UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

DENDREON CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

DENDREON CORPORATION

3005 First Avenue

Seattle, Washington 98121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 7, 2006

The Annual Meeting of Stockholders (the “Annual Meeting”) of Dendreon Corporation, a Delaware corporation (the “Company”), will be held on Wednesday, June 7, 2006, at 9:00 a.m., local time, at 3005 First Avenue, Seattle, Washington 98121, for the following purposes:

| | (1) | To elect three directors to hold office until the 2009 Annual Meeting of Stockholders; |

| | (2) | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the current fiscal year; and |

| | (3) | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on April 11, 2006, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

By Order of the Board of Directors,

Richard F. Hamm, Jr.

Senior Vice President, Corporate Development, General Counsel and Secretary

April 28, 2006

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. IF YOU PLAN TO ATTEND, PLEASE CONTACT INVESTOR RELATIONS AT (206) 829-1500 OR IR@DENDREON.COM.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. YOU ALSO MAY VOTE YOUR SHARES ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD.

EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

DENDREON CORPORATION

3005 First Avenue

Seattle, Washington 98121

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

June 7, 2006

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Dendreon Corporation, a Delaware corporation (unless the context suggests otherwise, “Dendreon”, the “Company”, “we”, “us”, or “our”), for use at the Annual Meeting of Stockholders (the “Annual Meeting”), to be held on June 7, 2006, at 9:00 a.m., local time, or at any adjournments or postponements thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at 3005 First Avenue, Seattle, Washington 98121. This proxy statement and the accompanying proxy card were first mailed to stockholders on or about April 28, 2006.

Solicitation

The Company will bear the entire cost of the solicitation of proxies for the Annual Meeting, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. The Company will furnish copies of the solicitation materials to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), beneficially owned by others to forward to such beneficial owners. The Company may, on request, reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. In addition to solicitation of proxies by mail, proxies may be solicited by telephone, facsimile or personal solicitation by directors, officers or other employees of the Company. No additional compensation will be paid to the Company’s directors, officers or other employees for such services.

Voting Rights and Outstanding Shares

Only stockholders who owned their shares at the close of business on April 11, 2006 (the “record date”) will be eligible to vote at the Annual Meeting. As of the record date, there were 71,202,709 shares of Common Stock outstanding. Each stockholder will be entitled to one vote for each share owned. Stockholders have no right to cumulative voting as to any matter, including the election of directors. A list of stockholders of record will be open to the examination of any stockholder for any purpose germane to the meeting at Dendreon Corporation, 3005 First Avenue, Seattle, Washington 98121, for a period of ten days prior to the Annual Meeting.

At the Annual Meeting, inspectors of election shall determine the presence of a quorum and shall tabulate the results of the vote of the stockholders. The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person or by proxy to constitute a quorum for any business to be transacted at the Annual Meeting. Properly executed proxies marked “abstain” and “broker non-votes” will be considered “present” for purposes of determining whether a quorum is present at the Annual Meeting. “Broker non-votes” occur when certain nominees holding shares for beneficial owners do not vote those shares on a particular proposal because the nominees do not have discretionary authority to do so and have not received voting instructions with respect to the proposal from the beneficial owners. For purposes of calculating votes in the election of directors (Proposal 1), broker non-votes and abstentions will not be counted as votes and will not effect the results of the vote. However, for Proposal 2, abstentions have the same effect as votes against ratification of the Company’s independent public accounting firm. Broker non-votes will have no effect on the results of Proposal 2.

1

Proposal 1. The nominees for election as directors who receive the greatest number of votes will be elected as directors.

Proposal 2.The affirmative vote of holders of a majority of the shares of Common Stock represented at the meeting is required to approve the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the current fiscal year.

The shares represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific instructions are not indicated on a valid proxy, the shares represented by such proxies received will be voted: “For” the election of the nominees for director named in this proxy statement, “For” for the ratification of the selection Ernst & Young LLP as the Company’s independent registered public accounting firm for the current fiscal year, and in accordance with the best judgment of the persons named in the proxy for any other matter that properly comes before the Annual Meeting.

Voting Via the Internet or by Telephone

Stockholders may submit their voting instructions by means of the telephone or through the Internet. The telephone and Internet voting procedures are described on the proxy card and are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders submitting voting instructions via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholders.

Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Pacific Time, on June 6, 2006. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Revocability of Proxies

Stockholders may revoke their proxies at any time before they are voted at the Annual Meeting in any one of the following ways: voting by Internet or by telephone, by attending the Annual Meeting and voting in person or by filing a written notice of revocation or a duly executed proxy bearing a later date with the Secretary of the Company at the Company’s principal executive office, 3005 First Avenue, Seattle, Washington 98121. Attendance at the Annual Meeting will not, by itself, revoke a proxy. If the shares are held in the name of a bank, broker or other nominee, the stockholder must obtain a proxy executed in his or her favor from the nominee to be able to vote at the meeting.

Stockholder Proposals for the 2007 Annual Meeting

The deadline for submitting a stockholder proposal for inclusion in the Company’s proxy materials for the Company’s 2007 Annual Meeting of Stockholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934 (the “Exchange Act”) is the close of business on December 28, 2006. Stockholders who do not wish to use the mechanism provided by the rules of the Securities and Exchange Commission (the “SEC”) in proposing a matter for action at the next annual meeting must notify the Company in writing of the proposal and the information required by the provisions of the Company’s Amended and Restated Bylaws dealing with advance notice of stockholder proposals and director nominations. The notice must be submitted in writing to the Company not less than 90 days nor more than 120 days before the first anniversary of the previous year’s annual meeting. Accordingly, any stockholder proposal for next year’s meeting submitted to the Company on or between February 7, 2007 and March 9, 2007 will be considered filed on a timely basis.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the Board of Directors shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board of Directors is presently composed of nine members. There are three directors in the class whose term of office expires in 2006: Susan B. Bayh, M. Blake Ingle, Ph.D. and David L. Urdal, Ph.D., all of whom are nominees. Each of the nominees for election to this class is currently a director of the Company who was previously elected by the stockholders and has been nominated for re-election upon recommendation of the Board of Directors. If elected at the Annual Meeting, Ms. Bayh, Dr. Ingle and Dr. Urdal would serve until the 2009 Annual Meeting and until his or her successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting. Proxies will be voted, unless authority is withheld, for the election of the three nominees named below. In the event that any nominee should become unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board of Directors may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

The Board of Directors has determined that seven of its nine current directors are independent under the rules of the SEC and the listing standards of the National Association of Securities Dealers, Inc. (the “NASD”). Those directors are Ms. Bayh, Mr. Brewer, Mr. Canet, Dr. Dziurzynski, Dr. Ingle, Ms. Kunath and Mr. Watson.

Set forth below is biographical information for each person nominated for election at the Annual Meeting for a term expiring at the 2009 Annual Meeting and each person whose term of office as a director will continue after the Annual Meeting.

Nominees for Election for a Three-year Term Expiring at the 2009 Annual Meeting

Susan B. Bayh, age 45, has been a director of the Company since its acquisition of Corvas International, Inc., a biotechnology company, in July 2003. Prior to that, she had served as a director of Corvas since June 2000. Since 1994, she has been a Distinguished Visiting Professor at the College of Business Administration at Butler University in Indianapolis, Indiana. From 1994 to 2000, she was a Commissioner for the International Joint Commission of the Water Treaty Act between the United States and Canada. From 1989 to 1994, Ms. Bayh served as an attorney in the Pharmaceutical Division of Eli Lilly and Company, a pharmaceutical company. She currently serves on the Boards of Directors of Wellpoint, Inc., a health benefits company, Dyax Corp., a biotechnology company, Curis, Inc., a therapeutic drug development company, Emmis Communications, a diversified media company, Novavax, Inc., a biopharmaceutical company, and Nastech Pharmaceutical Co. Inc., a biotechnology company. Ms. Bayh received a B.S. from the University of California, Berkeley and her J.D. from the University of Southern California Law School.

M. Blake Ingle, Ph.D., age 63, has been a director of the Company since its acquisition of Corvas International, Inc. in July 2003. Prior to that, Dr. Ingle had served as Chairman of Corvas since June 1999 and as

3

a director of Corvas since January 1994. Since 1998, Dr. Ingle has been a general partner of Inglewood Ventures, a venture capital firm. From March 1993 to February 1996 when it was acquired by Schering-Plough, he was the President and Chief Executive Officer of Canji, Inc., a biopharmaceutical company. From 1980 to 1993, he was employed in a variety of capacities with the IMCERA Group, Inc., a healthcare company consisting of Mallinckrodt Medical, Mallinckrodt Specialty Chemicals and Pitman Moore, most recently serving as President and Chief Executive Officer. Dr. Ingle currently serves on the Boards of Directors of Vical, Inc., a biopharmaceutical company, and Alerion Biomedical, Inc., a biotechnology company.

David L. Urdal, Ph.D., age 56, has served as our Senior Vice President and Chief Scientific Officer since June 2004. In January 2006, Dr. Urdal assumed oversight of manufacturing operations for the Company. Previously, he served as Vice Chairman of the Company’s Board of Directors and Chief Scientific Officer since joining the Company in July 1995, and has served as a member of the Board of Directors since that date. He served as the Company’s President from January 2001 to December 2003, and he served as the Company’s Executive Vice President from January 1999 through December 2000. From 1982 until July 1995, Dr. Urdal held various positions with Immunex Corporation, a biotechnology company, including President of Immunex Manufacturing Corporation, Vice President and Director of Development, and head of the departments of biochemistry and membrane biochemistry. Dr. Urdal received a B.S. and M.S. in Public Health and a Ph.D. in Biochemical Oncology from the University of Washington.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR THE ELECTION OF EACH NAMED NOMINEE.

Directors Continuing In Office Until the 2008 Annual Meeting

Richard B. Brewer,age 54, has served as the Company’s Chairman of the Board of Directors since June 2004 and has served as one of the Company’s directors since February 2004. He is the founding partner of Crest Asset Management, a management advisory and investment firm, a position he has held since January 2003. From September 1998 until February 2004, Mr. Brewer served as Chief Executive Officer and President of Scios Inc., a biopharmaceutical company. From 1996 until 1998, Mr. Brewer served as the Chief Operating Officer at Heartport, a cardiovascular device company. From 1984 until 1995, Mr. Brewer was employed by Genentech, Inc., a biotechnology company, and served as its Senior Vice President of Sales and Marketing, and Senior Vice President of Genentech Europe and Canada. Mr. Brewer is an advisory board member for the Center for Accelerating Medical Solutions, a non-profit organization dedicated to expediting the discovery and development of life-saving drugs. Mr. Brewer is a director of Corgentech Inc., a publicly traded biopharmaceutical company, Corus Pharma, Inc., a biopharmaceutical company, and Agensys, Inc., a privately-held biotechnology company. He is an advisory board member at the Kellogg Graduate School of Management Center for Biotechnology at Northwestern University. Mr. Brewer holds a B.S. from Virginia Polytechnic Institute and an M.B.A. from Northwestern University.

Mitchell H. Gold, M.D., age 39, has served as our Chief Executive Officer since January 1, 2003, and as a director since May 2002. Dr. Gold also served as the Company’s Vice President of Business Development from June 2001 to May 2002, and as the Company’s Chief Business Officer from May 2002 through December 2002. From April 2000 to May 2001, Dr. Gold served as Vice President of Business Development and Vice President of Sales and Marketing for Data Critical Corporation, a company engaged in wireless transmission of critical healthcare data, now a division of GE Medical. From 1995 to April 2000, Dr. Gold was the President and Chief Executive Officer, and a co-founder of Elixis Corporation, a medical information systems company. From 1993 to 1998, Dr. Gold was a resident physician in the Department of Urology at the University of Washington. Dr. Gold currently serves on the boards of the University of Washington/Fred Hutchinson Cancer Research Center Prostate Cancer Institute and the Washington Biotechnology and BioMedical Association. Dr. Gold received his B.S. from the University of Wisconsin-Madison and his M.D. from Rush Medical College.

Ruth B. Kunath, age 54, has served as one of the Company’s directors since December 1999. Ms. Kunath was biotechnology portfolio manager for Vulcan Inc., a venture capital firm, from 1991 until November 2003.

4

Ms. Kunath has been a private investor engaged primarily in managing her personal investments since November 2003. Prior to her employment at Vulcan Inc., Ms. Kunath spent nine years at Seattle Capital Management, a financial management company, and eight years as the Senior Portfolio Manager for the healthcare sector of Bank of America Capital Management, a financial management company. Ms. Kunath received a B.A. from DePauw University and is a Chartered Financial Analyst.

Directors Continuing In Office Until the 2007 Annual Meeting

Gerardo Canet, age 60, has served as one of the Company’s directors since December 1996. Mr. Canet is chairman of the Board of Directors of IntegraMed America, Inc., and from 1994 to 2005, its Chief Executive Officer. Integramed provides services to patients and medical practices that specialize in the diagnosis and treatment of infertility. From 1989 to 1994, Mr. Canet held various executive management positions with Curative Health Services, Inc., a health services company, most recently as Executive Vice President and President of its Wound Care Business Unit. Mr. Canet received a B.A. in Economics from Tufts University and an M.B.A. from Suffolk University.

Bogdan Dziurzynski, D.P.A., age 57, has served as one of the Company’s directors since May 2001. Since 2001, Dr. Dziurzynski has been a consultant in strategic regulatory management to the biotechnology industry and serves on the Board of Directors of the Biologics Consulting Group, Inc. From 1994 to 2001, Dr. Dziurzynski was the Senior Vice President of Regulatory Affairs and Quality Assurance for MedImmune, Inc., a biotechnology company. From 1988 to 1994, Dr. Dziurzynski was Vice President of Regulatory Affairs and Quality Assurance for Immunex Corporation, a biotechnology company. Dr. Dziurzynski has a B.A. in Psychology from Rutgers University, an M.B.A. from Seattle University and a Doctorate in Public Administration from the University of Southern California.

Douglas G. Watson, age 61, has served as one of the Company’s directors since February 2000. Mr. Watson is Chief Executive Officer of Pittencrieff Glen Associates, a consulting firm that he founded in July 1999. From July 2000 to September 2001, Mr. Watson also served as acting President and Chief Executive Officer of ValiGen, N.V., a European-American life sciences company. From January 1997 to May 1999, Mr. Watson served as President and Chief Executive Officer of Novartis Corporation, a pharmaceutical company. From April 1996 to December 1996, Mr. Watson served as President and Chief Executive Officer of Ciba-Geigy Corporation, which merged into Novartis Corporation in December 1996. Mr. Watson’s career spanned 33 years with Novartis, having joined Geigy (UK) Ltd. in 1966. Mr. Watson also currently serves as chairman of OraSure Technologies, Inc., a medical diagnostics company, and Innovative Drug Delivery Systems Inc., a pharmaceutical company, and as a director of Engelhard Corporation, an industrial manufacturing company, Genta Incorporated, a biopharmaceutical company, InforMedix Inc., a medical management company, BioElectronics Corporation, a medical device company, and Javelin Pharmeceuticals, Inc., a pharmaceutical company, as well as a number of privately held biotechnology companies. Mr. Watson received an M.A. in Pure Mathematics from Churchill College, Cambridge University and holds an ACMA qualification as an Associate of the Chartered Institute of Management Accountants.

Board of Directors Committees and Meetings

In 2005, the Board of Directors held seven meetings. The Company encourages but does not require the directors to attend the Annual Meeting. The Company schedules a regular meeting of the Board of Directors after the Annual Meeting. With the exception of Ms. Bayh, all of the Company’s directors attended the 2005 Annual Meeting of Stockholders. The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance Committee. With the exception of Mr. Brewer, who attended 58% of the aggregate of the meetings of Board and the committees on which he served, no director attended less than 75% of the aggregate of the meetings of the Board and the committees on which he or she served.

5

Audit Committee

The Company has a separately designated standing Audit Committee. The Board of Directors adopted a revised Audit Committee Charter in March 2005 that complies with Rule 4350(d)(1) of the NASD listing standards. The Charter of the Audit Committee is available on the Company’s investor relations website athttp://investor.dendreon.com/governance.cfm. The Audit Committee has the responsibility and authority set forth in Rule 4350(d)(3) of the NASD listing standards under the revised charter. The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board of Directors. Among other things, the Audit Committee is responsible for overseeing the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. The Audit Committee is also directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, including the resolution of disagreements between management and the auditors regarding financial reporting. Additionally, the Audit Committee will approve any related party transaction that is required to be disclosed pursuant to Item 404 of Regulation S-K promulgated under the Exchange Act.

The Audit Committee is currently composed of Mr. Watson (Chair), Dr. Ingle and Ms. Kunath, each of whom the Board of Directors has determined is independent under SEC rules and the NASD listing standards. The Audit Committee met eight times during 2005. The Board of Directors has determined that Mr. Watson, Dr. Ingle and Ms. Kunath are each an “audit committee financial expert,” as that term is defined in Item 401(h)(2) of Regulation S-K.

Compensation Committee

The Compensation Committee develops compensation policies, makes recommendations concerning salaries and incentive compensation, awards stock options and restricted stock to officers and employees under the Company’s stock incentive plans and otherwise determines compensation levels and performs such other functions regarding compensation as the Board of Directors may delegate in accordance with the Charter of the Compensation Committee, which is available on the Company’s investor relations website.

The Compensation Committee is currently composed of Mr. Canet (Chair) and Dr. Dziurzynski and Mses. Bayh and Kunath, each of whom is independent under the NASD listing standards. The Compensation Committee met five times during fiscal year 2005.

Corporate Governance Committee

The Corporate Governance Committee considers and makes recommendations regarding corporate governance requirements and principles, periodically reviews the performance and operations of the standing committees of the Board of Directors, oversees information flow to the Board of Directors and its committees, evaluates and recommends individuals for membership on the Company’s Board of Directors and committees thereof. The Corporate Governance Committee adopted a charter, which is available on the Company’s investor relations website.

Potential nominees for director are referred to the Corporate Governance Committee for consideration and evaluation. If the Committee identifies a need to replace a current member of the Board of Directors, to fill a vacancy in or to expand the size of the Board of Directors, the Corporate Governance Committee considers those individuals recommended as candidates for Board membership, including those recommended by stockholders, holds meetings from time to time to evaluate biographical information and background material relating to the candidates and interviews selected candidates.

According to its adopted policy, the Corporate Governance Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of

6

management, the Company’s advisors and executive search firms. The Corporate Governance Committee will consider director candidates recommended by stockholders and will evaluate those candidates in the same manner as candidates recommended by other sources if stockholders submitting recommendations follow the procedures established by the Corporate Governance Committee.

In making recommendations for director nominees for the annual meeting of stockholders, the Corporate Governance Committee will consider any written recommendations of director candidates by stockholders received by the Secretary of the Company not later than the close of business on the 90th day nor earlier than the 120th day prior to the first anniversary of the previous year’s annual meeting of stockholders. Recommendations must include the candidate’s name and contact information and a statement of the candidate’s background and qualifications, as well as the name and contact information of the stockholder or stockholders making the recommendation, and such other information as may be required under the Company’s Amended and Restated Bylaws. Recommendations must be mailed to Dendreon Corporation, 3005 First Avenue, Seattle, Washington 98121, Attention: Secretary, faxed to the Secretary of the Company at (206) 219-7211 or e-mailed to secretary@dendreon.com.

No stockholder recommendations for director nominees were received for consideration at the Annual Meeting.

The Board of Directors does not currently prescribe any minimum qualifications for director candidates. The Corporate Governance Committee will consider the Company’s current needs and the qualities needed for Board of Directors service, including experience and achievement in business, finance, biotechnology, health sciences or other areas relevant to the Company’s activities; reputation, ethical character and maturity of judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of the responsibilities of a director; independence under SEC rules and the listing standards of the NASD; service on other boards of directors; sufficient time to devote to Board of Directors matters; and the ability to work effectively with other Board of Directors members.

The Corporate Governance Committee is currently composed of Ms. Bayh (Chair), Drs. Ingle and Dziurzynski and Mr. Watson, each of whom is independent under the NASD listing standards. The Corporate Governance Committee met three times during fiscal year 2005.

Stockholder Communications with the Board of Directors

The Company has established a procedure for stockholders to communicate with the Board of Directors or a particular Board member. Communications should be in writing, addressed to: Dendreon Corporation, 3005 First Avenue, Seattle, Washington 98121, and marked to the attention of the Board of Directors or any of its individual committees. Copies of all communications so addressed will be promptly forwarded to the chair of the committee involved, or in the case of communications addressed to the Board of Directors as a whole, to the Corporate Governance Committee.

Report of the Audit Committee of the Board of Directors

The Audit Committee represents and assists the Board of Directors in its oversight of the integrity of Dendreon’s financial reporting, the independence, qualifications, and performance of Dendreon’s independent registered public accounting firm and Dendreon’s compliance with legal and regulatory requirements. The Audit Committee consists of the three members listed below, and each is an independent director as defined in Rule 4200(a)(15) of the NASD listing standards and, in accordance with SEC and NASD requirements, meets additional independence standards applicable to audit committee members. Each of the members of the Audit Committee qualifies as an “audit committee financial expert” within the meaning of that term as defined by the SEC pursuant to Item 401(h)(2) of Regulation S-K.

7

Management is responsible for the Company’s internal controls and the financial reporting process. The Audit Committee is directly responsible for the compensation, appointment and oversight of Dendreon’s independent registered public accounting firm. The Company’s independent registered public accounting firm reports directly to the Audit Committee. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and for issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee also meets privately in separate executive sessions periodically with management and the independent registered public accounting firm.

In this context, the Audit Committee has met and held discussions with management and the Company’s independent registered public accounting firm. Management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with accounting principles generally accepted in the United States. The Audit Committee has reviewed and discussed the financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) and other professional standards.

The Company’s independent registered public accounting firm also provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent registered public accounting firm that firm’s independence.

Based on the Audit Committee’s review of the Company’s audited financial statements and its discussion with management and the independent registered public accounting firm and the Audit Committee’s review of the representations of management and the report of the independent registered public accounting firm to the Board of Directors and Stockholders, the Audit Committee recommended that the Board of Directors include the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the SEC.

From the members of the Audit Committee of the Board of Directors.

Douglas B. Watson (Chair)

M. Blake Ingle, Ph.D

Ruth B. Kunath

8

PROPOSAL 2

RATIFICATION OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP (“Ernst & Young”) as the Company’s independent registered public accounting firm for the current fiscal year and the Board is asking stockholders to ratify that selection. Although current laws, rules, and regulations, as well as the charter of the Audit Committee, require the Company’s independent registered public accounting firm to be engaged, retained, and supervised by the Audit Committee, the Board considers the selection of the independent registered public accounting firm to be an important matter of stockholder concern and is submitting the selection of Ernst & Young for ratification by stockholders as a matter of good corporate practice. If the stockholders do not ratify the selection of Ernst & Young as the Company’s independent registered public accounting firm, the Audit Committee will consider this vote in determining whether or not to continue the engagement of Ernst & Young.

Ernst & Young has audited the Company’s financial statements since 1994. Representatives of Ernst & Young are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

The affirmative vote of holders of a majority of the shares of Common Stock represented at the meeting is required to approve the ratification of the selection of Ernst & Young as the Company’s independent registered public accounting firm for the current fiscal year.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION

OF THE SELECTION OF ERNST & YOUNG AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

INFORMATION REGARDING OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit Fees. During the fiscal years ended December 31, 2004 and 2005, the aggregate fees billed by Ernst & Young for the audit of the Company’s financial statements for such fiscal years, the reviews of the Company’s interim financial statements, Sarbanes-Oxley Section 404 attestation services and assistance with registration statements were $827,000 and $718,000, respectively.

Audit-Related Fees. During the fiscal years ended December 31, 2004 and 2005, Ernst & Young did not bill the Company for any audit-related services related to the performance of the audit or review beyond the fees disclosed under “Audit Fees” above.

Tax Fees. During the fiscal years ended December 31, 2004 and 2005, the aggregate fees billed by Ernst & Young for preparing state and federal income tax returns were $17,000 and $25,000, respectively. During 2004 and 2005, Ernst & Young fees for other tax services were $89,000 and $30,000, respectively. The 2004 service was primarily for a study to determine the application of Section 382 of the Internal Revenue Code to the Company, and the 2005 service was related to a study of the income and sales tax implication to the Company in connection with the potential commercialization of Provenge® (sipuleucel-T), the Company’s most advanced active immunotherapy product candidate.

All Other Fees. During the fiscal years ended December 31, 2004 and 2005, all other fees billed by Ernst & Young were $2,500 and $1,800, respectively. These fees were principally related to a subscription for an online financial reporting and accounting research tool.

The Audit Committee has determined that the rendering of these non-audit services by Ernst & Young is compatible with maintaining its independence.

9

Audit Committee Pre-Approval Policy. All services to be performed by Ernst & Young for the Company must be pre-approved by the Audit Committee. Pre-approval is granted usually at regularly scheduled meetings of the Audit Committee. If unanticipated items arise between meetings of the Audit Committee, the Audit Committee has delegated authority to the Chairman of the Audit Committee to pre-approve services involving fees of up to $15,000, in which case the Chairman communicates such pre-approval to the full Audit Committee at its next meeting. All other services must be approved in advance by the full Audit Committee. During 2004 and 2005, all services billed by Ernst & Young were pre-approved by the Audit Committee in accordance with this policy.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of April 11, 2006, based on 71,202,709 shares outstanding as of that date, by (1) each person or group who is known to the Company to be the beneficial owner of more than five percent of the Company’s outstanding Common Stock, (2) each director of the Company, (3) each executive officer named in the Summary Compensation Table under “Executive Compensation”, and (4) all of the Company’s directors and executive officers as a group.

| | | | | | | | | |

| | | Beneficial Ownership | |

Name and Address (1) | | Shares Beneficially Owned | | Shares

Acquirable Within 60 Days (6) | | Total Beneficial Ownership | | Percentage

Beneficially

Owned | |

Mazama Capital Management, Inc. (2) One S.W. Columbia Street, Suite 1500 Portland, Oregon 97258 | | 6,655,065 | | — | | 6,655,065 | | 9.3 | % |

Mitchell H. Gold, M.D. | | 50,933 | | 678,916 | | 729,849 | | 1.0 | |

David L. Urdal, Ph.D. (3) | | 436,494 | | 365,000 | | 801,494 | | 1.2 | |

Richard F. Hamm, Jr. | | 6,624 | | 115,000 | | 121,624 | | * | |

Robert M. Hershberg, M.D., Ph.D. (4) | | 15,724 | | 185,000 | | 200,724 | | * | |

Susan B. Bayh | | 1,000 | | 40,050 | | 41,050 | | * | |

Richard B. Brewer | | 4,400 | | 42,500 | | 46,900 | | * | |

Gerardo Canet | | 22,556 | | 47,500 | | 70,056 | | * | |

Bogdan Dziurzynski, D.P.A. | | 4,000 | | 52,500 | | 56,500 | | * | |

M. Blake Ingle, Ph.D. | | 4,950 | | 43,650 | | 48,600 | | * | |

Ruth B. Kunath | | 2,000 | | 73,900 | | 75,900 | | * | |

Douglas G. Watson | | 5,000 | | 66,400 | | 71,400 | | * | |

Martin A. Simonetti (5) | | 227,355 | | — | | 227,355 | | * | |

| | | | | | | | | |

All executive officers and directors as a group (10 persons) | | 537,957 | | 1,525,416 | | 2,063,373 | | 2.9 | % |

| (1) | The information set forth in this table is based upon information supplied to the Company by the Company’s officers, directors and principal stockholders and Schedules 13D and 13G, if any, filed with the SEC. Except as otherwise indicated, and subject to applicable community property laws, the Company believes that the persons named in the table have sole voting and investment power with respect to all shares of Common Stock beneficially owned by them. |

| (2) | Pursuant to Amendment No. 5 to Schedule 13G filed with the SEC on February 8, 2006, Mazama Capital Management, Inc. reported that, as of December 31, 2005, it had sole investment discretion over 6,655,065 shares, with respect to which it holds sole voting power for 3,822,404 shares and no voting power for 2,832,661 shares. |

| (3) | Includes 436,494 shares owned jointly with Dr. Urdal’s wife, Shirley G. Urdal. |

| (4) | Dr. Hershberg’s employment terminated with the Company on March 15, 2006. He remains a consultant to the Company under an agreement dated March 15, 2006. |

| (5) | Mr. Simonetti’s employment terminated with the Company on July 31, 2005. For beneficial ownership information after that date, the Company has relied upon Mr. Simonetti’s filings with the SEC and the Company’s records. |

| (6) | Reflects the number of shares that could be purchased by exercise of options vested at April 11, 2006 or within 60 days thereafter. |

11

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and persons who own more than ten percent of the Company’s Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of the Common Stock. The Company’s directors and executive officers and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all forms that each has filed pursuant to Section 16(a) of the Exchange Act.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company during 2005, SEC filings and certain written representations that no other reports were required, during the fiscal year ended December 31, 2005, the Company’s officers, directors and greater than ten percent stockholders complied with all applicable Section 16(a) filing requirements, with the exception of the filing of a Form 4 by Dr. Dziurzynski one day late.

Compensation of Directors

Only non-employee directors are compensated for serving as directors of the Company. The Board of Directors adopted guidelines for the compensation of the Company’s non-employee directors. Under these guidelines, for each fiscal year of service non-employee directors receive a retainer of $35,000, payable ratably at the end of each quarter. In addition, the Chairman of the Board receives an additional $75,000 per annum. The chairs of the Audit, Compensation and Corporate Governance Committees receive an additional $10,000, $8,000, and $4,000, respectively, per annum for such service. These amounts are paid ratably at the end of each quarter. In 2005, the total compensation earned by non-employee directors was $284,333. The members of the Board of Directors are also eligible for reimbursement of their expenses incurred in connection with attendance at Board of Directors meetings in accordance with Company policy.

Upon first joining the Board of Directors, non-employee directors are also granted a stock option to acquire 22,500 shares of Common Stock under the Amended 2000 Equity Incentive Plan (the “2000 Equity Plan”), 7,500 options vest on the grant date and the remainder in equal annual installments over a two-year period and have an exercise price equal to the fair market value of the Common Stock on the date of grant. In addition, after the third anniversary of each director’s election to the Board of Directors, such director receives an annual grant to purchase 10,000 shares of the Company’s Common Stock, which vests in full upon the date of grant. All options granted to non-employee directors are granted at the fair market value of the Company’s Common Stock on the date of grant.

The table below sets forth, for each non-employee director, the amount of cash compensation paid and the number of stock options received for his or her service during 2005.

| | | | | | | | |

Non-Employee Director | | Cash ($) | | Number of

Shares

Underlying

Options Granted | | Exercise Price ($) | | Grant Date |

Susan B. Bayh | | 34,000 | | — | | — | | — |

Richard B. Brewer | | 83,333 | | 10,000 | | 5.45 | | 12/13/2005 |

Gerardo Canet | | 38,000 | | 10,000 | | 5.45 | | 12/13/2005 |

Bogdan Dziurzynski, D.P.A. | | 30,000 | | 10,000 | | 5.45 | | 12/13/2005 |

M. Blake Ingle, Ph.D. | | 30,000 | | — | | — | | — |

Ruth B. Kunath | | 30,000 | | 10,000 | | 5.45 | | 12/13/2005 |

Douglas G. Watson | | 39,000 | | 10,000 | | 5.45 | | 12/13/2005 |

12

EXECUTIVE COMPENSATION

Summary of Compensation

The following table shows for the fiscal years ended December 31, 2003, 2004 and 2005, compensation awarded or paid to, or earned by, the Company’s Chief Executive Officer, the Company’s three most highly compensated executive officers serving at the end of 2005, and Martin A. Simonetti, a former executive officer, who would have been one of the four most highly compensated executive officers but for the fact that he was no longer an executive officer as of December 31, 2005. We refer to these individuals as the Company’s “Named Executive Officers.”

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | Annual Compensation | | Long Term

Compensation | | All Other

Compensation

($)(4) |

Name and Principal Position | | Year | | Salary $ | | Bonus ($)(1) | | Other Annual Compensation ($)(2) | | Restricted

Stock

Awards

($)(3) | | Securities

Underlying

Options (#) | |

Mitchell H. Gold, M.D. | | 2005 | | 450,000 | | 222,976 | | 8,830 | | 309,375 | | 112,500 | | 4,079 |

President and Chief | | 2004 | | 425,000 | | 216,250 | | 9,479 | | — | | 150,000 | | 5,021 |

Executive Officer | | 2003 | | 375,000 | | 218,300 | | 78,006 | | 165,900 | | 350,000 | | — |

| | | | | | | |

David L. Urdal, Ph.D. | | 2005 | | 375,000 | | 148,650 | | — | | 82,500 | | 30,000 | | 6,716 |

Senior Vice President and | | 2004 | | 375,000 | | 150,000 | | — | | — | | 50,000 | | 5,684 |

Chief Scientific Officer | | 2003 | | 375,000 | | 110,041 | | 15,287 | | 30,123 | | 130,000 | | 4,341 |

| | | | | | | |

Richard F. Hamm, Jr. (5) | | 2005 | | 280,000 | | 110,992 | | 1,803 | | 205,366 | | 33,750 | | 52,061 |

Senior Vice President, Corporate Development, General Counsel and Secretary | | 2004 | | 41,461 | | 28,000 | | — | | — | | 115,000 | | — |

| | | | | | | |

Robert M. Hershberg, M.D., Ph.D. (6) | | 2005 | | 290,000 | | 114,956 | | 2,027 | | 61,875 | | 22,500 | | 2,240 |

Senior Vice President and | | 2004 | | 286,779 | | 157,100 | | 2,215 | | — | | 75,000 | | 2,000 |

Chief Medical Officer | | 2003 | | 60,000 | | — | | — | | — | | 75,000 | | — |

| | | | | | | |

Martin A. Simonetti (7) | | 2005 | | 286,825 | | — | | — | | — | | — | | 3,721 |

Senior Vice President, Chief | | 2004 | | 275,000 | | 110,000 | | — | | — | | 65,000 | | 4,436 |

Financial Officer and Treasurer | | 2003 | | 240,000 | | 108,227 | | 23,333 | | 48,201 | | 80,000 | | 3,597 |

| (1) | Bonuses were paid in the year following the year in which they were earned. |

| (2) | For 2003, the amounts shown in this column represent tax payments the Company made on behalf of each officer. For 2004-2005, the amounts shown in this column are for executive memberships. |

| (3) | In January 2006, pursuant to the 2000 Equity Plan and for service during the year 2005, Drs. Gold, Urdal, and Hershberg and Mr. Hamm received grants of restricted stock awards in the amounts of 56,250, 15,000, 11,250 and 16,875 shares, respectively. The stock grants were valued at $5.50 per share based on the closing price of the Common Stock on January 18, 2006, the day prior to the date of the grant. Mr. Hamm received an additional grant of 25,756 restricted stock awards valued at $4.37 per share, the closing price of the Common Stock on March 24, 2006, the day prior to the date of the grant. The restricted stock awards vest 25% on the first anniversary of the date of the grant and 6.25% at the end of each quarter thereafter until fully vested. Pursuant to the 2000 Equity Plan, in 2003, Dr. Gold received a grant of 35,000 shares of restricted stock, Mr. Simonetti received a grant of 10,169 shares of restricted stock and Dr. Urdal received a |

13

| | grant of 6,355 shares of restricted stock. Pursuant to the 2000 Equity Plan, the restricted stock grants were valued at the amounts shown above, based on $6.32 per share, the closing price of the Common Stock on September 2, 2003, the day prior to the date of grant. The restricted stock grants vest 25% on the date of the grant and 10% at the end of each three-month period thereafter until fully vested. The 25% portion of each restricted stock grant that vests on the date of grant is reported as a bonus for each named executive officer. At December 31, 2005, Dr. Gold, Dr. Urdal and Mr. Simonetti owned 35,000, 6,355 and 9,660 vested shares of restricted stock with a fair market value of $189,700, $34,444, and $52,357 respectively, and there were not any unvested shares of restricted stock on December 31, 2005. |

| (4) | For the year ended December 31, 2005, all other compensation includes: (a) 401(k) matching contribution of $2,000, (b) life and long term executive disability premiums along with imputed insurance costs of $2,079, $4,716, $240, $3,221 and $1,721 for Drs. Gold, Urdal, and Hershberg, Messrs. Hamm and Simonetti, respectively. In addition, Mr. Hamm received $46,840 for relocation assistance. |

| (5) | Mr. Hamm was appointed Senior Vice President, General Counsel and Secretary in November 2004. Accordingly, the amounts reflected for Mr. Hamm represent approximately two months of compensation during fiscal year 2004. |

| (6) | Dr. Hershberg was appointed Senior Vice President and Chief Medical Officer in January 2004, and served as Vice President of Strategic Product Development beginning in October 2003. Dr. Hershberg’s employment terminated with the Company on March 15, 2006. |

| (7) | Mr. Simonetti’s employment terminated with the Company on July 31, 2005. Included in his salary is $71,706 in consulting fees for services from August 1, 2005 through October 31, 2005. |

Executive Compensation Plan Information

Stock Option Grants

The following options were granted to the Company’s Named Executive Officers in 2005.

Option Grants in Fiscal Year 2005

| | | | | | | | | | | | |

| | | Individual Grants | | Exercise

Price Per

Share ($) | | Expiration

Date | | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term (1) ($) |

| | | Number of

Securities

Underlying

Options

Granted (#) | | Percentage of

Total Options

Granted to

Employees

in 2005 (%) | | | |

| | | | | | | 5% | | 10% |

Mitchell H. Gold, M.D. | | 112,500 | | 10 | | 5.45 | | 12/13/2015 | | 385,591 | | 977,163 |

David L. Urdal, Ph.D. | | 30,000 | | 3 | | 5.45 | | 12/13/2015 | | 102,824 | | 260,577 |

Robert M. Hershberg, M.D., Ph.D. | | 22,500 | | 2 | | 5.45 | | 12/13/2015 | | 77,118 | | 195,433 |

Richard F. Hamm, Jr. | | 33,750 | | 3 | | 5.45 | | 12/13/2015 | | 115,677 | | 293,149 |

Martin A. Simonetti | | — | | — | | — | | — | | — | | — |

| (1) | There is no assurance that the actual stock price appreciation over the option term will be at the assumed 5% or 10% annual rate of compound stock price appreciation or at any other defined level. Unless the market price of the Common Stock appreciates over the option term, no value will be realized from the option grants made to the executive officers. |

The Company granted options to purchase 1,181,683 shares of the Company’s Common Stock to employees during fiscal year 2005 under the Company’s 2000 Equity Plan and 2002 Broad-Based Equity Incentive Plan (the “2002 Equity Plan”). As of December 31, 2005, options to purchase 5,823,025 shares were outstanding and 1,178,703 shares remained available for grant.

On August 2, 2004, the Company entered into a Change of Control Executive Severance Plan with its executive officers. Under that plan, a change in control in the Company’s ownership will cause all outstanding and unexpired stock options under the 2000 Equity Plan and 2002 Equity Plan to automatically vest in full upon the termination of the executive officers.

14

Stock Option Exercises and Holdings

The following table sets forth the number of shares of the Company’s Common Stock acquired upon the exercise of stock options by the Named Executive Officers during fiscal year 2005, and the number and value of the shares of the Company’s Common Stock underlying unexercised options held by the Named Executive Officers as of December 31, 2005. The value realized is based on the fair market value of the underlying securities as of the date of exercise, minus the per share exercise price, multiplied by the number of shares underlying the option. The value of the unexercised in-the-money options is based on $5.42 (the closing sale price of the Company’s Common Stock on December 30, 2005) less the exercise price, multiplied by the number of shares underlying the option. All options that were exercised had been granted under the Company’s 2000 Equity Plan.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | | | | | |

Name | | Shares

Acquired on

Exercise (#) | | Value

Realized ($) | | Number of Shares

Underlying Unexercised

Options at

December 31, 2005 (#) | | Value of the Unexercised

In-the-Money Options at

December 31, 2005 ($) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Mitchell H. Gold, M.D. | | — | | — | | 666,084 | | 127,416 | | 281,552 | | 46,968 |

David L. Urdal, Ph.D. | | — | | — | | 362,709 | | 32,291 | | 50,623 | | 1,077 |

Robert M. Hershberg, M.D., Ph.D. | | — | | — | | 185,000 | | 22,500 | | — | | — |

Richard F. Hamm, Jr. | | — | | — | | 115,000 | | 33,750 | | — | | — |

Martin A. Simonetti | | 92,209 | | 177,353 | | 160,000 | | — | | — | | — |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

On October 8, 2004, we entered into Executive Employment Agreements with Mitchell H. Gold, M.D., President and Chief Executive Officer and Robert M. Hershberg, M.D., Ph.D., Senior Vice President and Chief Medical Officer. On December 8, 2004, we entered into an Executive Employment Agreement with Richard F. Hamm, Jr., Senior Vice President, Corporate Development, General Counsel and Secretary, which was amended on March 23, 2006. On June 9, 2005, we entered into an Executive Employment Agreement with David L. Urdal, Senior Vice President and Chief Scientific Officer. The agreements, as amended, provide for annual base salaries as follows: Dr. Gold, $475,000; Dr. Urdal, $375,000; and Mr. Hamm, $315,000. If targets set in advance by the Board of Directors are met, the executive is eligible for a bonus as determined by the Board of up to 50% of base salary for Dr. Gold and Mr. Hamm for the year ending December 31, 2006, and up to 40% of base salary for Dr. Urdal. The Executive Employment Agreement with Dr. Hershberg was terminated on March 15, 2006.

The agreements have no specified term, and the employment relationship may be terminated by the executive officers or by us at any time. If we terminate the executive officer’s employment without cause, or if the executive officer resigns for good reason, as such terms are defined in the agreements, the executive will be entitled to a lump sum severance payment that, in the case of Dr. Gold, equals his base salary plus his maximum annual bonus for the year in which termination occurs, and in the case of any of the other executive officers, equals 75% of his base salary plus 75% of his maximum annual bonus for such year. In that event, the executive officer would also be entitled to full accelerated vesting of any unvested stock options and any unvested stock held by him pursuant to restricted stock grants. Each agreement requires the executive not to compete with us after termination of employment for a period of one year for Dr. Gold and nine months for the other executives, and provides a one-year post-termination non-solicitation obligation for all of the executives.

15

Report of the Compensation Committee of the Board of Directors

The Compensation Committee is currently composed of Mr. Canet (Chair), Dr. Dziurzynski and Mses. Bayh and Kunath. The Committee is responsible for establishing the Company’s compensation programs for all employees, including executives. For executive officers, the Committee evaluates performance and determines compensation policies and levels.

Compensation Philosophy

The goals of the Company’s compensation program are to align employee compensation with the Company’s business objectives and performance and to enable the Company to attract and retain the highest quality executive officers and other employees, reward them for the Company’s progress and motivate them to enhance long-term stockholder value. The key elements of this philosophy are as follows:

| | • | | The Company pays competitively with leading biotechnology companies with which the Company competes for talent. To ensure that compensation is competitive, the Company compares its practices with those companies and sets its parameters based on this comparison. |

| | • | | The Company maintains short- and long-term incentive opportunities sufficient to provide motivation to achieve specific operating goals and to generate rewards that bring total compensation to competitive levels. |

Base Salary. The Compensation Committee annually reviews each executive officer’s base salary. When reviewing base salaries, the Compensation Committee considers individual and corporate performance, levels of responsibility, prior experience, breadth of knowledge and competitive pay practices. Base salaries for executive officers for 2005 were increased between 0% and 8.3% as compared to fiscal year 2004. The increases were due to the executive officers’ and the Company’s fiscal year 2005 performance, including, among other things, the sale to the public of approximately $49 million of the Company’s Common Stock in December 2005, the achievement of regulatory goals and the progress of the Company’s clinical and preclinical programs and commercialization efforts.

Near-Term Incentives. In December 2005, the Compensation Committee met and approved cash bonuses for performance for the 2005 fiscal year for all executive officers. The actual cash bonus awarded depends on the achievement of specified goals of the Company and individual performance objectives for each executive officer. Cash bonuses awarded to executive officers for performance in 2005 ranged from 40% to 50% of the executive officers’ respective base salaries. The Compensation Committee and the full Board of Directors review and approve the annual performance objectives for the Company. The Company objectives consist of operating, strategic and financial goals that are considered to be critical to the Company’s fundamental long-term goal of building stockholder value. Amounts reflected as bonuses in the Summary Compensation Table above were paid based on the criteria set forth above.

Long-Term Incentives. The Company’s long-term incentive program for its officers consists of stock option and restricted stock grants pursuant to the Company’s 2000 Equity Plan and 2002 Equity Plan, and the opportunity to purchase Common Stock through the 2000 Employee Stock Purchase Plan (the “ESPP”). Stock options and restricted stock granted to Dendreon’s executive officers under the 2000 Equity Plan or 2002 Equity Plan generally vest over a four-year period to encourage employees to remain with the Company. Through stock option and restricted stock grants, executives and employees receive significant equity as an incentive to assist the Company in building long-term stockholder value. Stock option grants in 2005 were made at an exercise price of 100% of the fair market value of the Company’s Common Stock on the date of grant. Executive officers receive value from these grants only if the Company’s Common Stock appreciates over the long-term. The Compensation Committee does consider the number of outstanding options, both vested and unvested, held by executive officers when awarding new grants.

16

Corporate Performance and Chief Executive Officer Compensation

Dr. Gold’s base salary as Chief Executive Officer in fiscal year 2005 was $450,000. His bonus for the fiscal year consisted of $222,976 in cash, which was paid in 2006. Dr. Gold’s fiscal year 2005 base salary and bonus were determined by the Compensation Committee in accordance with the criteria set forth above for all executive officers. In 2005, the Company achieved a number of key objectives, including, among others, the sale to the public of approximately $49 million of the Company’s Common Stock in December 2005, the achievement of regulatory goals and the progress in the Company’s clinical and preclinical programs and commercialization efforts generally. In December 2005, the Compensation Committee granted Dr. Gold options to purchase 112,500 shares of Common Stock at an exercise price of $5.45 per share, and, in January 2006, a restricted stock award of 56,250 shares.

Limitation on Deduction of Compensation Paid to Certain Executive Officers

Section 162(m) of the Internal Revenue Code (the “Code”) limits the Company to a deduction for federal income tax purposes of no more than $1 million of compensation paid to certain executive officers in a taxable year. Compensation above $1 million may be deducted if it is performance-based compensation within the meaning of the Code. The Compensation Committee’s policy with respect to Section 162(m) is to try and preserve the deductibility of compensation payable to executive officers, although deductibility is only one among a number of factors considered in determining appropriate levels or means of compensation for these officers.

The Compensation Committee has determined that stock options granted under the 2000 Equity Plan and the 2002 Equity Plan with an exercise price at least equal to the fair market value of the Company’s Common Stock on the date of grant shall be treated as performance-based compensation.

Conclusion

Through the compensation philosophy described above, a significant portion of the Company’s executive compensation program, including Dr. Gold’s compensation, is contingent upon Company performance, and realization of benefits is linked to increases in long-term stockholder value. The Company remains committed to this philosophy of pay for performance, recognizing that the competitive market for talented executives and the volatility of the Company’s business may result in highly variable compensation for a particular time period.

From the members of the Compensation Committee of Dendreon Corporation.

Gerardo Canet (Chair)

Susan B. Bayh

Bogdan Dziurzynski, D.P.A.

Ruth B. Kunath

17

Equity Compensation Plan Information

Dendreon maintains the 2000 Equity Plan, the 2002 Equity Plan and the ESPP, pursuant to which it may grant equity awards to eligible persons. Dendreon also has issued warrants as compensation to consultants and contractors for goods and services provided to Dendreon. The following table provides information as of December 31, 2005, regarding the 2000 Equity Plan, the 2002 Equity Plan and the ESPP and certain other compensatory arrangements pursuant to which Dendreon has issued, or agreed to issue, warrants to purchase shares of Common Stock:

| | | | | | | | | | |

Plan category | | (a) Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | | (b) Weighted-average

exercise price of

outstanding

options, warrants

and rights | | | (c) Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column (a)) | |

Equity compensation plans approved by security holders (1) | | 4,442,466 | (3) | | $ | 7.39 | (3) | | 1,075,897 | (4) |

Equity compensation plans not approved by security holders (2) | | 1,380,559 | | | $ | 8.40 | | | 102,806 | |

| | | | | | | | | | |

Total | | 5,823,025 | | | $ | 8.34 | | | 1,178,703 | |

| (1) | These plans are the 2000 Equity Plan and the ESPP. |

| (2) | These plans are the 2002 Equity Plan and certain compensatory arrangements pursuant to which Dendreon has issued, or agreed to issue, warrants to purchase an aggregate of 8,688 shares of Common Stock. |

| (3) | Includes information relating solely to options to purchase Common Stock under the 2000 Equity Plan. |

| (4) | Of these shares, 883,942 remained available for purchase under the ESPP as of December 31, 2005. |

Compensation Committee Interlocks and Insider Participation

As noted above, decisions about executive compensation are made by the Compensation Committee. No member of the Company’s Compensation Committee has been an officer or employee of the Company at any time. No executive officer of the Company during 2005 served as a director or as a member of the compensation committee of another entity that has an executive officer who served as a director of the Company or on the Company’s Compensation Committee during 2005.

18

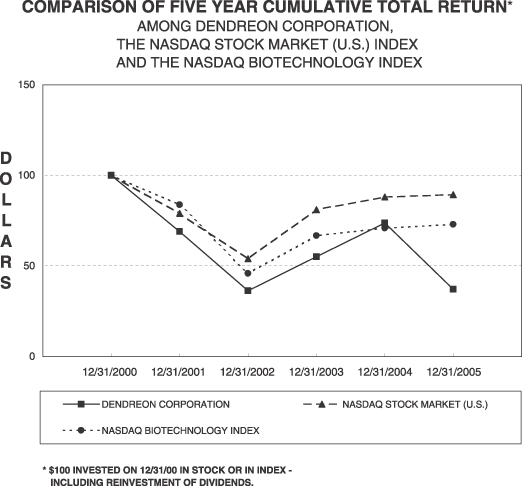

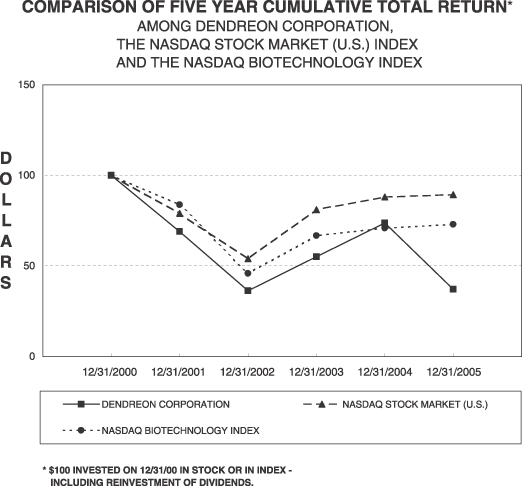

PERFORMANCE MEASUREMENT COMPARISON

The following graph shows the total stockholder return of an investment of $100 in cash in the Company’s Common Stock or in each of the following indices on December 31, 2000: (i) the Nasdaq Biotech Index and (ii) the Nasdaq Stock Market (US) Index. All values assume reinvestment of the full amount of all dividends and are calculated as of December 31, 2005.

| | | | | | | | | |

| | | Dendreon

Corporation | | Nasdaq Biotech

Index | | Nasdaq Stock

Market (US) Index |

December 31, 2000 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

December 31, 2001 | | $ | 68.88 | | $ | 78.95 | | $ | 83.79 |

December 31, 2002 | | $ | 36.32 | | $ | 54.06 | | $ | 45.81 |

December 31, 2003 | | $ | 55.13 | | $ | 81.09 | | $ | 66.77 |

December 31, 2004 | | $ | 73.73 | | $ | 88.06 | | $ | 70.86 |

December 31, 2005 | | $ | 37.07 | | $ | 89.27 | | $ | 72.87 |

19

Management and Certain Security Holders of Dendreon—Certain Transactions

The Company has entered into indemnity agreements with its directors, executive officers and certain other members of senior management that provide, among other things, that the Company will indemnify such officer or director, under the circumstances and to the extent provided for therein, for expenses, damages, judgments, fines and settlements he or she may be required to pay in actions or proceedings in which he or she is or may be made a party by reason of his or her position as a director, officer or other agent of the Company, and otherwise to the full extent permitted under Delaware law and the Company’s Amended and Restated Bylaws. The Company has also entered into agreements with some of its officers and directors as set forth above in the section entitled “Employment Contracts, Termination of Employment and Change-in-Control Arrangements.”

Other Matters

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005 is available without charge upon written request to: Investor Relations, Dendreon Corporation, 3005 First Avenue, Seattle, Washington 98121.

April 28, 2006

20

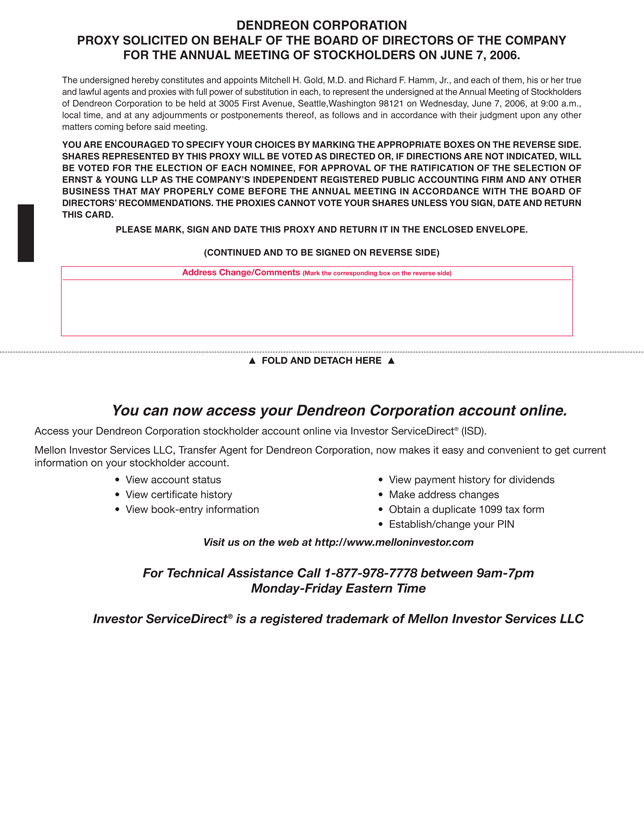

DENDREON CORPORATION

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY

FOR THE ANNUAL MEETING OF STOCKHOLDERS ON JUNE 7, 2006.

The undersigned hereby constitutes and appoints Mitchell H. Gold, M.D. and Richard F. Hamm, Jr., and each of them, his or her true and lawful agents and proxies with full power of substitution in each, to represent the undersigned at the Annual Meeting of Stockholders of Dendreon Corporation to be held at 3005 First Avenue, Seattle,Washington 98121 on Wednesday, June 7, 2006, at 9:00 a.m., local time, and at any adjournments or postponements thereof, as follows and in accordance with their judgment upon any other matters coming before said meeting.

YOU ARE ENCOURAGED TO SPECIFY YOUR CHOICES BY MARKING THE APPROPRIATE BOXES ON THE REVERSE SIDE. SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED OR, IF DIRECTIONS ARE NOT INDICATED, WILL BE VOTED FOR THE ELECTION OF EACH NOMINEE, FOR APPROVAL OF THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND ANY OTHER BUSINESS THAT MAY PROPERLY COME BEFORE THE ANNUAL MEETING IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS. THE PROXIES CANNOT VOTE YOUR SHARES UNLESS YOU SIGN, DATE AND RETURN THIS CARD.

PLEASE MARK, SIGN AND DATE THIS PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

Address Change/Comments (Mark the corresponding box on the reverse side)

FOLD AND DETACH HERE

You can now access your Dendreon Corporation account online.

Access your Dendreon Corporation stockholder account online via Investor ServiceDirect® (ISD).

Mellon Investor Services LLC, Transfer Agent for Dendreon Corporation, now makes it easy and convenient to get current information on your stockholder account.

View account status View certificate history View book-entry information

View payment history for dividends Make address changes Obtain a duplicate 1099 tax form Establish/change your PIN

Visit us on the web at http://www.melloninvestor.com

For Technical Assistance Call 1-877-978-7778 between 9am-7pm Monday-Friday Eastern Time

Investor ServiceDirect® is a registered trademark of Mellon Investor Services LLC

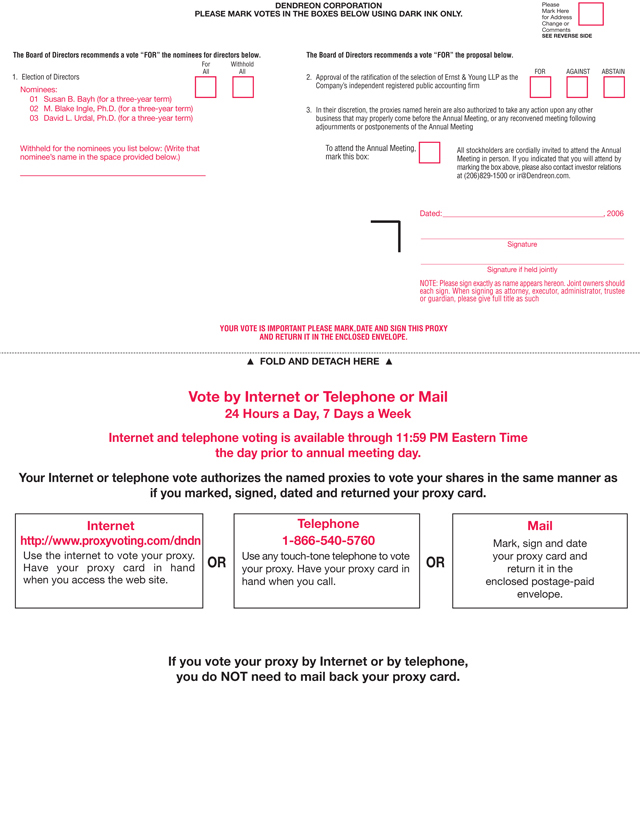

DENDREON CORPORATION

PLEASE MARK VOTES IN THE BOXES BELOW USING DARK INK ONLY.

Please Mark Here for Address Change or Comments

SEE REVERSE SIDE

The Board of Directors recommends a vote “FOR” the nominees for directors below.

For All

Withhold All

1. Election of Directors

Nominees:

01 Susan B. Bayh (for a three-year term)

02 M. Blake Ingle, Ph.D. (for a three-year term)

03 David L. Urdal, Ph.D. (for a three-year term)

Withheld for the nominees you list below: (Write that nominee’s name in the space provided below.)

The Board of Directors recommends a vote “FOR” the proposal below.

2. Approval of the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm

FOR

AGAINST

ABSTAIN

3. In their discretion, the proxies named herein are also authorized to take any action upon any other business that may properly come before the Annual Meeting, or any reconvened meeting following adjournments or postponements of the Annual Meeting

To attend the Annual Meeting, mark this box:

All stockholders are cordially invited to attend the Annual Meeting in person. If you indicated that you will attend by marking the box above, please also contact investor relations at (206)829-1500 or ir@Dendreon.com.

Dated:

, 2006

Signature

Signature if held jointly

NOTE: Please sign exactly as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such

YOUR VOTE IS IMPORTANT PLEASE MARK, DATE AND SIGN THIS PROXY

AND RETURN IT IN THE ENCLOSED ENVELOPE.

FOLD AND DETACH HERE

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern Time the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated and returned your proxy card.

Internet http://www.proxyvoting.com/dndn

Use the internet to vote your proxy. Have your proxy card in hand when you access the web site.

OR

Telephone 1-866-540-5760

Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call.

OR

Mail

Mark, sign and date your proxy card and return it in the enclosed postage-paid envelope.

If you vote your proxy by Internet or by telephone, you do NOT need to mail back your proxy card.