UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09821

Allied Asset Advisors Funds

(Exact name of registrant as specified in charter)

8925 South Kostner Avenue

Hometown, IL 60456

(Address of principal executive offices) (Zip code)

Bassam Osman

Allied Asset Advisors Funds

8925 South Kostner Avenue

Hometown, IL 60456

(Name and address of agent for service)

(877) 417-6161

Registrant’s telephone number, including area code

Date of fiscal year end: May 31, 2024

Date of reporting period: November 30, 2024

Item 1. Reports to Stockholders.

(a)

| | |

| Iman Fund | |

| Class K | IMANX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Iman Fund for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://investaaa.com/literature/. You can also request this information by contacting us at 1-888-386-3785.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class K | $61 | 1.17% |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $205,573,698 |

Number of Holdings | 106 |

Portfolio Turnover | 15% |

Visit https://investaaa.com/literature/ for more recent performance information.

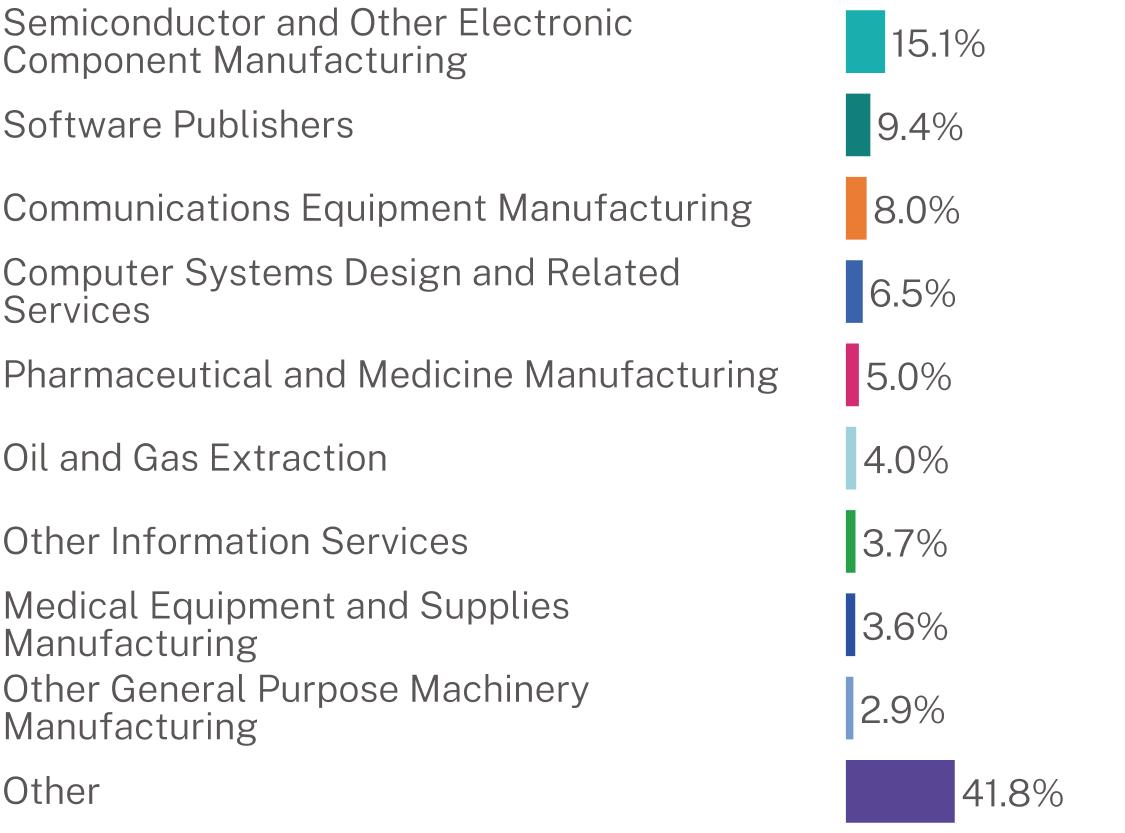

WHAT DID THE FUND INVEST IN? (as of November 30, 2024)

| |

Top 10 Issuers | (%) |

Apple, Inc. | 7.5% |

Microsoft Corp. | 6.4% |

NVIDIA Corp. | 5.7% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 4.5% |

Alphabet, Inc. | 4.3% |

Meta Platforms, Inc. | 3.7% |

Exxon Mobil Corp. | 3.0% |

O’Reilly Automotive, Inc. | 2.3% |

Novo Nordisk AS | 2.1% |

Texas Pacific Land Corp. | 2.0% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://investaaa.com/literature/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Allied Asset Advisors, Inc. documents not be householded, please contact Allied Asset Advisors, Inc. at 1-888-386-3785, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Allied Asset Advisors, Inc. or your financial intermediary.

| Iman Fund | PAGE 1 | TSR-SAR-018866103 |

15.19.48.06.55.04.03.73.62.941.8

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

(a)

TABLE OF CONTENTS

Iman Fund

Schedule of Investments

November 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 99.7%

| | | | | | |

Agriculture, Construction, and Mining Machinery Manu

facturing - 0.5%

| | | | | | |

Toro Co. | | | 10,900 | | | $949,172 |

Apparel Accessories and Other Apparel Manufacturing - 0.3%

| | | | | | |

Deckers Outdoor Corp.(a) | | | 2,910 | | | 570,244 |

Architectural, Engineering, and Related Services - 1.2%

| | | | | | |

Exponent, Inc. | | | 12,800 | | | 1,263,488 |

Simpson Manufacturing Co., Inc. | | | 6,760 | | | 1,273,584 |

| | | | | | 2,537,072 |

Automotive Parts, Accessories, and Tire Retailers - 2.3%

| | | | | | |

O’Reilly Automotive, Inc.(a) | | | 3,745 | | | 4,655,859 |

Bakeries and Tortilla Manufacturing - 0.1%

| |

J & J Snack Foods Corp. | | | 935 | | | 162,494 |

Basic Chemical Manufacturing - 1.9%

| | | | | | |

Linde PLC | | | 8,565 | | | 3,948,379 |

Building Equipment Contractors - 1.7%

| |

EMCOR Group, Inc. | | | 7,030 | | | 3,586,144 |

Clothing Stores - 2.3%

| | | | | | |

Boot Barn Holdings, Inc.(a) | | | 1,200 | | | 164,568 |

Lululemon Athletica, Inc.(a) | | | 750 | | | 240,495 |

Ross Stores, Inc. | | | 21,535 | | | 3,335,125 |

TJX Cos., Inc. | | | 7,600 | | | 955,244 |

| | | | | | 4,695,432 |

Communications Equipment Manufacturing - 8.0%

| | | | | | |

Apple, Inc. | | | 65,370 | | | 15,514,262 |

QUALCOMM, Inc. | | | 6,390 | | | 1,013,007 |

| | | | | | 16,527,269 |

Computer and Peripheral Equipment Manufacturing - 0.1%

| | | | | | |

Super Micro Computer, Inc.(a) | | | 6,700 | | | 218,688 |

Computer Systems Design and Related Services - 6.5%

| | | | | | |

Alphabet, Inc. - Class A | | | 41,350 | | | 6,986,082 |

Alphabet, Inc. - Class C | | | 10,585 | | | 1,804,637 |

EPAM Systems, Inc.(a) | | | 1,505 | | | 367,100 |

PDF Solutions, Inc.(a) | | | 5,700 | | | 180,120 |

SAP SE - ADR | | | 13,400 | | | 3,183,840 |

ServiceNow, Inc.(a) | | | 755 | | | 792,327 |

| | | | | | 13,314,106 |

| | | | | | | |

| | | | | | | |

Computing Infrastructure Providers, Data Processing, Web Hosting, and Related Services - 0.5%

| | | | | | |

Shopify, Inc. - Class A(a) | | | 8,500 | | | $982,600 |

Cut and Sew Apparel Manufacturing - 0.2%

| | | |

Cintas Corp. | | | 1,700 | | | 383,843 |

Drugs and Druggists’ Sundries Merchant Wholesalers - 1.2%

| | | | | | |

McKesson Corp. | | | 1,075 | | | 675,637 |

Roche Holding AG - ADR | | | 49,000 | | | 1,775,760 |

| | | | | | 2,451,397 |

Electric Power Generation,

Transmission and Distribution - 0.3%

| | | |

GE Vernova, Inc.(a) | | | 1,800 | | | 601,416 |

Footwear Manufacturing - 0.6%

| | | | | | |

NIKE, Inc. - Class B | | | 13,000 | | | 1,024,010 |

Skechers USA, Inc. - Class A(a) | | | 3,700 | | | 236,134 |

| | | | | | 1,260,144 |

Freight Transportation Arrangement - 0.3%

| | | |

Expeditors International of Washington, Inc. | | | 1,800 | | | 218,952 |

JB Hunt Transport Services, Inc. | | | 1,630 | | | 308,249 |

| | | | | | 527,201 |

General Freight Trucking - 0.2%

| | | | | | |

Old Dominion Freight Line, Inc. | | | 1,480 | | | 333,207 |

Household Appliance Manufacturing - 0.6%

| | | |

SharkNinja, Inc. | | | 13,000 | | | 1,307,150 |

Industrial Machinery Manufacturing - 2.8%

| | | |

Applied Materials, Inc. | | | 4,800 | | | 838,608 |

ASML Holding NV | | | 4,200 | | | 2,883,762 |

Axcelis Technologies, Inc.(a) | | | 1,700 | | | 126,208 |

Kadant, Inc. | | | 4,485 | | | 1,851,363 |

| | | | | | 5,699,941 |

Machinery, Equipment, and Supplies Merchant Wholesalers - 0.2%

| | | | | | |

Ferguson Enterprises, Inc. | | | 2,000 | | | 431,860 |

Medical Equipment and Supplies Manufacturing - 3.6%

| | | | | | |

Boston Scientific Corp.(a) | | | 10,000 | | | 906,600 |

Edwards Lifesciences Corp.(a) | | | 4,450 | | | 317,507 |

Intuitive Surgical, Inc.(a) | | | 1,480 | | | 802,160 |

Johnson & Johnson | | | 24,850 | | | 3,851,999 |

MSA Safety, Inc. | | | 6,535 | | | 1,135,848 |

ResMed, Inc. | | | 1,155 | | | 287,618 |

| | | | | | 7,301,732 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Iman Fund

Schedule of Investments

November 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Metal Ore Mining - 1.1%

| | | | | | |

Agnico Eagle Mines Ltd. | | | 14,400 | | | $1,215,648 |

Alamos Gold, Inc. - Class A | | | 58,000 | | | 1,091,560 |

| | | | | | 2,307,208 |

Miscellaneous Durable Goods Merchant Wholesalers - 2.5%

| | | | | | |

Pool Corp. | | | 7,357 | | | 2,774,251 |

Wheaton Precious Metals Corp. | | | 37,265 | | | 2,322,728 |

| | | | | | 5,096,979 |

Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers - 0.8%

| | | | | | |

Copart, Inc.(a) | | | 25,043 | | | 1,587,476 |

Motor Vehicle Manufacturing - 2.7%

| | | | | | |

Federal Signal Corp. | | | 19,500 | | | 1,899,495 |

Tesla, Inc.(a) | | | 10,620 | | | 3,665,599 |

| | | | | | 5,565,094 |

Navigational, Measuring, Electromedical, and Control Instruments Manufacturing - 1.8%

| | | | | | |

Danaher Corp. | | | 12,300 | | | 2,948,187 |

Transcat, Inc.(a) | | | 5,230 | | | 548,575 |

Veralto Corp. | | | 2,233 | | | 241,588 |

| | | | | | 3,738,350 |

Nursing Care Facilities (Skilled Nursing Facilities) - 0.1%

| | | | | | |

Ensign Group, Inc. | | | 1,000 | | | 146,210 |

Oil and Gas Extraction - 4.0%

| | | | | | |

BHP Group Ltd. - ADR | | | 27,100 | | | 1,426,815 |

EOG Resources, Inc. | | | 4,500 | | | 599,670 |

Exxon Mobil Corp. | | | 51,920 | | | 6,124,483 |

| | | | | | 8,150,968 |

Other Chemical Product and Preparation Manufacturing - 0.0%(b)

| |

Aspen Aerogels, Inc.(a) | | | 5,900 | | | 87,320 |

Other Fabricated Metal Product Manufacturing - 0.9%

| | | | | | |

Watts Water Technologies,

Inc. - Class A | | | 8,815 | | | 1,902,189 |

Other Financial Investment Activities - 0.1%

| |

Chemed Corp. | | | 400 | | | 228,956 |

Other General Purpose Machinery Manufacturing - 2.9%

| | | | | | |

Graco, Inc. | | | 38,700 | | | 3,524,796 |

Mettler-Toledo International, Inc.(a) | | | 740 | | | 925,888 |

Nordson Corp. | | | 6,125 | | | 1,598,564 |

| | | | | | 6,049,248 |

| | | | | | | |

| | | | | | | |

Other Information Services - 3.7%

| | | | | | |

Meta Platforms, Inc. - Class A | | | 13,100 | | | $7,523,592 |

Other Professional, Scientific, and Technical Services - 1.0%

| | | | | | |

Gartner, Inc.(a) | | | 2,270 | | | 1,175,701 |

IDEXX Laboratories, Inc.(a) | | | 1,965 | | | 828,739 |

| | | | | | 2,004,440 |

Petroleum and Coal Products Manufacturing - 1.5%

| | | | | | |

Chevron Corp. | | | 19,200 | | | 3,109,056 |

Pharmaceutical and Medicine Manufacturing - 5.0%

| | | | | | |

Abbott Laboratories | | | 16,300 | | | 1,935,951 |

Eli Lilly & Co. | | | 3,340 | | | 2,656,469 |

Novo Nordisk AS - ADR | | | 40,300 | | | 4,304,040 |

Regeneron Pharmaceuticals, Inc.(a) | | | 915 | | | 686,451 |

Vertex Pharmaceuticals, Inc.(a) | | | 1,300 | | | 608,569 |

| | | | | | 10,191,480 |

Plastics Product Manufacturing - 0.4%

| |

AZEK Co., Inc.(a) | | | 15,600 | | | 828,672 |

Residential Building Construction - 1.9%

| |

Lennar Corp. - Class A | | | 10,300 | | | 1,796,217 |

NVR, Inc.(a) | | | 235 | | | 2,170,361 |

| | | | | | 3,966,578 |

Restaurants and Other Eating Places - 0.2%

| |

Chipotle Mexican Grill, Inc.(a) | | | 5,750 | | | 353,740 |

Rubber Product Manufacturing - 1.0%

| |

West Pharmaceutical Services, Inc. | | | 6,535 | | | 2,128,319 |

Sawmills and Wood Preservation - 0.9%

| |

UFP Industries, Inc. | | | 13,900 | | | 1,889,010 |

Scientific Research and Development Services - 0.2%

| | | | | | |

Marvell Technology, Inc. | | | 5,000 | | | 463,450 |

Semiconductor and Other Electronic

Component Manufacturing - 15.1%

| | | |

Advanced Micro Devices, Inc.(a) | | | 8,700 | | | 1,193,422 |

Analog Devices, Inc. | | | 4,350 | | | 948,518 |

Broadcom, Inc. | | | 18,430 | | | 2,987,134 |

FormFactor, Inc.(a) | | | 16,700 | | | 669,002 |

Lam Research Corp. | | | 12,400 | | | 916,112 |

Micron Technology, Inc. | | | 11,200 | | | 1,097,040 |

Monolithic Power Systems, Inc. | | | 350 | | | 198,674 |

NVIDIA Corp. | | | 84,650 | | | 11,702,863 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 50,000 | | | 9,233,000 |

Texas Instruments, Inc. | | | 8,800 | | | 1,769,064 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Iman Fund

Schedule of Investments

November 30, 2024 (Unaudited)(Continued)

| | | | | | | | |

COMMON STOCKS - (Continued)

| |

Semiconductor and Other Electronic

Component Manufacturing - (Continued)

| | | |

Vertiv Holdings Co. - Class A | | | 1,540 | | | $196,504 | |

Vicor Corp.(a) | | | 4,100 | | | 218,161 | |

| | | | | | 31,129,494 | |

Services to Buildings and Dwellings - 0.1%

| |

Rollins, Inc. | | | 3,300 | | | 166,089 | |

Soap, Cleaning Compound, and Toilet Preparation Manufacturing - 1.8%

| | | | | | | |

Oil-Dri Corp. of America | | | 1,447 | | | 100,017 | |

Procter & Gamble Co. | | | 20,565 | | | 3,686,482 | |

| | | | | | 3,786,499 | |

Software Publishers - 9.4%

| | | | | | | |

Adobe, Inc.(a) | | | 1,915 | | | 988,006 | |

ANSYS, Inc.(a) | | | 1,325 | | | 465,207 | |

Cadence Design Systems, Inc.(a) | | | 1,470 | | | 451,011 | |

Microsoft Corp. | | | 31,180 | | | 13,203,483 | |

NEXTracker, Inc. - Class A(a) | | | 4,100 | | | 156,456 | |

Salesforce, Inc. | | | 9,070 | | | 2,993,009 | |

Tyler Technologies, Inc.(a) | | | 1,660 | | | 1,044,422 | |

| | | | | | 19,301,594 | |

Support Activities for Mining - 0.4%

| | | | | | | |

Rio Tinto PLC - ADR | | | 13,100 | | | 823,204 | |

Ventilation, Heating, Air-Conditioning,

and Commercial Refrigeration

Equipment Manufacturing - 1.9%

| | | | |

Lennox International, Inc. | | | 5,220 | | | 3,482,419 | |

Trane Technologies PLC | | | 1,260 | | | 524,437 | |

| | | | | | 4,006,856 | |

Warehousing and Storage - 0.9%

| | | | | | | |

Landstar System, Inc. | | | 10,000 | | | 1,859,200 | |

Water, Sewage and Other Systems - 2.0%

| | | | |

Texas Pacific Land Corp. | | | 2,565 | | | 4,104,231 | |

TOTAL COMMON STOCKS

(Cost $139,508,534) | | | | | | 204,940,852 | |

TOTAL INVESTMENTS - 99.7%

(Cost $139,508,534) | | | | | | $204,940,852 | |

Other Assets in Excess of

Liabilities - 0.3% | | | | | | 632,846 | |

TOTAL NET ASSETS - 100.0% | | | | | | $205,573,698 | |

| | | | | | | | |

Classifications are based on the North American Industry Classification System.

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

AS - Aksjeselskap

NV - Naamloze Vennootschap

PLC - Public Limited Company

SE - Societas Europeae

(a)

| Non-income producing security.

|

(b)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

IMAN FUND

Statement of Assets and Liabilities

November 30, 2024 (Unaudited)

| | | | |

Assets:

| | | |

Investments, at value (cost $139,508,534) | | | $204,940,852 |

Cash | | | 1,132,016 |

Receivable for capital shares sold | | | 7,531 |

Dividends receivable | | | 221,315 |

Other assets | | | 17,519 |

Total Assets | | | 206,319,233 |

Liabilities:

| | | |

Payable for investments purchased | | | 203,846 |

Payable to Adviser (Note 3) | | | 393,547 |

Payable for capital shares redeemed | | | 15,067 |

Payable for professional fees | | | 54,995 |

Payable for Trustee fees | | | 6,789 |

Accrued fund administration & fund accounting expense | | | 41,427 |

Accrued expenses and other liabilities | | | 29,864 |

Total liabilities | | | 745,535 |

Net Assets | | | $205,573,698 |

Net Assets Consist of:

| | | |

Paid-in capital | | | $143,155,978 |

Total distributable earnings | | | 62,417,720 |

Net assets | | | $205,573,698 |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 12,389,904 |

Net asset value, redemption price and offering price per share | | | $16.59 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

IMAN FUND

Statement of Operations

For the Period Ended November 30, 2024 (Unaudited)

| | | | |

Investment income:

| | | |

Dividend income (Net of foreign withholding tax of $22,519) | | | $889,475 |

Total investment income | | | 889,475 |

Expenses:

| | | |

Advisory fees (Note 3) | | | 882,881 |

Administration fees | | | 105,444 |

Transfer agent fees and expenses | | | 58,335 |

Fund accounting fees | | | 29,197 |

Legal fees | | | 27,847 |

Federal and state registration fees | | | 15,561 |

Custody fees | | | 10,809 |

Trustees’ fees and related expenses | | | 9,791 |

Audit fees | | | 7,409 |

Reports to shareholders | | | 4,049 |

Other expenses | | | 1,282 |

Total expenses | | | 1,152,605 |

Net investment loss | | | (263,130) |

Realized and unrealized gain (loss) on investments:

| | | |

Net realized gain from security transactions | | | 4,826,783 |

Change in net unrealized appreciation on investments | | | 12,232,194 |

Realized and unrealized gain on investments | | | 17,058,977 |

Net increase in net assets from operations | | | $16,795,847 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

IMAN FUND

STATEMENTS OF CHANGES IN NET ASSETS (Unaudited)

| | | | | | | |

FROM OPERATIONS:

| | | | | | |

Net investment loss | | | $(263,130) | | | $(371,104) |

Net realized gain on investments | | | 4,826,783 | | | 6,525,809 |

Change in net unrealized appreciation on investments | | | 12,232,194 | | | 34,230,749 |

Net increase in net assets from operations | | | 16,795,847 | | | 40,385,454 |

FROM DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Net decrease in net assets resulting from distributions paid | | | — | | | — |

FROM CAPITAL SHARE TRANSACTIONS:

| | | | | | |

Proceeds from sale of shares | | | 13,954,863 | | | 12,143,234 |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | — |

Payments for shares redeemed | | | (11,007,898) | | | (15,552,487) |

Net increase (decrease) in net assets from capital share transactions | | | 2,946,965 | | | (3,409,253) |

Total increase in net assets | | | 19,742,812 | | | 36,976,201 |

NET ASSETS:

| | | | | | |

Beginning of period | | | 185,830,886 | | | 148,854,685 |

End of period | | | $205,573,698 | | | $185,830,886 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

IMAN FUND

FINANCIAL HIGHLIGHTS

Per share data for a share outstanding throughout each year (Unaudited)

| | | | | | | |

Net asset value, beginning of period | | | $15.23 | | | $11.93 | | | $11.21 | | | $15.73 | | | $11.63 | | | $12.76 |

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.02) | | | (0.03) | | | (0.03) | | | (0.10) | | | (0.13) | | | (0.05) |

Net realized and unrealized gains (loss) on investments | | | 1.38 | | | 3.33 | | | 0.90 | | | (1.41) | | | 4.65 | | | 0.56 |

Total from investment operations | | | 1.36 | | | 3.30 | | | 0.87 | | | (1.51) | | | 4.52 | | | 0.51 |

LESS DISTRIBUTIONS PAID:

| | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | — | | | — | | | — | | | — | | | — |

From net realized gain on investments | | | — | | | — | | | (0.15) | | | (3.01) | | | (0.42) | | | (1.64) |

Total distributions paid | | | — | | | — | | | (0.15) | | | (3.01) | | | (0.42) | | | (1.64) |

Net asset value, end of year | | | $16.59 | | | $15.23 | | | $11.93 | | | $11.21 | | | $15.73 | | | $11.63 |

Total return (loss) | | | 8.93%(2) | | | 27.66% | | | 7.93% | | | (14.19)% | | | 38.85% | | | 2.50% |

Net assets at end of period (000’s) | | | $205,574 | | | $185,831 | | | $148,855 | | | $139,665 | | | $154,638 | | | $115,345 |

Ratio of expenses to average net assets | | | 1.17%(3) | | | 1.31% | | | 1.35% | | | 1.28% | | | 1.29% | | | 1.33% |

Ratio of net investment income (loss) to average net assets | | | −0.27%(3) | | | (0.24)% | | | (0.24)% | | | (0.77)% | | | (0.93)% | | | (0.40)% |

Portfolio turnover rate | | | 15.4%(2) | | | 25.1% | | | 71.9% | | | 114.5% | | | 106.6% | | | 95.4% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book to tax differences. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Unaudited)

1. ORGANIZATION

Allied Asset Advisors Funds (the “Trust”), an open-end management investment company, was organized as a Delaware statutory trust on January 14, 2000. The Trust currently offers one series of shares to investors, the Iman Fund (the “Fund”), a diversified series of the Trust. Allied Asset Advisors, Inc. (the “Adviser”), a Delaware corporation, serves as investment adviser to the Fund.

The Trust is authorized to issue an unlimited number of shares without par value, of each series. The Trust currently offers one class of shares of the Fund.

The Fund seeks growth of capital while adhering to Islamic principles. The Fund seeks to achieve its investment objective by investing in common stocks and equity-related securities of domestic and foreign issuers that meet Islamic principles and whose prices the Adviser anticipates will increase over the long term. Islamic principles generally preclude investments in certain businesses (e.g., alcohol, pornography and gambling) and investments in interest bearing debt obligations or businesses that derive interest income as their primary source of income. The Fund may invest in companies of all market capitalizations. Any uninvested cash will be held in non-interest bearing deposits or invested in a manner following Islamic principles. There can be no guarantee that the Fund will achieve its investment objective.

The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates: In preparing the financial statements in conformity with GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Security Valuation: Investment securities are carried at fair value determined using the following valuation methods:

| • | Equity securities listed on a U.S. securities exchange or NASDAQ for which market quotations are readily available are valued at the last quoted sale price on the valuation date. |

| • | Options, futures, unlisted U.S. securities and listed U.S. securities not traded on the valuation date for which market quotations are readily available are valued at the most recent quoted bid price. The Fund did not hold any such securities during the year ended November 30, 2024. |

| • | Securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Adviser under direction of the Board of Trustees. The Fund did not hold any such securities during the year ended November 30, 2024. |

The Fund has adopted fair valuation accounting standards which establish an authoritative definition of fair value and a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes.

TABLE OF CONTENTS

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Unaudited)(Continued)

Summary of Fair Value Exposure at November 30, 2024

The Trust has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 –

| Unadjusted quoted prices in active markets for identical securities the Fund has the ability to access. |

Level 2 –

| Other significant observable inputs (including quoted prices for similar securities in active markets, quoted prices for identical or similar instruments in markets that are not active, model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, interest rates, prepayment speeds, credit risk, etc.) |

Level 3 –

| Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Inputs that are used in determining a fair value of an investment may include price information, credit data, volatility statistics and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments and is affected by various factors such as the type of investment or similar investments in the marketplace. The inputs will be considered by the Adviser, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Adviser. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2024:

| | | | | | | | | | | | | |

Common Stocks | | | $ 204,940,852 | | | $ — | | | $ — | | | $ 204,940,852 |

Total* | | | $ 204,940,852 | | | $— | | | $— | | | $ 204,940,852 |

| | | | | | | | | | | | | |

*

| Additional information regarding the industry and/or geographical classification of these investments is disclosed in the Schedule of Investments. |

The Fund did not hold any investments during the year ended November 30, 2024 with significant unobservable inputs which would be classified as Level 3. The Fund did not hold any derivative instruments during the reporting period.

Foreign Securities: Investing in securities of foreign companies and foreign governments involves special risks and consideration not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. The Fund does not invest in securities of U.S. or foreign governments.

TABLE OF CONTENTS

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Unaudited)(Continued)

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, and the Fund intends to distribute all of its taxable income and net capital gains to shareholders. Therefore, no federal income tax provision is required.

As of and during the year ended May 31, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as other expenses in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The statute of limitations on the Fund’s tax returns remains open for the years ended May 31, 2021 through May 31, 2024.

As of May 31, 2024, the tax cost of investments and the components of distributable earnings/(accumulated losses) on a tax basis were as follows:

| | | | |

Cost of investments | | | $131,791,898 |

Gross tax unrealized appreciation | | | $57,756,914 |

Gross tax unrealized depreciation | | | (4,852,529) |

Net tax unrealized appreciation | | | 52,904,385 |

Other accumulated losses | | | (7,282,512) |

Total distributable earnings | | | $45,621,873 |

| | | | |

The difference between book basis and tax basis unrealized appreciation is attributable primarily to the tax deferral of losses relating to wash sale transactions.

At May 31, 2024, the Iman Fund had short-term tax basis capital losses of $3,949,255 and long-term tax basis capital losses of $3,241,755 which may be carried forward to offset future capital gains. To the extent that the Iman Fund may realize future net capital gains, those gains will be offset by any of its unused capital loss carryforwards. These losses do not expire.

During the 2024 fiscal year, the Iman Fund utilized $1,813,429 of long-term capital loss carryover and $4,716,966 of short-term capital loss carryover.

A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended May 31, 2024, the Fund deferred, on a tax basis, ordinary late year losses of $91,502, and did not defer any post-October capital losses.

Distributions to Shareholders: The Fund will distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

The tax character of distributions paid were as follows:

| | | | |

Ordinary income | | | $ — | | | $— |

Long-term capital gains | | | $— | | | $1,816,367 |

| | | | | | | |

Dividend income and distributions to shareholders are recorded on the ex-dividend date. The Fund may periodically make reclassifications among certain of its capital accounts to reflect the tax character of permanent book to tax differences related to the components of the Fund’s net assets. These reclassifications have no impact on the net assets or net asset value of the Fund.

For the fiscal year ended May 31, 2024, total distributable earnings was increased by $279,573 and paid-in capital was decreased by $(279,573) resulting from such reclassification. This reclassification was due to net operating losses.

TABLE OF CONTENTS

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Unaudited)(Continued)

Other: Investment transactions and shareholder transactions are accounted for on the trade date. Net realized gains and losses on securities are computed on the basis of specific security lot identification. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

The Fund reports net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

Subsequent Events: In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. For the period noted above, there were no such events or transactions.

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

The Trust has an Investment Advisory Agreement (the “Agreement”) with the Adviser, with whom certain officers and a Trustee of the Trust are affiliated, to furnish investment advisory services to the Fund. Under the terms of the Agreement, the Trust, on behalf of the Fund, compensates the Adviser for its management services at the annual rate of 1.00% of the Fund’s daily average net assets.

For the period ended November 30, 2024, the Fund had advisory expenses of $882,881 and as of November 30, 2024, the Fund had $393,547 payable to the Adviser.

North American Islamic Trust (“NAIT”) is the parent company of the Adviser. NAIT acts as a consultant for the Fund with respect to Shariah compliance matters. All fees for these services are paid by the Adviser outside of the Fund’s net assets. During the year ended May 31, 2024, the Board approved a Consulting Services Agreement between the Adviser and NAIT whereby the Adviser will allocate a portion of its management fee to NAIT for these consulting services.

The Adviser will waive a portion of its management fee for two years beginning on the date of effectiveness of the annual update to the Fund’s registration statement such that the Trust, on behalf of the Fund, will compensate the Adviser for its management services at the annual rate of 0.70% of the Fund’s daily average net assets (instead 1.00% as set forth in the investment advisory contract), and (ii) a Consulting Services Agreement, which provides that during the effective period of the Advisory Fee Waiver Agreement the Adviser will allocate a portion of the management fee received by the Adviser to the North American Islamic Trust (“NAIT”), the parent company of the Adviser, such that the Adviser will pay to NAIT an amount equal an annual rate of 0.10% of the Fund’s daily average net assets for NAIT’s consulting services to the Adviser regarding Shariah compliance matters for the Fund.

The Trust has a distribution agreement and a servicing agreement with Quasar Distributors, LLC (the “Distributor”), a subsidiary of ACA Global. Fees for such distribution services are paid to the Distributor by the Adviser.

TABLE OF CONTENTS

IMAN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Unaudited)(Continued)

4. CAPITAL SHARE TRANSACTIONS

Capital Share Transactions of the Fund for the period ended November 30, 2024, were as follows:

| | | | | | | |

Shares sold | | | $13,954,863 | | | 878,580 |

Shares reinvested | | | — | | | — |

Shares redeemed | | | (11,007,898) | | | (691,730) |

Net Increase | | | $2,946,965 | | | 186,850 |

Shares Outstanding

| | | | | | |

Beginning of period | | | | | | 12,203,054 |

End of period | | | | | | 12,389,904 |

| | | | | | | |

Capital Share Transactions of the Fund for the year ended May 31, 2024, were as follows:

| | | | | | | |

Shares sold | | | $12,143,234 | | | 912,214 |

Shares reinvested | | | — | | | — |

Shares redeemed | | | (15,552,487) | | | (1,183,842) |

Net Decrease | | | $(3,409,253) | | | (271,628) |

Shares Outstanding

| | | | | | |

Beginning of year | | | | | | 12,474,682 |

End of year | | | | | | 12,203,054 |

| | | | | | | |

5. Securities Transactions

During the period ended November 30, 2024, the cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $33,192,532 and $29,999,786, respectively. There were no purchases or sales of U.S. government securities for the Fund.

6. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940 (“1940 Act”). As of November 30, 2024, NAIT held 50.36% of the Fund.

TABLE OF CONTENTS

IMAN FUND

OTHER INFORMATION (Unaudited)

Tax Information

The Fund designates 0.00% of its ordinary income distribution for the year ended May 31, 2024 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

For the year ended May 31, 2024, 0.00% of the dividends paid from net ordinary income for the Fund qualifies for the dividends received deduction available to corporate shareholders.

For the year ended May 31, 2024, 0.00% of the percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C).

The Fund designates 0.00% of its ordinary income distributions for the year ended May 31, 2024 as interest-related dividends under Internal Revenue Code Section 871(k)(1)(C).

Liquidity Risk Management Program

Consistent with Rule 22e-4 under the Investment Company Act of 1940, the Fund has established a liquidity risk management program to manage “liquidity risk” (the “LRMP”). “Liquidity Risk” is defined as the risk that the Fund could not meet requests to redeem shares issued by a Fund without significant dilution of remaining investors’ interest in the Fund. The LRMP is overseen by the Program Administrator, a committee comprised of representatives of the Fund’s investment adviser and officers of the Fund. The Fund’s Board of Trustees has approved the designation of the Program Administrator to oversee the LRMP.

The LRMP’s principal objectives include supporting the Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that the Fund will be unable to meet its redemption obligations timely. The LRMP also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the Fund’s liquidity and the periodic classification and re-classification of the Fund’s investments into groupings that reflect the Program Administrator’s assessment of their relative liquidity under current market conditions.

During the period covered by the report, the Fund’s board discussed and determined in the October 2024 board meeting, that: (1) the LRMP continues to be reasonably designed to effectively assess and manage the Fund’s Liquidity Risk; and (2) the LRMP has been adequately and effectively implemented with respect to the Fund during the reporting period. There can be no assurance that the LRMP will achieve its objectives in the future. Please refer to the Fund’s Prospectus for more information regarding the Fund’s exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

TABLE OF CONTENTS

IMAN FUND

OTHER INFORMATION

November 30, 2024 (Unaudited)

PROXY VOTING POLICIES AND PROCEDURES

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (877) 417-6161 or by accessing the Fund’s website at http://www.investaaa.com. Furthermore, you can obtain the description on the SEC’s website at http://www.sec.gov.

PROXY VOTING RECORD

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling (877) 417-6161. Furthermore, you can obtain the Fund’s proxy voting records on the SEC’s website at http://www.sec.gov.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PRIVACY POLICY

In the course of servicing your account, we collect the following nonpublic personal information about you:

| • | Information we receive from you on or in applications or other forms, correspondence, or conversations, including, but not limited to, your name, address, phone number, social security number, assets, income and date of birth; and |

| • | Information about your transactions with us, our affiliates, or others, including, but not limited to, your account number and balance, parties to transactions, cost basis information, and other financial information. |

| • | Information collected from our website (including from the use of “cookies”). |

We do not disclose any nonpublic personal information about our current or former shareholders to nonaffiliated third parties, except as permitted by law. For example, we are permitted by law to disclose all of the information we collect, as described above, to our transfer agent to process your transactions. Furthermore, we restrict access to your nonpublic personal information to those persons who require such information to provide products or services to you. We maintain physical, electronic, and procedural safeguards that comply with industry standards to guard your nonpublic personal information.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your financial intermediary shares nonpublic personal information with nonaffiliated third parties.

TABLE OF CONTENTS

IMAN FUND

OTHER INFORMATION

Item 8 – Changes in and Disagreements with Accountants for Open-End Management Investment Companies November 30, 2024 (Unaudited)

There were no changes in or disagreements with accountants during the period covered by this report.

TABLE OF CONTENTS

IMAN FUND

OTHER INFORMATION

Item 9 – Proxy Disclosures for Open-End Management Investment Companies

November 30, 2024 (Unaudited)

There were no matters submitted to a vote of shareholders during the period covered by this report.

TABLE OF CONTENTS

IMAN FUND

OTHER INFORMATION

Item 10 – Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies

November 30, 2024 (Unaudited)

Included under Item 7a in the Financial Statements.

TABLE OF CONTENTS

IMAN FUND

OTHER INFORMATION

Item 11 – Statement Regarding Basis for Approval of Investment Advisory Contract

November 30, 2024 (Unaudited)

Not Applicable for the period covered by this report.

TABLE OF CONTENTS

INVESTMENT ADVISER

Allied Asset Advisors, Inc.

Hometown, Illinois

DISTRIBUTOR

Quasar Distributors, LLC

Portland, Maine

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

Milwaukee, Wisconsin

ADMINISTRATOR, TRANSFER AGENT,

AND FUND ACCOUNTANT

U.S. Bank Global Fund Services

Milwaukee, Wisconsin

CUSTODIAN

U.S. Bank, N.A.

Milwaukee, Wisconsin

LEGAL COUNSEL

Kirkland & Ellis LLP

Chicago, Illinois

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus. Quasar Distributors, LLC is the Distributor for the Fund.

(b) Financial Highlights are included within the financial statements filed under Item 7 of this Form.

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

See Item 7(a).

Item 9. Proxy Disclosure for Open-End Investment Companies.

See Item 7(a).

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

See Item 7(a).

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

See Item 7(a).

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

(a) The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider.

(b) There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable to open-end investment companies.

Item 19. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable |

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not Applicable

(3) A separate certification for each principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (5) | Change in the registrant’s independent public accountant. Not applicable to open-end investment companies |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | (Registrant) | Allied Asset Advisors Funds | |

| | By | /s/ Bassam Osman | |

| | | Bassam Osman, President | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Bassam Osman | |

| | | Bassam Osman, President | |

| | By | /s/ Salah Obeidallah | |

| | | Salah Obeidallah, Treasurer | |