Annual Report

May 31, 2024

Trading Symbol: IMANX

IMAN FUND

July 10, 2024

Dear Shareholder,

Assalamu Alaykum (Greetings of Peace),

We at Iman Fund are pleased to report that Iman Fund (the Fund) has done well in the year ending on May 31 ,2024. The Fund returned 27.66% in that period. The Fund outperformed its benchmark, the Dow Jones Islamic Market World Index (DJIM), which returned 23.27% during the same period. For longer periods of performance, the Fund again outperformed its benchmark for the ten-year period ending on May 31,2024 returning 11.04% annually as compared the annual return of 10.23% for the Dow Jones Islamic Market World Index (DJIM) for the same ten-year period.

U.S. equity markets saw strong gains in the Fund’s fiscal year ending May 31, 2024, attributed to robust economic growth, resilient corporate profits and slowing inflation following the U.S. Federal Reserve’s aggressive rate hikes. The S&P 500 continued its late-2023 momentum and it ended in recent all-time high.

The U.S. Federal Reserve raised interest rates four times in 2023, the last increase was in July 2023. The increases helped lower inflation from a peak of 9.06% in June 2022 to a low of around 3.00% lately. However, inflation proved stickier than desired and crept up. It reached 3.48% in March 2024. That produced a hiccup in the market in April. Nonetheless, the Fed indicated that they envision a modest rate cut later this year and the market went up again. All but one of the eleven sectors turned in positive results for the 12 months ended May 31. Communication Services and Information Technology stocks (which we outweighed) produced the highest return, followed by Consumer Discretionary. Real estate and utilities stocks (which were underweighted in the Fund) lagged.

After a particularly challenging 2022, the broader technology sector rebounded throughout 2023 and into 2024 bolstered by advancements in artificial intelligence (AI) that helped drive renewed investor excitement for the sector. Semiconductor stocks soared including our large holding in Taiwan Semiconductor. Microsoft, which is now the largest holding in Iman Fund rebounded strongly from a challenging 2022.

Health care stocks did not particularly shine but a few did. Novo Nordisk, one of the largest holdings of Iman Fund, had a remarkable performance attributed to Ozempic. Eli Lilly had an excellent rise as it reported increased revenues of 26% for the first quarter of 2024, driven by strong sales of their popular GIP/GLP-1 drugs, Mounjaro for diabetes and Zepbound for weight loss.

Outlook: In the month of May and through early July 2024, corporate earnings growth was better than expected, and economic data showed signs of disinflation. The Nasdaq, S&P 500, and Dow Jones reached new all-time highs. However, the market breadth was narrow. More than half of the S&P 500’s May gains were attributed to four mega-cap tech stocks. We believe this narrow group of mega-cap tech stocks has the potential to cause more volatility for equity indices than desired.

Economic data in May was soft. Gross Domestic Product, consumer price index, retail sales, and job creation were all lower than expected. The disinflation narrative from these weak numbers led some investors to expect rate cuts sooner, fueling a rally. Iman Fund continues to balance downside risk and upside opportunity. We seek capital appreciation with lower volatility throughout market cycles.

Iman Fund strives to produce competitive returns with low volatility over time. The fund does not chase the fad sock of the week. We aim to reduce the impact of declining markets, while still participating meaningfully when markets rise. We continue to believe in the Fund’s fundamental, bottom-up investment process and will continue our careful research and risk-management strategies. We believe the Iman Fund offers a time-tested track record seeking companies with sustained, underestimated earnings and a good growth profile as well as a value-added approach.

We look forward to providing you, as Iman Fund valuable shareholder, with sharply focused experienced and disciplined fund management that we believe underpins an effective, long-term investment strategy. We take our mission to give investors the best chance of investment success while adhering to Islamic principles seriously. Our work is grounded in maintaining perspective, long term discipline and vigilance.

We thank you for entrusting your assets to us and giving us the opportunity to help you reach your financial goals in the years to come. We would like to take this opportunity to welcome our new shareholders to the fund and to thank current investors for the trust and confidence they have placed in us.

Very Truly Yours,

Bassam Osman, President

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the recent month end may be obtained by visiting www.investaaa.com.

IMAN FUND

Past performance does not guarantee future results.

The above discussion and analysis of the Fund reflect the opinions of the Adviser as of July 2024, are subject to change and any forecasts made cannot be guaranteed and should not be considered investment advice.

Mutual Fund investing involves risk; principal loss is possible. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Historically, the Adviser believes that the Islamic restrictions placed on the Fund have not adversely affected the Fund; however, it is possible that these restrictions may result in the Fund not performing as well as mutual funds not subject to such restrictions.

The benchmark for the Fund is the Dow Jones Islamic Market World Index. The Dow Jones Islamic Market World Index measures the global universe of investable equities considered by Dow Jones to be in compliance with Islamic principles.

The Standard and Poor’s 500 (S&P 500) is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

The Wilshire 5000 Total Market Index is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of Fund holdings, please refer to the Schedule of Investments included in this report.

IMAN FUND

EXPENSE EXAMPLE

May 31, 2024 (Unaudited)

As a shareholder of the Iman Fund (the “Fund”), you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (12/1/2023 - 5/31/2024).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, (doing business as U.S. Bank Global Fund Services), the Fund’s transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. The example below includes, but is not limited to, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. Please note that Iman Fund does not have any sales charge (loads), redemption fees, or exchange fees.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 12/1/23 | 5/31/24 | 12/1/23 - 5/31/24* |

| Actual | $1,000.00 | $1,195.40 | $7.19 |

| Hypothetical (5% return before expenses) | 1,000.00 | 1,018.45 | 6.61 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.31% multiplied by the average account value over the period multiplied by 183/366 (to reflect the one-half year period). |

IMAN FUND

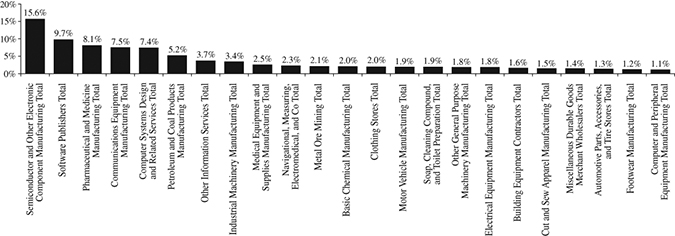

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

May 31, 2024 (Unaudited)

IMAN FUND

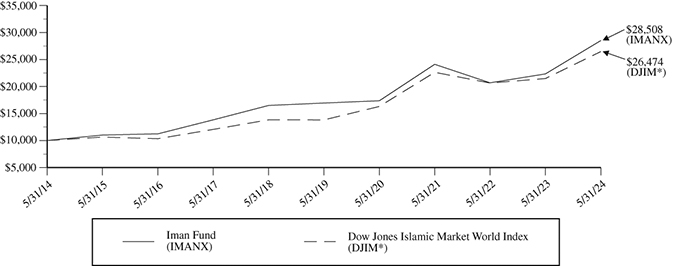

Total Rate of Return

For the Period May 31, 2014 to May 31, 2024

(Unaudited)

This chart assumes an initial investment of $10,000 made on May 31, 2014 and held through May 31, 2024.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the recent month end may be obtained by visiting www.investaaa.com.

Indices mentioned are unmanaged and used to measure stock markets. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

| | One | Five | Ten |

| Average Annual Total Return as of May 31, 2024 | Year | Years | Years |

| Iman Fund | 27.66% | 10.97% | 11.04% |

| Dow Jones Islamic Market World Index* | 23.27% | 13.88% | 10.23% |

| * | The Dow Jones Islamic Market World Index is a compilation of various country-level benchmark indexes considered by Dow Jones to be in compliance with Islamic principles. The index provides a definitive standard for measuring stock market performance for Islamic investors on a global basis, in accordance with Dow Jones Indexes’ established index methodology. |

The Fund’s gross expense ratio, per the Fund’s prospectus dated September 30, 2023, was 1.35%.

IMAN FUND

SCHEDULE OF INVESTMENTS

May 31, 2024

(Classifications are based on the North American Industry Classification System)

| | | Shares | | | Value | |

| COMMON STOCKS - 99.4% | | | | | | |

| | | | | | | |

| AGRICULTURE, CONSTRUCTION, AND MINING MACHINERY MANUFACTURING - 0.5% | | | | | | |

| Toro Co. | | | 10,900 | | | $ | 874,071 | |

| | | | | | | | | |

| APPAREL ACCESSORIES AND OTHER APPAREL MANUFACTURING - 0.2% | | | | | | | | |

Deckers Outdoor Corp.(a) | | | 285 | | | | 311,767 | |

| | | | | | | | | |

| ARCHITECTURAL AND STRUCTURAL METALS MANUFACTURING - 0.6% | | | | | | | | |

| Simpson Manufacturing Co., Inc. | | | 6,760 | | | | 1,121,619 | |

| | | | | | | | | |

| ARCHITECTURAL, ENGINEERING, AND RELATED SERVICES - 0.6% | | | | | | | | |

| Exponent, Inc. | | | 12,800 | | | | 1,217,536 | |

| | | | | | | | | |

| AUDIO AND VIDEO EQUIPMENT MANUFACTURING - 0.8% | | | | | | | | |

| Dolby Laboratories, Inc. - Class A | | | 19,200 | | | | 1,555,392 | |

| | | | | | | | | |

| AUTOMOTIVE PARTS, ACCESSORIES, AND TIRE RETAILERS - 1.3% | | | | | | | | |

O'Reilly Automotive, Inc.(a) | | | 2,530 | | | | 2,437,048 | |

| | | | | | | | | |

| BASIC CHEMICAL MANUFACTURING - 2.0% | | | | | | | | |

| Linde PLC | | | 8,565 | | | | 3,730,229 | |

| | | | | | | | | |

| BUILDING EQUIPMENT CONTRACTORS - 1.6% | | | | | | | | |

| EMCOR Group, Inc. | | | 7,490 | | | | 2,911,063 | |

| | | | | | | | | |

| CLOTHING STORES - 1.9% | | | | | | | | |

| Ross Stores, Inc. | | | 21,535 | | | | 3,009,732 | |

| TJX Cos., Inc. | | | 5,900 | | | | 608,290 | |

| | | | | | | | 3,618,022 | |

| COMMUNICATIONS EQUIPMENT MANUFACTURING - 7.5% | | | | | | | | |

| Apple, Inc. | | | 65,370 | | | | 12,567,382 | |

| QUALCOMM, Inc. | | | 6,390 | | | | 1,303,880 | |

| | | | | | | | 13,871,262 | |

| COMPUTER AND PERIPHERAL EQUIPMENT MANUFACTURING - 1.1% | | | | | | | | |

Super Micro Computer, Inc.(a) | | | 2,525 | | | | 1,980,888 | |

| | | | | | | | | |

| COMPUTER SYSTEMS DESIGN AND RELATED SERVICES - 7.4% | | | | | | | | |

Alphabet, Inc. - Class A(a) | | | 41,350 | | | | 7,132,875 | |

Alphabet, Inc. - Class C(a) | | | 10,585 | | | | 1,841,366 | |

Aspen Technology, Inc.(a) | | | 2,415 | | | | 508,720 | |

EPAM Systems, Inc.(a) | | | 3,075 | | | | 547,135 | |

PDF Solutions, Inc.(a) | | | 23,000 | | | | 805,460 | |

| SAP SE - ADR | | | 13,400 | | | | 2,444,696 | |

ServiceNow, Inc.(a) | | | 755 | | | | 495,982 | |

| | | | | | | | 13,776,234 | |

| COMPUTING INFRASTRUCTURE PROVIDERS, DATA PROCESSING, | | | | | | | | |

| WEB HOSTING, AND RELATED SERVICES - 0.3% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 2,055 | | | | 503,311 | |

| | | | | | | | | |

| CUT AND SEW APPAREL MANUFACTURING - 1.5% | | | | | | | | |

| Cintas Corp. | | | 3,650 | | | | 2,474,590 | |

Lululemon Athletica, Inc.(a) | | | 750 | | | | 233,993 | |

| | | | | | | | 2,708,583 | |

| DRUGS AND DRUGGISTS' SUNDRIES MERCHANT WHOLESALERS - 0.8% | | | | | | | | |

| Roche Holding AG - ADR | | | 49,000 | | | | 1,568,490 | |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

(Classifications are based on the North American Industry Classification System)

| | | Shares | | | Value | |

| COMMON STOCKS - 99.4% (Continued) | | | | | | |

| | | | | | | |

| ELECTRICAL EQUIPMENT MANUFACTURING - 1.8% | | | | | | |

| Lennox International, Inc. | | | 6,640 | | | $ | 3,337,264 | |

| | | | | | | | | |

| FOOTWEAR MANUFACTURING - 1.2% | | | | | | | | |

| NIKE, Inc. - Class B | | | 20,000 | | | | 1,901,000 | |

Skechers USA, Inc. - Class A(a) | | | 3,700 | | | | 264,254 | |

| | | | | | | | 2,165,254 | |

| FREIGHT TRANSPORTATION ARRANGEMENT - 0.5% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 3,400 | | | | 411,060 | |

| JB Hunt Transport Services, Inc. | | | 3,780 | | | | 607,635 | |

| | | | | | | | 1,018,695 | |

| GENERAL FREIGHT TRUCKING - 0.2% | | | | | | | | |

| Old Dominion Freight Line, Inc. | | | 2,500 | | | | 438,125 | |

| | | | | | | | | |

| HARDWARE, AND PLUMBING AND HEATING EQUIPMENT | | | | | | | | |

| AND SUPPLIES MERCHANT WHOLESALERS - 0.2% | | | | | | | | |

| Ferguson PLC | | | 2,000 | | | | 411,480 | |

| | | | | | | | | |

| INDUSTRIAL MACHINERY MANUFACTURING - 3.4% | | | | | | | | |

| Applied Materials, Inc. | | | 4,800 | | | | 1,032,384 | |

| ASML Holding NV | | | 4,200 | | | | 4,033,470 | |

| Kadant, Inc. | | | 4,485 | | | | 1,282,755 | |

| | | | | | | | 6,348,609 | |

| MEDICAL EQUIPMENT AND SUPPLIES MANUFACTURING - 2.5% | | | | | | | | |

Edwards Lifesciences Corp.(a) | | | 2,225 | | | | 193,330 | |

Intuitive Surgical, Inc.(a) | | | 1,480 | | | | 595,138 | |

| Johnson & Johnson | | | 24,850 | | | | 3,644,749 | |

| ResMed, Inc. | | | 1,155 | | | | 238,311 | |

| | | | | | | | 4,671,528 | |

| METAL ORE MINING - 2.1% | | | | | | | | |

| Alamos Gold, Inc. - Class A | | | 58,000 | | | | 969,180 | |

| Franco-Nevada Corp. | | | 12,300 | | | | 1,522,740 | |

| Wheaton Precious Metals Corp. | | | 24,665 | | | | 1,359,288 | |

| | | | | | | | 3,851,208 | |

| MISCELLANEOUS DURABLE GOODS MERCHANT WHOLESALERS - 1.4% | | | | | | | | |

| Pool Corp. | | | 7,357 | | | | 2,674,637 | |

| | | | | | | | | |

| MOTOR VEHICLE AND MOTOR VEHICLE PARTS AND | | | | | | | | |

| SUPPLIES MERCHANT WHOLESALERS - 0.7% | | | | | | | | |

Copart, Inc.(a) | | | 25,043 | | | | 1,328,782 | |

| | | | | | | | | |

| MOTOR VEHICLE MANUFACTURING - 1.9% | | | | | | | | |

| Federal Signal Corp. | | | 19,500 | | | | 1,794,390 | |

Tesla, Inc.(a) | | | 9,565 | | | | 1,703,335 | |

| | | | | | | | 3,497,725 | |

| NAVIGATIONAL, MEASURING, ELECTROMEDICAL, | | | | | | | | |

| AND CONTROL INSTRUMENTS MANUFACTURING - 2.3% | | | | | | | | |

| Danaher Corp. | | | 9,200 | | | | 2,362,560 | |

IDEXX Laboratories, Inc.(a) | | | 2,365 | | | | 1,175,287 | |

Transcat, Inc.(a) | | | 5,230 | | | | 666,302 | |

| | | | | | | | 4,204,149 | |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

(Classifications are based on the North American Industry Classification System)

| | | Shares | | | Value | |

| COMMON STOCKS - 99.4% (Continued) | | | | | | |

| | | | | | | |

| NURSING CARE FACILITIES (SKILLED NURSING FACILITIES) - 0.4% | | | | | | |

| Ensign Group, Inc. | | | 6,500 | | | $ | 788,060 | |

| | | | | | | | | |

| OIL AND GAS EXTRACTION - 0.9% | | | | | | | | |

| BHP Group Ltd. - ADR | | | 27,100 | | | | 1,613,263 | |

| | | | | | | | | |

| OTHER CHEMICAL PRODUCT AND PREPARATION MANUFACTURING - 0.5% | | | | | | | | |

Aspen Aerogels, Inc.(a) | | | 31,900 | | | | 954,448 | |

| | | | | | | | | |

| OTHER FINANCIAL INVESTMENT ACTIVITIES - 0.9% | | | | | | | | |

| Chemed Corp. | | | 3,150 | | | | 1,746,265 | |

| | | | | | | | | |

| OTHER FOOD MANUFACTURING - 0.2% | | | | | | | | |

| J & J Snack Foods Corp. | | | 1,870 | | | | 304,268 | |

| | | | | | | | | |

| OTHER GENERAL PURPOSE MACHINERY MANUFACTURING - 1.8% | | | | | | | | |

Mettler-Toledo International, Inc.(a) | | | 1,385 | | | | 1,944,665 | |

| Nordson Corp. | | | 6,125 | | | | 1,437,660 | |

| | | | | | | | 3,382,325 | |

| OTHER INFORMATION SERVICES - 3.7% | | | | | | | | |

| Meta Platforms, Inc. - Class A | | | 14,660 | | | | 6,843,728 | |

| | | | | | | | | |

| PETROLEUM AND COAL PRODUCTS MANUFACTURING - 5.2% | | | | | | | | |

| Chevron Corp. | | | 19,200 | | | | 3,116,160 | |

| Exxon Mobil Corp. | | | 55,485 | | | | 6,506,171 | |

| | | | | | | | 9,622,331 | |

| PHARMACEUTICAL AND MEDICINE MANUFACTURING - 8.1% | | | | | | | | |

| Abbott Laboratories | | | 14,405 | | | | 1,472,047 | |

| Eli Lilly & Co. | | | 3,340 | | | | 2,739,936 | |

Moderna, Inc.(a) | | | 3,100 | | | | 441,905 | |

| Novo Nordisk AS - ADR | | | 49,300 | | | | 6,669,304 | |

Regeneron Pharmaceuticals, Inc.(a) | | | 915 | | | | 896,846 | |

Vertex Pharmaceuticals, Inc.(a) | | | 1,300 | | | | 591,942 | |

| West Pharmaceutical Services, Inc. | | | 6,535 | | | | 2,165,764 | |

| | | | | | | | 14,977,744 | |

| RESIDENTIAL BUILDING CONSTRUCTION - 1.0% | | | | | | | | |

NVR, Inc.(a) | | | 235 | | | | 1,804,972 | |

| | | | | | | | | |

| RESTAURANTS AND OTHER EATING PLACES - 0.8% | | | | | | | | |

Chipotle Mexican Grill, Inc.(a) | | | 115 | | | | 359,895 | |

Manhattan Associates, Inc.(a) | | | 3,830 | | | | 840,838 | |

| Veralto Corp. | | | 2,233 | | | | 220,129 | |

| | | | | | | | 1,420,862 | |

| SAWMILLS AND WOOD PRESERVATION - 0.9% | | | | | | | | |

| UFP Industries, Inc. | | | 13,900 | | | | 1,660,772 | |

| | | | | | | | | |

| SEMICONDUCTOR AND OTHER ELECTRONIC | | | | | | | | |

| COMPONENT MANUFACTURING - 15.6% | | | | | | | | |

Advanced Micro Devices, Inc.(a) | | | 8,700 | | | | 1,452,030 | |

| Analog Devices, Inc. | | | 4,350 | | | | 1,020,032 | |

FormFactor, Inc.(a) | | | 13,700 | | | | 749,664 | |

| Lam Research Corp. | | | 1,240 | | | | 1,156,226 | |

| Micron Technology, Inc. | | | 11,200 | | | | 1,400,000 | |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

(Classifications are based on the North American Industry Classification System)

| | | Shares | | | Value | |

| COMMON STOCKS - 99.4% (Continued) | | | | | | |

| | | | | | | |

| SEMICONDUCTOR AND OTHER ELECTRONIC | | | | | | |

| COMPONENT MANUFACTURING - 15.6% (Continued) | | | | | | |

| Monolithic Power Systems, Inc. | | | 2,675 | | | $ | 1,967,810 | |

| NVIDIA Corp. | | | 8,465 | | | | 9,280,433 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 52,800 | | | | 7,974,912 | |

| Texas Instruments, Inc. | | | 17,000 | | | | 3,315,170 | |

Vicor Corp.(a) | | | 20,700 | | | | 724,293 | |

| | | | | | | | 29,040,570 | |

| SERVICES TO BUILDINGS AND DWELLINGS - 0.2% | | | | | | | | |

| Rollins, Inc. | | | 7,300 | | | | 333,537 | |

| | | | | | | | | |

| SOAP, CLEANING COMPOUND, AND TOILET PREPARATION MANUFACTURING - 1.9% | | | | | | | | |

| Oil-Dri Corp. of America | | | 4,689 | | | | 391,813 | |

| Procter & Gamble Co. | | | 19,400 | | | | 3,192,076 | |

| | | | | | | | 3,583,889 | |

| SOFTWARE PUBLISHERS - 9.7% | | | | | | | | |

Adobe, Inc.(a) | | | 1,915 | | | | 851,715 | |

ANSYS, Inc.(a) | | | 1,940 | | | | 615,853 | |

Cadence Design Systems, Inc.(a) | | | 4,590 | | | | 1,314,163 | |

| Microsoft Corp. | | | 30,745 | | | | 12,763,172 | |

| Salesforce, Inc. | | | 5,890 | | | | 1,380,851 | |

Shopify, Inc. - Class A(a) | | | 6,000 | | | | 354,900 | |

Tyler Technologies, Inc.(a) | | | 1,660 | | | | 797,398 | |

| | | | | | | | 18,078,052 | |

| SUPPORT ACTIVITIES FOR MINING - 0.5% | | | | | | | | |

| Rio Tinto PLC - ADR | | | 13,100 | | | | 918,310 | |

| | | | | | | | | |

| WAREHOUSING AND STORAGE - 0.8% | | | | | | | | |

| Landstar System, Inc. | | | 8,185 | | | | 1,489,915 | |

TOTAL COMMON STOCKS (Cost $131,496,158) | | | | | | | 184,696,282 | |

| | | | | | | | | |

TOTAL INVESTMENTS - 99.4% (Cost $131,496,158) | | | | | | | 184,696,282 | |

| Other Assets in Excess of Liabilities - 0.6% | | | | | | | 1,134,604 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 185,830,886 | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

PLC - Public Limited Company

| (a) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2024

| Assets: | | | |

| Investments, at value (cost $131,496,158) | | $ | 184,696,282 | |

| Cash | | | 1,604,533 | |

| Receivable for capital shares sold | | | 20,723 | |

| Dividends receivable | | | 208,375 | |

| Other assets | | | 28,998 | |

| Total Assets | | | 186,558,911 | |

| | | | | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 461,674 | |

| Payable to Adviser (Note 3) | | | 154,640 | |

| Payable for capital shares redeemed | | | 3,559 | |

| Payable for professional fees | | | 34,489 | |

| Payable for Trustee fees | | | 4,498 | |

| Accrued fund administration & fund accounting expense | | | 42,179 | |

| Accrued expenses and other liabilities | | | 26,986 | |

| Total Liabilities | | | 728,025 | |

| Net Assets | | $ | 185,830,886 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 140,209,013 | |

| Total distributable earnings | | | 45,621,873 | |

| Net Assets | | $ | 185,830,886 | |

| | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 12,203,054 | |

| Net asset value, redemption price and offering price per share | | $ | 15.23 | |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

STATEMENT OF OPERATIONS

For the Year Ended May 31, 2024

| Investment income: | | | |

| Dividend income (net of foreign withholding tax of $55,439) | | $ | 1,764,475 | |

| Total investment income | | | 1,764,475 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (Note 3) | | | 1,635,663 | |

| Administration fees | | | 184,338 | |

| Transfer agent fees and expenses | | | 112,506 | |

| Legal fees | | | 66,162 | |

| Fund accounting fees | | | 51,932 | |

| Federal and state registration fees | | | 31,564 | |

| Trustees’ fees and related expenses | | | 19,504 | |

| Custody fees | | | 13,884 | |

| Audit fees | | | 15,246 | |

| Reports to shareholders | | | 2,944 | |

| Other expenses | | | 1,836 | |

| Total expenses | | | 2,135,579 | |

| Net investment loss | | | (371,104 | ) |

| | | | | |

| Realized and unrealized gain on investments: | | | | |

| Net realized gain on investments | | | 6,525,809 | |

| Change in net unrealized appreciation/depreciation | | | | |

| on investments and foreign currency translation | | | 34,230,749 | |

| Realized and unrealized gain on investments | | | 40,756,558 | |

| Net increase in net assets from operations | | $ | 40,385,454 | |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | May 31, 2024 | | | May 31, 2023 | |

| From operations: | | | | | | |

| Net investment loss | | $ | (371,104 | ) | | $ | (328,316 | ) |

| Net realized gain (loss) on investments | | | 6,525,809 | | | | (13,777,851 | ) |

| Change in net unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency translation | | | 34,230,749 | | | | 24,672,576 | |

| Net increase in net assets from operations | | | 40,385,454 | | | | 10,566,409 | |

| | | | | | | | | |

| Net decrease in net assets resulting from distributions paid | | | — | | | | (1,816,367 | ) |

| | | | | | | | | |

| From capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 12,143,234 | | | | 10,488,168 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 1,785,279 | |

| Payments for shares redeemed | | | (15,552,487 | ) | | | (11,833,619 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (3,409,253 | ) | | | 439,828 | |

| | | | | | | | | |

| Total increase in net assets | | | 36,976,201 | | | | 9,189,870 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 148,854,685 | | | | 139,664,815 | |

| End of year | | $ | 185,830,886 | | | $ | 148,854,685 | |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended May 31, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 11.93 | | | $ | 11.21 | | | $ | 15.73 | | | $ | 11.63 | | | $ | 12.76 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.03 | ) | | | (0.03 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.05 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 3.33 | | | | 0.90 | | | | (1.41 | ) | | | 4.65 | | | | 0.56 | |

| Total from investment operations | | | 3.30 | | | | 0.87 | | | | (1.51 | ) | | | 4.52 | | | | 0.51 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions paid: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

| From net realized gain on investments | | | — | | | | (0.15 | ) | | | (3.01 | ) | | | (0.42 | ) | | | (1.64 | ) |

| Total distributions paid | | | — | | | | (0.15 | ) | | | (3.01 | ) | | | (0.42 | ) | | | (1.64 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 15.23 | | | $ | 11.93 | | | $ | 11.21 | | | $ | 15.73 | | | $ | 11.63 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 27.66 | % | | | 7.93 | % | | | -14.19 | % | | | 38.85 | % | | | 2.50 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 185,831 | | | $ | 148,855 | | | $ | 139,665 | | | $ | 154,638 | | | $ | 115,345 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.31 | % | | | 1.35 | % | | | 1.28 | % | | | 1.29 | % | | | 1.33 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (0.24 | )% | | | (0.24 | )% | | | (0.77 | )% | | | (0.93 | )% | | | (0.40 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 25.1 | % | | | 71.9 | % | | | 114.5 | % | | | 106.6 | % | | | 95.4 | % |

(1) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book to tax differences. |

The accompanying notes are an integral part of these financial statements.

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

1. Organization

Allied Asset Advisors Funds (the “Trust”), an open-end management investment company, was organized as a Delaware statutory trust on January 14, 2000. The Trust currently offers one series of shares to investors, the Iman Fund (the “Fund”), a diversified series of the Trust. Allied Asset Advisors, Inc. (the “Adviser”), a Delaware corporation, serves as investment adviser to the Fund.

The Trust is authorized to issue an unlimited number of shares without par value, of each series. The Trust currently offers one class of shares of the Fund.

The Fund seeks growth of capital while adhering to Islamic principles. The Fund seeks to achieve its investment objective by investing in common stocks and equity-related securities of domestic and foreign issuers that meet Islamic principles and whose prices the Adviser anticipates will increase over the long term. Islamic principles generally preclude investments in certain businesses (e.g., alcohol, pornography and gambling) and investments in interest bearing debt obligations or businesses that derive interest income as their primary source of income. The Fund may invest in companies of all market capitalizations. Any uninvested cash will be held in non-interest bearing deposits or invested in a manner following Islamic principles. There can be no guarantee that the Fund will achieve its investment objective.

The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates: In preparing the financial statements in conformity with GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Security Valuation: Investment securities are carried at fair value determined using the following valuation methods:

| • | Equity securities listed on a U.S. securities exchange or NASDAQ for which market quotations are readily available are valued at the last quoted sale price on the valuation date. |

| | |

| • | Options, futures, unlisted U.S. securities and listed U.S. securities not traded on the valuation date for which market quotations are readily available are valued at the most recent quoted bid price. The Fund did not hold any such securities during the year ended May 31, 2024. |

| | |

| • | Securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Adviser under direction of the Board of Trustees. The Fund did not hold any such securities during the year ended May 31, 2024. |

The Fund has adopted fair valuation accounting standards which establish an authoritative definition of fair value and a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes.

Summary of Fair Value Exposure at May 31, 2024

The Trust has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| Level 1 - | Unadjusted quoted prices in active markets for identical securities the Fund has the ability to access. |

| | |

| Level 2 - | Other significant observable inputs (including quoted prices for similar securities in active markets, quoted prices for identical or similar instruments in markets that are not active, model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, interest rates, prepayment speeds, credit risk, etc.) |

| | |

| Level 3 - | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS (Continued)

May 31, 2024

Inputs that are used in determining a fair value of an investment may include price information, credit data, volatility statistics and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments and is affected by various factors such as the type of investment or similar investments in the marketplace. The inputs will be considered by the Adviser, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Adviser. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2024:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 184,696,282 | | | $ | — | | | $ | — | | | $ | 184,696,282 | |

| Total* | | $ | 184,696,282 | | | $ | — | | | $ | — | | | $ | 184,696,282 | |

| * | Additional information regarding the industry and/or geographical classification of these investments is disclosed in the Schedule of Investments. |

The Fund did not hold any investments during the year ended May 31, 2024 with significant unobservable inputs which would be classified as Level 3. The Fund did not hold any derivative instruments during the reporting period.

Foreign Securities: Investing in securities of foreign companies and foreign governments involves special risks and consideration not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. The Fund does not invest in securities of U.S. or foreign governments.

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, and the Fund intends to distribute all of its taxable income and net capital gains to shareholders. Therefore, no federal income tax provision is required.

As of and during the year ended May 31, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as other expenses in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The statute of limitations on the Fund’s tax returns remains open for the years ended May 31, 2021 through May 31, 2024.

As of May 31, 2024, the tax cost of investments and the components of distributable earnings/(accumulated losses) on a tax basis were as follows:

| Cost of investments | | $ | 131,791,898 | |

| Gross tax unrealized appreciation | | $ | 57,756,914 | |

| Gross tax unrealized depreciation | | | (4,852,529 | ) |

| Net tax unrealized appreciation | | | 52,904,385 | |

| Other accumulated losses | | | (7,282,512 | ) |

| Total distributable earnings | | $ | 45,621,873 | |

The difference between book basis and tax basis unrealized appreciation is attributable primarily to the tax deferral of losses relating to wash sale transactions.

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS (Continued)

May 31, 2024

At May 31, 2024, the Iman Fund had short-term tax basis capital losses of $3,949,255 and long-term tax basis capital losses of $3,241,755 which may be carried forward to offset future capital gains. To the extent that the Iman Fund may realize future net capital gains, those gains will be offset by any of its unused capital loss carryforwards. These losses do not expire.

During the 2024 fiscal year, the Iman Fund utilized $1,813,429 of long-term capital loss carryover and $4,716,966 of short-term capital loss carryover.

A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended May 31, 2024, the Fund deferred, on a tax basis, ordinary late year losses of $91,502, and did not defer any post-October capital losses.

Distributions to Shareholders: The Fund will distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

The tax character of distributions paid were as follows:

| | | Year Ended | | | Year Ended | |

| | | May 31, 2024 | | | May 31, 2023 | |

| Ordinary income | | $ | — | | | $ | — | |

| Long-term capital gains | | $ | — | | | $ | 1,816,367 | |

Dividend income and distributions to shareholders are recorded on the ex-dividend date. The Fund may periodically make reclassifications among certain of its capital accounts to reflect the tax character of permanent book to tax differences related to the components of the Fund’s net assets. These reclassifications have no impact on the net assets or net asset value of the Fund.

For the fiscal year ended May 31, 2024, total distributable earnings was increased by $279,573 and paid-in capital was decreased by $(279,573) resulting from such reclassification. This reclassification was due to net operating losses.

Other: Investment transactions and shareholder transactions are accounted for on the trade date. Net realized gains and losses on securities are computed on the basis of specific security lot identification. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

The Fund reports net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

Subsequent Events: In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. For the period noted above, there were no such events or transactions.

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS (Continued)

May 31, 2024

3. Investment Advisory and Other Agreements

The Trust has an Investment Advisory Agreement (the “Agreement”) with the Adviser, with whom certain officers and a Trustee of the Trust are affiliated, to furnish investment advisory services to the Fund. Under the terms of the Agreement, the Trust, on behalf of the Fund, compensates the Adviser for its management services at the annual rate of 1.00% of the Fund’s daily average net assets.

For the year ended May 31, 2024, the Fund had advisory expenses of $1,635,663 and as of May 31, 2024, the Fund had $154,640 payable to the Adviser.

During the year ended May 31, 2024, the Board approved an Advisory Fee Waiver Agreement between the Adviser and the Trust whereby the Adviser will waive a portion of its management fee, which will go into effect after the date this report was made available. See additional information regarding the agreement on page 21 of this report.

North American Islamic Trust (“NAIT”) is the parent company of the Adviser. NAIT acts as a consultant for the Fund with respect to Shariah compliance matters. All fees for these services are paid by the Adviser outside of the Fund’s net assets. During the year ended May 31, 2024, the Board approved a Consulting Services Agreement between the Adviser and NAIT whereby the Adviser will allocate a portion of its management fee to NAIT for these consulting services. This agreement will go into effect after the date this report was made available. See additional information regarding the agreement on page 21 of this report.

The Trust has a distribution agreement and a servicing agreement with Quasar Distributors, LLC (the “Distributor”), a subsidiary of ACA Global. Fees for such distribution services are paid to the Distributor by the Adviser.

4. Capital Share Transactions

Capital Share Transactions of the Fund for the year ended May 31, 2024, were as follows:

| | | Amount | | | Shares | |

| Shares sold | | $ | 12,143,234 | | | | 912,214 | |

| Shares reinvested | | | — | | | | — | |

| Shares redeemed | | | (15,552,487 | ) | | | (1,183,842 | ) |

| Net decrease | | $ | (3,409,253 | ) | | | (271,628 | ) |

| Shares Outstanding | | | | | | | | |

| Beginning of year | | | | | | | 12,474,682 | |

| End of year | | | | | | | 12,203,054 | |

Capital Share Transactions of the Fund for the year ended May 31, 2023, were as follows:

| | | Amount | | | Shares | |

| Shares sold | | $ | 10,488,168 | | | | 938,942 | |

| Shares reinvested | | | 1,785,279 | | | | 170,351 | |

| Shares redeemed | | | (11,833,619 | ) | | | (1,088,869 | ) |

| Net increase | | $ | 439,828 | | | | 20,424 | |

| Shares Outstanding | | | | | | | | |

| Beginning of year | | | | | | | 12,454,258 | |

| End of year | | | | | | | 12,474,682 | |

5. Securities Transactions

During the year ended May 31, 2024, the cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $40,833,966 and $44,786,023, respectively. There were no purchases or sales of U.S. government securities for the Fund.

6. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940 (“1940 Act”). As of May 31, 2024, NAIT held 45.58% of the Fund.

IMAN FUND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Iman Fund and

Board of Trustees of Allied Asset Advisors Funds

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Allied Asset Advisors Funds comprising Iman Fund (the “Fund”) as of May 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2024, by correspondence with the custodian and broker. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2006.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

July 19, 2024

IMAN FUND

DISCLOSURE REGARDING THE BOARD OF TRUSTEES

APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT (Unaudited)

In approving the continuance of the investment advisory contract between Allied Asset Advisors Inc. (the “Adviser”) and the Iman Fund (the “Fund”), the Board of Trustees of the Fund (the “Board”) was advised by, and the independent Trustees of the Board met in executive session with, independent legal counsel to discuss the duties of the Trustees in consideration of the continuance of the agreement. The Board received and reviewed a substantial amount of information provided by the Adviser and third parties in response to the Board’s requests. Based on its evaluation of the information provided, the Board, at a meeting held April 29, 2024, approved continuation of the investment advisory contract for a period through June 30, 2025.

The Board reviewed and analyzed various factors in considering the contract and reaching its conclusions, including each of the factors described below.

1. Nature, Quality, and Extent of Services

The Board’s analysis of the nature, quality, and extent of the Adviser’s service to the Fund took into account the knowledge gained from the Board’s regular meetings with the Adviser throughout the prior year. In addition, the Board reviewed information on the key personnel involved in providing investment management services to the Fund and the Adviser’s performance of services for the Fund, such as stock selection, adherence to the Fund’s investment restrictions, and monitoring compliance with applicable Fund policies and procedures. The Board concluded that the nature, quality, and extent of the services provided by the Adviser to the Fund were appropriate and the Fund was likely to continue to benefit from services provided under its contract with the Adviser.

2. Investment Performance of the Fund and the Adviser

In considering the performance of the Fund and the Adviser, the Board compared the Fund’s performance with that of a universe of greater than 1,300 U.S. large cap growth mutual funds, as determined by Morningstar, an independent data service provider. The performance data was for the one-, three-, five- and ten-year periods ended April 30, 2024. The Board also compared the Fund’s performance for the three-month, six-month and one-, three-, five- and ten-year periods ended March 31, 2024 with that of several benchmark indices: the Dow Jones Islamic Market US Index (the “IMUS”), the Dow Jones Islamic Market World Index (the “DJIM”), the Wilshire 5000 (the “W5000”), the S&P 500 Index and the S&P Shariah Index. In addition, the Board also compared the Fund’s performance for the three-month and one-, three-, five- and ten-year periods ended March 31, 2024 with five other mutual funds that follow Islamic principles.

The Board considered that the Fund had outperformed all benchmark indices for the three-month and six-month periods ended March 31, 2024.

The Board considered that the Fund had outperformed all the Islamic principles peer funds for the three-month and six-month periods ended March 31, 2024, and performed competitively for the one-year, three-year, five-year, and ten-year periods ended March 31, 2024.

After considering all the information, the Board concluded that, although past performance cannot be a guarantee of future performance, the Fund and its shareholders were benefiting from the Adviser’s investment management of the Fund.

3. Costs of Services and Profits Realized by the Adviser

The Board examined the fee and expense information for the Fund as compared to that of other comparable funds and noted that the Adviser’s management fees, as a percentage of net assets, were in the fourth quartile of comparable funds and were higher than the peer group median reported by Morningstar. The Board also noted that the Fund’s net expense ratio, as a percentage of net assets, was in the fourth quartile of comparable funds and was higher than the peer group median reported by Morningstar. The Board noted, however, that the Fund’s special nature makes it distinct from most of the funds in its Morningstar peer group, which included many funds that are part of much larger families of funds and, therefore, realize economies of scale that the Fund does not.

In addition, the Board considered the Adviser’s costs in serving as the Fund’s investment adviser and manager. The costs include those associated with the personnel and systems necessary to manage the Fund. The Board noted, also, that the costs included those associated with Rule 12b-1 expenses that the Adviser had paid on behalf of the Fund, since the Fund did not have a Rule 12b-1 Plan. The Board also considered the financial condition of the Adviser, which was operating at a loss. The Board concluded that the total expenses of the Fund were reasonable in light of the services provided and the performance the Fund achieved over various time periods, and that the other expenses of the Fund were also reasonable.

4. Economies of Scale

The Board considered the extent to which the Fund’s management fee reflected economies of scale for the benefit of Fund shareholders. The Board noted that because the Adviser was operating at a loss, a discussion of economies of scale was not applicable with respect to the management fee received by the Adviser.

IMAN FUND

DISCLOSURE REGARDING THE BOARD OF TRUSTEES

APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT (Unaudited), (Continued)

5. Other Benefits to the Adviser

The Board considered benefits that accrue to the Adviser from its relationship with the Fund. The Board noted that the Adviser did not employ soft-dollars and therefore did not derive research products or services from brokerage commissions paid by the Fund on its brokerage transactions.

Additionally, the Board reviewed and approved (i) an Advisory Fee Waiver Agreement between the Adviser and Allied Asset Advisors Funds (the “Trust”), which provides that the Adviser will waive a portion of its management fee for two years beginning on the date of effectiveness of the annual update to the Fund’s registration statement such that the Trust, on behalf of the Fund, will compensate the Adviser for its management services at the annual rate of 0.70% of the Fund’s daily average net assets (instead 1.00% as set forth in the investment advisory contract), and (ii) a Consulting Services Agreement, which provides that during the effective period of the Advisory Fee Waiver Agreement the Adviser will allocate a portion of the management fee received by the Adviser to the North American Islamic Trust (“NAIT”), the parent company of the Adviser, such that the Adviser will pay to NAIT an amount equal an annual rate of 0.10% of the Fund’s daily average net assets for NAIT’s consulting services to the Adviser regarding Shariah compliance matters for the Fund. The Board noted that the Advisory Fee Waiver Agreement and the Consulting Services Agreement will ultimately cause the Adviser to retain a management fee of 0.60% of the Fund’s daily average net assets during the period of the waiver.

After full consideration of the above factors as well as other factors, the Board, including all independent trustees, unanimously concluded that approval of the Fund’s advisory contract was in the best interest of the Fund and its shareholders.

IMAN FUND

SUPPLEMENTAL INFORMATION (Unaudited)

Information pertaining to the Trustees and Officers of the Fund is set forth below. Each trustee will serve until the termination of the Trust or his earlier death, resignation, retirement, incapacity or removal. The statement of additional information (SAI) includes additional information about the Trustees and is available without charge, upon request by calling (877) 417-6161 or writing to Iman Fund, c/o Allied Asset Advisors, Inc., 8925 South Kostner Avenue, Hometown, IL 60456.

| | | | | Other |

| | Position/Term | | | Directorships |

| | of Office and | | | Held by Trustee |

| Name, Year of | Length of Time | Principal Occupations | No. of Funds | During the Past |

| Birth and Address | Served Complex | During the Past Five Years | in Overseen | Five Years |

| Independent Trustees | | | | |

| Abdalla Idris Ali | Independent Trustee, | 2017 to present – Senior Community and | 1 | None |

| Year of birth: 1949 | indefinite term, | Religious Advisor of “ISNA Canada”. | | |

| 8925 S. Kostner Avenue | since 2000 | | | |

| Hometown, IL 60456 | | | | |

| Mohammed Kaiseruddin | Independent Trustee, | Retired. 1973 to 2017 – | 1 | None |

| Year of birth: 1944 | indefinite term, | Nuclear Engineer, | | |

| 8925 S. Kostner Avenue | since 2000; | Sargent & Lundy. | | |

| Hometown, IL 60456 | Chairperson since 2006 | | | |

| Muhammad M. Kudaimi | Independent Trustee, | 1988 to present – | 1 | None |

| Year of birth: 1956 | indefinite term, | Medical Doctor. | | |

| 8925 S. Kostner Avenue | since 2009 | | | |

| Hometown, IL 60456 | | | | |

| Interested Trustee | | | | |

Bassam Osman(1)(2) | Trustee, | 1980 to present – Medical Doctor; | 1 | None |

| Year of birth: 1950 | indefinite term, | 2000 to present – Portfolio | | |

| 8925 S. Kostner Avenue | since 2000 | Manager to the Fund. | | |

| Hometown, IL 60456 | | | | |

| Officers | | | | |

Bassam Osman(1)(2) | President | (See Above.) | 1 | N/A |

| Year of birth: 1950 | since 2000 | | | |

| 8925 S. Kostner Avenue | | | | |

| Hometown, IL 60456 | | | | |

| Mohamad Nasir | Interim Chief | General Manager of Allied | 1 | N/A |

| Year of birth: 1966 | Compliance Officer | Asset Advisors since May, 2011. | | |

| 8925 S. Kostner Avenue | and Secretary | | | |

| Hometown, IL 60456 | since 2022 | | | |

| Salah Obeidallah | Treasurer | President of Allied Asset | 1 | N/A |

| Year of birth: 1956 | since 2022 | Advisors since June, 2015; | | |

| 8925 S. Kostner Avenue | | Executive Director of NAIT | | |

| Hometown, IL 60456 | | March, 2015 – September, 2022. | | |

(1) | This Trustee is deemed to be an “interested person” of the Trust as that term is defined in Section 2(a)(19) of the 1940 Act because of his affiliation with the Adviser. |

(2) | Dr. Osman serves on the Board of Trustees of NAIT, which is an affiliate of the Fund. |

IMAN FUND

SUPPLEMENTAL INFORMATION (Unaudited), (Continued)

Tax Information

The Fund designates 0.00% of its ordinary income distribution for the year ended May 31, 2024 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

For the year ended May 31, 2024, 0.00% of the dividends paid from net ordinary income for the Fund qualifies for the dividends received deduction available to corporate shareholders.

For the year ended May 31, 2024, 0.00% of the percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C).

The Fund designates 0.00% of its ordinary income distributions for the year ended May 31, 2024 as interest-related dividends under Internal Revenue Code Section 871(k)(1)(C).

Liquidity Risk Management Program

Consistent with Rule 22e-4 under the Investment Company Act of 1940, the Fund has established a liquidity risk management program to manage “liquidity risk” (the “LRMP”). “Liquidity Risk” is defined as the risk that the Fund could not meet requests to redeem shares issued by a Fund without significant dilution of remaining investors’ interest in the Fund. The LRMP is overseen by the Program Administrator, a committee comprised of representatives of the Fund’s investment adviser and officers of the Fund. The Fund’s Board of Trustees has approved the designation of the Program Administrator to oversee the LRMP.

The LRMP’s principal objectives include supporting the Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that the Fund will be unable to meet its redemption obligations timely. The LRMP also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the Fund’s liquidity and the periodic classification and re-classification of the Fund’s investments into groupings that reflect the Program Administrator’s assessment of their relative liquidity under current market conditions.

During the period covered by the report, the Fund’s board discussed and determined in the October 2023 board meeting, that: (1) the LRMP continues to be reasonably designed to effectively assess and manage the Fund’s Liquidity Risk; and (2) the LRMP has been adequately and effectively implemented with respect to the Fund during the reporting period. There can be no assurance that the LRMP will achieve its objectives in the future. Please refer to the Fund’s Prospectus for more information regarding the Fund’s exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

IMAN FUND

ADDITIONAL INFORMATION (Unaudited)

May 31, 2024

Proxy Voting Policies and Procedures (Unaudited)

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (877) 417-6161 or by accessing the Fund’s website at http://www.investaaa.com. Furthermore, you can obtain the description on the SEC’s website at http://www.sec.gov.

Proxy Voting Record (Unaudited)

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling (877) 417-6161. Furthermore, you can obtain the Fund’s proxy voting records on the SEC’s website at http://www.sec.gov.

Availability of Quarterly Portfolio Schedule (Unaudited)

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PRIVACY POLICY

In the course of servicing your account, we collect the following nonpublic personal information about you:

| | • | Information we receive from you on or in applications or other forms, correspondence, or conversations, including, but not limited to, your name, address, phone number, social security number, assets, income and date of birth; and |

| | | |

| | • | Information about your transactions with us, our affiliates, or others, including, but not limited to, your account number and balance, parties to transactions, cost basis information, and other financial information. |

| | | |

| | • | Information collected from our website (including from the use of “cookies”). |

We do not disclose any nonpublic personal information about our current or former shareholders to nonaffiliated third parties, except as permitted by law. For example, we are permitted by law to disclose all of the information we collect, as described above, to our transfer agent to process your transactions. Furthermore, we restrict access to your nonpublic personal information to those persons who require such information to provide products or services to you. We maintain physical, electronic, and procedural safeguards that comply with industry standards to guard your nonpublic personal information.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your financial intermediary shares nonpublic personal information with nonaffiliated third parties.

(This Page Intentionally Left Blank.)

INVESTMENT ADVISER

Allied Asset Advisors, Inc.

Hometown, Illinois

DISTRIBUTOR

Quasar Distributors, LLC

Milwaukee, Wisconsin

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

Milwaukee, Wisconsin

ADMINISTRATOR, TRANSFER AGENT,

AND FUND ACCOUNTANT

U.S. Bank Global Fund Services

Milwaukee, Wisconsin

CUSTODIAN

U.S. Bank, N.A.

Milwaukee, Wisconsin

LEGAL COUNSEL

Kirkland & Ellis LLP

Chicago, Illinois

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus. Quasar Distributors, LLC is the Distributor for the Fund.

Investment Advisor

AAA

Allied Asset Advisors, Inc.

8925 South Kostner Avenue

Hometown, IL 60456

(630) 789-0453

1-877-417-6161

www.investaaa.com

IF-ANNUAL524

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. The Registrant’s code of ethics is incorporated herein by reference to its form N-CSR filed on August 9, 2007.

Item 3. Audit Committee Financial Expert.

The Registrant’s board of trustees has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the Registrant believes that the experience provided by each member of the audit committee together offers the Registrant adequate oversight for the Registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

The Registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the Registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 5/31/2024 | FYE 5/31/2023 |

| ( a ) Audit Fees | 14,750 | 14,250 |

| ( b ) Audit-Related Fees | - | - |

| ( c ) Tax Fees | - | - |

| ( d ) All Other Fees | - | - |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre‑approve all audit and non‑audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 5/31/2024 | FYE 5/31/2023 |

Audit-Related Fees | 0% | 0% |

Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the Registrant’s accountant for services to the Registrant and to the Registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the Registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

Non-Audit Related Fees | FYE 5/31/2024 | FYE 5/31/2023 |

Registrant | - | - |

Registrant’s Investment Adviser | - | - |

( i ) Not applicable

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Allied Asset Advisors Funds

By (Signature and Title)* /s/Bassam Osman

Bassam Osman, President

Date July 26, 2024

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/Bassam Osman

Bassam Osman, President

Date July 26, 2024

By (Signature and Title)* /s/Salah Obeidallah

Salah Obeidallah, Treasurer

Date July 26, 2024

* Print the name and title of each signing officer under his or her signature.