SECURITIES AND EXCHANGE COMMISSION

Washington DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12.

OCULUS VISIONTECH INC. |

| Name of Registrant as Specified in its Charter |

| |

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

☐ | Fee paid previously with preliminary materials: |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

#507, 837 West Hastings Street

Vancouver, BC V6C 3N6

www.ovtz.com

Dear Shareholder:

We invite you to attend our annual and special meeting of shareholders to be held on April 30, 2019, in Vancouver, British Columbia, Canada. At the meeting you will hear a report on our operations and have a chance to meet your directors and executives.

This mailing includes the formal notice of the meeting and the Proxy Statement. The Proxy Statement tells you more about the agenda and procedures for the annual and special meeting. It also describes how the Board of Directors operates and gives personal information about our director candidates.

Even if you only own a few shares, we want your shares to be represented at the meeting. I urge you to complete, sign, date, and return your proxy promptly in the enclosed envelope.

To attend the meeting in person, please follow the instructions in the Proxy Statement.

Sincerely yours,

/s/ Anton J. Drescher

Anton J. Drescher

Corporate Secretary

March 19, 2019

(the “Company”)

#507, 837 West Hastings Street

Vancouver, BC V6C 3N6

www.ovtz.com

NOTICE OF 2019 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

Time: | 9:00 a.m., Pacific Time |

Place: | #507, 837 West Hastings Street Vancouver, British Columbia, Canada |

Purpose:

1. | To set the number of directors at five (5); |

3. | To ratify and approve the appointment of KWCO, PC as the Company’s independent auditors for the current fiscal year and authorizing the directors to fix their remuneration; |

4. | To authorize the board to proceed, at their discretion, with a consolidation of the Company’s shares on a 15:1 basis; |

5. | To approve the Stock Option Plan as more particularly described in the Proxy Statement; and, |

6. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only shareholders of record at the close of the business on March 19, 2019 may vote at the meeting.

If you are unable to attend the meeting in person, please read the notes accompanying the Form of Proxy enclosed herewith and then complete and return the Form of Proxy within the time set out in the notes. The enclosed Form of Proxy is solicited by management. If you so desire, you may appoint a representative in lieu of management’s designations by striking out the names listed therein and inserting in the space provided the name of the person you wish to represent you at the Meeting.

If you plan to attend the Meeting you must follow the instructions set out in the form of proxy and in the PROXY STATEMENT to ensure that your shares will be voted at the Meeting.

Your vote is important. Please complete, sign, date, and return your proxy promptly in the enclosed envelope.

| By Order of the Board of Directors | |

| | | |

| By: | /s/ Anton J. Drescher | |

March 19, 2019 | Anton J. Drescher, Corporate Secretary | |

| Please complete, date and sign the enclosed Form of Proxy and return it promptly in the envelope provided, whether or not you plan to attend the 2019 annual and special meeting of shareholders of Oculus VisionTech Inc. If you attend the meeting, you may vote your shares in person if you wish, even if you previously returned your Proxy. |

#507, 837 West Hastings Street

Vancouver, BC V6C 3N6

www.ovtz.com

PROXY STATEMENT

Dated March 19, 2019 (unless otherwise noted)

GENERAL INFORMATION

This Proxy Statement is being sent to you in connection with the solicitation of proxies for the 2019 annual general and special meeting of shareholders (the “Meeting”) by the management of Oculus VisionTech Inc. (“Oculus”) to be held at the offices of Oculus, #507, 837 West Hastings Street, Vancouver, British Columbia, Canada, V6C 3N6, at 9:00 a.m., Pacific Time, on April 30, 2019, and at any adjournments thereof. This proxy statement and the accompanying Notice of 2019 Annual General and Special Meeting of Shareholders and Form of Proxy were first mailed to stockholders on or about March 26, 2019. Shareholders are encouraged to review the information provided in this Proxy Statement in conjunction with our Annual Reports on Form 10-K for the years ended December 31, 2014, December 31, 2015, December 31, 2016, December 31, 2017 and December 31, 2018.

Who may vote

Only our shareholders as recorded in our stock register at the close of business on March 18, 2019 (the “Record Date”) may vote at the Meeting. At the close of business on the Record Date, we had 45,572,568 common shares outstanding and entitled to vote. Each common share is entitled to one vote on each matter properly brought before the Meeting.

How to vote

You may vote in person at the meeting or by proxy. We recommend that you vote by proxy even if you plan to attend the Meeting. You can always change your vote at the Meeting.

Voting Electronically via the Internet

If your shares are registered in the name of a bank or brokerage you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the Broadridge Financial Solutions, Inc. ("Broadridge") online program, which provides eligible shareholders who receive a paper copy of the Proxy Statement with the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm is participating in Broadridge’s program, your voting form from the bank or brokerage firm will provide instructions. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the enclosed envelope.

How Proxies work

Giving us your proxy means you authorize us to vote your shares at the Meeting in the manner you direct. You may vote for or not vote for the nominees for director named in this Proxy Statement. You may also vote for or abstain from voting on the proposal to ratify and approve the appointment of KWCO, PC, as our independent auditors and authorizing the directors to fix their remuneration, or you may vote for or vote against the Stock Option Plan.

If you sign and return the enclosed proxy but do not specify how to vote, we will vote your shares in favor of the nominees for director named in this Proxy Statement and in favor of the other proposals described in this Proxy Statement. In the discretion of the proxy holders, the proxies will also be voted for or against such other matters as may properly come before the Meeting. At the date this Proxy Statement went to press we did not know of any other matters to be raised at the Meeting.

The persons named in the enclosed proxy are our directors and officers and you may strike out the names of the persons whom you do not wish to act on your behalf. A shareholder has the right to appoint any person to attend and act for him or her at the Meeting. A Shareholder desiring to appoint a person to represent him at the Meeting may do so either by inserting such person’s name in the blank space provided and striking out the printed names in the Form of Proxy or by completing another proxy. In either case, the proxy must be delivered to the offices of our registrar and transfer agent, Computershare Trust Company Inc., Proxy Department, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, at least 48 hours prior to the scheduled commencement of the Meeting.

You may receive more than one proxy depending on how you hold your shares. Shares registered in your name are covered by one proxy. If you hold shares through someone else, such as a bank or broker (that is, in street name) please refer to your proxy card or the information forwarded by your bank, broker or other holder of record for voting instructions. If you want to vote in person at the Meeting, and you hold your shares in street name, you must obtain a proxy from your bank or broker and bring the proxy to the Meeting.

This Proxy Statement and the accompanying Form of Proxy are first being mailed to shareholders on or about March 26, 2019.

These securityholder materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner, and we or our agent have sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By choosing to send these materials to you directly, we (and not the intermediary holding on your behalf) have assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Revoking a Proxy

You may revoke your proxy before it is voted by submitting a new proxy with a later date, by voting in person at the Meeting, or by notifying our Corporate Secretary in writing at #507, 837 West Hastings Street, Vancouver, British Columbia, Canada, V6C 3N6.

In addition to revocation in any other manner permitted by law, a shareholder may revoke a proxy either by (a) signing a Form of Proxy bearing a later date and depositing it at the place and within the time aforesaid, or (b) signing and dating a written notice of revocation (in the same manner as the Form of Proxy is required to be executed as set out in the notes to the form of proxy) and either depositing it at the place and within the time aforesaid or with the Chairman of the Meeting on the day of the Meeting or on the day of any adjournment thereof, or (c) registering with the Scrutineer at the Meeting as a shareholder present in person, whereupon such proxy shall be deemed to have been revoked.

Only registered shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must, at least seven days before the Meeting, arrange for their respective Intermediaries to revoke the proxy on their behalf.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Meeting, you must bring to the Meeting a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares and that such broker, bank or other nominee is not voting your shares.

The Form of Proxy must be dated and be signed by the shareholder or by his attorney in writing, or, if the shareholder is a corporation, it must either be under its common seal or signed by a duly authorized officer.

Quorum

To conduct the business of the meeting, we must have a quorum. This means at least 25% of the outstanding shares entitled to vote must be represented at the Meeting, either by proxy or in person.

Votes needed

The five nominees for director receiving a plurality of the votes cast in person or by proxy at the Meeting shall be elected. Approval to ratify and approve the appointment of KWCO, PC as auditor and authorizing the directors to fix their remuneration, requires the affirmative vote of a majority of the votes cast in person or by proxy at the Meeting. If the Meeting is adjourned, your shares may be voted by the proxy holder on the new meeting date unless you have revoked your proxy.

Only votes cast “for” or “against” a proposal are counted. Abstentions and broker non-votes (or votes withheld in the election of directors) will not be counted, except for purposes of determining a quorum. Broker non-votes occur when a broker returns a proxy but does not have authority to vote on a particular proposal.

Attending in person

Only shareholders, their proxy holders, and Oculus’ guests may attend the Meeting.

If you hold your shares through someone else, such as a bank or a broker, send proof of your ownership to the Secretary at the address listed above, or you may bring proof of ownership with you in order to be admitted to the Meeting. Acceptable proof could include an account statement showing that you owned Oculus shares on March 19, 2019.

We will pay the expenses of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by telephone, email or fax. We will also reimburse banks, brokers and other persons holding shares in their names or in the names of their nominees for their reasonable out-of-pocket expenses in forwarding proxies and proxy material to the beneficial owners of such shares.

Non-Registered Shareholders

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of our company are “non-registered” shareholders because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares. More particularly, a person is a non-registered shareholder in respect of shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered either (a) in the name of an intermediary (the “Intermediary”) that the Non-Registered Holder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSP’s, RRIF’s, RESP’s and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary is a participant. In accordance with the requirements of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian Securities Administrators, we have distributed copies of the Notice of Meeting, Proxy Statement and Form of Proxy (collectively referred to as the “Meeting Material”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Material to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Material to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive the Meeting Material will either:

(a) | be given a Form of Proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted to the number of shares beneficially owned by the Non-Registered Holder, but which is otherwise not complete. Because the Intermediary has already signed the Form of Proxy, this Form of Proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the Form of Proxy and deposit it with our registrar and transfer agent, Computershare Trust Company Inc., as provided above; or |

(b) | more typically, be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy” or “authorization form”) which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre-printed form. Sometimes, instead of the one page printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions that contains a removable label containing a bar-code and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Holder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the shares that they beneficially own. Should a Non-Registered Holder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Holder should strike out the names of the management designated proxy holders named in the form and insert the Non-Registered Holder’s name in the blank space provided (executed by the broker). In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including when and where the proxy or proxy authorization form is to be delivered.

A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

FINANCIAL STATEMENTS

Our audited financial statements included in the Form 10-K Annual Reports for the years ended December 31, 2014, December 31, 2015, December 31, 2016, December 31, 2017 and December 31, 2018 will be presented to the shareholders at the Meeting.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as disclosed elsewhere in this Proxy Statement, no director or executive officer who was a director or executive officer since the beginning of our last financial year, each proposed nominee for election as a director, or any associate or affiliates of any such directors, executive officers or nominees, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting other than the election of directors.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

We are authorized to issue 500,000,000 shares of common stock. As of the Record Date, determined by the Board to be the close of business on March 19, 2019, a total of 45,572,568 common shares were issued and outstanding. Each share carries the right to one vote at the Meeting.

Only registered shareholders as of the Record Date are entitled to receive notice of, and to attend and vote at, the Meeting or any adjournment or postponement of the Meeting.

To the knowledge of our directors and executive officers, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, common shares carrying more than 10% of the voting rights attached to our outstanding common shares.

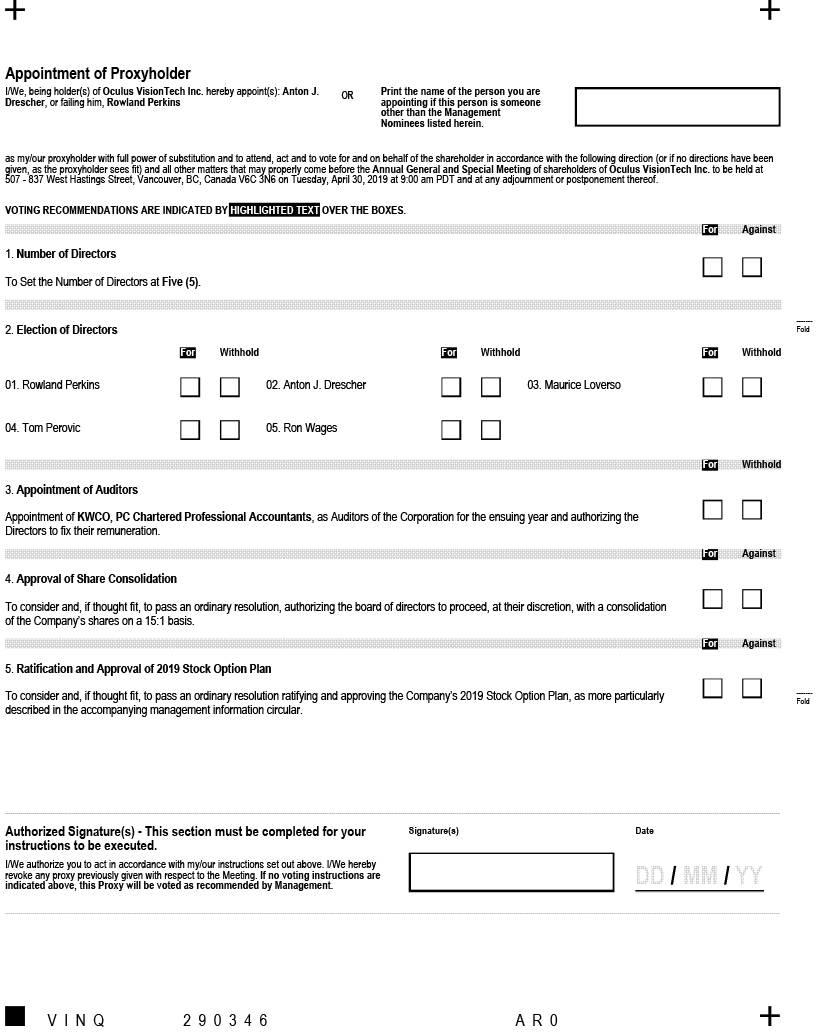

ITEM 1: NUMBER OF DIRECTORS

The board of directors has nominated and recommends FOR election of the five current directors for election at the Meeting. We are proposing that the number of directors be determined at five for the ensuing year, subject to such increases as may be permitted by our Bylaws. We currently have five directors.

The enclosed proxy will be voted FOR setting the number of directors at five unless otherwise indicated.

ITEM 2: ELECTION OF DIRECTORS

The enclosed proxy will be voted FOR the persons nominated unless otherwise indicated.

If any of the nominees should be unable to serve or should decline to do so, the discretionary authority provided in the proxy will be exercised by the proxy holders to vote for a substitute or substitutes to be designated by the Board of Directors. The Board of Directors has no reason to believe that any substitute nominee or nominees will be required.

Each nominee elected as a director will hold office until the next annual meeting of shareholders and until his successor is elected and qualified, or until his earlier death, resignation or retirement. Set forth below for each nominee is his age and his position, if any, in our company.

The information set forth below as to each nominee for director has been furnished to us by the respective nominee.

Name and Province or State and Country of Residence | Age | Position | Period of Service |

Rowland Perkins

Alberta, Canada | 65 | Director, President and Chief Executive Officer | Since 2005 |

Anton J. Drescher 1

British Columbia, Canada | 62 | Director, Chief Financial Officer and Corporate Secretary | Since 1994 |

Maurice Loverso 1

Quebec, Canada | 58 | Director | Since 2003 |

Tom Perovic

Ontario, Canada | 66 | Director | Since 2011 |

Ron Wages 1

North Carolina, USA | 56 | Director | Since 2011 |

1 Member of audit committee.

Rowland Perkins – President, Chief Executive Officer and Director

Mr. Perkins was formerly the President & Chief Executive Officer of ebackup Inc. (2001-2015), a digital cloud data service provider specializing in cloud services, data backup and business continuity. Mr. Perkins has over 35 years of business experience and 20 years with various public companies. Mr. Perkins is a director of two publicly traded companies, Oculus VisionTech Inc. (TSXV) since January 2005 and River Wild Exploration Inc. (TSXV) since 2018, and a former director of International Tower Hill Mines Ltd. (TSX) and Xiana Mining Inc. (TSXV). Mr. Perkins has a degree in Economics from the University of Manitoba.

Anton J. Drescher - Chief Financial Officer, Secretary and Director

Mr. Drescher has been a Chartered Professional Accountant, Certified Management Accountant since 1981. He is currently involved with several public companies including as: a director (since 1991) of International Tower Hill Mines Ltd., a public mining company listed on the TSX and the NYSE-MKT; a director (since 2007) of Trevali Mining Corporation, a public mining company listed on the TSX; a director (since 1996) and Chief Financial Officer (since 2012) of Xiana Mining Inc., a public mineral exploration company listed on the TSXV; a director (since 2007) of RavenQuest BioMed Inc., listed on the CSE; a director (since 2007) and the Chief Financial Officer of Oculus VisionTech Inc., a public company involved in watermarking of film and data listed on the TSXV and the OTC Bulletin Board; a director (since 2014) of Riverwild Exploration Inc. a. public exploration company listed on the CSE. Mr. Drescher is also the President (since 1979) of Westpoint Management Consultants Limited, a private company engaged in tax and accounting consulting for business reorganizations, and the President (since 1998) of Harbour Pacific Capital Corp., a private company involved in regulatory filings for businesses in Canada.

Maurice Loverso – Director

Mr. Loverso has been an independent director of Oculus since May 2003. He has been President of 3336298 Canada Inc. since 1996, providing financial consultation services to small capital public and private companies and has been a director of Group Intercapital Inc. since 1996, assisting a small cap venture capital firm with financial advice.

Tom Perovic –Director

Mr. Perovic has over 30 years of experience in high technology management, from research and development to high-level and top development and executive positions in businesses including automotive (vision based real time driver assistance applications), electronics (embedded hardware, imaging/video processing based products), software (real time, streaming content - movie watermarking products for the entertainment industry, machine vision 2D signal processing algorithms, IP based video communications), PCB production/development equipment, professional video (TV broadcasting), Internet imaging, security video surveillance, contract manufacturing, material handling/logistics and production/distribution. He has been General Manager of Magna International Inc. from 2006 to 2018 where he was responsible for restructuring since a takeover, P/L, development strategy, operational team building and leadership.

Ron Wages –Director

Mr. Wages is an innovative and results-driven corporate professional with an impressive 20 year record of success in delivering record profit growth in multiple markets worldwide. He is the founder and has been Chief Executive Officer of Vagues Solid State Lighting, a manufacturer of LED based lighting, since January 2009 As Chief Executive Officer, he developed the business strategy and full business plan including sales goals, market research, expense budgets and P&L plan. Previously, he was President and General Manager of MEMScAP Inc./JDS Uniphase, a public company in the semiconductors industry. He managed the day-to-day operations for sales, marketing, manufacturing, legal and finance. Mr. Wages has a B.S. in Electrical Engineering from the University of Maryland College Park and an MBA (Honors) from the University of Houston Executive MBA Program.

The Board of Directors has no reason to believe that any nominee will not serve if elected. If any nominee is unable to serve as a director, the shares represented by all valid proxies may be voted for the election for such other person(s) as the Board may recommend, unless the Board chooses to reduce the number of directors serving on the Board. Proxies will be voted FOR each nominee unless the shareholder specifies otherwise.

The Board of Directors unanimously recommends a vote FOR the election of each of the nominees named in this Proxy Statement. Proxies solicited by the Board of Directors will be so voted unless shareholders specify otherwise on the accompanying Proxy.

Corporate Cease Trade Orders

To the best of management’s knowledge, no proposed director of Oculus has, within 10 years before the date of this Proxy Statement, been a director or officer of any company that, while that person was acting in that capacity, (i) was the subject of a cease trade or similar order or an order that denied that person or company access to any exemption under securities legislation for a period of more than 30 consecutive days, or (ii) was subject to an event that resulted, after the director or officer ceased to be a director or officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days.

Bankruptcies

To the best of management’s knowledge, no proposed director of Oculus has, within 10 years before the date of this Proxy Statement, been a director or officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets.

Meetings of the Board of Directors

During fiscal 2018, the Board of Directors held a number of informal meetings, and took action by unanimous written consent on four occasions. During fiscal 2017, the Board of Directors held a number of informal meetings, and took action by unanimous written consent on four occasions.

Audit Committee

The Audit Committee of the Board of Directors consists of Maurice Loverso, Anton J. Drescher and Ron Wages, who serves as Chairman. The Board of Directors had determined that each Audit Committee member has sufficient knowledge in financial and accounting matters to serve on the Committee and that Anton J. Drescher is an “audit committee financial expert” as defined by SEC rules.

The Audit Committee meets with our independent auditors at least quarterly to discuss the results of the annual audit or interim periodic reviews and to review the financial statements; appoints the independent auditors to be retained; oversees the independence of the independent accountants; evaluates the independent auditors’ performance; approves fees paid to independent auditors and receives and considers the independent auditors’ comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee met informally by telephone conference four times and signed four consent resolutions during each of fiscal 2012 and 2013.

The Audit Committee is primarily concerned with the effectiveness of our audits by our internal audit staff and by our independent auditors. Its duties include: (1) recommending the selection of independent auditors; (2) reviewing the scope of the audit to be conducted by them, as well as the results of their audit; (3) reviewing the organization and scope of our internal system of audit and financial controls; (4) appraising our financial reporting activities (including our Proxy Statement and Annual Report) and the accounting standards and principles followed; and (5) examining other reviews relating to compliance by employees with important policies and applicable laws. The Audit Committee operates under a written Charter adopted by the Board of Directors, a copy of which is attached to this Proxy Statement as Schedule “A”.

Other Committees

The Board of Directors currently has no other committees.

Code of Ethics

We have adopted a Code of Ethics and Corporate Disclosure Policy that applies to our directors, officers and employees and Corporate Governance Guidelines that applies to our directors and officers. A copy of the Code of Ethics, Corporate Disclosure Policy and Corporate Governance Guidelines are posted on our website at http://www.ovtz.com. These documents are also available in print to any shareholder who requests a copy by sending a written request to our Corporate Secretary at #507, 837 West Hastings Street, Vancouver, British Columbia, V6C 3N6.

Relationship with Our Independent Auditors

The firm of KWCO, PC was appointed as our independent auditor on February 15, 2011. The Board of Directors recommended KWCO, PC to serve as our independent auditors for the fiscal years ending December 31, 2014, December 31, 2015, December 31, 2016, December 31, 2017, December 31, 2018 and December 31, 2019.

AUDIT COMMITTEE REPORT

The material in this report is not "soliciting material," is not deemed "filed" with the SEC, and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 (the “Exchange Act”), whether made before or after the date of this proxy statement and irrespective of any general incorporation language therein.

The Audit Committee of the Board assists the Board in carrying out its oversight responsibilities for our financial reporting process, audit process and internal controls.

The Audit Committee has reviewed and discussed our audited financial statements with management, which has primary responsibility for the financial statements. KWCO, our current independent auditors for our 2011, 2012 and 2013 audit, was responsible for expressing an opinion on the conformity of our audited financial statements with generally accepted accounting principles.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed in detail each of the financial statements for the years ended December 31, 2014, 2015, 2016, 2017 and 2018 with our management and with KWCO PC, our independent auditors. In addition, the Audit Committee has discussed with KWCO, PC the matters required to be discussed by Statement on Auditing Standards Number 61, Communication with Audit Committees, as modified or supplemented. The Audit Committee has received the written disclosures and the letter from KWCO PC required by Independence Standards Board Standard Number 1, Independence Discussions with Audit Committees, as modified or supplemented, and has discussed with the independent auditors their independence from our company and our management. The Audit Committee has also considered whether KWCO PC’s provision of non-audit services to us is compatible with the independence of such firm.

Members of the Audit Committee rely on the information provided to them and on the representations made to the Committee by management and our independent accountants without conducting independent verification of the accuracy of such information and representations. Accordingly, the Audit Committee's oversight does not ensure that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee's considerations and discussions referred to above do not ensure that any audit of our financial statements conducted by our internal and independent accountants has been carried out in accordance with generally accepted auditing standards, or that the financial statements are presented in accordance with generally accepted accounting principles.

Based on these reviews and discussions, the Audit Committee recommended to the Board, and the Board approved, that the audited financial statements be included in our Annual Reports on Form 10-Ks for each of the years ended December 31, 2014, 2015, 2016, 2017 and 2018, for filing with the Commission.

Based on the Audit Committee's and management's assessment of the performance of KWCO PC during the audit of our financial statements for the fiscal years ending December 31, 2014, 2015, 2016, 2017 and 2018, the Audit Committee recommended to the Board that KWCO PC be engaged as our independent auditors for fiscal year 2019.

Respectfully submitted,

Anton J. Drescher, Maurice Loverso, Ron Wages

SECURITY OWNERSHIP OF DIRECTORS, OFFICERS,

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth as of March 19, 2019, the number of our outstanding common shares beneficially owned by (i) each person known to us to beneficially own more than 5% of our outstanding common shares, (ii) each director, (iii) each Named Executive Officer, and (iv) all officers and directors as a group.

Name | Shares Owned | Percentage of Class |

Anton J. Drescher | 8,704,540 | 19.10% |

Maurice Loverso | 0 | 0.0% |

Rowland Perkins | 5,600,000 | 12.29% |

Tom Perovic | 1,300,000 | 2.85% |

Ron Wages | 200,000 | 0.44% |

All Executive Officers and Directors as a Group (five persons) | 15,804,540 | 34.68% |

Arness Cordick* | 3,000,000 | 6.58% |

*A person known to beneficially own more than 5%.

Certain Relationships and Related Transactions

The Company for the years ended December 31, 2014, 2015, 2016, 2017 and 2018 reimbursed or accrued to a company of a related party, Harbour Pacific Capital Corp. a total of $16,830 (2014), $29,846 (2015), $25,770 (2016), $31,622 (2017) and $19,522 (2018).

During the fiscal years ended December 31, 2014, 2015, 2016, 2017 and 2018, a total of $146,985 (2014), $129,260 (2015), $240,370 (2016), $47,490 (2017) and $0 (2018), respectively, was paid or accrued for research and development costs, which work was carried out by Mr. Tom Perovic, through 4C Inc., a private company wholly-owned by the spouse of Tom Perovic. Mr. Perovic was appointed as a director on December 30, 2011.

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of our company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of copies of Forms 3, 4 and 5 furnished to us and written representations that no other reports were required, during the fiscal years ended December 31, 2014, 2015, 2016, 2017 and 2018, our current officers, directors and 10% shareholders complied with all Section 16(a) filing requirements applicable to them.

DIRECTOR AND EXECUTIVE COMPENSATION AND

OTHER TRANSACTIONS WITH MANAGEMENT

Compensation Discussion and Analysis

Overview of Compensation Program

We do not have a compensation committee. Our Board of Directors (the “Board”) is responsible for establishing, implementing and monitoring adherence with our compensation policy. The Board ensures that the total compensation paid to our directors, officers and employees is fair, reasonable and competitive.

During the financial years ended December 31, 2014, 2015, 2016, 2017 and 2018, we had two Named Executive Officers (“NEO”) being Rowland Perkins, our Chief Executive Officer (“CEO”) and President and Anton J. Drescher, our Chief Financial Officer (“CFO”) and Corporate Secretary.

“Named Executive Officer” or “NEO” means: (a) each CEO, (b) each CFO, (c) each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000; and (d) each individual who would be a NEO under (c) above but for the fact that the individual was neither an executive officer of the company, nor acting in a similar capacity, at the end of that financial year.

Employments Contracts

We do not have an employment contract with Mr. Perkins and Mr. Drescher. We have no obligation to provide any compensation to Mr. Perkins or Mr. Drescher in the event of their resignation, retirement or termination, or a change in control of our company, or a change in any NEO’s responsibilities following a change in control.

We may in the future create retirement, pension, profit sharing and medical reimbursement plans covering our NEOs and directors.

Compensation Committee Interlocks and Insider Participation

Decisions concerning the compensation of our NEOs are made by the Board. All members of the Board during fiscal 2014, 2015, 2016, 2017 and 2018 participated in the Board’s deliberations concerning NEO compensation during each of the fiscal years ended December 31, 2014, 2015, 2016, 2017 and 2018.

Board of Directors Report on Executive Compensation

The Board determines the compensation of our NEOs.

We intend to establish a compensation committee at such time as we are able to attract a sufficient number of outside directors to the Board. We are unable to state when we will be able to establish a formal compensation committee. Pending establishment of the committee, the entire Board will continue to be responsible for our executive compensation policy.

Compensation Philosophy

We must compete for, attract, develop, motivate and retain high quality executive management personnel. In order to do so, we intend to offer a package including a competitive salary and, on a discretionary basis, additional compensation in the form of stock options.

Cash Compensation

Our executive salary levels are intended to be consistent with competitive salary levels and job responsibilities and experience level of each executive, as well as our overall salary structure and financial condition. Salary changes reflect competitive and economic trends, our overall financial performance and the performance of the individual executive. Salaries are reviewed annually by the Board.

Stock Options

Stock options are designed to attract and retain executives who can make significant contributions to our success, reward executives for such contributions, give executives a long-term incentive to increase shareholder value, and align the interests of our executive officers with those of our shareholders.

The Board has made, and expects to continue to make, grants of stock options to executive officers. Recipients of option grants, and the size of the grants, are determined based on several factors, including the responsibilities of the individual officers, their past and anticipated contributions to our success, our overall performance, and prior option grants.

Compensation of the CEO

In setting the compensation payable for fiscal 2014, 2015, 2016, 2017 and 2018 to our NEOs, the Board generally considered the same factors described above, as well as our current financial condition. Given that we currently do not have any financial resources a decision was made to defer compensation to the NEOs until such time as we have sufficient funding. The Board intends that compensation to the NEOs will be competitive with compensation paid to executive officers of similar sized companies in our industry and to reward our NEOs for directing our efforts in initiating and expanding our streaming media business.

Benefits and Perquisites

Our NEOs do not receive any benefits or perquisites other than as disclosed herein.

IRS Limits on Deductibility of Compensation

We are subject to Section 162(m) of the Internal Revenue Code of 1986, as amended, which limits the deductibility of certain compensation payments to our executive officers in excess of $1.0 million. No cash compensation was paid in fiscal 2014, 2015, 2016, 2017 or 2018 the CEO or any other executive officer. Section 162(m) also provides for certain exemptions to the limitations on deductibility, including compensation that is “performance-based” within the meaning of Section 162(m). Because we do not currently have a compensation committee comprised solely of outside directors, we currently cannot avail ourselves of the “performance-based” compensation exemption under Section 162(m).

The Board during fiscal 2014, 2015, 2016, 2017 and 2018 consisted of:

Anton J. Drescher

Maurice Loverso

Rowland Perkins

Tom Perovic

Ron Wages

The following table sets forth compensation awarded to, earned by or paid to our NEOs.

| | Long Term Compensation |

| | Summary Compensation Annual Compensation | Awards | Payouts |

Name and Principal Position | Year | Salary | Bonus | Other Annual Compen- sation | Restricted Stock Award(s) | Securities Underlying Options/SARs (#) | LTIP Payouts | All Other Compen- sation |

| | | $ | $ | $ | $ | | $ | $ |

Rowland Perkins

CEO | 2014

2015

2016

2017

2018 | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- |

Anton J. Drescher

CFO | 2014

2015

2016

2017

2018 | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- | -0-

-0-

-0-

-0-

-0- |

Outstanding Share Based Awards and Option-Based Awards

There were no outstanding share-based and option-based awards granted to our NEOs during the financial years ended December 31, 2014, 2015, 2016, 2017 and 2018, and that were outstanding as at December 31, 2018.

The following table sets forth certain information concerning exercises of stock options by the NEOs during the years ended December 31, 2014, 2015, 2016, 2017 and 2018 and stock options held at December 31, 2018.

Aggregated Option / SAR Exercises in Last Fiscal Year and FY-End Option / SAR Values |

| | Number of Securities Underlying Unexercised Options / SARs at Fiscal year End (#) | Value of Unexercised In-the- Money Options / SARs at Fiscal Year End ($) |

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable/ Unexercisable | Exercisable/ Unexercisable |

Rowland Perkins | -0- | -0- | N/A | N/A | N/A |

Anton J. Drescher | -0- | -0- | N/A | N/A | N/A |

(1) On December 31, 2018, the closing price of the common shares on the OTC BB was $0.08.

Stock Option Plan

The only plan pursuant to which we grant awards of any kind to our executive officers is our 2019 Stock Option Plan (the “Option Plan”). The Option Plan was approved by our shareholders and provides for the grant of stock options to directors, officers, consultants and key employees.

The Option Plan assists us to accomplish the following:

| | ● | to attract and retain the best available personnel for positions of responsibility within our company; |

| | ● | to provide additional incentives to employees, officers, directors and consultants of our company; |

| | ● | provide employees, directors and consultants of our company with an opportunity to acquire a proprietary interest in our company to encourage their continued provision of services to us; |

| | ● | to provide such persons with incentives and rewards for superior performance more directly linked to the profitability of our business and increases in shareholder value; and |

| | ● | aligning the interests of such persons with the interests of our shareholders generally. |

Grants of Plan-Based Awards

We do not have any plan-based awards in place at this time.

Termination and Change of Control Benefits

We do not have written agreements for termination or change of control with any of our NEOs.

Pension Benefits and Non-Qualified Defined Contribution and Other Non-Qualified Deferred Compensation Plans

We do not have a traditional defined benefit pension plan and does not provide pension benefits for our executive officers or for any of our other employees, and we do not have any non-qualified defined contribution plan or other non-qualified deferred compensation plan for our executive officers or for any of our other employees.

Compensation of Directors

We have no arrangements, standard or otherwise, pursuant to which directors are compensated by us for their services in their capacity as directors, or for committee participation, involvement in special assignments or for services as consultant or expert during the most recently completed financial year or subsequently, up to and including the date of this proxy statement, except as disclosed below.

The Company for the years ended December 31, 2014, 2015, 2016, 2017 and 2018 reimbursed or accrued to a company of a related party, Harbour Pacific Capital Corp. a total of $16,830 (2014), $29,846 (2015), $25,770 (2016), $31,622 (2017) and $19,522 (2018).

During the fiscal years ended December 31, 2014, 2015, 2016, 2017 and 2018, a total of $146,985 (2014), $129,260 (2015), $240,370 (2016), $47,490 (2017) and $0 (2018), respectively, was paid or accrued for research and development costs, which work was carried out by Mr. Tom Perovic, through 4C Inc., a private company wholly-owned by the spouse of Tom Perovic. Mr. Perovic was appointed as a director on December 30, 2011.

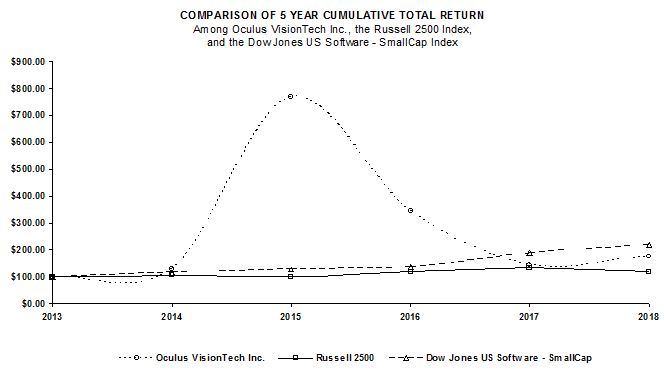

Performance Graph

The following chart compares the total cumulative shareholder return on $100 invested in common shares of Oculus VisionTech Inc. (TSXV: OVT) on December 31, 2013 with the cumulative total returns among Russell 2500 Index, and the Dow Jones US Software – SmallCap Index for the five most recently completed financial years.

| | 12/13 | 12/14 | 12/15 | 12/16 | 12/17 | 12/18 |

Oculus VisionTech Inc. (TSXV: OVT) | 100.00 | 130.77 | 769.23 | 346.15 | 146.15 | 176.92 |

Russell 2500 (R25I) | 100.00 | 105.59 | 101.02 | 116.88 | 134.51 | 119.23 |

Dow Jones US Software – SmallCap (DJUSSW) | 100.00 | 116.33 | 126.94 | 136.11 | 187.88 | 218.41 |

Director Compensation

We did not pay any compensation to our directors in their capacity as directors, or in their capacity as members of the Audit Committee, or as consultants or experts, for the years ended December 31, 2014, 2015, 2016, 2017 and 2018

Outstanding Share-Based Awards and Option-Based Awards

There were no share-based or option-based awards granted to our directors during the most recently completed fiscal year end, and that were outstanding as at December 31, 2017 and 2018.

Incentive Plan Awards – Value Vested or Earned During the Year

There were no incentive plans vested or earned by our non-executive directors during the fiscal years ended December 31, 2014, 2015, 2016, 2017 and 2018.

Certain Relationships and Related Transactions

As of December 31, 2018, we have accounts payable and accrued expenses to related parties of $120,156 and advances from related parties of $518,806.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

On March 14, 2019, we adopted our 2019 Stock Option Plan (the “Option Plan”). As at March 19, 2019, the following securities had been authorized for issuance under the Option Plan:

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders | Nil | N/A | 4,557,257 |

Equity compensation plans not approved by security holders | N/A | N/A | N/A |

Total | Nil | | 4,557,257 |

Terms of Option Plan

Administration

The Option Plan is administered by the Board of Directors. The Board of Directors may appoint a committee of the Board of Directors (the “Committee”) comprised of two or more of directors, each of whom will be a “Non-Employee Director” within the meaning of Rule 16b-3 under the Exchange Act, and an “Outside Director” within the meaning of Section 162(m) of the Code, to administer the Option Plan. Subject to the terms of the Option Plan, the Board of Directors or the Committee may determine and designate those employees, directors and consultants to whom options should be granted and the nature and terms of the options to be granted.

Eligibility

All of our employees, including our executive officers and directors who are also employees, are eligible to participate in the Option Plan. Additionally, directors who are not employees, as well as our consultants and advisers, are eligible to receive options under the Option Plan, except that such persons may only receive non-qualified options.

Exercise of Stock Options

The exercise price per share for each option granted under the Option Plan shall be determined by the Board of Directors or the Committee, subject to the policies of the TSX Venture Exchange (the “TSX.V”). The price is payable in cash.

Subject to earlier termination upon termination of employment and the incentive stock option limitations as provided in the Option Plan, each option shall expire on the date specified by the Board of Directors or the Committee, which shall be no later than five years from the date of grant for grants to 10% shareholders and ten years for all other options.

The options will either be fully exercisable on the date of grant or shall be exercisable thereafter in such installments as the Board of Directors or Committee may specify. Upon termination of employment or other service of an option holder, an option may only be exercised for a period of three months or, in the case of termination due to disability or death, a period of 12 months.

Transferability

Options granted under the Option Plan may not be transferred except by will or the laws of the descent and distribution and, during his or her lifetime, options may be exercised only by the optionee.

Certain Adjustments

In the event of any change in the number or kind of our outstanding common shares by reason of a stock dividend, stock split, recapitalization, combination, subdivision, rights issuance or other similar corporate change, the Board of the Committee shall make such adjustment in the number of common shares that may be issued under the Option Plan, and the number of common shares subject to, and the exercise price of, each then-outstanding option, as it, in its sole discretion, deems appropriate.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

None of our current or former directors, executive officers, employees, the proposed nominees for election to the Board, or their respective associates or affiliates, are or have been indebted to our company since the beginning of our last completed financial year.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no:

| | (a) | director or executive officer of Oculus; |

| | (b) | person or company who beneficially owns, directly or indirectly, common shares or who exercises control or direction of common shares, or a combination of both carrying more than 10% of the voting rights attached to the common shares outstanding (an “Insider”); |

| | (c) | director or executive officer of an Insider; or |

| | (d) | associate or affiliate of any of the directors, executive officers or Insiders, |

has had any material interest, direct or indirect, in any transaction since the commencement of our most recently completed financial year or in any proposed transaction which has materially affected or would materially affect our company, except with an interest arising from the ownership of common shares where such person or company will receive no extra or special benefit or advantage not shared on a pro rata basis by all holders of the same class of common shares.

MANAGEMENT CONTRACTS

Our management functions are not, to any substantial degree, performed by a person or persons other than our directors or senior officers, other than as disclosed herein.

CORPORATE GOVERNANCE

Pursuant to National Policy 58-101 Disclosure of Corporate Governance Practices, we are required to disclose certain corporate governance information as set out in Form 58-101F1 Corporate Governance Disclosure (“Form 58-101F1”). A description of our approach to corporate governance, together with a completed Form 58-101F1, is set out in Schedule “B” to this Proxy Statement.

ITEM 3: RATIFICATION AND APPROVAL OF APPOINTMENT OF INDEPENDENT AUDITORS

The firm of KWCO, PC (“KWCO”) was appointed by the Board of Directors to serve as our independent auditors for the 2014, 2015, 2016, 2017 and 2018 fiscal years.

During our fiscal years ended December 31, 2014, 2015, 2016, 2017 and 2018, and the period subsequent to such date and prior to engaging KWCO we have not consulted KWCO with respect to the application of accounting principles to a specific transaction, either completed or proposed, the type of audit opinion that might be rendered on our financial statements; or any disagreements with KWCO (of which there were none), or reportable events, as defined or described in Items 304(a)(2)(i) or (ii) of Regulation S-K.

Audit Fees

Audit and Non-Audit Fees

The following table presents fees for the professional audit services rendered KWCO for the audit of our annual financial statements for the years ended December 31, 2014, 2015, 2016, 2017 and 2018, and fees billed for other services rendered by KWCO during those periods.

Year ended December 31 | 2014

$ | 2015

$ | 2016

$ | 2017

$ | 2018

$ |

Audit fees | 22,000 | 18,192 | 23,000 | 15,725 | 16,825 |

Audit-related fees | 0 | 0 | 0 | 0 | 0 |

Tax fees | 0 | 0 | 0 | 0 | 0 |

All other fees | 0 | 0 | 0 | 0 | 0 |

Total | 22,000 | 18,192 | 23,000 | 15,725 | 16,825 |

The Audit Committee reviews all audit and non-audit related fees at least annually. The Audit Committee pre-approved all audit and non-audit related services in fiscal 2014, 2015, 2016, 2017 and 2018. The Audit Committee had concluded that as no non-audit services were provided during fiscal 2014, 2015, 2016, 2017 or 2018 there is no issue with respect to maintaining the independence of KWCO.

Financial Information Systems Design and Implementation Fees

KWCO did not provide any professional services to us with respect to financial information systems design and implementation for the years ended December 31, 2014, 2015, 2016, 2017 and 2018.

All Other Fees

KWCO was not paid any other fees for services rendered to us during the year ended December 31, 2012 and December 31, 2013.

Required Vote

The affirmative vote of a majority of the votes cast on this Item at the Meeting is required for the ratification and approval of the appointment of KWCO as our auditors for the fiscal year ending December 31, 2019 and to authorize the directors to fix their remuneration.

The Board of Directors unanimously recommends a vote FOR the ratification and approval of KWCO, PC as our independent auditors for the current fiscal year and authorizing the directors to fix their remuneration.

AUDIT COMMITTEE

We are required to have an audit committee comprised of not less than three directors, a majority of whom are not officers, control persons or employees of our company or an affiliate of our company. Our current audit committee consists of Anton J. Drescher, Maurice Loverso and Ron Wages.

Audit Committee Charter

The text of our Audit Committee Charter is attached as Schedule “A” to this Circular.

Composition of the Audit Committee and Independence

National Instrument 52-110 Audit Committees, (“NI 52-110”) provides that a member of an audit committee is “independent” if the member has no direct or indirect material relationship with a company, which could, in the view of the company’s Board, reasonably interfere with the exercise of the member’s independent judgment.

All of the members of our audit committee are independent, as that term is defined in NI 52-110, except for Anton J. Drescher, who is the Corporate Secretary and Chief Financial Officer.

Relevant Education and Experience

NI 52-110 provides that an individual is “financially literate” if he has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by a company’s financial statements. While Maurice Loverso does not meet the criteria of “financially literate”, both Ron Wages and Anton J. Drescher are considered financially literate. Collectively, they have many years of practical business experience, have served as a director of public companies and have experience reviewing financial statements of public companies. The following sets out the education and experience of Rowland Perkins and Anton J. Drescher that is relevant to the performance of their responsibilities as audit committee members.

Anton J. Drescher has been a Chartered Professional Accountant, Certified Management Accountant since 1981. He is currently involved with several public companies including as: a director (since 1991) of International Tower Hill Mines Ltd., a public mining company listed on the TSX and the NYSE-MKT; a director (since 2007) of Trevali Mining Corporation, a public mining company listed on the TSX; a director (since 1996) and Chief Financial Officer (since 2012) of Xiana Mining Inc., a public mineral exploration company listed on the TSXV; a director (since 2007) of RavenQuest BioMed Inc., listed on the CSE; a director (since 2007) and the Chief Financial Officer of Oculus VisionTech Inc., a public company involved in watermarking of film and data listed on the TSXV and the OTC Bulletin Board; a director (since 2014) of River Wild Exploration Inc. a. public exploration company listed on the CSE. Mr. Drescher is also the President (since 1979) of Westpoint Management Consultants Limited, a private company engaged in tax and accounting consulting for business reorganizations, and the President (since 1998) of Harbour Pacific Capital Corp., a private company involved in regulatory filings for businesses in Canada.

Ron Wages is founder and has been Chief Executive Officer of Vagues Solid State Lighting, a manufacturer of LED based lighting, since January 2009 As Chief Executive Officer, he developed the business strategy and full business plan including sales goals, market research, expense budgets and P&L plan. Previously, he was President and General Manager of MEMScAP Inc./JDS Uniphase, a public company in the semiconductors industry. He managed the day-to-day operations for sales, marketing, manufacturing, legal and finance. Mr. Wages has a B.S. in Electrical Engineering from the University of Maryland College Park and an MBA (Honors) from the University of Houston Executive MBA Program.

Audit Committee Oversight

Since the commencement of our most recently completed fiscal year, our Audit Committee has not made any recommendations to nominate or compensate an external auditor which were not adopted by our Board.

Reliance on Certain Exemptions

Since the commencement of our most recently completed financial year and the effective date of NI 52-110, we have not relied on the exemptions contained in sections 2.4 or 8 of NI 52-110. Section 2.4 provides an exemption from the requirement that the audit committee must pre-approve all non-audit services to be provided by the auditors, where the total amount of fees related to the non-audit services are not expected to exceed 5% of the total amount of fees payable to the auditor in the fiscal year in which the non-audit services were provided. Section 8 permits a company to apply to a securities regulatory authority for an exemption from the requirements of NI 52-110, in whole or in part.

Pre-Approval Policies and Procedures

Our audit committee has adopted specific policies and procedures for the engagement of non-audit services which is set out in the Audit Committee Charter attached to this Circular as Schedule “A” in the section entitled “Independent Auditor”.

Exemption

We are relying on the exemption provided by Part 6.1 of NI 52-110 for Venture Issuers which allows for an exemption from Part 3 (Composition of the Audit Committee) and Part 5 (Reporting Obligations) of NI 52-110 and allows for the short form of disclosure of audit committee procedures set out in Form 52-110F2 and disclosed in this Circular.

ITEM 4: APPROVAL OF SHARE CONSOLIDATION

At the Meeting there will be a proposal presented to Shareholders to authorize the Company’s board of directors, subject to their approval and that of the TSX-V, to consolidate its then existing share capital, comprised of Common Shares, on an up to 15 old for one new (15:1) basis (the “Consolidation”). All terms provided herein are on a pre-Consolidation basis.

The Board of Directors unanimously recommends a vote FOR the adoption of the Consolidation.

ITEM 5: APPROVAL OF 2019 STOCK OPTION PLAN

Introduction

At the Meeting there will be a proposal presented to Shareholders, to approve 2019 Stock Option Plan (the “Option Plan”) which was adopted by the board on March 14, 2019. The Option Plan authorizes the issuance of up to 4,557,257 (10% of current issued and outstanding) of our common shares, subject to adjustment under certain circumstances, pursuant to exercise of options to be granted under the Option Plan. The stock subject to options under the Option Plan will be authorized but unissued common shares, including shares issuable under options that terminate without being exercised in whole or in part. The Option Plan provides for the issuance of both incentive stock options and non-qualified options as those terms are defined in the Internal Revenue Code of 1986, as amended (the "Code"). Under the Code, for stock options to qualify as incentive stock options, the plan under which the options are issued must be approved by our shareholders within twelve months of the adoption of the Option Plan by the Board of Directors. If the Option Plan is not approved by the shareholders, the Option Plan will continue to be in effect; however, only non-qualified options may be issued under it.

The Option Plan is intended to promote the interests of our company and our shareholders by providing incentives to employees, directors and consultants, on whose judgment, initiative, and efforts the successful conduct of our business depends. These persons are responsible for the management, growth, and protection of our business, and the Option Plan provides these individuals with appropriate incentives and rewards to encourage them to maximize their performance and efforts for our company.

Adoption of the Option Plan is also subject to approval by the TSX.V. We will be submitting the Option Plan to the TSX.V and anticipate it will be approved. If the TSX.V should require any amendment to the Option Plan, the Board of Directors will make such amendment without shareholder approval to the extent it may do so under the Option Plan. If shareholder approval is required for any such amendment, the Board of Directors will either submit the Option Plan, as amended, for a vote of the shareholders as soon as reasonably practicable, or will discontinue the Option Plan.

On March 19, 2019, the closing bid price for the common shares on the OTC Bulletin Board was $0.0714 per share.

A copy of the full text of the Option Plan may be requested by submitting a request to Oculus VisionTech Inc., #507, 837 West Hastings Street, Vancouver, BC, V6C 3N6, Attention: Corporate Secretary. The principal features of the Option Plan are summarized below, but the summary is qualified in its entirety by the full text of the Option Plan.

Administration

The Option Plan will be administered by the Board of Directors. The Board of Directors may appoint a committee of the Board of Directors (the "Committee") comprised of two or more directors, each of whom will be a "Non-Employee Director" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and an "Outside Director" within the meaning of Section 162(m) of the Code, to administer the Option Plan. Subject to the terms of the Option Plan, the Board of Directors or the Committee may determine and designate those employees, directors and consultants to whom options should be granted and the nature and terms of the options to be granted.

Eligibility

All employees, including its executive officers and directors who are also employees, are eligible to participate in the Option Plan. Additionally, directors who are not employees, as well as consultants and advisers, are eligible to receive options under the Option Plan, except that such persons may only receive non-qualified options.

Exercise of Stock Options

The exercise price per share for each option granted under the Option Plan shall be determined by the Board of Directors or the Committee. However, the exercise price per share of each incentive stock option granted under the Option Plan shall not be less than the fair market value of the common shares on the date of the grant for incentive stock options; and 10% of the fair market value of the common shares for each incentive stock option granted to an individual owning more than 10% of the total combined voting power of all classes of stock ("10% Shareholders"). In addition, because our shares are traded on the TSX.V, the exercise price of options granted under the Option Plan may not be less than the minimum price permitted under TSX.V policies, which is generally the market price at the close of trading on the day immediately preceding the day the options are granted, subject to certain allowable discounts. The price is payable in cash.

Subject to earlier termination upon termination of employment and the incentive stock option limitations as provided in the Option Plan, each option shall expire on the date specified by the Board of Directors or the Committee, which shall be no later than five years from the date of grant for grants to 10% Shareholders and ten years for all other options.

The options will either be fully exercisable on the date of grant or shall be exercisable thereafter in such installments as the Board of Directors or Committee may specify. Upon termination of employment or other service of an option holder, an option may only be exercised for a period of three months or, in the case of termination due to disability or death, a period of 12 months.

Change in Control

If we were to be consolidated with or acquired by another entity in a merger, or there is to be a sale of all or substantially all of our assets or stock, the Board of Directors may either by agreement or by action taken before the triggering transaction (i) provide in any agreement with the surviving, new or acquiring company to grant options to the optionees to replace options granted under the Option Plan, (ii) make unvested options immediately exercisable, or (iii) take such other action as it determines may be reasonable under the circumstances in order to permit optionees to realize the value of the rights granted to them under the Option Plan.

Transferability

Options granted under the Option Plan may not be transferred except by will or the laws of the descent and distribution and, during his or her lifetime, options may be exercised only by the optionee.

Certain Adjustments

In the event of any change in the number or kind of our outstanding common shares by reason of a stock dividend, stock split, recapitalization, combination, subdivision, rights issuance or other similar corporate change, the Board of the Committee shall make such adjustment in the number of common shares that may be issued under the Option Plan, and the number of common shares subject to, and the exercise price of, each then-outstanding option, as it, in its sole discretion, deems appropriate.

Amendment or Discontinuance

The Board may amend or discontinue the Option Plan, provided that no amendment may, without an optionee's consent, materially and adversely effect any rights under any option previously granted to the optionee under the Option Plan. Additionally, the approval of our shareholders is required for any amendment that would:

| | ● | increase or decrease the number of common shares that may be issued under the Option Plan; or |

| | ● | materially modify the requirements as to eligibility for participation in the Option Plan. |

Tax Treatment of Options

Incentive stock options granted under the Option Plan are intended to be qualified incentive stock options under the provisions of Section 422 of the Code. All other options granted under the Option Plan are non-qualified options not entitled to special tax treatment under Section 422 of the Code. Generally, the grant of an incentive stock option will not result in taxable income for income tax purposes to the optionee at the time of the grant, and we will not be entitled to an income tax deduction at such time. Generally, the grant of non-qualified options will not result in taxable income to the optionee at the time of the grant and we will not be entitled to an income tax deduction at such time.

When incentive stock options granted under the Option Plan are exercised, the optionee will not be treated as receiving any taxable income, and we will not be entitled to an income tax deduction. However, the excess of the fair market value of the shares acquired over the option exercise price is an item of adjustment in computing the alternative minimum tax of the optionee. Upon the exercise of a non-qualified option, an optionee will recognize ordinary income in an amount equal to the excess of the fair market value of the underlying shares of our common stock at the time of exercise over the exercise price. Thus, the optionee will have to pay taxes at the time a non-qualified option is exercised even though the shares received upon exercise might not be sold until a later taxable year. For employees (including officers and directors who are considered employees for purposes of the withholding provisions of the Code), the income recognized on the exercise of a non-qualified option is subject to withholding of income tax under Section 3402(a) of the Code.

We will receive an income tax deduction for the amount of ordinary income recognized by the optionee at the time and in the amount that the optionee recognizes such income to the extent permitted by Section 162(m) of the Code and provided that (i) such income constitutes reasonable compensation and is otherwise deductible under the Code and (ii) our U.S. federal income tax withholding obligations with respect to such income are satisfied.

An optionee's tax basis in the shares received upon exercise of an incentive stock option will be equal to the exercise price paid by the optionee for such shares. An optionee's tax basis in the shares received upon the exercise of a non-qualified option will be equal to the sum of (i) the exercise price paid by the optionee for such shares and (ii) the amount that the optionee is required to include in gross income upon exercising the non-qualified option. Upon the later disposition of the shares received upon exercise of an option, any differences between the tax basis of the shares and the amount realized on the disposition is generally treated as long-term or short-term capital gain or loss, depending on the holding period of the common shares. Nevertheless, if the shares subject to an incentive stock option are disposed of before the expiration of two years from the date of grant and one year from the date of exercise, the optionee will realize ordinary income on an amount equal to the excess, if any, of the fair market value of the shares, upon exercise of the option over the option price (or, if less, the excess of the amount realized upon disposition over the option price) and we will receive a corresponding income tax deduction.

In order for an optionee to receive the favorable tax treatment for incentive stock options, certain requirements set forth in Section 422 of the Code must be met. For example, the optionee must be an officer or employee at all times within the period beginning on the date of grant of the option and ending on a date within three months before the date of exercise. In addition, the aggregate fair market value (determined at the time of grant) of the shares for which incentive stock options are exercisable for the first time by the optionee in any calendar year under all relevant plans of our company (and certain affiliates) cannot exceed $100,000.

The description above is intended to summarize the general principles of current federal income tax law applicable to options that may be granted under the Option Plan. The tax consequences of awards made under the Option Plan are complex, subject to change, and may vary depending on the taxpayer's particular circumstances. Additionally, the grant and exercise of options under the Option Plan to persons outside the United States may be taxed on a different basis.

Required Vote

The affirmative vote of a majority of the votes cast on this Item at the Meeting is required for the adoption of the Option Plan.

The Board of Directors unanimously recommends a vote FOR the adoption of the Stock Option Plan.

REQUIREMENTS, INCLUDING DEADLINES, FOR

SUBMISSION OF PROXY PROPOSAL, NOMINATION OF DIRECTORS

AND OTHER BUSINESS OF SHAREHOLDERS

Under the rules of the SEC, if a shareholder wants us to include a proposal in our Proxy Statement and Form of Proxy for presentation at our 2020 Annual Meeting of Shareholders, the proposal must be received by us, Attention: Mr. Anton J. Drescher, Secretary, at our principal executive offices no later than November 25, 2019 and all the other conditions of Rule 14a-8 under the Exchange Act must be satisfied, for such proposals to be included in our proxy statement and form of proxy relating to that meeting.

In addition, the proxy solicited by the Board of Directors for the 2020 annual meeting of shareholders will confer discretionary authority to vote on any shareholder proposal presented at that meeting, unless we are provided with notice of such proposal no later than February 8, 2020.

The Board is not aware of any matters that are expected to come before the annual and special meeting other than those referred to in this Proxy Statement. If any other matter should come before the annual and special meeting, the persons named in the accompanying proxy intend to vote the proxies in accordance with their best judgment.

The chairman of the meeting may refuse to allow the transaction of any business not presented beforehand, or to acknowledge the nomination of any person not made in compliance with the foregoing procedures.

It is important that the proxies be returned promptly and that your shares be represented. Shareholders are urged to mark, date, execute and promptly return the accompanying proxy card in the enclosed envelope.

ADDITIONAL INFORMATION