- RPM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

RPM International (RPM) DEF 14ADefinitive proxy

Filed: 26 Aug 20, 4:56pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | |

RPM INTERNATIONAL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

| Frank C. Sullivan |

| Chairman and Chief Executive Officer |

August 26, 2020

TO RPM INTERNATIONAL STOCKHOLDERS:

I would like to extend a personal invitation for you to participate in this year’s Annual Meeting of RPM Stockholders, which will be held in a virtual meeting format on Thursday, October 8, 2020 at 2:00 p.m., Eastern Daylight Time.

At this year’s Annual Meeting, you will vote (i) on the election of four Directors, (ii) in a non-binding, advisory capacity, on a proposal to approve our executive compensation, and (iii) on a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending May 31, 2021. We also look forward to giving you a report on the first quarter of our current fiscal year, which ends on August 31. As in the past, there will be a discussion of the Company’s business, during which time your questions and comments will be welcomed.

Due to the public health impact of the Covid-19 pandemic and to support the health and well-being of our stockholders, employees and their families, this year’s Annual Meeting will be held in a virtual meeting format only, through a live webcast. You will not be able to attend the Annual Meeting physically in person in light of public health concerns. You will be able to vote and submit questions by visiting www.virtualshareholdermeeting.com/RPM2020 and participating live in the webcast. A secure control number that will allow you to participate in the meeting electronically can be found on the enclosed proxy card.

All stockholders are cordially invited to participate in the Annual Meeting. Whether or not you plan to participate in the Annual Meeting virtually, the return of the enclosed Proxy as soon as possible would be greatly appreciated and will ensure that your shares will be represented at the Annual Meeting. If you do participate in the Annual Meeting virtually, you may, of course, withdraw your Proxy should you wish to vote during the Annual Meeting.

On behalf of the Directors and management of RPM, I would like to thank you for your continued support and confidence.

| Sincerely yours, |

|

| FRANK C. SULLIVAN |

2628 PEARL ROAD • P.O. BOX 777

MEDINA, OHIO 44258

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the Annual Meeting of Stockholders of RPM International Inc. will be on Thursday, October 8, 2020, at 2:00 p.m., Eastern Daylight Time, for the following purposes:

| (1) | To elect four Directors to serve in Class III of the Board; |

| (2) | To hold a non-binding, advisory vote to approve the Company’s executive compensation; |

| (3) | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2021; and |

| (4) | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Due to the public health impact of the Covid-19 pandemic and to support the health and well-being of our stockholders, employees and their families, this year’s Annual Meeting will be held in a virtual meeting format only, through a live webcast. Stockholders will not be able to attend the Annual Meeting physically in person in light of public health concerns. Stockholders will be able to vote and submit questions by visiting www.virtualshareholdermeeting.com/RPM2020 and participating live in the webcast. A secure control number that will allow you to participate in the meeting electronically can be found on the enclosed proxy card.

Holders of shares of Common Stock of record at the close of business on August 14, 2020 are entitled to receive notice of and to vote at the Annual Meeting.

By Order of the Board of Directors.

| EDWARD W. MOORE |

Secretary

|

August 26, 2020

Please fill in and sign the enclosed Proxy and return the Proxy

in the envelope enclosed herewith.

2628 PEARL ROAD • P.O. BOX 777

MEDINA, OHIO 44258

PROXY STATEMENT

Mailed on or about August 26, 2020

Annual Meeting of Stockholders to be held on October 8, 2020

This Proxy Statement is furnished in connection with the solicitation of Proxies by the Board of Directors of RPM International Inc. (the “Company” or “RPM”) to be used at the Annual Meeting of Stockholders of the Company to be held on October 8, 2020, and any adjournment or postponement thereof. The time, place and purposes of the Annual Meeting are stated in the Notice of Annual Meeting of Stockholders which accompanies this Proxy Statement.

The accompanying Proxy is solicited by the Board of Directors of the Company. All validly executed Proxies received by the Board of Directors of the Company pursuant to this solicitation will be voted at the Annual Meeting, and the directions contained in such Proxies will be followed in each instance. If no directions are given, the Proxy will be voted (i) FOR the election of the four nominees listed on the Proxy, (ii) FOR Proposal Two relating to the advisory vote on executive compensation and (iii) FOR ratifying the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending May 31, 2021.

Any person giving a Proxy pursuant to this solicitation may revoke it. A stockholder, without affecting any vote previously taken, may revoke a Proxy by giving notice to the Company in writing, in open meeting or by a duly executed Proxy bearing a later date.

The expense of soliciting Proxies, including the cost of preparing, assembling and mailing the Notice, Proxy Statement and Proxy, will be borne by the Company. The Company may pay persons holding shares for others their expenses for sending proxy materials to their principals. In addition to solicitation of Proxies by mail, the Company’s Directors, officers and employees, without additional compensation, may solicit Proxies by telephone, electronic means and personal interview. Also, the Company has engaged a professional proxy solicitation firm, Innisfree M&A Incorporated (“Innisfree”), to assist it in soliciting proxies. The Company will pay a fee of approximately $15,000, plus expenses, to Innisfree for these services.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on October 8, 2020: Proxy materials for the Company’s Annual Meeting, including the 2020 Annual Report on Form 10-K and this Proxy Statement, are now available over the Internet by accessing the Investor Information section of our website at www.rpminc.com. To access the proxy materials over the Internet or to request an additional printed copy, go to www.rpminc.com. You also can obtain a printed copy of this Proxy Statement, free of charge, by writing to: RPM International Inc., c/o Secretary, 2628 Pearl Road, P.O. Box 777, Medina, Ohio 44258.

| 1 |

This summary highlights information contained elsewhere in this Proxy Statement and in the Company’s Annual Report on Form 10-K. For more complete information about these topics, please review the Company’s complete Proxy Statement and Annual Report on Form 10-K.

RPM International Inc.

RPM International Inc. owns subsidiaries that are world leaders in specialty coatings, sealants, building materials and related services. The Company operates across four reportable segments: consumer, construction products, performance coatings and specialty products. RPM has a diverse portfolio with hundreds of market-leading brands, including Rust-Oleum, DAP, Zinsser, Varathane, Day-Glo, Legend Brands, Stonhard, Carboline, Tremco and Dryvit. From homes and workplaces, to infrastructure and precious landmarks, RPM’s brands are trusted by consumers and professionals alike to help build a better world. The Company employs approximately 14,600 individuals worldwide.

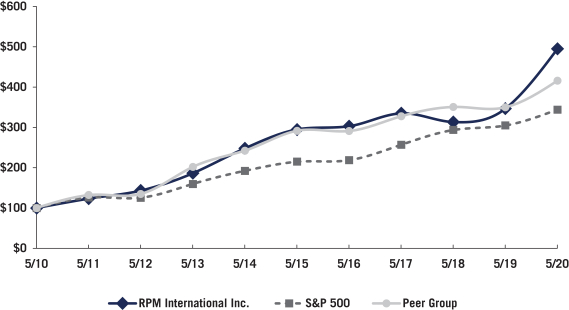

The Company’s consolidated net sales, net income, and diluted earnings per share for the fiscal year ended May 31, 2020 were as follows:

| • | Consolidated net sales decreased 1.0% to a $5.51 billion in fiscal 2020 from $5.56 billion in fiscal 2019; |

| • | Net income attributable to RPM International Inc. stockholders increased 14.2% to $304.4 million in fiscal 2020 from $266.6 million in fiscal 2019; and |

| • | Diluted earnings per share increased 16.4% to $2.34 in fiscal 2020 from $2.01 in fiscal 2019 (adjusted diluted earnings per share* increased 13.3% to $3.07 in fiscal 2020 from $2.71 in fiscal 2019). |

| * | See Appendix A for information about how we calculated adjusted diluted earnings per share for fiscal 2020 and fiscal 2019. The Compensation Committee considered our fiscal 2020 operating results, including our adjusted diluted earnings per share, in connection with its compensation decisions. |

Dividend

On October 3, 2019, the Board of Directors increased the quarterly dividend on shares of the Company’s Common Stock to $0.36 per share, an increase of 2.9% from the prior year and the highest ever paid by the Company. With a 46-year track record of a continuously increasing cash dividend, the Company is in an elite category of less than one-half of one percent of all publicly traded U.S. companies to have increased the dividend for this period of time or longer, according to the 2020 edition of the Mergent Handbook of Dividend Achievers. During this timeframe, the Company has returned approximately $2.6 billion in cash dividends to its stockholders.

MAP to Growth Operating Improvement Plan Remains on Track

The Company remains on track to reach its targeted $290 million in annualized savings over the course of its MAP to Growth. As part of the MAP to Growth, the Company’s MS-168 manufacturing system, which focuses on continuous improvement, continued to be implemented at the Company’s plants around the world, allowing the Company to produce better products more quickly, cost effectively and sustainably. The Company’s efforts to centralize procurement provided greater control over the Company’s supply chain, enabling the Company to obtain certain raw materials at better price points. The Company also made great strides in streamlining its administrative functions and consolidating its many information technology platforms. Additionally, the Company has closed 22 out of the 31 plants that were originally targeted for consolidation at the start of the MAP to Growth program.

Corporate Transactions

The Company acquired the following businesses and product lines with combined annualized sales of approximately $43 million during fiscal 2020:

| • | In June 2019, we acquired Schul International Co., LLC, a manufacturer of joint sealants for commercial construction, and Willseal LLC, a business that markets and sells Schul products. Both companies are headquartered in Hudson, New Hampshire, and have combined annual net sales of approximately $15 million. |

| • | In November 2019, we acquired Logiball, Inc., a leading manufacturer of trenchless pipe rehabilitation equipment. Logiball is headquartered in Quebec, Canada, and has annual net sales of approximately $3 million. |

| • | In December 2019, we acquired Profile Food Ingredients, a manufacturer of dry stabilizer and emulsifier blends for the food industry. Profile Food Ingredients is headquartered in Elgin, Illinois, and has annual net sales of approximately $25 million. |

| 2 | ||

PROXY STATEMENT SUMMARY (CONTINUED)

Stock Repurchase Program

On January 8, 2008, the Board of Directors authorized a stock repurchase program under which the Company may repurchase shares of its Common Stock at management’s discretion. As announced on November 28, 2018, the Company’s goal is to return $1.0 billion in capital to stockholders by May 31, 2021 through share repurchases. On April 16, 2019, after taking into account share repurchases under the Company’s existing stock repurchase program to date, the Board of Directors authorized the repurchase of the remaining $600.0 million in value of Common Stock by May 31, 2021. As a result, the Company may repurchase shares from time to time in the open market or in private transactions at various times and in amounts and for prices that management deems appropriate, subject to insider trading rules and other securities law restrictions. The timing of purchases will depend upon prevailing market conditions, alternative uses of capital and other factors. The Company may limit or terminate the repurchase program at any time. During the fiscal year ended May 31, 2020, the Company repurchased 2,041,847 shares of Common Stock at a cost of approximately $125.0 million, or an average cost of $61.22 per share, under this program. During the fiscal year ended May 31, 2019, the Company repurchased 3,286,907 shares of Common Stock at a cost of approximately $200.2 million, or an average cost of $60.92 per share, under this program. During the fiscal year ended May 31, 2018, the Company did not repurchase any shares of Common Stock under this program. Given recent macroeconomic uncertainty resulting from the Covid-19 pandemic, the Company has suspended its stock repurchase program.

Adoption of Rooney Rule

In fiscal 2020, the Governance and Nominating Committee of the Board of Directors adopted the “Rooney Rule” under which the Governance and Nominating Committee set forth in its Charter its commitment to include, for the purposes of filling any vacancies on the Board of Directors, qualified candidates who reflect diverse backgrounds, including diversity of gender and ethnicity, in each search for new Directors.

Publication of Inaugural Environmental, Social and Governance (ESG) Report

In August 2020, the Company published its inaugural Environmental, Social and Governance (ESG) Report which, in addition to describing its corporate governance practices and some of its many employee programs and benefits, includes a description of the Company’s comprehensive materiality assessment of ESG topics that adheres to Global Reporting Initiative (GRI) Standards and SASB Standards: Chemical Sector. For more information, see the Company’s ESG Report at 2020ar.rpminc.com/ESG-report.

Termination of Rights Agreement

On August 17, 2018, the Company entered into an amendment to the Rights Agreement, dated as of April 21, 2009 (the “Rights Agreement”), that accelerated the termination date of the rights to purchase Common Stock (the “Rights”) under the Rights Agreement from May 11, 2019 to August 17, 2018. As a result of the amendment, the Rights Agreement and the related Rights terminated as of August 17, 2018.

Corporate Governance

The Company is committed to meeting high standards of ethical behavior, corporate governance and business conduct. This commitment has led the Company to implement the following practices:

| • | Board Independence – eleven of twelve Directors are independent under the Company’s Corporate Governance Guidelines and NYSE listing standards. All members of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee are independent. |

| • | Independent Directors Meetings – independent Directors meet in executive sessions each year in January, April and July, without management present. |

| • | Lead Director – one independent Director serves as Lead Director. |

| • | Majority Voting for Directors – in an uncontested election, any nominee for Director who receives more votes “withheld” from his or her election than votes “for” such election is expected to tender his or her resignation for prompt consideration by the Governance and Nominating Committee and by the Board of Directors. |

| • | Director Tenure – the average tenure of our independent Directors has decreased from 16.5 years for each independent Director in 2011 to 8.2 years as of May 31, 2020, and seven of our current independent Directors joined the Board of Directors since 2012. |

| • | Stock Ownership Guidelines for Directors and Executive Officers – the Company adopted stock ownership guidelines for Directors and executive officers in July 2012, and the Company increased the stock ownership guidelines for Directors in July 2014. Each of the Directors and executive officers satisfies the stock ownership guidelines or is within the grace period provided by the stock ownership guidelines to achieve compliance. |

| 3 |

PROXY STATEMENT SUMMARY (CONTINUED)

| • | Annual Board and Chief Executive Officer Self-Evaluations – each year, the Governance and Nominating Committee of the Board of Directors administers self-evaluations of the Board of Directors and its committees, and the Compensation Committee of the Board of Directors administers an evaluation of the Chief Executive Officer. |

| • | Hedging Transactions Prohibited – the Company’s insider trading policy prohibits short sales and hedging transactions of shares of the Company’s Common Stock by Directors, officers and employees. |

| • | Pledging Prohibited – the Company’s insider trading policy was amended in fiscal 2017 to provide that, effective as of June 1, 2017, pledging of shares of the Company’s Common Stock by Directors, officers and employees is prohibited, subject to limited exceptions. |

| • | Performance-Based Compensation – the Company relies heavily on performance-based compensation for executive officers, including awards of performance-based restricted stock. |

| • | Double-Trigger Vesting Provisions – the 2014 Omnibus Plan provides double-trigger vesting provisions for long-term equity awards. |

| • | Clawback Policy – the Board of Directors may require reimbursement of certain bonuses or incentive compensation awarded to an executive officer if, as the result of that executive officer’s misconduct, the Company is required to restate all or a portion of its financial statements. |

| • | Chief Executive Officer Succession Planning – the Company’s succession plan, which the Board of Directors reviews annually, addresses both an unexpected loss of the Chief Executive Officer as well as longer-term succession. |

| • | The Values & Expectations of 168 – the Company’s code of business conduct and ethics, entitled “The Values & Expectations of 168,” emphasizes individual responsibility and accountability, encourages reporting and dialogue about ethics concerns, and focuses on the Company’s core principles of integrity, commitment, responsible entrepreneurship and moral courage. |

| • | Statement of Governance Policy – the Board of Directors adopted our Statement of Governance Policy in 2016, which recognizes that conducting our business in conformity with The Values & Expectations of 168 is essential to advancing our fundamental objective of building long-term stockholder value. |

See also “Information Regarding Meetings and Committees of the Board of Directors” at page 17 for further information on the Company’s governance practices. Additional information about our majority voting policy appears under the caption “Voting Rights” on page 7.

RPM INTERNATIONAL INC.

STATEMENT OF GOVERNANCE POLICY

RPM International’s fundamental objective is to build long-term stockholder value by profitably growing our businesses and consistently delivering strong financial performance. We think that our ability to generate value for our stockholders is inextricably linked to our ability to provide value to our principal stakeholders, including our customers and associates.

| • | We must continue to earn the ongoing commitment and trust of our stockholders by delivering the solid returns expected by them from an investment in RPM. |

| • | We must continue to offer our customers innovative, high-quality products and services at competitive prices. |

| • | We must attract and retain high-quality associates at every level of our organization, provide them with the tools they need to do their jobs, and compensate them in such a way as to closely align their interests with our long-term success. |

| • | We must conduct our business in conformity with The Values & Expectations of 168, which encompass complying with all legal and ethical standards, and working to be exemplary corporate citizens of the communities in which we work. |

We do not focus narrowly on efforts to maximize the short-term price of our stock, and think that such an approach is fundamentally misguided. Instead, we believe that emphasizing consistent value creation in our businesses will maximize the long-term value of our stockholders’ investment.

In short, we manage our businesses to create wealth for our stockholders. Creating value for our other stakeholders is how we have achieved, and will continue to achieve, that objective.

| 4 | ||

PROXY STATEMENT SUMMARY (CONTINUED)

Enterprise-Wide Risk Oversight

The Board of Directors, assisted by its committees, oversees management’s enterprise-wide risk management activities. Risk management activities include assessing and taking actions necessary to manage risk incurred in connection with the long-term strategic direction and operation of the Company’s business. See “Information Regarding Meetings and Committees of the Board of Directors – Role in Risk Oversight” for further information.

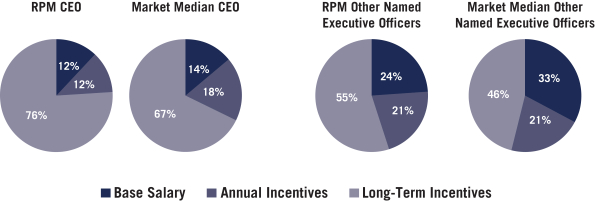

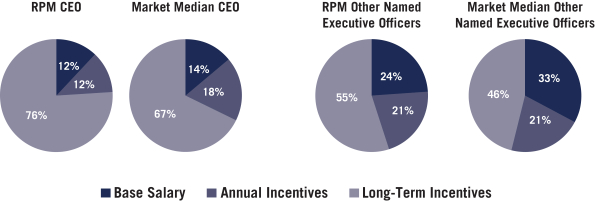

Executive Compensation

The Company’s executive compensation program utilizes a mix of base salary, annual and long-term cash incentives, equity awards and standard benefits to attract and retain highly qualified executives and maintain a strong relationship between executive pay and Company performance. Ninety-four percent (94%) of the votes cast on the “say-on-pay” proposal last year were voted in support of the compensation of our named executive officers set forth in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables and narratives in last year’s Proxy Statement. The Compensation Committee will continue to consider results from future stockholder advisory votes, as well as input from its stockholders between meetings, in its ongoing evaluation of the Company’s executive compensation programs and practices.

Overall Compensation Program Principles

Pay for performance – The Company’s general compensation philosophy is performance-based in that the Company’s executive officers should be well compensated for achieving strong operating and financial results. The Company engages in a rigorous process intended to provide its executive officers a fair level of compensation that reflects the Company’s positive operating financial results, the relative skills and experience of the individuals involved, peer group compensation levels and other similar benchmarks.

Compensation weighted toward at-risk pay – The mix of compensation of the Company’s named executive officers is weighted toward at-risk pay (consisting of cash and equity compensation). Maintaining this pay mix results in a pay-for-performance orientation, which aligns to the Company’s compensation philosophy of paying total direct compensation that is competitive with peer group levels based on relative company performance. For fiscal 2020, 55% of the amounts of the principal compensation components for our named executive officers in the aggregate was variable and tied to our performance.

Compensation Benchmark Study – In 2020, the Compensation Committee retained the professional consulting firm of Willis Towers Watson to conduct an executive compensation benchmark study. Based on its analysis and findings, Willis Towers Watson concluded that our Chief Executive Officer’s actual total direct compensation was competitive with the market median and that, overall, our named executive officers’ salaries and total cash compensation are generally at or below the market median, and that their long-term incentives and total direct compensation are generally at or above the market median.

| 5 |

PROXY STATEMENT SUMMARY (CONTINUED)

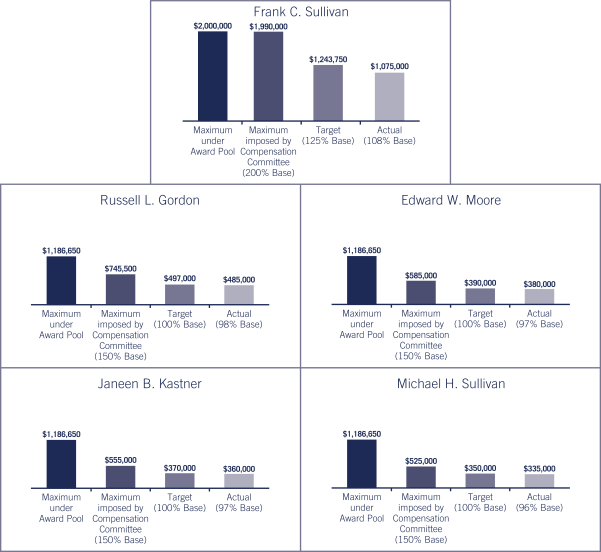

Summary of Compensation Paid to Frank C. Sullivan, the Company’s Chief Executive Officer, in Fiscal 2020

| • | Base salary – $995,000, which was 2.1% above his fiscal 2019 base salary1. |

| • | Annual cash incentive compensation – Annual cash incentive compensation of $1,075,000, which was $100,000 more than his fiscal 2019 annual cash incentive compensation. |

| • | Equity compensation – Stock appreciation rights (“SARs”) with 200,000 shares of Common Stock underlying the award, 18,000 Performance Earned Restricted Stock (“PERS”), and no shares of supplemental executive retirement plan (“SERP”) restricted stock. |

| • | Other compensation – Matching contribution of $11,400 under the Company’s 401(k); automobile allowance of $28,006; and life insurance premiums of $138,717. |

Stockholder Actions

Proposal One – Election of Directors (see pages 10–16)

The Board of Directors has nominated four candidates for election to serve in Class III of the Board. The Board recommends that stockholders vote FOR the election of each nominee.

Proposal Two – Advisory Vote to Approve the Company’s Executive Compensation (see pages 23–24)

The Board of Directors is seeking an advisory vote to approve the Company’s executive compensation. Before considering this proposal, please read the Compensation Discussion and Analysis in this Proxy Statement, which explains the Compensation Committee’s compensation decisions and how the Company’s executive compensation program aligns the interests of the executive officers with those of the Company’s stockholders. Although the vote is advisory and is not binding on the Board of Directors, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions. The Board recommends that stockholders vote FOR the approval of the Company’s executive compensation.

Proposal Three – Ratification of Appointment of Independent Registered Public Accounting Firm (see page 56)

The Audit Committee has appointed Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2021. The Board of Directors is seeking stockholder ratification of this appointment. The Board recommends that stockholders vote FOR ratification of the selection of Deloitte & Touche LLP.

VIRTUAL ANNUAL MEETING INFORMATION

This year, the Company will be hosting a virtual Annual Meeting. Stockholders will be able to participate in the Annual Meeting online, in virtual meeting format only, via live webcast. Provided below is the summary of the information that you will need to participate in the Annual Meeting:

| • | Stockholders can participate in the Annual Meeting online, in virtual meeting format only, via live webcast over the Internet at www.virtualshareholdermeeting.com/RPM2020. |

| • | You will need your unique control number, which is provided on your proxy card, to vote and submit questions during the Annual Meeting webcast. |

| • | The webcast of the Annual Meeting will begin at 2:00 p.m., Eastern Daylight Time. |

| • | Instructions as to how to participate via the Internet, including how to verify stock ownership, are available at www.virtualshareholdermeeting.com/RPM2020. |

| • | If you have questions regarding how vote your shares of Common Stock, you may call Innisfree M&A Incorporated, at (888) 750-5834 (Toll Free). |

| • | Replay of the Annual Meeting webcast will be available until October 7, 2021. |

| 1 | Effective May 1, 2020, Frank C. Sullivan’s base pay was temporarily reduced to $696,500 in response to the effects of the Covid-19 pandemic. Frank C. Sullivan’s base pay rate will be reinstated at September 1, 2020. |

| 6 | ||

The record date for determination of stockholders entitled to vote at the Annual Meeting was the close of business on August 14, 2020 (the “Record Date”). On that date, the Company had 129,972,127 shares of Common Stock, par value $0.01 per share (the “Common Stock”), outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote.

At the Annual Meeting, in accordance with the General Corporation Law of the State of Delaware and the Company’s Amended and Restated By-Laws (the “By-Laws”), the inspectors of election appointed by the Board of Directors for the Annual Meeting will determine the presence of a quorum and will tabulate the results of stockholder voting. As provided by the General Corporation Law of the State of Delaware and the By-Laws, holders of shares entitling them to exercise a majority of the voting power of the Company, present in person or by proxy at the Annual Meeting, will constitute a quorum for such meeting. Under applicable Delaware law, if a broker returns a Proxy and has not voted on a certain proposal (generally referred to as a “broker non-vote”), such broker non-votes will count for purposes of determining a quorum. The shares represented at the Annual Meeting by Proxies which are marked “withheld” with respect to the election of Directors will be counted as shares present for the purpose of determining whether a quorum is present.

Under the rules of the New York Stock Exchange, if you are the beneficial owner of shares held in street name and do not provide the bank, broker or other intermediary that holds your shares with specific voting instructions, that bank, broker or other intermediary may generally vote on routine matters but cannot vote on non-routine matters. Proposals One and Two are considered non-routine matters. Unless you instruct the bank, broker or other intermediary that holds your shares to vote on Proposals One and Two, no votes will be cast on your behalf with respect to those proposals. Therefore, it is important that you instruct the bank, broker or other intermediary to cast your vote if you want it to count on Proposals One and Two. Proposal Three is considered a routine matter and, therefore, broker non-votes are not expected to exist on Proposal Three.

For Proposal One, nominees for election as Directors who receive the greatest number of votes will be elected Directors. The General Corporation Law of the State of Delaware provides that stockholders cannot elect Directors by cumulative voting unless a company’s certificate of incorporation so provides. The Company’s Amended and Restated Certificate of Incorporation (the “Certificate”) does not provide for cumulative voting.

Our Corporate Governance Guidelines include a majority voting policy, which sets forth our procedures if a Director-nominee is elected but receives a majority of “withheld” votes. In an uncontested election, the Board of Directors expects any nominee for Director who receives a greater number of votes “withheld” from his or her election than votes “for” such election to tender his or her resignation following certification of the stockholder vote. The Board of Directors shall fill Board vacancies and shall nominate for election or re-election as Director only candidates who agree to tender their resignations in such circumstances. The Governance and Nominating Committee will act on an expedited basis to determine whether to accept a Director’s resignation tendered in accordance with the policy and will make recommendations to the Board of Directors for its prompt consideration with respect to any such letter of resignation. For the full details of our majority voting policy, which is part of our Corporate Governance Guidelines, please see our Corporate Governance Guidelines on our website at www.rpminc.com.

Proposals Two and Three will be decided by the vote of the holders of a majority of the shares entitled to vote thereon present in person or by proxy at the Annual Meeting. In voting for Proposals Two and Three, votes may be cast in favor, against or abstained. Abstentions will count as present for purposes of the items on which the abstention is noted and will have the effect of a vote against the proposal. Broker non-votes, however, are not counted as present for purposes of determining whether a proposal has been approved and will have no effect on the outcome of such proposal.

Pursuant to the By-Laws, any other matters brought before the Annual Meeting will be decided, unless otherwise provided by law or by the Certificate, by the vote of the holders of a majority of the shares entitled to vote thereon present in person or by proxy at the Annual Meeting. In voting on such other matters, votes may be cast in favor, against or abstained. Abstentions will count as present for purposes of the items on which the abstention is noted and will have the effect of a vote against any such matter. Broker non-votes, however, are not counted as present for purposes of determining whether any such matter has been approved and will have no effect on the outcome of such matter.

If you have any questions or need any assistance in voting your shares of Common Stock, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated

(888) 750-5834 (Toll Free)

| 7 |

The following table sets forth the beneficial ownership of shares of Common Stock as of May 31, 2020, unless otherwise indicated, by (i) each person or group known by the Company to own beneficially more than 5% of the outstanding shares of Common Stock, (ii) each Director and nominee for election as a Director of the Company, (iii) each executive officer named in the Executive Compensation tables in this Proxy Statement and (iv) all Directors and executive officers as a group. All information with respect to beneficial ownership of Directors, Director nominees and executive officers has been furnished by the respective Director, nominee for election as a Director, or executive officer, as the case may be. Unless otherwise indicated below, each person named below has sole voting and investment power with respect to the number of shares set forth opposite his or her name. The address of each Director nominee, Director and executive officer is 2628 Pearl Road, P.O. Box 777, Medina, Ohio 44258.

| Name of Beneficial Owner | Number of Shares of Common Stock Beneficially | Percentage of Shares of Common Stock(1) | ||||||

The Vanguard Group(2)

| 13,673,351 | 10.5 | ||||||

BlackRock, Inc.(3)

| 12,412,978 | 9.6 | ||||||

T. Rowe Price Associates, Inc.(4)

| 11,677,901 | 9.0 | ||||||

State Street Corporation(5)

| 6,737,866 | 5.2 | ||||||

Kirkland B. Andrews(6)

| 5,900 | * | ||||||

John M. Ballbach(7)

| 13,680 | * | ||||||

Bruce A. Carbonari(8)

| 36,521 | * | ||||||

David A. Daberko(9)

| 18,181 | * | ||||||

Jenniffer D. Deckard(10)

| 9,624 | * | ||||||

Salvatore D. Fazzolari(11)

| 14,242 | * | ||||||

Russell L. Gordon(12)

| 178,718 | 0.1 | ||||||

Thomas S. Gross(13)

| 16,668 | * | ||||||

Janeen B. Kastner(14)

| 118,798 | * | ||||||

Julie A. Lagacy(15)

| 6,050 | * | ||||||

Robert A. Livingston(16)

| 11,050 | * | ||||||

Edward W. Moore(17)

| 57,947 | * | ||||||

Frederick R. Nance(18)

| 18,097 | * | ||||||

Frank C. Sullivan(19)

| 1,466,224 | 1.1 | ||||||

Michael H. Sullivan(20)

| 0 | * | ||||||

William B. Summers, Jr.(21)

| 40,967 | * | ||||||

All Directors and executive officers as a group (eighteen persons including the Directors, Director nominees and executive officers named above)(22)

| 2,161,962 | 1.6 | ||||||

| * | Less than 0.1%. |

| (1) | In accordance with Securities and Exchange Commission (“Commission”) rules, each beneficial owner’s holdings have been calculated assuming full exercise of outstanding options covering Common Stock, if any, exercisable by such owner within 60 days after May 31, 2020, but no exercise of outstanding options covering Common Stock held by any other person. |

| (2) | According to an amended Schedule 13G filed with the Commission on February 12, 2020, The Vanguard Group (“Vanguard”), as of December 31, 2019, has sole voting power over 102,066 shares of Common Stock, shared voting power, with Vanguard Fiduciary Trust Company (“VFTC”) and Vanguard Investments Australia, Ltd. (“VIA”), wholly-owned subsidiaries of Vanguard, over 17,832 shares of Common Stock, sole dispositive power over 13,673,351 shares of Common Stock, and shared dispositive power, with VFTC and VIA, over 96,359 shares of Common Stock shown in the table above. Vanguard is located at 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (3) | According to an amended Schedule 13G filed with the Commission on February 6, 2020, BlackRock, Inc., together with its subsidiaries BlackRock Life Limited, BlackRock International Limited, BlackRock Advisors, LLC, BlackRock (Netherlands) B.V., BlackRock Fund Advisors, BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Ltd., BlackRock Asset Management Canada Limited, BlackRock (Luxembourg) S.A., BlackRock Investment Management (Australia) Limited, BlackRock Advisors (UK) Limited, BlackRock Asset Management North Asia Limited and BlackRock Fund Managers Ltd (together, “BlackRock”), as of December 31, 2019, has sole voting power over 11,683,992 shares of Common Stock, and sole dispositive power over the 12,412,978 shares of Common Stock shown in the table above. BlackRock is located at 55 East 52nd Street, New York, New York 10055. |

| 8 | ||

STOCK OWNERSHIP OF PRINCIPAL HOLDERS AND MANAGEMENT (CONTINUED)

| (4) | According to an amended Schedule 13G filed with the Commission on February 14, 2020, T. Rowe Price Associates, Inc., as of December 31, 2019, has sole voting power over 3,960,782 shares of Common Stock, and sole dispositive power over the 11,677,901 shares of Common Stock shown in the table above. T. Rowe Price Associates, Inc. is located at 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (5) | According to a Schedule 13G filed with the Commission on February 14, 2020, State Street Corporation, together with its subsidiaries SSGA Funds Management, Inc., State Street Global Advisors Limited (UK), State Street Global Advisors Ltd (Canada), State Street Global Advisors, Australia Limited, State Street Global Advisors Asia Ltd, State Street Global Advisors Singapore Ltd, State Street Global Advisors GmbH, State Street Global Advisors Ireland Limited and State Street Global Advisors Trust Company (together, “State Street”), as of December 31, 2019, has shared voting power over 6,218,769 shares of Common Stock, and shared dispositive power over the 6,737,866 shares of Common Stock shown in the table above. State Street is located at State Street Financial Center, One Lincoln Street, Boston, Massachusetts 02111. |

| (6) | Mr. Andrews is a Director of the Company. |

| (7) | Mr. Ballbach is a Director of the Company. |

| (8) | Mr. Carbonari is a Director of the Company. |

| (9) | Mr. Daberko is a Director of the Company. |

| (10) | Ms. Deckard is a Director of the Company. |

| (11) | Mr. Fazzolari is a Director of the Company. |

| (12) | Mr. Gordon is an executive officer of the Company. His ownership is comprised of 106,757 shares of Common Stock which he owns directly and 71,961 shares of Common Stock issuable under stock-settled stock appreciation rights currently exercisable or exercisable within 60 days of May 31, 2020. |

| (13) | Mr. Gross is a Director of the Company. |

| (14) | Ms. Kastner is an executive officer of the Company. Her ownership is comprised of 75,350 shares of Common Stock which she owns directly, 42,440 shares of Common Stock issuable under stock-settled stock appreciation rights currently exercisable or exercisable within 60 days of May 31, 2020, and approximately 1,008 shares of Common Stock held by Fidelity Management Trust Company, as trustee of the RPM International Inc. 401(k) Plan, which represents Ms. Kastner’s approximate percentage ownership of the total shares of Common Stock held in the RPM International Inc. 401(k) Plan as of May 31, 2020. |

| (15) | Ms. Lagacy is a Director of the Company. |

| (16) | Mr. Livingston is a Director of the Company. |

| (17) | Mr. Moore is an executive officer of the Company. His ownership is comprised of 49,790 shares of Common Stock which he owns directly and 8,157 shares of Common Stock issuable under stock-settled stock appreciation rights currently exercisable or exercisable within 60 days of May 31, 2020. |

| (18) | Mr. Nance is a Director of the Company. Mr. Nance pledged 5,569 of his shares of Common Stock prior to the Company amending its insider trading policy in fiscal 2017 to prohibit such practice, with limited exceptions. |

| (19) | Frank C. Sullivan is a Director and an executive officer of the Company. Frank C. Sullivan’s ownership is comprised of 904,770 shares of Common Stock which he owns directly, 3,000 shares of Common Stock which he holds as custodian for his son, 527,144 shares of Common Stock issuable under stock-settled stock appreciation rights currently exercisable or exercisable within 60 days of May 31, 2019, 2,000 shares of Common Stock which are held in a trust for the benefit of Frank C. Sullivan’s son, 15,000 shares of Common Stock held by a limited liability company of which Frank C. Sullivan is one-fifth owner and a managing member, 9,600 shares of Common Stock held in a trust for the benefit of Frank C. Sullivan, and approximately 4,710 shares of Common Stock held by Fidelity Management Trust Company, as trustee of the RPM International Inc. 401(k) Plan, which represents Frank C. Sullivan’s approximate percentage ownership of the total shares of Common Stock held in the RPM International Inc. 401(k) Plan as of May 31, 2020. Ownership of the shares of Common Stock held as custodian for his son and those held in a trust for the benefit of his son is attributed to Frank C. Sullivan pursuant to Commission rules. |

| (20) | Michael H. Sullivan is an executive officer of the Company. |

| (21) | Mr. Summers is a Director of the Company. |

| (22) | The number of shares of Common Stock shown as beneficially owned by the Directors, Director nominees and executive officers as a group on May 31, 2020 includes approximately 9,973 shares of Common Stock held by Fidelity Management Trust Company, as trustee of the RPM International Inc. 401(k) Plan, which represents the group’s approximate percentage ownership of the total shares of Common Stock held in the RPM International Inc. 401(k) Plan as of May 31, 2020. |

| 9 |

ELECTION OF DIRECTORS

The authorized number of Directors of the Company presently is fixed at 12, with the Board of Directors divided into three Classes. Currently, each Class has four Directors. The term of office of one Class of Directors expires each year, and at each Annual Meeting of Stockholders the successors to the Directors of the Class whose term is expiring at that time are elected to hold office for a term of three years.

The term of office of Class III of the Board of Directors expires at this year’s Annual Meeting. The term of office of the persons elected Directors in Class III at this year’s Annual Meeting will expire at the time of the Annual Meeting held in

2023. Each Director in Class III will serve until the expiration of such Director’s term or until his or her successor shall have been duly elected. The Board of Directors’ nominees for election as Directors in Class III are Julie A. Lagacy, Robert A. Livingston, Frederick R. Nance and William B. Summers, Jr. Ms. Lagacy and Messrs. Livingston, Nance and Summers currently serve as Directors in Class III.

Our Board of Directors unanimously recommends a vote FOR each of the nominees for Director named in this Proxy Statement for election to the Board of Directors.

The Proxy holders named in the accompanying Proxy or their substitutes will vote such Proxy at the Annual Meeting or any adjournment or postponement thereof for the election as Directors of the four nominees unless the stockholder instructs, by marking the appropriate space on the Proxy, that authority to vote is withheld. If any nominee should become unavailable for election (which contingency is not now contemplated or foreseen), it is intended that the shares represented by the Proxy will be voted for such substitute nominee as may be named by the Board of Directors. In no event will the accompanying Proxy be voted for more than four nominees or for persons other than those named below and any such substitute nominee for any of them.

| 10 | ||

PROPOSAL ONE (CONTINUED)

NOMINEES FOR ELECTION

| Julie A. Lagacy, age 53 – Director since 2017

Vice President of Global Information Services and Chief Information Officer, Caterpillar Inc. (NYSE: CAT). Caterpillar is a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives with 2019 sales and revenues of $53.8 billion. Ms. Lagacy joined Caterpillar in 1988, and served as Product and Commercial Manager from 1999 until 2004, Human Resources Manager from 2004 until 2006, Senior Business Resource Manager (Global Mining) from 2006 until 2012, and Chief Financial Officer (Global Mining) from 2012 until 2013. From 2013 until 2014, Ms. Lagacy served as Vice President (Financial Services Division), and became Vice President of Global Information Services and Chief Information Officer in 2014. Ms. Lagacy also serves on the board of the Illinois Cancer Care Charitable Foundation. She earned dual bachelor’s degrees in Management and Economics from Illinois State University, an M.B.A. degree from Bradley University, and is a Certified Management Accountant.

The Board of Directors has determined that Ms. Lagacy should serve as a Director because of her extensive executive management experience at Caterpillar. At Caterpillar, Ms. Lagacy deals with many of the major issues, such as financial, strategic, technology, cybersecurity, management development, acquisitions and capital allocation, that the Company deals with today. Specifically with regard to cybersecurity matters, Ms. Lagacy earned a Certificate in Cybersecurity Oversight from Carnegie Mellon University’s Software Engineering Institute. Also, with her extensive financial background, Ms. Lagacy is a financial expert for the Company’s Audit Committee. | |||

Shares of Common Stock beneficially owned: 6,050

| Nominee to Class III (term expiring in 2023) | |||

| Robert A. Livingston, age 66 – Director since 2017

Retired President and Chief Executive Officer, Dover Corporation, a $7.1 billion diversified manufacturer (NYSE: DOV). Mr. Livingston served as Dover’s President and Chief Executive Officer from 2008 until his retirement in 2018. Previously, he held positions with Dover business units Dover Engineered Systems, Inc. (as President and Chief Executive Officer) from 2007 until 2008, and Dover Electronics, Inc. (as President and Chief Executive Officer) from 2004 until 2007. Mr. Livingston was previously the President of Vectron International, Inc., a Dover business unit, from 2001 until 2004, and the Executive Vice President (from 1998 until 2001) and Vice President, Finance and Chief Financial Officer (from 1987 until 1998) of Dover Technologies, Inc. Prior to its acquisition by Dover in 1983, Mr. Livingston was Vice President, Finance of K&L Microwave, and continued to serve in that capacity until 1984, when he became Vice President and General Manager of K&L Microwave until 1987. Mr. Livingston was a director of Dover Corporation from 2008 until his retirement in 2018. Since December 2018, Mr. Livingston has been a director of Amphenol Corporation, a manufacturer of electrical and fiber optic connectors and interconnect systems (NYSE: APH), where he serves on Amphenol’s audit, compensation and executive committees. Mr. Livingston received his B.S. degree in business administration from Salisbury University.

The Board of Directors has determined that Mr. Livingston should serve as a Director because of his extensive executive management experience, including his service as President and Chief Executive Officer of Dover. In that position, Mr. Livingston dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. | |||

Shares of Common Stock beneficially owned: 11,050 | Nominee to Class III (term expiring 2023) | |||

| 11 |

PROPOSAL ONE (CONTINUED)

| Frederick R. Nance, age 66 – Director since 2007

Global Managing Partner of Squire Patton Boggs (US) LLP, Attorneys-at-law, Cleveland, Ohio, since 2017, where Mr. Nance is responsible for 36 offices in 16 countries. He received his B.A. degree from Harvard University and his J.D. degree from the University of Michigan. Mr. Nance joined Squire Patton Boggs directly from law school, became partner in 1987, served as the Managing Partner of the firm’s Cleveland office from 2002 until 2007, and served as the firm’s Regional Managing Partner from 2007 until 2017. Mr. Nance also served two four-year terms on the firm’s worldwide, seven-person Management Committee. In addition to his duties at Squire Patton Boggs, where he heads the firm’s U.S. Sports and Entertainment practice representing clients including LeBron James, Mr. Nance serves on the boards of the Greater Cleveland Partnership and the Cleveland Clinic, where he chairs the governance committee. In 2015, Mr. Nance was inducted into the Northeast Ohio Business Hall of Fame.

The Board of Directors has determined that Mr. Nance should serve as a Director primarily due to his significant legal background and global management experience. Mr. Nance’s background allows him to provide valuable insights to the Board of Directors, particularly in regard to corporate governance and risk issues that confront the Company. Mr. Nance also provides the Board of Directors a valuable perspective as a member of the boards of several prominent local non-profit organizations. | |||

Shares of Common Stock beneficially owned: 18,097 | Nominee to Class III (term expiring in 2023) | |||

| William B. Summers, Jr., age 70 – Director since 2004

Retired Chairman and Chief Executive Officer of McDonald Investments Inc., an investment banking and securities firm and a part of KeyBanc Capital Markets. Prior to his retirement, Mr. Summers served as Chairman of McDonald Investments Inc. from 2000 to 2006, and as its Chief Executive Officer from 1994 to 2000. From 1998 until 2000, Mr. Summers served as the Chairman of Key Capital Partners and an Executive Vice President of KeyCorp. Mr. Summers is a director of Integer Holdings Corporation, a medical device outsource manufacturer (NYSE: ITGR), and a member of the advisory board of Molded Fiber Glass Companies. From 2004 until 2011, Mr. Summers was a director of Developers Diversified Realty Corporation. Mr. Summers was previously a member of the NASDAQ Stock Market board of directors, and served as its chairman for two years. Mr. Summers is a trustee of Baldwin Wallace University, and serves on the board of the United States Army War College Foundation.

The Board of Directors has determined that Mr. Summers should serve as a Director because of his extensive executive management experience, including over 15 years of experience as Chairman and Chief Executive Officer of McDonald Investments Inc., service on the boards of both the New York Stock Exchange and National Association of Securities Dealers, and his experience serving as a director of other private and public companies. His experience enables Mr. Summers to provide keen insight and diverse perspectives on several critical areas impacting the Company, including capital markets, financial and external reporting, long-term strategic planning and business modeling. Mr. Summers also provides the Board of Directors a valuable perspective as a member of the boards of several prominent local non-profit organizations. | |||

Shares of Common Stock beneficially owned: 40,967 | Nominee to Class III (term expiring in 2023) | |||

| 12 | ||

PROPOSAL ONE (CONTINUED)

DIRECTORS WHOSE TERMS OF OFFICE WILL CONTINUE AFTER THE ANNUAL MEETING

| Kirkland B. Andrews, age 52 – Director since 2018

Executive Vice President and Chief Financial Officer of NRG Energy, Inc. (NYSE: NRG) since 2011. Since March 2020, Mr. Andrews has been a director of Evergy, Inc., a regulated utility holding company serving 1.6 million customers in Kansas and Missouri (NYSE: EVRG), where he is a member of the audit committee, the power delivery and safety committee, and the strategic review and operations committee. Mr. Andrews was a director of NRG Yield, Inc. from 2012 until 2018 (when NRG Yield, Inc. became Clearway Energy, Inc.), and also served as Executive Vice President, Chief Financial Officer of NRG Yield, Inc. from 2012 to 2016. Mr. Andrews has also served as Chief Financial Officer of GenOn Energy, Inc., a wholly-owned subsidiary of NRG, which filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in 2017. Prior to joining NRG, he served as Managing Director and Co-Head Investment Banking, Power and Utilities – Americas at Deutsche Bank Securities from 2009 to 2011. Prior to this, he served in several capacities at Citigroup Global Markets Inc., including Managing Director, Group Head, North American Power from 2007 to 2009, and Head of Power M&A, Mergers and Acquisitions from 2005 to 2007. In his banking career, Mr. Andrews led multiple large and innovative strategic, debt, equity and commodities transactions.

Mr. Andrews was initially appointed as a Director pursuant to the Cooperation Agreement, dated June 27, 2018, among the Company and Elliott Associates, L.P., Elliott International, L.P. and Elliott International Capital Advisors Inc. (the “Cooperation Agreement”) related to, among other things, appointment of additional Directors to the Board of Directors. The Board of Directors has determined that Mr. Andrews should serve as a Director because of his extensive executive management experience at NRG and his considerable financial background as NRG’s Executive Vice President and Chief Financial Officer. At NRG, Mr. Andrews deals with many of the major issues, such as financial, strategic, technology, management development, acquisitions and capital allocation, that the Company deals with today. Also, with his extensive financial background, Mr. Andrews is a financial expert for the Company’s Audit Committee. | |||

Shares of Common Stock beneficially owned: 5,900 | Director in Class I (term expiring in 2022)

| |||

| David A. Daberko, age 75 – Director since 2007

Retired Chairman of the Board and Chief Executive Officer, National City Corporation, now a part of PNC Financial Services Group, Inc. Mr. Daberko earned a bachelor’s degree from Denison University and a M.B.A. degree from the Weatherhead School of Management at Case Western Reserve University. He joined National City Bank in 1968. Mr. Daberko was elected Deputy Chairman of National City Corporation and President of National City Bank in Cleveland in 1987. He served as President and Chief Operating Officer of National City Corporation from 1993 until 1995. From 1995 until his retirement in 2007, Mr. Daberko served as Chairman and Chief Executive Officer of National City Corporation. Mr. Daberko retired in 2018 as lead director of Marathon Petroleum Corporation and as a director of MPLX GP LLC. He was formerly a director of Williams Partners L.P.

The Board of Directors has determined that Mr. Daberko should serve as a Director because of his extensive executive management experience, including 12 years as Chairman and Chief Executive Officer of National City Corporation. In that position, Mr. Daberko dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. His service on other boards of directors has given him exposure to different industries and approaches to governance and other key issues. | |||

Shares of Common Stock beneficially owned: 18,181 | Director in Class I (term expiring in 2022) | |||

| 13 |

PROPOSAL ONE (CONTINUED)

| Thomas S. Gross, age 66 – Director since 2012

Retired Vice Chairman and Chief Operating Officer for the Electrical Sector of Eaton Corporation plc, a global diversified power management company (NYSE: ETN). Mr. Gross joined Eaton in 2003 as Vice President, Eaton Business Systems, and from 2004 to 2009 served as President of Eaton’s power quality and controls business. From 2009 until his retirement in 2015, Mr. Gross served as Vice Chairman and Chief Operating Officer for Eaton’s Electrical Sector. Prior to joining Eaton, Mr. Gross held executive leadership positions with Danaher Corporation, Xycom Automation and Rockwell Automation. Mr. Gross was previously a director of WABCO Holdings Inc., a leading manufacturer of vehicle control systems (NYSE: WBC), until May 2020. Mr. Gross received his B.S. degree in electrical and computer engineering from the University of Wisconsin and his M.B.A. degree from the University of Michigan.

The Board of Directors has determined that Mr. Gross should serve as a Director because of his extensive executive management experience at Eaton Corporation plc. At Eaton, Mr. Gross dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions and capital allocation, that the Company deals with today. | |||

Shares of Common Stock beneficially owned: 16,668 | Director in Class I (term expiring in 2022) | |||

| Frank C. Sullivan, age 59 – Director since 1995

Chairman, President and Chief Executive Officer, RPM International Inc. Frank C. Sullivan entered the University of North Carolina as a Morehead Scholar and received his B.A. degree in 1983. From 1983 to 1987, Frank C. Sullivan held various commercial lending and corporate finance positions at Harris Bank and First Union National Bank prior to joining RPM as Regional Sales Manager from 1987 to 1989 at RPM’s AGR Company joint venture. In 1989, he became RPM’s Director of Corporate Development. He became a Vice President in 1991, Chief Financial Officer in 1993, Executive Vice President in 1995, President in 1999, Chief Operating Officer in 2001, Chief Executive Officer in 2002, and was elected Chairman of the Board in 2008 and President in 2018. Frank C. Sullivan serves on the boards of The Timken Company, the American Coatings Association, the Cleveland Rock and Roll Hall of Fame and Museum, Greater Cleveland Partnership, the Ohio Business Roundtable, the Army War College Foundation, Inc., the Chamber of Commerce of the United States, the Cleveland School of Science and Medicine, and the Medina County Bluecoats.

The Board of Directors has determined that Frank C. Sullivan should serve as a Director because of his role as the Company’s Chief Executive Officer, his intimate knowledge of the Company, and his experience serving as a director of other public companies and non-profit organizations. The Board of Directors believes that Frank C. Sullivan’s extensive experience in and knowledge of the Company’s business gained as a result of his long-time service as a member of management is essential to the Board of Directors’ oversight of the Company and its business operations. The Board of Directors also believes that continuing participation by qualified members of the Sullivan family on the Board of Directors is an important part of the Company’s corporate culture that has contributed significantly to its long-term success. | |||

Shares of Common Stock beneficially owned: 1,466,224 | Director in Class I (term expiring in 2022) | |||

| 14 | ||

PROPOSAL ONE (CONTINUED)

| John M. Ballbach, age 60 – Director since 2018

Former Chairman and Chief Executive Officer, VWR International, LLC, a leading global laboratory supply and distribution company. From 2007 to 2012, Mr. Ballbach served as Chairman of VWR International, LLC, and he was President and Chief Executive Officer from 2005 to 2012. A seasoned chemicals and coatings industry executive, Mr. Ballbach served as an independent director at Valspar from 2012 until the company’s sale to Sherwin-Williams in 2017. In addition, he is a former corporate officer of Valspar, having served as President and Chief Operating Officer from 2002 to 2004 and in various senior management positions since 1990. Mr. Ballbach served as an Operating Advisor with Clayton, Dubilier & Rice (“Clayton”), a private equity investment firm, from 2014 to 2017. In connection with his role as an Operating Advisor at Clayton, Mr. Ballbach also served as Chairman and director for Solenis, LLC, a specialty chemicals manufacturer and portfolio company of Clayton. Mr. Ballbach served as a director and member of the audit committee of The Timken Company, a publicly traded global manufacturer of bearings and related components, until mid-2014. He also previously served as a Director of Celanese Corp, a global technology leader in the production of specialty materials and chemical products.

Mr. Ballbach was initially appointed as a Director pursuant to the Cooperation Agreement related to, among other things, appointment of additional Directors to the Board of Directors. The Board of Directors has determined that Mr. Ballbach should serve as a Director because of his extensive executive management experience, including his service as Chairman and Chief Executive Officer of VWR International, LLC and his service as President and Chief Operating Officer of Valspar. In those positions, Mr. Ballbach dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. | |||

Shares of Common Stock beneficially owned: 13,680 |

Director in Class II (term expiring in 2021) | |||

| Bruce A. Carbonari, age 64 – Director since 2002

Retired Chairman and Chief Executive Officer, Fortune Brands, Inc., a diversified consumer products company. Prior to his retirement, Mr. Carbonari served as the Chairman and Chief Executive Officer of Fortune Brands from 2008 to 2011, and as its President and Chief Executive Officer from 2007 to 2008. Previously, he held positions with Fortune Brands business unit, Fortune Brands Home & Hardware LLC, as Chairman and Chief Executive Officer from 2005 until 2007 and as President and Chief Executive Officer from 2001 to 2005. Mr. Carbonari was the President and Chief Executive Officer of Fortune Brands Kitchen and Bath Group from 1998 to 2001, and was previously the President and Chief Executive Officer of Moen, Inc. from 1990 to 1998. Prior to joining Moen in 1990, Mr. Carbonari was Executive Vice President and Chief Financial Officer of Stanadyne, Inc., Moen’s parent company at that time. He began his career at PricewaterhouseCoopers prior to joining Stanadyne in 1981.

The Board of Directors has determined that Mr. Carbonari should serve as a Director because of his extensive executive management experience, including his service as Chairman and Chief Executive Officer of Fortune Brands, Inc. In that position, Mr. Carbonari dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. | |||

Shares of Common Stock beneficially owned: 36,521 |

Director in Class II (term expiring in 2021) | |||

| 15 |

PROPOSAL ONE (CONTINUED)

| Jenniffer D. Deckard, age 54 – Director since 2015

Former President and Chief Executive Officer of Covia Holdings Corporation, a leading provider of minerals and materials solutions for the industrial and energy markets (NYSE: CVIA). Ms. Deckard also served as a director on Covia’s board of directors from 2018 until 2019. Ms. Deckard previously served as President, Chief Executive Officer and director of Fairmount Santrol Holdings Inc. from 2013 until 2018, when Fairmount Santrol and Unimin Corporation merged to form Covia. Previously, Ms. Deckard served as Fairmount Santrol’s President from 2011 until 2013, Vice President of Finance and Chief Financial Officer from 1999 until 2011, Corporate Controller from 1996 to 1999 and Accounting Manager from 1994 until 1996. Ms. Deckard serves on the boards of the Cleveland Foundation and the Edwins Foundation. Ms. Deckard received a bachelor of science from the University of Tulsa and a M.B.A. degree from Case Western Reserve University.

The Board of Directors has determined that Ms. Deckard should serve as a Director because of her extensive executive management experience and financial expertise, including her service as President and Chief Executive Officer of Covia. In that position, Ms. Deckard dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. Also, with her extensive financial background, Ms. Deckard is a financial expert for the Company’s Audit Committee. Ms. Deckard also provides the Board of Directors a valuable perspective as a member of the boards of several prominent local non-profit organizations. | |||

Shares of Common Stock beneficially owned: 9,624 | Director in Class II (term expiring in 2021) | |||

| Salvatore D. Fazzolari, age 68 – Director since 2013

Former Chairman, President and Chief Executive Officer of Harsco Corporation, a diversified global industrial company. Mr. Fazzolari served as Chairman and Chief Executive Officer of Harsco Corporation from 2008 until 2012, in addition to serving as its President from 2010 until 2012. During the course of his over 30 years of service to Harsco Corporation, Mr. Fazzolari held various other positions, including President (2006 –2007), Chief Financial Officer (1998 –2007) and Treasurer and Corporate Controller. Mr. Fazzolari is a certified public accountant (inactive) and a certified information systems auditor (inactive). He serves on the board of directors of Gannett Fleming, Inc. and Bollman Hat Company. He previously served on the board of directors of OrangeHook, Inc., a software solutions company focused on identity solutions (OTCQB: ORHK), until February 2019. He is also an advisory board member of Current Capital LLC, an operating partner – metals for Sole Source Capital (a private equity firm), and is a member of the senior advisory council of AEA Investors LP (a private equity firm). He earned his bachelor of business administration degree in accounting from Pennsylvania State University.

The Board of Directors has determined that Mr. Fazzolari should serve as a Director because of his extensive executive management experience, including his service as Chairman, President and Chief Executive Officer of Harsco Corporation. In that position, Mr. Fazzolari dealt with many of the major issues, such as financial, strategic, technology, compensation, management development, acquisitions, capital allocation, government and stockholder relations, that the Company deals with today. Also, Mr. Fazzolari has extensive global experience, and because of his considerable financial background, he is a financial expert for the Company’s Audit Committee and serves as its chairman. | |||

Shares of Common Stock beneficially owned: 14,242 | Director in Class II (term expiring in 2021) | |||

| 16 | ||

The Board of Directors has an Executive Committee, an Audit Committee, a Compensation Committee, and a Governance and Nominating Committee. The Executive Committee has the power and authority of the Board of Directors in the interim period between Board meetings. The functions of each of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee are governed by charters that have been adopted by the Board of Directors. The Board of Directors also has adopted Corporate Governance Guidelines to assist the Board of Directors in the exercise of its responsibilities, and a code of business conduct and ethics (“The Values & Expectations of 168”) that applies to the Company’s Directors, officers, and employees.

The charters of the Audit Committee, Compensation Committee, and Governance and Nominating Committee and the Corporate Governance Guidelines and The Values & Expectations of 168 are available on the Company’s website at www.rpminc.com and in print to any stockholder who requests a copy. Requests for copies should be directed to Manager of Investor Relations, RPM International Inc., P.O. Box 777, Medina, Ohio 44258. The Company intends to disclose any amendments to The Values & Expectations of 168, and any waiver of The Values & Expectations of 168 granted to any Director or executive officer of the Company, on the Company’s website. As of the date of this Proxy Statement, there have been no such waivers.

Board Independence

The Company’s Corporate Governance Guidelines and the New York Stock Exchange (the “NYSE”) listing standards provide that at least a majority of the members of the Board of Directors must be independent, i.e., free of any material relationship with the Company, other than his or her relationship as a Director or Board Committee member. A Director is not independent if he or she fails to satisfy the standards for independence under the NYSE listing standards, the rules of the Commission, and any other applicable laws, rules and regulations. The Board of Directors adopted categorical standards (the “Categorical Standards”) to assist it in making independence determinations. The Categorical Standards specify the criteria by which the independence of the Directors will be determined and meet or exceed the independence requirements set forth in the NYSE listing standards and the rules of the Commission. The

Categorical Standards are available on the Company’s website at www.rpminc.com.

During the Board of Directors’ annual review of director independence, the Board of Directors considers transactions, relationships and arrangements between each Director or an immediate family member of the Director and the Company. The Board of Directors also considers transactions, relationships and arrangements between each Director or an immediate family member of the Director and the Company’s senior management.

In July 2020, the Board of Directors performed its annual director independence review for fiscal 2021. As a result of this review, the Board of Directors determined that 11 out of 12 current Directors are independent, and that all members of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee are independent. The Board of Directors determined that Ms. Deckard, Ms. Lagacy, and Messrs. Andrews, Ballbach, Carbonari, Daberko, Fazzolari, Gross, Livingston, Nance and Summers meet the Categorical Standards and are independent and, in addition, satisfy the independence requirements of the NYSE. Frank C. Sullivan is not considered to be independent because of his position as Chairman and Chief Executive Officer of the Company.

As part of this review, the Board of Directors also considered common private and charitable board memberships among our executive officers and Directors, including Ms. Deckard and Messrs. Nance and Summers. The Board of Directors does not believe that any of these common board memberships impairs the independence of the Directors.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its oversight of the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, and the performance of the Company’s internal audit function and independent auditor, and prepares the report of the Audit Committee. The specific functions and responsibilities of the Audit Committee are set forth in the Audit Committee Charter which is available on the Company’s website.

| 17 |

INFORMATION REGARDING MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS (CONTINUED)

The Board of Directors has determined that each member of the Audit Committee is financially literate and satisfies the current independence standards of the NYSE listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has also determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as that term is defined in Item 407(d) of Regulation S-K. Each of Ms. Deckard, Ms. Lagacy and Messrs. Andrews and Fazzolari also satisfies the NYSE accounting and financial management expertise requirements.

Compensation Committee

The Compensation Committee assists the Board of Directors in discharging its oversight responsibilities relating to, among other things, executive compensation, equity and incentive compensation plans, management succession planning and producing the Compensation Committee Report. The Compensation Committee administers the Company’s Incentive Compensation Plan, Restricted Stock Plan, Restricted Stock Plan for Directors, and 2014 Omnibus Plan. The Compensation Committee reviews and determines the salary and bonus compensation of the Chief Executive Officer, as well as reviews and recommends to the Board of Directors for its approval the compensation of the other executive officers of the Company. The Compensation Committee may delegate its authority to a subcommittee or subcommittees. Each member of the Compensation Committee is independent within the meaning of the NYSE listing standards and the Company’s Corporate Governance Guidelines.

Our Chief Executive Officer, together with the Compensation Committee, reviews assessments of executive compensation practices at least annually against our defined comparative framework. Our Chief Executive Officer makes recommendations to the Compensation Committee with the intent of keeping our executive officer pay practices aligned with our intended pay philosophy. The Compensation Committee must approve any recommended changes before they can be made. The Compensation Committee has the sole authority to retain and terminate any compensation and benefits consultant, independent legal counsel or other adviser, to assess the independence of such compensation and benefits consultant, independent legal counsel or other adviser and any potential conflicts of interest prior to engagement, and to approve the related fees and other retention terms of such compensation and benefits consultant, independent legal counsel or other adviser.

Before selecting any compensation and benefits consultant, independent legal counsel or other adviser, the Compensation Committee takes into account all factors relevant to that

adviser’s independence from management, including the following six factors:

| • | the provision of other services to the Company by the adviser’s employer; |

| • | the amount of fees received from the Company by the adviser’s employer, as a percentage of total revenues of the employer; |

| • | the policies and procedures of the adviser’s employer that are designed to prevent conflicts of interest; |

| • | any business or personal relationship of the adviser with a member of the Compensation Committee; |

| • | any Common Stock of the Company owned by the adviser; and |

| • | any business or personal relationship of the adviser or the adviser’s employer with an executive officer of the Company. |

Governance and Nominating Committee