| Writer’s Direct Number | Writer’s E-mail Address |

| 212.756.2376 | Eleazar.Klein@srz.com |

February 16, 2021

VIA E-MAIL AND EDGAR

Mr. Daniel F. Duchovny Special Counsel Office of Mergers and Acquisitions U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | |

| | | Re: | Pluralsight, Inc. Preliminary Proxy Statement Filed on February 4, 2021 by Eminence Capital, LP and Ricky C. Sandler Soliciting Materials filed pursuant to Rule 14a-12 Filed on February 9, 2021 by Eminence Capital, LP and Ricky C. Sandler File No. 001-38498 |

| | | | | |

Dear Mr. Duchovny:

On behalf of Eminence Capital, LP (“Eminence”) and Ricky C. Sandler (collectively, the “Filing Persons”), we are responding to your letter, dated February 11, 2021 (the “SEC Comment Letter”) in connection with the Preliminary Proxy Statement on Schedule 14A filed on February 4, 2021 (the “Preliminary Proxy Statement”) and the Filing Persons’ presentation filed as soliciting materials under cover of Schedule 14A on February 9, 2021 (the “Presentation”) regarding Pluralsight, Inc. (the “Company”). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) and respond below. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Preliminary Proxy Statement.

Concurrently with this letter, the Filing Persons are filing a revised Preliminary Proxy Statement on Schedule 14A (the “Revised Preliminary Proxy Statement”). The Revised Preliminary Proxy Statement reflects revisions made to the Preliminary Proxy Statement in response to the comments of the Staff in the SEC Comment Letter. Unless otherwise noted, the page numbers in the responses refer to pages in the Revised Preliminary Proxy Statement. For your convenience, the Staff’s comments are restated below in italics, with our responses following.

Mr. Duchovny

Page 2

February 16, 2021

Preliminary Proxy Statement

1. Please revise your proxy statement to include the disclosure required under Item 23(b) of Schedule 14A.

In response to the Staff’s comment, the Filing Persons have inserted the information required under Item 23(b) of Schedule 14A to page 8 of the Revised Preliminary Proxy Statement under the section titled “What is Householding of Proxy Materials?”

Cover Letter

2. We note your reference to the complaint filed against the company. Please include a background section in your proxy statement describing the history (if any) between Eminence and the company leading up to your solicitation.

In response to the Staff’s comment, the Filing Persons have included on pages 2 and 3 of the Revised Preliminary Proxy Statement a brief timeline of interactions between Eminence and the Company leading up to the solicitation.

Proposal 1: Merger Agreement Proposal

3. Please provide us supplemental support for the statements referring to Akaris Global Partners.

The Staff’s Comment appears to be directed at the statement, “As noted in Akaris Global Partners’ December 28, 2020 letter to the Board, the Merger Consideration represents a multiple to LTM sales and 2022 recurring sales estimates that is far lower than recent peer transactions, as well as the current valuation of comparable public companies.”

Per analyses performed by Citi Research that are represented in the following line graph, the Merger consideration of $20.26 per share represents a purchase multiple of ~6.6x enterprise value (EV) / 2022 estimated recurring sales, a significant discount to other subscription software companies that grow at a similar pace:

Mr. Duchovny

Page 3

February 16, 2021

In addition, the Merger consideration represents a multiple of only 9.6x enterprise value (EV) / last twelve month (LTM) recurring sales, a discount to other recent Sponsor enterprise software deals of 11.3x enterprise value / LTM recurring sales. By way of direct comparison, (i) Thoma Bravo’s acquisition of Ellie Mae provided for 10.6x EV/LTM recurring sales at the time its acquisition agreement was signed on February 12, 2019, (ii) Hellman & Friedman’s acquisition of Ultimate Software provided for 11.0x EV/LTM recurring sales at the time its acquisition agreement was signed on February 4, 2019, (iii) Vista Equity’s acquisition of Mindbody provided for 13.4x EV/LTM recurring sales at the time its acquisition agreement was signed on December 24, 2018, and (iv) Vista Equity’s acquisition of Apptio provided for 10.4x EV/LTM recurring sales at the time its acquisition agreement was signed on November 11, 2018.

In light of the Staff’s Comment, we have included the foregoing information in the form of a footnote on page 4 of the Revised Preliminary Proxy Statement.

4. Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide support for the following statements:

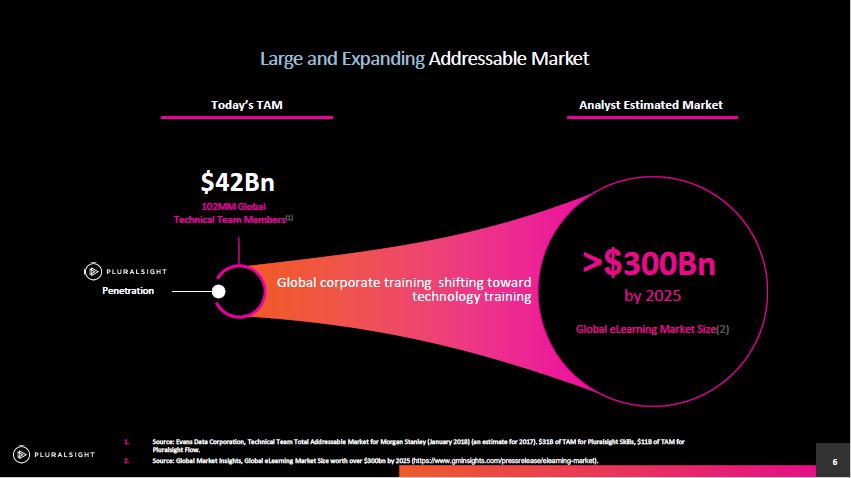

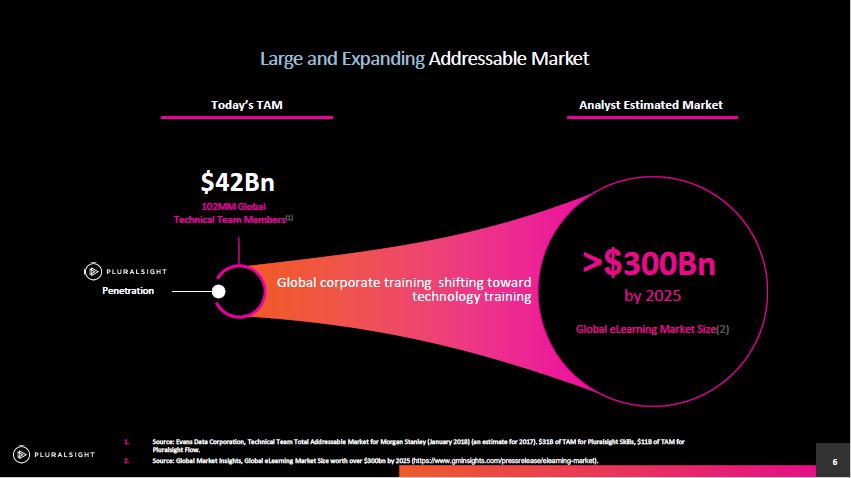

· Your belief that “…Pluralsight is poised to enter a period of sustained accelerated growth” and “…that Pluralsight has significant room to grow with an immediate total addressable market of $42 billion and 102 million potential global users... the global eLearning market that is over $300 billion.”

Mr. Duchovny

Page 4

February 16, 2021

In response to the Staff’s Comment, the Filing Persons respectfully note that the foregoing statement that “Pluralsight is poised to enter a period of sustained accelerated growth” and that it “has significant room to grow” is self-evident from the statement in the Preliminary Proxy Statement that the Company has just $390 million in annual recurring revenue and 1.5 million users. In addition, the slide titled “Businesses Face a Massive Technology Skills Gap" of the Company’s Q3 2020 Investor Presentation, dated November 9, 2020 (the “November Investor Presentation”),1 demonstrates the Company’s growth opportunities by stating, among other things, that there are “918,000 unfilled tech jobs in the US” and that, per an ACT – CompTIA IT Employment Tracker from November 2020, “software developers must redevelop skills every 12-18 months.” As a software development and IT administration skills development company, Pluralsight has the self-evident ability to capitalize on these opportunities.

Eminence’s statement regarding the Company’s immediate total addressable market of $42 billion, 102 million potential global users, and a global eLearning market that is over $300 billion and the foregoing figures referenced by Eminence in the Preliminary Proxy Statement are taken directly from the slide titled “Large and Expanding Addressable Market” of the November Investor Presentation. For ease of reference to the Staff, the relevant slides of the November Investor Presentation are reproduced in Exhibit A attached hereto.

In light of the Staff’s Comment, the Filing Persons have included reference to the November Investor Presentation in the form of a footnote on page 4 of the Revised Preliminary Proxy Statement.

· That “[t]he selected company analysis used by Qatalyst described in the Company’s Proxy Statement and relied upon by Qatalyst to deliver the Qatalyst Fairness Opinion uses the wrong comparable companies” (emphasis added).

In response to the Staff’s Comment, the Filing Persons believe they have provided in the Preliminary Proxy Statement adequate support for the statement that the “wrong” comparable companies were used to calculate the Company’s enterprise value based on revenue multiples for comparable companies by providing that:

[T]hree of the 21 companies used by the Compensation Committee of the Company’s Board of Directors for its 2019 compensation decisions (as set forth in the Company’s 2020 proxy statement) were used by Qatalyst in its analysis. For Qatalyst’s selections, the average CY2021E Revenue Multiple (defined as the fully-diluted enterprise value divided by the consensus estimated revenue for the calendar year 2021) is approximately 8.5x. The same multiple is nearly 17.0x for the Compensation Committee’s peer company selections.

__________________

1. Available at https://investors.pluralsight.com/static-files/bbfcebb8-585f-4eb8-b2c5-4cd0dc4e5497.

Mr. Duchovny

Page 5

February 16, 2021

Nevertheless, in order to illustrate the foregoing, the Filing Persons have provided a detailed breakdown of the selected comparables in Exhibit B attached hereto, showing Qatalyst’s listed comparables taken from page 66 of the Company’s definitive proxy statement, filed on January 29, 2021 (the “Company’s Proxy Statement”) on the lefthand column (with stated figures in blue and actual current figures in black) with the Company’s stated comparables in the righthand column with the three overlapping comparables, New Relic, Paylocity Holding and Qualys. In addition, out of deference to the spirit of Rule 14a-9, the Filing Persons have changed the word “wrong” to “inappropriate” on page 5 of the Revised Preliminary Proxy Statement and further qualified such statement as a belief.

In addition, in light of the Staff’s Comment, the Filing Persons have included the foregoing information in the form of a footnote on page 5 of the Revised Preliminary Proxy Statement.

5. With a view toward revised disclosure, please provide us supplemental support for the statement that the company “acknowledged the inadequacy of the original Transaction Committee.”

In response to the Staff’s Comment, the Filing Persons note that page 41 of the Company’s Proxy Statement states that at an October 7, 2020 meeting of the Board, Qatalyst, and the Board’s legal advisors, Wilson Sonsini Goodrich & Rosati LLP:

[T]he Transaction Committee resolved to recommend to the Pluralsight Board that it modify the composition of the Transaction Committee so that it would be comprised entirely of members of the Pluralsight Board that were not party to the TRA and were independent of management, namely Ms. Johnson and Ms. Stewart (with Messrs. Crittenden and Dorsey to step down given that they are both parties to the TRA), and that it expand the power and authority of the Transaction Committee, including so that Pluralsight would not effectuate a strategic transaction unless it is first approved or recommended by the Transaction Committee.

The Filing Persons note that this decision came approximately two weeks after the Transaction Committee was formed on September 24, 2020 and approximately 6 months after the Board invited representatives of Qatalyst to attend a meeting of the Board in April 2020, per the Company’s Proxy Statement. Given that the Company admits it needed to change the composition and expand the formal power and authority of the Transaction Committee, it is only logical that the original Transaction Committee would have been inadequate. Otherwise, such a change would not have been made.

Nevertheless, in light of the Staff’s Comment, the Filing Persons have removed the language “acknowledged the inadequacy of the original Transaction Committee” from the Revised Preliminary Proxy Statement.

6. With a view toward revised disclosure, please provide us supplemental support for the statement that “…the Company’s own advisors acknowledge the true economic value of the Tax Receivable Agreement was only approximately $130 million.”

Mr. Duchovny

Page 6

February 16, 2021

In response to the Staff’s Comment, the Filing Persons note that page 44 of the Company’s Proxy Statement states that at a November 2, 2020 meeting of the Transaction Committee, Qatalyst, and the Board’s legal advisors, Wilson Sonsini Goodrich & Rosati LLP:

Qatalyst also discussed with the Transaction Committee illustrative estimates of the present value of the portion of the tax benefits that might be payable in the future to the TRA beneficiaries under the TRA absent a change of control, calculated using a model approved by Pluralsight’s management and assuming achievement of the Pluralsight prospective financial information as of October 2020, an illustrative $22.00 per share price for the Class A common stock at which holders of Holdings units would exchange outstanding Holdings units into Class A common stock, a 23.8% tax rate as provided by Pluralsight’s management and discount rates ranging from 9.00 to 11.00 percent, among other assumptions. These illustrative present value estimates ranged from $112 to $144 million. The Transaction Committee authorized Qatalyst and Wilson Sonsini to initiate preliminary discussions with the TRA Representative, the representative of the TRA beneficiaries under the TRA, to explore potentially amending the TRA.

This meeting and acknowledgment took place only after all other bidders had dropped out of the bidding process and Vista Equity was the only remaining active potential viable bidder, providing a reasonable factual basis for the statement that the Company’s advisors acknowledged the true economic value of the Tax Receivable Agreement was between approximately $112 and $144 million.

In light of the Staff’s Comment, the Filing Persons have included certain of the foregoing analysis in the form of a footnote on page 5 of the Revised Preliminary Proxy Statement and adjusted the reference to “$130 million” to the range specified in the preceding sentence.

7. You must avoid issuing statements that directly or indirectly impugn the character, integrity or personal reputation or make charges of illegal, improper or immoral conduct without factual foundation. Provide us supplementally, or disclose, the factual foundation for the statements listed below. In this regard, note that the factual foundation for such assertion must be reasonable. Refer to Rule 14a-9.

| · | That the Company chose to issue forward quarter billings guidance for the first time in its history “[conveniently].” |

In response to the Staff’s Comment, the Filing Persons respectfully note that support for the fact that the Company issued specific forward quarter billings guidance for the first time in its history stems from the fact that the Company issued forward quarter billings guidance for the first time in its history based upon the Filing Persons’ review. Though the word “conveniently” modifies the sentence following the statement in question and not such statement itself, the Filing Persons have removed the word “conveniently” from the Revised Preliminary Proxy Statement.

| · | That such forward earnings guidance was “misleading.” |

Mr. Duchovny

Page 7

February 16, 2021

In response to the Staff’s Comment, and as provided in Eminence’s January 11, 2021 open letter to the Board (the “January Board Letter”),2 the Filing Persons submit that the billings growth guidance and projected fourth quarter growth was misleading because the Filing Persons understand that shortly after the release of the Company’s third quarter billings growth on its November 5, 2020 conference call, the Company’s CFO told a number of shareholders that billings for October 2020 (the first month of the fourth quarter) had accelerated to +47% year over year, yet the Company chose not to disclose this number on the conference call nor explain why they were guiding to +12-13% despite such a strong first month. The Filing Persons therefore believe a reasonable basis exists to assert that the initial projected fourth quarter billings delivered on the November 5, 2020 call was misleading due to the omission of material facts regarding the Company’s +47% year-over-year projected billings. Nevertheless, the Filing Persons have removed the word “misleading” from the Revised Preliminary Proxy Statement.

8. With a view toward revised disclosure, please provide us supplemental support for the statement that the UFCF multiple range and discount rate range used by Qatalyst in its DCF analysis are different from what “…most comparable public companies today trade at…” and “[a]t least one major sell-side analyst uses…,” respectively.

In response to the Staff’s Comment, the Filing Persons note that Qatalyst uses an Unlevered Free Cash Flow (UFCF) multiple range of 20-35x. In contrast, for example, Qatalyst provided a 30-45x UFCF range for Slack Technologies, Inc., as described in that company's proxy statement, filed on January 29, 2021 with the SEC.

In addition, Qatalyst uses a weighted average cost of capital (WACC) discount rate range of 9.5% to 11.0% whereas Morgan Stanley Research provided (under Eminence's research subscription) a 9% WACC discount rate for the Company on November 6, 2020. On the same date, Citi Research provided a WACC of 9.5% for the Company. A September 1, 2020 report by DA Davidson provided an average WACC of approximately 9.2% for the Company's future growth.

As these figures are technical and interpretations of them vary based on analytical methods, the Filing Persons have removed the foregoing references to UCFC and WACC discount ranges from the Revised Preliminary Proxy Statement in order to avoid any confusion by stockholders.

9. You state, in the last paragraph on page 5, that “[i]n light of the above, among other reasons…,” you recommend that shareholders vote against the merger proposal. Please explain what you mean by “among other reasons.”

In response to the Staff’s comment, the “among other reasons” references those provided in the January Board Letter and the Presentation. In order to avoid potential confusion, the Filing Persons have removed this reference from the Revised Preliminary Proxy Statement.

__________________

2. Available at https://www.businesswire.com/news/home/20210111005590/en/Eminence-Capital-Announces-Intention-to-Vote-Against-Pluralsight’s-Proposed-Transaction-With-Vista-Equity-Partners.

Mr. Duchovny

Page 8

February 16, 2021

Questions and Answers About the Proxy Materials and Special Meeting

How do I vote my shares?, page 8

10. We note that you do not provide instructions on the proxy card for shareholders to “…give instructions to your broker, bank, dealer, trust company or other nominee to vote AGAINST the Merger Proposals” despite your statement to that effect. Please revise or advise.

In response to the Staff’s Comment, the Filing Persons respectfully note that the Proxy Card provided that stockholders of the Company should “sign, date and promptly return” the proxy card in the provided return envelope. Nevertheless, the Filing Persons have revised the Proxy Card to provide additional instructions on how to vote against the Merger Proposals.

Where can I find additional information concerning Pluralsight and the Merger?, page 10

11. Please publish your solicitation filings on a website other than Edgar.

The Filing Persons have and will publish all solicitation filings on outlets other than Edgar.

Form of Proxy Card

12. Please revise the form of proxy card to state how you will vote unmarked proxy cards.

In response to the Staff’s Comment, the Filing Persons have revised the form of proxy card to state how they will vote unmarked proxy cards.

***

13. Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide support for the statement on slide 13 that “[t]he threat of a $400mm payout effectively deterred all potential bidders (other than Vista).”

In response to the Staff’s Comment, and as discussed in response to Comment (6), the Transaction Committee did not first authorize Qatalyst and Wilson Sonsini to begin negotiating the TRA Amendment in order to reduce the threat of a $400mm payout under the Tax Receivable Agreement until November 2, 2020, at which point all potential bidders other than Vista had dropped out of the bidding process. As provided on pages 43 and 44 of the Company’s Proxy Statement, each of these bidders cited an inability to “pay a meaningful premium” or “offer a proposal at a meaningful premium.” Given the proximity between these withdrawals on October 23, 2020 and October 26, 2020 and the November 2, 2020 decision to amend the Tax Receivable Agreement, as well as the fact that there is no evidence in the Company's Proxy Statement that other bidders knew about the potential for negotiations around the $400mm payout, it is reasonable to conclude that the Transaction Committee or the Board concluded that the threat of a $400mm payout was an “effective” deterrent to potential bidders. Nevertheless, the Filing Persons will make clear that any

Mr. Duchovny

Page 9

February 16, 2021

future statements to this effect will be qualified with characterization as an opinion or belief in any future soliciting material.

14. We note your statement on slide 15 that “[a]n acquisition by Vista would allow Skonnard to continue to run Pluralsight and to roll his equity post-transaction (as is common in PE transactions) PLUS get new incentives.” Please provide us support for your disclosure. We note that the company’s proxy statement has disclosure contrary to your statements.

In response to the Staff’s Comment, the Filing Persons note that it is standard practice in private equity transactions such as the one provided for in the Merger for executives to roll over equity post-transaction. For this reason, the Filing Persons provided in parentheses that this is “common in PE transactions.” While the Filing Persons note that pages 46, 49 and 52 of the Company’s Proxy Statement states that Mr. Skonnard did not have discussions regarding a potential rollover, page 45 of the Company’s Proxy Statement makes clear that Mr. Skonnard was not allowed to engage in such discussions pursuant to instructions from the Transaction Committee. Simply because Mr. Skonnard was not able to discuss a rollover does not imply that Mr. Skonnard would not be allowed to receive a rollover or that he is not going to receive a rollover. Moreover, question 15 of the Company’s Employee FAQ filed under cover of Schedule 14A with the SEC on December 15, 2020, states that Mr. Skonnard would continue as CEO of the Company. It is therefore reasonable to infer that an acquisition by Vista would allow Mr. Skonnard to receive a rollover in his equity and receive the benefits of any Company success under Vista’s ownership.

* * *

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

Very truly yours,

/s/ Eleazer Klein

Eleazer Klein

Exhibit A

Exhibit B

Revenue Multiples of Comparable Companies