Exhibit 99.1

Welcome to:

American Community Bancshares, Inc.

FIG Partners Road Show

Forward-looking Statements

This presentation may contain, in addition to historical information, various “forward looking statements” that represent our judgment concerning the future and are subject to risks and uncertainties that could cause American Community’s actual operating results and financial position to differ materially from those projected in the forward looking statements. Such forward looking statements can be identified by the use of forward looking terminology, such as “may,” “will,” “expect,” “anticipate,” “estimate,” or “continue” or the negative thereof or other variations thereof or comparable terminology. We caution that any such forward looking statements are further qualified by important factors that could cause American Community’s actual operating results and financial position to differ materially from the forward looking statements.

Our Market Area

Our primary market area is the Piedmont area of North and South Carolina

Union County, NC

Population of 151,000 – Monroe (pop. 29,000) is the largest city.

Fastest growing county in North Carolina.

3rd in market share in Union County

Mecklenburg County, NC

Population of 801,000 – Charlotte (pop. 594,000) is the State’s largest city and the second largest financial center in the country.

Charlotte has consistently been one of the fastest growing areas in the Southeast and is ranked 21st in US population.

14th in market share in Mecklenburg County

Cherokee County, SC

Population of 54,000

Population growth estimated to be approximately 4%

4th in market share in Cherokee County

York County, SC

Population of 170,000

2nd fastest growing county in South Carolina

4th in per capita income in South Carolina

Management and Board Profile

Management team comprised of seasoned bankers

Average age – 50

Average years in banking – 24

Board of directors with strong area ties and diverse backgrounds

Public accounting

Commercial banking

Investment banking/merger and acquisitions

Real estate

Mortgage banking

Insurance

Financial institution executive recruiting

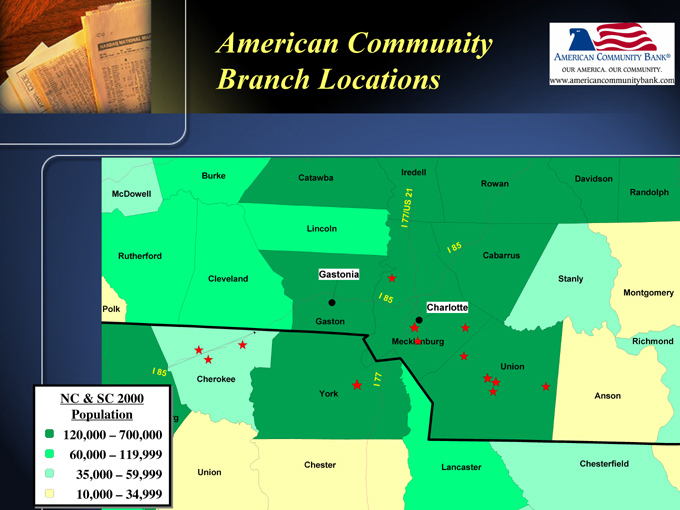

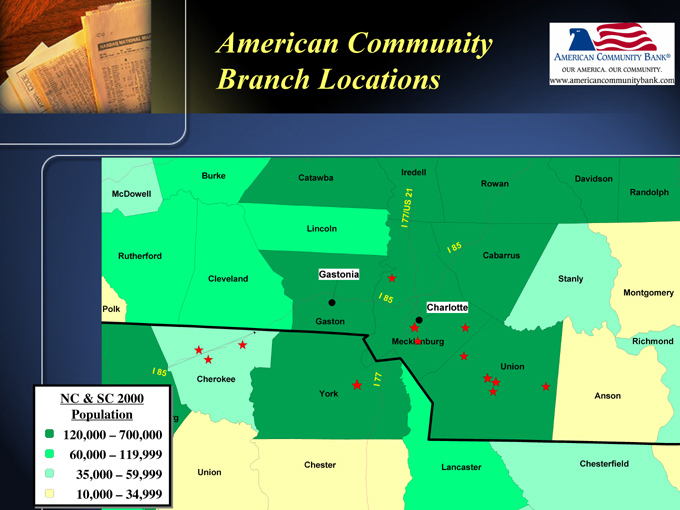

American Community Branch Locations

McDowell

Burke

Catawba

Lincoln

Cleveland

Rutherford

Polk

NC & SC 2000

Population

120,000 – 700,000

60,000 – 119,999

35,000 – 59,999

10,000 – 34,999

I 85

Cherokee

Union

Chester

York

Gaston

Gastonia

Iredell

I 77/US

21

I 85

I 77

Mecklenburg

Charlotte

I 85

Lancaster

Union

Cabarrus

Rowan

Davidson

Stanly

Randolph

Montgomery

Richmond

Anson

Chesterfield

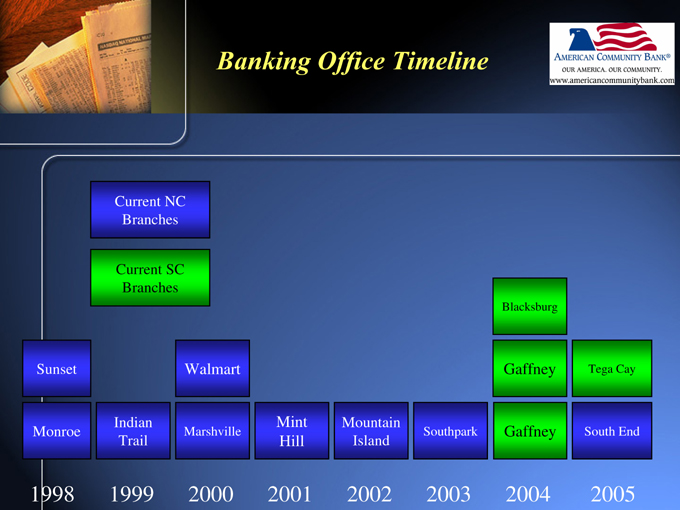

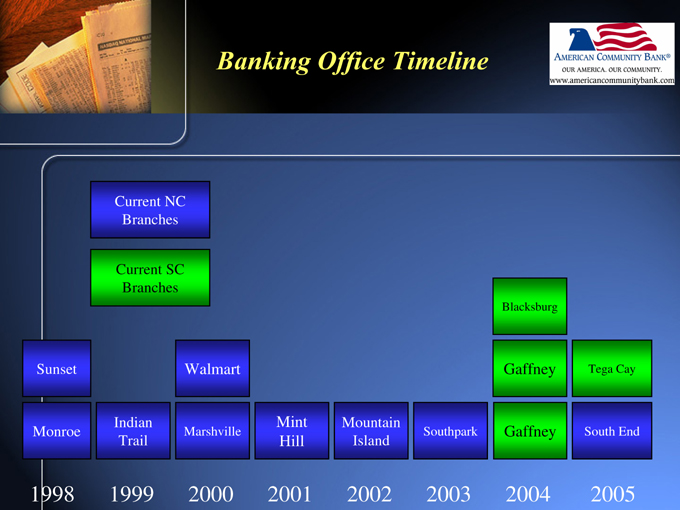

Banking Office Timeline

Current NC Branches

Current SC Branches

Sunset

Monroe

Indian Trail

Walmart

Marshville

Mint Hill

Mountain Island

Southpark

Blacksburg

Gaffney

Gaffney

Tega Cay

South End

1998

1999

2000

2001

2002

2003

2004

2005

Business Plan and Philosophy

Due to bank consolidation and economic growth, we believe a need exists in our marketplace for a locally based financial services provider focused on individuals and small to med.-sized businesses

We believe it takes a combination of a good location and good people to be successful in building and expanding our franchise.

We plan to continue to develop a branch network in growing markets within our geographic region.

Our strategy has been to open new branches only after we have identified a local banker with a loyal following of loan and deposit customers.

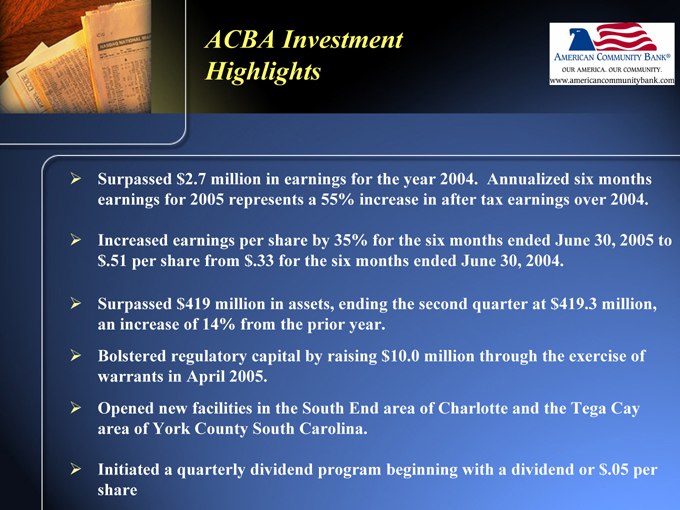

ACBA Investment Highlights

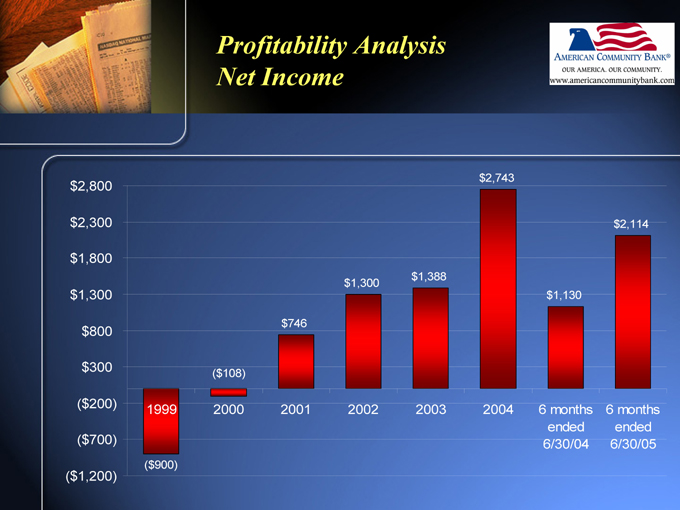

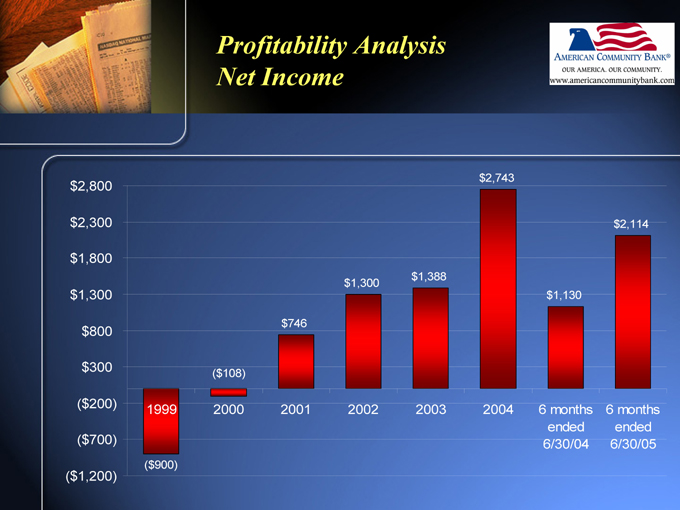

Surpassed $2.7 million in earnings for the year 2004. Annualized six months earnings for 2005 represents a 55% increase in after tax earnings over 2004.

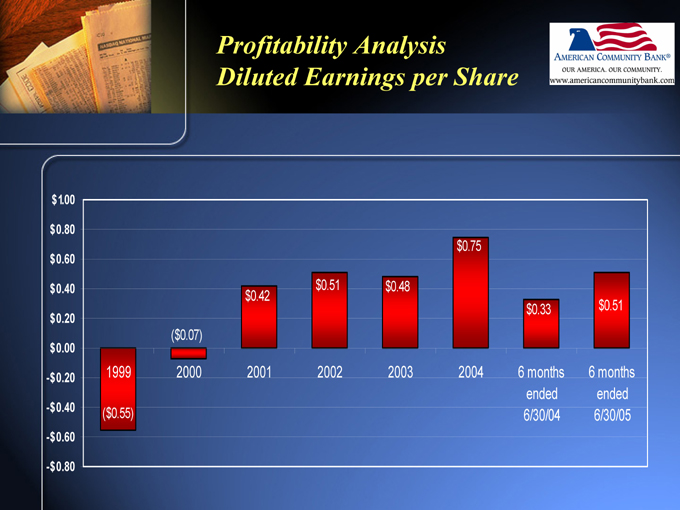

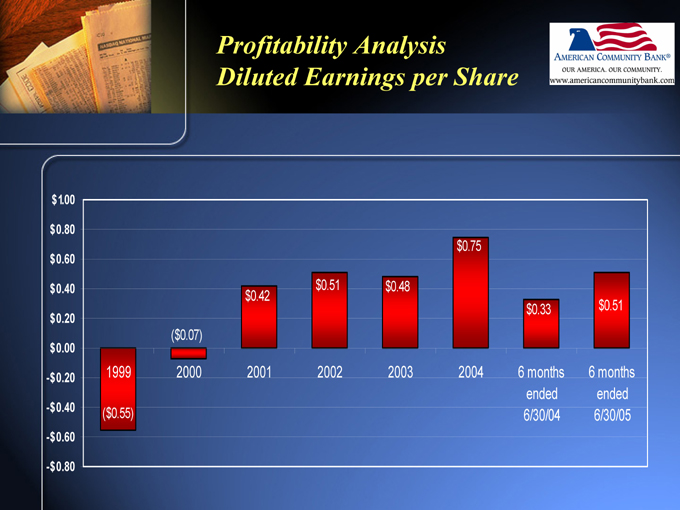

Increased earnings per share by 35% for the six months ended June 30, 2005 to $.51 per share from $.33 for the six months ended June 30, 2004.

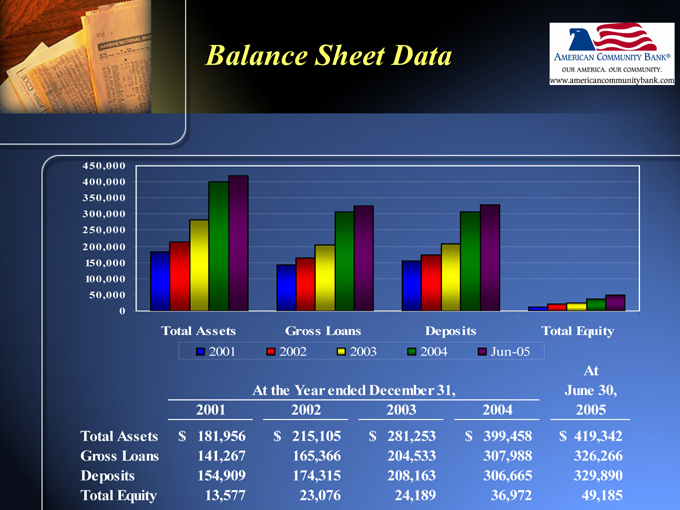

Surpassed $419 million in assets, ending the second quarter at $419.3 million, an increase of 14% from the prior year.

Bolstered regulatory capital by raising $10.0 million through the exercise of warrants in April 2005.

Opened new facilities in the South End area of Charlotte and the Tega Cay area of York County South Carolina.

Initiated a quarterly dividend program beginning with a dividend or $.05 per share

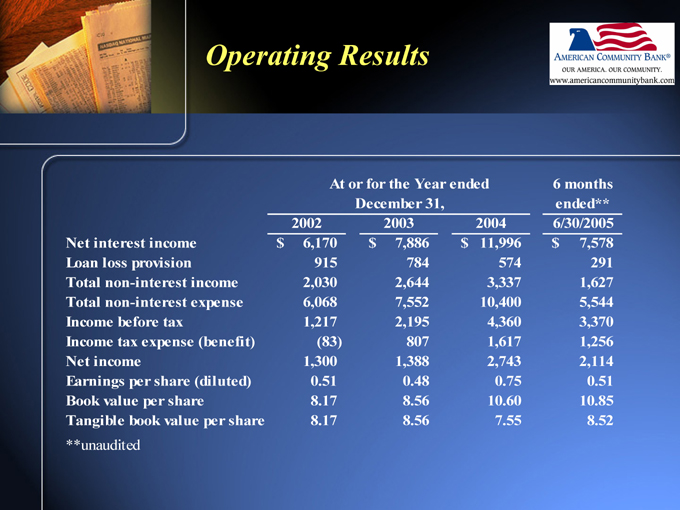

Operating Results

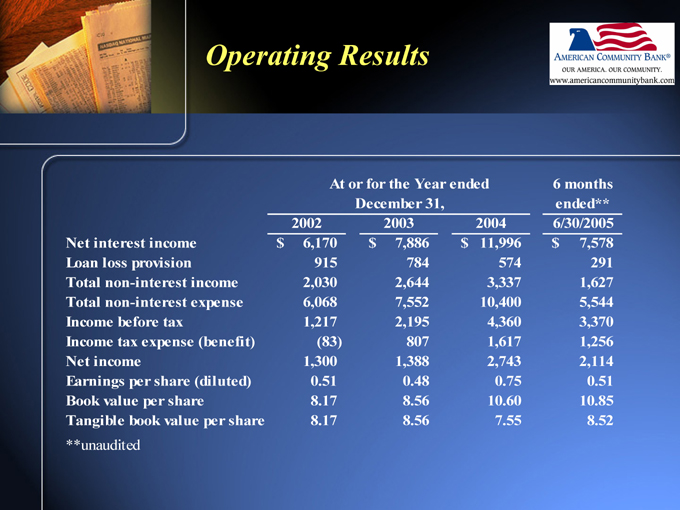

At or for the Year ended 2002 December 31, 2003 2004 6 months ended** 6/30/2005

Net interest income $6,170 $7,886 $11,996 $7,578

Loan loss provision 915 784 574 291

Total non-interest income 2,030 2,644 3,337 1,627

Total non-interest expense 6,068 7,552 10,400 5,544

Income before tax 1,217 2,195 4,360 3,370

Income tax expense (benefit) (83) 807 1,617 1,256

Net income 1,300 1,388 2,743 2,114

Earnings per share (diluted) 0.51 0.48 0.75 0.51

Book value per share 8.17 8.56 10.60 10.85

Tangible book value per share 8.17 8.56 7.55 8.52

**unaudited

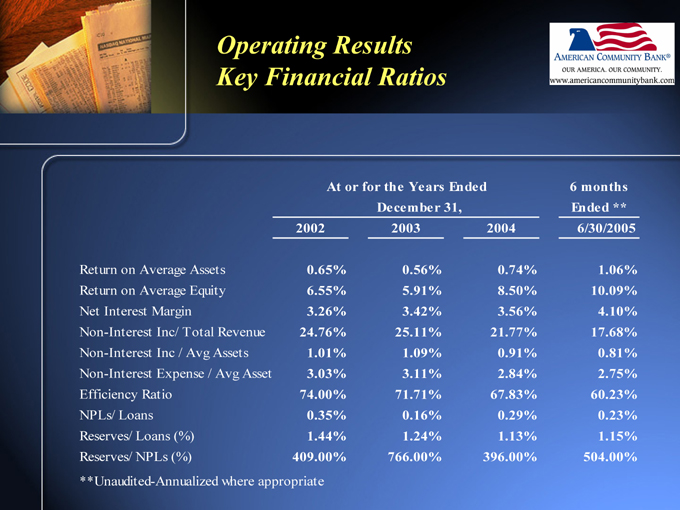

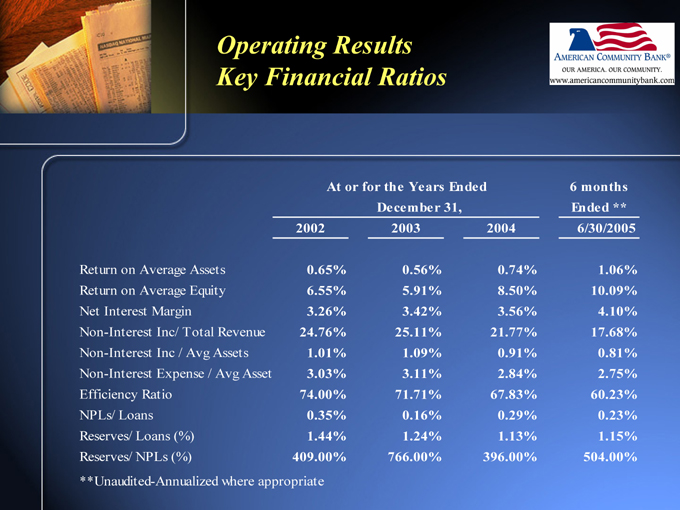

Operating Results Key Financial Ratios

At or for the Years Ended 6 months

December 31, Ended **

2002 2003 2004 6/30/2005

Return on Average Assets 0.65% 0.56% 0.74% 1.06%

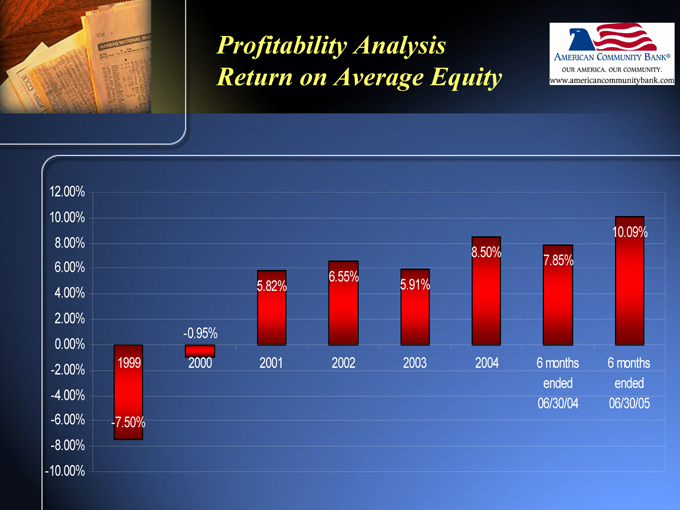

Return on Average Equity 6.55% 5.91% 8.50% 10.09%

Net Interest Margin 3.26% 3.42% 3.56% 4.10%

Non-Interest Inc/ Total Revenue 24.76% 25.11% 21.77% 17.68%

Non-Interest Inc / Avg Assets 1.01% 1.09% 0.91% 0.81%

Non-Interest Expense / Avg Asset 3.03% 3.11% 2.84% 2.75%

Efficiency Ratio 74.00% 71.71% 67.83% 60.23%

NPLs/ Loans 0.35% 0.16% 0.29% 0.23%

Reserves/ Loans (%) 1.44% 1.24% 1.13% 1.15%

Reserves/ NPLs (%) 409.00% 766.00% 396.00% 504.00%

**Unaudited-Annualized where appropriate

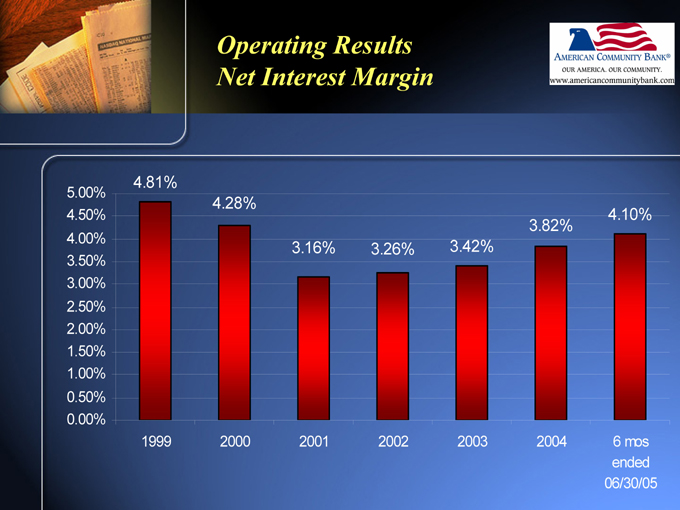

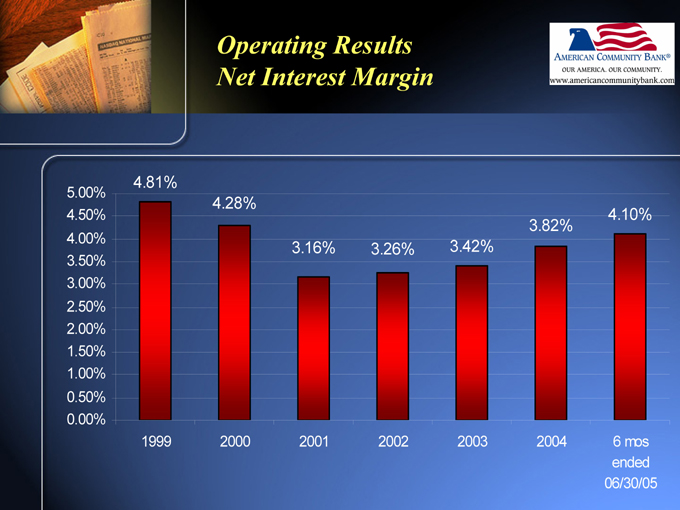

Operating Results Net Interest Margin

5.00%

4.50%

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

4.81%

4.28%

3.16%

3.26%

3.42%

3.82%

4.10%

1999

2000

2001

2002

2003

2004

6 mos ended 06/30/05

Profitability Analysis Net Income

$2,800

$2,300

$1,800

$1,300

$800

$300

($200)

($700)

($1,200)

1999

($900)

($108)

2000 $746

2001 $1,300

2002 $1,388

2003 $2,743

2004 $1,130

6 months ended 6/30/04 $2,114

6 months ended 6/30/05

Profitability Analysis Diluted Earnings per Share

$1.00

$0.80

$0.60

$0.40

$0.20

$0.00

-$0.20

-$0.40

-$0.60

-$0.80

1999

($0.55)

($0.07)

2000

$0.42

2001

$0.75

$0.51 $0.48 $0.33 $0.51

2002 2003 2004

6 months 6 months ended ended 6/30/04 6/30/05

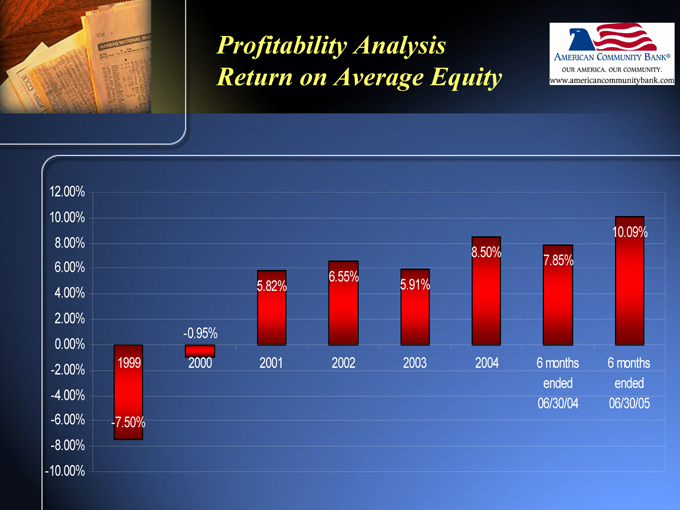

Profitability Analysis Return on Average Equity

12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% -2.00% -4.00% -6.00% -8.00% -10.00%

1999 2000 2001 2002 2003 2004 6 months 6 months ended ended 06/30/04 06/30/05

-7.50%

10.09% 8.50% 7.85% 6.55% 5.82% 5.91%

-0.95%

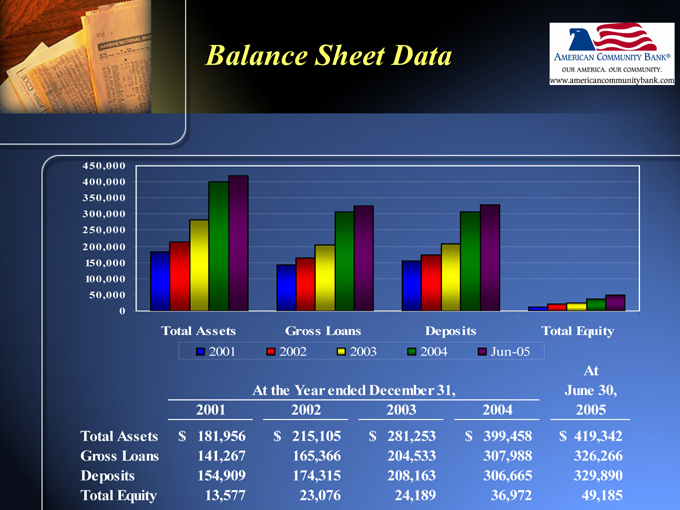

Balance Sheet Data

450,000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0

Total Assets Gross Loans Deposits Total Equity

2001 2002 2003 2004 Jun-05

2001 At the Year ended December 31, 2002 2003 June 30, 2004 At 2005

Total Assets $181,956 $215,105 $281,253 $399,458 $419,342

Gross Loans 141,267 165,366 204,533 307,988 326,266

Deposits 154,909 174,315 208,163 306,665 329,890

Total Equity 13,577 23,076 24,189 36,972 49,185

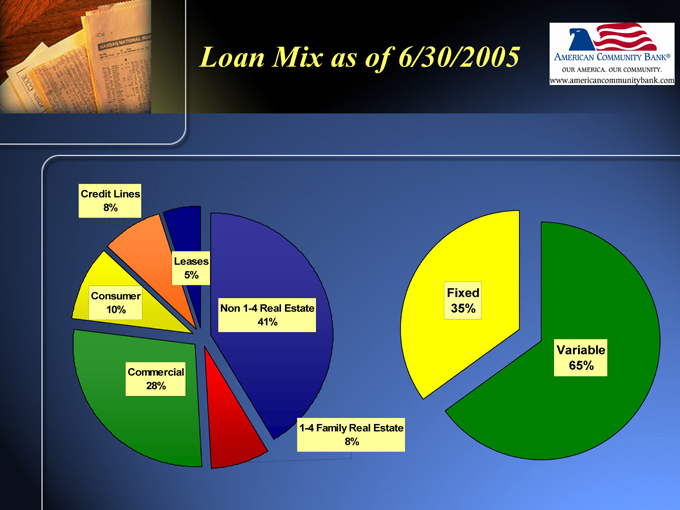

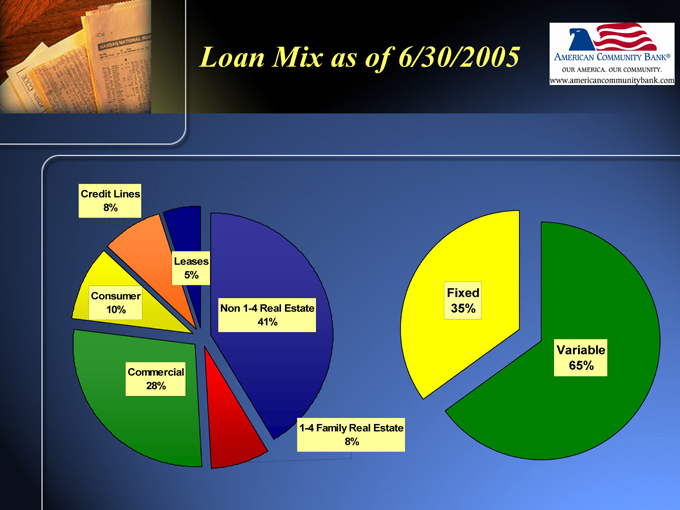

Loan Mix as of 6/30/2005

Credit Lines 8%

Consumer 10%

Leases 5%

Commercial 28%

Non 1-4 Real Estate 41%

1-4 Family Real Estate 8%

Fixed 35%

Variable 65%

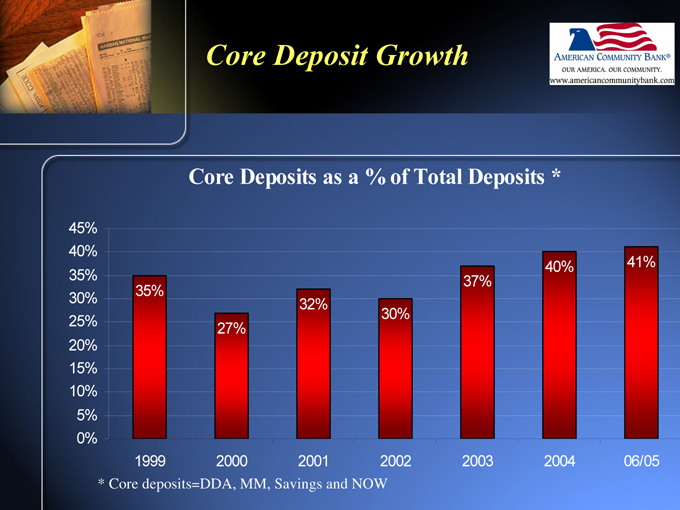

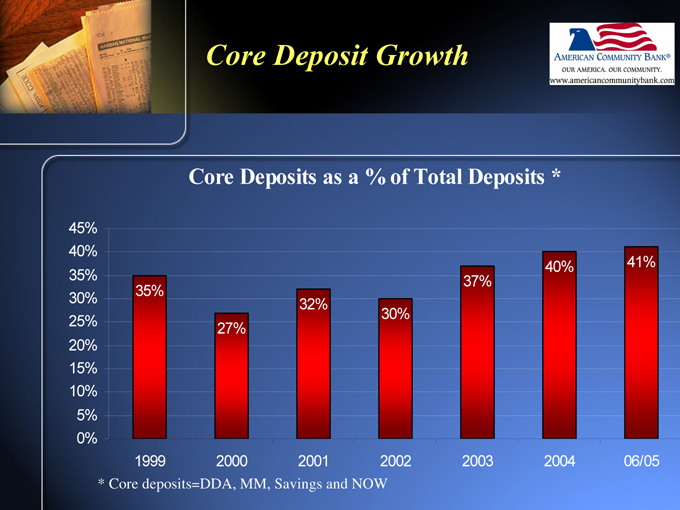

Core Deposit Growth

Core Deposits as a % of Total Deposits *

45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

40% 41% 37% 35% 32% 30% 27%

1999 2000 2001 2002 2003 2004 06/05

* | | Core deposits=DDA, MM, Savings and NOW |

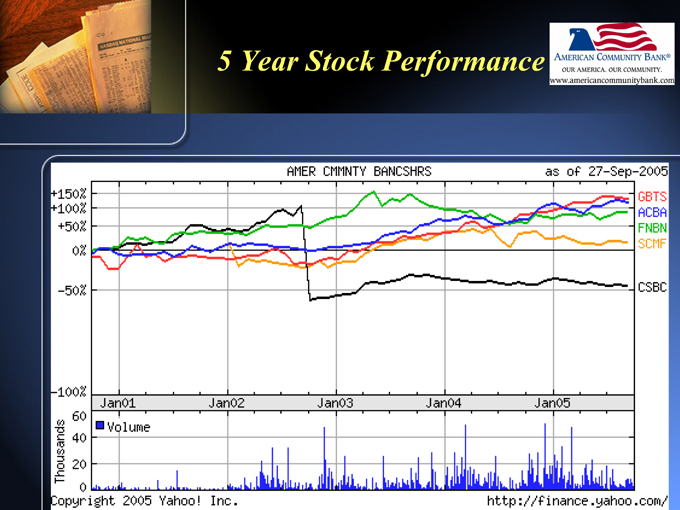

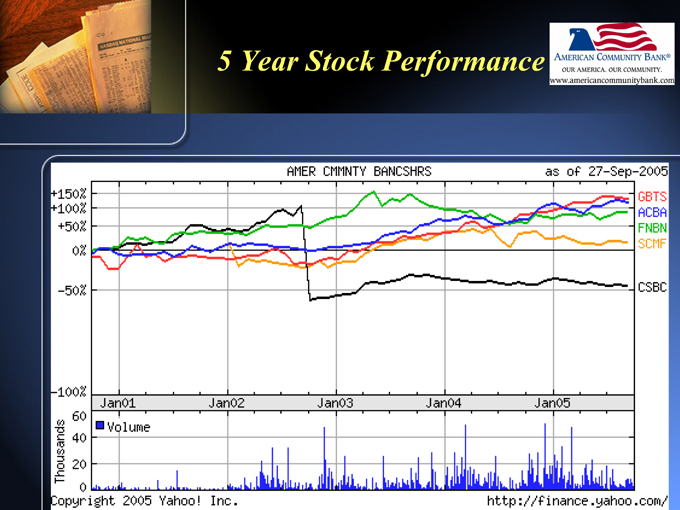

5 Year Stock Performance

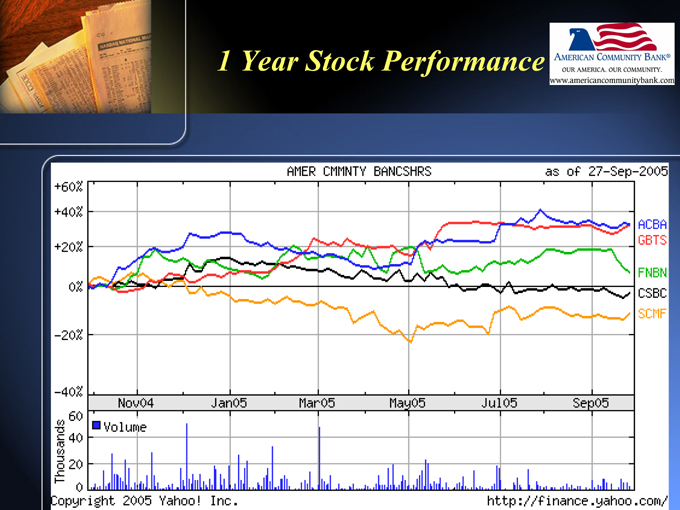

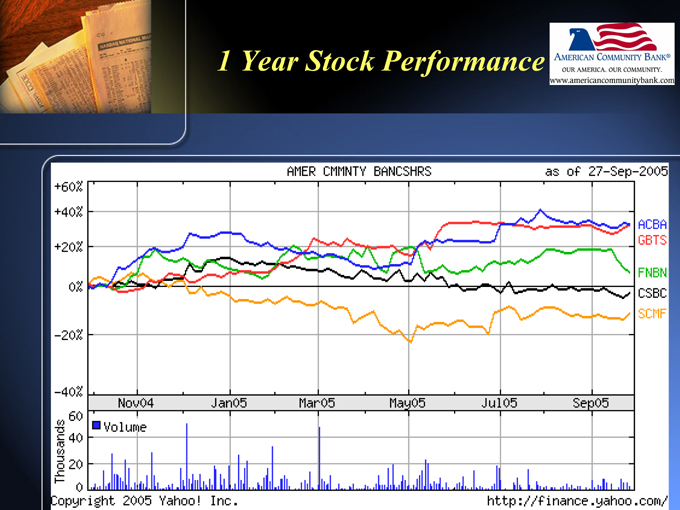

1 Year Stock Performance

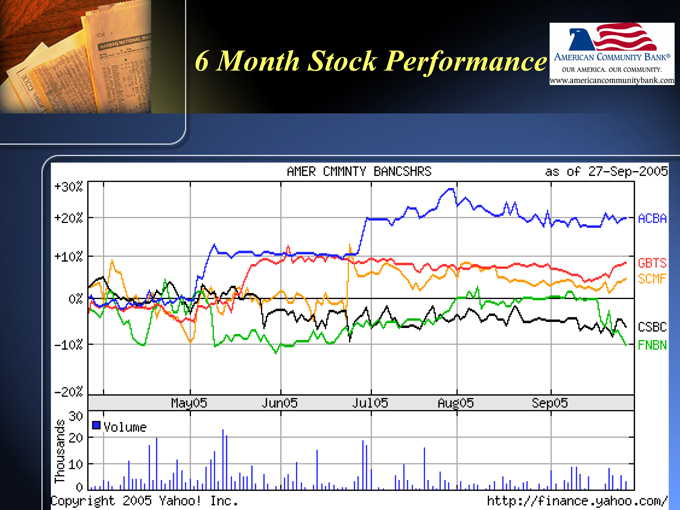

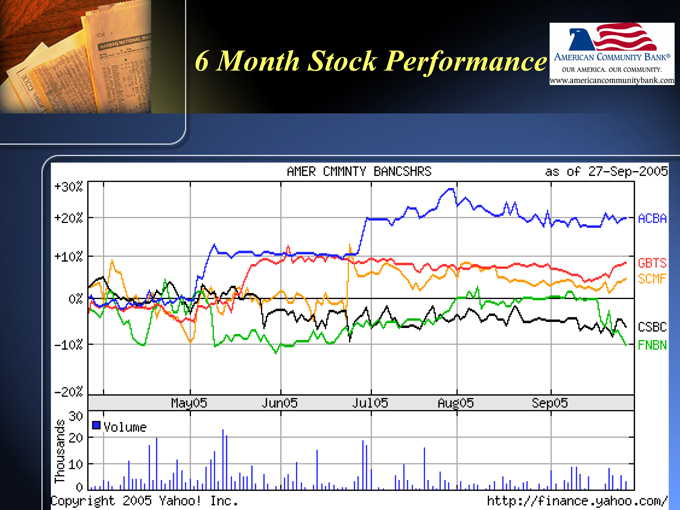

6 Month Stock Performance

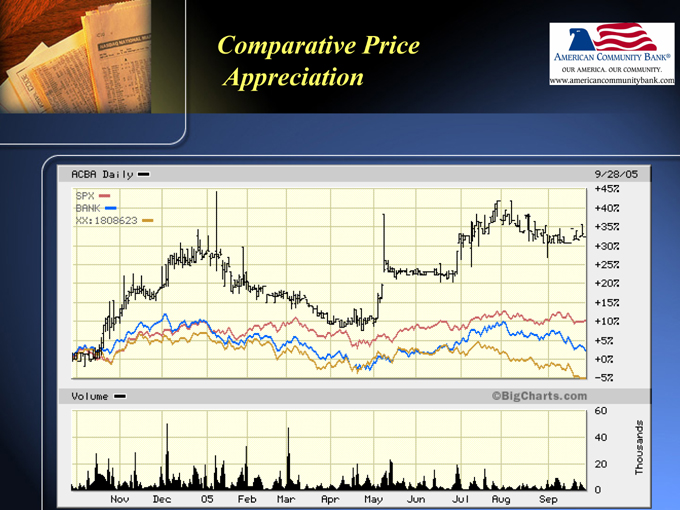

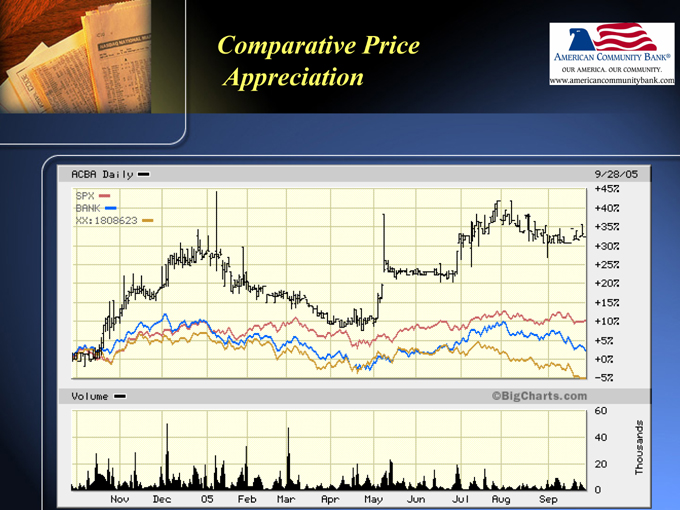

Comparative Price Appreciation

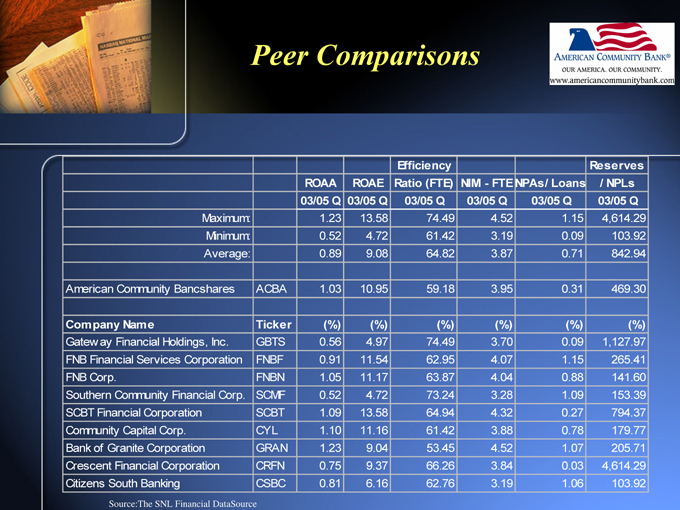

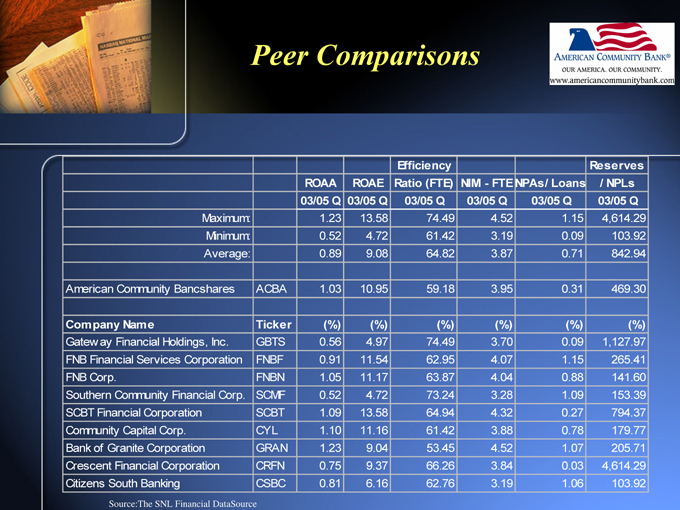

Peer Comparisons

Efficiency Reserves

ROAA ROAE Ratio (FTE) NIM - FTE NPAs/ Loans / NPLs

03/05 Q 03/05 Q 03/05 Q 03/05 Q 03/05 Q 03/05 Q

Maximum: 1.23 13.58 74.49 4.52 1.15 4,614.29

Minimum: 0.52 4.72 61.42 3.19 0.09 103.92

Average: 0.89 9.08 64.82 3.87 0.71 842.94

American Community Bancshares ACBA 1.03 10.95 59.18 3.95 0.31 469.30

Company Name Ticker (%) (%) (%) (%) (%) (%)

Gateway Financial Holdings, Inc. GBTS 0.56 4.97 74.49 3.70 0.09 1,127.97

FNB Financial Services Corporation FNBF 0.91 11.54 62.95 4.07 1.15 265.41

FNB Corp. FNBN 1.05 11.17 63.87 4.04 0.88 141.60

Southern Community Financial Corp. SCMF 0.52 4.72 73.24 3.28 1.09 153.39

SCBT Financial Corporation SCBT 1.09 13.58 64.94 4.32 0.27 794.37

Community Capital Corp. CYL 1.10 11.16 61.42 3.88 0.78 179.77

Bank of Granite Corporation GRAN 1.23 9.04 53.45 4.52 1.07 205.71

Crescent Financial Corporation CRFN 0.75 9.37 66.26 3.84 0.03 4,614.29

Citizens South Banking CSBC 0.81 6.16 62.76 3.19 1.06 103.92

Source: The SNL Financial DataSource

Market Competition

Competitor Asset Size

Bank of America $1,246,330,000,000

Wachovia 511,840,000,000

SunTrust 168,953,000,000

BB&T 105,835,000,000

RBC Centura 19,233,000,000

First Citizens 14,023,000,000

First Charter 4,633,000,000

Bank of Granite 1,069,000,000

American Community 409,000,000

First Trust 276,000,000

Scottish Bank 161,000,000

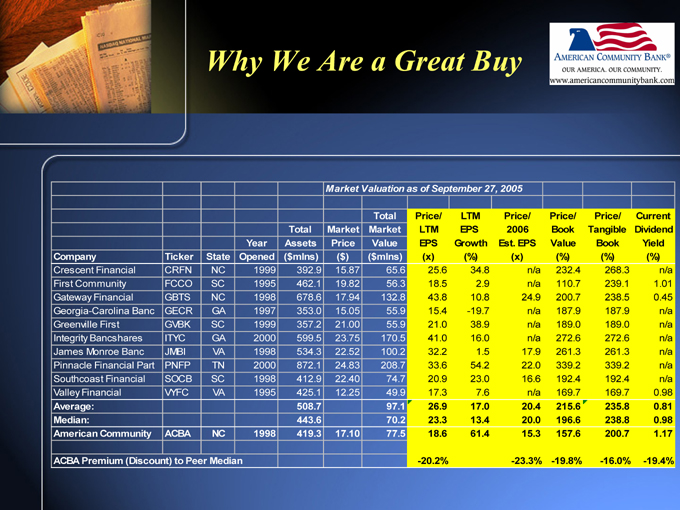

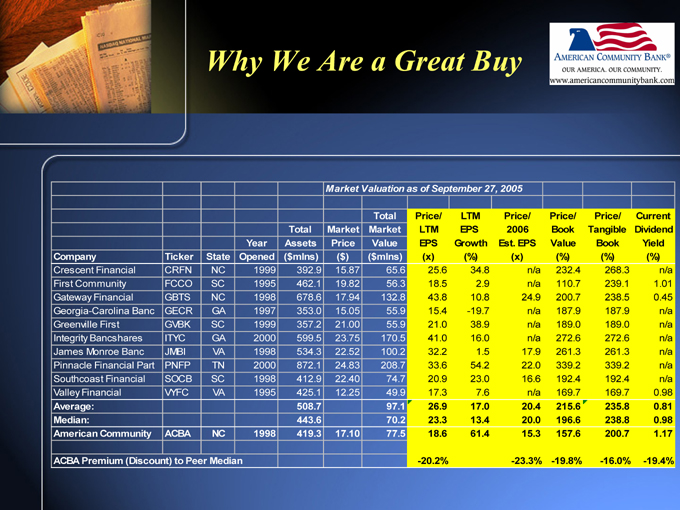

Why We Are a Great Buy

Market Valuation as of September 27, 2005

Company Ticker State Year Opened Total Assets ($mlns) Market Price ($) Total Market Value ($mlns) Price/ LTM EPS (x) LTM EPS Growth (%) Price/ 2006 Est. EPS (x) Price/ Book Value (%) Price/ Tangible Book (%) Current Dividend Yield (%)

Crescent Financial CRFN NC 1999 392.9 15.87 65.6 25.6 34.8 n/a 232.4 268.3 n/a

First Community FCCO SC 1995 462.1 19.82 56.3 18.5 2.9 n/a 110.7 239.1 1.01

Gateway Financial GBTS NC 1998 678.6 17.94 132.8 43.8 10.8 24.9 200.7 238.5 0.45

Georgia-Carolina Banc GECR GA 1997 353.0 15.05 55.9 15.4 -19.7 n/a 187.9 187.9 n/a

Greenville First GVBK SC 1999 357.2 21.00 55.9 21.0 38.9 n/a 189.0 189.0 n/a

Integrity Bancshares ITYC GA 2000 599.5 23.75 170.5 41.0 16.0 n/a 272.6 272.6 n/a

James Monroe Banc JMBI VA 1998 534.3 22.52 100.2 32.2 1.5 17.9 261.3 261.3 n/a

Pinnacle Financial Part PNFP TN 2000 872.1 24.83 208.7 33.6 54.2 22.0 339.2 339.2 n/a

Southcoast Financial SOCB SC 1998 412.9 22.40 74.7 20.9 23.0 16.6 192.4 192.4 n/a

Valley Financial VYFC VA 1995 425.1 12.25 49.9 17.3 7.6 n/a 169.7 169.7 0.98

Average: 508.7 97.1 26.9 17.0 20.4 215.6 235.8 0.81

Median: 443.6 70.2 23.3 13.4 20.0 196.6 238.8 0.98

American Community ACBA NC 1998 419.3 17.10 77.5 18.6 61.4 15.3 157.6 200.7 1.17

ACBA Premium (Discount) to Peer Median -20.2% -23.3% -19.8% -16.0% - -19.4%