Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

RPM similar filings

- 29 Oct 15 Other Events

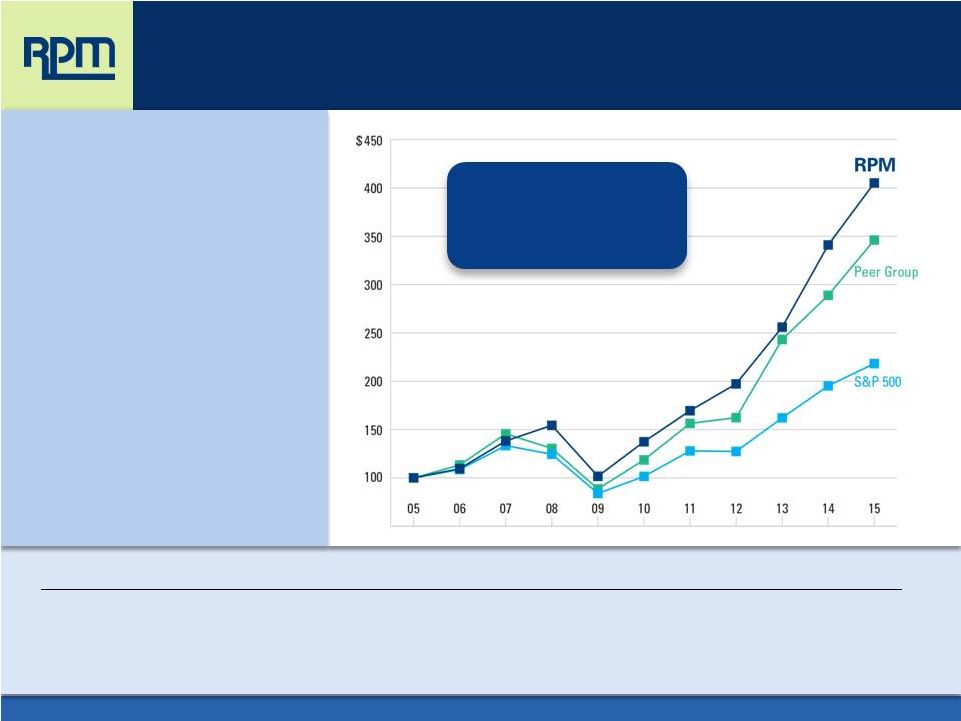

- 14 Oct 15 RPM Increases Cash Dividend For 42nd Consecutive Year

- 7 Oct 15 RPM Reports Fiscal 2016 First-quarter Results

- 27 Jul 15 RPM Reports Record Fourth-quarter

- 29 May 15 Entry into a Material Definitive Agreement

- 29 May 15 Entry into a Material Definitive Agreement

- 4 May 15 Changes in Registrant's Certifying Accountant

Filing view

External links