Exhibit 99.1 Investor Day October 7, 2022

Forward-Looking Statements and Regulation G This presentation contains “forward-looking statements” relating to our business. These forward-looking statements, or other statements made by us, are made based on our expectations and beliefs concerning future events impacting us and are subject to uncertainties and factors (including those specified below), which are difficult to predict and, in many instances, are beyond our control. As a result, our actual results could differ materially from those expressed in or implied by any such forward-looking statements. These uncertainties and factors include (a) global markets and general economic conditions, including uncertainties surrounding the volatility in financial markets, the availability of capital, and the viability of banks and other financial institutions; (b) the prices, supply and availability of raw materials, including assorted pigments, resins, solvents, and other natural gas-and oil-based materials; packaging, including plastic and metal containers; and transportation services, including fuel surcharges; (c) continued growth in demand for our products; (d) legal, environmental and litigation risks inherent in our construction and chemicals businesses and risks related to the adequacy of our insurance coverage for such matters; (e) the effect of changes in interest rates ; (f) the effect of fluctuations in currency exchange rates upon our foreign operations; (g) the effect of non-currency risks of investing in and conducting operations in foreign countries, including those relating to domestic and international political, social, economic and regulatory factors; (h) risks and uncertainties associated with our ongoing acquisition and divestiture activities; (i) the timing of and the realization of anticipated cost savings from restructuring initiatives and the ability to identify additional cost savings opportunities; (j) risks related to the adequacy of our contingent liability reserves; (k) risks relating to the Covid pandemic; (l) risks related to adverse weather conditions or the impacts of climate change and natural disasters; (m) risks relating to the Russian invasion of Ukraine and other wars; (n) risks related to data breaches and data privacy violations; and (o) other risks detailed in our filings with the Securities and Exchange Commission, including the risk factors set forth in our Annual Report on Form 10-K for the year ended May 31, 2022, as the same may be updated from time to time. We do not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events, information or circumstances that arise after the date of this presentation. This presentation includes certain company data that do not directly conform to generally accepted accounting principles, or GAAP, and certain company data that has been restated for improved clarity, understanding and comparability, or pro forma. All non-GAAP data in this presentation are indicated by footnote. Tables reconciling such data with GAAP measures are available in an appendix to this presentation and through our website, www.rpminc.com under Investor Information/Presentations. RPM Investor Day | October 7, 2022 2

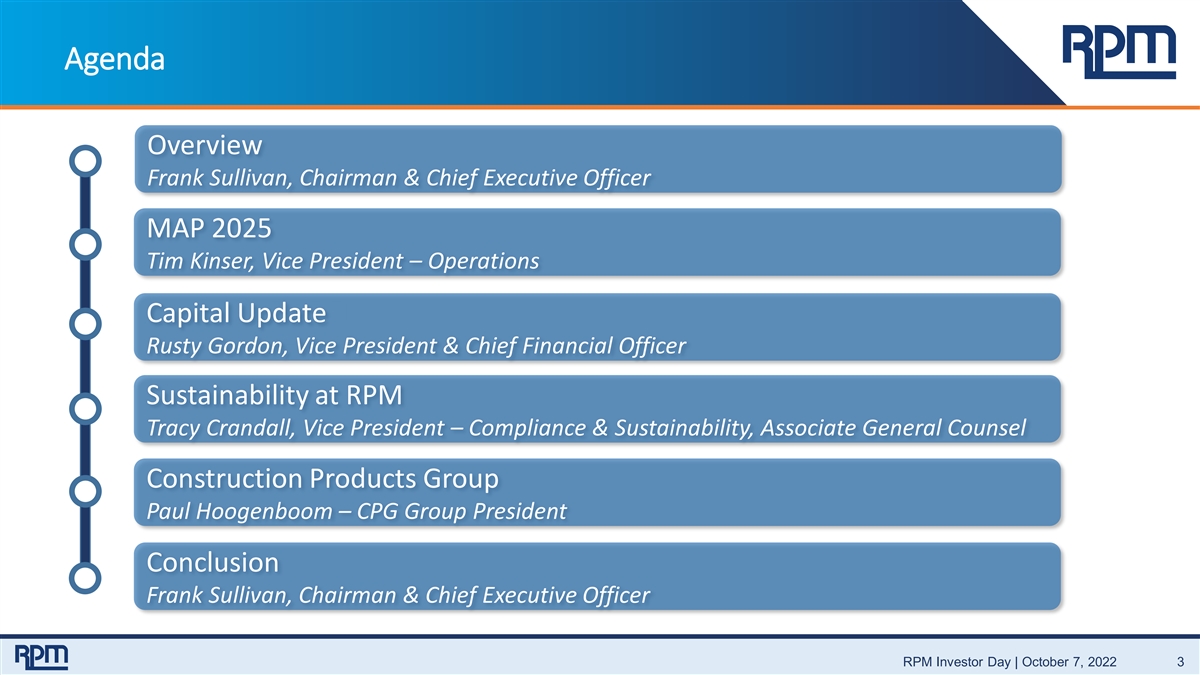

Agenda Overview v Frank Sullivan, Chairman & Chief Executive Officer MAP 2025 Tim Kinser, Vice President – Operations Capital Update Rusty Gordon, Vice President & Chief Financial Officer Sustainability at RPM Tracy Crandall, Vice President – Compliance & Sustainability, Associate General Counsel Construction Products Group Paul Hoogenboom – CPG Group President Conclusion Frank Sullivan, Chairman & Chief Executive Officer RPM Investor Day | October 7, 2022 3

Overview Frank Sullivan Chairman & Chief Executive Officer

RPM’s Culture 75 Years of RPM’s Entrepreneurial Growth Culture RPM Investor Day | October 7, 2022 5

RPM’s Transformation Driving Significant Improvements to Achieve Operating Efficiencies RPM Investor Day | October 7, 2022 6

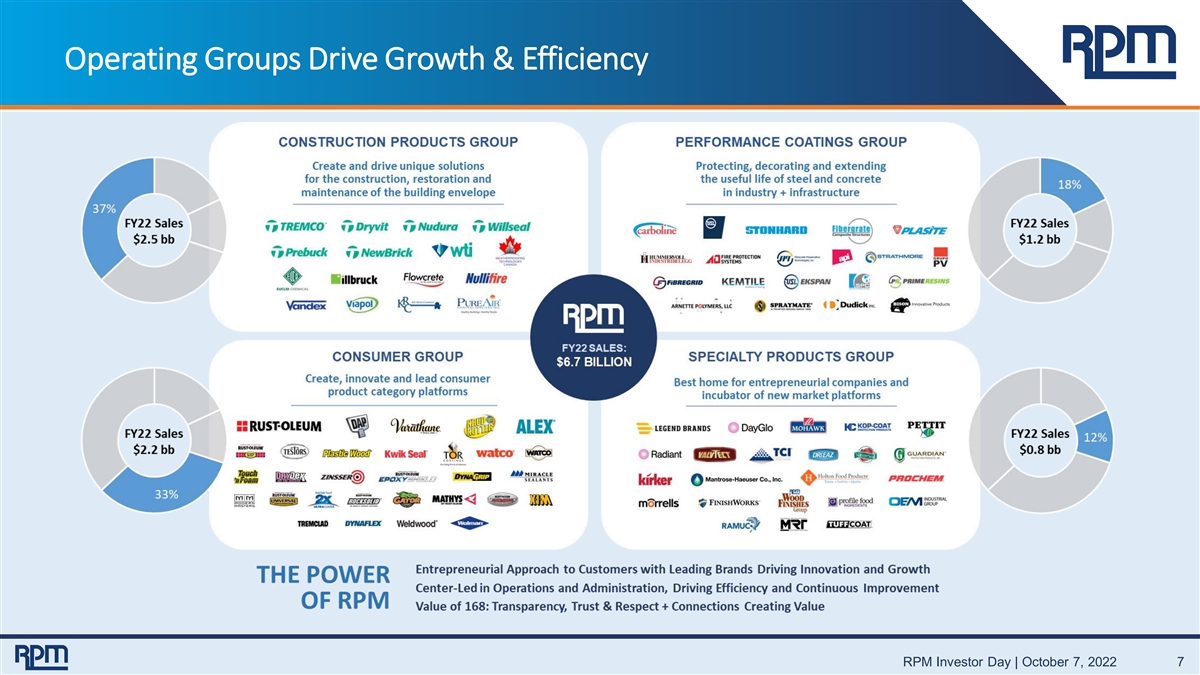

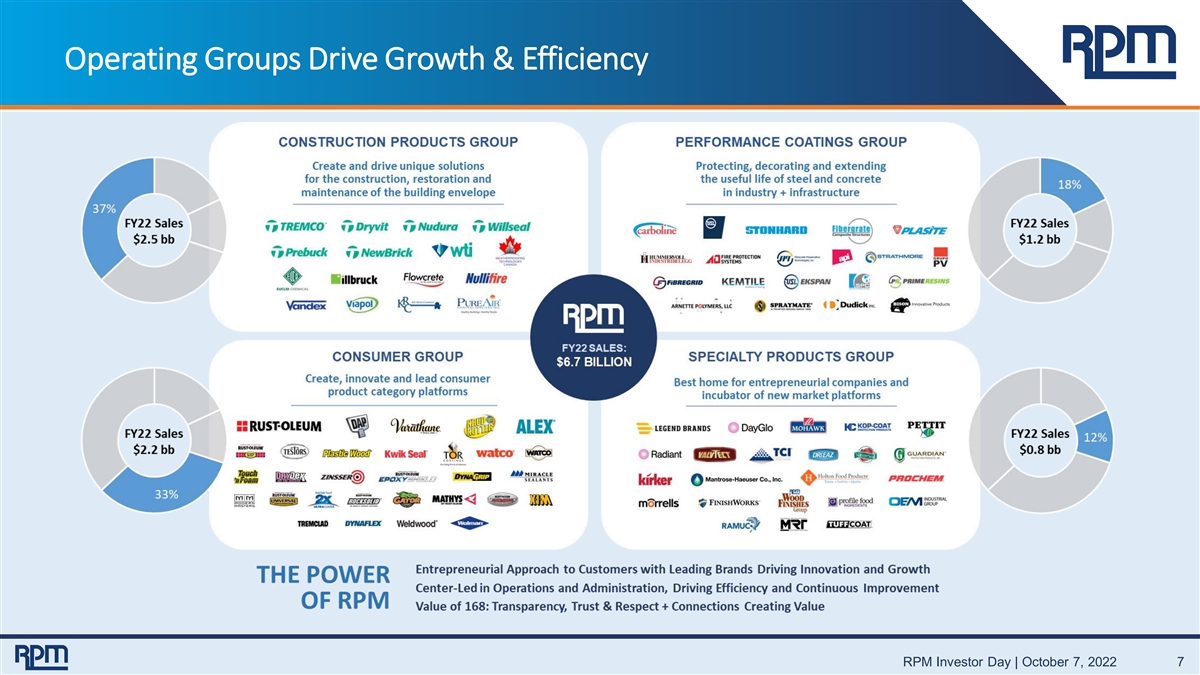

Operating Groups Drive Growth & Efficiency RPM Investor Day | October 7, 2022 7

Commitment to Total Shareholder Return Comparison of Cumulative Total Return vs. S&P 500 and a Customized Peer Group $480 RPM OUTPERFORMED: RPM OUTPERFORMED: $430 S&P 500 by Peers by S&P 500 by Peers by RPM 17.7% 17.5% 9.3% 11.1% $220 $380 S&P 500 Peer Group $200 $330 RPM $180 $280 S&P 500 $160 Peer Group $230 $140 $180 $2.3 BILLION $120 $1.4 BILLION Returned to Shareholders via Cash Returned to Shareholders via Cash Dividends and Share Repurchases¹ $130 Dividends and Share Repurchases¹ $100 $80 $80 5/18 5/19 5/20 5/21 5/22 5/12 5/13 5/14 5/15 5/16 5/17 5/18 5/19 5/20 5/21 5/22 (1) Includes $205M cash settlement of convertible debt Since Start of MAP to Growth Program: 10-Year: FY19 – FY22 FY13 – FY22 The graphs above compare the cumulative four- and ten-year total return provided to stockholders on RPM International Inc.’s common stock relative to the cumulative total returns of the S&P 500 Index and a customized peer group. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in RPM common stock, the peer group, and the index on 5/31/2012 and 5/31/2018 and their relative performance is tracked through 5/31/2022. Peer Group companies include: Akzo Nobel N.V., Axalta Coating Systems Ltd., Carlisle Companies Inc., H.B. Fuller Company, Masco Corporation, PPG Industries, Inc., The Sherwin-Williams Company and Sika AG. RPM Investor Day | October 7, 2022 8

MAP 2025 Tim Kinser Vice President - Operations

Where We’ve Been

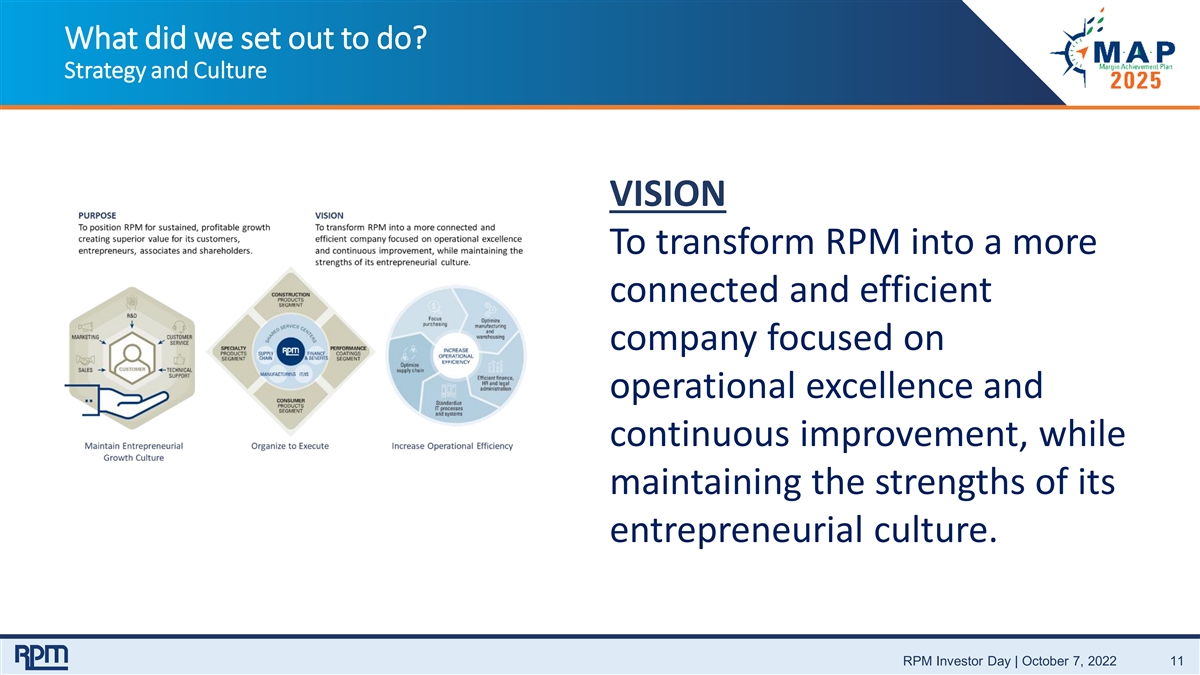

What did we set out to do? Strategy and Culture VISION To transform RPM into a more connected and efficient company focused on operational excellence and continuous improvement, while maintaining the strengths of its entrepreneurial culture. RPM Investor Day | October 7, 2022 11

MAP to Growth – Significant Operational Efficiency Improvement MAP to Growth Annualized Run Rate $320 $ in millions MAP Savings $290 $300 MAP Savings • Exceeded targets on efficiency improvements within our control $250 • Operational improvements driven by: • Center-led manufacturing $200 • Center-led procurement • Center-led administration $150 $100 INITIAL TARGET ACTUAL FY21 RPM Investor Day | October 7, 2022 12

MAP to Growth Financial Results Adapting to New Industry Conditions MAP initiatives helped RPM navigate compounding industry challenges Mar 2020 – COVID lockdowns Feb 2021 – Winter Storm Uri Mar 2021 – Supply chain disruptions begin Apr 2021 – Explosion at alkyd resin supplier 2021-2022 – Inflation surge and supply chain disruptions intensify 2022 – Uncertainty from Russia / Ukraine RPM Investor Day | October 7, 2022 13

MAP to Growth Financial Results MAP 2020 FY21 FY22 Goals $6.1B $6.7B Revenue $6.25B Gross margin 42.3%¹ 39.4% 36.3% Adjusted EBIT ² $1,000M $785M $708M Adjusted EBIT margin ² 16.0% 12.8% 10.6% Industry headwinds led to significant financial impact partially offset by controllable efficiency improvements 1 – Adjusted for reclass of freight after initial release of MAP 2020 goals 2 – Non-GAAP measure. Please see appendix for reconciliation to nearest GAAP measure. RPM Investor Day | October 7, 2022 14

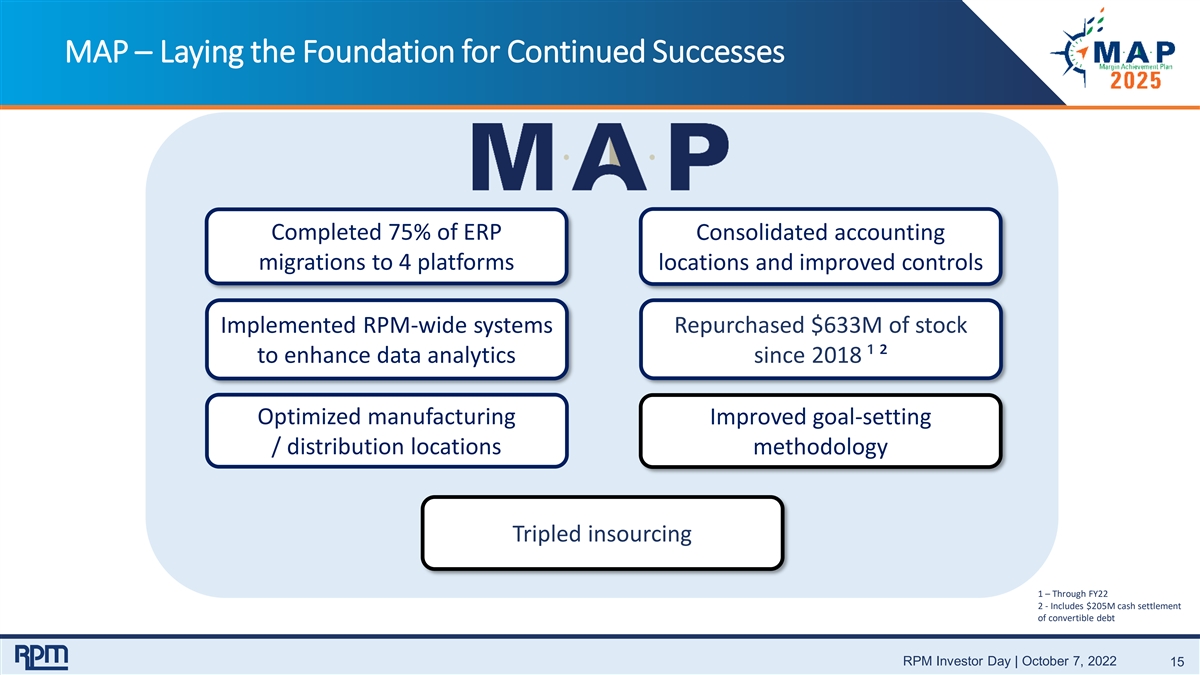

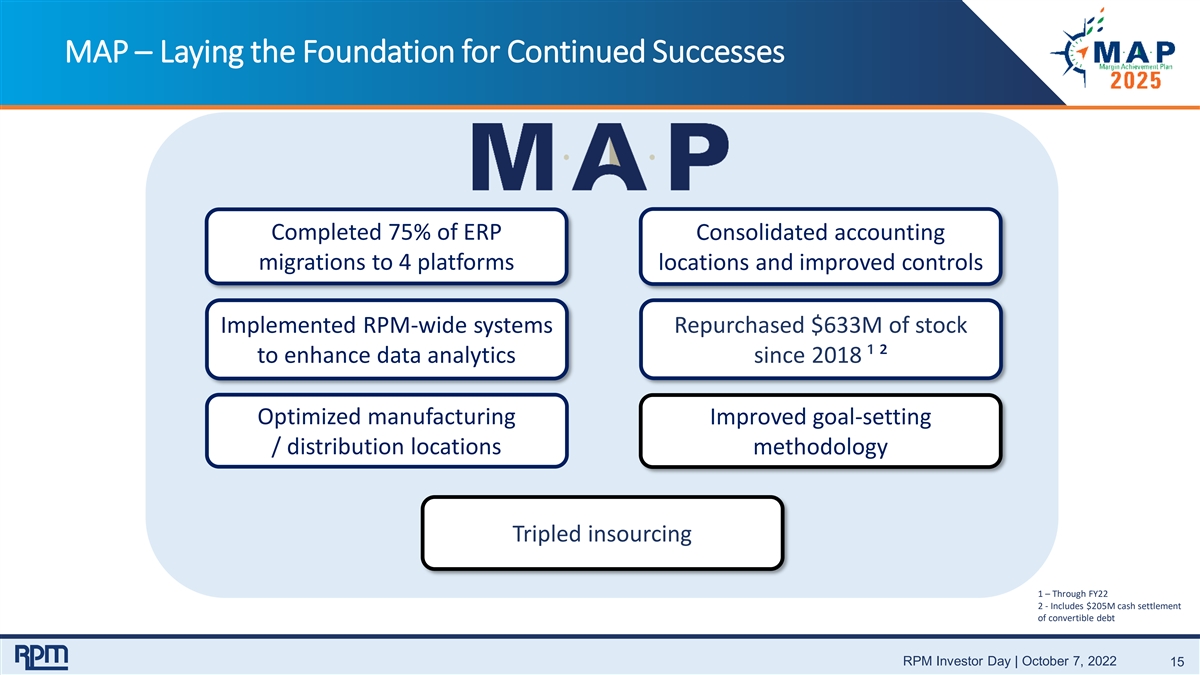

MAP – Laying the Foundation for Continued Successes Completed 75% of ERP Consolidated accounting migrations to 4 platforms locations and improved controls Implemented RPM-wide systems Repurchased $633M of stock to enhance data analytics since 2018 ¹ ² Optimized manufacturing Improved goal-setting / distribution locations methodology Tripled insourcing 1 – Through FY22 2 - Includes $205M cash settlement of convertible debt RPM Investor Day | October 7, 2022 15

What did we accomplish? Enhanced collaboration & coordination Adopted a culture for continued success • Connections Creating Value – increased intercompany interactions • Launched Global Shared Service Centers • Implemented RPM-wide systems to improve visibility, productivity and analytics capability • Incentives to collaborate for overall company performance RPM Investor Day | October 7, 2022 16

What did we accomplish? Corsicana – Generating Benefits from Collaboration • Purchased in September 2021 • First alkyds produced in October 2021 to help offset loss of large industry supplier • Supplier to all RPM segments • Strengthens and adds flexibility to supply chain RPM Investor Day | October 7, 2022 17

What did we set out to do? Strategy and Culture MAP 2020 was a milestone – not the finish line We’ve put in place resources, systems and a culture to achieve continued financial and organizational success RPM Investor Day | October 7, 2022 18

Where We’re Going

MAP to Growth Margin Acceleration Plan RPM Investor Day | October 7, 2022 20

MAP 2025 Margin Achievement Plan RPM Investor Day | October 7, 2022 21

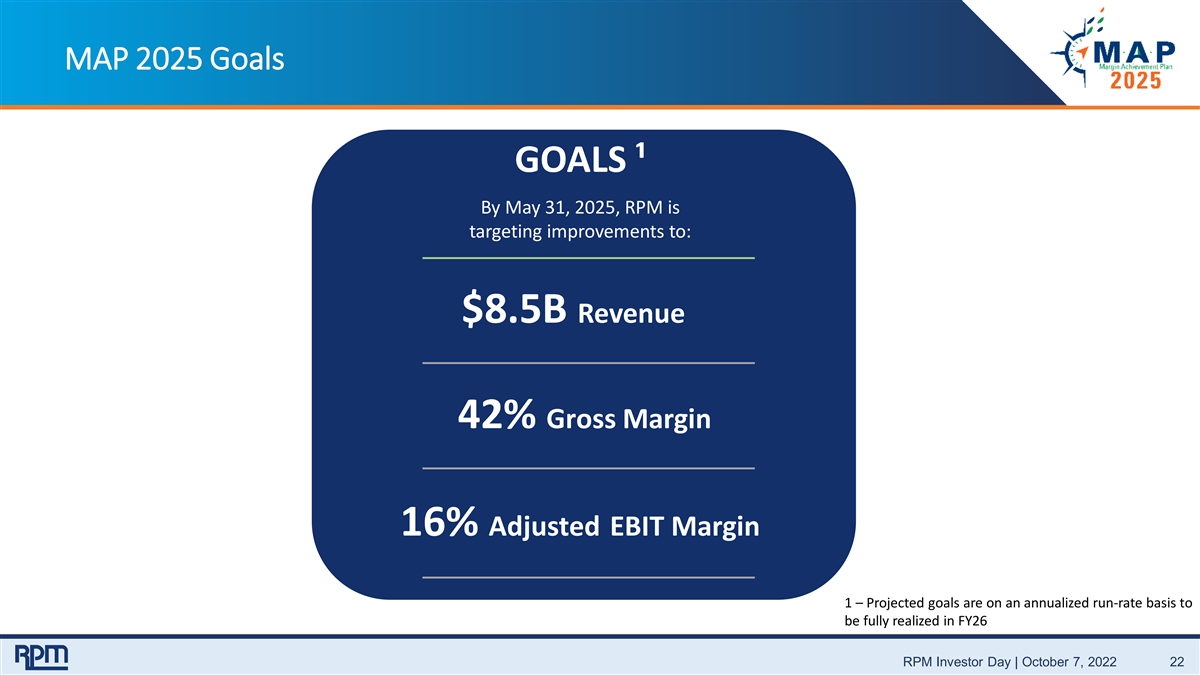

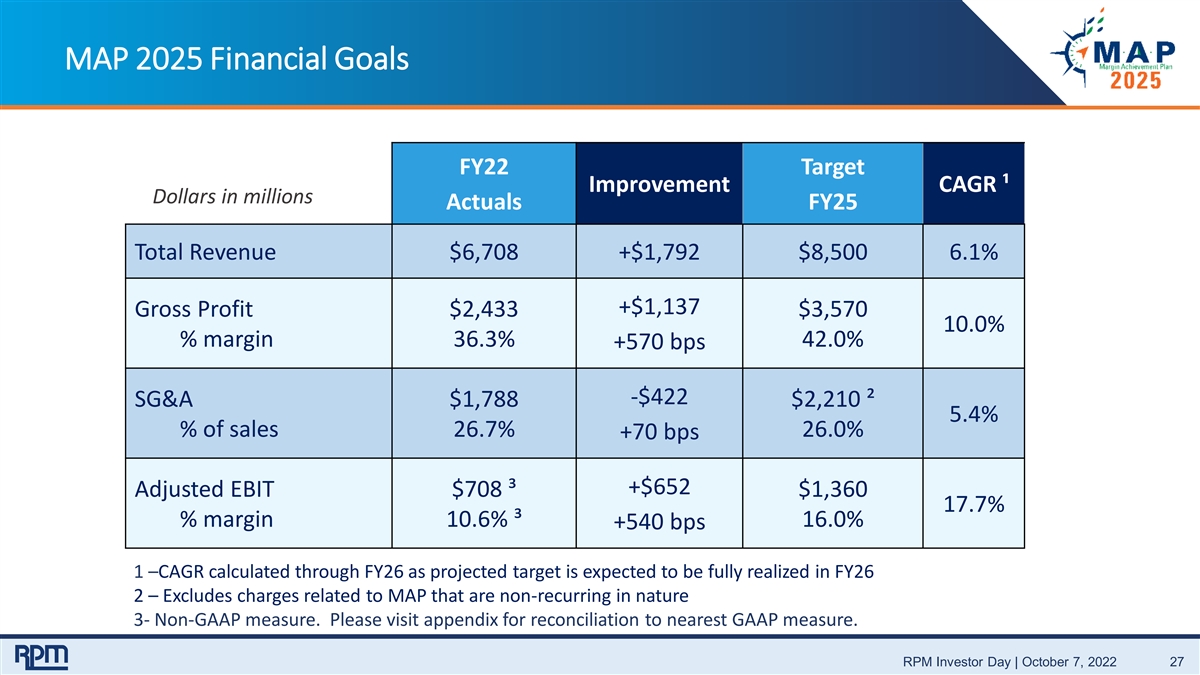

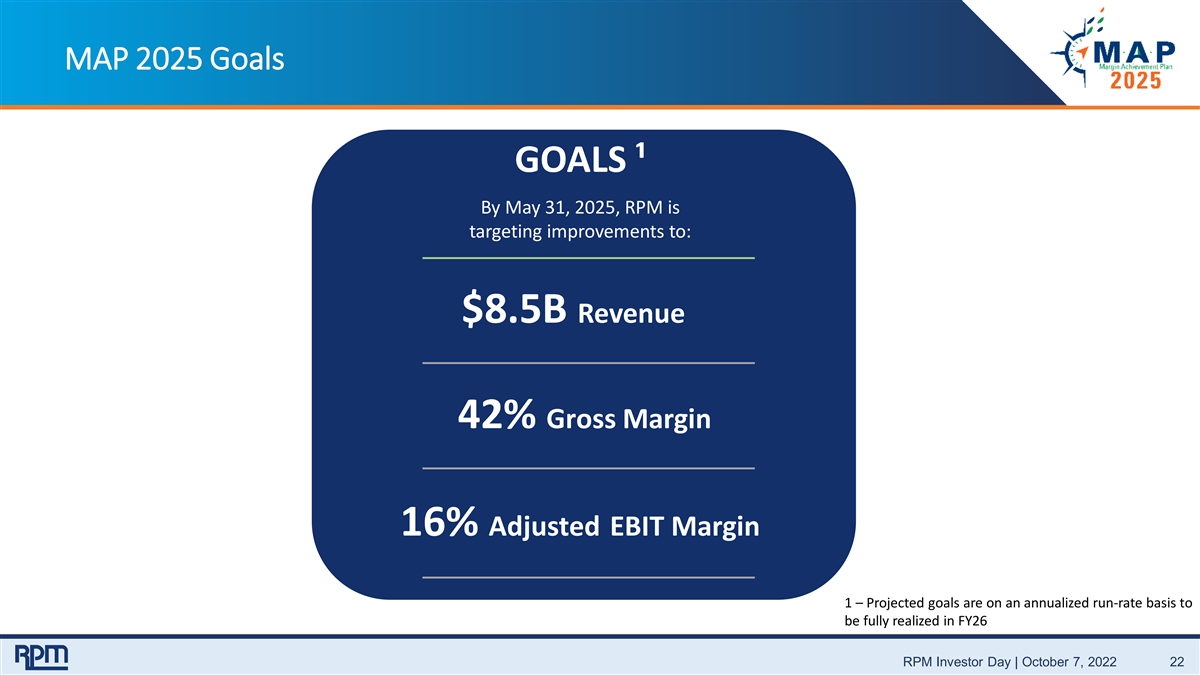

MAP 2025 Goals GOALS ¹ By May 31, 2025, RPM is targeting improvements to: $8.5B Revenue 42% Gross Margin 16% Adjusted EBIT Margin 1 – Projected goals are on an annualized run-rate basis to be fully realized in FY26 RPM Investor Day | October 7, 2022 22

MAP 2025 Revenue Bridge FY22 – FY25 Revenue Bridge ¹ • Forecast developed through $8,500 $250 $9,000 bottom-up analysis $485 $8,000 $1,057 • Core CAGR of 5% $6,708 $7,000 • Some examples of strategic investments include: $6,000 • Carboline end-market diversification $5,000 • CPG enhanced building efficiency $4,000• R&D Coating Center of Excellence • Assumes modest GDP growth $3,000 $2,000 $1,000 $0 FY22 Revenue Core Strategic + M&A FY25 Revenue CS-168 1 – On an annualized run-rate basis to be fully realized in FY26 RPM Investor Day | October 7, 2022 23 In millions

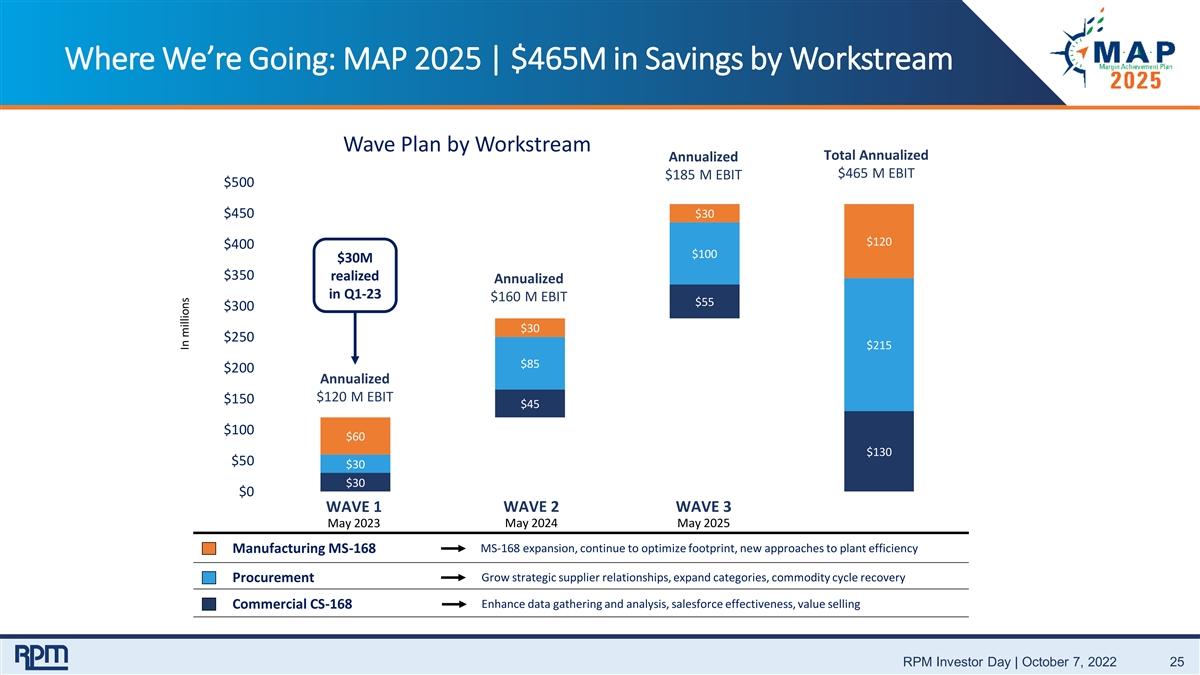

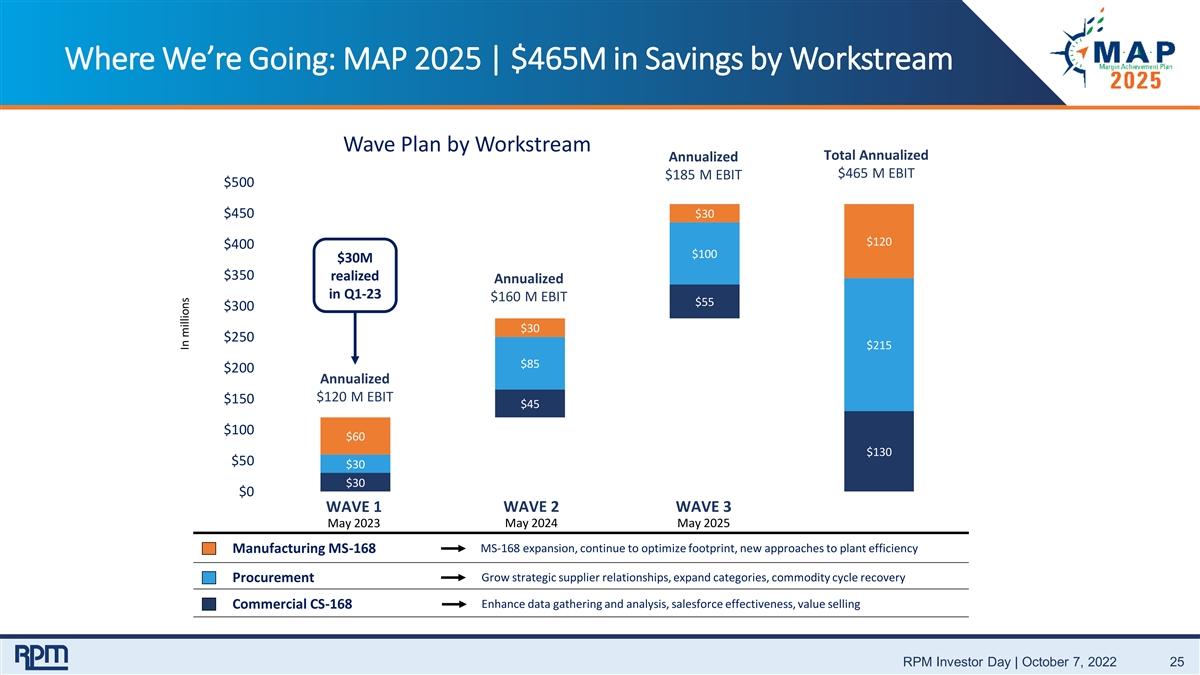

MAP 2025 Targeted Savings Forecasted MAP 2020 successes MAP 2025 focus savings • Implemented MS-168 at over 40 larger • Expand MS-168 to additional facilities Manufacturing facilities• Continue to optimize footprint $120 M • Created center-led manufacturing• Execute new approaches to plant (MS-168) • Purchased Corsicana, TX facility efficiency • Created center-led procurement • Grow strategic supplier relationships • Consolidated spend and developed • Expand categories of centralized strategic supplier relationships Procurement $215 M procurement • Value engineering focused on cost • Commodity cycle recovery reduction activities • Sales force effectiveness • Established commercial system process Commercial • Value added selling • Implemented tools needed for data capture $130 M • Improve margin management through (CS-168) • Expanded data analysis capabilities mix and innovation Total Targeted Annualized Savings by May 31, 2025 $465 M RPM Investor Day | October 7, 2022 24

Where We’re Going: MAP 2025 | $465M in Savings by Workstream Wave Plan by Workstream Total Annualized Annualized $465 M EBIT $185 M EBIT $500 $450 $30 $120 $400 $100 $30M $350 realized Annualized in Q1-23 $160 M EBIT $55 $300 $30 $250 $215 $85 $200 Annualized $120 M EBIT $150 $45 $100 $60 $130 $50 $30 $30 $0 WAVE 1 WAVE 2 WAVE 3 May 2023 May 2024 May 2025 MS-168 expansion, continue to optimize footprint, new approaches to plant efficiency Manufacturing MS-168 Grow strategic supplier relationships, expand categories, commodity cycle recovery Procurement Enhance data gathering and analysis, salesforce effectiveness, value selling Commercial CS-168 RPM Investor Day | October 7, 2022 25 In millions

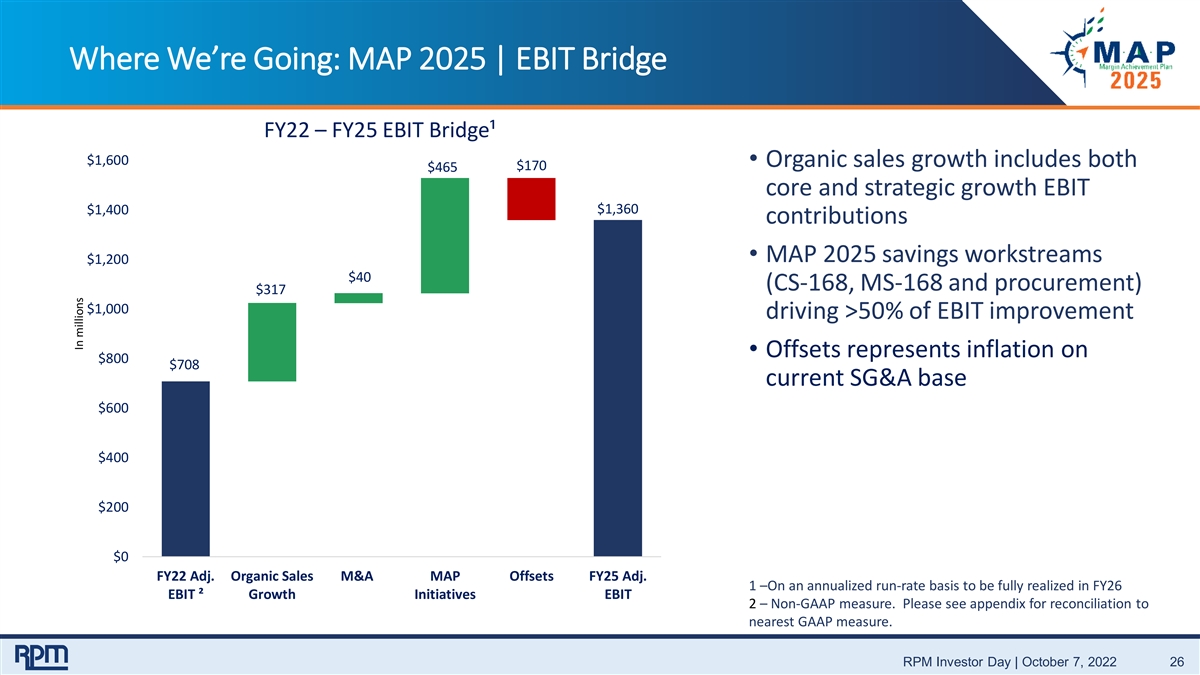

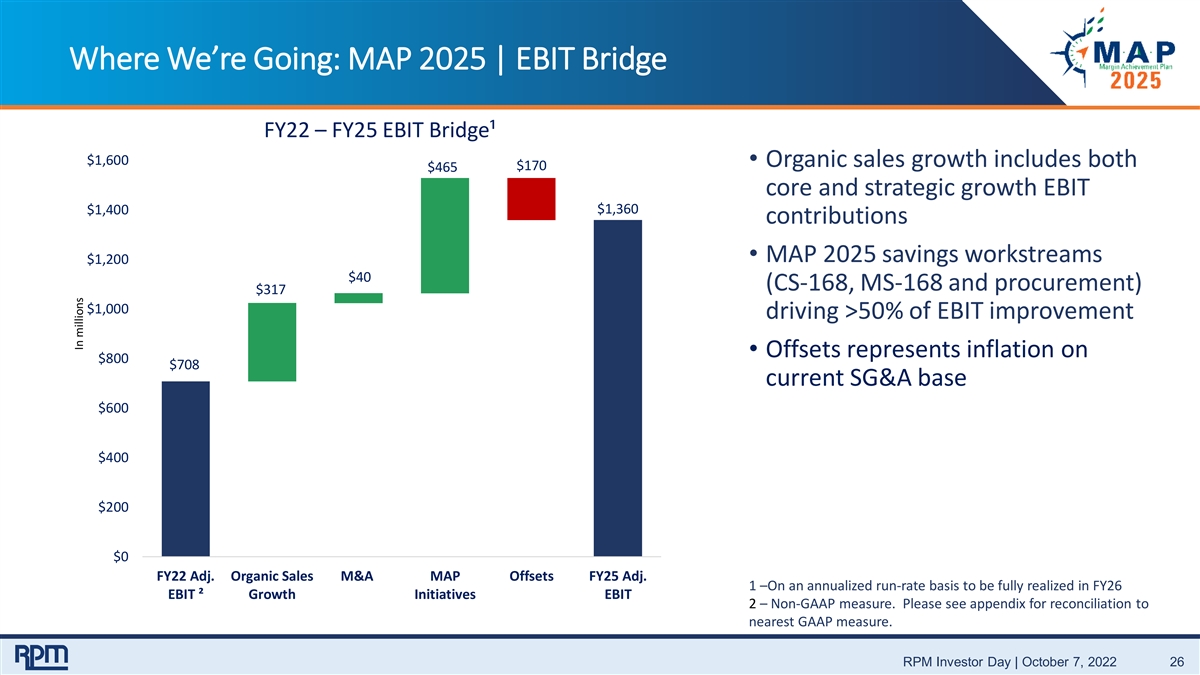

Where We’re Going: MAP 2025 | EBIT Bridge FY22 – FY25 EBIT Bridge¹ $1,600 • Organic sales growth includes both $170 $465 core and strategic growth EBIT $1,360 $1,400 contributions • MAP 2025 savings workstreams $1,200 $40 (CS-168, MS-168 and procurement) $317 $1,000 driving >50% of EBIT improvement • Offsets represents inflation on $800 $708 current SG&A base $600 $400 $200 $0 FY22 Adj. Organic Sales M&A MAP Offsets FY25 Adj. 1 –On an annualized run-rate basis to be fully realized in FY26 EBIT ² Growth Initiatives EBIT 2 – Non-GAAP measure. Please see appendix for reconciliation to nearest GAAP measure. RPM Investor Day | October 7, 2022 26 In millions

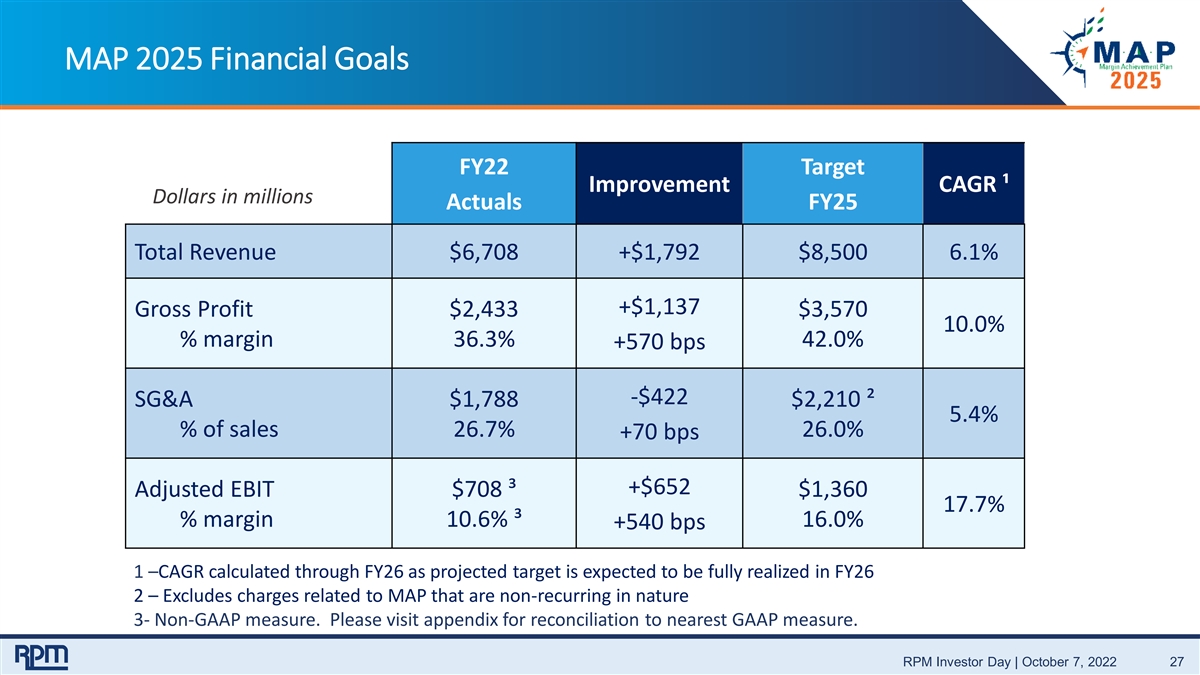

MAP 2025 Financial Goals FY22 Target Improvement CAGR ¹ Dollars in millions Actuals FY25 Total Revenue $6,708 +$1,792 $8,500 6.1% +$1,137 Gross Profit $2,433 $3,570 10.0% % margin 36.3% 42.0% +570 bps -$422 SG&A $1,788 $2,210 ² 5.4% % of sales 26.7% 26.0% +70 bps +$652 Adjusted EBIT $708 ³ $1,360 17.7% % margin 10.6% ³ 16.0% +540 bps 1 –CAGR calculated through FY26 as projected target is expected to be fully realized in FY26 2 – Excludes charges related to MAP that are non-recurring in nature 3- Non-GAAP measure. Please visit appendix for reconciliation to nearest GAAP measure. RPM Investor Day | October 7, 2022 27

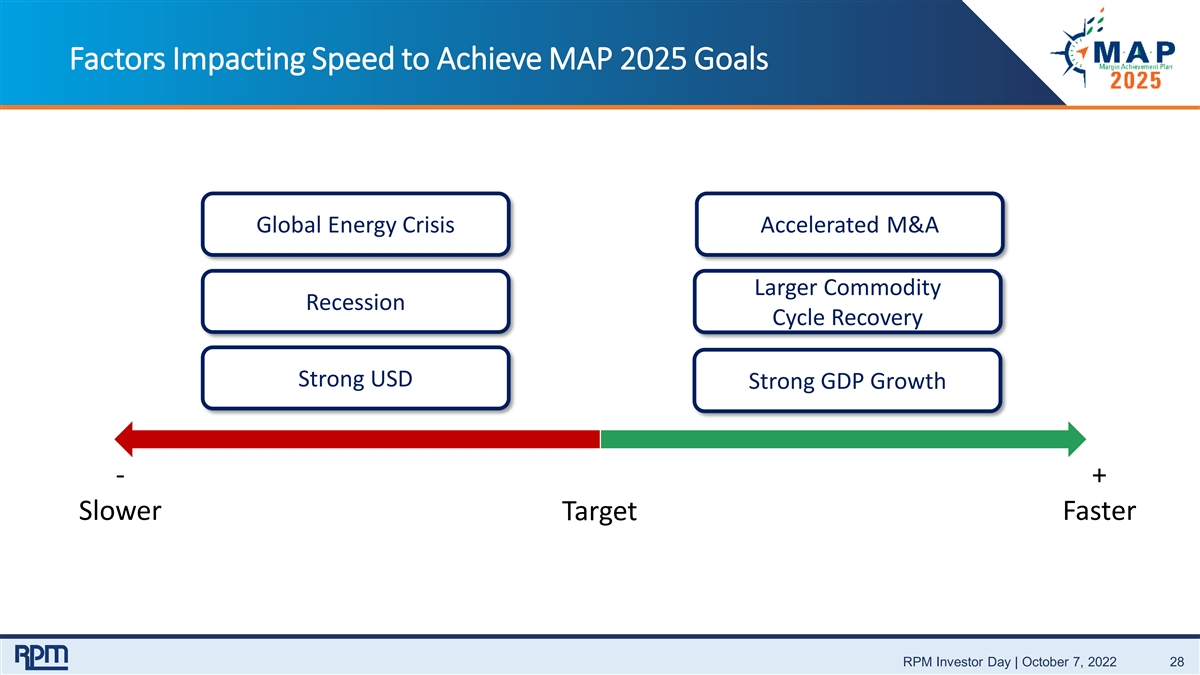

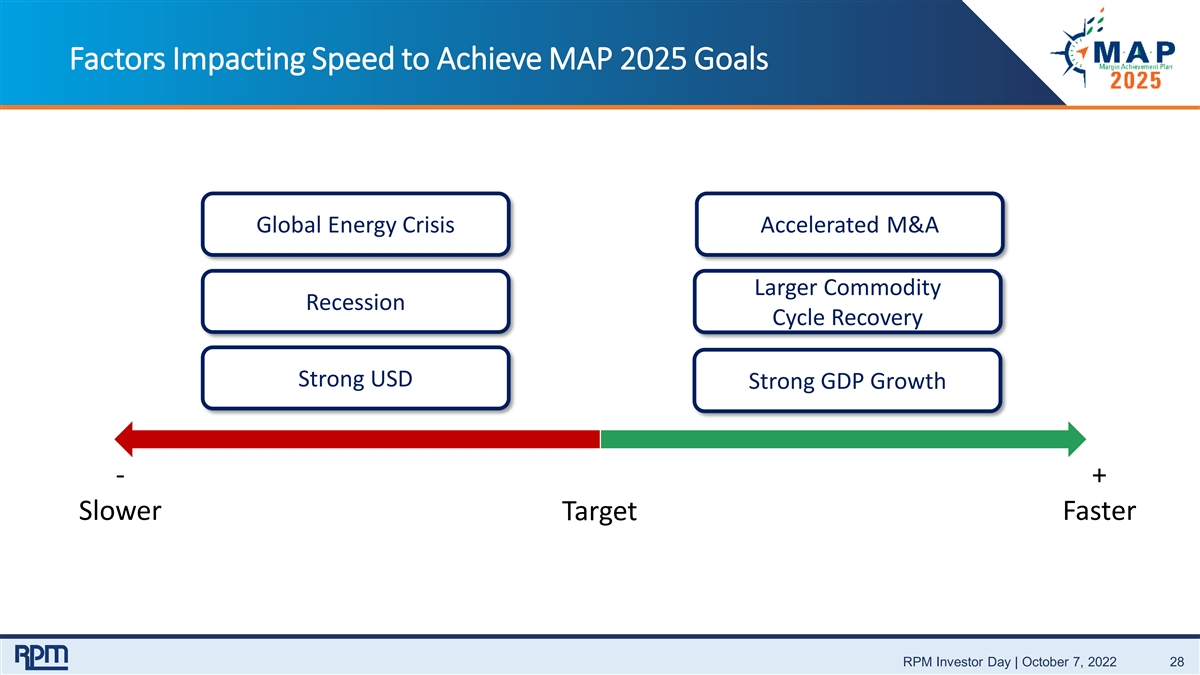

Factors Impacting Speed to Achieve MAP 2025 Goals Global Energy Crisis Accelerated M&A Larger Commodity Recession Cycle Recovery Strong USD Strong GDP Growth - + Slower Target Faster RPM Investor Day | October 7, 2022 28

Capital Update Rusty Gordon Vice President & Chief Financial Officer

Current Capital Priorities Maintain Investment Favor Internal Growth 49 Years of Consecutive Grade Rating through Capex Dividend Increases Continue Share M&A with Reasonable Repurchases Above Valuation Pre-MAP levels RPM Investor Day | October 7, 2022 30

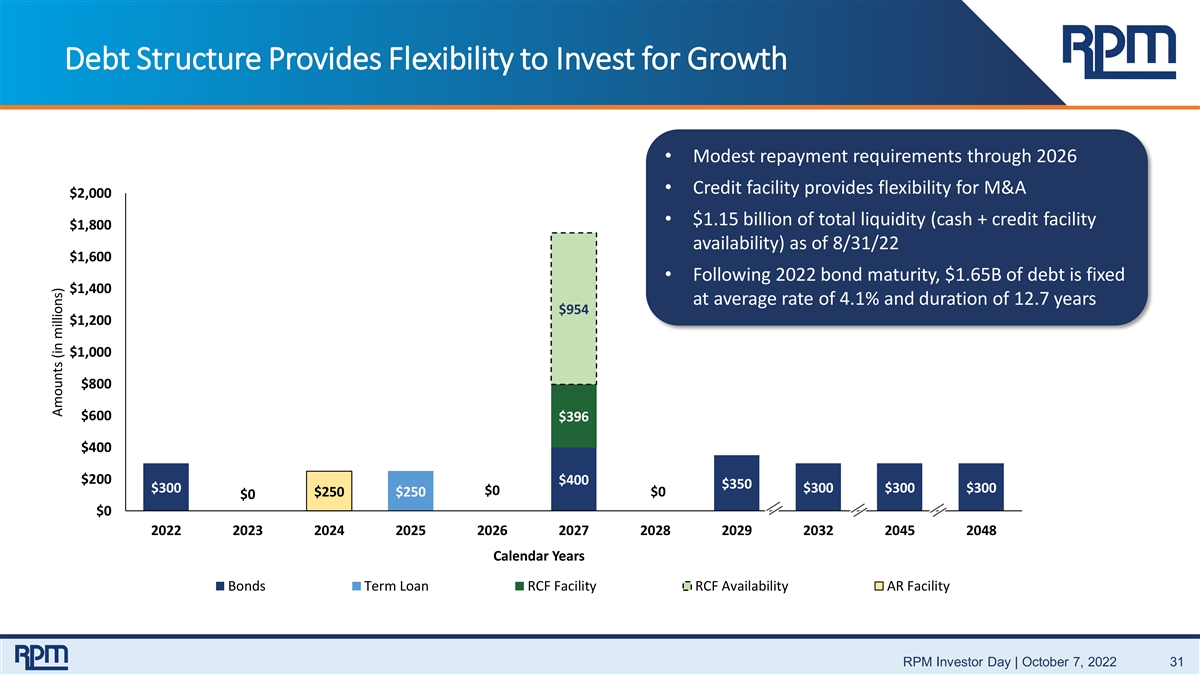

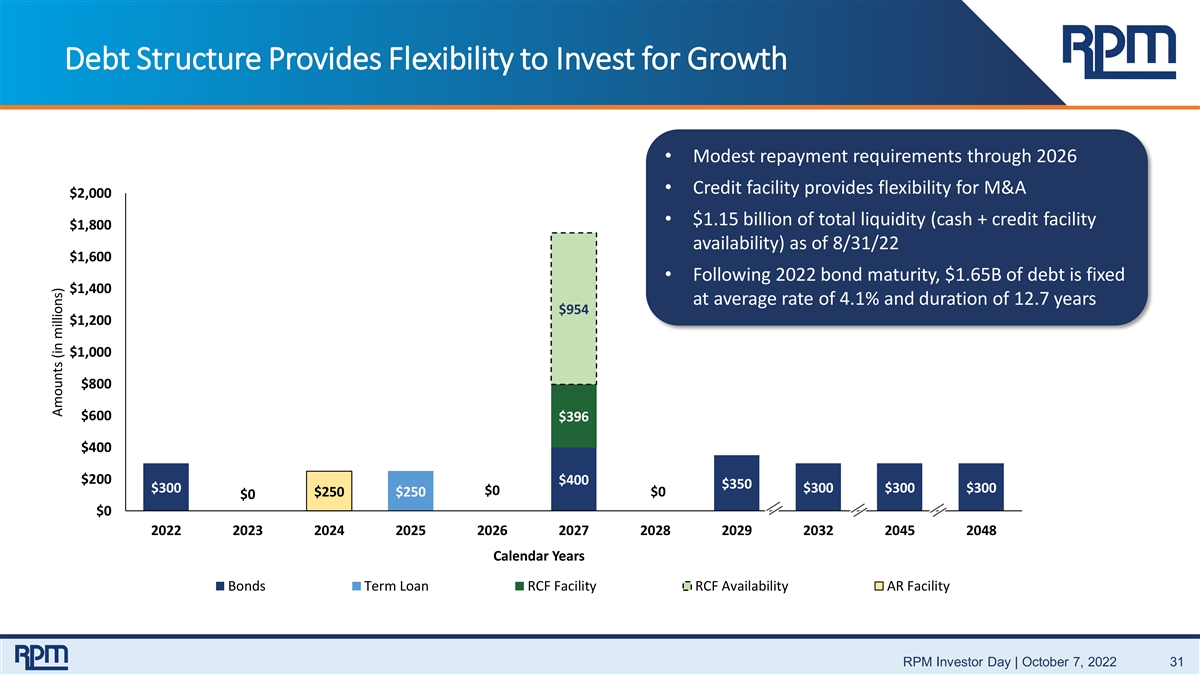

Debt Structure Provides Flexibility to Invest for Growth • Modest repayment requirements through 2026 • Credit facility provides flexibility for M&A $2,000 • $1.15 billion of total liquidity (cash + credit facility $1,800 availability) as of 8/31/22 $1,600 • Following 2022 bond maturity, $1.65B of debt is fixed $1,400 at average rate of 4.1% and duration of 12.7 years $954 $1,200 $1,000 $800 $600 $396 $400 $200 $400 $350 $300 $300 $300 $300 $0 $250 $250 $0 $0 $0 2022 2023 2024 2025 2026 2027 2028 2029 2032 2045 2048 Calendar Years Bonds Term Loan RCF Facility RCF Availability AR Facility RPM Investor Day | October 7, 2022 31 Amounts (in millions)

Sustainability at RPM Tracy Crandall Vice President – Compliance & Sustainability, Associate General Counsel

Sustainability = Building a Better World Building a Better World is about engaging associates throughout RPM in our ongoing commitment to create a sustainable future using our values of transparency, trust and respect. These values fuel our continued focus on solutions that grow our business, drive innovative product development, prioritize the people important to our success, and honor the planet we call home. 33 RPM Investor Day | October 7, 2022

Sustainability Report – Released in August of 2022 34 RPM Investor Day | October 7, 2022

Our Approach RPM Investor Day | October 7, 2022 35

2025 Sustainability Goals Reduce our Scope 1 and 2 greenhouse Identify and Reduce our waste to gas (GHG) emissions implement additional landfill by 10% and from our facilities by opportunities for increase recycling by 20% per ton of water reuse and 20% per ton of production and conservation and production from our energy consumed in collaborate with facilities. our facilities by 10% suppliers to do the per ton of same. production. RPM Investor Day | October 7, 2022 36

Our Products AlphaGuard, a liquid applied Nudura Insulated Concrete roofing system, keeps tons of Forms (ICFs) provide superior Kop-Coat and AGPRO material out of stressed energy efficiency by lowering produce adjuvants that landfills each year because it utility costs, including in a increase crop yields and can is applied over the existing number of net zero projects. help reduce the use of roof. The AlphaGuard line Nudura ICFs also provide pesticides by up to 50%. includes bio-based products strength, safety and durability and all are used to promote against extreme weather more energy efficiency in the conditions. buildings they are applied to. RPM Investor Day | October 7, 2022 37

Our People Tremco RISE (Roofing Diversity and Inclusion Training and Development Individuals Succeed through We embrace the ways our Using associate feedback to Education) associates are different, develop new and improved This program helps educate a including their background, initiatives focused on new generation of roofing age, gender, ability, sexuality associate professionals in technical and or any other characteristics training and development. business skills, including that make our associates offering apprenticeships and unique. scholarships and working with Departments of Corrections. RPM Investor Day | October 7, 2022 38

Our Processes Environmental, Health and Water Stress Analysis MS-168 Safety We completed a water stress Closed older/redundant Maintaining safe and analysis for all manufacturing inefficient locations sustainable operations for locations in 2021, which Focused on operational our associates, communities supports Cap Ex and other efficiency and the planet planning processes Significantly reduced greenhouse gas emissions and energy, waste and water use RPM Investor Day | October 7, 2022 39

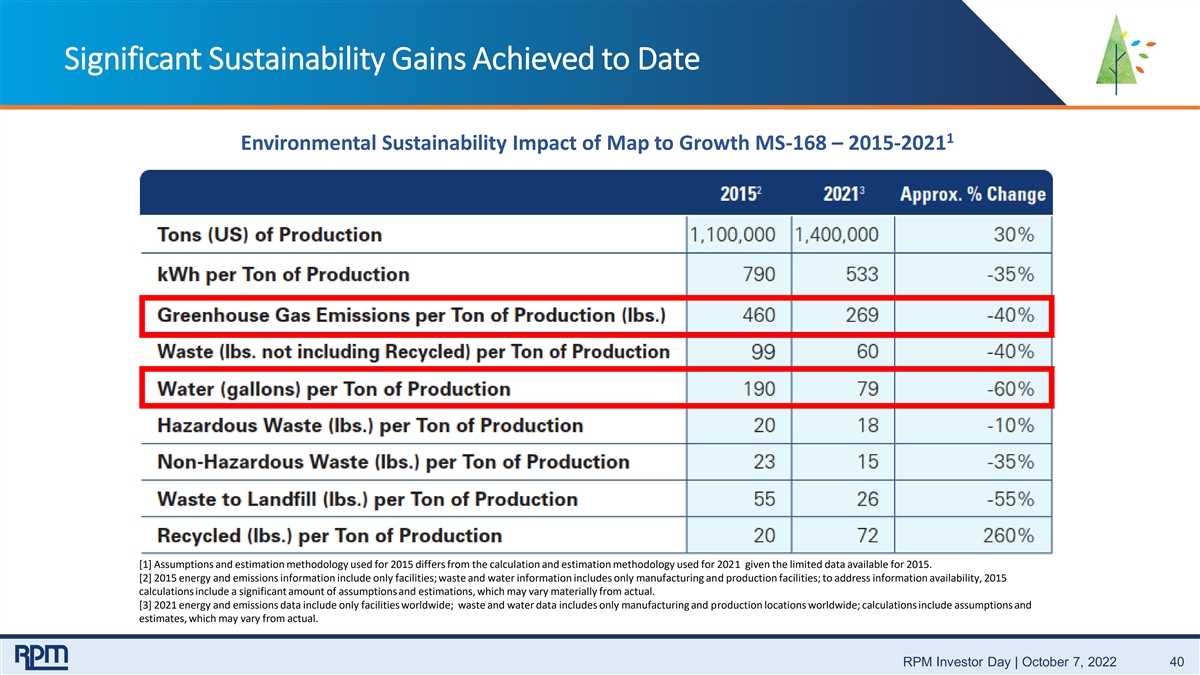

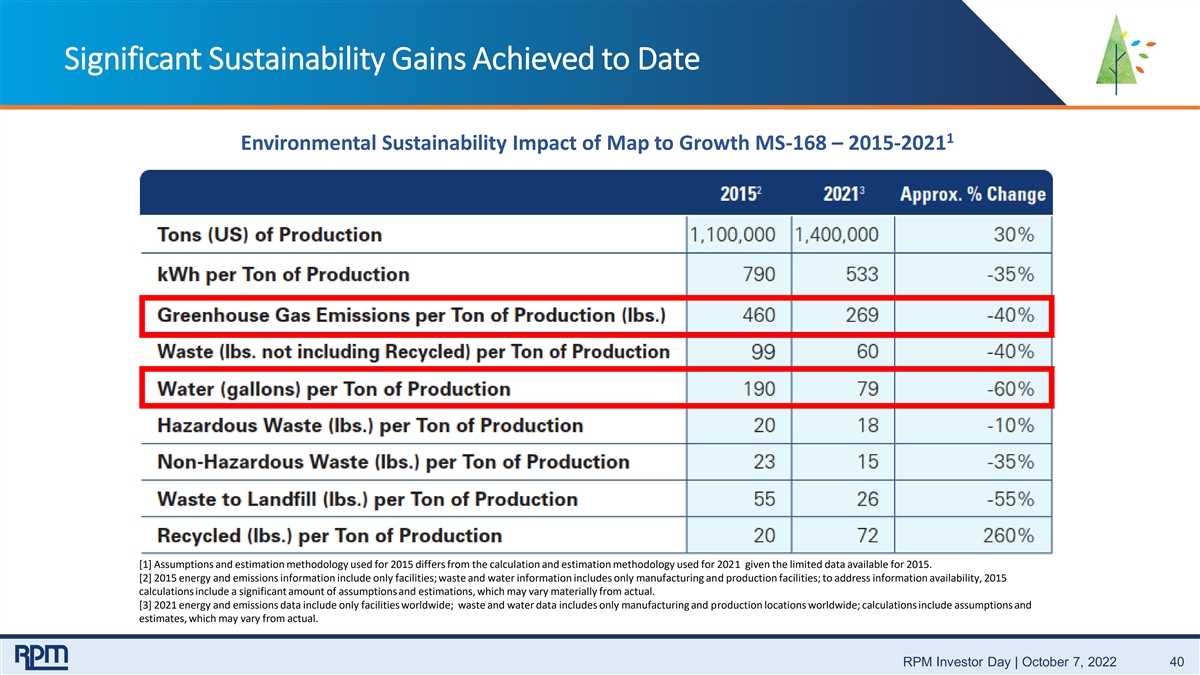

Significant Sustainability Gains Achieved to Date 1 Environmental Sustainability Impact of Map to Growth MS-168 – 2015-2021 [1] Assumptions and estimation methodology used for 2015 differs from the calculation and estimation methodology used for 2021 given the limited data available for 2015. [2] 2015 energy and emissions information include only facilities; waste and water information includes only manufacturing and production facilities; to address information availability, 2015 calculations include a significant amount of assumptions and estimations, which may vary materially from actual. [3] 2021 energy and emissions data include only facilities worldwide; waste and water data includes only manufacturing and production locations worldwide; calculations include assumptions and estimates, which may vary from actual. RPM Investor Day | October 7, 2022 40

Our Governance Board of Directors • Governance and Nominating Committee - oversight responsibility • Our three most recently appointed board members are: • Ellen M. Pawlikowski, General (Retired) of the United States Air Force • Elizabeth F. Whited, Executive Vice President – Sustainability & Strategy, Union Pacific Corporation. • Julie A. Lagacy, Chief Sustainability and Strategy Officer, Caterpillar Inc. • All Directors independent, except Chairman and CEO RPM Investor Day | October 7, 2022 41

Objectives for Driving Continued Progress • Develop People and Products Goals • Develop renewable energy strategy • Update materiality assessment • Improved data analytics in risk assessment process • Further assess and model climate change risks to report using TCFD framework • Meet 2025 goals • Track and report sustainably advantaged product development initiatives • Continue to implement best practices in governance and compliance initiatives • Implement corporate-wide training and development programs RPM Investor Day | October 7, 2022 42 42

Construction Products Group Paul Hoogenboom CPG Group President

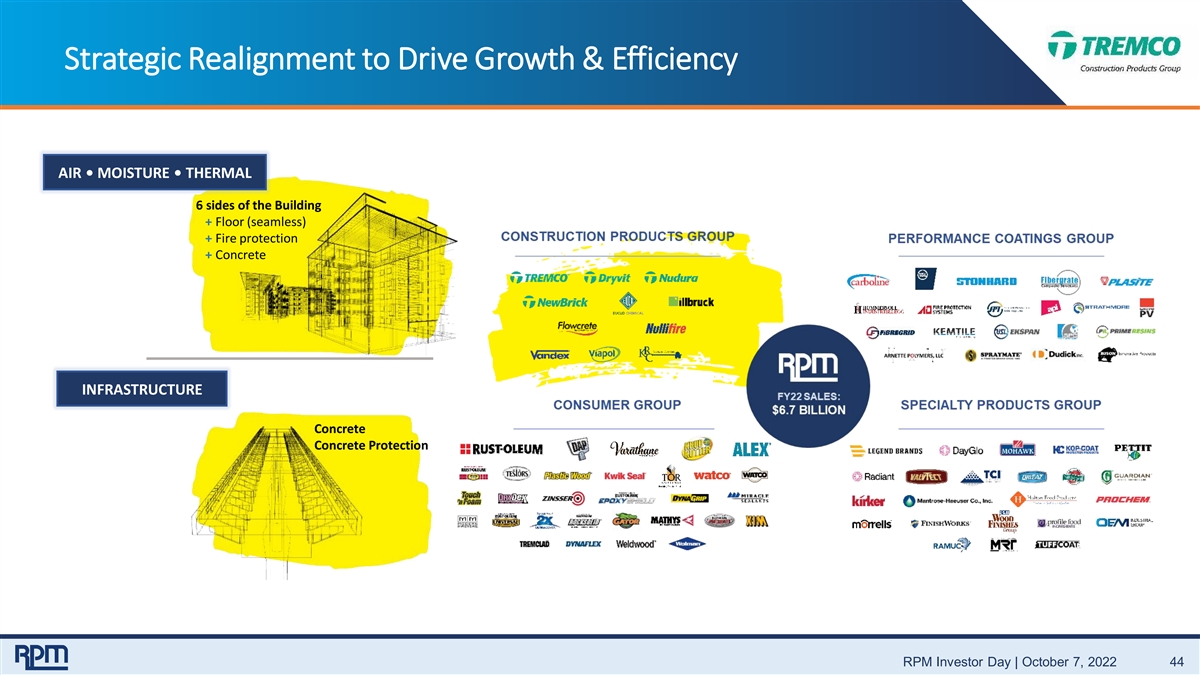

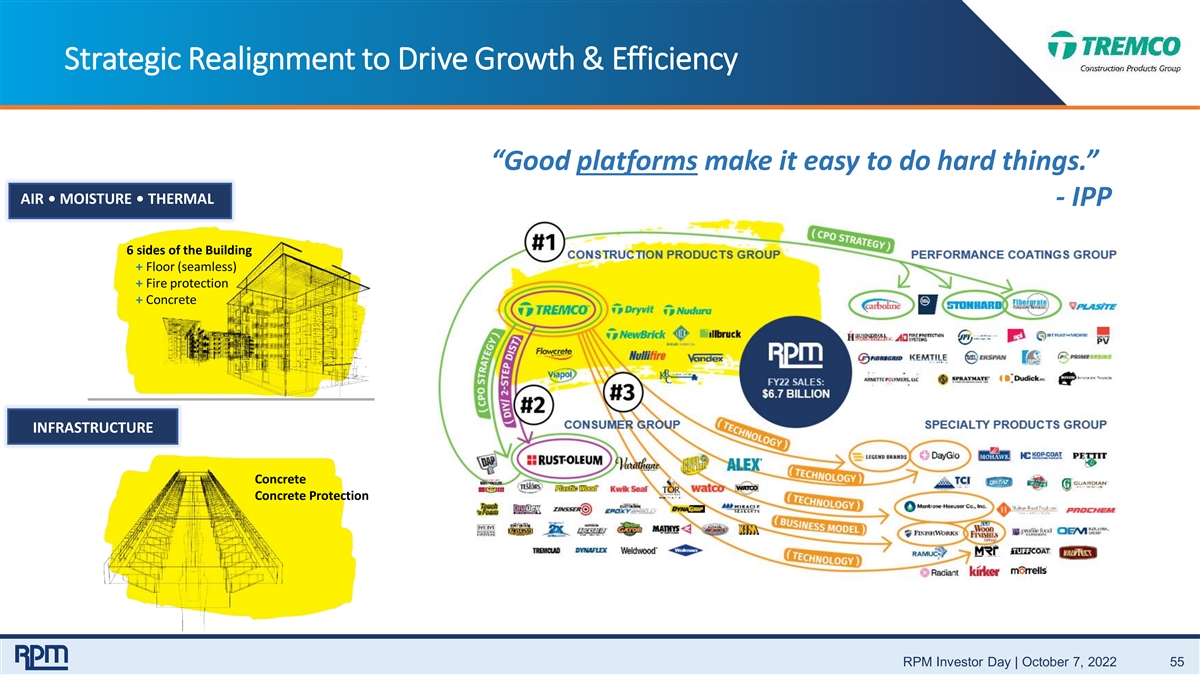

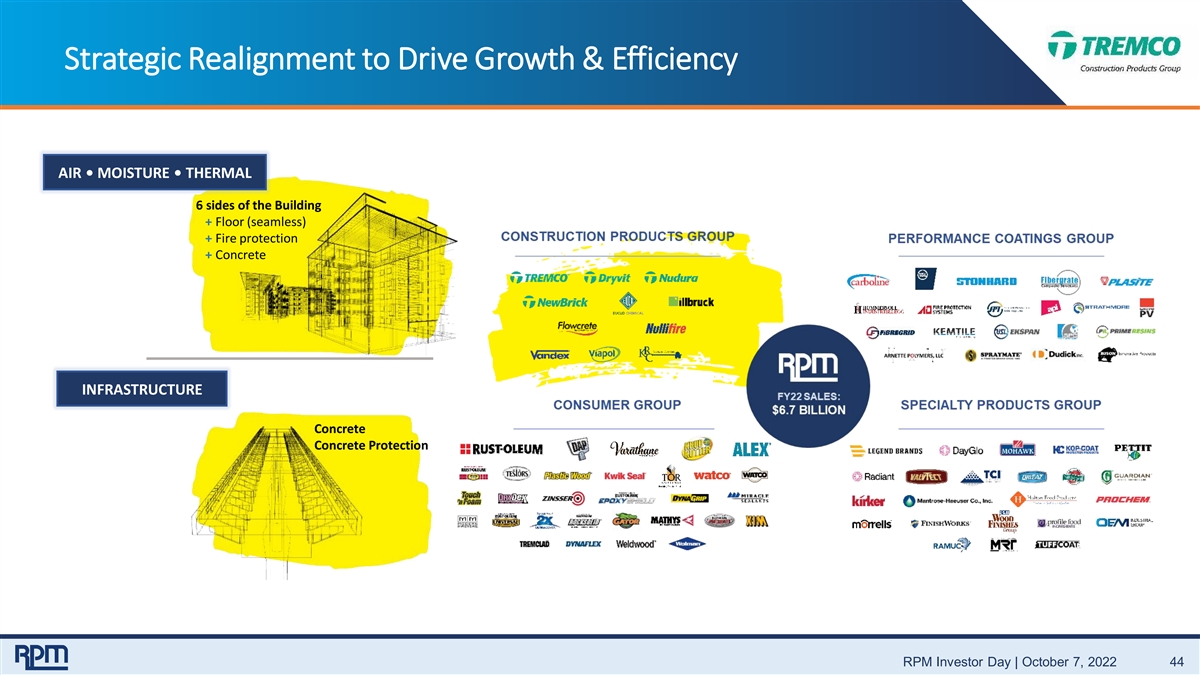

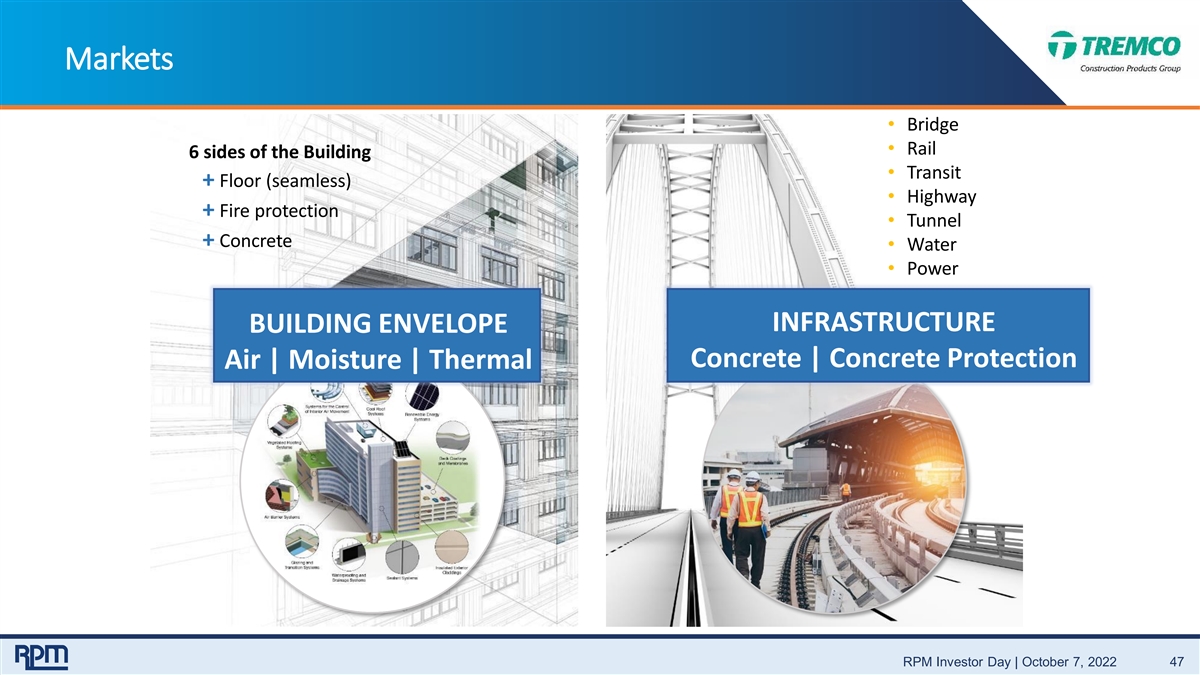

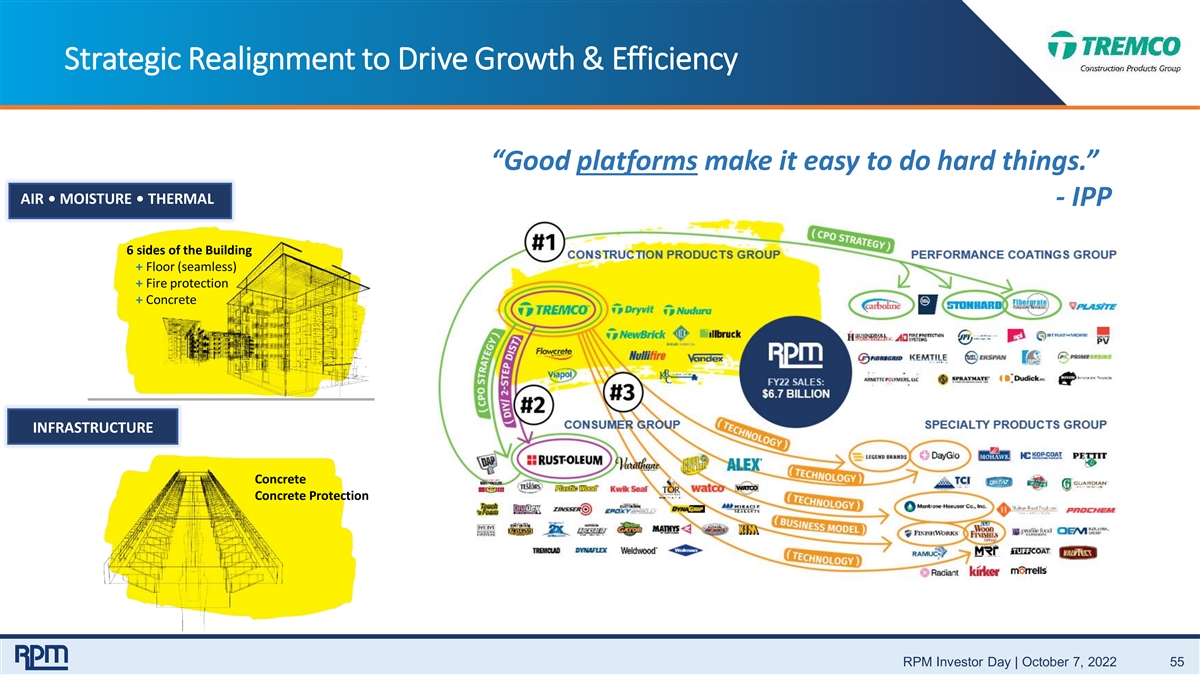

Strategic Realignment to Drive Growth & Efficiency AIR • MOISTURE • THERMAL 6 sides of the Building + Floor (seamless) + Fire protection + Concrete INFRASTRUCTURE Concrete Concrete Protection RPM Investor Day | October 7, 2022 44

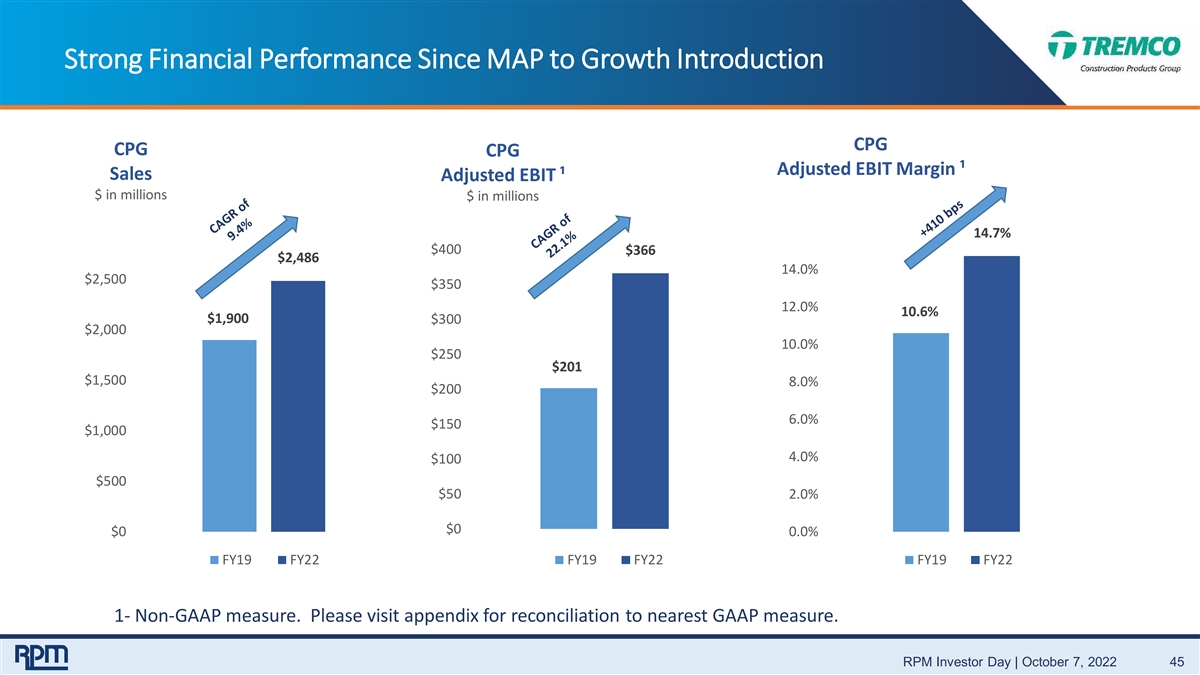

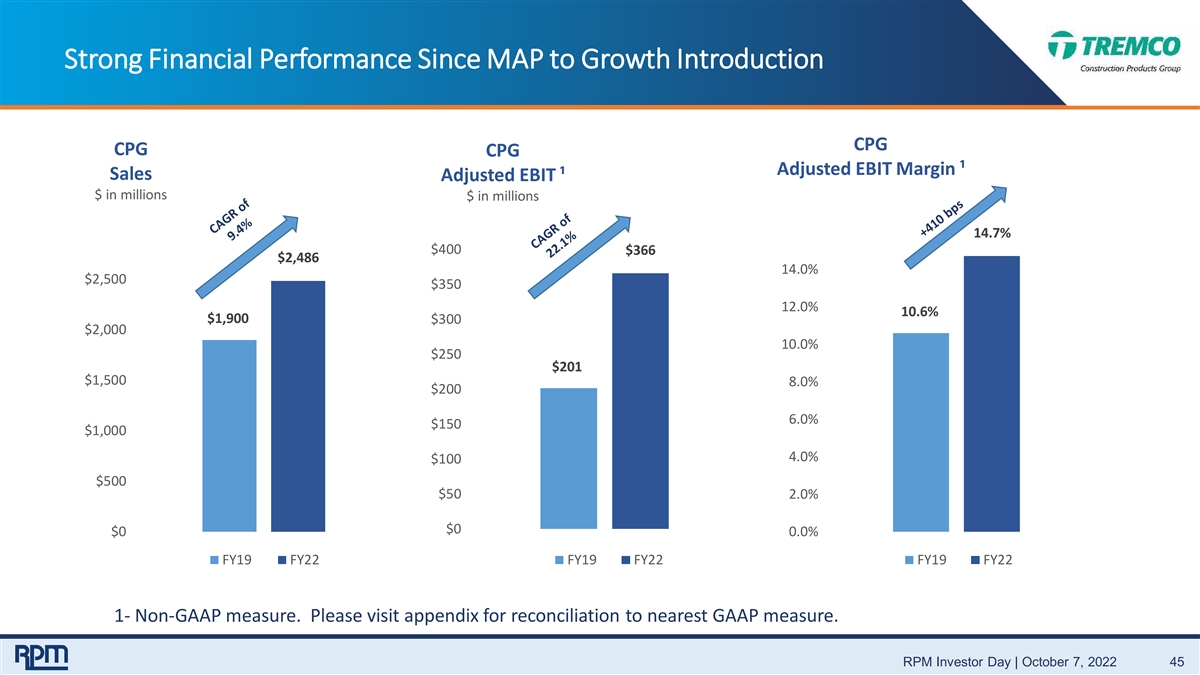

Strong Financial Performance Since MAP to Growth Introduction CPG CPG CPG Adjusted EBIT Margin ¹ Sales Adjusted EBIT ¹ $ in millions $ in millions 14.7% $400 $366 $2,486 14.0% $2,500 $350 12.0% 10.6% $1,900 $300 $2,000 10.0% $250 $201 $1,500 8.0% $200 6.0% $150 $1,000 4.0% $100 $500 $50 2.0% $0 $0 0.0% FY19 FY22 FY19 FY22 FY19 FY22 1- Non-GAAP measure. Please visit appendix for reconciliation to nearest GAAP measure. RPM Investor Day | October 7, 2022 45

Trusted Brands GLOBAL BRANDS REGIONAL BRANDS RPM Investor Day | October 7, 2022 46

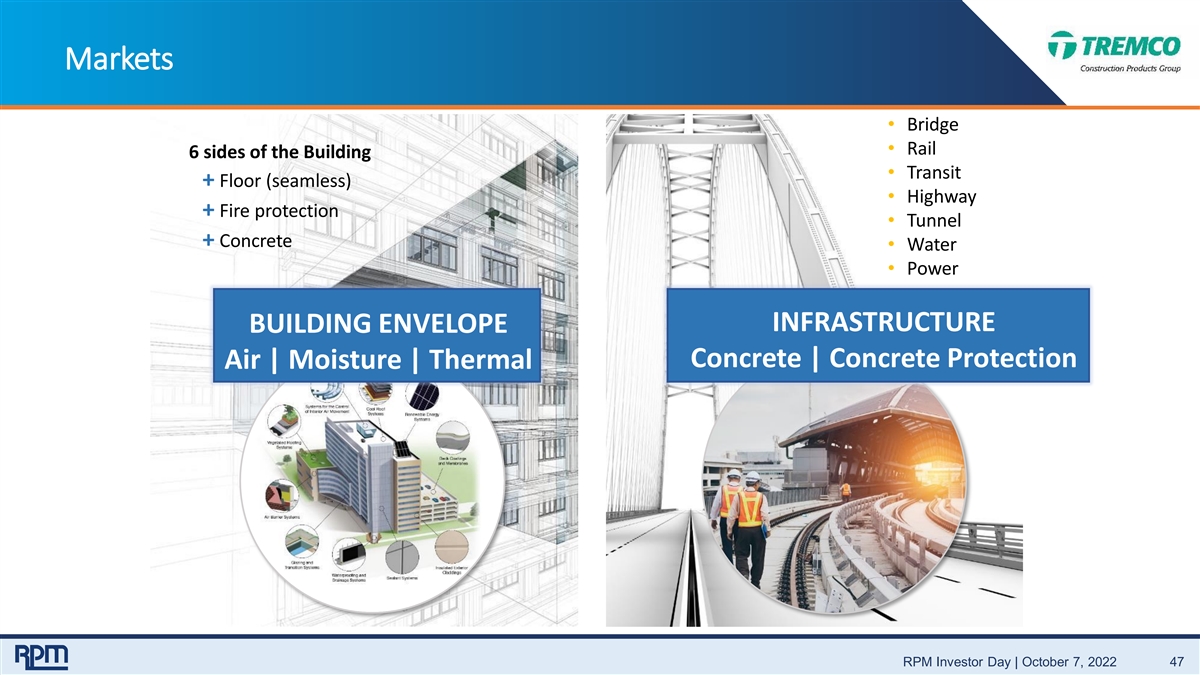

Markets • Bridge • Rail 6 sides of the Building • Transit + Floor (seamless) • Highway + Fire protection • Tunnel + Concrete • Water • Power INFRASTRUCTURE BUILDING ENVELOPE Concrete | Concrete Protection Air | Moisture | Thermal RPM Investor Day | October 7, 2022 47

RPM Theory of Competition MAP 2025 1947 Decision Making The as Close to + Wolfpack the Customer as Possible RPM Investor Day | October 7, 2022 48

CPG Theory of Competition CREATE + DRIVE … platforms … “Good platforms make it easy THE MARKET to do hard things.” - IPP … solve unique problems … “CPG wins when we solve unique problems.” - PGH … new scientific truth … “ A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.” - Max Planck RPM Investor Day | October 7, 2022 49

Create + Drive the Market “Platforms…Solve Unique Problems…A New Generation…” STRATEGIC TECHNOLOGY PLATFORMS (12) #1 #2 #3 #4 #5 #6 #7 #8 #9 #10 #11 #12 R&D + Manufacturing + Supply Chain + M&A Consultative Sales + Technical Support + Training Direct + Specialty Distribution + Self-Perform Regional Business Platform Customer RPM Investor Day | October 7, 2022 50

Restoration…the roof Asset Management: eliminate run-to-failure Cost of Neglect / Run-To-Failure MACRO TRENDS 2012 2015 2018 2022 SF Wet 5,000 25,000 50,000 170,000 • Labor shortage Cost/SF $40 $40 $40 $40 • Less “feet in the street” • “Unmaintainable” buildings Replace $ $200K $1M $2M $6.8M • Zero landfill • Energy efficiency • Indoor air quality • “Lead with Safety” • IoT monitoring + diagnostics • Chief Procurement Officer: Fluid Applied Roofing CPE, “Method to buy” • Climate change (volatility) North America • Thermal stability/harmony Services are Tremco is 14% of creating + $796 driving market’s $11+ $5.64 billion million share gain billion total low/no market (2x materials) slope market RPM Investor Day | October 7, 2022 51

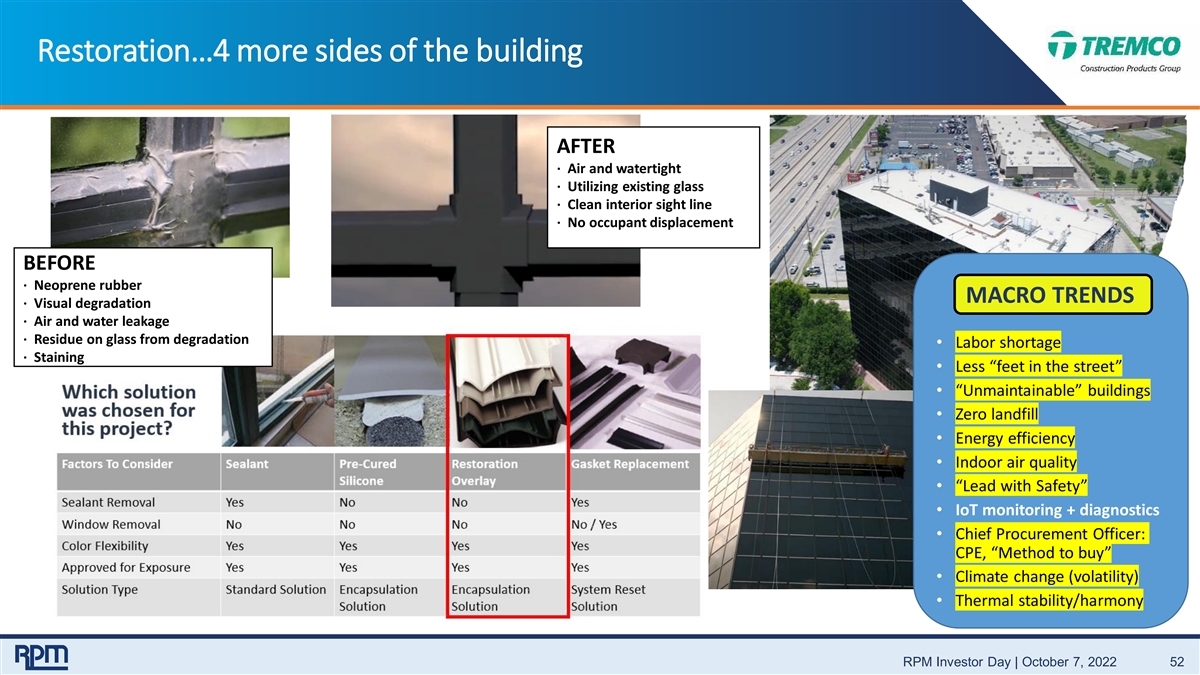

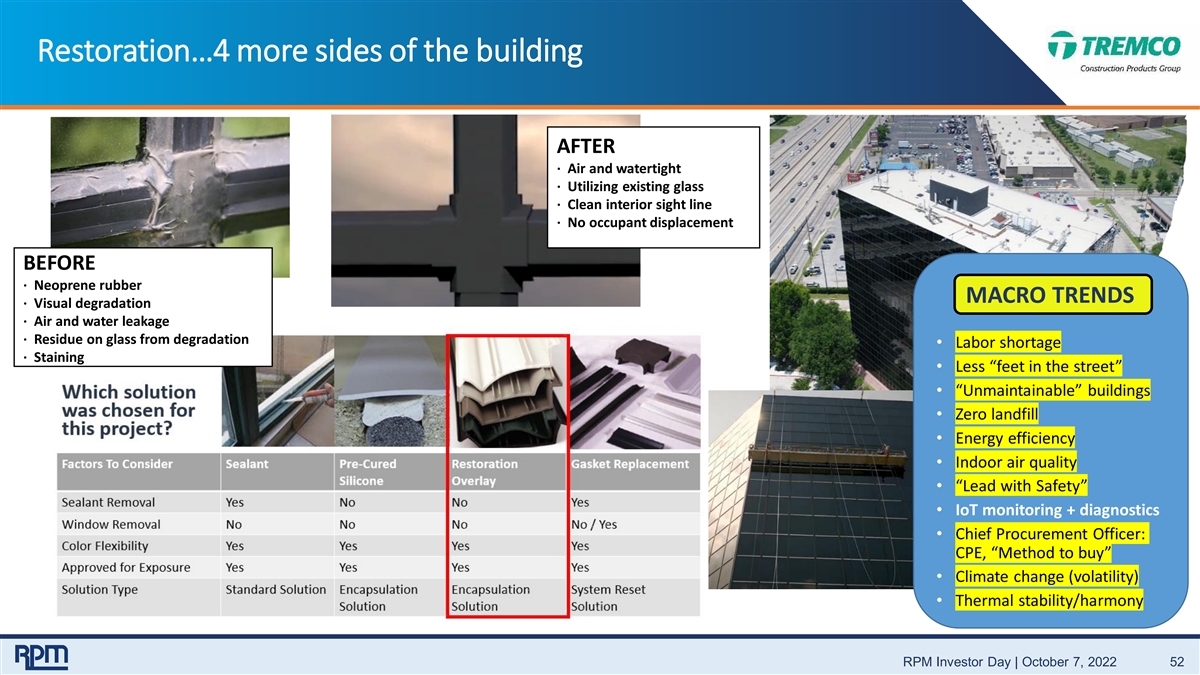

Restoration…4 more sides of the building AFTER · Air and watertight · Utilizing existing glass · Clean interior sight line · No occupant displacement BEFORE · Neoprene rubber MACRO TRENDS · Visual degradation · Air and water leakage · Residue on glass from degradation • Labor shortage · Staining • Less “feet in the street” • “Unmaintainable” buildings • Zero landfill • Energy efficiency • Indoor air quality • “Lead with Safety” • IoT monitoring + diagnostics • Chief Procurement Officer: CPE, “Method to buy” • Climate change (volatility) • Thermal stability/harmony RPM Investor Day | October 7, 2022 52

X Restoration…Insulated Concrete Forms (ICF) FAST FACTS · First net-zero school in North America (2010) · Cost comparable to “conventional” schools · International recognition, extensive national press of ICF technology MACRO TRENDS · PV sqft 25% of “conventional” construction · Tornado-resistant walls (to 250+ mph winds) • Labor shortage · Dozens of large windows • Less “feet in the street” Richardsville Elementary School · Huge suspended radius wall Bowling Green, KY · Sound resistance• “Unmaintainable” buildings • Zero landfill • Energy efficiency • Indoor air quality • “Lead with Safety” • IoT monitoring + diagnostics • Chief Procurement Officer: CPE, “Method to buy” • Climate change (volatility) • Thermal stability/harmony More More More energy Stronger environmentally comfortable efficient friendly RPM Investor Day | October 7, 2022 53

After Before Parking Garage Restoration: Before After Facade Restoration: Roofing + HVAC Restoration: Before After RPM Investor Day | October 7, 2022 54

Strategic Realignment to Drive Growth & Efficiency “Good platforms make it easy to do hard things.” AIR • MOISTURE • THERMAL - IPP 6 sides of the Building + Floor (seamless) + Fire protection + Concrete INFRASTRUCTURE Concrete Concrete Protection RPM Investor Day | October 7, 2022 55

“Life’s Most Persistent and Urgent Question” RPM Investor Day | October 7, 2022 56

Conclusion Frank Sullivan Chairman & Chief Executive Officer

Takeaways Culture of collaboration, efficiency and entrepreneurial growth 1 MAP improvements led by manufacturing, procurement and commercial initiatives 2 Strong balance sheet with flexibility to invest in growth projects 3 Sustainability is an integral part of RPM’s operations and culture 4 CPG’s focus on solving unique customer problems is key growth driver 5 CPG positioned to benefit from macro trends 6 RPM Investor Day | October 7, 2022 58

Q&A Thank you for your interest in RPM RPM Investor Day | October 7, 2022 59

Appendix Reconciliation of Non-GAAP to GAAP Measures

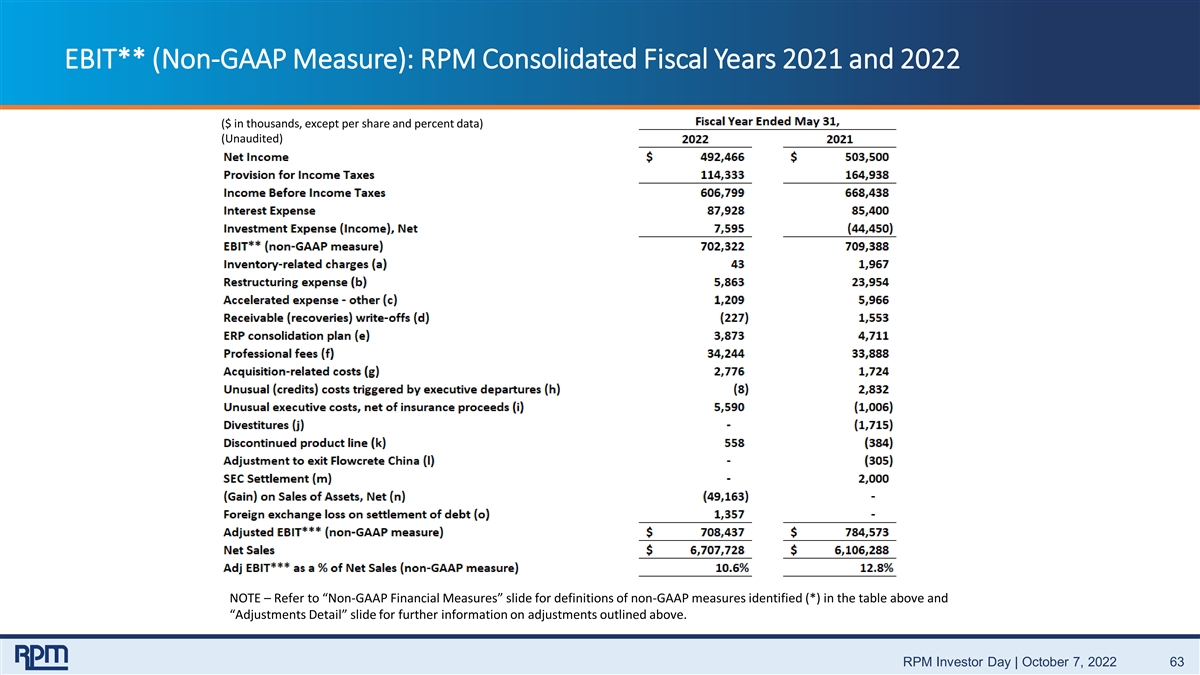

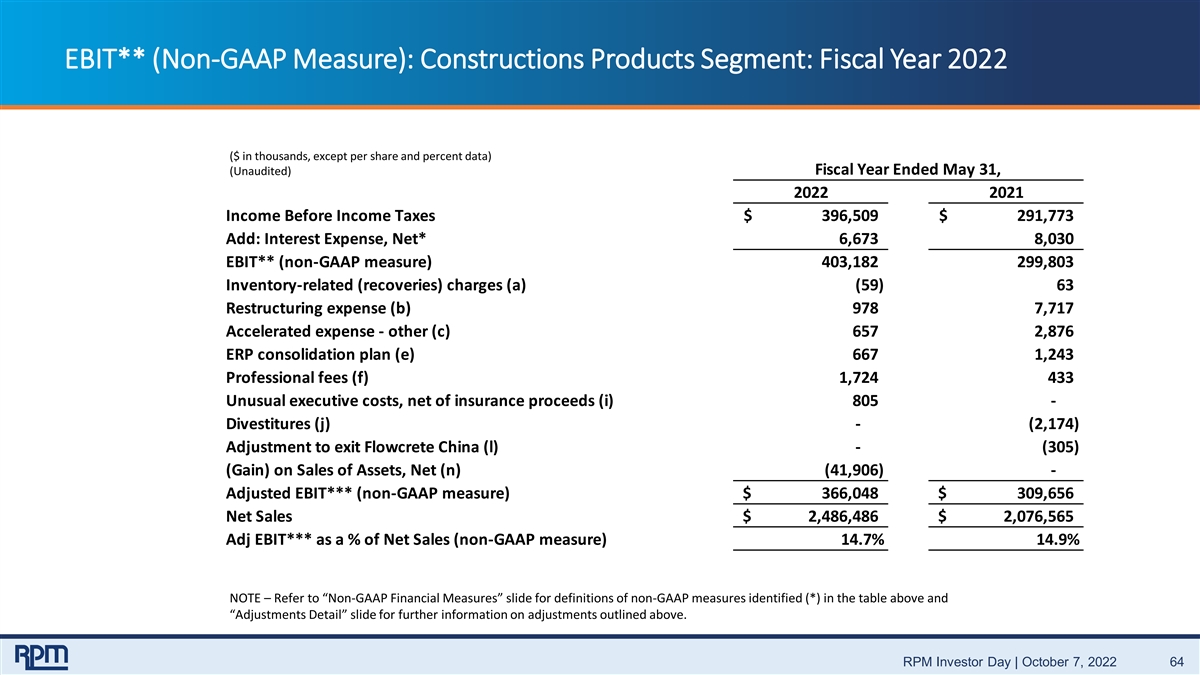

Non-GAAP Financial Measures The following are the non-GAAP financial measures used in this presentation: *Interest (Income) Expense, Net includes the combination of interest (income) expense and investment (income) expense, net. **EBIT is defined as earnings (loss) before interest and taxes. Management uses EBIT, as defined, as a measure of operating performance, since interest (income) expense, net, essentially relates to corporate functions, as opposed to segment operations. ***Adjusted EBIT is defined as earnings (loss) before interest and taxes, adjusted for items that management does not consider to be indicative of ongoing operations. Management uses Adjusted EBIT, as defined, as a measure of operating performance, since interest expense, net, essentially relates to corporate functions, as opposed to segment operations. Tables reconciling this non-GAAP data with GAAP measures are available in the appendix of this presentation. RPM Investor Day | October 7, 2022 61

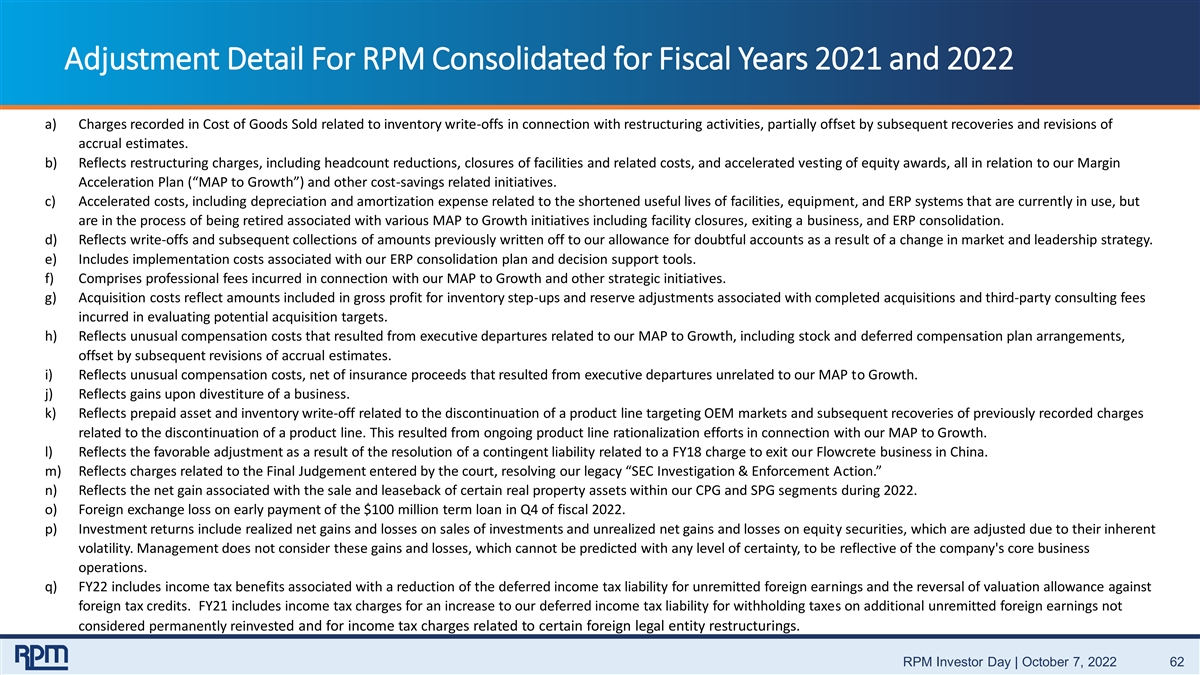

Adjustment Detail For RPM Consolidated for Fiscal Years 2021 and 2022 a) Charges recorded in Cost of Goods Sold related to inventory write-offs in connection with restructuring activities, partially offset by subsequent recoveries and revisions of accrual estimates. b) Reflects restructuring charges, including headcount reductions, closures of facilities and related costs, and accelerated vesting of equity awards, all in relation to our Margin Acceleration Plan (“MAP to Growth”) and other cost-savings related initiatives. c) Accelerated costs, including depreciation and amortization expense related to the shortened useful lives of facilities, equipment, and ERP systems that are currently in use, but are in the process of being retired associated with various MAP to Growth initiatives including facility closures, exiting a business, and ERP consolidation. d) Reflects write-offs and subsequent collections of amounts previously written off to our allowance for doubtful accounts as a result of a change in market and leadership strategy. e) Includes implementation costs associated with our ERP consolidation plan and decision support tools. f) Comprises professional fees incurred in connection with our MAP to Growth and other strategic initiatives. g) Acquisition costs reflect amounts included in gross profit for inventory step-ups and reserve adjustments associated with completed acquisitions and third-party consulting fees incurred in evaluating potential acquisition targets. h) Reflects unusual compensation costs that resulted from executive departures related to our MAP to Growth, including stock and deferred compensation plan arrangements, offset by subsequent revisions of accrual estimates. i) Reflects unusual compensation costs, net of insurance proceeds that resulted from executive departures unrelated to our MAP to Growth. j) Reflects gains upon divestiture of a business. k) Reflects prepaid asset and inventory write-off related to the discontinuation of a product line targeting OEM markets and subsequent recoveries of previously recorded charges related to the discontinuation of a product line. This resulted from ongoing product line rationalization efforts in connection with our MAP to Growth. l) Reflects the favorable adjustment as a result of the resolution of a contingent liability related to a FY18 charge to exit our Flowcrete business in China. m) Reflects charges related to the Final Judgement entered by the court, resolving our legacy “SEC Investigation & Enforcement Action.” n) Reflects the net gain associated with the sale and leaseback of certain real property assets within our CPG and SPG segments during 2022. o) Foreign exchange loss on early payment of the $100 million term loan in Q4 of fiscal 2022. p) Investment returns include realized net gains and losses on sales of investments and unrealized net gains and losses on equity securities, which are adjusted due to their inherent volatility. Management does not consider these gains and losses, which cannot be predicted with any level of certainty, to be reflective of the company's core business operations. q) FY22 includes income tax benefits associated with a reduction of the deferred income tax liability for unremitted foreign earnings and the reversal of valuation allowance against foreign tax credits. FY21 includes income tax charges for an increase to our deferred income tax liability for withholding taxes on additional unremitted foreign earnings not considered permanently reinvested and for income tax charges related to certain foreign legal entity restructurings. RPM Investor Day | October 7, 2022 62

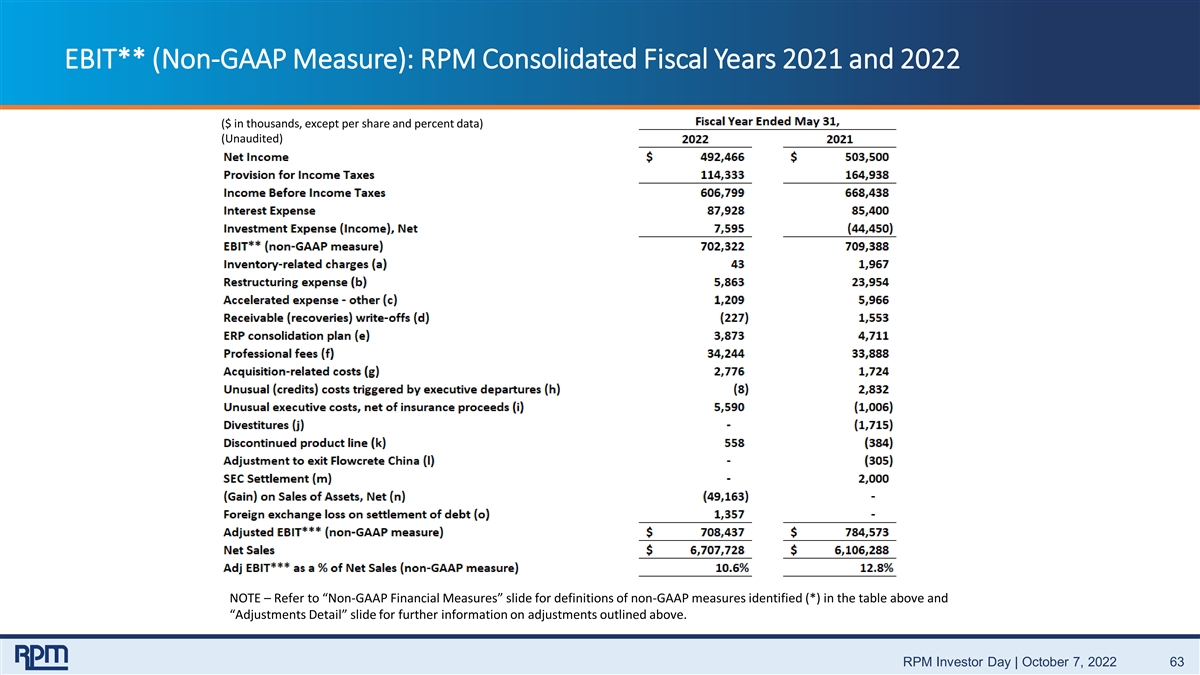

EBIT** (Non-GAAP Measure): RPM Consolidated Fiscal Years 2021 and 2022 ($ in thousands, except per share and percent data) (Unaudited) NOTE – Refer to “Non-GAAP Financial Measures” slide for definitions of non-GAAP measures identified (*) in the table above and “Adjustments Detail” slide for further information on adjustments outlined above. RPM Investor Day | October 7, 2022 63

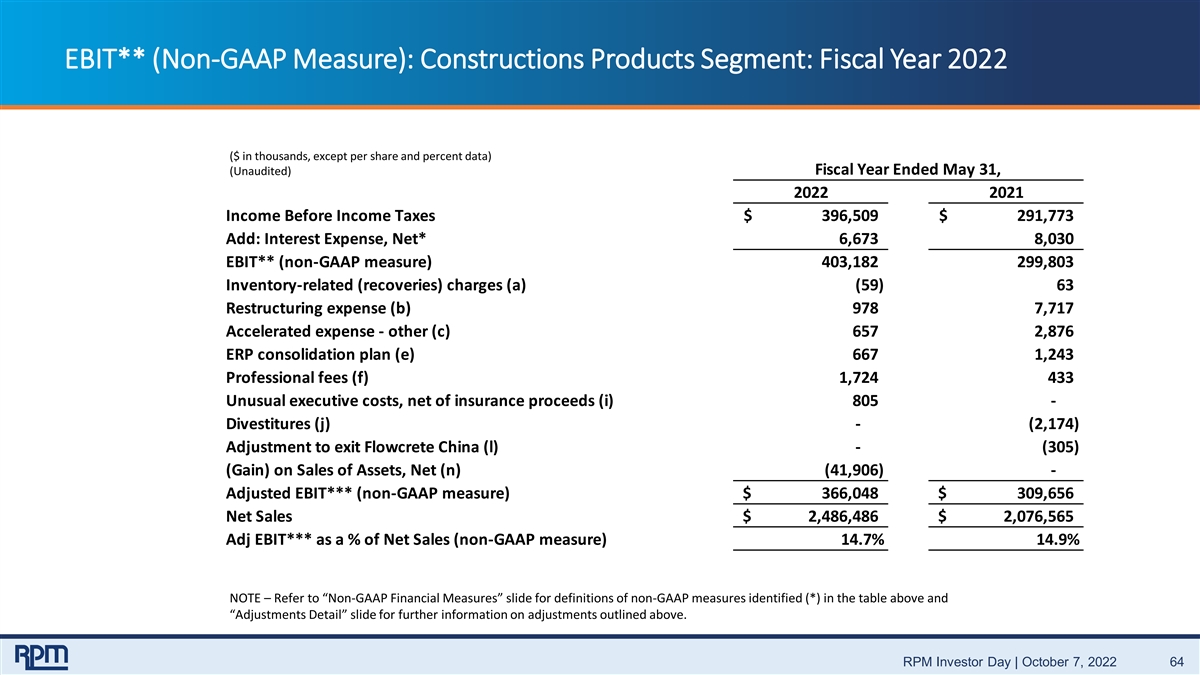

EBIT** (Non-GAAP Measure): Constructions Products Segment: Fiscal Year 2022 ($ in thousands, except per share and percent data) (Unaudited) Fiscal Year Ended May 31, 2022 2021 Income Before Income Taxes $ 396,509 $ 2 91,773 Add: Interest Expense, Net* 6,673 8,030 EBIT** (non-GAAP measure) 403,182 299,803 Inventory-related (recoveries) charges (a) (59) 63 Restructuring expense (b) 978 7 ,717 Accelerated expense - other (c) 657 2 ,876 ERP consolidation plan (e) 667 1,243 Professional fees (f) 1 ,724 433 Unusual executive costs, net of insurance proceeds (i) 805 - Divestitures (j) - (2,174) Adjustment to exit Flowcrete China (l) - ( 305) (Gain) on Sales of Assets, Net (n) (41,906) - Adjusted EBIT*** (non-GAAP measure) $ 366,048 $ 309,656 Net Sales $ 2,486,486 $ 2,076,565 Adj EBIT*** as a % of Net Sales (non-GAAP measure) 14.7% 14.9% NOTE – Refer to “Non-GAAP Financial Measures” slide for definitions of non-GAAP measures identified (*) in the table above and “Adjustments Detail” slide for further information on adjustments outlined above. RPM Investor Day | October 7, 2022 64

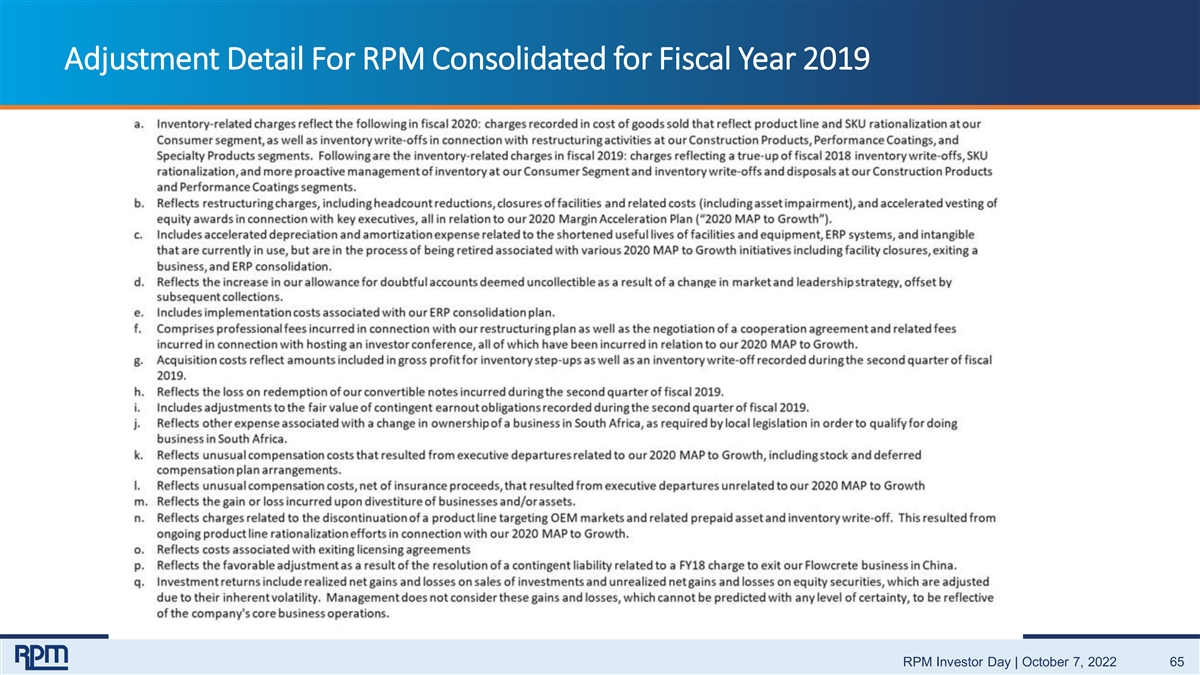

Adjustment Detail For RPM Consolidated for Fiscal Year 2019 RPM Investor Day | October 7, 2022 65

EBIT** (Non-GAAP Measure): Constructions Products Segment: Fiscal Year 2019 RPM Investor Day | October 7, 2022 66