UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | |

| Filed by the Registrant ¨ | | Filed by a Party other than the Registrant x | | |

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Pursuant to §240.14a-12 |

THE MEN’S WEARHOUSE, INC.

(Name of the Registrant as Specified In Its Charter)

EMINENCE CAPITAL, LLC

EMINENCE GP, LLC

RICKY C. SANDLER

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

This filing contains (1) a press release issued by Eminence Capital, LLC (“Eminence”) on November 20, 2013, and (2) an investor presentation released by Eminence on November 20, 2013.

***********************************************************

FOR IMMEDIATE RELEASE

EMINENCE CAPITAL RELEASES PRESENTATION DESCRIBING HOW

SHAREHOLDERS CAN UNLOCK VALUE AT THE MEN’S WEARHOUSE, INC.

Largest Shareholder Seeks Special Meeting to Approve Amendments to Bylaws to Allow

Shareholders to Remove Directors Without Cause, Increase Board Accountability

NEW YORK, NY (November 20, 2013) – Eminence Capital, LLC, which owns 9.8% of the common stock of The Men’s Wearhouse, Inc. (MW) and is its single largest shareholder, today released a presentation describing how shareholders can unlock value at the company and why MW’s Board of Directors should engage in merger discussions with Jos. A. Bank Clothiers, Inc. (JOSB). Eminence Capital also said that it has retained Moelis & Company as a strategic advisor.

The presentation, which was developed with the assistance of Moelis & Company, is available athttp://dressmwforsuccess.com/investor_presentation_nov2013.pdf or by contacting Eminence Capital’s proxy solicitor, D.F. King & Co., Inc., at (212) 269-5550.

On November 15, Eminence Capital filed a preliminary solicitation statement with the SEC in connection with calling a special meeting of MW shareholders to vote on a number of bylaw amendments that, if approved, will permit shareholders to remove directors without cause before the next annual meeting of shareholders. Pursuant to Texas law the special meeting may be called by holders of at least ten percent (10%), in aggregate, of all of the shares of MW entitled to vote at the special meeting.

Additional Information Regarding the Solicitation For Agent Designations

In connection with its solicitation of agent designations to call a special meeting of shareholders of The Men’s Wearhouse, Inc., Eminence Capital, LLC and certain of its affiliates (collectively, the “Participants”) have filed a preliminary solicitation statement with the Securities and Exchange Commission (the “SEC”) to solicit agent designations from shareholders of The Men’s Wearhouse, Inc.Investors and security holders are urged to read the preliminary solicitation statement in its entirety and the definitive solicitation statement and other relevant documents when they become available because they will contain important information regarding the consent solicitation. The preliminary and definitive solicitation statement and all other relevant documents will be available, free of charge, on the SEC’s website atwww.sec.gov.

-MORE-

Information regarding the Participants in the solicitation of agent designations and a description of their direct and indirect interests, by security holdings or otherwise, to the extent applicable, is available in the preliminary solicitation statement filed with the SEC.

If shareholders have any questions, please call Eminence Capital’s proxy solicitor, D.F. King & Co., Inc., at (212) 269-5550.

About Eminence Capital, LLC

Eminence Capital, LLC is an asset management firm founded in 1998 that currently manages more than $4.5 billion on behalf of institutions and individuals. The firm employs a bottom-up, research-driven investment strategy that utilizes a combination of industry research, rigorous financial analysis and dialog with company management to execute its investment process.

Forward-Looking Statements

This press release includes forward-looking statements that reflect our current views with respect to future events. Statements that include the words “expect,” “intend,” “estimate,” “plan,” “believe,” “project,” “anticipate,” “will,” “may,” “would,” “shall” or similar words are often used to identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond our control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Any forward-looking statements made in this press release are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, The Men’s Wearhouse, Inc. or its business, operations or financial condition. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. This press release relates only to the synergies and cost savings which will result from the combination of The Men’s Wearhouse, Inc. and Jos. A. Bank Clothiers, Inc. and does not address the competitive benefits for consumers that will flow from such combination.

Investors Contact:

Edward McCarthy/Thomas Germinario

D.F. King & Co., Inc.

(212) 269-5550

Media Contact:

Scott Tagliarino/Samantha Leon

ASC Advisors LLC

(203) 992-1230

|

The Men’s Wearhouse, Inc. You’re Going to Like the Way This Looks November 20, 2013 |

|

[ 1 ] Overview of Eminence Capital, LLC Eminence Capital, LLC is a global asset management firm with over $4.5 billion in assets under management, primarily invested in publicly traded equity securities Our firm and flagship long / short equity hedge funds have been in business nearly 15 years fundamental company and industry due diligence with detailed financial analysis to identify companies that fit our investment criteria Eminence is currently the single largest shareholder in Men’s Wearhouse owning approximately 4.7 million shares (9.8% of shares outstanding) with a current market value of $215 million¹ We also own approximately 1.4 million shares of Jos. A. Bank, representing an investment with a current market value of $70 million² Note: 1. Schedule 13-D, The Men’s Wearhouse, Inc. filed November 7, 2013. Current market value assumes Men’s Wearhouse share price of $46.38 as of market close November 18, 2013 2. Represents current market value and our positions as of November 18, 2013 In addition to our long / short funds we also manage a series of long equity funds We invest with a “quality value” based framework combining bottom–up, |

|

Why We Like Men's Wearhouse Note: 1. 10-K for fiscal year ended February 2, 2013. Merchandise margins calculated based on retail clothing product and tuxedo rental services UNDERLEVERED BALANCE SHEET and POSITIVE FREE CASH FLOW provide the opportunity for further return of capital to shareholders ATTRACTIVE NICHE, in that Men’s Wearhouse services need-based purchases with inventory that is subject to reduced fashion cycles EARNINGS UPSIDE that we believe will follow from the recent decision to shed non-core businesses and re-focus on the higher-margin suit and tuxedo categories SCALE, as the largest men’s specialty retailer in North America GROWTH driven by the introduction of premium-priced Joseph Abboud, an exclusive label strategy which we expect will drive enhanced sales, margins and ROIC [ 2 ] ATTRACTIVE CORE BUSINESSES, with STABLE merchandise margins that are over 60% in core apparel and tuxedo – among the highest and most consistent in retail apparel 1 |

|

ACCORDINGLY, THE MEN’S WEARHOUSE BOARD SHOULD ENGAGE WITH JOS. A. BANK TO EVALUATE AND PURSUE A COMBINATION Eminence did not initially invest in Men’s Wearhouse to agitate for change The magnitude of potential value creation from this combination indicates to us that Jos. A. Bank should be prepared to offer a SIGNIFICANT PREMIUM for Men’s Wearhouse that is far greater than its standalone prospects [ 3 ] However, when Jos. A. Bank surfaced with an offer, we recognized that this combination offers a COMPELLING OPPORTUNITY for Men’s Wearhouse shareholders In our view, the VALUE CREATION from this combination is MASSIVE with a potential for $2 billion of value to be created from a combination of cost savings, revenue synergies and multiple expansion |

|

Men's Wearhouse's Board Should Engage with Jos. A. Bank 4 We have launched a special meeting initiative that will not alter the composition of the Board but enables the owners of a MAJORITY of the shares to HOLD THE BOARD ACCOUNTABLE and replace the Board if its members continue not to act in the best interest of shareholders We agree that the preliminary offer submitted by Jos. A. Bank was inadequate – but Jos. A. Bank has indicated the potential for a HIGHER price following confirmatory due diligence Given the compelling value creation that we anticipate will result from this combination, we are surprised and disappointed that Men’s Wearhouse’s Board has decided NOT to engage with Jos. A. Bank Men’s Wearhouse shareholders DESERVE THE OPPORTUNITY to benefit from value creation from a combination – whether through a compelling takeover premium OR a merger The Men’s Wearhouse Board erected defensive measures that we believe are AGAINST THE BEST INTERESTS of shareholders |

|

In our view, a combined entity results in: JOS. A. BANK RECOGNIZES THE VALUE CREATION IN A COMBINATION AND HAS INDICATED THAT IT WOULD CONSIDER RAISING ITS BID FOR MEN’S WEARHOUSE. ACCORDINGLY, THE MEN’S WEARHOUSE BOARD SHOULD ACTIVELY EXPLORE THIS COMBINATION SIGNIFICANT VALUE CREATION through COST SAVINGS and REVENUE SYNERGIES A MUST-OWN INDUSTRY PARTICIPANT for equity investors that compares favorably to peers and offers the potential for an EXPANDED VALUATION MULTIPLE An enhanced focus on the HIGH MARGIN CORE BUSINESS of men’s apparel and tuxedo Significantly greater OPERATING and FINANCIAL SCALE [ 5 ] Men’s Wearhouse/Jos. A. Bank: A Highly Attractive Combination |

|

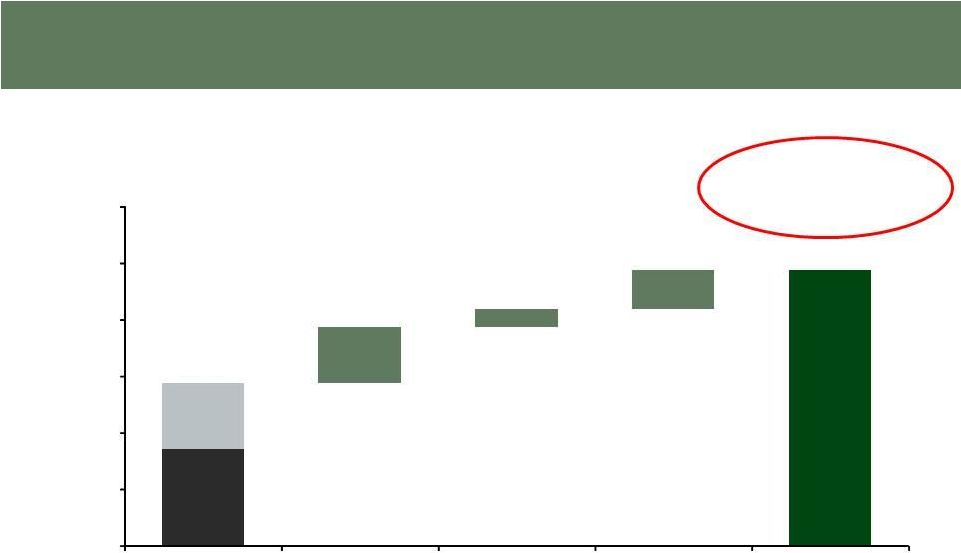

A True Value Creation Opportunity: Cost Savings + Revenue Synergies + Multiple Expansion Sources: Company filings and presentations Note: 1. As of October 8, 2013 2. Represents midpoint of $75 – 125 million in potential cost savings 3. Assumes blended tax rate of 35.5%; blended P/E multiple of 15.2x based on respective market value contribution from Men’s Wearhouse and Jos. A. Bank as of October 8, 2013; EBIT impact from revenue synergies assumes 11.4% margin, representing combined margin of Men’s Wearhouse and Jos. A. Bank pro forma for a combination with $100mm of cost savings 4. Value creation calculated as 2.5x the combined LTM 08/03/13 net income of Men’s Wearhouse ($129.4mm) and Jos. A. Bank ($64.5mm) plus net income impact of $100mm of cost savings ($64.5mm) and revenue synergies ($20.8mm) 4 MW $1,715 $4,881 JOSB $1,169 $982 $317 $698 $ -- $1,000.0 $2,000.0 $3,000.0 $4,000.0 $5,000.0 $6,000.0 Combined Unaffected Market Value ¹ Implied Value of $100mm Cost Savings ² ³ Implied Value of $283mm Revenue Synergies ³ Implied Value of 2.5x Increase to LTM P/E Multiple of 15.2x Total Market Value of Combination $2,884 Represents 69% premium to unaffected market value ($ in millions) [ 6 ] |

|

We Believe Cost Savings are Significant and Identifiable [ 7 ] Category Description / Rationale Low High Purchasing Efficiencies (Procurement) $20mm $35mm Represents ~50 – 100 bps improvement in pro forma gross margin through purchasing efficiencies Product costs represent ~44% of net sales Leverage purchasing scale for improved terms from outsourced manufacturers and suppliers Leverage consumption of underlying commodities (wool, cotton, electricity, etc.) for improved pricing Distribution Center and Logistics Rationalization $15mm $25mm Rationalize duplicative distribution infrastructure Optimize logistics/freight cost Jos. A. Bank operates a centralized distribution operation through facilities representing ~900,000 sq. ft. in Maryland Men’s Wearhouse operates a centralized distribution operation though facilities representing ~1,500,000 sq. ft. in Texas Seek improved terms from freight and logistics vendors Advertising & Marketing $20mm $30mm Rationalize combined advertising and marketing spend of ~$175 million G&A Rationalization $20mm $35mm Corporate headquarters, redundant professional services, public company costs, back-office, systems, IT and other duplicative costs Store and/or Outlet Optimization ?? ?? Total $75mm $125mm Sources: Company filings Note: 1. Estimates based on industry research and analysis of precedent transactions Illustrative Potential Savings 1 Optimize real estate footprint as leases roll off contracts over time |

|

Clear Precedent for Savings in Retail Combinations Merger with Sale to Sale to $6,920 $400 - $600 $1,969 $52 - $60 $3,187 $103 ($ in millions) [ 8 ] Sale to Sale to $449 $25 $666 ¹ $18 LTM Sales Est. Synergies Sources: OfficeMax / Office Depot: J. Jill / Talbots: Saks / Hudson Bay: May / Federated: Charming Brands / Ascena: Hudson Group / Dufry: Note: 1. Merger with $14,441 $450 Similarly large and strategic retail mergers have delivered cost savings in the approximate range of 3% to 7% of target sales Sale to $2,503 $75 - $125 5.0% Potential cost savings range from 3% to 5% of Men’s Wearhouse sales 7.2% 5.6% 3.0% 3.2% 3.1% 2.8% 2.7% -- 2.0% 4.0% 6.0% 8.0% Synergies as a % of Target Sales Hudson Group reflects latest fiscal year revenue before transaction and not LTM sales Sales and synergies from Half-Year Results 2008 & Hudson Transaction presentation Sales and synergies from April, 2012 10-Q and 2012 10 - K, and October 18, 2012 conference call respectively Sales and synergies from 2004 10-K and February 28, 2005 press release respectively Sales and synergies from May, 2013 10-Q and 2013 10-K, and July 29, 2013 press release respectively Sales and synergies from 2006 10-K and February 6, 2006 press release respectively Sales and synergies from 2012 10-K and July 29, 2013 Merger Update presentation respectively |

|

Cost Savings Alone Can Create Significant Equity Value Illustrative Potential Cost Savings Low High Illustrative EBIT Impact of Cost Savings $75mm $125mm Tax-Affected Illustrative Cost Savings $48mm $81mm Unaffected Blended TTM P/E Multiple 15.2x Implied Value Created $737mm $1,228mm Note: 1.Assumes pro forma combined tax rate of 35.5% 2.Represents the blended P/E multiple of 15.2x based on respective market value contribution from Men’s Wearhouse and Jos. A. Bank as of October 8, 2013 9 1 2 |

|

Cross-Selling and Revenue Synergies Provide Potential Incremental Upside Cross-Selling / Revenue Opportunity Low High E-Commerce $75mm $100mm • Leverage Jos. A. Bank’s competency in direct marketing /e- Commerce • Share best practices in omni-channel retailing • Leverage insights and data of a larger customer base • Improve translation of in-store customers into follow-on online sales Tuxedos $50mm $175mm • Leverage Men’s Wearhouse leadership position in tuxedo rental sales across Jos. A. Bank’s platform • Analysis assumes proportional tuxedo sales on Jos. A. Bank’s platform, consistent with Men’s Wearhouse’s historical performance Exclusive Branded Business $50mm $115mm • Introduce Joseph Abboud on the Jos. A. Bank footprint • Analysis assumes Men’s Wearhouse exclusive branded products translate into an incremental 5% to 10% of Jos. A. Bank’s total net sales Total $175mm $390mm Sources: Company filings, estimates based on industry research, and precedent transactions Note: 1. Estimates based on industry research and analysis of precedent transactions Description / Rationale [ 10 ] Illustrative Synergies 1 |

|

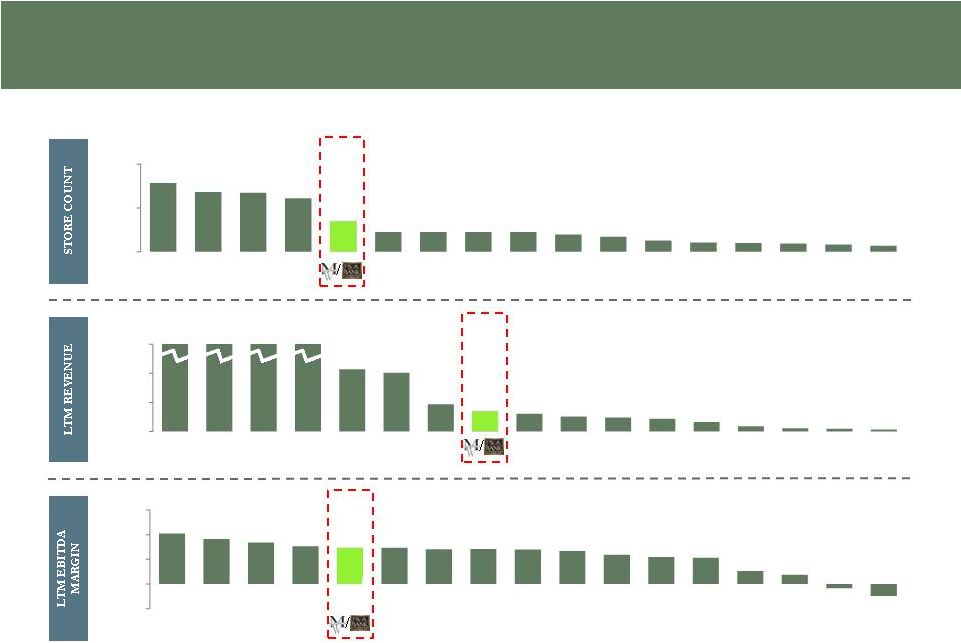

We Believe the Combined Company Will Be A "Must Own" Name in Apparel Retail… Sources: Company filings and presentations Notes: ($ in millions) $19,274 $26,767 $28,079 $16,186 1 3,918 3,407 3,364 3,050 1,745 1,357 1,310 1,199 1,146 984 854 640 530 511 476 412 347 2,500 5,000 ASNA GPS LTD TJX CHS CATO ROST KSS ANN M EXPR WTSL FNP URBN DXLG BEBE $10,690 $10,115 $4,715 $3,519 $3,038 $2,609 $2,433 $2,192 $1,671 $936 $575 $482 $395 $ -- $5,000 $10,000 $15,000 M TJX KSS GPS LTD ROST ASNA URBN CHS ANN EXPR FNP CATO WTSL BEBE DXLG -- 20.4% 18.2% 16.8% 15.4% 14.7% 14.7% 14.1% 14.2% 13.9% 13.4% 11.8% 10.9% 10.6% 5.3% 3.8% (1.7%) (4.8%) (10.0%) -- 10.0% 20.0% 30.0% LTD URBN GPS ROST CHS TJX KSS EXPR M CATO ANN ASNA DXLG FNP WTSL BEBE [ 11 ] 1. Includes mid-point of $75 – 125 million in cost savings |

|

…With the Potential for an Expanded Trading Multiple [ 12 ] INCREASED SCALE, MARKET PRESENCE AND RELEVANCE in Apparel Retail Combined company becomes the ONLY PUBLIC “PURE PLAY” in ATTRACTIVE MEN’S APPAREL NICHE IMPROVED FINANCIAL METRICS ACROSS THE BOARD: estimated cost savings and revenue synergies create a combined company that has faster revenue growth, higher margins and an enhanced ROIC compared to Men’s Wearhouse on a standalone basis LARGER COMPANY and ENTERPRISE VALUE should increase sell side coverage and investor interest Sources: Bloomberg Notes: 1. As of November 18, 2013 |

|

Ignore $2 Billion of Potential Value Creation…? [ 13 ] Sources: Company filings and presentations Note: 1. As of October 8, 2013 2. Represents midpoint of $75 – 125 million in potential cost savings 3. Assumes blended tax rate of 35.5%; blended P/E multiple of 15.2x based on respective market value contribution from Men’s Wearhouse and Jos. A. Bank as of October 8, 2013; EBIT impact from revenue synergies assumes 11.4% margin, representing combined margin of Men’s Wearhouse and Jos. A. Bank pro forma for a combination with $100mm of cost savings 4. Value creation calculated as 2.5x the combined LTM 08/03/13 net income of Men’s Wearhouse ($129.4mm) and Jos. A. Bank ($64.5mm) plus net income impact of $100mm of cost savings ($64.5mm) and revenue synergies ($20.8mm) 4 MW $1,715 $4,881 JOSB $1,169 $982 $317 $698 $ -- $1,000.0 $2,000.0 $3,000.0 $4,000.0 $5,000.0 $6,000.0 Combined Unaffected Market Value ¹ Implied Value of $100mm Cost Savings ² ³ Implied Value of $283mm Revenue Synergies ³ Implied Value of 2.5x Increase to LTM P/E Multiple of 15.2x Total Market Value of Combination Represents 69% premium to unaffected market value $2,884 ($ in millions) |

|

The Men’s Wearhouse Standalone Plan Carries Execution Risk The strategic plan is NOT NEW and therefore was reflected in the unaffected share price of Men’s Wearhouse Standalone Plan Fact Assumes 4 – 5% of SSS growth over the next three years • SSS growth averaged 1.1% over the past five years for Men’s Wearhouse’s core and tuxedo segments • Last three quarters have averaged 1.1% SSS growth Assumes 86% INCREASE in total EBIT over the next three years • EBIT in FY 2012 was 11.1% lower than FY 2006 • Assuming company guidance for the current fiscal year, EBIT is FLAT over the past three years in an otherwise improving consumer environment Assumes 35% INCREMENTAL margin flow through • Company has not achieved 35% incremental margins in ANY YEAR SINCE FY 2006 Assumes 30 new full-price stores per year • Plan implies 4.5% annual store growth versus 2.5% compound annual growth rate over the past five years Assumes 100 outlet store locations in five years • Currently only operating eight outlet stores and extrapolated returns on 100 stores is speculative • Tailored product offering (suits) may not conform to outlet channels [ 14 ] Missed earnings guidance for each of the last two fiscal years and the significant underperformance to plan of the acquired corporate apparel segment adds to our SKEPTICISM regarding Men’s Wearhouse’s ability to deliver on its standalone plan |

|

We Believe the Arguments Made by Men's Wearhouse Board are Wrong 15 Men’s Wearhouse Board Objection Reaction Inadequate Valuation • We agree that Jos. A Bank’s $48 per share offer is inadequate • However, Jos. A. Bank has indicated the potential to pay more • Only by engaging will Jos. A. Bank be positioned to increase its offer Opportunistic Timing • Jos. A. Bank’s offer of $48 per share was at a meaningful premium to historical levels : 42.4% premium to the September 17, 2013 closing price of $33.71 39.1% premium to the 30-day volume-weighted average share price of $34.51 17.8% premium to the 52-week and 5-year highs of $40.75 • The timing to finance such a transaction is highly attractive Diligence Requirements • Confirmatory diligence is customary for public mergers • Jos. A. Bank indicated confirmatory diligence would be limited and expeditious Financing Uncertainty • Jos. A Bank and Men’s Wearhouse do not have any existing debt and operate from a net cash position • There is adequate debt capacity to finance this transaction and a leading investment bank has given a highly confident letter • The financing markets are robust and are likely to be highly receptive • A highly regarded private equity firm with significant retail experience is willing to support this financing with approximately $250 million of equity funding Antitrust Issues • Men’s Wearhouse and Jos. A. Bank compete with dozens of rival apparel retailers, hundreds of e-tailors AND massive “big box” department stores Note: 1. Calculated as of close of trading October 8, 2013 unless otherwise noted. 1 |

|

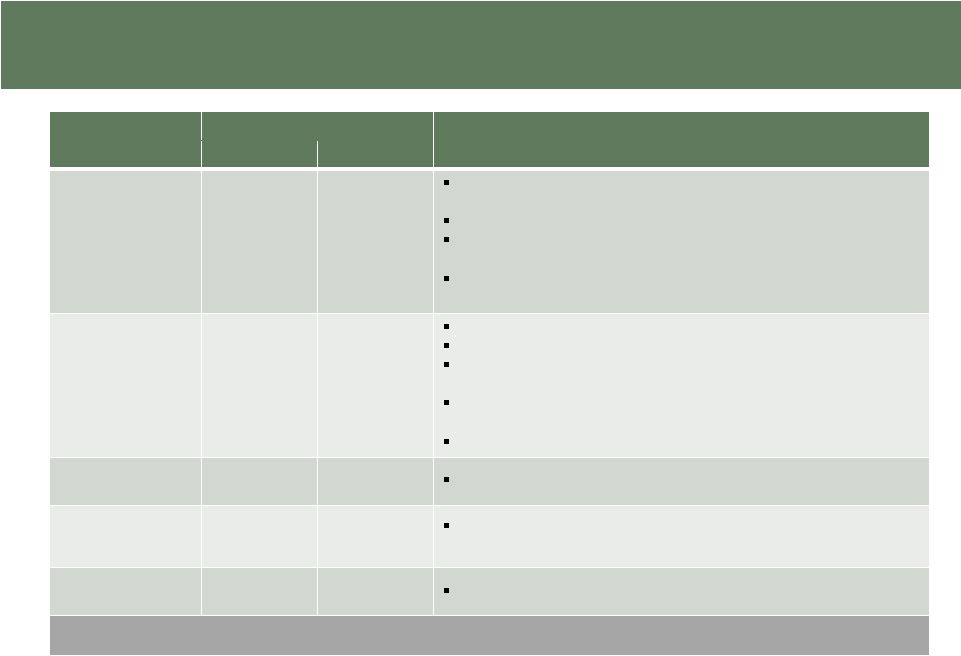

[ 16 ] Source: Company filings Note: 1. ROIC is return on invested capital calculated as adjusted operating profit divided by invested capital Category Metric Time Period Jos. A. Bank has achieved superior operating margins to Men’s Wearhouse Adjusted Operating Margins LTM 10.2% 7.9% FY07 to FY12 14.6% 6.9% Jos. A. Bank has achieved superior returns on invested capital to Men’s Wearhouse ROIC 1 LTM 31.5% 23.1% FY07 to FY12 56.6% 18.6% Jos. A Bank has achieved superior SSS growth to Men’s Wearhouse Same Store Sales Growth FY07 to FY12 5.5% 0.9% Jos. A. Bank has achieved superior cash generation efficiency to Men’s Wearhouse Cumulative FCF as a Percentage of Net Sales FY07 to FY12 6.5% 4.0% Jos. A Bank has achieved superior employee productivity to Men’s Wearhouse Sales per Employee LTM $160,233 $143,040 Jos. A. Bank HAS OUTPERFORMED Men’s Wearhouse across a broad range of operating metrics |

|

Why Are We Calling a Special Meeting? [ 17 ] We believe the Men’s Wearhouse Board is WRONG in its decision to not engage with Jos. A. Bank. Men’s Wearhouse shareholders are being DENIED the potential to receive compelling value from the benefits of this combination The defenses enacted by the Men’s Wearhouse Board – a super-majority vote for shareholder amendments to the bylaws and implementation of a poison pill – reflect, in our view, a troubling “entrenchment” mindset by the Men’s Wearhouse Board The benefits from a combination should be captured by a compelling takeover premium for Men’s Wearhouse shareholders or through the equity value created in a merger The special meeting can empower shareholders with the tools to HOLD THE BOARD ACCOUNTABLE – if approved, the bylaw amendments will permit shareholders to REMOVE Directors without cause before the next annual meeting of shareholders MEN’S WEARHOUSE DIRECTORS SHOULD KNOW THEIR SHAREHOLDERS WILL HOLD THEM ACCOUNTABLE BY REMOVING THEM IF THEY DO NOT ACT IN SHAREHOLDERS’ BEST INTERESTS |

|

What Will Happen Next? Eminence will solicit agent designations to call a special meeting Holders of a combined 10% of outstanding shares may call a special meeting under Texas law The special meeting is currently scheduled for February 14, 2014 At the special meeting, shareholders would be asked to consider and vote on a package of bylaw amendments If proposed bylaw amendments are approved at the special meeting, a simple majority of shares could remove and replace the entire board at a subsequent special meeting 18 |

|

Conclusion Eminence continues to believe in the Men’s Wearhouse story However, THE VALUE CREATION POTENTIAL IN A COMBINATION BETWEEN MEN’S WEARHOUSE AND JOS. A. BANK CANNOT BE IGNORED The Men’s Wearhouse standalone plan is in our opinion based on targets and profitability levels that management has never achieved and has considerable execution risk Men’s Wearhouse shareholders can still benefit from the standalone plan through either a merger or a premium offer that reflects its value The Men’s Wearhouse Board SHOULD IMMEDIATELY ENGAGE WITH JOS. A. BANK AND AGGRESSIVELY PURSUE A TRANSACTION If the Board does not engage Jos. A. Bank, we call upon our fellow shareholders to support our agenda at the special meeting and enable Men’s Wearhouse shareholders to elect Directors who will represent SHAREHOLDERS’ best interests before the next annual meeting [ 19 ] |

|

Disclaimer Additional Information Regarding the Solicitation For Agent Designations In connection with their solicitation of agent designations to call a special meeting of shareholders of The Men’s Wearhouse, Inc. (“Men’s Wearhouse”), Eminence Capital, LLC (“Eminence”) and certain of its affiliates (collectively, the “Participants”) have filed a preliminary solicitation statement with the Securities and Exchange Commission (the “SEC”) to solicit agent designations from shareholders of Men’s Wearhouse. Investors and security holders are urged to read the preliminary solicitation statement in its entirety, and the definitive solicitation statement and other relevant documents when they become available, because they will contain important information regarding the consent solicitation. SEC’s website at www.sec.gov. Information regarding the Participants in the solicitation of agent designations and a description of their direct and indirect interests, by security holdings or otherwise, to the extent applicable, is available in the preliminary solicitation statement filed with the SEC. If shareholders have any questions, please call Eminence’s proxy solicitor, D.F. King & Co., Inc., at (212) 269-5550. Forward-Looking Statements This presentation includes forward-looking statements that reflect our current views with respect to future events. Statements that include the words “expect,” “intend,” “estimate,” “plan,” “believe,” “project,” “anticipate,” “will,” “may,” “would,” “should” or similar words are often used to identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond our control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Any forward-looking statements made in this presentation are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Men’s Wearhouse or its business, operations or financial condition. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. This presentation relates only to the synergies and cost savings which will result from the combination of Men’s Wearhouse and Jos. A. Bank Clothiers, Inc. and does not address the competitive benefits for consumers that The preliminary and definitive solicitation statements and all other relevant documents will be available, free of charge, on the will flow from such combination. [ 20 ] |