RSUs shall be subject to all applicable terms of the Plan, mutatis mutandis, and may be subject to any other terms that are not inconsistent with the Plan as determined by the Committee. The provisions of the various Restricted Share Unit Agreements entered into under the Plan need not be identical. RSUs may be granted in consideration of a reduction in the recipient’s other compensation.

Other than the par value of the Shares, no payment of cash shall be required as consideration for RSUs. RSUs may or may not be subject to vesting. Vesting shall occur, in full or in installments, upon satisfaction of the conditions specified in the Restricted Share Unit Agreement.

Without limitation of Section 13 above, no voting or dividend rights as a shareholder shall exist prior to the actual issuance of Shares in the name of the Grantee. Notwithstanding anything else in this Plan (as may be amended from time to time) to the contrary, unless otherwise specified by the Committee, each RSU shall be for a term of seven (7) years. Each Restricted Share Unit Agreement shall specify its term and any conditions on the time or times for settlement, and provide for expiration prior to the end of its term in the event of termination of employment or service providing to the Company, and may provide for earlier settlement in the event of the Grantee’s death, Disability or other events.

Settlement of vested RSUs shall be made in the form of Shares. Distribution to a Grantee of an amount (or amounts) from settlement of vested RSUs can be deferred to a date after settlement as determined by the Committee and subject to any additional required corporate approvals. The amount of a deferred distribution may be increased by an interest factor or by dividend equivalents. Until the grant of RSUs is settled, the number of such RSUs shall be subject to adjustment pursuant hereto.

| 15. | RESTRICTIONS ON ASSIGNABILITY AND SALE OF OPTIONS |

1415.1 | No Option or any right with respect thereto, purchasable hereunder, whether fully paid or not, shall be assignable, transferable or given as collateral or any right with respect to it given to any third party whatsoever, except as specifically allowed under the ISOPISIP, and during the lifetime of the Optionee each and all of such Optionee's rights to purchase Shares hereunder shall be exercisable only by the Optionee. |

Any such action made directly or indirectly, for an immediate validation or for a future one, shall be void.

15